#Day Trading Forex

Explore tagged Tumblr posts

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#Leverage Credit Recovery#Yonkers Young Entrepreneurs #westchester county#hudson valley#vote#please vote#kamala harris#democratic#democracy#day trading#forex market#crypto#bitcoin#veteran#us army#activists#advocate#marginalized communities#immigrants#msnbc#Fox News

2 notes

·

View notes

Note

Sounds like you need to be put back to sleep 🤪 could I come drain your energy? Or just eat it out?

i wish i could but i have to get work done😪 !!

i just need someone between my legs while i edit content & work on other stuff🥺❤️

#that’s what kept me up so late last night & i have like 3 customs i need to get on top of;-;#and like i started day trading & made a bad forex exchange yesterday/fell asleep while trading & lost $5 so i need to make it back today;-;#and like the best time to start is around now;-;#IM SO TIRED AND DONT WANT TO LOOK AT SCREENS ANYMORE;-; !!!#anon asks#replies

4 notes

·

View notes

Text

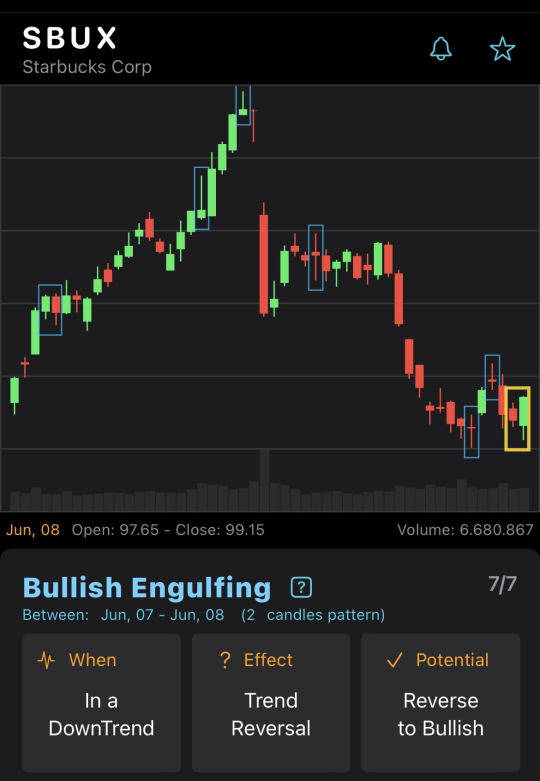

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

THE BEST MT4 SYSTEM

+656 Pips Profit with “Exynox Scalper” (+5 FRESH Screenshots)

It looks like you are missing out... Lots of Traders have already made hundreds of pips with brand new “Exynox Scalper” by Karl Dittmann.

It's easy, it’s accurate and it keeps generating amazing winning trades. Just look at these fresh screenshots: See New Screens with Open Trades

I highly recommend you get your own copy of “Exynox Scalper” and finally start making easy high profit with us: www.ExynoxScalper.com

#day trading#day trading for beginners#how to day trade#stocks#forex#crypto#how to trade stocks#learn to trade#how to trade#learn to day trade#how to day trade for beginners#day trader#how to get started day trading#day trade#how i learned to day trade#learn how to day trade#how to trade stocks for beginners#how i learned to day trade in a week#books to learn how to trade#learn how to trade#how to day trade stocks#how to trade forex in 2023

5 notes

·

View notes

Text

E-book in my bio👉👉🚀🚀

#commercial#crypto#investing#marketing#stock market#ecommerce#fyp#daytrader#forexmarket#forex online trading#day trading#trading view

6 notes

·

View notes

Text

Why Haven’t You Read My Latest SubStack Article? It’s Time to Wake the Sleeping Giant!

Dear Readers, Students, Parents, Teachers, Administrators, Philanthropists, Donors, Nonprofits, Politicians, Business Owners, and Leaders,

I have one question for all of you: Why haven’t you read my latest SubStack article, Day Trading: A New Game Changer For Youth of Color in Marginalized Communities? Or any of my other articles for that matter?

https://open.substack.com/pub/tyroneglover/p/day-trading-a-new-game-changer-for?r=1rkcyh&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

For those of you who have taken the time to read them—thank you! I’d love to hear your thoughts and opinions, though whether or not they align with mine is beside the point. It’s more important that we’ve sparked a conversation, a much-needed one about the future of our most vulnerable asset: Youth of Color in Marginalized Communities.

The truth is, this isn’t just an article; it’s a wake-up call. It’s time for us all to realize the potential we are wasting, the opportunities we are missing to empower these young people. Financial literacy, investing, and day trading are no longer luxuries—they’re necessities if we want to level the playing field for these communities.

But let’s face it—our system, as it stands, has failed them. We’ve seen leaders who could have been champions for change, but instead, they chose selfishness, arrogance, and lies over the well-being of the people they swore to serve. Donald Trump, with all the potential to lead, chose instead to destroy, to divide, to betray the trust of the very people who believed in him. On the other hand, I have hope in Vice President Kamala Harris—someone I believe has the heart of a patriot and the courage to lead for all Americans.

This upcoming election presents us with a stark contrast: one path that promises division and the erosion of democracy, and another that stands for unity and genuine service to We The People. Our choice has never been clearer. To those who still believe that Trump offers something worthwhile, I ask you: Is your vote truly worth the betrayal of your daughters, your mothers, your sisters, and your future?

To my fellow Americans, to our immigrant brothers and sisters who have built this nation alongside slaves who toiled for free while others profited: you are not the reason for our country’s failures. The blame lies squarely on the shoulders of those who have exploited you, who have spread lies, and profited from division. It is time for those who have manipulated and deceived to retire into oblivion, where their names will be spoken no more.

So, I urge you—read, share, follow, engage, and comment on this article and the conversations we need to have. It’s time we move forward as a nation. Stay safe, travel well, and most importantly, vote like democracy depends on it—because this time, it truly does.

In solidarity,

Tyrone Glover

CEO Leverage Credit Recovery |

Founder Yonkers Young Entrepreneurs | Economic Development Committee Chair, NAACP Yonkers Branch | Advocate | Activist | Educator

#yonkers#newyork#investors#rule of law#democracy#day trading#forex#crypto#bitcoin#ethereum#ethics#kamala harris#obama#clintons#biden#democratic#trump#republicans#maga#Fox News#msnbc#congress#supreme Courts#senate#house of Representatives#vote blue#please vote#leverage credit recovery#Yonkers Young Entrepreneurs#new york

2 notes

·

View notes

Text

Surviving the Ups and Downs: My Toughest Journey to Thriving in Trading Without Losing My Mind

Let's be honest, trading is more than just analyzing data. It's a challenging journey, both emotionally and mentally. Some days you feel on top of the world, while others you question whether it's all worth it. I've been there more times than I can count, and it is not easy. In fact, through all of the ups and downs, I've learned that it's not the market that defines your success, but how you manage your thinking.

Over time, I've learned how to navigate the chaotic world of trading without losing my mind.

Emotional Rollercoaster

A Trader's Reality:

Anyone who has ever traded understands that there will always be ups and downs. At first, I assumed it was all about profitable trading and watching my wealth increase. But I immediately discovered there was a lot more to it. The market, like life, is unpredictable, and it may be a difficult emotional experience at times.

Why Emotional Control Matters:

One of the most difficult lessons I had to learn was that trading involves more than simply the technical aspects; it is also about mental power. You could have the best strategy, but if you can't control your emotions, it won't matter in the end.

Psychological impact:

The highs feel fantastic, but the lows may be terrible. The truth is that many traders fail not because they don't understand what they're doing, but because they don't know how to deal with the emotional toll.

Mastering the Mindset:

What distinguishes great traders from the rest is their ability to remain calm, stick to their strategy, and avoid making rash judgments. Honestly, this is what distinguishes you over time.

My Toughest Moments: Turning Struggles into Success

There were days when I wanted to give up. It can be exhausting to watch your investments fluctuate wildly, sometimes up and sometimes down. However, I've come to realize that this is something that every trader faces.

The idea is not to avoid losses; rather, to bounce back stronger each time.💪

Overcoming Fear of Loss

Losses are part of the process:

When I originally started, I considered every loss a failure. But now I understand that losses are unavoidable, and more importantly, they provide significant learning opportunities. Actually, long term successful traders are those that accept losses, learn from them, and move on.

Don't let emotions influence your actions:

The fear of losing money can cloud your judgment and lead you to make reckless decisions. It took me a long time to truly understand this, but once I did, it completely altered my approach. Staying calm, even while you're losing, can mean the difference between success and failure.

"We're Building This Together"

Success is more meaningful when we achieve it together, with each shared story and learned lesson. This is more than just trading knowledge it’s about building a supportive community where we can openly share advice, experiences, and encouragement.

Your story could truly encourage someone else who is struggling on their journey!

Remember, each of you brings unique value and respect to this community, and I’m really grateful to have you here. Let's keep learning, growing, and achieving success together. 🤝

Your shared experiences, with all their ups and downs, encourage us all.

Together We're not just a community; we're a family, always standing by each other.

Stay blessed

#stock market#cryptocurrency#financialfreedom#learntotrade#trading tips#hardworkpaysoff#stock trading#tradingskills#forex traders#trading success#traderlife#trading strategies#financialgrowth#tradingmotivation#day trading#trading psychology#investmentstrategies#entreprenuership#stockmarkettips#tradesmart#risk management#passive income

1 note

·

View note

Text

ℑ𝔣 𝔞 𝔪𝔞𝔫 𝔨𝔫𝔬𝔴𝔰 𝔪𝔬𝔯𝔢 𝔱𝔥𝔞𝔫 𝔬𝔱𝔥𝔢𝔯𝔰, 𝔥𝔢 𝔟𝔢𝔠𝔬𝔪𝔢𝔰 𝔩𝔬𝔫𝔢𝔩𝔶..

#model#dark aesthetic#entrepreneur#masculine#photography#masked men#aesthetic#finance#economy#forex#forex market#day trading

1 note

·

View note

Text

The Top Reasons NVSTly Is the Leading Social Investing App in 2024

In the rapidly evolving world of social investing, NVSTly has emerged as a groundbreaking platform, setting new standards with its innovative features and unparalleled user experience. Unlike other apps in the market, NVSTly is not just about trading but about creating a comprehensive and engaging social investing ecosystem. Here's an in-depth look at why NVSTly stands out as the best social investing app available today.

Completely Free to Use

One of the most compelling aspects of NVSTly is its commitment to accessibility. Unlike many other social investing platforms that impose subscription fees or hide essential features behind a paywall, NVSTly is completely free to use. This approach democratizes access to powerful trading tools and insights, making it possible for everyone—from novice investors to seasoned traders—to benefit from the platform's offerings without financial barriers.

Multi-Platform Availability

NVSTly understands that investors need flexibility in how they access their trading platforms. That's why it is available both on the web and on mobile devices (Google Play and iOS). While many competitors focus solely on mobile apps, NVSTly ensures that users can seamlessly transition between devices, providing a consistent and efficient trading experience whether you're at home on your computer or on the go with your smartphone.

Unique Discord Integration

In a first-of-its-kind feature, NVSTly offers full integration with Discord through a unique bot. This integration allows users to perform almost all functions available on the NVSTly app directly within Discord. The bot enables users to track, share, and discuss trades in real-time, fostering a vibrant community of traders. This seamless integration with Discord is a game-changer, offering unmatched convenience and engagement for users who are active on this popular communication platform.

Real-Time Trade Tracking and Insights

NVSTly excels in providing real-time tracking and insights for trades. Users can track, share, or copy trades with extensive insights on every position. Each trade is accompanied by a detailed Trade Insight UI, which shows all events related to the position—such as open, average, trim or partial closes, and exit—along with real-time asset data. The unique POV Chart marks the candlesticks on when the trader took actions, offering a clear and comprehensive view of trading strategies.

Comprehensive Market Support

The app supports a wide range of markets, including stocks, options, and over 25 cryptocurrency exchanges, with futures and forex market support on the horizon. This extensive market coverage ensures that NVSTly caters to a diverse group of traders, providing opportunities across various asset classes and trading environments.

Global Trades Feed and Leaderboard

NVSTly's global trades feed is a dynamic feature that showcases all trades submitted by traders in real-time. Users can filter this feed to view trades from those they follow, top trades, or trades involving specific tickers. Additionally, the global leaderboard ranks top traders across different markets, allowing users to identify and follow successful traders, gaining insights from their strategies and performance.

Real-Time Notifications and Automated Sharing

Staying updated on trading activity is crucial, and NVSTly delivers with real-time notifications. Users can follow any trader and receive instant updates on their trades. Furthermore, NVSTly offers automated signals or auto trade sharing to social media and Discord. When a trade is submitted, it can be instantaneously shared on X/Twitter or Discord, amplifying the reach and impact of traders' activities.

Brokerage Integration

To streamline the trading experience, NVSTly offers brokerage integration. This feature automates the tracking and sharing of trades by automatically submitting them to the app when executed within the broker. Cryptocurrency exchange integration is also in the works, which will further enhance the platform's functionality and user convenience.

Future Plans: 1-Click Copy Trading

Looking ahead, NVSTly plans to introduce 1-click copy trading, a feature that will allow users to replicate the trades of top-performing traders with a single click. This future enhancement underscores NVSTly's commitment to continuous improvement and innovation, aiming to provide users with even more powerful and user-friendly tools.

Trader Dashboards

NVSTly offers detailed trader dashboards that display trade history and in-depth performance stats, visualized through intuitive and interactive graphs. Metrics such as win rate, total gain, average gain/loss/return, highest winning trade, and short vs long ratio are presented in an easy-to-understand format. These dashboards provide invaluable insights, helping traders analyze their performance and refine their strategies. By transforming raw data into actionable intelligence, the use of graphs enhances the overall trading experience

Conclusion

NVSTly's blend of innovative features, user-friendly design, and commitment to accessibility makes it the best social investing app available today. Its multi-platform availability, unique Discord integration, real-time trade tracking, comprehensive market support, and future-forward enhancements like 1-click copy trading position NVSTly as a leader in the social investing space. Whether you're a seasoned trader or just starting, NVSTly offers the tools and community support you need to succeed in the dynamic world of investing. Join NVSTly today and experience the future of social investing.

#crypto#cryptocurrency#fintech#finance#forex#futures#investing#investors#stock market#stocks#financial#social media#social networks#cryptocurrencies#day trading

0 notes

Text

💡✨AI Trading Bot Magic: Turn $50 into $95,560 on Pocket Option

#aitradingbot #pocketoption #tradingbot #passiveincome #financialfreedom #forex #binaryoptions #crypto #daytrading #swingtrading #technicalanalysis #fundamentalanalysis #riskmanagement #moneymanagement #financialeducation #onlinetrading #automatedtrading algorithmictrading

🔔Subscribe & 👍Like💖 for new VIDEOS📼Every Day!👇

🔗https://youtu.be/O0PnWlmfffc

🔗https://cos.tv/videos/play/56861213153072128

dailymotion

#AI Trading Bot#Pocket Option#Trading Bot#Passive Income#Financial Freedom#Forex Trading#Binary Options#Crypto Trading#Day Trading

0 notes

Text

Forex Trading Methods Amid Heightened Market Volatility

Geopolitical and Economic Drivers

As we approach a period of significant market volatility, traders should be prepared for potential lag or differences in order placements by brokers, with the Presidential Elections anticipated to impact the market aggressively.

This week, major data releases include the RBA Rate Statement, U.S. ISM Services PMI, and critical employment data for the Kiwi on Wednesday. Thursday will bring the Pound’s Monetary Policy Reports and U.S. Unemployment Claims, while Friday will feature the FED’s rate cut announcement and CAD employment reports.

Net shorts on U.S. Treasury two-year note futures, signaling bets on price declines from both leveraged funds and non-commercial accounts, reached record highs last week, according to Friday’s Commodity Futures Trading Commission data. The US10Y yield climbed to 4.386% as of Saturday at 1 AM. Additionally, US30 and US500 indices are trending lower ahead of the elections.

Further developments in Ukraine and West Asia will influence price strength and market expectations, impacting Oil and Metals movements significantly. These factors are crucial in shaping market dynamics this week.

Market Analysis

GOLD Gold maintains a bullish outlook, with RSI and MACD indicating continued rise. Price action shows a failure to reach the previous swing low, suggesting strong bullish potential. Election uncertainties and potential ceasefire in West Asia further support GOLD’s investment growth.

SILVER Silver breached its previous swing low, shifting momentum from buying to selling. Current chart conditions indicate a potential shift, with RSI and MACD suggesting a bullish run. Price hovers at a key support level of 32.518, aligning with a bullish outlook supported by fundamental factors.

DXY The Dollar fell ahead of the elections and FED’s rate cut announcements, breaking its previous swing low and aligning with bearish momentum indicated by the MACD and RSI. Further selling is anticipated as markets opened with a gap and 10-Year Yields continue to rise.

GBPUSD The Pound rebounded following a gap due to Dollar weakness, though price action has yet to confirm a momentum shift. The MACD and RSI signal a recent rise after crossing at oversold levels. If the price surpasses the previous swing high and breaks above 1.29966, a bullish trend could unfold, especially with the upcoming FED rate cut announcement.

AUDUSD The Aussie Dollar shifted to bullish momentum after breaking the previous swing high. MACD cross and RSI divergence suggest continued bullish potential following the Dollar's gap weakness. However, a correction may occur before any substantial rise due to gaps in order placement. Current price movement suggests increased buying potential.

NZDUSD The Kiwi has yet to breach its previous swing high. MACD cross upward and RSI show divergence favoring a buy movement, although the recent gap suggests a fill-in order similar to the AUD. Current price action does not yet indicate a market shift, as the previous swing high has yet to be broken.

EURUSD The Euro followed expected trends with continued buying momentum driven by diminished rate-cut expectations for the December ECB meeting. RSI divergence and MACD’s recent cross further support this bullish momentum.

USDJPY The Yen regained strength amid Dollar weakness, with the MACD crossing and RSI divergence indicating recovery. Current market conditions suggest the Dollar’s short-term selling will continue until Friday’s announcements.

USDCHF The Franc shows sustained consolidation. Recent price moves suggest a continuation to the downside, supported by the RSI and MACD, although confirmation awaits a break below the previous swing low.

USDCAD The CAD followed previous expectations in recent trading. Market opened with bearish momentum, evidenced by the MACD cross and RSI divergence. As long as the price remains above the prior swing low, buying momentum may persist. This is reinforced by fundamentals, with oil prices steady amid rising tensions in West Asia.

Refining Forex Trading Methods for Volatility

During heightened market volatility, robust forex trading methods are essential. Implementing forex scalping strategies can help capitalize on short-term price movements.

Understanding forex market trends and utilizing reliable forex signal trading tools are essential for informed decision-making. Effective forex risk control measures can mitigate potential losses, enhancing overall trading performance. By staying informed and employing sound strategies, traders can navigate unpredictable markets effectively.

#Forex scalping techniques#Day trading strategies in forex#Forex signal strategies#Effective investment strategies in forex#Understanding forex market trends

0 notes

Text

Trading Indicators: A Comprehensive Guide

In the trading world, the excitement to gain potential profit and the fear of loss can overpower the trader's judgment, resulting in poor trading conditions. Fortunately, understanding the intricacies of the market and preparing effective strategies using trading indicators can empower them to make more informed decisions. In this comprehensive guide, we will delve into the different types of trading indicators, their applications, and how traders can incorporate them into their trading toolkit.

What Are Trading Indicators?

Trading indicators are mathematical calculations based on the price, volume, or open interest of a security. These calculations provide valuable insights to traders, allowing them to make more informed decisions. With the help of these indicators, traders can interpret market trends, identify potential entry and exit points, and check market sentiment.

Types of Trading Indicators

There are different types of trading indicators that fall into several categories. Each one of them serves a distinct purpose. Trading platforms like the mt4 trading platform offer a range of built-in indicators that can help traders to understand the current market trends. These are explained below-

Trend Indicators

These are the indicators designed to identify the direction of the market. They help traders to determine whether a market is bullish (upward trend), bearish (downward trend) or moving sideways (consolidation). Some of the popular trend indicators include:

Moving Averages (MA): These smooth out price data to create a trend-following indicator. It helps traders identify potential support and resistance levels. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are the two most common types of moving averages.

Average Directional Index (ADX): It measures the strength of a trend, regardless of its direction. A rising ADX indicates a strong trend, while a falling ADX indicates a weak trend.

Momentum Indicators

Momentum indicators help traders check the speed and strength of price movements. They can indicate potential reversals and confirm trends. These indicators are essential for forex day trading.

The critical momentum indicators include:

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, typically on a scale from 0 to 100. An RSI above 70 indicates an overbought condition, while an RSI below 30 suggests an oversold condition.

Stochastic Oscillator: This indicator compares a security's closing price to its price range over a specific period. Values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions.

Volatility Indicators

Volatility indicators measure the rate of price fluctuations in a security. High volatility may indicate potential opportunities to trade, while low volatility may signal a lack of interest. Some of the notable volatility indicators include the following:

Bollinger Bands: These consist of a middle band (SMA) and two outer bands representing standard deviations away from the SMA. When prices approach the outer bands, it can indicate overbought or oversold conditions.

Average True Range (ATR): This indicator measures market volatility by calculating the average range between the high and low prices over a specified period. A rising ATR suggests increasing volatility, while a falling ATR indicates decreasing volatility.

Volume Indicators

Volume indicators are trading indicators that provide insights into the strength or weakness of a price move by analyzing the trading volume. A higher volume often confirms the validity of a price movement, while a lower trading volume may suggest uncertainty.

The key volume indicators that a trader must use while analysing the market include:

On-Balance Volume (OBV): This indicator uses volume flow to predict changes in stock price. An increasing OBV suggests that buyers are willing to step in, while a decreasing OBV indicates that sellers are taking control.

Chaikin Money Flow (CMF): The CMF combines price and volume to show the buying and selling pressure over a specific period. If a CMF is positive, it indicates buying pressure, while a negative CMF indicates selling pressure.

How to use Trading Indicators effectively?

To incorporate trading indicators into your forex trading strategies, you need to carefully consider and practice. Here are some tips to help you use them effectively:

Combine Indicators: It is important to combine different indicators to analyse the market condition. Relying on a single indicator may lead to misleading signals. Thus, use a combination of indicators from different categories to confirm your analysis. For instance, you can pair a trend indicator with a momentum indicator, as it can provide a clearer picture of market conditions.

Understand the Market Context: Do not use the trading indicators in isolation. Always consider the broader market context, which includes news events, economic data, and geopolitical developments. All these factors can significantly influence market behaviour and, thus, should be considered important.

Backtest Your Strategy: Before implementing your strategy in live trading, it is important to backtest it using historical data. Backtesting the strategy will help you understand how your chosen indicators perform under various market conditions. Based on the observation, you can refine your approach.

Practice Risk Management: No matter how reliable your indicators may seem, it is always essential to implement risk management strategies. Set stop-loss and take-profit levels to protect your capital and minimize the impact of potential losses.

Stay Disciplined: Trading can evoke strong emotions, especially when you are a beginner. Thus, it is one of the necessities to maintain discipline. Create a personalised trading plan, stick with it, and trust your analysis, even when faced with market volatility.

Conclusion

To conclude, trading indicators can be a powerful tool in your trading journey. It provides insights that can help traders navigate the complexities of the market. By understanding the various types of indicators and incorporating them into a well-rounded strategy, traders can boost their confidence as well as improve their decision-making.

0 notes

Video

youtube

Happy Birth Day Lavish Sir BotBro CEO Yorker FX Forex Trading | TLC Coin...

#youtube#Happy Birth Day Lavish Sir BotBro CEO Yorker FX Forex Trading | TLC Coin |Real Or Fake Business Plan

0 notes

Text

From Analysis to Action: Combining Technical and Fundamental Approaches in Forex Trading

#Forex Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Currency Trading#Forex Market#Investment Strategies#Market Analysis#Day Trading#Swing Trading#Forex Education#Online Trading#Global Economics#Economic Indicators#Risk Management#Forex Signals#Trading Tips#Trading Psychology#Market Trends#Forex News#Foreign Exchange#Financial Markets#Trade Setup#Forex Charts#Forex Community#Trading Systems#AI in Trading#Forex Forecasting#Wealth Building#PipInfuse

1 note

·

View note

Video

tumblr

Trade Running Inside EURUSD POSITIVE PROFITS FOREX

1 note

·

View note