#Business Loan Approval

Explore tagged Tumblr posts

Text

Fast Working Capital Loans in Illinois

Running a business comes with its fair share of challenges, especially when it comes to managing cash flow. Unforeseen expenses, seasonal slowdowns, or new growth opportunities can leave businesses in need of quick financial support. This is where a working capital loan becomes a valuable lifeline. But is it a good choice for business growth? Let’s explore why working capital loans can be a game-changer for businesses in Illinois.

1. Fast Working Capital Loans in Illinois

In the fast-paced world of business, timing is everything. Delays in funding can lead to missed opportunities or operational slowdowns. This is where Fast Working Capital Loans come into play. These loans are designed to provide quick access to funds, often with minimal documentation and a swift approval process.

Benefits of Fast Working Capital Loans:

Quick Approval: Get funds within days, sometimes within 24-48 hours.

No Collateral Required: Many fast loans are unsecured, meaning you don’t have to risk your business assets.

Use Funds Freely: Cover expenses like inventory, payroll, or equipment repairs without restrictions.

Biz2loan makes it easy for businesses in Illinois to access fast working capital loans in Illinois. Whether you’re a retailer preparing for a busy holiday season or a service provider covering payroll, fast access to cash can make a significant difference.

Call Biz2loan at (888) 204-9748 to apply for a fast working capital loan today.

2. Flexible Working Capital Loans in Illinois

Business needs are constantly evolving, which means flexibility is key. A Flexible Working Capital Loan provides you with the freedom to use the funds as you see fit. Unlike traditional loans that have rigid terms and restrictions, flexible loans adapt to the needs of your business.

Why Choose a Flexible Working Capital Loan?

Customizable Repayment Terms: Payback schedules that align with your cash flow.

Use Funds Freely: Cover any operational costs, from rent and utilities to marketing and advertising.

Available for Various Business Types: Retailers, manufacturers, service providers, and more can qualify.

Biz2loan’s flexible working capital loans give Illinois businesses the freedom to manage day-to-day expenses or seize new opportunities without being constrained by rigid rules.

Apply for a flexible working capital loan with Biz2loan by calling (888) 204-9748 today.

3. Business Line of Credit in Illinois

If you’re looking for ongoing access to funds, a Business Line of Credit might be the best option. Unlike a traditional loan where you receive a lump sum, a line of credit allows you to withdraw funds as needed up to a certain limit. You only pay interest on the amount you use, making it a cost-effective and versatile funding option.

Key Advantages of a Business Line of Credit:

On-Demand Access to Funds: Use funds as needed and only pay for what you use.

Revolving Credit: As you repay, the funds become available again.

Perfect for Seasonal Businesses: Handle seasonal fluctuations in cash flow with ease.

Whether you’re dealing with seasonal cash flow gaps or funding a new project, a business line of credit from Biz2loan gives Illinois businesses the control and flexibility they need to stay competitive.

Call Biz2loan at (888) 204-9748 to learn how a business line of credit can benefit your business.

Is a Working Capital Loan a Good Choice for Business Growth?

The answer is a resounding YES. A working capital loan provides quick, flexible, and ongoing access to funds that can help your business grow. Here’s how:

Fast Funding for Opportunities: Seize time-sensitive opportunities without delay.

Flexibility for Business Needs: Use funds to cover operational costs, payroll, or expansion.

Low Risk: No need to put your assets at risk with unsecured loan options.

With options like fast working capital loans, flexible working capital loans, and business lines of credit, Illinois businesses can ensure they have the financial backing needed to grow and thrive.

Need funds to grow your business? Call Biz2loan at (888) 204-9748 (TOLL-FREE) to get started.

#Best Working Capital Loans#Short-Term Working Capital Loans#Working Capital Loan Rates#Working Capital Financing#Quick Working Capital Loans#Unsecured Working Capital Loans#Working Capital Loan Requirements#Fast Working Capital Loans#Flexible Working Capital Loans#Business Working Capital Loan in USA#Small Business Working Capital Loan#Business Capital Loans for Startups#Business Line of Credit#Business Loan Rates USA#Fast Business Capital Loans#Unsecured Business Working Capital#Business Loan Eligibility#Business Loan Approval#Working Capital Loan for Business Expansion#Business Loan Application#without credit check business loan#Business Loans in USA

0 notes

Text

Essential Documents for Business Loan Approval: Your Ultimate Checklist

Preparing for a business loan? Ensure a smooth approval process with our comprehensive checklist of key documents. From financial statements and tax returns to business plans and identification, this guide outlines everything you need. Stay organized and ready to present your business’s financial health, increasing your chances of securing the funding you need for growth and success.

0 notes

Text

youtube

Simple Funding Approvals from $10k-$2M based on your monthly sales.

LEARN MORE & APPLY

COURTESY OF : ASB Capital Loan Funding

#business loans for small business#small business loans no credit check#business loan#business loan with bad credit#business lenders#money lender business#business loan approval#how to approach bank for business loan#small business loans#alternative small business loans#loans#small business#business finance#small business grants#business funding with bad credit#small business loan#sba loan#small business grants 2021#business loans for small company covid 19#Youtube#smallbusinessloans#BusinessLineofCredit#EquipmentFinancing#HybridgeSBALoan#PerformanceAdvance#CannaBusinessFinancingSolution#Cannabisbusinessloans#marijuanabusinessloans#AssetBasedLending#SBALoans

0 notes

Text

Personal loan apply online in Noida

Unlock Financial Flexibility with Our Personal Loan Apply Online in Noida Dreaming of renovating your home or planning a grand celebration but tight on funds? Our Home loan balance transfer services in Noida. With our user-friendly online application, you can easily apply for a personal loan and access the funds you need without any hassle. Whether you're a salaried individual or self-employed, our flexible loan options cater to all. Applying is simple – just fill out our online form, submit the necessary documents, and receive quick approval. Get ready to bring your dreams to life with our Apply for Business loan in Noida. Apply Now: https://finaqo.in/

#Personal loan apply online in Noida#business loan against property apply in noida#personal loan balance transfer online in noida#pre approved personal loan apply online in noida#credit card balance transfer facility in noida#home loan in noida#apply personal loan overdraft facility in noida

2 notes

·

View notes

Text

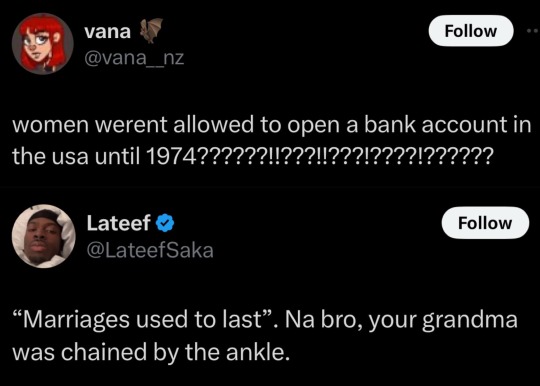

Literally the lyrics to the song. Y'know what pays the rent on your humble flat and helps you at the automat? That ice you get or else no dice, because once the louses go back to their spouses (or divorce them, but square cut or pear shaped the rocks don't lose their shape), a girl can sell the diamonds.

When you are legally barred from banking or owning real property, very valuable very portable commodities are your best friend. Just small enough to fit in a suitcase, and able to buy a future without him.

#no bank account#no credit cards#no line of credit#without a man to sign or her husband's approval#so no loans#no small businesses#no credit history#no equity#no home ownership#no financial independence at all#except for what she could pack in a suitcase#diamonds and furs#portable and valuable

42K notes

·

View notes

Text

Empowering Women in Business: Secure Loans with RBI-Approved Apps

Thanks to their innovative ideas, persistence, and determination, women entrepreneurs are already revolutionizing the commercial landscape. However, the process of scaling such businesses sometimes faces financial constraint. It is there that business loan applications, especially those granted approval by RBI, help and give women-led businesses a lifeline. Leading this financial revolution is…

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/understanding-l1-comparison-strategic-advantage-msmes-tenders

Unlocking the Power of L1 Comparison for MSMEs in Tenders

Securing government and private contracts can be challenging for MSMEs, but understanding the L1 comparison process can provide a strategic advantage. This guide explores the significance of L1 comparison in tenders, how it impacts bidding, and ways MSMEs can leverage it to stay competitive. Learn how to navigate the tendering process effectively and enhance your chances of winning contracts.

#digitalloanapproval#onlinepsbloans#small business#psb59#digital approval#business loan#loans#psbloansin59minutes#msme loan#business

0 notes

Text

Income-Based Loans Services | Income Based Loans Online

Access flexible income-based loans online. From payday to installment and mortgage loans, get funding tailored to your income, no credit check needed!

#income-based loans#income based loans#income based loans online#income based loans only#income based payday loans#income based installment loans#income based mortgage loans#income based loans texas#loans based on income not credit score#no credit check income based loans#income based loans no credit check#income based loans near me#best income based loans#income based loans no credit check instant approval#online income based loans#income based business loans#income based loans no credit check near me

0 notes

Text

Best Loan Against Property Deals in Hyderabad

Unlock the value of your property with the best loan against property deals in Hyderabad. We offer low-interest rates, quick approval, and flexible repayment terms, making it easier to access funds for your personal or business needs. Whether it’s a residential or commercial property, our hassle-free process and low processing fees ensure a seamless experience from start to finish. Our dedicated team guides you through eligibility criteria and supports you every step of the way. With our reliable and transparent service, you can confidently leverage your property to meet your financial goals. Get the best loan against property solution in Hyderabad today.

#quick approval#and flexible repayment terms#making it easier to access funds for your personal or business needs.#you can confidently leverage your property to meet your financial goals.#Get the best loan against property solution in Hyderabad today

0 notes

Text

Unlocking Global Opportunities with Spinac Financial’s International Project Financing

In today’s interconnected world, businesses are seeking to expand their horizons through international project financing. Spinac Financial stands as a trusted partner in making these global ventures a reality, offering tailored solutions for diverse industries and project scales.

Why Choose International Project Financing?

International Project Financing enables businesses to secure the necessary funds to launch or expand operations abroad. Whether it’s infrastructure, renewable energy, or large-scale development, Spinac Financial ensures your projects are financially viable, aligning with international standards and expectations.

What Makes Spinac Financial Different?

At Spinac Financial, we specialize in creating customized financial structures for cross-border projects. Our expertise in international project financing ensures smooth transactions, mitigating risks associated with foreign exchange, political climates, and regulatory frameworks. Our innovative strategies provide clients with the financial stability to execute their plans confidently.

Key Benefits of Partnering with Spinac Financial

Global Expertise: Our team offers unparalleled insights into international markets.

Tailored Solutions: Every project is unique; we design financing solutions to fit specific needs.

Risk Management: Spinac Financial minimizes potential risks, ensuring project sustainability.

A Brighter Future with Spinac Financial

International project financing is a gateway to global growth, and Spinac Financial is committed to empowering businesses in achieving their goals. With a proven track record and a client-focused approach, we ensure that your aspirations are not just dreams but attainable milestones.

Let Spinac Financial turn your international project financing needs into a success story. Reach out to us today and unlock the potential of global opportunities!

#International project financing#real estate project funding solutions#fast business loan approval#global investment platform for entrepreneurs#find investors for large-scale projects

0 notes

Text

Pre-approved personal loan in Noida

Are you Looking for a pre-approved personal loan in Noida? You're at the right place! Our Noida-based business is committed to helping individuals like you achieve financial freedom and accomplish their goals. Our streamlined loan application process ensures a quick and hassle-free experience at finaqo. Let go of your worries and get ready to tackle life's challenges head-on with our exclusive loan offerings. Whether it's funding your child's education or upgrading your Noida home, our Personal loan apply online is designed to suit your needs. Experience our customer-oriented service and competitive interest rates. Apply for home loan in Noida. Visit our website link Apply now: https://finaqo.in/

#Pre approved personal loan in Noida#personal loan apply online in noida#Apply for overdraft facility in Noida#Apply for Credit Card Balance Transfer Loan in Noida#Home loan balance transfer services in Noida#Apply for business loan in noida#Apply for home loan in noida#loan against property in noida

2 notes

·

View notes

Text

Cause literally MSU has a huge, well-known agriculture program and she seriously just acted like she didn't know what agriculture was and then said she didn't understand why I would want a degree to farm

#at the least it greatly increases my chance of getting approved for small business loans so I can scale or get new equipment later#she just lies to lie I swear#I told her I'd help her pay off the mortgage if she willed me the property#I don't think she loves me enough at this point

0 notes

Text

Are you a resident of Gurugram looking to leverage your property to meet your financial needs? At Capified, we understand the significance of your assets and offer tailored Loan Against Property (LAP) solutions that help you unlock the hidden potential of your real estate. Whether you need funds for business expansion, education, medical emergencies, or any other personal requirements, our LAP offerings provide a flexible and efficient way to access substantial finances.

Why Choose Loan Against Property?

A Loan Against Property allows you to utilize the value of your owned residential, commercial, or industrial property to secure a loan. The benefits are manifold:

High Loan Amount: With LAP, you can borrow a significant amount, often up to 70% of your property's market value, providing you with the necessary funds for large-scale expenses.

Lower Interest Rates: Compared to unsecured loans like personal loans, LAP offers relatively lower interest rates, making it an affordable option to meet your financial needs.

Flexible Tenure: At Capified, we offer flexible repayment tenures, allowing you to choose a plan that suits your financial capacity. Our loan tenures range from 5 to 15 years, ensuring that you can repay at your own pace.

Continued Ownership: Despite mortgaging your property, you retain ownership and can continue using it as before, ensuring that your lifestyle remains unaffected.

Capified’s Loan Against Property in Gurugram

At Capified, we take pride in offering customized LAP solutions that cater to the diverse financial requirements of Gurugram residents. Here’s why choosing Capified for your Loan Against Property is a smart decision:

Quick and Hassle-Free Process: We understand that time is of the essence. Our streamlined application process ensures quick approvals and disbursals, so you can access funds when you need them most.

Competitive Interest Rates: Our interest rates are among the most competitive in the market, ensuring that your loan remains affordable throughout the tenure.

Expert Guidance: Our team of financial experts is dedicated to helping you understand the nuances of Loan Against Property, guiding you through every step to make informed decisions.

Transparent Process: At Capified, we believe in transparency. All our terms and conditions are clearly laid out, with no hidden charges or fees.

How to Apply?

Applying for a Loan Against Property with Capified is simple:

Step 1: Visit our website or contact our Gurugram branch.

Step 2: Submit your property documents and other necessary paperwork.

Step 3: Our team will evaluate your property and provide you with a loan offer.

Step 4: Upon agreement, your loan will be sanctioned and disbursed promptly.

Conclusion

Capified’s Loan Against Property in Gurugram is your gateway to financial freedom. Whether you need funds for personal or business purposes, our LAP solutions offer you the flexibility and affordability you need. Trust Capified to help you turn your property into a powerful financial resource. Apply today and take the first step towards unlocking the full potential of your real estate.

Loan Against Property in Delhi

Loan Against Property in Noida

Loan Against Property in Gurugram

Loan Against Property in Faridabad

0 notes

Text

Fast-Track Your MSME Growth with Instant Loan Approvals

Need quick funding for your business? Get MSME loans approved in just 59 minutes with the PSB59 platform! 🚀 ✔ Loan up to ₹5 Cr ✔ 100% Online Process ✔ Lower Interest Rate Options ✔ Single Application Submission

Download the PSB59 app today and accelerate your business growth!

#psbloansin59minutes#loans#onlinepsbloans#digitalloanapproval#business loan#digital approval#small business#business#psb59#msme loan

0 notes

Text

youtube

नमस्ते अलवर के व्यापारियों, दाधीच फिनसर्व से 24 घंटे के भीतर बिजनेस लोन प्राप्त करें|

नमस्कार, क्या आप अलवर में बिजनेस लोन की तलाश कर रहे हैं लेकिन आपको नहीं पता कि कहां और कैसे अप्लाई करें।दाधीच फिनसर्व है जो आसान प्रक्रिया के जरिए 24 घंटे के अंदर लोन अप्रूव कर देती है। और अगर आप भी लोन लेना चाहते हैं तो हमने आपको इस वीडियो के जरिए समझाया है कि बिजनेस लोन अप्लाई करने के लिए आपको क्या-क्या चाहिए होगा। तो इंतजार किस बात का, अभी हमारी वेबसाइट पर जाएं और बिजनेस लोन के लिए अप्लाई करें, धन्यवाद।

आज ही संपर्क करें दाधीच फिनसर्व:+91-9119241400 और जानकारी के लिये हमारी वेबसाइट चैक करे।

Website:- www.dadhichfin.com

#business loan#loan approval#personal loan#loan provider#loan provider in alwar#instant personal loan#instant loan#apply now#get approved loan#Youtube

0 notes

Text

RBI Approved Loan Apps: Quick, Safe, and Transparent Lending Options

Get Quick Approvals with RBI-approved loan apps. Secure, transparent, and designed for your financial peace of mind.

0 notes