#DailyFX

Explore tagged Tumblr posts

Text

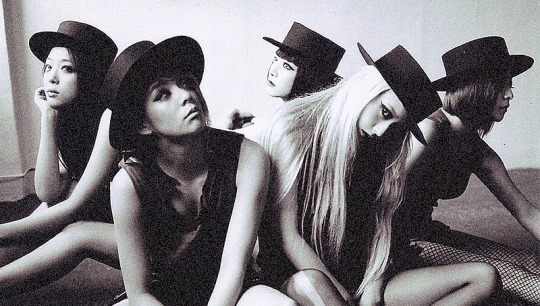

Happy 15th anniversary to f(x) ladies!!‧₊˚❀༉‧₊˚.

#f(x)#victoria#sulli#amber#krystal#choijnri#jungsoojung#parksunyoung#songqian#amberliu#kpopggsedit#femaleidolsedit#femaleidols#femaleidol#idolady#smsource#dailyfx#fxedit#femadolsnet#femadolsedit#femaidolsedit#userpcultures#popularcultures

284 notes

·

View notes

Text

#forex education#learn to trade#forex#forex trading#learn forex#trader#babypips#investopedia#tradingview#dailyfx#forex factory

0 notes

Text

Top 10 Accurate Forex Signals Service Providers for Portugal.

Forex trading in Portugal has seen rapid growth in recent years. With increasing interest from beginner and experienced traders alike, the demand for reliable forex signal providers has skyrocketed. Accurate forex signals are essential for successful trading, offering traders insights on when to enter and exit trades to maximize profits. Below, we present the top 10 forex signal providers for Portugal, helping you choose the best platform to guide your trading journey.

1. Forex Bank Liquidity

Forex Bank Liquidity takes the top spot for its exceptional track record in providing accurate forex signals. Known for its 95%+ accuracy rate, this platform offers real-time signals covering various currency pairs, commodities, and indices. Traders in Portugal benefit from:

24/7 signals on major pairs and gold.

A dedicated Telegram community: Join Here.

Expert insights from professional traders.

Tailored account management services.

With Forex Bank Liquidity, traders can confidently navigate market volatility, making it the premier choice for both beginners and seasoned traders.

2. FXStreet Signals

FXStreet is a well-known platform that provides free and premium forex signals. Their services include:

Real-time trading alerts.

Insights backed by technical analysis.

A user-friendly interface suitable for traders in Portugal.

3. Learn2Trade

Learn2Trade is popular among forex traders for its focus on beginner-friendly forex education combined with accurate signals. Key features:

Free Telegram forex signals.

High success rates for GBP/USD, EUR/USD, and gold.

Access to paid premium services with higher frequency signals.

4. MyForexBook

A trusted platform that offers forex signals along with tools for market analysis. Their USP includes:

Integration with MetaTrader 4 (MT4) and MT5 platforms.

Alerts tailored for European time zones, perfect for traders in Portugal.

5. ZuluTrade

ZuluTrade is renowned for its copy-trading services. It allows Portuguese traders to follow successful signal providers and automate their trades. Benefits include:

A leaderboard ranking top-performing signal providers.

Customizable risk management settings.

6. ForexGDP

ForexGDP focuses on high-quality signals rather than quantity. Their service offers:

Fewer but highly accurate signals daily.

Targeted insights on major pairs like EUR/USD and AUD/USD.

7. Signal Start

Signal Start is ideal for those who want signal management integrated with their trading accounts. Features include:

Compatibility with most brokers in Portugal.

Automated execution of signals.

8. Pipchasers

Popular for its beginner-friendly approach, Pipchasers focuses on educating traders alongside providing accurate signals. Portuguese traders gain access to:

A vibrant trading community.

Video tutorials and live trading sessions.

9. MQL5 Signals

MQL5 is a marketplace for forex signals accessible through the MetaTrader platform. Features include:

A wide range of signal providers to choose from.

Transparent performance statistics.

10. DailyFX Plus

DailyFX Plus, a part of IG Group, offers premium signals and technical analysis. Highlights include:

Insights tailored for European traders.

Frequent updates on market trends and opportunities.

Why Forex Signals Are Essential for Traders in Portugal

Forex signals serve as a roadmap for navigating the complexities of the market. Accurate signals provide key benefits:

Time-saving: They eliminate the need for extensive market research.

Risk management: Signals come with predefined entry, stop-loss, and take-profit levels.

Enhanced profitability: Leveraging expert knowledge increases the chances of successful trades.

Choosing the Best Forex Signal Provider

When selecting a forex signal provider, traders should consider:

Accuracy Rate: High success rates are crucial for profitable trading.

Transparency: Providers should disclose their past performance.

Ease of Use: Signals must be simple to understand and execute.

Support: Look for platforms offering excellent customer service.

Forex Bank Liquidity stands out in these aspects, making it a top choice for traders in Portugal.

Conclusion

For traders in Portugal, having a reliable forex signal provider is the key to success in the forex market. Platforms like Forex Bank Liquidity offer unparalleled accuracy, expert guidance, and community support, ensuring traders are well-equipped to make informed decisions. Whether you’re a beginner or an experienced trader, choosing the right signal provider can transform your trading journey, unlocking consistent profits and financial freedom.

#forex education#forexsignals#forex expert advisor#forex#forex robot#bankliquidity#forex market#forextrading#forexbankliquidity#digital marketing

0 notes

Text

Hedge Like a Pro Using PMI: Secret Strategies Most Traders Miss Finding the Signal in the Noise of PMI and Hedging Forex trading isn't all glamorous sunsets over spreadsheets and yacht-lounging moments of euphoria. It can feel more like trying to predict the future by staring at tea leaves—or worse, at your poor dog's eyes while you awkwardly ask if you should go long or short. One tool, though, that can actually help you decode the future with a fair bit of finesse is the PMI (Purchasing Managers Index). And if you're already thinking, "Another boring index?" then sit tight, because this might just be the secret sauce to leveling up your hedging strategies without inadvertently re-enacting a bad sitcom plot—the one where the protagonist hits the wrong button and spirals into financial catastrophe. (We've all been there—metaphorically at least.) What Is PMI and Why Should You Care About It? You might think that the PMI is just another economic statistic that nerdy economists parade around in their data-laden reports, but let me let you in on a little secret: the PMI is basically a crystal ball for economic health. This little number—or, let’s say, big number—is actually the aggregated view of purchasing managers. These are the folks on the frontlines of supply chains, who tend to have a pretty good idea about what’s up ahead. They know whether orders are rolling in or factories are slowing down. Why does that matter to you, a savvy Forex trader? Because fluctuations in the PMI often predict currency movements—giving you a leg up in executing ninja-level hedging strategies before other traders even realize they should be concerned. Using PMI to Time Your Hedging Strategy Let’s break down why PMI is a powerful predictive tool in hedging your forex trades. The PMI, which gauges the health of the manufacturing sector, can give you an early warning if the economy is expanding or contracting. Think of it as checking the GPS for traffic before a big road trip. You don’t want to get stuck halfway because the market suddenly flipped, and you’re sitting there with open positions—panicking. No, thanks. So, here’s the trick: Use PMI trends to time when to hedge. If PMI numbers start to drop below 50, which indicates a contraction, you can hedge against possible declines in the associated currency. For example, if the Eurozone's PMI looks bleak, consider positioning for a weaker Euro. This ensures that any currency exposure that might be going south gets effectively covered—it’s like buying insurance before a storm instead of during one. Oh, and as a side note—don’t confuse hedging with trying to buy a pair of those elusive "sale" shoes that you’ll "probably need" someday but never end up wearing. The goal here is to actually cover potential losses, not hoard currency pairs for a rainy day. Expert Insight: According to James Stanley, a senior strategist at DailyFX, "The PMI serves as one of the foremost indicators of an economy's health. By acting on PMI trends, traders can proactively manage currency exposure and stay ahead of major market moves." Pro-level insight: it’s like anticipating the next scene in a thriller movie—you’re already moving to the next step when everyone else is still holding their breath. How to Hedge Like a Fortune Teller (With Data) If you’re thinking, “Okay, I see that PMI tells me what’s happening, but how do I make an actual move?” Great question. Here’s a step-by-step guide on turning that PMI knowledge into your hedging strategy. 1. Identify Key Countries and Correlating Currencies: Look at the PMI of the major economies that correlate to the currency pairs you’re interested in. For example, if you trade USD/JPY, pay attention to both US and Japanese PMIs. 2. Recognize Market Reactions to PMI Announcements: PMI announcements often lead to increased volatility. Be ready to hedge your positions right after these releases, once you have a grasp of the market direction—which is easier than trying to make sense of those Shakespearean texts in high school, I promise. 3. Use Stop Loss Orders Wisely: Setting up stop losses might sound like what your friend’s grandma keeps telling everyone at family dinners ("Put a stop on those losses, honey!"), but it’s true. PMIs can cause quick reactions, so give yourself room for the market to breathe without getting caught in "spike whiplash." The Hidden Patterns That Drive the Market Here’s where we dive into what makes the PMI truly powerful. See, PMIs are monthly. They’re consistent, like that friend who always insists you need another round at the bar when you’re already tipsy (let’s call them... convincing). This consistency means you can identify hidden patterns. Let me illustrate: Next-Level Pro Tip: Consider tracking PMI over multiple months for three key signals: - Above 50 but Dropping: This usually signals that the economy is slowing down but not yet in contraction. You might hedge a portion of your long positions, anticipating a minor reversal. - Below 50 and Still Dropping: The market’s going to look a lot like a meme-stock crash—think carefully about closing long positions entirely and focus on hedging risks. - Crossing Above 50: Ah, the sweet moment. When PMI climbs above 50, hedge any short positions and think about going long—a recovery is in play. Emerging Trends in PMI-Driven Hedging Strategies Remember that markets are also deeply connected. With China leading PMI growth, it’s safe to expect commodity currencies like AUD and NZD to make a similar rise. Unheard-of insight: If you see the Chinese PMI leading the way, start prepping your Aussie Dollar hedge for that uptick—it’s like knowing the song that’s going to be a hit before it even hits the radio. Why Most Traders Get It Wrong (And How You Can Avoid It) Most traders see PMI data and think, "That’s nice." They either disregard it or forget it can drive significant market momentum. It’s like walking past the treasure chest in a video game without even opening it. The trick is to connect PMI with market sentiment. Let me throw in a quick anecdote: One time, I ignored PMI news because I thought, "It's just one report." Well, the market didn’t care about my negligence, and suddenly EUR/USD was doing a Swan Lake dance, and my positions got hit. Hard. Lesson learned? PMI isn’t just a number—it’s a whisper from the economy, a nudge to let you know what’s coming. The Forgotten Strategy That Outsmarted the Pros Want to know a ninja-level hedging move that’s both sneaky and effective? Here it is: pair PMI announcements with market positioning data. Commit to hedging positions if the PMI moves contrary to general market sentiment. For instance, if PMI drops, but speculative traders have their largest long positions in months—hedge. The crowd is about to learn a harsh lesson in contrarianism. Pro Tip: Pairing PMI data with Commitment of Traders (COT) reports gives you an insight into what the smart money might be doing. This is how you leverage the PMI to really stack the odds in your favor. Applying Ninja PMI Hedging Tactics Using PMI as a signal to inform your hedging strategy allows you to navigate Forex markets like a pro. You’ll have better insight into which way the wind is blowing and how to cover yourself if things go off-script—no more sweaty palms at the trading screen (at least not for that reason). What to Remember? - PMI is your advance traffic warning for currency movements. - Hedging isn’t about avoiding losses entirely; it’s about minimizing downside risks and maximizing the odds. - Pair PMI with market sentiment data to outsmart the herd. So, what are you waiting for? Start using these tactics to hedge like a Fortune 500 purchasing manager with a crystal ball. And remember—no one ever said Forex trading was easy, but with PMI as your secret weapon, it just got a whole lot more manageable. Invite to Action: If you want exclusive insights into economic trends and hands-on hedging strategies, join our StarseedFX community today. Visit StarseedFX Community to get daily alerts, live trading insights, and more. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Trading forex for a living from the comfort of your home is what many online investors aspire to do. Learn and adapt to the market and watch those profits soar.There are as many naysayers as there are 'fire your boss there is money to be made' kind of people in the forex trading advice arena. But with daily trading volumes of over $5.3 trillion, anyone who has heard of this trade wants a piece of the pie.The foreign exchange market also known as forex trading is where the big money boys come to play. Why? It is the largest financial market in the world immune to manipulation and incredibly liquid in nature. These characteristics are what has made it a gold mine for Steve Cohen, George Soros, and their ilk.Can You Make A Living Off Of FX Trading?Is trading forex for a living a pipe dream or is there a forex trading holy grail that can lead you to riches? Can you possibly obtain financial freedom and escape the rat race through forex trading? To begin with, learn an important truth from the naysayers " the market will hurt you if you give it the opportunity."From the statistics, most forex traders do lose their cash. One of the pioneers of the retail forex market, FXCM features a scary disclaimer on their platform. They warn that 79.8% of their retail accounts end up in the red while trading. This may not make much sense in an era where trading forex for a living has generated so much interest.The ugly truth is that more traders tend to lose more cash on their losing trades than they make on their winning trades. Nasdaq actually warns that within the first six months of trading, 90% of day traders will have lost their initial investments. Grim statistics aren't they? Yes, they are but chew on this other statistic. According to DailyFX's research 50% of forex trades close in again. That's profit Y'all! There are pitfalls, yes, but there is an opportunity to make some income from forex trading. Basic Rules Of Trading Forex For A LivingDrop The Idea That This Is A Get-Rich-Quick Scheme. Far from it. It is a very unforgiving market. Look at it as an investment. Set your targets then get to a thorough analysis of the markets while giving yourself time to meet those targets.Study Your Risk Tolerance.How much market volatility can you tolerate? Forex trading is very volatile, and that coupled with the availability of leverage, your accounts can empty in a flash. Understanding your level of risk tolerance will assist you to come up with a long-term winning strategy. Be Careful When SpeculatingDailyFX’s senior strategist David Rodriguez says that human psychology is often the cause of the huge losses experienced by traders. Most traders are easily excited over wins and rely too much on their intuition while executing trades. You can only trust your gut instinct after completed the four fundamental analyses listed here in the IDDA.Get SchooledWhile it is not rocket science, trading forex for a living is a science of sorts. Get a thorough education in the trade before jumping off the deep end.

0 notes

Text

عنوان: سایت فارکس: راهنمای کامل استفاده و منابع مفید برای معاملهگران

سایت فارکس یک منبع مهم برای معاملهگران بازار ارزهای خارجی (فارکس) است که اطلاعات و ابزارهای متنوعی را برای تحلیل بازار، انجام معاملات و بهبود دانش و مهارتهای معاملاتی فراهم میکند. بسیاری از سایتهای مرتبط با فارکس به معاملهگران در جهت یادگیری استراتژیهای معاملاتی، تحلیل تکنیکال و بنیادی، و دسترسی به اخبار و دادههای لحظهای بازار کمک میکنند. انتخاب یک سایت مناسب میتواند تأثیر زیادی بر موفقیت شما در این بازار پیچیده داشته باشد.

1. اخبار و تحلیلهای بازار: یکی از اصلیترین مزایای استفاده از سایتهای فارکس، دسترسی به اخبار و تحلیلهای بهروز است. معاملهگران حرفهای به دنبال اطلاعاتی هستند که بتواند به آنها در پیشبینی حرکتهای آینده بازار کمک کند. سایتهای معتبر فارکس معمولاً تحلیلهای تکنیکال و بنیادی روزانه، هفتگی و ماهانه را ارائه میدهند. این تحلیلها به معاملهگران کمک میکنند تا تصمیمات آگاهانهتری در بازار بگیرند. برخی از معروفترین سایتها در این زمینه شامل “Forex Factory”، “Investing.com” و “DailyFX” هستند.

2. منابع آموزشی: سایتهای فارکس نه تنها برای معاملهگران حرفهای، بلکه برای مبتدیان نیز منابع آموزشی متنوعی فراهم میکنند. این منابع شامل آموزشهای ویدیویی، مقالات، کتابها و وبینارهای زنده است که به کاربران در یادگیری اصول پایهای فارکس، مدیریت ریسک، و استراتژیهای معاملاتی کمک میکنند. وبسایتهای معتبری مانند “Babypips” آموزشهای جامع و مرحله به مرحلهای را برای تازهکاران در بازار فارکس ارائه میدهند.

3. ابزارهای معاملاتی: یکی دیگر از ��یژگیهای مهم سایتهای فارکس، ارائه ابزارهای معاملاتی مانند نمودارهای قیمت، شاخصهای تکنیکال، و ماشینحسابهای مختلف برای محاسبه ریسک و حجم معاملات است. این ابزارها به معاملهگران کمک میکنند تا بتوانند بازار را به صورت دقیقتر تحلیل کنند و بهترین نقاط ورود و خروج را شناسایی کنند. برخی سایتها همچنین نسخههای دمو از پلتفرمهای معاملاتی را در اختیار کاربران قرار میدهند تا بتوانند بدون ریسک، مهارتهای خود را آزمایش کنند.

4. مقایسه و بررسی بروکرها: سایتهای فارکس اطلاعاتی درباره بروکرهای مختلف فارکس ارائه میدهند و کاربران میتوانند ویژگیهای هر بروکر را با یکدیگر مقایسه کنند. این ویژگی به معاملهگران کمک میکند تا بروکری را انتخاب کنند که بهترین شرایط معاملاتی را متناسب با نیازهایشان فراهم میکند. اطلاعاتی مانند اسپرد، کمیسیون، سرعت اجرای سفارشها و میزان اهرم در این بخش بررسی میشود.

در نهایت، سایتهای فارکس یکی از مهمترین ابزارهایی هستند که هر معاملهگری باید از آنها برای موفقیت در بازار ارز استفاده کند. انتخاب یک سایت مناسب و استفاده از منابع و ابزارهای موجود میتواند تأثیر زیادی بر عملکرد و سودآوری شما در بازار داشته باشد.

0 notes

Text

Live Forex News

Forex market are highly sensitive to news. Announcements related to economic indicators such as GDP, employment figures, and inflation rates can cause immediate and significant movements in currency pairs. For instance, an unexpected interest rate hike by a central bank can lead to a surge in the currency's value, while geopolitical tensions might lead to a sharp decline. Live Forex news provides traders with real-time updates, allowing them to react swiftly to these market-moving events. 2. Strategic Decision-Making: Effective trading strategies are often built on the analysis of current events and their potential impact on currency markets. Traders use live news feeds to gauge market sentiment, assess potential risks, and identify trading opportunities. Whether it’s a central bank policy announcement, political unrest, or changes in trade policies, staying informed helps traders make strategic decisions and adjust their positions accordingly. 3. Predictive Analysis: Forex news isn't just about reacting to events; it also involves predicting how future events might unfold. Analysts and traders use live news to anticipate market trends and movements. For example, if a country's economic data consistently shows growth, traders might predict a strengthening of that country’s currency in the future. Live news provides the latest information that can validate or adjust these predictions. Sources of Live Forex News 1. Financial News Websites: Major financial news websites like Bloomberg, Reuters, and CNBC offer live Forex news feeds. These platforms provide up-to-the-minute updates on economic data releases, geopolitical developments, and market trends. Subscribing to these services ensures that you receive timely and accurate information. 2. Forex News Apps: Many traders use specialized Forex news apps on their smartphones or tablets. These apps are designed to deliver live updates and alerts directly to your device, enabling you to stay informed even when you’re on the go. Popular apps include Investing.com, DailyFX, and FXStreet. 3. Trading Platforms: Most trading platforms come equipped with integrated news feeds. These platforms not only offer real-time news but also provide tools for analyzing how news impacts the markets. By using these features, traders can view news in the context of their trading charts and strategies. Utilizing Live Forex News Effectively 1. Timing is Everything: One of the most important aspects of trading with live Forex news is timing. News can cause rapid and substantial price movements, so being among the first to receive and act on news can be advantageous. However, it's also crucial to avoid impulsive decisions based on initial market reactions. Analyzing the news and understanding its long-term implications can provide a more balanced perspective. 2. Combining News with Technical Analysis: While live news is valuable, combining it with technical analysis can enhance your trading strategy. Technical analysis involves studying price charts and patterns to predict future movements. By integrating news with technical indicators, traders can better assess the market’s direction and make more informed trading decisions. 3. Risk Management: Even with the best news feeds and analysis, trading in the Forex market carries risks. It’s essential to employ effective risk management strategies to protect your investments. This includes setting stop-loss orders, managing position sizes, and diversifying your trades. Conclusion Live Forex news plays a pivotal role in the world of currency trading, offering insights and updates that can significantly influence market behavior. By staying informed through reliable news sources and combining this information with thorough analysis, traders can navigate the complexities of the forex market with greater confidence and precision. Remember, the key to successful Forex trading lies in not only reacting to news but also understanding its broader impact and integrating it into a well-rounded trading strategy.

0 notes

Text

Nhung loi khuyen cho nha dau tu khi xem tin tuc ck my

Tin tức CK Mỹ luôn tạo ra những tác động mạnh mẽ đến thị trường tài chính nước Mỹ và toàn cầu. Các nhà đầu tư quốc tế thường được khuyên phải theo dõi và cập nhật liên tục các chuyển động của nền kinh tế Mỹ. Đồng thời nắm vững các nguyên tắc khi xem tin tức CK Mỹ để đưa ra các quyết định giao dịch đúng đắn. Để tìm hiểu chi tiết hơn về vấn đề này, hãy cùng chúng tôi phân tích và đi tìm lời khuyên hợp lý ngay bài viết dưới đây nhé!

Tầm quan trọng của việc theo dõi tin tức tài chính CK Mỹ đối với nhà đầu tư

Thị trường chứng khoán Mỹ (CK Mỹ) được thành lập vào ngày 17/05/1792 tại phố Wall. Tại đây, cho đến thời điểm hiện tại, chứng khoán Mỹ vẫn đang giữ vai trò cực kỳ quan trọng đối với nền kinh tế tài chính toàn cầu. Nguyên nhân là vì:

Mọi sự biến động trong nền kinh tế và đồng đô la Mỹ đều mang đến tác động to lớn đến nền kinh tế toàn cầu. Chỉ số GDP của Mỹ chiếm khoảng 1/5 trong nền kinh tế toàn cầu. Đồng đô la Mỹ cũng được biết đến là đồng tiền dự trữ toàn cầu, có thể giải quyết các giao dịch quốc tế.

Mỹ còn là nơi thành lập của hàng loạt công ty top đầu của thế giới như Google, Apple, Meta, Microsoft, Intel, Amazon, ... Những chuyển biến về giá cổ phiếu của các công ty này sẽ tạo ra tác động vô cùng mạnh mẽ đến thị trường toàn cầu. Ví dụ, khi các công ty này hoạt động tốt, thể hiện nền kinh tế thế giới đang tăng trưởng, niềm tin của nhà đầu tư tăng lên và giá cổ phiếu tăng vọt.

Những điều chỉnh của Mỹ trong chính sách hoạt động cũng ảnh hưởng đến nền kinh tế ở các quốc gia khác. Ngoài ra, tình trạng lạm phát tại Mỹ cũng ảnh hưởng mạnh mẽ đến nền kinh tế thế giới. Do đó, các nhà đầu tư luôn phải theo dõi liên tục tình hình của nền kinh tế Mỹ để phòng ngừa rủi ro cũng như gia tăng lợi nhuận khi nhận thấy điều kiện thuận lợi.

Hầu hết các nhà đầu tư luôn dành sự quan tâm đặc biệt vào sự biến động lên xuống của chứng khoán Mỹ. Bởi việc theo dõi tin tức CK Mỹ thường xuyên sẽ giúp họ cập nhật được nhiều thông tin hữu ích và điều chỉnh chiến lược kịp thời.

Khi CK Mỹ có mức tăng trưởng cao, nhà đầu tư có thể thu được khoản lợi nhuận như mong muốn. Lúc này, các nhà đầu tư sẽ tiếp tục rót vốn vào các thị trường chứng khoán ở khu vực khác để đa dạng hóa danh mục đầu tư. Nhờ vậy mà các thị trường chứng khoán toàn cầu cũng trở nên sôi động hơn, giúp nâng cao giá trị cổ phiếu.

Và ngược lại khi nền kinh tế nước Mỹ suy thoái, thị trường CK Mỹ rơi vào tình trạng khủng hoảng. Các nhà đầu tư buộc phải rút vốn từ thị trường chứng khoán của các khu vực khác để bù đắp khoản thua lỗ hoặc các nhà đầu tư sẽ không có các động thái đầu tư mới. Đây cũng chính là nguyên nhân dẫn đến đồng tiền tại các khu vực bị trượt giá.

Lời khuyên khi thi dõi tin CK Mỹ cho nhà đầu tư

Có thể thấy, chỉ một biến động nhỏ trên bảng tin tức CK Mỹ cũng có thể xoay chuyển nền kinh tế toàn cầu. Dưới đây là một vài lời khuyên được các chuyên gia hàng đầu trong thị trường đầu tư chứng khoán đã chia sẻ như sau:

Chọn lọc nguồn tin đáng tin cậy

Hầu hết các nhà đầu tư khi mới tham gia vào thị trường chứng khoán quốc tế đều cảm thấy hoang mang, không biết nên đọc tin tức CK Mỹ ở đâu thì đáng tin cậy. Bởi tình trạng thông tin quá tải, xuất hiện tràn lan khiến cho việc chọn lọc tin tức uy tín trở nên khó khăn hơn. Một số trang tin tức tài chính không đảm bảo chính thống, cung cấp thông tin sai lệch có thể khiến kết quả đầu tư của trader gặp thất bại.

Đáp ứng nhu cầu của đông đảo trader, một số trang cung cấp tin tức uy tín đã ra đời, giúp mọi người có thể theo dõi tin tức tài chính CK Mỹ hàng ngày. Một số trang tin tức nổi tiếng như Investo, Bloomberg, FXStreet, Forex Factory, Yahoo Finance, DailyFX,... Trong đó, website Investo còn dành riêng một danh mục “Thị trường Mỹ” để trader có thể cập nhật tin tức CK Mỹ một cách nhanh chóng. Qua đó hạn chế việc bỏ lỡ thông tin nóng hổi hay những cơ hội giao dịch tốt.

Investo mang đến cho nhà đầu tư cái nhìn tổng thể về thị trường tài chính của Mỹ. Các mục chính trong danh mục “Thị trường Mỹ” có thể kể đến như tin tức kinh tế, thị trường chứng khoán, chính sách tài chính của chính phủ, tin tức đến từ một số doanh nghiệp lớn, xu hướng đầu tư nổi bật. Nội dung tin tức về giá cổ phiếu, hàng hóa, tiền điện tử, năng lượng và các chỉ số chính trên website được cập nhật liên tục.

Bằng cách truy cập nhanh vào chuyên mục thị trường Mỹ ngày trên website Investo tại https://www.investo.info/chuyen-muc/thi-truong-my các nhà đầu tư đã có thể theo dõi tin tức CK Mỹ theo từng giây, từng phút. Từ đó nắm bắt đ��ợc tình hình thị trường và xây dựng chiến lược đầu tư thông minh, hạn chế rủi ro thua lỗ, nắm bắt các cơ hội tiềm năng, nâng cao nguồn lợi nhuận.

Cập nhật và hiểu ngữ cảnh thị trường

Nhà đầu tư cần phải cập nhật tin tức CK Mỹ liên tục, hiểu rõ nguyên nhân gây ra biến động trên thị trường. Điều này sẽ giúp nhà đầu tư có được những phân tích đúng đắn và đưa ra quyết định giao dịch hiệu quả.

Bên cạnh đó cũng cần điều chỉnh danh mục đầu tư để phù hợp với thực trạng, bối cảnh thị trường hiện tại. Việc đa dạng hóa danh mục này sẽ giúp cho hoạt động quản lý và phòng ngừa rủi ro trở nên hiệu quả hơn, giảm tác động tiêu cực đến từ thị trường.

Tránh phản ứng thái quá với biến động ngắn hạn

Trên tin tức chứng khoán Mỹ sẽ xuất hiện các biến động ngắn hạn hay dài hạn. Đối với những biến động ngắn hạn, trader thường kiếm được lợi nhuận thông qua các khoản chênh lệch giá, giúp thu lời nhanh chóng và tiết kiệm thời gian giao dịch. Hình thức này chỉ diễn ra trong khoảng thời gian ngắn, có thể là vài giờ hay vài ngày.

Tuy nhiên, nhà đầu tư không nên phản ứng thái quá trước những biến động ngắn hạn. Bởi mức độ rủi ro của chúng là rất cao và phụ thuộc vào diễn biến thị trường. Đặc biệt, trong trường hợp thị trường có sự biến động liên tục với biên độ lớn thì tỷ lệ rủi ro cũng sẽ tăng cao.

Do đó, chiến dịch đầu tư ngắn hạn thường chỉ phù hợp với những người có nhiều kinh nghiệm, biết cách phân tích thị trường và dự đoán xu hướng giá chính xác. Bên cạnh đó phải kiểm soát cảm xúc của mình, tránh sự phấn khích thái quá khi thị trường thuận lợi cũng như hạn chế sự tiêu cực khi thị trường quay đầu, ngược với dự đoán.

Xây dựng chiến lược đầu tư dựa trên tin tức

Trước khi bắt tay vào đầu tư chứng khoán, việc nghiên cứu và xây dựng chiến lược là điều không thể thiếu. Mặc dù, chứng khoán có thể giúp nhà đầu tư thu lợi nhuận khủng, nhưng cũng rất nhiều rủi ro.

Do đó, nhà đầu tư nên dành thời gian để phân tích và lựa chọn những mà cổ phiếu phù hợp. Bên cạnh đó phải đa dạng danh mục đầu tư, tránh đặt toàn bộ số tiền vào một cổ phiếu duy nhất.

Nhà đầu tư hãy luôn tin tưởng vào quyết định và theo đuổi chiến lược giao dịch đến cùng, quản lý tốt cảm xúc, giữ trạng thái bình tĩnh và tâm lý vững vàng. Đừng quên xem tin tức CK Mỹ thường xuyên, theo dõi diễn biến thị trường qua các diễn đàn và mạng xã hội. Ngoài ra cũng cần kết hợp các công cụ phân tích để đánh giá xu hướng thị trường, đưa ra điều chỉnh cho chiến lược kịp thời.

Kết luận

Tin tức CK Mỹ luôn đóng vai trò quan trọng trong các quyết định giao dịch của nhà đầu tư. Do đó, việc theo dõi các trang web chính thống là cần thiết để cập nhật thông tin uy tín, chất lượng. Trong số đó, Investo được biết đến là một website chuyên cung cấp kiến thức thị trường đáng tin cậy. Bạn có thể theo dõi website của Investo để cập nhật thêm nhiều thông tin bổ ích nhé!

0 notes

Text

US Stocks Mixed, Trade Surpluses in China and Germany Fall

Major Events from Yesterday: Yesterday saw big movement in the markets. The US stock markets had a mixed session. The Dow Jones Industrial Average and the S&P 500 struggled to gain momentum, while the Nasdaq 100 showed a slight recovery. This comes on the heels of heavy losses in the Nasdaq and Nikkei 225 earlier this week (DailyFX) (DailyFX). Economic Data Released Today: China’s Balance of…

#CentralBanks#ChinaTrade#Commodities#CrudeOil#DowJones#EconomicData#EURUSD#FinancialNews#Forex#GBPUSD#GermanyTrade#GlobalEconomy#GoldPrices#Investing#MarketTrends#Nasdaq#SP500#USDJPY#USStockMarket

0 notes

Text

Top forex signals

Introduction: In the vast ocean of the foreign exchange market, traders are often in search of reliable guidance to navigate the turbulent waters of currency trading. Amidst the complexities and fluctuations, forex signals emerge as beacons of insight, offering traders invaluable information to make informed decisions. In this article, we delve into the realm of forex signals, exploring what they are, how they work, and unveiling some of the top forex signals providers in the industry. Understanding Forex Signals: Top Forex signals are essentially trading suggestions or recommendations generated by either human analysts or automated algorithms. These signals indicate potential opportunities to buy or sell a particular currency pair at a specific price and time. They are derived from thorough analysis of various factors such as technical indicators, economic data, geopolitical events, and market sentiment. The primary objective of forex signals is to assist traders in identifying profitable trading opportunities and managing risks more effectively. By leveraging these signals, traders can make well-informed decisions, potentially enhancing their chances of success in the forex market. Top Forex Signals Providers: 1. ForexSignals.com: Renowned for its comprehensive approach to forex trading education and signal provision, ForexSignals.com offers a range of services including live trading rooms, educational resources, and actionable trading signals. With a team of experienced traders and analysts, they deliver real-time signals accompanied by detailed analysis, empowering traders of all levels to make informed decisions. 2. DailyFX: As a subsidiary of the globally recognized broker, IG Group, DailyFX provides traders with access to a wealth of market analysis, trading tools, and forex signals. Their team of analysts curates timely signals based on technical and fundamental analysis, catering to the diverse needs of traders worldwide. 3. FX Leaders: With a focus on simplicity and accuracy, FX Leaders delivers high-quality forex signals through its user-friendly platform. Utilizing a combination of technical analysis, trend identification, and risk management strategies, FX Leaders aims to equip traders with reliable signals to capitalize on market opportunities. 4. ForexGDP: Specializing in providing signals for major currency pairs, ForexGDP distinguishes itself through its transparent approach and commitment to delivering consistent results. Their signals are based on both technical and fundamental analysis, with a focus on risk management and long-term profitability. 5. Learn 2 Trade: Recognized for its user-friendly interface and educational resources, Learn 2 Trade offers a range of forex signals services tailored to both novice and experienced traders. Their signals are generated by experienced analysts and algorithms, with a focus on accuracy and reliability. Conclusion: In the dynamic world of forex trading, access to reliable signals can be the difference between success and failure. While the forex market presents lucrative opportunities, it also entails inherent risks. By leveraging the expertise of top forex signals providers, traders can navigate the complexities of the market with confidence and precision. Whether you're a seasoned trader or just starting out, incorporating forex signals into your trading strategy can potentially enhance your performance and contribute to your long-term success.

0 notes

Text

How Does Scraping The DailyFX Calendar Data Enhance Trading Strategies?

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More : https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Happy 10th year anniversary to f(x)'s Red Light!

#im so late#f(x)#krystal#luna#victoria#sulli#amber#jungsoojung#parksunyoung#songqian#choijinri#amberliu#red light#idolady#femaleidolsedit#femaleidols#femaleidol#kpopggsedit#dailyfx#fxedit#mine#smsource#femaleidolsnet#femadolsnet#femadolsedit

357 notes

·

View notes

Text

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More : https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Bitcoin tüm zamanların en yüksek seviyesine ulaştı

Önde gelen kripto para birimi Pazartesi günü 72.000 doların üzerine çıktı. Dünyanın en değerli kripto para birimi Bitcoin, Pazartesi günü 72.000 doların üzerine çıkarak yeni bir rekora imza attı. CoinDesk verilerine göre token, tüm zamanların en yüksek seviyesi olan 72.030 dolara yükselerek Kasım 2021'de belirlenen rekoru kırdı ve yıl boyunca şimdiye kadarki kazançları neredeyse 'e çıkardı. 2021'de kripto sektörünün hızla büyümesi ve amatör yatırımcıların tasarruflarını dijital paralara aktarmasıyla Bitcoin 68.790 dolara ulaştı. Analistler, son yükselişi ABD merkezli spot Bitcoin borsa yatırım fonlarına (ETF'ler) yönelik nakit girişlerinin yanı sıra Federal Rezerv'in yakında faiz oranlarını düşüreceği beklentilerine bağlıyor. DailyFX stratejisti Nick Cawley, Reuters'e yaptığı açıklamada , "Bitcoin haftaya bir yükselişle başladı ve diğer kripto para birimlerini de kendisiyle birlikte daha da yukarı sürükledi" dedi . ETF'ler, daha fazla perakende yatırımcının borsalarda işlem gören fonlar aracılığıyla dolaylı olarak Bitcoin tutmasına olanak tanıyor. Kurumsal yatırımcılar, ABD düzenleyicisinin Ocak ayında kripto ETF'lerini onaylamasının ardından piyasa değerine göre en büyük kripto para birimine artan ilgi gösterdi. Değişken kripto paranın yükselişi, değerinin 2022'de 20.000 doların altına düşmesinin ardından geldi. 2022'de sektördeki iflasların ortasında yaklaşık 1,4 trilyon dolar kripto pazarından silindi. Kısa bir süre eski ABD Başkanı Donald Trump'ın iletişim direktörü olarak görev yapan SkyBridge Capital kurucusu Anthony Scaramucci'ye göre, tokendaki son yükseliş "dijital bir varlık olarak Bitcoin için gerçekten büyük bir atılım". Finansör, bunun "genel olarak dijital mülkiyet için çok daha geniş bir hikaye" olduğunu ekledi. Geçen yılın sonlarında Standard Chartered Bank, Bitcoin'in 2024'ün sonuna kadar, hatta daha önce 100.000 dolara ulaşacağını tahmin etmişti. Yatırım şirketi ARK Invest'in CEO'su Cathie Wood daha da ileri giderek Bitcoin fiyatının 2030 yılına kadar 1 milyon doları aşacağını tahmin etti. Dünyada yalnızca iki ülke Bitcoin'i yasal ödeme aracı olarak onayladı: El Salvador ve Orta Afrika Cumhuriyeti. Bitcoin, ABD, Kanada, İngiltere ve AB gibi birçok gelişmiş ülkede dijital bir varlık olarak kabul ediliyor; Almanya, Danimarka, Japonya, İsviçre ve İspanya, Bitcoin'in işlemlerde kullanılmasına izin veriyor. Bu arada Çin, Katar ve Suudi Arabistan da dahil olmak üzere birçok ülke Bitcoin'i yasakladı. Bir zamanlar Bitcoin madenciliğinin en popüler yerlerinden biri olan Çin, bankaların ve diğer kurumların takas ve takas gibi hizmetler sunmasını yasaklayarak 2021 yılında ülkede tüm kripto para birimi işlemlerini yasakladı ve ülkede madenciliği yasa dışı hale getirdi. Read the full article

0 notes

Text

Forex Trading News: Tips for Successful Traders

Staying updated with forex trading news is essential for traders aiming for success in the dynamic currency markets. With news impacting market volatility and currency values, having a solid strategy for utilizing forex trading news can make a significant difference in your trading outcomes. Here are some valuable tips for traders looking to leverage forex trading news effectively:

Stay Informed with Reliable Sources Financial News Websites: Regularly check reputable financial news websites such as Bloomberg, Reuters, and Financial Times for the latest updates. Forex News Platforms: Utilize specialized forex news platforms like Forex Factory, DailyFX, and Investing.com for specific market insights. Economic Calendars: Use economic calendars from trusted sources like Forex Factory and Investing.com to track key economic events.

Understand Market Reactions Immediate Reaction: Be prepared for immediate market reactions to news releases, especially during high-impact events like central bank announcements. Volatility Management: Have risk management strategies in place, such as stop-loss orders, to navigate volatile market conditions.

Analyze Market Sentiment Sentiment Indicators: Use sentiment indicators like the COT Report (Commitment of Traders) to gauge market sentiment and positioning. Social Media Analysis: Monitor social media platforms for trader sentiment and discussions on market-moving news.

Plan Ahead for Major Events Calendar Awareness: Mark major economic events and central bank meetings on your trading calendar to plan your strategies accordingly. Preparation is Key: Anticipate potential market scenarios based on different outcomes of economic releases or geopolitical events.

Trade the News Wisely Wait for Confirmation: Avoid trading immediately at news release times; wait for the initial market reaction to settle before entering a trade. Consider Scalping or Swing Trading: Adjust your trading style based on the time frame of the news and your risk tolerance.

JRFX - Empowering Your Trading Journey Advanced Tools: Explore JRFX's advanced trading tools and platforms for enhanced analysis and execution. Educational Resources: Access JRFX's educational materials and webinars to deepen your understanding of forex trading news. Customer Support: Benefit from JRFX's dedicated customer support team for assistance with trading queries.

In conclusion, forex trading news can be a powerful tool in a trader's arsenal when used wisely. By staying informed, understanding market reactions, and planning ahead, traders can navigate the markets with confidence. With JRFX as your trusted partner, you have access to the tools and support needed to thrive in the forex trading arena.

Elevate Your Trading with JRFX: Advanced Trading Tools: Experience JRFX's cutting-edge trading platforms for precise execution. Educational Resources: Enhance your trading knowledge with JRFX's educational resources and webinars. Personalized Support: Get personalized support from JRFX's dedicated customer service team.

Empower your trading journey with JRFX ( https://www.jrfx.com/?804 ) and make the most of forex trading news. Start trading with confidence today!

0 notes

Text

Trading forex for a living from the comfort of your home is what many online investors aspire to do. Learn and adapt to the market and watch those profits soar.There are as many naysayers as there are 'fire your boss there is money to be made' kind of people in the forex trading advice arena. But with daily trading volumes of over $5.3 trillion, anyone who has heard of this trade wants a piece of the pie.The foreign exchange market also known as forex trading is where the big money boys come to play. Why? It is the largest financial market in the world immune to manipulation and incredibly liquid in nature. These characteristics are what has made it a gold mine for Steve Cohen, George Soros, and their ilk.Can You Make A Living Off Of FX Trading?Is trading forex for a living a pipe dream or is there a forex trading holy grail that can lead you to riches? Can you possibly obtain financial freedom and escape the rat race through forex trading? To begin with, learn an important truth from the naysayers " the market will hurt you if you give it the opportunity."From the statistics, most forex traders do lose their cash. One of the pioneers of the retail forex market, FXCM features a scary disclaimer on their platform. They warn that 79.8% of their retail accounts end up in the red while trading. This may not make much sense in an era where trading forex for a living has generated so much interest.The ugly truth is that more traders tend to lose more cash on their losing trades than they make on their winning trades. Nasdaq actually warns that within the first six months of trading, 90% of day traders will have lost their initial investments. Grim statistics aren't they? Yes, they are but chew on this other statistic. According to DailyFX's research 50% of forex trades close in again. That's profit Y'all! There are pitfalls, yes, but there is an opportunity to make some income from forex trading. Basic Rules Of Trading Forex For A LivingDrop The Idea That This Is A Get-Rich-Quick Scheme. Far from it. It is a very unforgiving market. Look at it as an investment. Set your targets then get to a thorough analysis of the markets while giving yourself time to meet those targets.Study Your Risk Tolerance.How much market volatility can you tolerate? Forex trading is very volatile, and that coupled with the availability of leverage, your accounts can empty in a flash. Understanding your level of risk tolerance will assist you to come up with a long-term winning strategy. Be Careful When SpeculatingDailyFX’s senior strategist David Rodriguez says that human psychology is often the cause of the huge losses experienced by traders. Most traders are easily excited over wins and rely too much on their intuition while executing trades. You can only trust your gut instinct after completed the four fundamental analyses listed here in the IDDA.Get SchooledWhile it is not rocket science, trading forex for a living is a science of sorts. Get a thorough education in the trade before jumping off the deep end.

0 notes