#Cryptocurrency Hardware Wallet industry Growth Size

Explore tagged Tumblr posts

Text

Global Cryptocurrency Market: Key Players and Competitive Landscape

The global cryptocurrency market is projected to reach a size of USD 11.71 billion by 2030, according to a recent report by Grand View Research, Inc. The market is anticipated to grow at a compound annual growth rate (CAGR) of 13.1% from 2025 to 2030. This growth is expected to be driven by several factors, including the increasing demand for enhanced data security, greater operational transparency, and the integration of blockchain technology into digital payment systems. Furthermore, the ongoing legalization of the purchase, sale, and trading of digital currencies in several developed countries, including the U.S., is also expected to stimulate the expansion of the cryptocurrency market.

The cryptocurrency industry is set to benefit from the growing global adoption of digital currencies such as Bitcoin, Ethereum, and Litecoin. The increasing popularity of these digital currencies can be attributed to their ability to provide fast, transparent, secure, and efficient payment solutions to users. According to Crypto.com, the number of cryptocurrency owners surged to 295 million in December 2021, up from 228 million in July 2021, highlighting the accelerating growth and adoption of cryptocurrencies.

In addition to this, advancements in artificial intelligence (AI) are expected to positively impact the cryptocurrency market. The growing popularity of AI-powered cryptocurrency platforms has spurred interest and investment in this technology. For example, in August 2021, researchers at Los Alamos National Laboratory developed an AI algorithm capable of identifying unauthorized cryptocurrency miners who use research computers for cryptocurrency mining. Such innovations are expected to drive further market growth and encourage businesses to focus on the development of AI-based cryptocurrency solutions.

The COVID-19 pandemic had a negative effect on market growth in 2020, as global supply chain disruptions slowed the sales of cryptocurrency mining hardware, and border closures impacted operations. Additionally, blockchain companies were forced to reduce their staffing levels and budgets as a result of the pandemic's economic consequences. For instance, Cipher Trace cut jobs in its advertising and marketing departments, while Elliptic laid off employees in both the U.S. and the U.K. However, the market saw a recovery in 2021, with a steady uptick in growth as businesses adjusted to the new normal and demand for cryptocurrencies rebounded.

Gather more insights about the market drivers, restrains and growth of the Cryptocurrency Market

Cryptocurrency Market Report Highlights

• The hardware segment is expected to dominate the market in 2024. This dominance is primarily driven by the increasing demand for cryptocurrency mining devices, which are essential for mining new coins and adding them to the cryptocurrency supply chain. The growing reliance on mining operations and the necessity of efficient mining hardware will continue to fuel this segment's expansion.

• The graphics processing unit (GPU) segment is projected to experience the fastest growth during the forecast period. The rise in demand for GPUs in cryptocurrency mining is attributed to their ability to offer high-speed processing while consuming less energy compared to other types of hardware. This energy efficiency and processing power make GPUs the preferred choice for many cryptocurrency miners, driving growth in this segment.

• The wallet segment is also anticipated to witness the fastest growth during the forecast period. As cryptocurrencies gain broader adoption, the need for secure and user-friendly wallets to store, trade, send, and receive digital currencies will continue to rise. This growing demand for cryptocurrency wallets will be a key factor driving the expansion of this segment.

• The mining segment is expected to dominate the market in 2024. This is largely due to the significant investments being made by companies to establish large-scale cryptocurrency mining farms. These mining operations are crucial to the growth and sustainability of the cryptocurrency ecosystem, and continued investments in this area will contribute to the segment's market share.

• The bitcoin segment has been the dominant force in the cryptocurrency market in 2024 and is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to Bitcoin’s increasing popularity and its growing acceptance as a legitimate form of currency. Additionally, the adoption of Bitcoin by emerging countries, such as El Salvador, is expected to further fuel the segment’s growth as more nations recognize its potential.

• The retail & e-commerce segment is anticipated to grow at the fastest CAGR through the projection period. The increasing acceptance of cryptocurrencies by retail and e-commerce businesses, which are beginning to offer cryptocurrencies as a form of payment, will drive the expansion of this segment. As more consumers and businesses embrace cryptocurrencies, the retail and e-commerce industry will continue to see strong growth.

• The Asia Pacific region is expected to register rapid growth during the forecast period. The presence of a large number of cryptocurrency mining companies in the region, along with the growing adoption of cryptocurrencies, is expected to drive regional market growth. The region's established infrastructure and increasing investments in the cryptocurrency sector will contribute to its continued expansion.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• Augmented Reality Navigation Market: The global augmented reality navigation market size was estimated at USD 1.62 billion in 2024 and is expected to grow at a CAGR of 39.1% from 2025 to 2030.

• Serverless Computing Market: The global serverless computing market size was estimated at USD 24.51 billion in 2024 and is anticipated to grow at a CAGR of 14.1% from 2025 to 2030.

Cryptocurrency Market Segmentation

According to Grand View Research, the global cryptocurrency market is segmented into various components, processes, types, end-uses, and regions. Here’s a breakdown of the market:

Cryptocurrency Component Outlook (Revenue, USD Billion, 2018 - 2030)

• Hardware

o Central Processing Unit (CPU)

o Graphics Processing Unit (GPU)

o Application-Specific Integrated Circuit (ASIC)

o Field Programmable Gate Array (FPGA)

• Software

o Mining Software

o Exchange Software

o Wallet Software

o Payment Software

o Others

Cryptocurrency Process Outlook (Revenue, USD Billion, 2018 - 2030)

• Mining

• Transaction Processing

Cryptocurrency Type Outlook (Revenue, USD Billion, 2018 - 2030)

• Bitcoin

• Bitcoin Cash

• Ethereum

• Litecoin

• Ripple

• Others

Cryptocurrency End-use Outlook (Revenue, USD Billion, 2018 - 2030)

• Banking

• Gaming

• Government

• Healthcare

• Retail & E-commerce

• Trading

• Others

Cryptocurrency Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

• Latin America

o Brazil

• Middle East and Africa (MEA)

o KSA

o UAE

o South Africa

List of Key Players in the Cryptocurrency Market

• Advanced Micro Devices, Inc.

• Binance

• Bit fury Group Limited

• Bit Go, Inc.

• Bit Main Technologies Holding Company

• Intel Corporation

• NVIDIA Corporation

• Ripple

• Xapo Holdings Limited

• Xilinx, Inc.

Order a free sample PDF of the Cryptocurrency Market Intelligence Study, published by Grand View Research.

#Cryptocurrency Market Growth Trends#Cryptocurrency Market#Crypto Trends#Crypto Adoption#Crypto Investment#Market Insights#Crypto Growth#Crypto Innovation

0 notes

Text

Top International Integrated Payment Gateway Platforms in 2023

In our increasingly globalized world, choosing the right international Integrated Payment Platform is paramount for businesses of all sizes and industries are expanding their reach beyond borders, and e-commerce has become a key driver of this growth. To facilitate cross-border transactions and streamline online payments, the choice of a reliable international integrated payment gateway platform is crucial. As we step into 2023, let's explore some of the best international payment gateway platforms and, more importantly, how market intelligence reports can guide your choice.

Top 8 Payment Gateway Platform

Stripe

Stripe has consistently ranked among the top integrated payment gateway platforms worldwide. Known for its user-friendly interface and robust API, Stripe provides businesses with the tools they need to accept payments in over 135 currencies. Its features include support for subscriptions, one-click payments, and mobile wallets. Stripe's expansive global reach and commitment to security make it a top choice for businesses seeking international expansion.

PayPal

PayPal remains a household name in the world of online payments. With its presence in over 200 countries and support for 25 currencies, PayPal is an excellent choice for businesses that want to operate on a global scale. The platform offers various integration options, including easy-to-implement plugins for popular e-commerce platforms. Additionally, its reputation for trust and security makes it a preferred choice for international transactions.

Adyen

Adyen is a payment gateway platform designed for global commerce. It supports over 150 payment methods and 200 currencies, making it a favorite for businesses looking to expand internationally. Adyen's unique feature is its ability to offer a seamless, unified payment experience across various regions. It also provides extensive data insights to help businesses optimize their payment strategies.

Worldpay

Worldpay, a part of FIS Global, is a prominent player in the global payments industry. It offers a range of solutions designed to simplify international transactions for businesses of all sizes. Worldpay's platform supports multiple payment methods, currencies, and languages, making it a versatile choice for international operations. The platform's commitment to data security and fraud prevention is a strong selling point for businesses concerned about payment safety.

Talk With Us

Square Square, known for its user-friendly interface and in-person payment solutions, has also expanded its international reach. With support for multiple currencies and integration options for e-commerce websites, Square is a suitable choice for businesses looking to accept payments across borders. Square's point-of-sale (POS) hardware and software are especially popular among small and medium-sized businesses.

Authorize.Net

Authorize.Net is a well-established payment gateway platform that offers international payment solutions. It supports multiple currencies, payment methods, and e-commerce platforms. What sets Authorize.Net apart is its focus on providing secure and reliable payment processing services, making it an attractive option for businesses that prioritize data security.

Braintree

Braintree, a subsidiary of PayPal, is another strong contender for international payment processing. It provides support for more than 130 currencies and offers various payment options, including mobile wallets and credit cards. Braintree's robust developer tools and documentation make it an excellent choice for businesses with unique integration needs.

Skrill

Skrill, previously known as Moneybookers, is a digital wallet and integrated payment gateway that caters to international businesses. With support for over 40 currencies and multiple payment methods, including cryptocurrency, Skrill is a versatile choice. It is particularly popular among businesses in the e-gaming and online trading industries.

Every platform offers a unique features and capabilities. The choice of payment gateway platform should be based on your organization's specific needs, scale, and industry requirements. For better understanding, study Quadrant Knowledge Solutions' Market Intelligence (MI) reports play a crucial role in assisting companies in their decision-making processes. These reports are invaluable tools for businesses seeking to make informed choices about technology solutions, including payment gateway platforms. They provide comprehensive insights into the market landscape, including detailed analysis, market trends, and vendor comparisons. By leveraging Quadrant Knowledge Solutions' Integrated Payment Platform, 2022-2027, Worldwide reports, companies can gain a deeper understanding of the strengths and weaknesses of various payment gateway platforms, allowing them to choose the most suitable option that aligns with their specific business requirements and long-term objectives.

Conclusion

Selecting the best international Integrated Payment Platform for your business is a pivotal decision. Market intelligence reports serve as your guiding light, providing valuable insights into each platform's performance, customer satisfaction, and unique features. These reports empower you to make informed decisions that drive your global expansion and financial success. By utilizing the information from these reports, businesses can confidently navigate the complex landscape of payment gateway platforms and to make the right choice, consider your business's requirements, budget, and long-term growth strategy, and don't hesitate to seek expert advice when needed.

#InternationalPaymentGatewayPlatforms#IntegratedPaymentSolutions#CrossBorderTransactions#EcommerceExpansion#MarketIntelligenceReports#Worldpay#Square#AuthorizeNet#Braintree#Skrill#CurrencySupport#PaymentMethods#DataSecurity#FraudPrevention

0 notes

Text

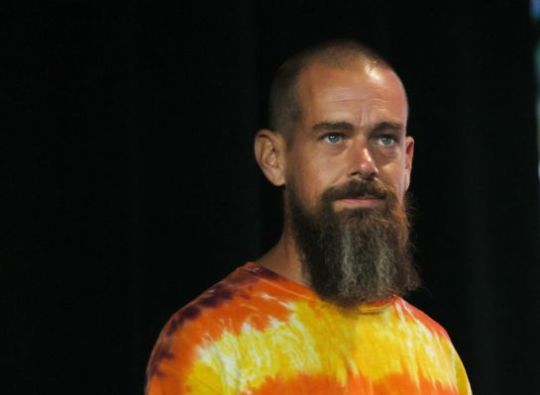

Block becomes the latest fintech to lay off workers

Block, the fintech company whose subsidiaries include Square, Cash App and Afterpay, is laying off staff at a tumultuous time for tech industry workers.

That’s according to an internal memo from CEO Jack Dorsey, obtained first by Business Insider, which states that “the growth of [Block] has far outpaced the growth of … business and revenue.”

.adtnl4-container { width: 100%; max-width: 100%; background-color: #34495e; border-radius: 10px; overflow: hidden; box-shadow: 0 10px 20px rgba(0, 0, 0, 0.2); margin: 20px auto; } .adtnl4-banner { width: 100%; max-height: 200px; overflow: hidden; } .adtnl4-banner img { width: 100%; height: auto; max-height: 200px; object-fit: cover; } .adtnl4-content { width: 100%; padding: 20px; box-sizing: border-box; text-align: left; font-family: 'Open Sans', sans-serif; color: #ecf0f1; background-color: #34495e; } .adtnl4-title a { font-size: 1.2em; font-weight: bold; margin-bottom: 10px; color: #fff; text-decoration: none; } .adtnl4-description { font-size: 1em; line-height: 1.6; color: #fff; margin-bottom: 15px; margin-top: 5px; } .adtnl4-learn-more-button { display: inline-block; padding: 10px 20px; font-size: 1em; font-weight: bold; text-decoration: none; background-color: #e74c3c; color: #fff; border-radius: 5px; transition: background-color 0.3s; } .adtnl4-learn-more-button:hover { background-color: #c0392b; } .adtnl4-marker a { font-size: 0.8em; color: #ccc; }

How to Get AdSense Approval Quickly a Personal Journey to Monetizing a Niche Blog

I will share my personal journey of getting AdSense approval quickly for my blog focused on the SME

Read Article

Ads by NSMEJ

The layoffs were executed this morning and affected staff in the Cash App, foundational and Square arms of Block. Reportedly, around 1,000 people — or 10% of Block’s headcount — were impacted.

“We decided it would be better to do at once rather than arbitrarily space them out, which didn’t seem fair to the individuals or to the company,” said Dorsey in the note to Block staff. “When we know we need to take an action, we want to take it immediately, rather than let things linger on forever.”

The firings don’t come as a total surprise. Block said in an earnings call last year that it would reduce its headcount from 13,000 in the Q3 2023 to an “absolute cap” of 12,000 by the end of this year.

But they add to a sense of malaise in the fintech and broader tech sector, which has seen tens of thousands of workers let go in the past few weeks.

Just today, PayPal said it would fire some 2,500 people, or 9% of the company. Last week, Brex, the expense management startup, laid off 282, or 20% of its staff. And Treasure Financial, a platform offering cash management software for businesses, let 14 employees go, leaving the company with about a third of its former workforce.

Block’s suffered a difficult, downward-trending year and change.

Revenues from Cash App, the peer-to-peer payments service, have declined steeply. Meanwhile, the buy now, pay later service Afterpay, which Block acquired in 2021 for $29 billion, has posted serious losses. Block’s Bitcoin revenue has fallen corresponding with the fall in the price of the cryptocurrency last year (although that’s recovered recently). And Square faces growing competition on multiple fronts, including from Fiserv’s Clover, Toast and Stripe.

Investors are displeased. Square stock retreated around 30% from January 2023 to October as Block founder Dorsey took the reigns from ex-Square head Alyssa Henry.

Block’s recent attempts to reinvigorate business include adding generative AI features to Square, acquiring music-focused fintech startup Hifi and launching a self-custody Bitcoin wallet, Bitkey, in the form of a mobile app and hardware storage.

Block reported $5.62 billion in revenue for the third quarter of 2023, with $44 million in profit on its Bitcoin holdings.

.adtnl4-container { width: 100%; max-width: 100%; background-color: #34495e; border-radius: 10px; overflow: hidden; box-shadow: 0 10px 20px rgba(0, 0, 0, 0.2); margin: 20px auto; } .adtnl4-banner { width: 100%; max-height: 200px; overflow: hidden; } .adtnl4-banner img { width: 100%; height: auto; max-height: 200px; object-fit: cover; } .adtnl4-content { width: 100%; padding: 20px; box-sizing: border-box; text-align: left; font-family: 'Open Sans', sans-serif; color: #ecf0f1; background-color: #34495e; } .adtnl4-title a { font-size: 1.2em; font-weight: bold; margin-bottom: 10px; color: #fff; text-decoration: none; } .adtnl4-description { font-size: 1em; line-height: 1.6; color: #fff; margin-bottom: 15px; margin-top: 5px; } .adtnl4-learn-more-button { display: inline-block; padding: 10px 20px; font-size: 1em; font-weight: bold; text-decoration: none; background-color: #e74c3c; color: #fff; border-radius: 5px; transition: background-color 0.3s; } .adtnl4-learn-more-button:hover { background-color: #c0392b; } .adtnl4-marker a { font-size: 0.8em; color: #ccc; }

How to Get AdSense Approval Quickly a Personal Journey to Monetizing a Niche Blog

I will share my personal journey of getting AdSense approval quickly for my blog focused on the SME

Read Article

Ads by NSMEJ

0 notes

Text

ESG Trends and Challenges in the Digital Payments Sector

Financial institutions and technology vendors have repurposed their strategies on digital payments—more so—on the back of a dip in physical cash. Add to it the technological innovations that have leveraged online banking. Cash may still be the king; electronic payment, however, is giving a run for the money. An exponential rise in smartphone usage, surging internet penetration and growth in e-commerce have made electronic payment a force to reckon with. Meanwhile, the luxury of contactless and fast payments comes with caveats—environmental, social and governance challenges.

Amidst climate change, a volatile economy and the Russia-Ukraine war, society, businesses and governments have exhibited a strong commitment to foster an inclusive workplace, accentuate low-carbon energy solutions, bolster transparency and create long-term value. Several financial institutions have started carbon offset programs, providing rewards and loyalty points. In September 2021, Ascenda joined forces with Patch to enable consumers to redeem their rewards points for carbon offsets, helping reduce and eliminate GHG emissions.

PayPal Propels Science-Based Targets (SBTs)

Carbon footprints from the digital payment ecosystem have prompted financial institutions to up their sustainable strategies. A study from Cambridge inferred that Bitcoin used 80% more energy consumption in 2021 compared to the preceding year. Digital wallets reportedly consume less energy vis-à-vis cryptocurrencies, offering opportunities galore. In March 2022, Helpful rolled out digital wallets that it claims can save up to 80% of the CO2 produced from payment transactions.

The potential risks posed by adverse weather conditions on facilities have encouraged companies, such as PayPal to underscore science-based GHG emission reduction targets. The Fintech player achieved 100% renewable energy sourcing for its data centers in 2021, while it reached 90% total energy use in 2022. The American giant formed science-based emission reduction targets—to minimize absolute operational GHG emissions by 25% by 2025. In 2022, the company set the goal to engage 75% of its suppliers (in terms of spending) to SBTs by 2025 and Its IT asset management team retired 338 metric tons of IT hardware across the data center services.

Global Payments Underscores Philanthropic Activities

The social criterion emphasizes a shifting business environment where companies are gearing up to enhance workplace diversity, financial literacy, social equity and health & wellness. In 2021, Global Payments Plano, Texas office teamed up with the National Breast Cancer Foundation (NBCF) and collected USD 1,600 for charity. Besides, the Lindon, Utah team formed a canned food drive to donate 2,500 cans to a local food bank. Taking the philanthropic work further, the company doled out USD 5 million in 2021 to underpin several organizations, such as Red Cross, the American Heart Association, UNCF, Leukemia & Lymphoma Society, Susan G. Komen and Mercer Medical School.

To reinforce financial literacy and economic inclusion, the Fintech company offers around 4 million (especially small and medium-sized businesses) locations globally with digital commerce solutions, allowing acceptance of more than 140 payment methods. Meanwhile, the U.S.-based company has propelled its DEI strategies to augment female representation to 47% and boost the number of people of color to 39% by 2025.

Is your business one of participants to the Digital Payments Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

JP Morgan Embeds Transparency and Accountability

Corporate governance has become a value proposition to impel ethics & compliance, board diversity, transparent work culture, independence and anti-corruption activities. In 2021, directors at JP Morgan were offered education on DEI, cybersecurity, its climate risk management framework and technology. The Board in the financial service company has ramped up corporate culture and values, boosting diversity in leadership positions. As of April 2022, Out of ten, there were four women directors and one black director. Further, women accounted for 37% of seats on the Operating Committee (as of December 2021).

While digital solutions have become invaluable in the economy, data privacy and cybersecurity threats have sent alarm bells to stakeholders. The Global Cybersecurity and Technology Controls organization analyzes changes in global threats and monitors JP Morgan’s operations. In 2022, the company was involved in policy issues, such as software bills of materials, evolving U.S. National Institute of Standards and Technology (NIST), zero trust and notification. The need to protect the global financial system and underpinning cybersecurity will help companies achieve ESG goals.

Fintech players have expedited their strategies to undergird climate solutions and build financial confidence among underserved and vulnerable communities. In the 2021-2022 ESG Report, American Express announced an infusion of USD 3 billion toward DEI initiatives and underrepresented groups through 2025. During the Earth Month of 2022, the financial service company asserted that at least 70% recycled or reclaimed plastic would be used to make most plastic cards by 2024. The rising footprint of contactless- and card payments against the backdrop of the COVID-19 pandemic has made electronic payment the next big thing. The global digital payments market size stood at USD 68.61 billion in 2021 and will expand at a CAGR of 20.5% between 2022 and 2030, reports Grand View Research.

Related Reports:

Digital Lending Industry ESG: https://astra.grandviewresearch.com/digital-lending-industry-esg-outlook

Real-time Payments Industry ESG: https://astra.grandviewresearch.com/real-time-payments-industry-esg-outlook

E-commerce Industry ESG: https://astra.grandviewresearch.com/e-commerce-industry-esg-outlook

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

#Digital Payments Industry ESG#ESG digital payments#Digital Payments Industry#digital payments industry sustainability#Digital Payments Market#esg in payments industry

0 notes

Text

Cryptocurrency Market Resilience in Economic Uncertainty

The cryptocurrency market, a dynamic and ever-evolving financial landscape, continues to capture the attention of investors, regulators, and enthusiasts around the world. In recent years, it has experienced remarkable growth, with established cryptocurrencies like Bitcoin and Ethereum reaching record highs and a plethora of new digital assets entering the scene. This rapid expansion has been driven by a combination of factors, including increased institutional interest, advancements in blockchain technology, and growing adoption of cryptocurrencies for various use cases. Nevertheless, the market is not without its challenges, as it grapples with issues such as regulatory uncertainty and market volatility

The Cryptocurrency Market study by Allied Market Research includes an overview of business trends, competitor analysis, and a future market and technical analysis forecast. In addition, the study gave an illustration of the global value and key regional trends in terms of Earthquake InsurMark size, share and growth opportunities. All information about the global market has been carefully analyzed and verified by industry professionals after being gathered from very reliable sources.

Download PDF Sample Copy: https://www.alliedmarketresearch.com/request-sample/2075

A comprehensive and detailed method that combined primary and secondary research was used to thoroughly investigate the global E-Banking Market. While secondary research gave a broad overview of the products and services, primary research involved a thorough examination of many factors that influence the market. A process of searching is done using a variety of sources, such as press releases, professional journals, and government websites, to gain insights into the industry. This approach has made it possible to acquire a clear, extensive understanding of the global E-Banking Market

Analysis of Key Players:

The market is fragmented, with many large and medium-scale vendors controlling minority shares. Vendors actively engage in product development by making significant investments in R&D initiatives. Through a variety of growth strategies, including alliances, partnerships, mergers, and acquisitions, they are increasing their Shop Insurance Marketshare.

Purchase this Report@ https://www.alliedmarketresearch.com/crypto-currency-market/purchase-options

Major players operating in the Cryptocurrency Market industry include Texas Instruments Incorporated, Aaeon Technology Inc., Nexcom International Co., Ltd., Dell Technologies, TE Connectivity Ltd, Adlink Technology Inc., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Co., Microchip Technology Inc., NXP Semiconductors.

By OFFERING

Hardware

Cryptocurrency for hardware, by type

ASIC

Programmable ASIC

.Full Custom ASIC

GPU

FPGA

Others

Software

Software solution, by type

Mining platform

Exchange

Coin Wallet

By PROCESS

Mining

Transaction

By TYPE

Bitcoin (BTC)

Ethereum (ETH)

Tether (USDT)

Binance Coin (BNB)

Cardano (ADA)

Cardano (ADA)

Others

By END USE INDUSTRY

Trading

Retail and E-commerce

Banking

Others

By Region

North America (U.S, Canada, and Mexico),

Europe (UK, Italy, Germany, France, Spain, Netherlands, Switzerland, and the Rest of Europe),

Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, and Rest of Asia-Pacific),

LAMEA (Latin America, Middle East, and Africa).

The expert team at Allied Market Research continuously analyzes the market environment by making precise predictions about the necessary driving and restraining factors. On these factors, the stakeholders can base their business plans.

Key Benefits for Stakeholders:

This report offers a quantitative examination of the market segments, estimations, recent trends, and dynamics of the Cryptocurrency Market analysis from 2023 to 2032 to specify the key competitive advantages.

An in-depth analysis of Market segmentation helps in determining current market opportunities.

Porter's five forces analysis places a strong emphasis on consumers' and vendors' capacity to develop their supplier-buyer networks and come to profitable business decisions.

The report examines regional and global market segmentation, LAMEA Travel Insurance MarkeTrends, leading players, market growth strategies, and application areas.

Market participants' positioning encourages comparative analysis and provides a clear understanding of the player's current position.

The major countries in each region are mapped based on their revenue contribution to the global market.

The report provides in-depth details of the business tactics used by the major market participants in Cryptocurrency Market growth.

Customization Before Buying, Visit @ https://www.alliedmarketresearch.com/request-for-customization/2075

Key Questions Answered in the Research Report-

What are the market sizes and rates of growth for the various market segments in the global and regional market?

What are the key benefits of the Cryptocurrency Market report?

What are the driving factors, restraints, and opportunities in the global Market?

Which region has the largest share of the global Market?

Who are the key players in the global Market?

Top Trending Reports:

1) POS Payment Market: https://www.alliedmarketresearch.com/pos-payment-market-A10023

2) Cloud Based Point Of Sales(POS) Market: https://www.alliedmarketresearch.com/cloud-based-point-of-sale-market-A11769

3) Cybersecurity in Banking Market: https://www.alliedmarketresearch.com/cybersecurity-in-banking-market-A12738

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 [email protected]

0 notes

Text

Navigating the Crypto Token Ecosystem: A Comprehensive Guide for Investors The cryptocurrency world has evolved rapidly over the past decade, with thousands of digital tokens now available for investors to explore. As this ecosystem continues to expand, it's becoming increasingly important for investors to understand how to navigate this complex landscape. In this comprehensive guide, we will explore key considerations for investors looking to enter the crypto token market and provide practical tips to help them make informed decisions. 1. Educate Yourself: Before investing in any crypto token, it is crucial to understand the underlying technology and the fundamentals of blockchain. Take the time to research and familiarize yourself with key concepts such as decentralized finance (DeFi), smart contracts, and consensus mechanisms. This knowledge will enable you to make better-informed investment decisions. 2. Conduct Thorough Research: Just like traditional investments, due diligence is essential when investing in crypto tokens. Investigate the team behind the token, their track record, and their vision for the project. Analyze the token's whitepaper, roadmap, and any available technical documentation. Evaluate the token's utility and potential adoption in the market. 3. Understand Tokenomics: Tokenomics refers to the economic model of a crypto token. It includes factors like the maximum supply, distribution mechanism, inflation rate, and token use cases. Consider the token's supply dynamics and token distribution to assess its scarcity and potential value over time. Analyze how the token interacts with the project's ecosystem and its potential for generating returns. 4. Assess Regulatory Environment: The cryptocurrency landscape is subject to evolving regulations. Stay updated with the rules and regulations in your jurisdiction to minimize legal and compliance risks. Understand how regulations could impact the token you are interested in, and be aware of any potential legal hurdles or restrictions. 5. Evaluate Market and User Adoption: Look beyond the hype and assess the token's market capitalization, trading volume, and user adoption. Consider factors such as the token's liquidity, trading platforms it is listed on, and its popularity within the crypto community. These indicators can provide insights into the token's potential for growth and longevity. 6. Diversify Your Portfolio: Crypto token investments can be volatile and unpredictable. Diversify your portfolio by investing in tokens across various sectors and sizes. This strategy can help mitigate risk and maximize potential returns. It's advisable to allocate a portion of your investment in well-established tokens with a proven track record while also exploring emerging projects with high growth potential. 7. Store Your Tokens Securely: Cryptocurrencies are digital assets, and their security is paramount. Understand the different types of wallets available, such as hardware wallets, software wallets, and custodial wallets. Choose a secure wallet solution that meets your needs and take necessary precautions to protect your private keys and seed phrases. 8. Stay Informed: The crypto token ecosystem is dynamic and ever-changing. Stay updated with the latest news, industry trends, and technological advancements. Join communities and forums to engage with other investors and industry experts. Additionally, follow reliable sources of information like reputable news outlets and well-regarded industry influencers. 9. Manage Risk: Investing in crypto tokens carries inherent risks. Set realistic investment goals and only invest what you can afford to lose. Implement risk management strategies like setting stop-loss orders, diversifying your portfolio, and avoiding impulsive investment decisions. Stay disciplined and have a long-term investment mindset rather than being swayed by short-term market fluctuations. 10. Seek Professional Advice: If you are unsure about investing in crypto tokens or lack knowledge in this area, consider seeking professional advice.

Engage with financial advisors or professionals who specialize in digital assets and can provide tailored guidance based on your investment goals and risk tolerance. In conclusion, navigating the crypto token ecosystem requires thorough research, a deep understanding of the underlying technology, and a disciplined approach to risk management. By educating yourself, conducting due diligence, and staying informed, you can make more informed investment decisions in this rapidly evolving market. Remember to approach crypto token investments with caution and always do your own research before making any investment decision.

0 notes

Text

World Cryptocurrency Hardware Wallet Market Analysis Industry Size, Share, Growth, Demand and Forecast to 2027

World Cryptocurrency Hardware Wallet Market Analysis Industry Size, Share, Growth, Demand and Forecast to 2027

KandJMarketResearch.com add new report on “World Cryptocurrency Hardware Wallet Market Research Report 2026 (Covering USA, Europe, China, Japan, India and etc)” covered new research with Covid-19 Outbreak Impact details. Market Overview The important market trends along with study of the market scenario and status has been presented in this report published on the Cryptocurrency Hardware Wallet…

View On WordPress

#APAC Cryptocurrency Hardware Wallet market#ASIA Cryptocurrency Hardware Wallet market#Bluetooth Connectivity Type#China Cryptocurrency Hardware Wallet market#Cryptocurrency Hardware Wallet#Cryptocurrency Hardware Wallet industry#Cryptocurrency Hardware Wallet industry Analysis#Cryptocurrency Hardware Wallet industry Growth#Cryptocurrency Hardware Wallet industry Growth Share#Cryptocurrency Hardware Wallet industry Growth Size#Cryptocurrency Hardware Wallet market#Cryptocurrency Hardware Wallet market Analysis#Cryptocurrency Hardware Wallet market Growth#Cryptocurrency Hardware Wallet market Share#Cryptocurrency Hardware Wallet market Size#Cryptocurrency Hardware Wallet market Trends#Digital BitBox#French Cryptocurrency Hardware Wallet market#Germany Cryptocurrency Hardware Wallet market#Individual#Japan Cryptocurrency Hardware Wallet market#Ledger#Middle East Cryptocurrency Hardware Wallet market#NFC Connectivity#North America Cryptocurrency Hardware Wallet market#Professionals#South America Cryptocurrency Hardware Wallet market#South Korea Cryptocurrency Hardware Wallet market#Trezor#UAE Cryptocurrency Hardware Wallet market

0 notes

Text

Near Field Communication to Dominate India Hardware Wallet Market through FY2027 – TechSci Research

Surge in the digitization process and the growing proliferation of smart devices is expected to drive the demand for India hardware wallet market in the forecast period.

According to TechSci Research report, “India Hardware Wallet Market By Connection Type (Near Field Communication, USB and Bluetooth), By Distribution Channel (Online and Offline), By End-User (Capital Market, BFSI (Excluding Capital Market), Real Estate and Others), By Region, Competition Forecast & Opportunities, FY2027”, the India hardware wallet market is expected to witness steady growth for the next five years. A hardware wallet can be defined as a kind of cryptocurrency wallet and is made to store private keys in a secure encrypted hardware device. Hardware devices are not affected by the attack of viruses or other cyber attacking computer viruses. Hardware wallets allow the storage of multiple currencies at the same time as they take up very little storage space. Every transaction is verified with the hardware device which makes it less prone and vulnerable to cyber fraud. The hardware wallet devices use technologies such as Bluetooth and USB, near field communication, among others to make the connection with other electronic devices. There has been a rise in the adoption of cryptocurrencies by consumers as they are a convenient, fast, and secure way to pay for goods. Cryptocurrencies can be used directly without the need for a banking license and eliminate the traditional banking system which is the major reason considered for the high demand for hardware wallets. Hardware wallets provide enhanced security by minimizing data threats. The surge in the adoption of digital technology across various prominent verticals and the rising demand for online transaction is influencing the growth of the market.

The COVID-19 outbreak across the world which has been declared as a pandemic by the World Health Organization has affected several countries adversely including India. Leading authorities of India imposed lockdown restrictions and released a set of precautionary measures to contain the spread of novel coronavirus. Due to imposition of strict regulations and policies by leading authorities, the business had to suffer huge losses. Manufacturing units were temporarily shut down and the shortage of workforce at the manufacturing plants was observed as the workers moved back to their native places. Disruption in the supply chain was observed which led to the lack of availability of raw materials, skilled workforce, and project delays.

However, the rise in concerns regarding data security and privacy of cryptocurrency may hamper the hardware wallet market growth.

Browse XX Figures spread through XX Pages and an in-depth TOC on “India Hardware Wallet Market”.

https://www.techsciresearch.com/report/india-hardware-wallet-market/7800.html

India hardware wallet market is segmented into connection type, distribution channel, end-user, regional distribution, and company. Based on connection type, the market can be bifurcated into near field communication, USB and Bluetooth. The near field communication segment is expected to account for a major market share of the hardware wallet market, FY2023F-FY2027F. The use of near field communication technology provides the storage facility which allows the flexible usage of cryptocurrency. The use of this technology enables consumers to use cryptocurrency as the normal mode of payment by connecting it with mobile applications. The transaction can take place even in the absence of the internet using near field technology which depends on the type of payment request. Based on the end-user, the market can be divided into capital market, BFSI (excluding capital market), real estate, and others. The capital market segment is expected to hold a major market share in the next five years owing to the rise in the market investments and huge revenue generation through them.

Unocoin, WazirX, Coinbase, Exodus, Guarda, Ledger, Trezor, Sugi, KeepKey LLC, BitBox Limited are the leading players operating in India hardware wallet market. Manufacturers are increasingly focusing on research and development process to fuel higher growth in the market. To meet evolving customer demand with respect to better efficiency and durability, several hardware wallet manufacturers are coming up with their technologically advanced offerings.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=7800

Customers can also request for 10% free customization on this report.

“High-end investments by the major players for invention of new technology is expected to fuel the growth of the hardware wallet market in India in the next five years. The development of a non-custodial wallet, and wireless hardware wallet aiming to simplify the cryptocurrency transactions, coupled with the availability of a diverse variety of hardware wallets based on the consumer needs and requirements in the market is bolstering the market growth. The adoption of advanced technology by the major companies such as blockchain technology to offer higher security and ease the transactions relating to cryptocurrency is facilitating the growing demand for e-commerce platforms, which is further expected to propel the hardware wallet market growth till FY2027F,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

According to TechSci Research “India Hardware Wallet Market By Connection Type (Near Field Communication, USB and Bluetooth), By Distribution Channel (Online and Offline), By End-User (Capital Market, BFSI (Excluding Capital Market), Real Estate and Others), By Region, Competition Forecast & Opportunities, FY2027” has evaluated the future growth potential of India hardware wallet market and provided statistics & information on market size, shares, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the India hardware wallet market.

Browse Related Reports

Global Hardware Wallet Market By Connection Type (Near Field Communication, USB and Bluetooth), By Distribution Channel (Online and Offline), By End-User (Capital Market, BFSI (Excluding Capital Market), Real Estate and Others), By Region, Competition, Forecast & Opportunities, 2016-2026

https://www.techsciresearch.com/report/hardware-wallet-market/7557.html

Thailand Managed Security Services Market By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Others), By Deployment Mode (On-Premise, Cloud), By Organization Size (Large Enterprise, SMEs), By End User Industry (BFSI, IT & Telecommunication, Energy & Utilities, Healthcare, Manufacturing, Government & Defense, Others), By Region, Competition, Forecast & Opportunities, 2016-2026

https://www.techsciresearch.com/report/thailand-managed-security-services-market/1430.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

#India Hardware Wallet Market#Cybersecurity Market#India Hardware Wallet Market Size#India Hardware Wallet Market Share#India Hardware Wallet Market Growth#India Hardware Wallet Market Forecast#India Hardware Wallet Market Analysis

2 notes

·

View notes

Text

Mining Firm Canaan Creative Secures Hundreds of Millions of Dollars in Funding

The sustained bear market has hit cryptocurrency miners hard and stalled the incredible growth experienced by hardware manufacturers that service the industry. It seems that investors are still willing to pour significant money into the business, however, judging by Canaan Creative’s latest raise.

Also Read: In the Daily: Amun Funding, Coinsource ATM, Etoro Wallet

Canaan Creative Now Worth Billions

Canaan Creative Co. Ltd, the Chinese company behind the Avalon lineup of ASIC mining chips and rigs, has successfully completed a round of financing worth hundreds of millions of dollars according to media reports from the Asian country. According to these reports, citing unnamed informed sources, the mining hardware manufacturer has now received a valuation in the billions of dollars following the latest funding round.

Known as the world’s second largest manufacturer of cryptocurrency mining hardware, Canaan Creative was founded back in 2013 and employed up to 200 people in Beijing and Hangzhou by 2018, mostly in research and development positions. Beyond its Avalon line of miners, the company was looking into creating other products such as home appliances, including a television set that mines cryptocurrencies “while you sleep” and specialized chips to power artificial intelligence (AI) applications.

Is Canaan Still Chasing an IPO?

Canaan getting a valuation in the billions can be seen a show of confidence by investors in the field. Previously the company was known to be trying to get its shares listed on the Hong Kong stock exchange in an initial public offering (IPO) estimated to range from $400 million to $1 billion. The IPO, which was initially expected in 2018, hasn’t materialized after regulators in Hong Kong reportedly raised concerns about Canaan’s business model and future prospects.

The Hong Kong market wasn’t the first avenue the company examined for listing its shares. In 2017 Canaan was known to be looking to list on China’s National Equities Exchange and Quotations, an over-the-counter market, and in early 2018 it was reportedly examining its options for a U.S.-based IPO.

Do you think the reported size of Canaan’s raise’s demonstrates faith in the mining industry’s future? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post Mining Firm Canaan Creative Secures Hundreds of Millions of Dollars in Funding appeared first on Bitcoin News.

READ MORE http://bit.ly/2VYrK9N

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

1 note

·

View note

Text

Crypto Hardware Wallets Market: Global Trends, Share, Industry Size, Growth, Opportunities, and Industry Forecast To 2029

The report on Crypto Hardware Wallets Market mainly encompasses fundamental dynamics of the market which include drivers, restraints, opportunities and challenges faced by the industry. It provides valuable insights with an emphasis on global market including some of the major players. Drivers and Restraints are intrinsic factors whereas opportunities and challenges are extrinsic factors of the market.

The crypto hardware wallets market is expected to witness market growth at a rate of 19.68% in the forecast period of 2021 to 2028. Data Bridge Market Research report on crypto hardware wallets market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in digital currency is escalating the growth of crypto hardware wallets market.

A crypto hardware wallet refers to the type of wallet that acts as a physical vault designed for offering safe storage for the cryptocurrency private key. These hard-drives are generally connected to the smartphone or computer through a USB. The hardware wallets do the transactions online but, stored offline as they deliver increased security. These wallets are known to be are compatible with various web interfaces and supports different currencies.

Download Sample PDF Copy of the Crypto Hardware Wallets Market Report to understand structure of the complete report (Including Full TOC, Table & Figures) @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-crypto-hardware-wallets-market

This crypto hardware wallets market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info crypto hardware wallets market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The crypto hardware wallets market is segmented on the basis of type, product type and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

On the basis of type, the crypto hardware wallets market is segmented into USB connectivity type, Bluetooth connectivity type, NFC connectivity and others.

On the basis of product type, the crypto hardware wallets market is segmented into web-based, and installed.

On the basis of application, the crypto hardware wallets market is segmented into individual, and professionals.

Browse Full Report Along With Facts and Figures @ https://www.databridgemarketresearch.com/reports/global-crypto-hardware-wallets-market

Scope of the Report:

Analysis and forecast of the market size of the Global Crypto Hardware Wallets Market, in terms of Value

The Report outline, categorized, and forecast the Crypto Hardware Wallets Industry on the premise of product kind, service provider, end-users, and application.

Competitive developments like expansions, technological advancement, services, and regulative framework within the Global Crypto Hardware Wallets market.

Market drivers and challenges for the Crypto Hardware Wallets Market

Detail profile of leading players with their Strategies.

Key Pointers in TOC of Crypto Hardware Wallets Market Report:

Sections 1: Definition, Specifications and Classification of Crypto Hardware Wallets, Applications of Global Crypto Hardware Wallets Market Segment by Regions

Sections 2: Technical Data and Manufacturing Plants Analysis of Crypto Hardware Wallets, Capacity and R&D Status and Technology Source, Raw Materials Sources Analysis

Sections 3: Market Analysis, Sales Examination, sales Value Investigation

Sections 4: Regional Market Investigation that incorporates North America, Europe, Asia Pacific, Latin America, Middle East & Africa Market Examination

Sections 5: The Crypto Hardware Wallets Segment Market Analysis (by Application) Major Manufacturers Analysis of Crypto Hardware Wallets

Sections 6: Market Trend Analysis, Regional Market Trend, Market Trend by Product Type

Sections 7: Regional Promoting Type Investigation, Inventory network Investigation

Sections 8: The Customers Examination of global Crypto Hardware Wallets

Sections 9: Crypto Hardware Wallets Research Findings and Conclusion, Appendix, system and information source

Sections 10: Crypto Hardware Wallets deals channel, wholesalers, merchants, traders, Exploration Discoveries and End, appendix and data source. Continued.....

Get Full Table of Contents with Charts, Figures & Tables @ https://www.databridgemarketresearch.com/toc/?dbmr=global-crypto-hardware-wallets-market

The major players covered in the crypto hardware wallets market report are Ledger SAS, Shift Cryptosecurity AG, Coinkite, BitLox, CoolWallet, Cryobit LLC., SatoshiLabs s.r.o., KeepKey, GEMNET Pte Ltd, BitMain Technologies Holding Company, Intel, OPENDIME, and Cryobit LLC., among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

The key questions answered in Crypto Hardware Wallets Market report are:

What are the market opportunities, market risks, and market overviews of the Crypto Hardware Wallets Market?

Who are the distributors, traders, and merchants in the Crypto Hardware Wallets Market?

What is the analysis of sales, inco me, and prices of the leading manufacturers in the Crypto Hardware Wallets Market?

What are the Crypto Hardware Wallets market opportunities and threats faced by the global Crypto Hardware Wallets Market vendors?

What are the main factors driving the worldwide Crypto Hardware Wallets Industry?

What are the Top Players in Crypto Hardware Wallets industry?

What is the analysis of sales, income, and prices by type, application of the Crypto Hardware Wallets market?

What is regional sales, income, and price analysis for Crypto Hardware Wallets Market?

Browse Related Reports:

Acoustic Emission Testing Market

Air Quality Control System Market

Air Treatment Market

Anti-Drone Market

Augmented Reality Market

Automated Storage and Retrieval System (ASRS) Market

Automotive Display Market

Automotive Sensor and Camera Technologies Market

Autonomous Robot Toys Market

Battery Energy Storage System Market

Biometric System Market

Borescope Market

0 notes

Text

Global Cryptocurrency Hardware Wallet Market Overview, Financials, Product portfolio, Current developments 2021-2027

The latest survey on Cryptocurrency Hardware Wallet Market Industry managed various organizations of the industry from different geographies or regions. The Report study consists of qualitative and quantitative information highlighting key market developments challenges that industry and competition are facing along with gap analysis, new opportunities available and trend also include COVID-19 impact Analysis in Cryptocurrency Hardware Wallet Market and impact various factors resulting in boosting Cryptocurrency Hardware Wallet Market at global as well as regional level. There are huge competitions take place worldwide and must require the study of MARKET ANALYSIS such as Top Competitors /Top Players are: Ledger, Trezor, KeepKey, Digital BitBox, Coinkite, BitLox, CoolWallet, CryoBit.

Our Research Analyst Analyses Research Methodology overview including Primary Research, Secondary Research, Company Share Analysis, Model ( including Demographic data, Macro-economic indicators, and Industry indicators: Expenditure, infrastructure, sector growth, and facilities ), Research Limitations and Revenue Based Modeling. Company share analysis is used to derive the size of the global market. As well as a study of revenues of companies for the last three to five years also provides the base for forecasting the market size (2021- 2027 ) and its growth rate. Porter’s Five Forces Analysis, impact analysis of covid-19 and SWOT Analysis are also mentioned to understand the factors impacting consumer and supplier behaviour. This Cryptocurrency Hardware Wallet Market Report covers global, regional, and country-level market size, market shares, market growth rate analysis (include Reseaon of highest and lowest peak Market analysis), product launches, recent trend, the impact of covid19 on worldwide or regional Cryptocurrency Hardware Wallet Market. This report includes the estimation of Cryptocurrency Hardware Wallet market size for value (million USD) and volume (K Units)

Download FREE PDF Sample Copy of Cryptocurrency Hardware Wallet Market @ https://www.syndicatemarketresearch.com/sample/cryptocurrency-hardware-wallet-market

We are here to implement a Free PDF Sample Report copy as per your Research Requirement, also including impact analysis of COVID-19 on Cryptocurrency Hardware Wallet Market Size

Don’t miss out on business opportunities in Cryptocurrency Hardware Wallet Market. Speak to our analyst and gain crucial industry insights that will help your business growth while filling Free PDF Sample Reports

Advantage of requesting FREE Sample PDF Report Before purchase

A brief introduction to the research report and Overview of the market

Syndicate Market Research methodology

Graphical introduction of global as well as the regional analysis

Selected illustrations of market insights and trends.

Know top key players in the market with their revenue analysis

Example pages from the report

Key Highlights of the TOC provided by Syndicate Market Research:

Cryptocurrency Hardware Wallet Market Executive summary: This section emphasizes the key studies, market growth rate, competitive landscape, market drivers, trends, and issues in addition to the macroscopic indicators.

Cryptocurrency Hardware Wallet Market Study Coverage: It includes key market segments, key manufacturers covered, the scope of products offered in the years considered, global Cryptocurrency Hardware Wallet Market and study objectives. Additionally, it touches the segmentation study provided in the report on the basis of the type of product and applications.

Cryptocurrency Hardware Wallet Market Production by Region: The report delivers data related to import and export, revenue, production, and key players of all regional markets studied are covered in this section.

Cryptocurrency Hardware Wallet Market Profile of Manufacturers: Analysis of each market player profiled is detailed in this section. This segment also provides SWOT analysis, products, production, value, capacity, and other vital factors of the individual player.

Major Product Type of Cryptocurrency Hardware Wallet Covered in Market Research report: USB Connectivity Type, Bluetooth Connectivity Type, NFC Connectivity, Others

Application Segments Covered in Market Research Report: Individual, Professionals

Global Cryptocurrency Hardware Wallet Industry Market: By Region

North America

U.S.Canada

Rest of North America

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

Southeast Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

The Middle East and Africa

GCC Countries

South Africa

Rest of Middle East & Africa

Competitive Market Share

In terms of Cryptocurrency Hardware Wallet market, Ledger, Trezor, KeepKey, Digital BitBox, Coinkite, BitLox, CoolWallet, CryoBit are the top players operating in the global market. These behemoths have implemented key business strategies such as product innovation, strategic partnerships & collaborations, new product launches, new service launches, joint ventures, and contracts to reinforce their market position along with gaining a huge chunk of the market share.

In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new type launch, agreements, partnerships, collaborations & joint ventures, research & development, regional expansion of major participants involved in the Cryptocurrency Hardware Wallet market on a global and regional basis.

Table of Content include Cryptocurrency Hardware Wallet Market Worldwide are:

1 Study Coverage 1.1 Cryptocurrency Hardware Wallet Product 1.2 Key Market Segments in This Study 1.3 Key Manufacturers Covered 1.4 Market by Type 1.4.1 Global Market Size Growth Rate by Type (USB Connectivity Type, Bluetooth Connectivity Type, NFC Connectivity, Others) 1.5 Market by Application 1.5.1 Global Market Size Growth Rate by Application (Individual, Professionals) 1.6 Study Objectives 1.7 Years Considered

2 Executive Summary —contd—

3 Cryptocurrency Hardware Wallet Market Size by Manufacturers 3.1 Production by Manufacturers 3.1.1 Production by Manufacturers 3.1.2 Production Market Share by Manufacturers 3.2 Revenue by Manufacturers 3.2.1 Revenue by Manufacturers (2013-2018) 3.2.2 Revenue Share by Manufacturers (2013-2018) 3.3 Price by Manufacturers 3.4 Mergers & Acquisitions, Expansion Plans

4 Cryptocurrency Hardware Wallet Production by Regions —–contd—

5 Cryptocurrency Hardware Wallet Consumption by Regions 5.1 Global Cryptocurrency Hardware Wallet Consumption by Regions 5.1.1 Global Cryptocurrency Hardware Wallet Consumption by Regions 5.1.2 Global Cryptocurrency Hardware Wallet Consumption Market Share by Regions 5.2 North America 5.2.1 North America Cryptocurrency Hardware Wallet Consumption by Application 5.2.2 North America Cryptocurrency Hardware Wallet Consumption by Countries 5.2.3 United States 5.2.4 Canada 5.2.5 Mexico 5.3 Europe 5.3.1 Europe Cryptocurrency Hardware Wallet Consumption by Application 5.3.2 Europe Cryptocurrency Hardware Wallet Consumption by Countries 5.3.3 Germany 5.3.4 France 5.3.5 UK 5.3.6 Italy 5.3.7 Russia 5.4 Asia Pacific 5.4.1 Asia Pacific Cryptocurrency Hardware Wallet Consumption by Application 5.4.2 Asia Pacific Cryptocurrency Hardware Wallet Consumption by Countries 5.4.3 China 5.4.4 Japan 5.4.5 South Korea 5.4.6 India 5.4.7 Australia 5.4.8 Indonesia 5.4.9 Thailand 5.4.10 Malaysia 5.4.11 Philippines 5.4.12 Vietnam 5.5 Central & South America 5.5.1 Central & South America Cryptocurrency Hardware Wallet Consumption by Application 5.5.2 Central & South America Cryptocurrency Hardware Wallet Consumption by Country 5.5.3 Brazil 5.6 Middle East and Africa 5.6.1 Middle East and Africa Cryptocurrency Hardware Wallet Consumption by Application 5.6.2 Middle East and Africa Cryptocurrency Hardware Wallet Consumption by Countries 5.6.3 GCC Countries 5.6.4 Egypt 5.6.5 South Africa

6 Market Size by Type —–contd—

7 Market Size by Application 7.1 Overview 7.2 Global Breakdown Dada by Application 7.2.1 Global Consumption by Application 7.2.2 Global Consumption Market Share by Application (2013-2018)

8 Manufacturers Profiles —–contd—

9 Production Forecasts —–contd—

10 Consumption Forecast —–contd—

11 Value Chain and Sales Channels Analysis 11.1 Value Chain Analysis 11.2 Sales Channels Analysis 11.2.1 Cryptocurrency Hardware Wallet Sales Channels 11.2.2 Distributors 11.3 Customers

12 Market Opportunities & Challenges, Risks and Influences Factors Analysis 12.1 Market Opportunities and Drivers 12.2 Market Challenges 12.3 Market Risks/Restraints 12.4 Key World Economic Indicators

13 Key Findings in the Global Cryptocurrency Hardware Wallet Study

14 Appendix 14.1 Research Methodology 14.1.1 Methodology/Research Approach 14.1.1.1 Research Programs/Design 14.1.1.2 Market Size Estimation 14.1.1.3 Market Breakdown and Data Triangulation 14.1.2 Data Source 14.1.2.1 Secondary Sources 14.1.2.2 Primary Sources 14.2 Author Details 14.3 Disclaimer

Read Our Other Exclusive Blogs:–

https://melvinasmarketblogs.blogspot.com/2020/11/global-virtual-machine-software-market.html

https://melvinasmarketblogs.blogspot.com/2020/11/global-endpoint-detection-and-response.html

About Syndicate Market Research:

At Syndicate Market Research, we provide reports about a range of industries such as healthcare & pharma, automotive, IT, insurance, security, packaging, electronics & semiconductors, medical devices, food & beverage, software & services, manufacturing & construction, defence aerospace, agriculture, consumer goods & retailing, and so on. Every aspect of the market is covered in the report along with its regional data. Syndicate Market Research committed to the requirements of our clients, offering tailored solutions best suitable for strategy development and execution to get substantial results. Above this, we will be available for our clients 24×7.

Contact US:

Syndicate Market Research 244 Fifth Avenue, Suite N202 New York, 10001, United States Website: https://www.syndicatemarketresearch.com/ Blog: Syndicate Market Research Blog

from NeighborWebSJ https://ift.tt/2VJazxW via IFTTT

from WordPress https://ift.tt/3BdsQE4 via IFTTT

0 notes

Text

Cryptocurrency Market Size Research Report

Growth opportunities in the global cryptocurrency market look promising over the next six years. This is mainly due to the increasing adoption of cryptocurrency for payments and various other options at the global level, along with the rising research & development activities and continuous technological advancements for the development of cryptocurrency.

Request for a FREE Sample Report on Global Cryptocurrency Market

Global Cryptocurrency Industry Dynamics (including market size, share, trends, forecast, growth, forecast, and industry analysis)

Key Drivers

The major factors that are responsible for the growth of the global cryptocurrency market include the accelerating adoption of cryptocurrency for payments and other options around the world. Numerous R&D activities, along with the continuous technological advancements for the development of cryptocurrency, which include the introduction of blockchain technology, is leading to the enhancement in cryptocurrency. Furthermore, differences in the monetary regulations, the rising number of cross-border payments followed by the increasing penetration of the internet are further surging the growth of the cryptocurrency market size.

There has been an increase in the application of cryptocurrency as it offers various benefits such as facilitates international trade, improves adaptability, more confidential transactions, decreases transaction fees, along instant payments. This will further contribute to the growth of the market during the forecast period. The outbreak of the COVID-19 pandemic has positively impacted market growth. Moreover, the rising focus on utilizing digital currencies, crypto assets, and other blockchain technologies is another factor that is driving the market growth. On the other hand, the growing concerns regarding privacy, security & control, along with the lack of technical understanding related to the cryptocurrency, are the two major factors that are hampering the market growth.

Type Segment Drivers

On the basis of the type, the bitcoin is anticipated to witness a faster CAGR over the forecast period. This is mainly attributed to the increasing adoption of bitcoin in various economies due to its improved versatility. There are numerous benefits related to the usage of bitcoin, such as user's autonomy, peer-to-peer focus, discretion, and decreases banking fees and low transaction fees for international payments. All these factors are further increasing the demand of the market.

Application Segment Drivers

On the basis of application, payment is projected to grow at a higher CAGR during the forecast period. The rising number of payments via cryptocurrency as if offers numerous benefits such as improved protection from fraud, secured transactions, and improved speed of international transfers.

Global Cryptocurrency Market’s leading Manufacturers:

· Xilinx

· BitMain Technologies Holding Company

· Quantstamp, Inc.

· Advanced Micro Devices, Inc.

· Intel Corporation

· Bitfury Group Limited

· Ripple

· BitGo

· Coinbase

· Ethereum Foundation

Global Cryptocurrency Market Segmentation:

Segmentation by Offering:

· Hardware

o Gpu

o Asic

o FPGA

o Wallet

· Software

o Coin Wallet

o Mining Platform

o Exchange

Segmentation by Process:

· Transaction

o Wallet

o Exchange

· Mining

o Pool Mining

o Solo Mining

o Cloud Mining

Segmentation by Type:

· Etgereum (ETH)

· Bitcoin

· Ripple (XRP)

· Bitcoin Cash

· Litecoin (LTC)

· Dashcoin

· Others

Segmentation by Application:

· Remittance

· Trading

· Payment

o Ecommerce & Retail

o Peer-To-Peer Payment,

o Travel & Tourism

o Media & Entertainment

o Others

Segmentation by Region:

· North America

o United States of America

o Canada

· Asia Pacific

o China

o Japan

o India

o Rest of APAC

· Europe

o United Kingdom

o Germany

o France

o Spain

o Rest of Europe

· RoW

o Brazil

o South Africa

o Saudi Arabia

o UAE

o Rest of the world (remaining countries of the LAMEA region)

About GMI Research

GMI Research is a market research and consulting company that offers business insights and market research reports for large and small & medium enterprises. Our detailed reports help the clients to make strategic business policies and achieve sustainable growth in the particular market domain. The company's large team of seasoned analysts and industry experts with experience from different regions such as Asia-Pacific, Europe, North America, among others, provides a one-stop solution for the client. Our market research report has in-depth analysis, which includes refined forecasts, a bird's eye view of the competitive landscape, key factors influencing the market growth, and various other market insights to aid companies in making strategic decisions. Featured in the 'Top 20 Most Promising Market Research Consultants' list of Silicon India Magazine in 2018, we at GMI Research are always looking forward to helping our clients to stay ahead of the curve.

Media Contact Company Name: GMI RESEARCH Contact Person: Sarah Nash Email: [email protected] Phone: Europe – +353 1 442 8820; US – +1 860 881 2270 Address: Dublin, Ireland Website: www.gmiresearch.com

0 notes

Text

ESG Metrics and Reporting in the Digital Payments Industry

Financial institutions and technology vendors have repurposed their strategies on digital payments—more so—on the back of a dip in physical cash. Add to it the technological innovations that have leveraged online banking. Cash may still be the king; electronic payment, however, is giving a run for the money. An exponential rise in smartphone usage, surging internet penetration and growth in e-commerce have made electronic payment a force to reckon with. Meanwhile, the luxury of contactless and fast payments comes with caveats—environmental, social and governance challenges.

Amidst climate change, a volatile economy and the Russia-Ukraine war, society, businesses and governments have exhibited a strong commitment to foster an inclusive workplace, accentuate low-carbon energy solutions, bolster transparency and create long-term value. Several financial institutions have started carbon offset programs, providing rewards and loyalty points. In September 2021, Ascenda joined forces with Patch to enable consumers to redeem their rewards points for carbon offsets, helping reduce and eliminate GHG emissions.

Learn more about the practices & strategies being implemented by industry participants from the Digital Payments Industry ESG Thematic Report, 2023, published by Astra ESG Solutions PayPal Propels Science-Based Targets (SBTs) Carbon footprints from the digital payment ecosystem have prompted financial institutions to up their sustainable strategies. A study from Cambridge inferred that Bitcoin used 80% more energy consumption in 2021 compared to the preceding year. Digital wallets reportedly consume less energy vis-à-vis cryptocurrencies, offering opportunities galore. In March 2022, Helpful rolled out digital wallets that it claims can save up to 80% of the CO2 produced from payment transactions.

The potential risks posed by adverse weather conditions on facilities have encouraged companies, such as PayPal to underscore science-based GHG emission reduction targets. The Fintech player achieved 100% renewable energy sourcing for its data centers in 2021, while it reached 90% total energy use in 2022. The American giant formed science-based emission reduction targets—to minimize absolute operational GHG emissions by 25% by 2025. In 2022, the company set the goal to engage 75% of its suppliers (in terms of spending) to SBTs by 2025 and Its IT asset management team retired 338 metric tons of IT hardware across the data center services.

Global Payments Underscores Philanthropic Activities The social criterion emphasizes a shifting business environment where companies are gearing up to enhance workplace diversity, financial literacy, social equity and health & wellness. In 2021, Global Payments Plano, Texas office teamed up with the National Breast Cancer Foundation (NBCF) and collected USD 1,600 for charity. Besides, the Lindon, Utah team formed a canned food drive to donate 2,500 cans to a local food bank. Taking the philanthropic work further, the company doled out USD 5 million in 2021 to underpin several organizations, such as Red Cross, the American Heart Association, UNCF, Leukemia & Lymphoma Society, Susan G. Komen and Mercer Medical School.

To reinforce financial literacy and economic inclusion, the Fintech company offers around 4 million (especially small and medium-sized businesses) locations globally with digital commerce solutions, allowing acceptance of more than 140 payment methods. Meanwhile, the U.S.-based company has propelled its DEI strategies to augment female representation to 47% and boost the number of people of color to 39% by 2025.