#Cash Against Gold in Kolkata

Explore tagged Tumblr posts

Text

When you sell old gold jewellery in Kolkata, both online and offline options are variable. Online stores will provide you with transparent pricing with either gold calculators or detailed explanations of services.

0 notes

Text

Money on Demand With 24x7 Top-Up Gold Loan

Are you ready to dive into a world where money isn’t just a question mark, but a simple and accessible answer? Welcome to Muthoot FinCorp ONE, where we have redefined the way you can access instant cash on demand.W ith us, it is your gold, your convenience, and 24x7 top-up Gold Loans at your fingertips.

Gold Loan from Home

So, what exactly is this fuss about Gold Loan from Home? Well, imagine a scenario where you don't have to rush to a bank or an NBFC, fretting about long queues or paperwork. Instead, we bring the solution to your doorstep. Yes, that’s right. You can now get a loan against your gold jewellery from the comfort of your home.

Swift Processing, Maximum Security

Getting a Gold Loan from Home with Muthoot FinCorp ONE is a breeze. Booking an appointment with us means welcoming a hassle-free, quick process that gets your loan approved within just 30 minutes*. We understand the value of your time, and that's why we ensure no long waits or endless procedures.

Your Gold's Safety

The ease, the speed, and the comfort. We not only process your loan swiftly but also ensure your gold's security. When you book an appointment, our team arrives at your doorstep, collects your pledged gold jewellery, and takes it to the nearest Muthoot FinCorp branch, all within a GPS-tracked safe locker. Safety? Check! Your jewellery is automatically insured for that added peace of mind.

No More Traditional Hassles

Unlike the traditional way of obtaining a Gold Loan, where you would have to carry your gold to a bank, our service eliminates that concern. We've simplified the process, making it more convenient, safer, and faster for you. We believe in offering you a hassle-free experience without any additional charges.

Flexible Repayment Tenure and Scheme Options

Curious about the repayment tenure? Don't worry; we've got you covered. With various Gold Loan schemes available on our app, you can choose a tenure that suits your needs. Whether you need a short-term loan or a longer repayment period, we have options tailored just for you.

Is Gold Loan from Home available in your city? As of now, we are offering this convenient service in Bangalore, Mumbai, Kolkata, Cochin, Trivandrum, Delhi-NCR, Bhubaneswar, Chandigarh, Pune, Jaipur, Indore, and Ahmedabad. Stay tuned because we're expanding to more cities soon!

Unlocking the value of your gold has never been this seamless. With Muthoot FinCorp ONE, getting instant money with Gold Loans at your convenience is no longer a dream—it's your reality. So, why wait? Embrace the ease, security, and speed of our Gold Loan from Home service today and say hello to instant cash on demand.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Is Investing in Gold Bars and Bullion a Prudent Financial Decision?

Recent events involving a prominent American politician facing indictment on charges related to alleged bribery for political favors have brought the issue of investing in gold bars, also known as gold bullion, into focus. While we refrain from making judgments about the case's merits or the individual's guilt or innocence, what caught our attention was the discovery made during an FBI search of the politician's residence. According to reports, the search uncovered gold bars valued at approximately $100,000 and a substantial sum of around $480,000 in cash.

This discovery prompted us to contemplate the merits of investing in gold bars, and like any other investment opportunity, investing in gold bars comes with its own set of advantages and disadvantages. It is essential to carefully evaluate these factors before determining whether gold bars align with your investment objectives. For the best gold buying and selling services in Kolkata, look no further.

Advantages of Investing in Gold Bars and Bullion

Tangible Assets: Gold bars represent physical assets that can be held and securely stored, offering a tangible sense of ownership, distinct from stocks or bonds.

Hedge Against Inflation: Gold boasts a historical reputation as a store of value and an effective hedge against inflation, safeguarding wealth during times of economic uncertainty.

Portfolio Diversification: Introducing gold into your investment portfolio can diversify your holdings, lowering overall risk due to its relatively low correlation with the stock market.

Relative Liquidity: Gold bars are relatively straightforward to buy and sell through dealers, banks, or online platforms, providing liquidity to investors.

Privacy Benefits: Ownership of physical gold bars can provide a degree of privacy compared to other investments, potentially reducing reporting requirements to governmental authorities.

Disadvantages of Investing in Gold Bars and Bullion

Selling Challenges: Finding buyers at desired prices, especially for large bars, can pose difficulties, potentially leading to liquidity issues.

Lack of Income Generation: Gold does not generate income like stocks or bonds; it does not yield dividends or interest, relying solely on price appreciation.

Security Risks: Owning physical gold bars necessitates security measures to guard against theft and damage, potentially incurring additional expenses for secure storage.

High Storage and Insurance Costs: Storing physical gold bars can be expensive, and insurance may be necessary, affecting potential returns.

Price Volatility: Gold prices can be highly volatile, experiencing significant fluctuations during economic uncertainties. For the finest gold-buying services, you can connect with the top gold-buying companies in Kolkata.

Tax Implications: Depending on your location, buying or selling gold bars may have tax implications, requiring a good understanding of local tax laws.

Ethical Concerns: There is often no way to verify the ethical sourcing of gold bars, raising concerns about the potential exploitation of miners and environmental damage.

What Gold Investments Are More Appealing?

The choice of gold investments hinges on your investment objectives, risk tolerance, and the role you want gold to play in your portfolio. It is advisable to consult a financial advisor or conduct comprehensive research before making investment decisions. Consider adopting a diversified investment approach, spreading your portfolio across various asset classes to effectively manage risk.

At Rahul Refiners, we favor investing in gold scrap over bullion. This preference stems from the ability to purchase certain types of gold scrap at reduced prices, recover the gold content, and realize substantial profits. Various forms of gold scrap, including gold and gold-plated jewelry, gold-filled eyeglass frames, gold dental appliances, and even gold dust and scrapings from jewelry factories, can offer more substantial returns compared to bullion investments, often with quicker results.

0 notes

Text

Gold costs today depend on Rs 50,730 notwithstanding the debilitating money Gold costs today depend on Rs 50,730 notwithstanding the debilitating money, while silver costs are down to Rs 56,800. Gold, silver costs on September 24: On Friday, Gold possibilities plunged to a six-month low of Rs 49,250 for each 10 gram spreading out a grim picture for dealers. Silver destinies were down at Rs 56,275 for every kg. Despite a falling Rupee and a more grounded dollar. Gold costs in India relied upon Rs 50,730, up Rs 530 from the past close of Rs 50,200, for 10 grams of 24-carat gold. The expense for 10 grams of 22-carat gold is Rs 46,500 after an addition of Rs 500. The silver expenses were down to Rs 56,800 for each kg. On Friday, gold possibilities tumbled to a six-month low of Rs 49,250 for every 10 grams. On MCX gold possibilities settled at Rs 49,399, down 1.2 percent, while silver at Rs 56,275 for every kg, down 3%.In the worldwide market, the yellow metal on Friday sank against a flooding dollar, dropping to new 2.5-year lows as the ongoing week’s heap of public bank funding cost climbs saw protections trades, security expenses, items, and computerized types of cash all tumble. In New York, the gold expenses were underneath $1,660 on Friday. Spot gold expense finished at a 2-year low of $1,643 per ounce ensuing to hitting its intraday low of $1,639 per ounce. Local expenses A 10 gram of 24-carat gold as of now costs Rs 50,730 in Mumbai and Rs 46,500 in Kolkata, while a 10-gram piece of 22-carat gold costs something similar. As of now, the cost per 10 gm for both 24-and 22-carat gold in Delhi is Rs 50,890. For Rs 50,950 and Rs 46,700, separately, 24-and 22-carat gold is presently being exchanged Chennai. The expense of gold shifts from one city to another and is affected by state government assessments and charges. Gold and extension Item costs sank generally speaking on Friday. Unusualness in the business areas and electrifying FX plays didn’t leave gold faultless as the significant metal fell one more 1.7 percent this week in the worldwide market. Resulting to raising rates by 75 reason centers for the third time in progression, the US Dealt with expanded its resource rates to 4.4 percent around the completion of 2022 and to 4.6 percent in 2023. This will impact the gold expenses further. Anyway gold is seen as a safeguarded adventure during times of money related weakness, expanding funding costs smooth down its charm since it yields no revenue. Experts feel that anyway the base example for gold is negative as a result of hawkish Went to mind of lengths, yet there can be signs of recuperation or potentially the US dollar can credit some assistance. Like, the more weak rupee, which reached the 81 flaw on Friday, has credited an assistance to local expenses

0 notes

Text

Vivo India remitted Rs 62,476 crore abroad, almost 50% to China: ED

A day after it was reported that two top executives of its associated company likely fled India, following raids, the ED on Thursday said that Chinese smartphone company Vivo was involved in huge 'hawala' transactions. It said that out of the total sale proceeds of Rs 1,25,185 crore, Vivo India remitted Rs 62,476 crore -- almost 50 per cent of the turnover out of India, mainly to China. A senior ED official said that they carried out searches at 48 locations across the country belonging to Vivo Mobiles India Private Ltd and its 23 associated companies such as Grand Prospect International Communication Pvt Ltd (GPICPL), and so far, 119 bank accounts of various entities with gross balance to the tune of Rs 465 crore, including FDs to the tune of 66 crore, of Vivo India, 2 kg gold bars, and cash amounting to approximately Rs 73 lakh has been seized under the provisions of the PMLA. According to the ED, all due procedures as per law were followed during the said operations at each premises but employees of Vivo India, including some Chinese nationals did not cooperate with the search proceedings and had tried to abscond, remove and hide digital devices which were retrieved by the search teams. Vivo Mobiles India Pvt Ltd was incorporated on August 1, 2014 as a subsidiary of Hong Kong-based Multi Accord Ltd, and was registered at ROC Delhi. The GPICPL was registered on December 3, 2014 at ROC Shimla, with registered addresses of Solan, Himachal Pradesh and Jammu. The said company was incorporated by Zhengshen Ou, Bin Lou and Zhang Jie with the help of chartered accountant Nitin Garg. Lou left India on April 26, 2018 whereas Ou and Jie left India in 2021. In February this year, the ED initiated a Prevention of Money Laundering case against them on the basis of an FIR lodged at Delhi's Kalkaji police station under sections 417, 120B and 420 of IPC against GPICPL and its Director, shareholders and certifying professionals etc on the basis of complaint filed by Ministry of Corporate Affairs. As per the FIR, GPICPL and its shareholders had used forged identification documents and falsified addresses at the time of incorporation. The allegations were found to be true as the investigation revealed that the addresses mentioned by the directors of GPICPL did not belong to them, but in fact it was a government building and house of a senior bureaucrat. The ED's investigation revealed that the same director of GPICPL, Lou, was also an ex-director of Vivo. He had incorporated multiple companies across the country spread across various states. A total of 18 companies were set up around the same time, just after the incorporation of Vivo in 2014-15, while another Chinese national Zhixin Wei had incorporated further 4 companies. These entities include Rui Chuang Technologies Private Ltd (Ahmedabad), V Dream Technology & Communication Private Ltd (Hyderabad), Regenvo Mobile Private Ltd (Lucknow), Fangs Technology Private Ltd (Chennai), Weiwo Communication Private Ltd (Bengaluru), Bubugao Communication Private Ltd (Jaipur), Haicheng Mobile (India) Private Ltd (New Delhi), Joinmay Mumbai Electronics Private Ltd (Mumbai), Yingjia Communication Private Ltd (Kolkata), Jie Lian Mobile India Private Ltd (Indore), Vigour Mobile India Private Ltd (Gurugram), Hisoa Electronic Private Ltd (Pune), Haijin Trade India Private Ltd (Kochi), Rongsheng Mobile India Private Ltd (Guwahati), Morefun Communication Private Ltd (Patna), and several others, the ED said. These companies were found to have transferred huge amounts of funds to Vivo India, which remitted them out of India, mainly to China. These remittances were made in order to disclose huge losses in Indian incorporated companies to avoid payment of taxes in India, the ED said. Read the full article

0 notes

Text

real estate news

APARTMENT BUYERS SUFFER MOST DUE TO DELAYED REGISTRATION: REAL ESTATE EXPERTS

Land promoters and specialists bring up glaring lacunae in MahaRERA's remain towards allottees of such projects.

Of the many undertakings enrolled with MahaRERA whose enlistment has passed because of non-restoration, the greatest loss is level buyers denied of a fast cure under the power.

Land specialists say this will affect home purchasers previously battling case against engineers for postponed projects in MahaRERA.

Ramesh Prabhu, CA and organizer executive of Maharashtra Societies Welfare Association (MahaSEWA) said, (https://cutt.ly/1QfLFZy)

"The actual motivation behind setting up an administrative authority is to guarantee that each land project enrolled with it is finished inside the course

of events pronounced by the advertiser at the hour of enlistment.

On the off chance that for an explanation the venture couldn't be finished inside the course of events, the advertiser should apply to RERA for its augmentation by presenting

the explanation. The authority might give augmentation for a greatest time of one year.

The deferral of the task impacts level buyers from multiple points of view and they go through troubles monetarily, truly and mentally."

He added that the allottees should shape a relationship to assume control over the undertaking under Sections 7 and 8 of RERA.

"Somewhere around 51% of the allottees are needed to join the affiliation," he added.

Promoter Godfrey Pimenta said, "Tragically, numerous level buyers who wish to seek after procedures before MahaRERA can't do as such as the enlistment has slipped by.

In any case, from March 2018 to March 2020, MahaRERA took suo motu cognisance of such cases and passed very nearly 200 or more orders guiding the engineers to give up the

rundown of allottees of the said ventures to empower them to shape a relationship in the event that they wished to assume control over the undertaking.

To secure the interests of the level buyers, orders should come for the relationship of allottees."

Promoter Nilesh Gala, who rehearses in MahaRERA said, "The RERA Act accommodates a component under Section 8 for projects which are denied or slipped by.

However, no means against defaulting designers have been taken for recuperation towards cost of such activities' finish. The allottees are kept stranded.

No cash has been recuperated by Maha RERA nor have these advertisers' organizations/organizations and gathering organizations been boycotted.

There is no coordination between Maha RERA and arranging specialists like MHADA/SRA/BMC/CIDCO, and so on to interlink these undertaking enlistments and their updates."

Backer Akash Menon, who additionally rehearses in MahaRERA, said, "While the RERA Act is powerful and complete, the requirement of its command is seriously needing.

In situations where the RERA enlistment of an undertaking has slipped by, Section 6 of the Act obviously recommends that a designer might look for expansion just if power

majeure occasions (like regular cataclysms) have happened influencing the improvement of the venture. Segment 8 sets out the commitments of the expert in the event that the

enlistment of a task has slipped by, and enables it to make medicinal strides incorporating talking with the public authority to make a vital move and additionally finishing the

improvement work by drawing in the skillful specialists or relationship of allottees. Lamentably, in spite of having such thorough forces available to its, only occasionally do

we see any proactive endeavors in such manner from the authority."Senior land advocate Vinod Sampat said, "When a task is repudiated, it should be made glaring and pitched so that

new allottees don't book in it. The law can follow all the way through, yet alleviation must be given to allottees whose well deserved cash is trapped.

Ordinarily, when an undertaking slips, there is an advance and the venture is sold. The expense must be borne by allottees or the approaching engineer.

The need of great importance is to boycott not just the organization which has attempted the work, yet to likewise make a severe move against any remaining advertisers related

straightforwardly or by implication with development exercises identified with the task."

Sampat has a few ideas for RERA. He said, "a) A title declaration gave by a promoter should have legitimacy just of 90 days. Today one can add-on a ten-year-old title

endorsement which doesn't fill any need. b) Balance sheets and pay and use records ought to be transferred on the RERA site each month. Also, a deviation of say 10% or more

ought to be brought by the reviewer to the notification of RERA and level buyers consistently."

"All grumblings held up by level buyers ought to be shown on the manufacturer's and MahaRERA sites. This will make manufacturers dread level buyers," he added.

HOUSING BUYERS SEEK DISCOUNTS, FREEBIES

A larger part of imminent homebuyers across India need limits, gifts and adaptable installment alternatives from manufacturers to urge them to buy their pads as land keeps on

being the favored resource class for venture, as per a joint review by land entryway Housing.com and realty body NAREDCO in the middle of January and June among more

than 3,000 customers. The study report was delivered as of late at an online class. As indicated by the study discoveries, land is the favored method of speculation

for 43% (35% last year) of respondents, trailed by stocks 20% (15% last year), fixed store 19% (22% last year) and gold 18% (28% last year).

Most of the respondents (71%) feel that adaptable installment plans and limits will give truly necessary monetary guide during current occasions.

Naredco President Niranjan Hiranandani said the manufacturers are working at dainty edges however limits and gifts are being offered by those engineers who are

left with more inventory and furthermore have different responsibilities like obligation reimbursement. "The cost of item is represented by request supply.

In case developers are locked with overabundance inventories, they do offer limits. Limits are likewise being given at some point as feel great factor to clients," he added.

Dhruv Agarwala, Group CEO of Housing.com, Makaan.com and PropTiger.com, said the Covid-19 wellbeing emergency has supported the significance of house purchasing across the world.

"Therefore, the private housing market isn't just seeing new interest from first time homebuyers yet in addition from a ton of customers who are moving up to greater lofts."

This interest increment, supported by absolute bottom lodging costs and verifiably low loan costs on home advances, has helped private land designers to explore through the

intense monetary circumstance," he added.Mani Rangarajan, Group head working official of Housing.com, Makaan.com and PropTiger, said developers' edges for under-development

properties have discounted because of an expansion in development expenses and land costs in certain urban communities. "In this manner, there is little extension for decrease

in fundamental selling value (BSP). Be that as it may, manufacturers have been offering adaptable installment plans and limits at times to draw in clients," he added.

Rangarajan said the real estate market has shown incredible strength during the second influx of Covid-19, with request and supply both developing during April-June 2021

contrasted with a similar period last year. "The overview shows that purchasers' estimations have improved since June and individuals have begun looking through properties

with recharged force. We anticipate that demand should stay solid during the happy season," he added. Rangarajan requested that state governments ought to decrease stamp

obligation on enlistment of properties to energize homebuyers. Solid lodging deals in Maharashtra's two key business sectors - Mumbai and Pune - recommend that stamp obligation

decrease by the state government assumed a significant part in animating interest during the September 2020 to March 2021 period. The study tracked down that monetary and pay

viewpoint for the coming a half year is more hopeful when contrasted with the main portion of 2020. The opinions have been less affected for this present year given that

vulnerability is lower when contrasted with last year. Additionally, lockdowns have been more particular alongside immunization accessibility.

AIR INDIA GOT RS 738 CR IN 6 YEARS VIA REAL ESTATE SALE.

Public transporter Air India (AIL), which is destined to be privatized, has raised Rs 738 crore from the offer of its land resources since 2015,

and procured rental pay of about Rs 100 crore every year from its properties, Minister of State for Civil Aviation VK Singh told the Lok Sabha on Thursday.

Singh, in a composed answer, said that Air India has sold 115 units of land resources from 2015 work July 12, 2021.

"Afflict has distinguished 111 packages of properties for adaptation out of which 106 bundles of properties are in India and rest five are abroad properties...

The 111 bundles of properties comprise of 211 units which are under adaptation," the clergyman said.

Air India has been adapting its resolute resources for offset its gigantic obligation of around Rs 60,000 crore.

Last month, a public notification was given welcoming e-closeout offers available to be purchased of Air India properties situated across India.

The property included private just as business units is prime urban areas like Delhi, Mumbai and Kolkata. The divestment-bound aircraft was hoping to

raise Rs 200 to 300 crore by selling these land resources.

Recently, Singh had educated that monetary offers for Air India are probably going to be gotten from qualified intrigued bidders (QIBs) by September 15 this year.

Without unveiling subtleties of the QIBs, Singh had emphasized that the public authority has gotten "various" articulations of interest for Air India's privatization.

HOUSING MARKET IN 2021: MUMBAI DOMINATES ALL-INDIA RESIDENTIAL SALES IN THE FIRST QUARTER.

Mumbai, the 'City of dreams,' is satisfying its name. It keeps on satisfying dreams and desires of individuals relocating to the city looking for occupations

and enterprising aspirations. The city with its created framework, simple availability and admittance to public conveniences makes it an optimal

area for transients to settle down.Mumbai is one of the costly housing markets in the nation, anyway an entire host of elements at play right now have

made purchasing a house in this city a reasonable alternative for some. Rumored engineers that guarantee quality homes and opportune conveyance

combined with most reduced at any point home credit loan costs in the previous twenty years, have fuelled this pattern of expanded deals in the

city.A late Q1 2021 report of Indian land by ANAROCK, India's driving free land administrations organization unmistakably shows that the deals of

homes in the best seven urban areas in India in this period have outperformed Q1 2020 by practically 29% at 58,920 units. This is essentially higher

than the pre-Coronavirus levels, which shows a monetary revival of sorts.Lending belief to the hypothesis that financial recuperation is certifiably

not an insignificant blip on a the radar is that the high offer of homes is joined by an increment in their dispatches too which plainly demonstrates

that this is a hearty pattern. The seven urban communities in Q1 2021 saw the dispatch of 62,130 private units, higher by 18% in the past quarter

and 51% on a year-on-year premise. The gathering of the best seven urban areas in India contains National Capital Region (NCR), Mumbai Metropolitan

Region (MMR), Bengaluru, Pune, Hyderabad, Chennai and Kolkata.

This uptick in the deals of homes in the seven urban areas was essentially driven by MMR and Pune, who together represented 31, 227 units which is 53%

of the relative multitude of private units sold in the quarter viable. The MMR locale involves nine Municipal Corporations of Greater Mumbai, Thane,

Navi Mumbai, Kalyan-Dombivali, Ulhasnagar, Bhiwandi, Vasai-Virar, Mira-Bhayander and Panvel. The MMR locale additionally incorporates nine Municipal

Councils of Palghar, Ambarnath, Badlapur, Karjat, Khopoli, Pen, Uran, Alibaug and Matheran.

MMR alone recorded an offer of 20,350 private units which was 35% of the complete deals of 58,920 units in the arrangement of seven urban communities

under consideration. This makes MMR the biggest market for private deals in the country. This offer of private units in MMR was higher by 16% than the

Q4-20 period and higher by 46% on a y-on-y basis.From a dispatch viewpoint as well, MMR had the biggest offer with 14,820 dispatches in FY1 2021.

This adds up to 24% of every one of the 62,130 dispatches in the country during this period. While the development in the country as far as dispatches was 18% on a Q-to-Q premise and 51% consistently.

The adjustment of Mumbai was higher than the public midpoints. The dispatches in Mumbai developed by 24% on a Q-to-Q premise and 41% on a year-to-year premise.

MMR had 11,910 new dispatches in the past quarter and 10,490 in the quarter last year of new private units. According to a stock point of view, i.e.available units available to be purchased, the MMR district has the most noteworthy number at 1,97,040 of private units in Indian urban communities.

The main seven urban areas in the nation have an absolute stock base of 6,41,860 homes available to be purchased of which the MMR locale has 31%.

These signs call attention to the pattern that the interest for private properties in MMR keeps on being solid and will improve its situation as probably the best city in the nation to live in.With designers offering different installment choices, low loan fee system and limits which impact the purchaser choice, the yearning to claim a home in Mumbai keeps on being solid. The solid vertical pattern in deal and dispatch numbers in MMR mean that the private area in Mumbai is recuperating and tenderly recovering from the pandemic incited lows.While worries over the third rush of the COVID-19 pandemic pose a potential threat, India has quit slacking of inoculations, which could give solace and henceforth the effect on the economy may not be pretty much as terrible as prior. The public authority appears to be more ready to manage circumstances emerging from this pandemic, and stay away from any enormous scope lockdowns that hurt the economy. Purchasing a house is a definitive all consuming purpose for some and this pandemic has reaffirmed the significance of claiming one. It is thusly expected that the homebuyer trust in Mumbai's private market will keep on being strong.Experts accept that this certainty will move home purchasing and conceivably lead to home costs firming up particularly with the merry season being around the bend. The augmentation of monetary advantages by the Government, the continuation of the delicate financing cost system by the RBI making home advances effectively open and reasonable, limits and better conveniences by the designers will keep purchaser traffic in Mumbai solid.

Be that as it may, the present circumstance isn't relied upon to keep going long as the high info costs which the engineers have been engrossing

so far are at last given to the home purchasers. There is vulnerability about the continuation of the low-loan fees too as expansion drifts behind the scenes of solid home interest that may prompt an ascent in home costs in the MMR district. Specialists have confidence considering these conceivable outcomes the ideal opportunity to get the fantasy house is currently.

GAINTS OF REAL ESTATE ARE WINNING THE PANDEMIC ECONOMY

In the months paving the way to the pandemic, purchasers had gone short on private land. Arrangements were going abegging and costs hadn't ascended for quite a long time.

Most huge engineers needed to manage a stock stack up. While tried and true way of thinking would have contended for a deteriorating of interest post pandemic,

the housing market has, all things considered, separated. Enormous coordinated designers have seen a lot of the pie increment, while more modest players with lesser

admittance to capital have battled.

"There is unquestionably more trust and confidence in bigger players who have been accomplishing quality work," says Niranjan Hiranandani, overseeing head of the

Hiranandani Group. A significant justification this has been the admittance to back that bigger engineers have. Before, private land depended on pre-deals to fund-raise

that financed development. Post the execution of the Real Estate (Regulation and Development) Act, a key financing device for more modest engineers has been refused.

While this was a pattern that existed even before the pandemic, it has sped up since, says Hiranandani. As individuals search for bigger homes and start their property

search on the web, it is the better-known names, with quick brand review, who have profited.

Information backs up this case. As indicated by research by Anarock, a land benefits firm, driving recorded land designers have seen their portion of the overall

industry increment from 6% in FY17 to 22 percent in FY21. Names in this class incorporate Prestige, Sobha, Puravankara, Kolte-Patil, Sunteck, DLF and Godrej Properties,

among others. Driving unlisted organizations—Piramal Realty, ATS, Wadhwa, Runwal—saw their offer ascent from 11% to 18 percent in a similar period.

Unbranded designers who had a 83 percent share in 2017 are presently down to 60 percent.

As per Anarock, out of 93,140 units sold in the initial 3/4 of FY21, recorded players represented 21.23 million sq ft or 2% more when contrasted with a similar period in FY20.

"While dealing with this overview, we addressed around 8,000 clients and the criticism was that while they were able to purchase under-development properties from a

bigger engineer, they were reluctant to do as such from a more modest player, even at a markdown," says Prashant Thakur, chief and head of exploration at Anarock.

Because of these purchaser inclinations, the housing market, which has been uniting throughout the previous five years, will probably move to a phase where there

will be about six designers dynamic in every city. Some will be across urban communities, however plainly the times of public engineers are finished. Organizations

like DLF and Godrej Properties that had public desires have pulled back to their home business sectors. It additionally has suggestions for their productivity and accounting

reports—both are probably going to work on in the years ahead.

As land deals eased back post 2013, most engineers clutched valuing. This brought about the business log jam proceeding and more modest players with lesser

admittance to back getting pressed. "In a situation where engineers couldn't create on schedule, there was a trust shortfall," says Shveta Jain, overseeing chief, private

administrations, Savills India. "First-time home purchasers, where the interest is, were not enthusiastic about purchasing homes under development."

In the 2019 Forbes India Real Estate Special, JC Sharma, overseeing chief at Sobha, had said, "We thought the stoppage that started in 2013 was a two-three-year wonders.

" But he'd likewise brought up that he saw this long spell of moderate deals and stale costs as being useful for bigger players, as they had the monetary muscle to climate them.

There was additionally the triple blow of the execution of the Goods and Services Tax, the Real Estate Regulation and Development Act, and demonetisation.

Sobha saw a 6 percent expansion in deal region to 1.13 million sq ft, at a worth of Rs 888 crore, up by 22%. The organization has not delivered numbers for Q4FY21.

The expansion in deals is reflected across other huge designers. Take Macrotech Developers, otherwise called Lodha. It saw a 116 percent increment in deal

region to 1.8 million sq ft in Q4FY21, even as deals for the entire year were somewhere near 10% to 5.1 million sq ft. Assortments were up by 10% in Q4 to Rs 2,089 crore.

Godrej Properties, which over the most recent five years has downsized tasks to zero in on Delhi-NCR, Mumbai, Pune and Bengaluru, saw its most noteworthy ever

appointments at Rs 6,725 crore in FY21, with region offered ascending by 23% to 10.8 million sq ft. Detachment Enterprises likewise saw deals ascend by 8% in FY21 to

4.6 million sq ft. The expansion in deals, "has been because of better monetary records and furthermore because of our capacity to convey throughout the most recent

couple of years", says MR Jaishankar, executive and overseeing head of the Brigade Group.

This increment has mostly been fueled by the way that few engineers have left their property distributes offered them to their bigger partners. There are likewise

joint advancement arrangements where the designer is just liable for deals and development while the land is possessed by another person. Deals are, nonetheless,

reserved in the marked designers' name.

A fall or stagnation in inventories has been another outcome of this pattern. At DLF, the country's most important designer, inventories tumbled from Rs 22,486 crore

in March 2020 to Rs 21,832 crore in September 2020. At Sunteck, they were down from Rs 2,720 crore to Rs 2,642 crore in a similar period. At Prestige Estates,

the number tumbled from Rs 11,375 crore in March 2020 to Rs 9,580 crore in March 2021.

Longer-term patterns for enormous designers look significantly really encouraging. At Prestige Estates, inventories have fallen by 37% over the most recent two years.

Conversely, somewhat recently, they rose by 571%. At DLF, while inventories have remained level over the most recent year and a half, they rose by 99% in the earlier decade.

Also, at Sunteck, as well, they remained level over the most recent year and a half, however rose by 198% throughout the last decade.

The improvement in accounting reports is probably going to bring about three key patterns over the course of the following five years. Initial, a fall in the expense of assets.

Enormous engineers are presently ready to get at rates that are a lot of lower than the sloppy area. At Sobha, the expense of assets remains at 9.17 percent in Q3FY21.

Contrast this with more modest players who regularly get at 15 to 18 percent, and the distinction in interest costs is obvious.

Second, lower obligation numbers. All recorded engineers overviewed showed a decrease in, or level, obligation numbers throughout the last year, despite the fact that somewhat

recently they had risen pointedly. Lower obligation numbers joined with higher deals could see them report critical working influence over the course of the following five years.

They all have something like a year of deals in stock. With land costs represented, these deals will excessively affect the bottomline.

Third, better admittance to land bargains. Landowners, having consumed their fingers with more modest engineers, are presently able to manage just notable names.

On their part, engineers can direct terms that permit them to share income and benefits just once deals start. There are additionally cost acceleration provisions:

If crude material costs rise, then, at that point the hit is imparted to the landowner.

As the market keeps on merging, anticipate that the sector should create an anticipated stream of profit and incomes. Likewise expect monetary records to shrivel as the

consistency of deals would lessen the requirement for extreme money saves. Return on value and return on capital would be in for an increment. Also, ultimately,

cost income products, which have throughout the most recent two years began considering in the expanded profit, could keep on rising.

https://www.mid-day.com/mumbai/mumbai-news/article/flat-buyers-suffer-most-due-to-lapsed-registration-real-estate-experts-23185583

https://www.thehansindia.com/business/homebuyers-seek-discounts-freebies-698961

https://www.newindianexpress.com/business/2021/jul/30/air-india-raised-rs-738-cr-in-6-years-via-real-estate-sale-2337553.html

https://www.businessinsider.in/business/news/housing-market-in-2021-mumbai-tops-all-india-residential-sales-in-the-first-quarter/articleshow/84338893.cms

https://www.forbesindia.com/article/real-estate-special/goliaths-of-real-estate-are-winning-the-pandemic-economy/68759/1

Visit my blog clicking link below

https://rrskartikeyaembedded.blogspot.com/

disclaimer:- the news is collected from internet search engines .the author dont endorse or take responsibility for authenticity of the news

#midday#thehansindia#homebuyers#real estate latest news in india#AirIndia#AirIndia land sale#newindianexpress#mumbai#lodhagroup#RESIDENTIALSALES#businessinsider

0 notes

Text

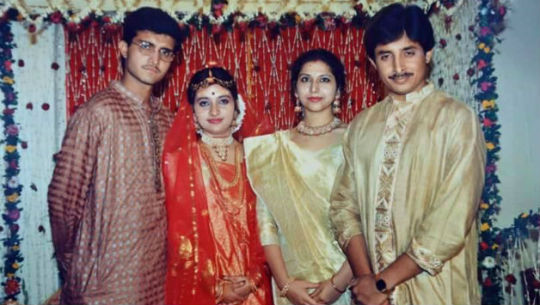

Sourav Ganguly Biography

Acknowledged as one of the most aggressive and successful captains of the Indian cricket team, Sourav Ganguly is known to lay the foundation of the aggressive Indian cricket team that later went on to win the various ICC titles. Ganguly has also earned himself the nickname of “Dada” in the Indian cricket due to his fearless approach on and off the field. Sourav Ganguly made his National team debut at the age of just 19 years against West Indies at the Benson & Hedges World Series on January 11, 1992. Ganguly is also called the “God of the Off Side” for his fastidious approach of hitting mammoth sixes down the ground as well as from within the crease.

Ganguly announced retirement in the home series against Australia in 2008 after the fourth test match at Nagpur. It was the end of his indelible career his contribution to the Indian cricket on the field. Due to his love for the sports, Ganguly served as the President of Cricket Association of Bengal and serving as the President of BCCI.

Sourav Ganguly's Personal Information

Sourav Date of Birth: Sourav Ganguly was born on 8th July 1972 to Nirupa Ganguly and businessman Chandidas Ganguly. Chandidas Ganguly was one of the richest men in Calcutta then, owing to his successful printing business. Sourav was the youngest member of his family and his elder brother, Debashish Ganguly is a former cricketer turned businessman.

Sourav Age: Sourav Ganguly’s age is currently 49 years old. He played International cricket till 2008 while he played IPL till 2012.

Sourav Height: Sourav Ganguly’s height is 5 ft 11 in but he is widely known for his pillar attitude in the Indian cricket team. However, it sometimes didn’t go well for him, especially when playing away for the other teams. The 5 ft 11 inches left-handed batsman made a big name in the International circuit and he was also the part of the Fab Four that included Sachin Tendulkar, VVS Laxman, and Rahul Dravid.

Sourav Ganguly's Family Information

Sourav Ganguly lives in his Behala’s residence in Kolkata and has a nuclear family including his septuagenarian mother. Sourav Ganguly’s family includes him, his wife Dona, and his daughter Sana Ganguly.

His wife Dona is an Indian Odissi classical dancer and she runs a dance school where she teaches Indian classical dance. Both of them were friends since childhood and finally got married in February 1997.

The couple gave birth to a girl in the year 2001 and named her Sana Ganguly. Sana is currently pursuing her graduations in the Oxford University after completing her schooling from Kolkata’s best schools i.e., La Martiniere for Girls and Loreto House School.

Sourav’s father Chandidas Ganguly passed away on 21 February 2013, aged 73 years old after a prolonged illness while his mother Nirupa Ganguly is suffering from heart ailments.

Ganguly family is brahmin and belongs to Bengali Kanyakubja Brahmin Category.

To know more about his family background and their lifestyle Click Here

Sourav Ganguly's Career Stats

Indian cricket produced one of the finest left-handed batsmen in the form of Sourav Ganguly. Ganguly donned the national jersey for the first time in 1992 during the Indian’s team tour to Australia for the Benson & Hedges World Series. Ganguly had a poor start to his career as he managed a meagre 3 runs off 13 balls before he was out on LBW in his debut match.

His potential was left unfathomed by the fans but the young blood was talented enough to become one the greatest batsmen India ever produced as he set new benchmarks and records in batting and also became the captain of the side. He made his Test debut after four years in 1996 and played Test cricket for 12 years before hanging his boots from International circuit in 2008.

In his career of 16 years, Ganguly amassed 11,363 runs in ODI, and 7212 runs in the Test cricket and also picking 100 wickets in the ODI. While he has 100 catches under his belt in the ODIs, adding as the cherry on top in Sourav Ganguly’s career stats.

The former skipper was at his peak whenever he played ODI matches which is clearly visible form his ODI stats. He played test matches as well and he was equally impressive in the longest format of the game. Checkout his career stats by Clicking Here.

Sourav Ganguly's IPL Career

Sourav Ganguly’s IPL career started with the Kolkata Knight Riders when the Bollywood actors Shahrukh Khan and Juhi Chawla acquired “Dada” in their team. Ganguly was the captain of KKR franchise the inaugural season of the T20 tournament which later became one of the most popular T20 leagues in the world.

Ganguly played for Kolkata Knight Riders for three seasons until 2010 season, before moving to the Pune Warriors where he played in 2011 and 2012.

In his IPL career, Ganguly played 59 matches and amassed 1349 runs at an average of 25.45. He also took 10 wickets and 6 of it came in during the first season with the KKR itself.

Ganguly also served as the mentor of the IPL team Delhi Capitals but since he has is serving as the President of the BCCI, he had to vacate that position.

Achievements & Awards

# Achievements:

Ganguly was by far the most successful captains in the Test cricket in the overseas conditions, registering 11 wins in as many as 28 matches under his leadership. (Virat Kohli has 13 wins)

Ganguly holds the record for the highest individual score in the Cricket World Cup when he scored 183 runs against Sri Lanka in 1999.

He is one of those five cricketers to have scored 10,000 runs, take 100 wickets and 100 catches respectively in the ODI format of the game.

Ganguly has the record of winning four back to back Man of the Match awards in the ODI format.

During the peak time of his career, Ganguly hit three centuries in the ICC Champions Trophy.

He is the fifth left-handed batsman and 2nd Indian batsman in the world to have reached 10,000 runs in the ODI. (11,363 runs)

Sourav Ganguly also served as the President of the Cricket Association of Bengal (CAB) from 2015-2019 and later he went on to become the President of the BCCI.

# Awards:

Sourav Ganguly was entitled with the Arjuna Award in 1998 for his outstanding performances in the Indian cricket.

In 2000, he received the CEAT Cricketer of the year award for his magnificent batting as an opener.

The following year saw him winning the CEAT Captain of the Year award for the way he led the side.

Two years later, in 2004, Ganguly received the Padma Shri Award for his valuable contribution to the Indian cricket.

Sourav Ganguly's Net Worth

Sourav Ganguly’s net worth has surged over the years even after his retirement from the game more than a decade ago. Sourav Ganguly’s net worth is currently $55.5 million which includes the combined income of his cricketing career, Indian Premier League, Brand endorsements and his term as the BCCI President.

Besides, he also endorsed brands such as StayHappi Pharmacy, Polycrol, My11Circle, Puma, Senco Gold & Diamonds, DTTC Couriers, TMT Captain, Essilor Lens, UnAcademy and Tata Tetley

Sourav Ganguly has also hosted Bengali TV shows such a “Ke Hobe Banglar Kotipoti” and “Dadagiri Unlimited” that became a massive hit on the television and also hit the maximum TRP ratings.

Ganguly is currently serving as the President of the Board of Control for Cricket in India (BCCI) and gets remunerated by₹ 5 Crores annually.

Puma alone pays him whopping ₹1.35 crores per year, thereby adding to his income from the endorsements.

Moreover, Ganguly has his own family business which is managed by his brother Debashish Ganguly.

Sourav Ganguly also owns a football team in the Indian Super League, Atletico De Kolkata alongside the business tycoons Harshvardhan Neotia, Sanjiv Goenka and Utsav Parekh since 2014.

The Prince of Kolkata also owns some big brand cars like Audi, Mercedes, and BMW and a couple of bikes.

Sourav Ganguly also owns a cricket Academy in Kolkata named ‘Videocon Cricket Academy’ where aspiring young cricketers enrol themselves for professional cricket coaching.

Sourav Ganguly's Controversies

Controversies have always surrounded Sourav Ganguly in his entire career. Who can forget his tiff with the former Indian coach Greg Chappell that almost destroyed his cricketing career! Here is the list of Sourav Ganguly’s controversies that have almost ruptured his image in professional life:

Disputation with Greg Chappell: Well, the most infamous controversies of his life that almost destroyed his career. Greg Chappel replaced John Wright as the coach of the Indian Cricket Team in 2005. During that time Ganguly was having a rough patch as he was not among runs in the last few matches. It was during that time that a few suggestions on his batting and captainship from Chappel didn’t go well with him. And the infuriated Ganguly spoke to the media against Chappel which sidelined him from the International cricket for one year despite regaining his form.

Parted ways with KKR due to split Captaincy: Ganguly led Kolkata Knight Riders in the inaugural season of the Indian Premier League, however, the next season of the cash-rich tournament was staged in South Africa. The management went with the strategy of “multiple captains” and appointed Brendon McCullum as the skipper. That decision left the KKR fans fumed and the side also had one of the most disastrous seasons.

Conflict with Shane Warne in IPL: The rivalry between India and Australia was clearly visible during the inaugural edition of the Indian Premier League in a match between Kolkata Knight Riders vs Rajasthan Royals. Supposedly KKR were to bat first but Ganguly didn’t show on on the crease on time. That left Rajasthan’s skipper Shane Warne annoyed which he later expressed in the front of the media.

Shirt Waive-off in Natwest Series: Ganguly hit the headlines yet again during the Natwest finals between England and India in 2002. Apparently, India had to chase down a stiff target of 326 runs to win the trophy. It was one of the most riveting and nail-biting contests that even forced the India skipper to open his shirt and waive off in the air as the Indian middle-order batsmen chased down the stiff target in a dramatic contest. Apparently, Ganguly did that deliberately because Andrew Flintoff’s did almost the same thing during England’s visit to India earlier that year.

Making Steve Waugh wait for the toss: Ganguly was in the headlines for yet again the similar reasons during the 2001 series against Australia. Apparently, the Australian skipper had to wait for the Indian counterpart for the toss which annoyed him and later he questioned Ganguly’s lack of respect for the game. Ganguly denied all the allegations of showing up late on most of the occasion saying he did that once as he couldn’t find his blazer.

Affair with the actress Nagma: Ganguly was under the limelight yet against in 2001 when a rumour of him dating the Bollywood actress Nagma spread on the social media all over. Before setting off for the series against Australia, Ganguly had visited a South Indian temple along with Nagma where it was alleged that he performed rituals that were performed by the married couples. However, his wife Dona rubbished all the rumours and stood by his side.

Refused to carry drinks on his debut: This takes us back to Ganguly as a rookie who had travelled to Australia with the Indian team during the 1991-1992 year. Ganguly was told to carry the drinks for his teammates which he refused to do so, which made him people say he was arrogant as a youngster. Later, after a few years, Ganguly recounted the incident as he bashed the then team manager Mr Ranbir Singh for his management skills.

Sourav Ganguly's Social Media

Sourav Ganguly is mostly active on Twitter and Instagram where he keeps his fans updated about his whereabouts and latest brand endorsements. Ganguly has over 1.3 million followers on Instagram and 5.1 million followers on Twitter. He also has an official page on Facebook but he is not so active there as he is on Instagram and Twitter.

Use: SouravGangulyBiography, SouravGangulyage, SouravGangulybirthday, SouravGangulyheight, SouravGangulynetworth

#SouravGangulyBiography#SouravGangulyage#SouravGangulybirthday#SouravGangulyheight#SouravGangulynetworth

0 notes

Text

Gold is a valuable asset that comes to use when people need it the most. You can easily get cash against gold in Kolkata from us. Cash On Old Gold provides a reliable way to obtain immediate funds by leveraging your gold assets. Our experts will assess the gold's value based on its purity and weight. They will evaluate the price according to the current market value. This will ensure a swift transaction, with instant cash payouts to meet urgent financial needs.

0 notes

Text

Sourav Ganguly Biography

Acknowledged as one of the most aggressive and successful captains of the Indian cricket team, Sourav Ganguly is known to lay the foundation of the aggressive Indian cricket team that later went on to win the various ICC titles. Ganguly has also earned himself the nickname of “Dada” in the Indian cricket due to his fearless approach on and off the field. Sourav Ganguly made his National team debut at the age of just 19 years against West Indies at the Benson & Hedges World Series on January 11, 1992. Ganguly is also called the “God of the Off Side” for his fastidious approach of hitting mammoth sixes down the ground as well as from within the crease.

Ganguly announced retirement in the home series against Australia in 2008 after the fourth test match at Nagpur. It was the end of his indelible career his contribution to the Indian cricket on the field. Due to his love for the sports, Ganguly served as the President of Cricket Association of Bengal and serving as the President of BCCI.

Sourav Ganguly's Personal Information

Sourav Date of Birth: Sourav Ganguly was born on 8th July 1972 to Nirupa Ganguly and businessman Chandidas Ganguly. Chandidas Ganguly was one of the richest men in Calcutta then, owing to his successful printing business. Sourav was the youngest member of his family and his elder brother, Debashish Ganguly is a former cricketer turned businessman.

Sourav Age: Sourav Ganguly’s age is currently 49 years old. He played International cricket till 2008 while he played IPL till 2012.

Sourav Height: Sourav Ganguly’s height is 5 ft 11 in but he is widely known for his pillar attitude in the Indian cricket team. However, it sometimes didn’t go well for him, especially when playing away for the other teams. The 5 ft 11 inches left-handed batsman made a big name in the International circuit and he was also the part of the Fab Four that included Sachin Tendulkar, VVS Laxman, and Rahul Dravid.

Sourav Ganguly's Family Information

Sourav Ganguly lives in his Behala’s residence in Kolkata and has a nuclear family including his septuagenarian mother. Sourav Ganguly’s family includes him, his wife Dona, and his daughter Sana Ganguly.

His wife Dona is an Indian Odissi classical dancer and she runs a dance school where she teaches Indian classical dance. Both of them were friends since childhood and finally got married in February 1997.

The couple gave birth to a girl in the year 2001 and named her Sana Ganguly. Sana is currently pursuing her graduations in the Oxford University after completing her schooling from Kolkata’s best schools i.e., La Martiniere for Girls and Loreto House School.

Sourav’s father Chandidas Ganguly passed away on 21 February 2013, aged 73 years old after a prolonged illness while his mother Nirupa Ganguly is suffering from heart ailments.

Ganguly family is brahmin and belongs to Bengali Kanyakubja Brahmin Category.

To know more about his family background and their lifestyle Click Here

Sourav Ganguly's Career Stats

Indian cricket produced one of the finest left-handed batsmen in the form of Sourav Ganguly. Ganguly donned the national jersey for the first time in 1992 during the Indian’s team tour to Australia for the Benson & Hedges World Series. Ganguly had a poor start to his career as he managed a meagre 3 runs off 13 balls before he was out on LBW in his debut match.

His potential was left unfathomed by the fans but the young blood was talented enough to become one the greatest batsmen India ever produced as he set new benchmarks and records in batting and also became the captain of the side. He made his Test debut after four years in 1996 and played Test cricket for 12 years before hanging his boots from International circuit in 2008.

In his career of 16 years, Ganguly amassed 11,363 runs in ODI, and 7212 runs in the Test cricket and also picking 100 wickets in the ODI. While he has 100 catches under his belt in the ODIs, adding as the cherry on top in Sourav Ganguly’s career stats.

The former skipper was at his peak whenever he played ODI matches which is clearly visible form his ODI stats. He played test matches as well and he was equally impressive in the longest format of the game. Checkout his career stats by Clicking Here.

Sourav Ganguly's IPL Career

Sourav Ganguly’s IPL career started with the Kolkata Knight Riders when the Bollywood actors Shahrukh Khan and Juhi Chawla acquired “Dada” in their team. Ganguly was the captain of KKR franchise the inaugural season of the T20 tournament which later became one of the most popular T20 leagues in the world.

Ganguly played for Kolkata Knight Riders for three seasons until 2010 season, before moving to the Pune Warriors where he played in 2011 and 2012.

In his IPL career, Ganguly played 59 matches and amassed 1349 runs at an average of 25.45. He also took 10 wickets and 6 of it came in during the first season with the KKR itself.

Ganguly also served as the mentor of the IPL team Delhi Capitals but since he has is serving as the President of the BCCI, he had to vacate that position.

Achievements & Awards

# Achievements:

Ganguly was by far the most successful captains in the Test cricket in the overseas conditions, registering 11 wins in as many as 28 matches under his leadership. (Virat Kohli has 13 wins)

Ganguly holds the record for the highest individual score in the Cricket World Cup when he scored 183 runs against Sri Lanka in 1999.

He is one of those five cricketers to have scored 10,000 runs, take 100 wickets and 100 catches respectively in the ODI format of the game.

Ganguly has the record of winning four back to back Man of the Match awards in the ODI format.

During the peak time of his career, Ganguly hit three centuries in the ICC Champions Trophy.

He is the fifth left-handed batsman and 2nd Indian batsman in the world to have reached 10,000 runs in the ODI. (11,363 runs)

Sourav Ganguly also served as the President of the Cricket Association of Bengal (CAB) from 2015-2019 and later he went on to become the President of the BCCI.

# Awards:

Sourav Ganguly was entitled with the Arjuna Award in 1998 for his outstanding performances in the Indian cricket.

In 2000, he received the CEAT Cricketer of the year award for his magnificent batting as an opener.

The following year saw him winning the CEAT Captain of the Year award for the way he led the side.

Two years later, in 2004, Ganguly received the Padma Shri Award for his valuable contribution to the Indian cricket.

Sourav Ganguly's Net Worth

Sourav Ganguly’s net worth has surged over the years even after his retirement from the game more than a decade ago. Sourav Ganguly’s net worth is currently $55.5 million which includes the combined income of his cricketing career, Indian Premier League, Brand endorsements and his term as the BCCI President.

Besides, he also endorsed brands such as StayHappi Pharmacy, Polycrol, My11Circle, Puma, Senco Gold & Diamonds, DTTC Couriers, TMT Captain, Essilor Lens, UnAcademy and Tata Tetley

Sourav Ganguly has also hosted Bengali TV shows such a “Ke Hobe Banglar Kotipoti” and “Dadagiri Unlimited” that became a massive hit on the television and also hit the maximum TRP ratings.

Ganguly is currently serving as the President of the Board of Control for Cricket in India (BCCI) and gets remunerated by₹ 5 Crores annually.

Puma alone pays him whopping ₹1.35 crores per year, thereby adding to his income from the endorsements.

Moreover, Ganguly has his own family business which is managed by his brother Debashish Ganguly.

Sourav Ganguly also owns a football team in the Indian Super League, Atletico De Kolkata alongside the business tycoons Harshvardhan Neotia, Sanjiv Goenka and Utsav Parekh since 2014.

The Prince of Kolkata also owns some big brand cars like Audi, Mercedes, and BMW and a couple of bikes.

Sourav Ganguly also owns a cricket Academy in Kolkata named ‘Videocon Cricket Academy’ where aspiring young cricketers enrol themselves for professional cricket coaching.

Sourav Ganguly's Controversies

Controversies have always surrounded Sourav Ganguly in his entire career. Who can forget his tiff with the former Indian coach Greg Chappell that almost destroyed his cricketing career! Here is the list of Sourav Ganguly’s controversies that have almost ruptured his image in professional life:

Disputation with Greg Chappell: Well, the most infamous controversies of his life that almost destroyed his career. Greg Chappel replaced John Wright as the coach of the Indian Cricket Team in 2005. During that time Ganguly was having a rough patch as he was not among runs in the last few matches. It was during that time that a few suggestions on his batting and captainship from Chappel didn’t go well with him. And the infuriated Ganguly spoke to the media against Chappel which sidelined him from the International cricket for one year despite regaining his form.

Parted ways with KKR due to split Captaincy: Ganguly led Kolkata Knight Riders in the inaugural season of the Indian Premier League, however, the next season of the cash-rich tournament was staged in South Africa. The management went with the strategy of “multiple captains” and appointed Brendon McCullum as the skipper. That decision left the KKR fans fumed and the side also had one of the most disastrous seasons.

Conflict with Shane Warne in IPL: The rivalry between India and Australia was clearly visible during the inaugural edition of the Indian Premier League in a match between Kolkata Knight Riders vs Rajasthan Royals. Supposedly KKR were to bat first but Ganguly didn’t show on on the crease on time. That left Rajasthan’s skipper Shane Warne annoyed which he later expressed in the front of the media.

Shirt Waive-off in Natwest Series: Ganguly hit the headlines yet again during the Natwest finals between England and India in 2002. Apparently, India had to chase down a stiff target of 326 runs to win the trophy. It was one of the most riveting and nail-biting contests that even forced the India skipper to open his shirt and waive off in the air as the Indian middle-order batsmen chased down the stiff target in a dramatic contest. Apparently, Ganguly did that deliberately because Andrew Flintoff’s did almost the same thing during England’s visit to India earlier that year.

Making Steve Waugh wait for the toss: Ganguly was in the headlines for yet again the similar reasons during the 2001 series against Australia. Apparently, the Australian skipper had to wait for the Indian counterpart for the toss which annoyed him and later he questioned Ganguly’s lack of respect for the game. Ganguly denied all the allegations of showing up late on most of the occasion saying he did that once as he couldn’t find his blazer.

Affair with the actress Nagma: Ganguly was under the limelight yet against in 2001 when a rumour of him dating the Bollywood actress Nagma spread on the social media all over. Before setting off for the series against Australia, Ganguly had visited a South Indian temple along with Nagma where it was alleged that he performed rituals that were performed by the married couples. However, his wife Dona rubbished all the rumours and stood by his side.

Refused to carry drinks on his debut: This takes us back to Ganguly as a rookie who had travelled to Australia with the Indian team during the 1991-1992 year. Ganguly was told to carry the drinks for his teammates which he refused to do so, which made him people say he was arrogant as a youngster. Later, after a few years, Ganguly recounted the incident as he bashed the then team manager Mr Ranbir Singh for his management skills.

Sourav Ganguly's Social Media

Sourav Ganguly is mostly active on Twitter and Instagram where he keeps his fans updated about his whereabouts and latest brand endorsements. Ganguly has over 1.3 million followers on Instagram and 5.1 million followers on Twitter. He also has an official page on Facebook but he is not so active there as he is on Instagram and Twitter.

Use: SouravGangulyBiography, SouravGangulyage, SouravGangulybirthday, SouravGangulyheight, SouravGangulynetworth

#SouravGangulyBiography#SouravGangulyage#SouravGangulybirthday#SouravGangulyheight#SouravGangulynetworth

0 notes

Text

Exploring the Compelling Advantages of Investing in Physical Gold Bars and Coins

Gold holds its position as the supreme choice among precious metals for investment in India. This preference is anchored in the enduring allure and prestige of this precious metal, reinforced by its exceptional liquidity and its role as a safeguard against inflation. Gold has unquestionably earned its reputation as one of the most highly sought-after investment options available. Its versatility, spanning from exquisite jewelry to coins, bars, gold exchange-traded funds (ETFs), gold funds, and sovereign gold bond schemes, underscores its universal appeal and adaptability as a potent investment avenue.

Irrespective of one's income level, the magnetism of physical gold remains robust as a secure and potentially lucrative asset that warrants thoughtful consideration for investment. When it comes to purchasing or selling gold, you can rely on reputable gold buyers and sellers in Kolkata, such as Rahul Refinery.

Protection Against Inflation Risk

In the expansive economic landscape of India, the specter of long-term inflation casts a formidable shadow over cash-based investments. To guard against this risk, allocating a portion of savings to gold can serve as an effective countermeasure. A meticulous examination of gold's consistent outperformance of inflation rates over time, accessible through online platforms, provides concrete evidence of its effectiveness as an inflation hedge.

Securing Future Savings

Strategically earmarking a portion of one's regular income for future needs remains a pivotal financial endeavor. Unlike other investment avenues like real estate or fixed deposits, channeling resources into physical gold promises enduring and stable returns over time. Opting for NABL-certified and quality-guaranteed gold coins not only ensures a prudent investment choice but also bolsters confidence in its authenticity.

Convenience in Transactions

The appeal of investing in gold bars and coins is further accentuated by the convenience of procurement through platforms like Rahul Refinery. Online avenues provide access to NABL-certified products, complete with comprehensive documentation for future reference. Additionally, the ease of selling gold through local traders during periods of favorable prices underscores the fluidity of such investments.

Minimal Maintenance Requirements

One distinctive facet of gold investment lies in its remarkably low-maintenance nature over the years. This sets it apart from other investment vehicles that demand ongoing upkeep. Gold can be securely stored within a locker for extended periods without necessitating regular attention, amplifying its allure.

Price Stability and Resilience

Historical data underscores the intrinsic resilience of gold prices. Instances of prolonged price declines are overshadowed by robust rebounds, particularly during times of financial upheaval. This phenomenon underscores gold's reputation as a haven, contributing to its long-term price stability.

Seamlessly Passing on Generational Wealth

Gold investments are imbued with a rich tradition in India - that of passing on wealth to successive generations. This cherished practice, which often manifests during significant life events such as weddings, underscores gold's enduring legacy as a treasured asset.

Collateral for Loans

Physical gold assets hold inherent liquidity, making them a viable collateral option for securing prompt loans from reputable banks and financial institutions.

Diversification for Balanced Portfolios

Despite the allure of returns presented by stock markets and real estate, they are accompanied by substantial long-term risks. Integrating gold into an investment portfolio can effectively diversify risk, leveraging its tendency for more stable rates.

Assurance of Secure Investments

Comparative analysis of historical rates highlights the enduring security gold investments offer for the future. Their ability to maintain value in the market over extended periods serves as a testament to their reliability.

Long-term Value Preservation

Unlike other assets subject to depreciation over time, gold assets stand resolute. Their value remains impervious to the ravages of age, ensuring favorable returns and long-term financial security.

For those seeking to invest, personalized gold and silver coins from trusted gold and silver sellers like Rahul Refinery promise transparency, substantiated by NABL certifications and other industry accreditations. Leveraging cutting-edge Swiss technology, our products epitomize excellence. Embark on the journey of acquiring customized coins for personal or corporate purposes by initiating your order with us.

0 notes

Text

Club together, Indian football’s new deal