#Banking Talent Acquisition

Explore tagged Tumblr posts

Text

Top Banking Recruitment Agencies: Global Staffing Solutions

Searching for reliable banking recruitment agencies? Reach out to Alliance Recruitment Agency. We offer both on-board and remote staffing solutions globally, ensuring you find the best talent for your banking needs. Contact us today to enhance your recruitment strategy!

#Banking Recruitment#Recruitment Agencies#Financial Staffing Solutions#Remote Staffing#On-Board Staffing#Banking Talent Acquisition#Global Recruitment#Banking Industry Jobs#Talent Recruitment

0 notes

Text

Gujarat, one of India's most industrially advanced states, offers a multitude of opportunities for job seekers in various sectors. Whether you're a fresh graduate looking for your first job or a seasoned professional aiming for a career change, recruitment consultancies can be your guiding light in navigating the job market. In this blog, we will explore the top recruitment consultancies in Gujarat, that will help you discover your dream job.

#Top Recruitment consultancy in Gujarat#professional staffing agencies near me#recruitment agency for it jobs#top Placement consultancy in India#top recruitment agencies in india#talent acquisition trends#Bank Jobs#list of staffing agencies near me

0 notes

Text

Lol.

This will be short. I’ll go on a little tangent but I’ll tie this back to Jungkook and BTS at the end.

You know, I was mostly ambivalent about the feud between HYBE and Min Heejin until I heard her call Bang Sihyuk and his sycophants “bastards” for ‘overpaying for garbage and forcing everyone to eat it because they think the price makes the music good.’ - I’m paraphrasing a bit because her language was more crude. That made me sit up a bit, because her sentiments mirrored my thoughts about the direction Bang Sihyuk has been taking the company in for some time now.

Another random connection is that, to me at least, it seems clear BigHit is still trying to make the HYBE America investment worth it, given:

1. The unnecessarily long credit lists filled with Scooter-linked writers that appear to have become a fixture of most HYBE releases. Bang PD is clearly taking advantage of Scooter’s connections although it’s yet to yield any significant improvement in music quality, and in terms of chart performance the results are mixed at best;

2. The fact that in addition to HYBE paying US$1.05 Billion in cash for Scooter’s company, essentially overpaying for Ithaca Holdings by consensus estimates (a deal Min Heejin also openly criticized as being hare-brained), HYBE America still generated hundreds of millions of dollars in losses as of the last fiscal year, two years after the acquisition was finalized.

But this is old news, we all knew that.

The thing about Min Heejin’s comments that concerned me is that, despite what is now clearly an underperforming investment both in terms of Scooter Braun himself and the man at HYBE that arranged the deal in the first place, Lee Jae-sang, rather than work to correct course and minimize losses, Bang Sihyuk appears to be doubling down on the deal by rewarding these two men in particular with more music and business opportunities within HYBE, even if the music quality suffers as a result, even if HYBE continues overpaying for shit, and even if the artists/idols are negatively impacted in the process. And according to Min Heejin, one big reason Bang Sihyuk allows it is because those men are adept at greasing his arse and eating it out.

Basically, it’s become an expensive joke. But he’s brute forcing the deal to work because so long as BTS is involved and so ARMYs are involved, it’s a joke that Bang PD is guaranteed to take laughing all the way to the bank.

This is where I say I realized shortly after Jungkook’s fan song for Festa was announced, that I wasn’t excited to hear it. I’m saying this only because now that the song is out, it’s confirmed everything I expected. And also because that apathetic feeling was so at odds with how I’ve been feeling about Jungkook as a person for the last year. If it’s not been clear from my reblogs and gush posts, I’ve been spending the better part of this hiatus loving Jungkook extremely. Jungkook is an empathetic songwriter, an emotive vocalist, a talented producer.

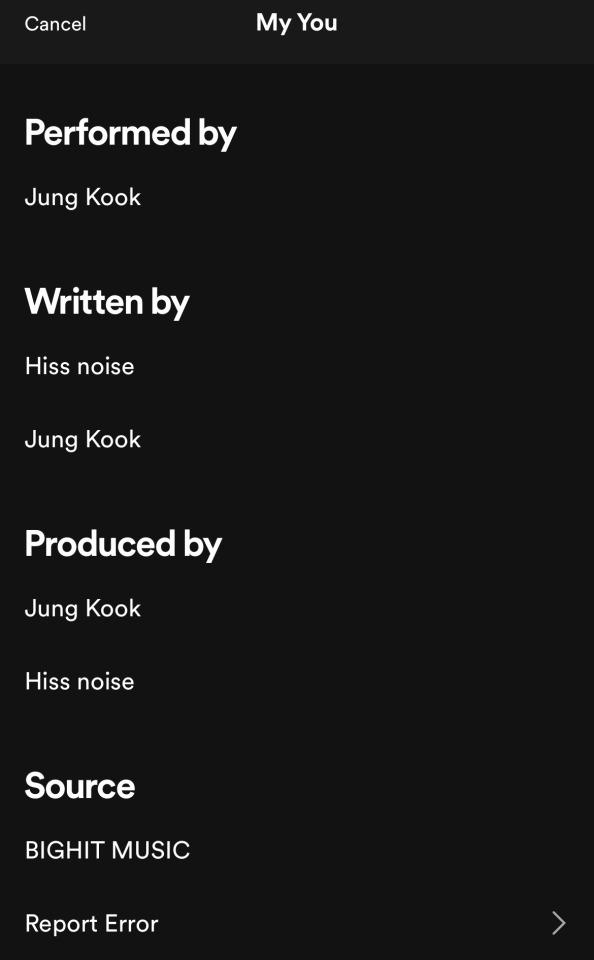

But nothing about Never Let Go is exciting. Who wants to listen to a fan song written by people who’ve never had fans? And on top of that, Jungkook is making less money from that song than any fan song he’s written before. Meaning, the song is mediocre, it feels blatantly insincere in ways only a crowdsourced fan song can be, and Jungkook has to split his revenue from the song with about 10 white people. Just look at this.

I’m actually laughing typing this out, but this turn of events is at least a little tragic.

Golden worked as a concept album because it was a collection of songs Jungkook felt represented his taste, he could take on the challenge of putting out a full English album with some help from the writers, and he showcased new vocal techniques and styles that only showed an evolution from his prior work in BTS. The songs themselves were just okay, good decent pop, but as a collection it worked.

Everything about Never Let Go feels almost audaciously soulless. Not quite a slap on the face but it’s like someone coming all up in your face with a bad case of halitosis and their nose barely touching yours, daring you to do something about it.

I have no issue with HYBE working with Scooter-linked writers or producers if it means something actually good comes of it. But it seems HYBE seems to believe their work is better simply because they slap on as many foreign names in the credits as they can fit. It betrays a worrying mentality about the head honchos in the company. Looking at the peak quality in FACE by Jimin, or in Right Place, Wrong Person by RM, which included acclaimed Korean, other Asian, and Black talent supposedly hand-picked by Jimin and Joon themselves, it’s clear HYBE has access to remarkable home-grown and foreign talent that could improve the work of the members. But what I’m seeing with too much frequency is HYBE picking off the bottom of the barrel in the unending list of Scooter’s contractors and otherwise choosing to do the bare minimum.

And that’s how we end up with a Festa fan song with a topline that sounds like an AI-generated jingle written by a soccer team of hired help.

Or idk, maybe I’m being just a bit too full of it. Maybe I’ve been brainwashed by the witch Min Heejin, maybe this was just one more song Jungkook worked on with his Golden team as he had no time to write a proper fan song, nothing more. And maybe as a silver lining, there are no glaring grammatical errors though I found the ones in My You very charming, and honestly part of the appeal. To hear the way Jungkook sees the fans who have been with him till now, even if in English it didn’t quite make sense.

I said this would be short but I’ve rambled, as usual. Sorry for that. When I started out writing this post, I did intend to keep it short.

To end things on a somewhat lighter note, for me the only thing I’m excited about this Festa, is SeokJin coming back. I’ll be working on a deal during the fanmeet so I didn’t bother participating in the raffle, but I’m happy for the ARMYs who get the opportunity to hug Jin, and for Jin who gets to spend time with his fans after so long. With him returning, things are starting to feel more right, even though there are worrying signs in high places. We’ve got about 1 year left to endure most of the members enlisted and then, the crew will be rounded up again.

Now more than ever, I find myself looking forward to that.

120 notes

·

View notes

Text

Obstacles Confronting the Private Equity Sector

Laws and regulations have undergone significant changes, impacting how a private equity (PE) professional can meet clients’ demands for reliable investment and exit strategies. In recent years, amid geopolitical and financial upheavals, PE advisors have faced recessionary threats. This post will delve into the main obstacles the private equity sector will encounter in 2024.

An Overview of the Private Equity Sector

The PE sector centers on investing in private companies. Additionally, private equity researchers facilitate buyouts of public companies, transitioning them to private ownership. Regulatory requirements render private equity investments complex, yet PE firms remain in demand due to their long-term positive outlook.

Services Provided by Private Equity Experts

High-net-worth individuals (HNWIs) and institutional investors frequently utilize investment banking services for wealth management and privatization goals. Meanwhile, PE professionals assist them in several ways:

1| Long-Term Investment Guidance

PE investments extend over several years. Consequently, private equity firms can enhance the value of acquired companies through strategic management. Their innovative interventions go beyond operational improvements and financial restructuring, including data-driven market expansion, product development, and talent acquisition.

2| Active Capital Management

PE firms adopt a hands-on approach to portfolio management, differentiating themselves from passive investors. They employ experienced financial professionals and collaborate with tech consultants to optimize performance. Their active capital management methods attract investors seeking higher returns. The expertise of PE specialists provides reassurance and confidence in the investment.

3| Leverage

Private equity transactions frequently involve substantial borrowing to finance acquisitions, using the acquired company’s assets as collateral. This leverage can enhance returns but also increases risk. Consequently, stakeholders perceive private equity deals as high-stakes endeavors.

4| Exit Strategies

Initial public offerings (IPOs) allow PE firms to exit investments. Alternatively, selling to strategic buyers is common. They also conduct secondary sales to other private equity firms. These exit strategies can yield substantial returns for investors.

Primary Obstacles in the Private Equity Sector

1| Managing Inflation and Interest Rate Pressures

Global inflation and tighter monetary policies necessitate careful management of private market portfolios. Therefore, limited partners (LPs) must leverage the best tools and talents to assess the impact of these macroeconomic pressures on their portfolios.

LPs need to monitor margin erosion, cash flow generation, and debt covenants. They can reassess which portfolio companies will thrive despite inflation or interest rate pressures.

For example, an organization that leads its market or excels in maintaining strong customer and supplier relationships will likely outperform others. However, LPs and private equity professionals must evaluate whether it has contractual pricing with minimal exposure to input price volatility. These traits boost a company’s resilience to macroeconomic forces.

Similarly, portfolio companies with high cash conversion ratios or conservative capital structures will be more rewarding. Businesses with flexible terms are expected to thrive in challenging market conditions.

Conversely, companies lacking these attributes will likely face significant challenges in the private equity sector. Therefore, stakeholders must pay closer attention to them.

2| Data Availability and Validation Issues

Private equity stakeholders require accurate data on an enterprise’s corporate performance, legal compliance, and sustainability commitments. Public information sources may not provide sufficient insights into target businesses' core metrics and risk-reward dynamics. Premium data providers might also employ data-driven profiling and recommendation reporting.

Insufficient information and poor data quality hinder PE stakeholders' portfolio improvement efforts. They must navigate markets using well-validated intelligence rather than biased information from public platforms. Malicious actors can falsify claims about a brand’s performance due to undisclosed interests.

Therefore, ensuring data quality to develop the best portfolio strategies remains a significant challenge, underscoring the need for ethical, transparent, and tech-savvy PE experts.

3| Employee Retention Challenges

Retaining top talent is crucial for PE firms to succeed in the private equity sector. Therefore, private equity managers and researchers must foster a healthy workplace culture that allows professionals to grow based on performance metrics. They must also offer competitive compensation packages and retention bonuses.

Collaborating with consultants to create guidelines and training programs can support your core team. Additionally, utilizing automation and third-party assistance can reduce the workload on employees. If PE firms neglect their employees' interests, staff may leave or underperform. Miscommunication between leaders and team members can exacerbate this issue, leading to high employee turnover.

4| Increasing Competition Amidst Fewer New Businesses

Private equity firms have grown by 58% between 2016 and 2021. However, new company registrations often include more startups, with few qualifying to raise funds through PE-supported pathways. While PE research providers have increased, established companies and investors must select the best ones.

As a result, firms and financial professionals have developed strategies to overcome competition-related obstacles in the private equity sector. They offer multiple buyout methods and leverage fintech scalability. They have also enhanced risk-reward modeling and data sourcing to meet clients’ expectations, particularly regarding legal compliance requirements.

However, processing a deal may not always proceed as initially envisioned. Although company owners, limited partners, and interested investors witness new deals, only a fraction reach completion. Therefore, PE businesses seeking a competitive edge must expedite screening, feasibility reporting, and data gathering with modern technologies. This approach is essential for private equity stakeholders to identify the right deals with long-term benefits.

Conclusion

The private equity sector must navigate macroeconomic risks such as inflation, tight monetary policies, and data quality issues. Embracing innovative fintech systems and engaging domain experts to optimize internal processes can help. If each PE firm enhances its operations, it will succeed despite public companies and strategic buyers adopting buy-to-sell principles for business acquisitions.

Competition from fellow PE firms for a relatively stable number of viable businesses seeking investors has prompted a more dynamic and risk-taking approach. Amid these obstacles facing the private equity sector in 2024, firms must prioritize talent acquisition and employee retention. Additionally, limited partners must continually revisit, expand, and optimize their portfolios as global events continue to impact PE deals.

3 notes

·

View notes

Text

Okay it’s prediction time. I’ve sorted these through almost nailed on too just I am allowed my fantasies okay.

Nailed on (if these don’t happen I’ll be shocked)

New shows for the young pairs that didn’t get one in part one. They’re all extremely bankable and there is zero way GMMTV aren’t going to take advantage of that. My personal desires would be something with a bit more bite for First/Khao and something a bit dramatic for Perth/Chimon.

Some kind of new het ensemble. I think maybe including some of the youngers who’ve not really done het yet. Force for instance has a large following and hasn’t done anything major out of pair yet. He’d work well in some kind of het ensemble.

Nanon het something. I think the kids been too burned by delulus to do a BL again anytime soon but he’s talked a lot about getting back to acting. So a het project seems likely.

New KristSingto project. Idk if it’s gonna be a sotus prt3 or something new but it’s happening.

New projects for TayNew & OffGun. They’ve had big years and they seem comfortable in wanting to push on. Perhaps something darker for OffGun? They’ve had a run of softer things.

Some new het thing for the usual het suspects.

One or two new GLs. (I’m hoping Jan/someone and Cize/someone. Or Jan/Cize. I really don’t care just give me the GL’s)

Boun/Prem. could be the vampire show could be something else whatever it is GMMTV is going to want to cash in on their popularity. (Probably going to in general make use of all their new acquisitions.)

More concerts

Idk probably some dance based reality show that I’ll never watch or remember until one of the winners breaks out into dramas.

Perhaps (could be)

Mark/Ohm. They’ve teased it so much. It feels unlikely it won’t be a thing but, also, Mark is a tease so I’m sticking it here in case it was just him pissing around.

An original pillars concert. Singto’s back. It would make bank. Seems a thing that could happen.

Another Japanese adaptation. Idk what? But with the success of Cherry Magic it seems possible. So long as it isn’t something deeply, intrinsically Japanese (I swear to god if you touch My Beautiful Man GMMTV I’m flying to Thailand and yelling at people) then I think it could be okay.

Full trailers for things like Ossan’s Love

A het thing for Gemini.

Maybe a Kdrama remake for someone like Mook. She’s a real talent and proven herself in het roles plenty at this point.

Listen a girl can dream

Something with actual bite for Fourth. The kid is talented. He deserves more than what he’s getting. I respect he’s young and bankable to teens but his acting talent is also being squandered. I’m not talking about high heat, I really rarely am when I say more bite, I’m talking about something with a bit of a darker plot and more opportunity for the kid to act.

Aou/Boom main role no ensemble. It’s my dream okay fuckers.

An ensemble for some of the talented and neglected side actors. Ford comes screaming to mind. Kid kills his roles every time.

Santa/Lego. Sorry but the visuals would be so pretty and I think they could have a similar energy to Santa/Earth and I loved them.

Some kind of highschool/college ensemble for the tiny wee babies. We need to get to know them better and ensembles help that.

Gay I’m Tee, Me Too. It should have been gay, we all know it, give me another ensemble with the original pillars.

5 notes

·

View notes

Text

Local Competition Analysis for Naija Shoppers:

Nigeria's vibrant retail landscape presents a dynamic mix of local and international competitors, each vying for a share of the lucrative market. Local competition for Naija Shoppers spans various industries and sectors, requiring a strategic approach to effectively compete and thrive. Here is a comprehensive analysis of the key factors influencing local competition in Nigeria:

1. Talent Acquisition:

Local competitors prioritize assembling high-quality talent, particularly from industries like banking, oil and gas, telecommunications, and IT.

Accessing top talent is crucial for Naija Shoppers to drive innovation, enhance customer experience, and maintain competitiveness.

2. Pricing Strategy:

Nigerians are highly price-sensitive consumers, constantly seeking value for money in their purchases.

Competitive pricing is essential for Naija Shoppers to attract and retain customers, given the daily financial constraints faced by Nigerian consumers.

3. Customer Service Excellence:

Nigerian consumers place significant emphasis on personalized and attentive customer service.

Building consumer loyalty through exceptional customer service experiences is vital for Naija Shoppers to differentiate itself and foster repeat business.

4. Product Innovation:

Products and services in Nigeria must offer value-added features to meet diverse consumer needs.

Naija Shoppers should prioritize innovation and product differentiation to stay competitive and capture market share effectively.

5. Strategic Advertising:

Advertising plays a crucial role in brand awareness and consumer engagement in Nigeria.

Naija Shoppers must invest in targeted advertising campaigns across various platforms to effectively reach and resonate with its target market.

6. Distribution Channels:

Leveraging existing distribution networks and partnerships is key for efficient product distribution in Nigeria.

Naija Shoppers should strategically align with reliable retail partners to expand its reach and optimize distribution channels.

7. Technological Integration:

Technology-driven solutions are increasingly shaping consumer experiences and preferences in Nigeria.

Naija Shoppers should prioritize technological innovation to enhance product design, delivery, and overall customer satisfaction.

8. Ownership Structure:

The ownership structure of a brand can influence consumer perceptions and competitive positioning.

Naija Shoppers should strive for a diverse and transparent ownership structure to build consumer trust and appeal to Nigeria's diverse demographics.

In summary, competing in Nigeria's retail market requires Naija Shoppers to navigate various challenges and capitalize on strategic opportunities. By prioritizing talent acquisition, competitive pricing, exceptional customer service, product innovation, targeted advertising, efficient distribution channels, technological integration, and transparent ownership, Naija Shoppers can effectively differentiate itself and succeed in Nigeria's competitive business environment.

2 notes

·

View notes

Text

Career prospects after MBA in Finance

Career prospects after MBA in Finance

What to do after getting an MBA in Finance: It’s safe to say that the specialty in finance is one of the most popular ones. The majority of MBA candidates choose it, mostly due to its alluring job prospects. Paying positions with exponential growth potential is promised by an MBA in finance. Graduates receive a mix of management and financial expertise as a result. What kind of employment options are there for those with a finance MBA? The purpose of this article is to go into further detail about the prospects and abilities needed to pursue certain occupations.

Money management is at the core of the career options after an MBA in Finance. Pursuing a finance specialization from a renowned business school opens the door to exciting career prospects. To list a few:

· Investment Banker: Among MBA graduates, a popular professional route. You can only get the necessary skill set and business savvy from an MBA if you want to take on this position. Investment bankers work in mergers and acquisitions, corporate restructuring, trading, and providing strategic consulting to major organizations. They also raise funds by issuing securities.

· Private equity: Another profession that needs strong business judgment and a passion for investing. Private equity firms purchase privately held businesses to enhance their value over time to ultimately sell the business for a good profit. A few crucial talents are commercial understanding, financial modeling, and knowledge of certain sectors.

· Management Consultant: A job that the majority of students at business schools want to pursue. Although having an MBA is not a requirement to work in consulting, it might make it simpler to enter the field and advance more quickly. The essence of consulting is problem-solving for firms to enhance company performance, which unquestionably calls for abilities like executive leadership, corporate strategy, and effective communication.

· Corporate Finance: The goal of corporate finance is to use a company’s financial resources as efficiently as possible. It might entail judgments about dividend distributions, raising money, managing financial resources, capital structure, and making important investment decisions.

· Entrepreneurship: Many MBA graduates are interested in starting their firm after learning essential management knowledge and key financial abilities. An MBA equips individuals with the abilities needed to form their creative ideas. Additionally, a finance MBA gives students the tools they need to manage their finances. This is a lethal mix of skill sets to reduce expenses during the early phases of an endeavor, therefore graduates who choose this path are in luck.

· Equity research: a position that entails conducting extensive market research, in-depth analysis of several companies, and report writing. To pursue this vocation, one has to have strong analytical financial abilities as well as up-to-date knowledge of market developments. The ability to manage one’s portfolio or fund is possible as one advances in this field. The key to this position is having analytical abilities to fully comprehend a company from its financials.

· Corporate Banking: Selling banking products to companies is a subset of investment banking. Among the offerings are mergers, risk management, and liquidity management. There are a ton of options here; one may create a financial product or work as a relationship manager up front to market these items to businesses.

Compensations/packages:

Your career will advance in terms of both prospects and pay with an MBA in finance. The fact that it is the most popular concentration is mostly due to the compensation after graduation. After earning an MBA in Finance, the typical annual pay is close to 7 lakhs. At entry-level positions, an MBA in Finance from a prestigious business school may expect to earn an average salary of more than $20,000. A financial specialty will surely lead to a very profitable future. The highest-compensated profession among the aforementioned ones is investment banking.

Summary:

You may have the best of both worlds with an MBA in finance: a stable position with a good salary. The high price for an MBA is justified by the competence it provides, and the need for workers with the financial acumen necessary to keep businesses operating offers stability. When you pair this with appropriate experience, remuneration packages soar. An MBA in finance can also assist you in managing your money and securing your financial future.

Your opportunities will increase, and your growth will occur more quickly if you establish a strong network and connections in the financial industry. Your career will advance, and you will be noticed by major corporations if you have an MBA in finance.

7 notes

·

View notes

Text

SNIPES Launches "Pay It Forward" Initiative to Support HBCUs and Empower Black Students

SNIPES, the leading streetwear and sneaker retailer, has announced the launch of its Pay It Forward initiative, a nationwide campaign to support Historically Black Colleges and Universities (HBCUs). The initiative is part of SNIPES' commitment to giving back to the community and investing in the future of HBCUs and their graduates. Through this program, SNIPES aims to provide opportunities for underrepresented communities and empower the next generation of leaders by supporting education and creating a platform for important conversations.

The inaugural event of the Pay It Forward initiative will launch in partnership with The Big Homecoming, afirst off it’s kind HBCU culture festival that focuses on creating ongoing impact for HBCU’s. The Pay It Forward initiative will launch with The Big Homecoming’s 365 Impact Tour, which will take place on April 11th at Clark Atlanta University, one of the most prestigious HBCUs in the nation. The event will offer a day of inspiring panel discussions, experiential activations, and one-on-one conversations with notable guests from the Atlanta community.

The Big Homecoming will kick off with an inspiring panel discussion led by members of SNIPES' leadership team, including Derek Bailey, Digital Content Manager, Jasmine Cordew, Social Media Manager, Gabrielle Golden, Sr. Talent Acquisition Specialist, JaNaie Fort, Buyer, Women’s & Kid’s. The panel will delve into critical topics such as workplace diversity, overcoming adversity, and the significance of inclusion in the workplace.

The Big Homecoming will also feature a Fireside Chat focused on essential topics such as leadership, financial literacy, health, entrepreneurship, and creating a sustainable legacy of Black excellence. The discussion will feature distinguished panelists such as comedian and social media star Desi Banks, reality star and entrepreneur Yandy Smith-Harris, media personality and comedian Rachael O'Neil and actor and singer Reed Shannon; providing students with valuable advice and insights from successful professionals in various fields.

In addition to the panel discussions, The Big Homecoming will include a variety of inspiring and engaging on-site activations, including:

● Wall of Affirmations: The Wall of Affirmations activation is a space for students to share their aspirations and affirmations, empowering them to visualize their collective ambition and inspiration. The activation is a reflection of SNIPES' commitment to fostering positivity and encouraging students to aim high.

● Custom Sock Creation: At the Custom Sock Creation activation, students will have the unique opportunity to design and create their own custom socks. This hands-on experience not only allows students to exercise their creativity but also enables them to give back to the community. The socks created by students will be donated to underprivileged children at ChopArt. ChopArt provides dignity, community, and opportunity to middle and high school aged youth experiencing homelessness through multidisciplinary arts immersion and mentorship.

● Alumni Legacy Wall: The Legacy Wall activation celebrates the impressive contributions of Clark Atlanta alumni who have made significant strides in their respective fields. This activation aims to inspire students to follow in the footsteps of trailblazers such as Eva Marcille, DJ Drama, Pinky Cole, and Kenya Barris. The Legacy Wall is a testament to SNIPES' commitment to showcasing the excellence and success of the Black community.

Moreover, SNIPES is committed to supporting education by providing $50,000 in scholarships for Atlanta students who sign up at the Scholarship Booth during the event. This pledge further showcases SNIPES' dedication to supporting education and empowering the next generation to achieve their goals.

"Celebrating the contributions of HBCUs to our nation's rich history is a responsibility that we all share. At SNIPES, we believe in the power of community and education to create a better future for all.” said Paula Barbosa, VP of marketing for SNIPES. “We are thrilled to launch the Pay It Forward initiative and The Big Homecoming event, which represent our commitment to empowering the next generation of leaders and giving back to the community. Through these efforts, we hope to inspire and uplift students, faculty, and alumni at HBCUs across the country, and to showcase the importance of education and community engagement in creating a better, more equitable world for all."

“Partnering with companies that are truly committed to creating consistent impact in the community is important to The Big Homecoming’s reason for existing. We’re more than a music festival, we’re a 365 Impact organization. And partnering with a community committed company like Snipes just helps further and accomplish our Impact goals for HBCUs and communities around the world,” said Amir Windom, Creator of The Big Homecoming.

Select students will also have the chance to join SNIPES for a one-on-one lunch conversation, where they can gain a deeper understanding of the SNIPES brand and its values. These conversations will provide students with unique opportunities to engage with experts in the industry and gain valuable insights into various fields.

Through the Pay It Forward initiative and The Big Homecoming event, SNIPES is not only demonstrating its commitment to giving back to the community and supporting education, but also creating a platform for important conversations and empowering the next generation of leaders. By investing in HBCUs and their students and faculty, SNIPES is contributing to the advancement of underrepresented communities and creating a more equitable world for all. As SNIPES continues to make a meaningful impact through its initiatives and partnerships, the brand remains dedicated to creating positive change and uplifting the voices that need to be heard.

This is dope! Salute.

3 notes

·

View notes

Text

Villar S. Boyle: An Investment Leader Who Transformed Ergo Partners

Investment is a vital element of the business world, and Villar S. Boyle is one of the best investment leaders in the industry. As the CEO of Ergo Partners, he has transformed the company into a global investment powerhouse with over $120 billion in assets under management. Villar S. Boyle, leadership, and business acumen have been instrumental in Ergo Partners' success. In this blog post, we'll take a closer look at his service and how he has contributed to Ergo Partners' growth.

Early Years and Education

Villar S. Boyle was born and raised in the United States. He completed his undergraduate studies at the University of Chicago, where he majored in Economics. He then went on to earn his MBA from Harvard Business School, where he specialized in Finance.

Professional Journey

Boyle's career began at a prominent investment bank, where he gained experience in investment banking, private equity, and mergers and acquisitions. He then joined Ergo Partners as an analyst in the firm's New York office. Over the years, he climbed the ranks and held several key positions before being named CEO in 2014.

Leadership at Ergo Partners

As CEO, Villar S. Boyle has led Ergo Partners through a period of significant growth and expansion. Here are some of the key initiatives he has implemented:

• Diversification: Under Boyle's leadership, Ergo Partners has diversified its investment portfolio across various sectors, including real estate, technology, and energy. This has helped the firm weather market fluctuations and generate consistent returns.

• Global Expansion: Ergo Partners has expanded its operations to Asia, Europe, and the Middle East, thanks to Boyle's vision and leadership. The firm now has a global presence, with offices in major financial centers around the world.

• Strategic Partnerships: Boyle has cultivated partnerships with significant strategic clients, industry leaders, and government officials. These partnerships have helped Ergo Partners access new markets, identify new investment opportunities, and strengthen its reputation in the industry.

• Succession Planning: As part of his leadership development initiatives, Boyle has implemented a robust succession planning program. This ensures that the company has a pipeline of talented executives who are ready to take on leadership roles as needed.

• Culture: Boyle has reinforced Ergo Partners' vision and culture, emphasizing the importance of integrity, teamwork, and a long-term perspective. This has helped create a cohesive and motivated workforce that is committed to delivering exceptional results.

• Philanthropy: Villar S. Boyle is a strong advocate for philanthropy, and he encourages Ergo Partners to give back to the community. The firm supports various charitable organizations, and Boyle is personally involved in several philanthropic initiatives.

• Innovation: Boyle is a strong proponent of innovation, and he encourages Ergo Partners to stay ahead of the curve. The firm has invested in cutting-edge technologies and is constantly exploring new investment opportunities.

• Risk Management: As CEO, Boyle places a strong emphasis on risk management. He has implemented robust risk management policies and procedures, which have helped the firm mitigate risks and avoid costly mistakes.

• Thought Leadership: Boyle is a recognized thought leader in the investment industry. He frequently speaks at conferences and events, sharing his insights and expertise with industry peers. He also contributes to leading publications and blogs on investment topics, helping to shape the discourse around investment trends and best practices.

Conclusion

Villar S. Boyle's leadership has been instrumental in Ergo Partners' success. His vision, business acumen, and ability to execute have transformed the company into a global investment powerhouse. Under his leadership, Ergo Partners has diversified its portfolio, expanded globally, cultivated strategic partnerships, implemented a robust succession planning program, and reinforced its vision and culture. It's no wonder that Boyle is widely regarded as one of the best investment leaders in the industry.

3 notes

·

View notes

Text

Career prospects after MBA in Finance:

What to do after getting an MBA in Finance: It's safe to say that the specialty in finance is one of the most popular ones. The majority of MBA candidates choose it, mostly due to its alluring job prospects. Paying positions with exponential growth potential are promised by an MBA in finance. Graduates receive a mix of management and financial expertise as a result. What kind of employment options are there for those with a finance MBA? The purpose of this article is to go into further detail about the prospects and abilities needed to pursue certain occupations.

Money management is at the core of the career options after an MBA in Finance. Pursuing a finance specialization from a renowned business school opens the door to exciting career prospects. To list a few:

Investment Banker: Among MBA graduates, a popular professional route. You can only get the necessary skill set and business savvy from an MBA if you want to take on this position. Investment bankers work in mergers and acquisitions, corporate restructuring, trading, and providing strategic consulting to major organizations. They also raise funds by issuing securities.

Private equity: Another profession that needs strong business judgement and a passion for investing. Private equity firms purchase privately held businesses with the intention of enhancing their value over time in order to ultimately sell the business for a good profit. A few crucial talents are commercial understanding, financial modelling, and knowledge of certain sectors.

Management Consultant: A job that the majority of students at business schools want to pursue. Although having an MBA is not a requirement to work in consulting, it might make it simpler to enter the field and advance more quickly. The essence of consulting is problem-solving for firms to enhance company performance, which unquestionably calls for abilities like executive leadership, corporate strategy, and effective communication.

Corporate Finance: The goal of corporate finance is to use a company's financial resources as efficiently as possible. It might entail judgments about dividend distributions, raising money, managing financial resources, capital structure, and making important investment decisions.

Entrepreneurship: Many MBA graduates are interested in starting their own firm after learning essential management knowledge and key financial abilities. An MBA equips individuals with the abilities needed to form their creative ideas. Additionally, a finance MBA gives students the tools they need to manage their own finances. This is a lethal mix of skill sets to reduce expenses during the early phases of an endeavor, therefore graduates who choose this path are in luck.

Equity research: a position that entails conducting extensive market research, in-depth analysis of several companies, and report writing. To pursue this vocation, one has to have strong analytical financial abilities as well as up-to-date knowledge of market developments. The ability to manage one's own portfolio or fund is possible as one advances in this field. The key to this position is having analytical abilities to fully comprehend a company from its financials.

Corporate Banking: Selling banking products to companies is a subset of investment banking. Among the offerings are mergers, risk management, and liquidity management. There are a ton of options here; one may create a financial product or work as a relationship manager up front to market these items to businesses.

Compensations/packages:

Your career will advance in terms of both prospects and pay with an MBA in finance. The fact that it is the most popular concentration is mostly due to the compensation after graduation. After earning an MBA in Finance, the typical annual pay is close to 7 lakhs. At entry-level positions, an MBA in Finance from a prestigious business school may expect to earn an average salary of more than $20,000. A financial specialty will surely lead to a very profitable future. The highest compensated profession among the aforementioned ones is investment banking.

Summary:

You may have the best of both worlds with an MBA in finance: a stable position with a good salary. The high price for an MBA is justified by the competence it provides, and the need for workers with the financial acumen necessary to keep businesses operating offers stability. When you pair this with appropriate experience, remuneration packages soar. An MBA in finance can also assist you in managing your money and securing your financial future.

Your opportunities will increase, and your growth will occur more quickly if you establish a strong network and connections in the financial industry. Your career will advance, and you will be noticed by major corporations if you have an MBA in finance.

2 notes

·

View notes

Text

How Partnering With Recruitment Agencies is an Effective Solution for Growing Businesses

The African business landscape has been undergoing vivid transformations, driven by rapid economic growth, technological advancements, and a rapidly expanding young population. According to the World Bank, Sub-Saharan Africa's economy is expected to expand by 4.0% in 2025, fuelled by increased trade, investment, and digital transformation. This dynamic environment presents both opportunities and challenges for businesses seeking to attract and retain top talent.

In this blog, we will discuss how partnering with Africa job consultants in India can help growing businesses tap into this potential by providing effective recruitment and talent acquisition solutions.

The Challenges of In-House Recruitment

Resource-Intensive Process

In-house recruitment can be a time-consuming and resource-intensive process. Businesses need to invest significant time and effort in advertising job openings, screening resumes, conducting interviews, and onboarding new hires. Generally, the recruitment process can take up to three months from job posting to onboarding, depending on the complexity of the role and the number of candidates.

Skill Shortages

Finding qualified candidates is one of the biggest challenges faced by businesses in Africa. According to the Skills for Employability and Productivity in Africa (SEPA) Action Plan, 2022–2025, the African continent is considered the least skilled in the world.

Compliance Issues

Businesses must ensure they are compliant with various legal requirements, such as minimum wage laws, working hours, and employee benefits. Non-compliance can result in legal penalties and damage to the company's reputation. According to the World Bank, 53% of African governments face challenges in meeting their debt obligations, which can impact their ability to enforce labour laws effectively.

Cost Implications

In-house recruitment can be costly, especially when considering the potential costs of bad hires and high turnover rates. The cost of a bad hire can be significant, including the expenses associated with recruiting, training, and lost productivity.

Benefits of Outsourcing Recruitment

Access to Expertise

Outsourcing recruitment to specialised agencies brings a wealth of industry expertise and market knowledge to the hiring process. Job consultants for Africa in India, like Ross Warners, have access to a vast network of qualified candidates and are well-versed in the latest trends and best practices in talent acquisition. Their knowledge and resources can help streamline the recruitment process and ensure that only the most qualified candidates are presented for consideration.

Time Savings

Outsourcing recruitment can significantly reduce the time spent on hiring, allowing businesses to focus on core operations. By leveraging the expertise of recruitment agencies, companies can streamline the hiring process and quickly fill expat jobs in West Africa. This efficiency is crucial in a competitive market where time is of the essence.

Cost Efficiency

Partnering with Africa job consultants in Mumbai can be cost-effective, reducing expenses related to advertising, screening, and interviewing. The cost savings can be substantial, especially for small and medium-sized enterprises (SMEs) that may not have the resources to manage an in-house recruitment team.

Quality of Hires

Recruitment agencies ensure a better match between candidates and job requirements, leading to higher retention rates. By thoroughly vetting candidates and understanding the business's specific needs, agencies can provide high-quality hires who are more likely to stay with the company long-term. This reduces the costs associated with turnover and retraining.

Conclusion

Partnering with a recruitment agency, like Ross Warner HR Solutions, can transform your hiring process, allowing you to focus on core operations and strategic growth. With strategic recruitment partners like Ross Warner HR Solutions, businesses can access a pool of pre-screened, qualified candidates that align with their company culture and values. This ultimately saves time and resources in the long run, while also increasing the likelihood of finding the right fit for the job.

Visit Ross Warner HR Solutions to learn more and get started today!

0 notes

Text

6 Easy Steps to Choose the Right Banking Recruitment Agency

Selecting the right banking recruitment agency can be a distinct advantage for both work searchers and banking foundations. The correct office can smooth out the employing system, guaranteeing that competitors with the right abilities and capabilities are coordinated with the right jobs. The following are six simple tasks to assist you with picking the best financial enlistment organization to address your issues.

1. Define Your Requirements

Before you start your advantage, it's squeezing to have a reasonable comprehension of what you really want from a banking recruitment agency. For work searchers, this recommends perceiving the sort of financial positions you're amped up for, for example, retail banking, experience banking, or cash related appraisal. For banks and monetary foundations, this integrates finishing up the particular positions you really want to fill, for example, credit specialists, consistence arranged specialists, or branch supervisors.

By framing your necessities, you can limit your rundown of expected organizations to those that have practical experience in your specific area of interest. For example, on the off chance that you're searching for significant level leaders, you could zero in on organizations with a solid history in chief hunt inside the financial area.

2. Check Their Industry Expertise

Banking is a specific field, so picking an enlistment office with profound industry knowledge is significant. Search for organizations that have a demonstrated history in banking recruitment and figure out the subtleties of different financial jobs. You can survey their aptitude by exploring their site, perusing client tributes, and requesting contextual investigations or examples of overcoming adversity.

A recruitment agency with a solid spotlight on financial will have laid out associations with industry experts and a superior handle of the abilities and capabilities expected for various jobs. This ability will be important in tracking down the right applicants or open positions.

3. Evaluate Their Recruitment Process

Understanding how an enlistment office leads its hunt and determination cycle can give you knowledge into their viability. Get some information about their way to deal with obtaining competitors, screening cycles, and how they guarantee that up-and-comers are ideal for the jobs they're filling.

For job seekers, ask about how the office coordinates your abilities and vocation objectives with accessible open doors. For bosses, it's crucial for know how the office surveys possibility to guarantee they meet your particular necessities and organizational culture.

An agency that uses a rigorous and transparent recruitment process is more likely to deliver high-quality candidates or job matches.

4. Consider Their Reputation and Reviews

Reputation speaks volumes about the effectiveness of a recruitment agency. Research online reviews, request references, and look for suggestions from associates or industry contacts. A respectable organization will have positive input from the two clients and competitors and a past filled with effective situations.

Pay attention to reviews that notice the office's correspondence, impressive skill, and capacity to comprehend client needs. These elements are significant in guaranteeing a smooth and fruitful enrollment process.

5. Assess Their Communication and Support

Effective communication is key to a successful partnership with a recruitment agency. Assess how well the organization speaks with you during the underlying phases of commitment. Is it true that they are receptive to your requests? Do they give clear and opportune updates?

For job seekers, great help from the office remembers standard updates for requests for employment and useful criticism. For businesses, it includes straightforward correspondence about the advancement of the enrollment interaction and any difficulties experienced.

An agency that focuses on correspondence and backing is bound to give a positive and useful experience.

Conclusion

Choosing the right banking recruitment agency involves careful consideration and due diligence. By characterizing your necessities, assessing industry ability, understanding the enlistment interaction, really taking a look at notoriety and surveys, evaluating correspondence and backing, and exploring expenses and terms, you can go with an educated choice. The right agency like Alliance Recruitment Agency will assist with smoothing out your pursuit of employment or enlistment process, prompting effective results for the two up-and-comers and businesses. Carve out opportunity to follow these means, and you’ll be well on your way to finding a recruitment partner that meets your needs effectively. Contact us now.

#Banking Recruitment Agencies#Banking Jobs#Recruitment Solutions#Hiring Agencies#Financial Sector Recruitment#Recruitment Tips#Job Placement Services#Banking Industry Experts#Recruitment Process#Talent Acquisition#Employment Agencies#Banking Talent#Career in Banking#Job Seekers in Banking

0 notes

Text

6 Popular Specializations in Mumbai MBA Colleges

Choosing the right specialization in your MBA program is a critical decision that can shape your career path. In Mumbai, which is home to some of India’s top MBA colleges, including Aditya School of Business Management (ASBM), students have the opportunity to select from a wide range of specializations that align with their career goals and industry interests. Below are 6 popular MBA specializations offered by leading institutions in Mumbai, including ASBM:

1. Finance

Overview: Finance is one of the most sought-after MBA specializations in Mumbai, given the city’s role as India’s financial capital. This specialization covers a wide array of financial management topics, including corporate finance, investment banking, portfolio management, risk management, and financial analysis.

Career Opportunities: Graduates with an MBA in Finance can pursue careers in investment banks, hedge funds, financial consulting firms, corporate finance departments, and private equity. Mumbai’s strong financial ecosystem makes it an ideal place to kick-start a career in finance.

Key Skills Acquired: Financial modeling, data analysis, financial reporting, risk assessment, and investment strategies.

2. Marketing

Overview: Marketing is a popular choice for MBA students who are passionate about branding, consumer behavior, digital marketing, and product management. This specialization focuses on areas such as market research, consumer psychology, advertising, sales management, and digital marketing.

Career Opportunities: MBA graduates in Marketing can pursue roles in brand management, advertising, sales, market research, digital marketing, and content creation. Mumbai, with its vibrant business ecosystem, offers numerous opportunities in both traditional marketing roles and emerging fields like digital marketing and e-commerce.

Key Skills Acquired: Consumer insights, market research, branding, strategic marketing, digital marketing, and customer relationship management (CRM).

3. Human Resources (HR)

Overview: An MBA in Human Resources is an ideal choice for students interested in talent management, employee relations, and organizational behavior. This specialization covers topics like recruitment, training and development, performance management, compensation and benefits, and labor laws.

Career Opportunities: HR specialists are in demand across industries, and roles in talent acquisition, HR consulting, organizational development, and employee engagement are popular career options. As companies in Mumbai continue to grow, skilled HR professionals are increasingly sought after to help manage workforce dynamics.

Key Skills Acquired: Employee engagement, conflict resolution, recruitment and selection, organizational development, and HR analytics.

4. International Business

Overview: Given Mumbai’s prominence as a global business hub, an MBA in International Business (IB) offers students the opportunity to understand global markets, international trade, cross-cultural management, and foreign investment. This specialization prepares students to manage business operations on a global scale, focusing on global supply chains, cross-border mergers and acquisitions, and international market entry strategies.

Career Opportunities: Graduates in IB often take up roles in global consulting firms, multinational corporations (MNCs), international trade organizations, and global marketing teams. Given Mumbai’s position as a gateway for international trade and finance, career opportunities for IB graduates are plentiful.

Key Skills Acquired: Cross-cultural communication, international market analysis, global supply chain management, and international finance.

5. Operations Management

Overview: Operations Management is a popular specialization for MBA students who are interested in optimizing business processes, supply chains, production management, and logistics. This specialization includes topics like operations strategy, supply chain management (SCM), quality management, and lean manufacturing.

Career Opportunities: Operations specialists are in demand in industries such as manufacturing, logistics, consulting, and e-commerce. Graduates of Operations Management often take on roles like operations manager, supply chain coordinator, logistics manager, and production planner in diverse sectors.

Key Skills Acquired: Process optimization, project management, logistics management, quality control, and lean manufacturing techniques.

6. Entrepreneurship

Overview: Entrepreneurship is an increasingly popular MBA specialization in Mumbai, especially with the growing startup culture. This program equips students with the skills necessary to launch, manage, and scale new ventures. Courses may cover topics such as business planning, venture capital, innovation management, marketing for startups, and fundraising.

Career Opportunities: Graduates with a focus on Entrepreneurship may choose to start their own startups, work in venture capital firms, or take on leadership roles in startup incubators and accelerators. Mumbai, with its thriving startup ecosystem, is an ideal city for students aspiring to launch or join high-growth ventures.

Key Skills Acquired: Business model development, funding strategies, innovation, market disruption, and entrepreneurial leadership.

Conclusion: Why Choose These Specializations at ASBM?

At Aditya School of Business Management (ASBM), students are likely to benefit from a comprehensive, industry-focused curriculum tailored to the specific needs of each specialization. Here’s why these 6 popular specializations are particularly valuable for MBA students at ASBM:

Industry Exposure: ASBM's connections with Mumbai's vibrant business ecosystem provide students with valuable industry exposure through internships, live projects, and corporate partnerships.

Customizable Career Paths: With the diverse range of specializations, ASBM offers students the flexibility to carve out a career path that aligns with their interests, whether it's in finance, marketing, HR, or entrepreneurship.

Networking Opportunities: Mumbai's global business hub nature allows ASBM students to connect with top industry professionals, entrepreneurs, and leaders, creating valuable networking opportunities for career growth.

Each specialization provides students with the necessary skills, knowledge, and hands-on experience to succeed in their chosen career paths, while the city of Mumbai serves as the perfect backdrop to launch your business career.

0 notes

Text

Top MBA PGDM Colleges in Indore: Career Paths & Placement Insights

Indore has emerged as a prominent educational hub, offering a range of opportunities for aspiring business professionals. Among the various courses available, an MBA or PGDM (Post Graduate Diploma in Management) is one of the most sought-after programs, with several top MBA PGDM colleges in Indore offering high-quality education. These institutions not only provide rigorous academic curricula but also equip students with the necessary skills to excel in the corporate world. Let’s delve into the career paths and placement insights associated with top MBA PGDM colleges in Indore.

Career Paths After MBA or PGDM

Graduating from a top MBA PGDM college in Indore opens a plethora of career opportunities. Depending on the specialization pursued during the course, students can embark on various professional journeys. Some of the common career paths include:

Management Consulting: A popular choice for MBA and PGDM graduates, consulting offers the chance to work with top organizations, advising them on strategy, operations, and management. Graduates from leading colleges often secure positions in top consulting firms such as McKinsey, BCG, or Deloitte.

Finance and Investment Banking: Many students from the top MBA PGDM colleges in Indore opt for careers in finance, including roles in investment banking, corporate finance, and financial analysis. Firms like Goldman Sachs, JP Morgan, and top Indian banks actively recruit graduates with strong analytical and financial skills.

Marketing and Sales: Another common path is a career in marketing and sales, which includes brand management, digital marketing, and product management. Top companies such as Unilever, P&G, and various startups look for graduates who can innovate and drive business growth.

Human Resources: MBA PGDM graduates with a focus on HR can take on roles such as HR managers, talent acquisition specialists, or organizational development consultants. Leading firms often hire graduates to manage their workforce efficiently.

Entrepreneurship: With a solid foundation in business management, many graduates choose to start their own ventures. The growing startup ecosystem in India, particularly in Indore, offers significant opportunities for those looking to build businesses from the ground up.

Placement Insights

The placement record of top MBA PGDM colleges in Indore is a key factor that attracts prospective students. These colleges have strong industry connections, ensuring that their students get access to some of the best job opportunities in the market.

Top Recruiters: Graduates from top MBA PGDM colleges in Indore have secured placements with renowned companies across various sectors. Top firms such as Accenture, Infosys, Wipro, Amazon, and KPMG visit these colleges to hire talent. These companies look for students with strong leadership qualities, communication skills, and strategic thinking abilities.

Average Salary Packages: The average salary package offered to graduates varies depending on the college and specialization. However, graduates from top colleges in Indore typically earn competitive salaries ranging from INR 6 to 12 lakhs per annum in the initial years. Some high performers, especially those with experience or specialized skills, can even secure packages exceeding INR 15 lakhs.

Internship Opportunities: Internships are a critical part of the MBA PGDM program, as they provide real-world experience and enhance a student’s employability. Top MBA PGDM colleges in Indore ensure that students receive internships with leading companies, giving them the opportunity to build networks and gain valuable industry experience before securing full-time roles.

Career Services and Alumni Network: The presence of robust career services and a strong alumni network in top MBA PGDM colleges in Indore helps students with mentorship and guidance, aiding in their career progression. Regular workshops, resume-building sessions, and career fairs further support students in their job search.

In conclusion, pursuing an MBA or PGDM from a top MBA PGDM college in Indore opens up diverse and lucrative career paths, supported by strong placement records and industry connections. With the right skills, networking, and exposure to top recruiters, graduates are well-equipped to succeed in the dynamic business world.

0 notes

Text

MBA Courses in Bangalore

Exploring the Top MBA Courses in Bangalore: A Guide for Aspiring Business Leaders

Bangalore, known as the "Silicon Valley of India," is more than just the country's tech hub. It's also a premier destination for higher education, especially in the field of business administration. With its thriving startup ecosystem, presence of multinational corporations, and academic excellence, Bangalore attracts ambitious students who aim to excel in the corporate world. If you’re contemplating pursuing an MBA, Bangalore offers numerous opportunities and world-class institutions to shape your career.

Why Pursue an MBA in Bangalore?

Bangalore’s appeal to MBA aspirants lies in its strategic blend of academic and professional environments. Here's why Bangalore stands out:

Vibrant Business Ecosystem: The city is home to some of India’s largest tech companies, promising startups, and global corporations. The exposure to real-world business problems and opportunities is unparalleled.

Networking Opportunities: Being a melting pot of professionals from various industries, Bangalore offers extensive networking opportunities. Many institutions regularly organize workshops, industry talks, and networking events, giving students a chance to connect with industry leaders.

High-Quality MBA Programs: Bangalore houses several top-tier B-schools offering diverse specializations and innovative learning approaches. Programs often emphasize experiential learning, case studies, and internships, making graduates industry-ready.

Top Specializations Offered in Bangalore

MBA courses in Bangalore cater to a variety of interests and career aspirations. Some of the most sought-after specializations include:

Finance: Ideal for those aiming to work in banking, investment, and financial management.

Marketing: For students who want to excel in consumer behavior analysis, brand management, and digital marketing.

Human Resource Management: Focusing on talent acquisition, employee relations, and strategic workforce planning.

Business Analytics: A rapidly growing field that leverages data to drive strategic business decisions.

Entrepreneurship: Perfect for students looking to launch their own businesses or join the startup ecosystem.

Leading MBA Institutes in Bangalore

Here’s a look at some prominent institutions that offer MBA programs:

Indian Institute of Management Bangalore (IIMB): A world-renowned B-school known for academic excellence and leadership development. IIMB's rigorous MBA curriculum is designed to equip students with critical management skills.

Xavier Institute of Management and Entrepreneurship (XIME): XIME is known for its holistic approach to management education, emphasizing ethical leadership and innovation.

Symbiosis Institute of Business Management (SIBM), Bangalore: Offering a robust curriculum with a focus on entrepreneurship and global management practices.

TA Pai Management Institute (TAPMI), Bangalore: Known for its strong industry connections and emphasis on practical learning through simulations and live projects.

International Institute of Business Studies (IIBS): A highly respected institution with a diverse range of MBA specializations and a focus on research-driven education.

What to Expect from an MBA Program in Bangalore

Curriculum: A typical MBA program includes core courses in business fundamentals such as economics, accounting, and strategy, followed by electives based on the chosen specialization.

Industry Exposure: Institutes in Bangalore frequently collaborate with companies for internships, live projects, and case studies. This industry integration ensures students are well-prepared to handle corporate challenges.

Diverse Peer Group: Studying in Bangalore means being part of a diverse cohort, with students coming from various cultural and professional backgrounds. This diversity enriches classroom discussions and expands networking opportunities.

Admission Criteria and Process

Admission to MBA programs in Bangalore generally involves:

Entrance Exams: Most institutions accept scores from exams like CAT, MAT, GMAT, XAT, or CMAT.

Group Discussions and Personal Interviews: These are crucial stages of the selection process, testing your communication, leadership, and analytical skills.

Academic Background and Work Experience: Some programs prefer candidates with prior work experience, though fresh graduates are also welcomed in many courses.

Career Prospects After an MBA in Bangalore

An MBA from a reputed Bangalore-based institution can open doors to exciting career opportunities. Graduates often secure roles such as:

Business Analyst

Marketing Manager

Financial Consultant

Product Manager

HR Manager

Strategy Consultant

The city’s flourishing job market and the presence of global tech giants and startups make it easier for graduates to find rewarding roles that align with their career aspirations.

Conclusion

Choosing the right MBA course is crucial to achieving your professional goals. Bangalore, with its rich academic environment and thriving business landscape, provides an ideal setting for aspiring business leaders to learn and grow. If you’re ready to immerse yourself in a city that’s constantly innovating and evolving, an MBA in Bangalore could be your gateway to success.

Whether you’re looking to climb the corporate ladder or embark on an entrepreneurial journey, Bangalore’s dynamic MBA programs offer the perfect foundation. Take the plunge and start shaping your future today!

#management#business#leadership#business development#mba programs#project management#internationalstudies#mba#leadershipdevelopment

0 notes

Text

Career Opportunities After Doing an MBA Course in Patna, Bihar

Completing an MBA course in Patna offers promising career prospects across various industries. With Patna emerging as an educational hub, students can benefit from a blend of quality education, practical training, and affordability. The city is home to some top MBA colleges in Bihar, providing excellent programs for students aiming for successful business careers. Here’s why choosing an MBA in Patna can be a stepping stone to a rewarding future.

Why Opt for an MBA Course in Patna?

Choosing an MBA college in Patna brings numerous benefits. The city’s leading management colleges in Patna, Bihar, are known for their industry-aligned curricula, focusing on practical skills through internships, case studies, and live projects. An MBA course in Patna is also more affordable compared to other metropolitan areas, providing students with cost-effective education while ensuring a high-quality learning experience.

Moreover, an MBA in Bihar gives access to a growing job market, with several companies establishing their presence in the region, making it easier for graduates to find local placement opportunities.

Career Opportunities After MBA

An MBA opens doors to diverse career paths in multiple sectors. Here are some of the career opportunities available after completing an MBA course in Patna:

1. Business Management

Graduates from a top MBA college in Patna can pursue management roles in various fields. Job options include:

Operations Manager: Focuses on streamlining processes to enhance productivity.

Project Manager: Leads projects to ensure they are delivered on time and meet quality standards.

General Manager: Takes on broad responsibilities, including strategic planning and team leadership.

2. Finance and Banking

For those interested in finance, an MBA with a finance specialization from a management college in Patna, Bihar, offers lucrative opportunities:

Financial Analyst: Involves analyzing financial data for strategic decision-making.

Banking Officer: Positions in corporate banking or retail banking.

Investment Analyst: Working in investment firms or financial advisory roles.

3. Marketing and Sales

MBA graduates specializing in marketing have vast opportunities in Patna and beyond:

Marketing Manager: Develops strategies to boost sales and brand visibility.

Sales Manager: Manages sales teams to meet revenue targets.

Brand Manager: Shapes the image of a company or product.

4. Human Resource Management (HRM)

An MBA in HR prepares graduates to manage employee-related tasks effectively:

HR Manager: Handles recruitment, training, and employee relations.

Talent Acquisition Specialist: Focuses on hiring the right talent for the company.

5. Entrepreneurship

Many MBA graduates from MBA colleges in Patna venture into entrepreneurship, equipped with the skills needed to launch and grow their own businesses.

You can also read Career Opportunities after paramedical Courses

Conclusion

Choosing an MBA course in Patna offers multiple benefits, from quality education to promising career opportunities. Graduates from an MBA college in Bihar can pursue careers in management, finance, marketing, HR, and entrepreneurship. With affordable education, a growing job market, and the chance to gain practical skills, pursuing an MBA in Bihar is a smart investment for a bright future.

0 notes