#Cash App is one of the best online transaction and mobile banking system no doubt. But without any confusion

Explore tagged Tumblr posts

Text

Best Site To Buy Verified Cash App Accounts (ps) Lusi and more

Looking to Buy Verified Cash App Accounts! Get 100% verified accounts with BTC enabled for secure and hassle-free transactions.

If you get more information

24 Hours Reply/Contact Email: – [email protected] WhatsApp: +1 (765) 422-5303 Skype: – wisbizs Telegram: – @wisbizs

We Provide all kinds of accounts of all countries similar as USA, UK, Germany, and so on, at cheap rate. If you want to buy any accounts then visit our website.

Buy Cash App Accounts

Cash App is one of the best online transaction and mobile banking system no doubt. But without any confusion, old cash app account is better than new one. Old and New Accounts Are fully documents verified. If you want to Buy Verified Cash App Accounts at cheap price from wisbizs.com, place your order fast now .

Email verified Phone number verified Debit card attached and verified Bank accounts verified and attached Bitcoin enable accounts available Providing documents confirmed with acc. details USA accounts available Cheap price for each acc. Replacement and cashback guaranteed

Buy Verified Cash App Accounts Buy Verified Cash App Accounts, In the present speedy advanced economy, remaining on the ball is fundamental. Furthermore, with regards to computerized installments, the Buy Verified Cash app Account is a distinct advantage. With upgraded security includes and added benefits, these Verified Accounts offer a consistent and dependable installment experience. At the point when you have a Verified Cash App Account, you can partake in the comfort of sending and getting cash quickly, making on the web buys, and, surprisingly, covering bills. Yet, what separates the inner serenity accompanies realizing your exchanges are secure. With cutting edge verification estimates set up, Buy Verified Cash App Account offers an additional layer of assurance against extortion and unapproved access. This implies you can unhesitatingly involve your Account for all your monetary necessities without stressing over expected gambles. Additionally, these Verified Accounts accompany selective advantages and advantages, giving you admittance to limits, cashback offers, and different prizes. Whether you’re an entrepreneur or an individual, having a Buy Verified Cash App Account can give you an edge in the computerized installment game. Along these lines, to smooth out your monetary exchanges and remain one stride ahead, now is the ideal time to get your Cash App Account confirmed. Join the developing local area of fulfilled clients who have proactively embraced this game-evolving arrangement.

The Importance of Verified Cash App Accounts In Today, where online exchanges have turned into the standard, having a Buy Verified Cash App Account is of most extreme significance. It gives accommodation as well as guarantees the security and security of your monetary data. Buy Verified Cash App Accounts offers a few benefits over an unconfirmed one. Right off the bat, it gives you admittance to a more extensive scope of elements and administrations. You can send and get cash in a split second, make online buys, cover bills, and even put resources into stocks and Bitcoin. These highlights are not accessible to unconfirmed clients, restricting their choices and usefulness. Buy Verified Cash App Account Also safe. With cutting edge confirmation measures, like two-factor validation and biometric check, you can be certain that your account is safeguarded against unapproved access and misrepresentation. This is especially significant in a computerized scene where cybercrimes are on the ascent. Anyway, having a Verified Cash App account permits you to construct entrust with different clients. At the point when you send or get cash, your Account status adds validity and consolation to the exchange. This can be critical, particularly while managing new people or organizations. In outline, a Verified Cash App account is fundamental for boosting the advantages of the stage, guaranteeing the security of your financial exchanges, and laying out entrust with different clients.

What are the benefits of Buy Verified Cash App Accounts? Having a verified Cash app account comes with a plethora of benefits that can enhance your digital payment experience. With a verified Cash app account, you can send and receive money instantly. Whether you need to split a bill with friends, pay for goods or services, or send money to family members, the process is quick and hassle-free. Say goodbye to the days of waiting for funds to clear or dealing with delays in traditional banking systems. Or Buy Verified Cash app Accounts. Online shopping has become increasingly popular, and a verified Cash app account makes it even more convenient. With just a few clicks, you can make purchases from your favorite online retailers, eliminating the need to enter your credit card details repeatedly. This not only saves time but also provides an added layer of security by reducing the risk of your card information being compromised. Keeping track of bills and making timely payments can be a headache. However, with a verified Cash App account, you can streamline the process. Whether it’s your monthly utility bills, rent, or subscription services, you can set up automatic payments or pay manually with ease. No more worrying about missed due dates or incurring late fees.

Why you Buy Verified Cash App Accounts If you’re looking to dip your toes into the world of investing, a verified Cash App account can provide you with the opportunity to invest in stocks and Bitcoin. The app offers a user-friendly interface and allows you to start investing with as little as $1. This accessibility makes it a great option for beginners who want to explore the world of investments. Buy Verified Cash App Accounts.

Buy Verified Cash App Accounts often come with exclusive perks and rewards that can save you money. These can include cashback offers, discounts at partner merchants, or even special promotions. By taking advantage of these benefits, you can stretch your dollar further and make the most out of your financial transactions. Buy Verified Cash app Accounts. ● Increased transaction limits ● Ability to send and receive higher amounts of money ● Enhanced security features ● Access to additional features and perks ● Increased trust from other users

How to Verify Your Cash App Account Buy Verified Cash App Accounts, The most effective method to Verified Cash App accounts Verified your Cash App account is a straightforward interaction that includes giving your complete name, date of birth, and the last four digits of your government managed retirement number. Whenever you have presented this data, Cash App will verify your account inside a couple of days, permitting you to get to every one of the advantages of a Verified Cash App account. Verified your Cash App account is a direct cycle that guarantees the security and usefulness of your payments. how to Verify your Account: Buy Verified Cash App Accounts, In the event that you haven’t as of now, download the Cash App on your cell phone from the App Store or Google Play Store. It’s accessible for the two iOS and Android gadgets. Open the App and follow the prompts to make another Account. You’ll have to give your email address or telephone number to begin. Adhere to the directions to set up a safe secret key. To check your Account, you’ll have to connect a money source, for example, a ledger or charge card. This permits you to add assets to your Cash app account and pull out cash when required. To check your Account, you’ll have to give some private data, including your complete name, date of birth, and the last four digits of your Government backed retirement number. Cash app Account views protection and security in a serious way, so have confidence that your data will be safeguarded. Buy Verified Cash app Accounts. Two-factor validation adds an additional layer of safety to your Cash app account. Whenever you’ve Verified your Account , empower this element to get a remarkable code by means of SMS each time you sign in. This guarantees that regardless of whether somebody acquires your login certifications, they will not have the option to get to your Account without the one of a kind code. Fast verify, Buy Verified Cash App Accounts. Cash app will send a check code to the telephone number you gave during the record arrangement process. Enter the code in the app to confirm your telephone number. Adding a profile picture to your Cash App account helps other people remember you during exchanges. It likewise adds an extra layer of safety by making it more challenging for somebody to imitate your Account.

Common Issues with Unverified Cash App Accounts Using an unverified Cash App account can come with certain limitations and potential issues. Here are some common problems unverified users may encounter: Buy Verified Cash App Account, Unverified Cash App accounts often have lower transaction limits compared to verified accounts. This means you may be unable to send or receive larger amounts of money, limiting your financial flexibility. Unverified accounts may also have restrictions on the amount of money you can withdraw from your Cash App balance. This can be inconvenient if you need access to larger sums of money or if you frequently transfer funds to your linked bank account.

Tips for Using a Verified Cash App Accounts Effectively Buy Verified Cash App Account, here are some tips to make the most of this game-changing digital payment solution: Cash App allows you to customize notifications, so you stay informed about your transactions. Enable notifications for incoming and outgoing payments, account activity, and important updates. This way, you’ll always be aware of the status of your financial transactions.

To enhance your financial flexibility, consider linking multiple funding sources to your Cash App account. This could include different bank accounts or debit cards. Having multiple options can be useful if you need to access funds from different sources or if you want to keep your finances organized.Buy Verified Cash app Accounts.

100% on Cash app accounts Buy from Our Team Buy Verified Cash app Accounts, Verifying your Cash app account is a simple process that involves providing your full name, date of birth, and the last four digits of your social security number. Once you have submitted this information, Cash App will verify your account within a few days, allowing you to access all the benefits of a verified account. When compared to other digital payment platforms, Cash app stands out for its user-friendly interface, fast transaction speeds, and competitive fees. Additionally, Cash App offers a wide range of features, such as the ability to buy and sell Bitcoin, direct deposit, and Cash Boost rewards. So Buy Verified Cash app Accounts.

Verified Cash App Account limit Buy Verified Cash App Accounts With all limit. When it comes to using Verified Cash app, there are certain limits that users need to be aware of. For example, Cash App has a sending limit of $7,500 per week for unverified accounts. However, by verifying your account, you can increase this limit to $10,000 per week. Additionally, there is a receiving limit of $1,000 per 30 days for unverified accounts, which can be increased to $1,250 per 30 days for verified accounts.

#across the spiderverse#aesthetic#alternative#artists on tumblr#70s#60s#1950s#80s#asexual#barbie#Cash App is one of the best online transaction and mobile banking system no doubt. But without any confusion#old cash app account is better than new one. Old and New Accounts Are fully documents verified. If you want to Buy Verified Cash App Accoun#place your order fast now .

1 note

·

View note

Text

Buy Verified Cash App Account - 100% Safe & BTC…in 2024

Looking to Buy Verified Cash App Accounts! Get 100% verified accounts with BTC enabled for secure and hassle-free transactions.

If you get more information

24 Hours Reply/Contact Email: – [email protected] WhatsApp: +1 (765) 422-5303 Skype: – wisbizs Telegram: – @wisbizs

We Provide all kinds of accounts of all countries similar as USA, UK, Germany, and so on, at cheap rate. If you want to buy any accounts then visit our website.

Buy Cash App Accounts

Cash App is one of the best online transaction and mobile banking system no doubt. But without any confusion, old cash app account is better than new one. Old and New Accounts Are fully documents verified. If you want to Buy Verified Cash App Accounts at cheap price from wisbizs.com, place your order fast now .

Email verified Phone number verified Debit card attached and verified Bank accounts verified and attached Bitcoin enable accounts available Providing documents confirmed with acc. details USA accounts available Cheap price for each acc. Replacement and cashback guaranteed

Buy Verified Cash App Accounts Buy Verified Cash App Accounts, In the present speedy advanced economy, remaining on the ball is fundamental. Furthermore, with regards to computerized installments, the Buy Verified Cash app Account is a distinct advantage. With upgraded security includes and added benefits, these Verified Accounts offer a consistent and dependable installment experience. At the point when you have a Verified Cash App Account, you can partake in the comfort of sending and getting cash quickly, making on the web buys, and, surprisingly, covering bills. Yet, what separates the inner serenity accompanies realizing your exchanges are secure. With cutting edge verification estimates set up, Buy Verified Cash App Account offers an additional layer of assurance against extortion and unapproved access. This implies you can unhesitatingly involve your Account for all your monetary necessities without stressing over expected gambles. Additionally, these Verified Accounts accompany selective advantages and advantages, giving you admittance to limits, cashback offers, and different prizes. Whether you’re an entrepreneur or an individual, having a Buy Verified Cash App Account can give you an edge in the computerized installment game. Along these lines, to smooth out your monetary exchanges and remain one stride ahead, now is the ideal time to get your Cash App Account confirmed. Join the developing local area of fulfilled clients who have proactively embraced this game-evolving arrangement.

The Importance of Verified Cash App Accounts In Today, where online exchanges have turned into the standard, having a Buy Verified Cash App Account is of most extreme significance. It gives accommodation as well as guarantees the security and security of your monetary data. Buy Verified Cash App Accounts offers a few benefits over an unconfirmed one. Right off the bat, it gives you admittance to a more extensive scope of elements and administrations. You can send and get cash in a split second, make online buys, cover bills, and even put resources into stocks and Bitcoin. These highlights are not accessible to unconfirmed clients, restricting their choices and usefulness. Buy Verified Cash App Account Also safe. With cutting edge confirmation measures, like two-factor validation and biometric check, you can be certain that your account is safeguarded against unapproved access and misrepresentation. This is especially significant in a computerized scene where cybercrimes are on the ascent. Anyway, having a Verified Cash App account permits you to construct entrust with different clients. At the point when you send or get cash, your Account status adds validity and consolation to the exchange. This can be critical, particularly while managing new people or organizations. In outline, a Verified Cash App account is fundamental for boosting the advantages of the stage, guaranteeing the security of your financial exchanges, and laying out entrust with different clients.

What are the benefits of Buy Verified Cash App Accounts? Having a verified Cash app account comes with a plethora of benefits that can enhance your digital payment experience. With a verified Cash app account, you can send and receive money instantly. Whether you need to split a bill with friends, pay for goods or services, or send money to family members, the process is quick and hassle-free. Say goodbye to the days of waiting for funds to clear or dealing with delays in traditional banking systems. Or Buy Verified Cash app Accounts. Online shopping has become increasingly popular, and a verified Cash app account makes it even more convenient. With just a few clicks, you can make purchases from your favorite online retailers, eliminating the need to enter your credit card details repeatedly. This not only saves time but also provides an added layer of security by reducing the risk of your card information being compromised. Keeping track of bills and making timely payments can be a headache. However, with a verified Cash App account, you can streamline the process. Whether it’s your monthly utility bills, rent, or subscription services, you can set up automatic payments or pay manually with ease. No more worrying about missed due dates or incurring late fees.

Why you Buy Verified Cash App Accounts If you’re looking to dip your toes into the world of investing, a verified Cash App account can provide you with the opportunity to invest in stocks and Bitcoin. The app offers a user-friendly interface and allows you to start investing with as little as $1. This accessibility makes it a great option for beginners who want to explore the world of investments. Buy Verified Cash App Accounts.

Buy Verified Cash App Accounts often come with exclusive perks and rewards that can save you money. These can include cashback offers, discounts at partner merchants, or even special promotions. By taking advantage of these benefits, you can stretch your dollar further and make the most out of your financial transactions. Buy Verified Cash app Accounts. ● Increased transaction limits ● Ability to send and receive higher amounts of money ● Enhanced security features ● Access to additional features and perks ● Increased trust from other users

How to Verify Your Cash App Account Buy Verified Cash App Accounts, The most effective method to Verified Cash App accounts Verified your Cash App account is a straightforward interaction that includes giving your complete name, date of birth, and the last four digits of your government managed retirement number. Whenever you have presented this data, Cash App will verify your account inside a couple of days, permitting you to get to every one of the advantages of a Verified Cash App account. Verified your Cash App account is a direct cycle that guarantees the security and usefulness of your payments. how to Verify your Account: Buy Verified Cash App Accounts, In the event that you haven’t as of now, download the Cash App on your cell phone from the App Store or Google Play Store. It’s accessible for the two iOS and Android gadgets. Open the App and follow the prompts to make another Account. You’ll have to give your email address or telephone number to begin. Adhere to the directions to set up a safe secret key. To check your Account, you’ll have to connect a money source, for example, a ledger or charge card. This permits you to add assets to your Cash app account and pull out cash when required. To check your Account, you’ll have to give some private data, including your complete name, date of birth, and the last four digits of your Government backed retirement number. Cash app Account views protection and security in a serious way, so have confidence that your data will be safeguarded. Buy Verified Cash app Accounts. Two-factor validation adds an additional layer of safety to your Cash app account. Whenever you’ve Verified your Account , empower this element to get a remarkable code by means of SMS each time you sign in. This guarantees that regardless of whether somebody acquires your login certifications, they will not have the option to get to your Account without the one of a kind code. Fast verify, Buy Verified Cash App Accounts. Cash app will send a check code to the telephone number you gave during the record arrangement process. Enter the code in the app to confirm your telephone number. Adding a profile picture to your Cash App account helps other people remember you during exchanges. It likewise adds an extra layer of safety by making it more challenging for somebody to imitate your Account.

1 note

·

View note

Text

How iPay helps Customers and Merchants with Streamlining their Payments Needs

Digital payments have been booming in Australia, and many customers are moving from cash to cashless. With the evolution of mobile payment apps and e-wallets, customers can quickly pay for anything from their smartphone.

A recent report from Roy Morgan states that around 72.4%, roughly three-quarters of Australians, are embracing digital payment solutions. It is found that nearly 60% of Australians are using online payment methods to pay bill services.

Now you might wonder what is new to this, we already have apps that make online payment more comfortable, but I am sure the way iPayPro eWallet facilitates digital payments, very few in the industry can do it.

Following are the ways i-Pay benefits customers and merchants:

For Customers,

Cashbacks and Points:

iPayPro eWallet is designed to keep customers' benefit in mind. Every time a user does a top-up, they receive points and cashback into their iPayPro eWallet. On every successful top-up, an iPayPro user gets points based on the amount. Not just points, they receive cashback too. Imagine yourself adding money to the iPayPro eWallet and receiving amazing cashback and points, isn't it amazing?

With these points, a customer reaches different levels. These levels unlock more benefits and offers. We benefit users who bring their friends to our platform too. For every referral, we give $5 as a referral bonus to the user.

Pay at Nearby Merchants & Online Stores:

With numerous merchants signing up with iPay every day, iPay users can directly pay at any iPay merchant and get exciting rewards. With various coupons available for online and in-store purchases, customers get fantastic discounts. They can redeem extra benefits by availing themselves of the coupons found in the "rewards" section.

Pay your Online bills:

With everything under one roof, iPayPro users can directly pay their bills from the app. No need to have any third-party apps; pay your electricity bill, water bill within seconds. As easy it is, we aim to provide an all-in-one app for an individual's payment hassles.

Best offers and promo codes:

Now, who doesn't like having 20-30-40-50% discounts on their purchases? With iPay, you stand a chance to get these promo-codes and the best offers. When you go over to the Rewards section within the app, many rewards are waiting for you.

Play and Earn with i-Pay:

Facilitating how customers make payments, iPayPro eWallet brings modernization back with customer involvement; we provide customers with an interactive way to make money from their knowledge. Within the iPayPro app, we provide exciting trivia/contests/quiz in which customers can participate and make money. Great in-app benefits to the customer; make those extra bucks for your beer with iPayPro.

Revolutionising Urgent Deliveries:

In case you need to deliver the urgent document or look forward to sending the parcel or wanting a custom to be delivered in no time, iPayPro got you covered there too! With iPay Delivery Solution, you can send the package in no time. Get it delivered to the desired location at the best possible price.

For Merchants,

If you're a merchant at iPay Business, you can make your customers' lives so much easier by providing them cashback and discounts for using your services. Not just that, iPay offers a lot of touchpoints for customers to interact with the brands.

Be it cash backs, discounts, offers, you got it all. Brands can integrate and run their unique offers for special occasions, give special benefits to loyal customers and provide exciting coupons for individuals to use their services.

Our easy to manage API's can integrate with your app or website and streamline the payment process.

With iPay, you can

No Card/Monthly Fees:

The merchants at iPay don't have to pay any monthly fees for our services. Unlike others, we don't have any hidden charges; we provide Merchants with a platform to digitalise their business by every means at no cost. You can integrate our payment gateway seamlessly into your business. Have your business online? Our Online payment gateway will help you accept payments from anywhere globally with full customisation as per your brand’s needs—one of the best payment gateways in Australia. Digitise your business with i-Pay.

Unlimited Payments at 0% Fee:

Imagine your business is doing 100grand in transactions and out of which you'd have to pay 10grand in totally ridiculous transaction fees. With i-Pay, you don't have to pay a penny in transaction fees. Accept Payments globally directly into your iPay account at no costs with our POS system

Free Visitor Management:

In the modern-day and age, keeping track of your visitors has become significant. You need to have data about the people coming into your venue. Hence, we've designed our Guest Registry tool, which suits you perfectly for your business. Get your custom-designed QR poster and manage your visitors for FREE—no need to pay for any third-party apps.

24Hrs On-Demand Settlement:

Get your money when you want it. Our 24 hours on-demand settlement helps you transfer money from your iPay wallet into your bank account even at 2 am in the night. Our merchants can directly settle their account 24x7

Free Online Invoice Generator:

With iPay, you can generate quick bills or quotes anytime. Get your GST Invoice at your fingertips. You don't have to worry about how you can get reminders of your bills. We give timely notifications of all your due invoices so that you don't miss any date. Our Online invoice generator lets you generate as many invoices as you want—a free Invoice Generator for your business to manage your invoices.

POS System:

One outlet? Multiple outlets? Don't worry! Managing your deliveries or keeping up with the incoming orders, be it simplified billing, integrated payments, Real-time Inventory, Advanced Reporting, Our POS system is the answer. You can accept all the orders from your restaurant in our Restaurant POS system. Stand a chance to win our free pos system or get a pos system for a restaurant or get a pos system for sale.

Restaurant POS System

Using our POS System for restaurants, you can handle inventory, control user access, monitor performance, get orders, track sales, and so much more. If you have multiple restaurant outlets, you don't have to worry about multiple logins to manage your store chains. You can do it all in our restaurant pos system.

Manage your Deliveries with our Courier Service (iPayPro Delivery Solution)

If your business is the food and drinks sector, grocery, retail, pharmacy, or any other industry and you need to manage the order and get it delivered to your customer in no time, you can do that too with i-Pay. Revolutionising the way urgent deliveries are made, iPayPro Delivery Solution makes it easier and at the best possible rates. Nobody likes late deliveries. We're here to take care of that! If you’re looking for a courier service in Melbourne, or courier service in Australia or one of the best courier services, then iPayPro Delivery Solution is the solution for it.

Promote your Business with our Offers & Vouchers:

The best way to engage the customers with your business is to make them feel valued. With iPay, you can give exciting cashbacks and vouchers to all your customers and bring them back to you again. Give them exciting cashback or provide them with a freebie and make them know they're valued.

Integrations:

Our API's are designed to take only a couple of minutes to integrate into your app or website. Our Payment Gateway is so easy to use that it would barely take a minute to checkout.

Our team of experts take ultimate care of all the brands associated with iPay, and we've designed custom API's keeping in mind our clients needs.

Security:

Security becomes a severe matter of concern, and the transactions at i-Pay are 99.9% Secured. We are PCI DSS Compliant with 128-bit encryption. iPay never stores card details, and our Fraud Protection team is always monitoring so that even the slightest of doubts are taken care of in the initial stage.

Our security protocols are stringent, and we do not entertain even the minutest of risks.

If you have concerns or queries, you can reach us at [email protected] .

0 notes

Text

Most Complete Aiwa Review & Bonus!

>> Aiwa review

Aiwa bonus: Are you searching for more understanding about AIWA? Please read out my truthful evaluation about It before picking, to assess the weak points and strengths of it.

Can it worth for your time and money?AIWA or Artificial Intelligence Site Assistant is an AI powered site contractor that assists you build smart, super streamlined, simple and professional websites in less than one minute. You do not have to be a tech genius to merely drag and drop features to create your successful website.

Simply pick the block and drag to tailor and include onto your website instantly!AI Site Assistant is so simple because it is powered by our instinctive innovation that knows your preferences and easily builds the website on your behalf.

Now you can make big profits with no effort. AIWA websites are extensive and make you a caring leader! All the functions of the website are ADA (Americans with Special needs Act) certified. The wise functions include screen readers that read the text out for those with visual disabilities. The colors are also enhanced for those with small disabilities. The sizes of font styles have been thoroughly picked to make them understandable to all age groups. Images can have unique captions using "ALT Tag" that allows images to be described by the text reader to those who are not able to see it. Not to forget, this keeps you far from any legal troubles and helps you concentrate on growing your business.

AIWA sites have been created to top the charts and make you # 1. This can only happen when your website ranks within the leading 3 on Google each time one searches.

All our material is optimized to make you rank greater and make more earnings. Guideline search engines without paying an extra dollar to external agencies! Now you don't need to buy a membership to any external website with stock graphics. We have you covered with our endless images and videos.

High meaning and ideal for every specific niche, these resources can be utilized within your site to boost the visual appeal. You can edit your image using our inbuilt tool.

It lets you improve, crop and resize images to perfection and utilize them within your website immediately. You can develop as numerous websites as you like beginning now.

Single pages or sub-pages can be constructed immediately without any limitations. AIWA differs from any other site structure tool.

It uses you limitless storage and bandwidth.

This means you can grow and increase your client-base without a doubt. You do not have to constantly pay more to earn more.

You merely have to pay when and go on expanding your company with each passing day ...

there is no constraint whatsoever!

You can also integrate any expert domain name to your website. Simply link the domain name by going to the domain tab and inserting your custom domain. It is possible to personalize your subdomain too.

Worry not if you don't have a domain name yet! You can also search for it utilize our in-built features. The world is your play ground with AIWA.

The sites can be equated in over 100 languages.

Accuracy is key, and so we use Google translation services to assist you reach out to international audiences through your website.

Now analyze your product stock, gather payments with PayPal/Stripe, redeem coupons within this effective feature. It looks after everything from shop style, delivering management, and even personalizing e-mail alerts for your shop. Buying and offering through AIWA is simple and 100% safe.

Complete robust module.

All card transactions are protected with HTTPS protocols utilized by banks nationwide.

So now you can increase your sales greatly without blinking an eyelid. Link with your audience like never before using our in-built blogging system.

You can incorporate a blog site within your site that allows you to develop and keep a relationship with your consumer base.

This is a sure-shot approach to increase brand name awareness and rank greater across search engines! You can tailor them to consist of any information that you may wish to collect from your consumers. AIWA works perfectly with top auto-responders and can be embedded onto your site utilizing short code. Your sites, any variety of them are hosted on our rock-solid cloud servers! You can broaden your web of websites with no issues and at no extra expense!

You can also tailor the domain as you like! Just enter a keyword or pick your industry and struck 'Enter'. The integrated AI creates a distinct website for you in genuine time.

If you desire-- you can likewise just choose a design template and start. AI Site Assistant is simple as ABC. Your kid in school could make profits instantly utilizing this advanced innovation.

All one requires doing is point and click and go into a few words to produce sites that will sell for the leading dollar.

You do not need to have any experience or special skills!

That would be unfortunate, wouldn't it? But only for us!

We have designed this technology for you.

So, when you buy AI Site Assistant today, you likewise get a 14-day cash back guarantee from our end.

If you don't enjoy it, simply state the word and you will get the whole amount back as per our 14-days reimburse policy.

More details in the REFUND POLICY link below!AI Site Assistant works like magic using any OS or gadget. It is hosted on trustworthy cloud servers so you can log on from anywhere at any time. For a restricted (extremely brief) duration of time, AIWA is being provided at the least expensive one-time cost ever. So you don't have to pay any monthly charges. However, should you delay your purchase ... you will lose this extraordinary chance and will have to pay a repeating charge. Yes, we have actually got you covered. Our group of professionals are readily available round the clock to supply you the assistance that you require. Detailed training is also consisted of to make you a professional within minutes. For a minimal time, you can get AIWA with early bird discount rate of $47, ONLY in the chosen alternatives listed below.

Pick the alternative that you think will compliment your unique company requirements, but rush since the deal cost won't last forever. AIWA is available for a low one-time cost for a short period just. Ensure you act before the costs rise. The price will keep on increasing every hour.

The Unrestricted upgrade incredibly charges the AIWA app and unlocks everything. Utilizing AIWA limitless you can create endless sites, endless pages for each site, link unrestricted sub-domains or main domains, create Com shops and blogs, include SSL to unrestricted sites free of charge, unlimited website cloud hosting and social viral traffic generation function. With the AIWA Specialist upgrade we take things one-step further by unlocking some powerful yet need to have features including elimination AIWA

Branding from ALL Website, SuperFast Websites-- Google Friendly, Brand Name New Templates, International Characteristics-- AutoTranslate Website, More Autoresponder Integrations, Reseller Panel-- 50 Accounts and more.

With the AIWA White label, your users will have the ability to white label AIWA and rebrand it to produce and selling users accounts and start their really own website, shop and funnel home builder software application company. Everything hosted for them by us, and we take care of the assistance.

Ideally, with my truthful thoughts about AIWA, I actually hope it did help you with your purchasing choice.

I comprehend the decision of securing $47 one time price is not just made however this financial investment pays and for a sustainable service.

And your financial investment is ensured safely thanks to 1 month Refund without any questions asked. Thank you so much for reading my AIWA

This system is coming out with lots of bonus offers for the early riser.

Take your action ASAP for the very best deal.1 st: Press Ctrl + Shift + Erase to clear all the cookies and caches from your internet browser.

Grow your clients service and Facebook fans with producing viral coupons!

With this plugin you can develop vouchers you can print to provide to offline consumers with a QR code to share the voucher on Facebook.

Quickly develop a mobile landing page where you can expose a voucher code once they share the voucher on Facebook.

When it comes to actual everyday use, Instagram leaves other larger platforms in the dust.

People not only use it every day, but they keep returning.

In fact, a great deal of individuals inspects their Instagram feed every few hours. As long as a niche is picture or video-friendly or graphically extensive, there is an audience on Instagram for that specific niche.

Instagram presents an enormous traffic chance for online marketers. Video has actually always been around.

In truth, its marketing capacity has actually always appeared to a lot of online marketing experts. But here's the issue. The challenge to video online marketers nowadays is that video might have been the victim of its own success.

More than 1.9 billion users check out YouTube on a monthly basis and watch billions of hours of videos every day, making YouTube the second most gone to site worldwide.

Since of that YouTube has actually ended up being a serious marketing platform where organizations are offered the chance to promote material in a real visual and extremely engaging way.

If you aren't benefiting from YouTube for your organization you are missing out on marketing your company and growing your business. Start developing engagement with your brand-new leads by making your landing page remarkable and satisfying!

Just upload, click activate and you are prepared to produce unrestricted incredible pages!

Pictures might deserve a thousand words but videos are worth thousands of images ... and more!

With video, you can load a remarkable amount of spoken and non-verbal signals. Simply put, video has the ability to put a face to your brand and make your brand speak with the requirements, fears, hopes, and aspirations of your prospective customers. Sadly, a lot of online marketers do video marketing WRONG!

Grab AIWA Now

Before The Rate Boosts!

+ Get our Bonuses [FREE!]

Don't lose out!

1 note

·

View note

Text

HOW MUCH DOES IT COST TO DEVELOP AN APP LIKE Smart Salik?

Highways across the globe have different methods of collecting tolls for their usage. Manual collection, automatic cash collection and electronic collection are widely used ones. Among these, electronic toll collection is the most advanced method. Especially during the outbreak of coronavirus pandemic, this carries much importance as it involves a contactless process. The government of Dubai, UAE was one of the foremost in the world to introduce an electronic road toll system in 2007 called ‘Salik’.

What is Salik?

Dubai's Road and Transport Authority (RTA) built Salik as a free-flowing system. It was aimed to avoid stopping vehicles at any point on the Dubai highway and do a manual payment. Because of Salik, there is no toll booth waiting times, barriers and one can just drive through a toll gate without stopping.

Salik promotes automatic transactions with the use of a Salik tag. Your vehicle is detected and the tag is scanned by the Radio Frequency Identification (RFID) technology. Dh4 is deducted from the prepaid Salik account every time the vehicle passes via toll point. Regardless of the vehicle driver, the money is deducted from the Salik holder account at all the trips.

Salik must be obtained online via www.salik.gov.ae and it will be sent to the buyer’s address. It can also be bought from petrol bunks, Emirates NBD bank or Dubai Islamic bank. According to the RTA, a person is only exempted from toll fees if the vehicle is registered as a military or police vehicle or is an ambulance, school, college, or RTA public bus.

Smart Salik App:

RTA has launched a Smartphone application (Smart SALIK) that lets its users manage their SALIK account and accomplish top-ups, check balance, look at the trips, etc. This app was launched by H.H. Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai for their plans of Smart City.

Smart Salik app is a mobile app to aid users to pay and manage their Salik account on their smartphones. Smart Salik app makes operations with the Salik account smoother and more convenient. It is a very useful app that records every move and payment operations. The user needs to have a Salik account online, recharge the account using Salik recharge, or a card voucher.

Many advanced features are added to the app that aids the users. Along with the presence of existing features such as checking the balance, recharging the account user can add or remove the vehicles, verify their trips and violations, update or edit the profile and also access general Salik information.

Below are the services provided by the smart Salik app to the users:

Creation of new Salik User that lets the customer manage their Salik account. They could easily create their profile for getting easy access and get all the updates and news about Salik.

• Balance Top Up - recharging a SALIK account employing a Salik recharge card or e-voucher.

• Look for all the violations incurred and fines paid. Users can also lookout or create a violation dispute.

Get push notifications from Salik related to the app u[dates or any latest news regarding the features.

• Look for all the locations of Salik toll gates and customer service stations.

• Call and speak to the Salik for any doubts.

• Answer to all doubts via FAQs, updates, and other announcements.

• Access Salik information such as FAQs, News, and Announcements

Along with all these features, a user can set up online Salik, that lets them access additional services like:

• Recharging a SALIK account via recharge card, e-voucher, or e-Pay.

• Check the violations and unpaid trips.

• Check the trips via SALIK toll gates.

• A complete summary of the particular SALIK account.

• Check out all the vehicles/tags registered with their SALIK account.

• Update their Salik account with a new vehicle/tag.

• Update a registered phone number or add a phone number to their Salik account.

• Lookout and download Salik account reports with details of all trips taken and top-ups done.

Along with all these features, Salik aids with helpful links and guidance on all the app screens. The experience would be similar to the one found on the Salik website.

SYSTEM SPECIFICATIONS FOR SOFTWARE IMPLEMENTATION

Android studio and Java are employed for App creation.

The front end of the app is programmed by PHP, XML, and Ajax.

Java is used for logical aspects and in the back-end.

For iOS apps, Swift and XCode are used.

Cost of developing an app like Smart Salik in Dubai:

Many regions across the globe have developed the ETC system and the relative Smart Salik type app. Therefore, if you are planning to develop a smart Salik type app in your region it is of utmost importance to associate with a reliable app development company.

The overall cost may be dependent on the scope of the final product and more importantly on the number and complexity of the features included in the app. Along with these factors, the system size (i.e. number of lanes and toll points), the type of platform on which app will be built, customizable software required, location of the development company will all affect the final cost of the app.

The most complex and advanced features will indeed enhance the quality of the app but they will also have a direct impact on the final product. But is very important to hire an experienced mobile app development company that is well-versed with all the key elements of technology and industry who guide you towards the right path of success.

Bottom line: Smart Salik mobile app rated among the top 10 best mobile apps in UAE for many years. If you have a solid idea to build a Smart Salik like app in Dubai then you must associate with one of the reliable and experienced mobile app development companies in Dubai, like Brill Mindz.

0 notes

Text

The Best Credit Card Processing Companies (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

There are many touchpoints along the customer journey. The transaction is of course one of the most important, if not the most important.

So, the way in which you accept payments matters for both you and the customer. You need to have the right software and/or hardware in place to make sure transactions are simple and secure for both parties.

Not only that, as a business owner you need to know that you’re not shelling out cash on inferior services or unnecessary additional fees.

Therefore, this post will cover everything you need to know about choosing the right credit card processing company. Plus, I’ll introduce my top picks for a wide range of businesses of different sizes and with different needs.

The Top 10 Credit Card Processing Companies

Square

PayPal

FIS

Stripe

Payline Data

Fiserv

BitPay

Adyen

Dharma Merchant Services

Fattmerchant

How to Choose the Best Credit Card Processing Company for You

Here are some key elements to consider when choosing the right credit card processing company for you:

1. Fees

Look at the payment terms and fees carefully. Different companies offer different pricing models and things can start to get a little complex.

Firstly, there are interchange fees, which is the percentage taken by the company on every transaction made. Full-service credit card processing companies also take a monthly fee. There may also be additional costs, such as setup or monthly minimum fees.

2. Accepted Payment Methods

Nowadays, you need a payment processing company that accepts more than just debit and credit cards. Digital wallets like PayPal, Google Pay or Apple Pay have become extremely popular.

3. Customer Experience

When shopping, customers want the entire experience to be quick and easy. This is particularly important in e-commerce where the checkout process needs to be streamlined.

In fact, a long and complicated checkout process is the number three reason why consumers abandon their carts in 2020.

It’s also vital that the payment gateway is secure because obviously we’re dealing with sensitive data here. So, look for elements such as PCI compliance and encryption.

4. User Experience

Of course, you or your staff are going to be the ones actually using these systems. Thus, the software, apps and/or hardware need to be user-friendly.

Furthermore, with tech, there’s likely to be a glitch or an issue at some point. This means that you need a credit card processing company that offers superior customer support. The reason being, the longer your payment processor is down, the more sales you lose.

Now you know what you need to consider when researching credit card processing companies, let’s take a look at how they work.

The Different Types of Credit Card Processing Company

There are two main types of credit card processing company. Here’s the 411:

Credit Card Processor

A credit card processor is the go-between that takes care of transactions. The processor takes the funds from the customer’s account and deposits them in your merchant account. It also ensures that the transaction information is correct, the customer has sufficient funds and notifies the payment gateway that the transaction was successful.

Full-Service Credit Card Processor & Merchant Account

Full-service providers do the same as credit card processors but also provide a merchant account, meaning you don’t need an additional merchant account with a bank. These providers tend to offer lower interchange fees but also charge a monthly fee and additional fees, such as the above-mentioned setup fees and so on.

Depending on the size of your operation and the volume of payments you receive, you’ll have to calculate which type of credit card processing company is going to keep costs low overall. Look for companies that are transparent and straightforward about the way in which they operate and take fees.

#1 – Square — The Best for Ease of Use

Square is a hugely popular, low-fee credit card processing company for online and brick-and-mortar stores.

Its POS app is rich in features and easy-to-use. Square is also known for providing an exceptional, frictionless range of POS systems:

Bonus: you can get the software and Square Reader for free.

The beauty of Square truly lies in its simplicity. The company offers a transparent, straightforward pricing model: 2.6% + 10¢ for every tap (mobile payment), dip (chip card) or swipe (magstripe card) on the POS and 2.9% + 30¢ for e-commerce transactions.

Other benefits include active fraud prevention, end-to-end encryption, a quick sign-up process and live phone support.

Essentially, Square is an easy-to-use all-rounder that would be an excellent choice for a wide range of businesses.

#2 – PayPal Commerce Platform Review — The Best for Individuals & Low-Volume Sellers

You’re no doubt familiar with PayPal (unless you’ve been living under a rock), but you may not be as familiar with its commerce platform.

With the PayPal Commerce Platform you can take payments online, in-store, on-the-go with an iZettle card reader, by QR code, over the phone and via social shopping links:

If you’re a solopreneur or small business just starting out then the platform is a fantastic choice for you. PayPal offers a flat-rate system where you only pay for the processing services you use.

The other great thing about PayPal is that it’s a highly recognizable and trusted brand. Therefore, advertising the fact that you accept PayPal payments could lead to more conversions.

Overall, the PayPal Commerce Platform is a secure, user-friendly and low-cost solution for beginners, individuals and low-volume sellers.

#3 – FIS — The Best for Small Businesses

FIS (formerly Worldpay) is a global banking software provider that offers payment processing solutions for large enterprises, small businesses and e-commerce stores.

However, this company puts most of its focus on small businesses, serving a range of industries including grocery, retail, restaurants, personal and professional services:

And this is where FIS really shines as they work directly with small businesses to give them competitive terms and rates. You must contact FIS for a quote.

FIS also stands out as a great provider because of their superior 24/7/365 customer support. Furthermore, their software integrates with 1000+ POS systems which is great if you don’t wish to purchase one of their smart terminals.

FIS is the choice for you if you own a small business and want a customizable solution.

#4 – Stripe — The Best for Internet Businesses

Stripe was designed with a range of online businesses in mind, including e-commerce, mobile commerce, subscription services, marketplaces and other platforms. So, if you’re primarily a web-based business then Stripe is the choice for you.

What also makes it the best choice for online businesses is that the company provides tons of pre-built integrations and ready-made checkout forms for major e-commerce platforms, subscription services and the like:

There’s a simple pay-as-you-go pricing model of 2.9% + 30¢ with no additional monthly or setup fees.

Stripe is also one of the most technologically-advanced solutions out there with its dedication to improving the platform and machine learning models for intelligent optimizations.

If you’re looking for a competitively-priced credit card processor that will integrate easily with your online business, choose Stripe.

#5 – Payline Data — The Best for High-Risk Merchants

Payline Data offers in-person, online and mobile payment solutions for companies of varying sizes.

It’s the best option for high-risk merchants that struggle to get approved for accounts elsewhere. Thanks to its partnerships with major banks and premiere support team, Payline Data is able to simplify high-risk account management.

Payline Data’s pricing model is a little more complex than other options with setup, monthly and other additional fees involved. Take a look:

However, you can work out exactly what your monthly costs will be using their payment calculator tool.

Another advantage of using Payline Data is its integrations with major POS, shopping cart and accounting software providers, along with developer APIs for a customizable solution.

As long as you consider the costs carefully, this could be the simplest and cheapest option for those looking for a high-risk merchant account.

#6 – Fiserv — The Best for High-Volume Retailers

This company provides a convenient, secure and reliable payment processing service as well as end-to-end accounting services, if you require them.

What makes Fiserv the best choice for high-volume retailers is the fact that you can negotiate favorable interchange-plus pricing and terms. Or you can opt for flat-rate pricing via its Clover platform.

Having recently merged with international payment processing leader First Data, Fiserv is also a great option for those who operate globally.

Seven out of the ten largest digital merchants trust Fiserv. Plus, retailers can accept a range of payment methods that are popular around the world, such as Alipay.

Fiserv is the right choice for more experienced, high-volume and global retailers.

#7 – BitPay — The Best for Accepting Crypto

Though technically not a credit card processing company, BitPay is a forward-thinking payment processing company for those who want to add crypto into the mix.

Owned by Shark Tank powerhouse, Mark Cuban, BitPay allows you to accept a range of cryptocurrencies online, via email and in-store.

The way it works is simple – the customer gets an invoice, they pay in crypto at a locked-in exchange rate, BitPay converts the payment into your local currency and you receive the payment in your account the next day:

Due to the nature of crypto, you can accept payments from around the globe without having to worry about fraudulent purchases. What’s more, BitPay promises a flat rate fee of 1% and no hidden fees.

So, if you’d like to expand your reach and gain access to the crypto market, BitPay is for you.

#8 – Adyen — The Best for Growing Enterprises

Adyen isn’t for newbies. It counts the likes of Uber, Virgin Hotels, Hunter and Spotify among its customers. So, it’s perfect for growing enterprises that are ready to take their business to the next level.

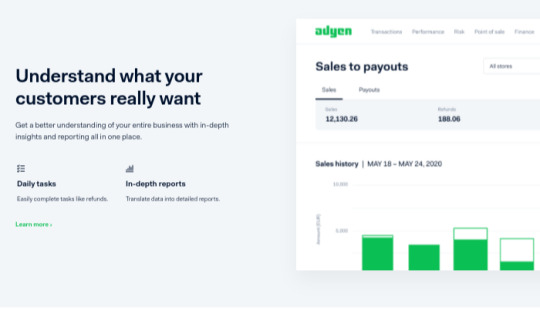

You can benefit from transaction optimization to help you get the most revenue from your sales, as well as in-depth reporting on the platform to better understand your customers and aid growth:

Fees vary depending on the payment method used. Yet, Adyen provides a transparent list of all fees for each payment method on their site.

Other benefits include data-driven security, fraud prevention and access to a dedicated team of payment specialists who will provide you with expert advice.

Overall, if you’re focused on growth, Adyen is the perfect partner.

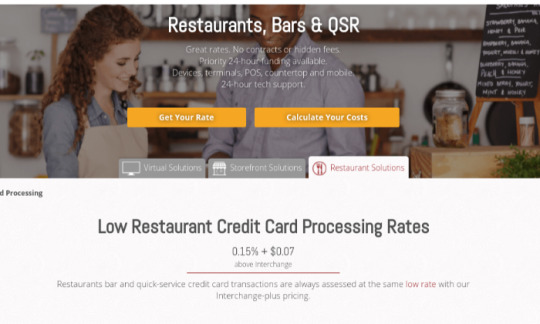

#9 – Dharma Merchant Services — The Best for Quick Service Payments

Dharma is a low-fee credit card processor that specializes in retail and quick service transactions. In other words, if you own a restaurant, bar, fast food joint or other quick service business then this is a great choice for you.

The company offers a low fee of 0.15% and $0.07 per transaction above interchange for storefronts and restaurants:

Plus, the virtual terminal and app are free. The e-commerce rate is slightly higher at 0.20% + $0.10.

With Dharma, you also benefit from exceptional customer service. If you’re new to credit card processing you can get a free consultation and ask all of the questions you need to. Plus, they offer 24/7 tech support.

Choose Dharma if you own a quick service business and need support along the way.

#10 – Fattmerchant — The Best for Professional Services

Fattmerchant provides a range of smart payment processing solutions, but really nails it when it comes to professional service providers.

The reason being, the platform offers the ability to send invoices and retrieve recurring payments quickly and easily. There’s also the option to create payment links and even buttons to take payments for subscription services.

The platform has features which will speed up your business processes through automation, e.g. automated payment reminders:

Fattmerchant offers a different pricing model to many other credit card processing companies. There’s a flat rate subscription fee starting at $99 but 0% markup on interchange and no pesky additional fees.

Essentially, Fattmerchant’s software is a fantastic choice for a range of businesses, but especially for those in professional services or that take recurring payments.

Summing Up

Naturally, there are several criteria to consider when choosing a credit card processing company. Often it will depend on the type of business you run and the volume of payments you take.

Furthermore, some options are better suited to smaller businesses or beginners while others provide more advanced solutions for experienced, higher-volume companies.

Above all, you want a company that offers transparency, security, strong customer support, great software and hardware and the right pricing model to suit your needs.

Now it’s over to you to explore these top providers further and make the right choice.

The post The Best Credit Card Processing Companies (In-Depth Review) appeared first on Neil Patel.

The Best Credit Card Processing Companies (In-Depth Review) Publicado primeiro em https://neilpatel.com

0 notes

Text

The Best Credit Card Processing Companies (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

There are many touchpoints along the customer journey. The transaction is of course one of the most important, if not the most important.

So, the way in which you accept payments matters for both you and the customer. You need to have the right software and/or hardware in place to make sure transactions are simple and secure for both parties.

Not only that, as a business owner you need to know that you’re not shelling out cash on inferior services or unnecessary additional fees.

Therefore, this post will cover everything you need to know about choosing the right credit card processing company. Plus, I’ll introduce my top picks for a wide range of businesses of different sizes and with different needs.

The Top 10 Credit Card Processing Companies

Square

PayPal

FIS

Stripe

Payline Data

Fiserv

BitPay

Adyen

Dharma Merchant Services

Fattmerchant

How to Choose the Best Credit Card Processing Company for You

Here are some key elements to consider when choosing the right credit card processing company for you:

1. Fees

Look at the payment terms and fees carefully. Different companies offer different pricing models and things can start to get a little complex.

Firstly, there are interchange fees, which is the percentage taken by the company on every transaction made. Full-service credit card processing companies also take a monthly fee. There may also be additional costs, such as setup or monthly minimum fees.

2. Accepted Payment Methods

Nowadays, you need a payment processing company that accepts more than just debit and credit cards. Digital wallets like PayPal, Google Pay or Apple Pay have become extremely popular.

3. Customer Experience

When shopping, customers want the entire experience to be quick and easy. This is particularly important in e-commerce where the checkout process needs to be streamlined.

In fact, a long and complicated checkout process is the number three reason why consumers abandon their carts in 2020.

It’s also vital that the payment gateway is secure because obviously we’re dealing with sensitive data here. So, look for elements such as PCI compliance and encryption.

4. User Experience

Of course, you or your staff are going to be the ones actually using these systems. Thus, the software, apps and/or hardware need to be user-friendly.

Furthermore, with tech, there’s likely to be a glitch or an issue at some point. This means that you need a credit card processing company that offers superior customer support. The reason being, the longer your payment processor is down, the more sales you lose.

Now you know what you need to consider when researching credit card processing companies, let’s take a look at how they work.

The Different Types of Credit Card Processing Company

There are two main types of credit card processing company. Here’s the 411:

Credit Card Processor

A credit card processor is the go-between that takes care of transactions. The processor takes the funds from the customer’s account and deposits them in your merchant account. It also ensures that the transaction information is correct, the customer has sufficient funds and notifies the payment gateway that the transaction was successful.

Full-Service Credit Card Processor & Merchant Account

Full-service providers do the same as credit card processors but also provide a merchant account, meaning you don’t need an additional merchant account with a bank. These providers tend to offer lower interchange fees but also charge a monthly fee and additional fees, such as the above-mentioned setup fees and so on.

Depending on the size of your operation and the volume of payments you receive, you’ll have to calculate which type of credit card processing company is going to keep costs low overall. Look for companies that are transparent and straightforward about the way in which they operate and take fees.

#1 – Square — The Best for Ease of Use

Square is a hugely popular, low-fee credit card processing company for online and brick-and-mortar stores.

Its POS app is rich in features and easy-to-use. Square is also known for providing an exceptional, frictionless range of POS systems:

Bonus: you can get the software and Square Reader for free.

The beauty of Square truly lies in its simplicity. The company offers a transparent, straightforward pricing model: 2.6% + 10¢ for every tap (mobile payment), dip (chip card) or swipe (magstripe card) on the POS and 2.9% + 30¢ for e-commerce transactions.

Other benefits include active fraud prevention, end-to-end encryption, a quick sign-up process and live phone support.

Essentially, Square is an easy-to-use all-rounder that would be an excellent choice for a wide range of businesses.

#2 – PayPal Commerce Platform Review — The Best for Individuals & Low-Volume Sellers

You’re no doubt familiar with PayPal (unless you’ve been living under a rock), but you may not be as familiar with its commerce platform.

With the PayPal Commerce Platform you can take payments online, in-store, on-the-go with an iZettle card reader, by QR code, over the phone and via social shopping links:

If you’re a solopreneur or small business just starting out then the platform is a fantastic choice for you. PayPal offers a flat-rate system where you only pay for the processing services you use.

The other great thing about PayPal is that it’s a highly recognizable and trusted brand. Therefore, advertising the fact that you accept PayPal payments could lead to more conversions.

Overall, the PayPal Commerce Platform is a secure, user-friendly and low-cost solution for beginners, individuals and low-volume sellers.

#3 – FIS — The Best for Small Businesses

FIS (formerly Worldpay) is a global banking software provider that offers payment processing solutions for large enterprises, small businesses and e-commerce stores.

However, this company puts most of its focus on small businesses, serving a range of industries including grocery, retail, restaurants, personal and professional services:

And this is where FIS really shines as they work directly with small businesses to give them competitive terms and rates. You must contact FIS for a quote.

FIS also stands out as a great provider because of their superior 24/7/365 customer support. Furthermore, their software integrates with 1000+ POS systems which is great if you don’t wish to purchase one of their smart terminals.

FIS is the choice for you if you own a small business and want a customizable solution.

#4 – Stripe — The Best for Internet Businesses

Stripe was designed with a range of online businesses in mind, including e-commerce, mobile commerce, subscription services, marketplaces and other platforms. So, if you’re primarily a web-based business then Stripe is the choice for you.

What also makes it the best choice for online businesses is that the company provides tons of pre-built integrations and ready-made checkout forms for major e-commerce platforms, subscription services and the like:

There’s a simple pay-as-you-go pricing model of 2.9% + 30¢ with no additional monthly or setup fees.

Stripe is also one of the most technologically-advanced solutions out there with its dedication to improving the platform and machine learning models for intelligent optimizations.

If you’re looking for a competitively-priced credit card processor that will integrate easily with your online business, choose Stripe.

#5 – Payline Data — The Best for High-Risk Merchants

Payline Data offers in-person, online and mobile payment solutions for companies of varying sizes.

It’s the best option for high-risk merchants that struggle to get approved for accounts elsewhere. Thanks to its partnerships with major banks and premiere support team, Payline Data is able to simplify high-risk account management.

Payline Data’s pricing model is a little more complex than other options with setup, monthly and other additional fees involved. Take a look:

However, you can work out exactly what your monthly costs will be using their payment calculator tool.

Another advantage of using Payline Data is its integrations with major POS, shopping cart and accounting software providers, along with developer APIs for a customizable solution.

As long as you consider the costs carefully, this could be the simplest and cheapest option for those looking for a high-risk merchant account.

#6 – Fiserv — The Best for High-Volume Retailers

This company provides a convenient, secure and reliable payment processing service as well as end-to-end accounting services, if you require them.

What makes Fiserv the best choice for high-volume retailers is the fact that you can negotiate favorable interchange-plus pricing and terms. Or you can opt for flat-rate pricing via its Clover platform.

Having recently merged with international payment processing leader First Data, Fiserv is also a great option for those who operate globally.

Seven out of the ten largest digital merchants trust Fiserv. Plus, retailers can accept a range of payment methods that are popular around the world, such as Alipay.

Fiserv is the right choice for more experienced, high-volume and global retailers.

#7 – BitPay — The Best for Accepting Crypto

Though technically not a credit card processing company, BitPay is a forward-thinking payment processing company for those who want to add crypto into the mix.

Owned by Shark Tank powerhouse, Mark Cuban, BitPay allows you to accept a range of cryptocurrencies online, via email and in-store.

The way it works is simple – the customer gets an invoice, they pay in crypto at a locked-in exchange rate, BitPay converts the payment into your local currency and you receive the payment in your account the next day:

Due to the nature of crypto, you can accept payments from around the globe without having to worry about fraudulent purchases. What’s more, BitPay promises a flat rate fee of 1% and no hidden fees.

So, if you’d like to expand your reach and gain access to the crypto market, BitPay is for you.

#8 – Adyen — The Best for Growing Enterprises

Adyen isn’t for newbies. It counts the likes of Uber, Virgin Hotels, Hunter and Spotify among its customers. So, it’s perfect for growing enterprises that are ready to take their business to the next level.

You can benefit from transaction optimization to help you get the most revenue from your sales, as well as in-depth reporting on the platform to better understand your customers and aid growth:

Fees vary depending on the payment method used. Yet, Adyen provides a transparent list of all fees for each payment method on their site.

Other benefits include data-driven security, fraud prevention and access to a dedicated team of payment specialists who will provide you with expert advice.

Overall, if you’re focused on growth, Adyen is the perfect partner.

#9 – Dharma Merchant Services — The Best for Quick Service Payments

Dharma is a low-fee credit card processor that specializes in retail and quick service transactions. In other words, if you own a restaurant, bar, fast food joint or other quick service business then this is a great choice for you.

The company offers a low fee of 0.15% and $0.07 per transaction above interchange for storefronts and restaurants:

Plus, the virtual terminal and app are free. The e-commerce rate is slightly higher at 0.20% + $0.10.

With Dharma, you also benefit from exceptional customer service. If you’re new to credit card processing you can get a free consultation and ask all of the questions you need to. Plus, they offer 24/7 tech support.

Choose Dharma if you own a quick service business and need support along the way.

#10 – Fattmerchant — The Best for Professional Services

Fattmerchant provides a range of smart payment processing solutions, but really nails it when it comes to professional service providers.

The reason being, the platform offers the ability to send invoices and retrieve recurring payments quickly and easily. There’s also the option to create payment links and even buttons to take payments for subscription services.

The platform has features which will speed up your business processes through automation, e.g. automated payment reminders:

Fattmerchant offers a different pricing model to many other credit card processing companies. There’s a flat rate subscription fee starting at $99 but 0% markup on interchange and no pesky additional fees.

Essentially, Fattmerchant’s software is a fantastic choice for a range of businesses, but especially for those in professional services or that take recurring payments.

Summing Up

Naturally, there are several criteria to consider when choosing a credit card processing company. Often it will depend on the type of business you run and the volume of payments you take.

Furthermore, some options are better suited to smaller businesses or beginners while others provide more advanced solutions for experienced, higher-volume companies.

Above all, you want a company that offers transparency, security, strong customer support, great software and hardware and the right pricing model to suit your needs.

Now it’s over to you to explore these top providers further and make the right choice.

The post The Best Credit Card Processing Companies (In-Depth Review) appeared first on Neil Patel.

Original content source: https://neilpatel.com/blog/best-credit-card-processing/ via https://neilpatel.com

See the original post, The Best Credit Card Processing Companies (In-Depth Review) that is shared from https://imtrainingparadise.weebly.com/home/the-best-credit-card-processing-companies-in-depth-review via https://imtrainingparadise.weebly.com/home

0 notes

Text

The Best Credit Card Processing Companies (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

There are many touchpoints along the customer journey. The transaction is of course one of the most important, if not the most important.

So, the way in which you accept payments matters for both you and the customer. You need to have the right software and/or hardware in place to make sure transactions are simple and secure for both parties.

Not only that, as a business owner you need to know that you’re not shelling out cash on inferior services or unnecessary additional fees.

Therefore, this post will cover everything you need to know about choosing the right credit card processing company. Plus, I’ll introduce my top picks for a wide range of businesses of different sizes and with different needs.

The Top 10 Credit Card Processing Companies

Square

PayPal

FIS

Stripe

Payline Data

Fiserv

BitPay

Adyen

Dharma Merchant Services

Fattmerchant

How to Choose the Best Credit Card Processing Company for You

Here are some key elements to consider when choosing the right credit card processing company for you:

1. Fees

Look at the payment terms and fees carefully. Different companies offer different pricing models and things can start to get a little complex.

Firstly, there are interchange fees, which is the percentage taken by the company on every transaction made. Full-service credit card processing companies also take a monthly fee. There may also be additional costs, such as setup or monthly minimum fees.

2. Accepted Payment Methods

Nowadays, you need a payment processing company that accepts more than just debit and credit cards. Digital wallets like PayPal, Google Pay or Apple Pay have become extremely popular.

3. Customer Experience

When shopping, customers want the entire experience to be quick and easy. This is particularly important in e-commerce where the checkout process needs to be streamlined.

In fact, a long and complicated checkout process is the number three reason why consumers abandon their carts in 2020.

It’s also vital that the payment gateway is secure because obviously we’re dealing with sensitive data here. So, look for elements such as PCI compliance and encryption.

4. User Experience

Of course, you or your staff are going to be the ones actually using these systems. Thus, the software, apps and/or hardware need to be user-friendly.

Furthermore, with tech, there’s likely to be a glitch or an issue at some point. This means that you need a credit card processing company that offers superior customer support. The reason being, the longer your payment processor is down, the more sales you lose.

Now you know what you need to consider when researching credit card processing companies, let’s take a look at how they work.

The Different Types of Credit Card Processing Company

There are two main types of credit card processing company. Here’s the 411:

Credit Card Processor

A credit card processor is the go-between that takes care of transactions. The processor takes the funds from the customer’s account and deposits them in your merchant account. It also ensures that the transaction information is correct, the customer has sufficient funds and notifies the payment gateway that the transaction was successful.

Full-Service Credit Card Processor & Merchant Account

Full-service providers do the same as credit card processors but also provide a merchant account, meaning you don’t need an additional merchant account with a bank. These providers tend to offer lower interchange fees but also charge a monthly fee and additional fees, such as the above-mentioned setup fees and so on.

Depending on the size of your operation and the volume of payments you receive, you’ll have to calculate which type of credit card processing company is going to keep costs low overall. Look for companies that are transparent and straightforward about the way in which they operate and take fees.

#1 – Square — The Best for Ease of Use

Square is a hugely popular, low-fee credit card processing company for online and brick-and-mortar stores.

Its POS app is rich in features and easy-to-use. Square is also known for providing an exceptional, frictionless range of POS systems:

Bonus: you can get the software and Square Reader for free.

The beauty of Square truly lies in its simplicity. The company offers a transparent, straightforward pricing model: 2.6% + 10¢ for every tap (mobile payment), dip (chip card) or swipe (magstripe card) on the POS and 2.9% + 30¢ for e-commerce transactions.

Other benefits include active fraud prevention, end-to-end encryption, a quick sign-up process and live phone support.

Essentially, Square is an easy-to-use all-rounder that would be an excellent choice for a wide range of businesses.