#Billionaires Income Tax Act

Explore tagged Tumblr posts

Text

No free rides for old money! - Pass The Billionaires Income Tax Act! (S. 3367)

I am writing to express my strong support for the proposed S. 3367 bill, which aims to amend the Internal Revenue Code of 1986. This legislation represents a crucial step towards achieving economic justice by seeking to eliminate tax loopholes that have allowed billionaires to defer taxes indefinitely. By doing so, we would be ensuring a fairer distribution of wealth and rectifying a system that has long favored the ultra-wealthy. Additionally, the bill modifies over 30 tax provisions, requiring billionaires to contribute annually. It's time to ensure that those with the most significant influence and wealth contribute proportionately to our society's well-being. Therefore, I urge you to support and pass the Billionaires Income Tax Act.

Billionaires have amassed vast wealth, often at the expense of their employees who struggle to make ends meet on minimum wages. It is only just and equitable that they pay their employees a living wage AND contribute proportionally to the betterment of our society.

Furthermore, if billionaires wield significant influence over our government and policy-making, they should demonstrate their commitment by financially supporting the very system that has allowed them to prosper. No longer should they enjoy free rides on the backs of hardworking taxpayers. It is past time to ensure that billionaires are contributing their fair share to the well-being of our country.

Passing the Billionaires Income Tax Act is not only a matter of fiscal responsibility but also a moral imperative. It is time to ensure that our tax system is fair and equitable for all, not just the wealthy few.

Thank you for considering my views on this important issue. I urge you to stand on the side of fairness and justice by supporting S.3367.

No free rides for old money!

📱 Text SIGN POZZVN to 50409

🤯 Liked it? Text FOLLOW IVYPETITIONS to 50409

#eat the rich#Wealth Redistribution#ivy petitions#open letter#S. 3367#Billionaires Income Tax Act#Tax Reform#economic justice#us politics#taxes#tax the rich#billionaires should not exist#Tax Fairness#Wealth Distribution#oligarchy#Tax Loopholes#Tax Provisions#Billionaires Tax#Living Wage#Tax Responsibility#Policy Change#Government Influence#Social Justice#Fair Taxation#Income Inequality#Progressive Taxation#Wealth Gap#Tax Policy#Tax Reform Now#Billionaire Responsibility

11 notes

·

View notes

Text

Who'd'a thunk people don't like being knocked down and robbed by the gluttonous traitorous psychos at the top of the corporate and industrial food chain...

CNBC is burying the lede in this headline though: McDonalds isn't raising the red flag for the long-term health and sustainability of humanity but for the short-term impact said looming crisis could have on their short-term profits, ergo their share price on Wall St. (and thence vis a vis their respective executive compensation packages).... picture scavengers strategizing how to hoard the biggest chunk of a rapidly diminishing pool of carrion and that's basically what this is about.

#mind blown#greed is a disease#it's a zero sum game#bring back the 95% top marginal income tax#the sherman anti-trust act is still on the books#poverty kills#CEOs & shareholders are the Hitlers of the 21st century#billionaires don't exist without a population to fleece

0 notes

Video

youtube

Trump’s Tax Scam: Why Nothing Trickled Down

The Trump tax cuts were a YUGE scam.

But this November we have a chance to end this trickle-down hoax once and for all.

Donald Trump’s biggest legislative achievement (if you want to even call it that) was the 2017 Tax Cuts and Jobs Act.

The law permanently slashed corporate taxes and temporarily cut income tax rates mostly for rich individuals through the year 2025. The results were worse than I could have imagined.

Trump and his officials claimed the tax cuts would lead to corporations hiring more workers and would “very conservatively” lead to a $4,000 boost in household incomes.

What actually happened in the years since?

In AT&T’s case, the company saw its overall federal tax bill drop by 81%. It spent 31 times more on dividends and stock buybacks to enrich wealthy shareholders than it paid it in taxes. Meanwhile, it slashed over 40,000 jobs.

That was par for the course with Trump’s tax cuts.

Like AT&T, America’s biggest corporations didn’t use their tax savings to increase productivity or reward workers. Instead, they increased their stock buybacks and dividends.

Many of them, including AT&T, even ended up paying their executives more in some years than what they paid Uncle Sam.

Those executives (along with other high earners) then got to keep more of their earnings because Trump’s tax cuts for individuals were heavily skewed toward the rich. The lowest earners? They got squat.

And many middle-income families saw their taxes go up.

And those supposed $4,000 raises, did you get one?

The bottom line is that Trump’s tax law fueled a massive transfer of wealth into the hands of the rich and powerful. Corporate profits have skyrocketed. U.S. billionaire wealth has more than DOUBLED since 2018.

The tax cuts have also added $2 trillion to the national debt so far, but that hasn’t stopped Trump and the so-called “party of fiscal responsibility” from doubling down on renewing them.

If Trump is reelected and Republicans take control of Congress, they’re planning to renew the expiring tax cuts for individuals that primarily benefited the rich. This would cost $4.6 trillion over the next decade, more than double the cost of the original tax cuts.

Trump has also threatened to lower the corporate tax rate even further from 21% to 15% — which would cost another $1 trillion.

It’s trickle-down economics on steroids.

All of this would cause the federal deficit and debt to soar — which Republicans will then use as an excuse to cut spending on government programs the rest of us rely on.

But the Democrats have their own tax plan. We can make it a reality this November. What would it do? Just the opposite of Trump’s tax plan.

ONE: It would increase taxes on wealthy individuals with incomes in excess of $400,000 a year, while cutting taxes for lower-income Americans.

TWO: It would make billionaires pay at least 25 percent of their incomes in taxes, still leaving them with plenty left over.

THREE: It would raise the corporate income tax to 28 percent, which is about what it was in 1990.

LASTLY, it would quadruple the tax on stock buybacks to get corporations to invest more of their earnings in workers’ wages and productivity instead of windfalls for investors.

So the real choice is between the Republicans’ plan to make the rich much richer, and the Democrats’ plan to make the rich pay their fair share and provide what Americans need.

Which do you want?

345 notes

·

View notes

Text

Corporate Bullshit

I'm coming to BURNING MAN! On TUESDAY (Aug 27) at 1PM, I'm giving a talk called "DISENSHITTIFY OR DIE!" at PALENQUE NORTE (7&E). On WEDNESDAY (Aug 28) at NOON, I'm doing a "Talking Caterpillar" Q&A at LIMINAL LABS (830&C).

Corporate Bullshit: Exposing the Lies and Half-Truths That Protect Profit, Power, and Wealth in America is Nick Hanauer, Joan Walsh and Donald Cohen's 2023 book on the history of corporate apologetics; it's great:

https://thenewpress.com/books/corporate-bullsht

I found out about this book last fall when David Dayen reviewed it for the The American Prospect; Dayen did a great job of breaking down its thesis, and I picked it up for my newsletter, which prompted Hanauer to send me a copy, which I finally got around to reading yesterday (I have gigantic backlog of reading):

https://pluralistic.net/2023/10/27/six-sells/#youre-holding-it-wrong

The authors' thesis is that the business world has a well-worn playbook that they roll out whenever anything that might cause industry to behave even slightly less destructively is proposed. What's more, we keep falling for it. Every time we try to have nice things, our bosses – and their well-paid Renfields – dust off their talking points from the last go-round, do a little madlibs-style search and replace, and bust it out again.

It's a four-stage plan:

I. First, insist that there is no problem.

Enslaved people are actually happy. Smoking doesn't cause cancer. Higher CO2 levels are imaginary and they're caused by sunspots and they're good for crop yields. The hole in the ozone layer is only a problem if you foolishly decide to hang around outside (this is real!).

II. OK, there's a problem, but it's your fault.

An epidemic of on-the-job maimings is actually an epidemic of sloppy workers. A gigantic housing crash is really a gigantic cohort of greedy, feckless borrowers. Rampant price gouging is actually a problem of too much "spending power" (that is, "money") in the hands of working people.

III. Any attempt to fix this will make it worse.

Equal wages for equal work will cause bosses to fire women and people of color. Protecting people with disabilities will cause bosses to fire disable people. Minimum wages will cause bosses to buy machines and fire "unskilled" workers. Gun control will only increase underground gun sales. Banning carcinogenic pesticides will end agriculture as we know and we'll all starve to death.

IV. This is socialism.

Income tax is socialism. Estate tax is socialism. Medicare and Medicaid are socialism. Food stamps are socialism. Child labor laws are socialism. Public education is socialism. The National Labor Relations Act is socialism. Unions are socialism. Social security is socialism. The Fair Labor Standards Act is socialism. Obamacare is socialism. The Civil Rights Act is socialism. The Occupational Health and Safety Act is socialism. The Family Medical Leave Act is socialism. FDR is a socialist. JFK is a socialist. Lyndon Johnson is a socialist. Carter is a socialist. Clinton is a socialist. Obama is a socialist. Biden is a socialist (Biden: "I beat the socialist. That's how I got the nomination").

Though this playbook has been in existence since the nation's founding, the authors point out that from the New Deal until the Reagan era, it didn't get much traction. But starting in the Reagan years, the well-funded network of billionaire-backed think-tanks, endowed economics chairs, and latter-day propaganda vehicles like Prageru breathed new life into these tactics.

We can see this playing out right now as the corporate world scrambles for a response to the Harris campaign's proposal to address price-gouging. Reading Matt Stoller's dissection of this response, we can see the whole playbook on display:

https://www.thebignewsletter.com/p/monopoly-round-up-price-gouging-vs

First, corporate apologists insisted that greedflation didn't exist, despite the fact that CEOs kept getting on earnings calls and boasting to their investors about how they were using the excuse of inflation to jack up prices:

https://pluralistic.net/2023/03/11/price-over-volume/#pepsi-pricing-power

Or the oil CEOs who boasted that the Russian invasion of Ukraine gave them cover to just screw us at the pump:

https://pluralistic.net/2022/03/15/sanctions-financing/#soak-the-rich

There are all these out-in-the-open commercial entities whose sole purpose is to "advise" large corporations about their prices, which is just a barely disguised euphemism for price-fixing, from meat-packing:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

To rents:

https://pluralistic.net/2024/07/24/gouging-the-all-seeing-eye/#i-spy

That's stage one: "there's no problem." Stage two is "it's your fault." That's Larry Summers and co insisting that a couple of stimulus checks a couple years ago are responsible for inflation, because it gave you too much "buying power," and so the only possible fix is to jack up interest rates and trigger mass layoffs and sharp wage decreases across the economy:

https://pluralistic.net/2022/12/14/medieval-bloodletters/#its-the-stupid-economy

Stage three is "any attempt to fix this will make it worse." When Isabella Weber pointed out that there was a long history of price-controls being used to fight price-gouging, corporate apologists lost their minds and brigaded her, calling her all kinds of nasty names and insisting that her prescription didn't even warrant serious discussion, because any attempt to control prices would destroy the economy:

https://www.theglobeandmail.com/podcasts/lately/article-the-millennial-economist-who-took-on-the-world/

You may recognize this as cousin to the response to rent control proposals, which inevitably trigger a barrage of economists screaming that this will not work and will actually reduce the housing supply and drive up prices, which is true, provided that you ignore all evidence and history:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

And stage four is "this is socialism." Look, I am a literal card-carrying member of the Democratic Socialists of America and I can assure you, Kamala Harris is not a socialist (and more's the pity). But that didn't stop the most eminently guillotineable members of the investor class from hair-on-fire, ALL-CAPS denunciations of the Harris proposal as SOCIALISM and Harris herself as a COMMUNIST:

https://twitter.com/Jason/status/1824580470052725055

The author's thesis is that by naming the playbook and giving examples of it – for example, showing how the "proof" that minimum wage increases will destroy jobs was also offered as "proof" not to abolish slavery, ban child labor, add fireproofing to textile factories, and pay women and Black people the same as white guys – we can vaccinate ourselves against it.

Certainly, we've reached a moment where the public is increasingly skeptical of claims that we can't fix anything because the economists say that this is the best of all possible worlds, and if that means that we're all going to boil to death in our own skin, so be it:

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

In other words, after 40 years of subordinating politics to economics, there's a resurgence of belief in politics – that is, doing stuff – rather than hunkering down and waiting for the technocrats to fix everything:

https://www.programmablemutter.com/p/seeing-like-a-matt

Corporate Bullshit is a brisk and bracing read – I got through it in about an hour in my hammock yesterday – and, in laying out the bullshit playbook's long history of nonsensical predictions and pronouncements, it does make a very good case that we should stop listening to people who quote from it.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/19/apologetics-spotters-guide/#narratives

#pluralistic#narratives#lakoff#joan walsh#david cohen#nick hanauer#apologetics#bullshit#history#books#reviews#gift guide

245 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 16, 2025

Heather Cox Richardson

Jan 17, 2025

In his final address to the nation last night, President Joe Biden issued a warning that “an oligarchy is taking shape in America of extreme wealth, power, and influence that literally threatens our entire democracy, our basic rights and freedoms, and a fair shot for everyone to get ahead.”

It is not exactly news that there is dramatic economic inequality in the United States. Economists call the period from 1933 to 1981 the “Great Compression,” for it marked a time when business regulation, progressive taxation, strong unions, and a basic social safety net compressed both wealth and income levels in the United States. Every income group in the U.S. improved its economic standing.

That period ended in 1981, when the U.S. entered a period economists have dubbed the “Great Divergence.” Between 1981 and 2021, deregulation, tax cuts for the wealthy and corporations, the offshoring of manufacturing, and the weakening of unions moved $50 trillion from the bottom 90% of Americans to the top 1%.

Biden tried to address this growing inequality by bringing back manufacturing, fostering competition, increasing oversight of business, and shoring up the safety net by getting Congress to pass a law—the Inflation Reduction Act—that enabled Medicare to negotiate drug prices for seniors with the pharmaceutical industry, capping insulin at $35 for seniors, for example. His policies worked, primarily by creating full employment which enabled those at the bottom of the economy to move to higher-paying jobs. During Biden’s term, the gap between the 90th income percentile and the 10th income percentile fell by 25%.

But Donald Trump convinced voters hurt by the inflation that stalked the country after the coronavirus pandemic shutdown that he would bring prices down and protect ordinary Americans from the Democratic “elite” that he said didn’t care about them. Then, as soon as he was elected, he turned for advice and support to one of the richest men in the world, Elon Musk, who had invested more than $250 million in Trump’s campaign.

Musk’s investment has paid off: Faiz Siddiqui and Trisha Thadani of the Washington Post reported that he made more than $170 billion in the weeks between the election and December 15.

Musk promptly became the face of the incoming administration, appearing everywhere with Trump, who put him and pharmaceutical entrepreneur Vivek Ramaswamy in charge of the so-called Department of Government Efficiency, where Musk vowed to cut $2 trillion out of the U.S. budget even if it inflicted “hardship” on the American people.

News broke earlier this week that Musk, who holds government contracts worth billions of dollars, is expected to have an office in the Eisenhower Executive Office Building adjacent to the White House. And the world’s two other richest men will be with Musk on the dais at Trump’s inauguration. Musk, Amazon founder Jeff Bezos, and Meta chief executive officer Mark Zuckerberg, who together are worth almost a trillion dollars, will be joined by other tech moguls, including the CEO of OpenAI, Sam Altman; the CEO of the social media platform TikTok, Shou Zi Chew; and the CEO of Google, Sundar Pichai.

At his confirmation hearing before the Senate Committee on Finance today, Trump’s nominee for Treasury Secretary, billionaire Scott Bessent, said that extending the 2017 Trump tax cuts was "the single most important economic issue of the day." But he said he did not support raising the federal minimum wage, which has been $7.25 since 2009 although 30 states and dozens of cities have raised the minimum wage in their jurisdictions.

There have been signs lately that the American people are unhappy about the increasing inequality in the U.S. On December 4, 2024, a young man shot the chief executive officer of the health insurance company UnitedHealthcare, which has been sued for turning its claims department over to an artificial intelligence program with an error rate of 90% and which a Federal Trade Commission report earlier this week found overcharged cancer patients by more than 1,000% for life-saving drugs. Americans championed the alleged killer.

It is a truism in American history that those interested in garnering wealth and power use culture wars to obscure class struggles. But in key moments, Americans recognized that the rise of a small group of people—usually men—who were commandeering the United States government was a perversion of democracy.

In the 1850s, the expansion of the past two decades into the new lands of the Southeast had permitted the rise of a group of spectacularly wealthy men. Abraham Lincoln helped to organize westerners against a government takeover by elite southern enslavers who argued that society advanced most efficiently when the capital produced by workers flowed to the top of society, where a few men would use it to develop the country for everyone. Lincoln warned that “crowned-kings, money-kings, and land-kings” would crush independent men, and he created a government that worked for ordinary men, a government “of the people, by the people, for the people.”

A generation later, when industrialization disrupted the country as westward expansion had before, the so-called robber barons bent the government to their own purposes. Men like steel baron Andrew Carnegie explained that “[t]he best interests of the race are promoted” by an industrial system, “which inevitably gives wealth to the few.” But President Grover Cleveland warned: “The gulf between employers and the employed is constantly widening, and classes are rapidly forming, one comprising the very rich and powerful, while in another are found the toiling poor…. Corporations, which should be the carefully restrained creatures of the law and the servants of the people, are fast becoming the people's masters.”

Republican president Theodore Roosevelt tried to soften the hard edges of industrialization by urging robber barons to moderate their behavior. When they ignored him, he turned finally to calling out the “malefactors of great wealth,” noting that “there is no individual and no corporation so powerful that he or it stands above the possibility of punishment under the law. Our aim is to try to do something effective; our purpose is to stamp out the evil; we shall seek to find the most effective device for this purpose; and we shall then use it, whether the device can be found in existing law or must be supplied by legislation. Moreover, when we thus take action against the wealth which works iniquity, we are acting in the interest of every man of property who acts decently and fairly by his fellows.”

Theodore Roosevelt helped to launch the Progressive Era.

But that moment passed, and in the 1930s, Franklin Delano Roosevelt, too, contended with wealthy men determined to retain control over the federal government. Running for reelection in 1936, he told a crowd at Madison Square Garden: “For nearly four years you have had an Administration which instead of twirling its thumbs has rolled up its sleeves…. We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering. They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.”

“Never before in all our history have these forces been so united against one candidate as they stand today,” he said. “They are unanimous in their hate for me—and I welcome their hatred.”

Last night, after President Biden’s warning, Google searches for the meaning of the word “oligarchy” spiked.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#President Joe Biden#warning#political#oligarchy#Letters From An American#Heather Cox Richardson#income inequality#history#American History#FDR#Theodore Roosevelt#Robber Barrons

74 notes

·

View notes

Text

ASOIAF modern AU class/wealth distinctions bc in the wise words of Mod Sam from the Inn at The Crossroads Discord: “i love modern aus where theyre like oh yeah the lannisters are filthy rich and here's the starks, piling into a minivan to go to public school. they would not fucking do that”

Lannisters: Private jets and COO/CEO/CFO positions at the family company and plain white tshirts that cost $5000. 1% of the 1%. They’re the Roys we already know this no need to elaborate.

Starks: they’re a rugged type of Minnesota/North Dakota/Wyoming wealth. Land rich. Own ranches and mining operations and oil drilling companies. Ppl think they’re normal bc they look like average farmers until they get a tour of their 300,000 acres and private mountain. Seem down to earth but grew up breeding ranch horses, don’t really understand what a car note is, and Nedcat paid for all the starklings college apartments. Also wear normal looking vests and ranching jeans and boots that cost absurd amounts

Tyrells: masters at the “quiet wealth” bullshit. Wayyyy older money compared to the Lannisters, and aren’t aggressive/scrappy like them bc of it. Literal aristocracy like lords or barons or some shit. Multiple residences, family tradition of politics, and loads of passive income. Maybe run a newspaper or two and own some global shipping companies bc of their merchant roots or whatever. Margaery was at one of those international debutante balls for the ubër-wealthy.

Tullys: Not as rich as the Tyrells or Lannisters but still nothing to scoff at. Not upper middle class but more like lower rungs of the upper class. Family tradition of sending all the kids to boarding school (that’s where Lysa got pregnant 🙂↕️) and they have some nice yachts and the like. Have one really nice permanent house on the river, a summer house upstate, and an apartment in the city. Normal enough to blend in with most people at their school. Also made their money thru shipping lanes.

Martells: Southern oil barons. Nymeria emigrated over and immediately discovered oil on her apparently shitty piece of land. Thousands of acres dedicated to drilling and cattle ranching. Awful for the environment but greenwash the fuck out of their business. Good at being a man of the ppl despite literally being in the one percent. Very publicly donate to progressive charities and causes to offset the backlash they get from pay the people who work for them slave wages. People stan them on Twitter because they’re hot and not like other billionaires.

Baratheons: slightly newer money but old enough to have no excuse to act the way they do. Loud annoying displays of wealth. Made their fortune mostly because they were good at being overly aggressive when it came to the stock market or sales or smthn idk what they do. Robert buys an egregious house in Florida where him and some other rich repulsive republicans do Labor Day weekend on their yachts with women they paid to be there. Absolutely terrible at saving their money (except Stannis and kinda Renly) and quite literally have to have their accounts frozen by their investment bankers. Actively going bankrupt.

Greyjoys: Not even rich anymore. Had a sizable shipping company at one point before they got poached bought out by the Lannisters. Also they engaged in too much tax fraud and embezzlement so now no one wants to touch them with a ten foot pole. Still live in their dilapidated cliffside house that’s literally ab to crumble into the sea. Theon got to live with the Starks bc once the Greyjoys got audited Ned felt bad.

Targaryens: REAL old money that stretches back like at least 500 years. Have had multiple income sources over the years and almost all of it is blood money of some kind and extracted through violence :) Giant ass portraits of their ancestors in their multiple residences, they all speak Valyrian at home, and they don’t even go to school it’s just private tutors. Obscene wealth that isn’t even fathomable to most people. Famously bred race horses and hunting dogs for a while until there was some familial infighting about ownership of the racetracks and stables and that collapsed. Got audited and investigated twenty years ago and Aerys just killed himself instead of going to jail.

#not a single one of these ppl would send their kids to public school#not even Theon would go#just bc he’s a fallen angel doesn’t mean he’s not an angel 😔#asoiaf shitposting

140 notes

·

View notes

Text

Jonathan Cohn at HuffPost:

Early in Donald Trump’s first term, Steve Bannon met with some House Republicans who were wavering on whether to vote for a Trump-backed bill that would have slashed Medicaid, the federal-state program that today pays medical bills for about 72 million low-income Americans. Bannon, who at the time was a senior White House adviser, read them the riot act: “This is not a debate,” he said, as Axios reported at the time. “You have no choice but to vote for this bill.” Eight years later, Trump and the Republicans are back in power ― and maybe laying the groundwork for a similar vote. The budget proposal House Republicans voted out of committee on Thursday night envisions massive spending reductions virtually certain to include Medicaid, in part to finance the tax cuts Trump has said are his top legislative priority. But this time around, Bannon has some different advice for the Republicans ― and the Trump White House, too. “A lot of MAGA is on Medicaid,” Bannon said on Thursday on his “War Room” podcast. “If you don’t think so, you are dead wrong. Medicaid is going to be a complicated one. You just can’t take a meat ax to it, although I would love to.”

Bannon probably understands this better than most high-profile figures in American politics. The proposed Medicaid cuts during Trump’s first term were part of legislation to repeal the Affordable Care Act, aka Obamacare. That bill proved spectacularly unpopular ― and ultimately failed to pass ― in part because even many diehard Trump supporters would’ve stood to lose health coverage had it succeeded. Which is exactly what could happen now, as Bannon knows. But these days, it’s not just cuts to Medicaid threatening Trump supporters. Since reassuming the presidency, Trump has issued a torrent of executive orders that seek to limit, downsize or even eliminate key federal programs and agencies. To implement all of this, Trump has deputized adviser and billionaire tech tycoon Elon Musk, whose Department of Government Efficiency has been laying off federal workers by the thousands and blocking federal spending by the billions. Trump says the purpose of these orders and Musk’s demolition tour of the executive branch is to eliminate wasteful spending ― and, no less important, to clean out the left-wing, “woke” politics that he says have infected these federal initiatives. Which may or may not be worthwhile on the merits, depending on your perspective.

[...]

What DOGE Looks Like In Rural America

One Republican who seems to understand is Katie Britt, the senator from Alabama. Last weekend, a reporter from AL.com asked her to react to news that the National Institutes of Health was sharply reducing its research grants. The University of Alabama-Birmingham is a top recipient of NIH grants, and also Alabama’s largest employer. Britt said she was all for cutting waste, to make sure taxpayer dollars are “spent efficiently, judiciously and accountably.” But she added that she wanted to work with the administration on “a smart, targeted approach … in order to not hinder lifesaving, groundbreaking research at high-achieving institutions like those in Alabama.” It sounded a lot like a warning, or at least an objection, especially from a staunch Trump supporter. And it wasn’t the only one out there. Bill Cassidy, the Republican senator from Louisiana who also happens to be a physician, told STAT News: “One thing I’ve heard loud and clear from my people in Louisiana is that Louisiana will suffer from these cuts. And research that benefits people in Louisiana may not be done.” Louisiana, like Alabama, is a strongly pro-Trump state. It also gets about $300 million a year in NIH research funding, according to an analysis of public data by the Louisiana Illuminator. Other solidly red states with big NIH-backed institutions include Texas and Tennessee. The rural sections of these states ― or any state, really ― can be especially dependent on NIH money, because universities, teaching hospitals and affiliated clinics may be the only large employers there, and the sole providers of major medical care, as well. [...] Cuts at USAID might seem less likely to have a perceptible effect stateside, because American jobs don’t generally depend on foreign assistance. But in farm country, they do, because that’s where USAID gets food: Farmers, who voted overwhelmingly for Trump, could lose as much as $2 billion if food aid goes away. “You’re talking about a direct impact on American products and American jobs,” George Ingram, a senior fellow at the Brookings Institution, told the Washington Post. Republican lawmakers from Kansas, Arkansas and other rural states are rallying behind legislation to save the primary food aid program by moving it out of the State Department and over to the Department of Agriculture.

Trump/Musk cuts have harmed every state, including red ones.

14 notes

·

View notes

Text

Early in Donald Trump’s first term, Steve Bannon met with some House Republicans who were wavering on whether to vote for a Trump-backed bill that would have slashed Medicaid, the federal-state program that today pays medical bills for about 72 million low-income Americans.

Bannon, who at the time was a senior White House adviser, read them the riot act: “This is not a debate,” he said, as Axios reported at the time. “You have no choice but to vote for this bill.”

Eight years later, Trump and the Republicans are back in power ― and maybe laying the groundwork for a similar vote. The budget proposal House Republicans voted out of committee on Thursday night envisions massive spending reductions virtually certain to include Medicaid, in part to finance the tax cuts Trump has said are his top legislative priority.

But this time around, Bannon has some different advice for the Republicans ― and the Trump White House, too.

“A lot of MAGA is on Medicaid,” Bannon said on Thursday, during an interview on Fox. “If you don’t think so, you are dead wrong. Medicaid is going to be a complicated one. You just can’t take a meat ax to it, although I would love to.”

Bannon probably understands this better than most high-profile figures in American politics. The proposed Medicaid cuts during Trump’s first term were part of legislation to repeal the Affordable Care Act, aka Obamacare. That bill proved spectacularly unpopular ― and ultimately failed to pass ― in part because even many diehard Trump supporters would’ve stood to lose health coverage had it succeeded. Which is exactly what could happen now, as Bannon knows.

But these days, it’s not just cuts to Medicaid threatening Trump supporters.

Since reassuming the presidency, Trump has issued a torrent of executive orders that seek to limit, downsize or even eliminate key federal programs and agencies. To implement all of this, Trump has deputized adviser and billionaire tech tycoon Elon Musk, whose Department of Government Efficiency has been laying off federal workers by the thousands and blocking federal spending by the billions.

Trump says the purpose of these orders and Musk’s demolition tour of the executive branch is to eliminate wasteful spending ― and, no less important, to clean out the left-wing, “woke” politics that he says have infected these federal initiatives. Which may or may not be worthwhile on the merits, depending on your perspective.

But whatever the rationale, the effect is likely to be especially strong in communities where Trump is popular. Some have already taken a hit. The question now is how quickly that realization sets in, and whether anything changes as a result.

What DOGE Looks Like In Rural America

One Republican who seems to understand is Katie Britt, the senator from Alabama. Last weekend, a reporter from AL.com asked her to react to news that the National Institutes of Health was sharply reducing its research grants. The University of Alabama-Birmingham is a top recipient of NIH grants, and also Alabama’s largest employer.

Britt said she was all for cutting waste, to make sure taxpayer dollars are “spent efficiently, judiciously and accountably.” But she added that she wanted to work with the administration on “a smart, targeted approach … in order to not hinder lifesaving, groundbreaking research at high-achieving institutions like those in Alabama.”

It sounded a lot like a warning, or at least an objection, especially from a staunch Trump supporter. And it wasn’t the only one out there. Bill Cassidy, the Republican senator from Louisiana who also happens to be a physician, told STAT News: “One thing I’ve heard loud and clear from my people in Louisiana is that Louisiana will suffer from these cuts. And research that benefits people in Louisiana may not be done.”

Louisiana, like Alabama, is a strongly pro-Trump state. It also gets about $300 million a year in NIH research funding, according to an analysis of public data by the Louisiana Illuminator. Other solidly red states with big NIH-backed institutions include Texas and Tennessee. The rural sections of these states ― or any state, really ― can be especially dependent on NIH money, because universities, teaching hospitals and affiliated clinics may be the only large employers there, and the sole providers of major medical care, as well.

As of Friday, a judge has temporarily blocked the NIH funding reduction, citing federal law that would seem to prohibit the Trump administration from making those cuts unilaterally. The same goes for orders that have effectively shut down most foreign aid through the U.S. Agency for International Development.

Cuts at USAID might seem less likely to have a perceptible effect stateside, because American jobs don’t generally depend on foreign assistance. But in farm country, they do, because that’s where USAID gets food: Farmers, who voted overwhelmingly for Trump, could lose as much as $2 billion if food aid goes away.

“You’re talking about a direct impact on American products and American jobs,” George Ingram, a senior fellow at the Brookings Institution, told the Washington Post.

Republican lawmakers from Kansas, Arkansas and other rural states are rallying behind legislation to save the primary food aid program by moving it out of the State Department and over to the Department of Agriculture.

And they aren’t the only GOP lawmakers making the case to protect programs on the Trump target list. Nearly two dozen House Republicans have been lobbying their leadership to spare federal subsidies for electric vehicles that Trump has said he is determined to eliminate.

It’s not the potential of backsliding on climate progress that worries these Republicans. It’s the potential of losing jobs in their districts, which are home to new, sprawling EV factories in what’s become known as the “battery belt” stretching across the South. And what’s true for EVs is true for the clean energy push more generally: The money that President Joe Biden and the Democrats invested in projects like solar and wind power has gone disproportionately to Republican districts.

Take the money away, and it’s those districts that could suffer disproportionately.

How Republican Leaders Might React

Just what that suffering would look like in practice is hard to say. Cuts may not turn out to be as devastating as critics fear or say — and, in the case of the executive actions Trump and Musk have been carrying out, it’s always possible the courts will block these cuts, as they have with DOGE’s attempted NIH funding reduction.

But Trump is already well on his way to making some long-term changes — by, among other things, getting his appointees confirmed. That includes Robert F. Kennedy Jr., whose nomination as Secretary of Health and Human Services once seemed to be in doubt because even some Republicans seemed queasy about his repeated, dishonest attacks on vaccines.

Among those voting yes were Sen. Cassidy, a vocal Kennedy critic, which is a reminder that even Republicans raising concerns about elements of the Trump agenda may vote to support them anyway. As for Sen. Britt, 24 hours after expressing concern about those NIH cuts, she was hanging out with Trump at the Super Bowl in New Orleans.

Kennedy’s confirmation wasn’t the only vaccine-related news this week. The other piece was word of a measles outbreak that has already infected two dozen people in Gaines County, Texas, where the vaccination rate is among the lowest in the state — and where more than nine out of ten voters picked Trump in 2024.

That’s not surprising. Republican-leaning voters are less likely to trust or get vaccines, studies and polls have shown. And Trump has made plenty of vaccine-skeptical statements of his own.

Installing Kennedy at HHS at the very least reinforces that message. At worst, it turns U.S. vaccination policy over to somebody who has spent a career making false and misleading statements on vaccine safety. In either case, Trump’s own supporters could feel the effects most directly — though perhaps only when it’s too late to stop them.

17 notes

·

View notes

Text

SOMETHING YOU CAN DO

look up the legislation trump is trying to pass. and contact capitol switchboard email (look up the email you need to use in your state) or call 202-244-2131 and tell them what you are opposing. For my socially anxious girlies that are only willing to email (like me) feel free to reference/copy this and send it via email to the capitol switchboard of your state.

Dear [Representative’s Name],

I am writing to express my deep concern and strong opposition to several policies being proposed and implemented under former President Trump’s leadership. These policies threaten the well-being of working-class Americans, marginalized communities, and the economic stability of our country.

1. Tax Policies Favoring the Wealthy

I strongly oppose the continuation and expansion of tax cuts for large corporations and the ultra-wealthy. The Tax Cuts and Jobs Act of 2017 and the proposed capital gains tax cuts disproportionately benefit the rich while leaving middle-class and low-income Americans struggling with rising costs of living. Additionally, potential cuts to Social Security, Medicare, and Medicaid would put millions at risk while billionaires continue to receive unfair advantages.

2. Anti-LGBTQ+ Discrimination

I am deeply concerned about the push for laws and executive actions that target LGBTQ+ individuals, stripping them of their rights and legal protections. Policies that allow for discrimination in healthcare, education, and employment not only harm LGBTQ+ Americans but also set a dangerous precedent for civil rights in this country. Every person deserves equal protection under the law, regardless of gender identity or sexual orientation.

3. Harmful Tariffs That Hurt American Workers

The recent tariffs imposed on Canada, Mexico, and China are reckless and will directly harm working-class Americans by driving up prices on essential goods, damaging small businesses, and triggering retaliatory tariffs that threaten American jobs. Instead of protecting American workers, these tariffs will make it harder for families to afford necessities while benefitting only a select few industries.

4. Inhumane Immigration Policies & Deportation of Hardworking Immigrants

The proposal to detain up to 30,000 undocumented immigrants at Guantánamo Bay and mass deport individuals who contribute to our economy and communities is both cruel and economically damaging. Many of these individuals are hardworking people who pay taxes, start businesses, and contribute to vital industries such as agriculture, healthcare, and construction. Targeting them does not make our country safer—it only tears families apart and weakens our workforce.

My Demand for Action

I urge you to stand against these harmful policies and fight for legislation that: ✅ Ensures the wealthy pay their fair share in taxes while protecting the middle class. ✅ Defends the rights and dignity of LGBTQ+ Americans. ✅ Repeals harmful tariffs that will hurt American workers and businesses. ✅ Advocates for humane immigration policies that protect hardworking individuals and their families.

These policies do not reflect the values of fairness, justice, and economic opportunity that this country should uphold. I implore you to take a stand for the rights of all Americans, not just the wealthiest and most powerful. I will be closely watching your actions on these issues, and I urge you to fight for policies that benefit everyday people rather than harm them.

Thank you for your time, and I look forward to your response.

Sincerely, [Your Name] [Your Address (optional)] [Your Contact Information (optional)] i realize this is probably really strange coming from a vtuber account that never posts lmao

11 notes

·

View notes

Text

I have a tax structure concept in my mind and I'm not sure if it would even function as a policy but. I am rotating it.

So one of the reasons a lot of wealthy people get away with paying minimal taxes is because a lot of their money is tied up in investments, so their net worth can be 2 billion but they're only paying taxes on the $400k they make in a year because they aren't actively selling the investments, right?

I think that a possible partial solution to this is that the tax rate is based on the net worth. You don't tax the investments themselves, necessarily, but if your net worth is… IDK over 10mil, your effective tax rate on your income is 90%, even if the annual income itself is something like 200k.

It still not a great solution to billionaires existing, but it does introduce some kind of penalty for amassing wealth.

It also, admittedly, has minimal effect on people who act as though they've made all of 10k because they supposedly lost more money than they earned. [Side-eyes Warren Buffet]

It's like… idk. It's a policy concept that I haven't thought through but has probably been trialed somewhere in the world.

It would probably result in them moving assets offshore to try and hide them from the government, or putting them into a 'philanthropic foundation' or something.

Thoughts? I haven't looked into whether it's been implemented with any success in other parts of the world.

23 notes

·

View notes

Text

By now, we are all aware of the plans of the mad scientists and billionaires to cover (CO2 absorbing) pasture and crop land with onshore wind turbines and solar plants. We are also aware of the intent to remove livestock – cattle, sheep, pigs and chickens – so that we ear bugs and ay land not polluted with solar panels and wind turbines is returned to nature for “rewilding”. We have seen how, in the UK, the Royal Society for the Protection of Birds is a huge sponsor of wind turbines that kill birds.

Here is an article that highlights the continuing war on farmers in the UK – via the inheritance tax that taxes unrealised capital gains – forcing the farms to be sold if there is insufficient cash to pay the inheritance tax calculated by bureaucrats.

Pay particular attention to the verbiage here:

“Inheritors will have to pay 20% of the value of the agricultural and business property above £1million. Having tax exemptions currently costs "about £1bn a year for taxpayers", according to Chief Secretary to the Treasury, Darren Jones.”

“Taxation exemption costs…”!!! Hey Mr Jones, it’s not your effing money! What you are doing is not “closing an exemption”, it is imposing a tax that did not previously exist! The argument here s that “society” is being cheated by people who have accumulated wealth in the value of farms – regardless of the ups and downs of the land owned by the farm or whether the value is in livestock or solar panels/wind turbines!

All taxation is theft. No money paid to the State is the State’s by right – it is a privilege granted by voters.

In my view, VAT is a tax imposed on the country in order for it to join the EU. The UK is no longer in the EU, ergo, VAT should be abolished. It acts as a trade tariff for imports and has increased the cost of living by its percentage rate.

Mind you, it is also my view that government spending, especially on health, needs to be reduced by at least half and that taxation should be simplified to abolish ALL customs and excise duties, tobacco or alcohol taxes, or road taxes, TV license fees and there should be a flat corporate and income tax rate of 15% with NO ALLOWANCES. Vote for me!

9 notes

·

View notes

Text

I care about the issues, the policies, & the administration — I don’t care about age or a single 90-minute debate performance — I care about the performance as President.

Democrats are acting like our nominee just became a convicted felon & that we should abandon him… oh wait… Republicans rallied to Trump after he became a felon because they (for better or worse) like that Trump will continue gun policies that kill school children, ban abortion nationwide, ruin the climate & our planet, steal seats on the Supreme Court, give billionaires tax-breaks, & deny healthcare to millions of low-income children.

Trump refused to admit he lost the Presidency in 2020 & sent a mob to the White House to overturn the election results. I’ll pick “old” over *THAT* any day of the week.

12 notes

·

View notes

Text

As corporate outlets like ABC News and The Washington Post bend to incoming President Trump’s threats to send his FBI against them, censoring themselves and settling dubious lawsuits out-of-court, and as social media from X to Facebook blast hate and disinformation, public broadcasting remains a crucial lifeline. But this lifeline is under dire threat.

“Legacy media must die,” Elon Musk declared on X, putting public broadcasting over TV and radio (PBS and NPR) directly in his sights. No doubt, Musk sees his own tilted platform, X, as the natural heir apparent to the “legacy media” he wants to kill.

Now, his megaphone amplified as co-chair of Trump’s so-called Department of Government Efficiency (DOGE), Musk has proposed eliminating all $535 million in funding for public broadcasting. The move already has the backing of MAGA-friendly Speaker Mike Johnson.

To put this into perspective, the entire public broadcasting budget is just a fraction of what Musk spent to buy Twitter in 2022 -- $44 billion, more than 80 times the annual allocation for NPR and PBS combined.

But what is the real value of public broadcasting? Perhaps no one has put it so well as the beloved Fred Rogers, whotestified before Congress back when the Nixon administration was trying to cut PBS funding in 1969:

“We don’t have to bop somebody over the head to make drama on the screen. We deal with such things as getting a haircut… I feel that if we in public television can only make it clear that feelings are mentionable and manageable, we will have done a great service for mental health.”

Compared to the bloviations on X and Breitbart, Mr. Rogers is a breath of fresh air!

Take action today! Tell Congress: Public broadcasting is essential to the mental health of our national discourse, and must be maintained in service to our nation, rural and urban, rich and poor, young and old.

Not only does public broadcasting provide beloved programs like Sesame Street and All Things Considered, it also supports over 1,000 public radio stations, delivering local news, educational programming, and vital emergency alerts. NPR is within listening distance of 98% of Americans, including rural and underserved communities.

Back in the same 1969 hearing, Mr. Rogers showed the senators how he used simple songs and stories to promote children’s emotional resilience and self-regulation. He cited these words from his song about how to prevent oneself from having a tantrum:

“What do you do with the mad that you feel? When you feel so mad you could bite? When the whole wide world seems oh so wrong, and nothing you do seems very right? It’s great to be able to stop when you’ve planned the thing that’s wrong. And be able to do something else instead -- and think this song: I can stop when I want to. Can stop when I wish. Can stop, stop, stop anytime And what a good feeling to feel like this! And know that the feeling is really mine."

Meanwhile, Musk and DOGE co-chair Vivek Ramaswamy’s proposal to slash $2 trillion from government spending is wildly unrealistic. Their target represents nearly one-third of the $6.1 trillion federal budget -- and only 16% of that budget is allocated to non-defense discretionary programs such as public broadcasting.

Musk’s own SpaceX benefits from billions in federal defense contracts, which remain untouched in their plans. Yet, the $535 million needed to sustain NPR and PBS could be easily funded many times over by a common-sense wealth tax on billionaires like Musk and Ramaswamy.

Act now to save NPR and PBS! Urge Congress to preserve its funding for the Corporation for Public Broadcasting.

@upontheshelfreviews

@greenwingspino

@one-time-i-dreamt

@tenaflyviper

@akron-squirrel

@ifihadaworldofmyown

@justice-for-jacob-marley

@voicetalentbrendan

@thebigdeepcheatsy

@what-is-my-aesthetic

@ravenlynclemens

@thegreatallie

@writerofweird

@anon-lephant

@mentally-quiet-spycrab

3 notes

·

View notes

Text

January 16, 2025

HEATHER COX RICHARDSON

JAN 17

In his final address to the nation last night, President Joe Biden issued a warning that “an oligarchy is taking shape in America of extreme wealth, power, and influence that literally threatens our entire democracy, our basic rights and freedoms, and a fair shot for everyone to get ahead.”

It is not exactly news that there is dramatic economic inequality in the United States. Economists call the period from 1933 to 1981 the “Great Compression,” for it marked a time when business regulation, progressive taxation, strong unions, and a basic social safety net compressed both wealth and income levels in the United States. Every income group in the U.S. improved its economic standing.

That period ended in 1981, when the U.S. entered a period economists have dubbed the “Great Divergence.” Between 1981 and 2021, deregulation, tax cuts for the wealthy and corporations, the offshoring of manufacturing, and the weakening of unions moved $50 trillion from the bottom 90% of Americans to the top 1%.

Biden tried to address this growing inequality by bringing back manufacturing, fostering competition, increasing oversight of business, and shoring up the safety net by getting Congress to pass a law—the Inflation Reduction Act—that enabled Medicare to negotiate drug prices for seniors with the pharmaceutical industry, capping insulin at $35 for seniors, for example. His policies worked, primarily by creating full employment which enabled those at the bottom of the economy to move to higher-paying jobs. During Biden’s term, the gap between the 90th income percentile and the 10th income percentile fell by 25%.

But Donald Trump convinced voters hurt by the inflation that stalked the country after the coronavirus pandemic shutdown that he would bring prices down and protect ordinary Americans from the Democratic “elite” that he said didn’t care about them. Then, as soon as he was elected, he turned for advice and support to one of the richest men in the world, Elon Musk, who had invested more than $250 million in Trump’s campaign.

Musk’s investment has paid off: Faiz Siddiqui and Trisha Thadani of the Washington Post reported that he made more than $170 billion in the weeks between the election and December 15.

Musk promptly became the face of the incoming administration, appearing everywhere with Trump, who put him and pharmaceutical entrepreneur Vivek Ramaswamy in charge of the so-called Department of Government Efficiency, where Musk vowed to cut $2 trillion out of the U.S. budget even if it inflicted “hardship” on the American people.

News broke earlier this week that Musk, who holds government contracts worth billions of dollars, is expected to have an office in the Eisenhower Executive Office Building adjacent to the White House. And the world’s two other richest men will be with Musk on the dais at Trump’s inauguration. Musk, Amazon founder Jeff Bezos, and Meta chief executive officer Mark Zuckerberg, who together are worth almost a trillion dollars, will be joined by other tech moguls, including the CEO of OpenAI, Sam Altman; the CEO of the social media platform TikTok, Shou Zi Chew; and the CEO of Google, Sundar Pichai.

At his confirmation hearing before the Senate Committee on Finance today, Trump’s nominee for Treasury Secretary, billionaire Scott Bessent, said that extending the 2017 Trump tax cuts was "the single most important economic issue of the day." But he said he did not support raising the federal minimum wage, which has been $7.25 since 2009 although 30 states and dozens of cities have raised the minimum wage in their jurisdictions.

There have been signs lately that the American people are unhappy about the increasing inequality in the U.S. On December 4, 2024, a young man shot the chief executive officer of the health insurance company UnitedHealthcare, which has been sued for turning its claims department over to an artificial intelligence program with an error rate of 90% and which a Federal Trade Commission report earlier this week found overcharged cancer patients by more than 1,000% for life-saving drugs. Americans championed the alleged killer.

It is a truism in American history that those interested in garnering wealth and power use culture wars to obscure class struggles. But in key moments, Americans recognized that the rise of a small group of people—usually men—who were commandeering the United States government was a perversion of democracy.

In the 1850s, the expansion of the past two decades into the new lands of the Southeast had permitted the rise of a group of spectacularly wealthy men. Abraham Lincoln helped to organize westerners against a government takeover by elite southern enslavers who argued that society advanced most efficiently when the capital produced by workers flowed to the top of society, where a few men would use it to develop the country for everyone. Lincoln warned that “crowned-kings, money-kings, and land-kings” would crush independent men, and he created a government that worked for ordinary men, a government “of the people, by the people, for the people.”

A generation later, when industrialization disrupted the country as westward expansion had before, the so-called robber barons bent the government to their own purposes. Men like steel baron Andrew Carnegie explained that “[t]he best interests of the race are promoted” by an industrial system, “which inevitably gives wealth to the few.” But President Grover Cleveland warned: “The gulf between employers and the employed is constantly widening, and classes are rapidly forming, one comprising the very rich and powerful, while in another are found the toiling poor…. Corporations, which should be the carefully restrained creatures of the law and the servants of the people, are fast becoming the people's masters.”

Republican president Theodore Roosevelt tried to soften the hard edges of industrialization by urging robber barons to moderate their behavior. When they ignored him, he turned finally to calling out the “malefactors of great wealth,” noting that “there is no individual and no corporation so powerful that he or it stands above the possibility of punishment under the law. Our aim is to try to do something effective; our purpose is to stamp out the evil; we shall seek to find the most effective device for this purpose; and we shall then use it, whether the device can be found in existing law or must be supplied by legislation. Moreover, when we thus take action against the wealth which works iniquity, we are acting in the interest of every man of property who acts decently and fairly by his fellows.”

Theodore Roosevelt helped to launch the Progressive Era.

But that moment passed, and in the 1930s, Franklin Delano Roosevelt, too, contended with wealthy men determined to retain control over the federal government. Running for reelection in 1936, he told a crowd at Madison Square Garden: “For nearly four years you have had an Administration which instead of twirling its thumbs has rolled up its sleeves…. We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering. They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.”

“Never before in all our history have these forces been so united against one candidate as they stand today,” he said. “They are unanimous in their hate for me—and I welcome their hatred.”

Last night, after President Biden’s warning, Google searches for the meaning of the word “oligarchy” spiked.

—

4 notes

·

View notes

Text

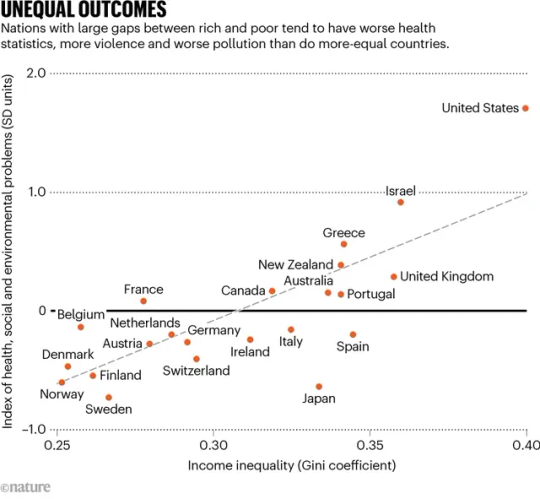

As environmental, social and humanitarian crises escalate, the world can no longer afford two things: first, the costs of economic inequality; and second, the rich. Between 2020 and 2022, the world’s most affluent 1% of people captured nearly twice as much of the new global wealth created as did the other 99% of individuals put together, and in 2019 they emitted as much carbon dioxide as the poorest two-thirds of humanity. In the decade to 2022, the world’s billionaires more than doubled their wealth, to almost US$12 trillion. The evidence gathered by social epidemiologists, including us, shows that large differences in income are a powerful social stressor that is increasingly rendering societies dysfunctional. For example, bigger gaps between rich and poor are accompanied by higher rates of homicide and imprisonment. They also correspond to more infant mortality, obesity, drug abuse and COVID-19 deaths, as well as higher rates of teenage pregnancy and lower levels of child well-being, social mobility and public trust. Bullying among schoolchildren is around six times as common in more-unequal countries. The homicide rate in the United States — the most unequal Western democracy — is more than 11 times that in Norway. Imprisonment rates are ten times as high, and infant mortality and obesity rates twice as high. These problems don’t just hit the poorest individuals, although the poorest are most badly affected. Even affluent people would enjoy a better quality of life if they lived in a country with a more equal distribution of wealth, similar to a Scandinavian nation. They might see improvements in their mental health and have a reduced chance of becoming victims of violence; their children might do better at school and be less likely to take dangerous drugs. The costs of inequality are also excruciatingly high for governments. For example, the Equality Trust, a charity based in London, estimated that the United Kingdom alone could save more than £100 billion ($126 billion) per year if it reduced its inequalities to the average of those in the five countries in the OECD that have the smallest income differentials — Denmark, Finland, Belgium, Norway and the Netherlands. And that is considering just four areas: greater number of years lived in full health, better mental health, reduced homicide rates and lower imprisonment rates. Many commentators have drawn attention to the environmental need to limit economic growth and instead prioritize sustainability and well-being. Here we argue that tackling inequality is the foremost task of that transformation. Greater equality will reduce unhealthy and excess consumption, and will increase the solidarity and cohesion that are needed to make societies more adaptable in the face of climate and other emergencies. (...)

The scientific evidence is stark that reducing inequality is a fundamental precondition for addressing the environmental, health and social crises the world is facing. It’s essential that policymakers act quickly to reverse decades of rising inequality and curb the highest incomes. First, governments should choose progressive forms of taxation, which shift economic burdens from people with low incomes to those with high earnings, to reduce inequality and to pay for the infrastructure that the world needs to transition to carbon neutrality and sustainability. (...) International agreements to close tax havens and loopholes must be made. Corporate tax avoidance is estimated to cost poor countries $100 billion per year — enough to educate an extra 124 million children and prevent perhaps 8 million maternal and infant deaths annually. (...) Bans on advertising tobacco, alcohol, gambling and prescription drugs are common internationally, but taxes to restrict advertising more generally would help to reduce consumption. Energy costs might also be made progressive by charging more per unit at higher levels of consumption. Legislation and incentives will also be needed to ensure that large companies — which dominate the global economy — are run more fairly. For example, business practices such as employee ownership, representation on company boards and share ownership, as well as mutuals and cooperatives, tend to reduce the scale of income and wealth inequality. (...)

More in-depth explanation for the reasons behind the fragment I've included in this post can be found in the article linked above, as well as the sources for all the claims.

#sustainability#climate emergency#environmentalism#environment#capitalism#anticapitalism#science#💬#social science#anti capitalism#anti advertising

7 notes

·

View notes

Text

Mike Luckovich

* * * * *

LETTERS FROM AN AMERICAN

December 11, 2024

Heather Cox Richardson

Dec 12, 2024

Yesterday, President Joe Biden spoke at the Brookings Institution, where he gave a major speech on the American economy. He contrasted his approach with the supply-side economics of the forty years before he took office, an approach the incoming administration of Donald Trump has said he would reinstate. Biden urged Trump and his team not to destroy the seeds of growth planted over the past four years. And he laid out the extraordinary successes of his administration as a benchmark going forward.

The president noted that Trump is inheriting a strong economy. Biden shifted the U.S. economy from 40 years of supply-side economics that had transferred about $50 trillion from the bottom 90% to the top 1% and hollowed out the middle class.

By investing in the American people, the Biden team expanded the economy from “the middle out and the bottom up,” as Biden says, and created an economy that he rightfully called “the envy of the world.” Biden listed the numbers: more than 16 million new jobs, the most in any four-year presidential term in U.S. history; low unemployment; a record 20 million applications for the establishment of new businesses; the stock market hitting record highs.

Biden called out that in the two years since Congress passed the Inflation Reduction Act and the CHIPS and Science Act, the private sector has jumped on the public investments to invest more than a trillion dollars in clean energy and advanced manufacturing.

Disruptions from the pandemic—especially the snarling of supply chains—and Russian president Vladimir Putin’s attack on Ukraine created a global spike in inflation; the administration brought those rates back to around the Fed’s target of 2%.

Biden pointed out that “[l]ike most…[great] economic developments, this one is neither red nor blue, and America’s progress is everyone’s progress.”

But voters’ election of Donald Trump last month threatens Biden’s reworking of the economy. Trump and his team embrace the supply-side economics Biden abandoned. They argue that the way to nurture the economy is to free up money at the top of the economy through deregulation and tax cuts. Investors will then establish new industries and jobs more efficiently than they could if the government intervened. Those new businesses, the theory goes, will raise wages for all Americans and everyone will thrive.

Trump and MAGA Republicans have made it clear they intend to restore supply-side economics.

The first priority of the incoming Republican majority is to extend the 2017 Trump tax cuts, many of which are due to expire in 2025. Those tax cuts added almost $2 trillion to budget deficits, but there is little evidence that they produced the economic growth their supporters promised. At the same time, the income tax cuts delivered an average tax cut of $252,300 to households in the top 0.1%, $61,090 to households in the top 1%, but just $457 to the bottom 60% of American households. The corporate tax cuts were even more skewed to the wealthy.

In the Washington Post yesterday, Catherine Rampell noted that Republicans’ claim that extending those cuts isn’t extraordinarily expensive means “getting rid of math.”

At a time when Republicans like Elon Musk and Vivek Ramaswamy, who are leading the new “Department of Government Efficiency,” are clamoring for cuts of $2 trillion from the budget, the Congressional Budget Office estimates that extending the tax cuts will add more than $4 trillion to the federal budget over the next ten years. Republicans who will chair the House and Senate finance committees, Representative Jason Smith (R-MO) and Senator Mike Crapo (R-ID), say that extending the cuts shouldn’t count as adding to the deficit because they would simply be extending the status quo.

Trump has also indicated he plans to turn the country over to billionaires, both by putting them into government and by letting them act as they wish. Last night, on social media, President-elect Trump posted: “Any person or company investing ONE BILLION DOLLARS, OR MORE, in the United States of America, will receive fully expedited approvals and permits, including, but in no way limited to, all Environmental approvals. GET READY TO ROCK!!!”

Biden called out the contrast between these two economic visions, saying that the key question for the American people is “do we continue to grow the economy from the middle out and the bottom up, investing in all of America and Americans, supporting unions and working families as we have the past four years? Or do we…backslide to an economy that’s benefited those at the top, while working people and the middle class struggle…for a fair share of growth and [for an] economic theory that encouraged industries and…livelihoods to be shipped overseas?”

Biden explained that for decades Republicans had slashed taxes for the very wealthy and the biggest corporations while cutting public investment in infrastructure, education, and research and development. Jobs and factories moved overseas where labor was cheaper. To offset the costs of tax cuts, Biden said, ‘advocates of trickle-down economics ripped the social safety net by trying to privatize Social Security and Medicare, trying to deny access to affordable health care and prescription drugs.” He added, “Lifting the fortunes of the very wealthy often meant taking the rights of workers away to unionize and bargain collectively.”

This approach to the economy “meant rewarding short-termism in pursuit of short-term profits [and] extraordinary high executive pay, instead of making long-term investments…. As a consequence, our…infrastructure fell…behind. A flood of cheap imports hollowed out our factory towns.”

“Economic opportunity and innovation became more concentrated in [a] few major cities, while the heartland and communities were left behind. Scientific discoveries and inventions developed in America were commercialized in countries like China, bolstering their manufacturing investment and jobs instead of [our] economy. Even before the pandemic, this economic agenda was clearly failing. Working- and middle-class families were being hurt.”

“[W]hen the pandemic hit,” Biden said, “we found out how vulnerable America was.” Supply chains failed, and prices soared.

Biden told the audience that he “came into office with a different vision for America…: grow the economy from the middle out and the bottom up; invest in America and American products. And when that happens, everybody does…well…no matter where they lived, whether they went to college or not.”

“I was determined to restore U.S. leadership in industries of the future,” he said. The Bipartisan Infrastructure Law, CHIPS and Science Act, and Inflation Reduction Act “mark the most significant investment in America since the New Deal,” with new factories bringing good jobs that are rejuvenating towns that had been left behind in the past decades. Biden said he required that the government buy American goods as the country invested in “modernizing our roads; our bridges; our ports; our airports; our clean water system; affordable, high-speed Internet systems; and so much more.”

Eighty percent of working-age Americans have jobs, and the average after-tax income is up almost $4,000 since before the pandemic, significantly outpacing inflation.

Biden and his team worked to restore competition in the economy—just today, the huge grocery chain Albertsons gave up on its merger with another huge grocery chain, Kroger, after Biden’s Federal Trade Commission sued to block the merger because it would raise prices and lower workers’ wages by eliminating competition—and their negotiations with big pharma have dramatically cut the costs of prescription drugs for seniors. The administration cut junk fees, capping the cost of overdraft fees, for example, from an average of $35 a month to $5.

Biden quoted Jeffrey Sonnenfeld and Stephen Henriques in Time magazine a month ago, saying: “President-elect Trump is receiving the strongest economy in modern history, which is the envy of the world.”

In his speech, Biden noted that it would be “politically costly and economically unsound” to disrupt the decisions and investments the nation has made over the past four years, and he urged Trump to leave them in place. “Will the next president stop a new electric battery factory in Liberty, North Carolina, that will create thousands of jobs?” he asked. “[W]ill we deny seniors living in red states $35-a-month insulin?”

In their article, Sonnenfeld and Henriques noted: “President Trump will likely claim he waved a magic wand on January 20 and the economic clouds cleared,” and they urged people: “Don’t Give Trump Credit for the Success of the Biden Economy.”

Biden gave yesterday’s speech in part to put down benchmarks against which we should measure Trump’s economic policies. “During my presidency, we created [16] million new jobs in America” and saw “the lowest average unemployment rate of…any administration in 50 years.” Economic growth has been a strong 3% on average, and inflation is near 2 percent, he said.

“[T]hese are simple, well-established economic benchmarks used to measure the strength of any economy, the success or failure of any president’s four years in office. They’re not political, rhetorical opinions. They’re just facts,” Biden said, “simple facts. As President Reagan called them, ‘stubborn facts.’”

Biden is willing to bet that if the American people pay attention to those facts, they will recognize that his approach to the economy, rather than supply-side economics, works best for everyone.

Today the NASDAQ Composite index, which focuses on tech stocks, broke 20,000 for the first time.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from an american#Heather Cox Richardson#Biden Administration#the economy#Trump lies#economic policies#the Biden Economy#Mike Luckovich

23 notes

·

View notes