#Clause 44 of FORM 3CD

Explore tagged Tumblr posts

Text

Clause 44 of Form 3CD of Income Tax Audit Report

Clause 44 of FORM 3CD of Tax Audit Report which deals with reporting requirements connected to GST expenditure, is a significant source of concern for both the tax auditors and the assessee. The application of clause 44 of Form 3CD for the assessment is creating confusion currently. Form 3CD Form 3CD of Tax Audit Report (TAR) was amended in July 2018 by Notification No. 33/2018 dated 20.07.2018…

View On WordPress

0 notes

Text

Clause 44 of Form 3CD – Break up of Total Expenditure

#Accounting firms in india#Accounting & bookkeeping services in india#Accounting outsourcing companies in Delhi

0 notes

Text

Clause 44 of Form 3CD – Break up of Total Expenditure

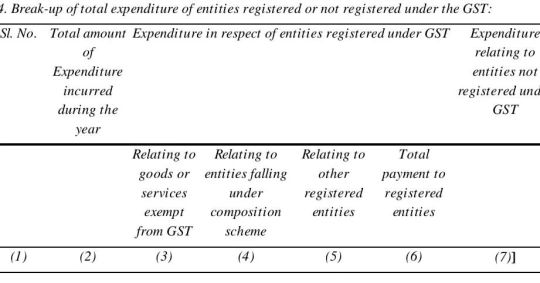

BDT had introduced the new clause, i.e., Clause 44 for Form 3CD, updated in the tax audit form.

Under this clause, a break up of total expenditure needs to be provided, including purchases made during the year. This clause is abeyance until 31st March 2022 vide CBDT Circular No. 5/2021 dated 25.03.2021. However, this clause is now applicable for the Assessment year 2023-24, i.e., the Financial year 2022-23. Therefore, let us understand the reporting requirement of this clause. Firstly, Let’s recapitulate about tax audit and its applicability. All assessees who are liable to tax audit as per section 44AB shall require to fill out Form 3CA or 3CB along with Form 3CD. Form 3CA or Form 3CB is a report that an auditor needs to sign considering the opinion provided for a tax audit. However, Form 3CD is a statement of particulars, which is quite comprehensive and contains all the details concerning various tax provisions.

Now coming to clause 44; newly inserted by CBDT. Under this clause, the assessee requires to provide details of expenses in the following format: S.No.The total amount of expenditure incurred during the yearExpenditure in respect of entities registered under GSTExpenditure relating to entities not registered under GST Relating to goods or services exempt from GST

Relating to

Entities falling under the composition schemeRelating to other registered entitiesTotal payment to registered entities 1234567

Let’s understand the reporting requirement under each column:

Column 1: Serial number.

Column 2: Total Amount of expenditure incurred during the year: The assessee requires to mention the amount of all expenditures incurred during the year, including purchases made during the year. However, there might be some confusion about whether the expenditure of capital nature is to be reported or not. Therefore, since the word used is ‘expenditure,’ it is advised that the capital expenditure may also be registered separately in Column no. 2 in the format prescribed.

Column 3: Expenditure relating to goods or services exempt from GST: Under this column, all expenses exempt from GST must be reported here.

Column 4: Expenditure relating to entities falling under the composition scheme: Reporting under this column applies to transactions entered with the Composition scheme as per section 10 of the CGST Act, 2017. Generally, while accounting transactions, small and medium taxpayers do not mention GSTIN on those invoices where input is ineligible as per section 17(5) or in case of purchase from persons registered under composition levy. Thus, reporting such expenditure may be categorized as “Expenditure relating to entities not registered under GST.”

Column 5: Expenditure relating to other registered entities: Under this column, assessees must report the amount of all inward supplies from registered dealers, other than supplies from composition dealers, and exempt supplies from registered dealers. Possibly, the assessee may have both inward supplies (i.e., taxable and exempt) from the same registered person; thus, exempt inward supplies must be reported under column 3. Finally, the only value of taxable inwards supplies should be reported under column 5.

Column 6: Total payment to registered entities: Under this column, the assessee must report the “Total payment made to registered entities.” Therefore, a question may arise whether we must report the total payment made to the registered person during the year or the total expenditure booked in the books of accounts. However, considering the harmonized interpretation of the column heading, i.e., “Total Payment to registered entities,” we should report the total amount of columns 3, 4, and 5, which is the value of expenditure booked as per books of accounts.

Column 7: Expenditure relating to entities not registered under GST: Under this column, the assessee must report the amounts of inward supplies of goods or services received from the unregistered person during the year. It should be ensured that the total of Columns 6 and 7 should tally with the amount reported in column 2.

0 notes

Photo

Tax audit Report 3CD contains a pool of various clauses that keep on amending owing to the disclosure requirements and transparency. New clause 44 of Form 3CD was introduced requiring entities to disclose the break up of total GST and non-GST expenditure irrespective of whether they are registered under GST or not. Let’s take a deeper look clause 44 of tax audit report!

0 notes

Photo

Clause 44 of Form No.3CD (Break-up of total expenditure of entities registered or not registered under the GST) @IncomeTaxIndia please issue some clarification on applicability this clause Compilation of all this information is too difficult https://t.co/duSdzU58G7 https://www.instagram.com/p/CfGGy8UqzzH/?igshid=NGJjMDIxMWI=

0 notes

Text

CBDT defers furnishing of GST amp; GAAR details in Form 3CD till March 31, 2022

CBDT defers furnishing of GST amp; GAAR details in Form 3CD till March 31, 2022

The CBDT vide Circular numbers 06/2018, 09/2019 and 10/2020 had deferred the reporting of details under clause 30C (pertaining to GAAR) amp; clause 44 (pertaining to GST) of Form 3CD multiple times. In view of prevailing situation due to COVID-19 pandemic across the country, the board has decided that the reporting under clauses 30C amp; 44 of tax audit report shall be kept in abeyance till March���

View On WordPress

0 notes

Text

CBDT decided reporting under clause 30C and clause 44 of the Tax Audit Report to be kept in abeyance till March 2021 end.

CBDT decided reporting under clause 30C and clause 44 of the Tax Audit Report to be kept in abeyance till March 2021 end.

The Central Board of Direct Taxes (CBDT) has once again extended the deadline for Indian corporates in reporting General Anti-Avoidance Rules (GAAR) and Goods & Services Tax (GST). In a circular last week, the CBDT stated that several representations were received by the board in regards to difficulty in implementation of reporting requirements under clause 30C and clause 44 of the Form No.3CD…

View On WordPress

0 notes

Photo

Clause 44 of Tax Audit Report Applicability - Form 3CD of GST Disclosures

0 notes

Link

The applicability of clause 44 of tax audit report was kept in abeyance till 31st March 2022 due to the prevailing Covid-19 situation in the country. However, for tax audit reports filed from 1st April 2022 onwards, reporting under this clause will be mandatory. Hence, you will be required to report the information as required in this clause for tax audit for the FY 2021-22.

0 notes