#Computerdriven

Explore tagged Tumblr posts

Photo

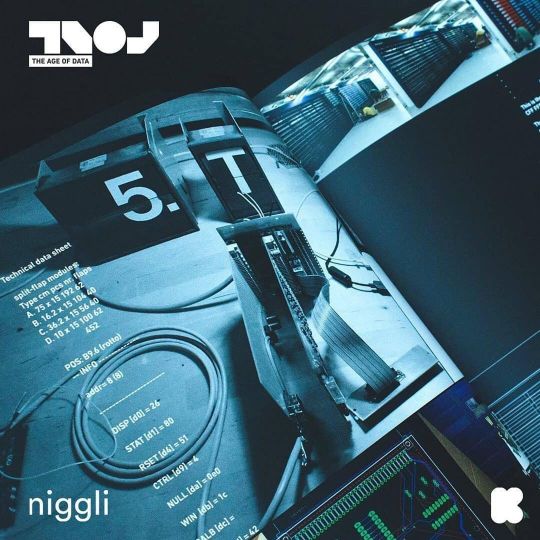

“THE AGE OF DATA!!” 🔪🔪🔪Next level data art!! With artists/ @detroitunderground ™️ friends @nonotakstudio / @defasten / @richarddevine / @iantdr / @jcnaour / @kuflexlab and more!!!’ THE AGE OF DATA – Embracing Algorithms in Art & Design is NOW on Kickstarter! >>> bit.ly/3ua8s3a link in bio!!! 40 contemporary artists and studios, global pioneers of data-driven design provide insights into their latest genre-defining artworks revealing how they impact our everyday and future living worlds. Edited by: @christophgruenberger Publisher: @niggli_verlag #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #3drender #technology #innovation #visualart #visualcommunication #animation #designfeed #newmediaart https://www.instagram.com/p/CMF3RjankF2/?igshid=sxjw2iws6xw0

#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#3drender#technology#innovation#visualart#visualcommunication#animation#designfeed#newmediaart

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Australian dollar left bloody after computer-driven crash

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

Australian dollar left bloody after computer-driven crash

© Reuters. Illustration photo of Australian dollars

By Wayne Cole

SYDNEY (Reuters) – The Australian dollar was picking up the pieces on Thursday after a torrent of automated selling against the yen sent it plunging to multi-year lows on a host of major currencies.

The suffered some of the largest intra-day falls in its history amid a drought of liquidity and a cascade of computerised sales.

At one point it was down 5 percent on the yen and almost 4 percent on the U.S. dollar, before clawing back much of the losses as trading calmed and humans took charge.

“Violent moves in AUD and JPY this morning bear all the hallmarks of a ‘flash crash’ similar to that which befell NZD in August 2015 and GBP in October 2016,” said Ray Attrill, head of FX strategy at National Australia Bank.

“The fact that over half the move down in both these pairs has since been retraced is testimony to today’s moves being first and foremost a liquidity event.”

One theory was that Japanese investors who had been crowded into trades borrowing yen to buy higher yielding currencies, were forced out en masse when major chart levels cracked.

The Aussie tumbled as far as 72.26 yen () on Reuters dealing, a level not seen since late 2011, having started around 75.21.

When the smoke cleared, buyers returned and it was last changing hands at 74.40 yen.

The selling spilled over into other crosses and the Aussie sank to as deep as $0.6715 , the lowest since March 2009, having started around $0.6984.

Again, bargain hunters emerged and it was last at $0.6922.

The New Zealand dollar also took an initial beating on the yen () to hit its lowest since late 2012, though whether any trades were done around those levels was hard to say.

The fared better on the U.S. dollar, easing to $0.6621 from $0.6654 late Wednesday.

EVERYONE’S BUYING BONDS

The rout from risk was sparked in part by an earnings warning from Apple Inc (O:). It blamed sluggish iPhone sales in China, adding to evidence of a deepening economic slowdown in the Asian giant.

Some investors fled to the relative safety of Australia’s triple-A rated debt, sending 10-year bond yields () diving to their lowest since late 2016.

Futures for the 10-year bond jumped 12 ticks to 97.8300, having been up as much as 25 ticks at one stage. The three-year bond contract rose 7.5 ticks to 98.305, implying a yield of just 1.695 percent.

Concerns about global growth also led the futures market to price in slightly more chance of a cut in interest rates by the Reserve Bank of Australia (RBA).

Yet the Aussie’s decline is providing a boost to the economy that makes it less likely the RBA will have to take the drastic step of cutting rates from already record lows.

Not only does a lower currency make exports more competitive but it offers an extra earnings windfall given Australia’s commodities are priced in U.S. dollars.

Gold, for instance, is trading at its highest level ever in Australian dollar terms around A$1,856 per ounce () having climbed 12 percent in just the past month.

Profits from iron ore, coal and liquefied will all get a lift, fattening the country’s terms of trade and the government’s tax coffers.

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/australian-dollar-left-bloody-after-computer-driven-crash

0 notes

Text

Computer-driven hedge funds lose out on volatility spike: HSBC data

Visit Now - http://zeroviral.com/computer-driven-hedge-funds-lose-out-on-volatility-spike-hsbc-data/

Computer-driven hedge funds lose out on volatility spike: HSBC data

LONDON (Reuters) – Performance from computer-driven hedge funds run by industry stalwarts Cantab Capital Partners and Systematica Investments took a hit after market volatility in February, showed data compiled by HSBC.

The Cantab Capital Partners Quantitative Fund and Systematica Alternative Markets Fund lost 10.7 percent and 8.9 percent, respectively, in the year to Feb. 9, according to the HSBC data seen by Reuters.

Reporting by Maiya Keidan; editing by Carolyn Cohn

Our Standards:The Thomson Reuters Trust Principles.

0 notes

Photo

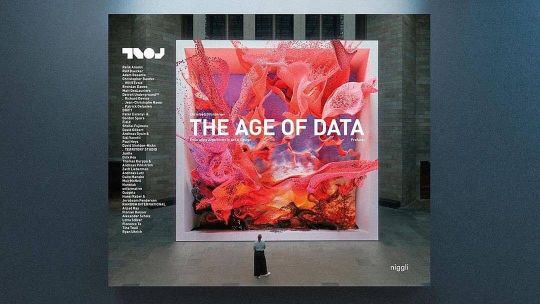

DU™️ #Repost @christophgruenberger ・・・ How is Data influencing more and more a wide range of creative expression an communication? How is it revolutionizing storytelling? 👉 Dive into the world of data-driven artwork 👉@theageofdata THE AGE OF DATA by Christoph Grünberger provides an in-depth view into the amazing projects of 40 contemporary artists and studios, spread across 400 pages in a cinematic format. . Global Pioneers in data-driven design share projects and insights behind some of the most genre-redefining work in the world today and how this influences our everyday and future worlds. . Featuring: @brendandawes @christopherbauder @daitomanabe @davidterritorystudio @detroitunderground @dirkkoy @joellesnaith @muirmcneil @nonotakstudio @onformative @quayola @randominternational @tinatouli @zach.lieberman and many many more… . Cover Artwork: @refikanadol . . #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #robotics #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #3drender #technology #innovation #visualart #visualcommunication #animation Reposted from @christophgruenberger https://www.instagram.com/p/CRaewmMFF5l/?utm_medium=tumblr

#repost#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#robotics#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#3drender#technology#innovation#visualart#visualcommunication#animation

0 notes

Photo

DU™️ #Repost @paul_heys ・・・ THE AGE OF DATA published on @niggli_verlag is almost finished. We are very happy that we have some great news about it. Some great people are in: • Ian Anderson / The Designers Republic™, Preface "Starting Point" @thedesignersrepublic • Sandro Kereselidze / ARTECHOUSE, Synopsis on data-driven Design from the perspective of a Producer/Enabler, "Switch On", Images by Vince Fraser "WE RISE ABOVE" @artechouse • Peter Eszenyi / CG Supervisor/Design Lead "BladeRunner 2049", Photogrammetry Experiment "APOLLO 50 – Virtual Archeology" @p.eszenyi • Thomas Kurppa / KurppaHosk & Andreas Pihlström / Suprb™, Semantic Machine-Interpretaions @kurppahosk • Proofreading by Paul Heys / Nottingham Trent University @paul_heys @theageofdata @christophgruenberger #datadriven #computerdriven #digitalart #artinstallation #motiondesign #musicvideo #openframes #artwork #stagedesign #lightinstallation #menandmachine #robotics #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #interactive #musiclife #musicinstallation #perfomringarts #newart #visualcommunication #publicrelation #branding #filmmaker #filmstudio Reposted from @theageofdata Ref: @ntuart @nottinghamtrentuni https://www.instagram.com/p/CO6_H8lFhZP/?igshid=1t4exrp9f3mb2

#repost#datadriven#computerdriven#digitalart#artinstallation#motiondesign#musicvideo#openframes#artwork#stagedesign#lightinstallation#menandmachine#robotics#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#interactive#musiclife#musicinstallation#perfomringarts#newart#visualcommunication#publicrelation#branding#filmmaker#filmstudio

0 notes

Photo

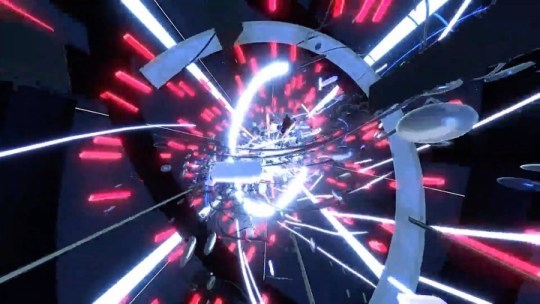

We are stoked to be part of this book “THE AGE OF DATA!!” 🔪🔪🔪Next level data art!! With artists/ @detroitunderground ™️ friends @nonotakstudio / @defasten / @richarddevine / @iantdr / @jcnaour / @kuflexlab and more!!!’ THE AGE OF DATA – Embracing Algorithms in Art & Design is NOW on Kickstarter! >>> bit.ly/3ua8s3a 40 contemporary artists and studios, global pioneers of data-driven design provide insights into their latest genre-defining artworks revealing how they impact our everyday and future living worlds. Edited by: @christophgruenberger Publisher: @niggli_verlag #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #3drender #technology #innovation #visualart #visualcommunication #animation #newmediaart #designfeed https://www.instagram.com/p/CMF1hAunn2D/?igshid=1relve0z7kv7z

#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#3drender#technology#innovation#visualart#visualcommunication#animation#newmediaart#designfeed

0 notes

Photo

DU™️ #Repost @djkero ・・・ Stoked to be part of this book “THE AGE OF DATA!!” 🔪🔪🔪Next level data art!! With artists/ @detroitunderground ™️ friends @nonotakstudio / @defasten / @richarddevine / @iantdr / @jcnaour / @kuflexlab and more!!!’ THE AGE OF DATA – Embracing Algorithms in Art & Design is NOW on Kickstarter! >>> bit.ly/3ua8s3a link in bio!!! 40 contemporary artists and studios, global pioneers of data-driven design provide insights into their latest genre-defining artworks revealing how they impact our everyday and future living worlds. Edited by: @christophgruenberger Publisher: @niggli_verlag #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #technology #innovation #visualart #visualcommunication #animation #designfeed #newmediaart https://www.instagram.com/p/CMWLAUTFMFd/?igshid=ye1xq74brqrz

#repost#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#technology#innovation#visualart#visualcommunication#animation#designfeed#newmediaart

0 notes

Photo

We are stoked to be part of this book “THE AGE OF DATA!!” 🔪🔪🔪Next level data art!! With artists/ @detroitunderground ™️ friends @nonotakstudio / @defasten / @richarddevine / @iantdr / @jcnaour / @kuflexlab and more!!!’ THE AGE OF DATA – Embracing Algorithms in Art & Design is NOW on Kickstarter! >>> bit.ly/3ua8s3a link in bio!!! 40 contemporary artists and studios, global pioneers of data-driven design provide insights into their latest genre-defining artworks revealing how they impact our everyday and future living worlds. Edited by: @christophgruenberger Publisher: @niggli_verlag #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #3drender #technology #innovation #visualart #visualcommunication #animation #newmediaart #designfeed https://www.instagram.com/p/CMF1TFlniLj/?igshid=hf6lsvs65cwm

#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#3drender#technology#innovation#visualart#visualcommunication#animation#newmediaart#designfeed

0 notes

Photo

DU™️ #DUVHS THE AGE OF DATA by Christoph Grünberger is now on Kickstarter! https://www.kickstarter.com/projects/niggliverlag/the-age-of-data-embracing-algorithms-in-art-and-design 40 contemporary artists and studios, spread across 400 pages in a cinematic format. . Global Pioneers in data-driven design share projects and insights behind some of the most genre-redefining work in the world today and how this influences our everyday and future worlds. . Featuring: @brendandawes @christopherbauder @daitomanabe @davidterritorystudio @detroitunderground @dirkkoy @joellesnaith @muirmcneil @nonotakstudio @onformative @quayola @randominternational @tinatouli @zach.lieberman and many many more… . Cover Artwork: @refikanadol . Publisher: @niggli_verlag . #datadriven #computerdriven #digitalart #artinstallation #motiondesign #openframes #artwork #stagedesign #lightinstallation #menandmachine #ui #screendesign #simulation #real #artificial #artificialintelligence #ai #kickstarter #productioncompany #designagency #filmproducer #livevisuals #3drender #technology #innovation #visualart #visualcommunication #animation https://www.instagram.com/p/CMDkmjNluvt/?igshid=1rpaixmjkbrpw

#duvhs#datadriven#computerdriven#digitalart#artinstallation#motiondesign#openframes#artwork#stagedesign#lightinstallation#menandmachine#ui#screendesign#simulation#real#artificial#artificialintelligence#ai#kickstarter#productioncompany#designagency#filmproducer#livevisuals#3drender#technology#innovation#visualart#visualcommunication#animation

0 notes