#Blowing Agents Market Size

Explore tagged Tumblr posts

Text

Blowing Agents Market Size, Share and Industry Analysis 2031

Global blowing agents market size was valued at USD 2.05 billion in 2023, which is expected to grow to USD 3.29 billion in 2031 with a CAGR of 6.1% during the forecast period between 2024 and 2031. The building and construction industry is the highest revenue-generating segment for the global blowing agents market. According to the Construction Industry Forecasts, 2022-2024 report published by the Construction Products Association, a global building and construction industry association, the global construction industry will register a year-on-year growth rate of 2.2% in 2023 as opposed to the year 2022.

The increasing adoption of blowing agents in the manufacturing of foams is driving the growth of the market at the global level. For instance, Arkema is developing next-generation foam-blowing agent solutions with low GWP. Their Forane FBA 1233zd is a high-performance, low GWP liquid blowing agent that is SNAP-approved for most polyurethane applications, including residential appliances, commercial refrigeration, construction panels, and doors. The product is also suitable for spray foam, appliance insulation, and various other applications.

The prime elements fuelling the growth of the building and construction activities include growing emphasis on replacing aging infrastructure, increasing development of high-rise buildings, rising investments in commercial construction projects, and rapid technological innovations. Henceforth, the bolstering building and construction activities are fueling the utilization of blowing agents, including hydrochlorofluorocarbons (HCFCs), hydrofluorocarbons (HFCs), and hydrocarbons (HCs) to ensure superior building, thereby accelerating the market growth. Likewise, the robust demand for electric vehicles and the recent investment in the automotive manufacturing zones are driving the production activities related to automotive vehicles. Therefore, the rise in automotive vehicle production is boosting the adoption of automotive parts and panels, which, in turn, is driving the blowing agents market growth.

The shifting consumer preference for environmentally sustainable blowing agents will create a lucrative opportunity for market growth during the projected forecast period. For instance, in April 2021, Kumyang launched Cellcom KY-ECO, the world's first eco-friendly blowing agent that is free from hazardous gases such as HCFCs. This blowing agent is designed to improve the finished good's flexibility, and thermal and acoustic insulation. Nonetheless, the strict regulatory framework associated with the manufacturing of the blowing agents is posing a major bottleneck for the growth of the market.

Download Free Sample Report

The Booming Building and Construction Activities is Accelerating the Market

Blowing agents, such as HFCs and HCs, are used in the building and construction industry to generate a cellular structure from liquid plastic resin. The blowing agent functions as an insulating component of the foam in the context of foam used for building insulation. Thus, the blowing agents are ideal for various applications in the building and construction industry, including residential and commercial construction projects. The rapid pace of industrial development in the Asia-Pacific region, increasing public-private partnerships in infrastructure development projects, and recent technology innovations are some of the prominent aspects resulting in the surge in building and construction activities at the global level.

For instance, according to the recent data published by Statistics Canada, a government of Canada office, in July 2023, the Canadian residential construction industry was valued at USD 11.7 billion, and in August 2023, it was USD 11.9 billion, registering a monthly growth rate of 1.6%. In addition, as of December 2023, a wide range of commercial constructions covering shopping malls, mixed-use buildings, and airports are under development at the global level, including Saya Status Shopping Mall in India (project completion year 2026), Markisches Zentrum Redevelopment in Germany (project completion year 2024), and the new terminal at Montreal Saint-Hubert Airport in Canada (project completion year 2025). Hence, booming building and construction activities are boosting the demand for blowing agents to reduce waste, energy consumption, and environmental impact, ultimately resulting in major long-term savings, further proliferating the growth of the market.

Recent Product Innovations Related to Blowing Agents is Amplifying the Market Growth

The increasing demand for environmentally sustainable products that address regulations and reduce emissions is accelerating the development of a new range of blowing agents. The development of blowing agents with lower global warming potential (GWP) and ozone depletion potential (ODP), aligning with global efforts to mitigate climate change is driving the growth of the market.

Furthermore, blowing agents designed to enhance the insulation properties of foam products, contributing to increased energy efficiency in buildings and appliances, are acting as a growth-inducing factor. In line with this, the introduction of blowing agents made of novel compounds and formulations that provide superior thermal insulation, while addressing concerns related to health, safety, and environmental impact, is propelling the market growth. Thus, the recent product innovations associated with the development of a new range of blowing agents are boosting the supply of product, which, in turn, is accelerating the market growth.

Tailoring blowing agent formulations for specific applications, ensuring optimal performance in diverse industries like construction, automotive, and appliances, is further accelerating the market growth. The next generation blowing agents, such as those being developed by Arkema, have low GWP and offer a balance of performance benefits and reduced environmental impact. In addition, innovations in blowing agents can improve the energy efficiency of products, such as appliances, by providing better insulation properties. For example, the Opteon 1100 blowing agent has very low GWP and delivers enhanced thermal performance, helping appliance manufacturers meet industry energy efficiency standards. Likewise, the development of new blowing agents, such as HFO products, highlights the ongoing advancements in technology, thereby supplementing the global blowing agents market growth.

For instance, in May 2023, Kumyang, a South Korea-based manufacturer of blowing agents introduced KY-ECO, a type of blowing agent that is safe for health. Therefore, the increasing focus on environmental sustainability, energy efficiency, and innovation in blowing agents is driving the development of next-generation products that offer improved performance and reduced environmental impact, thereby propelling the growth of the market.

Asia-Pacific Dominates the Blowing Agent Market

The growth of the blowing agents market in the Asia-Pacific region is driven by several factors, including the growing construction, automotive, and electronics industries. The increasing demand for lightweight materials, higher insulation, and higher elasticity in industries, such as automotive, construction, and aerospace, is also driving the growth of the blowing agents market in the region. The increasing disposable income of people, surging demand for larger living and commercial spaces, and the increasing production of aircraft across countries, such as India, China, and South Korea, are several crucial aspects augmenting the growth of the blowing agents market across the region.

For instance, in the year 2023, various building and construction projects commenced in the Asia-Pacific region, including Penang Chip Packaging Facility in Malaysia (project completion year 2024), Chashma Power Plant Unit V 1200 MW in Pakistan (project completion year 2030), Qinzhou Petrochemical refining and chemical integration upgrade project in China (project completion year 2025), and Dushanzi Petrochemical Complex in China (project completion year 2026). In addition, according to the recent statistics published by the Asia Automotive Analysis (AAA), in the first half of 2023, the production of automotive in Asia (South Asia, ASEAN, and East Asia) was 7,486,897 units, a year-on-year growth rate of 13.1% as opposed to 6,609,402 units in June 2022. Henceforth, the growth of the end-use industries, such as building and construction and automotive, in the Asia-Pacific are spurring the growth of the blowing agents market in the region.

Future Market Scenario (2024 – 2031F)

Investments in mining and construction sectors will further increase use cases of blowing agents, thereby creating a lucrative opportunity for market growth.

Innovation and R&D in automotive manufacturing will influence the demand growth of blowing agents. Thus, fostering the growth of the blowing agents market in the upcoming years.

Government-linked incentive schemes will help the market grow, especially applicable for appliances.

Report Scope

“Blowing Agents Market Assessment, Opportunities and Forecast, 2017-2031F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative and quantitative assessment of the current state of the global blowing agents market, industry dynamics and challenges. The report includes market size, segmental shares, growth trends, opportunities and forecast between 2024 and 2031. Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/blowing-agents-market

Contact

Mr. Vivek Gupta

5741 Cleveland street, Suite 120, VA beach, VA, USA 23462

Tel: +1 (757) 343–3258

Email: [email protected]

Website: https://www.marketsandata.com

#Blowing Agents Market#Blowing Agents Market Size#Blowing Agents Market Share#Blowing Agents Market Analysis

0 notes

Text

Blowing Agents Market: Key Players and Competitive Landscape

Blowing Agents Market is in Trends by Environmental Regulation The blowing agents market includes a wide range of chemical compounds that are used as foaming or blowing agents in the production of plastic and polymer foams. Blowing agents are inserted into the raw materials and on application of heat, they expand the material into a light, resilient cellular structure. Some common applications of blowing agents include insulation in construction and building products, packaging fillings, cushioning, and others. Due to their light weight and excellent thermal insulation properties, polymer foams are increasingly used across various industries.

The global blowing agents market is estimated to be valued at US$ 4.90 billion in 2024 and is expected to exhibit a CAGR of 6.6% over the forecast period from 2023 to 2030. Key Takeaways Key players operating in the blowing agents market include DuPont, Arkema S.A., Honeywell International Inc., Solvay S.A., Foam Supplies, Inc., AkzoNobel NV, Haltermann GmbH, Linde AG, Americhem, and HARP International Ltd. The global polymer foam market is growing rapidly due to increasing construction activities and rising demand from the automotive and packaging industries. Stringent environmental regulations regarding phasing out of hydrofluorocarbons (HFCs) are also fueling a shift toward more eco-friendly blowing agents. Several companies are expanding their production facilities globally to cater to the growing demand, especially in Asia Pacific and Latin America. Market key trends One of the key trends in the global blowing agents market is the shift toward eco-friendly alternatives due to stringent environmental regulations. Hydrofluoroolefin (HFO) blowing agents have emerged as one of the most popular sustainable substitutes for HFCs and HCFCs. They have zero ozone depletion potential and low global warming potential. Rapid technological advancements are also aiding product development. For instance, silicone-based blowing agents offer higher temperature stability, flexibility in processing, and better eco-credibility. Adoption of Industry 4.0 technologies further helps in optimizing manufacturing processes.

Porter’s Analysis

Threat of new entrants: New entrants will have difficulty in gaining economies of scale and cost advantage.

Bargaining power of buyers: Buyers have high bargaining power as there are many established manufacturers.

Bargaining power of suppliers: There is moderate supplier power as raw materials are specialized and prices are influenced by demand-supply conditions.

Threat of new substitutes: New substitutes in the form of bio-based blowing agents and natural gas are putting pressure on market share of traditional CFC and HCFC blowing agents.

Competitive rivalry: Intense competition among established manufacturers. The geographical regions where the value of blowing agents market is highly concentrated are North America and Europe. North America region accounts for more than 30% of the global market value due to presence of major polyurethane foam manufacturing industries. Europe is also one of the major markets for blowing agents considering the flourishing construction and automotive industries in the region. Asia Pacific region is expected to witness the fastest growth in blowing agents market during the forecast period. Rapid industrialization and economic development along with growth of end use industries especially construction and packaging are driving the market growth in Asia Pacific. Countries like China, India, Indonesia, and Vietnam offer immense opportunities for manufacturers given their huge population base and increasing disposable incomes.

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Text

North America Foam Blowing Agents Market Will Reach USD 451.5 Million By 2030

The size of the North American Foam Blowing Agents Market is USD 305.8 million. In 2023, and over the period from 2024 to 2030 it will increase at a rate of 5.8% per year. In 2030, the goal is to be USD 451.5 million. The foam-blowing agents are utilized to designate additives that make cellular structure in the substrate by means of a foaming procedure. Because of the significant size of…

View On WordPress

#North America Foam Blowing Agents Market#North America Foam Blowing Agents Market Demand#North America Foam Blowing Agents Market Outlook#North America Foam Blowing Agents Market Research Report#North America Foam Blowing Agents Market Share#North America Foam Blowing Agents Market Size#North America Foam Blowing Agents Market Trends

0 notes

Text

Foam Blowing Agents Market to Register a Strong Growth Rate and Huge Profits

The global Foam Blowing Agents Market is estimated to attain a valuation of US$ 2.9 Bn Bn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 5.7% during the forecast period, 2022-2031.

The key objective of the TMR report is to offer a complete assessment of the global market including major leading stakeholders of the Foam Blowing Agents industry. The current and historical status of the market together with forecasted market size and trends are demonstrated in the assessment in simple manner. In addition, the report delivers data on the volume, share, revenue, production, and sales in the market.

Request for a Sample of this Research Report (Use Corporate Mail ID for Top Priority) - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4151

#Foam Blowing Agents Market#Foam Blowing Agents#Foam Blowing Agents Market Size#Foam Blowing Agents Market Share#Foam Blowing Agents Market Growth#Foam Blowing Agents Market Analysis#Foam Blowing Agents Market Trends

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

Hydrazine Hydrate Market: Growth Opportunities and Forecast 2023–2030

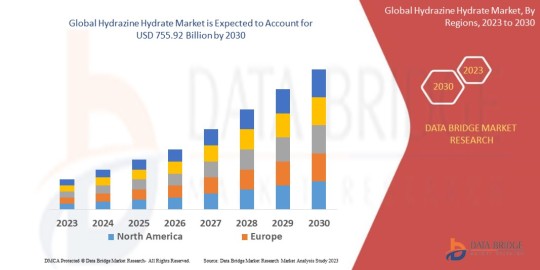

Data Bridge Market Research analyses that the hydrazine hydrate market which was USD 503.14 million in 2022, is expected to reach USD 755.92 billion by 2030, growing at a CAGR of 5.22% during the forecast period of 2023 to 2030.

The Hydrazine Hydrate Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2030. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the Hydrazine Hydrate Market:

The global Hydrazine Hydrate Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-hydrazine-hydrate-market

Which are the top companies operating in the Hydrazine Hydrate Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Hydrazine Hydrate Market report provides the information of the Top Companies in Hydrazine Hydrate Market in the market their business strategy, financial situation etc.

Arkema (France), Bayer AG (Germany), Fison (U.K.), Arrow Fine Chemicals (India), NIPPON CARBIDE INDUSTRIES CO., (Japan), Japan Finechem Inc. (Japan), LANXESS (Germany), Lansdowne Chemicals Plc (U.K.), Chemtex Specialty Limited. (India), Palm Commodities International LLC (U.S.), Sandrine Corporation (U.S.), Charkit Chemical Company LLC (U.S.), BOC Sciences (U.S.), GFS Chemicals Inc., (U.S.), Chemicals Incorporated (U.S.), Haviland USA (U.S.), Layson Bio, Inc. (U.S.), Spectrum Chemical (U.S.), Mil-Spec Industries, Inc. (U.S.)

Report Scope and Market Segmentation

Which are the driving factors of the Hydrazine Hydrate Market?

The driving factors of the Hydrazine Hydrate Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Hydrazine Hydrate Market - Competitive and Segmentation Analysis:

**Segments**

- By Concentration: 24%-35%, 40%-55%, 60%-85% - By Application: Agrochemicals, Polymerization, Pharmaceuticals, Water Treatment, Blowing Agents - By End-Use Industry: Agriculture, Chemicals, Pharmaceuticals, Polymers, Water Treatment - By Region: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa

In the hydrazine hydrate market, different segments play a crucial role in shaping the industry landscape and driving growth. Concentration-wise, hydrazine hydrate is available in various forms such as 24%-35%, 40%-55%, and 60%-85%, each catering to specific industrial requirements. In terms of application, the market is segmented into agrochemicals, polymerization, pharmaceuticals, water treatment, and blowing agents, reflecting the diverse uses of hydrazine hydrate across various sectors. Furthermore, the end-use industry segmentation includes agriculture, chemicals, pharmaceuticals, polymers, and water treatment, highlighting the broad spectrum of industries that rely on hydrazine hydrate. Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa, signifying the global reach and presence of the hydrazine hydrate market.

**Market Players**

- Arkema Group - Lonza - LANXESS - Arrow Fine Chemicals - Otsuka-MGC Chemical Company, Inc. - YAXING Chemical - Tanshang Chenhong Industrial - Hunan Zhuzhou Chemical Industry Group Co., Ltd - Weifang YAXING Chemical Co., Ltd. - Yibin Tianyuan Group Co., Ltd.

The global hydrazine hydrate market is characterized by the presence of several key players who have a significant impact on market dynamics and growth trends. Companies such as Arkema Group, LonzaThe global hydrazine hydrate market is witnessing significant growth and evolution, driven by various segmentation factors and key market players. The concentration-wise segmentation of hydrazine hydrate into categories such as 24%-35%, 40%-55%, and 60%-85% allows for tailored applications across different industries based on their specific needs. Hydrazine hydrate finds extensive use in agrochemicals, polymerization, pharmaceuticals, water treatment, and blowing agents, showcasing its versatility and broad range of applications. The end-use industry segmentation further underscores the importance of hydrazine hydrate in agriculture, chemicals, pharmaceuticals, polymers, and water treatment sectors, where it serves as a critical component in various processes and products.

Geographically, the market segmentation spanning North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa highlights the global presence and demand for hydrazine hydrate. Each region offers unique growth opportunities and challenges, with varying regulatory frameworks, market dynamics, and consumer preferences shaping the market landscape. North America and Europe are mature markets for hydrazine hydrate, driven by established industries and stringent regulations, while Asia-Pacific presents lucrative growth prospects due to rapid industrialization, increasing investments in infrastructure, and rising demand for end-use applications.

In the competitive landscape of the hydrazine hydrate market, key players such as Arkema Group, Lonza, LANXESS, Arrow Fine Chemicals, and Otsuka-MGC Chemical Company, Inc., play a pivotal role in driving innovation, product development, and market expansion. These companies leverage their technological expertise, research capabilities, and global presence to capture market share and stay ahead of the competition. Additionally, emerging players like YAXING Chemical, Tanshang Chenhong Industrial, and Hunan Zhuzhou Chemical Industry Group Co., Ltd are also making significant strides in the market, fueling competition and offering innovative solutions to meet evolving customer needs.

**Market Players** - Arkema (France) - Bayer AG (Germany) - Fison (U.K.) - Arrow Fine Chemicals (India) - NIPPON CARBIDE INDUSTRIES CO. (Japan) - Japan Finechem Inc. (Japan) - LANXESS (Germany) - Lansdowne Chemicals Plc (U.K.) - Chemtex Specialty Limited. (India) - Palm Commodities International LLC (U.S.) - Sandrine Corporation (U.S.) - Charkit Chemical Company LLC (U.S.) - BOC Sciences (U.S.) - GFS Chemicals Inc. (U.S.) - Chemicals Incorporated (U.S.) - Haviland USA (U.S.) - Layson Bio, Inc. (U.S.) - Spectrum Chemical (U.S.) - Mil-Spec Industries, Inc. (U.S.)

In the competitive landscape of the global hydrazine hydrate market, an array of key market players exerts significant influence on the industry's growth trajectory and market dynamics. Companies such as Arkema, Bayer AG, Fison, and LANXESS bring their expertise and innovation to drive market advancements and enhance product offerings. Arrow Fine Chemicals, NIPPON CARBIDE INDUSTRIES CO., and Japan Finechem Inc. contribute to market diversity and regional presence, adding valuable insights and solutions to the hyd

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Hydrazine Hydrate Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Hydrazine Hydrate Market, expected to exhibit impressive growth in CAGR from 2024 to 2030.

Explore Further Details about This Research Hydrazine Hydrate Market Report https://www.databridgemarketresearch.com/reports/global-hydrazine-hydrate-market

Key Benefits for Industry Participants and Stakeholders: –

Industry drivers, trends, restraints, and opportunities are covered in the study.

Neutral perspective on the Hydrazine Hydrate Market scenario

Recent industry growth and new developments

Competitive landscape and strategies of key companies

The Historical, current, and estimated Hydrazine Hydrate Market size in terms of value and size

In-depth, comprehensive analysis and forecasting of the Hydrazine Hydrate Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Hydrazine Hydrate Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of Hydrazine Hydrate Market Insights and Forecast to 2030

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Hydrazine Hydrate Market Landscape

Part 05: Pipeline Analysis

Part 06: Hydrazine Hydrate Market Sizing

Part 07: Five Forces Analysis

Part 08: Hydrazine Hydrate Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Hydrazine Hydrate Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-hydrazine-hydrate-market

China: https://www.databridgemarketresearch.com/zh/reports/global-hydrazine-hydrate-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-hydrazine-hydrate-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-hydrazine-hydrate-market

German: https://www.databridgemarketresearch.com/de/reports/global-hydrazine-hydrate-market

French: https://www.databridgemarketresearch.com/fr/reports/global-hydrazine-hydrate-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-hydrazine-hydrate-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-hydrazine-hydrate-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-hydrazine-hydrate-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1511

Email:- [email protected]

0 notes

Text

Pentane Plus Market

Pentane Plus Market Size, Share, Trends: ExxonMobil Corporation Leads

Shift Towards Eco-Friendly Blowing Agents in Polyurethane Foam Production

Market Overview:

The Pentane Plus Market is expected to develop at a 5.8% CAGR from 2024 to 2031. The market's worth is predicted to increase from USD XX billion in 2024 to USD YY billion by 2031. Asia-Pacific now dominates the market, with North America and Europe following closely after. Key metrics include pentane plus production volume, consumption patterns in various industries, and raw material pricing trends.

The market is growing steadily, owing to increased demand from the oil and gas industry, expanding uses in the chemical sector, and rising usage in the electronics industry for cleaning purposes. Pentane plus, recognised for its low boiling point and high energy content, is gaining popularity in a variety of industries.

DOWNLOAD FREE SAMPLE

Market Trends:

An important trend in the pentane plus market is the growing usage of pentane as an environmentally friendly blowing agent in polyurethane foam manufacture. Environmental laws aiming at decreasing the usage of HCFCs and HFCs, which have a large global warming potential, are driving this move.

For example, a major polyurethane foam manufacturer recently reported a 30% rise in the use of pentane-based blowing agents in their manufacturing processes during the previous two years. This change not only helped the company comply with environmental standards, but it also increased the thermal insulation capabilities of their foam products by up to 10%.

Another developing breakthrough is the use of pentane in the creation of aerogels, which are ultra-light materials with outstanding insulating qualities. A large chemical manufacturer recently released a new line of pentane-based aerogels for industrial insulation applications, claiming a 25% improvement in thermal efficiency over conventional insulation materials.

Market Segmentation:

Isopentane is the largest section of the pentane plus market. Its supremacy stems from its broad range of applications, which include blowing agents for polyurethane foams, gasoline additives, and aerosol propellants.

The isopentane segment has expanded significantly in recent years, particularly in the automotive and construction industries. For example, the usage of isopentane in the fabrication of lightweight automobile components has increased by 15% per year over the last three years, owing to the automotive industry's emphasis on fuel efficiency and emissions reduction.

In the building industry, isopentane-blown polyurethane foams are becoming increasingly popular for insulation applications. A prominent insulation materials company recently announced that 60% of their new product lines now include isopentane-based foams, up from 40% three years ago.

Market Key Players:

ExxonMobil Corporation

Shell plc

Phillips 66

Chevron Corporation

ConocoPhillips

Sasol Limited

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

0 notes

Link

Asia Pacific is projected to lead the global Blowing Agents market owing to advancement in the technology and presence of key industrial players coupled...

0 notes

Link

0 notes

Text

0 notes