Text

Best Group Financial Consolidation for Accuracy

Streamline and Simplify Your Global Financial Consolidation

Managing financial data for crypto companies with multiple entities across different jurisdictions can be complex, especially when dealing with diverse regulatory environments. Group financial consolidation is vital for presenting a unified financial statement, ensuring compliance, and providing stakeholders with transparent, actionable insights. CryptAcce specializes in simplifying and optimizing this process, using a blend of advanced tools and expert techniques to deliver accurate and timely consolidated financial reports

Read more: https://cryptacce.com/group-financial-consolidation/

#fiat to crypto#fiat in crypto#fiat crypto#tailored financial services#tax and financial planning#tax and financial planning services#Blockchain financial auditing#Crypto financial reporting#Cryptocurrency bookkeeping#cryptocurrency accounting firms#crypto trading websites

0 notes

Text

youtube

#CBDC#Finance#Cryptocurrency#Fintech#Blockchain#DigitalCurrency#CentralBank#Economics#FutureOfFinance#DigitalEconomy#AI#TechInnovation#FinancialTechnology#MonetaryPolicy#DigitalBanking#CryptoTrends#EconomicInsights#FinancialInnovation#TechTrends#FinancialFuture#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

2 notes

·

View notes

Photo

Blockchain and Crypto Bookkeeper Service

Units Consulting Ltd. can simplify and transform your daily life through our wide range of data entry & bookkeeping services for Blockchain and Crypto and business process outsourcing solutions delivered by experts and leveraging on technology and efficient data management.

Our goal is to offer you a working environment where interacting with and monitoring your delegates is easier than any previous experience. Our industry-focused accounting practice serves digital asset financial service firms, crypto marketing agencies, crypto-focused funds, cryptocurrency brokers, token projects, miners, stakers, and investment companies to fulfill the specific needs of the blockchain sector

At Units Consulting Ltd., we provide accurate, flexible and reliable outsourced cryptocurrency bookkeeping services giving you ample time to focus on your core business activities.

Please note, at Units Consulting Ltd., a leading accounting firm in Ukraine, we use a structured quality process which protects our client's privacy through strong confidentiality policies and practices.

To learn more about our Outsourced Cryptocurrency Bookkeeper Services, please contact us.

.

#bitcoin#crypto#cryptocurrency#bookkeeper#bookkeeping#bpo#blockchain#crypto analysis#blockchain news#blockchain bookeeper#crypto bookkeeper#blockchain accounting#crypto bookkeeping

1 note

·

View note

Text

Sharp Trade: Keto Breakfast

Sharp Trade: Keto Breakfast

View On WordPress

0 notes

Photo

https://beincrypto.com/australia-tax-regulators-know-your-crypto-investments/?fbclid=IwAR1WcMf7zVBmkXSiruqUe5Knz-2u3brR7JmUDKHPDA4OiMawr9kmw9eLg-s . Paying taxes on cryptocurrency transactions is essential to comply with Australian tax laws! . Many people may not realise they need to pay taxes on their cryptocurrency gains! . Maximising your growth with @maxgrowthhq #maxgrowth #cryptocurrency #essential #Australian #laws #accountant #bookkeeper #CFO #loveourwork #togetherwemakeadifference https://www.instagram.com/p/CpweJ9GPF0R/?igshid=NGJjMDIxMWI=

#maxgrowth#cryptocurrency#essential#australian#laws#accountant#bookkeeper#cfo#loveourwork#togetherwemakeadifference

0 notes

Text

hypothesis of monetary efforts: your spending habits, what you like to buy, and how you can budget/save money

yall know i'm a fan of persona charts - the same applies here. we are going to look at the 2h ruler's persona chart.

but first!

my 2h in aries - my mars is in the 7h in virgo so already i can tell you a lot of my money goes towards food, health, books, and craft supplies... i'm not someone who overspends like the typical 2h in aries stereotype tend to lead people to believe (I don't have the impulse control of a child lol).

but that makes sense because looking at my mars persona chart (the ruler of my 2h). my 1h is ruled by virgo - my monetary mindset tends to be to save or budget; virgos are like natural bookkeepers. mercury (the ruler of my monetary mindset (a.k.a. the asc of my mars persona (the ruler of my natal 2h's ruler))) is in the 2h! which emphasizes that i am someone who is conscious of my spending habits.

the 2h can tell me what i spend a majority of my money on and what i see are essentials - its virgo ruled with moon and mercury positioned in it. so again: food, health, books, and craft supplies. the moon tells me its comfort food (when i have a bad day i want a good meal - lobster risotto balls AND crab mac and cheese are my go to when its a really bad day), but also it emphasizes that i could be spending marital/familial money (lol my husband is going to give in to my spending habits - my mother and grandfather too loves to help me out monetarily). the moon also shows that i tend to buy objects the are comforting to me (a weighted pink dinosaur - lol I should do a dinosaur post on here, I love dinosaurs), things from family ran / woman owned shops, one of a kind shops, etc... i am tend to buy habitually - if i’m in a barnes and noble - i am buying a book, if i’m at the grocery store - i'm getting eggs, butter, nutella, etc every trip, etc. mercury here tells me that i am aware of the price of everything i buy (sign me up for the price is right). i like to buy books, car stuff, shopping bargains and sales (I will purposely bulk buy if the unit price is less than the unit price of the size I was originally going to get or if I have a coupon I will make sure I use it), and plants.

the 8h of this chart can tell me how i can save money that i typically would spend (so can saturn - its the long game of saving). it's empty but in pisces - 5h neptune and 11h jupiter. i could benefit from change bottles, an emergency fund account, cryptocurrency, and envelope stuffing based on neptune. having objectives, having a group/friend savings challenges, bullet journal icons to fill in, monetizing hobbies, and entering the lottery / raffles are all to my benefit to gain and receive passive money worth saving given the 5h and 11h placements of these lords.

that's all for now!

a.d.

click here for the masterlist

click here for more of nox's hypotheses

want a personal reading? click here to check out my reading options and prices!

© a-d-nox 2023 all rights reserved

#astrology#astro community#astro placements#astro chart#asteroid astrology#asteroid#natal chart#persona chart#greek mythology#astrology tumblr#astro content#astrology notes#astroblr#astro observations#money astrology#astrology readings

58 notes

·

View notes

Text

Top 10 AI Finance Tools

AI is transforming the finance industry by providing tools that analyze markets, offer trading insights, and streamline financial processes. Whether you're a professional investor or simply looking to make informed financial decisions, these 12 essential AI finance tools will help you navigate complex markets, optimize strategies, and maximize your financial potential.

1. Trade UI

aiwikiweb.com/Trade Trade UI offers a powerful AI-powered platform for traders to get real-time market insights, analyze trends, and optimize trading strategies. It is especially useful for those who need instant data analysis to make informed trading decisions.

2. Quandency AI

aiwikiweb.com/Quandency Quandency AI is a comprehensive platform that combines trading automation with portfolio management. It allows users to create custom trading bots, monitor performance, and adjust strategies to align with market trends, perfect for investors seeking to automate their trades.

3. AI Price

aiwikiweb.com/aiprice/ AI Price provides AI-driven price predictions and analyses for cryptocurrencies and stocks. By analyzing market movements and patterns, it helps investors make informed decisions with actionable insights.

4. Vic AI

aiwikiweb.com/Vic Vic AI is an AI accounting tool designed to help finance teams automate data entry and optimize bookkeeping. Its intelligent algorithms streamline workflows and reduce human error, making it a go-to for efficient accounting solutions.

5. Jinnee

aiwikiweb.com/Jinnee Jinnee is an AI-powered financial assistant that provides personalized insights and financial planning. With Jinnee, users can better manage their investments, track spending, and set financial goals.

6. Greip

aiwikiweb.com/Greip Greip offers AI-powered insights for investment research, helping investors make data-driven decisions. With tools for portfolio analysis and financial forecasting, Greip is a powerful assistant for anyone looking to optimize their investments.

7. Dipsway

aiwikiweb.com/Dipsway Dipsway provides AI-driven stock analysis, leveraging data to help investors identify trends and make more strategic trading decisions. Its intuitive platform is great for both beginners and experienced traders.

8. Danelfin

aiwikiweb.com/Danelfin Danelfin uses AI to analyze market data and deliver predictive insights for stock performance. Investors can benefit from its real-time data tracking and recommendations, making it a key tool for managing a diversified portfolio.

9. Coinscreener AI

aiwikiweb.com/Coinscreener Coinscreener AI is designed for cryptocurrency enthusiasts, offering tools to track, analyze, and predict crypto prices. Its advanced screening capabilities help users make timely, informed decisions in the volatile crypto market.

10. Composer

aiwikiweb.com/Composer Composer is an AI platform that allows investors to build and backtest trading strategies with ease. By providing access to multiple data sources, Composer helps users optimize strategies before deploying them in real markets.

💸 Optimize Your Financial Journey with AI! These AI-powered finance tools are designed to enhance your trading, investment research, and financial planning. Explore these platforms to discover new ways to gain insights, automate tasks, and maximize returns in your financial journey.

0 notes

Text

Empowering Logistics Companies | Form 2290

Welcome to the 2024 Key Tax Deadline and Strategies Season!

As we approach January 29th, the begin of the e-filing season, it’s time to center on proficient and stress-free assess filing.

We are committed to directing you through this prepare, guaranteeing a smooth involvement. Our group is here to oversee your monetary obligations with mastery and care, making assess recording direct and worry-free.

Forms to Anticipate by the Conclusion of January or the Starting of February Form W-2G: For detailing betting winnings. Form 1099-C: For announcing obligation of $600 or more canceled by certain monetary substances counting monetary teach, credit unions, and government government agencies. Form 1099-DIV: For announcing profits and selling distributions. Form 1099-G: For announcing certain government installments, counting unemployment recompense and state and nearby charge discounts of $10 or more.

Form 1099-INT: For detailing intrigued, counting intrigued on conveyor certificates of deposit. Form 1099-K: For announcing installments gotten from a third-party settlement entity. Form 1099-LS: For detailing reportable approach deals of life insurance. Form 1099-LTC: For announcing long-term care and quickened passing benefits. Form 1099-MISC: For detailing eminence installments of $10 or more, lease or other commerce installments of $600 or more, prizes and grants of $600 or more, edit protections continues of $600 or more, angling pontoon continues, restorative and wellbeing care installments of $600 or more.

Form 1099-NEC: For announcing nonemployee compensation. Form 1099-OID: For announcing unique issue discount. Form 1099-PATR: For announcing assessable disseminations gotten from cooperatives. Form 1099-Q: For detailing conveyances from 529 plans and Coverdell ESAs. Form 1099-QA: For detailing disseminations from ABLE accounts. Form 1099-R: For detailing conveyances from retirement or profit-sharing plans, IRAs, SEPs, or protections contracts. Form 1099-SA: For announcing conveyances from HSAs, Toxophilite MSAs, or Medicare Advantage MSAs. Form 1098: For announcing $600 or more of contract interest. Form 1098-E: For detailing $600 or more of understudy advance interest. Form 1098-MA: For announcing contract help payments. Form 1098-T: For announcing qualified educational cost and expenses. Form 8300: For announcing exchanges of more than $10,000 in cash (counting computerized resources such as virtual cash, cryptocurrency, or other advanced tokens speaking to value).

Form 8308: For detailing trades of a organization intrigued in 2023 that included unrealized receivables or significantly acknowledged stock items. Form 5498: For announcing IRA commitments, counting conventional, Roth, SEPs, and SIMPLEs, and giving the December 31, 2023, reasonable advertise esteem of the account and required least dispersion (RMD) if applicable. For proficient handling of your assess return, it is fundamental that we accumulate all essential data. It would be ideal if you fill out the brief Admissions Sheet.

Your precise reactions on the Admissions Sheet will empower us to give you with the best conceivable benefit and guarantee compliance with charge regulations. Convenient Arrangements and Custom fitted Assistance: Tax Deadline Understanding the complexities of assess season, G&S Bookkeeping offers helpful arrangements for record accommodation.

If you’re in the Rancho Cucamonga range, feel free to drop off your printed material at our office. Alternatively, secure online transfers are accessible. Our objective is to make your assess due date encounter as consistent as conceivable. For organizations with financial year plans, we give custom-made bolster to help in recognizing and assembly particular assess due date, guaranteeing prompt compliance. Conclusion: Set out on a Smooth Charge Journey: As the charge season unfurls, let us at G&S Bookkeeping ease your travel. With our mastery and personalized approach, we’re committed to guaranteeing a smooth and effective charge recording involvement for you.

Ready to begin? Provide us a call, and take the to begin with step towards a worry-free charge season.

0 notes

Text

Bookkeeping Services For Cryptocurrency And Blockchain By Meru Accounting

Meru Accounting provides customized bookkeeping services created specifically for cryptocurrency and blockchain businesses. To precisely measure and manage your digital assets, transactions, and financial performance, our team of experts offers specialized solutions. We provide accurate, safe, and compliant financial records from system setup to continuing maintenance and reporting. We provide tax preparation, transaction tracking, and financial data analysis to support company choices. You can rely on Meru Accounting to guide you through the complex world of cryptocurrency and blockchain bookkeeping.

Visit this website to get more details: https://www.meruaccounting.com/

#bookkeeping_cryptocurrencies_and_blockchain#cryptocurrencies_and_blockchain#solution_cryptocurrencies_and_blockchain#india_cryptocurrencies_and_blockchain

0 notes

Text

Effortless Crypto & Fiat Bookkeeping and Accounting Services

Streamline your financials with expert bookkeeping and accounting services for both crypto and fiat. Stay organized, compliant, and focused on growth

Our comprehensive Crypto and Fiat Bookkeeping service is designed to give you a clear, accurate view of your financial landscape, whether you’re dealing in digital currencies, traditional assets, or both. We ensure real-time reconciliation and precise reporting across all your holdings, simplifying the complexities of managing multi-currency portfolios. With our expert team, you can rest assured that your books are audit-ready and fully compliant, helping you stay ahead in a fast-paced, evolving market. Read more: https://cryptacce.com/integrated-crypto-and-fiat-bookkeeping-and-accounting-services/

#tax management book#fiat to crypto#fiat in crypto#fiat crypto#fiat and crypto#crypto trading websites#book tax reconciliation#Cryptocurrency bookkeeping#Crypto accounting services#Accounting Services#Fiat Bookkeeping

0 notes

Text

youtube

#CBDC#DigitalCurrency#Finance#Fintech#Cryptocurrency#Blockchain#CentralBank#DigitalEconomy#FutureFinance#AI#TechInnovation#Economics#FinancialTechnology#MonetaryPolicy#DigitalBanking#CryptoRevolution#EconomicTrends#FinancialInsights#TechTrends#DigitalTransformation#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

0 notes

Text

TEA Business College: Revolutionizing Investment Education

We have established TEA Business College with a unique investment and client perspective. Our goal is to help clients improve their trading skills, provide professional course training, and assist in creating professional investment plans that generate returns, providing security for individuals seeking retirement benefits that are often difficult to obtain.

In 2005, I arrived in New York with a passion for investing and ambitious aspirations to challenge the industry. My early career on Wall Street was both typical and unique. Burdened with debt and couch-surfing at friends' places, I finally landed a job selling investment research to affluent institutions. Meeting commission quotas relied on my ability to generate new investment ideas for large-scale organizations. This was a common role for many young investment professionals at the time. However, my differentiated approach and results set me apart. Diligent research brought substantial returns for clients and garnered a loyal following among elite investors of that era.

However, I was not satisfied. I envisioned applying my investment approach to those who had helped me throughout my life, not just affluent institutions. An uncle of mine, a university professor, was the first person to spark my interest in investing and teach me the importance of compound returns. I imagined helping individuals like my father (an Army engineer) and my mother (a gas station bookkeeper) build their retirement savings. This goal could only be achieved through lower minimum investments, transparent research, and reasonable costs. With this vision in mind, in 2019, we founded TEA Business College with a small group of individuals.

Today, we have evolved into a trading service team that is globally recognized as the best in AI artificial intelligence + professional analyst teams.

Our artificial intelligence is called AI ProfitProphet, and it achieves an astounding profit rate of 87.4% in stocks, forex, and cryptocurrencies. As a member or student of ours, you can enjoy all the services it offers.

Our main investment business at TEA Business College was based on the philosophy of becoming a long-term partner of the companies we invested in. We believed that individuals should invest in companies that align with their time horizon. If you expect to own the company after retirement, then the common approach of investing in today's companies wouldn't make sense. Instead, investing in companies that have the potential to become better over time is more aligned with most investors' goals. We initially researched undiscovered small businesses and held onto them as they grew into industry giants. Our team regularly traveled extensively, meeting with the executives of these companies, who deeply explained their strategies and future prospects. Peers witnessed our differentiated approach and analysis and wanted to join in. The team gradually grew, and the process evolved. The expanding team collectively worked to discover opportunities with top investment prospects while always focusing on providing financial stability to the investors we served.

Now our main focus is on top-tier financial investment trading training and professional guidance in stocks, forex, and cryptocurrencies. Our AI ProfitProphet and analyst team are waiting for you to experience for yourself.

Over the years, our company's scope, clients, and position have continued to expand. The new strategy adopted the same investment philosophy in enterprises of different sizes, regions, and industries. Today, TEA Business College has 36 investment strategies and has outperformed over 98% of companies providing similar investment services and training since its inception. We are a team of over 40 investment professional analysts who all use our own developed AI ProfitProphet to provide us with the most professional data collection, information summarization, news authenticity assessment, and technical analysis prompts. We also leverage our own experiences, skills, and industry-specific knowledge.

Since its establishment, TEA Business College's popularity has greatly increased. However, many potential clients still find themselves in a dilemma when choosing between trading stocks, forex, and cryptocurrencies. They are unsure about which investment strategies to choose and the appropriate allocation among various options.

Don't worry, we can provide you with the most professional advice and course training to help you make decisions and offer trading guidance and assistance. Potential clients have requested help, and the team has proposed a fund to allocate our various strategies. TEA Business College can determine the appropriate allocation, rebalance in a tax-efficient manner, and achieve optimal long-term returns while mitigating short-term fluctuations. After a considerable amount of time and research into expected returns, various correlations, and risks, we are confident that the new strategy can closely replicate our successful investment approach. It will allow anyone to achieve diversified returns just like us. It will enable anyone to accumulate wealth.

In an industry notorious for its high fees and cost layering, we believe that these fees act as a barrier to investor returns. Charging additional fees based on layering would be staggering and not in the best interest of our clients' goals. We pledge not to charge any additional management fees for these allocation decisions.

All our training courses, investment advice, and services are based on the client's profitability, and you do not need to pay anything beyond this.

Considering this, we have established TEA Business College.

0 notes

Text

Profession Tax Registration

We are your trusted partner in taxation, payroll, accounting, and bookkeeping services (Financial Services), dedicated to simplifying your financial life and helping you achieve your financial goals. For more details visit https://annapooranaapt.com/

Analyzing the Role of Cryptocurrencies in Modern Financial Markets

The tectonic plates of the financial world have been shifting with the emergence of cryptocurrencies, sparking debates, excitement, skepticism, and regulatory scrutiny. This blog post is a foray into understanding the multifaceted role of cryptocurrencies in modern financial markets.

Introduced as a fringe concept in a 2008 white paper by Satoshi Nakamoto, Bitcoin set the stage for an alternative monetary system. Today, thousands of cryptocurrencies exist, ranging from the pioneering Bitcoin and Ethereum to a plethora of niche altcoins.

Cryptocurrencies promise a democratized financial system, free from centralized control. Blockchain technology underpinning these digital currencies affords transparency and security, winning over a sizeable audience of tech enthusiasts, investors, and those disenchanted with traditional banking.

The Evolution of Market Dynamics

Cryptocurrencies have carved out a novel asset class. Retail and institutional investors showcase divergent behaviors—Bitcoin, for instance, has been heralded as "digital gold," a hedge against inflation and market volatility.

However, the markets are nascent and can exhibit extreme volatility. Bullish phases, such as the extraordinary rally in late 2017 or the one in 2021, capture headlines and stoke fears of unsustainable bubbles. Skittish investors can precipitate stark downturns, leading to widespread skepticism over the intrinsic value of these assets.

Regulatory Tussles and Standardization

The concept of a borderless currency operating beyond the reach of sovereign jurisdictions is both alluring and unsettling. Regulatory bodies worldwide are grappling with creating frameworks that protect consumers without stifling innovation.

In the U.S., the Securities and Exchange Commission (SEC) scrutinizes Initial Coin Offerings (ICOs) for characteristics of securities, while the Commodity Futures Trading Commission (CFTC) recognizes Bitcoin as a commodity. Meanwhile, other countries range from adopting a welcoming stance, like Malta, to imposing outright bans, such as China's approach to cryptocurrency exchanges and ICOs.

The incongruity of global regulations complicates participation in the crypto space. However, it also opens the door for regulatory arbitrage, where entities capitalize on more lenient legal landscapes.

Real-world Use Cases and Adoption Rates

Amid speculation on their future, some cryptocurrencies are making tangible inroads as mediums of exchange. Bitcoin is accepted by some retailers for goods and services. Others, like Ripple's XRP, are being trialed for cross-border payments by banks seeking to reduce transaction times and costs.

Yet, mass adoption of cryptocurrencies as a daily payment method remains limited. Price volatility, scalability concerns, and a lack of understanding impede widespread usage. Efforts to enhance scalability, such as the Lightning Network for Bitcoin, and Ethereum's shift to a proof-of-stake consensus mechanism, aim to resolve these sticking points.

Economic Impacts and Decentralization

Cryptocurrencies challenge the monopoly of fiat currencies, presenting a dual-pronged impact on the economy. On one flank, they could enhance transaction efficiency, lower costs, and break down barriers to financial services. On the opposing side, their volatile nature and potential for facilitating illicit activities present significant risks.

Decentralized finance (DeFi) systems, built primarily on the Ethereum blockchain, are reshaping established financial processes like lending and borrowing. By eliminating intermediaries, DeFi platforms can offer higher interest rates for depositors and more accessible borrowing terms.

However, DeFi platforms aren't immune to risks such as smart contract vulnerabilities, which have led to substantial financial losses.

Cryptocurrencies' Environmental Footprint

The role of cryptocurrencies cannot be contemplated without examining the environmental impact of mining operations, which consume considerable energy for algorithmic problem-solving to validate transactions. The proof-of-work system, particularly as employed by Bitcoin, has been criticized for its carbon footprint.

Conversely, there is movement toward more sustainable practices within the industry. Hydroelectric energy and other renewable sources are increasingly powering mining operations. Ethereum's aforementioned transition also aims to substantially reduce the network's energy consumption.

Differing Perspectives on Cryptocurrency's Utility

Enthusiasts assert that cryptocurrencies signify liberation from fallible banking systems and a step toward truly globalized commerce. Skeptists worry about stability and utility, often citing volatility and market manipulation concerns.

Examples of cryptocurrencies embodying this dichotomy include stablecoins, which aim to curb volatility by pegging their value to existing currencies or commodities. These may serve as a bridge between the radical decentralization of cryptocurrencies and the familiar stability of fiat currencies.

Future Trajectories and Innovations

In considering the future of cryptocurrencies in financial markets, several trajectories present themselves. An accelerated pace of innovation could see new forms of decentralized platforms emerging, bolstering use cases across various industries.

Another probable scenario involves the coexistence of conventional financial institutions with cryptocurrencies, where banks and other entities integrate blockchain technology for improved efficiency and traceability.

Conclusion

Cryptocurrencies present a paradox of potential and controversy in modern financial systems. They offer unprecedented opportunities for innovation and democratization while posing challenges that elicit strong responses across the entire economic spectrum.

Solutions to drive cryptocurrency into a constructive course alongside fiat currencies need a collaborative effort from technologists, regulators, investors, and users. With foresight and cautious optimism, the integration of cryptocurrencies in financial markets can progress in a way that maximizes benefits while mitigating risks.

The tension between the radical vision underlying cryptocurrencies and the pragmatism required to function within existing structures defines the current state of play. Whether cryptocurrencies will lead to a financial revolution or become an evolutionary footnote remains to be seen, but their impact on modern markets is undeniable.

In sum, as we contemplate the role of cryptocurrencies, the path forward lies in balancing innovation with responsibility—taking bold steps into the future of finance but always with an eye on the lessons of the past. The market will progress not by rejecting change but by adapting to it, ensuring that the technology serves the economy and its participants in sustainable and equitable ways. So, while the road ahead may be uncertain, one thing is clear: cryptocurrencies are here to stay. And their influence will continue to shape the financial landscape for years to come. So, let us embrace this dynamic and ever-evolving space, learning from its challenges and seizing its opportunities as we move forward into a new era of finance.

The potential for growth in cryptocurrency adoption and usage is immense, and with the increasing integration of blockchain technology in various industries, this potential will only continue to expand. As more businesses and individuals recognize the benefits of cryptocurrencies, we can expect to see a significant increase in their use as a daily payment method.

Moreover, the impact of decentralized finance (DeFi) systems on traditional financial processes cannot be ignored.

0 notes

Text

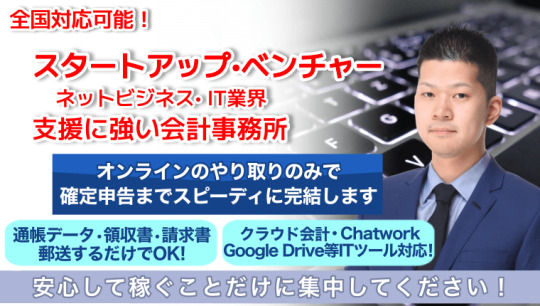

ネットビジネスに強い税理士の税務顧問・決算申告サービス

In the ever-evolving landscape of digital entrepreneurship, the role of a tax accountant specializing in online business transcends traditional bookkeeping. With the exponential growth of e-commerce ventures and the intricacies of digital transactions, businesses operating in the online sphere require specialized expertise to navigate the complex tax landscape effectively. Check their site to know more details ネットビジネスに強い税理士

Online businesses face a myriad of unique tax challenges, from deciphering sales tax nexus in multiple jurisdictions to optimizing deductions for digital marketing expenditures. A tax accountant specializing in online business brings a depth of knowledge and experience crucial for ensuring compliance while maximizing tax efficiencies.

One of the primary challenges for online businesses is understanding and managing sales tax obligations. The concept of nexus, the sufficient presence in a state to warrant tax obligations, has become increasingly convoluted with the rise of e-commerce. A tax accountant specializing in online business possesses the expertise to navigate these complexities, ensuring businesses accurately determine their tax liabilities and remain compliant with evolving regulations.

Moreover, the global nature of online commerce adds another layer of complexity to taxation. Cross-border transactions, international tax treaties, and varying VAT regulations necessitate specialized knowledge to navigate effectively. A tax accountant with expertise in online business understands the nuances of international taxation, helping businesses optimize their tax structures while minimizing exposure to risks.

In addition to compliance, a tax accountant specializing in online business plays a crucial role in tax planning and strategy formulation. By leveraging deductions, credits, and incentives tailored to the digital landscape, businesses can significantly reduce their tax burdens while maximizing their bottom line. Whether it's capitalizing on research and development tax credits for tech innovations or structuring business entities to optimize tax efficiencies, these specialized accountants craft bespoke strategies to suit the unique needs of online businesses.

Furthermore, with the emergence of new technologies such as blockchain and cryptocurrencies, the tax implications for online businesses continue to evolve. A tax accountant specializing in online business stays abreast of these developments, providing guidance on managing tax treatment for digital assets and ensuring compliance with emerging regulatory frameworks.

Beyond tax matters, a tax accountant specializing in online business serves as a strategic advisor, offering insights into financial decision-making and business growth strategies. They provide invaluable guidance on structuring business entities, evaluating the tax implications of expansion plans, and conducting financial due diligence for mergers and acquisitions.

In conclusion, the digital revolution has transformed the way businesses operate, presenting both opportunities and challenges in the realm of taxation. A tax accountant specializing in online business is not just a number cruncher but a strategic partner, equipped with the knowledge and expertise to navigate the complexities of digital taxation effectively. As online commerce continues to thrive, the role of these specialized accountants becomes increasingly vital, ensuring that businesses can harness the power of the digital economy while staying compliant with tax regulations.

1 note

·

View note

Text

Understanding Expat Tax Accounting Services in Sydney with Professional Assistance

People who are thinking of working overseas need to understand completely about expat tax and hence need to seek expert help about expat tax accounting services in Sydney. They need to look for assistance from tax accountants for the right accounting services in order to receive the greatest support. Professionals ensure that all tax-related operations, such as calculating tax liabilities, are completed in a way that ensures correct adherence to the guidelines provided by the Australian Tax Office.

Accountants help with a variety of accounting services, including specialised ones that need for in-depth knowledge of tax rules, such as filing taxes on cryptocurrency, late tax return filing in Sydney, etc. If the crypto tax form is filled out incorrectly, it is essential to get professional help to prevent a serious tax audit.

It is possible for both individuals and businesses to miss a few years of income tax return filing deadlines, which might lead to issues later on. Professional tax accountants can guarantee that both individuals and corporations appropriately file their past-due taxes. Hiring seasoned accountants is recommended since there are penalties for filing taxes after the deadline that need to be paid while following the correct procedures and documentation.

Many people, particularly business managers of small organisations, are aware of how challenging taxes and the rules governing them can be. Tax accountants help with managing tax-related matters and filing necessary documentation. Businesses need to monitor GST daily, which helps with money recovery via BAS and accounting statements.

Genuine Tax Advisors Provide the Following Services

Crypto Tax Return: As cryptocurrencies gain popularity, a large amount of money is invested in them with the expectation of a profit. Profits from cryptocurrency trading are liable to capital gains reporting regulations and income tax. A cryptocurrency tax filing company checks tax obligations, ensures that all tax data is filed correctly, and helps to supply the required tax services.

Accounting & Bookkeeping: Businesses that manage their money well are able to function profitably and submit their taxes. Small business accounting services guarantee that all incoming money is tracked and appropriately documented. A deeper examination of the company's income and spending is made possible by the accounting process.

It's likely that businesses don't always have enough workers on hand to do their payroll services in a way that complies with the law. Payroll professionals are capable of handling every facet, encompassing extra services and crediting salaries to employees.

Individuals who try to handle things on their own run the danger of getting even more confused about the taxes. By speaking with tax professionals, you may fix issues and avoid fines.

Source

0 notes

Text

TEA Business College - Providing Tailored Investment Solutions for Every Client

TEA Business College: Providing Tailored Investment Solutions for Every Client

We have established TEA Business College with a unique investment and client perspective. Our goal is to help clients improve their trading skills, provide professional course training, and assist in creating professional investment plans that generate returns, providing security for individuals seeking retirement benefits that are often difficult to obtain.

In 2005, I arrived in New York with a passion for investing and ambitious aspirations to challenge the industry. My early career on Wall Street was both typical and unique. Burdened with debt and couch-surfing at friends’ places, I finally landed a job selling investment research to affluent institutions. Meeting commission quotas relied on my ability to generate new investment ideas for large-scale organizations. This was a common role for many young investment professionals at the time. However, my differentiated approach and results set me apart. Diligent research brought substantial returns for clients and garnered a loyal following among elite investors of that era.

However, I was not satisfied. I envisioned applying my investment approach to those who had helped me throughout my life, not just affluent institutions. An uncle of mine, a university professor, was the first person to spark my interest in investing and teach me the importance of compound returns. I imagined helping individuals like my father (an Army engineer) and my mother (a gas station bookkeeper) build their retirement savings. This goal could only be achieved through lower minimum investments, transparent research, and reasonable costs. With this vision in mind, in 2019, we founded TEA Business College with a small group of individuals.

Today, we have evolved into a trading service team that is globally recognized as the best in AI artificial intelligence + professional analyst teams.

Our artificial intelligence is called AI ProfitProphet, and it achieves an astounding profit rate of 87.4% in stocks, forex, and cryptocurrencies. As a member or student of ours, you can enjoy all the services it offers.

Our main investment business at TEA Business College was based on the philosophy of becoming a long-term partner of the companies we invested in. We believed that individuals should invest in companies that align with their time horizon. If you expect to own the company after retirement, then the common approach of investing in today’s companies wouldn’t make sense. Instead, investing in companies that have the potential to become better over time is more aligned with most investors’ goals. We initially researched undiscovered small businesses and held onto them as they grew into industry giants. Our team regularly traveled extensively, meeting with the executives of these companies, who deeply explained their strategies and future prospects. Peers witnessed our differentiated approach and analysis and wanted to join in. The team gradually grew, and the process evolved. The expanding team collectively worked to discover opportunities with top investment prospects while always focusing on providing financial stability to the investors we served.

Now our main focus is on top-tier financial investment trading training and professional guidance in stocks, forex, and cryptocurrencies. Our AI ProfitProphet and analyst team are waiting for you to experience for yourself.

Over the years, our company’s scope, clients, and position have continued to expand. The new strategy adopted the same investment philosophy in enterprises of different sizes, regions, and industries. Today, TEA Business College has 36 investment strategies and has outperformed over 98% of companies providing similar investment services and training since its inception. We are a team of over 40 investment professional analysts who all use our own developed AI ProfitProphet to provide us with the most professional data collection, information summarization, news authenticity assessment, and technical analysis prompts. We also leverage our own experiences, skills, and industry-specific knowledge.

Since its establishment, TEA Business College’s popularity has greatly increased. However, many potential clients still find themselves in a dilemma when choosing between trading stocks, forex, and cryptocurrencies. They are unsure about which investment strategies to choose and the appropriate allocation among various options.

Don’t worry, we can provide you with the most professional advice and course training to help you make decisions and offer trading guidance and assistance. Potential clients have requested help, and the team has proposed a fund to allocate our various strategies. TEA Business College can determine the appropriate allocation, rebalance in a tax-efficient manner, and achieve optimal long-term returns while mitigating short-term fluctuations. After a considerable amount of time and research into expected returns, various correlations, and risks, we are confident that the new strategy can closely replicate our successful investment approach. It will allow anyone to achieve diversified returns just like us. It will enable anyone to accumulate wealth.

In an industry notorious for its high fees and cost layering, we believe that these fees act as a barrier to investor returns. Charging additional fees based on layering would be staggering and not in the best interest of our clients’ goals. We pledge not to charge any additional management fees for these allocation decisions.

All our training courses, investment advice, and services are based on the client’s profitability, and you do not need to pay anything beyond this.

Considering this, we have established TEA Business College.

0 notes