#Commodity Derivatives Workshop

Explore tagged Tumblr posts

Video

youtube

Industry Connect Program organized by Globsyn Business School | MCX & SEBI

In today’s Industry Connect Program organized by Globsyn Business School, Multi Commodity Exchange (MCX) and SEBI conducted a Commodity Derivatives Workshop on Introduction to Commodity Markets, where industry veterans like Mr. Gaurav Kaushik, Zonal Head (AVP) - Business Development (East), MCX, and Ms. Sudha Rani Kindo, Assistant Manager, SEBI - ERO, shared their expertise with the students.

Sessions such as these expose and prepare the students for the corporate world, make them ‘industry-relevant’, and help them to ace their employability quotient – thereby minimizing the supply-demand gap within the industry. 🎓🌍💡🔧

#youtube#industry connect#industry connect program#education#educational event#Commodity Derivatives#Commodity Derivatives Workshop

2 notes

·

View notes

Text

Capital: The Lie of Free Enterprise

The basis of modern society and modern economics as a whole is capitalism. A system based on the ‘free market’. This system in principle, is supposed to reward those who have the knowledge and ability to be successful in the system to succeed. However in reality this is not how this system works. Capitalism on the contrary rewards those with advantages to be successful in this system. In short under capitalism, If you were born into wealth you will thus likely stay wealthy. Many then say in response, “Well it is their right.” However, I disagree. It comes from the fundamental disagreements between how we understand free enterprise and economics vs the reality of how the world economy works. Adam Smith is often cited as the modern father of capitalism, and with no discredit to him, those who cite them in this way are certainly correct. Adam Smith is the modern father of capitalism and thusly can provide us with some background information on a few fundamental questions we have to answer. Who creates wealth in society, who collects that wealth, and is the enterprise truly a free system? And why don't more people care?

The first question is quite easy to answer as Adam Smith says in his book The Wealth of Nations ‘Labour was the first price, the original purchase-money that was paid for all things. It was not by gold or by silver, but by labour, that all wealth of the world was originally purchased.’ (Smith, A. (1902) ‘Chapter 5’, in The Wealth of Nations. New York: American Home Library Co., p. 48.) From this, we can come to the simple conclusion that in a capitalist society wealth is generated through labour. This is called in economics the ‘Labour Theory of Value’. LTV is the basic statement that all value in an object is derived from the labour put into it. If we have a tree, labour was required to fell that tree, then that tree required labour to be transported to a sawmill or other form processing area. Further, still, the processed wood must be sent to a workshop or factory, and then labour there may turn it into a chair. All through that process labour has added value to the wood and eventually the chair. Then at the end of this process, the price for the chair is calculated from its labour and sold. Then this profit was used to produce another chair. However, there is a rather strange happening during all of that. The owner, the entrepreneur, pocketed the leftovers from the chair, the chair that was just sold as a commodity to the free market. However he did not cut the tree down, nor did he process, transport or carve it. He in this process has put no labour into the chair he didn't add to its value. Then why did he take that wealth?

In 1887 a German economist by the name of Karl Marx published a book called Capital after being translated from its original German to English that same year. In this book, Marx goes over many topics but Marx also speaks on several things namely the processes of the circulations of commodities and capital and the appropriation of surplus value from labours. Marx poses that the reality of both the appreciation of the surplus value gained from the commodity and its use to expand either the existing commodity production of the ‘entrepreneur’ is further strange. Marx poses a format of a process for understanding the transformation of the value existing before the labour was put into the commodity versus the after. He calls this the M-C-M format or the money-to-commodity-to-money format. Marx puts forward the simple idea that if the entrepreneur of a free enterprise puts forward £100 to buy Iron, then a further £75 for labour then sells it for £175 he has essentially turned the commodity value into money which Marx declares at this point is itself a commodity. The value you paid for the iron and labour to turn it into a commodity is indistinguishable from the money except for its use value. Now let's say the entrepreneur still puts £175 into the commodity but instead sold the commodity for £275 there is now a remaining £100 extra than we had before. This is called profit or as Marx called this profit surplus labour value. Marx declares simply that profits that are pocketed by the entrepreneur were appropriated from those who did the labour i.e. turned the iron into a commodity. So the labourers are being exploited out of the value that is rightly theirs while all the entrepreneur did was contribute the original commodity of the capital or money with the M-C-M process. However, make no mistake the labourers made the value of the product however they receive the least of the whole transaction the most benefit being to the entrepreneur who can now do with their surplus labour what he wishes.

The myth of free enterprise truly starts to crumble when you understand the concepts we have discussed. Free enterprise is built upon the labour of others being stolen or thusly appropriated. The value that belongs to the labour is taken instead for the entrepreneur or entrepreneurs of the enterprise and used in many ways. This money may be used to expand the ability to make more money by expanding the production or collection that the enterprise does. Or it could go to new enterprises owned by others that have stakes in the first enterprise or it may go to making the entrepreneur's life luxurious. The use truly is irrelevant to the point. The “free enterprise” is built on the theft of value that did not belong to them. This creates a fundamental imbalance between the entrepreneur (the bourgeoises) and the labourers (the proletariat). Adam Smith states in The Wealth of Nations “Wherever there is great property there is great inequality. For one very rich man, there must be at least five hundred poor, and the affluence of the few supposes the indigence of the many” (Smith, A. (1902b) ‘V: I.b’, in The Wealth of Nations. New York: American Home Library Co., pp. 709–710.) The inevitable outcome of this difference in wealth is class. The ones who create the value in society become the lower class the proletariat while the entrepreneur becomes the high class the bourgeoisie. This relationship between the bourgeoisie and the proletariat necessarily requires the oppression of the proletariat as the bourgeoisie's entire class is based on the theft of the value that rightly belongs to the proletariat. So to the vast majority of society, the enterprise of the bourgeois is not a free existence; they are used and exploited for what is rightly their own and fear losing the ability to create that labour and thus exist in that society based on the power of the bourgeoisie. This thus leads to the power of institutions like the state being irrevocably held in the interests of the bourgeoisie as opposed to the majority of society. This means that the overall power of society is held by the minority of society that control the majority of the capital and commodities of society leading to a society where there is no question about the said “freeness” of the society. Because under the capitalist system, society is unquestionably controlled by the bourgeoisie with a power imbalance that cannot be solved from within the system. The true oppression of the system is not seen in the 1st world, however. The greatest amount of oppression and violence from the bourgeois comes from the 1st world to the 3rd. Underdeveloped countries like Thailand, Pakistan and many others bare the brunt from both national and international bourgeois. Many textile companies haven't or don't have the ability to fully automate their work. So many of these countries often for extremely low wages bear the brunt of such jobs often in dangerous conditions and from young ages. This violence, the violence of greed is a favoured tool in these nations. Once the commodity is produced it is then shipped to wherever it needs to go whether it's America or France that textile is worn but that person wearing it would never know the horror story of its price. This is the case for many items you purchase as Daniel Kahn said in his song ‘The Butchers Sher’, “Every pair of pants and grain of rice contains a horror story in its price.”

Karl Marx said in 1869 in a letter to Fredrich Engels “The English working class will never accomplish anything” but this quote is out of context, it lacks other vital parts and necessary understandings about the day Karl Marx lived. However, let's pretend for a second that wasn't the case. Is this true? The working class of the 1st world especially in our modern day is so terribly separated from the working class of the 3rd world. Almost at times these groups and their interests seem so far apart many would try to argue they are at this point different classes for a simple reason. In Karl Marx’s day, the working class tried organising itself under what were called internationals. As Marx thought capitalism could not be defeated if it was not defeated internationally and wholly. But by the 1950s amid the decolonialism of the postwar period, the true uninternationality of the anti-capitalist movement became all too apparent. This led to major anti-capitalist leaders all over the 3rd world theorising an idea that only the working class of the 3rd world could sufficiently challenge capitalism. This was based on experiences major anti-capitalist leaders like Ho Chi Mihn had with anti-capitalists from the 1st world. Seeing the early beginnings of the consumer economy. This development led many to reexamine Marx’s works and come up with solutions many did and many came to conclusions and one I enjoy is also quite poetic.

The Butchers Sher, you may recognise it, referenced a song by the same name earlier. The Butchers Sher refers to a general idea that the workers in not just the West but all countries must as a result of the system they are a part of consume commodities the necessary conclusion of the capitalist system as we discussed earlier the M-C-M. The idea I propose with this name is the indifference workers have to one another based on the effects of the need for commodities in a capitalist society as well as the unwillingness to learn or empathise with them. The song The Butchers Sher tackles this issue by putting forward the statement that as long as the commodity needs of the West are met the working class of the West does not care and would rather be content to let the ‘butcher’ (the bourgeois) have their share of the exploitation (the surplus value of the 3rd world workers and profits from commodities sold in the west) of the 3rd world. We brought up a lyric from that song earlier “Every pair of pants and grain of rice contains a horror story in its price” The song later makes the statement “You can build yourself a garden, you can cover it in green, but my dear I beg your pardon. How do you keep your little fingers clean?” This is a statement appealing to the nature of the consumer. You can ignore all the privileges and benefits you gain from the exploitation of the 3rd world because the “butcher” gets his share. This is later near the end of the song reinforced by these lyrics. “You gotta give the butcher his price. No matter what you think of human rights. You’ve got to give the butcher his lot, for being everything you think you're not. You gotta give the butcher his share. No matter how you say you care. ‘Cause he’s the one who did the stealing and then named you as the heir. Whose filthiness provided you with the privileges you bare”. This is a statement that as long as the capitalists get their share, the working class of the 1st world can wipe their hands clean if they let someone else do it their collaboration in that system will be washed away even because they didn't do it personally is perfectly encompassed in the line “he’s the one who did the stealing and then named you as the heir”. Because the West is the heir to the exploitation and suffering of the 3rd world and benefits from it every day but at least we can live in comfort.

This is the essence of why the idea of free enterprise is a lie. Because any enterprise is always built on the destruction and theft of the human rights of the proletariat and the only conclusion from the idea of a “free enterprise” is that there isn't one.

#anarchism#anarchocommunism#leftism#marxism#communism#marxist#anti capitalism#trotskyism#socialism#anarchy

12 notes

·

View notes

Text

Why Enrolling in a Derivatives Trading Course Is the Best Investment!

Introduction to Derivatives Trading

In the fast-paced world of financial markets, staying ahead of the curve is crucial. One of the most dynamic and lucrative segments is derivatives trading. Whether you're a budding investor or a seasoned professional, understanding the intricacies of derivatives can open doors to new financial opportunities. This is where enrolling in a Derivatives Trading Course becomes a game-changer.

What is a Derivative?

A derivative is a financial contract whose value is derived from an underlying asset like stocks, commodities, currencies, or indices. Common types of derivatives include futures, options, swaps, and forwards. These instruments are essential for hedging risks, speculating on price movements, and optimizing investment strategies.

Why is a Derivatives Trading Course Essential?

1. Master the Fundamentals

Understanding derivatives requires more than just surface-level knowledge. A Derivatives Trading Course provides in-depth training, covering everything from basic terminologies to advanced trading strategies.

2. Learn Risk Management

Derivatives trading involves significant risk. A structured course teaches you how to manage these risks effectively, ensuring you make informed decisions that safeguard your investments.

3. Stay Ahead with Practical Insights

Theory alone won't cut it in the real world. A quality Derivatives Trading Course includes practical sessions, case studies, and market simulations, helping you apply concepts in real-time trading scenarios.

4. Enhance Career Prospects

With specialized skills in derivatives trading, you become an asset to financial institutions, investment firms, and brokerage houses. Certification from a reputable course can significantly boost your resume.

Why Choose ICFM for Your Derivatives Trading Course?

The Institute of Career in Financial Market (ICFM) stands out as a premier institute offering comprehensive and industry-relevant courses in financial markets. Here’s why ICFM should be your top choice:

Expert-Led Training

ICFM's courses are designed and delivered by industry veterans with years of experience in financial markets. Their insights ensure you receive both theoretical knowledge and practical expertise.

State-of-the-Art Curriculum

The Derivatives Trading Course at ICFM is continually updated to reflect the latest market trends and regulatory changes. You'll learn the most current strategies and tools used by professional traders.

Hands-On Experience

ICFM emphasizes practical learning. The course includes live trading sessions, workshops, and simulations that give you real-world exposure.

Career Support and Networking

Graduating from ICFM doesn't just earn you a certificate—it opens doors. The institute offers career guidance, placement assistance, and networking opportunities with industry experts.

What You'll Learn in ICFM’s Derivatives Trading Course

Introduction to Derivatives Markets

Understanding the types of derivatives

Market participants and their roles

Regulatory frameworks and compliance

Trading Strategies and Techniques

Futures and options strategies

Hedging, arbitrage, and speculation tactics

Technical and fundamental analysis methods

Risk Management and Mitigation

Identifying potential risks in trading

Tools and techniques for risk mitigation

Practical exercises for risk assessment

Live Market Exposure

Simulated trading environments

Analysis of current market trends

Real-time strategy implementation

Who Should Enroll?

Aspiring traders looking to build a solid foundation

Financial professionals aiming to upskill

Students interested in capital markets

Investors seeking to diversify their portfolios

How to Enroll in ICFM’s Derivatives Trading Course?

Getting started is simple. Visit the ICFM website, explore the course details, and complete your registration. You can also reach out to their career advisors for personalized guidance.

Conclusion

In a world where financial acumen dictates success, equipping yourself with specialized knowledge in derivatives trading is invaluable. The Derivatives Trading Course at ICFM doesn't just teach you the basics; it empowers you to navigate complex markets confidently.

Don't just watch others succeed in the financial markets—become a skilled trader and carve out your own path to financial freedom. Enroll in ICFM's Derivatives Trading Course today and take the first step towards mastering the art of derivatives trading!

Read More blogs: Derivatives Trading Course

#Derivatives trading course#Derivatives trading course in india#Derivatives trading course online#Derivatives trading course free#options#futures and other derivatives course#Best Derivatives course in India#Advanced derivatives course#Derivatives courses

0 notes

Text

Top 5 Trading Course in Delhi

Here are five top trading courses in Delhi, each offering unique features for aspiring traders:

NIFM Education Institutonals LTD Offering interactive online trading courses, NIFM focuses on simplifying complex trading concepts, making it ideal for beginners and advanced traders alike.

NSE Academy The National Stock Exchange (NSE) offers professional training in trading, covering topics like technical analysis, equity trading, and derivatives. It's perfect for beginners and experienced traders.

Sharekhan Trading Academy Sharekhan provides both online and offline trading education, including workshops, webinars, and hands-on trading sessions to improve skills in stock market analysis.

BSE Institute A trusted name, BSE Institute offers comprehensive courses on financial markets, including options and futures trading, risk management, and technical analysis.

ICICI Direct Academy ICICI Direct provides an all-encompassing curriculum with personalized mentoring, covering equity, currency, and commodity trading.

Each course equips individuals with the tools to succeed in the stock market.

0 notes

Text

Unleashing Financial Potential: Why Ruchir Gupta Training Academy is the Leading Share Market Institute in Delhi

Delhi, as India’s bustling capital, attracts people from all walks of life with aspirations of financial independence and investment acumen. Among the many educational pursuits in the city, a growing number of individuals seek expertise in stock trading and investments. To serve this demand, Ruchir Gupta Training Academy has emerged as a premier institute for share market training in Delhi, dedicated to imparting practical skills and knowledge to students, professionals, and aspiring investors alike.

Here’s a comprehensive look at why Ruchir Gupta Training Academy has established itself as the leading share market institute in Delhi, and how it can empower you to navigate the complexities of the stock market with confidence and insight.

Why Choose Ruchir Gupta Training Academy for Share Market Training?

Experienced Mentorship and Expertise Ruchir Gupta Training Academy is led by seasoned market professionals who bring years of hands-on experience to the table. With deep knowledge in financial analysis, market psychology, and trading strategies, the instructors at the academy offer a well-rounded education that covers both theory and practice. This mentorship approach ensures that students learn not only the fundamentals of the stock market but also the practical nuances that can make a real difference in their trading journeys.

Comprehensive Curriculum Covering All Aspects of Trading The curriculum at Ruchir Gupta Training Academy is meticulously designed to cater to both beginners and seasoned investors. Starting with the basics of the stock market, the courses gradually advance to cover complex trading strategies, technical analysis, risk management, portfolio diversification, and even behavioral finance. This all-encompassing approach ensures that students build a solid foundation and gain insights into every aspect of the stock market, equipping them to make informed decisions in real-time scenarios.

Hands-On Learning Approach One of the standout features of Ruchir Gupta Training Academy is its focus on experiential learning. The institute places a strong emphasis on live trading sessions, interactive workshops, and simulated stock market environments where students can apply theoretical knowledge in real-market settings. This hands-on approach helps bridge the gap between classroom learning and practical application, enabling students to gain confidence and refine their strategies under the guidance of expert mentors.

Tailored Programs for Different Skill Levels Ruchir Gupta Training Academy offers a variety of programs suited to different levels of expertise:

Beginner’s Course: This program is designed for individuals new to the stock market, covering the basic principles of trading, market terminologies, and entry-level strategies.

Advanced Trading Course: This course is ideal for those with prior knowledge of the market who wish to dive deeper into technical analysis, risk management, and sophisticated trading tactics.

Professional Trader Program: A comprehensive course aimed at those looking to pursue a career in trading or investment management, focusing on portfolio management, derivatives, and long-term investment strategies.

Specialized Workshops: These workshops cover niche topics such as algorithmic trading, commodity markets, and global investment opportunities, adding value to those looking to diversify their skillset.

Focus on Risk Management and Financial Discipline Investing in the stock market involves an inherent level of risk, and successful trading often requires discipline and an understanding of how to minimize losses. The instructors at Ruchir Gupta Training Academy emphasize the importance of risk management techniques, teaching students how to protect their capital, set stop-loss orders, and avoid emotional trading. This focus on discipline and prudence is a hallmark of the academy, aiming to nurture responsible and strategic investors.

Interactive Learning and Peer Support At Ruchir Gupta Training Academy, learning is not confined to textbooks or lectures. The academy fosters an interactive learning environment where students can ask questions, engage in discussions, and collaborate on case studies. This peer-supported approach enables students to learn from each other’s experiences, share insights, and build a supportive network that can extend beyond the classroom.

State-of-the-Art Facilities and Learning Resources The academy is equipped with modern facilities and advanced learning resources to enhance the student experience. From real-time market data feeds and sophisticated trading software to access to market research tools and libraries, Ruchir Gupta Training Academy ensures that students have all the resources they need to succeed. The academy also regularly updates its content to align with the latest market trends and regulatory changes, ensuring that students stay ahead of the curve.

Placement Assistance and Career Guidance For those who aim to build a career in finance and investment, Ruchir Gupta Training Academy provides placement assistance and career guidance. The academy’s connections with financial firms, brokers, and investment firms across Delhi and beyond offer students access to various job opportunities. Through regular placement drives and industry workshops, the academy supports students in launching rewarding careers in the finance sector.

Courses Offered at Ruchir Gupta Training Academy

To cater to the diverse needs of its students, Ruchir Gupta Training Academy offers several comprehensive courses:

Fundamentals of Stock Market: Ideal for newcomers, this course covers market basics, investment principles, and the importance of financial literacy.

Technical Analysis: This course introduces students to chart patterns, technical indicators, and the study of market trends.

Equity and Options Trading: A course focused on equity markets and options trading, suitable for those interested in more advanced strategies.

Portfolio Management and Investment Planning: This course is designed for those who wish to learn how to build and manage a balanced investment portfolio.

Each of these courses is structured to provide in-depth knowledge while allowing students to learn at their own pace. The courses are delivered through a blend of in-person classes and online sessions, ensuring flexibility for working professionals and students alike.

Success Stories from Ruchir Gupta Training Academy

Over the years, Ruchir Gupta Training Academy has produced countless success stories. Graduates have gone on to build impressive portfolios, secure positions in leading financial institutions, and even become independent traders. This legacy of success is a testament to the academy’s quality of education and commitment to student growth. Many alumni also credit their achievements to the academy’s emphasis on emotional resilience, risk management, and strategic thinking, all crucial skills in the volatile world of stock trading.

Conclusion: Charting Your Path to Financial Freedom

Ruchir Gupta Training Academy in Delhi stands out as a premier destination for individuals looking to break into the world of stock market trading. By offering a well-rounded education that combines theoretical knowledge, practical application, and continuous mentorship, the academy equips students with the skills needed to navigate the financial markets confidently.

Whether you are a novice eager to understand the basics or an experienced trader seeking advanced strategies, Ruchir Gupta Training Academy provides a nurturing and rigorous environment to develop your trading skills. With a commitment to excellence and a focus on student success, Ruchir Gupta Training Academy is helping individuals from all backgrounds unlock their financial potential and achieve lasting success in the stock market.

For more details on enrollment, course structure, and upcoming workshops, visit Ruchir Gupta Training Academy’s official website or contact their Delhi office. Take the first step towards your financial journey today!

0 notes

Text

MSEI Share Price Moving Northwards

Introduction

The Metropolitan Stock Exchange of India, formerly known as MCX Stock Exchange Ltd., has been among the most commanding institutions in the financial markets of India since its very inception. MSEI, through these years, has increased its influence and presence manifoldly, overcoming many odds. Of late, the MSEI Share Price has been moving northwards, driven by renewed investor confidence and a spate of strategic initiatives by the exchange to improve market participation and operational efficiency.

A Brief History of MSEI

MSEI was incorporated in 2008 as a vertical of the Multi Commodity Exchange of India Ltd. (MCX). The exchange was basically set up to trade in currency derivatives. It further added equities, equity derivatives, and interest rate futures to its basket. In 2014, it was rebranded as MSEI, and entered into a new phase of its journey with an objective of correcting the rebranding, thereby establishing it as a comprehensive financial market platform.

Factors Driving up the MSEI Share Price

Improved products offered in the market:

One of the chief reasons behind the ever-increasing MSEI share price is its continuous attempt to expand the basket of its market products. It has been able to attract many types of investors and traders through the introduction of new products and services. The inclusion of innovative financial instruments increased the attractiveness of the exchange towards the participants of the market, which in turn fueled its share price.

Regulatory Support and Reforms

Regulatory support and reforms have been instrumental in the buildup of investor confidence in MSEI. A lot of initiatives have come out from the Securities and Exchange Board of India to bring transparency and cut down the risks for investors. These regulatory changes brought an atmosphere wherein trading could be done in a much more friendlier way, increasing participation and thereby impacting the price of MSEI Shares.

Technological Changes

MSEI has made significant investments in technology, augmenting trading infrastructure, and ensuring smooth operations. Moreover, the implementation of high-end trading platforms with advanced risk management systems and robust cyber security arrangements has improved the overall trading experience. It has added to the list of investors as well as contributed to the upside in the MSEI share price.

Sustainable Practices

Strategy Initiatives and Partnerships

Deepening Market Reach

It has launched various strategic programmes to reach out to more markets and bring in new entrants. Such goals are attained by different tie-ups with financial institutions, brokerages, and technology partners. By such partnering, MSEI has been better placed at targeting new segments of customers and geographical regions. With this, it could enhance its market share and therefore its share price.

Financial Literacy Weston et al.

Higher financial literacy has been part of the strategy to get more people participating in markets for quite some time at MSEI. The exchange has initiated several educational programs, workshops, and seminars on investor and trader education regarding market dynamics, investment strategies, and risk management. MSEI has empowered people through knowledge and created an educated and engaged investor base, which has in turn driven its stock price.

Sustainability and ESG Focus

The commitment of MSEI to ESG has also resonated very well with investors. It has introduced a few ESG-oriented initiatives, such as green bond listings and encouraging companies toward sustainable practices. This has added to the reputation of MSEI and helped attract socially conscious investors, thereby impacting its share price in a positive way.

The Road Ahead for MSEI

Upcoming Product Launches

Looking ahead, MSEI has a few product launches in the pipeline that are bound to further support its share price. Couple of new derivatives and exchange-traded fund ETF launches, along with commodity trading options, may bring in more investors and result in enhanced trading volumes. All these would add fresh streams of revenue and help it remain competitive among other exchanges.

Strengthening Regulatory Compliance

MSEI aims to further strengthen and cement the framework of regulatory compliance toward providing an avenue for a safe and secured trading environment. It is bound to establish much trust with investors through rigid adherence to regulatory standards of high levels of transparency. This no doubt will contribute to strengthening investor confidence and uphold the rising trend of MSEI share price.

Harnessing Technological Innovations

As part of this strategy to stay ahead of competition, technological innovations will also be one of the core focus areas for MSEI. To further enhance efficiency and security in trading, the exchange is planning to adopt newer technologies such as blockchain, artificial intelligence, and machine learning. Enabled with these innovations, MSEI will be better equipped to facilitate a superior trading experience that will attract a higher order of participation, and hence drive its share price higher.

Conclusion

The upward trajectory in MSEI's share price is a testimony to such strategic initiatives taken up by the exchange when supported by regulatory bodies and technology advancements. In that direction, MSEI has created a strong platform through market offerings, financial literacy, and sustainability, firmly establishing itself in India's financial markets. Infusion of new ideas and strict adherence to compliance stipulations are most likely to further this growth momentum and offer great promise to investors.

As MSEI continues to develop and aligns itself with the market dynamics, its share price is sure to head north, pushed by such developments. For any investor on the lookout for value in financial markets, MSEI would most likely become one of the very strong cases for investment, driven by fundamentals and growth potential.

0 notes

Text

Janis Urste A Pillar of Dedication and Hard Work in the Trading Community

In the dynamic and ever-evolving world of trading, where success hinges on adaptability, knowledge, and unwavering commitment, Janis Urste stands as a paragon of dedication and hard work. As a trainer, Urste has carved out a reputation for not only mastering the intricacies of trading but also for his relentless commitment to educating and mentoring others. His journey from a novice trader to a revered trainer is a testament to his perseverance, expertise, and an unyielding work ethic.

Early Beginnings and Passion for Trading

Janis Urste's foray into the world of trading was not born out of a mere interest but a profound passion. From a young age, Urste exhibited a keen interest in financial markets, devouring books, attending seminars, and immersing himself in the intricacies of trading. This foundational knowledge, coupled with a relentless drive, propelled him into the world of professional trading.

Urste's early days in trading were marked by intense learning and adaptation. The initial challenges and setbacks only fueled his determination to succeed. Unlike many who might be deterred by early failures, Urste saw them as opportunities to learn and grow. This mindset not only helped him refine his strategies but also laid the groundwork for his future role as a trainer.

Mastering the Craft

As Urste honed his skills, he developed a deep understanding of various trading instruments and strategies. Whether it was stocks, commodities, forex, or derivatives, Urste demonstrated an exceptional ability to navigate different markets. His analytical prowess, combined with a disciplined approach, enabled him to achieve consistent success.

One of the key attributes that set Urste apart was his commitment to continuous learning. In an industry where trends and techniques are constantly evolving, Urste remained ahead of the curve by staying updated with the latest developments. He actively sought out new knowledge, be it through advanced courses, market research, or interactions with other experts in the field.

Transition to Training

Urste's transition from a successful trader to a dedicated trainer was driven by a desire to give back to the community. Recognizing the lack of comprehensive education and mentorship in the trading world, he took it upon himself to bridge this gap. His goal was not just to teach trading techniques but to instill the values of discipline, patience, and continuous learning in aspiring traders.

Urste's training sessions quickly gained popularity for their depth and practicality. Unlike generic courses that often skim the surface, Urste's programs delved deep into the nuances of trading. He emphasized the importance of a strong foundation, meticulous analysis, and a disciplined approach. His hands-on training methods, coupled with real-world examples, made complex concepts accessible to traders of all levels.

Commitment to Mentorship

What truly distinguishes Janis Urste as a trainer is his unwavering commitment to his mentees. He believes that successful trading is not just about understanding markets but also about developing the right mindset. To this end, Urste offers personalized mentorship, guiding traders through their individual journeys.

Urste's mentorship extends beyond the confines of traditional training. He is known for his accessibility and willingness to support his mentees at every step. Whether it's a late-night query or a need for strategic advice during market hours, Urste is always there to provide guidance. This level of dedication has earned him the trust and respect of countless traders.

Building a Community

Janis Urste's impact on the trading community goes beyond individual mentorship. He has played a pivotal role in building a supportive and collaborative trading community. Through forums, webinars, and workshops, Urste has created platforms where traders can share knowledge, discuss strategies, and learn from each other.

Urste's vision for the trading community is one of inclusivity and continuous improvement. He encourages traders to support one another, fostering an environment where everyone can thrive. His efforts have not only elevated the standards of trading education but have also created a sense of camaraderie among traders.

Achievements and Recognition

Urste's contributions to the trading community have not gone unnoticed. He has received numerous accolades for his dedication and hard work. His training programs are highly sought after, and he is frequently invited to speak at industry conferences and seminars. Despite the accolades, Urste remains humble and focused on his mission to educate and empower traders.

The Legacy of Dedication and Hard Work

Janis Urste's journey in the trading community is a shining example of what can be achieved through dedication and hard work. His relentless pursuit of excellence, combined with a genuine desire to help others, has left an indelible mark on the trading world. As a trainer, mentor, and community builder, Urste continues to inspire and guide traders towards success.

In a field where the stakes are high and the challenges numerous, Janis Urste's story serves as a beacon of hope and inspiration. His legacy is not just one of personal success but of a commitment to the success of others. For aspiring traders, Urste's journey is a powerful reminder that with dedication, hard work, and the right guidance, the sky's the limit.

0 notes

Text

National Stock Exchange Programs: Empowering Investors and Strengthening Markets

Investor Awareness Programs

One of the cornerstone initiatives of the NSE is its comprehensive Investor Awareness Programs. These programs are designed to educate retail investors about the intricacies of stock markets, investment strategies, and risk management. NSE conducts seminars, webinars, and workshops across India, often in collaboration with educational institutions and financial experts. These sessions cover a wide range of topics, from the basics of investing and trading to more advanced subjects like derivatives, portfolio management, and technical analysis. By fostering financial literacy, National Stock Exchange Programs NSE aims to create a more informed investor base capable of making prudent investment decisions.

Certification and Education

To further professionalize the securities market, NSE offers a range of certification programs under the NSE Academy. These certifications, such as the NSE's Certification in Financial Markets (NCFM), are highly regarded in the financial industry. They cover various facets of the market, including equity, derivatives, debt, and mutual funds. NSE Academy also provides specialized courses in partnership with leading global institutions like New York Institute of Finance (NYIF) and Moody’s Analytics. These programs are designed to equip professionals with the latest knowledge and skills, ensuring that they stay abreast of the dynamic market environment.

Technology and Innovation Initiatives

NSE has always been at the forefront of technological innovation. The exchange continuously upgrades its trading platforms to enhance speed, security, and reliability. Programs like NSE NOW (NSE’s online trading platform) provide seamless and efficient trading experiences for investors and brokers alike. Moreover, NSE’s focus on fintech and blockchain technology has led to the development of innovative solutions that streamline trading processes and enhance transparency.

Corporate Social Responsibility (CSR)

NSE’s commitment to social responsibility is reflected in its CSR initiatives, which focus on education, healthcare, and community development. Through programs like ‘NSE Foundation,’ the exchange supports numerous educational institutions, healthcare projects, and skill development centers across India. These initiatives aim to uplift underprivileged sections of society and contribute to sustainable development.

Financial Literacy Campaigns

Recognizing the importance of financial literacy, NSE runs extensive campaigns to educate the public about financial planning, saving, and investing. These campaigns leverage multiple media platforms, including social media, print, and television, to reach a broad audience. By demystifying financial concepts and promoting the benefits of systematic investing, NSE helps individuals build a secure financial future.

Market Development Programs

NSE also undertakes various market development programs to promote new financial instruments and trading practices. Initiatives like the launch of index-based products, commodity derivatives, and currency futures have broadened the market’s scope, offering investors diverse investment opportunities. These programs are backed by rigorous research and market analysis, Wealth Management Classes ensuring their relevance and effectiveness.

Collaborative Programs

Collaborating with global exchanges and financial institutions is another key aspect of NSE’s strategy. Through partnerships with entities like the Singapore Exchange (SGX) and the London Stock Exchange (LSE), NSE facilitates cross-border investments and knowledge exchange. These collaborations enhance the global reach of the Indian capital market and provide domestic investors with access to international financial markets.

0 notes

Text

The Interweaving Charm of the East: A Cultural Exploration and Artistic Imagination of European Chinoiserie

During the late Ming Dynasty, from the late 16th century to the early 17th century, there was a significant expansion in the production volume and scope of luxurious handcrafted goods in Europe imitating Chinese style, known as Chinoiserie. This expansion aimed to meet the growing demands of the increasingly prosperous and confident middle class in continental Europe. Despite various reasons leading to the oversight of the cultural integrity of Chinese items, these luxury goods and commodities garnered high appreciation among Westerners for their bright luster, saturated colors, and intricate decorations.

Merchants also commissioned Chinese craftsmen to produce items according to the tastes, styles, and uses prevalent in Europe at that time, resulting in a fusion of Western and Eastern forms and patterns. Asian craftsmen quickly began anticipating Western demands for design and appearance, emphasizing in their products the captivating visual language specific to Eurocentric Chinoiserie. This phenomenon has recently been described as “self-Orientalization.”

Between 1818 and 1820, British artist Robert Jones created canvas wall panels in the Banqueting Room of the Royal Pavilion, Brighton. Drawing inspiration from patterns found on Chinese export porcelain, paintings, and silk, as well as incorporating character imagery from the works of William Chambers and William Alexander, Jones crafted Chinoiserie decorative panels depicting Chinese dignitaries and court ladies.

In the mid-20th century, ChuCui Palace once again turned its gaze towards the East. In contrast to the Eurocentric Chinoiserie that often overlooked cultural integrity and lacked thorough understanding, ChuCui Palace accurately captured the essence of Chinese aesthetics within Chinoiserie. Their works provided a precise interpretation of the natural and artistic beauty imbued with Eastern aesthetics and the cultural connotations behind it, in stark contrast to the superficial understanding prevalent in Eurocentric interpretations.

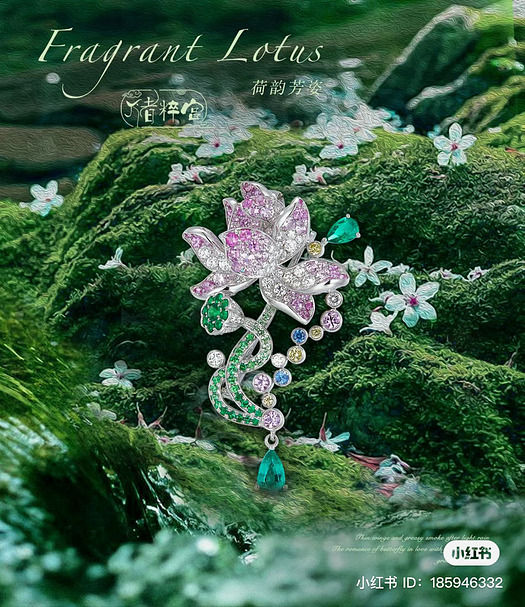

The artwork “Fragrant Lotus” exudes vitality and a natural form. The beauty of the East is inherently natural, characterized by organic curves, which is one of the core aesthetics resonating with Chinoiserie. The beauty of the artwork also emanates from its colors — derived from nature — but refined from traditional Chinese meticulous brushwork. Following the technique of color gradation in traditional Chinese brush paintings, creatively laying out gems with varying hues, mimicking layers of shading as if ink on paper, diffusing and blending, opens up a new modern craftsmanship on top of Chinoiserie and traditional Chinese painting. This rejuvenates the ancient Chinese brushwork among the gems.

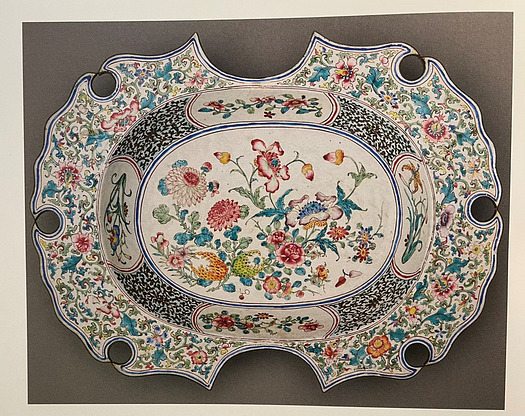

Even successful exchanges between East and West often undergo a cycle of translation and retranslation, resulting in a final product that appears “exotic” from any perspective. The technique of applying painted enamel to metal crafts was introduced to the Imperial Chinese workshops in Beijing during the 1710s and 1720s, utilized during the Kangxi and Yongzheng periods, and later adopted by artisans in Guangzhou. For instance, the barber’s bowl at Kedleston Hall features copper enamel, allowing for a variety of decorative colors. The central natural floral vignette is executed in a Chinese brushwork style, asymmetrical in nature, whereas the floral patterns at the edges are more stylized and symmetrical. Dense, symmetrical black leaves are used as a background in the recesses, forming a pattern known as the “classic scroll” in Europe.

(Note: A barber’s bowl was once an essential tool for European barbers when shaving customers. It has a shallow basin and a wide rim. The semi-circular opening on the rim allows it to snugly fit against the neck of the person being shaved, allowing their chin to extend over the edge of the bowl.)

This confident practice of switching between different styles of patterns became increasingly common in 18th-century Chinese decorative arts, inspired by the diversity found in palace decoration. Another mode of blending seen in the artwork is the dramatic incorporation of the semi-circular opening characteristic of European barber’s bowls onto the form of Chinoiserie.

During the heyday of European Chinoiserie, Eastern aesthetics were not merely a decorative style but also a result of cultural exchange and understanding. It reminds us that culture is not isolated but evolves gradually through exchange and mutual influence. These artworks not only represent aesthetic ideals but also express cultural identities, consolidating connections and dialogues between different civilizations through art. This beauty of art transcends the constraints of time and borders, becoming a universal spiritual wealth of humanity. At the same time, it echoes humanity’s pursuit of beauty and exploration of the unknown.

0 notes

Text

10 Reasons to Visit Angel One Office Mumbai

Angel One is a full-service broker in India that provides a wide range of retail trading, investment, and insurance services. It is a member of several regulatory bodies, such as the BSE, NSE, MSX, NCDEX, CDSL, and SEBI. Angel One offers products and services such as stock trading, commodity trading, and currency trading.

Angel One Branches

Angel One has a huge number of branches, franchises, and sub-brokers across India. With over 18,500 locations in 900+ cities, It has the largest network of branches. Angel One sub-brokers are present in almost every city and town in India. Here are ten reasons to visit the Angel One office Mumbai.

Expert Guidance: Step into Angel One's Mumbai office, and you'll be surrounded by seasoned financial experts ready to provide tailored advice and insights.

Cutting-edge Technology: Angel One prides itself on staying ahead in technological innovations. You can experience firsthand the innovative tools and platforms designed to streamline trading processes and enhance investment strategies.

Educational Workshops: Knowledge is power in the world of finance, and Angel One understands the importance of education. Visitors to their Mumbai office can participate in a range of workshops and seminars designed to enhance financial literacy and empower individuals to make informed investment decisions.

Networking Opportunities: Angel One's Mumbai office is a lively centre where individuals with similar interests come together to share their ideas and experiences and create valuable connections.

Comprehensive Research: Sound investment decisions require reliable research and analysis. Angel One's Mumbai office provides visitors with access to a multitude of research papers, market analyses, and investing insights.

Diverse Investment Options: From stocks and bonds to mutual funds and derivatives, the company offers a diverse range of investment options to suit every investor's needs and preferences. You can explore these options and gain a deeper understanding of the opportunities available in the market.

Personalised Service: At Angel One, every client is unique, and their needs are honoured. You may also expect personalised service tailored to their individual financial goals, risk tolerance, and investment preferences.

State-of-the-art Facilities: When you step into Angel One's Mumbai office, and you will be greeted by a modern space equipped with state-of-the-art facilities.

Commitment to Transparency: Transparency is essential to fostering confidence in the financial services sector, and Angel One takes this responsibility very seriously. Visitors can expect honest and transparent communication, ensuring that they are fully informed every step of the way.

Community Engagement: Beyond its role as a financial services provider, Angel One is deeply committed to giving back to the community. Individuals can participate in various community engagement initiatives aimed at making a positive impact.

Conclusion

Visit the Angel One headquarters in Mumbai to experience a world of knowledge, creativity, and community that goes well beyond financial services. Whether you're an experienced investor or just starting your financial journey, Angel One's Mumbai office has something for everyone. If you are looking to visit it, find all the relevant details on Value Broking, including its address.

0 notes

Text

National Institute of Securities Markets -

(NISM)

The National Institute of Securities Markets (NISM) is an educational and research institution located in India. It was established by the Securities and Exchange Board of India (SEBI), the regulatory body for the securities and commodities market in India. NISM's primary objective is to enhance the knowledge and skills of various stakeholders in the Indian securities market, including investors, market intermediaries, and regulatory staff.

Key functions and objectives of NISM include:

Education and Certification: NISM offers a wide range of educational programs and certification courses related to various aspects of the securities market. These programs aim to equip individuals with the necessary knowledge and skills to work in the financial industry.

Research and Development: NISM conducts research on various topics related to the securities market and financial industry. This research contributes to the development of best practices and policies in the Indian financial markets.

Training and Capacity Building: NISM conducts training programs and workshops for market participants, including brokers, mutual fund distributors, investment advisors, and others. These programs are designed to enhance the professionalism and competency of individuals working in the financial sector.

Dissemination of Information: NISM plays a crucial role in disseminating information and updates related to regulatory changes, market trends, and best practices in the securities market. It helps in creating awareness among market participants and investors.

Regulatory Support: NISM collaborates with SEBI and other regulatory bodies to develop and implement regulatory initiatives and reforms in the Indian securities market.

NISM has several centers of excellence that focus on specific areas within the financial industry, such as mutual funds, derivatives, and corporate governance. These centers provide specialized training and research in their respective domains.

Overall, NISM plays a vital role in promoting investor education, improving market integrity, and enhancing the overall functioning of the Indian securities market through education, research, and training initiatives.

youtube

#stockstowatch#StockMarket#StockMarketIndia#StockMarketCrash#Nifty#BankNifty#SGXNIFTY#Sensex#ShareTrading#OptionTrading#FnoTrading#StockUpdate#MarketUpdate

0 notes

Photo

2,000 year old glass bowl !

Archaeologists working at a dig in the Dutch city of Nijmegen uncovered a well-preserved, 2,000-year-old blue glass bowl late last year. The palm-sized dish had survived centuries buried underground, remaining perfectly intact with little to no wear.

The item is distinguished by its pattern of vertical stripes. “Such dishes were made by allowing molten glass to cool and harden over a mold,” lead archaeologist Pepijn van de Geer tells de Gelderlander, per an ARTNews translation. “The pattern was drawn in when the glass mixture was still liquid. Metal oxide causes the blue color.”

Nijmegen is among the oldest cities in the Netherlands. Ancient Romans first established a military camp near the location of present-day Nijmegen in the first century C.E., around the time of the glass bowl’s creation. The settlement expanded and became the first Roman city in the present-day Netherlands, a designation that gave town residents Roman citizenship.

Nijmegen’s modern Dutch name derives from the Latin Noviomagus, meaning “new market.” Its location overlooking the Waal river afforded Roman forces a strategic military advantage and access to trade routes, per the university.

Archaeologists suggest that the blue glass bowl might have been made by Roman artisans or carried by traders, given Nijmegen’s unique status as a hub of ancient Roman activity. The bowl may have been created in glass workshops in Germany or Italy, making it a valuable commodity for trade.

Researchers at Winkelsteeg have also unearthed tombs, dishware and jewelry.

Words by Nora McGreevy

Image Courtesy of the Municipality of Nijmegen

#art#design#glass art#archeology#the netherlands#bowl#glass bowl#antiquity#style#history#nijmegen#roman#waal river#blue#blue glass#collectors

56 notes

·

View notes

Text

23rd Lexember

taus "rate"

taus /toz/ [toz] - rate, speed, the rapidity at which some process takes place; - value, worth, the quality which renders someone or something desirable or valuable; - (rare) price, cost, the monetary quantity needed to pruchase an item

Etymology: from Old Boral taus "tax, price", deverbal of taussar "to impose a tax on" borrowed from Old French and reflecting Latin taxō "I handle, charge, appraise, reckon" (compare modern French taux "level, amount, quantity" with an etymological respelling).

Taus gran alcot es y molin rouð faint la? /toz gran alˈkɔt ɛz i moˈlɪn ruθ fent la/ [toz gʀan ɐˈgɔt ɪz i mʊˈlɪn ʀuh fen la] rate big how.much be.3s 3s mill wheel make-p.prs there At what rate does the factory make wheels?

---

excerpt from the introduction of Modern Developments in Benjamine Detaxion [Aromatic Synthesis], a 1942 quire written by alchemist Ferris Bewly through the Conster Health Edifice and intended to provide a reference on the recent synthesis of various new substances and medicines around the world.

…Jawan frankincense.

The first major section of this work will cover those hebetant substances [painkillers] which have come out of workshops globally over the last two decades. The sterling example is undoubtedly cozebdone-diamaschal benjamine (CD) [1], sold under various names and perhaps most familiar to Markland as the coveted 'Tommy pills', is a product of collaboration between the Branwen Sanatory in New Leudong and the University of Rimack in Tavance [2] to find hebetants with faster action and fewer adversions.

Comprising (as the longform name implies) branches of cozebdone oil and maschal [3] in opposed position, the substance was first synthesised in 1932 and has already surpassed salix-derivative pills [4] in annual sales everywhere from Sangathy to Adighe [5]. This is due to the former's greater efficacy in relieving pain, which finds it more widely used than the previous bevy of remedies which may merely help to reduce symptoms of fever.

In sufficiently high concentrations CD has also been demonstrated to function in unguento, although the inefficiency and commodity of this…

---

[1] Here the longform unambiguous name for ibuprofen. [2] Polities in southeastern Chrysia [Australia] and northwestern Cappatia [South America]. [2] Or as we would call them, isobutane (2-methylpropane) and propionic (propanoic) acid. [4] For example, aspirin. [5] Polities in far-inland Mendeva [North America] and the Caucasus.

4 notes

·

View notes

Text

Damien Hirst at Gagosian Britannia Street, London

April 12, 2021

DAMIEN HIRST Fact Paintings and Fact Sculptures

Opening April 12, 2021 6–24 Britannia Street, London __________ I like to say something and deny it at the same time. —Damien Hirst Gagosian is pleased to announce Fact Paintings and Fact Sculptures, an exhibition of rarely seen works by Damien Hirst created between 1993 and 2021. The exhibition marks the first phase of Hirst’s yearlong takeover of the Britannia Street gallery, and is his first exhibition there since The Complete Spot Paintings 1986–2011 in 2012. As artist and curator, Hirst presents this highly personal series of work through his own eyes. Throughout his storied career, Hirst has confronted the systems of belief that define human existence, from common trust in medicine to the seduction of consumerism. At a moment when the idea of “truth” has never been more tenuous, Hirst’s Fact Paintings and Sculptures question the obduracy of “fact” as a governing principle of society. Mimicking color photographs, the Fact Paintings are rendered in oil on canvas, sometimes with meticulous fidelity, at others reveling in the physicality of mark making. Their verisimilitude recalls the historical role of painting as a tool to represent the visible world and lead the viewer to believe that a two-dimensional image is, in fact, the three-dimensional object it portrays. With the birth of photography in the nineteenth century, painting’s relationship with reality continued to evolve. Hirst’s Fact Paintings explore this back and forth between the brush and the camera as the agents of “truth.”

The first exhibition of the Fact series, The Elusive Truth, was presented at Gagosian New York in 2005 and focused on paintings derived from newspaper photographs. Other subjects include Hirst’s signature motifs of butterflies and diamonds, depictions of his own previous works, and portraits of his friends and family. In many ways, the Fact series can be seen as the artist’s self-portrait, highlighting significant moments of Hirst’s life and career: Michael with Diamond Skull (2008), for example, portrays Michael Craig-Martin—his former tutor at Goldsmiths—posing with the famed sculpture For the Love of God (2007); in Self-Portrait as Surgeon (2007) the artist, dressed in blue scrubs, stands next to a hospital bed; while Cleaning New Baby (Cyrus) (2007) depicts his own newborn son. In the Fact Sculptures, presented alongside the related paintings, Hirst moves beyond the readymade, instead constructing detailed replicas of real objects. In Love Dies Fast (2020) and Station (2014), physical elements of workshops and storage spaces appear, while in Snob (2006–20) and Public School Tosser (2006–20) he makes reference to his own iconic jewelry cabinets, wryly juxtaposed here with garbage bags and cans. Other sculptures attest to Hirst’s preoccupation with the order of things, their preservation and display: in Persil (2015) and Coke/Diet Coke Vending Machine (2007), a stacked pallet and a vending machine underscore the significance of consumer goods and product packaging, the high with the low. Some of the sculptures on view are charged with relevance to lived experience in the COVID-19 era. Remedies Against the Great Infection (2020) offers hand sanitizer and personal protective equipment, while sculptures such as Don’t Stop Me Now (2006) and Warsaw (2008), replete with medical supplies, take on new meaning within the context of the enduring pandemic. By incorporating these by-now-ubiquitous commodities into sculptures, Hirst speaks to the new landscape of material culture that has become a dark fact of contemporary life. Damien Hirst was born in Bristol, England, and lives and works in London and Devon, England. Collections include Tate, London; Gallery of Modern Art, Glasgow, Scotland; Stedelijk Museum Amsterdam; Museum für Moderne Kunst, Frankfurt am Main, Germany; Museum Brandhorst, Munich; Astrup Fearnley Museet, Oslo; Centro de Arte Dos de Mayo, Madrid; Museo d’Arte Contemporanea Donnaregina, Naples, Italy; Israel Museum, Jerusalem; Museum of Modern Art, New York; Hirshhorn Museum and Sculpture Garden, Washington, DC; Art Institute of Chicago; The Broad, Los Angeles; Museo Jumex, Mexico City; National Centre for Contemporary Arts, Moscow; and 21st Century Museum of Contemporary Art, Kanazawa, Japan. Exhibitions include Cornucopia, Musée océanographique de Monaco (2010); Tate Modern, London (2012); Relics, Qatar Museums Authority, Al Riwaq, Qatar (2013); Signification (Hope, Immortality and Death in Paris, Now and Then), Deyrolle, Paris (2014); Astrup Fearnley Museet, Oslo (2015); The Last Supper, National Gallery of Art, Washington, DC (2016); Treasures from the Wreck of the Unbelievable, Palazzo Grassi and Punta della Dogana, Venice, Italy (2017); Damien Hirst at Houghton Hall: Colour Space Paintings and Outdoor Sculptures, Houghton Hall, Norfolk, England (2019); and Mental Escapology, St. Moritz, Switzerland (2021). Hirst received the Turner Prize in 1995. _____ Damien Hirst, Papillio palinurus in Achillea millefolium, 2009, oil on canvas, 36 × 54 inches (91.4 × 137.2 cm) © Damien Hirst and Science Ltd. All rights reserved, DACS 2021. Photo: Prudence Cuming Associates

12 notes

·

View notes

Text

Conclusions and sorrow

I've nearly finished editing the three books. I'm slightly overdue with submission, but it is what it is.

Underpinning most of my PhD research has been my ongoing relationship with the two elderly Staffordshire bull terriers that my partner and I adopted right at the start of it, around Christmas 2016.

It is with overwhelming heartbeat that yesterday, after I visit from the mobile vet, we discovered that Lea has a late stage inoperable growth. The vets are returning tomorrow and we will be saying goodbye to lea. I don't have the words yet to address the feeling of loss, or the anxiety of this ongoing 48 where I with lea at every moment to make sure she is as comfortable as possible. it's a lot. And I need to keep writing things in order to occupy my mind. So this is a draft (since edited, but that's in InDesign files I can't access from my phone) of the potential lines beyond the PhD, including the thing I worked on for a year regarding dogs, but couldn't emotionally deal with even prior to this last illness.

I could not have done this research without my relationship with Buster and Lea. The concept of care which I've addressed is as much drawn from this relationship as it is from Sedgwick. How to care for someone across the lines of different bodies and senses and desires. The concept of play as emergent collaboration equally comes from learning to play with dogs who had suffered neglect at the hands of their original owners, and then a year recovering in the noisy RSPCA kennels before they were well enough to be rehomed. I love you lea.

Conclusions and exits.

The structure and methodology of this PhD Output consisting of three approaches to a central area of art practice, and within each approach multiple overlapping attempts through the various documents, turns the issue of a conclusion into a challenge.

Rather than attempt to draw books and documents toward a unifying conclusion, erasing the differences between then, I have offered conclusions in the documents individually. Some of these are clearly labeled as such, some are more demonstrative, and some left as provocations.

Throughout the three books are indications of where future paths could proceed. For continuation of creative research and the application of concepts developed, these indications are generally placed at the end of documents. Paths which are more tangential, or areas where the research could be reinforced through engaging with a separate discipline or practitioner appear in endnotes.

In place of some kind of ending for the PhD Output as whole I will raise three of the avenues of future research not already mentioned in individual documents, that will be pursued at its end. All of these examples incorporate work already commenced, that for practical reasons has not been addressed in documents.

The Incomplete Object.

Archeologist Chantal Conneller has produced a large amount of research focused Star Carr, a Mesolithic site in Yorkshire (Conneller, 2004, 2011; Little et al., 2016; Milner, Conneller, & Taylor, 2018a, 2018b). In particular, Conneller has provided a framework for examining some of the objects recovered from the site, and through this reassess the historic inhabitants of the area’s relationship to animals and objects. The objects, twentyone of which were found during the site’s excavation by Professor J.G.D. Clark between 1949 and 1951, consist of the “uppermost part of the skull of a red deer, with the antlers still attached” and are referred to as “antler frontlets” (Conneller, 2004, p. 37). In offering an interpretation for the frontlet’s use, Clark “suggested they could have been used either as hunting aids, to permit hunters to stalk animals at close range without being seen, or as headgear in ritual dances” (Conneller, 2004, p. 37). This interpretation resulted in an impasse between a “‘functional’ and a ‘ritual’ analogy” and has according to Conneller, meant that “in the intervening 50 years they have been ignored” (Conneller, 2004, p. 37).

Conneller’s research breaches the impasse of an animal derived object needing to be either functional or ritual by use of philosopher Gilles Deleze and psychoanalyst Félix Guattari’s work in “A Thousand Plateaus” (Deleuze & Guattari, 1987). Firstly, Conneller outlines how in Deleuze and Guattari, “animals come to be seen [...] as an assemblage composed of a number of ways of perceiving and acting in the word” (Conneller, 2004, p. 44). In this view, animals are not singular fixed entities, and the objects derived from them are therefore not limited to being symbolic of the animal whole or else be understood only as practical material. Animals are here understood as collection of “affects” (Deleuze & Guattari, 1987, p. 253), and the objects derived from them convey those Affects to the user in a manner which outside of the binary of ritual and functional. From this point Conneller proceeds to “examine the specific ways in which different things are seen to modify or extend the capacities of people in particular contexts” (Conneller, 2004, p. 51), bridging Deleuze and Guattari to theorist Donna Haraway’s concept of “situated knowledges” which replaces a fixed epistemological view with “webs of differential positioning” (D. Haraway, 1988, p. 590). The use of animal objects becomes simultaneously a process of taking on capacities as well as the ethical/epistemological/affective engagement with the world from another position.

These observations from archeology are useful not because they set some historic precedent for how art should function, but because they articulate processes which are important to art from another perspective. In the documents in this PhD Output which examine artworks I have consciously treated both the processes deployed by the artist and those of her characters in the same manner. In the art I am interested in, things are not easily split between the practical and the ritual but form processes across these lines to perform different things.

Finally, when I contacted Conneller in 2019 she was continuing to examine the frontlets of Star Carr in terms of how they function as “unfinished things”. Conneller has already observed that the frontlets were “broken up as a source of raw material” (Conneller, 2004, p. 46), but is now considering how this occurred concurrently with their uses. A framework for considering art objects which do not reach a fixed state, but are continually re-worked, and drawn from while being used is relevant to a number of documents in this PhD Output. It is relevant to the analysis of artist Tai Shani’s works (SHANI, 2019) which undergo edits between redeployments, or the ongoing work “sidekick” (Price, 2013) by Elizabeth Price. Going forward, I would consider how unfinished things connects to the writing practice of William Burruoghs both through the “cut-up” technique to “cut oneself out of language” (Hassan, 1963, p. 9), and the process whereby his novels were re-edited in subsequent editions. Burroughs is also relevant to the other side of unfinished things whereby these things are not just refined, but are a source of material for future things. I am also interested in the process by which computer software is updated via “patches” (Fisher, 2019) as another model for an unfinished thing.

I’m interested in the political implications of objects which refuse the linear transition from raw material to finished commodity, but is instead part of processes which cross that distinction. To borrow the image from Karl Marx’s Capital Vol. 1 (Marx, 1981), what would it mean for “coat” to remain functioning as “ten yards of linen”, to be always in a process of being woven/unwoven/rewoven into different forms? I feel there is something here to be pursued via the concepts of Incomplete Provocations, and the improvisations and departures which are centred in Tabletop Role Playing Games.

Divination Storytelling

The second exit is far more practical and straightforward. During my research I have used and developed methods for creating parts of narratives based on sortation systems such as card decks and dice rolls. In 2018 I produced an artwork entitled “The Sodden Gates of Vulnerability” which borrowed a mechanic used in multiple games whereby the space in which play takes places is procedurally generated. A hypothetical example of this mechanic would be a game which takes place in a derelict spaceship, the interior rooms and corridors of which is represented with cardboard tiles. When the players reach the exit of one room, a new random room tile is placed at the exit from the first, so the spaceship is configured, and unpredictable, with each subsequent playthrough. In The Sodden Gates of Vulnerability I combined some of the lore from Games Workshop’s derelict spaceship exploration game “Space Hulk” (Games Workshop, 1999) with their subsequently released rules for randomly generated spaceships (Hunt, 2013), to randomly generate prompts for a narrative built from a fictionalised version of my own past.

As a result of the cessation symptoms I was experiencing while coming off antidepressants I found memories returning that medication use had suppressed. In addition, there were physical cessation symptoms which mnemonically triggered some often confused memories of spaces in the town centre of Luton where I spent my teens, frequently from times in the early hours of the morning after leaving a club or a party. I reconstructed these fragmented memories, and the bodily feelings which connected them to the present, and any emergent feelings and noted them down as prompts on index cards. Some memories were so abstract as to not describe a place but just a sensation, or an action. These abstract memories, combined with some other images and thoughts were written up in a list and labeled 1-20.

The Sodden Gates of Vulnerability was produced as a single take spoken performance to microphone. It began with a short reflection on the different ways in which physical geography and brain chemistry are both modulated by chemicals. After this I shuffled and dealt an index card, describing the derelict spaceship/ 4am Luton Town Centre space it represented in the manner of Games Master setting a scene for players of a Role Playing Game. I then rolled a 20 sided dice and used the corresponding entry from the list as a prompt for what the player (the audience to whom the work is addressed) did in traversing this space. A partial transcription of one room follows;

“You stagger out of the thickening fog into the area where escaping heat from the many times kicked in door makes a dim pocket at the edge of the street. Banging on the door that feels like it should have given in by now and it is finally opened by someone inside. You roll in, and so does the fog, and the door opener is already turning the corner ahead into the living room so you guess you will follow them, remembering to shut the door behind you.

The living room is thick with dust and hair and ash over the brown carpet and old sofas. No one has their feet on the floor, all bunched up to keep warm or to manage some symptoms of intake.

You just want to buy, but that isn't how this is going to work out. It never does.

Everything slips. Someone makes you take a music cassette and in lock-eyed intensity tells you why you will like it and when you will die.

A man takes you to one side and rapidly ages while sharing with you a one sided conversation about how he has lived his life. He has little ears like fins and catfish whiskers and it's clear from the way he holds and interacts with the portable stereo he cradles that he has a relationship with Fabio and Grooverider which is both more beastially physical and more vapourusly transcendental than you will ever understand.

You slip out and it's dawn and you have the cassette and you don't think you bought anything but now do not think you need anything so maybe you bought it and weren't paying attention during intake or maybe someone else was in charge of your body.

You roll out with the fog and luckily town is down hill but my god you would never be able to find this place again and my god you would probably never want to because all those people would want to check how closely you been following their advice on how to live.

Oh yeah the plot twist is you're a rabbit”.

Going forward, I would like to explore the mechanics of procedural narrative based on sortation systems, both as an improvised Rendition, and as material which is subsequently cut up and deployed in other ways, possibly as a development of Diagramatics. I’m looking into how I might produce these works for a platform like YouTube, possible using a split screen where half the image shows the face that speaks, and half shows the sortation system such as tarot-style cards.

Dog Mod

Running throughout all three books of this PhD Output are dogs. When I started this PhD in 2016, I soon afterward began living with Lea and Buster, two elderly Staffordshire Bull Terriers. The importance of this relationship to the research is something I have attempted, and failed, to articulate on many occasions in the last three years. As much as the majority of the documents in this PhD Output are underpinned by a desire to understand my own trans* non-binary gender identity, they are also a response to learning about what Deleuze and Guattari would call dog affects, as well as negotiating my emotions towards Lea and Buster particually during the sadly increasing points where they have become unwell.

In mid 2019 I sketched an outline for what I called the “Dog Mod”. In the language of games, a mod is something added to the game which alters part or all of its systems in some way. Mods are often produced by a third party, and can range from something which simply adds some different functionality (such as the campaign generator for Space Hulk referenced in the previous section) or completely reorientate the system, such as the mod “DayZ” that reconfigures military sim “ARMA” into a zombie survival game and spawned an entire genre of video games (Davison, 2014).

The aim of Dog Mod was to produce a document which could provide a means to reconfigure the rest of the PhD Output through its unspoken focus, dogs. Dog Mod is something I decided was both conceptually and emotionally too overwhelming for me to be able to complete in time for submission, but I remains as a point of departure for my future research. It connects the Becoming-Animal of Deleuze and Guattari (Deleuze & Guattari, 1987; Stark & Roffe, 2015), philosopher Patricia MacCormack’s expansion of this into animal rights discourse in the Ahuman (MacCormack, 2014), with other ideas around, animals, play and care (Chen, 2012; D. J. Haraway, 2016; Massumi, 2014; Vint, 2008).

Bibliography