#BioBucks Preview

Explore tagged Tumblr posts

Text

BioBucks Review – Automated Cash Machine Social Media

Welcome to my BioBucks Review Post. This is a real user-based BioBucks Review Review where I will focus on the features, upgrades, demo, pricing and bonus how BioBucks Review can help you, and my opinion. This is the world’s first AI app that turns any bio section into a cash Machine Allowing Us To Profit $653.65 Daily With Zero Followers With Zero Ads.

<< Click Here to Get BioBucks + My $29000 Special Bonus Bundle to Boost Up Your Earnings More Traffic, Leads & Commissions >>

BioBucks Review: What Is It?

BioBucks Review: Overview

Creator: Al Cheeseman

Product: BioBucks

Date Of Launch: 2024-Jan-21

Time Of Launch: 10:00 EST

Front-End Price: $17

Official Website: Click Here

Product Type: Software (Online)

Support: Effective Response

Discount : Get The Best Discount Right Now!

Recommended: Highly Recommended

Skill Level Required: All Levels

Refund: YES, 90 Days Money-Back Guarantee

BioBucks Review: Key Features

Make Over $2,000 A Day From This Exact Same System

Instantly Tap Into Lucrative Paydays Without Knowing Anything At All.

ZERO Tech Setup, Everything Is Done For You

100% Success Rate With Beta-Testers

No Waiting — 60 Second Set Up

30 Days Money-Back Guarantee

Completely Newbie Friendly

No Need To Run Ads. We Can Get Unlimited Clicks For FREE

Start Getting Results Within 30 Minutes Of Using The BioBucks System

Guaranteed Affiliate Approval

Nothing To Pay Inside, And Nothing To Setup.

ZERO Upfront Cost

<< Click Here to Get BioBucks + My $29000 Special Bonus Bundle to Boost Up Your Earnings More Traffic, Leads & Commissions >>

BioBucks Review: How Does It Work?

BioBucks Review: Can Do For You

Done For You: In a few clicks fire up a full side income system with over 50 different functions including your affiliate links. True autopilot income funnels are created within seconds and earn you a commission.

Commission Bio App: Instant 1 Click monetizes any social media bio using the brand new A.I software. This super smart app lets you build and monetize any social media account within seconds.

100% Success Rate: Everybody who has duplicated BioBucks and put it into action has had success with this system. BioBucks system requires no further monthly fees on expensive tools at all.

AI Profit Funnels: Supersmart humanlike sales funnels with high converting clickthrough rates. All generated by AI and completely done for you! And BioBucks, allows us to make a lot of commission without actually doing any work And not only that, the AI sales bots will convert them for you & follow them up!

AI Smart Recognition: This app is so powerful that it understands and responds to sales questions and potential rejections from leads. Directing them to sales funnels that pump out huge commissions. Following up and closing for you 24/7.

AI List Builder: This is the best part. After BioBucks do all the work for you. You can build your list directly from inside the platform, with just a few clicks.

BioBucks Review: Verify User Feedback

BioBucks Review: Who Should Use BioBucks?

Affiliate Marketers

YouTube Marketers

Social Media Marketers

Bloggers & Website owners

Local Businesses

eCom, Shopify, and Amazon Sellers

Coaches & Course Creators

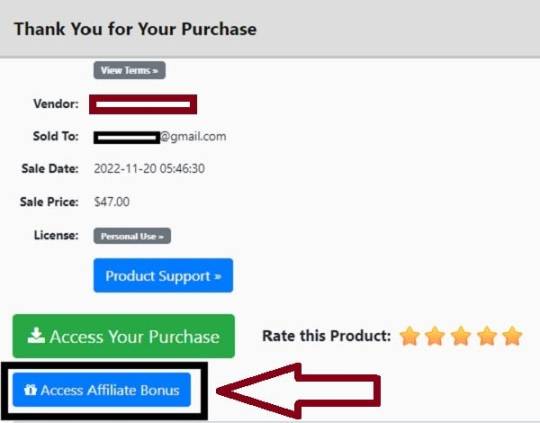

BioBucks Review: OTO And Pricing

Front End Price: BioBucks ($17)

OTO 1: BioBucks Unlimited ($37)

OTO 2: BioBucks Done-For-You — $197

OTO 3: BioBucks Automation ($67)

OTO 4: BioBucks DFY Vault ($67)

OTO 5: BioBucks Traffic ($147)

OTO 6: BioBucks Reseller ($197)

OTO 7: BioBucks Software Saver ($17)

OTO 8: BioBucks 1k A Day Club ($67)

<< Click Here to Get BioBucks + My $29000 Special Bonus Bundle to Boost Up Your Earnings More Traffic, Leads & Commissions >>

BioBucks Review: My Special Bonus Bundle

BioBucks Review: Money Back Guarantee

Our 90 Days Iron Clad Money Back Guarantee.

BioBucks Review: Conclusion

In Summary, BIOBucks promises automatic affiliate marketing riches using AI to perform the labour and leave you swimming in earnings. Despite the hoopla, doubts remain. Doubts surround the AI engine, overstated promises, and hidden expenses. BioBucks provides automation and specialised insights, but affiliate success requires hard effort, skill, and quality content. Consider it a tool, not a moneymaker. Research, study, and work hard. Though lengthy, affiliate success requires hard effort, not simply promises.

Frequently Asked Questions

Q1. Do I need any experience to get started?

None, all you need is just an internet connection. And you’re good to go

Q2. Is there any monthly cost?

Depends, If you act now, None. But if you wait, you might end up paying $997/mo It’s up to you.

Q3. How long does it take to make money?

Our average member made their first sale the same day they got access to BioBucks

Q4. Do I need to purchase anything else for it to work?

No, BioBucks is the complete thing. You get everything you need to make it work. Nothing is left behind.

Q5. What if I failed?

While that is unlikely, we removed all the risk for you. If you tried BioBucks and failed, we will refund you every cent you paid And send you $300 on top of that just to apologize for wasting your time.

Q6. How can I get started?

Awesome, I like your excitement, All you have to do is click any of the buy buttons on the page and secure your copy of BioBucks at a one-time fee.

<< Click Here to Get BioBucks + My $29000 Special Bonus Bundle to Boost Up Your Earnings More Traffic, Leads & Commissions >>

Thank for reading my BioBucks Review till the end. Hope it will help you to make purchase decision perfectly.

Note: Yes, this is a paid tool, however the one-time fee is $17 for lifetime

#Ai#App#Artificial Intelligence#BioBucks#BioBucks App Review#BioBucks Benefits#BioBucks Bonus#BioBucks Bonuses#BioBucks By Al Cheeseman#BioBucks Demo#BioBucks Discount#BioBucks FE#BioBucks Features#BioBucks Honest Review#BioBucks legal#BioBucks OTO#BioBucks Overview#BioBucks Preview#BioBucks Price#BioBucks Pricing#BioBucks Pros#BioBucks Review#BioBucks Reviews#BioBucks Scam#BioBucks Software#BioBucks Software Review#BioBucks Upgrades#BioBucks Works#Buy BioBucks#Get BioBucks

1 note

·

View note

Text

ASCO 2019 preview: Big Pharmas looking for cancer R&D revival as we hit next-gen crossroads

It’s that time of year again, when the big and the small come together to shout about (or try to quietly hide) their latest cancer data at the American Society of Clinical Oncology (ASCO) annual meeting.

The last few years, if we’re honest, have not created the most exciting sets of oncology data we’ve ever seen. We’re at something of a crossroads: A few years back, we had the late-stage results from checkpoint inhibitors showing us their promise, and then we had the rise of cell therapies in the form of Gilead Sciences' (nee Kite Pharma) and Novartis’ chimeric antigen receptor T-cell (CAR-T)therapies.

These drugs are now approved, and what we will see next as a "new way" will be CRISPR, but that’s only just getting clinic time, and we’re some way off from getting any major data sets. Now, we’re caught in a realm of combos, notably with checkpoint inhibitors such as Merck’s Keytruda (now with more than 1,000 trials) and a focus on next-generation T cell therapies, including those that are off-the-shelf or able to combat solid tumors—something many have struggled to do, with nearly all successes coming from blood cancers.

As they say in the publishing world, you’re only as good as your last book, and us in the media especially can be guilty of wanting "the next big thing" and not seeing the promise of newer versions of marketed drugs or effective combinations.

Atara Biotherapeutics

There is genuine excitement (though the caveat remains heavy and constant throughout about how early these data are, and how small the patient populations remain) about one of these next-gen treatments, namely California biotech Atara Biotherapeutics' work on mesothelin-targeted CAR-T.

This therapy, being researched with the Memorial Sloan Kettering Cancer Center, has shown glimpses of promise in a hard-to-treat form of lung cancer and will be posting updated data at ASCO this coming week.

Celgene/BMS

Celgene, in the middle of being subsumed by Bristol-Myers Squibb, also has new data out from a next-gen CAR-T. JCAR-017 (bought from its $9 billion deal with biotech Juno last year), is being tested specifically in chronic lymphocytic leukemia, where the phase 2 data follow last year's American Society of Hematology update on hitting 65% to 83% complete response rates and improved safety in heavily treated patients.

This continues to be a phoenix from the flames story for Juno/Celgene and a big pipeline catalyst for the BMS deal, after Celgene had to stop work on a different version of a CAR-T therapy, known as JCAR-015, when it caused major safety concerns and a string of deaths, leading it to be axed, and focus on 017.

Then there is the story of Big Pharma: Sanofi and AstraZeneca to be exact, which are both posting new updates to their experimental cancer drugs and combos in the hopes they are not overshadowed by the smaller biotechs.

Sanofi and AstraZeneca both have long histories in cancer, but have both in recent months shaken up their R&D teams and are looking to the future of oncology research with renewed vigor.

Sanofi

Sanofi just this very week poached Atara’s R&D chief Dietmar Berger as its new head of development. The appointment also reunites Berger with John Reed, now Sanofi’s global head of R&D. Reed spent six years running the pRED unit at Roche, during which time Berger held senior positions in the oncology and hematology global clinical development teams at Genentech.

Berger arrives at a time when Reed, who joined Sanofi in July 2018, is starting to reshape the R&D group in line with his plans for the company. In February, Sanofi punted 38 projects and is still considering further, albeit smaller, revisions to its focus.

“We're continuing to review the portfolio and, in fact, are in the process now of refreshing our disease area strategies and looking at one of the places where we will prioritize and focus. So, while I don't expect major changes of the type you saw last year, I think we'll continue to see an effort to focus the R&D organization that will involve some prioritization,” Reed told investors last month.

If all goes to plan, a growing portion of the assets prioritized and advanced by Reed and Berger will originate at Sanofi. Having long relied on partners such as Regeneron for innovation, Sanofi now aims to derive about two-thirds of its pipeline from internal research.

One of these assets is anti-CD38 antibody isatuximab, which is being tested in combination with pomalidomide and dexamethasone. The latest data showed this cocktail led to about a 40% improvement in progression-free survival, 11.6 months vs. 6.5 months for pomalidomide and dexamethasone alone (p=0.001), in certain forms of multiple myeloma.

The drug is hoping to be a rival to the $500 million-IPO-seeking Genmab and its multiple myeloma therapy Darzalex. Whatever the financial impact of isatuximab, the drug will have symbolic importance to Sanofi if it comes to market.

Through a period in which partnerships have been critical to Sanofi, isatuximab was one of the in-house assets management pointed to as evidence that internal R&D was firing again. Sanofi’s researchers developed isatuximab with ImmunoGen but were heavily involved as far back as preclinical. With Sanofi looking internally for innovation, it needs isatuximab to be an R&D lodestar.

AstraZeneca

The British-based Big Pharma has also been rejigging its R&D structure after a continued exodus of research executives left over the past two years; it created a new unit focused on cancer to be led by scientist José Baselga, M.D., Ph.D.

AstraZeneca has been leaning heavily on the approval of checkpoint inhibitor Imfinzi as evidence of its cancer success. But coming after a host of similar drugs were approved before it, and with its continual struggles to gain success in combo tests for the drug, it’s no surprise that it’s tacitly looking elsewhere for future innovation.

In the build-up to ASCO, Baselga spoke with The Wall Street Journal, saying under his leadership AZ would seek out assets and trials that focused on hitting cancer at an earlier stage. It also recently opened a near $7 billion biobucks deal with Japanese pharma Daiichi Sankyo for its next-gen breast cancer therapy.

At ASCO, the focus will be on AKT inhibitor capivasertib, a fairly under-the-radar drug, which analysts at Jefferies describe in its pre-ASCO note to clients as previously showing “encouraging efficacy." AZ says data will be presented from the phase 2 FAKTION trial, sponsored by Velindre NHS Trust, combining capivasertib plus its older drug Faslodex in relapsed metastatic oestrogen receptor-positive breast cancer.

0 notes