#Bank loan

Explore tagged Tumblr posts

Text

6 notes

·

View notes

Text

5 things to consider when choosing a bank account

Choosing the right bank account is crucial for managing your finances effectively. With so more

#choosing a bank account#bank account#bank loan#banka#bankai#cryptocurrency news latest#btc latest news#bankmanfried#crypto latest news#bitcoin latest news#banksy#bank#tyra banks#announces

2 notes

·

View notes

Text

Free Debt Consultation Loan

FREE Debt Relief Consultation See If You Qualify In 1 Minute. Debt settlement services - No upfront fees and no obligation!

0 notes

Text

Bank Loan: Availing Loan From HDFC Bank Becomes Cheaper

Bank Loan: Availing Loan From HDFC Bank Becomes Cheaper Bank Loan: HDFC Bank has announced a cut in interest rates. Based on the information given by the bank, the bank has reduced its MCLR by up to 5 basis points (BPS) on selected periods. After this cut, HDFC Bank’s MCLR now ranges from 9.15% to 9.45%. The new rates have come into effect from today i.e. January 7, 2025. The reduction in MCLR…

0 notes

Text

Study Abroad latest News in Gujarati. If your child is also planning to study abroad, the largest public sector bank, State Bank of India, is offering you an education loan of up to Rs 50 lakh without any guarantee.

#news#gujarati news#latest news#latest gujarati news#breaking news#breaking news in gujarati#SBI news#Study Abroad latest News in Gujarati#study abroad news#largest public sector bank#largest public sector bank SBI#education loan#education loan upto 50 lakh#bank loan#student loan#SBI Education loan

0 notes

Text

Project Reporting Services for CMEGP, PMEGP, and Bank Loans

sample project report for cmegp loan

Finaxis Business Consultancy specialises in creating thorough and professional project reports for loan applications under CMEGP, PMEGP, and other bank loan schemes. Our papers include extensive business descriptions, financial estimates, market analysis, and implementation strategies that match the specific needs of funding organisations. With expertise in a variety of industries, we ensure that your application stands out, increasing the likelihood of loan approval. Whether you're beginning a new business or growing an existing one, Finaxis will provide precise, customised, and compliant project reports to help you along your entrepreneurial journey.

0 notes

Text

PMEGP Loan Project Report

PMEGP loan project report requirements include a detailed business plan, cost estimates, market analysis, financial projections, and loan amount needed. The report helps assess eligibility for government-subsidized loans under the scheme. The Prime Minister's Employment Generation Programme (PMEGP) is a significant initiative aimed at promoting self-employment and creating sustainable job opportunities across India. To successfully apply for a PMEGP loan,

1 note

·

View note

Text

Procedures for Obtaining Educational Loans for Nepali Students

Navigating the process of obtaining educational loans is crucial for Nepali students aiming to study abroad. This guide outlines the key steps, from securing an offer letter to understanding loan requirements and meeting with bank officials.

Start by obtaining your offer letter and No Objection Certificate (NOC). Next, assess the loan amount needed for tuition and living expenses. Then, schedule a meeting with a bank, where you'll discuss collateral and the loan process. After valuation and legal agreements, the bank will issue a sanction letter and eventually disburse the loan.

For detailed guidance on each step and to ensure you don't miss any important details, visit our comprehensive guide on educational loans for Nepali students.

#educational loans#study abroad#Nepali students#loan process#study in USA#study in Australia#financial aid#bank loan#student loans#NOC#offer letter

0 notes

Text

What is the Current Loan Interest Rate in Sri Lanka?

Understanding the current bank loan interest rates in Sri Lanka is essential for anyone considering borrowing funds for personal, business, or investment purposes. The loan interest rate is the percentage charged on the total loan amount, impacting the overall cost of borrowing.

In Sri Lanka, loan interest rates are influenced by various factors, including the Central Bank's monetary policy, inflation rates, and the financial health of the lending institution. Typically, these rates can range significantly based on the type of loan, the borrower's creditworthiness, and the loan tenure.

Personal loans generally come with higher interest rates compared to secured loans like home or auto loans. This is due to the increased risk for the lender when offering unsecured credit. Business loans, on the other hand, might have varying rates based on the business's financial stability and the specific loan terms negotiated.

To find the best loan interest rate, it's crucial to compare offerings from different banks and financial institutions. Many institutions provide detailed information about their loan products online, making it easier for potential borrowers to make informed decisions. Additionally, consulting with financial advisors can provide insights into the most suitable loan options based on individual financial situations.

Prospective borrowers should also be aware of any additional fees and charges associated with loans, such as processing fees, early repayment penalties, and insurance costs. These can add to the overall cost of borrowing, making it important to read the fine print and understand all terms and conditions before committing to a loan.

Staying informed about the current loan interest rates in Sri Lanka helps borrowers make sound financial decisions. By comparing rates and understanding the various factors influencing these rates, individuals and businesses can secure loans that best meet their financial needs.

For competitive loan interest rates and reliable financial services, consider exploring the offerings from Siyapatha Finance.

Siyapatha Finance

0 notes

Text

If you’re looking to apply for a loan, you’ll need to prepare a Detailed project report or DPR to submit to the lender. This report is a crucial component of the loan application process, as it provides the lender with a detailed overview of your project and your ability to repay the loan. Our Team will help you in getting Project Report for bank loan that will be accurate and will be accepted by every bank and financial institutions. Read More >> https://setupfiling.in/project-report-for-bank-loan/

#project report#bank loan#DPR#project report software for bank loan#project report for business loan#finline project report#pmegp project report#project report format for bank loan

1 note

·

View note

Text

How to Get a Business Loan in Dubai

Dubai, a global business hub, offers a myriad of opportunities for entrepreneurs. Securing a business loan in Dubai is a critical step for many business owners looking to start or expand their operations. This guide will walk you through the various aspects of obtaining a business loan in Dubai.

Types of Business Loans Available in Dubai

SBA Backed Loans: These are loans backed by the Small Business Administration, offering lower interest rates and longer repayment terms. Loans for Businesses Requiring Vehicles: Specialized loans for businesses that need vehicles for operations. Small Business Loans: Tailored for small-scale businesses, offering manageable loan amounts and terms. Self-Employment Loans: Designed for individuals running their own business. Islamic Finance Options: Sharia-compliant financial products for businesses.

Who Offers Business Loans in Dubai? Numerous banks and financial institutions in Dubai offer business loans, including both local and international banks.

Eligibility and Requirements Who is Eligible?

Residents and non-residents with a business in the UAE. Startups and established businesses.

Basic Requirements

Valid business license. Business plan and feasibility study.

Documentation Needed

Business and personal bank statements. Financial statements and projections. Valid identification and residency documents.

Credit Score and Financial History A good credit score and a clean financial history can significantly increase the chances of loan approval.

Applying for a Business Loan in Dubai Step-by-Step Process

Research and select a financial institution. Prepare and submit the required documentation. Wait for approval and disbursement of funds.

Choosing the Right Financial Institution Consider factors like interest rates, loan terms, reputation, and customer service.

Common Mistakes to Avoid

Incomplete or incorrect documentation. Overestimating loan requirements. Ignoring credit score and financial history.

Repayment and Interest Rates Understanding Interest Rates Interest rates in Dubai can vary based on loan type, duration, and risk assessment.

Repayment Terms and Options Repayment terms can range from short-term (1–3 years) to long-term (up to 10 years), with flexible repayment options available.

Calculating the Cost of a Loan Over Time It’s crucial to calculate the total cost of the loan, including interest, to assess affordability.

Alternatives to Traditional Business Loans

Islamic Finance Options: Non-interest based financing methods. Angel Investors and Venture Capital: For high-growth potential businesses. Government Grants and Support Programs: Financial support for specific sectors or initiatives.

Conclusion Embarking on your financial journey in Dubai requires careful planning and understanding of the various loan options and requirements. By following this guide, you can navigate the process of securing a business loan in Dubai more effectively, setting your business up for success.

M.Hussnain

Private Wolf | facebook | Instagram | Twitter | Linkedin

#business loan#loan in dubai#how to get loan#bank loan#how to get bank loan#business setup#business setup in dubai#dubai#private wolf#business#business in dubai#cost calculator

0 notes

Text

Unveiling the Factors: What Drives Up Your Total Loan Balance?

The total amount of loans you have is an important aspect of managing your finances that needs to be closely watched. Make wise financial decisions when it comes to your mortgage, auto loan, student loan, or personal loan by being aware of the things that add to your overall loan balance. We'll examine the main causes of what increases your total loan balance in this blog post and provide tips on how to effectively manage them.

1. Interest Rates: The Unseen Offender

The total cost of your loan is heavily influenced by interest rates. A higher interest rate means you'll pay more over the loan's life. It is critical to understand the interest rates associated with your loans and to look for ways to secure lower rates. Refinancing or consolidating loans at a lower interest rate can reduce your total loan balance significantly over time.

Also read: https://justpaste.it/b0r48

2. Loan Term: Impact of Short-Term vs. Long-Term

Your total balance is also affected by the term of your loan. While longer loan terms may result in lower monthly payments, they frequently result in higher overall costs due to interest accrued. In contrast, shorter loan terms may result in higher monthly payments but lower total interest paid. When selecting a loan term that aligns with your financial goals, consider the trade-offs between short-term affordability and long-term savings.

3. Late Payments and Fees: The Price of Delay

Missed loan payments not only result in late fees, but they can also significantly increase your overall loan balance. Late payments can harm your credit score, resulting in higher interest rates on future loans. Setting up automatic payments and creating a budget can help you avoid late fees, maintain a positive credit history, and ultimately reduce your total loan balance.

4. Further Borrowing: The Snowball Effect

Taking on new debt while repaying existing debts can quickly increase your total loan balance. Before considering new loans, assess your current financial situation and prioritize debt repayment. Responsible borrowing and a clear understanding of your financial capacity can help you keep your total loan balance under control.

5. Loan Repayment and Forgiveness: A Double-Edged Sword

Forgiveness programs and income-driven repayment plans can be beneficial for certain types of loans, such as student loans. While these options may provide temporary relief, it is critical to understand their long-term consequences. Specific criteria must be met for some forgiveness programs, and income-driven repayment plans may result in a longer repayment period, ultimately increasing the total amount repaid. Examine the terms and conditions of such programs thoroughly before making decisions about their impact on your total loan balance.

Conclusion

Finally, understanding the factors that contribute to your total loan balance is critical for maintaining financial health. You can make informed decisions to reduce the growth of your total loan balance by understanding the impact of interest rates, loan terms, late payments, additional borrowing, forgiveness programs, and economic conditions. Remember that financial responsibility is essential for long-term financial stability, so assess your current situation and plan for a future with a manageable and reduced total loan balance.

1 note

·

View note

Text

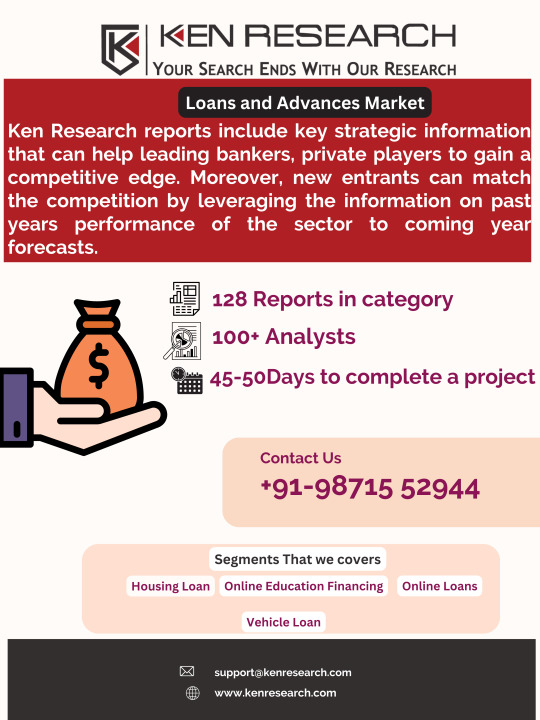

Discover the investment potential in the loans and advances market as it adapts to changing financial landscapes.

0 notes

Text

vimeo

Welcome to Biz Banking Consultancy

Trust Biz Banking's Business Consultancy to be your partner in achieving business excellence. We offer innovative solutions, financial expertise, and strategic planning to drive your company's growth, reduce risk, and maximize profitability. Your success is our priority. For more information, contact us at +971 552046346 or visit our website today!

0 notes