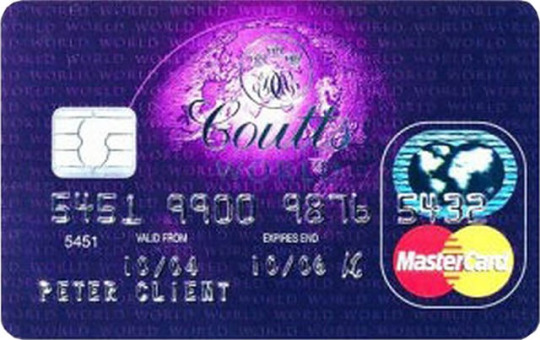

#Coutts World Silk Card

Explore tagged Tumblr posts

Video

youtube

Credit Card for British Royalty - Coutt's World Silk Card

0 notes

Text

Virginia Woolf: Mrs Dalloway in Bond Street

Virginia Woolf

Mrs Dalloway

Mrs Dalloway said she would buy the gloves herself.

Big Ben was striking as she stepped out into the street. It was eleven o'clock and the unused hour was fresh as if issued to children on a beach. But there was something solemn in the deliberate swing of the repeated strokes; something stirring in the murmur of wheels and the shuffle of footsteps.

No doubt they were not all bound on errands of happiness. There is much more to be said about us than that we walk the streets of Westminster. Big Ben too is nothing but steel rods consumed by rust were it not for the care of H.M.'s Office of Works. Only for Mrs Dalloway the moment was complete; for Mrs Dalloway June was fresh. A happy childhood--and it was not to his daughters only that Justin Parry had seemed a fine fellow (weak of course on the Bench); flowers at evening, smoke rising; the caw of rooks falling from ever so high, down down through the October air - there is nothing to take the place of childhood. A leaf of mint brings it back: or a cup with a blue ring.

Poor little wretches, she sighed, and pressed forward. Oh, right under the horses' noses, you little demon! and there she was left on the kerb stretching her hand out, while Jimmy Dawes grinned on the further side.

A charming woman, poised, eager, strangely white-haired for her pink cheeks, so Scope Purvis, C.C.B., saw her as he hurried to his office. She stiffened a little, waiting for burthen's van to pass. Big Ben struck the tenth; struck the eleventh stroke. The leaden circles dissolved in the air. Pride held her erect, inheriting, handing on, acquainted with discipline and with suffering. How people suffered, how they suffered, she thought, thinking of Mrs Foxcroft at the Embassy last night decked with jewels, eating her heart out, because that nice boy was dead, and now the old Manor House (Durtnall's van passed) must go to a cousin.

'Good morning to you!' said Hugh Whitbread raising his hat rather extravagantly by the china shop, for they had known each other as children. 'Where are you off to?'

'I love walking in London,' said Mrs Dalloway. 'Really it's better than walking in the country!'

'We've just come up,' said Hugh Whitbread. 'Unfortunately to see doctors.'

'Milly?' said Mrs Dalloway, instantly compassionate.

'Out of sorts,' said Hugh Whitbread. 'That sort of thing. Dick all right?'

'First rate!' said Clarissa.

Of course, she thought, walking on, Milly is about my age--fifty, fifty-two. So it is probably that, Hugh's manner had said so, said it perfectly--dear old Hugh, thought Mrs Dalloway, remembering with amusement, with gratitude, with emotion, how shy, like a brother--one would rather die than speak to one's brother--Hugh had always been, when he was at Oxford, and came over, and perhaps one of them (drat the thing!) couldn't ride. How then could women sit in Parliament? How could they do things with men? For there is this extra-ordinarily deep instinct, something inside one; you can't get over it; it's no use trying; and men like Hugh respect it without our saying it, which is what one loves, thought Clarissa, in dear old Hugh.

She had passed through the Admiralty Arch and saw at the end of the empty road with its thin trees Victoria's white mound, Victoria's billowing motherliness, amplitude and homeliness, always ridiculous, yet how sublime, thought Mrs Dalloway, remembering Kensington Gardens and the old lady in horn spectacles and being told by Nanny to stop dead still and bow to the Queen. The flag flew above the Palace. The King and Queen were back then. Dick had met her at lunch the other day--a thoroughly nice woman. It matters so much to the poor, thought Clarissa, and to the soldiers. A man in bronze stood heroically on a pedestal with a gun on her left hand side--the South African war. It matters, thought Mrs Dalloway walking towards Buckingham Palace. There it stood four-square, in the broad sunshine, uncompromising, plain. But it was character, she thought; something inborn in the race; what Indians respected. The Queen went to hospitals, opened bazaars--the Queen of England, thought Clarissa, looking at the Palace. Already at this hour a motor car passed out at the gates; soldiers saluted; the gates were shut. And Clarissa, crossing the road, entered the Park, holding herself upright.

June had drawn out every leaf on the trees. The mothers of Westminster with mottled breasts gave suck to their young. Quite respectable girls lay stretched on the grass. An elderly man, stooping very stiffly, picked up a crumpled paper, spread it out flat and flung it away. How horrible! Last night at the Embassy Sir Dighton had said, 'If 1 want a fellow to hold my horse, I have only to put up my hand.' But the religious question is far more serious than the economic, Sir Dighton had said, which she thought extraordinarily interesting, from a man like Sir Dighton. 'Oh, the country will never know what it has lost,' he had said, talking of his own accord, about dear Jack Stewart.

She mounted the little hill lightly. The air stirred with energy. Messages were passing from the Fleet to the Admiralty. Piccadilly and Arlington Street and the Mall seemed to chafe the very air in the Park and lift its leaves hotly, brilliantly, upon waves of that divine vitality which Clarissa loved. To ride; to dance; she had adored all that. Or going long walks in the country, talking, about books, what to do with one's life, for young people were amazingly priggish--oh, the things one had said! But one had conviction. Middle age is the devil. People like Jack'll never know that, she thought; for he never once thought of death, never, they said, knew he was dying. And now can never mourn--how did it go?--a head grown grey . . . From the contagion of the world's slow stain, . . . have drunk their cup a round or two before. . . . From the contagion of the world's slow stain! She held herself upright.

But how jack would have shouted! Quoting Shelley, in Piccadilly, 'You want a pin,' he would have said. He hated frumps. 'My God Clarissa! My God Clarissa!'--she could hear him now at the Devonshire House party, about poor Sylvia Hunt in her amber necklace and that dowdy old silk. Clarissa held herself upright for she had spoken aloud and now she was in Piccadilly, passing the house with the slender green columns, and the balconies; passing club windows full of newspapers; passing old Lady Burdett-Coutts' house where the glazed white parrot used to hang; and Devonshire House, without its gilt leopards; and Claridge's, where she must remember Dick wanted her to leave a card on Mrs Jepson or she would be gone. Rich Americans can be very charming. There was St James's Palace; like a child's game with bricks; and now--she had passed Bond Street--she was by Hatchard's book shop. The stream was endless--endless endless. Lords, Ascot, Hurlingham--what was it? What a duck, she thought, looking at the frontispiece of some book of memoirs spread wide in the bow window, Sir Joshua perhaps or Romney; arch, bright, demure; the sort of girl--like her own Elizabeth--the only real sort of girl. And there was that absurd book, Soapy Sponge, which Jim used to quote by the yard; and Shakespeare's Sonnets. She knew them by heart. Phil and she had argued all day about the Dark Lady, and Dick had said straight out at dinner that night that he had never heard of her. Really, she had married him for that! He had never read Shakespeare! There must be some little cheap book she could buy for Milly--Cranford of course! Was there ever anything so enchanting as the cow in petticoats? If only people had that sort of humour, that sort of self-respect now, thought Clarissa, for she remembered the broad pages; the sentences ending; the characters--how one talked about them as if they were real. For all the great things one must go to the past, she thought. From the contagion of the world's slow stain . . . Fear no more the heat o' the sun. . . . And now can never mourn, can never mourn, she repeated, her eyes straying over the window; for it ran in her head; the test of great poetry; the moderns had never written anything one wanted to read about death, she thought; and turned.

Omnibuses joined motor cars; motor cars vans; vans taxicabs, taxicabs motor cars--here was an open motor car with a girl, alone. Up till four, her feet tingling, I know, thought Clarissa, for the girl looked washed out, half asleep, in the corner of the car after the dance. And another car came; and another. No! No! No! Clarissa smiled good-naturedly. The fat lady had taken every sort of trouble, but diamonds! orchids! at this hour of the morning! No! No! No! The excellent policeman would, when the time came, hold up his hand. Another motor car passed. How utterly unattractive! Why should a girl of that age paint black round her eyes? And a young man, with a girl, at this hour, when the country-- The admirable policeman raised his hand and Clarissa acknowledging his sway, taking her time, crossed, walked towards Bond Street; saw the narrow crooked street, the yellow banners; the thick notched telegraph wires stretched across the sky.

A hundred years ago her great-great-grandfather, Seymour Parry, who ran away with Conway's daughter, had walked down Bond Street. Down Bond Street the Parrys had walked for a hundred years, and might have met the Dalloways (Leighs on the mother's side) going up. Her father got his clothes from Hill's. There was a roll of cloth in the window, and here just one jar on a black table, incredibly expensive; like the thick pink salmon on the ice block at the fish monger's. The jewels were exquisite--pink and orange stars, paste, Spanish, she thought, and chains of old gold; starry buckles, little brooches which had been worn on sea-green satin by ladies with high head-dresses. But no good looking! One must economise. She must go on past the picture dealer's where one of the odd French pictures hung, as if people had thrown confetti--pink and blue--for a joke. If you had lived with pictures (and it's the same with books and music) thought Clarissa, passing the Aeolian Hall, you can't be taken in by a joke.

The river of Bond Street was clogged. There, like a Queen at a tournament, raised, regal, was Lady Bexborough. She sat in her carriage, upright, alone, looking through her glasses. The white glove was loose at her wrist. She was in black, quite shabby, yet, thought Clarissa, how extraordinarily it tells, breeding, self-respect, never saying a word too much or letting people gossip; an astonishing friend; no one can pick a hole in her after all these years, and now, there she is, thought Clarissa, passing the Countess who waited powdered, perfectly still, and Clarissa would have given anything to be like that, the mistress of Clarefield, talking politics, like a man. But she never goes anywhere, thought Clarissa, and it's quite useless to ask her, and the carriage went on and Lady Bexborough was borne past like a Queen at a tournament, though she had nothing to live for and the old man is failing and they say she is sick of it all, thought Clarissa and the tears actually rose to her eyes as she entered the shop.

'Good morning,' said Clarissa in her charming voice. 'Gloves,' she said with her exquisite friendliness and putting her bag on the counter began, very slowly, to undo the buttons. 'White gloves,' she said. 'Above the elbow,' and she looked straight into the shop-woman's face--but this was not the girl she remembered? She looked quite old. 'These really don't fit,' said Clarissa. The shop-girl looked at them. 'Madame wears bracelets?' Clarissa spread out her fingers. 'Perhaps it's my rings.' And the girl took the grey gloves with her to the end of the counter.

Yes, thought Clarissa, if it's the girl I remember, she's twenty years older. . .. There was only one other customer, sitting sideways at the counter, her elbow poised, her bare hand drooping, vacant; like a figure on a Japanese fan, thought Clarissa, too vacant perhaps, yet some men would adore her. The lady shook her head sadly. Again the gloves were too large. She turned round the glass. 'Above the wrist,' she reproached the grey-headed woman; who looked and agreed.

They waited; a clock ticked; Bond Street hummed, dulled, distant; the woman went away holding gloves. 'Above the wrist,' said the lady, mournfully, raising her voice. And she would have to order chairs, ices, flowers, and cloak-room tickets, thought Clarissa. The people she didn't want would come; the others wouldn't. She would stand by the door. They sold stockings--silk stockings. A lady is known by her gloves and her shoes, old Uncle William used to say. And through the hanging silk stockings quivering silver she looked at the lady, sloping shouldered, her hand drooping, her bag slipping, her eyes vacantly on the floor. It would be intolerable if dowdy women came to her party! Would one have liked Keats if he had worn red socks? Oh, at last--she drew into the counter and it flashed into her mind:

'Do you remember before the war you had gloves with pearl buttons?'

'French gloves, Madame?'

'Yes, they were French,' said Clarissa. The other lady rose very sadly and took her bag, and looked at the gloves on the counter. But they were all too large--always too large at the wrist.

'With pearl buttons,' said the shop-girl, who looked ever so much older. She split the lengths of tissue paper apart on the counter. With pearl buttons, thought Clarissa, perfectly simple--how French!

'Madame's hands are so slender,' said the shop-girl, drawing the glove firmly, smoothly, down over her rings. And Clarissa looked at her arm in the looking-glass. The glove hardly came to the elbow. Were there others half an inch longer? Still it seemed tiresome to bother her perhaps the one day in the month, thought Clarissa, when it's an agony to stand. 'Oh, don't bother,' she said. But the gloves were brought.

'Don't you get fearfully tired,' she said in her charming voice, 'standing? When d'you get your holiday?'

'In September, Madame, when we're not so busy.'

When we're in the country thought Clarissa. Or shooting. She has a fortnight at Brighton. In some stuffy lodging. The landlady takes the sugar. Nothing would be easier than to send her to Mrs Lumley's right in the country (and it was on the tip of her tongue). But then she remembered how on their honeymoon Dick had shown her the folly of giving impulsively. It was much more important, he said, to get trade with China. Of course he was right. And she could feel the girl wouldn't like to be given things. There she was in her place. So was Dick. Selling gloves was her job. She had her own sorrows quite separate, 'and now can never mourn, can never mourn,' the words ran in her head. 'From the contagion of the world's slow stain,' thought Clarissa holding her arm stiff, for there are moments when it seems utterly futile (the glove was drawn off leaving her arm flecked with powder)--simply one doesn't believe, thought Clarissa, any more in God.

The traffic suddenly roared; the silk stockings brightened. A customer came in.

'White gloves,' she said, with some ring in her voice that Clarissa remembered.

It used, thought Clarissa, to be so simple. Down down through the air came the caw of the rooks. When Sylvia died, hundreds of years ago, the yew hedges looked so lovely with the diamond webs in the mist before early church. But if Dick were to die tomorrow, as for believing in God--no, she would let the children choose, but for herself, like Lady Bexborough, who opened the bazaar, they say, with the telegram in her hand--Roden, her favourite, killed--she would go on. But why, if one doesn't believe? For the sake of others, she thought, taking the glove in her hand. The girl would be much more unhappy if she didn't believe.

'Thirty shillings,' said the shop-woman. 'No, pardon me Madame, thirty-five. The French gloves are more.'

For one doesn't live for oneself, thought Clarissa.

And then the other customer took a glove, tugged it, and it split.

'There!' she exclaimed .

'A fault of the skin,' said the grey-headed woman hurriedly. 'Sometimes a drop of acid in tanning. Try this pair, Madame.'

'But it's an awful swindle to ask two pound ten!'

Clarissa looked at the lady; the lady looked at Clarissa.

'Gloves have never been quite so reliable since the war,' said the shop-girl, apologising, to Clarissa.

But where had she seen the other lady?--elderly, with a frill under her chin; wearing a black ribbon for gold eyeglasses; sensual, clever, like a Sargent drawing. How one can tell from a voice when people are in the habit, thought Clarissa, of making other people--'It's a shade too tight,' she said--obey. The shop-woman went off again. Clarissa was left waiting. Fear no more she repeated, playing her finger on the counter. Fear no more the heat o' the sun. Fear no more she repeated. There were little brown spots on her arm. And the girl crawled like a snail. Thou thy worldly task hast done. Thousands of young men had died that things might go on. At last! Half an rich above the elbow; pearl buttons; five and a quarter. My dear slow coach, thought Clarissa, do you think I can sit here the whole morning? Now you'll take twenty-five minutes to bring me my change!

There was a violent explosion in the street outside. The shop-women cowered behind the counters. But Clarissa, sitting very upright, smiled at the other lady. 'Miss Anstruther!' she exclaimed.

0 notes

Text

Những loại thẻ tín dụng ngân hàng mà người siêu giàu sử dụng

Người siêu giàu trên thế giới sở hữu các loại thẻ tín dụng riêng với những đặc quyền xa xỉ vượt trội khác hẳn với chúng ta.

Thẻ American Express Centurion Black Card:

American Express đã từ chối cung cấp chi tiết về thẻ Centurion c��ng như số lượng thẻ đã phát hành. Tuy nhiên, họ tiết lộ rằng việc đăng ký thành viên chỉ mất 7.500 USD phí ban đầu và 2.500 USD phí thường niên. Theo đó, quyền lợi và tiện ích của thẻ sẽ được điều chỉnh tùy theo nhu cầu của chủ thẻ.

Được biết, khách hàng mục tiêu của loại thẻ này cần phải tiêu từ 250.000 USD - 450.000 USD mỗi năm đối với thẻ American Express thông thường. Thẻ Centurion cũng được cung cấp các quyền lợi tương tự thẻ American Express Platium, bao gồm các đặc quyền về vé máy bay cũng như dịch vụ khách sạn. Có thể nói, người sở hữu thẻ Centurion có thể mua mọi thứ mà họ muốn.

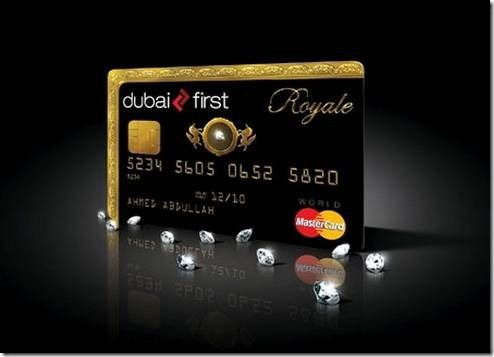

Thẻ Dubai First Royale MasterCard:

là một loại thẻ tín dụng khá đặc biệt. Cũng giống như sự giàu có ở Dubai, thẻ này được làm bằng vàng thật và đính kim cương 0,235 carat. “Khi có trong tay chiếc thẻ này, bạn có thể tận hưởng mọi thứ theo lối sống hoàng gia và như có một người quản lý chuyên nghiệp dành riêng cho bạn”, theo cam kết của Dubai First - công ty tín dụng có trụ sở tại Các tiểu vương quốc Ả Rập thống nhất.

Thẻ J.P. Morgan Reserve (Palladium):

Loại thẻ này là phiên bản mới của thẻ The Chase Palladium - loại thẻ mà cựu Tổng thống Mỹ Barack Obama được cho là từng sở hữu. Theo Bloomberg, đây là thẻ tín dụng chỉ dành cho giới siêu giàu.

Yêu cầu để được mở thẻ là bạn phải là thành viên của Chase Private Bank - là những khách hàng phải có ít nhất 10 triệu USD trong tài khoản. Cũng tương tự thẻ Chase Sapphire Reserve dành cho những người ưa thích du lịch, thẻ J.P. Morgan Reserve thường yêu cầu mức phí phải trả khoảng 450 USD, chủ thẻ có thể tích điểm thưởng cho mỗi lần đi du lịch, ăn uống tại nhà hàng hay đi mua sắm. Chưa dừng lại ở đó, chủ thẻ còn được hưởng những quyền lợi xa xỉ khác về phòng chờ sân bay, dịch vụ vé máy bay…

Loại thẻ tín dụng Hoàng gia này không có hạn mức và điều kiện ràng buộc. "Bất kỳ thứ gì khách hàng muốn, đơn giản như mua một chiếc du thuyền thì chỉ cần quẹt thẻ là xong", cựu giám đốc truyền thông Amit Marawah của Dubai First cho biết. Và tất nhiên, chỉ những người thuộc giới siêu giàu mới có đủ điều kiện để được mời mở thẻ. Đây có lẽ cũng là loại thẻ có nhiều đặc quyền nhất thế giới.

Những quyền lợi khác bao gồm dịch vụ quản lý cá nhân, giảm giá chuyến bay điều lệ, dịch vụ xe hơi, nâng cấp phòng khách sạn sang trọng, giảm giá hàng hóa và tư vấn tâm lý. Thẻ có phí hàng năm là 1.500 USD. Stratus Awards Visa là một loại thẻ khá đặc biệt so với các loại thẻ “cao cấp” khác. Thẻ được cung cấp có sẵn cho các cá nhân có tài sản cao chỉ thông qua lời mời. Tuy nhiên, những người giàu có này có thể gộp các điểm thưởng của họ lại với nhau để sử dụng đặc quyền lớn như máy bay riêng và các quyền lợi dành riêng cho thẻ này.

Ngoài Nữ hoàng Elizabeth II là người sử dụng thẻ Coutts World Silk Card, những người có từ 1 triệu USD trở lên trong tài khoản đều đủ điều kiện sở hữu tấm thẻ này. Được biết đến là thẻ tín dụng độc quyền nhất của Anh, thẻ Coutts World Silk đi kèm với dịch vụ trợ giúp 24/7, quyền sử dụng phòng chờ độc quyền tại sân bay và mua sắm riêng tại các cửa hàng độc quyền thiết kế.

Theo Zing.vn

0 notes

Text

Little Known Facts About Rich Credit Cards - And Why They Matter

The ultra-wealthy have varying requirements to normal individuals like us. While we are always on the look-out totally free traveling insurance policy when reserving our trip, they are wanting to work with a private jet at a moment's notice with their credit card.

When shopping for credit card, these high internet worth individuals look for different requirements. According to a survey by the High-end Institute, the affluent are looking for a card that gives them "unique gain access to, unrivaled advantages as well as improved consumer experience".

So what charge card can you discover in extremely abundant individuals's pocketbooks? Right here are 5 of the most high-status, special charge card on earth:

1. American Express Centurion Card 1. American Express Centurion Card

Practically every person has heard of "The Black Card", one of the most prominent special card out there. All of it began with a rumour of a secret as well as super-exclusive high-end American Express "black card", back in the very early 1980s.

At Some Point, American Express determined to capitalize the rumour, presenting the Centurion Card in 1999 for only its wealthiest consumers. The card is made of anodised titanium, making the card black in colour.

Just how do you obtain a Centurion Card? The initiation charge alone is US$ 7,500 (RM28,203), while the yearly fee is US$ 2,500 (RM 9,410).

There's no limit on the card, so you can bill, as one consumer did in 2014, HK$ 281 million (RM 136 million) to purchase an old Chinese ceramic mug from Sotheby's Hong Kong. For this acquisition, Liu Yiqian won 422 million American Express points, which he can trade for "28 million frequent leaflet miles or concerning US$ 180,000 (RM677,512) well worth of vouchers at Hong Kong merchant ParknShop," according to Bloomberg Company.

Cardholders additionally obtain access to a whole host of luxurious points, most of which American Express conceals, however some details are leaked out. Several of these "secretive" things consist of renting a Formula One cars and truck, and concierge services. Benefits differ from nation to country, but it's secure to claim that nearly whatever is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

If you think titanium cards are too conventional, you will change you mind with the JP Morgan Palladium Card Introduced in 2009, it's made of palladium and also 23K gold. A Bloomberg record approximates that the materials of the card alone set you back US$ 1,000 (RM3,764). Your name and trademark are laser-etched onto the card. Elegant.

This might be further out of your reach than the Centurion Card In order to receive the Palladium Card, you require to have a private lender with JP Morgan, as well as the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Clients can additionally qualify, reducing the minimum to US$ 250,000 (RM941,007). The annual charge, according to Dr Credit Card, is a monstrous US$ 595 (RM2,239)!

What are the benefits? For every single buck spent, you obtain one factor, or two factors if you spend on travel. And as soon as you strike US$ 100,000 (RM376,355) in costs, you get a perk 35,000 points.

There are no foreign exchange fees, late fees, cash loan fees, or over-limit fees. This is ideal for those that intend to take a trip like a queen, as you likewise get access to greater than 600 airport terminal lounges worldwide, as well as you can likewise utilize MarquisJet, the globe's largest fleet of exclusive jets.

There are numerous other advantages to holding this card, and you can money in your points for skydiving lessons, complimentary golf lessons with a professional, as well as various other unique rewards. Also, did we discuss it's made of gold?

[communication id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the rare-earth elements type of man or lady, you will undoubtedly be excited with valuable treasures. This of a kind card, the Dubai First Royale Card, is not only trimmed with gold, yet it additionally come with a white.235-carat ruby smack bit in the middle of it.

Ibrahim al Ansari, primary executive of Dubai First, told The National that this is "the most exclusive credit score card in the globe". Not everyone can apply for these cards.

To provide first-rate advantages and also advantages, the bank has actually partnered with Quintessentially, a high-end services company, to supply specialized concierge services for the cardholders.

" What are their demands? It's not money-- it's service," al Ansari stated. The concierge solutions can supply practically anything your heart's wish. Want tickets to the Oscars? Not a problem. The attendant solution when flew a client to Stuttgart, Germany even if he wanted to test-drive the latest Porsche.

On top of all that high-ends, cardholders can likewise get 4% cash back on all purchases, without any yearly charges. There is an AED7,000 (RM7,171) signing up with cost (as of 2011). Certainly, there's no investing limit, since if you're the type of man that has a ruby in his bank card, you do not need one.

The card prides itself on its superior service. "You request the moon and also we try as well as obtain it," al Ansari stated. And you can most likely bill the rate of the real moon to this card

4. Coutts Silk Card. coutts silk card.

Known as the "a lot of popular and also prestigious card", it was initially presented by the exclusive financial institution Coutts & Co. in 2013. A cost card, the Silk Card offers accessibility to a first-rate attendant solution, to help make your life simpler in every feasible method.

Cardholders do not need track their rewards points. The financial institution sends you a letter requesting for you to choose the reward you desire everytime you pass a costs limit.

For a taste, at ₤ 25,000 (RM146,181), you can obtain two containers of Brice Bouzy Grand Cru Sparkling Wine 2002 and also 2007, and also at ₤ 100,000 (RM584,693), you can get exclusive assisted scenic tour, sampling and also lunch at Hush Health Estate for 2 with The Vintner.

This card comes with a ₤ 30,000 (RM175,408) per month investing limit, yet you can always raise it by speaking with the bank. The annual fee is ₤ 350 (RM2,046), which is virtually a swipe compared to various other cards in this category. This card isn't in fact made from silk, however, but it is motivated by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you believe all these cards are quite out of your reach, geographically, below is something a little closer to house. The Citibank Ultima Infinite, is offered in Singapore, India, the UAE, and Hong Kong. Like any exclusive cards, this card is invite-only for the wealthiest Citibank clients, and also is the very first exclusive card to be initial provided in Asia!

When it was very first introduced, it was targeted to customers in Singapore that were earning a minimum of S$ 350,000 a year, however they changed this to consumers with minimal possessions of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the yearly charge of this card is S$ 3,888 (RM10,852), thought to be a fortunate number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To accommodate their cardholders' demands, they get a devoted Lifestle Supervisor each, who can help you with scheduling travel, getting tickets to exclusive events, as well as various other distinguished advantages. If that's not good enough, your card will certainly also be hand-delivered to you by your Lifestyle Manager, where he will have a conversation with you to recognize your requirements. Based upon that, they can recommend events or opportunities that deal with your interests.

The advantages vary from country to nation. In Hong Kong, you get 120,000 Asia Miles yearly, which suffices for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). And also you obtain free of charge eco-friendly fees on a few of the region's finest fairway. Not too shabby.

These cards and also their wonderful advantages might be desire or life goals for most of us average individuals. Do we actually require 24/7 accessibility to exclusive jets anyway? Really did not assume so. For us, the routine cards with rewards that match our way of lives will do just fine.

Exactly how do you obtain a Centurion Card? The annual fee, according to Dr Credit score Card, is a monstrous US$ 595 (RM2,239)!

A fee card, the Silk Card provides access to a world-class attendant solution, to help make your life much easier in every possible method. The yearly cost is ₤ 350 (RM2,046), which is virtually a take compared to other cards in this category. Like any exclusive cards, this card is invite-only for the wealthiest Citibank clients, and is the initial unique card to be initial supplied in Asia!

0 notes

Text

40 Ways To Avoid Rich Credit Cards Burnout

The ultra-wealthy have differing needs to average folks like us. While we are constantly on the look-out free of cost travel insurance when scheduling our flight, they are seeking to hire a personal jet at a moment's notification with their charge card.

These high total assets individuals look for various standards when buying charge card. According to a study by the Deluxe Institute, the wealthy are seeking a card that supplies them "unique gain access to, unparalleled benefits as well as enhanced consumer experience".

What credit cards can you discover in extremely abundant people's wallets? Right here are five of one of the most high-status, unique bank card on earth:

1. American Express Centurion Card 1. American Express Centurion Card

Nearly everybody has come across "The Black Card", one of the most preferred unique card available. All of it began with a rumour of a secret and also super-exclusive high-end American Express "black card", back in the very early 1980s.

Ultimately, American Express decided to capitalize the rumour, presenting the Centurion Card in 1999 for only its wealthiest customers. The card is made of anodised titanium, making the card black in colour.

Exactly how do you obtain a Centurion Card? The initiation fee alone is US$ 7,500 (RM28,203), while the yearly charge is US$ 2,500 (RM 9,410).

There's no restriction on the card, so you can bill, as one customer did in 2014, HK$ 281 million (RM 136 million) to purchase an ancient Chinese ceramic cup from Sotheby's Hong Kong. For this acquisition, Liu Yiqian won 422 million American Express factors, which he can exchange for "28 million frequent flyer miles or concerning US$ 180,000 (RM677,512) worth of coupons at Hong Kong seller ParknShop," according to Bloomberg Company.

Cardholders additionally obtain access to a whole host of elegant things, the majority of which American Express conceals, but some information are dripped out. Some of these "secretive" points consist of renting out a Solution One vehicle, and concierge services. Advantages differ from nation to nation, but it's safe to state that virtually every little thing is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

If you believe titanium cards are as well conventional, you will certainly change you mind with the JP Morgan Palladium Card Released in 2009, it's made of palladium as well as 23K gold. A Bloomberg record estimates that the products of the card alone set you back US$ 1,000 (RM3,764). Your name and also trademark are laser-etched onto the card. Sophisticated.

This might be additionally out of your reach than the Centurion Card In order to get the Palladium Card, you need to have a personal lender with JP Morgan, and the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Customers can additionally qualify, lowering the minimum to US$ 250,000 (RM941,007). The yearly charge, according to Dr Bank card, is a massive US$ 595 (RM2,239)!

What are the benefits? For every single dollar invested, you obtain one factor, or more points if you spend on traveling. And once you strike US$ 100,000 (RM376,355) in investing, you obtain an incentive 35,000 points.

There are no fx costs, late charges, cash advance fees, or overdraft account costs. This is perfect for those who intend to travel like a queen, as you additionally obtain accessibility to greater than 600 airport terminal lounges worldwide, as well as you can also utilize MarquisJet, the globe's biggest fleet of personal jets.

There are several other benefits to holding this card, and you can cash in your factors for skydiving lessons, totally free golf lessons with a pro, as well as other special incentives. Did we discuss it's made of gold?

[interaction id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the rare-earth elements type of individual or girl, you will surely be excited with valuable gems. This of a kind card, the Dubai First Royale Card, is not only trimmed with gold, however it also come with a white.235-carat diamond slap dab in the center of it.

Ibrahim al Ansari, chief executive of Dubai First, informed The National that this is "one of the most special bank card worldwide". It's readily available to members of the royal household and individuals that are certainly rolling in loan. Not everyone can make an application for these cards. You need to be welcomed, and the bank scouts customers from throughout the world.

To supply first-rate advantages and also benefits, the bank has actually partnered with Quintessentially, a high-end services firm, to give dedicated attendant services for the cardholders.

" What are their requirements? It's not money-- it's service," al Ansari said. The concierge services can offer almost anything your heart's need. Want tickets to the Oscars? Not an issue. The attendant solution once flew a consumer to Stuttgart, Germany just because he wished to test-drive the most recent Porsche.

On top of all that high-ends, cardholders can likewise obtain 4% cash back on all purchases, without any annual charges. However, there is an AED7,000 (RM7,171) joining cost (as of 2011). Obviously, there's no costs limitation, due to the fact that if you're the kind of individual who has a diamond in his charge card, you don't need one.

The card prides itself on its superior service. "You ask for the moon and also we attempt and get it," al Ansari claimed. As well as you can possibly bill the price of the real moon to this card

4. Coutts Silk Card. coutts silk card.

Called the "a lot of prominent as well as sought-after card", it was initially introduced by the exclusive financial institution Coutts & Co. in 2013. A credit card, the Silk Card gives access to a first-rate attendant service, to assist make your life easier in every possible way. From occasion administration to trip bookings to advising gifts that will certainly surprise the recipient-- you can count on the card. They'll even assist you employ the best tutors for your youngster.

Cardholders don't need keep track of their incentives points. The financial institution sends you a letter requesting for you to choose the reward you desire everytime you pass an investing limit.

For a preference, at ₤ 25,000 (RM146,181), you can get two containers of Brice Bouzy Grand Cru Champagne 2002 and 2007, as well as at ₤ 100,000 (RM584,693), you can get exclusive led tour, tasting and lunch at Hush Health Estate for 2 with The Vintner.

This card features a ₤ 30,000 (RM175,408) per month investing restriction, yet you can constantly increase it by speaking to the financial institution. The yearly charge is ₤ 350 (RM2,046), which is virtually a swipe contrasted to various other cards in this category. This card isn't in fact constructed from silk, however, however it is motivated by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you believe all these cards are fairly out of your reach, geographically, right here is something a little closer to house. The Citibank Ultima Infinite, is provided in Singapore, India, the UAE, and also Hong Kong. Like any special cards, this card is invite-only for the wealthiest Citibank clients, and is the very first unique card to be initial offered in Asia!

When it was first released, it was targeted to consumers in Singapore who were gaining a minimum of S$ 350,000 a year, but they altered this to customers with minimal properties of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the yearly charge of this card is S$ 3,888 (RM10,852), thought to be a lucky number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To deal with their cardholders' needs, they obtain a specialized Lifestle Supervisor each, that can assist you with booking travel, getting tickets to special occasions, and various other respected rewards. If that's unsatisfactory, your card will also be hand-delivered to you by your Way of living Manager, where he will certainly have a chat with you to understand your needs. Based upon that, they can suggest events or chances that satisfy your rate of interests.

The advantages differ from country to nation. In Hong Kong, you get 120,000 Asia Miles annually, which suffices for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). As well as you obtain complimentary green charges on several of the area's finest golf courses. Not as well shoddy.

These cards as well as their fantastic rewards may be desire or life goals for many of us average folks. For us, the routine cards with advantages that suit our way of lives will do simply great.

How do you get a Centurion Card? The annual cost, according to Dr Credit score Card, is a tremendous US$ 595 (RM2,239)!

A fee card, the Silk Card gives accessibility to a world-class attendant solution, to aid make your life less complicated in every possible way. The annual fee is ₤ 350 (RM2,046), which is virtually a steal contrasted to other cards in this group. Like any kind of special cards, this card is invite-only for the richest Citibank clients, and is the initial exclusive card to be initial supplied in Asia!

0 notes

Text

Thinking About Rich Credit Cards? 10 Reasons Why It's Time To Stop!

The ultra-wealthy have varying demands to normal individuals like us. While we are constantly on the look-out completely free travel insurance when scheduling our flight, they are seeking to hire a private jet at a moment's notification with their charge card.

These high total assets individuals look for different standards when buying charge card. According to a survey by the High-end Institute, the wealthy are seeking a card that provides them "special accessibility, exceptional benefits and improved client experience".

So what bank card can you find in very abundant individuals's purses? Right here are 5 of one of the most high-status, exclusive credit cards in the world:

1. American Express Centurion Card 1. American Express Centurion Card

Virtually everyone has actually become aware of "The Black Card", one of the most prominent exclusive card available. It all started with a rumour of a super-exclusive and secret high-end American Express "black card", back in the very early 1980s.

Ultimately, American Express made a decision to profit the rumour, introducing the Centurion Card in 1999 for only its wealthiest clients. The card is made from anodised titanium, making the card black in colour.

Exactly how do you get a Centurion Card? The initiation cost alone is US$ 7,500 (RM28,203), while the yearly cost is US$ 2,500 (RM 9,410).

What are the benefits? Virtually anything you could consider. There's no limit on the card, so you can bill, as one client carried out in 2014, HK$ 281 million (RM 136 million) to purchase an ancient Chinese ceramic mug from Sotheby's Hong Kong. For this purchase, Liu Yiqian won 422 million American Express points, which he can trade for "28 million constant leaflet miles or regarding US$ 180,000 (RM677,512) worth of vouchers at Hong Kong merchant ParknShop," according to Bloomberg Organisation.

Cardholders additionally obtain accessibility to a whole host of lavish points, a lot of which American Express conceals, but some details are dripped out. Some of these "deceptive" things consist of renting out a Formula One car, and also attendant services. Advantages vary from country to country, but it's secure to claim that nearly every little thing is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

A Bloomberg record estimates that the products of the card alone set you back US$ 1,000 (RM3,764). Your name and signature are laser-etched onto the card.

Nonetheless, this might be even more out of your reach than the Centurion Card In order to get the Palladium Card, you need to have a private banker with JP Morgan, as well as the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Customers can likewise certify, decreasing the minimum to US$ 250,000 (RM941,007). The yearly cost, according to Dr Credit Card, is a monstrous US$ 595 (RM2,239)!

What are the advantages? For every single buck invested, you get one point, or two factors if you invest in traveling. And as soon as you strike US$ 100,000 (RM376,355) in investing, you obtain a perk 35,000 points.

There are no forex charges, late charges, cash loan fees, or over-limit costs. This is ideal for those that want to travel like a queen, as you additionally get access to more than 600 airport lounges worldwide, and you can likewise make use of MarquisJet, the globe's largest fleet of exclusive jets.

There are several other benefits to holding this card, as well as you can cash in your factors for skydiving lessons, cost-free golf lessons with a professional, as well as various other exclusive benefits. Did we discuss it's made of gold?

[communication id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the precious metals kind of individual or woman, you will surely be excited with precious gems. This one of a kind card, the Dubai First Royale Card, is not just cut with gold, however it additionally include a white.235-carat diamond slap dab in the center of it.

Ibrahim al Ansari, primary exec of Dubai First, informed The National that this is "the most special debt card in the world". Not everyone can use for these cards.

To offer world-class benefits and also advantages, the financial institution has actually partnered with Quintessentially, a high-end solutions company, to supply committed attendant services for the cardholders.

" What are their requirements? The concierge services can supply virtually anything your heart's need. The concierge solution once flew a client to Stuttgart, Germany simply because he desired to test-drive the most current Porsche.

In addition to all that deluxes, cardholders can additionally get 4% cash money back on all purchases, with no annual fees. There is an AED7,000 (RM7,171) joining fee (as of 2011). Certainly, there's no investing limitation, due to the fact that if you're the type of individual that has a ruby in his bank card, you don't require one.

The card prides itself on its top-notch solution. "You request for the moon as well as we try as well as obtain it," al Ansari said. As well as you can probably bill the price of the actual moon to this card

4. Coutts Silk Card. coutts silk card.

Called the "many sought-after as well as prominent card", it was initially introduced by the personal financial institution Coutts & Co. in 2013. A charge card, the Silk Card gives access to a first-rate attendant service, to help make your life much easier in every feasible method. From event administration to flight reservations to advising gifts that will blow away the recipient-- you can trust the card. They'll even assist you work with the very best tutors for your child.

Cardholders do not need track their rewards points. The financial institution sends you a letter requesting for you to select the reward you want everytime you pass a costs limit.

For a preference, at ₤ 25,000 (RM146,181), you can get 2 bottles of Brice Bouzy Grand Cru Sparkling Wine 2002 and 2007, and also at ₤ 100,000 (RM584,693), you can obtain personal guided tour, tasting as well as lunch at Hush Heath Estate for two with The Vintner.

This card comes with a ₤ 30,000 (RM175,408) per month spending limit, yet you can always raise it by talking with the bank. The annual charge is ₤ 350 (RM2,046), which is almost a take contrasted to other cards in this group. This card isn't really constructed from silk, though, but it is inspired by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you assume all these cards are quite out of your reach, geographically, here is something a little closer to house. The Citibank Ultima Infinite, is provided in Singapore, India, the UAE, and also Hong Kong. Like any type of special cards, this card is invite-only for the wealthiest Citibank customers, as well as is the initial exclusive card to be first used in Asia!

When it was very first introduced, it was targeted to customers in Singapore that were gaining at least S$ 350,000 a year, yet they changed this to customers with minimal possessions of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the annual charge of this card is S$ 3,888 (RM10,852), thought to be a lucky number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To satisfy their cardholders' demands, they get a dedicated Lifestle Manager each, that can help you with reserving travel, getting tickets to unique events, and also other prestigious rewards. If that's unsatisfactory, your card will certainly likewise be hand-delivered to you by your Way of living Supervisor, where he will certainly have a conversation with you to recognize your demands. Based upon that, they can advise events or chances that deal with your passions.

The benefits differ from country to nation. In Hong Kong, you get 120,000 Asia Miles each year, which is enough for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). And you get free environment-friendly fees on several of the area's finest golf courses. Not as well shabby.

These cards and also their wonderful perks may be dream or life objectives for most of us average people. Do we truly require 24/7 access to personal jets anyway? Didn't believe so. For us, the normal cards with rewards that suit our way of lives will do just fine.

Just how do you get a Centurion Card? The annual cost, according to Dr Credit score Card, is a massive US$ 595 (RM2,239)!

A cost card, the Silk Card offers accessibility to a first-rate attendant service, to assist make your life easier in every feasible method. The annual fee is ₤ 350 (RM2,046), which is virtually a steal contrasted to various other cards in this group. Like any type of special cards, this card is invite-only for the richest Citibank clients, and is the initial unique card to be very first used in Asia!

0 notes

Text

Sick And Tired Of Doing Rich Credit Cards The Old Way? Read This

The ultra-wealthy have varying demands to ordinary individuals like us. While we are always on the look-out free of charge traveling insurance policy when reserving our trip, they are wanting to hire a private jet at a moment's notification with their credit card.

When going shopping for credit rating card, these high internet worth individuals look for different requirements. According to a survey by the Deluxe Institute, the wealthy are searching for a card that supplies them "unique accessibility, unparalleled advantages as well as enhanced client experience".

What debt cards can you discover in very rich people's pocketbooks? Below are 5 of one of the most high-status, unique charge card on the planet:

1. American Express Centurion Card 1. American Express Centurion Card

Practically everyone has come across "The Black Card", one of the most prominent exclusive card around. Everything began with a rumour of a super-exclusive as well as secret premium American Express "black card", back in the very early 1980s.

Ultimately, American Express determined to profit the rumour, presenting the Centurion Card in 1999 for only its wealthiest clients. The card is made of anodised titanium, making the card black in colour.

Exactly how do you obtain a Centurion Card? The initiation charge alone is US$ 7,500 (RM28,203), while the yearly cost is US$ 2,500 (RM 9,410).

Yet what are the advantages? Practically anything you might consider. There's no restriction on the card, so you can charge, as one client carried out in 2014, HK$ 281 million (RM 136 million) to get an old Chinese ceramic mug from Sotheby's Hong Kong. For this acquisition, Liu Yiqian won 422 million American Express factors, which he can exchange for "28 million constant flyer miles or regarding US$ 180,000 (RM677,512) worth of vouchers at Hong Kong seller ParknShop," according to Bloomberg Company.

Cardholders additionally obtain access to an entire host of glamorous points, the majority of which American Express conceals, but some details are leaked out. A few of these "secretive" points consist of leasing a Formula One auto, and also attendant solutions. Advantages vary from country to nation, yet it's secure to state that practically whatever is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

If you assume titanium cards are as well mainstream, you will certainly transform you mind with the JP Morgan Palladium Card Introduced in 2009, it's made of palladium and 23K gold. A Bloomberg record approximates that the products of the card alone set you back US$ 1,000 (RM3,764). Your name and signature are laser-etched onto the card. Stylish.

This might be additionally out of your reach than the Centurion Card In order to get approved for the Palladium Card, you need to have a personal banker with JP Morgan, as well as the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Clients can also certify, lowering the minimum to US$ 250,000 (RM941,007). The annual charge, according to Dr Credit Card, is a massive US$ 595 (RM2,239)!

What are the advantages? For each dollar spent, you obtain one point, or more factors if you invest in travel. And also as soon as you strike US$ 100,000 (RM376,355) in spending, you get a benefit 35,000 points.

There are no foreign exchange charges, late fees, cash advance charges, or over-limit costs. This is best for those who intend to travel like a queen, as you additionally obtain accessibility to more than 600 airport terminal lounges worldwide, as well as you can also make use of MarquisJet, the world's largest fleet of personal jets.

There are lots of various other benefits to holding this card, as well as you can cash in your factors for skydiving lessons, complimentary golf lessons with a pro, and also various other unique rewards. Did we discuss it's made of gold?

[communication id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the rare-earth elements kind of individual or girl, you will surely be impressed with priceless treasures. This set of a kind card, the Dubai First Royale Card, is not only cut with gold, but it also include a white.235-carat diamond slap dab in the center of it.

Ibrahim al Ansari, chief executive of Dubai First, informed The National that this is "the most special credit scores card in the world". Not everyone can apply for these cards.

To supply first-rate privileges and also advantages, the financial institution has actually partnered with Quintessentially, a deluxe services firm, to provide devoted concierge services for the cardholders.

" What are their demands? It's not money-- it's solution," al Ansari claimed. The attendant solutions can offer practically anything your heart's desire. Want tickets to the Oscars? Not a trouble. The concierge service when flew a consumer to Stuttgart, Germany even if he wanted to test-drive the latest Porsche.

On top of all that deluxes, cardholders can additionally obtain 4% cash money back on all acquisitions, without any annual fees. There is an AED7,000 (RM7,171) joining charge (as of 2011). Certainly, there's no investing limitation, due to the fact that if you're the kind of individual who has a ruby in his credit card, you do not need one.

The card prides itself on its top-notch solution. "You request for the moon and also we attempt and also obtain it," al Ansari said. As well as you can most likely bill the price of the real moon to this card

4. Coutts Silk Card. coutts silk card.

Called the "the majority of respected and in-demand card", it was initially introduced by the private financial institution Coutts & Co. in 2013. A credit card, the Silk Card admits to a world-class attendant solution, to help make your life much easier in every possible method. From event management to flight reservations to advising gifts that will certainly surprise the recipient-- you can trust the card. They'll also aid you work with the very best tutors for your kid.

Cardholders don't require monitor their incentives points. The financial institution sends you a letter asking for you to select the benefit you want everytime you pass a costs limit.

For a preference, at ₤ 25,000 (RM146,181), you can obtain two bottles of Brice Bouzy Grand Cru Champagne 2002 as well as 2007, and at ₤ 100,000 (RM584,693), you can obtain private directed excursion, tasting and also lunch at Hush Heath Estate for 2 with The Vintner.

This card includes a ₤ 30,000 (RM175,408) each month costs limit, however you can constantly raise it by speaking to the financial institution. The yearly fee is ₤ 350 (RM2,046), which is virtually a take contrasted to various other cards in this classification. This card isn't in fact constructed from silk, however, however it is motivated by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you believe all these cards are fairly out of your reach, geographically, right here is something a little closer to home. The Citibank Ultima Infinite, is provided in Singapore, India, the UAE, and Hong Kong. Like any kind of exclusive cards, this card is invite-only for the richest Citibank clients, and also is the initial exclusive card to be initial supplied in Asia!

When it was very first launched, it was targeted to consumers in Singapore who were making at the very least S$ 350,000 a year, however they transformed this to consumers with minimum assets of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the annual charge of this card is S$ 3,888 (RM10,852), believed to be a fortunate number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To cater to their cardholders' requirements, they get a dedicated Lifestle Supervisor each, that can aid you with booking travel, getting tickets to special events, as well as other respected rewards. If that's not good enough, your card will also be hand-delivered to you by your Lifestyle Manager, where he will certainly have a chat with you to recognize your demands. Based on that, they can recommend events or possibilities that satisfy your passions.

In Hong Kong, you obtain 120,000 Asia Miles every year, which is enough for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). And you get complimentary green charges on some of the region's finest golf programs.

These cards and their amazing perks may be dream or life objectives for most of us regular folks. Do we truly require 24/7 access to personal jets anyway? Really did not believe so. For us, the regular cards with perks that fit our way of livings will certainly do just great.

How do you get a Centurion Card? The annual fee, according to Dr Credit rating Card, is a tremendous US$ 595 (RM2,239)!

A cost card, the Silk Card provides accessibility to a first-rate concierge solution, to aid make your life less complicated in every possible means. The annual charge is ₤ 350 (RM2,046), which is virtually a take contrasted to various other cards in this classification. Like any kind of special cards, this card is invite-only for the wealthiest Citibank clients, and also is the very first exclusive card to be first supplied in Asia!

0 notes

Text

Rich Credit Cards Secrets

The ultra-wealthy have differing needs to normal people like us. While we are constantly on the look-out absolutely free travel insurance policy when reserving our flight, they are wanting to work with a personal jet at a minute's notification with their charge card.

These high net worth individuals seek various standards when buying bank card. According to a study by the High-end Institute, the well-off are seeking a card that provides them "special access, exceptional advantages and boosted customer experience".

So what credit cards can you locate in extremely rich people's wallets? Right here are 5 of one of the most high-status, unique charge card in the world:

1. American Express Centurion Card 1. American Express Centurion Card

Practically everybody has actually heard of "The Black Card", the most prominent unique card out there. Everything started with a rumour of a secret as well as super-exclusive high-end American Express "black card", back in the early 1980s.

Eventually, American Express made a decision to profit the rumour, introducing the Centurion Card in 1999 for just its wealthiest customers. The card is made of anodised titanium, making the card black in colour.

Exactly how do you get a Centurion Card? The initiation fee alone is US$ 7,500 (RM28,203), while the annual charge is US$ 2,500 (RM 9,410).

But what are the advantages? Practically anything you might consider. There's no limit on the card, so you can bill, as one consumer did in 2014, HK$ 281 million (RM 136 million) to get an old Chinese ceramic cup from Sotheby's Hong Kong. For this purchase, Liu Yiqian won 422 million American Express factors, which he can exchange for "28 million regular flyer miles or regarding US$ 180,000 (RM677,512) well worth of coupons at Hong Kong store ParknShop," according to Bloomberg Service.

Cardholders additionally obtain accessibility to an entire host of luxurious things, the majority of which American Express keeps secret, but some details are leaked out. Some of these "secretive" things include renting a Formula One vehicle, and concierge solutions. Advantages vary from country to nation, however it's secure to state that almost whatever is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

You will change you mind with the JP Morgan Palladium Card if you think titanium cards are also conventional Launched in 2009, it's made from palladium and 23K gold. A Bloomberg report approximates that the products of the card alone cost US$ 1,000 (RM3,764). Your name and also trademark are laser-etched onto the card. Elegant.

Nevertheless, this may be better out of your reach than the Centurion Card In order to qualify for the Palladium Card, you need to have an exclusive banker with JP Morgan, and the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Customers can likewise qualify, decreasing the minimum to US$ 250,000 (RM941,007). The annual charge, according to Dr Credit Card, is a tremendous US$ 595 (RM2,239)!

What are the benefits? For every single buck spent, you get one point, or two factors if you invest in traveling. And when you strike US$ 100,000 (RM376,355) in investing, you get a benefit 35,000 factors.

There are no fx charges, late charges, cash advance costs, or overdraft account costs. This is best for those that intend to travel like a queen, as you additionally get accessibility to more than 600 airport terminal lounges worldwide, as well as you can also make use of MarquisJet, the globe's largest fleet of exclusive jets.

There are lots of various other advantages to holding this card, as well as you can cash in your factors for skydiving lessons, free golf lessons with a professional, and also various other special incentives. Additionally, did we discuss it's made from gold?

[communication id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the rare-earth elements type of guy or girl, you will certainly be excited with valuable treasures. This one of a kind card, the Dubai First Royale Card, is not only cut with gold, but it also feature a white.235-carat diamond slap dab in the center of it.

Ibrahim al Ansari, chief executive of Dubai First, informed The National that this is "the most exclusive credit card in the world". Not everyone can apply for these cards.

To offer first-rate benefits as well as advantages, the bank has partnered with Quintessentially, a luxury services company, to supply committed attendant services for the cardholders.

" What are their requirements? It's not money-- it's solution," al Ansari said. The attendant services can give virtually anything your heart's wish. Want tickets to the Oscars? Not an issue. The concierge solution once flew a consumer to Stuttgart, Germany just because he wished to test-drive the most recent Porsche.

In addition to all that luxuries, cardholders can also obtain 4% cash money back on all acquisitions, without yearly fees. There is an AED7,000 (RM7,171) joining charge (as of 2011). Certainly, there's no costs restriction, due to the fact that if you're the type of guy who has a ruby in his charge card, you don't require one.

The card prides itself on its top-notch solution. "You ask for the moon and also we try as well as get it," al Ansari claimed. And also you can probably bill the rate of the actual moon to this card

4. Coutts Silk Card. coutts silk card.

Known as the "a lot of prestigious and desired card", it was first introduced by the private bank Coutts & Co. in 2013. A charge card, the Silk Card offers access to a world-class concierge solution, to help make your life easier in every possible way.

Cardholders do not require track their rewards factors. The financial institution sends you a letter requesting for you to pick the reward you desire everytime you pass a costs threshold.

For a preference, at ₤ 25,000 (RM146,181), you can get two containers of Brice Bouzy Grand Cru Sparkling Wine 2002 as well as 2007, as well as at ₤ 100,000 (RM584,693), you can get personal assisted trip, sampling as well as lunch at Hush Health Estate for two with The Vintner.

This card features a ₤ 30,000 (RM175,408) monthly investing limitation, but you can always raise it by speaking to the financial institution. The yearly cost is ₤ 350 (RM2,046), which is virtually a swipe compared to various other cards in this category. This card isn't really made of silk, though, but it is influenced by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you assume all these cards are quite out of your reach, geographically, below is something a little closer to home. The Citibank Ultima Infinite, is offered in Singapore, India, the UAE, as well as Hong Kong. Like any special cards, this card is invite-only for the wealthiest Citibank clients, as well as is the very first special card to be initial provided in Asia!

When it was initial released, it was targeted to customers in Singapore that were earning at the very least S$ 350,000 a year, yet they altered this to customers with minimal possessions of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the yearly fee of this card is S$ 3,888 (RM10,852), believed to be a lucky number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To deal with their cardholders' needs, they obtain a dedicated Lifestle Supervisor each, that can aid you with scheduling travel, obtaining tickets to special events, and also various other distinguished perks. If that's not good enough, your card will likewise be hand-delivered to you by your Way of life Manager, where he will certainly have a conversation with you to comprehend your requirements. Based upon that, they can advise occasions or chances that satisfy your passions.

In Hong Kong, you get 120,000 Asia Miles every year, which is sufficient for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). As well as you get free eco-friendly fees on some of the area's finest golf courses.

These cards as well as their amazing benefits may be desire or life objectives for most of us average people. For us, the normal cards with rewards that fit our lifestyles will do just fine.

Just how do you get a Centurion Card? The annual charge, according to Dr Credit report Card, is a tremendous US$ 595 (RM2,239)!

A fee card, the Silk Card offers accessibility to a world-class concierge service, to assist make your life easier in every feasible method. The annual charge is ₤ 350 (RM2,046), which is almost a swipe compared to various other cards in this category. Like any type of unique cards, this card is invite-only for the wealthiest Citibank customers, as well as is the first unique card to be very first offered in Asia!

0 notes

Text

What You Can Learn From Tiger Woods About Rich Credit Cards

The ultra-wealthy have varying demands to common people like us. While we are always on the look-out for free traveling insurance coverage when scheduling our trip, they are aiming to work with a personal jet at a minute's notice with their bank card.

When shopping for credit score card, these high net worth individuals look for various criteria. According to a study by the High-end Institute, the well-off are looking for a card that supplies them "unique accessibility, unparalleled advantages and also enhanced consumer experience".

So what credit cards can you locate in super abundant individuals's wallets? Right here are 5 of one of the most high-status, exclusive bank card on the planet:

1. American Express Centurion Card 1. American Express Centurion Card

Almost every person has heard of "The Black Card", one of the most preferred exclusive card available. Everything began with a rumour of a super-exclusive and secret high-end American Express "black card", back in the very early 1980s.

Ultimately, American Express determined to cash in on the rumour, introducing the Centurion Card in 1999 for only its richest consumers. The card is made of anodised titanium, making the card black in colour.

How do you get a Centurion Card? The initiation charge alone is US$ 7,500 (RM28,203), while the annual charge is US$ 2,500 (RM 9,410).

However what are the benefits? Virtually anything you can think of. There's no limit on the card, so you can charge, as one client performed in 2014, HK$ 281 million (RM 136 million) to purchase an old Chinese ceramic mug from Sotheby's Hong Kong. For this purchase, Liu Yiqian won 422 million American Express factors, which he can exchange for "28 million constant leaflet miles or about US$ 180,000 (RM677,512) worth of vouchers at Hong Kong retailer ParknShop," according to Bloomberg Organisation.

Cardholders also get accessibility to an entire host of extravagant points, a lot of which American Express keeps secret, however some details are dripped out. Several of these "secretive" things include leasing a Solution One vehicle, and attendant services. Benefits differ from country to nation, however it's secure to say that virtually everything is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

A Bloomberg report approximates that the products of the card alone cost US$ 1,000 (RM3,764). Your name and also signature are laser-etched onto the card.

Nonetheless, this might be additionally out of your reach than the Centurion Card In order to receive the Palladium Card, you require to have an exclusive lender with JP Morgan, and the minimum for that is US$ 1 million (RM3,764,030), although Chase Private Clients can additionally certify, reducing the minimum to US$ 250,000 (RM941,007). The yearly charge, according to Dr Credit Card, is a monstrous US$ 595 (RM2,239)!

What are the benefits? For each dollar invested, you get one factor, or 2 points if you invest in travel. And also as soon as you strike US$ 100,000 (RM376,355) in costs, you obtain a reward 35,000 factors.

There are no foreign exchange charges, late fees, cash advance fees, or over-limit fees. This is best for those who intend to take a trip like a queen, as you additionally get accessibility to more than 600 flight terminal lounges worldwide, and also you can additionally utilize MarquisJet, the globe's biggest fleet of exclusive jets.

There are many other advantages to holding this card, as well as you can money in your points for skydiving lessons, totally free golf lessons with a professional, and other exclusive incentives. Also, did we state it's made of gold?

[interaction id=" 558b9698ab9dc6b44931c890 ″] 3. Dubai First Royale Card. Dubai First Royale Card.

If you are not the rare-earth elements type of man or woman, you will definitely be thrilled with precious gems. This one of a kind card, the Dubai First Royale Card, is not just cut with gold, yet it additionally come with a white.235-carat diamond slap dab in the middle of it.

Ibrahim al Ansari, chief exec of Dubai First, told The National that this is "the most exclusive credit score card in the world". Not everybody can use for these cards.

To supply world-class advantages as well as advantages, the bank has actually partnered with Quintessentially, a high-end solutions business, to offer committed concierge services for the cardholders.

" What are their demands? It's not loan-- it's service," al Ansari claimed. The concierge solutions can offer almost anything your heart's desire. Want tickets to the Oscars? Not an issue. The attendant solution as soon as flew a customer to Stuttgart, Germany even if he wished to test-drive the latest Porsche.

On top of all that high-ends, cardholders can also obtain 4% money back on all purchases, without annual fees. Nonetheless, there is an AED7,000 (RM7,171) signing up with fee (as of 2011). Of course, there's no investing limitation, since if you're the type of guy who has a ruby in his bank card, you don't need one.

The card prides itself on its superior service. "You request the moon and also we attempt and obtain it," al Ansari stated. And you can most likely charge the rate of the real moon to this card

4. Coutts Silk Card. coutts silk card.

Known as the "a lot of in-demand and also respected card", it was initially presented by the private financial institution Coutts & Co. in 2013. A charge card, the Silk Card gives access to a world-class concierge solution, to help make your life easier in every feasible means. From occasion monitoring to trip reservations to advising gifts that will certainly blow away the recipient-- you can depend on the card. They'll also assist you hire the best tutors for your kid.

Cardholders do not need keep an eye on their rewards points. The financial institution sends you a letter asking for you to choose the reward you desire everytime you pass a costs limit.

For a preference, at ₤ 25,000 (RM146,181), you can get 2 containers of Brice Bouzy Grand Cru Sparkling Wine 2002 and 2007, and also at ₤ 100,000 (RM584,693), you can get personal assisted tour, sampling and lunch at Hush Health Estate for 2 with The Vintner.

This card features a ₤ 30,000 (RM175,408) per month investing limit, yet you can constantly increase it by speaking to the bank. The annual charge is ₤ 350 (RM2,046), which is practically a swipe contrasted to various other cards in this classification. This card isn't really made from silk, however, but it is inspired by silk patterns from Chinese tapestries.

5. Citibank Ultima Infinite Citibank Ultima Card

If you assume all these cards are quite out of your reach, geographically, right here is something a little closer to home. The Citibank Ultima Infinite, is used in Singapore, India, the UAE, and also Hong Kong. Like any type of unique cards, this card is invite-only for the richest Citibank customers, as well as is the very first unique card to be initial supplied in Asia!

When it was first introduced, it was targeted to consumers in Singapore who were making at the very least S$ 350,000 a year, but they transformed this to consumers with minimum properties of S$ 5 million (RM13,955,463) when they relaunched in 2010. In Singapore, the yearly cost of this card is S$ 3,888 (RM10,852), thought to be a lucky number. In Hong Kong, it's, HK$ 23,800 (RM11,552).

To cater to their cardholders' requirements, they get a committed Lifestle Supervisor each, that can help you with booking traveling, obtaining tickets to unique occasions, and also other distinguished benefits. If that's unsatisfactory, your card will certainly likewise be hand-delivered to you by your Way of life Manager, where he will certainly have a chat with you to recognize your needs. Based on that, they can advise occasions or opportunities that accommodate your interests.

In Hong Kong, you get 120,000 Asia Miles every year, which is enough for a round-trip business-class ticket from Hong Kong to London (valued at RM27,919). As well as you obtain free of charge environment-friendly charges on some of the region's finest golf courses.

These cards and their superb perks might be desire or life objectives for most of us normal people. Do we actually need 24/7 access to private jets anyhow? Really did not assume so. For us, the normal cards with benefits that fit our way of lives will do simply great.

Just how do you obtain a Centurion Card? The annual charge, according to Dr Credit score Card, is a massive US$ 595 (RM2,239)!

A charge card, the Silk Card offers access to a world-class attendant service, to aid make your life less complicated in every feasible means. The yearly fee is ₤ 350 (RM2,046), which is practically a steal contrasted to various other cards in this group. Like any type of unique cards, this card is invite-only for the wealthiest Citibank clients, and is the first unique card to be initial provided in Asia!

0 notes

Text

How To Slap Down A Rich Credit Cards

The ultra-wealthy have differing requirements to average people like us. While we are constantly on the look-out absolutely free traveling insurance coverage when reserving our flight, they are seeking to work with an exclusive jet at a moment's notice with their credit card.

These high total assets individuals look for various criteria when purchasing bank card. According to a study by the Luxury Institute, the wealthy are looking for a card that supplies them "special access, exceptional advantages and boosted customer experience".

So what bank card can you find in very rich individuals's purses? Right here are five of the most high-status, special credit cards in the world:

1. American Express Centurion Card 1. American Express Centurion Card

Nearly every person has actually become aware of "The Black Card", the most popular unique card out there. All of it started with a rumour of a super-exclusive and also secret premium American Express "black card", back in the early 1980s.

At Some Point, American Express made a decision to profit the rumour, introducing the Centurion Card in 1999 for just its wealthiest customers. The card is made of anodised titanium, making the card black in colour.

Just how do you obtain a Centurion Card? The initiation cost alone is US$ 7,500 (RM28,203), while the annual cost is US$ 2,500 (RM 9,410).

There's no restriction on the card, so you can charge, as one consumer did in 2014, HK$ 281 million (RM 136 million) to purchase an ancient Chinese ceramic cup from Sotheby's Hong Kong. For this purchase, Liu Yiqian won 422 million American Express points, which he can exchange for "28 million constant leaflet miles or concerning US$ 180,000 (RM677,512) worth of vouchers at Hong Kong retailer ParknShop," according to Bloomberg Company.

Cardholders also obtain access to a whole host of glamorous points, a lot of which American Express keeps secret, yet some details are leaked out. Several of these "secretive" things include renting a Formula One vehicle, as well as attendant services. Advantages differ from country to nation, but it's risk-free to state that practically everything is within your reach with the Centurion Card

2. JP Morgan Palladium Card JP Morgan Palladium Card

If you believe titanium cards are also mainstream, you will certainly transform you mind with the JP Morgan Palladium Card Released in 2009, it's constructed from palladium and 23K gold. A Bloomberg record approximates that the products of the card alone cost US$ 1,000 (RM3,764). Your name as well as trademark are laser-etched onto the card. Classy.