#Cash vs Accrual Accounting

Explore tagged Tumblr posts

Text

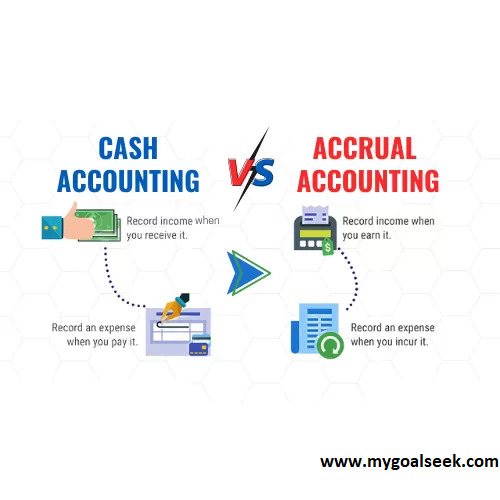

Discover the disparities between cash and accrual accounting to manage finances effectively. Cash accounting records transactions when cash exchanges hands, whereas accrual accounting recognizes revenue and expenses when they are incurred, regardless of cash flow. Understand these methods to make informed financial decisions for your business's success.

#Cash vs Accrual Accounting#cash vs accrual#basis of accrual accounting#accounting method accrual or cash#accrual accounting basis

0 notes

Text

Cash Accounting vs Accrual Accounting in Healthcare

Accrual accounting in healthcare records revenues and expenses when earned or incurred, matching them to the period they relate to, providing a more accurate financial picture. Cash accounting, however, recognizes transactions only when cash is exchanged, potentially distorting cash basis net income. In medical accounting, accuracy is crucial, reflecting net income accrual basis for comprehensive financial analysis.

#Accrual accounting in healthcare#cash basis net income#medical accounting#Cash Accounting vs Accrual Accounting in Healthcare

0 notes

Text

This won't make sense to most of you, but those of you that do business financials on a cash basis I hope we never meet because I will end up on the news.

I DESPISE cash books so much.

Accrual for life

0 notes

Text

Counting on Accounting: Cash Vs Accrual Accounting

Every business is unique in its way and so are its methods of working. Depending upon the need of the business or the ease of owner they decide the way they wish to transact with customers, products, purchase, sales, and stakeholders or even with the books of account. Where there are two types of recording transactions, viz. Cash accounting and accrual accounting; businessman opts for the one that suits his objectives.

What is cash accounting?

In simple terms, recording the transaction when the cash is paid is cash accounting. Be it income or expenditure, when the cash is transacted, is the time when the transaction is recorded in the book of accounts. For example, if the x party has purchased something from y in January and has not paid any cash for the transaction done in the same month. The transaction will not be recorded. On the other hand, when the party clears the due in February, the transaction is recorded in February.

Is that suitable for your business type?

Since this is real-time cash transaction tapping, it is always the first choice, so that the cash gets tallied. But in actuality, this is more suitable for all those who deal with a limited cash business transaction. Moreover, if the business is small and mostly the type of transaction done is cash-based, this should suit your business needs.

Accrual Accounting:

In simple terms, this is the type of account where the transactions are recorded even when they are not realized in cash. This is exactly the opposite of recording the cash transaction. The income or expenditure is recorded in the book of accounts irrespective of the time frame when it has occurred. For instance, when Vendor A sells his good to B and asks him to settle his accounts to clear his dues in the weekend, B has an increase in purchasing power and hence this leverages his business. A would only record the transaction without the time or cash constraint as he is dealing with books by the accrual accounting method.

Keeping the stuff simple, cash being earned or not, the revenue is recorded as soon as the product is sold or the services are offered, ensuring that the expenditure is recorded as well.

Is that suitable for your business type?

Well, if you are dealing with huge cash transactions, or you are in macro business; it is a sure shot Yes! When you have more than certain cash transactions, it is not manageable to record them always. Hence the same is recorded in the accrual accounting pattern.

Let’s get into a sneak peek as to how cash accounting differs from accrual accounting:

If you wish to know your exact cash transaction done in a day, cash accounting shall be a great aid. Think of a moment when you recorded cash but have not paid in the expenses, will that give you the exact picture? The answer to the same is NO!. The income in cash can be recorded if done in the day whereas in accrual the expenditure and income both can be recorded, hence providing you the exact picture. Cash accounting will not provide you with a clear picture if payable and receivable are not done on the same day.

Cash is the easiest way to apply in day-to-day accounting methods, whereas accrual is a bit complex. However, GAAP and IFRS acknowledge the accrual accounting method.

The income level recorded in the cash accounting system will be less and the levels in comparison will be more in the accrual accounting system as the cash will be actual and the income will be assumed. Cash received can be part of actual cash on hand in the cash accounting system, whereas Income is not equal to cash flow. All in all, Different business has different strategies and so is the accounting system. Pick up the method that suits the need of the business.

2 notes

·

View notes

Text

10 Essential Bookkeeping Tips To Keep Your Business Finances In Check

Introduce the importance of accurate bookkeeping for business success, emphasizing how it helps track income, manage expenses, and maintain a clear picture of financial health. Mention that whether you’re a small business owner or managing a large corporation, good bookkeeping practices are essential.

Outline:

Separate Personal and Business Finances Explain the importance of having separate accounts to avoid confusion and simplify tax time.

Track Every Expense Describe how tracking every expense, no matter how small, adds up to a more accurate financial picture.

Automate Where Possible Suggest using bookkeeping software to automate data entry and reduce human error.

Stay on Top of Invoicing Offer tips on creating a consistent invoicing system to improve cash flow.

Schedule Time for Weekly Financial Review Encourage readers to set aside time each week to review financial reports.

Keep Your Receipts Organized Provide ideas for organizing receipts digitally, making it easier for audits and tax filing.

Understand Basic Accounting Principles Briefly explain terms like debits, credits, and accrual vs. cash accounting.

Prepare for Tax Time Throughout the Year Suggest setting aside funds for taxes and keeping accurate records to ease tax season stress.

Work with a Professional Accountant Explain the benefits of working with an accountant, especially as the business grows.

Regularly Backup Financial Data: Recommend secure data backup solutions to prevent data loss.

Conclusion: Wrap up by emphasizing how consistent bookkeeping habits lead to financial clarity, better decision-making, and business growth. Encourage readers to implement these tips right away for a more organized financial future.

0 notes

Text

Cash Basis Accounting vs. Accrual Accounting: Key Differences

In the world of accounting, small businesses have to make critical decisions about how to record and report their finances. For many, especially those just starting out or those with simpler bookkeeping needs, cash basis accounting becomes the method of choice. Cash basis accounting provides a straightforward way of managing finances without the complexities of more advanced systems. In this article, we’ll cover everything you need to know about cash basis accounting, its benefits, limitations, and why it’s commonly favored among small businesses.

What is Cash Basis Accounting?

Cash basis accounting is a method of accounting in which revenue is recorded when cash is received, and expenses are recorded when they are paid. Unlike accrual accounting, which records revenue and expenses when they are earned or incurred, cash basis accounting strictly follows the actual cash flow of the business. This makes it easy for business owners to understand their current cash position, making it a popular choice for small businesses and individuals.

For instance, if you run a small service business and receive payment for your work only when the client pays, cash basis accounting records that income at the time of payment. The same applies to expenses: costs are recorded only when cash goes out.

Why Small Businesses Choose Cash Basis Accounting

Cash basis accounting offers simplicity and ease of use, making it ideal for smaller companies that may not have a dedicated finance team. Here’s why many small businesses, including those utilizing Small Business Bookkeeping Services in USA, choose cash basis accounting:

Easy to Implement and Understand

Cash basis accounting requires minimal knowledge of complex accounting practices, allowing business owners to handle their finances with basic bookkeeping skills. Many small businesses don’t have the resources to hire an accountant or bookkeeper, so a simpler method is advantageous.

Better Cash Flow Management

Cash basis accounting provides a clear picture of the cash available to the business. Since it only records transactions when cash changes hands, small businesses can easily track their liquidity, which helps in managing day-to-day expenses.

Tax Advantages

In some cases, cash basis accounting can provide tax advantages for small businesses. Since income is only recorded when it’s received, businesses may be able to defer income at year-end to reduce tax liability for the current year.

Cost-Effective

Cash basis accounting is less costly to implement than accrual accounting. With fewer journal entries and adjustments required, it minimizes the need for comprehensive bookkeeping services, though some businesses still prefer to consult Small Business Bookkeeping Services in USA to ensure compliance and accuracy.

How Does Cash Basis Accounting Work?

In cash basis accounting, every transaction is recorded when there is an actual movement of cash. This means:

Revenue is recorded only when cash or payment is received.

Expenses are recorded only when they are paid out.

Let’s look at an example:

Suppose a small business completes a project for a client in November but doesn’t receive payment until December. Under cash basis accounting, the revenue from this project would be recorded in December, the month in which the payment was actually received. Similarly, if the business purchased supplies in October but didn’t pay the supplier until November, the expense would be recorded in November.

Pros and Cons of Cash Basis Accounting

Pros

Simplicity: Cash basis accounting is easy to understand and operate, making it a user-friendly method for small businesses.

Clear Cash Flow Picture: Since the method aligns with actual cash flow, it’s easier to see how much cash is available at any given time, which is valuable for managing cash reserves.

Lower Costs: Implementing cash basis accounting is cost-effective and often less time-consuming than accrual accounting. Businesses working with Small Business Bookkeeping Services in USA can typically expect lower fees if they use cash basis accounting, as it requires fewer adjustments and entries.

Potential Tax Benefits: Businesses can potentially defer income to reduce tax liability, especially if payments for services rendered are delayed until after the new tax year.

Cons

Limited Financial Insights: Cash basis accounting does not provide a complete picture of a company’s financial health, as it does not account for receivables and payables.

Less Accurate Financial Analysis: Because revenue and expenses are only recorded when cash changes hands, this method may not give an accurate representation of long-term profitability.

Not Suitable for All Businesses: Larger companies, those with complex financial structures, or companies with extensive inventories are generally required to use accrual accounting for a more precise view of their finances.

Not GAAP-Compliant: The Generally Accepted Accounting Principles (GAAP) favor accrual accounting, so if a business plans to seek investment or loans, they may eventually need to switch to an accrual basis.

Cash Basis vs. Accrual Accounting

Understanding the difference between cash basis and accrual accounting is crucial for small business owners, especially when seeking Small Business Bookkeeping Services in USA.

Is Cash Basis Accounting Right for Your Small Business?

Choosing cash basis accounting over accrual accounting depends on the nature of your business, your goals, and your resources. For many small businesses that prioritize cash flow management and simplicity, cash basis accounting offers a range of benefits. However, businesses that have large inventories, significant credit sales, or ambitious growth plans might consider accrual accounting for a clearer long-term financial outlook.

Consulting with Small Business Bookkeeping Services in USA can help assess whether cash basis accounting is the best fit for your unique business needs. Professional bookkeepers can provide valuable insights and help you understand the financial implications of choosing one method over the other.

How Small Business Bookkeeping Services in USA Can Support Cash Basis Accounting

For small business owners who lack accounting expertise, working with professional bookkeeping services can bring several advantages. Here’s how Small Business Bookkeeping Services in USA can support cash basis accounting:

Setting Up the Books

Setting up a cash basis system requires proper categorization of accounts and understanding tax implications. A professional service can help streamline this setup and provide guidance on key cash flow metrics.

Accurate Cash Flow Tracking

Small businesses often need help tracking inflows and outflows accurately. Bookkeeping services can ensure that every cash transaction is recorded accurately, giving business owners a precise view of their cash position.

Preparing for Tax Season

Many small business owners choose cash basis accounting to simplify tax filing. Bookkeeping services can prepare year-end financial statements and tax-ready reports, ensuring that all income and expenses are properly documented.

Monitoring Business Health

Even with cash basis accounting, it’s essential to keep an eye on the financial health of the business. Bookkeepers can provide regular financial statements and insights that help owners monitor cash flow trends and make better business decisions.

Transition Support if Needed

If a business grows and needs to switch to accrual accounting, bookkeeping services can facilitate a smooth transition, ensuring continuity and accuracy in the financial records.

Conclusion

Cash basis accounting is a simple yet effective accounting method that meets the needs of many small businesses. By focusing on actual cash movements, it enables business owners to track their liquidity without complicated accounting processes. Though it has its limitations, the benefits of cash basis accounting make it a practical choice for startups and small companies with straightforward financial transactions.

For businesses looking to enhance their accounting practices, Small Business Bookkeeping Services in USA can provide essential support, ensuring accuracy in cash basis records, guidance on tax planning, and expert insights into business financials. Ultimately, cash basis accounting can offer small businesses the ease and clarity they need to manage finances effectively, helping them to focus on growth and success.

0 notes

Text

youtube

Strategy 6 Cash vs. Accrual Accounting https://www.youtube.com/watch?v=IQb7LQDnT50 Strategy 6 Cash vs. Accrual Accounting Do you run a construction business and want to reduce your tax liability in 2024? In this video, we’ll share 12 crucial tax-saving strategies to help your business grow while keeping more money in your pocket. For personalized advice, visit my website at https://ift.tt/S0PN8Yq From choosing the right business structure to maximizing tax credits, we break down how successful business owners like Bob use these tactics to protect their assets and save big. Don’t miss out on tips for payroll tax, expense tracking, and even planning for multiple business exits! 📚 Avoid tax pitfalls in retirement with insights from "Avoiding the Nine Biggest Tax Mistakes." Check it out on Amazon: https://a.co/d/5nExzeB Bob and his partner Sally, who are balancing family and business, face tax challenges as their construction company grows. With guidance from tax consultant David Tuck, an ex-IRS auditor, they implement 12 tax-saving strategies, including choosing the right business structure, separating finances, leveraging tax credits, and planning multiple exits. These strategies reduce tax liabilities, protect assets, and secure the financial future. Learn how to optimize your business's tax planning and ensure long-term success with these insightful tips. Subscribe, like, and leave a comment to stay updated on more tax-saving tips for your business. This video is about 12 Tax-Saving Strategies For Construction Businesses In 2024 (Do It Now!). But It also covers the following topics: Construction Business Tax Tips How To Save On Taxes Tax Strategies For Small Business 🔔 Avoid overpaying on taxes and maximize your wealth! Subscribe now for expert Portland tax advice, retirement planning, and strategies to grow your wealth! https://www.youtube.com/@TaxAnvil/?sub_confirmation=1 🔗 Stay Connected With Me. 👉 Facebook: https://ift.tt/gisTJvj 👉 Twitter (X): https://x.com/AnvilTax 👉 Linkedin: https://ift.tt/fRUqAOv 👉 Website: https://ift.tt/S0PN8Yq 👉 Blog: https://ift.tt/CVkvnoM 📩 For Business Inquiries: [email protected] ============================= 🎬 Recommended Playlists 👉 Tax Planning Insights with Daveed Tuck https://www.youtube.com/playlist?list=PLPNQ5Z_646DO8_79h1DovpYC8HYUJnOLX 👉 Avoiding The Biggest Tax Mistakes Playlist https://www.youtube.com/playlist?list=PLPNQ5Z_646DObYKvEGg-Rdz-zo18I3vvn 🎬 WATCH MY OTHER VIDEOS: 👉 Surprising Tax Deductions Even Criminals Can Use: IRS Tax Loopholes - Portland Tax Tips https://www.youtube.com/watch?v=5kNelL0AvAk 👉 Top NFL Players' Secret Tax Strategies: Portland Business Tax Tips https://www.youtube.com/watch?v=tpX0MqjDU0w 👉Secrets The Wealthy Use To Save Millions: Real Estate Tax Consultant Portland https://www.youtube.com/watch?v=iWEh4gpAmII 👉Why Switching Payroll In Q4 Saves You Time And Money? https://www.youtube.com/watch?v=5LhISn-tVGE ============================= #taxplanning #constructionbusiness #businesstaxes #taxsavings #smallbusiness #payrolltax ⚠️ Disclaimer: I do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of my publications. You acknowledge that you use the information I provide at your own risk. Do your research. ✖️ Copyright Notice: This video and my YouTube channel contain dialogue, music, and images that are the property of Anvil Tax, Inc. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my YouTube channel is provided. © Anvil Tax, Inc. ✨LTC 31902-C via Anvil Tax, Inc. https://www.youtube.com/channel/UCUoFv7UTag1d1H9RoZ5wqmw October 25, 2024 at 12:00AM

#retirementtaxstrategies#avoidingtaxmistakes#wealthmanagement#estateplanning#portlandtaxconsultant#oregontaxplanning#taxpreparationportland#Youtube

0 notes

Text

Financial Transparency: The Backbone of Non-Profit Success

Non-profit organizations play a vital role in addressing social, environmental, and economic challenges. To achieve their missions, non-profits rely on financial resources from donors, grants, and other sources. Effective financial management is crucial to ensure accountability, transparency, and sustainability. In this article, we'll explore the basics of financial statements for non-profits and why accounting is beneficial.

Basic Financial Statements for Non-Profits

Balance Sheet (Statement of Financial Position): Provides a snapshot of assets, liabilities, and net assets at a specific point in time.

Income Statement (Statement of Activities): Reports revenues, expenses, and changes in net assets over a specific period.

Statement of Cash Flows: Shows inflows and outflows of cash and cash equivalents.

Statement of Functional Expenses: Classifies expenses by program, administrative, and fundraising categories.

Why Accounting for Non-Profits is Beneficial

Transparency and Accountability: Accurate financial reporting ensures stakeholders understand how resources are utilized.

Compliance: Non-profits must adhere to laws, regulations, and grant requirements.

Decision-Making: Reliable financial data informs strategic decisions.

Fundraising: Financial transparency attracts donors and grants.

Resource Optimization: Effective accounting helps allocate resources efficiently.

Risk Management: Identifies potential financial risks and opportunities.

Stakeholder Trust: Demonstrates commitment to responsible financial management.

Key Accounting Principles for Non-Profits

Fund Accounting: Tracks restricted and unrestricted funds.

Accrual Accounting: Recognizes revenues and expenses when earned/incurred.

GAAP (Generally Accepted Accounting Principles) Compliance.

FASB (Financial Accounting Standards Board) Guidelines.

Benefits of Accounting for Non-Profits

Improved financial management and planning.

Enhanced credibility with donors and stakeholders.

Better decision-making and resource allocation.

Compliance with laws and regulations.

Increased transparency and accountability.

Reduced financial risk and errors.

Improved grant management and reporting.

Common Accounting Challenges for Non-Profits

Tracking and reporting restricted funds.

Managing grants and contracts.

Accounting for in-kind donations.

Classifying expenses (program vs. administrative).

Ensuring GAAP compliance.

Best Practices

Regular financial statement reviews.

Independent audits.

Budgeting and forecasting.

Financial reporting to stakeholders.

Ongoing staff training and development.

Implementing accounting software.

Seeking professional advice.

Conclusion

Effective accounting and financial management are essential for non-profit organizations. By prioritizing transparency, accountability, and compliance, non-profits can:

Enhance credibility and stakeholder trust

Optimize resource allocation

Manage risks and opportunities

Achieve long-term sustainability

Hiring a non profit accountant is a strategic decision that can benefit your organization in numerous ways

Note: This article provides general information and is not intended to be a comprehensive guide or professional advice. Consult a certified public accountant or financial expert for specific guidance on non-profit accounting.

0 notes

Text

Cash Basis Accounting vs. Accrual Accounting: Key Differences

Cash basis accounting is a straightforward and popular accounting method, especially for small businesses. In this guide, we will explore what Cash basis accounting is, how it works, and its advantages and disadvantages. We will also explain why it is often the preferred method for small businesses and how it fits into Small Business Bookkeeping Services in the USA.

What is Cash Basis Accounting?

Cash basis accounting is a method where revenue and expenses are recorded only when cash is actually received or paid. Unlike the accrual method of accounting, where transactions are recorded when they are incurred (regardless of when cash changes hands), cash basis accounting focuses on the actual flow of money in and out of the business.

For instance, if you provide a service in March but don't receive payment until May, under cash basis accounting, the income is recorded in May when the cash is received, not in March when the service was provided. The same applies to expenses – they are recorded when the payment is made, not when the expense is incurred.

This simplicity makes cash basis accounting ideal for businesses with straightforward transactions or those with limited bookkeeping resources, including Small Business Bookkeeping Services in the USA. This method is particularly useful for businesses that need to maintain a clear picture of cash flow without getting bogged down in tracking receivables and payables.

Key Features of Cash Basis Accounting

Cash Flow-Oriented: Cash basis accounting gives a clear picture of your cash flow. By focusing solely on money that has actually been received or paid, it provides an immediate and accurate snapshot of your business's liquidity.

Simple to Implement: One of the main reasons small businesses choose cash basis accounting is its simplicity. It requires less bookkeeping, fewer journal entries, and it’s easier to manage without professional accounting assistance. This method aligns perfectly with the services offered by Small Business Bookkeeping Services in the USA, which often cater to small businesses with limited accounting needs.

No Need for Complex Adjustments: Since revenue and expenses are recorded when cash changes hands, there’s no need to deal with complex adjustments for accounts payable or receivable. This is especially beneficial for businesses that handle cash transactions, like retail stores, freelancers, or sole proprietors.

Tax Simplicity: For tax purposes, cash basis accounting is often easier to manage, as the revenue is recognized only when it is received. Many small businesses in the USA use cash basis accounting for tax filing purposes, as it aligns with their cash flow patterns, making tax planning more straightforward.

Benefits of Cash Basis Accounting for Small Businesses

1. Easier to Manage for Non-Accountants Cash basis accounting is often easier to understand and manage, particularly for business owners without a background in accounting. Many small business owners in the USA find it difficult to maintain complex bookkeeping systems, and Small Business Bookkeeping Services in the USA often recommend the cash basis method as it requires fewer entries and less tracking of outstanding receivables or payables.

2. Provides a Real-Time View of Cash Flow One of the main advantages of cash basis accounting is that it gives a real-time view of your cash position. This is critical for businesses that need to keep a close eye on their liquidity, especially small businesses where cash flow issues can quickly become problematic.

For instance, if you are a freelancer or a small business owner in the USA, cash basis accounting can give you a clear picture of how much money you have on hand to cover expenses, payroll, and other costs.

3. Simplifies Tax Reporting Many small businesses opt for cash basis accounting because it can simplify tax reporting. In the USA, the Internal Revenue Service (IRS) allows businesses with an annual gross income of $25 million or less to use cash basis accounting for tax purposes. By using cash basis accounting, you can defer paying taxes on income until it is actually received, which can be a significant advantage for small businesses.

Small Business Bookkeeping Services in the USA often recommend this method to reduce the complexities of tax season. With cash basis accounting, there's no need to worry about paying taxes on revenue that hasn’t yet been collected.

Drawbacks of Cash Basis Accounting

While cash basis accounting offers many advantages, especially for small businesses, it’s important to consider the drawbacks as well.

1. Limited Insight into Financial Health While cash basis accounting provides a clear picture of cash flow, it may not provide a complete view of your business’s financial health. Because it only recognizes income and expenses when cash changes hands, it doesn’t account for outstanding invoices or unpaid bills. This can create a misleading impression of profitability or financial stability.

For example, if you have a large number of unpaid invoices, your cash flow may look healthy, but your actual financial situation could be more precarious. Small Business Bookkeeping Services in the USA can help bridge this gap by offering additional reporting services to keep an eye on receivables and payables, even when using cash basis accounting.

2. Not Suitable for Larger Businesses Cash basis accounting is generally not suitable for larger businesses or those with more complex transactions. The accrual method, which records revenue and expenses when they are incurred (rather than when cash is exchanged), provides a more accurate picture of financial performance for businesses with larger operations or more sophisticated accounting needs.

Larger companies in the USA are required to use the accrual method because it provides a more accurate reflection of the company’s financial health, particularly in terms of long-term liabilities and assets.

3. Inconsistent Financial Results Another potential drawback of cash basis accounting is that it can result in inconsistent financial results from one period to the next. Since transactions are only recorded when cash changes hands, a business might appear to have a windfall in one period and a deficit in another, even if the underlying activity is relatively stable. This variability can make it harder to analyze trends over time or make accurate financial projections.

This is where Small Business Bookkeeping Services in the USA can play a vital role. By providing tailored financial reporting and analysis, bookkeeping professionals can help smooth out these inconsistencies and provide more meaningful insights into business performance.

Cash Basis Accounting vs. Accrual Accounting: Which is Better for Your Business?

Both cash basis accounting and accrual accounting have their strengths and weaknesses. The best choice depends on the size and nature of your business.

Cash Basis Accounting is ideal for small businesses that need a simple and straightforward accounting system. If your business has few transactions and operates mainly on a cash basis, this method will give you a clear picture of your cash flow without the complexities of tracking receivables and payables. This is why many Small Business Bookkeeping Services in the USA recommend cash basis accounting to their clients, especially for sole proprietors, freelancers, and small service providers.

Accrual Accounting, on the other hand, is better suited for businesses that have more complex transactions or those that need to account for income and expenses as they are incurred, regardless of when cash is received or paid. Larger businesses, or those that extend credit to customers or carry significant liabilities, will benefit more from the accrual method.

For small businesses that do not need to track accounts receivable and payable, and that want to focus on cash flow, cash basis accounting is usually the best choice. However, for businesses looking to expand or scale, moving to accrual accounting may provide better financial insights.

Conclusion: Cash Basis Accounting for Small Business Bookkeeping Services in the USA

Cash basis accounting is a popular and practical choice for many small businesses, particularly those with straightforward transactions and a need to keep their bookkeeping simple. It offers a clear view of cash flow, simplifies tax reporting, and reduces the administrative burden associated with more complex accounting systems.

For small businesses in the USA, cash basis accounting is often the recommended method by Small Business Bookkeeping Services. However, it's important to weigh the benefits and drawbacks, especially if your business is growing or if you need a more comprehensive view of your financial health.

Choosing the right accounting method is a crucial decision for any small business. If you’re unsure which method is best for your business, consulting with Small Business Bookkeeping Services in the USA can help ensure that you make the right choice for your financial management needs.

With the right approach, cash basis accounting can be an excellent tool for managing your business's finances and ensuring long-term success. Whether you handle your own books or work with professional bookkeeping services, understanding cash basis accounting will give you the foundation you need to make informed financial decisions and keep your business on the path to growth.

0 notes

Text

The Complete Guide to Law Firm Accounting for Financial Success

This guide covers essential accounting principles, including billing, trust accounting, expense tracking, and compliance with legal regulations. It helps law firms streamline their financial processes, improve cash flow management, and make informed decisions to boost profitability. With practical advice and expert tips, this guide ensures legal professionals understand how to maintain accurate financial records while maximizing their firm's financial performance, ultimately leading to long-term success and growth in a competitive legal landscape.

Understanding the Basics of Law Firm Accounting

Law firm accounting differs from traditional business accounting due to the unique financial responsibilities law firms handle, including client trust accounts and time billing. Understanding these basics is essential for ensuring compliance and maintaining financial stability. This section introduces key concepts such as accrual vs. cash accounting, legal fee structures, and revenue recognition. By mastering these fundamentals, law firms can build a solid financial foundation that promotes accuracy in reporting and helps avoid costly mistakes.

The Importance of Trust Accounting in Law Firm Accounting

One of the most critical aspects of law firm accounting is trust accounting. Lawyers often manage client funds in trust accounts, which must be handled with extreme precision and transparency. Mishandling these funds can lead to severe legal consequences, including disbarment or lawsuits. This section explains the importance of trust accounting, how to track client funds, and the best practices for maintaining compliance with regulatory requirements. Proper management of trust accounts ensures client confidence and protects the firm from potential financial liabilities.

Managing Expenses and Overhead in Law Firm Accounting

Effective law firm accounting requires careful attention to the firm's expenses and overhead. Managing costs like rent, payroll, software, and operational supplies can significantly impact a law firm’s profitability. This section delves into the strategies for budgeting, tracking, and minimizing overhead expenses without compromising the quality of service. It also explores how law firms can benefit from modern financial software that automates expense tracking, offering greater visibility into spending patterns. Smart expense management is a cornerstone of long-term financial success for any law firm.

Invoicing and Billing: Key Components of Law Firm Accounting

Billing and invoicing are central to law firm accounting. Legal services are typically billed on an hourly, flat fee, or contingency basis, and accurate invoicing is vital to maintaining strong client relationships. This section discusses the different billing structures used by law firms and highlights best practices for creating clear and transparent invoices. It also covers the role of automated billing systems in speeding up payments and improving cash flow management. Ensuring that clients receive accurate, detailed invoices helps prevent disputes and ensures timely compensation for legal services.

Financial Reporting and Analysis in Law Firm Accounting

To ensure long-term financial success, law firms need to generate and analyze financial reports regularly. This section explains the importance of tracking key financial metrics such as revenue, profitability, and cash flow. By understanding these reports, law firms can make informed decisions on resource allocation, client management, and strategic growth. Common financial statements covered include balance sheets, income statements, and cash flow reports. With accurate reporting, firms can identify financial trends, adjust their strategies, and drive sustained profitability.

Ensuring Compliance in Law Firm Accounting

Compliance is a crucial component of law firm accounting. Law firms must adhere to various financial and legal regulations, including IRS requirements, local bar rules, and ethical guidelines related to client trust accounts. Failure to comply with these regulations can result in penalties, sanctions, or damaged reputations. This section covers the common regulatory requirements law firms face and offers practical tips for maintaining compliance. By staying updated with accounting standards and legal regulations, firms can avoid costly penalties and maintain a trusted standing in the legal community.

How Technology is Revolutionizing Law Firm Accounting?

Technology plays an increasingly important role in law firm accounting, helping firms automate processes, reduce errors, and improve efficiency. This section explores the various accounting software options available for law firms, such as time tracking tools, billing systems, and trust account management platforms. The adoption of cloud-based accounting solutions allows law firms to access real-time financial data and collaborate more effectively across teams. By embracing technology, law firms can streamline their financial operations, improve accuracy, and gain valuable insights into their financial performance, leading to better decision-making and long-term success.

Conclusion

The Complete Guide to Law Firm Accounting for Financial Success offers a comprehensive approach to managing your legal practice’s finances with precision and efficiency. This guide covers essential accounting principles tailored for law firms, including trust account management, revenue recognition, and expense tracking. By following the best practices outlined, law firms can improve their financial health, ensure compliance with industry regulations, and maximize profitability. Whether you’re a solo attorney or managing a large firm, this guide provides valuable insights and tools to streamline your accounting processes and achieve long-term financial success in the legal industry.

0 notes

Text

The Difference Between the Most Well-Known Accounting Procedures

Understanding the various accounting procedures is essential for businesses to maintain accurate financial records and make informed decisions. At More Than Numbers CPA, recognized as the best accountant firm in Canada, we explain the key differences between the most well-known accounting procedures.

Accrual Accounting vs. Cash Accounting

Accrual Accounting: This method records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. As the best accountant firm in Canada, More Than Numbers CPA recommends accrual accounting for businesses that need a comprehensive view of their financial position, as it reflects all financial commitments and obligations.

Cash Accounting: This method records revenues and expenses only when cash is received or paid. It's simpler and often used by small businesses and sole proprietors. However, the best accountant firm in Canada, More Than Numbers CPA, points out that cash accounting might not provide a complete picture of a company's financial health, especially for businesses with significant receivables or payables.

Single-Entry vs. Double-Entry Accounting

Single-Entry Accounting: This basic accounting system records each financial transaction as a single entry in the financial records. It is straightforward and used primarily by small businesses with minimal transactions. The best accountant firm in Canada, More Than Numbers CPA, notes that single-entry accounting is less detailed and may not provide sufficient information for comprehensive financial analysis.

Double-Entry Accounting: This method involves recording each transaction in two accounts: debits and credits. It ensures that the accounting equation (Assets = Liabilities + Equity) always balances. As the best accountant firm in Canada, More Than Numbers CPA highly recommends double-entry accounting for businesses of all sizes due to its accuracy and reliability in financial reporting.

FIFO vs. LIFO Inventory Valuation

FIFO (First-In, First-Out): This inventory valuation method assumes that the first items added to inventory are the first ones sold. It aligns well with actual physical inventory flow in many businesses. The best accountant firm in Canada, More Than Numbers CPA, suggests FIFO for businesses looking to match inventory costs with current sales prices, often resulting in higher profits during inflationary periods.

LIFO (Last-In, First-Out): This method assumes that the last items added to inventory are the first ones sold. It can be beneficial for tax purposes during times of rising prices, as it matches higher recent costs with current revenues. However, the best accountant firm in Canada, More Than Numbers CPA, warns that LIFO can result in outdated inventory values on the balance sheet.

Depreciation Methods: Straight-Line vs. Declining Balance

Straight-Line Depreciation: This method spreads the cost of an asset evenly over its useful life. It is simple and provides a consistent expense amount each period. The best accountant firm in Canada, More Than Numbers CPA, recommends straight-line depreciation for assets that provide equal utility over their lifespan.

Declining Balance Depreciation: This accelerated method expenses a larger portion of an asset's cost in the early years of its life. It reflects the higher usage or obsolescence rate in the initial years. The best accountant firm in Canada, More Than Numbers CPA, advises using declining balance depreciation for assets that lose value quickly or have higher maintenance costs as they age.

Job Order Costing vs. Process Costing

Job Order Costing: This method assigns costs to specific jobs or batches, making it suitable for businesses that produce customized products or services. The best accountant firm in Canada, More Than Numbers CPA, highlights that job order costing provides detailed cost information for each job, aiding in pricing and profitability analysis.

Process Costing: This method allocates costs to processes or departments and is ideal for businesses producing homogeneous products in continuous processes. The best accountant firm in Canada, More Than Numbers CPA, recommends process costing for industries like manufacturing, where products undergo similar production steps.

Budgeting: Static vs. Flexible Budgets

Static Budget: A static budget is fixed and does not change with variations in business activity levels. It is useful for setting baseline expectations and controlling costs. The best accountant firm in Canada, More Than Numbers CPA, notes that static budgets may not adapt well to changing business conditions.

Flexible Budget: This budget adjusts based on actual activity levels, providing a more accurate reflection of expenses and revenues. The best accountant firm in Canada, More Than Numbers CPA, advises businesses to use flexible budgets for better planning and performance evaluation.

Conclusion

Understanding the differences between these well-known accounting procedures is essential for effective financial management. As the best accountant firm in Canada, More Than Numbers CPA is dedicated to helping businesses choose the right accounting methods to meet their unique needs. By leveraging our expertise, you can ensure accurate financial reporting, compliance, and strategic decision-making. For more information and personalized guidance, contact More Than Numbers CPA, the best accountant firm in Canada, and let us assist you in optimizing your accounting practices.

0 notes

Text

Introduction To Financial Accounting: Principles And Concepts

In the grand tapestry of corporate operations, financial accounting stands tall as the bedrock, an unyielding foundation that not only shoulders the weight of record-keeping and reporting but also orchestrates a harmonious symphony of fiscal intricacies. It transcends its utilitarian role, metamorphosing into a meticulous curator, fashioning a structured framework that not only captures the pulsating lifeblood of financial data but also distills it with an artistry that communicates the narrative of a company’s economic health. This narrative, far from being an internal affair, unfurls itself as a luminous guide, casting its glow on a diverse audience—perceptive investors seeking insight, discerning creditors evaluating risk, and regulatory entities ensuring compliance. In this introductory odyssey, we embark on a deliberate exploration into the foundational principles and bedrock concepts that breathe vitality into financial accounting, unraveling its profound influence on the intricate labyrinth of the business world.

Understanding Financial Accounting

1. Purpose:

Financial accounting aims to provide accurate and timely information about a company’s financial performance and position. This information is essential for decision-making, investment analysis, and ensuring accountability.

2. Principles:

Financial accounting is guided by a set of principles known as the Generally Accepted Accounting Principles (GAAP). These principles ensure consistency, comparability, and reliability in financial reporting across different organizations.

3. Accrual Basis vs. Cash Basis:

Financial accounting follows the accrual basis of accounting, where transactions are recorded when they occur, not when the cash is exchanged. This method provides a more accurate depiction of a company’s financial reality over time.

4. Double-Entry System:

The foundation of financial accounting lies in the double-entry system. Every transaction affects at least two accounts, with debits and credits ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

5. Financial Statements:

Key financial statements generated through financial accounting include the Income Statement, Balance Sheet, and Cash Flow Statement. These reports offer a comprehensive view of a company’s performance, financial position, and cash flows.

Core Concepts in Financial Accounting

1. Entity Concept:

The entity concept asserts that a business is a separate economic entity from its owners. This principle ensures that personal and business finances are distinct, providing clarity in financial reporting.

2. Going Concern Concept:

The going concern idea expects that a business will keep on working endlessly. This allows financial statements to reflect long-term plans and investments, contributing to a more accurate portrayal of the company’s financial health.

3. Historical Cost Concept:

Financial accounting often values assets at their historical cost, representing the original amount paid for them. While market values may change, historical cost provides a reliable and verifiable basis for financial reporting.

4. Consistency Concept:

Consistency in financial reporting is crucial. Companies should apply the same methods and principles consistently over time, allowing stakeholders to compare financial information across different periods.

5. Materiality Concept:

Materiality focuses on the significance of an item or event in financial statements. If an item’s omission or misstatement could influence decision-making, it is considered material and must be accurately reported.

You can contact us by

Phone: +1 (315) 557-6525

Email: at [email protected]

Website: INTQBOOKS SOLUTIONS: YOUR GATEWAY TO EFFICIENT BUSINESS OPERATIONS

Visit us: 701 Market Street, Suite 110 PMB1424 Saint Louis, MO 63101, United States.

#Gst Services in USA#Audit Services in USA#Advisory Services in USA#Excel Services in USA#Intqbooks Solutions

0 notes

Text

Steering Clear Of Audit Triggers: Identifying Red Flags In Bookkeeping

Bookkeeping is the cornerstone of financial management for businesses, serving as a systematic process for recording, organizing, and managing financial transactions. It plays a vital role in providing business owners with a clear understanding of their company’s financial health, facilitating informed decision-making, ensuring compliance with regulations, and supporting long-term growth. In this guide, we will delve into the essential elements of bookkeeping that every business owner should grasp.

Importance of Bookkeeping:

Bookkeeping is essential for businesses of all sizes as it enables owners to track income, expenses, assets, and liabilities accurately. By maintaining proper financial records, business owners can monitor their financial performance, identify trends, and make informed decisions to drive growth and profitability.

Double-Entry Accounting:

Double-entry accounting is a fundamental principle of bookkeeping that ensures every financial transaction impacts at least two accounts: a debit and a credit. This system of recording transactions helps maintain accuracy and balance in financial statements, providing a reliable representation of the company’s financial position.

Chart of Accounts:

The chart of accounts is a categorized listing of all the accounts used by a business to record financial transactions. It typically includes assets, liabilities, equity, revenue, and expenses. Establishing a well-structured chart of accounts is crucial for organizing financial data effectively and facilitating accurate reporting.

Recording Transactions:

Timely and accurate recording of financial transactions is essential for maintaining reliable financial records. This includes documenting sales, purchases, expenses, loans, and payments. Proper documentation ensures transparency and accountability in financial reporting.

Cash vs. Accrual Accounting:

Businesses can use either cash or accrual accounting methods to record transactions. Cash accounting recognizes revenue and expenses when cash is received or paid, while accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of cash flow. Understanding the difference between these methods is critical for financial reporting and tax compliance.

Bank Reconciliation:

Regular bank reconciliation is necessary to ensure that a company’s financial records match its bank statements. This process involves comparing transactions recorded in the accounting system with those in the bank statement, identifying discrepancies, and making necessary adjustments to reconcile the accounts.

Financial Statements:

Bookkeeping produces essential financial statements, including the balance sheet, income statement, and cash flow statement. These statements provide insights into a company’s financial performance, profitability, and liquidity, enabling owners to assess their financial health and make informed decisions.

Budgeting and Forecasting:

Bookkeeping data serves as the foundation for budgeting and financial forecasting. By analyzing past financial trends and projecting future income and expenses, business owners can set realistic financial goals, allocate resources effectively, and make strategic decisions to drive growth and profitability.

Tax Compliance:

Accurate bookkeeping is essential for tax compliance, as it ensures that all income and deductible expenses are properly recorded and reported to the relevant tax authorities.

In conclusion, experts offering CPA bookkeeping services in Marlboro, NJ play a crucial role in optimizing financial management for businesses. Their specialized expertise, comprehensive services, and commitment to accuracy and compliance provide businesses with the confidence and support they need to thrive in today’s competitive landscape.

0 notes

Text

Cash Basis Accounting vs. Accrual Accounting: Key Differences

Accounting methods form the backbone of financial reporting and analysis for any business. Two predominant methods stand out: cash basis accounting and accrual accounting. Understanding these methods is crucial for making informed financial decisions and ensuring accurate reporting. This blog delves into "Cash Basis Accounting vs. Accrual Accounting: Key Differences" to elucidate their distinctions, advantages, and applicability for businesses, particularly small ones.

Introduction to Accounting Methods

Before diving into the specifics, it's essential to understand what accounting methods entail. Essentially, they determine when and how income and expenses are recorded in financial statements. This affects everything from day-to-day bookkeeping to long-term financial strategy.

In the realm of accounting, choosing the right method can significantly impact how you view your financial health and make decisions. For small businesses, the choice between cash basis accounting and accrual accounting can influence everything from tax obligations to cash flow management. Let's explore "Cash Basis Accounting vs. Accrual Accounting: Key Differences" to better understand which might be more suitable for your needs.

Cash Basis Accounting: Simplicity and Clarity

Cash basis accounting is straightforward. Income is recorded when cash is received, and expenses are noted when they are paid. This method aligns with a business's cash flow, providing a clear picture of how much cash is actually available at any given time.

One of the key advantages of cash basis accounting is its simplicity. It's easy to implement and understand, making it ideal for small businesses and sole proprietors who might not have extensive accounting knowledge. Moreover, this method allows for a straightforward approach to bookkeeping, which is particularly beneficial for small business bookkeeping services in the USA, where simplicity and clarity can save both time and money.

Accrual Accounting: A Comprehensive View

Accrual accounting, on the other hand, records income and expenses when they are earned or incurred, regardless of when cash transactions happen. This method provides a more comprehensive view of a company’s financial status by matching revenues with the expenses incurred to generate them.

For larger businesses or those with more complex transactions, accrual accounting offers a better picture of financial health. It allows for more accurate financial forecasting and budgeting, as it includes all earned revenue and incurred expenses, even if cash hasn't changed hands yet. This can be particularly advantageous for companies needing to track long-term liabilities and receivables.

Cash Basis Accounting vs. Accrual Accounting: Key Differences

The most significant difference between cash basis and accrual accounting lies in the timing of transaction recording. This fundamental difference influences several aspects of financial management and reporting:

Revenue Recognition: In cash basis accounting, revenue is recognized only when cash is received. In accrual accounting, revenue is recognized when earned, regardless of when payment is received.

Expense Recognition: Cash basis accounting records expenses when they are paid. Accrual accounting records expenses when they are incurred, even if payment is made later.

Financial Statements: Cash basis financial statements provide a clear view of cash flow but may not accurately represent the overall financial health of a business. Accrual accounting offers a more accurate representation of a business’s financial status, though it can be more complex and require more detailed record-keeping.

Tax Implications

Taxation is another area where "Cash Basis Accounting vs. Accrual Accounting: Key Differences" becomes evident. The IRS allows small businesses (those with average annual gross receipts of $25 million or less over the past three years) to choose between cash and accrual accounting for tax purposes.

Under cash basis accounting, businesses report income in the year it's received and deduct expenses in the year they're paid. This can offer a deferral advantage, as taxes on income are only paid when cash is in hand. However, it can also lead to large tax liabilities in profitable years.

Accrual accounting, while more complex, can provide a more accurate picture of tax liabilities, as it aligns revenue with the expenses incurred to earn it. This can smooth out income and expenses over time, potentially leading to more predictable tax obligations.

Small Business Considerations

For small businesses, the choice between cash basis accounting and accrual accounting can significantly impact their operations. Many small businesses prefer cash basis accounting because of its simplicity and alignment with cash flow. It’s easier to manage and understand, which can be particularly beneficial for owners without a strong accounting background.

However, as businesses grow, accrual accounting might become more advantageous. It offers a more accurate financial picture, which can be crucial for obtaining financing, attracting investors, and managing long-term financial health. For small business bookkeeping services in the USA, understanding these nuances is key to providing the best advice and service to clients.

Practical Examples

To further illustrate "Cash Basis Accounting vs. Accrual Accounting: Key Differences," let's consider two practical examples.

Cash Basis Example: A freelance graphic designer receives a $2,000 payment for a project completed in December but only receives the payment in January. Under cash basis accounting, this income would be recorded in January when the cash is received.

Accrual Basis Example: A construction company completes a project worth $50,000 in December but won't receive payment until March. Under accrual accounting, the $50,000 is recorded as revenue in December, reflecting the earned income, even though the cash hasn't been received yet.

Pros and Cons of Cash Basis Accounting

Pros:

Simplicity: Easy to implement and understand.

Clear Cash Flow: Provides a clear view of available cash.

Tax Deferral: Income is taxed when received, which can be advantageous for deferring tax liabilities.

Cons:

Incomplete Financial Picture: May not accurately reflect long-term financial health.

Limited Applicability: Not suitable for larger businesses or those with complex transactions.

Pros and Cons of Accrual Accounting

Pros:

Accurate Financial Picture: Provides a more comprehensive view of financial health.

Better Matching: Matches revenues with the expenses incurred to generate them.

Useful for Long-Term Planning: More useful for financial forecasting and budgeting.

Cons:

Complexity: More complex and requires detailed record-keeping.

Cash Flow Misalignment: Doesn't align directly with cash flow, which can be confusing for some business owners.

Regulatory Requirements

Regulations also play a significant role in determining which accounting method to use. Public companies are required to use accrual accounting under Generally

Accepted Accounting Principles (GAAP). For small businesses, while there is more flexibility, understanding the regulatory environment is crucial for compliance and optimal financial management.

For businesses operating in the USA, especially those utilizing small business bookkeeping services in the USA, staying compliant with IRS regulations and GAAP standards is vital. Choosing the appropriate accounting method helps ensure accurate reporting and compliance with tax laws.

Impact on Financial Statements

The choice between cash basis accounting and accrual accounting significantly impacts financial statements. Here’s how:

Balance Sheet: Under cash basis, the balance sheet may not show accounts receivable or payable, potentially underrepresenting liabilities and assets. Accrual accounting includes these items, offering a fuller picture of financial position.

Income Statement: Cash basis income statements show income and expenses only when cash changes hands, which can lead to fluctuations that do not reflect actual business activity. Accrual accounting matches revenues with corresponding expenses, providing a more stable and accurate reflection of business performance.

Statement of Cash Flows: This statement is crucial under both methods but interpreted differently. Cash basis accounting naturally aligns with the cash flow statement, while accrual accounting requires adjustments to reconcile net income with cash flow from operations.

Software and Tools

The choice of accounting method also influences the tools and software a business might use. Many accounting software solutions offer support for both methods, but the features and complexity can vary.

For businesses using small business bookkeeping services in the USA, leveraging software that can handle accrual accounting might be necessary as they grow. Solutions like QuickBooks, Xero, and FreshBooks offer robust features to support both methods, ensuring businesses can scale their accounting practices as needed.

Transitioning Between Methods

There might come a time when a business needs to transition from cash basis to accrual accounting, or vice versa. This transition requires careful planning and execution to ensure accuracy and compliance.

When transitioning to accrual accounting, businesses need to start recognizing receivables and payables, which can be a complex process. Conversely, transitioning to cash basis accounting simplifies bookkeeping but requires adjustments to remove receivables and payables from the books.

For small businesses, particularly those relying on small business bookkeeping services in the USA, professional guidance can make this transition smoother. Accountants and bookkeepers with expertise in both methods can provide the necessary support to ensure a seamless switch.

Industry-Specific Considerations

Different industries might favor one accounting method over the other. For instance:

Service-Based Businesses: Often prefer cash basis accounting due to its simplicity and direct alignment with cash flow.

Manufacturing and Retail: Typically use accrual accounting to better match revenues with the cost of goods sold and to manage inventory accurately.

Construction: Frequently use a hybrid approach, incorporating elements of both methods to manage project-based accounting more effectively.

Understanding "Cash Basis Accounting vs. Accrual Accounting: Key Differences" in the context of specific industries helps businesses make more informed choices.

Case Studies

Case Study 1: A Small Retail Business

A small retail business initially uses cash basis accounting for simplicity. As it grows, the owner finds it challenging to manage inventory and match revenues with the cost of goods sold. Transitioning to accrual accounting provides a clearer picture of profitability and helps in managing inventory more effectively.

Case Study 2: A Freelance Consultant

A freelance consultant prefers cash basis accounting to keep bookkeeping simple and directly tied to cash flow. This method works well, allowing for straightforward tax reporting and easy management of personal and business finances.

Choosing the Right Method

Deciding between cash basis and accrual accounting depends on several factors, including business size, complexity, and financial goals. Small businesses often start with cash basis accounting for its simplicity but may transition to accrual accounting as they grow and require more detailed financial analysis.

For those offering small business bookkeeping services in the USA, understanding the nuances of both methods allows them to provide tailored advice to clients. Helping clients choose the right method ensures accurate financial reporting and better long-term financial management.

Conclusion

"Cash Basis Accounting vs. Accrual Accounting: Key Differences" reveals that while both methods have their merits, the choice largely depends on the specific needs and circumstances of the business. Cash basis accounting offers simplicity and clarity, making it ideal for small businesses and sole proprietors. Accrual accounting, though more complex, provides a comprehensive financial picture, essential for larger businesses and long-term planning.

For small business bookkeeping services in the USA, understanding these differences is crucial. Providing clients with informed advice on the best accounting method can enhance their financial health and compliance. As businesses evolve, revisiting the chosen accounting method ensures it continues to meet their needs, supporting growth and success in the competitive business landscape.

0 notes

Text

Real estate accounting is a critical component of managing real estate investments and operations. It involves tracking income and expenses, maintaining accurate financial records, and ensuring compliance with relevant regulations and standards. This comprehensive guide will delve into the essential aspects of real estate accounting, providing valuable insights for property managers, investors, and accounting professionals.

Key Principles of Real Estate Accounting

Accrual vs. Cash Accounting

In real estate accounting, accrual accounting and cash accounting are two fundamental methods.

Accrual Accounting: This method records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. It provides a more accurate picture of a company’s financial health.

Cash Accounting: This simpler method records revenues and expenses only when cash changes hands. While easier to maintain, it may not provide as complete a financial picture as accrual accounting.

Revenue Recognition

Revenue recognition is crucial in real estate accounting. It involves determining when and how to record income from various sources such as rental income, sales of properties, and service fees. Proper revenue recognition ensures compliance with accounting standards and provides a clear view of financial performance.

Expense Tracking

Accurately tracking expenses is vital for real estate businesses. Common expenses include property maintenance, utilities, insurance, property taxes, and management fees. Detailed records help in budgeting, tax preparation, and financial analysis.

Specialized Real Estate Accounting Topics

Depreciation of Real Estate Assets

Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life. In real estate, buildings and improvements are depreciated, but land is not. Understanding and applying depreciation correctly is essential for accurate financial reporting and tax compliance.

Straight-Line Depreciation: The most common method, spreading the cost evenly over the asset’s useful life.

Accelerated Depreciation: Allows for higher expenses in the early years of the asset’s life, beneficial for tax purposes.

1031 Exchanges

A 1031 exchange, under the Internal Revenue Code, allows real estate investors to defer capital gains taxes when they sell a property and reinvest the proceeds in a similar property. This strategy is highly advantageous for managing tax liabilities and growing investment portfolios.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-producing real estate. Accounting for REITs involves unique considerations, including special tax treatments and regulatory requirements. Investors in REITs must understand how these entities are structured and how their income is reported and taxed.

Financial Reporting for Real Estate

Balance Sheets

A real estate balance sheet provides a snapshot of a company’s financial position at a specific point in time. Key components include assets (properties, cash, receivables), liabilities (loans, payables), and equity (owner’s capital, retained earnings).

Income Statements

The income statement, or profit and loss statement, shows the company’s revenues, expenses, and profits over a period. For real estate businesses, it includes rental income, property sales, management fees, and associated expenses.

Cash Flow Statements

Cash flow statements track the inflow and outflow of cash within the business. For real estate companies, this includes rental income, property sales proceeds, mortgage payments, maintenance expenses, and other operational cash flows. Understanding cash flow is crucial for ensuring liquidity and financial stability.

Regulatory Compliance in Real Estate Accounting

GAAP and IFRS Standards

Real estate accounting must comply with Generally Accepted Accounting Principles (GAAP) in the United States or International Financial Reporting Standards (IFRS) internationally. These frameworks provide guidelines for financial reporting, ensuring consistency, transparency, and comparability of financial statements.

Tax Compliance

Real estate businesses must adhere to various tax regulations, including property taxes, income taxes, and capital gains taxes. Accurate record-keeping and timely tax filings are essential to avoid penalties and optimize tax liabilities.

Audit Requirements

Periodic audits, either internal or external, are vital for ensuring the accuracy and integrity of financial records. Audits help identify discrepancies, improve financial controls, and enhance investor confidence.

Technology and Real Estate Accounting

Accounting Software

Modern accounting software tailored for real estate businesses can streamline financial management. Features include automated invoicing, expense tracking, financial reporting, and integration with other business systems.

Blockchain and Real Estate Transactions

Blockchain technology is emerging as a transformative force in real estate transactions, offering enhanced security, transparency, and efficiency. Blockchain can facilitate more accurate and tamper-proof record-keeping, particularly in areas like property transfers and lease agreements.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are revolutionizing real estate accounting by improving accuracy, reducing manual workloads, and providing predictive analytics. AI-powered tools can analyze large datasets to uncover trends, optimize financial strategies, and ensure compliance with accounting standards.

Best Practices in Real Estate Accounting

Maintain Detailed Records

Keeping meticulous records of all financial transactions, including receipts, invoices, contracts, and statements, is foundational to effective real estate accounting. Detailed documentation supports accurate reporting and audit readiness.

Regular Financial Reviews

Conducting regular financial reviews helps identify trends, assess performance, and make informed business decisions. Monthly or quarterly reviews can highlight areas for improvement and ensure alignment with financial goals.

Engage Professional Services

Hiring experienced accountants or accounting firms with expertise in real estate can provide significant advantages. Professionals can offer insights into complex issues, ensure compliance, and help optimize financial performance.

Leverage Financial Metrics

Utilizing key financial metrics such as net operating income (NOI), capitalization rate (cap rate), and return on investment (ROI) can provide deeper insights into the financial health of real estate investments. These metrics are essential for evaluating performance and guiding investment decisions.

0 notes

Text

Cash Basis Accounting vs. Accrual Accounting: Key Differences

Cash basis accounting is a straightforward and popular accounting method, especially for small businesses. In this guide, we will explore what Cash basis accounting is, how it works, and its advantages and disadvantages. We will also explain why it is often the preferred method for small businesses and how it fits into Small Business Bookkeeping Services in the USA.

What is Cash Basis Accounting?

Cash basis accounting is a method where revenue and expenses are recorded only when cash is actually received or paid. Unlike the accrual method of accounting, where transactions are recorded when they are incurred (regardless of when cash changes hands), cash basis accounting focuses on the actual flow of money in and out of the business.

For instance, if you provide a service in March but don't receive payment until May, under cash basis accounting, the income is recorded in May when the cash is received, not in March when the service was provided. The same applies to expenses – they are recorded when the payment is made, not when the expense is incurred.

This simplicity makes cash basis accounting ideal for businesses with straightforward transactions or those with limited bookkeeping resources, including Small Business Bookkeeping Services in the USA. This method is particularly useful for businesses that need to maintain a clear picture of cash flow without getting bogged down in tracking receivables and payables.

Key Features of Cash Basis Accounting

Cash Flow-Oriented: Cash basis accounting gives a clear picture of your cash flow. By focusing solely on money that has actually been received or paid, it provides an immediate and accurate snapshot of your business's liquidity.

Simple to Implement: One of the main reasons small businesses choose cash basis accounting is its simplicity. It requires less bookkeeping, fewer journal entries, and it’s easier to manage without professional accounting assistance. This method aligns perfectly with the services offered by Small Business Bookkeeping Services in the USA, which often cater to small businesses with limited accounting needs.

No Need for Complex Adjustments: Since revenue and expenses are recorded when cash changes hands, there’s no need to deal with complex adjustments for accounts payable or receivable. This is especially beneficial for businesses that handle cash transactions, like retail stores, freelancers, or sole proprietors.

Tax Simplicity: For tax purposes, cash basis accounting is often easier to manage, as the revenue is recognized only when it is received. Many small businesses in the USA use cash basis accounting for tax filing purposes, as it aligns with their cash flow patterns, making tax planning more straightforward.

Benefits of Cash Basis Accounting for Small Businesses

1. Easier to Manage for Non-Accountants Cash basis accounting is often easier to understand and manage, particularly for business owners without a background in accounting. Many small business owners in the USA find it difficult to maintain complex bookkeeping systems, and Small Business Bookkeeping Services in the USA often recommend the cash basis method as it requires fewer entries and less tracking of outstanding receivables or payables.

2. Provides a Real-Time View of Cash Flow One of the main advantages of cash basis accounting is that it gives a real-time view of your cash position. This is critical for businesses that need to keep a close eye on their liquidity, especially small businesses where cash flow issues can quickly become problematic.

For instance, if you are a freelancer or a small business owner in the USA, cash basis accounting can give you a clear picture of how much money you have on hand to cover expenses, payroll, and other costs.

3. Simplifies Tax Reporting Many small businesses opt for cash basis accounting because it can simplify tax reporting. In the USA, the Internal Revenue Service (IRS) allows businesses with an annual gross income of $25 million or less to use cash basis accounting for tax purposes. By using cash basis accounting, you can defer paying taxes on income until it is actually received, which can be a significant advantage for small businesses.

Small Business Bookkeeping Services in the USA often recommend this method to reduce the complexities of tax season. With cash basis accounting, there's no need to worry about paying taxes on revenue that hasn’t yet been collected.

Drawbacks of Cash Basis Accounting

While cash basis accounting offers many advantages, especially for small businesses, it’s important to consider the drawbacks as well.

1. Limited Insight into Financial Health While cash basis accounting provides a clear picture of cash flow, it may not provide a complete view of your business’s financial health. Because it only recognizes income and expenses when cash changes hands, it doesn’t account for outstanding invoices or unpaid bills. This can create a misleading impression of profitability or financial stability.

For example, if you have a large number of unpaid invoices, your cash flow may look healthy, but your actual financial situation could be more precarious. Small Business Bookkeeping Services in the USA can help bridge this gap by offering additional reporting services to keep an eye on receivables and payables, even when using cash basis accounting.

2. Not Suitable for Larger Businesses Cash basis accounting is generally not suitable for larger businesses or those with more complex transactions. The accrual method, which records revenue and expenses when they are incurred (rather than when cash is exchanged), provides a more accurate picture of financial performance for businesses with larger operations or more sophisticated accounting needs.

Larger companies in the USA are required to use the accrual method because it provides a more accurate reflection of the company’s financial health, particularly in terms of long-term liabilities and assets.