#Cash FlowManagement

Explore tagged Tumblr posts

Text

Financial planning is a dynamic process that requires constant attention and adaptation. By following these five tips from Sam Higginbotham, small business owners can build a solid foundation for financial success. Whether it's setting clear goals, creating a comprehensive budget, building an emergency fund, monitoring cash flow, or making strategic investments, these practices contribute to the overall stability and resilience of a small business in today's ever-changing economic landscape.

#entrepreneur#financial advisor#Small business finance#Financial planning tips#Sam higginbotham#Cash FlowManagement#Financial Stability

0 notes

Text

How to get a bookkeeper hire

Many business owners have experienced the frustration of being tied to their computers, trying to balance the books while wishing someone else could handle the bookkeeping. Although managing everything on your own may seem appealing, it can lead to distractions and a loss of focus on core business activities. Hiring a professional bookkeeper can ease this burden, allowing you to concentrate on growth. To ensure you choose the right fit, consider factors like qualifications, experience, and communication style. Keep reading for key advice on how to hire a bookkeeper, including essential tips and questions to ask.

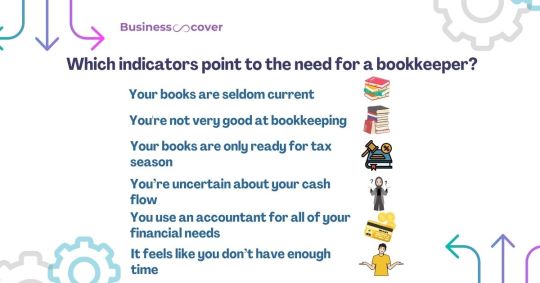

Indicators That You Need a Bookkeeper

DIY bookkeeping isn't suitable for everyone, especially for those with more complex financial situations. As businesses grow and diversify, accounting roles can become more intricate and demanding. Many small business owners eventually realize they can no longer manage everything on their own, and that's a natural part of business expansion. Here are some common indicators that it’s time to hire a bookkeeper.

Your books are rarely up to dateIf you have piles of old receipts and a backlog of paperwork, it's a clear sign you need help. Falling behind on tracking expenses can mean losing control over your business finances. A bookkeeper can get you back on track and improve your financial clarity.

You lack bookkeeping skillsIf you’re unsure about bookkeeping or lack confidence in your skills, mistakes can easily happen. Hiring a bookkeeper reduces errors and provides peace of mind, ensuring your financial records are accurate and reliable.

You only update your books for tax seasonIf you rush to organize your books just before tax season, it's time to hire a bookkeeper. They’ll keep your financials organized year-round, making tax filing smoother and less stressful.

Uncertainty about cash flowManaging accounts payable and receivable can be overwhelming. If you don’t have a clear grasp of when or how much you’ll be paid, a bookkeeper can help you manage and understand your cash flow better.

You rely on an accountant for everythingWhile accountants are more qualified and expensive, bookkeepers handle the day-to-day financial tasks for less. Hiring a bookkeeper for routine work can save you money in the long run.

You don’t have enough timeIf bookkeeping is consuming too much of your time, it’s time to hire help. A bookkeeper can free up your schedule, allowing you to focus on growing your business or attending to clients.

What Does a Bookkeeper Do?

If managing your business’s finances is becoming difficult, hiring a bookkeeper can help you focus on growth. Here’s a summary of their key responsibilities:

Financial Tasks

Syncing accounting software with bank accounts

Tracking and paying business expenses

Monthly bank reconciliations

Preparing financial summaries

Organizing books for the accountant

Answering any bookkeeping-related questions

Financial StatementsBookkeepers provide essential reports like:

Income Statements (Profit & Loss)

Cash Flow Statements

Balance Sheets

Statement of Retained Earnings

Benefits of Hiring a Bookkeeper

Accurate Records: Avoid errors that may happen when doing bookkeeping on your own.

Cost Savings: Save money by hiring a bookkeeper instead of an accountant for routine tasks.

Tax Savings: Get expert advice on deductible expenses to reduce tax liability.

Time Management: Free up your time to focus on growing your business.

If these benefits sound appealing, explore how to choose the right bookkeeper.

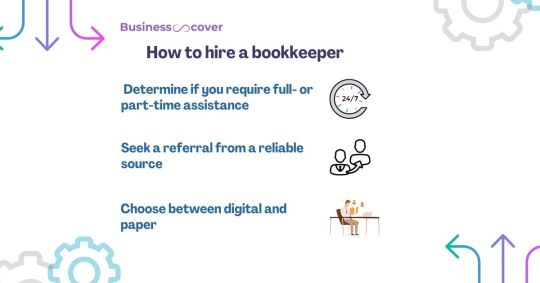

How to Hire a Bookkeeper

When hiring a bookkeeper, consider the following factors to ensure the best fit for your business:

1.Full-Time vs. Part-Time Assistance

Full-Time Employee: Ideal if your business is growing fast or handling many transactions. While more expensive, an in-house bookkeeper offers dedicated support.

Contractor/Freelancer: More affordable, especially for smaller businesses. Freelancers provide flexible support, but their qualifications can vary, so review their credentials carefully.

Pro Tip: Regularly assess your needs to ensure you're getting the right level of bookkeeping support as your business evolves.

2. Get a Referral from a Trusted Source

Ask for recommendations from friends or colleagues who have hired bookkeepers for their businesses. While recruiters are an option, word-of-mouth referrals are often the most reliable way to find a qualified and trustworthy bookkeeper.

Pro Tip: You get what you pay for, so avoid the cheapest option. Investing a bit more in experienced and reliable services is worth it.

3. Choose Digital or Paper-Based Bookkeeping

Decide if you prefer traditional paper-based bookkeeping, where documents are reviewed in person, or modern digital bookkeeping, typically cloud-based, allowing you to access records anywhere.

Pro Tip: Digital bookkeeping provides quick and easy access to financial data from any location.

By keeping these tips in mind, you'll be better prepared to find the right bookkeeper for your business.

7 Factors to Consider When Hiring the Right Bookkeeper

Hiring a qualified bookkeeper can greatly simplify your business operations, but choosing the right one is key. Here are seven important factors to consider when selecting a bookkeeper:

1. Certifications and Qualifications

Look into the credentials and qualifications of the candidate. Since anyone can call themselves a bookkeeper, ensure they have relevant experience. Common qualifications include a CPA, an accounting degree, or registration with the Tax Practitioners Board.

2. Services Offered

Understand the range of services they provide. Whether they work independently or through a bookkeeping firm, it’s important to know if they can handle the tasks your business requires. Assess your own business needs to find a good match.

3. Industry Experience

Ensure the bookkeeper has experience in your specific industry. Ask if they have worked with businesses of similar size and structure to yours. This can provide valuable insight into their ability to meet your unique needs.

4. Communication Style

Bookkeepers should maintain clear and open communication. Find out how they prefer to communicate (email, phone, etc.) and how frequently they provide updates to clients. Make sure their style aligns with your expectations.

5. Pricing

Clarify their pricing structure to avoid unexpected fees. Once you have their rates, compare them with other qualified bookkeepers to ensure you're getting a fair deal.

6. Software Proficiency

Ask about the accounting software they use and whether you’ll have access to it. Ensure there’s transparency and that you have administrative rights to your financial data.

7. Solo vs. Bookkeeping Firm If the bookkeeper works independently, consider a backup plan in case they are unavailable due to illness or other reasons. For larger bookkeeping firms, inquire about their quality control and internal review processes to ensure consistency and reliability.

Considering these factors will help you choose the best bookkeeper for your business, ensuring both efficiency and peace of mind.

Bookkeeper

Bookkeepers handle daily record-keeping tasks but cannot practice accounting without specific certifications. They are responsible for managing day-to-day financial records, and since they don’t require the same qualifications as accountants, hiring a bookkeeper is generally more cost-effective for businesses.

Accountant

Accountants typically hold more advanced roles than bookkeepers and possess higher levels of expertise. They are responsible for interpreting financial data, performing analysis, and making forecasts. Unlike bookkeepers, accountants must undergo formal education to earn degrees or certifications, which is why hiring an accountant is usually more expensive than hiring a bookkeeper.

0 notes

Video

youtube

july 2020 channel update | a middle aged guy | thank you

0 notes