#CryptocurrencyImpacts

Explore tagged Tumblr posts

Text

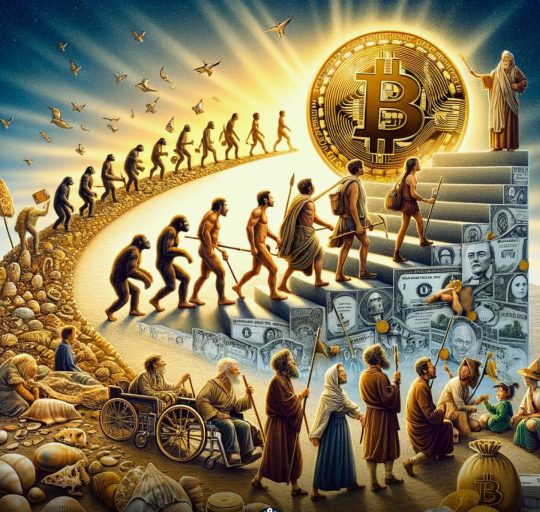

Unveiling Bitcoin And The Virtual Worlds

Explore the intersection of cryptocurrency and future technology with Bitcoin And The Virtual Worlds.🚀Authored by Jacob Smith, this insightful book delves into the transformative impact of Bitcoin and other cryptocurrencies on the digital landscape. With clarity and depth, the author illuminates how cryptocurrency investments are shaping the future of technology and infrastructure.

#BitcoinInvestments#CryptocurrencyFuture#VirtualCurrencyTrends#FutureTechnology#DigitalInfrastructure#BlockchainInnovations#DecentralizedFinance#CryptocurrencyImpacts#DigitalEconomy#VirtualWorlds#BitcoinAndTechnology#CryptocurrencyInvestments#FutureInfrastructure#DigitalInnovation#FinancialRevolution#CryptoEcosystem#BlockchainTechnology#DigitalAssets#VirtualCurrencyInvesting#TechInfrastructure#BitcoinTrends#CryptocurrencyEvolution#FutureFinance#DigitalTransformation#VirtualEconomy#BitcoinTechnology#CryptocurrencyTrends#VirtualCurrencyInvestments#DigitalFuture#FinancialTechnology

5 notes

·

View notes

Text

Top Amazed Impact of Bitcoin on Wall Street

Introduction to Bitcoin and Wall Street

I believe it is essential to understand the basics of Bitcoin and its impact on Wall Street. Bitcoins are digital currencies created and held electronically, with no physical form. They are decentralized and not controlled by any government or financial institution. As a result, they have gained popularity as an alternative investment. On Wall Street, Bitcoin's rise has disrupted traditional financial markets, leading to discussions on regulation, adoption, and its potential to reshape the future of finance. Understanding the connections between Bitcoin and Wall Street is crucial in grasping the broader implications of this digital currency revolution. The adoption of Bitcoin on Wall Street has changed significantly over time. Initially, Bitcoin was seen as a fringe asset with little relevance to traditional finance. However, the introduction of Bitcoin ETFs has led to a significant shift in this perception, with Wall Street now embracing the cryptocurrency as a mainstream asset. The launch of Bitcoin ETFs has been a game-changer for the cryptocurrency market, with the total value of Bitcoin traded on cryptocurrency exchanges increasing significantly. The increased liquidity has led to a decrease in Bitcoin's volatility, with some market players predicting that the cryptocurrency will behave better on Wall Street over time. The adoption of Bitcoin by Wall Street has also led to increased interest from institutional investors, with many investing in Bitcoin through ETFs. This has resulted in a significant increase in the total value of Bitcoin held by ETFs, with more than 644,000 Bitcoin worth over $27 billion held by 11 U.S. ETFs after just two trading days. The adoption of Bitcoin on Wall Street has changed significantly over time, with the cryptocurrency now seen as a mainstream asset by many investors.

The Disruption of Traditional Finance

- I believe that Bitcoin has the potential to revolutionize traditional finance by challenging the centralized banking system. - I have witnessed how Bitcoin's decentralized nature empowers individuals to take control of their own financial transactions without the need for intermediaries. - I have seen how Wall Street is starting to pay attention to Bitcoin as a legitimate asset class, despite initial skepticism. - I think that the increasing adoption of Bitcoin and blockchain technology could reshape the way we think about wealth, investments, and financial security.

Adoption of Bitcoin by Wall Street Institutions

I have observed a significant shift in the stance of Wall Street institutions towards Bitcoin. Major financial players, including investment firms and banks, are starting to recognize the potential of Bitcoin as a valuable asset. These institutions are now investing in Bitcoin, offering Bitcoin-related products to their clients, and even integrating Bitcoin into their financial services. The adoption of Bitcoin by Wall Street institutions indicates a growing acceptance of this digital currency as a legitimate investment option. This trend is reshaping the traditional financial landscape and paving the way for further mainstream adoption of Bitcoin.

Regulatory Challenges and Considerations

- I believe that regulatory challenges surrounding Bitcoin on Wall Street are significant. - I anticipate increased scrutiny from regulatory bodies like the SEC and CFTC. - I expect greater emphasis on anti-money laundering (AML) and know your customer (KYC) regulations. - I am concerned about the potential for regulatory uncertainty impacting Bitcoin's market stability.

Wall Street Companies that have Adopted Bitcoin or Blockchain Technology

These companies have adopted Bitcoin and blockchain technology in various ways, including offering cryptocurrency trading and custody services, developing blockchain solutions for businesses, and investing in Bitcoin-related products. This adoption has contributed to the growing mainstream acceptance of Bitcoin and other cryptocurrencies as legitimate assets for investment and commerce. Here is the List: 1. Block, Inc. (formerly Square, Inc.) - Block, Inc. is a financial services and digital payments company that allows users to buy, sell, and store Bitcoin through its Cash App platform. The company has also invested in Bitcoin and has been a vocal advocate for the cryptocurrency, with its CEO, Jack Dorsey, stating that he believes Bitcoin will become the "native currency" of the internet. 2. Coinbase - Coinbase is a cryptocurrency exchange platform that offers users the ability to buy, sell, and store various cryptocurrencies, including Bitcoin. The company has also launched a suite of institutional products, including custody and trading services, to cater to the growing demand from institutional investors. 3. NVIDIA - NVIDIA is a technology company that specializes in creating crypto chip mining processors (CMPs) for computers, which are used for mining Bitcoin and other cryptocurrencies. The company has seen strong demand for its CMPs, with revenue from its data center segment, which includes CMPs, increasing by 61% in the fourth quarter of 2021. 4. PayPal- PayPal allows users to buy, sell, and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin on its platform. The company has also partnered with several cryptocurrency firms, including Paxos and Coinbase, to facilitate the buying and selling of cryptocurrencies. 5. IBM - IBM offers blockchain solutions for businesses, including its own blockchain platform and open-source framework known as Hyperledger Fabric. The company has also partnered with various organizations, including Maersk and Walmart, to develop blockchain applications for supply chain management and food safety. 6. Microsoft - Microsoft partners with ConsenSys to offer the Quorum Blockchain Service on its Azure platform, which is used by companies across various sectors to establish blockchain applications. The company has also developed blockchain-based solutions for supply chain management, digital identity, and gaming. 7. Intel - Intel develops blockchain technology, including the Hyperledger Sawtooth network, which is an enterprise-level blockchain platform for creating blockchain applications and its own blockchain platform, Intel Blockscale ASIC. The company has also partnered with various organizations, including the Linux Foundation and the Enterprise Ethereum Alliance, to promote the development of blockchain technology. 8. Grayscale Bitcoin Trust - Grayscale Bitcoin Trust is a publicly traded investment vehicle that allows investors to gain exposure to Bitcoin without actually owning the cryptocurrency. The trust has become increasingly popular among institutional investors, with its assets under management (AUM) reaching a record $40 billion in 2021. 9. CME Group - CME Group offers Bitcoin futures and options contracts, allowing institutional investors to gain exposure to the cryptocurrency. The company has seen strong demand for its Bitcoin derivatives, with the average daily volume of its Bitcoin futures contracts reaching a record 18,374 contracts in 2021. 10. Fidelity Investments - Fidelity Investments offers Bitcoin custody and trading services to institutional investors. The company has also launched a Bitcoin fund for accredited investors, which allows them to gain exposure to the cryptocurrency without actually owning it. These companies represent just a few examples of the growing adoption of Bitcoin and blockchain technology by Wall Street firms. As the cryptocurrency market continues to mature and gain mainstream acceptance, it is likely that we will see even more companies entering the space and offering new and innovative products and services.

Impact of Bitcoin on Wall Street Trading Strategies

- Bitcoin has introduced new volatility into the market. - I have noticed a shift in trading strategies on Wall Street due to the emergence of Bitcoin. - The traditional Wall Street approach to trading is being influenced by the unique characteristics of Bitcoin. - I have observed increased diversification in investment portfolios to include cryptocurrencies like Bitcoin. - Some traders are adopting a more long-term view when incorporating Bitcoin into their trading strategies. - The need to stay informed and adapt to changes in the market due to Bitcoin's impact is more crucial now than ever.

Bitcoin's Influence on Investment Banking

I find that the introduction of Bitcoin has significantly impacted investment banking in various ways: - Increased Interest: Investment banks are now closely following Bitcoin's performance and exploring ways to incorporate digital assets into their investment strategies. - New Investment Products: Banks are creating new financial products linked to Bitcoin, such as Bitcoin futures contracts and exchange-traded funds (ETFs). - Additional Revenue Streams: Some investment banks have started offering services specifically related to Bitcoin, such as trading desks and custody solutions. - Regulatory Challenges: The emergence of Bitcoin has raised regulatory concerns for investment banks, leading to increased oversight and compliance requirements.

The Future of Bitcoin and Wall Street Integration

- Bitcoin is increasingly gaining acceptance on Wall Street as a legitimate asset. - I anticipate more institutional investors will incorporate Bitcoin into their portfolios in the future. - Wall Street's embrace of Bitcoin could lead to increased mainstream adoption and regulatory clarity for cryptocurrency. - The integration of Bitcoin into traditional financial systems may pave the way for innovative financial products and services. - As Wall Street continues to explore Bitcoin, we may see a shift in the financial industry towards a more decentralized and inclusive system.

Risks and Opportunities for Wall Street with Bitcoin

- Risks: - Price Volatility: The high price fluctuations of Bitcoin can pose risks for Wall Street investors. - Regulatory Uncertainty: Regulations surrounding cryptocurrencies are still evolving, leading to uncertainty for Wall Street. - Security Concerns: Hacking and fraud risks are prevalent in the cryptocurrency space and can impact Wall Street. - Opportunities: - Diversification: Bitcoin offers Wall Street the opportunity to diversify portfolios and hedge against traditional assets. - Innovation: Embracing blockchain technology behind Bitcoin can lead to innovative financial solutions on Wall Street. - Market Expansion: Integrating Bitcoin into Wall Street operations can open doors to new markets and clients.

The Role of Bitcoin in Global Financial Markets

I believe that Bitcoin has become a significant player in global financial markets due to its characteristics. - Bitcoin's decentralized nature allows for borderless transactions, making it attractive for international trade and investments. - Its finite supply of 21 million coins gives it a store of value appeal similar to gold. - Institutional adoption of Bitcoin as a hedge against inflation and economic uncertainty has further solidified its position in global financial markets. - Bitcoin's price volatility, however, remains a point of contention for some traditional investors, impacting its mainstream acceptance.

Conclusion: The Ongoing Evolution of Bitcoin and Wall Street

I believe that the intersection of Bitcoin and Wall Street will continue to be transformative. As Bitcoin gains more mainstream acceptance, Wall Street will likely adapt further to incorporate cryptocurrencies into traditional financial systems. The evolving regulatory landscape will play a crucial role in shaping how Bitcoin interacts with Wall Street. Moreover, the increasing institutional interest in Bitcoin signifies a significant shift in the financial industry. Moving forward, I anticipate further innovation, collaboration, and potential challenges as Bitcoin's influence on Wall Street continues to evolve. Read the full article

#bitcoin#BitcoinAdoption#BitcoinFinanceInsights#BitcoinFinanceNews#BitcoinImpact#BitcoinMarketImpact#BitcoinWallStreet#CryptocurrencyImpact#CryptoFinance#WallStreetTrends

0 notes

Text

Unveiling Bitcoin And The Virtual Worlds ₿🚀

Explore the intersection of cryptocurrency and future technology with Bitcoin And The Virtual Worlds. Authored by Jacob Smith, this insightful book delves into the transformative impact of Bitcoin and other cryptocurrencies on the digital landscape. With clarity and depth, the author illuminates how cryptocurrency investments are shaping the future of technology and infrastructure. From blockchain innovations to decentralized finance, this book offers a compelling exploration of the possibilities unlocked by the rise of virtual currencies.

Whether you are a seasoned investor or simply curious about the future of digital finance, "Bitcoin And The Virtual Worlds" is your guide to understanding the profound implications of cryptocurrency for the world of tomorrow.

#BitcoinInvestments#CryptocurrencyFuture#VirtualCurrencyTrends#FutureTechnology#DigitalInfrastructure#BlockchainInnovations#DecentralizedFinance#CryptocurrencyImpacts#DigitalEconomy#VirtualWorlds#BitcoinAndTechnology#CryptocurrencyInvestments#FutureInfrastructure#DigitalInnovation#FinancialRevolution#CryptoEcosystem#BlockchainTechnology#DigitalAssets#VirtualCurrencyInvesting#TechInfrastructure#BitcoinTrends#CryptocurrencyEvolution#FutureFinance#DigitalTransformation#VirtualEconomy#BitcoinTechnology#CryptocurrencyTrends#VirtualCurrencyInvestments#DigitalFuture#FinancialTechnology

6 notes

·

View notes