#Billing Machines in Government Estate

Explore tagged Tumblr posts

Text

Froggie's (Almost) Very Productive Day

I try to fit as many out-and-about chores as possible into a single day so I only have one set of post-exertional malaise consequences instead of consequences after each day of doing a thing. So any time I decide to drive, I try to find several tasks to accomplish all at once.

My first stop was the Family Services Division in the hopes of getting some help with grocery bills. I am making ends meet, but it seems to be getting harder each month. And maybe I could have skipped my trip to Florida and saved that money, but if I don't do something drastic for my mental health, I fear this first holiday season without a parent could send me into the darkness.

I needed to do an interview to finish applying for SNAP. I wanted to do a phone interview, but the next appointment was in January. So I went to social services where they allow walk-in appointments. I waited in a tiny plastic chair for several hours until they called my name. She yelled out "Benjamin" because when most people see "Grelle" they aren't really sure how to say it. (Rhymes with belly.)

She started my interview and it was going swimmingly at first. But then she started asking questions about the house and my inheritance and my trust. I had no idea what to tell her. It feels like a mistake now, but I have had pretty much no involvement in that process. I have no idea how it works. And I started to panic because she was acting like I was committing fraud or something by not mentioning the trust. But the entire point of the trust was to protect my benefits. Nothing is mine. I own nothing. I have no access. But I had no idea how to explain that.

Maybe my lawyer can help me apply, but I did not want them investigating everything and screwing things up before we even have the estate through probate. We specifically hired a lawyer and went through this convoluted process to make sure everything was on the up and up. But she really made me feel like I was doing something wrong. And that made me panic, which probably made me look even more guilty of something. So I just canceled everything and left.

After a few hours in a crowded government office, I decided to head to a different crowded government office.

I know I didn't need it until 2025, but I decided to go ahead and get my Real ID thingie before my first flight. I was kind of hoping they'd retake my picture because my current driver's license is... well...

And I'm so glad they took my big terrible picture and made it into a smaller, more terrible picture.

People complain about the DMV, but the one near me runs like a machine. It was filled with people and I still only had a 10 minute wait time.

I'm starting to wonder if all of those 80s comedians who were all, "What's the deal with the DMV?" were exaggerating.

Good stuff, Jerry.

I head up to the counter and ask for a Real ID. She asks for two pieces of mail and my birth certificate.

And this disappointed me a little bit.

I did my research. I went to the Real ID website and used their interactive guide to figure out exactly which documents I would need. They gave me this entire checklist and I printed it out and went through all my records and mail trying to find everything.

I had to wait a week for my internet bill to come because it's the only thing I forgot to change to paperless. This took a lot of effort and I was ready to be validated for being so prepared.

And she asks for two pieces of mail.

Any mail.

So I was off to get new tires.

Driving around on 8 year old bald tires was giving me anxiety. I didn't have the money for new tires, but I remember the guy saying they had financing. Recently several of my past debts went past the statute of limitations, and so my credit score lifted itself out of the pits of "poor" and into the realm of "fair." So I decided to take a chance and apply for a Discount Tire credit card. It's a 6 month payment plan with no interest, so that didn't feel as predatory as all the credit card offers I get in the mail with 8000% interest.

We started going through the approval process and I was answering all of the questions and then I saw the name of the bank offering the credit. It was the same bank that tried to sue me and also the bank that can longer collect due to the statute. I was worried they put me on some sort of list and would deny me. But, to my surprise, they approved me instantly. And wouldn't you know it, they gave me almost exactly the amount needed for a new set of tires.

I'm hoping we'll be doing another auction of the house stuff soon, so I plan to pay off the card and then cancel it, but this was the only solution I could come up with to drive safely until then.

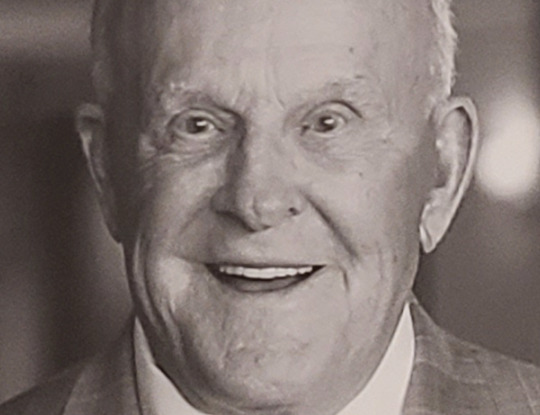

I was having a weird day where photos of crusty rich wide dudes followed me everywhere I went. Here is my good ol' boy governor at the entrance to social services.

And at the tire place, I noticed this fella...

Why does every rich CEO think they are a font of wisdom capable of creating compelling quotes?

Does he think no one has ever said "work hard" and "have fun"? And after he said this was he like...

"That's gold, put that in *every* store."

"Oh, and use that picture of me where it looks like a handsome gal just grabbed my undercarriage."

He probably thinks, "Well, no one has put these specific generic platitudes together into a single mega-platitude. I am a genius."

"Be honest, work hard, have fun, be grateful, pay it forward" sounds like he had a bunch of motivational posters on his wall and started reading them all at once.

Like, every line could have a picture of an eagle above it.

In any case, the guy at the tire store, Dakota, was really nice. He made the experience very low anxiety. And he really liked my Thor's Hammer keychain with built in fidget spinner.

He went around showing it to all his coworkers. "Look, it even spins!" And they were like, "Dude, where did you get that??" And I was like, "Amazon." Now I'm just imagining 10 dudes at a tire store all fidgeting their hammers.

As nice as he was, Dakota was still a salesman and had a job to do. He gave me two tire options and tried to upsell me. The cheapest tires had a "1" rating for winter. He said they get "super hard" in the cold... I tried not to giggle. But I explained I drive about twice a month and mostly to the grocery store. If it is a bad winter day, I'll just wait or get delivery. He understood and set me up with the cheaper tires.

He then checked out my car and noticed my tire pressure sensors were dying. I keep getting a warning light on my dash. Apparently they all have tiny batteries in them that die after 7 years. And you can't just replace the batteries so you have to install brand new sensors.

And this is where my social anxiety got me into trouble.

I don't actually need these sensors. They are usually inaccurate. I prefer to test my tires with an actual gauge. But I got so caught up in his sales pitch that I agreed to replace them... at $60 each. For that I could have gotten the fancier tires. I really don't care if an orange light shows up on my dash. And I looked up the price online and a pack of 4 is $30. Though that is without installation.

But still... I wasn't thinking and he was so nice that I was just like, "I want to please Dakota. Saying no might make Dakota sad." Dakota's job is selling me but that doesn't mean I have to buy anything. He would live if I had said "no thanks."

To make my blunder more blunderous, when they finished the tires he asked for my key fob. And it decided that was the time for the battery to die. And in order to reset the system for the new tire pressure sensors, you have to press two buttons on the fob for 7 seconds. Thankfully I had a spare fob at home, but if I want my fancy new $240 sensors to work, I have to return to Dakota and have him initialize them.

I really hope these are the Cadillac of sensors.

Or, like, the ones they use on Cadillacs?

They better be accurate, is what I'm saying.

I do feel safer with new tires. So I am glad I did that. And I gave them a good obligatory kick and felt the tread. They seem nice enough even if they get boners in the winter. It's crazy how bald my other tires were in comparison. Like, I can fit half my finger down into the tread on the new ones—which did not get them super hard.

The way I drive, I probably won't wear them down. They'll probably start to rot before I do.

Before I do, meaning before I wear them down.

Not before I rot.

I am not in a rotting competition with my tires.

I was then off to Sam's. I decided all of my hard work accomplishing 2 out of 3 goals deserved some sushi. So I grabbed some California Rolls and headed home. On my way out, a Hummer and a Porsche nearly collided in the parking lot. And they sort of got stuck facing each other. One of them needed to back up and they both signaled at each other like "You back up, I'm not backing up." And it was just this weird standoff between the two douchiest looking cars you could imagine.

I mean, you have to be a douche to drive a Hummer.

I still remember the mystery Hummer dialysis patient from when my dad was going 3 time per week. We could never figure out who owned the Hummer, but we knew it was not the underpaid nurses and techs. So it had to be one of the patients. And none of them seemed the type. We never solved that mystery.

That hummer started off a delightful safety yellow. (Elon would cry.)

They decided this wasn't extra enough... so they did this...

Katrina and I could never decide... are these cow spots or the world's least effective camoflauge?

There was another patient who drove this old beater...

And I loved seeing this car because we had the same one when I was a little kid. I'm afraid the aesthetics of the 1980s Caprice Classic did not stand the test of time, but it had great sentimental appeal for me.

But this maroon beast that squeaked and sputtered its way from here to there belonged to a very sweet older gentleman. Sometimes he and my dad would be dialysis buddies—sitting next to each other in the recliners. And the worst thing about dialysis was the boredom. All you have to do is watch broadcast TV with 4 channels.

All of the TVs require headphones. They give you your own set of super cheap headphones in the dialysis welcome bag. They were very uncomfortable so I ordered my dad better ones with cushioned ear cups.

His dialysis buddy noticed them and thought they looked nice. And then he revealed that his free headphones broke and he didn't know how to get new ones. He had been watching TV with no sound for weeks. So, I bought another pair with the soft ear cups and my dad gave them to his friend. And it just made me happy imagining the two of them watching The Price is Right in matching headphones.

I do have to make fun of this sweet old man a little bit. When I walked passed his car I noticed he implemented the world's most effective anti-theft device ever created.

That's right... The Club™.

If someone decides they have to have a 40 year old car with an engine that sounds like a dying hyena and a hubcap missing... they are out of luck.

But hey, you gotta protect what is important to you. And if I needed a getaway car and my choices were between his beater and the Cow Hummer, I'd take his ride for sure.

Well, I'd try... and then get arrested because The Club™ is undefeatable.

Do NOT look that up on YouTube. It's 100% true. (And the Lock Picking Lawyer doesn't count due to him being able to break into Fort Knox with a paperclip and then doing it again to make sure it isn't a fluke.)

The dialysis center is in the same complex as my local Tolerable Schnucks and I still see that maroon boat of a car every once in a while. I always smile whenever it is there because it lets me know he is hanging in there and hopefully still has sound for his TV.

Wow, I went off on a mega-tangent.

I didn't even finish talking about my day. Where was I? Oh, the douche standoff finally ended. The Porsche Douche capitulated and backed up. Probably due to the fact the Hummer Douche has 0 visibility behind him.

When I got home I started devouring my sushi. I finally heard back from my lawyer. He submitted the last of the evidence for my appeal. And I was finally able to confirm he got the records of my ECT treatments from 20 years ago. I worked so hard to get those. At first, they forgot to send all records before 2011. I had to call back and figure that out. They shipped them and they didn't arrive until a week before we had to file. Everything was so last minute and my anxiety has been... palpable. It felt like when I did my science fair project on Sunday night.

He's hoping to get a decision at the beginning of next year. He warned me that these appeals are usually rejected. And that the most effective method of approval was a hearing in front of an administrative law judge. But that could be delayed by up to a year. So I might need to figure out how to survive until 2025. As long as my brother does what he is legally required to do, I should be okay. But counting on that also gives me palpable anxiety.

And that was my day.

Every time I go out is always an adventure.

But remember...

BE NICE. EAT YOUR VEGGIES. PET CUTE DOGS. DREAM BIG. KEEP YOUR TIRES WARM... FOR REASONS. 5 LIFE LESSONS -Froggie, Mildly Famous Internet Person

210 notes

·

View notes

Text

Weaponizing violence. With alarming regularity, the nation continues to be subjected to spates of violence that terrorizes the public, destabilizes the country’s ecosystem, and gives the government greater justifications to crack down, lock down, and institute even more authoritarian policies for the so-called sake of national security without many objections from the citizenry.

Weaponizing surveillance, pre-crime and pre-thought campaigns. Surveillance, digital stalking and the data mining of the American people add up to a society in which there’s little room for indiscretions, imperfections, or acts of independence. When the government sees all and knows all and has an abundance of laws to render even the most seemingly upstanding citizen a criminal and lawbreaker, then the old adage that you’ve got nothing to worry about if you’ve got nothing to hide no longer applies. Add pre-crime programs into the mix with government agencies and corporations working in tandem to determine who is a potential danger and spin a sticky spider-web of threat assessments, behavioral sensing warnings, flagged “words,” and “suspicious” activity reports using automated eyes and ears, social media, behavior sensing software, and citizen spies, and you having the makings for a perfect dystopian nightmare. The government’s war on crime has now veered into the realm of social media and technological entrapment, with government agents adopting fake social media identities and AI-created profile pictures in order to surveil, target and capture potential suspects.

Weaponizing digital currencies, social media scores and censorship. Tech giants, working with the government, have been meting out their own version of social justice by way of digital tyranny and corporate censorship, muzzling whomever they want, whenever they want, on whatever pretext they want in the absence of any real due process, review or appeal. Unfortunately, digital censorship is just the beginning. Digital currencies (which can be used as “a tool for government surveillance of citizens and control over their financial transactions”), combined with social media scores and surveillance capitalism create a litmus test to determine who is worthy enough to be part of society and punish individuals for moral lapses and social transgressions (and reward them for adhering to government-sanctioned behavior). In China, millions of individuals and businesses, blacklisted as “unworthy” based on social media credit scores that grade them based on whether they are “good” citizens, have been banned from accessing financial markets, buying real estate or travelling by air or train.

Weaponizing compliance. Even the most well-intentioned government law or program can be—and has been—perverted, corrupted and used to advance illegitimate purposes once profit and power are added to the equation. The war on terror, the war on drugs, the war on COVID-19, the war on illegal immigration, asset forfeiture schemes, road safety schemes, school safety schemes, eminent domain: all of these programs started out as legitimate responses to pressing concerns and have since become weapons of compliance and control in the police state’s hands.

Weaponizing entertainment. For the past century, the Department of Defense’s Entertainment Media Office has provided Hollywood with equipment, personnel and technical expertise at taxpayer expense. In exchange, the military industrial complex has gotten a starring role in such blockbusters as Top Gun and its rebooted sequel Top Gun: Maverick, which translates to free advertising for the war hawks, recruitment of foot soldiers for the military empire, patriotic fervor by the taxpayers who have to foot the bill for the nation’s endless wars, and Hollywood visionaries working to churn out dystopian thrillers that make the war machine appear relevant, heroic and necessary. As Elmer Davis, a CBS broadcaster who was appointed the head of the Office of War Information, observed, “The easiest way to inject a propaganda idea into most people’s minds is to let it go through the medium of an entertainment picture when they do not realize that they are being propagandized.”

Weaponizing behavioral science and nudging. Apart from the overt dangers posed by a government that feels justified and empowered to spy on its people and use its ever-expanding arsenal of weapons and technology to monitor and control them, there’s also the covert dangers associated with a government empowered to use these same technologies to influence behaviors en masse and control the populace. In fact, it was President Obama who issued an executive order directing federal agencies to use “behavioral science” methods to minimize bureaucracy and influence the way people respond to government programs. It’s a short hop, skip and a jump from a behavioral program that tries to influence how people respond to paperwork to a government program that tries to shape the public’s views about other, more consequential matters. Thus, increasingly, governments around the world—including in the United States—are relying on “nudge units” to steer citizens in the direction the powers-that-be want them to go, while preserving the appearance of free will.

Weaponizing desensitization campaigns aimed at lulling us into a false sense of security. The events of recent years—the invasive surveillance, the extremism reports, the civil unrest, the protests, the shootings, the bombings, the military exercises and active shooter drills, the lockdowns, the color-coded alerts and threat assessments, the fusion centers, the transformation of local police into extensions of the military, the distribution of military equipment and weapons to local police forces, the government databases containing the names of dissidents and potential troublemakers—have conspired to acclimate the populace to accept a police state willingly, even gratefully.

Weaponizing fear and paranoia. The language of fear is spoken effectively by politicians on both sides of the aisle, shouted by media pundits from their cable TV pulpits, marketed by corporations, and codified into bureaucratic laws that do little to make our lives safer or more secure. Fear, as history shows, is the method most often used by politicians to increase the power of government and control a populace, dividing the people into factions, and persuading them to see each other as the enemy. This Machiavellian scheme has so ensnared the nation that few Americans even realize they are being manipulated into adopting an “us” against “them” mindset. Instead, fueled with fear and loathing for phantom opponents, they agree to pour millions of dollars and resources into political elections, militarized police, spy technology and endless wars, hoping for a guarantee of safety that never comes. All the while, those in power—bought and paid for by lobbyists and corporations—move their costly agendas forward, and “we the suckers” get saddled with the tax bills and subjected to pat downs, police raids and round-the-clock surveillance.

Weaponizing genetics. Not only does fear grease the wheels of the transition to fascism by cultivating fearful, controlled, pacified, cowed citizens, but it also embeds itself in our very DNA so that we pass on our fear and compliance to our offspring. It’s called epigenetic inheritance, the transmission through DNA of traumatic experiences. For example, neuroscientists observed that fear can travel through generations of mice DNA. As The Washington Post reports, “Studies on humans suggest that children and grandchildren may have felt the epigenetic impact of such traumatic events such as famine, the Holocaust and the Sept. 11, 2001, terrorist attacks.”

Weaponizing the future. With greater frequency, the government has been issuing warnings about the dire need to prepare for the dystopian future that awaits us. For instance, the Pentagon training video, “Megacities: Urban Future, the Emerging Complexity,” predicts that by 2030 (coincidentally, the same year that society begins to achieve singularity with the metaverse) the military would be called on to use armed forces to solve future domestic political and social problems. What they’re really talking about is martial law, packaged as a well-meaning and overriding concern for the nation’s security. The chilling five-minute training video paints an ominous picture of the future bedeviled by “criminal networks,” “substandard infrastructure,” “religious and ethnic tensions,” “impoverishment, slums,” “open landfills, over-burdened sewers,” a “growing mass of unemployed,” and an urban landscape in which the prosperous economic elite must be protected from the impoverishment of the have nots. “We the people” are the have-nots.

The end goal of these mind control campaigns—packaged in the guise of the greater good—is to see how far the American people will allow the government to go in re-shaping the country in the image of a totalitarian police state.

10 notes

·

View notes

Text

FORGOTTEN HISTORY

A Daily Dose of History

Suggested for you · 1d ·

In 1920 the yacht building business that Bill McCoy operated with his brother Ben was struggling. So, Bill assessed the situation. He knew that he was a good sailor who knew how to make fast boats. And he knew that Prohibition had created a huge demand for liquor in the American northeast. Recognizing the business opportunity that presented itself, Bill McCoy seized it, becoming the king of the rumrunners, one of America’s most celebrated and notorious bootleggers.

McCoy bought a 127-foot fishing schooner capable of carrying 6,000 cases of alcohol and retrofitted it to make it one of the fastest commercial sailing vessels on the Atlantic coast. He registered his ship in Great Britain and renamed it “Tomoka.” He was in business.

He would load his cargo of spirits in Nassau in the Bahamas, then sail to the Jersey shore, anchoring between Sandy Hook and Atlantic City, just outside the three-mile boundary of international waters. Customers would come out to him in small boats that could evade the Coast Guard, and McCoy would sell them the booze in sacks that held nine bottles each. Ben McCoy would bring out supplies to the Tomoka, so that she never had to port.

McCoy made no effort to hide what he was doing. In fact, he welcomed the publicity. He boasted that he never diluted his product (as many bootleggers did), and that he never paid a dime to organized crime or to bribe law enforcement. And no law prohibited him from selling liquor in international waters. His enterprise was so successful that he soon added four more boats. In a little more than two years he sold an estimated two million bottles.

McCoy’s brazenness and his celebrity status infuriated government authorities, however, and they were determined to shut him down. In 1923, after first getting the tacit consent of British authorities, the Coast Guard was ordered to arrest McCoy, and to sink the Tomoka if he resisted.

On November 25 the Coast Guard cutter Senaca steamed out to the Tomoka and sent over a 15-man boarding party. When they were aboard, the commanding officer ordered McCoy to bring his ship into port. Instead, he set sail and raced away, with the boarding party still on board. The Seneca opened fire with her four-inch deck guns and the Tomoka’s crew answered with a machine gun set up on her forward deck. But as the shells from the Seneca started dropping closer to his ship, McCoy realized the game was up. He lowered his jib and surrendered. On board the Coast Guard found $60,000 in cash (about a million dollars in today’s money) and only 400 cases of the original 4,200 case cargo.

Once brought ashore reporters asked McCoy how he intended to defend himself against the charges. He answered with a smile, “I was outside the three-mile limit, selling whisky, and good whisky, to anyone and everyone who wanted to buy.”

But after two years of legal wrangling, McCoy ultimately decided to accept a plea bargain. He pled guilty to violating the Volstead Act and was sentenced to nine months in jail.

After serving his time, McCoy retired from rumrunning, returning instead to the boat building business. He also became a successful real estate investor and when Prohibition ended he cashed in on his notoriety by putting out his own brand of whisky, called “The Real McCoy” and featuring the Tomoka on the label.

William Frederick “Bill” McCoy, the King of the Rumrunners, died in Florida at age 71 on December 30, 1948, seventy-five years ago today.

18 notes

·

View notes

Text

This day in history

#10yrago UK police arrest man who built anti-immigrant nail-bomb, decline to press terrorism charges https://www.theguardian.com/uk-news/2014/nov/28/soldier-jailed-nailbomb-ryan-mcgee-manchester-bomb

#10yrsago Library’s seed sharing system threatened by Big Ag regulations https://www.mprnews.org/story/2014/11/30/duluth-librarys-seed-sharing-program-hits-a-hurdle

#10yrsago Haunted Mansion leg sleeve tattoo https://www.reddit.com/r/tattoos/comments/2o20s0/haunted_mansion_leg_sleeve_in_progress_by_darin/

#10yrsago Interview with fantasy writer Tim Powers about being a “secret historian” https://web.archive.org/web/20150103220737/http://likeiwassayingblog.com/2014/12/02/tim-powers-interview-with-a-secret-historian/

#5yrsago McKinsey designed ICE’s gulags, recommending minimal food, medical care and supervision https://www.propublica.org/article/how-mckinsey-helped-the-trump-administration-implement-its-immigration-policies#172207

#5yrsago Frustrated game devs automated the production of 1,500 terrible slot machine apps and actually made money https://www.gdcvault.com/play/1025766/1-500-Slot-Machines-Walk

#5yrsago The Supreme Court just heard the State of Georgia’s argument for copyrighting the law and charging for access to it https://arstechnica.com/tech-policy/2019/12/justices-debate-allowing-state-law-to-be-hidden-behind-a-pay-wall/

#5yrsago UK Apostrophe Protection Society surrender’s, saying “ignorance and lazines’s have won” https://www.standard.co.uk/news/uk/apostrophe-society-shuts-down-because-ignorance-has-won-a4301391.html

#5yrsago MMT: when does government deficit spending improve debt-to-GDP ratios? https://carnegieendowment.org/china-financial-markets/2019/10/mmt-heaven-and-mmt-hell-for-chinese-investment-and-us-fiscal-spending

#5yrsago Using the Challenger Disaster to illustrate the 8 symptoms of groupthink https://web.archive.org/web/20150326031934/https://courses.washington.edu/psii101/Powerpoints/Symptoms of Groupthink.htm

#5yrsago A sweeping new tech bill from Silicon Valley Democrats promises privacy, interoperability, and protection from algorithmic discrimination and manipulation https://web.archive.org/web/20191105215639/https://eshoo.house.gov/news-stories/press-releases/eshoo-lofgren-introduce-the-online-privacy-act/

#5yrsago Harry Shearer interviews Uber’s smartest critic: Hubert “Bezzle” Horan https://harryshearer.com/le-shows/december-01-2019/#t=10:10

#5yrsago Reading the “victory letter” a white nationalist sent to his followers after getting $2.5m from UNC, it’s obvious why he tried to censor it https://twitter.com/greg_doucette/status/1201547992748216322

#5yrsago “Harbinger households”: neighborhoods that consistently buy products that get discontinued, buy real-estate that underperforms, and donate to losing political candidates https://journals.sagepub.com/doi/abs/10.1177/0022243719867935

#5yrsago White nationalists who got a $2.5m payout from UNC abuse the DMCA to censor lawyer’s trove of documents about it https://twitter.com/greg_doucette/status/1201635924158881792

6 notes

·

View notes

Text

BUT, BY ALL MEANS LET THESE F***'S "POLICE" THEMSELVES!

The history of American judicial and governmental scandals is extensive, with notable examples including the early impeachment of federal judges like John Pickering and Samuel Chase, the "Teapot Dome" scandal during the Harding administration, the Watergate scandal under Nixon, and various instances of corruption within state and local governments, often involving bribery and political machines manipulating elections to gain power.

John Pickering: Impeached and removed from the Supreme Court in 1804 for drunkenness and inappropriate behavior on the bench.

Samuel Chase: Impeached by the House of Representatives in 1804 for political bias, but acquitted by the Senate.

Early 20th Century Scandals:

Teapot Dome Scandal: A major corruption scandal involving the leasing of government oil reserves in Wyoming during the Harding administration.

Watergate Scandal (1970s):

Nixon Administration: A major political scandal involving the break-in at the Democratic National Committee headquarters and subsequent attempts to cover up the crime, leading to President Nixon's resignation.

Other Notable Scandals:

Iran-Contra Affair (Reagan Administration): The illegal sale of arms to Iran to fund the Contra rebels in Nicaragua.

Whitewater Controversy (Clinton Administration): Investigations into questionable real estate dealings by Bill and Hillary Clinton.

Enron Scandal: A major corporate accounting fraud that led to significant financial losses.

Factors contributing to scandals:

Political Patronage: Appointing individuals to positions based on loyalty rather than merit, which can create opportunities for corruption.

Campaign Finance Laws:Loopholes in campaign finance regulations that allow for large donations and potential influence peddling.

Lack of Transparency:Government agencies or officials not adequately disclosing their activities, creating opportunities for abuse.

Impact of Scandals:

Erosion of Public Trust:Scandals can significantly damage public confidence in the government and its institutions.

Legislative Reform:Major scandals often lead to new laws and regulations aimed at preventing similar occurrences in the future.

Political Fallout:Individuals involved in scandals may face legal repercussions and damage to their political careers.

0 notes

Text

The number of humans that don't understand JUST STOP OIL's protests are astounding to me.

Everything they do targets the 1%, yet people claim they work for an oil company that no longer exists, their protests are dumb & most complaining of their tactics have zero understanding of what ART Museums are.

How are protests dumb if you, an absolutely nobody, an average taxpaying knuckle dragger, are on every single social network posting & ranting & railing about it? I'd say the protest is working exactly as intended. You just don't understand. The papers are picking it up. It's on all the news networks & even the lowest wage earning taxpayer has an opinion about it.

Yep. Misson accomplished.

Some of you are fine with billionaire jets getting targeted, but not billionaire owned art? King Francis the I of France purchased the Mona Lisa. Directly from DaVinci. No average person ever had it in their possesion. Same with almost every single piece of art in every museum in the world. Most of it, on loan from a rich family or estate or stolen by the rich, and the taxpayer footing the bill for the housing, enviromental stability, insurance, the whole damn museum, it's staff, etc. The owners get to take millions off on their taxes for that Van Gogh they've loaned the marble museum that the peasants go to. They don't have to insure it because YOU are. Most of the art you get to see was commissioned, curated, chosen, or stolen by the 1%, kings or colonial governments.

As an artist, yes, some of it is amazing. I'm 100% in support of art museums, although I do believe the tax laws need changed & local artists should be showcased as well. Of course, if you did that, art museums would cease to exist.

Don't let the rich fool you. They don't give a shit about Van Gogh, DaVinci, Monet, O'Keefe, or any other artist. What they do care about is the $$$ having those things SAVES them. Take that away & it all would disappear over night.

So, that's why throwing soup on a Van Gogh does actually mean something. It is a message to the 1% & you. Here you are, absolutely clutching your slave wage produced clothing in fury that someone would DARE attack sacred public art that you pay to house, insure, & keep while the rich laugh all the way to the bank & continue to rape the earth for resources, that eventually will run out & you will lose all access to. You get to see art because they allow you to & they make $$$ off you seeing it. You get AC in your house because they allow you to. You use the resources their family owns. When those resources start to dwindle, do you really think you will be allowed acess them? Air Conditioning? Heating? LMAO. They're already suggesting you turn your AC to 78°F to "save" energy. Eventually, they will enforce it. You gotta turn up your AC, but they don't. They need that energy to cool/heat their mansions. Fly their private jets to your taxpayer funded Van Gogh opening at the huge Marble Museum you pay for but can't get into until tomorrow because the Van Gogh opening is limited & tickets cost $150. There's wine & cheese & delicious pastries & caviar, that YOU paid for through taxes, & they all hobknob in the climate controlled chilly 68°F cooled building as you sit in your 78°F house with a crying baby that's fussy because it is uncomfortably warm & you hope you can afford diapers & formula & rent next month.

Van Gogh's "Sunflowers" that had tomato soup thrown on it? Do you know who owns it?

Do you?

Sunflowers was bought in 1987 by the Yasuda insurance company to display in an art museum on the 42nd floor of its Tokyo headquarters. In 2002 Yasuda was incorporated into a new company named Sompo.

Go look up who owns Stonehenge. Look up the whole sordid history.

These aren't "random attacks".

They can't do ALL the work for you. You've got to do your part. Investigate. Actually see what they are showing you.

It's absolutely astounding how easily the propaganda machine turns the average taxpaying citizen against those fighting FOR them.

Getty Oil no longer exists. You can research that, too. How the heir feels a tremendous responsibility to correct past horrors committed by her ancestors. But they've convinced you ALL rich people are evil. If it looks like they are trying to help it's some deep state conspiracy, right?

It's a much easier pill to swallow that she's an evil psyop. It requires no research & 0% activism or support from you.

Astounding.

I challenge you to look up every owner of every target of JUST STOP OIL. The history of the targeted object. Then use context & comprehension to understand WHY that makes sense. It is working. It's why your reading this right now. It's why you're feeling all these strong emotions about this post. Because it IS working.

1 note

·

View note

Text

Modern KYC Capabilities: Revolutionizing Compliance and Customer Experience

Know Your Customer (KYC) is one of the most important processes and compliances followed in several industry verticals such as banking, telecom, insurance, healthcare, real estate, gaming, retail, eCommerce, telecommunications, and government. The importance of robust KYC practices cannot be overstated. As financial institutions and telecom digital financial platforms strive to meet stringent regulatory requirements and enhance customer trust, modern KYC has emerged as a critical component. Traditional KYC processes, however, have often been cumbersome and prone to inefficiencies.

The advent of modern KYC capabilities, integrated with digital financial solutions, is revolutionizing compliance and customer experience. By leveraging advanced technologies such as AI, machine learning, and blockchain, financial institutions can now achieve greater accuracy, efficiency, and security in customer verification. These innovations not only streamline the onboarding process but also reduce fraud and financial crimes, offering a seamless experience for customers.

Furthermore, modern KYC solutions are playing a pivotal role in the broader context of digital financial solutions, including agency banking solutions, mobile wallet solutions, and convergent billing platforms. These integrated systems ensure a holistic approach to managing customer data, improving operational efficiency, and maintaining compliance. The transformation brought about by modern KYC is a significant leap forward, positioning financial institutions to better serve their clients while adhering to evolving regulatory landscapes.

The Global Importance of KYC Compliance

KYC compliance is crucial for financial institutions to verify customer identities and ensure secure transactions. When onboarding new customers, banks perform KYC checks to meet regulatory standards. If verification fails, banks can deny account opening requests. This process helps combat money laundering and terrorist financing.

As the financial world digitizes, manual KYC checks are becoming outdated. Online KYC verification offers a more efficient solution, aligning with global compliance requirements. Modern KYC technologies enhance accuracy, security, and efficiency, making them essential for today’s digital financial solutions.

How KYC Protects Global Businesses?

KYC compliance enables financial institutions to conduct thorough customer due diligence, preventing identity theft, money laundering, and fraud. Robust KYC processes involve extensive verification, blacklist screening, and risk assessment, ensuring only legitimate customers engage with businesses. According to Fenergo, over 10 years, about 91% of the total value of non-compliance-related fines which is around $23.52 billing related to KYC is registered in the USA.

Regulatory authorities impose strict penalties for non-compliance with KYC and anti-money laundering (AML) norms. Despite this, companies face significant fines and reputational damage due to compliance failures.

Major Challenges with Traditional KYC Process

1. Time-Consuming Manual Verification

Traditional KYC processes rely heavily on manual verification. This not only slows down customer onboarding but also increases the risk of human error. Employees must handle large volumes of paperwork, leading to inefficiencies and potential mistakes. Manual processes also extend the time needed to verify customer identities, frustrating customers and increasing operational costs.

2. Increased Vulnerability to Fraud

Manual KYC checks are less effective at detecting sophisticated fraud schemes. Financial institutions using traditional methods are more vulnerable to money laundering and identity theft. Fraudsters can exploit weaknesses in the manual verification process, making it easier for them to bypass checks and engage in illegal activities.

3. Lack of Integration with Modern Digital Solutions

Traditional KYC methods often fail to integrate with modern digital financial solutions. This lack of integration is particularly problematic for telecom digital financial platforms and agency banking solutions, which require seamless and efficient verification processes. The result is a fragmented system that struggles to provide a cohesive customer experience.

4. Challenges in Meeting Regulatory Compliance

Regulatory requirements for KYC are constantly evolving. Traditional methods lack the agility needed to adapt quickly to new regulations. This can lead to compliance risks, as financial institutions may not be able to update their processes in time. Non-compliance can result in hefty fines and damage to the institution’s reputation.

5. Inefficiencies Without Convergent Billing Platforms

Traditional KYC processes are often incompatible with convergent billing solutions. These platforms unify billing processes across different services, but without proper KYC integration, institutions face difficulties in consolidating customer data. This leads to inefficiencies and potential gaps in compliance, as the data remains siloed and harder to manage.

Modern KYC Overcomes Challenges of Traditional KYC

Modern KYC solutions address the limitations of traditional KYC by leveraging advanced technologies and integrating seamlessly with digital financial platforms. They offer automated verification, enhanced fraud detection, and agility in regulatory compliance. Compatibility with convergent billing platforms further ensures efficient data management and operational effectiveness. Adopting modern KYC is essential for financial institutions to stay competitive and compliant in today's digital age.

Automated Verification Processes

Modern KYC platforms leverage advanced technologies like AI and machine learning to automate customer verification. This automation dramatically reduces the time and effort required for customer onboarding, eliminating the inefficiencies and errors associated with manual processes. With AI, institutions can quickly scan and verify documents, cross-reference data, and perform biometric checks. This reduces onboarding times from days to minutes. Customers experience faster service, leading to higher satisfaction rates, while institutions benefit from streamlined operations, reduced costs, and the ability to handle larger volumes of customers efficiently.

Enhanced Fraud Detection

Modern KYC systems employ sophisticated algorithms to analyze vast datasets and identify suspicious patterns that might indicate fraud. Unlike traditional methods, these systems can continuously monitor transactions in real time, updating risk profiles as new data emerges. Advanced machine learning models detect anomalies and potential threats with greater accuracy, significantly reducing the risk of money laundering, identity theft, and other financial crimes. The system's ability to learn and adapt ensures it stays ahead of evolving fraudulent tactics, providing a higher level of security and compliance.

Seamless Integration with Digital Financial Platforms

Modern KYC solutions are designed to integrate seamlessly with various digital financial platforms, including telecom digital financial platforms and agency banking solutions. This integration enables a unified and efficient verification process, ensuring that customer data is consistently verified and updated across all services. Customers benefit from a cohesive experience, as their verification details are accessible and usable across multiple platforms, reducing the need for repeated checks and enhancing the convenience and speed of transactions.

Agility in Meeting Regulatory Compliance

Modern KYC systems are built to be highly adaptable, allowing financial institutions to quickly update their processes in response to evolving regulatory requirements. This agility ensures continuous compliance with KYC and AML norms, minimizing the risk of penalties and reputational damage. Automated compliance features help institutions stay ahead of regulatory changes by automatically adjusting verification processes and maintaining up-to-date records. This reduces the need for extensive manual updates and audits, ensuring that institutions remain compliant without significant operational disruptions.

Compatibility with Convergent Billing Platforms

Modern KYC solutions are compatible with convergent billing solutions, which unify billing processes across various services. This compatibility ensures efficient data consolidation and management, enhancing operational efficiency and regulatory compliance. Financial institutions can better track and manage customer data, ensuring comprehensive records and streamlined processes. Integration with convergent billing platforms allows for seamless customer verification and billing across multiple services, reducing administrative overhead and improving the accuracy of billing information.

Global Industries Redefining Identity Verification: eKYC and Mobile KYC

Both eKYC and Mobile KYC solutions offer innovative approaches to identity verification, catering to the evolving needs of businesses and customers alike. By harnessing the power of technology and addressing associated challenges, organizations can unlock new levels of efficiency, security, and accessibility in the verification process.

Unlocking Efficiency and Security: The Power of eKYC

Brief Overview of eKYC

Electronic Know Your Customer (eKYC) revolutionizes identity verification by digitizing the process, eliminating the need for physical documents or in-person visits. Leveraging cutting-edge technologies like biometrics and AI, eKYC streamlines onboarding, enhances security, and ensures compliance with regulatory requirements.

Process

Digital Data Collection: Users provide personal information through online channels.

Biometric Verification: Biometric data such as fingerprints or facial recognition is captured for identity authentication.

Document Authentication: Digital documents like passports or driver's licenses are scanned and authenticated electronically.

Automated Checks: Automated checks verify the accuracy of provided information and ensure compliance with regulatory standards.

Benefits

Efficiency: Streamlines the onboarding process, reducing time and effort for both customers and businesses.

Security: Enhances security with advanced biometric authentication and encryption methods.

Accuracy: Minimizes errors associated with manual data entry and document processing.

Compliance: Helps organizations meet regulatory requirements and mitigate risk.

Challenges

Privacy Concerns: Balancing data security with user privacy remains a challenge.

Technological Limitations: Integration with existing systems and compatibility issues may arise.

Regulatory Compliance: Adapting to evolving regulations and ensuring compliance can be complex.

Solutions

Advanced Encryption: Implement robust encryption protocols to protect sensitive data.

Continuous Monitoring: Utilize AI-driven fraud detection systems to identify and prevent fraudulent activities.

Regulatory Compliance Tools: Invest in compliance management software to ensure adherence to regulatory standards.

Enhancing Accessibility and Convenience: Mobile KYC Solutions

Brief Overview of Mobile KYC

Mobile KYC solutions empower organizations to verify identities remotely using mobile devices. By leveraging smartphone capabilities such as cameras and biometric sensors, Mobile KYC offers a convenient and accessible way to onboard customers, enhance security, and improve user experience.

Process

Mobile App Interaction: Users interact with a mobile application to provide personal information.

Biometric Authentication: Biometric data like fingerprints or facial features is captured for identity verification.

Document Capture: Users can scan and upload digital documents directly from their smartphones.

Real Time Verification: Verification processes are conducted in real time, enabling instant decision-making.

Benefits

Convenience: Enables remote verification, allowing users to onboard from anywhere, at any time.

Accessibility: Expands access to services for individuals without access to traditional verification methods.

Speed: Accelerates onboarding processes with real-time verification and instant decision-making.

User Experience: Enhances customer experience with intuitive and user-friendly mobile interfaces.

Challenges

Device Compatibility: Ensuring compatibility with various mobile devices and operating systems can be challenging.

Network Connectivity: The reliability of network connections can impact the speed and efficiency of verification processes.

Data Security: Safeguarding sensitive information on mobile devices requires robust security measures.

Solutions

Cross-Platform Development: Develop applications that are compatible with a wide range of devices and operating systems.

Offline Capabilities: Implement offline functionality to enable verification processes in areas with limited connectivity.

Data Encryption: Utilize encryption techniques to secure data stored and transmitted on mobile devices.

Unveiling Modern KYC Trends: Enhancing Efficiency and Security

With advancements in digital financial solutions, the industry is constantly evolving, presenting both challenges and opportunities. Forward-thinking banks that anticipate KYC changes and take proactive steps can position themselves for success. Here are four pivotal trends reshaping KYC efforts:

1. Embracing ESG in Compliance

The scope of KYC due diligence now extends to encompass environmental, social, and corporate governance (ESG) factors. Regulatory bodies like the FATF are increasingly scrutinizing ESG violations, reflecting the need to address issues such as illegal mining and human trafficking. Integrating ESG factors into KYC practices is essential for maintaining reputation and compliance.

Incorporate ESG considerations into KYC due diligence.

Adapt existing workflows to include ESG parameters.

Leverage data-driven processes to enhance reporting.

2. Harnessing AI and Machine Learning

Advancements in AI and machine learning offer banks powerful tools to bolster AML efforts. These technologies can analyze vast datasets swiftly, improving fraud detection and reducing false positives. However, effective implementation requires robust training, monitoring, and governance mechanisms.

Train AI models on high-quality data.

Establish procedures for monitoring AI performance.

Mitigate risks associated with AI biases and errors.

3. Turning KYC into a Profit Center

Transforming KYC from a cost center into a profit center is a strategic imperative for financial institutions. By enhancing customer lifecycle management, banks can streamline onboarding processes, reduce costs, and unlock revenue opportunities through targeted marketing and personalized offerings.

Offer superior KYC experiences to attract and retain customers.

Streamline processes to minimize costs and improve efficiency.

Leverage automated CLM to identify upsell and cross-sell opportunities.

4. Adopting a Holistic Approach to KYC

A holistic view of the customer enables banks to better assess risk, detect fraud, and capitalize on growth opportunities. Leveraging data fabric technology, organizations can orchestrate end-to-end KYC workflows seamlessly, ensuring compliance while maintaining agility in response to evolving regulatory landscapes.

Implement data fabric technology to streamline KYC workflows.

Ensure organizational agility to adapt to new regulations and risks.

Embrace a unified approach to KYC to enhance speed, security, and agility.

By embracing these trends, financial institutions can navigate the complexities of KYC compliance effectively, driving operational efficiency, and delivering superior customer experiences in the digital age.

Embracing the Future: Revolutionizing Compliance and Customer Experience with Modern KYC Capabilities

The significance of robust Know Your Customer (KYC) practices cannot be overstated. As financial institutions and telecom digital financial platforms strive to meet stringent regulatory requirements and foster customer trust, modern KYC capabilities have emerged as a game-changer. Traditional KYC processes, often cumbersome and inefficient, are undergoing a paradigm shift with the integration of digital financial solutions.

The advent of modern KYC capabilities, integrated with Aureus, Digital Financial Suite, is revolutionizing compliance and customer experience. By harnessing advanced technologies such as AI, machine learning, and blockchain, financial institutions can achieve greater accuracy, efficiency, and security in customer verification. These innovations streamline the onboarding process, reduce fraud, and elevate the overall customer experience.

Furthermore, modern KYC solutions are pivotal within the broader context of digital financial platforms, including agency banking solutions and convergent billing platforms. These integrated systems ensure a holistic approach to managing customer data, driving operational efficiency, and maintaining compliance. The transformation brought about by modern KYC represents a significant leap forward, positioning financial institutions to better serve their clients while adhering to evolving regulations.

The importance of KYC compliance remains paramount in the digital financial industry. Modern KYC capabilities not only enhance security and efficiency but also empower financial institutions to thrive in an increasingly digital world. By embracing these trends and leveraging innovative solutions, institutions can achieve operational excellence while delivering unparalleled value to their customers. 6D Technologies offers the best telecom digital financial platform that provides modern KYC capabilities. To learn more about this platform, please visit https://www.6dtechnologies.com/products-solutions/digital-financial-suite/

0 notes

Text

youtube

Yes, all Hell is about to break loose --- unless we arrest the criminals and keep our heads and hearts together.

Most recent statistics show that 40 million Americans can't pay their bills, but these statistics don't begin to reveal the actual state of affairs, because these statistics are tracking the impact of inflation on people on fixed incomes, people working minimum wage jobs, and people who were "low income, but making it" just a few months ago before the Fed began cranking up its hyperinflation machine.

Those are the "new" impoverished who are seeking help for the first time from food banks and churches and philanthropic NGOs and "government" programs.

This Fire Alarm does not count the long-term unemployed (substantially unemployed for three years or more), the alienated (such as those living on "Indian Reservations") and the generationally impoverished (like those living in Appalachia who have been poor for a hundred years or more).

If you look at real poverty in America, the number is more like one quarter of all Americans below the poverty line and struggling to survive. Right now.

There are also many other strange cracks appearing in the facade of the corporate "government".

Why, you may ask, is the DOD, that is, the Municipal United States Department of Defense paying for school lunches? (Hint: Occupying forces are required to provide food, water, and shelter to the civilian populace.)

Why are all these people being imported from South America, China, and the Middle East, and being injected with the mRNA poison as a condition of being here?

They stagger across the border, accrue a tremendous amount of "book value" by being redefined as "Americans" and within seven years, statistically, they will be dead.

All their purported American estates will be up for grabs -- at least that's what the Perps who are planning on profiting from all the death and misery are counting on, along with charging everyone here for all the medical care for the dead and dying, all the disabled and maimed.

Let the arrests begin.

Let the lawsuits against the Congress, Inc. begin, along with the lawsuits now possible against the vaccine producers who no longer have any cover from calling something that was never a "vaccine" by that name.

We'll vaccinate them all, right in the wallet.

And the lawyers and judges will help us do it, because their families have been decimated, too.

#blacklivesmatter#blackvotersmatters#donald trump#joe biden#naacp#blackmediamatters#blackvotersmatter#news#ados#youtube

0 notes

Text

The Attention Economy

“The old world is dying, and the new world struggles to be born; now is the time of monsters.”

This past decade (and even since the advent of Web 2.0 you could argue) has seen a plethora of horrendous macroeconomic insanity, all related in one way or another to telecommunications. It's no coincidence that the Crash of 2008 occurred at the same time with the release of the first iPhones.

What I think this is indicative of, is that we're living in a New World Order (no, no that one) where our socioeconomic means are intrinsically tied to social media and the Internet. We have effectively become cyborgs, symbiotic with the metal boxes in our pockets, one altogether.

The legacy establishment, such as big box Government, the stock market and the banking system, are aware of it but still haven't adapted to this Brave New World because they're a bunch of decrepit octogenarian old farts that couldn't save a document as PDF to save their lives. Socioeconomic phenomena such as the Trump presidency, the GameStop (meme stock) sways, cryptocurrency and the Coronavirus lockdowns can all be attributed to Information technology.

Sometimes this puts people in very dark spots because they become prey to strange games of complexes, fears and scapegoating (that's why conspiracy theory, such as the Pizzagate 'War against the paedophile elites' abounds in 4chan of all places by the way: if Bill Gates was found to be a paedophile, he'd effectively be the perfect scapegoat), other times things go "We did it Reddit" and John Cena shows up to care for a dying child and everyone gets puppies and hugs and we all laugh and the screen fades to black and we're in a Satmon cartoon.

And again, what else would you expect when everyone has a black box, ultrafast, always-on, always online pornoedipal supercomputer Schizophrenia machine in their pockets where the Ghost in the Machine algorithms dictate and sway people's opinions? One doesn't need to decide what to think, what to like, what to do or what to believe anymore, because it's all fed to one through hyper-saccharine brainrot 5 second videos on TikTonk.

Other phenomena such as the advent of remote-first work, digital nomadism, crowdfunding, crowdsourcing, open-sourcing and live-streaming are also indicators of the fact that a Sea Change is not coming, but rather it’s already happened long, long ago, and the economy hasn’t caught up to it yet (we're still living in the dead, rotten husk of it). Turns out that if you become a streamer and the planets align and you catch enough people's teary-eyed, dehydrated (remember to go drink some water right now) eyes, that's effectively a replacement for a full time job nowadays.

That apparently, the economy is now based on how many people you can get to notice you (and the ad revenue underneath it).

The thing is that effectively this forces us to reconsider what our standards for living should actually be. Gone are the days of the 9 to 5 where you had to commute to an office to make a living because you can effectively work remotely --but alas, some Gen X asshole with an inflamed prostate will call you lazy if you dare challenge his Commercial Real Estate investments and propose to work remote-first.

Maybe this also forces us to reconsider what the damn economy actually is, if four years ago a minority of people were branded as "essential workers" and made to work the shit jobs while everyone else stayed indoors to collect stimmy checks (thanks for the inflation btw). Notice how all of that happened and the world not only didn't end, but shot some stock tickers into the stratosphere. Maybe it's all pies in the sky. Maybe the Fed prints 1 Trillion dollars every 100 days to finance stupid bomb runs that we're not even supposed to care about, and money is basically a collective hallucination.

No Gold Standard, just vibes.

But lo, here come the radical assholes, happy to brandish their cries of "this is all because of CAPITALISM", and well, yes, it is because of capitalism but maybe learn a skill and do some cool shit first and get yourself a clean shirt and clean your room bucko and remove those nasty tattoos and hair dye from yourself first before you dare rework the whole status quo, dummy. Cue r/antiwork, a community that I don't support but that I think has some validity to their claims, that effectively a vast amount of work is not actually necessary and is just work for the sake of work, completely performative, a mechanism to keep the hamster wheels of an economy that's based upon rampant, cold consumerism running.

Maybe it's all so fake and stupid and it makes me feel bad. The Jobs are fake, the Money is fake, and the Economy is fake.

But fuck you if your alternative comes from a fucking College professor that's basically repackaging Maoist China.

To conclude, I insist that we are kind of the in-between at the moment and something's got to give. This cannot go on much longer, and a deep, new zeitgeist rethinking of what work, life and the economy are will happen very, very soon. but in the interim, retain your zen, and remember to bring something for the potluck. There's quarter-donuts and dairy free milk in the break room so you can use the new Nespresso. Happy Friday!

1 note

·

View note

Text

So that’s a lie. India and Taiwan banned it because of political tensions. Indonesia, Somalia, and Pakistan because of indecency. Nebulous “security concerns” are why it’s banned on Anglo and European government phones but transparently because NATO is anticommunist. Facebook and Twitter should easily elicit the same concerns but the US is the neoliberal capital of the world. The United States is joining the Taliban in banning TikTok because of “misinformation” and we know it’s about Palestine because this bill finally saw bipartisan movement because Joe Biden is suffering from One Issue in Particular among the one demographic who doesn’t get their news primarily from pro-Israel mainstream media, the same media who uncritically spread the Bush administration’s lies to put us in the Iraq War. But of course the media positioned itself as the Fourth Estate defending democracy and truth in the Trump presidency so—to someone who uncritically believes that—you sound like a fascist for being critical of a corporate propaganda machine whose problem with Trump was being rude to them for neutrally describing what he did.

So TikTok is getting banned in the US because its users are able to see the “Israel-Hamas War” for what it really is, a genocide,

WHILE

American mainstream media can uncritically repeat the most vile propaganda directly from the IDF, like the fake “intel” derived from torture that led to the defunding of the UNRWA.

I am once again reminded that the repugnant ethnoreligiously motivated mass detention of Uyghurs which the US was quick to identify as a genocide is several orders of magnitude less fatal (if fatal at all beyond lowering birth rate) than the ethnoreligiously motived genocide of Palestinians by Israel or the civilian death toll of the American wars in Iraq and Afghanistan.

It’s not even a double standard. It’s whatever reality is most convenient to fabricate for their interests.

4K notes

·

View notes

Text

Eco-Upgrade Your London Rental: Green Living Tips

In the heart of London's vibrant rental market, landlords have a unique opportunity to provide comfortable rental property Balham and contribute to a greener future. With growing environmental awareness, renters are increasingly looking for eco-friendly rental properties. Adopting energy-efficient appliances and sustainable improvements can reduce your property's carbon footprint and attract environmentally conscious renters. Let's explore how you can make your rental property eco-friendly in bustling London.

1. Start with an Energy Audit

Start your journey to an energy-efficient rental property with an energy audit. This assessment will help identify areas where your property could be more environmentally friendly. A professional energy audit can identify insulation issues, drafts, and equipment upgrade opportunities, providing a roadmap for improvement.

2. Choose Energy Star Appliances

When it comes to home appliances, choose those with the Energy Star label. These devices meet strict energy efficiency guidelines set by the government, helping to reduce energy consumption and utility costs. Upgrading to Energy Star-rated refrigerators, washing machines, and dishwashers can significantly impact your property's eco-footprint.

3. Invest in LED Lighting

Replace traditional incandescent light bulbs with energy-saving LED lights. LED bulbs use less energy and last longer, reducing the need for frequent replacement. This simple swap can lower your and your tenant's electricity bills while reducing overall energy consumption.

4. Seal and Insulate

Good insulation and sealing of windows and doors is essential to save energy. Make sure your homes management Balham property is well-insulated to maintain a comfortable temperature year-round. Consider using weatherstripping and caulking to seal gaps that allow heat to escape in the winter and cool air in the summer.

5. Smart Thermostats

Install a smart or programmable thermostat in your rental property. These devices allow leasing management London to control their heating and cooling systems more effectively, reducing energy waste. Smart thermostats can also be programmed to adjust temperature based on occupancy, maximising comfort and savings.

6. Low-Flow Fixtures

Replace standard faucets and showerheads with low-flow fixtures. These devices reduce water consumption without affecting water pressure, helping tenants conserve water and reduce utility bills. Also, remember to repair any leaks quickly to avoid wasting water real estate management Tooting.

7. Solar Panels

Consider installing solar panels on the roof if your estate management London property allows it. Solar energy can help offset electricity costs and reduce your home's carbon footprint. In some cases, you can even generate excess energy to sell back to the grid.

8. Green Landscaping

Enhance the look of your commercial property management Balham with eco-friendly landscaping. Planting native species, using mulch to retain soil moisture, and installing rain barrels for outdoor water use can contribute to a greener landscape. Additionally, maintaining green spaces with a manual or electric lawn mower reduces emissions compared to gasoline alternatives.

9. Recycling Facilities

Provide recycling facilities on your premises to encourage tenant management London to recycle effectively. Make sure recycling bins are easily accessible and clearly labelled. Educate tenants about local recycling guidelines and the benefits of recycling to promote responsible waste management.

10. Incentivize Eco-Friendly Practices

Consider offering incentives to tenants who adopt environmentally friendly practices. This may include rent reductions for energy-saving behaviours, such as lowering thermostat settings or using energy-efficient appliances. Rewards can encourage renters to pay more attention to their energy usage.

11. Communicate Your Green Efforts

Remember to communicate your property's eco-friendly features to potential rental management services Balham. Highlight energy-efficient appliances, sustainable improvements, and eco-friendly landscaping in your real estate listings and in showings. Environmentally conscious renters will be more likely to choose your property if they know you are committed to sustainability.

In London's competitive rental market, making your rental management Balham eco-friendly benefits the environment and attracts tenants who value sustainability. Investing in energy-efficient appliances, making sustainable improvements, and promoting environmentally friendly practices can reduce your property's carbon footprint while also providing zero Living space, which is more attractive and cost-effective. Adopt these eco-friendly measures, and you'll contribute to a greener London and improve the appeal and value of your rental property.

0 notes

Text

Introduction to Investment in Financial Market

Investment

The meaning of word investment is to commit money in order to earn a financial return or to make use of the money for future benefits or advantages. People commit money to investments with an expectation to increase their future wealth by investing money to spend in future years. Investment benefits both the economy and the society. It is an outgrowth of economic development and the maturation of modern capitalism.

Economic Investment: Economic investment includes net additions to the capital stock of the society for production of other goods, such as increase in residential or commercial buildings, machines and plants, inventories etc.

General Investment: General investment to a common man means buying a new house or flat or a new car or motorcycle or investment in banks or post offices in other deposits scheme or investment in shares, bonds of the companies. Such investments are very general in nature and most of such investments are without any rate of return or capital growth.

Financial Investment: It means and exchange of financial claims such as securities, real estate mortgages etc. but does not include consumer items investment.

How Do We Invest?

Investor manage their wealth effectively, obtaining the most from it while protecting it from inflation or taxes and other factors. Some people may wish to improve the return from their savings account funds by investing in alternatives.

Safety: - It is the foremost criteria for investment decision of anyone. It is the probability of getting back the money invested. Government securities, treasury bills and commercial papers are considered the safest instrument among all.

Liquidity: - The liquidity of an instrument refers to the ability of the investor to convert it into cash on short notice without incurring any loss. An instrument will give definite written if it is held till maturity but risk of loss is high if sold prematurely.

Return or Yield:- The age of an instrument is the return earned from it by way of interest dividend and capital appreciation. Some instrument does not pay interest but are redeemed at face value.

Maturity Period: - It is the life in instruments. While some instruments have a fixed original maturity is other can have tailor-made maturity like Certificate Of Deposit, Commercial Paper, Gilt-Edged security. Normally the longer the maturity the greater the return.

One of the best way to start studying the stock market to Join India's best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari sir. The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

Investment Activity

Types Of Investors

Mode of Investments

Securities for of investment

1. (a) Corporate Bonds/Debentures:

A bond is a debt obligation. A corporate bond is debt issued by a company in order for it to raise capital. Investors who buy corporate bonds are lending money to the company issuing the bond. In return, the company makes a legal commitment to pay interest on the principal and, in most cases, to return the principal when the bond comes due, or matures.

(b) Convertible Bonds: A convertible bond is a fixed-income corporate debt security that yields interest payments, but can be converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock can be done at certain times during the bond's life and is usually at the discretion of the bondholder.

(c) Non-Convertible Bonds: Non-convertible bonds or debentures are a type of debenture that cannot be converted into equity shares or stocks, hence called non-convertible. The interest rate on non-convertible debentures can be paid either monthly, quarterly, or annually. NCDs also have a fixed maturity date.

2. Public Sector Bonds:

Like central and state governments, even public sector units (PSUs) can raise funds from the general public by issuing bonds known as Public Sector Bonds. These bonds are mostly issued by top public sector companies or institutions to fund their growth and expansion needs. They are relatively less risky than corporate bonds.

(a) Taxable: A taxable bond is a debt security (i.e., a bond) whose return to the investor is subject to taxes at the local, state, or federal level, or some combination thereof. An investor trying to decide whether to invest in a taxable bond or tax-exempt bond should consider what they will have left in income after taxes are taken. Taxable bonds are those bonds where we will invest in that bond and will be taxed in return, meaning the government will also collect tax on its income from us, returns are always high in such bonds.

(b) Tax Free: Tax-free bonds are issued by public sector companies with an aim to raise funds for specific projects. Tax-Free Bonds are one of the most sought-after bonds in India. And rightly so. Tax-free bonds help investors earn tax free interest income unlike ordinary bonds and fixed deposit. tax-free bonds are issued by the government, they are extremely safe and carry zero default risk. Apart from the zero risk, the biggest advantage of tax-free bonds is that they provide tax-free income. The interest you earn from tax-free bonds is exempt from tax under section 10 of the Income Tax Act, 1961. for the returns received from tax free bonds, the government says that you are exempted from income tax. But these are tax adjusted returns, we have to understand that these are tax adjusted returns, that means they will always give less returns than taxable bonds, that means the government has already adjusted its tax. That's why the government is calling it tax free. So let us not invest by being happy that it is tax free.

Let us assume that it is taxable there, now every person can have his own capacity and invest in it according to his own accord, like, if a person is 30 % tax slab, and he is buying a taxable bond, then it is more beneficial for him, rather than he should buy tax free bond. Taking, if a person is in the tax slab of 5%, he is buying a taxable bond then it will be more beneficial for him rather than he buys a tax-free bond. In taxable he will get more return, in tax free he will get less return. Got more return and here he is already in 5% tax slab so he doesn't have to pay tax, maybe his tax is already adjusted, so he bought taxable bond, got high return also, and he doesn't have to pay tax here So it became beneficial for him here. But, if the same person is in the tax slab of 5% - 10%, and he buys tax free bonds, then it can be said that it is his ignorance, because he is buying tax free, he has got his tax adjusted, The government has adjusted the average tax of 10%-12%, if it is not in the slab of this percentage, then it can be harmful for him. If someone is in the 30% slab, and he buys taxable bonds, then it can be beneficial for him. Why can it be beneficial? Because he has got the tax adjusted, and now he does not have to pay tax on the income earned from it.

Preference Shares: Preference shares, more commonly referred to preferred stocks, are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

Preference Shares: - Preference Shares Whenever any company is listed, before that if we invest in that particular company, then such shares are called Preference Shares. Means before listing means, now there is a company, it is seen that this company is very good, we have invested money in that company, we have not become the owner of that company, but we definitely have preference shares of that company. Yes, when that company will grow, then as it grows, my money will also keep increasing according to those shares. Once the company is going to be listed, during that time that company will ask us that the company is going to be listed, do you want to withdraw your money, or do you want to continue as a promoter in our company. Because now public money is going to come in that company, till now the company did not have public money. Till now the company had received some specific money.

Equity Shares: An equity share, normally known as ordinary share is a part ownership where each member is a fractional owner and initiates the maximum entrepreneurial liability related to a trading concern. These types of shareholders in any organization possess the right to vote.

New Shares: A share that is available for the first time buy.