#Buffett resisted

Explore tagged Tumblr posts

Text

The Week 1 roundup can be found here. The Week 2 roundup can be found here. The Week 3 roundup can be found here.

Week 5 commences posting Monday the 28th October.

Day 15

Title: Synthesis Creator: ??? Prompt: 2024-21 - Non-magical AU: “You’re a wizard, Harry.” Rating: Explicit Word Count: 11.2k Summary: Severus is a brilliant but hard-to-work-with chemistry professor, who only teaches because he has to but would much rather spend all his time doing research. Harry is the grad student that either Albus or Minerva - the head of the chemistry department on paper, even though everyone knows Severus always gets what he wants - has assigned to essentially follow Severus around and tell him “no” when he’s being unreasonable. Harry is tasked with keeping Severus on budget and preventing all his students from quitting his class. Severus takes this as a personal affront.

💚❤️ Read on AO3 💚❤️

Title: Bad Ideas Creator: ??? Prompt: Prompt 2024-82: An alligator features prominently in the fan work Rating: General Audiences Word Count: 684 Summary: A romantic weekend gets run aground when a hunt for mythological creatures finds “something.”

💚❤️ Read on AO3 💚❤️

Title: Muggle Adventures (Alligators Edition) Creator: ??? Prompt: 2024-82: An alligator features prominently in the fan work Rating: General Audiences Word Count: Artwork Summary: You want alligators? I'll give you alligators.

💚❤️ View on AO3 💚❤️

Day 16

Title: Reckoning Creator: ??? Prompt: 2024-51: Corporate Snarry! CEOs, IT guys, or just regular employees finding love. Rating: Explicit Word Count: 31.2k Summary: Harry discovers that there is something wrong at his company and sets out to visit it undercover, pretending to be the new Happiness Manager.

💚❤️ Read on AO3 💚❤️

Day 17

Title: baring my arse (baring my heart) Creator: ??? Prompt: 2024 09 - Naked wedding. That's it, that's the prompt. Rating: Explicit Word Count: 5k Summary: "Why do we have to be naked again?"

💚❤️ Read on AO3 💚❤️

Title: Raven King Creator: ??? Prompt: 2024-78 - James warned Harry not to go. Rating: Explicit Word Count: 5.4k Summary: Against his father's wishes, Harry and his friends, freshly graduated from Hogwarts High, visit the elusive Euphemia Club. Where for the right price, dreams come true.

“The head is too wise. The heart is all fire.” ― Maggie Stiefvater, The Raven King

💚❤️ Read on AO3 💚❤️

Day 18

Title: A Prize Worth Any Price Creator: ??? Prompt: N/a Rating: Explicit Word Count: 7.7k Summary: Defeated by the Rogue King and his army, the remaining nobles of Voldania sacrifice omega Severus Snape as a war prize. They know the propaganda about the Rogue King's marauding ways and discarded lovers. The nobles laugh about sending an old, 'ugly' omega and taunt Severus with predictions that he'll be hate-ravished or killed outright for the insult. Meanwhile Harry thinks he's agreed to an arranged marriage for the peace contracts. He knows about the spy who worked for the resistance during Voldemort's reign. He's excited to have such a dashing spouse.

💚❤️ Read on AO3 💚❤️

Title: Wasting Away Again in Margaritaville Creator: ??? Prompt: 2024-80 - A fanwork inspired in some way by the works of the late, great Jimmy Buffett. Rating: Teen And Up Audiences Word Count: 2.1k Summary: Severus Snape hanging out in a resort, life in shambles, enjoys a frozen margarita or three and eyes the bartender.

💚❤️ Read on AO3 💚❤️

Day 19

Title: Too Hot To Handle: Wizarding Edition Creator: ??? Prompt: 2024-102: wizards discover reality TV. Rating: Explicit Word Count: 92.7k Summary: In a world where Voldemort died during the blitz and the Wizarding War, led by Bellatrix Lestrange, ended for good in 1981 when the attack on the Potters led to the Death Eaters being captured without incident, the Ministry is at a loss. The younger generation are not showing any inclination to settle down and have children, as their parents did before them. They considered a number of ideas but the development of the two-way mirror allowed for reality television to become a viable option. Welcome to Too Hot To Handle: Wizarding Edition, a show designed to encourage contestants to form deep and meaningful connections, punishing anyone who breaks the rules. Making more meaningful connections often has unforeseen consequences and what people intend to happen isn't necessarily what actually happens.

💚❤️ Read on AO3 💚❤️

2024 Snarry AUctoberfest Entries || HOS Tumblr || Discord

#2024 snarry auctoberfest entries#2024 snarry auctoberfest#snarry#pro snape#snarry fanfic#house of snarry#Harry x Severus#Severus x Harry#Week 4#Auctoberfest 2024 roundup#Snarry fanart

16 notes

·

View notes

Text

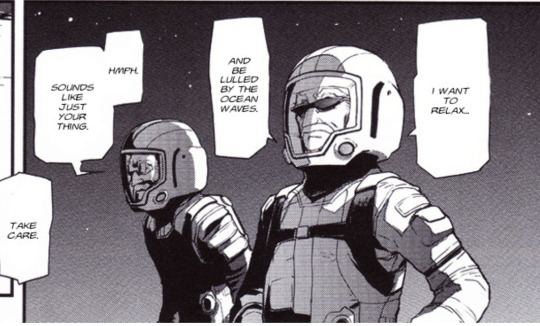

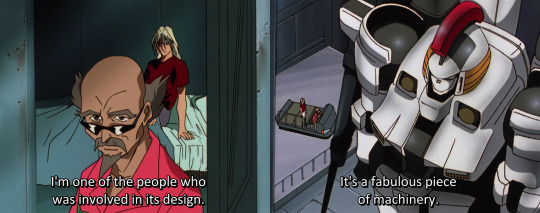

Howard: Wastin’ Away Again in Margaritaville, Some People Claim a Mobile Suit Is to Blame

In light of the recent passing of Jimmy Buffett, let us pay our respects by talking about Howard:

The man, the myth, the fashion icon; part of the first generation of mobile suit engineers, designer of the Tallgeese and the Peacemillion, rocket scientist, honorary member of the Five Doctors Polycule, weed guy to Duo and OZ’s best, a man so thoroughly chill he brought Island Time (and his sunglasses) with him into space.

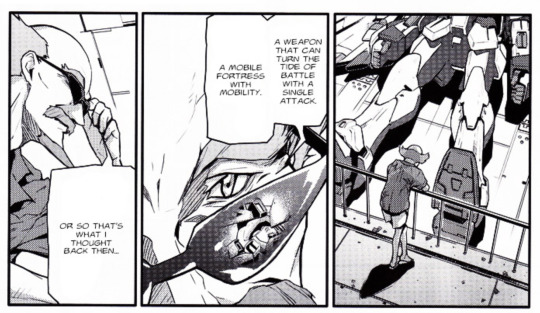

Howard is one of those brilliant people who was in the unenviable position of working in a field where their discoveries and advancements are often co-opted for use by militaries looking for any kind of technological or strategic edge– that’s most fields, by the way. The entertainment industry gets scooped by the military. Even paleontology¹ sometimes gets scooped by the military. But Howard is an aerospace engineer and robotics expert, and those lend themselves to being exploited more than most, particularly because they often rely on the kind of big-budget funding that only the military industrial complex can provide.

“Mobile Suits are nearly as old as the colonies themselves. When man took his first steps into space and started building new structures in the heavens, it was clear that new tools would be needed to perform the construction. Mobile Suits evolved from early motorized spacesuits and spacecraft manipulator arms. [...]Whether humanoid or pod-shaped, early mobile suits were any mechanized craft or suit that had the ability to perform complex manipulations. While Mobile Suits were originally intended for use in space, it was soon discovered that their versatility was easily adapted for terrestrial use as well. The new Earth-bound MS became more humanoid in shape, as ‘legs’ allowed the large machines to become truly all-terrain.” –Mobile Suit Gundam Wing Technical Manual

(I was so excited when I noticed these guys. There they are! The original MS! Of the get-your-hands-off-her-you-bitch Xenomorph-punching variety!)

Mobile Suits weren’t always war machines; they had a perfectly respectable start as construction exo-suits designed for Colony building and other elements of space infrastructure. Plenty of engineers and scientists who would have been involved in developing Colony tech and space exploration would also probably have been involved with Mobile Suit design; when those projects came under Alliance control, those same engineers would find themselves making weapons, and whatever other notable human advancements they might have been working on– interstellar travel, Mars terraforming, nanotech etc., would be shelved for the foreseeable future.

But that wouldn’t necessarily be huge bummer news for people like Howard or the Gundam scientists– working for an unscrupulous organization might go against their conscience, but who doesn’t love a cool robot? Howard, like many people in the After Colony timeline and our own, is a Mobile Suit nerd who is just as fascinated by the idea of a big damn hero machine with a beam sword and rockets as the rest of us.

That’s just the duality of Man, man.

Luckily for everyone, once OZ started mass production of Mobile Suits, Howard and the five Gundam scientists who had been working on the Tallgeese project all took their ball and went home. The others left for the Colonies to start building OZ’s worst nightmare, gundanium Mobile Suits that would outclass anything that had been built on earth; Howard, on the other hand, took the route of passive resistance. VERY passive resistance.

…Well, he’d LIKE it to be this relaxed all the time, but Howard nevertheless finds himself helping wayward Gundam pilots and rehabilitating ex-OZ aces whenever they drop by, using his crane-operating salvage ship as an unofficial mobile base for the resistance. Later, Peacemillion serves the same function in space, eventually housing ALL the Gundams and their allies in their fight against White Fang.

So Howard ends up being pretty busy for a retired guy who just wants to crack open a cold one with the boys and watch the sunset off shore of Key West. But who better to remind a crew of hyper-vigilant, stressed out pilots to chill out once and a while?

Take it from a man in a hot pink Hawaiian shirt: slow down and get some rest. Remember, if you don't schedule time for maintenance, your equipment (or your body) will schedule it for you.

_ ______________________ _

1) Hadrosaur dental batteries are apparently so weird and unique that they have material science applications that the DoD was interested in. I’m going out on a limb here because this is apparently unpublished stuff as of writing this, but HEY it’s an opportunity to plug The Skeleton Crew– who do NOT typically talk about the military industrial complex, but are in fact very cool professional paleontologists who make excellent dinosaur content videos. And now, back to the giant robots. 2) If you’re reading this, you’re a NERD.

25 notes

·

View notes

Text

September 2024 Wrapup!

There’s often a joke about ‘wake me up when September ends.’ It’s a reference to a song, a good song I like a lot that’s about a meaningful emotional thing from a queer artist. Thing is, this September, nah, I didn’t want to sleep through any of it.

This September, I wanted to remember every night of it.

(Especially the 21st night of it.)

This month’s Game Pile articles were:

Apiary, a Stonemeier game of bees! in! space! that I found extremely good in all the ways that Stonemeier games tend to be good.

Infidel, and Circling to Failure, a classic infocom text adventure about how the game frames you as a crappy dude. The unreliable narrator and the failure end point has not been revolutionary for a long time.

Kentucky Route Zero and the Three Games About America, a video about finally putting to the page an incident that I think is hilariously awful and reflects the parochial vision of American centrism that defines games culture.

Pine Shallows, a really cool adventurey TTRPG!

Over in the Story Pile, we got

Girls Band Cry, a revolutionary 3d anime in that it’s not revolutionary just in that it looks really, really cool!

Manhunter, a live action movie about this ‘Hannyball Lecktor’ guy, and the way that, turns out, serial killers aren’t amazing superminds?

Hokkaido Gals Are Super Adorable, a tourism brochure for Hokkaido, a part of Japan defined, thanks to this series, by snow and massive tits.

Hoot, a Jimmy Buffett movie which of course I’m going to wind up watching because I am such a sap for Jimmy Buffett’s work, and the resultant movie kinda belongs in a sort of Pride Month closet key collection.

Then There Were Five, which goes up tomorrow and you’ll get to enjoy as I grapple with a classic novel from my childhood that set up a status quo and didn’t deliver on it.

If you come to this blog for worldbuilding, fantasy, and generic tabletop kinds of conversations? Well, I covered the Inevitables and Modrons from 3rd edition Dungeons & Dragons, the thing we call a ‘druid’ and where that fits in and out of character fantasy, and the way that convenient magic creates an everyday industry. I talked about how in Cobrin’Seil, the Ogre represents not a species but a choice, and player options for if you want to play a bird person, in the form of the Aarakocra and Harpies and how they fit into Cobrin’Seil.

In other articles, I talked about the fantastic event called ‘the miracle of the brick,’ some great anime OPs that outweigh the anime that they present, the criminality of Pokemon in the vibes they project, and some good, old fashioned complaining about a badly made ASMR video by a media mill called Chefclub. And, not related to that particular waft of internet fartings, I talked about why I am resistant to calling my own work content these days.

I also designed a set of shirts inspired by Animorphs:

a black shirt with white text reading ‘Jake & Cassie & Marco & Rachel & Tobias & Ax’

a white shirt with black text reading ‘Jake & Cassie & Marco & Rachel & Tobias & Ax’

a black shirt with white text reading ‘Jake & Cassie & Marco & & Tobias & Ax’

a white shirt with black text reading ‘Jake & Cassie & Marco & Rachel & Tobias & Ax’

a black shirt with white text reading ‘tiger & wolf & gorilla & bear & hawk & ax”

a white shirt with black text reading ‘tiger & wolf & gorilla & bear & hawk & ax’

There are more designs, which are present as a collection over on my Redbubble.

What happened in September? Work was work — fully online classes mean I spend lots of time inside and don’t have the time to get up to things between classes. That’s an interesting challenge in my day to day life that means I’m just not leaving the house a lot, something that’s bothering me a little. Walking the dog, enjoying the weather as best I can in the late hours I walk him – because the dog’s got anxiety – that’s something that puts me out in the air, in a space where I can breath cool air.

What else, what else…

Oh yeah!

When this post goes up, Cohost is two days away from being put into Read-Only mode, and it will be closed and deleted at the end of the year. If you weren’t on it, and didn’t care about it, Cohost was essentially a type of social media website that didn’t work the way any of the other ones worked.

There’s a lot of talk about Cohost that wants to compare it to platforms like Tumblr or Twitter or Bluesky or Mastodon but none of them were really like it. It’s much easier, for me, to tell you what Cohost did: It let you post some pictures, it let you post text, it let you use some CSS or HTML to do things that I understand were pretty fun. To me what Cohost presented as a platform where I could draft articles in public, where there was a commentary culture, and where people would use tags and spoilers to control and present what you were writing or making.

It was also, to me, most importantly, a place where a bunch of my friends were hanging out. Not all of them — it sure seems to be a place biased towards white folks — but it was a place where what they offered was a meaningful chunk of my friend group.

Cohost was a place where the kind of people I like to show things to, the people whose input matters to me, felt okay talking about things. I could get feedback and responses and interest (even modestly) and people weren’t afraid that William Rando Hurst was going to wander into the conversation and accuse them of hating waffles. I have a very small fund of money I think of as my ‘spend on the internet’ kind of money. One of the only places I spent that money was on Cohost Plus, which gave me access to, as far as I know, nothing. I paid for Cohost because I wanted Cohost to succeed, and I wanted people who couldn’t afford to pay for Cohost to not feel they had to shoulder a burden.

And it’s going away.

I loved Cohost, and I’m going to miss Cohost. I get to do that. I’m so glad I get to miss Cohost. I’m glad I get to think about the things that Cohost taught me about how to be a person on the internet and I’m happy of that. It showed me ways the people around me are creative and how they are sad and how they are willing to be when they don’t feel like they’re in risk of being threatened for existing.

I’m gunna miss you, Cohost.

Keep on eggbugging.

Check it out on PRESS.exe to see it with images and links!

3 notes

·

View notes

Text

Being rendered helpless (PANOPTICON)

• Rita Ora's thumb (Encounter for aftercare following multiple organ transplant)

• Florence Welch's thumb (Laceration with foreign body of right ring finger with damage to nail)

• Winona Ryder's thumb (Secondary lacrimal gland atrophy)

• Lucy Hale's thumb (Failure in dosage during unspecified surgical and medical care)

• Conan O'Brien's thumb (Influenza due to other identified influenza virus with otitis media)

• Tyra Banks's thumb (Malignant neoplasm of overlapping sites of other and unspecified parts of mouth)

• AnnaSophia Robb's thumb (Laceration of extensor muscle, fascia and tendon of left middle finger at forearm level)

• Minka Kelly's thumb (Acute tonsillitis, unspecified)

• Djimon Hounsou's thumb (Cyst and mucocele of nose and nasal sinus)

• Forest Whitaker's thumb (Meningococcal myocarditis)

• Jimmy Buffett's thumb (Other disorders of continuity of bone, right radius)

• Kate Bosworth's thumb (Other hyperparathyroidism)

• Kristen Bell's thumb (Solitary bone cyst, left ulna and radius)

• Matt Bomer's thumb (Laceration of other muscles, fascia and tendons at shoulder and upper arm level, unspecified arm)

• Prince Harry's thumb (Laceration without foreign body of back wall of thorax without penetration into thoracic cavity)

• Avril Lavigne's thumb (Calcification and ossification of muscle)

• Demi Lovato's thumb (Nondisplaced fracture of lateral condyle of unspecified femur)

• Carmen Electra's thumb (Salter Harris Type III physeal fracture of upper end of humerus, left arm)

• Mary-Louise Parker's thumb (Atherosclerosis of other type of bypass graft(s) of the extremities with intermittent claudication, left leg)

• Vince Vaughn's thumb (Toxic effect of contact with other venomous marine animals, assault)

• Sean Lennon's thumb (Unspecified open wound of left front wall of thorax without penetration into thoracic cavity)

• Tate Donovan's thumb (Osseous and subluxation stenosis of intervertebral foramina of abdomen and other regions)

• Jennifer Aniston's thumb (Alcohol abuse with intoxication)

• Zachary Quinto's thumb (Mooren's corneal ulcer, unspecified eye)

• Tracy Morgan's thumb (Preterm labor without delivery, unspecified trimester)

• Jenna Elfman's thumb (Inflammatory polyneuropathy, unspecified)

• Kaley Cuoco-Sweeting's thumb (Perforated corneal ulcer, unspecified eye)

• DJ AM's thumb (Kaschin-Beck disease, left knee)

• Gordon Ramsay's thumb (Unspecified injury of extensor muscle, fascia and tendon of right index finger at forearm level)

• Elle Fanning's thumb (Benign neoplasm of connective and other soft tissue of unspecified upper limb, including shoulder)

• Scott Speedman's thumb (Encounter for routine postpartum follow-up)

• Curtis Stone's thumb (Swimmer's ear, left ear)

• Uma Thurman's thumb (Altered mental status, unspecified)

• Khloe Kardashian's thumb (Retinal hemorrhage, left eye)

• Maria Menounos's thumb (Passenger in three-wheeled motor vehicle injured in collision with fixed or stationary object in nontraffic accident)

• Miranda Kerr's thumb (Other combined immunodeficiencies)

• Brooklyn Decker's thumb (Atherosclerosis of other type of bypass graft(s) of the extremities with intermittent claudication, left leg)

• Ellie Goulding's thumb (Osteonecrosis in diseases classified elsewhere, thigh)

• Bethenny Frankel's thumb (Other chronic hematogenous osteomyelitis, left humerus)

• Judi Dench's thumb (Resistance to unspecified beta lactam antibiotics)

2 notes

·

View notes

Note

i was going to say give me some of that originshipping, but i can't cannot resist the confusing allure of the phrase "Escape from Margaritaville" please elaborate!

Hehehe

Mild Black Butler manga spoilers

Okay I don't even remember where this idea came from, but it's essentially a Black Butler casefic where Undertaker has assumed the identity of wealthy tycoon James "Jimmy" Buffett to create a micro-dimension paradise (Margaritaville) for dissatisfied businessmen so he has a quick supply of blood

Mean while the Queen has noticed that salarymen keep going missing, and Reaper Dispatch has noticed that souls are disappearing— cue Ciel, Sebastian, and Will being sent to investigate Margaritaville.

3 notes

·

View notes

Text

There's no way to resist the New World Order Dictatorship - We must focus on our personal lives and in our relationship with God

They are promoting crappy organizations, ideologies and stupid ideas to lure the sheep and NPCs down to hell, there's no way to fight them. Look what we have to battle against:

Globalism, New Age, Paganism, Catholicism, Frankism, Freemasonry, Rose Cross, Kabbalah, Frankfurt School (Eros and Civilization and Negative Dialectics), Repressive Tolerance, Hegelian Dialectics, Nihilism, Sabbathean Cults, Social Credit System, Satanism, Censorship, Under the Skin Surveillance, Eugenics, Mind Control programs (MK Ultra and Monarch), Robots taking jobs and leaving room for Transhumanist control of our bodies (as an excuse to "improve" - enslave - ourselves), Bioweapons, Elementary School Indoctrination, Theory of Evolution, Big Bang crap theory (Created by a Jesuit), Gnosis, Climate Lockdowns, Carbon Footprint, Food Poisoning, Fake Meat and Food (Bill Gates, Soylent Green style), Socialist Dictatorship, Universal Basic Income, Crazy Non governmental organizations funded by the elite and fighting against it's own people, Crony Capitalism, Lgztqur√+#ultra∆¥, WEForum, United Nations, Club of Rome, Bilderberg, CFR, CIA, FED, The Bankers, Tax Robbery, Broken Justice System, Mass Decarceration, Crappy Distric Attorneys serving the elite, Gun Control, Wall Street (read Wall Street and the Bolshevik Revolution), Military Industrial Complex, Burglars, Good countries turning into Hell, Social Chaos, Mafia, False Flag Operations to shift the public opinion and perception of reality, Bohemian Grove, Environmental madness, HAARP, Weather Manipulation, Bill and Melinda Foundation, George Soros, Warren Buffett (funding abortion), Silicon Valley Community Foundation (funding abortion), Big Pharma, Mark Zuckerberg, Klaus Schwab, Yuval Harari, Elitists, BlackRock, Vanguard, Hollywood Predictive Programming, Shills, Actors and Musicians fabricated to brainwash the sheep and to push New Stupid Trends that will help in the destruction of society, Debauchery, The West is turning into Sodom and Gomorrah, Overtaxation, Elon Musk getting taxpayer money and playing with his crazy brainchips to enslave the sci-fi fans tech savvy idiots in a digital interconnected interface, The Media (under globalist control), Fake Wars to kill the population and impoverish the sheep, Georgia Guidestones agenda, Most Prophecies Fulfilled and the NWO (read the Scarlet and the Beast) after the WW3 - and a Fake Alien invasion - Aliens are demons, Aleister Crowley had summoned "Lam" (known as Grey Alien) and his followers engaged in a crazy cult to worship that kind of demon. Aliens are demons in disguise, that's why they rape and hurt their victims (propagating fake philosophies and knowledge to deceive people and contradicting the bible). Lam appears in a book cover about Helena Blavatsky (satanist who created theosophy). The Aliens are connected to the "New Age" cults.

Our society is collapsing, the only way to handle this situation is trying to improve our relationship with God and not going to hell with them.

2 notes

·

View notes

Text

10 tips for navigating the share market

Everyone is aware that the stock market may be a profitable venture if you know what you're doing, but novice investors frequently lack a thorough understanding of how the market operates and the precise reasons why equities rise and fall. Before you begin investing, here are some tips for navigating the share market.

Knowing how to invest well over the long run

Peter Lynch frequently discussed "ten baggers"—investments that saw a tenfold increase in value. He said that a select few of these stocks in the share market in his portfolio were the reason for his success. Yet if he believed there was still tremendous upside potential, he would need to have the self-control to hold onto equities even after they had appreciated by a significant amount. The lesson is to not hold to arbitrary standards and to evaluate a stock according to its own merits.

Build a diversified investment portfolio

Diversification in the share market is crucial because it lowers the likelihood that any single stock in the portfolio will significantly detract from overall performance, which actually increases overall returns. In contrast, if you only purchase one stock, you are effectively putting all of your eggs in that one basket.

Taxes should be a concern but don't worry

Investors who prioritize taxes may end up making poor choices. Tax ramifications are significant, no doubt, but investing and safely growing your money comes first. While you should work to reduce your tax obligations, getting large returns should be your top priority.

Never follow a hot tip

Never take a stock suggestion at face value, regardless of the source. Before you invest your hard-earned money, always conduct your own research on a company. Certain tips can be profitable depending on the source's credibility, but a thorough investigation is necessary for long-term success.

Choose a course of action and follow it

There are numerous approaches to stock selection, so it's crucial to adhere to just one style of thinking. Vacillating between different tactics essentially makes you a market timer, which is risky ground. Consider how renowned investor Warren Buffett avoided the dotcom boom of the late '90s by adhering to his value-oriented strategy, avoiding significant losses when tech businesses failed.

Selling off investments

Being realistic about the possibility of underperforming investments is vital because there is no assurance that a stock will recover after a protracted slump. Also, while admitting to losing stocks may psychologically signify failure, there is no shame in making corrections and selling off holdings to prevent additional loss.

Don't worry about minor specifics

It's better to follow an investment's long-term trend than to freak out over its short-term fluctuations. Have faith in an investment's bigger picture and resist the urge to be influenced by volatility in the short term.

Don't overstate the few pennies you might save by using a limit order as opposed to a market order. Yes, savvy traders employ minute-to-minute variations to secure profits. But, long-term investors are successful over spans of years or more.

Maintain a long-term vision and concentrate on the future

Making educated judgments about future events is a requirement of investing. Although historical data can predict future events, this is never a guarantee. Significant short-term gains can frequently lure market novices, but one needs to remember that long-term investing is crucial for higher success. Also, while short-term active trading can generate profits, there is a higher risk involved than with buy-and-hold tactics.

Don't emphasize the P/E ratio too much.

Price-earnings ratios are frequently given significant weight by investors, but focusing too heavily on one statistic is unwise. The ideal way to use P/E ratios is in conjunction with other analytical techniques. As a result, neither a low P/E ratio nor a high P/E ratio implies that a security or firm is inherently cheap or overvalued.

Begin right away

It usually doesn't work well to wait for the ideal moment to invest in the stock market. Nobody can say with absolute confidence when it is best to enter. Also, investment is a long-term endeavor. There is no ideal moment to begin.

3 notes

·

View notes

Text

Bullish Buffet: Knowing When to Feast on Gains in Trading with MintCFD

In the world of online trading, the “Bullish Buffet” approach is about feasting on gains when market conditions align just right. This mindset focuses on recognizing bullish signals and making the most of market opportunities without letting excitement lead to reckless decisions. MintCFD, with its powerful tools and data-driven features, offers traders a smart way to adopt this approach, helping them maximize gains while keeping uncertainty in check.

The “Bullish Buffet” Mindset

The Bullish Buffet isn’t just about grabbing profits — it’s about identifying the right moments to enter the market, based on solid analysis. On the MintCFD trading app, traders can leverage a variety of tools, like real-time data and types of trading chart patterns, to spot market trends and ensure that their decisions are informed and precise. Recognizing a bull market, which refers to a steady rise in asset prices, is critical. In these scenarios, a Bullish Buffet investor aims to “feast” on the gains that come from upward trends while remaining vigilant.

Identifying Bullish Signals on the MintCFD Platform

A bull market often brings strong momentum, which can be tracked using MintCFD’s analytical tools. With access to chart patterns like the Rising Wedge or Cup and Handle, traders can spot signs of a sustained uptrend. The MintCFD app also offers alerts and indicators to catch these moments early. For example, a breakout from a resistance level may signal a potential upward trend, giving a Bullish Buffet trader a clear opportunity to enter the market.

How to Implement the Bullish Buffett Strategy with MintCFD

Focus on Market Indicators: Using tools like moving averages, MintCFD traders can spot bullish trends early. By observing patterns and comparing them to historical data, traders can build a case for their decisions rather than relying solely on market sentiment.

Set Clear Profit Goals: The Bullish Buffet approach isn’t about greed; it’s about maximizing gains while the market is favorable. Setting clear profit targets in the CFD trading app helps traders lock in gains without holding on too long, reducing the likelihood of reversal losses.

Manage Hazards with Stop-Loss Orders: Even in a bull market, fluctuations can happen. MintCFD’s stop-loss feature allows traders to manage risk by automatically selling if prices fall below a set level. This way, traders can capitalize on gains without risking too much if the market turns.

Why MintCFD is Perfect for the Bullish Buffet Strategy

MintCFD provides a streamlined, data-focused platform for investors looking to make informed decisions. The app’s comprehensive set of trading tools allows traders to view trends, make quick decisions, and keep their focus on long-term gains. With features like instant market alerts, access to diverse chart patterns, and flexible trading options, MintCFD is a great fit for traders following the Bullish Buffet approach.

In Conclusion

The Bullish Buffet is about being prepared to “feast” on gains when the market is upswing while protecting profits from sudden drops. MintCFD’s advanced features make it easy to apply this strategy, helping traders make confident, timely decisions. MintCFD users can successfully navigate bullish markets and fully embrace the Bullish Buffet approach by focusing on real-time data and smart hazard management.

0 notes

Text

The Psychology of Money: Understanding the Human Side of Financial Success

Money is one of the most influential aspects of modern life, shaping everything from our daily decisions to our long-term goals. Yet, managing money effectively isn’t just about technical skills or knowing financial terms. In his book, The Psychology of Money, author Morgan Housel explores the profound role psychology plays in financial decisions and outcomes. Housel emphasizes that our financial behavior is driven more by emotions and experiences than by strict logic or intelligence. This article delves into some key insights from The Psychology of Money and explores how they can transform our approach to personal finance.

1. Money is More About Behavior than Knowledge

One of Housel’s main points is that wealth-building depends less on knowledge and more on behavior. Most financial literature focuses on the “what”—strategies like investing, saving, and budgeting. However, understanding the “why” and “how” of our financial behaviors is often more important. For instance, two people may have the same income, but one might save diligently while the other spends impulsively. The difference lies in their financial behavior, which is shaped by emotions, habits, and experiences rather than an understanding of finance itself.

Housel suggests that success in personal finance doesn’t require technical brilliance; rather, it requires patience, discipline, and self-control. Developing healthy financial habits, such as consistent saving and avoiding debt, can often trump sophisticated investment strategies.

2. The Influence of Personal Experiences

Another key concept in The Psychology of Money is that our financial decisions are largely influenced by our individual life experiences. If someone grew up during an economic downturn, they might be cautious about investments and inclined to save aggressively. Conversely, someone who has only experienced booming economies may be more prone to risk-taking. Our financial “lens” is shaped by the economic conditions we witness, making financial decisions highly personal and subjective.

Housel highlights how these varied experiences can lead to vastly different approaches to money. Recognizing how your unique background influences your financial choices can help you avoid decisions based on biases or fears. For instance, if you’re overly cautious due to past financial struggles, you might miss growth opportunities in your portfolio. By understanding these tendencies, you can develop a more balanced approach that aligns with both your financial goals and your comfort level.

3. The Role of Compounding and Patience

One of the most important principles in personal finance is the power of compounding, yet it requires patience to realize its full potential. Compounding is the idea that the returns on an investment generate additional returns over time, leading to exponential growth. Housel emphasizes that many people underestimate the value of long-term investing due to impatience. They want immediate results, which can lead to decisions like selling investments too soon or failing to save consistently.

Warren Buffett is a prime example of compounding at work; much of his wealth accumulated after his 50s, as he allowed his investments to grow over decades. By recognizing that compounding requires time and resisting the urge to make frequent changes, individuals can maximize their wealth over the long term.

4. The Paradox of Wealth and Contentment

In The Psychology of Money, Housel discusses how people often equate wealth with happiness. Yet, studies and real-life experiences show that after meeting basic needs, happiness doesn’t increase significantly with more wealth. Often, the desire for more—be it a bigger house, a fancier car, or a higher paycheck—leads to lifestyle inflation, where expenses rise along with income. This paradox can trap people in a cycle of dissatisfaction, as they chase after more rather than focusing on financial stability or meaningful goals.

Housel suggests that true financial freedom comes from being content with what you have and resisting unnecessary spending. The goal, he argues, should not be to endlessly accumulate wealth but to reach a point of “enough”—a level where you feel secure and satisfied. This mindset can help you prioritize what truly matters, whether it’s freedom, family time, or pursuing passions.

5. Risk, Luck, and Humility

One of Housel’s most profound insights is the role of luck and risk in financial outcomes. People often attribute financial success solely to hard work and intelligence, but luck plays a significant role. Timing, economic conditions, and even one-off opportunities can have an outsized impact on financial success. Conversely, even the most prudent investors and savers can face setbacks due to unexpected events beyond their control.

Understanding the influence of luck and risk leads to a more balanced view of money, one that combines humility with gratitude. Housel advises people to avoid risky, high-stakes financial decisions and instead take a conservative approach, acknowledging that while you can control your actions, you cannot control every outcome.

6. Building Financial Resilience

Finally, The Psychology of Money emphasizes the importance of building financial resilience. Life is unpredictable, and unexpected expenses or financial shocks are inevitable. By saving more than you think you need and avoiding excessive debt, you create a financial buffer that protects you during difficult times. Housel encourages people to maintain flexibility with their finances so they can adapt to changing circumstances without severe consequences.

Resilience doesn’t just come from saving but from diversifying income sources, living below your means, and having contingency plans. It’s not about always maximizing returns but about minimizing the impact of downturns and giving yourself options in any situation.

Conclusion

The Psychology of Money teaches us that personal finance is deeply influenced by psychology and behavior. It reminds us that financial success isn’t about memorizing formulas or following market trends; it’s about self-awareness, patience, and discipline. By understanding our personal biases and emotional triggers, we can make more balanced financial decisions. Ultimately, wealth should serve as a tool for stability, security, and freedom, not as a constant race toward “more.” Embracing these insights can lead to a healthier relationship with money, empowering us to achieve financial goals while finding contentment along the way.

1 note

·

View note

Video

youtube

Warren Buffett's SECRET to Achieving FINANCIAL FREEDOM!

Learn Warren Buffett's strategies for achieving financial freedom in this video! Discover the secrets to successful trading, risk management, and mastering trading psychology. Unlock the keys to financial success today! Hey everyone! Today, I want to dive into something that’s been a game changer for so many people: the principles of wealth-building, specifically through the lens of one of the greatest investors of our time, Warren Buffett. Now, I know what you might be thinking—“Warren Buffett? That guy’s a billionaire! What can I possibly learn from him?” But trust me, his principles are not just for the ultra-rich; they’re for anyone looking to take control of their financial future. So, let’s break it down step by step. First up, let’s talk about the power of compound interest. This is like the magic trick of investing. The earlier you start, the more time your money has to grow. Picture this: if you start investing just a little bit in your twenties, by the time you hit your sixties, you could have a significant nest egg, all thanks to compounding. It’s not about timing the market; it’s about time in the market. Buffett himself has said that his favorite holding period is “forever.” He encourages us to think long-term. So, if you’re in your twenties or thirties, get started now! Next, let’s discuss living below your means. I can hear the eye rolls already—“But I want to enjoy life!” I get it, I do. But here’s the thing: frugality doesn’t mean deprivation. Buffett has lived in the same modest house since 1958. He’s not out there flaunting his wealth; he’s making it work for him. Keeping your expenses low allows you to save and invest more. And please, avoid unnecessary debt like the plague! High-interest debt can sabotage your financial health faster than you can say ��credit card.” Remember, the first rule of investing is don’t lose money, and the second rule? Don’t forget the first rule! Now, let’s talk about investing in what you understand. This is where so many people go wrong. They see a trend, everyone’s buzzing about it, and they jump in without really knowing what they’re getting into. Buffett advises us to stick to industries and businesses we understand. If you can’t explain how a company makes money in a few sentences, maybe it’s best to sit that one out. And patience is key here. Buffett often holds onto his investments for decades. He’s not looking for a quick buck; he’s looking for solid fundamentals and the right price. Speaking of price, let’s shift gears to value investing. This is Buffett’s bread and butter. He looks for undervalued stocks—those gems that the market has overlooked but have strong business models. When you find a company that’s “on sale,” that’s your cue to buy. And here’s the kicker: ignore the daily stock price fluctuations. Markets can be irrational, but if you focus on the intrinsic value of a company, you’ll be better off in the long run. Now, when your investments do well, resist the urge to cash out early. Instead, reinvest those profits. This is where the compounding magic happens again. Let your money work for you, and you’ll be amazed at how quickly your wealth can grow over time.

0 notes

Text

Hong Kong stocks rebounded after falling for two consecutive days before the holiday last Thursday. Benefiting from the People's Bank of China's launch of RMB 500 billion swap facility to rescue the market, and the anticipation of good news from the Ministry of Finance press conference held on Saturday, the Hang Seng Index opened 408 points higher at 21,046 points and continued its upward trend. It once rose 985 points to 21,622 points in the afternoon. After reaching a high level, the upward trend rebounded and closed up 614 points, or 2.97%, at 21,251 points; the technology index rose 95 points, or 2.05%, to 4,736 points. Main board transaction volume was HK$325.3 billion.

The Hang Seng Index started its upward trend from 16,964 points on September 10 to 23,241 points on October 7. The low of the index last week was 20,190 points, which was close to the midpoint of the entire trend of 20,103 points. The index also rebounded immediately, starting from gold ratio theory, this may mean that the index's upward trend may not be over yet. The 23,241 point is a short-term upward resistance, but it may not be the high in 2024. The Hang Seng Index is expected to fluctuate between 19,900 and 23,200 points in the short term. The 10-DMA (21,490) must be recovered to confirm the completion of the adjustment and resume the upward trend. On the other hand, if the index falls below 20,100 points, it may be a sign that the market is weakening.

If China's stock market rescue fails, the political consequences will be serious. If the bull market ends after only one week, all political credibility will be lost. The central government had already issued 1 trillion RMB of special treasury bonds in March, of which only about 300 billion RMB was confirmed to have been used. The urgency of increasing the issuance of 2 trillion RMB of special treasury bonds remains to be seen. The current market expectations are not low, and investors need to manage their expectations well. The amount and timing of overweighting may be variable.

Bill Gross, known as the "Bond King", believes that the bull market in U.S. stocks over the past five years is coming to an end, and the rise will slow down in the future, and investors should expect a decline in returns. Gross said, "It's not a bear market, but it's not the same bull market anymore. (No bear market, but it's not the same bull market anymore)" In addition, he said investors should pay attention to multiple risks such as high valuations and geopolitical risks. , high U.S. government debt, and the possible emergence of corporate value-added tax, and also mentioned other negative factors such as inflation approaching the Federal Reserve target and artificial intelligence (AI) spending. He also pointed out that the proportion of cash held by Warren Buffett's investment flagship Berkshire Hathaway reached a record high, which may be a warning signal for the future bumpy trend of the stock market.

European stock markets performed well, with British, French and German stocks rising by 0.19%, 0.48% and 0.85% respectively.

The satisfactory performance of major Wall Street banks drove U.S. stocks to rise sharply on Friday. After the Dow opened 53 points higher, the increase expanded to as much as 445 points, reaching 42,899 points, a record high; the S&P 500 also broke through its peak, rising 0.73% to 5,822 points. ; The Nasdaq, which is dominated by technology stocks, once rose 0.51%. The Dow and S&P closed at record highs.

U.S. stocks closed at 42,863 points, with the Dow Jones Industrial Average rising 409 points or 0.97%, the S&P 500 rising 35 points or 0.61% to 5,815 points, and the Nasdaq rising 60 points or 0.33% to 18,342 points.

The U.S. dollar index fell 0.21% to 102.769, the euro rose 0.18% to $1.0954, and the yen fell 0.46% to 149.26 per dollar.

0 notes

Text

AUctoberfest: Day 18

Title: A Prize Worth Any Price

Creator: ???

Pairing: Harry Potter/Severus Snape

Prompt: N/a

Rating: Explicit

Word Count: 7.7k

Warnings/Tags: No Archive Warnings Apply, Alpha Harry Potter, Omega Severus Snape, Misunderstandings, Arranged Marriage, Omega Verse, War Prize, Minor Dubcon Due to Misunderstanding, resolved to, Enthusiastic Consent, mentions of mpreg, Inspired by The Accidental Warlord and His Pack Series - inexplicifics

Summary: Defeated by the Rogue King and his army, the remaining nobles of Voldania sacrifice omega Severus Snape as a war prize. They know the propaganda about the Rogue King's marauding ways and discarded lovers. The nobles laugh about sending an old, 'ugly' omega and taunt Severus with predictions that he'll be hate-ravished or killed outright for the insult. Meanwhile Harry thinks he's agreed to an arranged marriage for the peace contracts. He knows about the spy who worked for the resistance during Voldemort's reign. He's excited to have such a dashing spouse.

💚❤️ Read on AO3 💚❤️

Title: Wasting Away Again in Margaritaville

Creator: ???

Pairing: Harry Potter/Severus Snape

Prompt: 2024-80 - A fanwork inspired in some way by the works of the late, great Jimmy Buffett.

Rating: Teen And Up Audiences

Word Count: 2.1k

Warnings/Tags: Song: Margaritaville (Jimmy Buffett), Inspired by a Jimmy Buffett Song, Vacation, Florida, Alcohol, Bartender Harry Potter, Barfly Severus Snape, Songfic

Summary: Severus Snape hanging out in a resort, life in shambles, enjoys a frozen margarita or three and eyes the bartender.

💚❤️ Read on AO3 💚❤️

2024 Snarry AUctoberfest Entries || HOS Tumblr || Discord

#2024 snarry auctoberfest entries#2024 snarry auctoberfest#snarry#pro snape#snarry fanfic#house of snarry#Harry x Severus#Severus x Harry

7 notes

·

View notes

Text

Is Bitcoin a Good Investment For Beginners?

Bitcoin, the world’s most popular cryptocurrency, recently went through a major event called “halving” on April 19-20, 2024. This means that the reward for mining new Bitcoins was cut in half, from 6.25 to 3.125 Bitcoins per block. Many people expected Bitcoin’s price to skyrocket after the halving, but so far, it hasn’t moved much and is currently trading around $65,000.

However, Bitcoin experts aren’t too worried. They say that in the past, Bitcoin’s price didn’t always jump right after halving, but instead grew steadily over the following months. They believe that Bitcoin could still reach $100,000 or more in the near future.

Investing in Bitcoin can be very risky, though. Its price can go up and down a lot in a short time. If you’re thinking about buying Bitcoin, make sure you can afford to lose some or all of your investment. Don’t put all your money in Bitcoin – instead, spread it out across different types of investments to be safer.

No one knows for sure what will happen with Bitcoin, but many believe it has a bright future ahead. If you’re curious about Bitcoin or other cryptocurrencies, do your research and be careful with your money.

What type of investment is Bitcoin?

Investing in Bitcoin is different from investing in traditional assets like stocks. When you buy Bitcoin, you are purchasing a digital asset that is not backed by any physical commodity or government. The value of Bitcoin is determined by market demand on cryptocurrency exchanges. In addition to buying Bitcoin, it’s also possible to acquire it through a process called mining, where powerful computers solve complex mathematical problems to validate Bitcoin transactions and are rewarded with newly minted Bitcoins.

Pros and Cons of Bitcoin Investment

Before diving into Bitcoin investment, it’s crucial to weigh the potential benefits against the risks involved.

Bitcoin Investment Pros:

Potential for high returns due to Bitcoin’s historical price appreciation

Decentralized nature provides independence from government control and inflation

Growing acceptance as a means of payment by businesses worldwide

24/7 trading on cryptocurrency exchanges

Bitcoin Investment Cons:

Extremely volatile prices with potential for significant financial losses

Lack of regulatory oversight leaves investors vulnerable to fraud and manipulation

Risk of losing access to Bitcoin wallets or exchange accounts

Concerns over Bitcoin’s environmental impact due to energy-intensive mining

Uncertainty regarding future government regulations and restrictions

Does Bitcoin Have a Real Value?

There is ongoing debate about whether Bitcoin has any intrinsic value. Skeptics argue that Bitcoin is not backed by any tangible asset and its worth is purely speculative. They claim it’s a bubble waiting to burst. On the other hand, proponents believe Bitcoin represents the future of money – a decentralized, digital currency that is borderless, secure, and resistant to inflation. They see Bitcoin’s scarcity (only 21 million will ever exist) and growing adoption as drivers of its long-term value.

What Do Crypto and Financial Experts Think about Bitcoin?

Opinions on Bitcoin among experts are divided. Some, like MicroStrategy CEO Michael Saylor, have gone all-in, investing billions in Bitcoin as a treasury reserve asset. Others, including Warren Buffett, have dismissed it as a speculative gamble with no real value.

The first spot Bitcoin ETF launched in Canada in 2021. In the same year, the SEC approved the ProShares Bitcoin Trust, the first U.S.-listed futures-based Bitcoin ETF, which accumulated $1 billion in assets within its first days of trading.

In 2022, the SEC rejected several applications for spot Bitcoin ETFs, including those from Grayscale, SkyBridge, Fidelity, and Bitwise. Grayscale subsequently sued the SEC over its decision.

In 2023 when a federal appeals court ruled in favor of Grayscale, stating that the SEC did not justify its rejection. This, along with a surge of new spot Bitcoin ETF applications from major players like BlackRock and Fidelity, raised hopes for approval.

Finally, in January 2024, the SEC approved 11 proposals for spot Bitcoin ETFs, marking a significant milestone in Bitcoin’s mainstream acceptance.

Despite these developments, experts continue to urge caution due to Bitcoin’s high-risk nature. Thorough research and a long-term perspective remain essential for any investment decisions.

What Should Be My First Minimum Bitcoin Investment?

When it comes to investing in Bitcoin, a good rule of thumb is to invest no more than you can afford to lose. Bitcoin is designed to appreciate in value over the long term, so even a small investment today could yield significant returns in a decade. There’s no need to risk large sums of money; having just a small portion of your investment portfolio in Bitcoin can help mitigate risks such as the emergence of quantum computers, regulatory bans, or other unforeseen threats.

Should I Consider Other Cryptocurrencies?

While Bitcoin remains the dominant cryptocurrency, there are thousands of alternative coins or “altcoins” available, each with its own unique features and potential. Diversifying your crypto portfolio with other promising projects can help spread risk and capture opportunities in this fast-evolving space. ECOS offers its services to help you choose what to mine in order to improve your financial situation.

0 notes

Text

Bitcoin has been making headlines as the hottest investment opportunity of the decade. With its value skyrocketing and experts predicting even further growth, there are two compelling reasons why you should consider buying Bitcoin like there's no tomorrow. Find out why jumping on the Bitcoin bandwagon could be the smartest financial decision you'll ever make. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] When you think about Bitcoin, don't get caught up in the ups and downs of its price in the short term. Focus on the long-term potential it offers instead. Recently, Bitcoin (BTC) experienced significant volatility, dropping from its all-time high of $73,750 in mid-March to below $57,000 by the end of April. Currently, it has bounced back to around $62,000. But what lies ahead for Bitcoin in 2024? Is it overvalued or undervalued at its current price? To answer these questions, let's delve into two key factors. Firstly, the introduction of new spot Bitcoin exchange-traded funds (ETFs) has had a major impact on Bitcoin's price. In the first four months of 2024, these ETFs saw massive investor inflows, boosting Bitcoin's value. The iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund have garnered over $30 billion in assets under management, garnering widespread investor interest. According to BlackRock, the next wave of institutional investors, including sovereign wealth funds, pension funds, and endowments, are poised to pour more money into Bitcoin through these ETFs, fueling its price further. Secondly, the recent halving event on April 19 has slashed Bitcoin miners' rewards in half. This reduction enhances Bitcoin's scarcity and solidifies its position as a disinflationary asset, making it an attractive long-term investment. Historically, previous halving events have propelled Bitcoin's price to new heights, with investors seeking a store of value that is both scarce and resistant to inflation. However, it's crucial to note that Bitcoin's price can be highly volatile, with fluctuations of up to 10% in a single day. This level of risk is why some prominent investors, like Warren Buffett, steer clear of Bitcoin. Despite this, the emergence of spot Bitcoin ETFs has made investing in Bitcoin more accessible to retail investors while attracting bigger institutional players. As long as money keeps flowing into these ETFs, the future looks bright for Bitcoin. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. Why should I buy Bitcoin? - Buying Bitcoin can be a good investment opportunity as its value has been steadily increasing over the years. 2. Is it safe to invest in Bitcoin? - While there are risks involved with any investment, many people believe that Bitcoin has the potential for high returns. 3. Can I use Bitcoin for regular purchases? - Yes, there are more and more businesses that accept Bitcoin as a form of payment, making it easier to use in everyday transactions. 4. How do I buy Bitcoin? - You can buy Bitcoin through online exchanges, where you can trade your regular currency for Bitcoin.

5. What happens if the value of Bitcoin goes down? - Like any investment, the value of Bitcoin can fluctuate. It's important to do your research and only invest what you can afford to lose. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Video

youtube

The Psychology of Investment: Unravelling the Emotional Decisions that Drive Financial Success

Investing is often perceived as a rational and analytical process driven solely by numbers and market trends. However, beneath the surface lies a complex web of emotions that can significantly influence investment decisions. Understanding the psychological aspect of investing is crucial for investors looking to navigate the markets successfully. In this article, we delve into why investing is often based on emotional decisions and how recognizing and managing these emotions can lead to better financial outcomes.

Emotional Investing: The Human Factor in Financial Decisions

1. Fear and Greed:

Contrarian investor, Warren Buffett, said: “be fearful when others are greedy and be greedy only when others are fearful”. Fear and greed are two potent emotions that can sway investment decisions. During market downturns, fear can lead investors to sell off assets hastily, fearing further losses. Conversely, in bull markets, greed can drive investors to make impulsive decisions, potentially buying into overvalued assets. Recognizing these emotions and learning to control their impact is key to making sound investment choices.

2. Aversion to Loss

The fear of losses can be more powerful than the prospect of gains, a phenomenon known as loss aversion. Investors often go to great lengths to avoid losses, sometimes leading to conservative choices that may hinder long-term growth. Understanding this emotional bias can help investors strike a balance between risk and reward, making more informed and strategic investment decisions. Be self aware, Maybe you have lost in the past due to a poor or uninformed decision and this is making you overly cautious?

The Role of Cognitive Biases in Investment

1. Anchoring Bias:

Anchoring bias occurs when investors fixate on specific reference points, such as past prices or market highs. This fixation can lead to irrational decision-making, as investors may be reluctant to adjust their strategies based on new information. Overcoming anchoring bias involves staying adaptable and reassessing investment decisions in light of current market conditions.

2. Confirmation Bias:

Confirmation bias is the tendency to seek out information that supports pre-existing beliefs while ignoring evidence to the contrary. Investors may fall into this trap by only considering data that aligns with their initial investment thesis. Actively seeking diverse opinions and regularly reassessing investment strategies can help mitigate the impact of confirmation bias.

The Importance of Emotional Intelligence in Investing

1. Self-Awareness:

Developing self-awareness is crucial for investors to recognize their emotional triggers and biases. By understanding their own risk tolerance and emotional responses, investors can make decisions aligned with their long-term financial goals rather than succumbing to short-term market fluctuations.

2. Patience and Discipline:

Emotional investing often leads to impulsive actions. Cultivating patience and discipline is vital for investors to resist the urge to make snap decisions based on fear or greed. Establishing a well-thought-out investment plan and sticking to it can help investors weather market volatility with confidence.

Your Past Experience, Background and Upbringing.

Americans spend more money on Lottery tickets than movies, video games, sporting events and books combined. Source: Morgan Housel, The Psychology of Money.

The lowest income households spent $412 a year on lottery tickets, four times the amount of people in higher income groups.

People buying the most lottery tickets are the same people who cannot come up with $412 in an emergency and are blowing their security on gambling with a ‘million to one’ shot of ever winning.

We can criticise the poorest in society for giving up security of having money in the bank for a one in a million chance of hitting the jackpot, but people make buying and investment decisions based on emotions and the current circumstances rather than logic.

If you’re a lower paid worker who feels there is no prospect of ever earning much more having a piece of the good life then you could be forgiven for saying the lottery ticket as your only chance of having the finer things in life.

But don’t think because you are Rich or middle class that you don’t also make investing decisions based on emotion, your upbringing on your past experience.

People who have lived through recessions, depressions, or extended market downturns, make very different investment decisions from people who have only seen the good times.

Just as people from well-off, financially, secure families make very different investment decisions than someone from a poor family.

This is also true of most decisions we make in life, whether it’s making a large purchase or choosing a future spouse, it is rarely based on logic or a spreadsheet!

Great salespeople know that people buy based on emotion, which is why they are at the top. On the other hand, average salespeople sell features of a product, which is why they are average.

When investing, you need to understand why people make seemingly irrational decisions, like selling at the bottom of the market, when it has crashed, or buying at the top of the market.

Warren Buffett knows that it is important to be fearful when everyone else around him is brave and vice versa.

Navigating the Emotional Landscape of Investing

In conclusion, investing is not a purely rational endeavour. Emotions play a significant role in shaping financial decisions, and understanding this dynamic is paramount for success in the markets. Investors who acknowledge the impact of emotions, recognize cognitive biases, and cultivate emotional intelligence are better positioned to make informed, strategic decisions that align with their financial objectives.

By embracing the psychological aspect of investing, individuals can develop a more holistic approach to managing their portfolios. In a world where market dynamics are influenced by both quantitative factors and human emotions, the ability to strike a balance between reason and sentiment is the key to achieving long-term financial success.

Gold and silver have a long-established reputation as effective hedges against inflation. When fiat currencies lose value due to inflationary pressures, the purchasing power of gold and silver tends to rise. This characteristic makes them particularly attractive to investors seeking to protect their wealth from the eroding effects of inflation.

While the investment landscape continues to evolve with the emergence of new opportunities such as cryptocurrencies, the enduring appeal of gold and silver remains undeniable. These precious metals offer stability, tangibility, diversification, inherent value, and a time-tested hedge against inflation. Investors looking for a reliable and proven store of value should consider the enduring allure of gold and silver as foundational elements of a well-rounded investment portfolio.

For a free gold, investment report, and Discovery Call, click here.

https://pure-gold.co/charles-kelly

Where to find me:

Money Tips website: https://moneytipsdaily.com/

YouTube Channel: https://www.youtube.com/channel/UC2tLUxod264Qy0gPntvx6Eg

Money Tips Facebook Community: https://www.facebook.com/groups/No1businessopportunities

LinkedIn: www.linkedin.com/in/charles-kelly-ba-cmgr-fcmi-b5300a2

See: – Transfer Property Into A Limited Company Without Paying CGT or Stamp Duty https://youtu.be/mtGq7WaVxLA

What’s in Store in 2024? Stock Markets, Property and Gold

Watch full video on Money Tips Podcast YouTube Channel https://youtu.be/difmr0fp5-Q

For a free gold, investment report, and Discovery Call, click here (https://pure-gold.co/charles-kelly)

7 Things To Make 2024 Your Best Year Ever - Watch video version at Charles Kelly Money Tips Podcast: https://youtu.be/8oZ30NHVAr8

Join me online on my free live money management training Wednesday at 8.00PM.

Places are limited, so register now below to avoid disappointment.

https://bit.ly/3QPp8IH

#interestrates #inflation #oilprices #gold #silver #property #stockmarket #money #financialfreedom #inflation #section24 #Investing #EmotionalIntelligence #FinancialDecisions #CognitiveBiases #MarketPsychology #WealthManagement #warrenbuffett #harrydent #valueinvesting

0 notes

Text

Mastering The Art Of Credit: A Guide To Safeguard Your Score

Maintaining a healthy credit score is akin to steering a ship through tumultuous waters. Your credit score, like a financial report card, speaks volumes about your creditworthiness. A high credit score opens doors to favorable interest rates and financial opportunities, while a dismal one can cast a shadow over your financial journey. So, how can you avoid the pitfalls that lead to a bad credit score? Let's navigate through some simple yet effective strategies to keep your credit score sailing smoothly.

Understanding The Credit Score Landscape

Before we dive into the strategies, let's decode the credit score itself. Think of it as a numerical representation of your creditworthiness, a three-digit number that ranges from 300 to 850. The higher your score, the better your credit health. Now, let's explore the nitty-gritty of avoiding the dreaded low credit score.

Also Read: Why Digital Lending Is A True End-to-End System

1. Timely Repayment

Warren Buffett once said, "The chains of habit are too light to be felt until they are too heavy to be broken." Applying this wisdom to your credit habits, the keystone habit is timely repayment. Whether it's credit card dues or loan installments, make it a habit to pay on time. Delayed payments not only incur hefty interest but also tarnish your credit history.

2. Beware The Sirens Of Multiple Credit Cards

In the financial odyssey, owning multiple credit cards simultaneously may seem like a tempting adventure. However, it's a double-edged sword. The frequent juggling between credit limits and due dates can lead to confusion, increasing the risk of missed payments. Instead, stick to a card or two and manage them diligently.

3. The Bankruptcy Abyss

Filing for bankruptcy is akin to navigating through turbulent financial storms. It leaves an indelible mark on your credit report, signaling to creditors that you've weathered a significant financial setback. While recovery is possible, the aftermath of bankruptcy can haunt your credit score for years. Prioritize financial resilience to avoid this extreme measure.

4. The Temptation Of Maximum Credit Limits

Resist the allure of pushing your credit card to its limit. Maxing out your credit limit not only raises red flags for lenders but also affects your credit utilization ratio – a crucial factor in credit scoring. Maintain a healthy balance between your credit limit and usage to showcase responsible financial behavior.

Also Read: Understanding The ABCs Of Personal Loans

5. The Peril Of Closing Credit Card Accounts

Closing a credit card account might seem like a logical step, especially if it carries an outstanding balance. However, doing so can harm your credit score. It affects the average age of your credit accounts and reduces your overall credit limit. Instead, focus on settling the outstanding balance while keeping the account open to maintain a positive credit history.

Navigating The Storm

According to Abhay Bhutada, MD of Poonawalla Fincorp, factors such as delayed credit card payments, missed loan repayments, multiple credit card ownership, bankruptcy filings, extensive credit card usage, and closing a credit card with an outstanding balance can significantly impact your credit score.

Also Read: Unveiling the Traits of Non-Collateral NBFC Services

Conclusion

In the intricate world of personal finance, a good credit score is your financial compass. By cultivating habits like timely repayments, prudent credit card management, and avoiding financial pitfalls like bankruptcy, you can ensure your credit health remains robust. Remember, your credit score is a reflection of your financial journey, so navigate wisely to secure a smooth sailing ahead.

Master the art of credit, and you'll find yourself not only avoiding the traps that lead to a bad credit score but also opening doors to a brighter financial future. After all, in the world of finance, as Warren Buffett wisely noted, "It takes 20 years to build a reputation and five minutes to ruin it." The same holds true for your credit score. Choose your financial habits wisely, and your creditworthiness will speak volumes. Abhay Bhutada's expertise reinforces the significance of these principles in your credit management journey.

0 notes