#Daytrading

Explore tagged Tumblr posts

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

🚨 RBNZ Inflation Alert 🚨 Sectoral Factor Inflation: 3.1% YoY (Q4 2024)

New Zealand’s economy stays steady! But will this number nudge the RBNZ toward tightening or cooling down? 🔥

💡 What it means: 🔹 Controlled inflation signals stability. 🔹 Key to upcoming RBNZ decisions. 🔹 Could define NZ's economic path in 2025.

📈 Thoughts? Let’s discuss!!!

#RBNZ #Inflation #Economics

#forextrading#forex market#forex#rbnz#nzdusd#nzdn#economics#new zealand#dollar#cryptocurrency#cryptocurreny trading#bitcoin#cryptotrading#cryptonews#usdc#ethereum#forex expert advisor#forex education#daytrading#crypto#blockchain#altcoin#elon musk#presidential election of 2024#donald trump#trumps#writers on tumblr#writerscommunity#blog#girl blogger

3 notes

·

View notes

Text

Are We At The “Sweet Spot” to Buy Gold, Silver, and Bitcoin?

Charlotte of Investing News and Chris discussed how the stock market and precious metals will behave going into the end of the year. “I can have a bearish outlook on the markets yet still be in positions. I follow the trends, not opinions, news, projections, etc. No one knows what will happen. I let the charts paint the picture, analyze the information, invest accordingly, and manage the risk.”

Watch Today’s Free Video Here

2 notes

·

View notes

Text

Our First Indicator Script Is Live! EasyChartSignals - Now Available for TradingView!

We are thrilled to announce that our very first indicator script, EasyChartSignals, is finally ready and available for you! 🚀 This powerful tool provides you with automated buy, sell, and stop-loss signals that make trading on TradingView more efficient and simple.

EasyChartSignals has been optimized and tested thoroughly by experienced traders to bring you the most accurate and reliable signals. Whether you're new to trading or an experienced trader, EasyChartSignals helps you make better trading decisions!

Get started with EasyChartSignals today and take your trading to the next level! 🔥

👉 Available for TradingView users now!

📌 Features:

Accurate buy and sell signals

Easy integration with TradingView

Adjustable settings to suit your trading style

🌐 Learn more at: https://easychartsignals.de

Hashtags:

#EasyChartSignals#TradingView#IndicatorScript#TradingSignals#BuySellSignals#AutomatedTrading#TradingTools#ForexTrading#CryptoTrading#DayTrading#StockTrading#TechnicalAnalysis#TradeSmart#ChartSignals

2 notes

·

View notes

Text

#ForexTrading#InvestmentTips#DayTrading#ForexMarket#TechnicalAnalysis#TradingStrategies#Cryptocurrency#FinancialMarkets#ForexSignals#StockMarket#Investing101#ForexEducation#MarketAnalysis#PassiveIncome#AlgoTrading#ForexLifestyle#TradingPsychology#RiskManagement#EconomicNews#TradingMentor#ForexCommunity#ForexBlog#TradingJourney#ForexTips#TradingMindset

2 notes

·

View notes

Photo

In a neon-lit cafe, beneath cherry blossom skies, pixels of laughter dance in her eyes. Love trades whispers like golden stocks, joy surging as hearts sync to the rhythm of virtual clocks. Animated souls, bound by electric threads, find paradise in each other's heads.

2 notes

·

View notes

Text

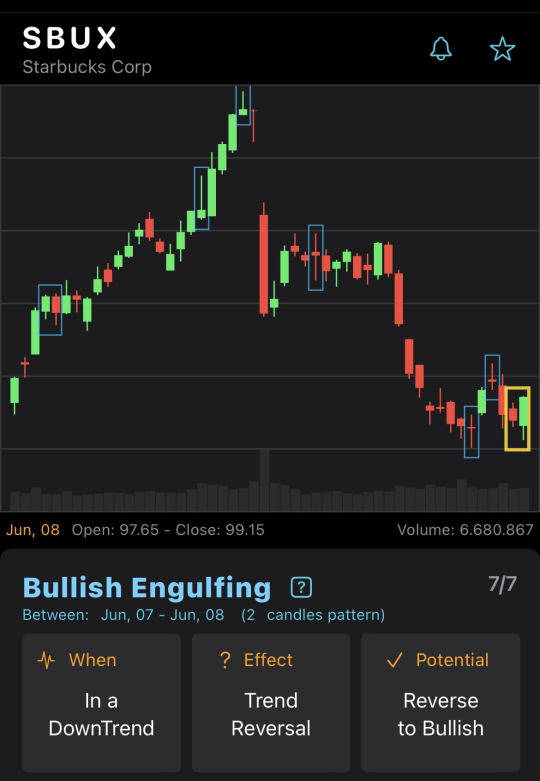

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Photo

💡For more posts like this: FOLLOW @traderdivergent - Learn my Rule-Based Strategies by clicking the link in my bio 💫 - P.s if this post hit for you please click the share icon below to add this to you story or share your thoughts on it. #forex #tradingmemes #forextrading #forextrader #daytrader #daytrading #forexeducation #financialfreedom #learntotrade #tradingpsychology #pips #entrepreneur #forexbeginners #entrepreneurship #investing #forexmemes #motovationalpost #motovationalmeme #onegoodtrade #tradingeducation #stocks #stocktrading #thedivergenttrader https://www.instagram.com/p/Crnhv9ossFk/?igshid=NGJjMDIxMWI=

#forex#tradingmemes#forextrading#forextrader#daytrader#daytrading#forexeducation#financialfreedom#learntotrade#tradingpsychology#pips#entrepreneur#forexbeginners#entrepreneurship#investing#forexmemes#motovationalpost#motovationalmeme#onegoodtrade#tradingeducation#stocks#stocktrading#thedivergenttrader

2 notes

·

View notes

Text

If Time Is Precious, Then What You Choose To Spend Your Time On Matters…..A Lot

It is vital that you embrace knowing who you are and take action to create a plan and rules to follow when trading and investing….Continue Reading Here.

5 notes

·

View notes

Text

How I Would Learn Day Trading

#traders#economy and trade#forextrading#investing#investing stocks#news economy market trade#gold price#gold trading#silver#daytrading

3 notes

·

View notes

Text

Ive been Day Trading for 5 years and Im not ashamed to admit

I’ve been Day Trading for 5 years and I’m not ashamed to admit… https://www.youtube.com/watch?v=0sTY0RJggT8 I’ve been day trading for 5 years and I’m not ashamed to admit… - I still get anxious entering a trade - I lost tens of thousands of dollars my first year. - I worked full time while learning how to trade for the first few years. - I used to be embarrassed to say I was a day trader because I either was just losing money or barely scraping by. - I used to stay with family and friends to save money - I've only had one person in my life support my dream - I've broken down crying over my habits, over losing money, and over the fear of not "making it" as a trader. - I’m still not a millionaire But after years of putting in the work and staying resilient I can safely say that I have become the trader I always envisioned and I’m still getting better and more confident every day. So if you are struggling just remember… Stay patient. Focus on the habits. Get 1% better every day. Success is closer than it seems. via TheRealTraderTrainer https://www.youtube.com/channel/UCMZjkOXOmG7MuVVJUQWRh3w February 27, 2025 at 11:28PM

#daytrading#tradingrules#strategy#tradingprofits#technicalcharts#consistentprofits#tradingedge#tradingstrategy

0 notes

Text

A Beginner’s Guide to Day Trading Crypto 🚀📊

Day trading cryptocurrency is all about making short-term trades to capitalize on market movements. It’s fast-paced, high-risk, and requires strategy, discipline, and market awareness. Whether you’re new to trading or looking to refine your skills, this guide will break down the essentials of crypto day trading.

🔹 What Is Day Trading Crypto?

Day trading is the process of buying and selling assets within the same day to profit from short-term price fluctuations. Unlike traditional markets, the crypto market runs 24/7, providing constant opportunities—but also requiring caution to avoid overtrading.

Why Trade Crypto?

✅ Volatility – Prices fluctuate frequently, offering profit potential ✅ Liquidity – Popular coins like Bitcoin (BTC) and Ethereum (ETH) have high trading volume ✅ Decentralization – Crypto operates independently of centralized financial institutions

Day trading relies heavily on technical analysis, market sentiment, and news monitoring to anticipate price movements. It’s not for everyone, but those who thrive in a fast-paced environment can find it rewarding.

💰 How Much Can a Crypto Day Trader Make?

Earnings depend on market conditions, experience, and strategy. Some traders make consistent daily profits, while others face losses.

Key Factors That Influence Profitability:

📈 Volatility – Coins like BTC and ETH have frequent price swings 🚀 Risk Management – Successful traders set stop-loss levels to control losses ⚡ Scalping Frequency – Quick, frequent trades can accumulate profits over time

Can day trading be a full-time job? Yes, but it requires dedication, experience, and a well-structured approach. Beginners should start by learning risk management and practicing with small amounts before considering it as a primary income source.

🛠 How To Start Day Trading Crypto

Getting started with crypto day trading involves research, strategy, and discipline. Follow these essential steps:

1️⃣ Choose a Time Frame

Different traders use different time frames based on their strategy: ✔ 15-minute charts – Ideal for quick trades ✔ 1-hour charts – Balances short-term analysis with broader trends ✔ 4-hour charts – Helps identify long-term patterns

2️⃣ Learn Technical Analysis

Mastering candlestick charts, moving averages, and trend lines helps traders make informed decisions. Popular indicators include: 📌 Relative Strength Index (RSI) – Identifies overbought or oversold conditions 📌 Moving Averages (MA) – Helps recognize price trends 📌 MACD (Moving Average Convergence Divergence) – Signals potential reversals

3️⃣ Implement Risk Management

🚨 Set Stop-Loss Orders – Protects against unexpected price drops 📉 Use Take-Profit Levels – Locks in gains before the market reverses 🔹 Risk Only 1-2% of Capital Per Trade – Prevents heavy losses

🔥 Is Crypto Day Trading Worth It?

Crypto day trading offers high-profit potential, but it’s not without risks.

Pros:

✅ Quick Profits – Earn gains from short-term price movements ✅ Flexibility – Trade from anywhere, anytime ✅ No Market Closures – The crypto market runs 24/7

Cons:

⚠ Requires Time and Focus – Constant monitoring is needed ⚠ High Volatility – Sudden market shifts can lead to losses ⚠ Psychological Pressure – Emotional trading can impact decision-making

For those willing to learn, practice, and manage risk effectively, day trading crypto can be a rewarding venture.

📊 Best Cryptos for Day Trading

When selecting cryptocurrencies for day trading, focus on:

🔹 High Volatility – BTC, ETH, and altcoins with frequent price swings 🔹 Liquidity – Coins with high trading volume allow for smoother transactions 🔹 Market Sentiment – News and trends influence price movements

Monitoring social media trends, exchange listings, and global events can help anticipate price action.

📈 Alternative Crypto Trading Strategies

Day trading isn’t the only way to profit from crypto. Here are other strategies traders use:

📌 Scalping – Making small, frequent trades for quick profits 📌 Swing Trading – Holding positions for several days to ride price trends 📌 Arbitrage – Buying crypto on one exchange and selling on another at a higher price 📌 HODL (Buy and Hold) – Long-term investing in promising cryptocurrencies

⚖️ Is Day Trading Crypto Legal?

Yes, crypto day trading is legal in most countries, but regulations vary.

✔ Compliance – Many governments require tax reporting on crypto gains ✔ Regulated Exchanges – Platforms like Binance, Coinbase, and Kraken follow local laws ✔ Check Local Regulations – Some countries restrict or ban crypto trading

Understanding your country’s tax laws and trading permissions ensures you trade legally and securely.

🚀 Final Thoughts on Crypto Day Trading

Crypto day trading is exciting and profitable for those who approach it strategically. Success comes from continuous learning, discipline, and risk management.

📌 Start small, practice risk control, and develop a strategy that works for you. Patience and consistency are key to long-term success.

0 notes

Text

Unlocking consistent returns: the power of forex signals

Understanding Forex Signals:

Forex signals are indicators or recommendations that provide insights into potential trading opportunities. These signals can be generated through manual analysis by experienced traders or through automated systems. The primary aim of these signals is to alert traders to potentially profitable trades based on specific criteria.

Types of Forex Signals:

Manual Signals:

Expert Analysis: Skilled and experienced traders analyze the market and provide signals based on their insights and strategies.

News-Based Signals: Events and economic indicators can significantly impact currency values. Manual signals may be based on breaking news and economic reports.

Automated Signals:

Algorithmic Trading: Using pre-programmed algorithms to analyze market conditions and execute trades automatically.

Copy Trading: Traders can automatically copy the trades of successful signal providers.

Advantages of Forex Signals:

Time Efficiency:

Forex signals save time by providing traders with pre-analyzed opportunities, eliminating the need for extensive market research.

Expert Guidance:

Access to the expertise of seasoned traders allows less experienced individuals to benefit from the knowledge of professionals.

Emotion Management:

Emotions can cloud judgment in trading. Following signals allows traders to stick to a predefined strategy without being swayed by emotions like fear or greed.

Diversification:

Signals often cover a range of currency pairs, providing diversification benefits and reducing risk.

Key Factors for Consistent Returns:

Risk Management:

Regardless of the accuracy of signals, risk management is crucial. Setting stop-loss orders and controlling the size of trades helps protect against significant losses.

Education:

Traders should understand the basics of forex trading to make informed decisions, even when using signals. Knowledge enhances the ability to assess and filter signals effectively.

Continuous Monitoring:

Markets can change rapidly. Regularly monitoring trades and adjusting strategies based on changing conditions is essential for consistent returns.

Choosing Reliable Signal Providers:

Not all signal providers are equal. Researching and choosing reputable providers with a track record of success is vital.

Challenges and Risks:

Market Conditions:

Signals may not perform well in all market conditions. Understanding the strengths and limitations of the chosen signals is crucial.

Over-Reliance:

Overreliance on signals without understanding the underlying market dynamics can lead to losses.

Scams:

The forex market is not immune to scams. Traders should be cautious and choose signal providers carefully to avoid fraudulent schemes.

Conclusion:

While forex signals offer a valuable tool for traders seeking consistent returns, they are not a guaranteed pathway to success. Successful trading requires a holistic approach that includes a blend of education, strategic thinking, and effective risk management. Traders should view signals as part of their toolkit and not as a standalone solution. When used wisely, forex signals can indeed contribute to achieving more consistent returns in the ever-evolving world of forex trading.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

17 notes

·

View notes

Photo

💡For more posts like this: FOLLOW @traderdivergent - Learn my Rule-Based Strategies by clicking the link in my bio 💫 - P.s if this post hit for you please click the share icon below to add this to you story or share your thoughts on it. #forex #tradingmemes #forextrading #forextrader #daytrader #daytrading #forexeducation #financialfreedom #learntotrade #tradingpsychology #pips #entrepreneur #forexbeginners #entrepreneurship #investing #forexmemes #motovationalpost #motovationalmeme #onegoodtrade #tradingeducation #stocks #stocktrading #thedivergenttrader https://www.instagram.com/p/CpkUGCjMtep/?igshid=NGJjMDIxMWI=

#forex#tradingmemes#forextrading#forextrader#daytrader#daytrading#forexeducation#financialfreedom#learntotrade#tradingpsychology#pips#entrepreneur#forexbeginners#entrepreneurship#investing#forexmemes#motovationalpost#motovationalmeme#onegoodtrade#tradingeducation#stocks#stocktrading#thedivergenttrader

4 notes

·

View notes