#Blockchain Payment Tool Market Opportunity

Explore tagged Tumblr posts

Text

Blockchain Payment Tool Market Major Technology Giants in Buzz Again | BitPay, Coinomi, Cryptopay, Electroneum

Advance Market Analytics published a new research publication on Global Blockchain Payment Tool Market Insights, to 2027 with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Blockchain Payment Tool market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

Electroneum (United Kingdom), BitPay (United States), Coinomi (United States), Cryptopay (United Kingdom), Blockonomics (India), CoinsPaid (Estonia), Paytomat (Estonia), Confirmo (Singapore) and ZuPago HyBrid (HD) (United Kingdom)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/193439-global-blockchain-payment-tool-market#utm_source=DigitalJournalVinay

Scope of the Report of Blockchain Payment Tool

Blockchain payment system is drawing a lot of attention for its promising performance and applications. One relevant application or use case we have all seen and heard of is cryptocurrency trading. Blockchain networks are successfully hosting cryptocurrency exchanges such as Bitcoin, Ether etc. Blockchain refers to a chain of blocks. The blocks contain time-stamped digital records of any transactions or data exchange on the distributed network of computers. Blockchain technology was initially used to support the digital currency Bitcoin but is now being explored for various applications that dont involve bitcoin.

On 30th April 2022, Crypto lender Nexo said it has teamed up with global payments company Mastercard to launch what it calls the world’s first “crypto-backed” payment card. It signals the latest move by crypto and incumbent financial networks to join forces as digital assets become more mainstream. Nexo said the card, available in selected European countries initially, allows users to spend without having to sell their digital assets such as bitcoin, which are used as collateral to back the credit granted.

The Global Blockchain Payment Tool Market segments and Market Data Break Down are illuminated below:

by Type (Cross-Boundary, Non-Cross-Boundary), Application (BFSI, Retail, Logistics, Healthcare and Lifesciences), Providers (Application providers, Middleware providers, Infrastructure providers)

Market Opportunities:

Increase in Funding and Investments in Blockchain Payment Tools By Key Players, Eventually, new players, which are better ready to use the Po-tential of Blockchain, will give a Strong motivation to this improvement and Technology is Potentially the Absolu

Market Drivers:

Blockchain Innovation has started an lively Discussion among Researchers and Blockchain Payments Represents a Major Cornerstone of Banking and the Cradle of this Technology

Market Trend:

Rapid Use of Computers and Mobiles in financial aspects and payments and Increase in Popularity of Blockchain Among Retailers/Distributors for Better Supervision & Data Management

What can be explored with the Blockchain Payment Tool Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Blockchain Payment Tool Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Blockchain Payment Tool

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Blockchain Payment Tool Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/193439-global-blockchain-payment-tool-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Blockchain Payment Tool Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Blockchain Payment Tool market

Chapter 2: Exclusive Summary the basic information of the Blockchain Payment Tool Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Blockchain Payment Tool

Chapter 4: Presenting the Blockchain Payment Tool Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Blockchain Payment Tool market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Blockchain Payment Tool Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=193439#utm_source=DigitalJournalVinay

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA 08837

#Blockchain Payment Tool Market Analysis#Blockchain Payment Tool Market Forecast#Blockchain Payment Tool Market Growth#Blockchain Payment Tool Market Opportunity#Blockchain Payment Tool Market Share#Blockchain Payment Tool Market Trends

0 notes

Text

Elon Musk, the renowned CEO of Tesla and SpaceX, recently addressed a crowd during a town hall meeting in Pittsburgh, sharing insights about cryptocurrency's role in preserving individual freedoms. Although he refrained from explicitly endorsing XRP, Musk emphasized how digital currencies like it can play a pivotal role in counteracting centralized control. His remarks resonated with supporters of XRP, particularly as Ripple Laboratories continues its ongoing legal tussle with the SEC regarding the classification of XRP as a security. Musk’s comments highlighted a growing realization in the financial landscape: the significance of cryptocurrencies extends beyond mere investment opportunities; they offer a potential pathway toward a more decentralized economic system. For instance, XRP advocates believe that the currency’s unique features can facilitate faster cross-border transactions compared to traditional banking systems. As transaction speeds increase and costs decrease, XRP could stand out as a practical solution amidst the challenges of global remittances. Moreover, the legal implications surrounding XRP cannot be ignored. Ripple’s CEO, Brad Garlinghouse, supported Musk's viewpoint, insisting that cryptocurrency regulations should evolve to foster innovation rather than hinder it. Garlinghouse contends that many voters are starting to recognize cryptocurrencies not just as financial instruments, but as essential tools for enabling innovation and empowering individuals in a digital economy. This aligns with a broader narrative—one where regulatory frameworks are increasingly evaluated on their impact on technological advancement. During the event, Musk also pointed to Tesla’s substantial financial maneuvers involving cryptocurrency. Recently, Tesla executed a transfer of $765 million worth of Bitcoin into new wallets. This strategic move signals Tesla's continued engagement with cryptocurrencies despite its earlier decision to halt Bitcoin payments over environmental concerns in 2021. Notably, the company has pivoted to accepting Dogecoin for certain merchandise, further solidifying Musk’s ongoing involvement in the crypto market. The mining process and energy consumption connected to cryptocurrencies have raised significant concerns, particularly in the context of environmental sustainability. Musk’s comments added an important dimension, suggesting that while there may be challenges, innovation in the energy efficiency of blockchain technology remains crucial for the future of cryptocurrencies. As digital currencies become mainstream, discussions surrounding them reflect evolving societal values. In democratic setups, voters are prioritizing policies that encourage responsible innovation and individual autonomy in financial transactions. The growing interest in cryptocurrencies may prompt legislators to comprehensively review existing financial regulations to create a more conducive environment for crypto technologies. Furthermore, Musk's assertions tie into a fundamental ethos of cryptocurrencies: empowering individuals against the backdrop of centralized banking entities and governmental authority. Histories of economic crises have often made populations more receptive to alternatives like cryptocurrencies, which promise greater control over personal finances. This is evident in emerging economies where citizens are increasingly turning to digital currencies as a means of preserving wealth against hyperinflation. In conclusion, the intersection of cryptocurrency and politics is indeed an area to watch. Musk's acknowledgment of cryptocurrencies' role in decentralization aligns with sentiments shared by an ever-growing community of advocates pushing for regulatory advancements. The path forward will necessitate engagement from not just corporate entities, but also governments and civil societies in harmonizing regulatory frameworks and promoting transparency. The future of cryptocurrencies, especially XRP, will undoubtedly involve navigating these complex dynamics.

If adequately harnessed, crypto has the potential to transform economies by fostering innovation and supporting the autonomy of individuals over their financial futures. As this narrative unfolds, the discourse surrounding digital currencies will likely serve as a bellwether for broader economic transformations poised to affect various sectors worldwide.

#News#SECBitcoinEthereumCryptocurrencyRegulations#BitcoinCryptocurrencyBlockchainInvestingMarketTrends#ElonMusk#EthereumCryptocurrencyInvestingBlockchainDigitalFinance#RippleXRPSECCryptocurrencyLegalUpdate

3 notes

·

View notes

Text

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

6 notes

·

View notes

Text

Exploring Multi-Sender Transactions: Importance on the Solana Blockchain

Understanding Multi-Sender Transactions

Multi-sender transactions on Solana represent a breakthrough in blockchain functionality, allowing multiple entities to initiate and execute transactions concurrently. Unlike traditional blockchain networks where transactions typically involve a single sender and recipient, Solana’s architecture supports simultaneous transaction submissions from multiple parties.

How Multi-Sender Transactions Work

Solana achieves this capability through its innovative consensus mechanism, combining Proof of History (PoH) with Tower BFT (Byzantine Fault Tolerance). This hybrid approach ensures high throughput and fast confirmation times, making it feasible for numerous senders to interact within a single transaction batch.

Practically, multi-sender transactions facilitate:

Collaborative Payments: Where multiple parties contribute to a single payment, streamlining processes like shared expenses, group purchases, or payroll distributions.

Decentralized Finance (DeFi): Enabling complex transactions such as liquidity provisioning across different pools or executing automated market-making strategies simultaneously.

Governance and Voting: Allowing decentralized autonomous organizations (DAOs) and governance platforms to conduct collective voting and decision-making efficiently.

Importance of Multi-Sender Transactions on Solana

1. Scalability and Efficiency

Solana’s scalability is a cornerstone of its multi-sender transaction capability. With the ability to process thousands of transactions per second, Solana supports high-frequency trading, gaming transactions, and other applications requiring rapid and efficient transaction processing.

2. Cost-Effectiveness

By consolidating multiple transactions into a single batch, multi-sender transactions reduce network congestion and transaction fees. This cost-effectiveness is critical for users and developers seeking to optimize operational costs while maintaining high throughput.

3. Enhanced User Experience

For end-users, multi-sender transactions enhance usability by minimizing transaction delays and simplifying complex interactions. Whether it’s participating in token sales, distributing rewards across multiple accounts, or executing cross-platform transactions, users benefit from streamlined processes and improved transaction management.

4. Innovative Use Cases

Developers leverage Solana’s multi-sender functionality to create innovative decentralized applications (dApps). These applications span various sectors, including supply chain management, digital asset management, and real-time data processing, thanks to Solana’s robust infrastructure and developer-friendly environment.

Implementing Multi-Sender Transactions

Developers can integrate multi-sender transactions into their applications using Solana’s comprehensive developer tools. Solana’s JavaScript SDK (SolanaWeb3.js), Rust programming language support, and Solana Command Line Interface (CLI) provide essential resources for building and deploying applications that harness multi-sender capabilities effectively.

Future Outlook and Potential Innovations

Looking ahead, Solana’s multi-sender transactions are poised to catalyze further advancements in blockchain technology. As scalability improves and interoperability expands, Solana remains at the forefront of blockchain innovation, enabling new use cases and fostering growth across decentralized finance, gaming, and digital economies.

Conclusion

Multi-sender transactions on the Solana blockchain represent a pivotal advancement, enhancing scalability, efficiency, and user experience in blockchain interactions. By enabling multiple parties to engage in simultaneous transactions, Solana empowers developers to create sophisticated decentralized applications and drives innovation in digital finance and beyond.

Embrace the potential of multi-sender transactions on Solana to unlock new opportunities and propel your journey into the decentralized future.

2 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

Crossnetics: a platform for earning influencers

Introduction to Crossnetics

Crossnetics is a multifunctional platform for Influencer Marketing that makes it easy to find Influencers, digital specialists, and advertisers. Based on blockchain, the platform guarantees secure collaboration thanks to smart contracts. Crossnetics offers influencers a unique opportunity to earn and promote through mutual PR with bloggers with your target audience, and facilitates effective brand engagement.

You already have everything you need to gain global reach and increase your income! Crossnetics will help you with everything from accessing advertisers to withdrawing funds from anywhere in the world!

Benefits of Crossnetics for Influencers

ONE-STOP PLATFORM

On Crossnetics, all aspects of advertiser interaction are centralized. Influencers can manage campaigns, track their performance, and communicate with advertisers through a single system.

THE SMART SELECTION OF TASKS

With Crossnetics' advanced analytics tools, Influencers can find projects that match their audience's interests. This increases the chances of successful interactions and increased revenue from advertising campaigns.

SMART CONTRACTS TO PROTECT YOUR REVENUE

Smart contracts on Crossnetics automate the fulfillment of deal terms, ensuring transparency and fairness in payments. Influencers can rest assured that all campaign terms will be strictly followed, and payment will be made in full as agreed.

AFFILIATE MARKETING

Crossnetics allows Influencers to participate in affiliate programs, expanding earning opportunities through affiliate links and promo codes. This approach increases potential revenue and will enable Influencers to offer exclusive discounts and offers to their audience.

Crossnetics Mutual PR for Influencers

The Crossnetics platform provides unique opportunities for cross-promotion, allowing influencers to expand their audiences and strengthen their professional relationships. From audience sharing to collaborative projects, learn how to utilize these tools to increase your visibility and revenue.

Crossnetics uses advanced analytics tools to analyze audiences, allowing Influencers to find peers with similar or overlapping audience interests. The platform also makes it easy to organize collaborative promotions and events such as joint broadcasts, blog posts, or joint contests. With smart contracts, Crossnetics ensures that all terms of cooperation are met, which is important when organizing cross-promotions. Influencers can be sure that all agreements will be honored and their rights and interests protected.

Crossnetics offers tools to automate routine processes related to reciprocal PR.

Crossnetics' Mutual PR platform is a powerful tool for expanding your influence and strengthening your professional relationships in influencer marketing. With the platform's sophisticated tools and support, every Influencer can effectively utilize cross-promotion to achieve their business goals and increase revenue.

WHY DO INFLUENCERS CHOOSE CROSSNETICS?

Crossnetics is your ideal partner to grow your revenue. The platform provides all the tools and opportunities you need to realize your ambitions. Crossnetics works with a wide range of brands worldwide, giving Influencers unique opportunities to collaborate. Whether local startups or international corporations, every Influencer will be able to find the right projects that match his or her interests and audience.

Crossnetics provides access to an in-depth analysis of campaign performance. Influencers can track reach, audience engagement, and conversion rates, allowing them to optimize promotion strategies and increase revenue from each campaign.

Regardless of the geographic location of your audience, Crossnetics will enable you to monetize them internationally. This means you can attract subscribers and earn from audiences not only in your country but also beyond.

Crossnetics offers simple and reliable ways to withdraw your earnings. With smart contracts and reliable payment systems, you can quickly and securely transfer your earnings via web3 wallet, regardless of your location.

Using Crossnetics, Influencers get a platform for cooperation with advertisers and a powerful tool for achieving international success and financial well-being.

Conclusion

Using the Crossnetics platform gives Influencers access to a wide range of tools to monetize their content. With Crossnetics, Influencers can not only make money but also build strong partnerships with brands based on advanced technologies and transparent terms of cooperation.

3 notes

·

View notes

Text

Amar Bahadoorsingh: Blockchain's Boost for Businesses

In a world driven by the relentless pursuit of efficiency and trust, blockchain technology has emerged as a true game-changer. Since its groundbreaking introduction in 2009, blockchain's impact on business has been undeniable. Advocates like Amar Bahadoorsingh and countless others champion its potential, and it's easy to understand why. This revolutionary technology provides a range of advantages that can transform the way companies operate.

Let's delve into the compelling reasons why blockchain continues to gain traction in the business landscape:

1. The Strength of Decentralization

The cornerstone of blockchain's appeal lies in its decentralized nature. Unlike traditional systems where power resides with a central authority, blockchain distributes control across a network of participants. This eliminates the risk of manipulation and censorship, promoting fairness and transparency. Businesses benefit from increased trust between stakeholders, removing concerns about biases that can plague centralized systems.

2. Unlocking Efficiency and Speed

Blockchain streamlines business processes by eliminating intermediaries. Transactions happen directly between the involved parties, leading to extraordinary speed and efficiency gains. Smart contracts, the self-executing contracts enabled by blockchain, further accelerate transactions. For businesses, this translates into less bureaucracy, reduced costs, and the ability to act at the speed the market often demands.

3. Unparalleled Traceability

Every transaction on a blockchain is meticulously recorded, creating an immutable audit trail. While participants remain anonymous, the record offers unparalleled visibility into the authenticity and movement of assets or data. Supply chains become transparent, counterfeit goods are easier to identify, and compliance with regulations is greatly simplified.

4. Accelerating Business Operations

Speed and efficiency are cornerstones of success in the competitive world of business. Blockchain delivers on both fronts. With automated transactions, reduced redundancies, and streamlined processes, operations are significantly accelerated. Imagine the benefits this transformation offers: faster delivery times, quicker decision-making, and the ability to respond to market shifts in real-time.

5. The Cost-Saving Advantage

Traditional payment systems incur high fees and surcharges, a persistent pain point for businesses. Blockchain offers a solution with significantly lower transaction costs. By cutting out intermediaries, businesses save money, increasing their profitability and freeing up resources to invest in innovation and growth. The financial impact of this shift can be a crucial factor in business expansion and market competitiveness.

6. Data-Driven Marketing That Delivers

In an increasingly data-driven world, blockchain presents a wealth of opportunities for marketers. The technology enables the tracking of customer information and behavior, providing valuable insights into consumer preferences. Analyzing this data helps marketers personalize campaigns, refine targeting, and generate an impressive return on investment. Blockchain's potential to improve marketing effectiveness is transforming how businesses connect with their target audiences.

The Future is Bright for Blockchain in Business

The power of blockchain to reshape businesses is undeniable. As the technology matures and adoption grows, we can expect even broader applications. Industries like healthcare, finance, logistics, and many others are already feeling the disruptive power that blockchain offers. From building bulletproof supply chains to streamlining financial processes, the possibilities are endless.

I, like many experts in the field, strongly believe that blockchain will become an indispensable tool for businesses that want to thrive in the digital age. Its ability to enhance trust, efficiency, transparency, and cost-effectiveness positions it as a critical component for future-proofing businesses worldwide.

2 notes

·

View notes

Text

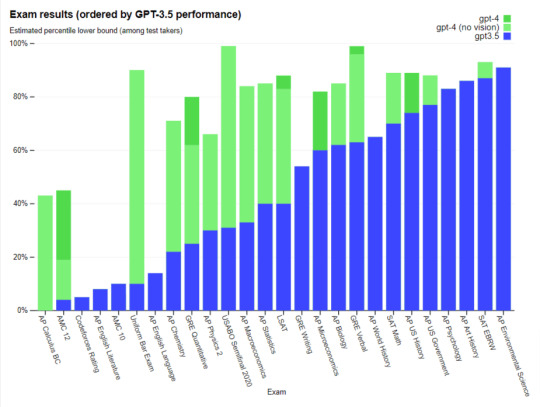

OpenAI’s GPT-4: The Future Of AI Or Potential Threat To Jobs?

OpenAI, one of the leading companies in artificial intelligence, has recently announced the release of their latest model, GPT-4. This new model boasts impressive improvements, such as being able to process up to 25,000 words, understand images, and score high on exams designed to test knowledge and reasoning. GPT-4 is being used to power Microsoft’s Bing search engine platform, and Microsoft has invested a massive $10 billion into OpenAI. However, the model still faces significant challenges like other language models, including social biases, generating incorrect information, and exhibiting disturbing behaviors when given an “adversarial” prompt.

Key Highlights

Conor Grogan, a former director at Coinbase, claimed that he successfully embedded a live Ethereum smart contract into GPT-4 and quickly identified various ��security vulnerabilities” in the code. He also explained how these vulnerabilities could be exploited.

OpenAI’s latest language model, GPT-4, offers impressive multilingual capabilities and can understand images.

GPT-4 can process up to 25,000 words and has a longer memory, but it still faces challenges like social biases and generating incorrect information.

Microsoft has invested $10 billion into OpenAI, and GPT-4 is already being used to power Bing search engine platform.

GPT-4 could potentially take over jobs currently done by humans, raising concerns about its impact on our economy.

As AI technology continues to advance, we need to ask questions about its impact on our society and ensure it is used ethically and with proper supervision.

Related: Tron and BitTorrent Team Up to Support AI Tool ChatGPT with New Payment System

Despite its limitations, GPT-4’s new capabilities could lead to new ways of exploiting it. As a generative AI, it uses algorithms and predictive text to create new content based on prompts. GPT-4 is less likely to be tricked and more stable than previous models, has a longer memory, and can remember up to 50 pages of text. Additionally, it is more multilingual and can answer thousands of multiple-choice questions in 26 languages with high accuracy. GPT-4 is a promising model that can describe images for visually impaired users through a partnership with Be My Eyes. Moreover, it can suggest an appropriate recipe if provided a photo of ingredients on a kitchen counter or explain the conclusions that can be drawn from a chart. However, there are concerns about it potentially taking over jobs currently done by humans.

It is essential to note that GPT-4 is initially only available to ChatGPT Plus subscribers who pay $20 per month for premium access. While this subscription model may seem prohibitive, it could offer an excellent opportunity for researchers and businesses to experiment with the model’s capabilities and understand its limitations.

In conclusion, GPT-4 is an impressive advancement in the field of artificial intelligence. Its multilingual capabilities, expanded token count, and longer memory offer substantial benefits. However, as with any AI model, it is not perfect and still faces significant challenges. We need to take precautions to ensure that it is used ethically and with proper supervision. As AI technology continues to advance, we must continue to ask questions about its impact on our society and our economy.

More Articles

Meta Platforms Inc. Discontinues NFT Support On Instagram And Facebook To Focus On Fintech

Square Enix Launches Symbiogenesis: A Groundbreaking NFT-Based Game With Narrative-Unlocked Entertainment

Ethereum Whale Sells 500 Moonbirds NFT, Suffers Significant Losses, And Causes Turbulence In NFT Market

Halborn Uncovers Critical Vulnerabilities In Dogecoin, Litecoin, And Other Blockchain Networks

2 notes

·

View notes

Text

BitPower: A new option for digital asset appreciation

How to use the BitPower platform for digital asset management and appreciation With the development of blockchain technology and the rise of decentralized finance (DeFi), more and more investors are paying attention to how to manage and increase the value of their digital assets through the DeFi platform. As an advanced DeFi platform, BitPower provides a variety of tools and services that allow users to circulate, borrow and save funds safely and efficiently. This article will explore how to use the BitNest platform for digital asset management and appreciation.

Understanding the BitPower platform BitPower is a blockchain-based decentralized financial platform that provides comprehensive financial services, including but not limited to fund circulation, borrowing and saving. The platform uses smart contracts to ensure the security and transparency of all transactions, which means that users can trade without relying on traditional financial intermediaries.

In the field of decentralized finance (DeFi), efficient capital flow and utilization are key needs of every investor. As the core product of the BitPower platform, BitPower Loop not only meets this need, but also provides an innovative solution that makes the lending of crypto assets more flexible and efficient. Let's discuss in detail how BitPower Loop works and provides value to users.

Using BitPower Loop for capital circulation BitPower Loop is a decentralized lending protocol based on blockchain that allows users to use their crypto assets as collateral to obtain loans or earn interest. The mechanism is automatically executed through smart contracts to ensure the transparency and security of transactions.

(1) Main features: Decentralization and automation: All lending operations are automatically executed through smart contracts without the need for intermediaries or third parties. Flexibility: Users can withdraw or add collateral assets at any time to adjust their financial strategies according to market conditions. Security: Collateral assets are locked in smart contracts and will not be used unless the loan is repaid.

(2) How BitPower Loop works The working mechanism of BitPower Loop can be divided into the following steps: Asset collateralization: Users pledge their own crypto assets to the smart contract of BitPower Loop as collateral for borrowing. Loan acquisition: Based on the market value of the collateral assets, users can immediately borrow USDT or other stablecoins. Usually, the borrowed amount is lower than the total value of the collateral assets to ensure the security of the system. Interest payment: Borrowers need to pay a certain amount of interest, which serves as the lender's income and promotes the liquidity of funds. Loan repayment: Borrowers can repay their loans at any time and get back their collateral assets, including principal and accrued interest.

(3) BitPower Loop usage strategy Short-term capital turnover: Enterprises or individuals can quickly obtain liquidity through BitPower Loop to meet short-term funding needs without having to sell their valuable crypto assets. Investment leverage: By borrowing against collateral assets, users can use borrowed funds to make further investments, expand their portfolios and take advantage of market opportunities. Maximizing returns: Lending crypto assets to earn interest provides passive income opportunities for those seeking stable returns. Avoiding capital losses: In an uncertain market, users can avoid realizing capital losses by borrowing against collateral assets instead of selling them.

(4) BitPower Loop security measures Security is an important factor in attracting users to use BitPower Loop. The platform adopts a variety of security measures to protect user assets and data: Overcollateralization: requires the value of collateral assets to exceed the loan amount to reduce the risk of market volatility. Liquidation mechanism: If the value of collateral assets falls below a certain threshold, the system will automatically initiate liquidation to protect the borrower's funds. Cryptographic security: All transaction data is protected by encryption technology to ensure the privacy of user information and assets.

BitPower Loop plans to introduce more crypto assets and stablecoins to provide a wider range of services. In addition, the platform will continue to optimize its algorithms and interfaces to enhance the user experience and attract more participants to join the ecosystem.

Use BitPower Savings to achieve asset appreciation Although BitPower Savings has not yet been launched, it heralds a function that allows users to deposit digital currencies and earn interest income, which will take advantage of DeFi and provide higher interest rates than traditional banks.

Expected function: Users only need to deposit crypto assets to earn passive income, which will be used for other financial activities on the platform, such as lending. Potential Benefits: This will provide a low-risk investment method, allowing users' crypto assets to generate stable income, further enhancing the potential for asset appreciation.

Obtain liquidity through BitPower Lending As an auxiliary function, BitPower Lending provides a mortgage service, where users can pledge their own cryptocurrencies in exchange for USDT or other stablecoins. This service is particularly suitable for users who need short-term funds.

Functional description: Provide users with a way to obtain instant liquidity using their own crypto assets without selling them. User benefits: This provides convenience for users who need liquidity but do not want to sell their crypto assets, helping them solve short-term funding needs.

Participate in BitPower DAO to influence platform development Although BitPower DAO has not yet been launched, it is expected to be a decentralized autonomous organization that allows Melion Coin holders to influence the future development of the platform through voting.

Expected functions: Users will decide the future development direction of the platform through voting, including the launch of new features and adjustments to key policies. Potential Benefits: This will give users real decision-making power, allowing them to directly influence platform policies and functional adjustments to ensure that the platform meets their needs and expectations.

Conclusion BitPower provides a safe, transparent and efficient way to manage and increase the value of digital assets. Whether you are an experienced investor or a beginner, BitPower can provide the necessary tools and resources to help you thrive in the era of digital finance. As more and more users and capital pour into the DeFi market, it will become increasingly important to understand and utilize platforms such as BitPower. #BitPower Please visit BitPower Site official website: https://www.bitpower.space/ For more information about Bitpower, please contact us on Telegram: https://t.me/Anna8999999

0 notes

Text

Revolutionizing Industry 4.0 with Blockchain: A New Era of Digital Transformation

The advent of Industry 4.0 has brought about a technological revolution, fundamentally transforming industrial operations and manufacturing processes. This new era emphasizes the use of cutting-edge technologies like the Internet of Things (IoT), Artificial Intelligence (AI), robotics, and data analytics to create smart factories and optimize the digital supply chain. In this blog, we delve into the role of blockchain in shaping the future of Industry 4.0, highlighting its potential to revolutionize industries by enhancing transparency, security, and efficiency.

How Blockchain Drives Industry 4.0 Forward

Blockchain, with its decentralized and immutable ledger, brings transformative capabilities that address key challenges in Industry 4.0. Here's how it is making an impact:

Enhancing Supply Chain Transparency

One of the most significant advantages of blockchain is its ability to provide end-to-end visibility across supply chains. By recording every transaction on a tamper-proof ledger, blockchain enables businesses to trace the origin and movement of goods with unparalleled accuracy.

This is particularly valuable in industries like manufacturing, retail, and logistics, where ensuring product quality and authenticity is paramount. For instance, companies can use blockchain to verify the ethical sourcing of raw materials or detect counterfeits in real time.

Securing IoT Devices

The proliferation of IoT devices in Industry 4.0 has introduced a new layer of complexity and vulnerability. With millions of interconnected devices exchanging data, the risk of cyberattacks has escalated. Blockchain mitigates this risk by providing a secure, decentralized framework for IoT networks, ensuring that devices communicate only through verified, encrypted channels.

Streamlining Smart Contracts

Blockchain-powered smart contracts are revolutionizing industrial processes by automating agreements between stakeholders. These self-executing contracts eliminate the need for intermediaries, significantly reducing costs and minimizing errors.

In Industry 4.0, smart contracts can be used for tasks like inventory management, supplier payments, and procurement, ensuring faster and more reliable operations.

Improving Data Integrity and Collaboration

Industry 4.0 relies heavily on data to drive automation and decision-making. Blockchain ensures that all data shared across the industrial ecosystem is tamper-proof and reliable, fostering greater trust and collaboration among stakeholders.

For instance, manufacturers, suppliers, and distributors can share operational data on a blockchain network without worrying about data breaches or unauthorized alterations.

The Way Forward

Blockchain is not merely a complementary technology in Industry 4.0 but a foundational pillar that strengthens its core objectives. By enhancing transparency, securing networks, and streamlining processes, blockchain is paving the way for a more resilient, transparent, and efficient industrial ecosystem.

As adoption grows, businesses must address challenges like scalability, regulatory compliance, and implementation costs to unlock blockchain’s full potential. Collaborating with experienced partners and leveraging tailored blockchain solutions will be critical for organizations aiming to stay ahead in this digital transformation journey.

Conclusion

The integration of blockchain into Industry 4.0 represents a giant leap toward creating a connected and intelligent industrial future. By addressing existing challenges and offering innovative solutions, blockchain empowers businesses to thrive in a competitive and rapidly evolving market. The road ahead is filled with opportunities, and blockchain will undoubtedly play a central role in shaping the industries of tomorrow.

For businesses ready to embrace the future, blockchain offers the tools to build a smarter, more secure, and efficient world. The time to act is now!

0 notes

Text

How Digital Payment Solutions Are Driving Global Connectivity ?

In today’s hyperconnected world, the way we transact has transformed radically. From the days of barter systems to the advent of currency and now digital transactions, commerce has consistently evolved to meet human needs. At the heart of this transformation lies the digital payment solution, a game-changing innovation that has made financial transactions seamless, efficient, and borderless. Coupled with advances in technology, these solutions are driving global connectivity like never before.

The Evolution of Digital Payment Solutions

Digital payment solutions have rapidly evolved to keep up with the demands of a fast-paced, interconnected global economy. These systems include mobile wallets, payment gateways, peer-to-peer (P2P) payment platforms, and cryptocurrency-based transactions. They leverage technology to enable individuals and businesses to send and receive money with unparalleled ease and security.

As globalization continues to break down geographical barriers, the need for efficient payment systems has grown. Software solutions designed to handle digital payments have become the backbone of this global financial ecosystem, enabling businesses of all sizes to operate seamlessly across borders.

Breaking Down Barriers with Digital Payment Solutions

1. Connecting Global Markets

Digital payment solutions empower businesses to expand their reach to international markets. Whether it’s a small e-commerce store selling handmade crafts or a multinational corporation offering software services, the ability to accept payments from customers worldwide is essential.

Payment platforms like PayPal, Stripe, and Xettle are bridging this gap, providing businesses with tools to accept payments in multiple currencies and ensure smooth transactions. These solutions reduce the complexity of cross-border trade by handling currency conversions, compliance with local regulations, and fraud prevention, making it easier for companies to scale globally.

2. Empowering Underbanked Regions

One of the most significant contributions of digital payment solutions is their ability to bring financial services to underbanked and unbanked populations. In many developing countries, access to traditional banking infrastructure is limited. However, with the proliferation of mobile phones and internet access, digital payment platforms have become a lifeline for millions.

Software solutions tailored for these regions enable individuals to make payments, receive salaries, and even access credit, fostering economic inclusion and development. This democratization of financial services is connecting people in remote areas to the global economy, creating opportunities that were previously unattainable.

3. Streamlining International Payouts

For businesses operating on a global scale, managing payouts to employees, suppliers, or freelancers across different countries can be a logistical challenge. This is where advanced software solutions for payouts come into play. These tools automate and simplify the process of distributing funds, reducing errors and ensuring timely payments.

Companies like Xettle offer solutions that handle complex payout scenarios, such as multi-currency disbursements and compliance with international regulations. By removing barriers to efficient payouts, businesses can focus on growth rather than administrative hurdles.

Enhancing Global Connectivity with Advanced Features

The rise of digital payment solutions isn’t just about speed or convenience—it’s also about innovation. Modern payment systems are equipped with features that enhance global connectivity, such as:

Real-Time Transactions: Instantaneous fund transfers enable businesses to operate more efficiently, whether they’re paying international suppliers or receiving payments from customers halfway across the globe.

Blockchain Integration: Blockchain technology is revolutionizing cross-border payments by reducing costs and increasing transparency. Decentralized systems eliminate the need for intermediaries, making transactions faster and more secure.

AI-Driven Fraud Prevention: Advanced software solutions use artificial intelligence (AI) to detect and prevent fraudulent activities, ensuring the safety of users and maintaining trust in the system.

Building Trust in a Digital Ecosystem

For global connectivity to thrive, trust is paramount. Digital payment solutions must offer robust security features to protect user data and financial information. Encryption, tokenization, and biometric authentication are just some of the measures being employed to ensure the safety of transactions.

Platforms like Xettle emphasize security without compromising user experience. By prioritizing trust, these solutions encourage more users to embrace digital payments, further strengthening the interconnected global economy.

Challenges and Opportunities

Despite their many advantages, digital payment solutions face challenges that must be addressed to unlock their full potential.

Regulatory Hurdles: Different countries have varying regulations governing digital payments, which can complicate cross-border transactions.

Cybersecurity Threats: As systems become more interconnected, the risk of cyberattacks increases. Continuous innovation in security measures is essential to mitigate these threats.

Digital Divide: While technology is advancing rapidly, not everyone has equal access to it. Bridging the digital divide is crucial for ensuring inclusive global connectivity.

However, these challenges also present opportunities for growth and innovation. By investing in infrastructure, enhancing security protocols, and fostering partnerships between governments and technology providers, the global community can overcome these obstacles and maximize the benefits of digital payment solutions.

The Future of Global Connectivity

The impact of digital payment solutions on global connectivity is undeniable. They have transformed how businesses operate, enabled financial inclusion, and fostered economic growth in ways that were previously unimaginable. As technology continues to evolve, the role of software solutions in driving this transformation will only grow stronger.

In the years to come, we can expect even greater advancements in this space, from the widespread adoption of blockchain technology to the integration of artificial intelligence in payment systems. Companies like Xettle are leading the charge, setting new standards for efficiency, security, and user experience.

By embracing digital payment solutions, businesses and individuals alike can become active participants in the interconnected global economy, unlocking opportunities that transcend borders and create a truly unified financial landscape.

1 note

·

View note

Text

Real-World Assets Turn Digital with Blockchain Technology: UPB Crypto Bank – Changing the Way We Make Payments

Fintech is moving at an unmatched speed, and it is in this context that blockchain has become a new reality and a new approach to the perception of real-world assets. Blockchain technology has introduced a world of opportunity on the financial services front. New solutions like crypto banking, cross-chain payment, and universal payment are now possible. Leading this revolution is UPB Crypto Bank – an innovative digital finance company that uses blockchain to offer tokenization of assets and instant crypto payments.

Tokenizing Real-World Assets

The key process involved in the digitalization of assets through blockchain involves tokenization, which involves tokens such as real estate, commodities and intellectual property. They are digital tokens that provide evidence of a stake in an underlying asset or security, meaning that these can be traded, bought or sold within a reliable environment. These transactions involve trading in commodities. UPB Crypto Bank employs UPB Token and UPB Coin to perform these functions, thus offering users direct access to the global investment market without being required to transact through an intermediary.

Tokenization can instil liquidity into markets while at the same time bringing equality to everyone in accessing valuable assets. For instance, rather than buying the houses, the entire property can be bought through tokens in fractions. Blockchain guarantees that these transactions are unalterable, transparent, and safe, eliminating the disadvantages of traditional financial systems.

The Rise of Crypto Banking

There are many disadvantages to using traditional banking systems, such as a slow rate of transactions, expensive charges, and, in some places, there are no banks at all. Crypto banking, advanced by disruptors such as UPB Crypto Bank, checks these hurdles by providing financial services through blockchain. Thus, by implementing decentralized technology, UPB Crypto Bank is a tool that makes it possible to store and transfer digital assets as easily as possible.

These initial features, such as Crypto UPI (Universal Payment Interface) and UPB, actually connect traditional payment with crypto payment. Crypto UPI allows instantaneous, inexpensive, and global transactions, and the user is ready to transfer or withdraw money from any corner of the world with just a few clicks.

Seamless Cross-Chain Payments

Interoperability between blockchain networks has been a major issue in the crypto space, among many other issues. In regard to this problem, UPB provides a CrossChain payment solution that allows users to transfer assets from one blockchain to another. This innovation is aimed at making users cross the silos of a single blockchain ecosystem, thereby increasing their flexibility and use.

Being an integration of cross-chain services, UPB reduces difficult transactions, and payment solutions are as direct as banking. It is especially helpful for companies and persons engaging in the import and export business or trade.

Universal Payment Bank takes its place as a powerful state policy among such financial strategies.

UPB envision itself repainting the whole spectrum of financial services with a unique model called Universal Payment Bank. It integrates a blend of existing banking systems and blockchain features to provide all the services one might need from a bank. It includes an asset tokenization feature, as well as payment in cryptocurrencies and the use of decentralized financial services, which are all summed up in UPB.

As a result of the inclusion of digital currencies, UPB Coin and UPB Token are the universal payment bank, which provides users with a universal currency tool for investment, payment, and savings.

Conclusion

Thus, established markets such as UPB Crypto Bank belong to the forefront of this ongoing change caused by Selectable Advanced Technology: Blockchain. With its integrated solutions of real-world assets, secure means of cross-chain payment, and Crypto UPI, UPB is rolling out financial services that are convenient, transparent, and efficient.

The time for digital finances has come, and with leaders such as UPB Crypto Bank, all the possibilities for payment and space assets management are higher than ever. Suppose you are an investor, a business owner, a technology follower or any one of these. In that case, the embrace of blockchain-based solutions is the way to open a new world of opportunities in the global economy.

#Crypto Bank#Crypto Banking#CrossChain Payment#crypto Payment#Crypto UPI#Universal Payment Bank#UPB Token#UPB coin

0 notes

Text

Coinbase: Shaping the Future of Money in a Digital Era

We're the most trusted place for people and businesses to buy, sell, and manage crypto.

READ MORE IN GOOGLE

In a rapidly evolving financial landscape, Coinbase has positioned itself as a pivotal player, revolutionizing how people and businesses interact with money. From its humble beginnings, Coinbase has grown into a trusted platform for buying, selling, and managing cryptocurrencies, boasting a user-friendly interface and unparalleled security measures.

A Vision for the Future of Money

The tagline, "The future of money is here," perfectly encapsulates Coinbase's mission. In an era where digital assets are becoming integral to the global economy, the platform serves as a gateway for millions to participate in the cryptocurrency revolution. By simplifying complex blockchain technology and making it accessible to everyday users, Coinbase empowers individuals to embrace a decentralized financial system.

READ MORE IN GOOGLE

Why Coinbase Stands Out

As the world’s most trusted cryptocurrency exchange, Coinbase offers a host of features that set it apart from competitors:

Ease of Use The platform is renowned for its intuitive design, making it simple for newcomers and experienced traders alike to navigate the crypto ecosystem. Whether you're buying your first Bitcoin or managing a diverse portfolio, Coinbase streamlines the process.

Security and Trust Security is at the heart of Coinbase’s operations. With robust measures such as two-factor authentication, encryption, and cold storage for digital assets, users can transact with confidence. This commitment to safety has made Coinbase a household name in the crypto space.

Diverse Asset Offerings From Bitcoin and Ethereum to emerging altcoins, Coinbase supports a wide range of cryptocurrencies. This diversity allows users to explore various investment opportunities and stay ahead of market trends.

Business Solutions Beyond individual users, Coinbase provides tools for businesses to integrate cryptocurrency payments, manage assets, and innovate their financial strategies. This is a crucial step in mainstreaming crypto adoption across industries.

Educating the Masses

Coinbase also prioritizes education, offering resources that demystify cryptocurrency and blockchain technology. By providing learning materials and tutorials, it equips users with the knowledge to make informed financial decisions in the crypto space.

Challenges and the Path Ahead

Despite its success, Coinbase operates in a dynamic and occasionally volatile industry. Regulatory challenges and market fluctuations present ongoing hurdles. However, the company's proactive approach to compliance and innovation ensures its resilience and growth.

READ MORE IN GOOGLE

Conclusion

Coinbase’s impact on the future of money cannot be overstated. By combining trust, innovation, and accessibility, it bridges the gap between traditional finance and the emerging world of digital currencies. As more individuals and businesses turn to crypto, Coinbase remains at the forefront, championing a new era of financial freedom.

To learn more or start your cryptocurrency journey, visit Coinbase.

0 notes

Text

Build Your Dream Crypto Casino with Plurance’s Advanced Stake Clone Script

In the dynamic world of online gaming, crypto casinos are transforming the industry by offering seamless, secure, and transparent gaming experiences. As an aspiring entrepreneur or investor looking to tap into this thriving market, a Stake Clone Script can be your golden ticket to success. Designed to replicate the functionality of Stake, a leading crypto casino platform, this solution enables you to establish a powerful and feature-rich crypto casino tailored to your business needs.

At Plurance, we provide a robust Stake Clone Script that offers cutting-edge technology, scalability, and customization options to create a top-tier gaming platform that stands out in the competitive crypto casino market.

Why Invest in a Crypto Casino Business?

The demand for crypto-based casino platforms has surged in recent years, thanks to the increased adoption of cryptocurrencies like Bitcoin, Ethereum, and others. Here’s why investing in this sector is a lucrative opportunity:

Global Accessibility: Crypto casinos allow players to access gaming platforms from anywhere in the world without geographical restrictions.

Enhanced Security: Blockchain technology ensures transparent and secure transactions, fostering trust among players.

Faster Transactions: Unlike traditional payment methods, crypto transactions are processed instantly with minimal fees.

High ROI Potential: Crypto casinos attract a broad user base, ensuring steady revenue streams and substantial returns on investment.

By opting for a Stake Clone Script, you can leverage these benefits and establish a gaming platform that caters to modern players seeking innovation and reliability.

Features of Plurance’s Stake Clone Script

Our Stake Clone Script is designed with advanced features to deliver a world-class gaming experience to your users:

Diverse Gaming Options: Include popular casino games such as roulette, poker, blackjack, slots, and live dealer games to engage your audience.

Multi-Currency Support: Accept payments in multiple cryptocurrencies, including Bitcoin, Ethereum, and stablecoins, for enhanced accessibility.

Provably Fair Gaming: Build trust among your players with provably fair algorithms that ensure transparent and unbiased gameplay.

Secure Payment Integration: Safeguard player funds and transactions with advanced encryption and secure wallets.

Mobile-Friendly Platform: Offer a seamless gaming experience across all devices, including desktops, tablets, and smartphones.

Admin Dashboard: Efficiently manage your platform with a comprehensive admin panel that provides real-time analytics and user management tools.

Customizable UI/UX: Create a unique brand identity with a fully customizable interface that aligns with your business goals.

Benefits of Choosing Plurance

Plurance is a trusted name in blockchain and gaming solutions, offering unparalleled expertise in developing crypto casino platforms. Here’s why we are the best choice for your Stake Clone Script needs:

Affordable Solutions: Launch your crypto casino at a cost-effective price without compromising on quality.

Scalable Architecture: Expand your platform effortlessly as your user base grows.

24/7 Support: Our dedicated team is always available to provide technical assistance and ensure seamless platform performance.

Quick Deployment: Get your platform up and running in no time with our ready-made and customizable Stake Clone Script.

Conclusion

The crypto casino industry is booming, presenting a golden opportunity for investors to capitalize on its growth. With Plurance’s advanced Stake Clone Script, you can create a feature-rich and secure platform that caters to the modern-day gaming enthusiast.

Plurance provides the best Stake Clone Script to help you establish a crypto casino platform at an affordable cost. Let us guide you in building a highly profitable gaming business that stands out in the competitive market. Reach out to us today to transform your envisioned casino into a tangible reality.For more info:

Call/Whatsapp - +918807211181

Mail - [email protected]

Telegram - Pluranceteck Skype - live:.cid.ff15f76b3b430ccc Website - https://www.plurance.com/stake-clone-script

0 notes

Text

Online Auction Software: Redefining the Auction Industry

The digital era has transformed how businesses and individuals interact; the auction industry is no exception. Online auction software has become an essential tool for auction houses, businesses, and collectors looking to buy or sell items in a streamlined and efficient manner. By integrating technology into traditional auction practices, these platforms have made bidding accessible to a global audience, ensuring convenience, transparency, and increased engagement.

The Evolution of Online Auctions

Auctions have a rich history, evolving from live gatherings in physical locations to hybrid and fully digital experiences. The advent of modern auction platforms has been pivotal in this transformation. These platforms eliminate geographical barriers, allowing participants from around the world to join auctions in real time. For auction houses, this means reaching a broader audience, while bidders enjoy the flexibility of participating from the comfort of their homes or offices.

Features and Benefits

Modern auction platforms come packed with features that make them indispensable tools for contemporary auctions. One of the most significant advantages is real-time bidding, where participants can place bids as the auction unfolds, fostering the excitement of a live event. For timed auctions, these systems can handle countdown timers, ensuring precise and fair bidding opportunities.

Another essential feature is catalog management, which allows auction houses to upload, organize, and display items in an appealing format. With high-quality images, detailed descriptions, and user-friendly navigation, potential buyers can explore the items effortlessly.

For bidders, automated notifications are a game-changer. Alerts about upcoming auctions outbid notices, and reminders for closing bids ensure they never miss an opportunity. Additionally, secure payment integrations make transactions safe and straightforward for all parties involved.

How Online Auction Software Empowers Auction Houses

Auction houses and businesses benefit immensely from the operational efficiencies provided by modern auction platforms. Beyond the bidding process, these systems often include tools for inventory management, marketing, and analytics.

Marketing tools, such as email campaigns and social media integrations, allow auction houses to promote their events effectively. Analytics dashboards provide insights into bidder behavior, helping businesses refine their strategies for future auctions.

Moreover, the scalability of these platforms means they cater to all types of auctions—whether it’s a small-scale event for niche collectors or a large-scale, high-profile auction with global participation.

Trends Shaping the Future of Online Auctions

As technology continues to evolve, so do the possibilities for online bidding software and platforms. Artificial intelligence (AI) and machine learning are being incorporated to provide personalized recommendations for bidders, improving their overall experience. Virtual reality (VR) is also making its way into the industry, enabling bidders to virtually inspect items, offering a more immersive experience.

Blockchain technology is another game-changer, providing an extra layer of security and transparency for transactions. By recording bids and sales on an immutable ledger, online bidding software utilizing blockchain can help build trust among participants.

Why Choose Bidsquare Cloud?

Among the many options available, Bidsquare Cloud stands out as a robust and reliable platform for auction houses. It supports live, timed, and hybrid auctions, catering to various needs with its intuitive interface and customizable features.

Bidsquare Cloud simplifies complex processes like catalog management, bidding, and payment handling, making it easier for organizers to run successful auctions. With its emphasis on innovation and user experience, it has become a trusted partner for auction houses looking to adapt to modern demands while maintaining efficiency and professionalism.

0 notes

Text

Top FinTech App Ideas for Startups in 2024

The article "Top FinTech App Ideas for Startups in 2024" presents innovative app concepts that can shape the future of financial technology. From AI-powered budgeting tools to blockchain-based payment solutions, it highlights opportunities for startups to disrupt the market. With a focus on user-centric features and emerging trends, the article provides insights into building impactful FinTech applications for a competitive edge in 2024.

0 notes