#Business Valuation

Explore tagged Tumblr posts

Text

The Valuation Slide That Wins Investors

The Valuation Slide That Wins Investors

In the glitzy world of startups, where innovation meets ambition, there’s one slide in a pitch deck that can command the attention of everyone in the room – the valuation slide. Whether you’re an early-stage startup or merely gauging the potential of a business idea, presenting the perfect valuation can set the stage for a successful fundraising effort. But how do you nail this slide, especially if you have no revenue yet? Let’s delve deeper.

Why Valuation Matters

The valuation of a startup isn’t just about numbers or potential revenue. It’s a narrative of the company’s potential, vision, and the value it aims to deliver to stakeholders. For investors, valuation serves as a compass – it guides them to ascertain the risk associated with your startup and the potential return on their investment. While revenue is a straightforward measure for established companies, startups often operate in the realm of vision, potential, and innovation. This makes the valuation slide not only about the worth but also about the story behind that worth.

Crafting the Perfect Valuation Slide

1. Simplicity is Key: Don’t overwhelm your audience with complex calculations or jargon. Present a clear, concise valuation figure and back it up with 3-4 key metrics or reasons that support it.

2. Storytelling: Numbers, on their own, can be lifeless. Weave a compelling story around your valuation. How did you arrive at this figure? What milestones or potential growth does this number represent?

3. Visual Appeal: A picture is worth a thousand words. Use charts, graphs, or infographics to represent data. It aids in comprehension and retention.

4. Be Prepared for Questions: The valuation slide will undoubtedly raise eyebrows and questions. Be ready to defend your valuation with data, research, and comparables from the industry.

The Role of Valuation Tools

Not everyone is a financial wizard, and that’s okay. In today’s tech-driven age, tools like ValuationGenius can give you an edge. These platforms provide an approximate valuation based on a range of factors, eliminating the need for deep financial know-how. While this shouldn’t be the sole basis of your valuation, it can serve as a starting point or a validation tool. When combined with market research and industry benchmarks, tools like these can make your valuation slide more credible and robust.

Case Study: Litemeup and the Power of AI in Valuation

Meet Litemeup, a fledgling startup on the brink of transforming the packaging industry with AI-driven design. While they had a groundbreaking concept, they faced a common challenge many early-stage startups grapple with: how to place a valuation on an idea when there’s no product or revenue in play?

Enter ValuationGenius

Without a product, without revenue, and seemingly without the necessary data points that typically inform valuation, Litemeup turned to our tool. ValuationGenius didn’t just spit out a random number. Instead, it provided a range of estimates based on different valuation methods. But what truly stood out was the grounding of these estimates. Each was justified not just by data, but by the wisdom of business development and an inherent understanding of the startup landscape.

So, when Litemeup pitched to investors, they had more than just a vision. They presented a detailed valuation slide that wasn’t built on optimistic projections or vague assumptions but on a solid foundation provided by ValuationGenius. The result? They secured the trust and, subsequently, the investment from stakeholders, proving that even in a world where numbers often dominate, there’s always room for common sense and astute business acumen.

Conclusion

While a startup’s journey is riddled with challenges, presenting the right valuation shouldn’t be one of them. Remember, your valuation is more than just a number. It’s a representation of your startup’s vision, potential, and promise. Craft it with care, back it up with data, and present it with confidence. Value startup with no revenue

#startup valuation#startup#business valuation#online startup valuation calculator#startup valuation calculator#startup valuation tool#valuation calculator startup#online valuation platform

2 notes

·

View notes

Text

In Melbourne, doctors not only diagnose and treat patients but also manage thriving medical practices. Understanding the value of your practice through independent business valuation, choosing the right business structure for doctors, and enlisting the support of a medical accountant are essential steps in achieving financial health.

2 notes

·

View notes

Text

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

The second quarter of 2023 was interesting. Typically, the summer months, especially July, are slow. However, this year, our firm saw an increase in business owners reaching out to learn about selling their business.

While interest rates continue to climb and put pressure on the selling prices, the number of businesses listed for sale continues to grow.

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

BizBuySell has recently released their insight report for the second quarter of 2023. These reports are helpful to business owners and potential buyers as they project market trends and explain what was on the rise and what declined over the past three months. To see the full report, you can visit BizBuySell’s website. Here is an overview of what was presented and where market trends are leading as we progress through 2023.

Full report: https://www.bizbuysell.com/insight-report/

Overview

The most important statistic from the last three months is that business acquisitions increased by 8% versus just 4.8% in the first quarter of the year. This continues the positive trend that buyers and sellers are adjusting to an environment with higher interest rates.

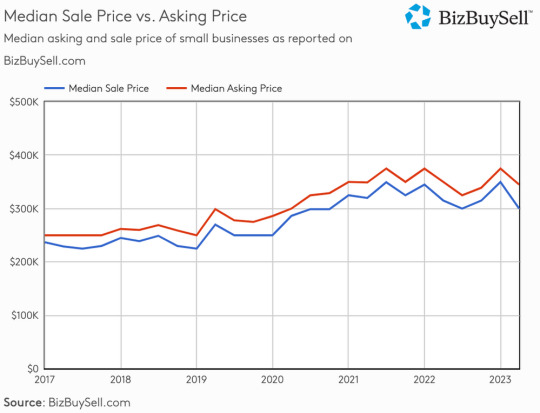

However, it’s important to note that while acquisitions are trending upward, sale prices have continued to trend downward. In the second quarter, the median business sale price dropped 14% to $300,000 largely due to higher interest rates.

While the decline in the sales prices may seem like bad news to buyers, this decline proves that sellers need to get more creative with their offers. For instance, sellers may have to offer financing or increase the monthly rent on the buyer’s lease.

Overview of business sales and listing information for Sacramento, CA

In the Sacramento, Arden-Arcade, and Roseville, California areas, the median asking price continued to increase. The median asking price rose to $399,000, and listings increased from 253 to 264. Median revenue also increased significantly from $550,000 to $609,445.

Here are 3 Key Takeaways from BizBuySell’s report:

1. Seller financing continues to play an important role.

With higher interest rates, many buyers and lenders require some form of seller financing. This can seem challenging for sellers as only 22% plan to offer it, while 70% of potential buyers intend to ask sellers to finance at least part of the deal.

However, sellers need to stay flexible and consider adding financing to their deals. Leaving out this crucial component can reduce the amount of potential buyers and, in some cases, be a deal breaker for lenders, as many lenders are beginning to require at least a 10% note from sellers. This is especially important to buyer and seller timelines. As roughly 28% of business owners intend to sell by 2024, and buyers continue to increase their desire to purchase, seller financing continues to play an impactful role.

In good news for sellers, because interest rates are on the rise, so are the rates on seller financing, allowing sellers to enjoy tax benefits and meet buyer demands as well.

2. Restaurants show a steady comeback, while the retail sector shows a decline.

The restaurant sector has been making a slow but steady comeback post-pandemic. Restaurants saw a 10.3% increase in transitions from last year, and sale prices increased 15.9% from the previous quarter and 6.7% from the previous year. While these numbers are positive, the report indicates that many restaurants are still struggling, offering purchasing opportunities from competitors.

While restaurant numbers have increased, retail numbers are showing a decline. 2022 showed promising numbers post-pandemic, but with more consumers purchasing online and higher interest rates and inflation, these numbers have slowed in 2023. According to the report, retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow fell 9.4%.

3. Buyers continue to seek independence with entrepreneurship.

The number of interested buyers looking to leave their traditional jobs and embrace entrepreneurship continues to rise. The report indicates that 46% of surveyed buyers want to leave their current position to be more in control of their future. This is good news for the baby boomer generation looking to exit the market, even though some want to reinvest in other markets.

It’s also important to note that service businesses made up the largest number of companies for sale recently. Almost half of the sales recorded in the second quarter were service-based businesses, and 59% of surveyed buyers indicated they were interested in purchasing a service-based business.

Outlook for the remainder of 2023:

The BizBuySell report indicates that interest rates continue to be the most significant factor in the small business market. Some sectors are seeing a return to the workforce, while others are still experiencing stagnant or declining numbers. However, there are a few positive notes to consider:

The baby boomer generation continues to exit the market. According to the report, 47% of sellers surveyed marked retirement as their reason for exiting, while 34% indicated burnout. As this age group continues to leave the market, it creates new opportunities for those looking to enter.

As mentioned, seller financing should be considered. This can be a great selling point to buyers looking for interest rate relief and impact new requirements from lenders.

Next Steps

As market conditions continue to change and evolve, and as more buyers indicate their desire to purchase a business, it’s essential to fully understand the value of your company. Are you looking for a Sacramento business broker? Reach out today for a free consultation.

source https://www.sacramentobusinessbrokers.com/post/q2-bizbuysell-report-shows-continued-increase-in-small-business-acquisitions

2 notes

·

View notes

Video

tumblr

Valuation of goodwill can be a complex and important process for any business. At Sapient Services, we offer expert valuation services to help you accurately determine the worth of your company's goodwill. Contact Sapient Services today and get a clear understanding of your business's true value.

#Valuation of goodwill#motivation#business valuation#business services#valuation services#create backlinks#sapient services#business consultation

2 notes

·

View notes

Text

Asset Sale vs. Stock Sale: Key Considerations for Buying or Selling a Business in Florida

Florida Real Estate & Business Attorneys Hey everyone, Florida Attorney Ryan S. Shipp here! Thinking about buying or selling a business in Florida? You have two main options: an asset sale or a stock sale. Asset Sale In an asset sale, the buyer purchases specific assets—like equipment, inventory, and customer lists—while the seller usually keeps the liabilities. This gives buyers more…

#asset sale#Asset Sale vs. Stock Sale: Key Considerations for Buying or Selling a Business in Florida#business acquisition#business assets#business contracts#business financing#business legal protection#business ownership transfer#business sale agreements#business sale structure#business succession planning#business transaction#business valuation#buying a business in Florida#buying a franchise#commercial law#contract negotiation#corporate law#due diligence#Florida business attorney#Florida business purchase#Florida corporate law#Florida legal services#legal guidance for business sale#liabilities in business sale#mergers and acquisitions#selling a business in Florida#selling a small business#small business sale#stock sale

0 notes

Text

Why Your Business Needs a Strategic Accounting Firm in Melbourne

Running a business in Melbourne is exciting, but it also comes with financial complexities that require expert guidance. Whether you’re a startup, a growing business, or an established company, partnering with a reliable accounting firm in Melbourne can be the game-changer that helps you scale efficiently, stay compliant, and maximize profits.

The Role of an Accounting Firm Beyond Numbers

A great accounting firm does more than just handle your books—it provides strategic financial insights that empower businesses to make informed decisions. Here’s how a trusted Melbourne-based accounting firm can help your business:

✅ Financial Health Assessment – Get a clear picture of your business's financial standing with professional analysis. ✅ Growth Planning & Business Scaling – Develop a roadmap for expansion while maintaining financial stability. ✅ Cash Flow Optimization – Ensure consistent cash flow to keep your business operations running smoothly. ✅ Advanced Tax Planning – Minimize liabilities while staying compliant with Australian tax regulations. ✅ Risk Management & Crisis Preparedness – Safeguard your business from financial downturns and market uncertainties. ✅ Investment & Funding Guidance – Secure the right funding and make smart investment decisions to fuel your business growth.

Why Melbourne Businesses Need a Proactive Accounting Partner

In a competitive market like Melbourne, businesses can’t afford to take a reactive approach to accounting. A dedicated accounting firm in Melbourne can offer:

🔹 Real-time financial reporting to make data-driven decisions. 🔹 Industry-specific tax strategies that help reduce financial burdens. 🔹 Long-term financial forecasting to ensure steady and sustainable growth.

DFK BKM: Your Trusted Accounting Firm in Melbourne

At DFK BKM, we don’t just crunch numbers—we create financial strategies that drive business success. Our expert team specializes in:

📌 Tailored Business Advisory Services – Helping businesses navigate financial challenges and seize growth opportunities. 📌 Proactive Tax & Compliance Solutions – Ensuring your business remains compliant while maximizing tax efficiencies. 📌 Strategic Financial Planning – Crafting financial strategies that align with your business goals. 📌 Risk & Crisis Management – Preparing your business to withstand financial uncertainties. Your business deserves more than basic accounting—it needs a strategic financial partner. Partner with DFK BKM, the trusted accounting firm in Melbourne, and take your business to new heights.

#AccountingFirmMelbourne#MelbourneBusiness#TaxPlanningMelbourne#Accounting Services#Audit and Assurance#SMSF Services#Financial Planning#Business Valuation

0 notes

Text

Unlock the True Value of Your Business with AKM Global’s Business Valuation Services

As a small business owner, understanding your business’s true value is key to making informed decisions. AKM Global’s Business Valuation Services provide accurate, detailed assessments that help you navigate critical moments like mergers, acquisitions, or securing funding.

Our experienced team uses advanced techniques to deliver valuations tailored to your unique business needs, ensuring you have the insights required to drive growth, negotiate effectively, and make strategic moves. Whether you're planning to sell, seek investment, or just want to understand your market position, AKM Global is here to help.

Contact us today to get a comprehensive, reliable business valuation that supports your goals and helps your business thrive!

0 notes

Text

Emerging M&A Trends in India’s Business Landscape

India’s business environment is evolving rapidly, making mergers and acquisitions (M&A) a powerful tool for companies seeking growth and competitive advantage. As industries adapt to changing market demands and technological advancements, understanding key trends in the M&A space becomes crucial. We specialize in offering insightful M&A transaction advisory, business valuation, and IPO advisory services to help businesses navigate this dynamic landscape.

How Digital Transformation Is Driving M&A Deals

Digital innovation is transforming the way businesses operate, and it’s no surprise that tech-driven M&A deals are on the rise. Companies are acquiring startups and digital-first enterprises to gain access to cutting-edge technology, streamline operations, and enhance customer experiences. This trend is particularly strong in sectors like fintech, e-commerce, and healthcare.

Our M&A strategy consulting helps businesses identify digital opportunities and integrate technology effectively.

The Growing Importance of ESG in M&A

Environmental, Social, and Governance (ESG) factors have moved to the forefront of M&A decision-making. Companies are increasingly seeking partners and acquisitions that align with their sustainability goals and ethical standards. Investors are also favoring businesses with strong ESG credentials.

We incorporate ESG assessments into due diligence processes to support sound and socially responsible decision-making.

Expanding Horizons with Cross-Border Transactions

Globalization and regulatory changes have made it easier for Indian businesses to explore international opportunities. Cross-border M&A deals are becoming more common as companies seek to expand their footprint and access new markets.

We offer comprehensive support for cross-border transactions, including business valuation calculator online and IPO advisory services.

Consolidation Trends in Traditional Industries

While tech and digital sectors are getting a lot of attention, traditional industries like manufacturing, automotive, and consumer goods are also seeing increased M&A activity. Companies are merging to gain economies of scale, optimize supply chains, and strengthen market positions.

We provide tailored strategies for companies in traditional sectors to help unlock value and drive growth. and well-executed M&A deals.

The Startup Ecosystem’s Role in M&A

India’s vibrant startup ecosystem is a hotbed of M&A activity. Established companies are eager to acquire innovative startups to inject fresh ideas, diversify offerings, and explore new market opportunities.

We assist businesses in identifying promising startups, conducting valuations, and executing transactions to fuel growth. that fuel innovation and long-term growth.

Government Reforms Boosting M&A Activity

The Indian government’s pro-business reforms and regulatory changes have created a fertile environment for M&A deals. Simplified compliance processes and investor-friendly policies have encouraged both domestic and international investments.

We stay updated with regulatory changes to help clients navigate legal complexities and seize opportunities.

Final Thoughts

At Mantraa, The M&A landscape in India is full of opportunities for businesses ready to take bold steps. But navigating this space requires a thoughtful approach, strategic insight, and expert execution.

Mantraa helps businesses make confident decisions, whether pursuing cross-border deals, integrating startups, or consolidating in traditional sectors., whether pursuing cross-border deals, integrating startups, or consolidating in traditional sectors. Our client-focused M&A transaction advisory services are designed to unlock new possibilities and help your business thrive.

Let’s explore the possibilities together and build a brighter future for your business.

#accounting#business valuation#finance#virtual cfo services#marketing#branding#sales#m&a transaction advisors#business valuation calculator online

0 notes

Text

The CPA’s Role In Business Valuation

Business valuation is a crucial process in assessing the value of a company for various purposes, such as mergers and acquisitions, estate planning, shareholder disputes, or financing. A Certified Public Accountant (CPA) plays a vital role in this process by providing expertise, ensuring accuracy, and offering an objective perspective. The CPA's role goes beyond simple financial analysis; it involves a deep understanding of accounting principles, financial reporting, and valuation methodologies.

Gathering Financial Information

The CPA begins by collecting comprehensive financial data, including balance sheets, income statements, cash flow statements, and tax returns. This step ensures that the valuation is based on solid and up-to-date financial information. The accuracy of these documents is critical because any discrepancies could lead to a distorted business valuation. CPAs ensure that all records are complete, consistent, and in compliance with accounting standards.

Selecting the Appropriate Valuation Method

There are several valuation methods a CPA can use, depending on the specific circumstances of the business and the purpose of the valuation. Common approaches include the Income Approach, Market Approach, and Asset Approach:

Income Approach: This method estimates the value based on the company’s ability to generate future earnings. It is commonly used for businesses with stable, predictable income streams.

Market Approach: This method compares the business to similar companies in the same industry that have recently been sold or valued. It is often used when reliable market data is available.

Asset Approach: This method focuses on the company’s tangible and intangible assets, such as property, equipment, and intellectual property. It is useful for companies with significant assets but less stable income.

A CPA offering CPA tax services uses their knowledge and judgment to select the most suitable method for the situation, ensuring a fair and credible valuation.

Analyzing Financial Performance

CPAs analyze the company’s financial performance over several years, looking for trends, such as revenue growth, profitability, and cost management. By comparing these trends to industry standards, they can assess the company’s operational efficiency and risk level. This analysis also helps in identifying any potential weaknesses or areas of concern that could affect the valuation.

Assessing Risks and Liabilities

Another key aspect of a business valuation is evaluating the risks and liabilities associated with the business. CPAs consider factors such as market competition, economic conditions, management quality, and legal issues. They also examine outstanding debts and contingent liabilities that could reduce the business's value. This comprehensive risk assessment helps in providing a more realistic and balanced valuation.

Ensuring Objectivity and Credibility

The CPA’s role in business valuation is to provide an objective and unbiased assessment. They use their expertise to analyze the business’s financials without personal or external influence. As a trusted third party, CPAs enhance the credibility of the valuation, which is crucial when the results are used in legal or financial negotiations.

Providing Valuation Reports

Once the valuation is complete, the CPA prepares a detailed report that outlines the methodology, data sources, assumptions, and conclusions. This report is vital for decision-makers, as it serves as the foundation for important business transactions. The CPA may also be called upon to explain and defend the valuation in court or other forums.

Conclusion

In business valuation, the CPA’s expertise is invaluable. By applying professional judgment, analyzing financial data, and selecting the appropriate valuation methods, they provide a comprehensive, accurate, and objective assessment of a business’s worth. Whether for tax purposes, mergers, or disputes, the CPA’s role ensures that business owners and stakeholders have a clear understanding of their company's value.

0 notes

Text

Asset Valuation: Key Concepts, Methods, and Importance

Asset valuation is a fundamental process in finance and business, used to determine the fair market value of tangible and intangible assets. Accurate asset valuation is crucial for decision-making in investments, mergers, acquisitions, financial reporting, and taxation. This comprehensive guide explores the concept of asset valuation, its methods, significance, and frequently asked questions to help you understand its vital role in the financial ecosystem.

What is Asset Valuation?

Asset valuation is the process of determining the current worth of a company’s assets. Assets can be:

Tangible Assets: Physical items such as real estate, machinery, inventory, and vehicles.

Intangible Assets: Non-physical items like patents, trademarks, goodwill, and intellectual property.

The valuation process considers factors such as market trends, asset condition, future earning potential, and replacement cost to estimate value.

Why is Asset Valuation Important?

Asset valuation is essential for several reasons:

Mergers and Acquisitions: It helps determine the fair price for buying or selling businesses.

Investment Decisions: Investors use asset valuation to assess the financial health of a company.

Financial Reporting: Ensures accurate representation of assets in financial statements as required by accounting standards.

Taxation: Provides the basis for calculating capital gains and property taxes.

Loan Applications: Lenders use asset valuations to determine loan eligibility and collateral value.

Insurance Coverage: Helps in assessing the right amount of insurance coverage for assets.

Methods of Asset Valuation

Asset valuation employs various methods depending on the asset type and purpose of valuation. Here are the most common methods:

1. Cost Method

The cost method values an asset based on its original purchase price, adjusted for depreciation and obsolescence. It is often used for tangible assets like machinery and equipment.

2. Market Value Method

This method determines an asset’s value based on current market conditions. It is suitable for assets like real estate, where market comparables are available.

3. Income Approach

The income approach values an asset based on its ability to generate future income. This is commonly used for intangible assets like patents and franchises.

Formula:

Asset Value = Net Present Value (NPV) of Future Cash Flows

4. Replacement Cost Method

This method estimates the cost of replacing an asset with a similar one at current market prices. It is useful for insurance and investment purposes.

5. Book Value Method

The book value method calculates an asset’s value based on its net worth in the company’s financial statements. It is straightforward but may not reflect market conditions.

6. Fair Value Method

Fair value considers market conditions, asset condition, and other factors to determine a realistic value. It is often used in compliance with accounting standards like IFRS and GAAP.

Factors Affecting Asset Valuation

Several factors influence the valuation process, including:

Market Trends: Fluctuations in supply and demand can impact asset prices.

Asset Condition: The physical or functional state of an asset affects its value.

Economic Conditions: Inflation, interest rates, and economic stability play a significant role.

Industry Performance: The performance of the industry in which the asset operates can affect its valuation.

Regulatory Environment: Changes in tax laws or accounting standards may influence asset valuation.

Depreciation and Obsolescence: The decline in value due to wear and aging impacts the final valuation.

Challenges in Asset Valuation

Asset valuation can be complex and comes with its challenges, such as:

Subjectivity: Valuation often involves judgment, which can lead to inconsistencies.

Market Volatility: Rapid changes in market conditions can impact valuation accuracy.

Data Limitations: Insufficient or outdated information can lead to unreliable valuations.

Intangible Assets: Valuing intangible assets like goodwill and intellectual property is inherently challenging.

Economic Uncertainty: Factors like recessions or global events can complicate valuation processes.

Steps in Asset Valuation

Identify the Asset: Determine the asset type and purpose of valuation.

Gather Data: Collect relevant information, including market trends, financial statements, and asset conditions.

Choose a Valuation Method: Select an appropriate method based on the asset’s characteristics and purpose.

Perform Calculations: Apply the chosen method to calculate the asset’s value.

Analyze Results: Cross-check the results for accuracy and reasonableness.

Prepare a Valuation Report: Document the methodology, assumptions, and final valuation.

Frequently Asked Questions (FAQs)

1. What is asset valuation in simple terms?

Asset valuation is the process of determining the worth of a company’s physical and intangible assets at a specific point in time.

2. Why is asset valuation needed?

Asset valuation is required for financial reporting, mergers and acquisitions, investment decisions, tax calculations, and loan applications.

3. Which is the most accurate method of asset valuation?

The accuracy of a method depends on the asset type and purpose. For example, the market value method is ideal for real estate, while the income approach is better for intangible assets.

4. How does depreciation affect asset valuation?

Depreciation reduces the book value of an asset over time, reflecting its decline in value due to wear and aging.

5. Can intangible assets be valued?

Yes, intangible assets like patents, trademarks, and goodwill can be valued using methods like the income approach or fair value method.

6. What role does market demand play in asset valuation?

Market demand significantly influences the value of an asset. High demand can increase value, while low demand may reduce it.

7. How often should assets be revalued?

Assets should be revalued periodically, especially during significant market changes or for compliance with financial reporting standards.

8. What is the difference between book value and market value?

Book value is the value of an asset as recorded in financial statements, while market value is the price it would fetch in the open market.

Conclusion

Asset valuation is a cornerstone of financial and business decision-making. Whether it’s determining the worth of a company, securing a loan, or planning for mergers and acquisitions, accurate asset valuation ensures informed decisions. By understanding the various methods, factors, and challenges involved, businesses and investors can maximize the potential of their assets.

As markets evolve, the importance of reliable and transparent asset valuation becomes even more critical. Engaging professional valuers and staying updated with market trends and regulations can further enhance the accuracy and reliability of asset valuations. Ultimately, asset valuation is not just about numbers but understanding the true value of what a business owns and how it contributes to overall success.

#asset valuation#company valuation#business valuation#valuation firm#business valuation firms#esop valuation#plant and machinery valuation#business valuation Services

0 notes

Text

Business Valuation Services offer critical insights into the true worth of your business. They support strategic decision-making, help attract investors, and facilitate smooth mergers, acquisitions, or sales. Valuations are essential for compliance, tax planning, and succession planning, ensuring transparency and fairness. By identifying financial strengths and risks, these services enhance credibility with stakeholders, enabling businesses to make informed choices and achieve sustainable growth.

1 note

·

View note

Text

9 Tips for Selling a Business in California

If you live in California and have considered selling your business, you may have a lot of questions. What do I need to complete before my business is ready to be sold? How much is my company worth? What should I focus on?

While selling a business can be complicated, a smooth transaction is possible with the right advice and planning. Here are 9 tips that will help you sell your business in California.

1. Determine why you want to sell your business.

Perhaps you’ve been considering selling your business for a while, so why now? What’s the driving force behind your readiness to hand over the reins of your company? There are ,many reasons why business owners sell, including:

Retirement

Relocating

Starting a new venture

Change in ownership

Your business is growing or slowing

Your prospective buyers will want to understand your motivation behind the sale. Articulating your reason will help you build credibility early in the evaluation process, so gaining clarity on this challenging question is critical.

2. Understand the value of your company.

Not only does a ,valuation help you to understand the full scope of your business, but it also helps you establish a listing price and financially plan for the sale. Many items are taken into consideration when determining the value of a business. These include:

Fundamental financial data such as balance sheets, tax returns, and cash flows.

Both tangible and intangible assets.

The geographic location of your business.

Current market conditions.

Your company’s potential for growth and expansion.

Your exit plan.

This process can seem cumbersome and confusing, so it’s best to visit with an experienced business broker. ,Click here to begin an assessment of the value.

3. Document all of your processes and procedures.

Potential buyers will be interested in how your business operates daily. Retaining detailed documentation of your operations and policies will show interested buyers that a smooth transition is possible. A few processes to ensure you’re documenting include:

Sales and marketing procedures

Daily operational processes

An employee handbook

Human Recourses documentation and practices

Showing interested buyers that the business can run smoothly without you is often a key selling point.

4. Review your financial records.

Before you start marketing the sale of your business, it's essential to have your financial records in order. Not only are these records ,fundamental documents you’ll need for the sale of your business, but they will also give interested buyers confidence that the numbers presented are accurate. When organizing your financial records, be sure you review the following:

The last three years of tax returns

A current balance sheet

An income statement

A cash flow statement

Providing accurate and comprehensive financial records will give potential buyers a better understanding of your business's financial health.

5. Focus on increasing sales.

One way to increase the value of your business and make it ,more appealing to buyers is to focus on boosting sales. This will show interested buyers that your business has growth potential and is a good investment. Here are a few ways to enhance sales:

Create a sales playbook and start delegating tasks to highlight a proven sales record independent of you, the owner.

Attract a diverse customer base ensuring revenue is generated from many different clients or customers and not from a small number of high-paying ones.

Establish streams of recurring revenue.

Upsell to current clients or customers.

Establish a Customer Relationship Management (CRM) tool if you don’t already have one.

Illustrating your business’s growth potential through increased sales will not only draw in more serious buyers but will also ensure you maximize your profits from the sale of your business.

6. Determine what will be included in the sale.

When selling your business, you'll need to decide what will be included in the sale. Your listing price may consist of both tangible and intangible items. Here are a few things to consider:

Inventory

Equipment

Real Estate

Intellectual property

Customer lists

Partnering with a ,successful team of advisors like a broker, attorney, CPA, and financial advisor can help you determine what needs to be included in the sale.

7. Interview business brokers.

Once you understand the value of your business and what selling it entails, you'll want to start interviewing business brokers. A ,broker can help you sell your business quickly and efficiently, maximizing your profits. They can also help you with the following:

Determining the value of your business.

Creating a marketing strategy for the sale of your company.

Maintaining high confidentiality as they seek to identify and connect with potential buyers.

Managing negotiations and providing due diligence before finalizing the sale.

We recommend working with a broker that belongs to the California Association of Business Brokers (CABB).

When searching for the ,right business broker to sell your business, be sure to ask about their experience selling businesses in your industry and in California specifically. Also, be sure who you partner with has your best interests in mind and understands the value of your company.

8. Get your business SBA approved.

SBA approval adds credibility to the health of your business. It's desirable to buyers who need to secure an ,SBA-guaranteed loan to purchase a business. If you’re working with a business broker, they can help you with this process, or you can work with an SBA-approved lender who may ask you for the following documents:

Past company tax returns

Profit and Loss Statements

Balance Sheets

Your W2

An asset list

Keep in mind that more documentation may be required, and there may also be other qualifications needed to ensure your buyer can acquire SBA funding.

9. Market your business and pre-qualify prospective buyers.

Once you've selected a broker, they will help you create ,effective marketing strategies that will attract buyers. A few ways to successfully promote the sale of your business include:

Create a buyer persona so you know who you’re listing is targeted to.

Contacting prospective buyers through cold outreach.

Determining how and where to advertise your listing.

Evaluating what other forms of advertising could be beneficial.

Remember that not all buyers will be qualified, so it's valuable to work with a broker with experience selling businesses in California to help you with this process.

If you're thinking about selling your California business, we can help. ,Contact us today for a consultation.

source https://www.sacramentobusinessbrokers.com/post/9-tips-for-selling-a-business-in-california

4 notes

·

View notes

Text

Looking to attract investors or scale your startup? AnBac Advisors offers the best business valuation services to help you understand your company’s true worth. 📊 Build trust, secure funding, and make informed decisions with expert valuation insights. Contact us today to get started.

0 notes

Text

Check out the essentials of financial projections for businesses. Learn about types, creation steps, and benefits to enhance planning and decision-making.

0 notes

Text

Who Needs Valuation Services?

Valuation services are essential across various sectors and industries, helping businesses and individuals determine the worth of assets, companies, and investments. But who exactly needs these services? Let’s delve into the diverse groups that benefit from valuation services and explore their unique needs.

1. Business Owners

Business owners often seek valuation services for several reasons:

Mergers and Acquisitions: When selling a business or merging with another company, understanding the company’s value is crucial for negotiations.

Exit Planning: Owners planning to retire or transition out of their business need a clear valuation to maximize their return.

Investment Attraction: Startups and growing businesses seeking investors require valuations to present their worth and potential for growth.

2. Investors and Venture Capitalists

Investors, particularly venture capitalists, heavily rely on valuation services:

Investment Decisions: Valuations help investors assess whether a startup or business is worth the investment based on its growth potential and market position.

Portfolio Management: Regular valuations enable investors to monitor their portfolio companies’ performance and make informed decisions about follow-on funding or exits.

3. Financial Institutions

Banks and other financial institutions use valuation services for various purposes:

Loan Underwriting: Lenders require accurate valuations to assess collateral for loans, ensuring they’re protected in case of default.

Risk Assessment: Valuations provide insights into the financial health of businesses seeking funding, helping institutions manage their risk exposure.

4. Estate Planners and Executors

Individuals planning their estates or managing the estates of deceased persons often need valuation services:

Estate Tax Calculation: Accurate valuations are necessary to determine estate taxes and ensure compliance with tax regulations.

Asset Distribution: Executors need to understand the value of assets to facilitate fair distribution among heirs.

5. Tax Professionals

Tax advisors and accountants utilize valuation services for:

Compliance and Reporting: Accurate valuations are essential for reporting assets and income correctly on tax returns.

Transfer Pricing: Multinational corporations often require valuations to establish appropriate pricing for transactions between subsidiaries in different countries.

6. Legal Professionals

Lawyers and legal firms frequently engage valuation services in various contexts:

Litigation Support: Valuations can be crucial in legal disputes, including divorce settlements, shareholder disputes, and bankruptcy cases.

Intellectual Property: Assessing the value of patents and trademarks requires specialized valuation expertise.

7. Nonprofits and Charities

Nonprofit organizations also benefit from valuation services, especially when:

Fundraising: Accurate valuations of assets can enhance fundraising efforts by providing potential donors with clear information about the organization’s worth.

Mergers: Nonprofits considering merging with other organizations need valuations to understand their combined worth and structure.

8. Insurance Companies

Insurance providers utilize valuations for underwriting purposes:

Policy Underwriting: Understanding the value of insured assets helps insurance companies determine appropriate coverage amounts and premiums.

Claim Settlements: In case of claims, accurate valuations are necessary to ensure fair settlements.

Conclusion

Valuation services are indispensable for a wide range of stakeholders, including business owners, investors, financial institutions, estate planners, tax professionals, legal advisors, nonprofits, and insurance companies. Each of these groups relies on accurate and timely valuations to make informed decisions, manage risks, and ensure compliance with regulations. Whether you’re planning for the future, seeking investment, or navigating legal complexities, understanding the need for valuation services is crucial in today’s dynamic financial landscape.

#valuation#business valuation#valuation services#business valuation services#valuation services in delhi#valuation services in noida#valuation services in India

1 note

·

View note