#Canadian Oilfield Chemicals Market Growth

Explore tagged Tumblr posts

Text

Canadian Oilfield Chemicals Market: An Exclusive Study On Upcoming Trends And Growth Opportunities

The Canadian oilfield chemicals market size is projected to reach USD 1.79 billion by 2025, registering a CAGR of 3.9% over the forecast period, as per a new report by Grand View Research, Inc. Growing exploration in the states such as Alberta, Newfoundland, British Columbia, and Manitoba is expected to promote the demand for chemicals used in the aforementioned processes.

The industry is characterized by the production of bio-based products which is expected to limit the demand for the oilfield chemicals. However, increasing complexity of the exploration processes coupled with the rise in the demand for oil in Mexico is expected to result in an increased demand for such chemicals over the forecast period.

The crude oil prices have been witnessing a steady decline due to overproduction and oversupply from OPEC members and North America, making the market less lucrative for E&P activities. As a result, the key players in the industry have adopted sustainable resolutions keeping in mind the long-term aids and the dominant regulatory situation

Large reserves of unconventional hydrocarbon reserves in the form of shale gas, tight oil and oil sands is likely to drive the industry growth. In addition, high investments from multinational oil and gas majors such as Imperial Oil, ExxonMobil, and Suncor is expected to steer drilling activities over the forecast period which is further expected to drive growth.

Browse full report with Table of Content @ https://bit.ly/3FZ7uMy

Canadian Oilfield Chemicals Market Report Highlights

• The use of corrosion inhibitor in the country is expected to realize market revenues of USD 415.0 Million by 2025 on account of high concerns regarding scale removal and pipeline protection

• The demand for oilfield chemicals in drilling is expected to grow at a CAGR of 3.9% from 2019 to 2025 on account of growth in the exploration activities driven by the demand for oil in North America

• The demand for the products for onshore exploration accounted for a revenue share of 91.4% of the overall market on account of the presence of majority of the oil wells onshore

• The segment development is mainly driven by the increasing E&P activities in unconventional reserves for shale gas, tight gas and CBM and large number of mature wells across the country

• Some of the companies operating in the Canadian oilfield chemicals industry include BASF, Dow Chemical Company, Lubrizol Canada, Ltd., and are integrated across the value chain to provide a number of services

For Requesting a Sample Copy of This Report, Please Visit @ https://bit.ly/3eV7OQs

#Canadian Oilfield Chemicals Market#Canadian Oilfield Chemicals Industry#Canadian Oilfield Chemicals Market Growth#Canadian Oilfield Chemicals Market Analysis#Canadian Oilfield Chemicals Market Forecast#Canadian Oilfield Chemicals Market Size#Canadian Oilfield Chemicals Market Share#Canadian Oilfield Chemicals Market Report#Canadian Oilfield Chemicals Market Research#Canadian Oilfield Chemicals Market Outlook#Canadian Oilfield Chemicals Market Segmentation#Canadian Oilfield Chemicals Market To 2025

0 notes

Text

Oilfield Process Chemicals Market Sales Revenue to Significantly Increase in the Next Few Years

Market Overview

Oilfield process chemicals are used in exploration and various extraction stages such as surfactant flooding and caustic flooding at oil and gas refineries or reservoirs. Oilfield process chemicals are used in separating gas from oil or separating oil from gas. Further Oilfield process chemicals control corrosion, fluid loss, waxes, bacteria, hydrogen sulfide and foam. It is also responsible for removal of water vapor, acid gas separation, and heavy hydrocarbon separation from the gases. Based on the application the major product categories of oilfield process chemicals include, stimulation fluids, drilling, workover, completion, cementing, production, and enhanced oil recovery chemicals. Drilling chemicals holds the largest market share in 2013.

To remain ‘ahead’ of your competitors, request for a samples@ https://www.persistencemarketresearch.com/samples/3081

Based on chemical characteristics the global market for oilfield process chemicals can be broadly categories as biocides, demulsifiers, corrosion and scale inhibitors, pour point depressants, advanced polymers, surfactants and others. Demulsifier holds the largest market share in 2013. Demulsifiers are special surface active agents comprising relatively high molecular weight of polymers. When they are added to the oil, they tend to migrate to the oil–water interface and break the stabilizing film present in crude oil.

The demand for oilfield process chemicals is influenced by numerous factors. The energy requirement of developing countries such as India, China, and Brazil, are continuously increasing owing to improving living standards of consumers in these regions. Crude oil and natural gas are crucial to the energy supply chain and plays an important role in overall economy development of a region. In recent years, several developing nations are stepping towards self-reliability in oil and gas by investing in development of new onshore as well as offshore oil reserve.

Moreover production capacities of oil and gas refineries are increasing. This increase demand and production capacity of oil and gas leads to an increased market for oilfield process chemicals. North America is the largest market for oilfield chemicals followed by Rest of the World (Middle East and Latin America) and Asia Pacific. The market for oilfield process chemicals in North America experiencing a double digit growth rate attributed to recent development of North America shale assets, oil sands, and Gulf of Mexico’s deepwater resources in this region. The oilfield process chemical is growing at moderate rate in Asia Pacific mainly led by the increase production capacity of China. Middle East and Latin America are two traditional markets for oilfield process chemicals where market is offering a lucrative growth owing to increasing production capacity of oil and gas processing plants in this region.

To connect with our sales representative- [email protected]

The major companies operating in global oilfield process chemical market include Baker Hughes, Inc., Ecolab, Inc., Halliburton Co., Schlumberger Ltd., Ashland, Inc., Gulf Coast Chemical LLC, BASF SE., Canadian Energy Services & Technology Corp., Chemex Inc., Chevron Corp., China National Petroleum Corp., Lamberti S.p.A., Sichem LLC, SMC Technologies, Inc., Stepan Co., Syrgis Performance Chemicals, The Dow Chemical Co., The Lubrizol Corp., Unitop Chemicals Pvt. Ltd.,Weatherford International, and Well Flow International LLC

Key points covered in the report

The report segments the market on the basis of types, application, products, technology, etc (as applicable)

The report covers geographic segmentation

North America

Europe

Asia

RoW

The report provides the market size and forecast for the different segments and geographies for the period of 2010 to 2020

The report provides company profiles of some of the leading companies operating in the market

The report also provides porters five forces analysis of the market

For in-depth competitive analysis, buy now@ https://www.persistencemarketresearch.com/checkout/3081

About Us: Persistence Market Research

Contact Us:

Persistence Market Research USA

Address – 305 Broadway, 7th Floor, New York City, NY 10007 United States U.S. Ph. – +1-646-568-7751 USA-Canada Toll-free – +1 800-961-0353

Sales – [email protected] Website – https://www.persistencemarketresearch.com

0 notes

Text

Global Benzalkonium Chloride Market- Industry Analysis and Forecast (2019-2027) – by Type, Application, End-use Industry, and Region.

Global Benzalkonium Chloride Market was valued US$ XX Mn in 2019 and is expected to grow US$ XX Mn by 2027, at a CAGR of XX% during the forecast period.

The report study has analyzed the revenue impact of COVID-19 pandemic on the sales revenue of market leaders, market followers, and market disrupters in the report, and the same is reflected in our analysis.

Market Definition:

Benzalkonium Chloride, also identified as alkyl dimethyl benzyl ammonium chloride (ADBAC), is a type of cationic surfactant. It is used as a corrosion inhibitor in the oil & gas industry. The security factor of benzalkonium chloride leads to use in several topical and ocular products as a preservative and to optimize emollient substantively.

Market Dynamics:

The demand of Benzalkonium Chloride from developing economies, growth in industrialization, and increase in applications drives the global benzalkonium chloride market. Advanced formulations using this chemical with quaternary ammonium derivatives is expected to grow benzalkonium market and improve the efficacy of benzalkonium based disinfection products. Also, the primary companies in benzalkonium chloride production are continuously involved in developing and studying surfactant technologies to provide dynamic inclinations of a growing consumer base.

On the other hand, the health hazards related to the exposure of benzalkonium chloride, like skin irritation, eye corrosion, etc. thereby leading to dermatitis and further limiting benzalkonium chloride market growth. Long-term use of products containing such ingredients can lead to the proliferation of resistant bacteria in food processing facilities, hospitals, farms, and households, further hampering the market growth.

Market Segmentation:

By type, the benzalkonium chloride 50% segment is expected to hold the largest market share by 2027. This product finds extensive usage as a disinfectant, antiseptic, and preservative in ocular drugs because of its germicidal nature and surface cationic properties in polymerization reactions. This product shows superb anti-infective properties and makes it ideal for hygiene products. This would supplement in encouraging market growth.

The benzalkonium chloride 80% segment held the largest market share in 2018, because of its wide adoption in leather, sugar, pulp & paper, industrial water treatment, and aquaculture industries. The product's excellent antibacterial properties increase its suitability for chemical, dairy, food & beverage, household, and agriculture disinfectant products. It shows noteworthy toxicity against fungi, algae, and enveloped viruses which should increase product demand for oilfield applications.

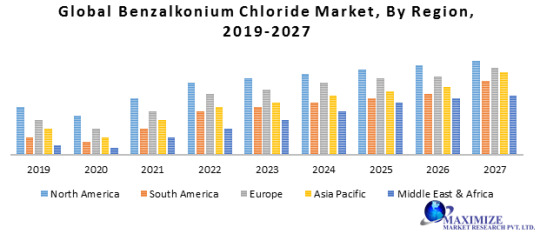

Region-wise, the North American market is expected to hold the largest market share of the global market by 2027. The countries in this region are the U.S. and Canada. Enhanced sales opportunities for the U.S. and Canadian oil-field equipment producers together with an impending overhaul of Mexican refineries should boost North America's oil & gas market and regional industry growth as well. This product is vital in the oil and gas industry to prevent the generation of toxic hydrogen sulfide gas by microbial growth, thereby, reducing the possibility of corrosion & stress cracks and encouraging product demand.

The objective of the report is to present a comprehensive analysis of the Global Benzalkonium Chloride Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Benzalkonium Chloride Market dynamics, structure by analyzing the market segments and project the Global Benzalkonium Chloride Market size. Clear representation of competitive analysis of key players by type, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Benzalkonium Chloride Market make the report investor’s guide.

Global Benzalkonium Chloride Market Request For View Sample Report Page :@https://www.maximizemarketresearch.com/request-sample/65386

Scope of the Global Benzalkonium Chloride Market

Global Benzalkonium Chloride Market, By Type

• Benzalkonium Chloride 50% • Benzalkonium Chloride 80% Global Benzalkonium Chloride Market, By Application

• Biocide o Eye & Ear Nasal Drops o Hand Sanitizers o Shampoos • Disinfectants o Spermicidal Creams o Cationic surfactant o Water Treatment • Oil and Gas o Horticulture and Household o Phase Transfer Agent o Organic Compounds o Drugs Global Benzalkonium Chloride Market, By End-use Industry

• Oil and Gas • Pharmaceuticals and Cosmetics • Chemical • Aquaculture • Timber Protection • Paper and Pulp • Textile • Leather Global Benzalkonium Chloride Market, By Region

• North America • Europe • Asia Pacific • Middle East & Africa • South America Key players operating in the Global Benzalkonium Chloride Market

• Kao • Quat-chem • Novo Nordisk pharmatech • Stepan • Aarti Industries Ltd • Boke Water treatment • Delta Chemsol • Noida Chemical • Ava Chemicals Private Limited • Premier Group of Industries • Innova Corporate

Global Benzalkonium Chloride Market Do Inquiry Before Purchasing Report Here @ :https://www.maximizemarketresearch.com/inquiry-before-buying/65386

About Us:

Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: Maximize Market Research Pvt.Ltd.Pune Email: [email protected] Contact: +919607065656 / +919607195908 Website:www.maximizemarketresearch.com

0 notes

Text

Global Benzalkonium Chloride Market: Industry Analysis and Forecast (2019–2027)

Global Benzalkonium Chloride Market was valued US$ XX Mn in 2019 and is expected to grow US$ XX Mn by 2027, at a CAGR of XX% during the forecast period.

The report study has analyzed the revenue impact of COVID-19 pandemic on the sales revenue of market leaders, market followers, and market disrupters in the report, and the same is reflected in our analysis.

Market Definition:

Benzalkonium Chloride, also identified as alkyl dimethyl benzyl ammonium chloride (ADBAC), is a type of cationic surfactant. It is used as a corrosion inhibitor in the oil & gas industry. The security factor of benzalkonium chloride leads to use in several topical and ocular products as a preservative and to optimize emollient substantively.

Market Dynamics:

The demand of Benzalkonium Chloride from developing economies, growth in industrialization, and increase in applications drives the global benzalkonium chloride market. Advanced formulations using this chemical with quaternary ammonium derivatives is expected to grow benzalkonium market and improve the efficacy of benzalkonium based disinfection products. Also, the primary companies in benzalkonium chloride production are continuously involved in developing and studying surfactant technologies to provide dynamic inclinations of a growing consumer base.

On the other hand, the health hazards related to the exposure of benzalkonium chloride, like skin irritation, eye corrosion, etc. thereby leading to dermatitis and further limiting benzalkonium chloride market growth. Long-term use of products containing such ingredients can lead to the proliferation of resistant bacteria in food processing facilities, hospitals, farms, and households, further hampering the market growth.

Market Segmentation:

By type, the benzalkonium chloride 50% segment is expected to hold the largest market share by 2027. This product finds extensive usage as a disinfectant, antiseptic, and preservative in ocular drugs because of its germicidal nature and surface cationic properties in polymerization reactions. This product shows superb anti-infective properties and makes it ideal for hygiene products. This would supplement in encouraging market growth.

The benzalkonium chloride 80% segment held the largest market share in 2018, because of its wide adoption in leather, sugar, pulp & paper, industrial water treatment, and aquaculture industries. The product’s excellent antibacterial properties increase its suitability for chemical, dairy, food & beverage, household, and agriculture disinfectant products. It shows noteworthy toxicity against fungi, algae, and enveloped viruses which should increase product demand for oilfield applications.

Region-wise, the North American market is expected to hold the largest market share of the global market by 2027. The countries in this region are the U.S. and Canada. Enhanced sales opportunities for the U.S. and Canadian oil-field equipment producers together with an impending overhaul of Mexican refineries should boost North America’s oil & gas market and regional industry growth as well. This product is vital in the oil and gas industry to prevent the generation of toxic hydrogen sulfide gas by microbial growth, thereby, reducing the possibility of corrosion & stress cracks and encouraging product demand.

The objective of the report is to present a comprehensive analysis of the Global Benzalkonium Chloride Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Benzalkonium Chloride Market dynamics, structure by analyzing the market segments and project the Global Benzalkonium Chloride Market size. Clear representation of competitive analysis of key players by type, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Benzalkonium Chloride Market make the report investor’s guide.

Global Benzalkonium Chloride Market Request For Sample Page @ : https://www.maximizemarketresearch.com/request-sample/65386

Scope of the Global Benzalkonium Chloride Market

Global Benzalkonium Chloride Market, By Type

• Benzalkonium Chloride 50% • Benzalkonium Chloride 80% Global Benzalkonium Chloride Market, By Application

• Biocide o Eye & Ear Nasal Drops o Hand Sanitizers o Shampoos • Disinfectants o Spermicidal Creams o Cationic surfactant o Water Treatment • Oil and Gas o Horticulture and Household o Phase Transfer Agent o Organic Compounds o Drugs Global Benzalkonium Chloride Market, By End-use Industry

• Oil and Gas • Pharmaceuticals and Cosmetics • Chemical • Aquaculture • Timber Protection • Paper and Pulp • Textile • Leather Global Benzalkonium Chloride Market, By Region

• North America • Europe • Asia Pacific • Middle East & Africa • South America Key players operating in the Global Benzalkonium Chloride Market

• Kao • Quat-chem • Novo Nordisk pharmatech • Stepan • Aarti Industries Ltd • Boke Water treatment • Delta Chemsol • Noida Chemical • Ava Chemicals Private Limited • Premier Group of Industries • Innova Corporate

About Us: Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Website:www.maximizemarketresearch.com

0 notes

Link

The oil price crash may have had a muted effect on Canadian stocks, especially in comparison with those down in the United States. But the fact is that hydrocarbon producers are facing some stiff headwinds.

Let’s take a look at alternative sectors for investment today. Here’s what energy investors need to know right now from commodities and a popular green power play to an exciting new IPO to watch.

Oil isn’t done yet, but it needs to change tack

There’s a strong case for going green in a stock portfolio. However, the black gold isn’t finished just yet. Oilfields could be repurposed for hydrogen sequestration. In the long run, therefore, some oil names may well be worth holding for long-term upside. Investors should also look beyond the energy industry for an oil recovery, since oil is also a major chemical and manufacturing component.

That said, it seems safe to say that there is no upside left in oil stocks in their current form. Where, then, should energy investors look for stronger returns and a healthier long-term outlook? With demand destruction eating away at the thesis for holding oil stocks, the green economy could provide an alternative source of upside. Undervalued commodities, such as lithium and uranium, are a potentially lucrative long-term play.

Scouting for green economy stocks? Buy for growth

Selling for $4.40 a share, Lithium Americas fits the bill as an undervalued pure play for potentially steep upside. Its high price target of $20 shows just how hefty the returns from this name could be in the mid- to long term. Uranium is a similar play for an undervalued commodity attached to the green economy. Cameco is strong a buy in this space, bringing the potential of 30% upside if uranium gains.

If you’re buying green power stocks, though, Brookfield Renewable Partners should be on your wish list. The Brookfield stable is renowned for world-class asset management expertise, so that’s reason number one to get invested. Other selling points include strong diversification across energy types and regions, and a tasty and reliable dividend. Revenue from wind, solar, and hydro sources feeds a 4.6% yield.

GFL Environmental is a key new IPO in the green economy space, and a strong buy. Comparing GFL and its closest competitor Waste Connections shows the main reason to buy the new IPO: GFL’s P/B is a touch lower at 2.5 times book. Its share price is also considerably lower at $24.80 at the time of writing. A dividend yield of 0.26% is on offer from GFL and could potentially grow as time goes on.

The bottom line

Investors should know how exposed they are to hydrocarbon in their portfolios. Rallies are as good a time as any to trim these types of names, especially the ones that are the most exposed to cratering crude prices. In the meantime, stacking shares in top names that span the full gamut of the green economy could bring tangible rewards from a global growth trend.

Just Released! 5 Stocks Under $49 (FREE REPORT)

Motley Fool Canada’s market-beating team has just released a brand-new FREE report revealing 5 “dirt cheap” stocks that you can buy today for under $49 a share.

Our team thinks these 5 stocks are critically undervalued, but more importantly, could potentially make Canadian investors who act quickly a fortune.

Don’t miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

Claim your FREE 5-stock report now!

0 notes

Text

The Next Big Thing In Flow Computer Market 2024 Is Here ($ 1474.13 Million Market) - Global Reporting

Global Flow Computer Market Research Report: by Component (Hardware, Software and Services), by Operations (Single Stream Flow Computers and Multi-Stream Flow Computers), by Connectivity (Wired Flow Computers and Wireless Flow Computers), by Equipment (Pressure Gauges, Temperature Probes, Gas Composition Sensors, Meter Prover, Sampling System, Density Measurement Equipment and others), by Applications (Fuel Monitoring, Liquid & Gas Measurement, Wellhead Measurement and Optimization, Pipeline Transmission and Distribution and others) and by Region (North America, Asia-Pacific, Europe, Middle East and Africa and South America) — Forecast till 2024

Flow Computer Market Highlights

The Global Flow Computer Market is expected to reach USD 1474.13 million at a CAGR of over 8.49% by the end of the forecast period 2019–2024.

FREE Sample@ https://www.marketresearchfuture.com/sample_request/8147

The global flow computer market is spanned across North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. North America is expected to account for the largest share in the flow computer market, with a significant growth rate during the forecast period. For the purpose of analysis, North America has been categorized into three regions — the US, Canada, and Mexico. During the forecast period, the US is expected to be the leading region in terms of market share, growing at a CAGR of 7.80%, followed by Canada with 6.72% and Mexico with 5.86%. The US accounted for the largest market share in the region due to the presence of advanced technology; furthermore, the country is the largest producer and consumer of oil & gas resources.

The key players in the oil production in Canada are Suncor, Canadian Natural Resources Limited, Imperial Oil, Husky, and Cenovus, which use flow computers to enhance their measurement operations and performance of the system by reducing measurement uncertainty during the process. Thus, flow computers make measurement systems more precise and accurate. Trillium Measurement and Control and Flowmetrics Inc., among others, are some of the companies operating in Canada and offering flow computers systems and equipment.

Europe accounts for the second-largest market share in the global flow computer market. Europe has various industries, including chemicals, petrochemical, and oil & gas, which use flow computer systems. The rising awareness for wastewater treatment is another factor driving the growth of the flow computer market. Countries such as the UK has various industries which use both oil and gas for production; for instance, milk-processing, breweries, alcohol, and beverages, among others. These industries use flow computers during the process for calculating the flow, volume, and temperature of fluids and gases.

Key Developments

In February 2019, Schlumberger Limited and Rockwell Automation announced an agreement to create a joint venture, Sensia, the first fully integrated digital oilfield automation solutions provider. The Sensia joint venture will become the fully integrated provider of measurement solutions and automation for the oil & gas industry. It will offer scalable, cloud, and edge-enabled process automation solutions.

In February 2019, ProSoft Technology Inc. launched its enhanced in-chassis flow computer for Rockwell Automation CompactLogix systems. This flow computer offers Lease Automatic Custody Transfer (LACT) accuracy solutions for oil & gas companies, reducing the maintenance costs

Browse Full Report Details @ https://www.marketresearchfuture.com/reports/flow-computer-market-8147

About Market Research Future: At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Reports (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research and Consulting Services. Contact: Market Research Future +1 646 845 9312 Email: [email protected]

#Flow Computer Market#Flow Computer#Flow Computer Market report#Flow Computer Market research#Flow Computer Market 2020#Flow Computer Market 2019#Flow Computer Market PDF#Flow Computer Market PPT#Flow Computer Market Trends#Flow Computer Market analysis#Flow Computer Market size#Flow Computer Market future#Flow Computer Market in US#Flow Computer Market in UK

0 notes

Text

4 Top “Green Economy” Stocks for Energy Investors

4 Top “Green Economy” Stocks for Energy Investors:

The oil price crash may have had a muted effect on Canadian stocks, especially in comparison with those down in the United States. But the fact is that hydrocarbon producers are facing some stiff headwinds.

Let’s take a look at alternative sectors for investment today. Here’s what energy investors need to know right now from commodities and a popular green power play to an exciting new IPO to watch.

Oil isn’t done yet, but it needs to change tack

There’s a strong case for going green in a stock portfolio. However, the black gold isn’t finished just yet. Oilfields could be repurposed for hydrogen sequestration. In the long run, therefore, some oil names may well be worth holding for long-term upside. Investors should also look beyond the energy industry for an oil recovery, since oil is also a major chemical and manufacturing component.

That said, it seems safe to say that there is no upside left in oil stocks in their current form. Where, then, should energy investors look for stronger returns and a healthier long-term outlook? With demand destruction eating away at the thesis for holding oil stocks, the green economy could provide an alternative source of upside. Undervalued commodities, such as lithium and uranium, are a potentially lucrative long-term play.

Scouting for green economy stocks? Buy for growth

Selling for $4.40 a share, Lithium Americas fits the bill as an undervalued pure play for potentially steep upside. Its high price target of $20 shows just how hefty the returns from this name could be in the mid- to long term. Uranium is a similar play for an undervalued commodity attached to the green economy. Cameco is strong a buy in this space, bringing the potential of 30% upside if uranium gains.

If you’re buying green power stocks, though, Brookfield Renewable Partners should be on your wish list. The Brookfield stable is renowned for world-class asset management expertise, so that’s reason number one to get invested. Other selling points include strong diversification across energy types and regions, and a tasty and reliable dividend. Revenue from wind, solar, and hydro sources feeds a 4.6% yield.

GFL Environmental is a key new IPO in the green economy space, and a strong buy. Comparing GFL and its closest competitor Waste Connections shows the main reason to buy the new IPO: GFL’s P/B is a touch lower at 2.5 times book. Its share price is also considerably lower at $24.80 at the time of writing. A dividend yield of 0.26% is on offer from GFL and could potentially grow as time goes on.

The bottom line

Investors should know how exposed they are to hydrocarbon in their portfolios. Rallies are as good a time as any to trim these types of names, especially the ones that are the most exposed to cratering crude prices. In the meantime, stacking shares in top names that span the full gamut of the green economy could bring tangible rewards from a global growth trend.

Just Released! 5 Stocks Under $49 (FREE REPORT)

Motley Fool Canada’s market-beating team has just released a brand-new FREE report revealing 5 “dirt cheap” stocks that you can buy today for under $49 a share.

Our team thinks these 5 stocks are critically undervalued, but more importantly, could potentially make Canadian investors who act quickly a fortune.

Don’t miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

Claim your FREE 5-stock report now!

0 notes

Link

Oilfield chemicals are specialty chemicals used in the downstream, midstream, and upstream operations in an oil & gas industry. Oilfield chemicals are used in well drilling & production facilities to increase the extraction operations by improving productivity and efficiency of the oil drilling process & petroleum refining and to succeed optimum performance with effective oil recovery. These chemicals ease the maintenance of smooth operating oilfield, which result in decrease of expenses over delays & stoppages during drilling processes.

According to study, “Global Oilfield Chemicals Market Size study, by Type (Biocides, Corrosion & Scale Inhibitors, Demulsifiers, Surfactants, Polymers, Gellants & Viscosifiers, Other Chemicals), by Application (Drilling Fluids, Cementing, Enhanced Oil Recovery, Production Chemicals, Well Stimulation, Workover & Completion) and Regional Forecasts 2018-2025” the key companies operating in the global oilfield chemicals market are Baker Hughes Inc., Akzo Nobel NV, Ashland, Inc., Clariant, Albemarle Corp., Ecolab Inc., Evonik Industries AG, Newpark Resources Inc., Dow Chemical Company, Stepan Company, Solvay S.A., Thermax Global, Huntsman International LLC, Versalis SpA, Canadian Energy Services & Technology Corp. (CESTC), Croda International PLC, Halliburton, SMC Oilfield Chemicals, BASF SE, Schlumberger Ltd., Kraton Corporation, Drilling Specialties Company (Chevron Phillips Chemical Company), Nalco Champion Technologies Inc. (ECOLAB), Exxonmobil Corporation, Scomi Energy Services BHD (Scomi Group BHD), Flotek Industries Inc., Innospec, The Lubrizol Corporation, Kemira, Zirax Limited.

Based on type, oilfield chemicals market is segmented into biocides, demulsifiers, corrosion & scale inhibitors, surfactants, gellants & viscosifiers, polymers, and others. Biocide segment is anticipated to hold major share in market owing to rise in utilization in offshore operations during the forecast period. Based on location, market is segmented into offshore and onshore. Based on raw material type, market is segmented into natural and synthetic. Synthetic segment includes hydroxyethyl cellulose, polyanionic cellulose and carboxymethyl cellulose while natural segment incldes fruits, plants, and others. In addition, based on application, market is segmented into drilling fluids, enhanced oil recovery, cementing, production chemicals, workover & completion and well stimulation. Drilling fluids are used to cool & lubricate the drill bit, interrupt formation cuttings and control formation pressure. Drilling fluids is expected as the largest segment due to increase in deep & ultra-deep drilling activities over the forecast period.

The oilfield chemicals market is driven by increase in demand for advanced drilling fluids, followed by rise in oil exploration & production activities, increase in productivity & optimizing costs, rise in demand for petroleum-based fuel from transportation industry, increase in shift towards unconventional drilling operations and rapid expansion of shale oil & gas drilling & production. However, increase in environmental concerns, rise in clean energy initiatives and crude oil price fluctuations may impact the market. Moreover, emergence of eco-friendly oilfield chemicals is a key opportunity for market.

Based on geography, the North American region holds major share in oilfield chemicals market owing to the expansion of shale oil & gas industries in region. The Asian-Pacific region is expected to witness higher growth rate due to large investment in the energy sector by China and India countries because of upsurge in demand for petroleum & crude oil over the forecast period. It is anticipated that the market will be reached at US $28.59 billion by 2025.

To know more, click on the link below:-

Global Oilfield Chemicals Market Research Report

Related Reports:-

Oilfield Biocides Chemicals Market Research: Global Status & Forecast by Geography, Type & Application (2015-2025)

Global Specialty Oilfield Chemicals Market Analysis 2013-2018 and Forecast 2019-2024

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

0 notes

Text

Global Oilfield Drilling Fluids Market 2019 | Manufacturers In-Depth Analysis Report to 2024

The latest trending report Global Oilfield Drilling Fluids Market 2019-2024 added by DecisionDatabases.com

Drilling fluids, also known as drilling mud, plays an important role in facilitating the drilling process by suspending cuttings, controlling pressure, stabilizing exposed rock, providing buoyancy, cooling and lubricating. Every drilling activity requires drilling fluids and they are used extensively across the globe. Drilling fluids are water, oil or synthetic-based, and each composition provides different solutions in the well. The worldwide market for Oilfield Drilling Fluids is expected to grow at a CAGR of roughly xx% over the next five years, will reach xx million US$ in 2024, from xx million US$ in 2019. This report focuses on the Oilfield Drilling Fluids in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Browse the complete report and table of contents @ https://www.decisiondatabases.com/ip/38884-oilfield-drilling-fluids-market-analysis-report

Market Segment by Manufacturers, this report covers

BASF

GENERAL ELECTRIC

Halliburton

Newpark Resources

Schlumberger

Baker Hughes (GE)

Halliburton

Weatherford

Schlumberger

Newpark Resources

Anchor Drilling Fluids

TETRA Technologies

Petrochem Performance Chemicals

Canadian Energy Services & Technology Corporation

Catalyst

Market Segment by Regions, regional analysis covers

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Market Segment by Type, covers

Water-based fluids

Oil-based fluids

Synthetic-based fluids

Market Segment by Applications, can be divided into

Onshore

Offshore

Download Free Sample Report of Global Oilfield Drilling Fluids Market @ https://www.decisiondatabases.com/contact/download-sample-38884

The content of the study subjects, includes a total of 15 chapters:

Chapter 1, to describe Oilfield Drilling Fluids product scope, market overview, market opportunities, market driving force and market risks. Chapter 2, to profile the top manufacturers of Oilfield Drilling Fluids, with price, sales, revenue and global market share of Oilfield Drilling Fluids in 2017 and 2018. Chapter 3, the Oilfield Drilling Fluids competitive situation, sales, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast. Chapter 4, the Oilfield Drilling Fluids breakdown data are shown at the regional level, to show the sales, revenue and growth by regions, from 2014 to 2019. Chapter 5, 6, 7, 8 and 9, to break the sales data at the country level, with sales, revenue and market share for key countries in the world, from 2014 to 2019. Chapter 10 and 11, to segment the sales by type and application, with sales market share and growth rate by type, application, from 2014 to 2019. Chapter 12, Oilfield Drilling Fluids market forecast, by regions, type and application, with sales and revenue, from 2019 to 2024. Chapter 13, 14 and 15, to describe Oilfield Drilling Fluids sales channel, distributors, customers, research findings and conclusion, appendix and data source.

Purchase the complete Global Oilfield Drilling Fluids Market Research Report @ https://www.decisiondatabases.com/contact/buy-now-38884

Other Reports by DecisionDatabases.com:

Global Drilling and Completion Fluids Market 2019 by Manufacturers, Regions, Type and Application, Forecast to 2024

Global Fire Resistant Hydraulic Fluids Market 2019 by Manufacturers, Regions, Type and Application, Forecast to 2024

Global Metal Cutting Fluids Market 2019 by Manufacturers, Regions, Type and Application, Forecast to 2024

About-Us:

DecisionDatabases.com is a global business research reports provider, enriching decision makers and strategists with qualitative statistics. DecisionDatabases.com is proficient in providing syndicated research report, customized research reports, company profiles and industry databases across multiple domains.

Our expert research analysts have been trained to map client’s research requirements to the correct research resource leading to a distinctive edge over its competitors. We provide intellectual, precise and meaningful data at a lightning speed.

For more details: DecisionDatabases.com E-Mail: [email protected] Phone: +91 9028057900 Web: https://www.decisiondatabases.com/

#Oilfield Drilling Fluids Market#Oilfield Drilling Fluids Market Report#Oilfield Drilling Fluids Market Industry Report#Oilfield Drilling Fluids Market Analysis#Oilfield Drilling Fluids Market Growth#Oilfield Drilling Fluids Market Trends#Oilfield Drilling Fluids Market Outlook#Global Oilfield Drilling Fluids Industry Report

0 notes

Text

Drilling Chemicals Market Industry Top Manufactures, Market Size, Industry Growth Analysis and Forecast: 2026

Drilling chemicals are majorly used in processes such as oil & gas exploration, metal & mineral extraction, coal seam gas drilling, and for bore well drilling. Drilling chemicals are useful in terms of cooling and lubrication of the drilling equipment, maintaining the pressure, removing cuttings from bore wells, and providing support and stabilizing the bore well area. Drilling chemicals are widely used to aid drilling boreholes into the earth’s crust. The rising number of deep water discoveries, especially in the Pacific regions as well as the Persian Gulf is expected to surge growth of the market.

Request PDF Sample of Drilling Chemicals Market: https://www.coherentmarketinsights.com/insight/request-pdf/334

Increasing usage of drilling chemicals is majorly attributed to major investments in energy & mineral exploration. Increasing demand for base metals, precious metals, oil, and natural gas is in turn resulting into rapid growth of the global drilling chemicals market in the recent past. This is primarily the resultant of rising rate of urbanization and industrialization in emerging economies. Growing concerns for spill containment, holding solid wastes and bore holes is also expected to augment growth of the market over the forecast period (2016–2024). Also, factors such as increasing offshore drilling activities across various regions, shale boom in few regions, and increasing exploration activities to discover untapped oil & gas reserves are also expected to be potential drivers of the market.

However, the global drilling chemicals market is affected by few restraints. One of the major restraints is the impact of drilling chemicals on the environment. The U.S. Environmental Protection Agency (EPA) puts a limit on the use of oil-based chemicals in offshore drilling processes, owing to its high level of aromatic substitutes in them which can be a major threat to marine organisms. Drilling chemicals can cause various environmental hazards during its usage and disposal which can have a direct detrimental impact on the flora and fauna and humans.

Onshore drilling is considered as the largest application which has a direct impact on the growth of the drilling chemicals market. Severe environmental conditions such as desert topography, extreme high and low temperatures, and dry environment necessitate deployment of various types of drilling chemicals either as a cooling agent or as a lubricant for the oil field drilling processes. Offshore drilling process is expected to be the fastest growing application market for drilling chemicals in the near future. Increasing expenditure in existing offshore wells in deep waters especially in the Gulf of Mexico, Persian Gulf , North Sea, and the South China Sea is expected escalate growth of the market globally.

Get More Information: https://www.coherentmarketinsights.com/market-insight/drilling-chemicals-market-334

Drilling Chemicals Market Outlook- Asia Pacific is expected to be the Most Lucrative Region for the Key Players

Regional segmentation for the global drilling chemicals market includes North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America holds a dominant position in the global drilling chemicals industry, owing to increasing oil and natural gas production in the region along with potential developments in oilfield in countries such as U.S. and Canada. Asia Pacific is expected to be the fastest growing market, owing to the increasing demand for drilling chemicals in countries such as China and India. According to data released by the Department of Industrial Policy and Promotion (DIPP), the petroleum and natural gas sector in India attracted FDI valued at US$ 6.8 billion between April 2000 and December 2016. Demand for drilling chemicals in certain countries such as UK and Netherland are significantly high owing to new oilfield exploration activities.

Major companies operating in the global drilling chemicals market include Anchor Drilling Fluids Inc., Tetra Technologies Inc., Canadian Energy Services Inc., Global Fluids & Chemical Co., Baker Hughes, Newpark Drilling Fluids LLC., M-I SWACO, and Halliburton.

About Coherent Market Insights:

Coherent Market Insights is a prominent market research and consulting firm offering action-ready syndicated research reports, custom market analysis, consulting services, and competitive analysis through various recommendations related to emerging market trends, technologies, and potential absolute dollar opportunity.

Contact Us

Mr. Shah

Coherent Market Insights 1001 4th Ave,

#3200

Seattle, WA 98154

Tel: +1-206-701-6702

Email: [email protected]

0 notes

Text

Pipe Coatings Market 2019 by Manufacturers, Types, Regions and Applications Research Report Forecast to 2023

Market Overview:

Pipe Coatings are protective coatings on metal pipes that are applied primarily to prevent corrosion and sustain harsh environmental conditions such as UV rays, moisture, solvents and others. The report published by Market Research Future (MRFR) states that the Global Pipe Coatings Market is anticipated to expand steadily at a CAGR of 5.18% during the forecast period of 2017-2023 and reach the valuation of USD 15,968.4 Mn by the end of 2023 from USD 11,800 Mn in the year 2017.

Industry Updates:

In September 2018, Altamont Capital Partners has announced the acquisition of major assets of The Bayou Companies, LLC, a Louisiana-based leading onshore and offshore pipeline coatings and insulation provider.

In February 2018, Shawcor Ltd., a Canadian oilfield services company, has received a conditional contract with the valuation of C$50 Mn from the EEW Group to provide anti-corrosion and concrete weight coatings for the replacement and upgrading activities being carried out at an offshore pipeline located in Qatar.

Key Players:

The prominent players that are profiled by MRFR in the report on the Global Pipe Coatings Market are AkzoNobel N.V, Arkema SA, 3M, The Sherwin-Williams Company, BASF SE, Axalta Coating Systems Ltd, Specialty Polymer Coating Inc, DowDupont Inc, PPG Industries, Inc, Wasco Energy, Shawcor, LyondellBasell Industries Holdings B.V, The Bayou Companies, LLC, and Tenaris.

Get Sample Report Copy for Brief Information @ https://www.marketresearchfuture.com/sample_request/4981

Market Drivers:

The substantial rise in the demand for energy from conventional sources has led to the increase in exploration and transport activities of oil and natural gas. The extensive application of pipe coatings in oil and natural gas industry in order to protect the pipelines from corrosion and environmental damage and increase the lifespan of the pipes are majorly fueling the growth of the Global Pipe Coatings Market.

The metal pipelines used in water and wastewater treatment plants are highly susceptible to corrosion due to constant contact with water and moisture. Increasing demand for high-quality pipe coatings in water and wastewater treatment plants in order to improve the durability of pipelines are propelling the growth of the Global Pipe Coatings Market.

Increased research and development activities are aiding in the introduction of high quality and long-lasting pipe coating chemicals. High adoption of chemical resistant, salinity resistant and long-lasting pipe coatings in marine and chemical processing units are aiding in the expansion of the global pipe coatings market.

Market Segmentation:

The Global Pipe Coatings Market has been segmented on the basis of Product Type, Surface Type, Form and End Use.

Based on Product Type, the Pipe Coatings Market has been segmented into thermoplastic polymer coatings, fusion bonded epoxy, metallic coatings, concrete coatings and others. The thermoplastic polymer coatings segment has been sub-segmented into polyethylene (PE), polypropylene (PP), polyurethane (PU), polytetrafluoroethylene (PTFE) and others.

Based on Surface Type, the Pipe Coatings Market has been segmented into internal and external.

Based on Form, the Pipe Coatings Market has been segmented into liquid and powder.

Based on End Use, the Pipe Coatings Market has been segmented into oil and gas, marine, chemical processing, water and wastewater treatment and others.

Read Comprehensive Overview of Report @ https://www.marketresearchfuture.com/reports/pipe-coatings-market-4981

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact: Market Research Future +1 646 845 9312 Email: [email protected]

0 notes

Text

Metal Injection Molding Market Keyplayers | Applications and Types | Forecast To 2025

Global Metal Injection Molding Market is expected to reach USD 6.52 billion by 2025. Metal Injection Molding (MIM) combines two recognized technologies; “powdered metallurgy” and “plastic injection molding” to offer cost-efficient solutions for complex geometries. The MIM process is executed in four main steps like mixing, injection molding, debinding, and sintering. The Metal Injection Molding Market is estimated to grow at a significant CAGR of 11.9% over the forecast period as the scope and its applications are rising enormously across the globe.

The factors that are playing a major role in the growth of Metal Injection Molding market are growing demand for small and complex components from manufacturers, reduction in wastage of raw materials, cost-efficient raw materials, and growing investment in the defense and medical sector. However, strict government policy may restrain overall Metal Injection Molding market growth in the years to come. Metal Injection Molding Market is segmented based on material type, end user, and region. The soft magnetic material, stainless steel, low alloy steel, and the other material types could be explored in Metal Injection Molding market in the forecast period.

Request Sample Copy of this Market Research @ https://www.millioninsights.com/industry-reports/metal-injection-molding-mim-market/request-sample

The other sector comprises tungsten, tool steel, and titanium. The stainless steel sector accounted for the significant Metal Injection Molding market share and is estimated to lead the overall market in the years to come. This could be due to its availability at lower cost in comparison with the other material types.

The Metal Injection Molding market may be categorized based on end users such as firearms & defense, electrical & electronics, industrial, automotive, consumer products, medical & orthodontics, and others that could be explored in the forecast period. The electrical & electronics sector is estimated to grow at a significant CAGR in the years to come. This may be because of growing demand for complex and small metal injection molded parts.

Globally, Asia Pacific accounted for the substantial share of Metal Injection Molding (MIM) market and is estimated to lead the overall market in the years to come. The reason behind the overall market growth could be increasing demand from end users like firearms & defense, automotive, industrial, electrical & electronics, and others. The developing countries like India and China are the major consumer Metal Injection Molding market in this region.

Browse Full Research Report @ https://www.millioninsights.com/industry-reports/metal-injection-molding-mim-market

Instead, North America and Europe are also estimated to have a positive influence on the future growth. North America is the second largest region with significant Metal Injection Molding market share. The reason behind the overall market growth could be Canadian and U.S. government initiative by providing several tax benefits. However, Europe is estimated to grow at fastest pace in the foremost period.

The key players of Metal Injection Molding Industry are Parmaco Metal Injection Molding, Indo-MIM, Parmatech Corporation, Dynacast International, Future High-Tech, ARC Group Worldwide, CMG Technologies, Phillips-Medisize, Sintex A/S, Smith Metal Products, Dean Group International, and NetShape Technologies. These players are concentrating on inorganic growth to sustain themselves amongst fierce competition.

Market Segment:

Metal Injection Molding market End-Use Outlook (Revenue, USD Million, 2014 - 2025)

Automotive

Consumer Product

Medical

Industrial

Defense

Others

Metal Injection Molding market Regional Outlook (Revenue, USD Million, 2014 - 2025)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Asia Pacific

China

India

Japan

CSA

Brazil

MEA

South Africa

Browse More Chemicals & Materials Related Market Research Reports:

Oilfield Chemicals Market Segmentation | Outlook and Application Till 2025

Vacuum Grease Market SWOT Analysis | Application and Demand Till 2025

Metallic Stearate Market Share, Size and Future Outlook Till 2025

For more details please visit @ Million Insights

0 notes

Text

Wood Group plc vs Royal Dutch Shell plc: which oil stock could make you rich?

Oilfield services play Wood Group (LSE: WG) has been splashed across the financial pages in recent days.

The engineer hit the newswires on Monday, when it announced plans to acquire industry rival Amec Foster Wheeler (LSE: AMEC) for £2.2bn. According to Wood Group chairman Ian Marchant, the deal will be a “transformational transaction,” and will create “a global leader in project, engineering and technical services delivery across a range of industrial sectors.”

The deal will enable Wood Group to lessen its reliance upon the fossil fuel segment, the new entity’s operations will be “diversified across the oil & gas, chemicals, renewables, environment & infrastructure and mining segments.”

On top of this, the combined group will also benefit to the tune of £110m from cost synergies, Wood Group said.

Big dog

And Wood Group made the papers again on Tuesday, after announcing that it had secured two separate contracts related to BP’s ‘Mad Dog 2’ deepwater asset in the Gulf of Mexico.

The engineer signed an $80m contract with Samsung Heavy Industries to provide engineering and procurement services for the topsides for BP’s Mad Dog Phase 2 floating production unit.

Furthermore, as part of Wood Group’s global services agreement with BP, the firm was awarded a $4.89m contract for subsea engineering and project management services to the offshore project.

Fossil fears

Whilst offering Wood Group a chance to enjoy multiple revenue streams, there is no guarantee that this week’s touted tie-up with Amec Foster Wheeler will prove a long-term solution to rampant profits growth as the oil market heaves with oversupply.

Indeed, Amec Foster Wheeler reported this week that revenues slumped 8% in 2016, to £5.4bn, as ongoing weakness in the fossil fuel sector offset strength in its solar and environment & infrastructure operations.

Frightening fundamentals

Concerns about the crude market’s supply and demand imbalance persisting long into the future could continue to hamper capital expenditure across the oil industry, and with it demand for the new company’s services.

Signs that output from US shale producers is about to spurt higher, allied with a steady build-up of North American crude stockpiles, has seen Brent slide back towards the $50 per barrel marker in recent days.

This situation clearly bodes badly for oil giants like Royal Dutch Shell (LSE: RDSB), whose hopes of a healthy earnings bounce-back are built on major producing nations keeping the taps turned down, in tandem with OPEC’s production freeze.

Last week, Shell’s ongoing divestment scheme saw it hive off some of its Canadian oil sands assets for a total of $7.3bn. Whilst essential in rebuilding its balance sheet, and thus financing bumper dividends, the business obviously needs a solid uptick in crude values to mend its stretched finances and reap the benefits of its blockbuster BG Group tie-up, too.

But this situation appears a world away, as the market remains swamped with unwanted material. And I don’t believe that Shell’s forward P/E ratio of 15.2 times or like Wood Group’s corresponding multiple of 15.6 times reflect either company’s still high-risk profiles.

I reckon cautious investors should give both stocks some distance right now.

Follow this Foolish advice

But splashing the cash on oil stocks like Shell and Wood Group is not the only mistake stock investors can make.

There are a multitude of traps share investors can fall into, from timing their trades incorrectly to listening to the wrong information. And this is where The Motley Fool can help.

Indeed, our crack team of boffins has drawn up a report titled Worst Mistakes Investors Make that outlines the key things you should consider before taking the plunge.

Click here to download the report. It's 100% free and can be delivered straight to your inbox.

More reading

Amec Foster Wheeler plc agrees £2.225bn takeover by John Wood Group plc

Is it your last chance to buy Royal Dutch Shell plc’s 7% yield?

Is this oil-and-gas stock the next Royal Dutch Shell plc?

Does $6m deal make this oil company a better buy than Royal Dutch Shell plc?

Are these ~6% dividend yields built on shaky foundations?

Royston Wild has no position in any shares mentioned. The Motley Fool UK has recommended Royal Dutch Shell B. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

0 notes