#Ben Bernanke

Explore tagged Tumblr posts

Text

78 notes

·

View notes

Text

found this on pintrest

238 notes

·

View notes

Text

someone: *makes fun of me*

me: do you think you can mock me? do you think you can capture my essence and throw it back at me with humour and rhetorical devices?

7 notes

·

View notes

Text

diversity win! this chairman of the federal reserve is GAY!!

11 notes

·

View notes

Text

ben bernake lemon demon

I already posted this on youtube but i had to

15 notes

·

View notes

Note

Leviathan, Pedro, and Ben you guys should take photo with each other please

#sugarverse#lemon demon oc#benjamin bernanke#benjamin#ben#benjamin s bernanke#ben bernanke#Pedro#Pedro Viellmann#Leviathan#Levi#Gef#Geffery#gef the mongoose#Geffery Agerwal

10 notes

·

View notes

Note

what is the lemon demon song about the worst magician that calls you a rich fuck etc?

ben bernanke! one of my favorites of all time. um i didnt realize he was a real guy until now LOL

anyway the "rich fuck" thing was referring to these lines in particular that stick out in my head

obviously this could probably be read more literally but ive seen it as a metaphor for money, especially after the line "are you proud of your country?"

7 notes

·

View notes

Text

I see you Spencer. With my eyes.

40 notes

·

View notes

Photo

I'll admit, Picard, you're handsome But what have you done with it? You think you can mock me, Picard? Do you?

#star trek#tng#lemon demon#ben bernanke#file this under stupid ideas that come to me and won't leave me alone#Picard#Q#you're old dry stale oats Picard!

40 notes

·

View notes

Text

Wow, you guys liked my View-Monster drawing more than I expected. Luckily for both of us, I made some doodles :)

Added some alt text for extra clarity, but these are just silly doodles of you choose not to care. “This one doesn’t have a meaning”

2 notes

·

View notes

Text

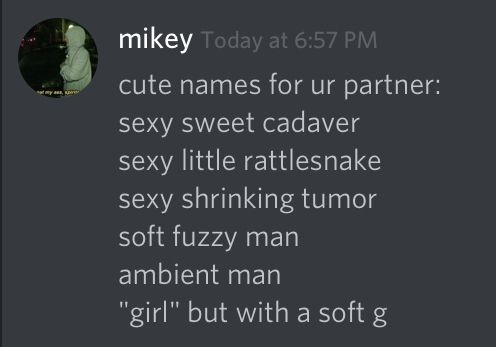

did you guys know that there's this one obscure slang term, "fuck like a rattlesnake" which refers to someone who .like. "copulates energetically"

also do you guys remember in Ben Bernanke near the end when he (Ben Bernanke) calls Spencer a "sexy little rattlesnake"

idk just thought that was interesting

4 notes

·

View notes

Text

heyyy babee are you a furious magician? because you seem to have a strange desire for my teeth

14 notes

·

View notes

Text

my interpretation of the VIEW MONSTER from the titular lemon demon album (seriously listen to it if you haven't, it's so good and probably one of if not my favorite albums of all time)

i don't think i've ever posted this one? it's super old so it's not as good as my recent art but i think it still has its merits!

#nonbinary#my ocs#my art#lemon demon#view monster#goat#goat furry#furry art#furry oc#fanart#2020#xray glasses#ralsei#it's not ralsei fuck you#autistic#neurodivergent#ben bernanke#neil cicierega#genderfluid#aromantic#asexual#they/them#xe/xem#digital art#view master#goth#emo#q#og post

6 notes

·

View notes

Link

Comment: Although published in late 2022, this seems an apt moment to revisit the economics of financial crisis/panic given the faultlines that have opened up, especially for regional US banks, in the wake of the Silicon Valley Bank collapse.

Extract.

[In 2022,]the Nobel Prize in Economics was given to a household name, Ben Bernanke [former Fed Chair], and two economists’ economists, Douglas Diamond and Philip Dybvig, largely for papers they published almost 40 years ago. So let’s talk about their work and why, unfortunately, it remains all too relevant.

Extract

Suppose that for some reason many depositors come to believe that many other depositors are about to cash out, and try to beat the pack by withdrawing their own funds. To meet these demands for liquidity, a bank will have to sell off its illiquid assets at fire sale prices, and doing so can drive an institution that should be solvent into bankruptcy. If that happens, people who didn’t withdraw their funds will be left with nothing. So during a panic, the rational thing to do is to panic along with everyone else.

Extract

What can be done to mitigate the risk of self-fulfilling panic? As Diamond and Dybvig noted, a government backstop — either deposit insurance, the willingness of the central bank to lend money to troubled banks or both — can short-circuit potential crises. Indeed, the mere knowledge that a backstop exists can often quell a bank run; no money need actually change hands.

But providing such a backstop raises the possibility of abuse; banks may take on undue risks because they know they’ll be bailed out if things go wrong. Case in point: the huge costs to taxpayers of bailing out irresponsible players during the savings and loans crisis in the 1980s. So banks need to be regulated as well as backstopped.

Extract

Another implication of their work, which unfortunately went unheeded for decades, was that we need to think carefully about what we mean by a “bank.” It doesn’t have to be a big marble building with rows of tellers. From an economic point of view, banking is any form of financial intermediation that offers people seemingly liquid assets while using their wealth to make illiquid investments.

Extract

Perhaps the most notable case in relatively recent times was the euro crisis of 2010-12. Market confidence in the economies of southern Europe collapsed, leading to huge spreads between the interest rates on, for example, Portuguese bonds and those on German bonds.

The conventional wisdom at the time — especially in Germany — was that countries were being justifiably punished for taking on excessive debt. But Belgian economist Paul De Grauwe argued that what was actually happening was a self-fulfilling panic — basically a run on the bonds of countries that couldn’t provide a backstop because they no longer had their own currencies.

Sure enough, when Mario Draghi, the president of the European Central Bank at the time, finally did provide a backstop in 2012 — he said the magic words “whatever it takes,” implying that the bank would lend money to the troubled governments if necessary — the spreads collapsed and the crisis came to an end.

#economics#political economy#2022#ben bernanke#paul krugman#finance#financial crisis#crisis#lender of last resort

2 notes

·

View notes

Text

this is just Spirit Phone and a few highlights from other albums! what about:

mmmm crayons,,, tastey and Crunchy

it's okay you can dance real silly! you better dance real silly!

Federal Reserve Chairman homoerotically convinces a man to give him his teeth (he's a wizard)

i'm falling. out of a plane yeah. yeah there's a squid you know how it is. might evade death for a while.

drink from the downspout boy

medieval merchant is tortured in the royal dungeon for refusing to give up pumpkin pie recipe

ahh shit dude, i think- i think i just destroyed that planet. fuck. sorry. don't tell anyone

i know your secret (you've got a murderous metal crab claw under your sleeve)

capitalist santa becomes a metaphor for capitalism through Eldritch Horrors

i'm gonna stalk/kiss/bang/cannibalize/steal the skin of famous reclusive cartoonist Bill Watterson. for funsies

“ohhh i’m so tired of love songs i wish people would write more original stuff” literally listen to lemon demon. some of his song topics include

Ronald Reagan fights his evil shadow self

Guy is trapped inside an evil arcade machine that kills people

You can do what you want to your body! dye your hair! get that tattoo! pull your teeth out! stick screws in your eyes! rip your arms off!

disgraced scientist is disgraced

I forgor 💀

Guy died and a bunch of cool haunted shit happened and it was really spooky

Please date me i’m a really nice ghost i mean normal man

I’m eating a corpse and it’s soo tasty and homoerotic come join me

ohohoho i am a Creature

well you probably know what two trucks is about

#lemon demon#cw gore#music#love all of these#ode to crayola#dance like an idiot#ben bernanke#i've still got some falling to do#rainwater#pumpkin pie#the saga of you confused destroyer of worlds#atomic copper claw#cryptosanta#bill watterson#kyewyeweeyewee

3K notes

·

View notes

Note

the only oc of yours iknpow by name is ben nbernanke Csan ypu throw rocks at him for me please ❤️

5 notes

·

View notes