#Choose Mutual Funds With High Return

Explore tagged Tumblr posts

Text

#Best Home loan banks in India#Shriram finance personal loan apply#home loan apply online#Top mutual fund investment in India#Choose Mutual Funds With High Return#Best investment plan#Best health insurance plan in India#best car insurance plan online#best two wheeler insurance plan online#Bike insurance plan online#Top Home loan plan in Noida

0 notes

Text

Portfolio Management Services (PMS) and Why Should You Care?

Introduction

Managing wealth effectively is an essential part of financial success, and one of the best ways to do this is through Portfolio Management Services (PMS). Whether you are a seasoned investor or just starting out, understanding PMS can help you make smarter financial decisions.

In this article, we’ll break down what PMS is, how it works, its benefits, and why you should consider it for wealth growth. Let’s dive in!

What is Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) is a professional investment service offered by financial experts or firms to manage your investments in stocks, bonds, mutual funds, and other assets. Unlike traditional mutual funds, PMS provides a more personalized and hands-on approach to investing, catering specifically to high-net-worth individuals (HNIs) and investors who want tailored strategies.

Types of PMS

There are three main types of Portfolio Management Services:

Discretionary PMS: The portfolio manager takes full control of investment decisions based on the investor's risk profile and financial goals.

Non-Discretionary PMS: The investor has full control over investment decisions, while the portfolio manager provides research and recommendations.

Advisory PMS: The portfolio manager only provides guidance, and the investor executes transactions independently.

How Does PMS Work?

Once you enroll in a Portfolio Management Service, the process generally follows these steps:

Assessment of Financial Goals: The PMS provider assesses your financial objectives, risk appetite, and investment horizon.

Investment Strategy Development: A customized strategy is developed based on your profile.

Execution: The portfolio manager makes investment decisions on your behalf (in discretionary PMS) or provides recommendations (in non-discretionary and advisory PMS).

Performance Monitoring: Regular monitoring and adjustments are made to optimize returns and minimize risks.

Reporting: You receive periodic reports to track portfolio performance.

Why Should You Care About PMS?

Now that you understand the basics, let's explore why Portfolio Management Services matter and how they can benefit you.

1. Personalized Investment Approach

Unlike mutual funds that follow a standard investment pattern, PMS provides customized investment strategies tailored to your financial goals and risk tolerance.

2. Professional Expertise

PMS ensures that your investments are managed by experienced professionals with in-depth market knowledge. This reduces emotional decision-making and improves the chances of wealth growth.

3. Higher Returns Potential

PMS investments are actively managed, meaning they can generate higher returns compared to passive investments like index funds or mutual funds.

4. Diversification

Portfolio managers allocate assets across different investment options, minimizing risk and ensuring a well-diversified portfolio.

5. Transparency and Control

With PMS, you get regular performance reports and updates. In non-discretionary PMS, you even have complete control over where your money is invested.

6. Tax Efficiency

Since PMS investments are individually managed, portfolio managers can implement tax-efficient strategies, such as harvesting capital losses to offset gains.

Who Should Consider PMS?

PMS is ideal for:

High-net-worth individuals (HNIs) who want a customized investment approach.

Investors looking for professional wealth management without handling investments themselves.

People with a long-term investment horizon seeking higher returns.

Busy professionals who don’t have time to track the stock market regularly.

Factors to Consider Before Choosing PMS

Before enrolling in PMS, consider the following:

1. Minimum Investment Requirement

PMS usually requires a minimum investment of ₹50 lakh in India. Ensure you meet the eligibility criteria.

2. Fee Structure

PMS providers charge fees in two ways:

Fixed Fee: A percentage of the total investment, regardless of portfolio performance.

Profit Sharing: A percentage of the returns generated beyond a certain benchmark.

3. Performance Track Record

Check the PMS provider’s historical performance and investment philosophy before making a decision.

4. Risk Management Approach

Understand how the portfolio manager mitigates risk during market downturns.

5. Investment Philosophy

Different PMS providers follow various strategies—growth investing, value investing, or sector-based investing. Choose one that aligns with your goals.

Common Myths About PMS

1. PMS is Only for the Ultra-Rich

While PMS does cater to high-net-worth individuals, some firms now offer customized solutions for investors with lower capital.

2. PMS Guarantees High Returns

Like any investment, PMS is subject to market risks. However, professional management can enhance returns over time.

3. Mutual Funds and PMS are the Same

Mutual funds are pooled investments, while PMS offers a personalized and actively managed portfolio.

Conclusion

If you are looking for a customized, professionally managed investment strategy with the potential for higher returns, Portfolio Management Services (PMS) might be the right choice for you.

It offers a tailored approach, expert management, and diversified investments, making it an excellent option for serious investors. However, always assess your risk appetite, research providers, and understand the fee structure before opting for PMS.

2 notes

·

View notes

Text

What is a Portfolio Management Service & What are its features?

Portfolio Management Service (PMS) is a specialized financial offering where seasoned investment professionals manage portfolios of stocks, bonds, and other securities tailored to the individual financial goals and risk tolerance of investors. This service is ideal for investors looking for personalized investment strategies aimed at maximizing returns and efficiently managing investment risks. With PMS, investors can benefit from the expertise of skilled portfolio managers who have a deep understanding of market dynamics and investment strategies. These managers utilize comprehensive research and analytics to construct a diversified portfolio that seeks to optimize returns while adhering to the investor's specific risk profile.

PMS is particularly beneficial for those who prefer a hands-off approach to investing but still desire a level of customization and active management that is not typically found in standard investment products like mutual funds or ETFs. This tailored approach not only aims to achieve superior financial outcomes but also provides peace of mind through professional oversight and strategic management.

In essence, Portfolio Management Services bridge the gap between individual investing and institutional-level asset management, offering a sophisticated solution for those seeking to enhance their wealth through personalized and expertly managed investment portfolios.

Understanding Portfolio Management Services

PMS provides a bespoke investment approach. Portfolio managers craft and oversee a portfolio that aligns with the investor’s financial objectives, risk tolerance, and investment horizon. This service involves deep analysis of investment opportunities and continuous market monitoring to make timely, strategic decisions.

Types of Portfolio Management

Active Management: Managers actively select investments to outperform the market based on research and market analysis.

Passive Management: This approach involves mimicking a market index, focusing on long-term growth with minimal trading.

Discretionary Management: Investors entrust managers with full decision-making authority over their portfolios.

Non-Discretionary Management: Managers provide investment advice, but the final investment decisions rest with the investors.

Key Features of Portfolio Management Services

Customization: Tailoring strategies to individual financial needs and risk profiles.

Expert Management: Access to professional managers with extensive market experience.

Active Monitoring: Ongoing assessment and adjustment of the portfolio to meet financial goals.

Risk Management: Strategies in place to mitigate risks and enhance potential returns.

Regulatory Compliance: Adherence to financial regulations, ensuring transparency and integrity.

Benefits of Portfolio Management Services

Professional Expertise: Leveraging the acumen of experienced investment professionals.

Time Efficiency: Allowing investors to focus on personal or other business endeavors.

Personalized Investment Strategies: Unlike mutual funds, PMS offers strategies that are tailored to the needs of individual investors.

Potential for Enhanced Returns: Customized, actively managed portfolios can potentially yield higher returns.

Statistical Insights and Facts

As of 2023, the global asset management market is valued at approximately $74 trillion, with a projected growth to $112 trillion by 2028, reflecting the increasing trust and reliance on professional investment management services.

Research indicates that portfolios managed through discretionary services have, on average, outperformed self-managed portfolios by 2-3% annually, attributed to timely and strategic decision-making by experienced portfolio managers.

A survey of high-net-worth individuals revealed that 75% prefer using professional portfolio management services to address their complex investment needs and for better risk-adjusted returns.

Why Choose Genesis for Portfolio Management?

Genesis, a product of Novel Patterns, leverages cutting-edge technology and analytics to deliver superior portfolio management services. Key offerings include:

Sophisticated Analytics: Utilizing advanced tools to interpret market data and improve investment decisions.

Customized Service: Dedicated management focusing on individual financial targets and risk preferences.

Strategic Diversification: Aiming to safeguard and grow investor wealth across diverse asset classes and regions.

Transparent Communication: Regular, detailed updates on portfolio performance and strategic adjustments.

Rewind Up

Choosing the appropriate portfolio management service is essential for attaining your financial goals. Services such as Genesis provide the necessary expertise, advanced technology, and personalized support to help navigate challenging market environments and pursue significant financial gains. By grasping the various aspects of Portfolio Management Services (PMS), investors can empower themselves to make educated decisions and greatly enhance their investment outcomes.

This detailed overview seeks to equip investors with a comprehensive understanding of portfolio management services, their advantages, and the reasons Genesis is distinguished as an exceptional option in today’s financial landscape.

#cart#fintech#account aggregator#novel patterns#bfsi#myconcall#credit underwriting#finance#wealth management#genesis#asset management#portfolio management services#portfolio management#alternative investment fund#AIF#PMS#investment#stock#asset and investment#assets

2 notes

·

View notes

Text

Which Small-Cap Funds Are Holding the Largest Cash Positions?

When it comes to investing in small-cap mutual funds, one of the savvy investors often examine is the amount of cash reserves held by the fund. High cash reserves can provide a cushion during fluctuating markets, allowing fund managers to grab opportunities

as they protect or arise against downturns. small-cap funds, which typically invest in smaller companies with higher growth potential, are often more changing than large-cap funds, making the management of cash even more critical.

In this article, We will know the small-cap mutual funds that are currently holding substantial cash reserves.

Why Cash Reserves Matter in Small-Cap Funds.

Cash reserves are a vital component in a fund's strategy, especially in the small-cap sector. Small-cap stocks are known for their potential to generate higher returns, but they can also experience significant price swings due to market volatility or changes in investor sentiment. When a small-cap fund has a healthy amount of cash on hand, the fund manager can make tactical decisions during market downturns. For instance, they may choose to invest in undervalued stocks or wait for better market conditions before deploying more capital. Conversely, too little cash can expose the fund to liquidity risks, forcing managers to sell off assets at less-than-ideal prices.

Top Small-Cap Funds with Significant Cash Holdings

While many small-cap mutual funds are fully invested inequities, some maintain higher cash positions to balance risk and take advantage of future buying opportunities. Below are a few small-cap mutual funds known for their prudent cash management strategies:

1. XYZ Small-Cap Growth Fund

This fund is known for its cautious approach, with nearly 15% of its assets in cash and cash equivalents. The fund's managers believe in holding cash during periods of market uncertainty, allowing them to take advantage of attractive stock valuations when the opportunity arises.

2. ABC Small-Cap Value Fund

A veteran in the small-cap space, ABC Small-Cap Value Fund has maintained approximately 12% of its portfolio in cash. This strategy helps it mitigate the risks associated with investing in small, volatile companies, especially during economic downturns.

3. 123 Small-Cap Dividend Fund

While typically focused on smaller companies that pay dividends, this fund also keeps a significant portion of its assets in cash—around 10%. The fund manager uses this cash to navigate market turbulence and seek out dividend-paying companies with strong growth prospects.

4. PQR Small-Cap Aggressive Fund

Known for its more aggressive investment style, PQR still holds about 8% of its assets in cash, particularly as a buffer against unexpected market swings. This allows the fund manager to pivot quickly in response to changing market conditions while maintaining a focus on high-growth small-cap stocks.

While cash reserves may not always lead to short-term gains, they offer fund managers flexibility and security during uncertain times. For investors who prioritize risk management, choosing small-cap mutual funds with significant cash holdings can be a wise move. These funds are better equipped to navigate volatile markets and capitalize on opportunities as they arise. Always consider a fund’s overall strategy and investment philosophy before making your investment decision.

2 notes

·

View notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

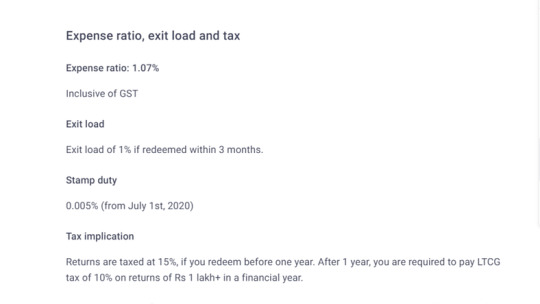

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

Exploring Peer-to-Peer Investments Through a P2P Lending Platform in Jabalpur

In today's fast-changing financial world, investors continually seek avenues to grow their finances while being mindful of risks. However, many individuals primarily focus on mutual funds and stocks for investment, unaware of the broader spectrum of available options. Let's explore the challenges investors face and learn how a P2P lending platform in Jabalpur helps them with the best investment opportunities.

Understanding Investor Challenges in Alternate Investment Avenues

As people try to make more money from their investments, they face problems because they don’t know about different ways to invest.

High Barriers to Entry:Investing in assets like real estate demands substantial capital, thus limiting access for many investors to diversify their portfolios effectively.

Opaque Investment Processes:Traditional investment structures can be complex and difficult to comprehend, making it challenging for investors to understand underlying risks and potential returns.

Lack of Information:Not having enough details about where to invest can make it tough to choose the right option. This might make people hesitant to invest at all.

Low Returns:Sometimes, the money invested doesn't grow much, offering lower profits compared to what people expected.

Limited Diversification:Investors might not have enough different types of investments. This lack of variety can make their money more at risk if one investment doesn’t do well.

Lack of Personalised Recommendations:Generic investment advice fails to cater to individual financial goals, risk appetites, and investment horizons, impacting the relevance of investment decisions.

The Potential of P2P Investments in India

Mutual funds are a reliable investment avenue today, but there are more such promising asset classes unexplored by investors. Swaraj FinPro, the best mutual funds investment services in Jabalpur, offers investments in one such asset class with Peer-to-peer (P2P) lending, backed by RBI guidelines where individuals can lend their money on higher interest while other individuals borrow funds from multiple investors through a digital platform. This transformative approach creates a marketplace connecting borrowers and lenders, facilitating secured personal loans while managing the loan life cycle to provide monthly returns to lenders. Here are the benefits of P2P lending platforms for investors:

Higher Potential Returns

P2P lending platforms typically yield higher interest rate to investors, compared to conventional savings accounts and investors can potentially benefit from higher returns up to 12%*.

Diversification Opportunities

By investing across a variety of borrowers on P2P platforms, investors can spread their risk and potentially increase returns by diversifying their investments.

Accessibility and Specific Advantages

P2P lending provides access to investments previously unavailable through traditional channels. Investors can participate with smaller investment amounts, diversify portfolios, and select the tenure.

Passive Income

P2P lending allows investors to earn interest regularly, providing a potential source of passive income.

Potential for Higher Yields

As investors can choose the tenure and interest rates they are willing to accept for lending, there's potential for higher yields based on their risk appetite.

Tailoring Investments for Investors

Swaraj FinPro empowers investors in Jabalpur and pan India to explore P2P lending as an accessible, reliable, and potentially lucrative avenue for diversification and growth within their investment portfolios. P2P lending works well because it's clear, gives different choices, and doesn’t lock your money away for too long.

#mutual fund financial in Jabalpur#best mutual fund distributors in Jabalpur#equity mutual funds in Jabalpur#best tax saving mutual funds services in jabalpur

2 notes

·

View notes

Text

Term Insurance vs. Mutual Funds: A Complete Comparison

This blog compares mutual funds and term insurance to help you understand their differences and choose the right financial plan. While mutual funds focus on wealth creation, term insurance provides financial security. The best approach is a balanced financial plan that includes both for long-term stability and growth.

Need help with investment planning? Start by securing your future today with the right mix of mutual funds and term insurance!

When it comes to financial planning, two of the most commonly discussed options are mutual funds and term insurance. Both serve different purposes but are essential for a well-rounded financial strategy. While mutual funds help in wealth creation, term insurance ensures financial security for your family in case of an unfortunate event. So, which one should you choose? Let’s break it down in simple terms.

Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors and invest in stocks, bonds, or other assets. They are managed by professional fund managers who aim to generate returns based on market performance. The primary goal of mutual funds is wealth accumulation over time.

Benefits of Mutual Funds:

Wealth Creation: Over time, mutual funds have the potential to offer significant returns.

Diversification: Your money is spread across multiple assets, reducing risk.

Liquidity: You can withdraw your investment anytime, depending on the fund type.

Professional Management: Experts handle your investment, making informed decisions for better returns.

Types of Mutual Funds:

Equity Mutual Funds: Invest mainly in stocks for long-term growth.

Debt Mutual Funds: Focus on fixed-income securities, offering stable returns.

Hybrid Funds: A mix of equity and debt for balanced risk and returns.

Understanding Term Insurance

Term insurance is a life insurance policy that provides financial protection to your family in case of your demise during the policy term. Unlike other life insurance plans, it does not have an investment component; instead, it is purely for risk coverage.

Benefits of Term Insurance:

Financial Protection: Ensures your family is financially secure if anything happens to you.

Affordable Premiums: Term plans offer high coverage at lower premiums.

Tax Benefits: Premiums paid for term insurance are tax-deductible under Section 80C.

Peace of Mind: Knowing your loved ones are protected brings a sense of security.

Key Differences Between Term Insurance and Mutual Funds

FeatureMutual FundsTerm InsurancePurposeWealth creationFinancial securityReturnsMarket-linkedNo returns (except for return-of-premium plans)Risk FactorMedium to HighLowLiquidityHigh (except ELSS funds)No liquidity (Only payout on death)Tax BenefitsUnder Section 80C & 10(10D)Under Section 80CInvestment HorizonLong-term for better returnsFixed policy term

Which One Should You Choose?

The choice between mutual funds and term insurance depends on your financial goals. If you want to grow your wealth and are comfortable with market risks, mutual funds are a great choice. On the other hand, if your priority is securing your family’s future, term insurance is a must-have.

A Balanced Approach:

Instead of choosing one over the other, a combination of both is ideal.

First, get a term insurance policy to safeguard your dependents.

Then, invest in mutual funds for wealth accumulation and long-term financial growth.

Conclusion

Both mutual funds and term insurance play a crucial role in financial planning. While mutual funds help in growing your wealth, term insurance ensures that your loved ones remain financially stable even in your absence. The best strategy is to use both wisely—term insurance for security and mutual funds for financial growth.

0 notes

Text

The Best Mutual Fund Companies & Trading Apps in India: A Guide Sip Investment Plans

Investing in mutual funds and stocks has become an essential financial strategy for wealth creation in India. With a variety of investment plans, trading apps, and market insights available, choosing the right platform and investment option can be overwhelming. This blog covers the top mutual fund companies, best trading apps, investment plans, and key stock insights, including Hero MotoCorp, Polycab, GRSE, and Voltas. We also discuss the impact of Federal Reserve interest rates on investments.

Top Mutual Fund Companies in India

Mutual fund investments are managed by leading Asset Management Companies (AMCs) that offer diverse schemes for investors. Some of the top mutual fund company in India include:

SBI Mutual Fund: Known for stable returns and government backing.

HDFC Mutual Fund: Offers a mix of equity, debt, and hybrid schemes.

ICICI Prudential Mutual Fund: Popular for innovation and diversified portfolio options.

Axis Mutual Fund: Focuses on high-performing funds with strong management.

Nippon India Mutual Fund: Known for a variety of schemes catering to different risk appetites.

Best Trading Apps in India

Stock market trading has been revolutionized with easy-to-use apps. Some of the top trading apps in India include:

Zerodha Kite: Offers a seamless and low-cost trading experience.

Groww: A simple platform for stocks, mutual funds, and SIP investments.

Upstox: Provides advanced trading features with minimal brokerage fees.

Angel One: A great choice for research-backed stock recommendations.

INDmoney: Ideal for investing in US stocks and mutual funds with zero commission.

Mutual Fund Investment Plans

Mutual fund investment plans cater to different financial goals. Some popular categories include:

Equity Mutual Funds: Suitable for high-risk investors seeking long-term capital appreciation.

Debt Mutual Funds: Ideal for risk-averse investors looking for stable returns.

Hybrid Mutual Funds: A mix of equity and debt for balanced risk and returns.

Tax-Saving ELSS Funds: Provide tax benefits under Section 80C with the stock market in india potential for high returns.

SIP Investment Plan Calculator

A Systematic Investment Plan (SIP) allows investors to invest small amounts regularly. To estimate potential returns, an SIP calculator can be used. Many platforms like Groww, Angel One, and ICICI Direct offer online SIP calculators that help investors plan their investments based on tenure and expected returns.

Best Investment Plans in India

The best investment plans depend on individual financial goals. Some top options include:

Mutual Funds (SIPs and Lump Sum Investments)

Fixed Deposits (FDs) for Low-Risk Investors

Public Provident Fund (PPF) for Long-Term Tax-Free Returns

Stocks for Aggressive Investors

ULIPs (Unit Linked Insurance Plans) for Insurance + Investment Benefits

Stock Market Insights: Hero MotoCorp, Polycab, GRSE & Voltas

Hero MotoCorp Share: Hero MotoCorp remains a key player in the automobile sector. Investors keep a close watch on its stock for long-term growth.

Polycab Share: A leader in the wires and cables sector, Polycab shares have shown strong growth potential and are favored by long-term investors.

GRSE (Garden Reach Shipbuilders & Engineers) Share Price: A major defense sector stock, GRSE has gained investor interest due to government contracts and industry demand.

Voltas Share Price: Voltas, a Tata Group company, has witnessed fluctuations but remains a solid investment in the cooling and engineering sector.

Impact of Federal Reserve Interest Rates on Investments

The Federal Reserve’s best investment plan in mutual fund decisions on interest rates affect global and Indian markets. Higher interest rates may lead to:

Lower stock market liquidity

A decrease in foreign investments

Higher borrowing costs, impacting corporate earnings

Investors should keep an eye on Fed meetings and plan their portfolios accordingly.

Final Thoughts

Choosing the right mutual fund company, trading app, or stock requires thorough research and understanding of financial goals. With top mutual funds, reliable trading platforms, and market insights, investors can build a strong portfolio for long-term wealth creation. Stay updated with market trends and make informed investment decisions.

Disclaimer: Investments are subject to market risks. Please consult a financial systematic investment plan calculator advisor before investing.

MoneyIsle is a cutting-edge financial platform dedicated to empowering investors with seamless investment solutions. Our mission is to simplify trading, mutual fund investments, and wealth management by offering intuitive tools, insightful market analysis, and a user-friendly experience.

0 notes

Text

Should You Choose HDFC Securities for Trading?

Hey there, traders and investors! If you’re searching for a solid trading platform, you might have stumbled upon HDFC Securities. But is it worth your time and money? Let’s break it down in this HDFC Securities Review!

Why HDFC Securities?

HDFC Securities is one of the most trusted names in trading, especially because it’s backed by HDFC Bank. This means secure transactions, seamless fund transfers, and a strong financial foundation.

What About Brokerage Charges?

Let’s be honest—brokerage fees matter! HDFC Securities charges a percentage-based brokerage, which might feel a little high compared to discount brokers. But in return, you get excellent research tools and customer support.

Trading Features You’ll Love

A variety of investment options, including stocks, mutual funds, IPOs, and derivatives.

A smooth trading experience across mobile, web, and desktop platforms.

Research-backed insights to help you make informed decisions.

Should You Open an Account?

If you value premium services, research tools, and a well-integrated banking experience, HDFC Securities is a great option. But if you're looking for ultra-low brokerage, you might want to compare with other brokers first.

The Verdict

This HDFC Securities Review highlights the pros and cons, making it easier for you to decide. Whether you're a seasoned investor or just getting started, weigh your priorities before making a choice!

0 notes

Text

NRI Investment Plans: A Comprehensive Guide to Growing Wealth Overseas

For Non-Resident Indians (NRIs), investing in India offers a lucrative opportunity to grow wealth while maintaining a connection to their home country. With a rapidly expanding economy, diverse investment options, and favorable government policies, India presents a compelling case for NRIs seeking financial growth. However, understanding the right NRI investment plans is crucial to making informed and profitable decisions.

In this guide, we will explore various NRI investment plans, their benefits, risks, and essential factors to consider while investing in India.

Why Should NRIs Invest in India?

India's financial market offers multiple advantages for NRIs, including:

High Growth Potential: India's GDP growth rate consistently outperforms global averages, providing high returns on investment.

Favorable Government Policies: The Indian government has introduced NRI-friendly policies, such as relaxed foreign exchange regulations and tax incentives.

Diverse Investment Opportunities: From real estate to mutual funds, India offers multiple avenues for NRIs to invest their money securely.

Rupee Depreciation Benefits: Investing in India can be beneficial for NRIs when converting foreign currency into INR at a favorable rate.

Top NRI Investment Plans

1. Fixed Deposits (FDs)

Fixed deposits remain one of the safest and most popular NRI investment plans due to their guaranteed returns and minimal risks. NRIs can choose from different types of FDs:

Non-Resident External (NRE) Fixed Deposits: These are tax-free and allow full repatriation of both principal and interest.

Non-Resident Ordinary (NRO) Fixed Deposits: These are taxable in India and can be used to manage income earned within the country.

Foreign Currency Non-Resident (FCNR) Fixed Deposits: These are maintained in foreign currency, eliminating exchange rate risks.

2. Mutual Funds

NRIs can invest in Indian mutual funds through their NRE or NRO accounts. Some key advantages of mutual funds include:

Professional fund management

Diversification across various sectors

Higher returns compared to traditional savings instruments

However, NRIs from the US and Canada must comply with FATCA regulations while investing in Indian mutual funds.

3. Real Estate

Investing in real estate is a popular choice among NRIs, given the high appreciation potential. Key investment options include:

Residential properties

Commercial spaces

Land investments

NRIs can finance their real estate purchases through home loans offered by Indian banks, making it easier to own property in India.

4. Stock Market Investments

NRIs can participate in the Indian stock market by opening a Portfolio Investment Scheme (PIS) account with an authorized bank. Benefits of stock market investments include:

Potential for high returns

Ownership in India's leading companies

Dividend income

However, stock investments carry risks due to market fluctuations and require thorough research before investing.

5. Government Bonds and Securities

For NRIs looking for low-risk investment options, government bonds and securities provide a secure alternative. These bonds offer:

Stable returns with government backing

Tax-saving opportunities under specific schemes

Long-term investment benefits

6. National Pension System (NPS)

NRIs looking for retirement planning can consider the National Pension System (NPS), a voluntary contribution-based pension scheme that offers:

Tax benefits under Section 80CCD

Flexible contribution options

Market-linked returns for long-term wealth accumulation

7. Insurance Plans

NRIs can also opt for life insurance and health insurance plans in India to secure their family’s financial future. Indian insurance plans often offer higher coverage at lower premiums compared to policies abroad.

Factors to Consider Before Investing

Before selecting an NRI investment plan, consider the following factors:

Repatriation Rules: Check whether the investment allows easy transfer of funds back to your foreign bank account.

Taxation Policies: Understand the tax implications for NRIs, including Double Taxation Avoidance Agreements (DTAA).

Risk Appetite: Choose investments that align with your risk tolerance.

Investment Horizon: Long-term investments typically yield better returns than short-term ones.

Regulatory Compliance: Ensure compliance with FEMA (Foreign Exchange Management Act) and other relevant regulations.

Conclusion

NRIs have a wide range of investment opportunities in India, each catering to different financial goals and risk profiles. Whether you prefer the stability of fixed deposits, the high returns of stock markets, or the long-term benefits of real estate and mutual funds, choosing the right NRI investment plan requires careful evaluation of personal financial goals and market conditions.

By diversifying investments and staying informed about regulatory changes, NRIs can maximize their financial growth while securing their wealth for the future.

Looking for the best NRI investment plans? Evaluate your options and consult a financial advisor to make well-informed investment decisions today!

0 notes

Text

Achieving Financial Success with Expert Guidance from Nick Trimble

Managing personal finances can often feel overwhelming, especially when it comes to long-term planning and making critical investment decisions. One way to take control of your financial future is by working with a trusted advisor. Nick Trimble Financial Advisor offers a wealth of experience and knowledge, helping individuals and families navigate the complexities of financial planning, investment strategies, and wealth management. With a deep understanding of the financial markets and a personalized approach, Nick helps clients create and implement strategies that align with their specific goals and aspirations.

The Importance of Financial Planning

Financial planning is more than just saving money or making occasional investments. It involves a comprehensive approach to managing your finances, ensuring that your current and future needs are met. Effective financial planning allows you to prepare for life’s uncertainties, achieve personal financial goals, and secure your long-term financial well-being.

Whether you're just starting out in your career or nearing retirement, having a clear financial plan is essential. It involves setting realistic goals, such as purchasing a home, funding education, or retiring comfortably. By working with an expert like Nick Financial Advisor, you can ensure that your plans are both actionable and tailored to your unique circumstances.

Understanding the Role of a Financial Advisor

A financial advisor plays a key role in helping individuals make informed decisions about their finances. They provide expert guidance on investments, budgeting, retirement planning, tax strategies, and more. One of the primary benefits of hiring a financial advisor is their ability to simplify complex financial concepts and provide advice based on their expertise.

Nick Trimble, as a financial advisor, helps clients navigate challenges and opportunities within the financial markets. He works closely with clients to understand their financial goals, risk tolerance, and preferences. Based on this understanding, he develops customized strategies that help clients grow and protect their wealth.

Key Areas of Focus for Financial Advisors

Investment Management Investments are a crucial part of building wealth over time. A financial advisor helps clients select investment opportunities that align with their goals and risk tolerance. Nick Financial Advisor provides guidance on building a diverse investment portfolio, including stocks, bonds, mutual funds, and alternative investments, to maximize returns while minimizing risks.

Retirement Planning Retirement planning is one of the most important financial decisions individuals make. A financial advisor helps create a strategy to ensure that you will have enough savings to retire comfortably. This includes choosing the right retirement accounts, determining how much to save, and developing strategies to reduce tax liabilities in retirement.

Tax Planning Taxes can have a significant impact on your wealth. Financial advisors help clients develop strategies to minimize taxes through efficient investment planning, tax-advantaged accounts, and other strategies. Nick provides valuable insights into tax planning, ensuring that his clients keep more of their earnings and invest those savings wisely.

Debt Management Managing debt is an essential part of financial well-being. Financial advisors work with clients to develop plans for paying down debt efficiently while still saving and investing for the future. Nick helps clients find a balance between managing debt and growing their wealth, offering strategies to pay off high-interest debt without sacrificing long-term financial goals.

Estate Planning Estate planning is vital for ensuring that your assets are distributed according to your wishes after your death. A financial advisor helps you prepare for the future by creating wills, trusts, and other estate planning tools. Nick provides estate planning services that ensure your loved ones are taken care of and that your assets are managed in the most tax-efficient manner.

Why Choose a Financial Advisor Like Nick Trimble?

With countless financial resources available today, you might wonder why you need a financial advisor. The reality is that personalized advice and a tailored financial strategy are invaluable, especially in the complex world of personal finance. Here are several reasons why working with Nick Financial Advisor could be the right choice for you:

1. Personalized Strategy

Unlike generic financial advice you may find online or in books, Nick works closely with clients to understand their individual circumstances. Whether you're looking to save for a large purchase, pay off debt, or plan for retirement, he crafts a strategy tailored to your goals and financial situation.

2. Expertise and Experience

Nick has extensive experience in financial planning and wealth management. His expertise allows him to offer well-informed guidance that can help you avoid common mistakes and optimize your financial decisions. With his in-depth knowledge of market trends, he can also help you navigate changes in the economy that might impact your finances.

3. Long-Term Focus

Financial success is about more than just short-term gains—it's about building a secure financial future. Nick focuses on long-term planning, helping clients set and achieve financial milestones over time. By focusing on long-term goals, he ensures that you are not just meeting today’s needs but also preparing for tomorrow’s challenges.

4. Holistic Approach

Financial planning isn't just about investments or retirement accounts; it's about managing every aspect of your financial life. Nick takes a holistic approach, considering your income, expenses, savings, debt, and future financial needs. This comprehensive view ensures that your financial decisions align with your overall goals.

5. Peace of Mind

Financial stress can be overwhelming, but working with a trusted advisor like Nick provides peace of mind. He will handle the complex details of your financial situation, giving you the confidence to focus on what matters most—whether that’s your family, career, or personal interests.

Building a Strong Financial Future

The key to building long-term financial success is understanding your financial goals and creating a clear plan to achieve them. Nick Trimble Financial Advisor offers the support, advice, and strategies needed to navigate the world of personal finance and ensure that you are on the right path toward financial security. Whether you're saving for retirement, planning for your children's education, or looking to grow your wealth, having a financial expert by your side makes all the difference in achieving your dreams.

0 notes

Text

ESG Investing: Beginner’s Guide to Sustainable Wealth

In recent years, ESG investing has become a buzzword in the financial world. But what exactly is it, and why is everyone talking about it? ESG stands for Environmental, Social, and Governance, and it’s a way of investing that considers not just financial returns, but also the impact of investments on the planet and society.

Whether you’re a seasoned investor or just starting out, understanding ESG investing can help you make more informed decisions that align with your values. Let’s break it down into four key aspects: what ESG investing is, how it works, its benefits, and the challenges it faces.

What Is ESG Investing?

ESG investing is a strategy that focuses on companies that prioritize environmental sustainability, social responsibility, and strong governance practices. Unlike traditional investing, which mainly looks at financial performance, ESG investing adds an extra layer of scrutiny.

Environmental: This looks at how a company impacts the planet. Does it reduce carbon emissions? Is it committed to renewable energy? Does it manage waste responsibly?

Social: This examines how a company treats people. Does it promote diversity and inclusion? Does it ensure fair labor practices? Is it involved in the community?

Governance: This focuses on how a company is run. Does it have transparent leadership? Are there measures to prevent corruption? Are shareholders’ rights respected?

ESG investing isn’t just about avoiding “bad” companies—it’s also about supporting “good” ones that are making a positive impact. For example, an ESG investor might choose a renewable energy company over a fossil fuel giant, even if the latter offers higher short-term returns.

How Does ESG Investing Work?

So, how do you actually invest using ESG principles? It’s not as complicated as it might sound. Here’s a step-by-step breakdown:

1. Research ESG Metrics: Companies are often rated on ESG criteria by specialized agencies. These ratings help investors compare how well different companies perform in areas like carbon footprint, employee treatment, and board diversity.

2. Choose Your Approach: There are several ways to incorporate ESG into your portfolio. You can:

Screen Investments: Exclude companies or industries that don’t meet your ESG standards (e.g., tobacco or weapons).

Focus on Positive Impact: Actively seek out companies with strong ESG practices.

Engage in Shareholder Advocacy: Use your position as a shareholder to push for better ESG practices.

3. Pick ESG Funds or ETFs: f you don’t want to pick individual stocks, you can invest in ESG-focused mutual funds or exchange-traded funds (ETFs). These funds pool money from multiple investors and allocate it to companies with high ESG ratings.

4. Monitor Performance: Like any investment, ESG portfolios need regular check-ins to ensure they’re meeting your financial and ethical goals.

The Benefits of ESG Investing

Why are so many people jumping on the ESG bandwagon? Here are some of the key benefits:

Aligns Investments with Values: For many investors, ESG offers a way to put their money where their heart is. If you care about climate change, social justice, or corporate transparency, ESG investing lets you support companies that share your values.

Potential for Strong Returns: Contrary to the myth that ethical investing means sacrificing profits, many ESG-focused companies have outperformed their peers. Why? Companies with strong ESG practices are often better managed, more innovative, and more resilient to risks like regulatory changes or reputational damage.

Risk Management: ESG factors can highlight risks that traditional financial analysis might miss. For example, a company with poor environmental practices might face hefty fines or lawsuits down the line. By avoiding such companies, ESG investors can reduce their exposure to these risks.

Positive Impact: ESG investing isn’t just about making money—it’s about making a difference. By directing capital toward sustainable and socially responsible companies, investors can help drive positive change in the world.

The Challenges of ESG Investing

While ESG investing has a lot going for it, it’s not without its challenges. Here are some of the hurdles investors might face:

Lack of Standardization: One of the biggest issues with ESG investing is the lack of consistent standards. Different rating agencies use different criteria, which can lead to conflicting ratings for the same company. This makes it hard for investors to know which companies truly align with their values.

Greenwashing: Some companies may exaggerate or misrepresent their ESG efforts to attract investors—a practice known as greenwashing. Without thorough research, it can be difficult to separate the genuinely sustainable companies from the ones just paying lip service.

Limited Options: While the number of ESG investment options is growing, it’s still a smaller market compared to traditional investing. This can make it harder to build a diversified portfolio, especially in certain sectors or regions.

Performance Concerns: Although many ESG funds perform well, there’s no guarantee that they’ll always outperform traditional investments. Some investors worry that focusing too much on ESG criteria could limit their opportunities for higher returns.

Is ESG Investing Right for You?

ESG investing isn’t a one-size-fits-all solution. Whether it’s right for you depends on your financial goals, risk tolerance, and personal values. If you’re passionate about sustainability and social responsibility, ESG investing can be a powerful way to align your portfolio with your beliefs.

However, it’s important to do your homework. Look beyond the labels and dig into the details of any ESG fund or company you’re considering. And remember, ESG investing is just one approach—there are other strategies like socially responsible investing (SRI) and impact investing that might also suit your needs.

Final Thoughts

ESG investing is more than just a trend—it’s a growing movement that reflects a broader shift in how people think about money and its impact on the world. By considering environmental, social, and governance factors, investors can not only grow their wealth but also contribute to a more sustainable and equitable future.

Of course, like any investment strategy, ESG comes with its own set of challenges. But for those willing to put in the effort, the rewards—both financial and ethical—can be well worth it.

So, whether you’re a seasoned investor or just starting out, ESG investing is worth exploring. Who knows? It might just be the key to building a portfolio that’s as good for the world as it is for your wallet.

#LegalFinancialAdvisor#BestRetirementPlanningBooks#ImpactInvesting#ESGInvesting#SociallyResponsibleInvesting#Flat-FeeFinancialPlanning#WhyFlat-FeeFinancialPlanningIsIdeal

1 note

·

View note

Text

How can an Investment Advisor in Chennai Help you Avoid These SIP Mistakes?

Systematic Investment Planning (SIP) is a powerful tool for disciplined investing. By investing a fixed amount regularly in a mutual fund, investors can benefit from rupee-cost averaging and compounding. However, despite its simplicity, certain mistakes can hinder its effectiveness. With the help of an experienced investment advisor in Chennai like Fairmoves, you can understand the risks and rewards of SIP strategies.

1. Investing Without Clear Financial Goals

A major mistake investors make is investing in SIPs without well-defined financial goals. Establishing SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals. This helps determine the ideal investment amount, tenure, and mutual fund type.

2. Choosing the Wrong Mutual Fund

Selecting an unsuitable mutual fund is another common mistake. Every fund has a different risk profile and aim. Investors must choose funds based on their financial goals and risk tolerance.

Equity funds suit long-term investors with a high-risk appetite.

Debt funds are ideal for those seeking stable returns with low risk.

Hybrid or balanced funds work well for moderate-risk investors.

Choosing the best investment consulting firm in Chennai can simplify fund selection by providing data on past performance, risk assessment, and category comparisons.

3. Ignoring Asset Allocation

Diversification is key to reducing risk. Many investors fail to allocate assets properly across different categories like equity, debt, and gold. A well-balanced portfolio provides stability and optimizes potential returns.

4. Stopping SIPs During Market Downturns

Market volatility often causes panic, leading investors to stop their SIPs. However, market downturns provide an opportunity to buy more units at lower prices. Ultimately bettering potential returns when the market rebounds.

5. Not Reviewing and Rebalancing the Portfolio

Investors often neglect portfolio reviews and rebalancing. Over time, market fluctuations may shift asset allocation, increasing risk exposure. Reviewing portfolios annually helps maintain the right mix of assets.

6. Investing for the Short Term

SIPs are most effective for long-term financial goals, allowing investors to leverage the power of compounding. Exiting SIPs too soon may result in suboptimal returns and missed opportunities.

7. Not Increasing SIP Amount with Rising Income

Many investors stick to the same SIP amount despite salary hikes. Increasing SIP contributions in line with income growth enhances corpus creation.

For instance, a 10% annual increment in SIP contributions makes sure investments keep pace with inflation.

Conclusion

SIPs are a popular way to invest, and for good reason. They offer a disciplined approach to corpus creation. However, to truly benefit from SIPs, you need to avoid some common mistakes. This includes having well-defined financial goals. Carefully select the right mutual funds, and spread your investments across different asset classes. Resisting the urge to pull out your money when the market goes down. It's also essential to regularly check in on your portfolio.

0 notes

Text

Expert-Led Investing: How Portfolio Management Services Can Boost Your Wealth

In today’s fast-moving financial world, growing your wealth isn’t just about picking the right stocks it’s about having a well-crafted, personalized strategy backed by expert knowledge. Portfolio Management Services (PMS) offer investors an opportunity to tap into professional expertise for building a diversified, high-performing portfolio. For those seeking tailored investment solutions, Zebu stands out as a trusted partner in this journey.

This guide breaks down how PMS works, its benefits, and why Zebu could be the key to unlocking your financial growth.

1. What is Portfolio Management Services (PMS)?

PMS is a professional investment service where a portfolio manager handles your investments based on your financial goals and risk appetite. Unlike mutual funds, PMS gives you direct ownership of securities and a customized approach ensuring your portfolio reflects your personal wealth ambitions.

Why Choose PMS?

Personalized strategy tailored to your financial goals

Direct ownership of assets for more control

Active management to adapt to changing market conditions

With Zebu, you get the advantage of seasoned market expertise paired with advanced technology making your money work smarter.

2. Benefits of Expert-Led Portfolio Management

a) Professional Expertise at Your Fingertips

One of the biggest advantages of PMS is having a dedicated financial expert making decisions on your behalf. Zebu’s portfolio managers continuously monitor the market, study trends, and make data-driven decisions to maximize returns.

Zebu’s Edge:

A team of experienced professionals guiding your investments

Market research and analysis for smarter decision-making

Proactive adjustments to stay ahead of market shifts

Investor Benefit:

Avoid emotional decisions and market speculation

Stay on track with your long-term goals

b) Tailored Strategies for Unique Goals

Everyone’s financial journey is different your investment strategy should be too. Whether you’re aiming for wealth creation, steady income, or capital preservation, Zebu customizes the portfolio to align with your aspirations.

Zebu’s Approach:

Personalized financial plans designed around your goals

Flexible adjustments as your life and market conditions change

Dedicated support to ensure your strategy stays on track

Investor Gain:

A personalized roadmap to achieve your financial dreams

Confidence that your investments evolve with you

c) Diversification and Risk Control

Diversification is key to minimizing risk while ensuring growth. PMS ensures your portfolio spreads across multiple asset classes, reducing exposure to market volatility. Zebu employs advanced risk analysis techniques to strike the right balance between risk and reward.

How Zebu Protects Your Wealth:

Balanced asset allocation across equities, bonds, and alternatives

Data-driven risk analysis to mitigate potential losses

Continuous portfolio performance tracking

Investor Win:

A balanced portfolio that weathers market fluctuations

Enhanced growth potential with reduced risk

3. Who Should Consider PMS?

PMS is designed for high-net-worth individuals (HNIs) and investors looking for personalized, expert-driven investment strategies. It’s ideal for those who:

Prefer a hands-off investment approach with professional oversight Seek direct ownership of stocks and securities Want a customized plan rather than a one-size-fits-all solution If that sounds like you, Zebu’s PMS could be the key to unlocking your portfolio’s potential.

4. Why Zebu’s PMS Stands Out

Choosing the right PMS provider is crucial. Zebu combines market expertise, data insights, and client-first values to deliver a superior investment experience. With Zebu, you get:

Tailored strategies designed by seasoned market experts

Advanced risk management to safeguard your capital

Real-time performance tracking for full transparency

When market conditions change, Zebu adapts — ensuring your portfolio remains resilient and aligned with your financial goals.

5. Begin Your Wealth-Building Journey with Zebu

Investing is no longer just about picking stocks it’s about having a clear, expert-led strategy that adapts to changing markets. PMS offers a smarter, more personalized way to grow your wealth, and Zebu provides the professional guidance, technology, and transparency you need to succeed.

Ready to let experts guide your financial future? Trust Zebu to lead you toward long-term, sustainable wealth growth.

Disclaimer: Investments in securities are subject to market risks. This guide is for informational purposes only and does not constitute financial advice. Always consult a SEBI-registered advisor and perform your due diligence before investing.

#zebu#finance#investment#mutual funds#financialfreedom#investing#investmentgoals#investors#investwisely#makemoney#Zebuetrade

0 notes

Text

Secure Your Future with Smart Wealth Creation

We all dream of financial independence, but achieving it requires a structured approach. Smart wealth creation is not about overnight success—it’s about making informed decisions, leveraging the right investment opportunities, and staying financially disciplined. Whether you're an individual or a business, partnering with a wealth management company in Gurgaon can help you navigate financial complexities with expert guidance. In this guide, we’ll take you through actionable steps to financial security, explore the best wealth creation investment options, and break down factors affecting wealth creation in today’s economic landscape.

What is Smart Wealth Creation?

Smart wealth creation is the art of growing financial resources sustainably through diversified investments, strategic planning, and risk management. It involves a mix of asset allocation, passive and active income strategies, and leveraging tax-efficient avenues to ensure long-term growth.

Steps to Financial Security

Achieving financial security isn’t just about earning; it’s about managing, investing, and protecting your wealth wisely. Here are some essential steps:

1. Set Clear Financial Goals

Before jumping into investments, define your goals. Whether it’s buying a home, funding your children’s education, or ensuring a comfortable retirement, having clarity will help shape your investment strategy.

2. Create a Budget and Emergency Fund

A solid budget helps control spending, while an emergency fund safeguards against unforeseen expenses. Ideally, your emergency fund should cover 6-12 months of living expenses.

3. Choose the Right Wealth Creation Investments

Different investments serve different purposes. Here are some options:

Mutual Funds: A great way to diversify and reduce risk.

Stocks and Equities: Higher returns but require risk tolerance.

Real Estate: Provides stability and passive income.

Fixed Deposits and Bonds: Secure but lower return investments.

Retirement Funds: Such as NPS, PPF, and pension plans.

4. Understand Factors Affecting Wealth Creation

Several factors impact how wealth grows, including:

Market Trends & Inflation: High inflation erodes purchasing power, making inflation-beating investments crucial.

Investment Risks: High-risk investments can bring high returns but may lead to significant losses if not managed properly.

Time Horizon & Compounding: The longer your investments stay, the better they benefit from compounding.

5. Work with a Wealth Management Company in Gurgaon

A wealth management company in Gurgaon can provide personalized investment advice, risk assessment, and tax-efficient strategies to maximize your financial growth.

Key Investment Strategies for Smart Wealth Creation

Investing without a strategy is like sailing without a map. Here are some proven strategies:

1. Diversify Your Portfolio

Spreading investments across asset classes minimizes risk. A mix of equities, fixed-income securities, and real estate provides stability.

2. Leverage Tax Benefits

Utilize tax-saving investment options such as ELSS, NPS, PPF, and 80C deductions to reduce liabilities and increase wealth.

3. Regularly Review and Rebalance Your Portfolio

Markets fluctuate, and so should your investment approach. Assess your portfolio every 6-12 months to align with your financial goals.

4. Automate Savings and Investments

Systematic Investment Plans (SIPs) and automated savings ensure disciplined investing, preventing emotional decision-making.

5. Stay Informed and Adapt

Financial markets evolve, so staying updated with trends and economic shifts ensures smarter investment decisions.

Key Factors Affecting Wealth Creation

What are the key factors affecting wealth creation?

Market Trends & Inflation: Impacts purchasing power and investment value.

Investment Risks: Higher risks can lead to greater returns but require careful planning.

Time Horizon & Compounding: The longer your money stays invested, the more it grows.

Taxation Policies: Optimize investments based on tax efficiency.

Financial Discipline: Regular savings and budget control significantly impact wealth growth.

Take Charge of Your Financial Future

The journey to smart wealth creation requires planning, patience, and the right investment strategies. Whether you’re just starting or looking to optimize your existing wealth, these steps will set you on the path to financial independence.

Looking for expert guidance? BellWether—a leading wealth management company in Gurgaon—offers tailored investment solutions, tax planning, and risk management strategies to help you achieve long-term financial success.

FAQs on Smart Wealth Creation

1. What is the best wealth creation investment for beginners?

Beginners should start with mutual funds, fixed deposits, and PPF accounts for stability. As risk tolerance increases, stock market investments and real estate can be added.

2. How can I ensure financial security in the long run?

To achieve long-term financial security, follow a disciplined approach: set financial goals, create an emergency fund, diversify investments, and regularly review your portfolio.

3. What role does a wealth management company play?

A wealth management company in Gurgaon provides personalized investment plans, risk assessment, and tax-efficient strategies to help you grow and protect wealth efficiently.

4. How does inflation affect wealth creation?

Inflation reduces purchasing power over time. Investing in inflation-beating assets like equities, real estate, and gold can help maintain financial growth.

5. Is it too late to start investing after 40?

No, it’s never too late! Consider tax-saving options, retirement funds, and diversified portfolios to maximize returns and build wealth efficiently.

#smart wealth creation#financial security#wealth management#investment strategies#Gurgaon financial experts

0 notes

Text

Best Diploma in Finance-Learn & Succeed

Diploma in Finance: A Pathway to a Lucrative Career

Introduction: Why Choose a Diploma in Finance?

A Diploma in Finance एक शानदार option है अगर आप financial sector में career बनाना चाहते हैं। यह program आप��ो banking, investment और risk management मे�� deep knowledge देता है।

Finance sector में jobs की demand बढ़ रही है, जिससे इस field में opportunities काफी बढ़ गई हैं। अगर आप finance में strong foundation चाहते हैं, तो यह diploma आपके लिए perfect है।

What is a Diploma in Finance?

A Diploma in Finance एक short-term course है जो आपको financial principles और market trends सिखाता है। यह course accounting, taxation और corporate finance के basics को cover करता है।

इस course को complete करने के बाद आप banking, insurance, और stock market जैसी fields में job पा सकते हैं। यह course theoretical knowledge के साथ-साथ practical skills भी develop करता है।

Benefits of Pursuing a Diploma in Finance

1. Short Duration, High Returns

यह course कम समय में पूरा होता है और आपको अच्छी job opportunities देता है। Traditional degrees की तुलना में यह course कम investment में अच्छा return देता है।

2. Wide Career Opportunities

Diploma करने के बाद आप financial analyst, accountant, या banking sector में jobs पा सकते हैं।

3. Skill Enhancement

यह program आपको accounting, taxation और risk analysis जैसी skills develop करने में मदद करता है।

Eligibility Criteria for a Diploma in Finance

इस course में admission के लिए आपको 12th pass होना जरूरी है। कुछ institutions entrance exams भी conduct करते हैं।

अगर आप graduation के बाद यह course करते हैं, तो career growth के ज्यादा chances होते हैं।

Course Curriculum: What Will You Learn?

A Diploma in Finance में कई core subjects होते हैं जो आपको finance field में expert बनाते हैं।

1. Financial Accounting

Accounting principles और financial statements की deep knowledge मिलती है।

2. Investment Management

Stock market और mutual funds में invest करने के smart तरीके सिखाए जाते हैं।

3. Risk and Insurance Management

Financial risks को analyze करके insurance policies को समझने की ability develop होती है।

4. Corporate Finance

Business world में finance की role को समझने में मदद करता है।

Job Opportunities After a Diploma in Finance

A Diploma in Finance आपको कई career options देता है। कुछ popular career paths नीचे दिए गए हैं:

1. Financial Analyst

Companies के financial data को analyze करके उन्हें smart decisions लेने में मदद करना।

2. Banking Sector Jobs

Banks में accounting और loan processing जैसी jobs के लिए opportunities मिलती हैं।

3. Tax Consultant

Income tax और GST जैसे areas में expert बनकर clients को financial guidance देना।

4. Stock Market Expert

Investment strategies को समझकर trading और portfolio management करना।

How to Choose the Right Institute for a Diploma in Finance?

1. Accreditation and Reputation

किसी भी institute को चुनने से पहले उसकी accreditation और reputation check करें।

2. Course Curriculum

Course content updated और industry-relevant होना चाहिए।

3. Placement Assistance

Institutes जो placements offer करते हैं, उनमें admission लेने से career growth के chances बढ़ जाते हैं।

Challenges in the Finance Industry & How to Overcome Them

1. Constantly Changing Regulations

Government policies और taxation laws में हमेशा changes होते रहते हैं। इसलिए updated रहना जरूरी है।

2. Competitive Job Market

Finance industry में jobs के लिए high competition होता है, इसलिए skill development बहुत जरूरी है।

3. Technological Advancements

आजकल finance sector में AI और blockchain का use बढ़ रहा है, इसलिए नए tools सीखना जरूरी है।

Conclusion: Is a Diploma in Finance Worth It?

A Diploma in Finance career के लिए एक बेहतरीन investment है। यह short-duration course आपको financial industry के लिए तैयार करता है।

अगर आप finance sector में career बनाना चाहते हैं, तो यह diploma आपके लिए perfect choice हो सकता है। यह आपको job-ready बनाता है और financial knowledge को enhance करता है।

Accounting Course in Delhi ,

Diploma in Taxation Course

courses after 12th Commerce ,

after b com which course is best ,

Diploma in finance,

SAP fico course fee,

Accounting and Taxation Course ,

GST Course ,

Basic Computer Course ,

Payroll Course in Delhi,

Online Tally course ,

One year diploma course ,

Advanced Excel classes in Delhi ,

Diploma in computer application course

Data Entry Operator Course,

diploma in banking finance ,

Stock market Course ,

six months course

Income Tax

Accounting

Tally

Career

0 notes