#Bank Nifty Options

Explore tagged Tumblr posts

Text

0 notes

Text

Although options trading is a bit more complex than stock trading, it helps make more significant profits when the security’s price rises and restricts losses when it goes down. Options in stock market are powerful as they can enhance a person’s portfolio through added income, leverage, and protection.

What is options trading?

Option trading allows traders to buy or sell stocks, ETFs, etc., at a specified price and within a specific date. It also gives the flexibility to wait to purchase the stocks at the decided price or date. Options trading allows investors to judge the future course of direction of the stock market or individual securities like bonds, stocks, etc.

When considering options trading, one should know what options are and their various types. If you are looking for tips and strategies for options trading for beginners, this article will help you find answers to each of your queries.

What are options?

Options are tradable contracts that give the bearer the right but not the obligation to buy or sell an asset at a predetermined price on or before the contract expires. Although options trading is a bit more complex than stock trading, it helps make more significant profits when the security’s price rises and restricts losses when it goes down. Options in stock market are powerful as they can enhance a person’s portfolio through added income, leverage, and protection. It can be used as –

Leverage – When the security price rises, options trading helps you grab more enormous profits as you don’t have to put down the total price of the share. It lets you have control over the shares without buying them outright.

Hedging – When the price of a share fluctuates, options trading protects the investor by allowing you to buy or sell the shares at a pre-determined price for a specified period.

Types of stock options trading

Options trading can be categorized into two types – call option and put option. Below is a detailed insight into the two categories.

Call options – When the underlying security rises in price, it gives the opportunity to buy. Call option allows the trader to buy stocks at a pre-determined price within a specified period. The price paid is the strike price, and the last date of exercising the call option is known as the expiration date.

There are two ways to earn profit from the call option: Close your position (sell the call option) when the asset’s price surpasses the break-even price and make the difference between the paid and current premium. Or you can buy the asset at the agreed strike price.

Put options – Unlike call options, where the trader has the opportunity to buy, the put option allows people to sell the underlying stock at the strike price on or before the date of expiry.

If you are willing to earn profits through put options, either close your position (sell the options contract) when the asset price is below the break-even level and make

the difference between the premium paid and the current premium. Or sell the underlying asset at the agreed strike price.

If the underlying asset’s price moves in the opposite direction to the desired call or put options, wait for the contract to expire, and your losses will equate to the amount you paid for the option.

Types of option trading strategies

There are multiple types of trading in the stock market. There are numerous options trading strategies, but if you are a beginner, you should initially be well-versed in these five for effective trading.

Long calls (Buying calls) – A bullish trader should take this strategy. When the price of an asset is expected to rise, you can buy a call option using less capital than the asset. Also, if the price falls, the losses are limited to just the premium paid and no more.

Long puts (Buying puts) – Bearish traders prefer this buying options strategy. It gives the holder the right to sell the particular stock at the strike price. Short selling is the only way a trader can benefit from this strategy.

Covered calls – This strategy is preferred during a moderate or neutral market. Out of all other option trading strategies, covered calls are one of the safest options trading strategies. Here the investor sells a call option while also owning the underlying asset.

Protective puts – It is a risk management strategy that guards against the downside movement of an asset. Although put options are a bearish strategy, protective puts are favored when the trader is still in a bullish trend but wishes to hedge against potential losses.

Long straddles – It is one of the best stock options trading strategies in the Indian stock market. Here the trader purchases both a long call and a long put on the same underlying stock having the same expiration date and strike price.

Profitability in options trading

There are various types of trading in stock market, but every kind has some profitability scenarios, which make it worth opting for. Below is a list of the three significant situations that may lead to profitable trading outcomes.

In-the-money option (ITM) – When the current index value is greater than the strike price, it is said to be an in-the-money option. It leads to a positive cash flow being exercised immediately.

At-the-money option (ATM) – When the current index value is equal to the strike price, it is said to be an at-the-money option. It leads to no profit and loss, i.e., zero cash flow being exercised immediately.

Out-of-the-money option (OTM) – When the index value is lower than the strike price, it is said to be an out-of-the-money option. It leads to a negative cash flow being exercised immediately.

#ashutosh bhardwaj#bank nifty#finance#finance education#financial market#investment research#investments#logical nivesh#option trade#option trading#Options trading for beginners#sebi#strategies

6 notes

·

View notes

Text

7 Strategies for Successful Options Trading Trading options within a single day or short-term has become a popular choice among traders looking to capitalize on price movements. But it takes talent, self-control, and practical tactics to master. TechnoFunda offers expert options trading tips and research.

0 notes

Video

youtube

बजट तक क्या करेगा बाजार? जानिए समझिए। #nifty #trading #shorts @HowTradin...

#youtube#howtrading2#trading live#option trading#live trading today#live trading#live trading intraday#intraday live trading#nifty live trading#nifty50#bank nifty#tomorrow market analysis#budget2025#budget or share market

0 notes

Text

0 notes

Text

Nifty Bank, also referred to as Bank Nifty, is one of the most popular stock market indices in India. It consists of the 12 most liquid and large capitalized banking stocks from the National Stock Exchange (NSE). Understanding the Nifty Bank index is crucial for traders and investors who want to take advantage of the banking sector's performance in the stock market.

#bank nifty share price#bank nifty today#bank nifty chart#bank nifty option chain#bank nifty live#bank nifty today- live chart#bank nifty expiry day#bank nifty share#bank nifty today prediction#bank nifty expiry#bank nifty prediction

0 notes

Text

Today's Nifty Outlook: Understanding Market Movements

The Nifty forecast, which includes the top 50 companies listed on the National Stock Exchange (NSE) often shows how well India's economy is doing overall.

Please visit our blog - https://hmatrading.in/nifty-forecast/ Address: Ground floor, D - 113, D Block, Sector 63, Noida, Uttar Pradesh 201301 Phone: 9625066561

#Tomorrow market prediction bank nifty#Bank nifty prediction today india#crude oil price prediction tomorrow in India#top 10 stock market advisor in india#Options Trading Guide

1 note

·

View note

Text

Emcure Pharmaceuticals IPO opens today: GMP, subscription status, review, other details. Apply or not?

Get insights from SEBI Registered experts-

FILL https://intensifyresearch.com/web/landingpage NOW & avail 3 Days DEMO

#investing#stock market#banknifty#nifty prediction#nifty50#nse#sensex#share market#finance#economy#ipo alert#ipo news#sharemarket#sebi#stockmarket#fed#banks#nseindia#niftytrading#bseindia#bse#bse sensex#option trading#f&o#researchanalyst

1 note

·

View note

Text

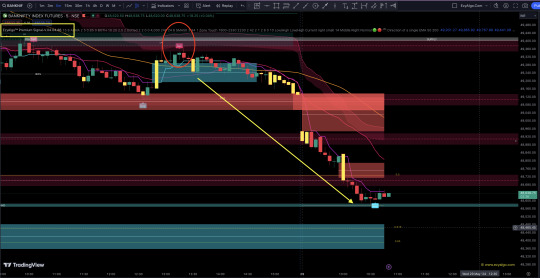

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024 by the (EzyAlgo) Premium Signal Indicator

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024, a notable spinning top candle indicated market indecision within a 400-500 point range. However, on 29 May 2024, the market opened below this range and moved decisively, achieving a target of approximately 500-600 points. This movement was confirmed by the (EzyAlgo) Premium Signal Indicator.

Updated Analysis:

Spinning Top Candle (27 May 2024): Initially indicated indecision within a 400-500 point range.

Breakout (29 May 2024): Market opened below the range and moved decisively.

Target Achieved: Approximately 500-600 points movement.

Indicator Confirmation: EzyAlgo Premium Signal Indicator confirmed the move.

Trading Implications:

Breakout Strategy: The decisive move below the range provided a clear breakout signal, leading to a significant price movement.

Indicator Use: Utilizing tools like the EzyAlgo Premium Signal Indicator can help confirm trading signals and improve decision-making.

By staying alert to breakout signals and leveraging reliable indicators, traders can capitalize on significant market moves effectively.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutions

#stock market#nifty50#option trading#nifty option tips#niftytrading#technical analysis#economy#finance#forex trading#forexsignals#banknifty#bank nifty

0 notes

Text

7 Strategies for Successful Options Trading

Trading options within a single day or short-term has become a popular choice among traders looking to capitalize on price movements. But it takes talent, self-control, and practical tactics to master. TechnoFunda offers expert options trading tips and research.

7 Options Trading Strategies:

Strategy 1: Mastering Risk Management

Effective risk management is essential for options trading success. Always set a stop-loss to limit losses and define target prices to secure profits.

Strategy 2: Analyzing Market Trends

Being aware of market trends enables you to make wise choices. Study charts and patterns to identify potential opportunities.

Strategy 3: Choosing Liquid Options

Trading liquid options ensures quick execution and low slippage.

Strategy 4: Keeping Emotions in Check

Trading emotionally often leads to poor decisions. Stick to your trading plan and avoid reacting to every market move.

Strategy 5: Timing the Market

Timing is everything in options trading. The first and last hours of market sessions often have the highest volatility.

Strategy 6: Staying Updated with News

News directly impacts options prices. Track key events like policy announcements and earnings reports.

Strategy 7: Learning and Evolving

Continuous improvement is vital for long-term success. Analyze past trades to identify what worked and what didn’t.

Conclusion

Options trading offers immense potential but demands strategy, discipline, and continuous learning. TechnoFunda offers expert options trading tips and research.Visit TechnoFunda Wealth to get started today!

0 notes

Text

Index Options tips | Nifty option tips | Bank Nifty option tips | Option Trading | option tips

Unlock the potential of Index Options with expert insights! Explore valuable Nifty option tips, Bank Nifty option tips, and master the art of Option Trading. Elevate your trading strategy with comprehensive option tips to navigate the dynamic market. Whether you're a seasoned trader or a beginner, our curated Index Options tips provide actionable advice to enhance your financial success. Stay ahead of market trends and make informed decisions with our specialized guidance. Discover the power of strategic option trading and maximize your returns. Gain confidence in your trades with our dedicated tips designed for success in the world of options. Take control of your financial future and optimize your trading portfolio with our precise and reliable advice. Start your journey to financial prosperity today!

#Index Option tips#stock option#option trading tips#options trading tips#nifty option tips#bank nifty option tips#nifty options tips#future and option tips#banknifty option tips provider#option trading tips free#option tips#option trading#options trading#option trading strategies#option trading strategy#option strategy#option strategies#option buying strategy#option trading for beginners#best option strategy#zero loss option strategy#what is option trading#option trading in hindi#best strategy for option trading#how to learn option trading#stock cash tips#stock future tips#hni trading tips#btst tips for today

0 notes

Text

Best App for Options Trading Tips in India

0 notes

Text

Become a stock market pro with the ultimate paper trading app. Practice investing in real-time without risking any money. Gain valuable experience and test your strategies before diving into the real market. Download now and start mastering the stock market today! join us:- paper trading app

#best app for paper trading#paper trading app#paper trading app for bank nifty#paper trading app for options in india#best free paper trading websites#best free paper trading website in india

1 note

·

View note

Text

The Best Bank Nifty option trading course-Bank Nifty Learn and Trade

Master the Best Bank Nifty option trading course with our comprehensive course. Enhance your skills and knowledge with Bank Nifty Learn and Trade. Unlock strategies, analysis, and techniques for successful trading. Join now to excel in the dynamic world of Bank Nifty options.

0 notes

Text

youtube

#Nifty and #banknifty best trading setup for tomorrow 21 aug #finvantege #midcpnifty #reliance #fii #dii #index #stockmarketupdate #stockmarketanalysis #stocks #tradinglevels #intradaylevels #niftytomorrow #niftylevelsfortomorrow #niftylevelstoday #bankniftytomorrow #bankniftylevelstoday #bankniftylevelsfortomorrow #optionwriting #optiontrading #reliance #hdfcbank #sbin #jublfood

#youtube#banknifty#nifty#finvantege#bankniftytomorrow#stockmarket#hdfcbank#sameergupta84#niftytomorrow#intraday#option trading#intraday level#nifty level#bank nifty tomorrow#bank nifty prediction for tomorrow#nifty prediction for tomorrow#reliance#tatasteel#tatamotors

0 notes