#Best Stock Trading App Development

Explore tagged Tumblr posts

Text

Best Stock Trading App Development Company

Looking for a reliable stock trading app development company? We specialize in building secure, scalable, and user-friendly trading apps tailored to your business needs. Contact us today!

#Best Stock Trading App Development Company#Best Stock Trading App Development#Stock Trading App Development Company#Stock Trading

0 notes

Text

Buy Cash App account with 15% discount now. Get the most out of your money. We offer the best service and most trustworthy platform for buying, selling, or trading Cash App at a cheap price.

We provide Cash App account with high quality and cheap price. Buy now Cash App account!

What Is Cash App?

Buy Verified Cash App Account. Cash App is a mobile payment service developed by Block, Inc. (formerly Square, Inc.) that allows users to send, receive, and store money. It functions as a peer-to-peer (P2P) payment platform, similar to services like Venmo or PayPal, and is available for both iOS and Android devices. Users can instantly transfer money to others using their Cash App account. A free debit card linked to the Cash App account that allows users to spend their balance at stores or online.

Cash App supports direct deposits and allows users to receive their paychecks directly into the app. Users can buy and sell stocks or invest in Bitcoin through the app. Offers discounts when using the Cash Card at specific merchants. Users can withdraw their balance to their bank account or at ATMs using the Cash Card. Cash App is widely used for personal transactions, like splitting bills, paying rent, or transferring money between friends and family.

What Is Bеnеfits of Vеrifiеd Cash App Accounts?

Verified Cash app accounts offer various benefits, making transactions and usage more secure and convenient. Some of the key benefits include:

Higher Transaction Limits: Verified Cash App accounts can send and receive larger amounts of money compared to unverified accounts. This is especially useful for businesses or individuals who regularly handle large sums of money.

Increased Security: Verifying your identity adds an extra layer of security to your account, helping to protect against fraud and unauthorized access.

Direct Deposit: With a verified account, you can enable features like direct deposit for paychecks, tax refunds and other payments.

Cash Card: A verified Cash App account allows you to order and use a Cash App debit card (Cash Card), which can be used for in-store and online purchases.

Bitcoin & Stock Trading: Verified Cash App users can access additional features like buying, selling, and withdrawing Bitcoin, as well as investing in stocks directly through the app.

Customizable Features: You can customize your $Cashtag and use more personalized features, such as getting detailed transaction history, which is useful for budgeting and tracking spending.

Increased trust: A verified account gives more credibility, especially when using the app for business transactions. This ensures that your identity is confirmed, so that people are more willing to do business with you.

Tax Reporting: A verified account makes it easier to track transactions for tax purposes, as Cash App provides documentation of your financial activities.

Tax Reporting: A verified Cash App account makes it easy to track transactions for tax purposes, as the Cash app provides documentation of your financial activity.

These benefits make verified accounts much more functional and trustworthy for both personal and business use.

Why do people use Cash App?

People use Cash App for a variety of reasons, including:

Convenient Money Transfers: The Cash App allows users to quickly and easily send and receive money between friends, family or other contacts without the need for cash or checks.

Ease of use: The app has a simple, user-friendly interface, making it easy for people who may not be tech-savvy to manage payments. Peer-to-Peer Payments: This is commonly used to splitting bills, pay for group activities, or reimbursing others.

Direct Deposits: Users can receive their paycheck directly into their Cash App account, sometimes getting paid earlier than traditional banking methods.

Cash Card: The Cash App offers a physical debit card (cash card) that users can use to make purchases in stores or online or to withdraw cash from ATMs.

Bitcoin and Stocks: Cash App account enables users to buy and sell Bitcoin, as well as invest in stocks, making it attractive to those interested in small-scale investing.

Security: The Cash app provides security features like passcodes and notifications, giving users confidence in their transactions.

Discounts and Boosts: The app offers “Boosts” that give users discounts at select stores and restaurants when using the Cash Card, providing extra savings.

Cash App’s combination of functionality, security, and ease of use makes it popular for everyday financial transactions and investments.

24 Hours Reply/Contact Telegram: @smmvirals24 WhatsApp: +6011-63738310 Skype: smmvirals Email: [email protected]

2 notes

·

View notes

Text

Passive Income Paradise How to Make Money Easily from Anywhere in the World

Welcome to the gateway of financial liberation — welcome to “Passive Income Paradise: How to Make Money Easily from Anywhere in the World.” In an era where autonomy and flexibility reign supreme, the pursuit of passive income has become a journey towards unrestricted financial prosperity. This blog delves into the multifaceted realm of passive income, offering you insights into diverse avenues that enable earnings without the shackles of constant effort. Join us as we explore traditional investments, online ventures, real estate, and intellectual property, guiding you on a path to financial freedom that transcends geographical boundaries. Embrace the art of making money effortlessly, and let’s start on a journey to the paradise of passive income together.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Types of Passive Income

Passive income refers to earnings derived from a business, investment, or other sources with little to no effort on the part of the recipient. While it often requires upfront work or investment, the goal is to generate income with minimal ongoing effort.

Here are some common types of passive income:

Dividend Stocks: Investing in stocks that pay regular dividends allows you to earn a portion of the company’s profits.

Rental Income: Owning real estate and renting out properties can provide a steady stream of passive income.

Real Estate Crowdfunding: Participating in crowdfunding platforms allows you to invest in real estate projects and receive a share of the profits.

Peer-to-Peer Lending: Platforms that facilitate peer-to-peer lending allow you to lend money to individuals or small businesses in exchange for interest payments.

Create and Sell Intellectual Property: This could include writing books, creating music, designing software, or developing other forms of intellectual property that can be sold or licensed.

Create an Online Course or e-Book: Sharing your expertise on a particular subject through an online course or e-book can generate passive income.

Affiliate Marketing: Promoting other people’s products and earning a commission for each sale made through your unique affiliate link.

Automated Online Businesses: Building and automating online businesses, such as dropshipping or affiliate marketing websites, can generate passive income.

Royalties from Intellectual Property: If you own patents, trademarks, or copyrights, you can earn royalties from others using or licensing your intellectual property.

Stock Photography: If you are a photographer, selling your photos to stock photography websites can provide ongoing royalties.

Create and Monetize a Blog or YouTube Channel: Building a blog or YouTube channel and monetizing it through ads, sponsorships, or affiliate marketing can generate passive income.

Dividend-Generating Funds: Investing in mutual funds or exchange-traded funds (ETFs) that focus on dividend-paying stocks.

Automated Investing Apps: Robo-advisors and automated investment platforms can help you invest in a diversified portfolio with minimal effort.

License Your Art or Designs: If you’re an artist or designer, licensing your work for use in various products can generate passive income.

Create a Mobile App: Developing a useful or entertaining mobile app and earning money through ads or in-app purchases.

The Pros and Cons of Passive Income

Venturing into the world of passive income brings both promises and challenges. Enjoy financial freedom, flexibility, and diversification, but be prepared for the initial effort required and potential market volatility. Navigate the landscape wisely to unlock the true potential of passive income.

A. Advantages

Financial Freedom: Attain the freedom to live life on your terms.

Flexibility: Enjoy a flexible lifestyle with more time for personal pursuits.

Diversification: Spread your income sources, reducing dependency on a single channel.

B. Challenges

Initial Effort: Many passive income streams require substantial effort upfront.

Market Volatility: External factors may impact income, especially in investments and online ventures.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Getting Started with Passive Income

The route to passive income begins with self-reflection. Determine your hobbies, investigate prospective revenue sources, and develop a strategic strategy. This first step is critical for building the groundwork for future financial success by aligning with your abilities.

Traditional Investments

Traditional investments offer a stable route to passive income. Dive into the dynamic world of the stock market, bonds, and mutual funds. Learn the art of strategic investment to secure steady returns and create a robust financial foundation for the future.

Online Ventures

Online ventures offer a dynamic path to passive income. Engage in affiliate marketing, promoting products for commission. Transform passions into profit with blogging, leveraging ads and sponsorships. Explore YouTube for ad revenue and e-commerce for a digital storefront that generates income while you sleep.

Start your journey of online entrepreneurship.

Affiliate Marketing: Identify products that resonate with your audience. Build a dedicated following for sustainable earnings.

Blogging: Choose a niche you’re passionate about. Monetize through various channels, gradually turning your blog into a passive income powerhouse.

YouTube: Craft engaging content, optimize for search engines, and let ad revenue and sponsorships contribute to your passive income.

E-commerce: Select the right platform, products, and marketing strategies. Build a brand that continues to generate income with minimal oversight.

Real Estate

If you want a safe way to make money while you sleep, get into real estate. If you want to make a steady income from rentals, you should buy rental homes. Check out real estate crowdfunding. When people pool their money and time to work on bigger projects, you can get a piece of the income without having to do any work yourself.

Explore the realm of bricks and mortar for long-term, reliable passive income.

Rental Properties: Invest in properties that attract tenants. Enjoy a steady rental income.

Real Estate Crowdfunding: Pool resources with others to invest in larger real estate projects, sharing the profits.

Intellectual Property

Unlock the potential of intellectual property as a passive income source. Write and publish, earning royalties from books and articles. Create online courses to share expertise globally. License innovative ideas, turning creativity into a continuous stream of income in the dynamic world of intellectual property.

Monetize your creativity and knowledge.

Writing and Publishing: Write books or articles and earn royalties. Leverage digital platforms for wider reach.

Creating Online Courses: Share your expertise through online courses, reaching a global audience.

Licensing Ideas: Turn your innovative ideas into passive income by licensing them to businesses.

Overcoming Challenges

Journey through the inevitable challenges of passive income. Embrace failures as invaluable lessons, adapting and growing stronger. Navigate market changes by staying vigilant and flexible. Overcoming these hurdles is integral to carving a resilient path to financial freedom through passive income.

Acknowledge and overcome the hurdles in your passive income journey.

Learning from Failures: Treat setbacks as learning experiences. Adapt and grow from your failures.

Adapting to Market Changes: Stay vigilant and adapt your strategies to navigate through market fluctuations.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Scaling Up Your Passive Income

Improve your passive income game by intelligently scaling up. Profits should be reinvested properly, compounding earnings for exponential development. Automate procedures to lessen your hands-on engagement, enabling your revenue to grow with less work. Investigate new enterprises to diversify and improve your financial situation.

Move beyond the basics and elevate your passive income game.

Reinvesting Profits: Compound your earnings by reinvesting in your existing ventures or exploring new ones.

Automating Processes: Streamline operations to minimize hands-on involvement, allowing your income to grow with reduced effort.

Exploring New Ventures: Stay dynamic by exploring new opportunities and expanding your passive income portfolio.

Case Studies

Set off on an inspirational adventure via real-life case studies. Dive into success stories to learn about the techniques and tactics people used to attain financial independence via different passive income sources. Take away key lessons from these situations to help you on your journey to success.

Learn from those who have successfully mastered the art of passive income.

Success Stories: Explore real-life examples of individuals who have achieved financial freedom through passive income.

Lessons Learned: Understand the challenges faced by others and gain insights into overcoming obstacles.

The Future of Passive Income

Peering into the future of passive income unveils exciting possibilities. Stay ahead by embracing emerging trends and leveraging technological influences. Constantly adapt and innovate to navigate the evolving landscape, ensuring sustained success in the dynamic realm of passive income.

Stay ahead of the curve by anticipating future trends.

Emerging Trends: Stay informed about new opportunities and technological advancements in the passive income landscape.

Technological Influences: Embrace technology to enhance and diversify your passive income streams.

Conclusion

As we conclude our exploration of Passive Income Paradise, reflect on the diverse avenues unveiled. Align your passions with profitable ventures, overcome challenges, and witness the evolution of your financial strategies. This journey isn’t just about earning; it’s about creating a lifestyle that affords freedom and fulfillment. Stay committed, learn from experiences, and watch your passive income flourish, providing the key to unlocking financial independence and making money easily from anywhere in the world. The possibilities are limitless, and your path to prosperity begins now.

FAQs

Q1. How much initial investment is needed for passive income?

The initial investment varies based on the chosen income stream. Some require minimal investment, while others may demand a more significant upfront commitment.

Q2. Can passive income replace a full-time job?

In many cases, yes. However, the transition depends on your financial goals, chosen income streams, and the effort you invest initially.

Q3. What are common mistakes to avoid in passive income ventures?

Avoid the mistake of expecting instant results. Patience is key. Additionally, thorough research and ongoing learning are crucial to success.

Q4. Is passive income suitable for everyone?

While passive income is a viable option for many, it’s essential to assess your skills, interests, and commitment level before diving in.

Q5. How long does it take to see significant returns from passive income?

The timeline varies, but it’s common for significant returns to take time. Be prepared for an initial period of effort and learning before experiencing substantial results.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Passive Income Paradise How to Make Money Easily from Anywhere in the World

Thanks for reading my article on “Passive Income Paradise How to Make Money Easily from Anywhere in the World“, hope it will help!

#FinancialFreedom#OnlineBusiness#LocationIndependent#EarnAnywhere#DigitalNomadLife#FinancialIndependence#SmartInvesting#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney#makemoneyonlineguide#freelancingtraining

3 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

https://rupeeseed.com/mobirupee/

Best Stock Trading App Development Solutions - Rupeeseed

Rupeeseed is one of the best software development company that offers custom stock trading app development solutions. We have a team of experienced developers who can create trading apps with advanced features. For more details please enquiry on our website.

2 notes

·

View notes

Text

Sure tips,

Sure tips,

Sure tips are often sought after by individuals looking to increase their chances of success in various endeavors, from sports betting to gaming and investments. While no tip can guarantee success 100% of the time, there are certain approaches, strategies, and methods that can help improve your odds. Here’s a breakdown of sure tips across different fields:

1. Sports Betting:

Sports betting is one of the most popular areas where people search for tips. However, it's important to remember that, while tips can increase your chances, they don't eliminate risk.

Key Sure Tips for Sports Betting:

Research is Crucial: Always stay updated on teams' form, player injuries, team tactics, and head-to-head records. A well-informed bet is a smarter bet.

Betting Value, Not Just Outcomes: Look for betting odds that offer value. It’s not always about picking the winner but finding where the odds are higher than they should be based on your analysis.

Stick to a Budget: Never bet more than you can afford to lose. Create a bankroll and manage it wisely. Betting should be fun, not a financial burden.

Diversify Your Bets: Instead of placing all your money on one bet, try diversifying to reduce risk. Consider various betting types like accumulators, in-play, and spread betting.

2. Gaming:

Whether you're into online games or mobile apps, tips in gaming help you advance faster and enhance your performance.

Sure Tips for Gaming:

Practice Regularly: Success in gaming often comes down to skill development. The more you practice, the better your chances of winning.

Study the Game: Learn about the game mechanics, strategies, and meta. Whether it's understanding the best character abilities or the most effective strategies, knowledge gives you an edge.

Stay Calm Under Pressure: Many gamers lose because they panic in difficult situations. Keeping a level head during intense moments can make a huge difference in your gameplay.

3. Investment & Trading:

In the world of investments and trading, the goal is to make money by predicting market movements. Sure tips in this field come from the combination of research, patience, and strategy.

Sure Tips for Investment:

Research Before Investing: Don't just follow the crowd; understand the assets you're investing in, whether it's stocks, bonds, or cryptocurrencies.

Diversify Your Portfolio: By spreading your investments across various sectors, you reduce the risk of a total loss. A balanced portfolio is key to long-term success.

Invest for the Long Term: Short-term market fluctuations can be unpredictable, but long-term investments typically yield better returns.

4. General Advice for Success:

In any field, certain universal principles increase your chances of success.

Consistency is Key: Regular effort leads to better results. Whether it’s betting, gaming, or investing, consistent actions based on thoughtful strategies win in the long run.

Learn from Mistakes: Every loss or failure is a learning opportunity. Reflect on what went wrong and improve your strategy for next time.

Stay Disciplined: In areas like betting or trading, discipline can prevent emotional decision-making, which is often a cause of failure. Stick to your strategy.

Final Thoughts:

While there is no such thing as a guaranteed win, sure tips help reduce uncertainty and increase your chances of success. The most important thing is to enjoy the process, learn continuously, and make informed decisions. Whether you're betting, gaming, or investing, combining research, strategy, and discipline is your best path to success.

Would you like tips for a specific area, such as sports betting or gaming?

4o mini

O

Search

Reason

0 notes

Text

Top FinTech App Trends You Can’t Ignore

If you’re considering diving into the world of financial technology, now is the time. The FinTech industry is booming, offering endless opportunities for innovation, convenience, and financial empowerment. Whether you're an entrepreneur, an investor, or a developer, there's a wealth of untapped fintech ideas waiting to be explored.

From digital banking and personal finance management to crypto trading and RegTech, the possibilities are vast. This article highlights some of the best FinTech app ideas that can redefine financial services while providing lucrative opportunities for startups.

1. Digital-Only Banking Apps

Traditional banking is fading fast. Today’s users expect seamless, 24/7 access to their finances without visiting a physical branch. Digital banks provide a mobile-first experience with features like:

Instant money transfers

Bill payments

Budgeting tools

AI-powered financial insights

Fraud alerts and security measures

Market Insight: The global digital banking market was valued at $20.8 billion in 2021 and is expected to grow at a 20.5% CAGR through 2030.

If you're considering launching a digital banking app, working with an experienced mobile app service provider can help ensure a smooth, scalable, and compliant development process.

2. Peer-to-Peer (P2P) Payment Apps

P2P payment apps like Venmo, Zelle, and Cash App have made transferring money easier than ever. These apps remove the need for cash or checks, offering:

Quick money transfers between individuals

Bill-splitting features

Payment request options

Integration with digital wallets and bank accounts

Market Insight: The P2P payment market was valued at $2.21 trillion in 2022 and is projected to hit $11.62 trillion by 2032.

Startups looking to disrupt this space should consider iOS and Android app development solutions that emphasize security, speed, and user-friendliness.

3. AI-Powered Personal Finance Management Apps

Consumers today seek better control over their spending habits. AI-driven personal finance apps help users:

Track expenses and categorize spending

Set financial goals and receive AI-driven advice

Automate bill payments and savings

Connect all financial accounts for a unified dashboard

Market Insight: The personal finance apps market was worth $101 billion in 2023 and is expected to reach $450.8 billion by 2030.

For businesses looking to enter this market, developing custom fintech software solutions can give users the advanced features they expect.

4. Robo-Advisory & Investment Apps

Investing is no longer limited to Wall Street professionals. With robo-advisors, anyone can access automated financial planning. Features include:

AI-powered investment strategies

Low-cost portfolio management

Stock and ETF trading

Fractional share investing

Market Insight: The robo-advisor market is expected to surpass 3.270 million users by 2028.

Building a robo-advisory app requires strong AI and machine learning integration, which can be achieved by hiring a mobile app developer with expertise in financial automation.

5. Cryptocurrency & Blockchain Apps

The rise of decentralized finance (DeFi) and blockchain-based apps has opened up new opportunities in the FinTech space. Features of a strong crypto app include:

Secure crypto trading

Digital wallets for multiple cryptocurrencies

AI-powered risk analysis

Smart contract integration

Market Insight: The crypto exchange market is projected to grow exponentially, fueled by rising adoption rates of blockchain technology.

For security and regulatory compliance, partnering with a team that specializes in blockchain-based custom fintech software solutions is essential.

6. InsurTech (Insurance Technology) Apps

Insurance apps simplify policy management and claims processing. Features include:

AI-driven policy recommendations

Instant claims approval

Risk analysis and fraud detection

Pay-as-you-go insurance options

Market Insight: The global InsurTech market was valued at $5.45 billion in 2022 and is expected to grow at a 52.7% CAGR through 2030.

With iOS and Android app development solutions, startups can offer seamless insurance experiences that appeal to tech-savvy consumers.

7. RegTech Apps for Compliance & Fraud Detection

With increasing regulatory requirements, financial institutions need RegTech solutions to stay compliant. These apps can:

Automate compliance reporting

Monitor transactions for suspicious activity

Verify customer identity (KYC/AML)

Detect fraud using AI and big data analytics

Market Insight: The RegTech industry is projected to reach $44.5 million by 2030 as demand for financial security grows.

For startups, this is one of the most untapped fintech ideas, with significant potential for expansion.

8. Micro-Investing & Fractional Ownership Apps

Investing in real estate, stocks, and collectibles is now accessible to everyone with micro-investing platforms. Features include:

Buy shares in fractional amounts

Automated round-up investing

Low or zero commission trading

Education and investment tracking tools

Market Insight: The stock trading app market generated $22 billion in revenue in 2021 and continues to expand.

To build fintech software solutions that stand out, integrating AI-driven insights and gamification can boost user engagement.

9. Subscription & Bill Management Apps

With multiple subscription services today, managing payments can be overwhelming. These apps help users:

Track and manage recurring subscriptions

Set reminders for bill payments

Identify and cancel unwanted subscriptions

Integrate with digital wallets for automatic payments

Market Insight: The subscription economy is growing, with the bill-splitting app market expected to reach $993.02 million by 2031.

For startups entering this space, partnering with a mobile app development service provider ensures a user-friendly and feature-rich app.

10. Sustainable & Ethical Investment Apps

With growing interest in ESG (Environmental, Social, and Governance) investing, apps that guide users toward sustainable financial decisions are in demand. Features include:

Investment in eco-friendly stocks and bonds

ESG risk analysis and reports

Carbon footprint tracking

AI-driven recommendations for ethical investing

Market Insight: The sustainable investment market is expected to grow significantly, driven by conscious consumerism.

By offering custom fintech software solutions focused on ethical investing, startups can differentiate themselves in the crowded financial market.

Final Thoughts

The FinTech industry presents endless opportunities for innovation and disruption. Whether you're planning to launch a digital bank, investment platform, InsurTech app, or a compliance-focused RegTech solution, success depends on:

User-centric design: Prioritize ease of use and security.

Regulatory compliance: Ensure adherence to financial regulations.

Scalable technology: Use iOS and Android app development solutions to expand your market reach.

If you’re ready to enter the FinTech space, now is the time to act. Hire a mobile app developer with expertise in building fintech software solutions and take your idea from concept to reality.

#hire developers#hire app developer#mobile app development#hire mobile app developers#ios app development#android app development#fintech app development company#fintech#finance

0 notes

Text

Are You Searching for a Stock Trading App Development Company?

The stock market is a wild ride, full of both exciting chances and serious dangers. If you want to succeed in this unpredictable world, you need to use the latest technology. That's where a specialized stock trading development company comes in they're the experts who can guide you through this complex maze.

The Changing Face of Stock Trading

The old ways of manually placing orders and basic market research are long gone. Now, superfast computer programs execute trades in the blink of an eye, and artificial intelligence systems predict market movements with impressive accuracy. This technology boom has turned stock trading into a data-focused, breakneck race, requiring advanced tools and strategies.

The Function of a StockTrading App Development Company

A specialized company that builds software for stock trading focuses on creating custom solutions perfectly suited to each trader or investment firm. These solutions cover a broad spectrum of abilities, including:

Algorithmic Trading Systems: It creates and uses advanced computer programs that automatically buy and sell investments. These programs follow specific instructions and react quickly to changes in the market. They can make trades very fast and accurately, reducing mistakes and taking advantage of short-lived opportunities to make money

High-Frequency Trading Platforms: It create systems that can complete trades incredibly fast. These systems are essential for taking advantage of tiny, fleeting opportunities in the market that only last for a fraction of a second."

Quantitative Trading Models: It creates and uses smart mathematical and statistical methods to examine market information. These methods help us spot opportunities to trade and improve how well our investments perform.

Risk Management Systems: It builds strong systems to identify and manage potential problems, such as sudden price swings in the market, the risk of borrowers not repaying loans, and issues within our operations.

Data Analytics and Visualization Tools: These create tools that collect, examine, and present market information in a clear way. This helps traders understand how the market is moving and find potential chances to make trades.

Order Management Systems (OMS): It creates systems that effectively and dependably handle trading orders. This includes sending orders to the right places, executing the trades, and ensuring all the details are accurately recorded and balanced after the trades are completed.

Primary Concerns When Choosing a Stock Trading App Development Company

Selecting the right stock trading development company is crucial for success in the active financial markets. Here are some key factors to consider:

Expertise and Experience: Find a company that's good at creating and using complex trading systems. They should have a strong history of success. I'm interested in [Algorithmic Trading / High-Frequency Trading / Quantitative Finance]. See how much experience they have in this specific area.

Technological Prowess: Make sure the company has the skills and knowledge needed in areas like creating software, analyzing data, and using cloud services. See how well they can use advanced technologies like AI, machine learning, and blockchain.

Domain Knowledge: The company that truly knows how financial markets work, understands the rules that govern them, and knows the best ways to trade. This deep knowledge is crucial for creating trading solutions that work well and are legal.

Client-Centric Approach: Choose a company that puts your needs first and crafts personalized solutions that align with your comfort level when it comes to risk.

Communication and Collaboration: Successful partnerships depend on clear communication and teamwork. Choose a company that encourages open dialogue and actively involves you in shaping the project.

The Benefits of Partnering with a Best Stock Trading Development Company

Partnering with a reputable stock trading development company offers multiple advantages, including:

Streamlined Trading: Automated systems make trading faster and smoother, allowing traders to spend more time analyzing the market and managing their investments.

Stronger Risk Control: Advanced risk management tools help safeguard your capital and minimize potential losses, ensuring your trading remains sustainable.

Boosted Profits: By using the latest technology and data-driven insights, traders can make better decisions, spot lucrative opportunities, and ultimately increase their profits.

Gaining the Advantage: Access to trading technology gives you a significant advantage in the fiercely competitive financial markets.

Lower Costs, Higher Efficiency: Automated systems reduce the need for manual work, leading to lower operating costs and improved cost-effectiveness.

The Destiny of Stock App Trading Development

Stock trading will keep getting better as we use more advanced technology like AI, machine learning, and blockchain. We can expect to see even smarter trading programs, trading that's perfectly suited to each individual trader, and trading platforms that are run by everyone, not just big companies.

Conclusion

Here we come to the conclusion the above-discussed qualities were met in this Stock trading app development company. In today's fast-changing world of finance, absolutely necessary to work with a company that specializes in building stock trading tools. By using the latest technology and the deep knowledge of experts in this field, traders and investment companies can confidently deal with the challenges of the financial markets and make better investments.

0 notes

Text

Best demat account app for seamless stock trading

The stock market is erratic, fast-moving, and volatile. Even if there are a ton of chances for development, success mostly hinges on timing and well-informed choices. Having the appropriate demat account software can be your greatest advantage in such a high-stakes setting. It facilitates stock trading, investment management, and portfolio tracking from any location at any time.

To choose the best demat account app, here are the key features you should prioritise:

Availability of several asset kinds

The best trading app is the one that offers a variety of asset classes, such as equities in the US, mutual funds, fixed-income securities, commodities, insurance, and derivatives (futures and options). You may easily develop aggressive, moderate, or conservative investment plans without hopping between apps by having access to many asset classes on a one platform.

Accessibility of excellent research

High-quality research insights catered to the requirements of all investors, from novices to experts, should be provided by the top demat account app. It must include daily suggestions, backed by thorough market research, for long-term investments, options methods, and intraday trading. To assist you in making well-informed judgments about when to enter and exit the market, features like sector analysis, stock screeners, and well curated reports are also crucial.

The MTF, or Margin Trading Facility

An MTF is a necessary for any good investment software if you want to maximize your market involvement. With the use of this service, you can borrow money from the broker to engage in more extensive trading than your present financial situation would allow. For instance, you can trade equities worth ₹40,000 if you have ₹10,000 in your demat account and the app offers a 4x margin. For short-term traders wishing to leverage high-confidence deals, this tool is especially helpful.

Learning resources and round-the-clock assistance and support

Knowledge is essential for successful investing, and a demat account app that provides instructional materials like articles, FAQs, and user manuals successfully satisfies this demand. These tools simplify difficult ideas into understandable explanations, including trading tactics, risk management, and stock market basics. Keep in mind that knowledgeable consumers are more likely to reach their financial objectives, make wiser judgments, steer clear of expensive mistakes, and receive larger returns.

Conclusion

The app that provides a seamless and worry-free investing experience is the finest demat account app for stock trading. A user-friendly interface, access to a variety of asset classes, excellent research, margin trading capabilities, instructional resources, and dependable round-the-clock assistance are important qualities to hunt for. The app's worth is further increased by value-added services including small case investments, early IPO access, and intelligent advice portfolios. Simply said, you can easily reach your investing goals, trade effectively, and keep informed with the proper software.

0 notes

Text

AI Live School Builder Review + Full OTO + Bonuses + Honest Reviews

Welcome to my AI Live School Builder Review. The education industry has seen rapid advancements in technology, and artificial intelligence (AI) is at the forefront of this transformation. AI-powered education platforms have revolutionized learning, offering personalized and automated teaching experiences.

One such platform is AI Live School Builder, an innovative application that allows users to create a fully functional AI live school with virtual AI teachers, AI-driven classes, and core subjects like math, physics, chemistry, biology, English, and social studies, among many others.

This in-depth AI Live School Builder review explores the app’s features, benefits, pricing, pros, and cons to help you determine if it’s the right solution for your online education needs. So, don’t miss this opportunity.

What Is AI Live School Builder?

AI Live School Builder is a next-generation an AI-powered educational platform which allows users to build entire AI LIVE Schools within one minute. This tool allows users to establish virtual learning institutions through done-for-you AI LIVE teachers thus enabling businesses and educators and entrepreneurs to establish learning platforms without specialized technical skills.

The application delivers support for diverse educational niches while understanding numerous languages thus catering to educators with international interests. Users can personalize their AI schools through this platform by defining different subjects and learning modules and interactive assessments which are AI-driven.

AI Live School Builder Product Overview

Product Creator: Uddhab Pramanik

Product: AI Live School Builder

Launch Date: 2025-Feb-10

Launch Time: 11:00 EST

Front-End Price: $17 (One-time payment)

Official Site: Click Here To Visit Official Salespage

Product Type: Tools and Software

Support: Effective and Friendly Response

Discount: Get The Best Discount Right Here!

Recommended: Highly Recommended

Bonuses: YES, Huge Bonuses

Skill Level Required: All Levels

Discount Coupon: Use Code “LIVESCHOOL30” for 30% off or “LIVESCHOOL5” for $5 off (Full Funnel)

Refund: YES, 30 Days Money-Back Guarantee

AI Live School Builder Review: About Authors

Uddhab Pramanik, the creative mind behind AI Live School Builder. Pramanik is at the top of the tech industry because he is always looking for new ways to do things. He is leading the way in creating AI-powered app’s, software’s that open up new possibilities for users all over the world. Uddhab is a tech pioneer who has helped move AI technology forward so that groundbreaking uses are no longer just a pipe dream but a real possibility for everyone.

Explore Pramanik’s impressive portfolio to see his list of successful launches, which includes VidAvatar AI, TalkFlow AI, RankGPT, OneAi 2.0, AI MovieMaker, OneAI, MusicBuddy AI, SiteRobot AI, Dropify AI, WP Defense, Explainer Video AI, MobiApp AI, FunnelBuddy AI, and many others.

Amazing Key Features of AI Live School Builder

The World’s First AI App Creates AI LIVE Schools In ANY Language In Less Than 60 Seconds…

Core Subjects: Math, Physics, Biology, Chemistry, History, Geography, English, Economics, Political Science

Technology & Coding: Computer Science, AI & Machine Learning, Web Development, Python, JavaScript

Creative & Skills-Based Learning: Art, Music, Graphic Design, Photography, Video Editing

Language & Communication: English, Spanish, French, German, Hindi, Mandarin & more

Business & Finance: Marketing, Entrepreneurship, Stock Trading, Personal Finance, Crypto Investing

Health & Wellness: Psychology, Yoga, Meditation, Nutrition, Personal Development

AI Live Teachers for 20+ Subjects – Covering academics, tech, business, languages, and wellness

Live & Interactive Classes – AI-powered explanations, problem-solving, and real-time Q&A

Student Management System – Track progress, issue certificates & provide personalized feedback

Built-in Monetization – Earn from your School with subscriptions, memberships, or one-time payments

AI-Powered Q&A & Tutoring – Instant assistance and adaptive learning tailored to students’ needs

AI Live School Builder Review: How Does It Work?

You’re Just 3 Steps Away! From Creating World Class AI LIVE School With Done-For-You LIVE Teachers, Classes, Students & Much More In Less Than 60 Seconds!

Step #1: Setup Your LIVE School

Choose your subjects, school theme, and structure in just a few clicks.

Step #2: Customize and Automate

Effortlessly add AI LIVE Teachers, interactive lessons, and automated student enrollments.

Step #3: Launch & Profit

Instantly start enrolling students and earning revenue from your AI-powered school!

Benefits of AI Live School Builder

Never-Seen-Before AI LIVE School Builder App

AI Live Teachers for 20+ Subjects – Covering academics, tech, business, languages, and wellness.

Live & Interactive Classes – AI-powered explanations, problem-solving, and real-time Q&A.

Student Management System – Track progress, issue certificates & provide personalized feedback.

AI-Powered Q&A & Tutoring – Instant assistance and adaptive learning tailored to students’ needs.

Run AI-Powered Tests, Exams, & Automatic Student Grading!

Monetize Your School With AI-Driven Subscription Models & Course Sales!

Use The “Automated Student Finder” To Get 1,000+ Students Instantly

Comprehensive Academic Curriculum – Covering core subjects like Math, Physics, Biology, Chemistry, History, Geography, English, Economics, and Political Science.

Technology & Coding Integration – Teach in-demand skills like Computer Science, AI & Machine Learning, Web Development, Python, and JavaScript.

Creative & Skills-Based Learning – Empower students with courses in Art, Music, Graphic Design, Photography, and Video Editing.

Multi-Language Learning – Offer classes in English, Spanish, French, German, Hindi, Mandarin, and more!

Business & Finance Education – Teach high-income skills like Marketing, Entrepreneurship, Stock Trading, Personal Finance, and Crypto Investing.

Health & Wellness Training – Provide learning on Psychology, Yoga, Meditation, Nutrition, and Personal Development.

Track Student Progress With Built-In AI Analytics & Reports!

Seamlessly Integrate With YouTube, Google, & Social Media For Free Traffic!

Ai-Driven Live Chat Support For Real-Time Assistance.

Fire All Your Expensive Tools & Services.

Say Goodbye To Monthly Fees.

Commercial License Included – Create & Sell as Many Assets As You Like To Your Clients…

Newbie Friendly, Easy-To-Use Dashboard.

Iron-clad 30 Day Money-Back Guarantee.

AI Live School Builder Review: Who Should Use It?

Affiliate Marketers

Bloggers

Freelancers

Product Creators

Video Marketers

Content Creators

Website Owners

Agency Owners

Product Creators

Vloggers

Coaches

Authors

And Many Others

AI Live School Builder Review: OTO’s And Pricing

Add My Bundle Coupon Code “LIVESCHOOL30″ – For 30% Off Any Funnel OTO Below

Front End Price: AI Live School Builder ($17)

OTO1: UNLIMITED Edition

Unlimited: $47

Unlimited GOLD: $67

OTO2: PRO Edition ($37)

OTO3: DONE FOR YOU

DFY: $97

DFY GOLD: $167

OTO 4: Automation Suite ($47)

OTO5: ELITE TRAFFIC

Elite Traffic: $47

Elite Traffic GOLD: $147

OTO6: AI Marketing Kit ($47)

OTO7: AGENCY LICENSE

Agency: $197

Agency GOLD: $297

OTO8: AI Course Marketplace ($37)

OTO9: Reseller License ($77)

OTO10: WhiteLabel License ($297)

AI Live School Builder Review: Money Back Guarantee

You’re In Safe Hands with Our 100% Risk-FREE, Iron-Clad 30 Days Money Back Guarantee

AI Live School Builder comes with a refund policy enabling users to return the product when satisfaction levels do not match purchased value. Our main goal is to provide a quality product that leads to absolutely no dissatisfied customers. Our quality should meet your expectations precisely or you should not pay anything to us since we do not deserve your money.

Contact us during the first 30 days for a complete refund if AI Live School Builder does not achieve your expectations. When you buy AI Live School Builder we are willing to provide supplementary software which will boost your business and sales to unprecedented levels. So either way, you only win.

AI Live School Builder Review: Pros and Cons

Pros:

Easy to Use – No technical knowledge required.

AI LIVE Teachers & Classes – Automated teaching process.

Multi-Language Support – Global reach.

Cost-Effective – Eliminates the need for human instructors.

Scalable – Accommodates unlimited students.

Quick Setup – Launches in under 60 seconds.

Customizable – Tailor lessons and subjects to niche audiences.

Cons:

Requires a one-time investment

Requires stable internet connection .

Nothing wrong with it, it works perfectly!

My Own Customized Exclusive VIP Bonus Bundle

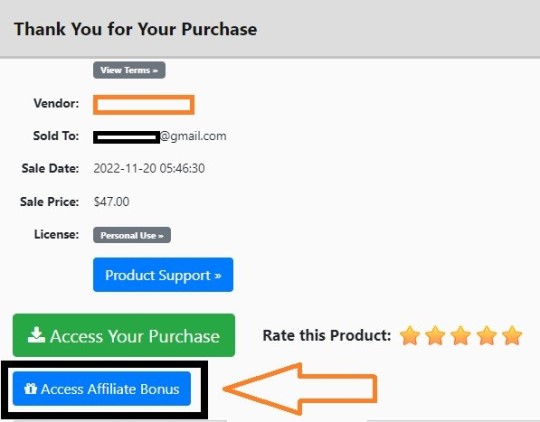

***How To Claim These Bonuses***

Step #1:

Complete your purchase of the AI Live School Builder: My Special Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase. And before ending my honest AI Live School Builder Review, I told you that I would give you my very own unique PFTSES formula for Free.

Step #2:

Send the proof of purchase to my e-mail “[email protected]” (Then I’ll manually Deliver it for you in 24 HOURS).

Frequently Asked Questions (FAQ’s)

What exactly is AI Live School Builder?

The World’s First AI LIVE School Builder App That Creates A Completely New AI LIVE School With Done-For-You AI LIVE Teachers In Any Niche & Language In Under 60 Seconds!

Do I need some prior skills or experience to get started?

AI Live School Builder is 100% newbie friendly with easy-to-use dashboard.

What happens if I don’t see results?

We’ve got you covered if you don’t see your desired results with AI Live School Builder just let us know within the next 30 days and we’ll refund you every penny.

What if I get confused along the way?

Don’t worry we have exclusive detailed video training for you that shows all the required steps.

What if I get confused along the way?

Don’t worry we have exclusive detailed video training for you that shows all the required steps.

Is This Compatible On Both PC, Mac, Android And iOS?

It works on any device.

How Do I Lock-In My Discount?

Click the button below to get the AI Live School Builder at the lowest price.

My Recommendation

AI Live School Builder is a game-changer in the online education industry. With its ability to create a fully functional AI-powered school in under a minute, it provides a highly scalable and efficient way to teach and earn online. While it may not completely replace traditional teaching methods, it offers a powerful supplement to digital education.

If you are looking for a hassle-free way to build an AI-driven educational platform, AI Live School Builder is worth considering. Whether you are an educator, entrepreneur, or institution, this tool provides the technology needed to revolutionize online learning.

>>> Click Here To Get Instant Access AI Live School Builder Now <<<

Check Out My Previous Reviews: Healix AI Review, $500 Google Payday Review, Human AI Review, AI Worker Review, and CloudBuddy AI Review

Thank for reading my “AI Live School Builder Review” till the end. Hope it will help you to make purchase decision perfectly

#AILiveSchool#AILiveSchoolBuilder#AILiveSchoolBuilderReview#AILiveSchoolBuilderOto#AILiveSchoolBuilderPrice#AILiveSchoolBuilderLegal#AILiveSchoolBuilderScam#EdTech#OnlineLearning#AIinEducation#eLearning#DigitalEducation#AIPlatform#TeachOnline#AIClassroom#VirtualSchool#SmartEducation#AIEducation#Edupreneur#OnlineTeaching#EducationRevolution#TechInnovation

0 notes

Text

How to Make Money Online in 2025

In 2025, the opportunities to earn money online are more diverse than ever. Whether you’re looking to generate a side income or build a full-fledged digital business, there are multiple paths to explore. Below are the top strategies to start making money online this year:

1. Freelancing

Freelancing remains one of the best ways to make money online. With platforms like Upwork, Fiverr, and Toptal, you can monetize your skills in areas like:

Content Writing: Companies need blogs, articles, and marketing copy.

Graphic Design: Eye-catching visuals are always in demand.

Programming: From web development to app creation, coding skills are invaluable.

Video Editing: Social media has made video editing a must-have skill.

The key is to build a strong portfolio and start with competitive rates to attract clients.

2. E-Commerce

E-commerce is booming in 2025, and starting an online store has never been easier. Options include:

Dropshipping: Sell products without holding inventory. Tools like Shopify and Oberlo make it simple.

Print-on-Demand: Offer custom-designed merchandise like T-shirts and mugs.

Handmade Products: Platforms like Etsy let you sell your crafts to a global audience.

With the right niche and effective marketing, e-commerce can become a profitable venture.

3. Affiliate Marketing

Affiliate marketing is perfect for earning passive income. By promoting products and earning commissions on sales, you can create a consistent revenue stream. Popular affiliate networks include:

Amazon Associates: Promote Amazon products and earn a percentage of sales.

Impact and CJ (Commission Junction): Work with established brands across multiple niches.

Temu Affiliate Program: The standout option in 2025. Temu offers lucrative commissions—up to $100,000 per month—and is beginner-friendly. Their transparent tracking system and quality products make it an ideal choice for new and experienced marketers alike.

Click here to join the Temu Affiliate Program: https://temu.to/k/u3dfjs2194s

4. Content Creation

Platforms like YouTube, TikTok, and Instagram provide creators with ad revenue, brand deals, and fan support through memberships. To succeed:

Choose a niche you’re passionate about.

Post consistently and engage with your audience.

Learn the basics of video editing and storytelling.

5. Online Courses and Coaching

If you’re an expert in a particular field, share your knowledge through online courses or one-on-one coaching. Platforms like Teachable, Kajabi, and Patreon can help you monetize your expertise.

6. Investing and Crypto Trading

While risky, investing in stocks, ETFs, or cryptocurrencies can provide significant returns. Educate yourself on market trends and start with small investments to minimize risk.

Final Thoughts

The internet offers endless opportunities to earn money in 2025. Whether you prefer freelancing, selling products, or affiliate marketing, there’s a path that fits your skills and interests. For a fast and reliable way to start earning, join the Temu Affiliate Program today and take advantage of their incredible commission structure.

The journey to online success starts now. Which path will you choose? Looking for a quick way to start earning? Join the Temu Affiliate Program and earn up to $100,000/month!

Looking for a quick way to start earning? Join the Temu Affiliate Program and earn up to $100,000/month!

#Money Online#Affiliate Marketing#Freelancing#E-commerce#Passive Income#Side Hustle#2025 Trends#Digital Marketing

1 note

·

View note

Text

iTrustCapital : Revolutionizing Speculation Through Crypto IRAs

iTrustCapital : Investing for the future is a foundation of budgetary security, and the way we approach this assignment has changed essentially over the a long time.

iTrustCapital, a driving stage in the venture world, offers a one of a kind approach by combining the assess preferences of Person Retirement Accounts (IRAs) with the development potential of cryptocurrency and valuable metals. This mix has made iTrustCapital a well known choice among financial specialists looking to differentiate their portfolios.

What is iTrustCapital ?

Key Highlights of iTrustCapital

Diverse Speculation Options

iTrustCapital offers get to to driving cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Speculators can too select from different valuable metals, such as gold and silver, guaranteeing a well-rounded portfolio.

Tax-Advantaged Accounts

By utilizing a Conventional IRA or Roth IRA, financial specialists can advantage from critical assess preferences. Conventional IRAs permit tax-deferred development, whereas Roth IRAs give tax-free withdrawals amid retirement.

User-Friendly Platform

The iTrustCapital interface is natural and planned to cater to both amateur and experienced financial specialists. It gives consistent route, real-time estimating, and strong analytics tools.

Low Costs

Secure Custody

Security is vital in the cryptocurrency world, and iTrustCapital conveys with institutional-grade guardianship arrangements. Resources are put away safely with Curv and Fireblocks, two exceedingly regarded names in advanced resource protection.

24/7 Trading

Unlike conventional stock markets with restricted exchanging hours, iTrustCapital permits clients to exchange cryptocurrencies 24/7, giving unmatched flexibility.

Why Select iTrustCapital?

Innovative Speculation Opportunities

Tax Efficiency

Tax focal points are a key offering point for iTrustCapital. For case, contributing in Bitcoin through a Conventional IRA implies you won’t pay capital picks up charges on its development until you pull back stores amid retirement. Selecting for a Roth IRA permits tax-free development, making it an alluring choice for long-term investors.

Accessibility and Transparency

The platform’s straightforwardness with respect to expenses and account setup makes it engaging to clients. Not at all like a few competitors, iTrustCapital gives clear taken a toll structures without covered up charges. Also, the clear onboarding prepare guarantees that indeed newcomers can set up an account with ease.

How to Get Begun with iTrustCapital

Open an Account

Visit the iTrustCapital site and total the account enlistment prepare. You’ll require to give essential individual data and select between a Conventional IRA or Roth IRA.

Fund Your Account

Transfer reserves from an existing IRA or make a coordinate commitment. The stage bolsters rollovers from 401(k) plans as well.

Start Investing

Once your account is financed, you can start exchanging cryptocurrencies or acquiring valuable metals. The user-friendly dashboard makes it simple to track your speculations and make educated decisions.

Who is iTrustCapital Best For?

iTrustCapital is perfect for:

Crypto Devotees: Those who accept in the long-term potential of advanced assets.

Retirement Savers: People centered on maximizing their retirement stores through tax-advantaged accounts.

Diversified Speculators: Individuals looking to broaden their portfolios past conventional stocks and bonds.

Cost-Conscious Dealers: Speculators looking for a low-fee stage for visit trading.

Potential Drawbacks

While iTrustCapital has numerous qualities, there are a few restrictions to consider:

Limited Resource Choices: In spite of the fact that the stage offers cryptocurrencies and valuable metals, it needs conventional speculation alternatives like stocks and bonds.

No Versatile App: As of presently, iTrustCapital does not have a committed versatile app, which may be a downside for clients who favor on-the-go trading.

Learning Bend for Modern Financial specialists: Apprentices new with cryptocurrencies may require time to get it the showcase elements and related risks.

Final Thoughts

iTrustCapital speaks to a progressive move in how people can develop their retirement reserve funds. By advertising get to to cryptocurrencies and valuable metals inside a tax-advantaged IRA, the stage engages speculators to take control of their budgetary prospects.

Whereas it may not be culminate for everybody, its inventive approach, moo expenses, and vigorous security measures make it a standout alternative in the world of self-directed IRAs. Whether you’re a prepared speculator or fair starting your budgetary travel, iTrustCapital gives a compelling way to accomplish long-term riches and security.

0 notes

Text

Day Trading Essentials: Your Path to Profit

Day trading has become one of the most popular ways for individuals to actively participate in financial markets. Whether you're trading stocks, forex, or cryptocurrencies, day trading offers opportunities to capitalize on market movements within a single trading day. In this guide, we'll cover essential day trading strategies, tools, and tips to help you succeed.

What is Day Trading?

Day trading involves buying and selling financial instruments within the same trading day to take advantage of small price movements. Unlike long-term investing, day traders close all their positions by the end of the day, avoiding overnight risks.

Choosing the Best Day Trading Platform

Finding the best day trading platform is crucial for your success. A reliable platform should offer fast execution speeds, advanced charting tools, and access to a wide range of markets. If you're based in Canada, it's worth exploring the best Canadian day trading platform options. Platforms like these are tailored to meet the specific needs of Canadian traders, including compliance with local regulations and offering tools for both novice and experienced traders.

The Funded Trader Program

One of the significant barriers for many aspiring traders is a lack of capital. This is where the funded trader program comes in. Programs like this allow traders to use company-provided capital, eliminating the need for significant upfront investment. In return, traders share a percentage of their profits with the funding company. Many platforms offer day trading funded account options, making it easier for traders to access resources and focus solely on their strategies.

Day Trading Strategies

To excel in day trading, you need effective strategies. Some popular day trading strategies include:

Scalping: This involves making multiple trades throughout the day to capture small price movements.

Momentum Trading: Identifying and riding trends fueled by high volume and volatility.

Breakout Trading: Entering trades when the price breaks through key levels of support or resistance.

Developing a strategy that aligns with your goals and risk tolerance is essential for long-term success.

Best Online Day Trading Platforms

The availability of best online day trading platforms has made it easier for anyone to start day trading. Platforms like MetaTrader, Thinkorswim, and TradingView provide the tools needed to analyze markets and execute trades efficiently. These platforms also integrate with day trading apps, allowing you to trade on the go.

Day Trading Crypto

Cryptocurrency trading has gained immense popularity in recent years. Day trading crypto involves taking advantage of the extreme volatility in digital currencies like Bitcoin, Ethereum, and others. To succeed in this niche, you'll need access to platforms that support crypto trading and tools for real-time market analysis.

Day Trading Tips for Beginners

Here are some valuable day trading tips for those just starting out:

Start Small: Begin with a limited amount of capital to minimize your risk.

Set Realistic Goals: Don’t expect to become a millionaire overnight.

Use Stop-Loss Orders: Protect your capital by setting stop-loss levels for every trade.

Stay Informed: Keep up with market news and events that can influence price movements.

Practice Discipline: Stick to your strategy and avoid emotional trading.

Day Trading Guide

For those new to the field, a comprehensive day trading guide can be invaluable. Such guides often cover topics like risk management, technical analysis, and the psychological aspects of trading. They also offer insights into selecting the right day trading app and tools to enhance your trading experience.

Conclusion

Day trading offers exciting opportunities for those willing to invest time and effort into mastering the craft. By choosing the best online day trading platforms, exploring day trading funded account options, and applying proven day trading strategies, you can increase your chances of success. Whether you’re interested in trading stocks, forex, or day trading crypto, the key is to stay disciplined and continuously learn from your experiences.

Visit apextraderfunding.com today and take the first step toward maximizing your trading success!

#best canadian day trading platform#day trading funded account#day trading platforms#best online day trading platforms#day trading strategies#day trading tips#day trading crypto#best day trading platform#the funded trader program#day trading guide#day trading app

0 notes

Text

Worldwide Gift Cards and Online Money-Making: A Comprehensive Guide

In today's digital economy, gift cards have become a global currency while online money-making opportunities continue to expand. This guide explores legitimate ways to earn and utilize gift cards, along with proven methods for generating income online.

Understanding the Global Gift Card Market

Gift cards have evolved from simple store credits to versatile financial instruments. Major platforms like Amazon, Google Play, and iTunes offer cards that work across multiple countries, making them valuable for international transactions and digital purchases.

Get Instant Access Now >>

Legitimate Ways to Earn Gift Cards

Several reputable methods exist for earning gift cards:

1. Survey and Research Platforms

-Swagbucks and Survey Junkie offer points redeemable for gift cards

-Focus groups and market research studies often provide gift card compensation

-Academic research participation frequently offers gift card incentives

2. Cashback Programs

-Major credit cards offer cashback rewards convertible to gift cards

-Shopping portals like Rakuten provide gift card rewards for online purchases

-Receipt-scanning apps reward users with gift cards for everyday shopping

3. Loyalty Programs

-Retail store loyalty programs often include gift card rewards

-Restaurant chains frequently offer gift card bonuses for regular customers

-Hotel and airline programs sometimes provide gift card options for points redemption

Get Instant Access Now >>

Legitimate Online Income Opportunities

While the internet offers numerous money-making possibilities, focus on these proven methods:

Freelancing and Professional Services

-Writing and content creation

-Graphic design and web development

-Virtual assistance and administrative support

-Translation and language services

-Social media management

Get Instant Access Now >>

Digital Product Creation

-Online courses and educational content

-E-books and digital guides

-Stock photos and video content

-Music and sound effects

-Digital art and design templates

Get Instant Access Now >>

E-commerce and Online Retail

-Dropshipping businesses

-Print-on-demand products

-Handmade crafts and digital designs

-Affiliate marketing for relevant products

-Reselling items on established platforms

Get Instant Access Now >>

Warning Signs of Scams

Be vigilant about these red flags:

-Promises of unrealistic earnings or "get rich quick" schemes

-Requests for upfront payments or personal banking information

-Unsolicited gift card trading or exchange offers

-Pressure to share gift card numbers or PINs

-Jobs that seem too good to be true

Get Instant Access Now >>

Best Practices for Success

Research Thoroughly

-Investigate platforms before investing time or money

-Read reviews from multiple sources

-Verify company legitimacy through official channels

Get Instant Access Now >>

Protect Your Information

-Use secure payment methods

-Never share gift card PINs or numbers

-Keep records of all transactions

-Use strong passwords and enable two-factor authentication

Get Instant Access Now >>

Diversify Income Streams

-Don't rely on a single platform or method

-Build multiple skills to increase earning potential

-Create passive income sources alongside active ones

Get Instant Access Now >>

Tax Considerations

Remember that income earned online, including gift cards, may be taxable:

-Keep detailed records of earnings

-Consult with tax professionals about obligations

-Report income according to local regulations

-Save appropriate documentation for tax season

Conclusion

The combination of gift cards and online income opportunities offers flexible ways to earn and manage money in the digital age. Success requires patience, dedication, and a commitment to legitimate methods while staying vigilant against scams. Start small, build gradually, and focus on developing sustainable income streams rather than seeking quick profits.

Get Instant Access Now >>

#cheap gift cards#750 shein gift cards#discounted gift cards#discounted disney gift cards#how to redeem amazon gift cards#how to buy discounted gift cards#how to get discounted gift cards#how to buy discounted gift cards online#how to buy gift cards at discounted price#how to redeem amazon gift cards on amazon#best website to buy discounted gift cards#virtual vanilla egift card apple pay wallet#giftcard#gift card#how to buy discounted gift cards top 5 websites#make money online#how to make money online#earn money online#how to earn money online#making money online#make money online fast#best way to make money online#make money online for free#make money#how to make money#online business#how to make money online 2024#make money online 2025#earn money#how to make money online 2025

0 notes

Text

Regulations and Compliance for Stock Trading App Development

Creating a stock trading app is an exciting endeavor, but it’s not just about sleek designs, real-time data, and smooth functionality. At the heart of successful stock trading app development lies a deep commitment to regulatory compliance. Why? Because when money is involved, so are the laws—and lots of them.

Understanding these regulations isn’t just a box-checking exercise. It’s about building trust with users, avoiding hefty fines, and ensuring your app can operate across different regions and markets. Let’s break it all down.

Why Compliance Matters in Stock Trading App Development

The financial industry is one of the most heavily regulated sectors worldwide, and for a good reason. Traders are trusting your app with their hard-earned money, and regulators want to ensure that this trust isn’t misplaced. Compliance ensures:

User Trust: A compliant app reassures users that their data and investments are secure.

Operational Longevity: Non-compliance can lead to legal actions, hefty fines, or even shutdowns.

Market Accessibility: To operate in different countries, you must meet their specific regulatory standards.

Key Regulatory Bodies You Need to Know

Here’s a snapshot of the major regulators you need to consider during stock trading app development:

United States:

Securities and Exchange Commission (SEC): Governs securities trading and protects investors.

Financial Industry Regulatory Authority (FINRA): Focuses on broker-dealer activities.

European Union:

MiFID II (Markets in Financial Instruments Directive): Ensures transparency and investor protection in trading.

GDPR (General Data Protection Regulation): Safeguards user data privacy.

India:

Securities and Exchange Board of India (SEBI): Regulates stock markets and trading platforms.

Global Initiatives:

Anti-money laundering (AML) and combating the financing of terrorism (CFT) are critical across jurisdictions.

Compliance Checklist for Stock Trading App Development

1. Secure User Authentication

Implement robust user verification methods like KYC (Know Your Customer) and AML compliance. KYC processes verify the identity of your users, while AML ensures the platform isn’t being used for illegal activities.

Tips:

Use AI-based tools for document verification.

Require identity proof and address verification during sign-up.

2. Data Protection and Privacy

Your app will handle sensitive user data, including personal information, financial records, and trading activity. Compliance with GDPR in the EU and CCPA in California is non-negotiable.

Key Steps:

Encrypt all user data, both at rest and in transit.

Offer clear, user-friendly privacy policies.

Provide options for users to control their data, like deletion requests.

3. Transparency in Operations

Users must have a clear understanding of how trades are executed, fees are charged, and how the app makes money. Compliance with MiFID II and similar regulations ensures fairness and transparency.

Best Practices:

Clearly disclose transaction costs and fees.

Provide real-time trade confirmations.

4. Secure Transactions

Stock trading apps must secure all financial transactions to prevent fraud and cyberattacks. Compliance with standards like PCI DSS (Payment Card Industry Data Security Standard) is essential if your app handles payments.

What to Do:

Implement two-factor authentication (2FA).

Use secure payment gateways with end-to-end encryption.

5. Anti-Fraud Measures

Fraud detection and prevention are critical in stock trading app development. Regulators expect apps to have mechanisms to detect unusual activities and report suspicious transactions.

How to Achieve This:

Integrate AI-based fraud detection systems.

Monitor trades for patterns that may indicate market manipulation.

6. Licensing and Regional Compliance

You can’t simply launch your app and expect to operate worldwide. Different regions have different licensing requirements.

Examples:

In the U.S., broker-dealers must register with the SEC and FINRA.

In Europe, obtaining an investment firm license under MiFID II is necessary.

Emerging Trends in Compliance