#CEO Financial Strategy Paytm

Explore tagged Tumblr posts

Text

How Paytm’s financial strategy is changing under CEO Vijay Shekhar Sharma leadership

Paytm is shifting its strategic focus to achieving profitability in terms of profit after tax (PAT) instead of concentrating solely on operational profit before employee stock option (ESOP) costs. This shift was announced by founder and CEO Vijay Shekhar Sharma on Thursday. Previously, Paytm had committed to reaching profitability before accounting for ESOP costs, which is a measure akin to earnings before interest, taxes, depreciation, and amortization (EBITDA).

Sharma emphasized that the company is evolving beyond merely focusing on EBITDA before ESOP, as this metric alone doesn’t fully capture a company’s financial health. The new goal is to mature as an organization and attain profitability based on PAT.

For the quarter ending June 30, 2024, Paytm reported a widened loss of ₹840 crore, compared to ₹358.4 crore for the same period last year. Additionally, consolidated revenue for the quarter fell by 33.48% to ₹1,639.1 crore from ₹2,464.2 crore year-over-year.

During the annual general meeting (AGM), Sharma also highlighted the transformative impact of artificial intelligence (AI) on various sectors. He forecasted a notable increase in automated vehicles over the next five years and stressed that AI technology will significantly affect financial services. Sharma pointed out that India, having made substantial progress in financial technology, is well-positioned to lead in AI advancements as well.

Paytm plans to bolster its AI capabilities in several areas, including risk management, credit risk assessment, fraud prevention, and insurance underwriting.

Furthermore, Paytm’s Chief Financial Officer, Madhur Deora, revealed that the company has invested considerable efforts in collaborating with local law enforcement agencies, including police, cyber cells, the enforcement directorate, and the Serious Fraud Investigation Office (SFIO). These collaborative workshops are aimed at helping investigative bodies understand and address the emerging challenges and types of crimes in the digital payments sector.

READ MORE

#Paytm Focus Shift#Profit After Tax Paytm#Operational Profit vs ESOP#Paytm CEO Statement#Paytm Financial Strategy#Profit Before ESOP#Paytm Tax Profit Focus#CEO Financial Strategy Paytm#Paytm Earnings Focus#Paytm Profit Metrics

0 notes

Text

Vijay Shekhar Sharma Payment Business Strategy

A senior company official stated on Sunday that Paytm, a fintech company, is prioritizing investments in its consumer payments division in an attempt to regain lost users as a result of RBI regulatory steps.

Paytm Payments Bank was not allowed to take deposits or process credit transactions in consumer accounts, including prepaid instruments and wallets, according to the RBI.

For Rs 2,048 crore, Paytm sold its ticketing division to foodtech company Zomato in August in order to concentrate more on its main business of distributing financial services and making payments.

“Payments continue to be our main business, with the merchant side performing well. However, we faced a notable decline in our consumer base due to regulatory hurdles. At an interactive event hosted by the Confederation of Indian Industry’s (CII) youth division, the Calcutta Chapter of Young Indians, Paytm CEO Vijay Shekhar Sharma stated, “We are dedicated to reinvesting in the consumer payments sector going forward.”

UPI payments are included in consumer payments, whereas merchant-side transactions use QR codes.Read More-https://voiceofentrepreneur.life/

2 notes

·

View notes

Text

Navigate the Digital Wave with a Specialized Online MBA in Fintech

The financial landscape in India is experiencing a similar transformation as the global market. Mobile wallets like Paytm and PhonePe are ubiquitous, and platforms like BharatPe are redefining lending for small businesses. This surge in Fintech adoption presents a wealth of opportunities for Indian professionals seeking to upskill or launch careers in this dynamic field.

An accredited online MBA specializing in Fintech can be your passport to success in the Indian Fintech revolution. It equips you with the knowledge, skills, and credentials to not only understand the intricacies of the local market but also thrive in the global Fintech ecosystem. Whether you're a seasoned banking professional in Mumbai or a recent graduate in Bangalore, a specialized online MBA can be your competitive edge.

Why Choose Fintech as Your Specialization in India?

The Indian Fintech market is booming, projected to reach a staggering $1 trillion by 2025. Here's why specializing in Fintech with an online MBA presents a compelling opportunity:

Immense Growth Potential: Be a part of this high-growth sector where innovation is key to success. Fintech is poised to revolutionize financial inclusion and access for millions of Indians.

Lucrative Career Options: Fintech jobs in India offer competitive salaries and excellent career progression. A specialized online MBA positions you for success in a field where talent is highly sought-after by both established financial institutions and disruptive startups.

Shape the Future of Indian Finance: Don't just be a bystander in this exciting transformation. Become a leader who helps shape the future of Indian Fintech with your specialized expertise and understanding of the local market.

Diverse Career Paths: The Indian Fintech industry offers a wide range of career paths, from developing mobile payment solutions to managing risks in the burgeoning P2P lending space. Find your niche and contribute to the financial empowerment of millions.

Beyond Textbooks: A Practical Approach for the Indian Market

A well-designed Fintech MBA goes beyond theoretical frameworks and dives deep into the practical application of technology within the Indian context. Here are some key areas you can expect a top online program to cover, tailored for the Indian market:

Understanding UPI and Aadhaar: Gain a comprehensive understanding of India's Unified Payments Interface (UPI) and its role in driving financial inclusion. Learn how to leverage Aadhaar, the world's largest biometric ID system, for secure and efficient financial transactions.

Navigating Regulatory Landscape: Master the intricacies of India's evolving Fintech regulations, including those pertaining to data privacy, digital KYC (Know Your Customer), and cryptocurrency trading.

Focus on Rural Fintech: Explore the challenges and opportunities of providing financial services to underserved rural populations in India. Learn about innovative Fintech solutions catering to this crucial segment.

Local Case Studies and Industry Insights: Analyze real-world examples of successful Indian Fintech companies like PhonePe and Zerodha. Gain insights from industry leaders and experts on the specific challenges and opportunities within the Indian market.

Learning Beyond Lectures: Experiential Opportunities Tailored for India

Many accredited online MBA programs with Fintech specializations go the extra mile to provide valuable hands-on learning experiences relevant to the Indian context:

Guest Lectures from Indian Fintech Leaders: Learn from the CEOs and founders shaping the Indian Fintech landscape. Gain insights into the local market dynamics and entrepreneurial strategies for success.

Case Studies of Indian Fintech Startups: Analyze real-world examples of disruptive Indian Fintech companies like BharatPe and Slice. Learn how these startups are solving financial challenges specific to the Indian market.

Fintech Simulations focused on Indian Scenarios: Simulate the challenges of launching a new micro-investment platform in India or develop a regulatory framework for the burgeoning digital lending space. These projects allow you to apply your learnings and hone your problem-solving skills within the Indian context.

Examples of Top-Ranked Online MBAs with Fintech Specializations in India:

Here are a few examples of well-respected online MBA programs with strong Fintech specializations that cater to the Indian market:

Indian Institute of Management Calcutta (IIM Calcutta) Online MBA: This prestigious institution offers an online MBA with a Fintech specialization, focusing on the specific needs of the Indian financial services sector.

XLRI Jamshedpur Online MBA: Renowned for its HR specialization, XLRI also offers an online MBA with a Fintech concentration. This program delves into the intersection of technology and human resources within the Indian Fintech space.

Symbiosis Centre for Distance Learning (SCDL) Online MBA: SCDL offers a UGC-approved online MBA program with a Fintech specialization. The program features a strong focus on the regulatory and technological landscape of Indian Fintech.

Remember, this is just a starting point. Numerous accredited online MBA programs in India offer Fintech specializations. Researching and finding the program that best aligns with your specific career aspirations.

0 notes

Text

Market Triggers: Sunil Subramaniam’s portfolio strategy for millennial investors

Market Triggers: Sunil Subramaniam’s portfolio strategy for millennial investors

“It is a good time to do selective buying across the mid and small caps. I do not think this correction in the indices is sustainable because Indian economy is on the mend. Diwali is a trigger where the markets could touch new lifetime highs unless domestic and global risk factors prevent it,” says Sunil Subramaniam, MD & CEO, Sundaram Mutual.

There has been a 5% reversal in small and midcap stocks and the big question being asked is are we in for a repeat of 2017 and 2018? No. The reason I say that is because 2017-2018 saw a decline in the progress of the Indian economy. I think the trigger there was the negative inflation in rural India followed by the financial crisis that saw IL&FS and DHFL fiascos. The midcap decline was probably correlated to a downtrend in the Indian economy which continued even as the Covid hit us. Then Covid gave it a further drubbing. Today the situation is opposite. We are on the back of a rebound in the economy.

Post Covid First Wave, we saw some rebound and then the second wave dampened it. Now the vaccination story is improving, the testing is improving and I think even if a third wave comes, the confidence of the economy can tackle it. There is good news on the export front, good news on the PLI investment front and lots of capex announcements. So I think, this is just a bit of profit taking because retail participation has driven this rally and naturally there will be a certain amount of profit booking as they see their money doubling and tripling.

But the underlying story is of an Indian economy in a recovery mode and by next year, we should be full on. There is a low base due to last year, but a sustainable 7% odd real GDP growth augurs very well for the mid and small caps space. I would say a long term investor should look at the correction to actually buy into quality midcaps and that is the differentiation I want to make. There has been a runup in everything and there is a lot of froth. Quality was forgotten in terms of the rally after the end of the first wave.

Now, quality stocks that can benefit from the economic revival and not just on news flows, are the ones which will benefit. So, it is a good time to do selective buying across the mid and small caps. I do not think this correction in the indices is something sustainable because Indian economy is on the mend.

While the template is not 100% right since markets are forward looking. What you are saying may play out, the economy will grow, earnings will come but maybe it is already in the price? Yes, what happens between what is in the price is the difference between a safety play and a cyclical growth play. In a safety play, you can say that it is in the price and can only expect normal growth rates as the earnings meet expectations.

In the cyclical growth plays, there is past evidence of V-shaped recovery in earnings predicting the recovery in cyclicals. I would say that the earnings will still come and give us an upside. The only difference is the timing. If the market expects it to happen by 2022-2023, it may actually happen by 2023-2024. But if you hang in there on the industrial cyclical belt, when you have something going 12, 10 or 8, market predicts 6; if you you called 8, 10, 12, market predicts 14. But it does not go in a linear line.

Economy sensitive small and midcap stocks have high fixed cost and high interest costs. A 10% increase in the top line will lead to a 20-25% increase in the bottom line. But the market will not take such a strong leap and they will come up with weighted average and put it in between.

So, when you pick a good quality company, it has the ability to invest in capex at the right time, build its order book and deliver. It is a very technical thing. In terms of quality, it is the capability of that company and the organisation to meet the demand surge. If quality stocks are picked, earnings exceeding market expectations is really going to drive them up.

You have given a lot of key drivers behind this rally in mid and small caps. Going forward what shape do you see this market take? Will it continue to be one of those markets where regardless of PE, regardless of valuations, you see a run up in the stock? The key point here is that when you look at the forward direction of the market, remember that there are two very different segments in the market; one is the established old world companies, some of which are well valued because there is predictability, some of which are cyclical and V-shaped.

In the manufacturing space, by and large things are predictable and the PLI scheme, the infrastructure pipeline, the real estate housing thing is going to drive these stocks forward. But there is another huge segment and that is what I call the emerging India which is largely in the services sector. The services sector is the most informal of all the sectors. About 55% of India’s GDP comes from the services space and why is that not reflected in the stock market?

Even today, the stock market is only reflecting 36% to 37% as a services market cap. So there is a huge 18% gap in the real economy that is driven by services which are not reflecting in the capital markets. What the recent boom has done is it has allowed all these companies to come into the stock market through IPOs.

All the IPOs which are largely in the services space, are coming in for the first time which means that there is no valuation history; there is no methodology to evaluate them; there is no earnings predictability because these are all businesses which start small and scale at 100 times. So the market will be in a discovery phase and that is where retail investors are all entering because they have a close connect with these companies in their day-to-day life. Now they do not know about the stock market, they are new investor;, the whole explosion of demat accounts and retail in India is coming from investors who sense that the internet, the digital world, the easy ordering that is their world and they sense it and they say that company is coming to the stock market I am confident it will do well. He does not care about valuations.

Going forward, this gap between services economy share and services market cap share has to narrow. If a very wide set of IPOs comes in, then the froth can get spread across the lot but definitely the new-age investor is going to invest in companies which he can understand and not in your traditional cyclical kind of bets. That is where one is going to differentiate.

The new IPOs are rising and so to play this market, one has to have a balanced perspective because as a market participant it is not just about your analysis and what you pick, it is also an understanding of what the others are buying and what is likely to then go up. The world including the stock market is changing and an awareness and a balanced approach will pay off.

Do you think that going forward, market leadership will be taken by simple businesses that you and I and the general mass understand like for example Zomato, Swiggy and Paytm. Do you think that is where we will see the next round of market rally? Yes, you have hit the nail on the head. For a new first time investor, he comes in understanding that that business will succeed. So all of these things where you mentioned Zomatos and Swiggys and Ubers and the Olas and the Oyos are what they know. Go back three decades ago. What was the favourite stock which everybody said that it is a good long term buy ? It was

. Why? Everyone uses toothpaste and knew they were going to use it his entire life. Today this generation is going to see what is simple, what is adding value to his life and coming to the stock market, is investing in it.

So what happens then to classic traditional businesses? The relatively secure, relatively less volatile businesses like large banks, FMCG and metal companies? Do you think that the metal rally will start tapering off? Not necessarily. The stock market today is a three-way pie. There is an FPI pie. There is a domestic institutional pie which is your LIC, insurance, mutual funds and then there is this retail pie. What I spoke about was the retail pie. FPIs are always going to look at two things – one is how is the world growth, where is India going to benefit. So export plays like IT and pharma and global cyclicals like metals. FPIs will be looking at global trends and then take the Indian companies to buy those. The domestic mutual funds by nature of their existence are going to be diversified. They are going to have a share of everything so they cannot get focussed into one.

It is true that there are focussed mutual funds which can do something like that but by and large this is diversified. Two-thirds of the play — FPIs and domestic institutions — are still going to be buying the broadbased old economy market based on the infrastructure story. The three pillars of infrastructure are the national infrastructure pipeline, the PLI scheme and the housing real estate sector boom. These are structural changes which are going to benefit in terms of actual earnings and the institutions understand this model well and that is where they will put their money. So they will continue to get support and so the rally will not fizzle. In fact, these people will drive those up.

One has to see how retail investors behave if and when there is a correction. How these so called Robinhood investors react is still an unknown commodity. So far they have shown resilience. I hope that sustains and continues but if they panic, then the froth in these new-age IPOs will come down and the old economy, traditional valuation based model will dominate the stock market.

One section of the market may drive this one way but in the overall market, the mix may change a little bit. I would still say our standard fundamental growth at a reasonable price basis is not going to go away and will continue to support the kind of sectors that you spoke about.

Right now if we have to construct the retail investor’s portfolio, what mix would you recommend? I would say that it should be safety oriented. When I say safety, it is the degree of certainty, of predictability of the earnings stream. So, I would put IT and consumption stocks into that bucket. That is one bucket of investment.

The second bucket is the Indian economy’s revival story which is largely cyclical, industrial and rate sensitive. In consumption, it will be consumer discretionaries, auto, housing and capital goods suppliers.

The third bucket is the new age companies coming in which have no history in the stock market and are coming in through the IPO mode and are presenting exciting opportunities.

For the new age investor, I would suggest a 30-40-30 allocation, 30% on the predictable earnings stream, 40% on the cyclicals going to a V-shape takeoff scheme and another 30% in the simple to understand but new to the capital markets businesses via IPOs or post IPO through the market. So that is the mix for a new age millennial kind of investor that I would recommend at this stage.

What could be the next trigger for markets to go higher? The next trigger is the continuance of the monsoon and the festival season related demand pickup. Because of the second wave, consumption has been held down and there is pent up demand. That combined with the fact that festival season will see festival bonuses in the eastern side in the Durga Puja, in the western side and the northern trough during Diwali. That will put a lot of money in the peoples’ hands. If data around vaccination progress from a domestic perspective, data around the monsoon progress, data around the third wave’s actual arrival beats the festival season and if we are able to push the third wave beyond the festival season, you will see a massive rise. That will then be a trigger. In terms of timeframe, I would say somewhere between Puja and Diwali is the time for a trigger.

The market will look at these numbers but it is not important just to look domestic. One also has to see on the overseas front how the US numbers look. The Fed is trying to calm the markets and keeps saying that tapering is very far away but the Fed has to be a slave to real data and if the real data surprises on the upside, the Fed will just forget its past speak and say the data looks good, inflation is no longer transient, we see that it is sustainable and they could announce, that is the one trigger which you have to keep in mind in terms of overseas.

There was a trigger around oil a few months back but I think that is easing in the sense of the Iran situation resolution, the OPEC policies and the fact for the US shale guys, the breakeven costs have come down substantially and they can always increase supply. So oil is not as much of a worry as it was a few weeks ago. For me, it is the US growth, inflation framework metrics that one has to keep an eye on.

Diwali is a trigger where the markets could touch new lifetime highs unless of course the risk factors that I have mentioned happen.

. Source link

0 notes

Text

Coronavirus blow: Firms prepare for slow capital flows, uncertainty

New Post has been published on https://apzweb.com/coronavirus-blow-firms-prepare-for-slow-capital-flows-uncertainty/

Coronavirus blow: Firms prepare for slow capital flows, uncertainty

Record capital flows into Indian startups, many of which have been chasing growth at all costs and seen valuations multiply in the past year, are expected to halt in the coming months as coronavirus disrupts economies around the world.

Companies have started preparing for the impact, initiating measures to protect their businesses and workforce. Paytm, Swiggy and Dailyhunt are among the firms which have announced mandatory work from home for employees while trying to maintain business continuity.

But tougher calls lie ahead: reducing cash burn, prioritising monetisation of existing customers over user growth, and adopting a strategy to break even or become profitable in what has been called a “Black Swan” event by Sequoia, the world’s top venture capital firm.

Online travel company MakeMyTrip’s executive chairman, Deep Kalra, now sees another “tough cycle” and a repeat of the 2008 global financial crisis that followed the collapse of Lehman Brothers. “People will hold back, which means grain gets separated from the chaff. Hunker down is my advice to all founders. Cash is completely the king; change your plans and survive the toughest times,” he said at an event in Delhi last week.

But the coronavirus outbreak and its effects are expected to change the investor mood in the coming months. Sudhir Sethi, founder and chairman of Chirate Ventures, said it would get tougher for both VCs and entrepreneurs, given the uncertainty over the scale of the impact of coronavirus on the global economy.

“Travel has fundamentally stopped. Limited Partners, or LPs, who invest in funds, have stopped travelling. Portfolio companies will really have to buckle down and save cash. Businesses will start getting tighter, spend less and last longer. They have to stay afloat and do well. This applies to both venture capital funds as well as portfolio companies,” said Sethi, whose portfolio companies include vertical e-tailers like Lenskart and Firstcry.

The impact on startups which are have cash reserves for six to 12 months and are looking to raise $15 million to $20 million will be the most significant, according to investors. These companies could face a potential cash crunch as they rely on investors based in the US and China. Travel to and from these countries, especially China, is unlikely to normalise before June or July.

Most of the top investors, like Tiger Global Management, Sequoia Capital India and Lightspeed Venture Partners, are in travel lockdown as venture firms with smaller teams could be at an even higher risk.

Though investors won’t stop evaluating deals, the decision-making cycle will take much longer. “Deals, where decisions have not been taken, could drag on. The consequence will be more internal rounds as it’s a genuine issue. Even companies that are doing well will need more time to raise money,” said Vinod Murali, managing partner at venture debt firm Alteria Capital. Meanwhile, investors are advising startups to rework their projections as a potential fall in top line could decrease the projections of their cash runways.

Supply chain still a concern “Expect companies with significant supply-chain linkages with China to be impacted in the short term,” said Aakash Goel, partner at venture debt firm Trifecta, adding that apart from online retail companies in social commerce and mobility, firms waiting for electric vehicle imports from China could also be affected. “I would suggest that startups focus on business continuity, ensuring safety stock on the supply side and using the crisis as an opportunity to strategically think about supply chain diversification, and even potentially indigenising portions of it.”

Some companies are already doing it. Fitness wearables maker Goqii, whose smartwatches are manufactured in Shenzhen, China, is evaluating alternative facilities in India, Vietnam and Taiwan. “One thing is certain now that we won’t like to rely only on China for our manufacturing,” said Goqii CEO Vishal Gondal. He added the company had deferred its new funding round for a few months and stopped mass media marketing to lower cash burn.

“Luckily our business model has been gross margin positive, so we were not in a rush (to raise money),” he said.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

Source link

0 notes

Text

Amazon now sells movie tickets in India

Amazon has set its eye on the next business it wants to disrupt in India: online movie tickets. The e-commerce giant said Saturday it has partnered with online movie ticketing giant BookMyShow to offer booking option on its shopping site and app.

The move comes months after the e-commerce giant began offering flight ticketing option in the country as it races to turn its payments service Amazon Pay into a “super app” — a strategy increasingly employed by players in emerging markets such as India.

Starting today, Amazon users in India can book their movie tickets from the “movie tickets” category under “shop by category” or the Amazon Pay tab, the e-commerce firm said. BookMyShow, which leads the online movie ticketing market, is the exclusive partner for this new offering, the two said.

Neither of the parties disclosed the financial arrangements of the deal, but BookMyShow is likely paying Amazon a fee for tapping “millions” of customers the e-commerce giant has amassed in the country.

Amazon said its credit card users in India will get a 2% cashback on each movie ticket purchase. Until November 14. it will also offer a cashback of up to Rs 200 on each ticket purchase.

For its flight ticketing service, Amazon India partnered with Cleartrip . Balu Ramachandran, SVP at Cleartrip, told TechCrunch in an interview earlier that the company was paying a promotional fee to Amazon, but declined to offer specifics.

An Amazon India spokesperson declined to comment on the financial arrangements.

BookMyShow, which employs 1,400 employees, sells about 15 million tickets each month. The service, which has a presence in over 650 towns and cities, today counts heavily-backed Paytm as one of its biggest rivals. Paytm, which entered the movie ticketing business three years ago, has been able to eat some of BookMyShow’s market share by offering cashback on each ticket purchase.

The media and entertainment business in India is worth $23.9 billion, a report from EY-FICCI said in March this year, which noted that consumer spendings on the web is increasingly growing. More than 50% of all tickets sold by the top four multiplex chains in the country in recent years have occurred on the web.

Ashish Hemrajani, founder and CEO of BookMyShow, said through the partnership the company will be able to access Amazon India’s “deep penetration across tier 2 and tier 3 cities.”

Mahendra Nerurkar, Director of Amazon Pay, said today’s partnership shows Amazon’s commitment to “simplify the lives of our customers in every possible way — as they shop, pay bills, or seek other services.”

Last month, Amazon introduced a new feature that allows Amazon Pay users to pay their mobile, internet, and utility bills. This is the first time Amazon is offering these functionalities in any market — it plans to bring this to the U.S. in coming months.

Amazon has been quietly expanding its payments offering, built on top of local banks-backed UPI payments infrastructure, in the country. Unlike its global rivals Google and Walmart that offer standalone apps for their payment services and also focus on transactions among customers, Amazon has kept Pay integrated with its e-commerce offering and focused on consumer-to-business transactions.

The company maintains tie-ups with several popular Indian online services and frequently offers cashback to incentivize users to pick Amazon Pay over other solutions. Earlier this week, Amazon pumped about $634 million into its India business.

0 notes

Text

#Paytm Profit#Paytm Strategy#Profit After Tax#Operational Profit#Paytm CEO#Financial Focus#Profit Metrics#ESOP Impact#Paytm Earnings#Profit Shift#marketing#ceo#entrepreneur#business#news

0 notes

Text

Alibaba and Amazon look to go global

IN SEPTEMBER 2014 Jeff Bezos announced his first big investment in India, hopping aboard a colourful bus in Bangalore. It was the start of a rapid $5bn investment in India, part of Mr Bezos’s plans to take Amazon global. Two months later Alibaba’s Jack Ma appeared in Delhi. “We will invest more in India,” he declared. The following year Alibaba put $500m into Paytm, an Indian digital-payments company. This year it led a fundraising round for Paytm’s e-commerce arm. The two giants seem set for an epic clash in India.

But in their home markets they have so far stayed out of each other’s way. Amazon has only a tiny business in China. Alibaba’s strategy in the United States has been to help American businesses sell in China and vice versa. “People always ask me, when will you go to the US?” says Alibaba’s CEO, Mr Zhang. “And I say, why the US? Amazon did a fantastic job.” The two firms have mostly invested in different foreign markets: Alibaba across South-East Asia and Amazon across Europe. But much of the rest of the world is still up for grabs.

The biggest tussles will probably be over growing economies and cross-border commerce. Alibaba aspires to serve 2bn customers around the world within 20 years—a benevolent empire that supports businesses. In some cases it has begun with digital payments, as in India with Paytm. In others it has invested in e-commerce sites, as with Lazada, in South-East Asia. But it intends to build a broad range of services within each market, including payments, e-commerce and travel services, and then link local platforms with Alibaba’s in China.

Mr Ma wants to enable small firms to operate just as nimbly as big ones on the global stage. Alibaba helps Chinese companies sell in places such as Brazil and Russia, and assists foreign firms with marketing, logistics and customs in China. Eventually it hopes to use its technology to link logistics networks around the world so that any product can reach any buyer anywhere within 72 hours. That is still a long way off, but it gives a glimpse of the company’s staggering ambition.

Amazon already earns more than one-third of its revenue from e-commerce outside North America. Germany is its second-biggest market, followed by Japan and Britain. This year it bought Souq, an e-commerce firm in the Middle East. Its criteria for expansion elsewhere include the size of the population and the economy and the density of internet use, says Russ Grandinetti, head of Amazon’s international business. India has been one of its main testing grounds.

Amazon, like Alibaba, also wants to help suppliers in any country to sell their products abroad. An Amazon shopper in Mexico, for instance, can buy goods from America. Mr Grandinetti sees such cross-border sales as an increasingly important component of Amazon’s value to consumers and sellers alike.

Yet both companies run the risk that strategies which did well in their home countries may not succeed elsewhere. In China, for instance, the popularity of e-commerce relied on a number of special factors. China’s manufacturers often found themselves with excess supplies of clothes and shoes; Alibaba provided a place to sell them. Alipay thrived because few consumers had credit cards. China has also benefited from having cheap labour and lots of big cities—more than 100 of them with over 1m people—creating a density of demand that made it worthwhile for logistics firms to build distribution networks.

As they expand, however, Amazon’s and Alibaba’s business models may shift and, in some markets, start to converge. So far the companies have differed in important ways. Amazon owns inventory and warehouses; Alibaba does not. But Alibaba has a broader reach than Amazon, particularly with Ant Financial’s giant payments business. As Amazon grows, it may become more like Alibaba. In India, for instance, regulations prevent it from owning inventory directly. And Amazon recently won a licence from the Reserve Bank of India for a digital wallet. Alibaba, for its part, may become more like Amazon. As the Chinese firm set its sights on South-East Asia, it invested in SingPost, Singapore’s state postal system. In September it became the majority owner in Cainiao, a Chinese logistics network, and said it plans to spend $15bn on logistics in the next five years.

Their advances may be slowed by other rivals. Smaller firms can flourish in niches. Flipkart, whose backers include Naspers and SoftBank, is competing fiercely with Amazon in India; the two companies routinely bicker over which has the bigger market share. Yoox Net-a-Porter, an online luxury-goods seller, is also expanding around the world.

Among the questions facing the two giants are whether other technology firms will pour more money into e-commerce, and what partnerships might emerge. Tencent’s WeChat Pay is already challenging Alipay in China. About one-third of WeChat’s users in China shop on that platform. Tencent is trying to recruit shops to accept its payment app in other countries, too, and recently took a stake in Flipkart. In deploying its services abroad, Tencent might get a helping hand from Naspers. The South African company owns about one-third of Tencent and has backed e-commerce firms around the world. Facebook is now muscling in on this business by making it easier for its users to buy goods through its messaging service as well as its other platforms, WhatsApp and Instagram.

The A-list still stands

In September 2014 Jeff Bezos announced his first big investment in India, hopping aboard a colourful bus in Bangalore

For now, however, Amazon and Alibaba remain each other’s most formidable international rivals. Success in e-commerce requires scale, which needs lots of capital. Local e-commerce firms in India have come under pressure from investors to boost profitability. Amazon has no problems on that score. As Amit Agarwal, head of Amazon India, puts it: “We will invest whatever it takes to make sure we provide a great customer experience.”

Big firms also have a natural advantage as they expand, because technologies developed for one market can be introduced across many. “It’s like a Lego set,” says Lazada’s chief executive, Maximilian Bittner. He can use pieces of Alibaba’s model, such as algorithms for product recommendations, to improve Lazada’s operations. Amazon’s investments in machine learning have myriad applications anywhere in the world.

That does not mean that Amazon and Alibaba will dominate every country around the world, nor that they will crush every competitor. Bob Van Dijk, chief executive of Naspers, maintains there is room for many operators: “I don’t believe in absolute hegemony.” But given the two giants’ ambitions and the benefits of scale, they are bound to become more powerful and compete directly in more places. That has implications for all sorts of industries, but particularly the retail sector.

This article appeared in the Special report section of the print edition under the headline "Home and away"

Special report: The new bazaarMore in this special report:

http://ift.tt/2gEv9I5

0 notes

Text

Unlocking the Trillion Dollar Opportunity!!

In 1998, Kodak sold 85% of photo film worldwide.Next few years Digital Camara slowly overlap the photo film.

In 2003, Iconic 1100 phone sold more than 500 million units by Nokia in an year. Which is highest selling phone till now.

In 2010, Blockbuster one of the most recognizable brand in the video rental space having around 9,000 stores & more than 60,000 employees. The company filed for bankruptcy protection.

In 2015, All the telecom operator in world together send 20B messages, which is less than 30B message send by the WhatsApp in a day.

All the above well-known & monopoly companies are bankrupt & certainly there business model disappears!!

“People think the CEO/directors of those companies must have been dumb not to see what was happening, but they were not dumb, they were very, very talented people, but they still missed the transition and made assumptions that were shown to be pretty poor in hindsight, but seemed fine at the time”. This highlights the importance of having someone in the organisation asking, constantly, what are our competitors doing to disrupt our business and our business model.

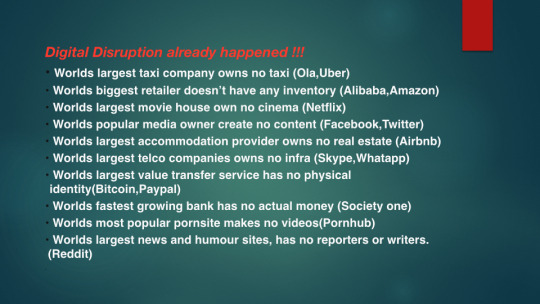

We stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one another. In its scale, scope, and complexity, this transformation will be unlike anything humankind has experienced before.This exponential growth transformed our life tremendously, in just a few years.

So what does disruption mean in this context?

Change that occurs when new digital technology & business model affect the value proposition of an existing goods & service, doing business, social interaction & more generally “WAY OF THINKING”.

Welcome to the ‘Exponential age of the Digital ERA’

These are the some area where Disruption is/was/will happened rapidly. & we saw the visible change in our daily life due to the disruption.

Print/Media/Entertainment

The role of traditional media has changed dramatically in the age of the internet-driven, 24-hour news cycle and the proliferation of social media. Technology will change the way of consuming the news. Newspaper no longer been an Ads or promotional channel. New generation consume news via Inshort,Dailyhunt,Buzzfeed,scoopwhoop,Reddit,Flipboard,Twitter,Facebook. & It’s generate more traffic than traditional newspaper,magazine,tv combine together. Its revenue & subscriber drastically reduced.Business model is slowly disappear.

Even world’s largest book publishers like Penguin,Pearson,McGraw-Hill face the heat of ebooks,iReader,kindle,online reader,audiobook,podcast,digital library.

Likewise, Largest music companies like Sony,HMV,T-series, & other bricks and mortar business are fight for the survival. With a plethora of services such as Pandora, Spotify, soundcloud, Hulu,and Scribd, subscription-based entertainment is becoming more and more ubiquitous across different types of media.

another example of digital disruption is the way Netflix is eating into the profits of CBS. Until few years ago, people could watch shows,movie etc only on television sets, home rental services. These shows etc were broadcasted to their TV sets by CBS, NBC, or Blockbuster.With the entry of Netflix and Youtubes the mode of delivery of videos has changed.

Technology giants like Facebook,Google,Netflix,Amazon make a major damage to their business model Bottom 👊🏼👊🏼 ✔️ $16.4Billion vs $17.9 Billion in past year its an revenue of all the news paper together in US vs FACEBOOK.

✔️ In 2011, Netflix suppressed the 20 million subscribers in the USA & Canada, making it the world’s leading subscription service for movies & TV show.

Transportation

The simplest & most famous example I can think of right now is the disruption created by cab companies like Uber/ Ola to private fleets of yellow taxis. The regular taxis relied on hand signals while plying empty on roads — or simply waiting at a taxi stand for a passenger to turn up. With Uber/Ola coming up with an easy to use mobile app to book cabs, there has been a huge digital disruption to regular taxis.

Automatic Car (Driverless car/ SelfDriving Car ) By the year end google & Uber come up with the self driving car. which is Code red for many drivers & other automakers. Most car companies might become bankrupt. Traditional car companies try the evolutionary approach and just build a better car, while tech companies will do the revolutionary approach & looking to reinvent the wheel.

Tesla go further in this research on most energy efficient electric cars & also huge invest in the mass transportation using Magnetic-Levitation system like Hyperloop.

Along with this new Ideas empowered with technology, it will disrupt the whole mode of transportation.

E-commerce & retail

As technology continues to advance, we see a shift in consumer expectations, which, in turn, leads to retailers rethinking their in-store strategies.Amazon already opened a supermarket without cash registers. You walk in, you take what you need and you walk out. Sensors and cameras automatically measure what you take and put everything on your credit card. In addition, Mobile, cloud, analytics,VR,Digital money and social media will be fully integrated into a unified merchandising system designed to vastly improve customer engagement.

Retail Industries are moving from small Kirana shops -> brick & mortar model -> departmental store -> hypermarkets(Metro,Walmart) -> Ecommerce shop (Virtual Shop,Drone delivery)

Bottom 👊🏼👊🏼

✔️ In america, Amazon takes market value $355.9B vs $297.8 market cap of all the retailers together which include Walmart, Target, Best Buy & others.

✔️ India’s E-commerce Revenue is expected to jump from $30 billion in 2016 to $100 billion in 2020.

Financial Services

The financial sector in India is currently experiencing a golden age, and its biggest driver is the effort to move toward a less-cash economy.In India, JAM (Jan Dhan, Aadhaar, Mobile)Enroute to the digital payments gaining the proportions of a mass movement. Majaorly due to the technology Innovation, New Business Model,Demographics,customer experience,mobile, it will disrupt the many vertical of Banking,Insurance,stock broking,payment,wealth management & many more financial services. Established technology firms are developing new products that enable the creation of new business models with enormous existing customer bases.

Trends in the financial sector

✔️Electronic trading now makes up almost 70% of all volume on the New York Stock Exchange and half of that is algorithmic trading. ✔️Electronic clearing of cheque (ECS) like IMPS,NEFT,RTGS,International Remittance make an ease of customer experience and also disrupt the traditional money transfers like checks and money orders. ✔️Starting of new payment bank (Airtel,Birla),small banks & mobile wallet(Paytm,Mobikwik),UPI (BHIM,PhonePe) help to reach the financial services to large audience. ✔️Intraducation of plastic money (Debit,Credit cards) Digital currency (Bitcoin, blockchain) promote the cashless economy. ✔️️Unbinding banking service from financial technology provide seamless experience in online/mobile banking, P2P Payments (Paypal,RuPay),Bill Payments.(Instamojo,billDesk,CCAvenue). ✔️Along with this lot of Fintech companies resolve problem in the different financial vertical like taxes (cleartax),Lending (Lendingkart),Personal Finance(FundsIndia) & many more. reach the common man in the societ

Telecom/Technology

Digitization is profoundly changing the competitive boundaries of the telecom industry. Core voice and messaging businesses have continued to shrink, in part because of regulatory pressures, but also because social media has opened new communications channels beyond traditional voice service.

After Graham bell discover Phone, next 100 years its never change its design.& AT & T realise its importance when mobile phone hit the market. same is in Set Top Box also.

Timeline Postcard →Telegram →Telephone →Radio →OpticalFiber →Internet→Email →Pager →Smartphone →MMS →VoIP

Day where we were charged us for messages to the Free internet, We are come up with the long way of voice to data migration.& also we move from telecom operators (AT &T/Verizon) to technology giants like (Google/Facebook) for communication. In Upcoming days technologies like 5G,MuLTEfire,IoT will completely vanishes the existing communication ways.

We’re at a critical time where Technology has eaten the world. Traditional industries such as automotive, fossil fuels, medical, insurance and real estate will be massively disrupted. IBMs Watson,Google deepmind computer is a perfect illustration of this computing power and it is set to disrupt traditional industries. ✔️Because of Watson, you can get legal advice within seconds and with 90% accuracy compared with 70% accuracy when done by humans. ✔️Adidas setup an 2 robotic shoe manufacturing plant in Germany.which is completely automated. ✔️Tesla is built an Gigafactory in Nevada which has complete automatic production line. ✔️️AI slowly eaten our workforce BPO services replace with bots ✔️Moving from31/2 Floppy to the Virtual Storage system Cloud Computing & big data will alter the definition of the Storage.

In less than 10 years, 📱 replaced:

📟 ☎️ 📠 💽 💾 💻 ⏰ 📷 📹 🎥 📺 📻 📰 💿 💳 💼 📎 📄 ⏳ 🔦 📼 📚 ⌚️ 🎮 📓 ✏️ 📁 🎤 📇 📆 🎰 💵 📬 📝 🆘 🏧 🎫 ✉️ 📤 ✒️ 📊 📋 🔎 🔑 📣 🎼 🎬 📀

Finally:

“In the new world, Its not the BigFish which eats the small fish, Its the fast fish which eat the slow fish”

All the above example, there is one thing is common that Business model move from traditional pipeline model to the Platform model. irrespective of the domain.

Platform business models!! Enable plug-and-play infrastructure into which producers and consumers can directly plug in, and they then govern the market interactions that ensue on top of the infrastructure.

We see pipes everywhere. Every consumer good that we use essentially comes to us via a pipe. All of manufacturing runs on a pipe model. Television and Radio are pipes spewing out content at us. Our education system is a pipe where teachers push out their ‘knowledge’ to children. Had the internet not come up, we would never have seen the emergence of platform business models. Unlike pipes, platforms do not just create and push stuff out. They allow users to create and consume value. At the technology layer, external developers can extend platform functionality using APIs. At the business layer, users (producers) can create value on the platform for other users (consumers) to consume. This is a massive shift from any form of business we have ever known in our industrial hangover.

Even before Internet there Platforms have existed for years. Malls link consumers and merchants; newspapers connect subscribers and advertisers. What’s changed in this century is that information technology has profoundly reduced the need to own physical infrastructure and assets. & increase the Network/marketplace/Communities,technology infrastructure,User/ProducerData. this will create great value to the product.

Platform business models gives lot of flexible in User acquisition,Product Design,Monetization.

Very few areas like Education & Healthcare still we difficult to break the pipe model.

How to survive??

1) Keep innovating, inventing

2) Survival for the fittest

3) keep update with technology

4) Winner take all, there is no second place

5) Mobile phone is entry point for the most of the things

What do Google’s crawlers, Uber’s drivers, and Instagram’s selfie-clickers have in common? In a world of platforms, they create the fuel needed to facilitate economic and social exchanges that power business and society.

“Let the game begin”

Reference

https://thecoverage.my/lifestyle/will-amazed-guy-speaks-changing-times-technology-society/

http://platformthinkinglabs.com/

http://www.ibmforentrepreneurs.com

https://richtopia.com/emerging-technologies/11-disruptive-technology-examples

https://www.slideshare.net/ProductNation/indian-banking-in-a-time-for-change-nandan-nilekani-64679460

http://www.economist.com/node/21542796

https://thinkgrowth.org/silicon-valley-is-right-our-jobs-are-already-disappearing-c1634350b3d8

https://www2.deloitte.com/in/en/pages/technology-media-and-telecommunications/articles/digital-india-unlock-trillion-dollar-opportunity.html

0 notes

Text

Alibaba’s Ant could be bigger than some Wall Street banks — What you need to know about the dual IPO

Ant Group, an affiliate of Alibaba, announced plans for its long-awaited dual listing in Shanghai and Hong Kong on Monday.

The company is known for running Alipay, one of China’s most popular mobile payment systems. But Ant Group has been expanding its reach into everything from wealth management to micro-loans. And beyond that, it has been focusing on selling financial technology products to enterprise customers.

While Ant Group may not be that well known outside of China, its valuation could top that of some of Wall Street’s biggest banks, according to one analyst who spoke to CNBC on Tuesday.

Brief history

Alipay was launched in 2004. It’s a so-called Quick Response or QR code system of payment. A user presents a digital barcode on their phone which is then scanned by the merchant. Alipay can also be used to pay for items online.

In 2011, Alibaba sold control of Alipay to a group controlled by Jack Ma, a move it said was done to satisfy Chinese regulations. Yahoo, which was Alibaba’s biggest shareholder at the time, said that transaction happened without its knowledge, something the Chinese e-commerce giant denied at the time.

Yahoo, another major shareholder SoftBank and Alibaba eventually came to a deal that same year: Alibaba would be paid at least $2 billion but no more than $6 billion if Alipay went public. Alipay was also required to pay licensing fees and continue serving Taobao, one of Alibaba’s e-commerce platforms.

Ant Financial was created in 2014 to encompass not just Alipay, but Alibaba’s bigger push into financial technology.

Then in 2018, Alibaba bought a 33% stake in Ant Financial. It was able to do so because of a clause in a contract between the two companies from 2014 when Ant was created. Alibaba founder Jack Ma still holds the controlling stake in Ant.

Recently, Ant Financial rebranded as Ant Group.

The business

Ant Group has over 900 million users in China for Alipay. But it offers financial products beyond that, including wealth management, loans to businesses and insurance.

An employee scans a quick response (QR) code displayed on the Ant Group’s Alipay app. Ant Group is preparing for a dual initial public offering in Shanghai and Hong Kong.

Bloomberg | Bloomberg | Getty Images

These digital financial services contributed more than 50% of Ant Group’s overall revenues for the fiscal year ended March 31.

But Ant has recently pivoted to focus more on what it calls technology services. That is creating financial technology products that it can sell to enterprise customers for a licensing fee. Eric Jing, former CEO and now current executive chairman of Ant Group, told CNBC in a 2018 interview that technology services would become the company’s main business in the future.

Ant’s international strategy is focused on the several investments it has in e-wallet firms around the world such as India’s PayTM. The company hasn’t looked to launch local versions of Alipay in countries around the world. The only Alipay branded wallet outside of mainland China is in Hong Kong.

IPO details

Ant Group will carry out a concurrent initial public offering (IPO) on the Shanghai Stock Exchange’s STAR board and the Hong Kong stock exchange. The STAR board is China’s push to create a domestic equivalent of the Nasdaq in the U.S.

But, so far, there are no details on pricing of shares.

Ant Group’s last major fundraising event was in 2018, when investors ploughed $14 billion into the company. At the time, the Wall Street Journal reported, citing sources, that the company was valued at $150 billion.

But its valuation could now be as high as $210 billion, according to David Dai, a senior analyst at Bernstein, who carried out his own calculation at the end of last year.

“(The) earnings power of the company has improved after we wrote that report … so I would expect that valuation to go up from that last round of assessment that we did at the end of last year,” Dai told CNBC’s “Street Signs” on Tuesday.

A valuation of over $200 billion would make Ant larger than some of America’s biggest banks including Goldman Sachs and Wells Fargo.

What does this mean for Alibaba?

Alibaba has a 33% equity stake in Ant Group. The e-commerce giant’s Hong Kong-listed shares were up over 5% on the news of Ant’s listing. Investors see the listing as a positive for Alibaba.

“We consider the potential listing of Ant can further unlock its value as a public company,” Jefferies said in a note.

The investment research firm added that based on a $150 billion market capitalization, Ant represents $19 of Alibaba’s American depositary shares (ADS).

Meanwhile, Bernstein’s Dai said Ant Group will be “highly accretive to current share price of Alibaba.”

Alibaba’s U.S.-listed shares closed at $254.81 on Monday. Dai said his current price target on the stock is $290 which could be hit by the end of this year or beginning of 2021.

Read More

from Job Search Tips https://jobsearchtips.net/alibabas-ant-could-be-bigger-than-some-wall-street-banks-what-you-need-to-know-about-the-dual-ipo/

0 notes

Text

BREAKING

Eco/Invest/Demography, Health, Non-Life, Pandemic : Fourth COVID wave: Infection spreading faster, high-grade fever, affecting younger population more

Eco/Invest/Demography, Life, Regulation : Life insures have to mandatorily launch standard term life product from Jan 21:IRDAI

Health, Life, Non-Life, Pandemic : Policyholders can now opt for renewal, migration and portability of their standard Covid covers:IRDAI

Non-Life, Risk Management : Sitharaman may announce the merger of 3 PSU gen insurers in Budget 2020

Eco/Invest/Demography : Financial services to add 47,800 new jobs in April-September FY20

Indian carriers to induct over 900 planes in coming years

Wealth Management : Investors rush to mutual funds; asset base grows over Rs 6 lakh crore

Reinsurance : GIC Re receives “In principle” approval for Lloyd's Syndicate, will start business by Apr 18

IRDAI Panel suggests competitive returns for life insurance customers

Health : Private bill in RS proposes health to be made a fundamental right

Eco/Invest/Demography, Health, Non-Life, Pandemic : Fourth COVID wave: Infection spreading faster, high-grade fever, affecting younger population more

Eco/Invest/Demography, Life, Regulation : Life insures have to mandatorily launch standard term life product from Jan 21:IRDAI

Health, Life, Non-Life, Pandemic : Policyholders can now opt for renewal, migration and portability of their standard Covid covers:IRDAI

Non-Life, Risk Management : Sitharaman may announce the merger of 3 PSU gen insurers in Budget 2020

Eco/Invest/Demography : Financial services to add 47,800 new jobs in April-September FY20

Indian carriers to induct over 900 planes in coming years

Wealth Management : Investors rush to mutual funds; asset base grows over Rs 6 lakh crore

Reinsurance : GIC Re receives “In principle” approval for Lloyd's Syndicate, will start business by Apr 18

IRDAI Panel suggests competitive returns for life insurance customers

Health : Private bill in RS proposes health to be made a fundamental right

Show Menu

Indian general insurance industry misses Rs 2 trillion premium mark, New India shines in Fy 2020-21

The Health portfolio, propelled by Covid 19 Pandemic might have grown by almost 40 per cent but it has not been able to make up the shrinking of overall motor business, that has fallen by 5 per cent, for the industry in 2020-21. ``It was a hugely challenging year. I am happy that we could pull it off like this. As at the end of October 2020, though the business of general insurance industry on an average was down by some 10-12 per cent, we managed to just keep our head over water by showing some business growth in decimal points but then we went into a tizzy and in subsequent five months we managed to grow our business each month by 15 to 22% each month,’’ said Atul Sahai, CMD, NIA.

Apr 12, 2021 Indian News >> Non-Life, Pandemic Source: AIP News Bureau

Atul Sahai, CMD, New India Assurance

Mumbai:

Though, the Indian general insurance industry, at Rs 1,98,735 crore, has ended the FY 2020-21 with a positive year on year (y-o-y) growth of 5 per cent, once again, thanks to Covid 19 Pandemic. it has missed out the much cherished milestone of Rs 2 trillion of gross premium during the year narrowly, due to negative growth in moror insurance, the largest portfolio in the industry and crop business., .

Analysts point out that the Health portfolio, expected to be propelled by Covid 19 Pandemic, has only grown by 11 per cent to Rs 58,584 crore there have been slow down in two large business segments-overall motor portfolio and crop business- of the industry during FY 2020-21.

Premiums in the overall motor portfolio has fallen by around two per cent to Rs 67,790 crore while th crop business have fallen by 3.5 per cent to 31184 crore during FY2020-21. .

Among the main components of the motor portfolio, motor third party(TP) premium, which has not been hiked by the IRDAI in FY2020-21,has grown by 5 per cent to Rs 10,650 crore,motor (own damage) segment has surged by 138 per cent to Rs 4136 crorewhile the premium out of motor package has contarcted by seven per cent during the reporting period.

The fact that premiums in Motor OD and Motor TP have gone up despite Covid-19 Pandemic, when long period of lock down has limited the use of all kind of vehicles,shows more people have bought automobiles and more uninsured vehicles have got insured, said analysts adding that the prediction, that Motor portfolio will be overtaken by Health Portfolio as the largest segement in the industry baecause of Covid-19 Pandemic, hasn't happened.

In one of the distinct achievements in the industry, despite Covid-19 Pandemic, which disrupted the domestic insurance industry extensively, New India Assurance(NIA), powered by a global premium of around Rs 32,500 crore has further scaled up its domestic market share to 14.33 per cent during the year from 14.11 per cent in 2019-20.

The company has operations in 28 countries.

The largest listed non-life company in the country, uniquely, has maintained its positive and profitable growth consistently through out 2020-21, and has ended year with a domestic premium of Rs 28,482 crore, showing a year on year (y-o-y) rise of 6.22 per cent.

Analysts point out that among the top 10 general insurers that include three large PSUs and , NIA is the only company which has the distinct achievements of positive premium growth, profitability and higher market shares by expanding its core business organically in FY 2020-21.

``It was a hugely challenging year. I am happy that we could pull it off like this. As at the end of October 2020, though the business of general insurance industry on an average was down by some 10-12 per cent, we managed to just keep our head over water by showing some business growth in decimal points but then we went into a tizzy and in subsequent five months we managed to grow our business each month by 15 to 22 per cent each month,’’ said Atul Sahai, CMD, NIA.

``And at the end, we managed to clock some 7 per cent upto the month growth, which given the large business base (the largest in the industry of course) and the circumstances we have been passing through as a nation, is a huge attainment,’’ felt Sahai.

This growth for NIA has been most evenly distributed over different line of business like Motor, Misc, Marine, Health etc, he explained.

``We hope to continue on this trajectory in coming months too. Repeating, the FY just gone by has been most challenging and rather emotionally and physically draining, given the spread of Covid. The way each member of team New India has responded to the challenges makes an amazing story of grit and determination,’’ observed Sahai.

The other PSU general insurers United India Insurance, National Insurance Company and Oriental Insurance Company have ended the year with negative growth and have lost their market shares during the period.

Led by Star Health & Allied Insurance,all the six stand health insurers, at Rs 15,720 crore, have together grown by 11 per cent y-o-y in 2020-21.

The largest private sector general insurer, ICICI Lombard general insurance, at Rs 14,003 crore, has grown its premium base by 5 per cent but its market share has almost remained flat 7.05 per cent during the year.

The company degrown its health portfolio by 6 per cent and grown its motor business marginally during the year.Earlier, it had exited crop business.

However, the company will soon emerge as the second largest domestic general insurer after it takes over Bharti Axa General Insurance.Together, the merged entity with a total premium base of Rs 17,160 will displace Chennai based second largest general insurer UII that has ended the FY 2021-22 with Rs16, 710 crore of premium , recording a y-o-y de-growth of 5 per cent.

Similarly, Bajaj Allianz General Insurance, though, has seen a fall in its gross premium marginally to Rs 12,569, has outranked Delhi based OIC, with a premium of Rs 12,452 crore, as the fifth largest general insurere in the country in 2020-21.

With a premium of Rs 12,295 crore, HDFC Ergo General Insurance, after integrating HDFC ERGO Health Insurance,HDFC’s health insurance arm with itself, has ended FY 2020-21 with a y-o-y growth of 28 per cent.

Another mid-sized general insurer, SBI General Insurance, which may be going for an IPO in FY 2021-22, has rapidly grown its premium base by 21.60 per cent y-o-y to Rs 8,264 crore in FY 2020-21.

Among the small ones, Raheja QBE General Insurance Company, which is being acquired by Indian payments firm Paytm, owned by One 97 Communications Ltd. along with its founder Vijay Shekhar Sharma, at Rs 272.22, has grown its premium by 72 per cent y-o-y, by mainly focusing on clinical trial covers provided for developing Covid-19 remedies.

While the PSU general insurers, except Agriculture Insurnace Company, have cut downn their exposures for crop business by almost 50 per cent, private sector insurers like Bajaja Allianz General, HDFC Ergo, Reliance General and Univeral Sampo have grown their crop premiums substantially during the year.

MORE NEWS

Comments

News in Brief

Apr 27

Madhu Malhotra appointed as CTO of Edelweiss General

Edelweiss General Insurance has appointed Madhu Malhotra as its chief technology officer

Madhu, with her two decades of rich experience across FinTech and Telecom domains., will spearhead the Technology function at EGI and drive digital innovation in line with the brand’s strategy of transforming the insurance landscape in India through tech driven solutions and offerings.

SBIG sponsors vaccination cost for its agents and POSPs

SBI General Insurance has sponsored the cost of vaccination for its agents and POSPs. The vaccination is extended to all advisors who have remained active with SBI General since March Year 2020.Further, this option is also extended to the spouses and dependent parents or in-laws of the advisor, up to a maximum of four members.

PC Kandpal, MD and CEO SBI General Insurance said, “Through this initiative, we aim to honour our channel partners – agents & POSPs and encourage them to get vaccinated at the earliest to protect themselves and their families”.

Apr 12

Kalpana Sampat appointed as MD & CEO of Pramerica Life Insurance

Pramerica Life Insurance appoints Kalpana Sampat as MD, CEO

Private life insurer Pramerica Life Insurance Monday announced the appointment of Kalpana Sampat its managing director and CEO, effective April 9.

Prior to this appointment, she was the chief operating officer for the company, a release said.

Pramerica Life Insurance is a joint venture company of Prudential International Insurance Holdings, a fully-owned subsidiary of Prudential Financial, Inc., and DIL (DHFL Investments Limited)

Apr 06

Charles Taylor Adjusting appoints Dan Yeo as MD for its Singapore P& team

Charles Taylor Adjusting has appointed Dan Yeo as Managing Director for its Property & Casualty team in Singapore, highlighting the company’s commitment to strengthen its services and product offerings in Singapore and in Asia-Pacific region

Prior to joining Charles Taylor Adjusting, he was the Marine technical claims manager for APAC at Chubb Insurance.

In his new position, Dan will report directly to Wee Loon Yong, Chief Executive Officer of Asia Property and Casualty and will assist in overseeing business development and strengthening the P&C team of adjusters in Singapore.

Mar 29

Sedgwick appoints Linda Sim head of forensic advisory services for Asia

Sedgwick, a leading global provider of technology-enabled risk, benefits and integrated business solutions, announced the appointment of Linda Sim as head of its forensic advisory services division in Asia.

Linda is a chartered accountant with more than 15 years of professional experience in the forensic advisory services arena. She has worked on numerous business interruption and fidelity losses of varying scope and size for both insurers and law firms across the Asia Pacific region.

Mar 25

Standard Club hires US Attorney for NY General Counsel Role

Leading mutual P&I insurer, the Standard Club, has appointed Gina Venezia as new General Counsel in their New York office.

The Standard Club has had a strong presence in the US long before the establishment of its New York office in 1998. The focus on the New York office as a claims service hub for the Americas demonstrates the club’s commitment to their existing clients.

Mar 11

Covers for ASHA and MGNREGA workers can be part of social sector quota:IRDA

The IRDA has clarified that the policies issued to persons under the occupations of ASHA workers and MGNREGA workers under regulations can be considered for complying their social sector quota.

ICICI Gen settles 1 million motor claims through 'InstaSpect'

ICICI Lombard General Insurance, had launched a DIY (Do-it-yourself) feature called 'InstaSpect', as part of the ILTakeCare app. This feature eliminates the need for vehicle damage assessment through a physical survey. Instead, it introduced live streaming, allowing virtual assessment and bringing down the claim approval time to a mere few hours.

The insurer has approved more than 1 million+ motor insurance claim approvals since its launch.

Feb 05

SBI Gen to donate Rs. 500 from its online biz for cancer treatment of underprivileged kids

SBI General Insurance has pledged to donate Rs. 500 for every general insurance policy,issued through their digital assets,towards cause of the cancer treatment of underprivileged kids suffering with Acute Lymphoblastic Leukaemia..

PC Kandpal, MD & CEO, SBI General said, “According to World Health Organization (WHO) report, every year approximately 1.16 million new cancer cases are observed in India. It is estimated that one in 10 Indians will develop cancer during their lifetime and one in 15 will die of the disease. We have conceptualized and launched this initiative called #MakeHopeWin.''

FEB 01

Mohanty takes over as MD of LIC

Siddhartha Mohanty has taken charge today as Managing Director of LIC of India and would serve LIC till June 2023..

Mohanty, who will be one of the front runners for the chairmanship of LIC after MR Kumar, chairman,LIC, retires in June 2021, started his career as a direct recruit officer with LIC of India in 1985 and has risen through the ranks to this senior position.

In a career spanning over three decades in the Corporation, Mohanty has made his mark in the areas of Marketing, HR, Investments and Legal.

Jan 13

AICTE to partner with Cyberpeace to train 5 lakh students and faculty on cybersecurity

AICTE has joined hands with Cyberpeace to train 5 lakh students and faculty on cybersecurity and with Pupilfirst for the CoronaSafe internship programme.

According to a press release, the cybersecurity training programme designed to educate 5 lakh students and faculty was unveiled by AICTE Chairman Anil D Sahasrabudhe.

Dec 27

AU Bank ties up with ICICI Prudential Life Insurance

AU Small Finance Bank (AU Bank), today, announced a partnership with ICICI Prudential Life Insurance to offer need and goal-based life insurance solutions.

Through this corporate agency arrangement, over 18 lakh customers of AU Bank can buy products of ICICI Prudential Life.

Max Life enhances contactless services for customers

Max Life Insurance Company has introduced a range of digital initiatives that are completely contactless and paperless, across most of its channels including the company’s branch offices.

0 notes

Text

Fintech Rapyd Launches Native Fee Providers in India

Rapyd, a world fintech as a service firm, introduced earlier at present that it has partnered with plenty of the most important funds gamers in India to roll out a fee service, permitting worldwide retailers to develop their enterprise inside India, in addition to native corporations develop overseas.

The announcement comes lower than every week after Rapyd introduced the launch of an related funds service in Mexico. In India, the fintech agency has partnered with Paytm Funds Financial institution, PhonePe, PayU, Citibank, DBS Financial institution, HDFC Financial institution, BharatPay, and Unimoni with the intention to roll out the answer.

By extending its World Funds Community to India, worldwide corporations will be capable to entry the popular fee strategies throughout the nation through a single expertise stack, permitting them to supply an area service for his or her Indian clients.

Specifically, Rapyd’s platform, Rapyd Gather, permits companies to just accept funds through on the spot UPI funds from financial institution accounts and eWallets, worldwide and home credit score and debit playing cards, together with RuPay, Visa, Mastercard, Amex, and Diners, settle for money over-the-counter which is then transformed to an digital fee, in addition to conventional netbanking through 55 banks.

Mahesh Muraleedharan, Nation Supervisor, Rapyd Supply: LinkedIn

Commenting on the launch, Mahesh Muraleedharan, Nation Supervisor, Rapyd mentioned within the assertion: “The roll-out of Rapyd’s Fintech as a Service platform in India will simplify entry to India’s strongest fee manufacturers in a single resolution, fixing scaling challenges in eCommerce, Fintech, lending, enterprise companies, and treasury administration.”

Rapyd Disburse

The fintech firm has additionally launched Rapyd Disburse, an answer that facilitates IMPS and UPI funds to financial institution accounts and eWallets, custom financial institution transfers by NEFT and money pickup over-the-counter.

“We’re glad to collaborate with Rapyd as their Enterprise Banking and Payout companion in India,” added Satish Kumar Gupta, MD & CEO, Paytm Funds Financial institution within the assertion.

“With this partnership, we’ll lengthen the comfort & flexibility of a number of fee modes, together with Paytm Wallets, Financial institution Transfers and UPI to world companies for accumulating & disbursing funds to their sellers, clients and companions. Our complete digital choices will improve Rapyd’s seamless fee expertise.”

source https://www.financeary.com/payments/fintech-rapyd-launches-native-fee-providers-in-india.html

0 notes

Text

China's mobile and digital dominance run deep into Indian economy

New Post has been published on https://apzweb.com/chinas-mobile-and-digital-dominance-run-deep-into-indian-economy/

China's mobile and digital dominance run deep into Indian economy

Sometime in 2019, India overtook the US to become the second largest smartphone market in the world, after China. Of the 158 million units shipped (meaning made available in the Indian market), around 114 million, or 72%, were Chinese brands, said Counterpoint Research. Xiaomi led the pack, with Vivo, Realme and Oppo figuring among the top five, according to figures released in January. It’s been an astounding market share grab, considering most of these brands have not been in India for more than a few years.

Chinese companies are now major players in a number of consumer segments. Lenovo is a heavyweight in computer hardware, Haier is inching up the league table in white goods. Huawei’s domination in telecom equipment is strong and its leadership in 5G technology, in particular, is absolute. In auto, 2019 saw a blockbuster entry for MG Motor, with its Hector SUV. A number of major Chinese automakers are now rolling into India.

Chinese companies are beginning to dominate in some digital segments as well. ByteDance-owned TikTok is a sensation in India. ByteDance plans to invest $1 billion in India over the next few years. Alibaba owned UC Browser, too, has significant users in India. Hangzhou-headquartered ecommerce player Club Factory is expanding its reach to tier-2, -3 and smaller cities in India. Investors such as Ant Financials and WeChat owner Tencent have picked up stakes in large digital players such as Paytm and Zomato. PUBG, one of India’s most popular mobile games, is owned by Tencent.

This is just the picture on the consumer-facing business. In business-to-business supplies, China is perhaps the most important trading partner for Indian businesses today.

The emerging picture is rather remarkable, considering the geopolitical unease that exists between India and China. The robust $87 billion in trade between the two countries sit sill at ease with a history of aggressive border disputes, memories of a war and China’s open support for Pakistan, including in international fora. In fact, at various points, India has asked its military personnel to refrain from using Chinese devices or apps, or both. Now Chinese companies are everywhere — from telecom infrastructure to handheld devices and the most popular apps. Perhaps nowhere in the world do two countries with such geopolitical suspicions on the one hand also share such deep trade links on the other.

Thinking Global Globally, as in India, China has managed a remarkable turnaround in perceptions — from a supplier of cheap and poor-quality products, its companies have won the world’s grudging respect. This has been achieved through strategic intent and global acquisitions.

For instance, Lenovo was only a big player in China before it bought IBM’s hardware business and emerged among the largest computer sellers globally. British brand MG Motor and Scandinavian Volvo are among the marquee brands that have been acquired by Chinese companies.

Much of China’s global scale and success in commerce goes back to the 1990s when free trade agreements resulted in zero-to-low tariffs, and China focused on becoming the lowest cost producer and invited American and European companies to set up their manufacturing capabilities.

“China makes inferior to good products across segments to cater to different price points and needs. So from cheap plastic toys, festive lights and wristwatch dials to computers, smartphones and solar panels, Chinese companies play across segments,” says Hitesh Sawhney, partner and leader of the China business group at PwC India.