#BNP 2014

Explore tagged Tumblr posts

Text

No one can make a crowd gasp like [Monfils] can, or laugh in unison, or sometimes groan. He is regarded as more of an entertainer than a winner, even though he often won. The suggestion that he could have done more to win is not crazy. I have seen him sky impossibly high for an overhead, and then goof it. I have watched him slide into a split to dig out a deep shot, and then needlessly scissor-kick a backhand into the net. During a changeover in a 2014 U.S. Open match, I saw him sip a Coke. “Sometimes, you know, I just feel like I want a Coke, you know, and I drink a Coke, you know,” he explained after the match. He made the quarterfinals of that tournament, where he took the first two sets off Roger Federer, had match points in the fourth set, and from there got rolled. It was the suggestions that he didn’t care enough, that he was undisciplined, that he didn’t maximize his talent that Monfils disputes. “No one is not working. Not top athletes,” he said. “Please write it. For kids, it is very important. Everybody is working hard to be the best.” When we spoke, he had just made the third round of the BNP Paribas Open at Indian Wells, where he ended up narrowly losing to Grigor Dimitrov, in one of the most thrilling matches of the year. He went on to Miami and made the fourth round; there, Sebastian Korda, one of the top young Americans, avenged a loss to him at Indian Wells, in three sets. Monfils has been playing some of his best tennis this season, relying less on his ability to retrieve any ball, perhaps, but maybe that’s a good thing. For all his shotmaking ability, Monfils sometimes defaulted to a defensive-minded approach, waiting for his opponent to make a mistake instead of forcing it. At times, it could seem that he was the only one in the stadium unaware that he was capable of hitting a forehand a hundred and twenty-four miles an hour—one of the fastest ever recorded in an A.T.P. match—and of doing it without straining much. At other times, it could seem that he’d forgotten that hitting a fun shot wasn’t the point. But why not? ...He liked tennis, he has said, because it is an individual sport, one that offers so many opportunities for creativity. He told me that his parents taught him that tennis was a “gift,” a “way to let go of the emotion, run a lot, be disciplined.” No one in his neighborhood played tennis. It made him feel “lucky,” he said. Even when it became his job, it remained a place where he could be happy, and where he could be himself.

...Monfils has said that Svitolina kept him in tennis, particularly through the pandemic, when he might have otherwise quit, and that being a father has changed his perspective. And I’m sure that’s true—but perspective, above all, is what Monfils has always seemed to have, compared with other players. In Australia this year, after he’d beaten the fourth seed, Taylor Fritz, who was the finalist at the 2024 U.S. Open, in a display of tennis so dazzling and clean that Fritz could only commend him, he was asked whether it was his dream to win the tournament. “That’s your dream, I guess, to win a Slam. I’ll tell you my dream,” Monfils replied. “My dream is to have an unbelievable family. Tennis is cool. Of course, you want to have goals, dreams, whatever. But my dream is out there.” Svitolina, as it happens, was playing on Margaret Court Arena, the same court on which Monfils had just played. When his press obligations were done, Monfils hurried back to watch her, and waited for her after she rallied to win and walked off. There won’t be many more moments like that, or like the one that will come when he takes the court on Monday at Roland Garros, where the French Open is held. If he can get past Hugo Dellien in the first round, he could face the fifth seed, Jack Draper, in the second. The crowd will be in Monfils’s corner. There is an intimacy there, on the red clay, where every shot leaves its mark. It is a special place for him. “My parents, they’d been separated super early in my life,” he said. Roland Garros is “a place where all my family gather together, the full family reunited.” People sometimes wonder what tennis might have become if he’d ever won that tournament, if he’d ever ascended to the top ranking—how many fans he would have drawn in, how much excitement he would have sparked and interest he would have drawn. But he doesn’t think that way. “Of course, my thinking at twenty and thinking at thirty-eight is different,” he said. And if he hadn’t experienced what he experienced then, he went on, he wouldn’t be the man he is now.

— Louisa Thomas, "Gael Monfils Is Winning In His Own Way"

#nothing here is especially groundbreaking for dedicated fans but it's my close personal friend louisa thomas writing about gael so.#tennis writing#gael monfils#rg25#ao25#g.e.m.s. life

37 notes

·

View notes

Text

Bangladesh's parliament has been dissolved, a day after prime minister Sheikh Hasina was forced from power.

Ms Hasina resigned and fled the country after weeks of student-led protests spiralled into deadly unrest.

The dissolution of parliament, a key demand of protesters, paves the way for establishing an interim government.

Bangladeshis are waiting to see what comes next, as the country's military chief is holding talks with political leaders and protest organisers.

According to local media, more than 100 people died in violent clashes across Bangladesh on Monday, the single deadliest day since mass demonstrations began.

Hundreds of police stations were also torched, with the Bangladesh Police Service Association (BPSA) declaring a strike "until the security of every member of the police is secure".

The group also sought to place the blame at the door of authorities, saying they were "forced to fire".

Overall, more than 400 people are believed to have died, as protests were met with harsh repression by government forces.

The protests began in early July with peaceful demands from university students to abolish quotas in civil service jobs, but snowballed into a broader anti-government movement.

Weeks of unrest culminated in the storming of the prime minister's official residence, not long after Ms Hasina had fled to neighbouring India, ending nearly 15 years of rule.

Bangladeshi leaders are under pressure to establish an interim government to avoid a power vacuum that could lead to further clashes.

Within hours of her resignation, Bangladesh's army chief Gen Waker-uz-Zaman pledged that an interim administration would be formed, adding on state television that "it is time to stop the violence".

Student leaders have been clear they will not accept a military-led government, pushing for Nobel Peace Prize winner Muhammad Yunus to become the interim government's chief adviser.

Mr Yunus, who agreed to take up the role, said: “When the students who sacrificed so much are requesting me to step in at this difficult juncture, how can I refuse?”

He is returning to Dhaka from Paris, where he is undergoing a minor medical procedure, according to his spokesperson.

Meanwhile, ex-prime minister and key opposition leader Khaleda Zia was released from years of house arrest, a presidential statement said.

She chairs the Bangladesh Nationalist Party (BNP), which boycotted elections in 2014 and again in 2024, saying free and fair elections were not possible under Ms Hasina.

The BNP wanted the polls to be held under a neutral caretaker administration. This has now become a possibility after the departure of Ms Hasina, who had always rejected this demand.

Ms Zia, 78, served as prime minister of Bangladesh from 1991 to 1996, but was imprisoned in 2018 for corruption, although she said the charges were politically motivated.

She was not the only opposition figure to be released after years of detention.

Activist Ahmad Bin Quasem was also released from detention, according to his lawyer Michael Polak.

Rights groups say Mr Quasem was taken away by security forces in 2016, just one of hundreds of forced disappearances in the country under Ms Hasina's rule.

"There were many points during his detention that he was feared dead, and the uncertainty was one of the many tools of repression utilised by the regime," Mr Polak explained, adding they hoped the decision to release political prisoners "is a positive sign of their intentions".

"Unfortunately, the good news won’t be shared by all," he told the BBC, stating that a number of political prisoners had died in custody.

At least 20 other families of political prisoners gathered outside a military intelligence force building in the capital Dhaka earlier in the day, still desperately waiting for news about their loved ones, AFP news agency reports.

"We need answers," Sanjida Islam Tulee, a co-ordinator of Mayer Daak (The Call of the Mothers) campaign group, told the news agency.

Across the border in India, Foreign Minister S Jaishankar said he was "deeply concerned till law and order is visibly restored" in Bangladesh, with which India shares a 4,096-km (2,545-mile) border and has close economic and cultural ties.

He gave the first official confirmation that Ms Hasina made a request to travel to India at "very short notice" and "arrived yesterday evening in Delhi".

India also deployed additional troops along its border with Bangladesh.

"Our border guarding forces have also been instructed to be exceptionally alert in view of this complex situation," Mr Jaishankar said.

14 notes

·

View notes

Text

Bangladesh minister says Yunus 'not going to step down'

Muhammad Yunus, Chief Adviser of the Government of Bangladesh, speaks at the Trust Women conference in London November 19, 2014. — Reuters Yunus needs to remain in office for peaceful transition, says Faiz. Threat to resign came after BNP held protests against interim govt. Minister Faiz warns army against meddling in politics. Bangladesh’s Muhammad Yunus “needs to remain” in office as interim…

0 notes

Text

The Left Party in Sweden has been obsessed with becoming part of the next government at any cost recently, and in pursuit of that it has been watering down its programme even further, attempting to become “respectable” and whatnot. 50 high ranking Left Party members will this spring attend some kind of conference to receive advice on how to govern and how to “cooperate with the business world” from the likes of Anders Borg and Jacob Wallenberg (SVT).

Anders is the liberal-conservative former finance minister who oversaw a wide variety of cuts, austerity measures, privatisations, and other attacks on the working class during his 2006-2014 reign. Jacob is one of the heads of the Wallenberg family of oligarchs, who together control about a third of Sweden's total BNP. He also happens to be the chairman of Svenskt Näringsliv, the lobbying organisation representing the interests of Swedish business owners.

Truly beyond parody. Not only watering down their programme into nothingness, not only promoting cross-class cooperation, but openly inviting the highest representatives of the capitalist class in with open arms.

1 note

·

View note

Text

El Departamento del Tesoro anunció la medida en contra de 21 funcionarios del presidente de Venezuela, Nicolás Maduro. Conozca quiénes son y los motivos de la decisión. En medio de protestas, manifestaciones, exiliados y escondidos; Maduro sigue gobernando. No obstante, hace pocas horas el Departamento del Tesoro de los Estados Unidos emitió una comunicación en la que anuncia la sanción que impartirá a 21 funcionarios de seguridad y del gabinete del mandatario venezolano por apoyar y llevar a cabo las órdenes de “reprimir a la sociedad civil en sus esfuerzos por declararse fraudulentamente ganador de las elecciones presidenciales. Han pasado cuatro meses después de las elecciones presidenciales de Venezuela y aunque autoridades internacionales y distintas naciones del mundo le solicitaron a Nicolás Maduro mostrar las actas que acreditaban su continuidad en el poder, nunca han sido publicadas. El 28 de julio de 2024, el Consejo Nacional Electoral del país suramericano anunció el triunfo de Maduro y la oposición rechazó el resultado. Hoy Estados Unidos afirma que ignoró la “voluntad de la abrumadora mayoría de los votantes venezolanos que eligieron a Edmundo González Urrutia como su próximo presidente” y de esta manera impartirá una sanción en contra de altos funcionarios, incluidos miembros de la Guardia Nacional Bolivariana (GNB), la Policía Nacional Bolivariana (BNP), la Milicia Bolivariana, el Servicio Bolivariano de Inteligencia Nacional (SEBIN) y la Dirección General de Contrainteligencia Militar (DGCIM). Como resultado de esta acción, todos los bienes e intereses en bienes de las personas designadas, así como de las entidades que poseen directa o indirectamente un 50 % o más de participación, que se encuentren en Estados Unidos o bajo control de personas estadounidenses, están bloqueados y deben ser reportados a la OFAC. Salvo autorización específica o general de la OFAC, o en caso de exención, se proh��ben las transacciones de personas estadounidenses o realizadas dentro de Estados Unidos que involucren bienes o intereses de personas designadas o bloqueadas. Además, quienes realicen transacciones con estas personas o entidades sancionadas podrían enfrentar sanciones o acciones legales. El objetivo final de las sanciones no es castigar, sino promover un cambio positivo de comportamiento. “Las acciones represivas de Maduro y sus representantes a raíz de las elecciones presidenciales venezolanas son un intento desesperado por silenciar las voces de sus ciudadanos”, dijo el subsecretario interino del Tesoro para Terrorismo e Inteligencia Financiera, Bradley T. Smith. “Estados Unidos seguirá poniendo de relieve a quienes buscan utilizar la violencia y la intimidación para socavar la gobernanza democrática y el ejercicio legítimo de la libertad de expresión”. Esta es la lista de algunos de los sancionados: - Aníbal Eduardo Coronado Millán ministro de la Oficina del Presidente de Maduro desde abril de 2024 y como Monitor de Desempeño Gubernamental de la Oficina del Presidente de Maduro. - William Alfredo Castillo Bolle viceministro de Políticas Antibloqueo de Maduro en el Ministerio de Economía, Finanzas y Comercio Exterior de Venezuela desde 2022. - Ricardo José Menéndez Prieto ha sido vicepresidente de Planificación de Maduro en la Oficina del Vicepresidente desde 2014. - Freddy Alfred Nazaret Nanez Contreras es ministro del Poder Popular para la Comunicación y vicepresidente sectorial de Comunicación, Cultura y Turismo de Maduro. - Daniella Desiree Cabello Contreras presidenta de la Agencia de Promoción de Exportaciones de Venezuela de Maduro desde septiembre de 2024. - Eloina Rodríguez Gómez, quien ha sido sancionada por la OFAC desde 2018. También es hija de Diosdado Cabello Rondón. - Julio José García Zerpa ha sido ministro de Servicios Penitenciarios de Maduro desde 2024. - América Valentina Pérez Dávila segunda vicepresidenta de la AN. Oficiales sancionados de la Guardia Nacional (GN) - Dilio Guillermo Rodríguez Díaz es comandante de la REDI Capital. Anteriormente, se desempeñó como comandante de la Capital 81 de la ZODI y como rector de la Universidad Militar Bolivariana. - José Yunior Herrera Duarte ha sido jefe del Comando de Zona No. 51 de la GNB desde 2022. - Carlos Eduardo Aigster Villamizar ha servido como comandante y general de división del estado Miranda en la ZODI desde 2023. También fue comandante del Comando de Zona No. 62 de la GNB en el estado Bolívar. - Jesús Rafael Villamizar Gómez ha sido comandante de la REDI Central desde 2024. Anteriormente, fue comandante de la ZODI La Guaira y jefe de la Guardia de Honor Presidencial. Es sospechoso de enriquecimiento personal mientras ocupaba altos cargos oficiales en Venezuela. - Ángel Daniel Balestrini Jaramillo se desempeñó anteriormente como comandante de la ZODI Aragua. - Pablo Ernesto Lizano Colmenter ocupó anteriormente el cargo de comandante de la ZODI Carabobo. - Luis Gerardo Reyes Rivero sirvió previamente como comandante y general de división de la ZODI Yaracuy. - José Alfredo Rivera Bastardo ha sido director de Servicios para el Mantenimiento del Orden Interno de la División de la GNB desde 2024. Anteriormente, fue comandante de la ZODI Falcón. - Alberto Alexander Matheus Meléndez ha sido director de la División de Logística de la GNB desde 2024. Previamente, fue jefe del Comando Nacional Antidrogas de Venezuela. - Jesús Ramón Fernández Alayón es director de Preparación Operativa de la GNB. También ocupó cargos anteriores como jefe del Comando de Vigilancia Costera y como comandante del Comando de Zona de la GNB en Lara. Personal sancionado de BNP, SEBIN,, DGCIM y oficiales de la milicia. - Rubén Darío Santiago Servigna ha sido general de brigada de la BNP desde 2023. También es el oficial encargado a nivel nacional de la implementación del operativo electoral de seguridad ciudadana. - Alexis José Rodríguez Cabello es el director del SEBIN. Es primo del ministro de Interior, Justicia y Paz de Maduro, Diosdado Cabello Rondón, quien ha sido sancionado por la OFAC desde 2018. - Javier José Marcano Tabata es el jefe de la DGCIM y de la Guardia de Honor Presidencial. - Orlando Ramón Romero Bolívar ha comandado la Milicia Bolivariana desde 2024. Anteriormente, fue comandante de la REDI Central Altos cargos en el gobierno de varios ministerios - Aníbal Eduardo Coronado Millán ha sido ministro de la Oficina de la Presidencia de Maduro desde abril de 2024 y monitor del Desempeño Gubernamental de dicha oficina. También es el "jefe de gobierno" del Territorio Insular Francisco de Miranda. Anteriormente, sirvió en la Guardia de Honor Presidencial. La Oficina de la Presidencia de Maduro ha ejecutado órdenes para cometer fraude electoral, reprimir a los venezolanos y continuar con actos antidemocráticos. - William Alfredo Castillo Bolle ha sido viceministro de Políticas Antibloqueo en el Ministerio de Economía, Finanzas y Comercio Exterior de Venezuela desde 2022. - Ricardo José Menéndez Prieto es vicepresidente de Planificación en la Oficina de la Vicepresidencia de Maduro desde 2014. Anteriormente, fue ministro de Educación Superior, ministro de Industria y ministro de Ciencia, Tecnología e Industria Intermedia. - Freddy Alfred Nazaret Ñáñez Contreras es ministro del Poder Popular para la Comunicación y vicepresidente sectorial de Comunicación, Cultura y Turismo de Maduro. Ha sido vicepresidente sectorial para la Comunicación y la Cultura y ministro de Comunicación e Información. Anteriormente, fue presidente de la Televisión Nacional Venezolana. - Daniella Desireé Cabello Contreras es presidenta de la Agencia Venezolana de Promoción de Exportaciones desde septiembre de 2024. Esta agencia está encargada de diversificar las exportaciones venezolanas y elaborar el Protocolo Único para Exportaciones No Petroleras y Actividades Relacionadas, que crea un pago único para exportaciones de Venezuela. Anteriormente, fue presidenta de la Fundación Marca País, que reportaba directamente a la vicepresidenta ejecutiva de Maduro, Delcy Eloína Rodríguez Gómez, sancionada por la OFAC desde 2018. Daniella es hija de Diosdado Cabello Rondón. - Julio José García Zerpa es ministro de Servicios Penitenciarios de Maduro desde 2024. Anteriormente, fue diputado por el estado Táchira y ocupa el cargo de primer vicepresidente de la Comisión de Finanzas de la Asamblea Nacional (AN) alineada con Maduro. Muchos opositores y presos políticos están injustamente encarcelados. Las prisiones venezolanas han sido criticadas por limitar libertades, el hacinamiento crítico, la demora procesal y el abandono penitenciario. En junio, reclusos de diversas prisiones en Venezuela realizaron una huelga de hambre, exigiendo medidas humanitarias y traslados a centros cercanos a sus familias o donde anteriormente estaban recluidos. - América Valentina Pérez Dávila es segunda vicepresidenta de la AN. Esta asamblea ha respaldado la fraudulenta proclamación de victoria de Maduro en las elecciones presidenciales del 28 de julio. FUENTE: Departamento del Tesoro USA. Read the full article

0 notes

Text

[ad_1] Bangladesh’s ousted Prime Minister Sheikh Hasina’s coalition, Jatiya Party, central office in Dhaka, has been set on fire after clashes on Thursday night. The office was partly damaged, the witnesses said. The Jatiya Party, founded by the late President Hussain Muhammad Ershad, was part of the Bangladesh Awami League-led Grand Alliance and participated in the previous three general elections despite the major party BNP boycotting. Protesters against Sheikh Hasina were angered when the Jatiya Party announced it would hold a rally in Dhaka on Saturday. Clashes erupted when protesters carrying the Chhatra Sramik Janata banner marched with a torch procession in front of the Jatiya Party’s central office in Kakrail area, the heart of the capital, Dhaka. The fire service went to the spot and extinguished the fire. When a large number of protestors went in front of the Jatiya Party, they left the office. The witnesses said protesters vandalised Jatiya Party offices, pulled down signboards, and smeared ink on party founder Ershad’s picture on the wall. Police and the Army were deployed in front of the Jatiya Party office. “We were passing in front of the Jatiya Party office with a torch procession. At that time, terrorists of Jatiya Party threw bricks at our procession from the roof of Jatiya Party office”, said Shakiluzzaman, a leader of Gono Audhikar Parishad, a political party that actively participated in the movement against Sheikh Hasina. “Jatiya Party. terrorists themselves set fire to their office and escaped. Jatya Party acted as a proxy of the fascist Awami League in the 2014, 2018 and 2024 elections”, Shakiluzzaman said. “We, the students, workers and citizens, have declared that we will not allow Jatiya Party to hold any rally”, he further said. No comment was immediately found from the Jatiya Party, but they will likely express their reaction officially later on Friday. Two months ago, a student-led movement ousted Bangladesh’s Prime Minister, Sheikh Hasina, after weeks of protests and clashes that killed over 600. Hasina, 76, fled to India on August 5, and an interim government led by Nobel Laureate Muhammad Yunus was formed. [ad_2] Source link

0 notes

Text

[ad_1] Bangladesh’s ousted Prime Minister Sheikh Hasina’s coalition, Jatiya Party, central office in Dhaka, has been set on fire after clashes on Thursday night. The office was partly damaged, the witnesses said. The Jatiya Party, founded by the late President Hussain Muhammad Ershad, was part of the Bangladesh Awami League-led Grand Alliance and participated in the previous three general elections despite the major party BNP boycotting. Protesters against Sheikh Hasina were angered when the Jatiya Party announced it would hold a rally in Dhaka on Saturday. Clashes erupted when protesters carrying the Chhatra Sramik Janata banner marched with a torch procession in front of the Jatiya Party’s central office in Kakrail area, the heart of the capital, Dhaka. The fire service went to the spot and extinguished the fire. When a large number of protestors went in front of the Jatiya Party, they left the office. The witnesses said protesters vandalised Jatiya Party offices, pulled down signboards, and smeared ink on party founder Ershad’s picture on the wall. Police and the Army were deployed in front of the Jatiya Party office. “We were passing in front of the Jatiya Party office with a torch procession. At that time, terrorists of Jatiya Party threw bricks at our procession from the roof of Jatiya Party office”, said Shakiluzzaman, a leader of Gono Audhikar Parishad, a political party that actively participated in the movement against Sheikh Hasina. “Jatiya Party. terrorists themselves set fire to their office and escaped. Jatya Party acted as a proxy of the fascist Awami League in the 2014, 2018 and 2024 elections”, Shakiluzzaman said. “We, the students, workers and citizens, have declared that we will not allow Jatiya Party to hold any rally”, he further said. No comment was immediately found from the Jatiya Party, but they will likely express their reaction officially later on Friday. Two months ago, a student-led movement ousted Bangladesh’s Prime Minister, Sheikh Hasina, after weeks of protests and clashes that killed over 600. Hasina, 76, fled to India on August 5, and an interim government led by Nobel Laureate Muhammad Yunus was formed. [ad_2] Source link

0 notes

Text

America's Collapse and Russia's Preparations

For the first time ever, the USA is no longer listed in the top ten nations when it comes to global competitiveness. Reasons include lack of social cohesiveness, a polarized political landscape, a slow-moving legislative process, debt, sanctions policies, and immorality. While US President Barack Obama had very cordial relations with Russia in late 2012, that changed afterwards after then Secretary of State Hillary Clinton tried to push aspects of the LGBTQ+ agenda on Russia. After Russia's Sergey Lavrov would not accept such interference in its internal affairs, the USA turned against Russia in many ways. The Washington Post, New York Times, and Wall Street Journal reported that the USA, through its Central Intelligence Agency (CIA), supported the anti-Russian forces in Ukraine against its pro-Russian president in 2014 and supported assassinations, Neo-Nazi Ukrainians, and paramilitary actions against pro-Russian Ukrainians thereafter. Because of USA actions, Russian President Vladimir Putin began a series of actions, starting with the formation of the Eurasian Economic Union, and then more involving the BRICS nations to separate Russia from the West. He also moved towards dedollarization and the accumulation of gold as he and other Russian leaders see that the USA is setting itself up for collapse because of its bullying tactics, increasing debt, and various monetary policies. Some assert that Russia will be in the best position when America collapses. Steps away from the petrodollar by Saudi Arabia and others are putting the US dollar at greater risk for collapse. Is the USA's reliance and promotion of oppression and perversity prophesied factors in its coming destruction? Dr. Thiel and Steve Dupuie discuss these matters and more.

A written article of related interest is titled 'USA’s declining competitiveness and Vladimir Putin’s masterplan for the collapse Of America?'

youtube

BNP Youtube video link: America's Collapse and Russia's Preparations

Related Items:

USA’s declining competitiveness and Vladimir Putin’s masterplan for the collapse Of America?

USA in Prophecy: The Strongest Fortresses Can you point to scriptures, like Daniel 11:39, that point to the USA in the 21st century? This article does. Two related sermon are available: Identifying the USA and its Destruction in Prophecy and Do these 7 prophesies point to the end of the USA?

Who is the King of the West? Why is there no Final End-Time King of the West in Bible Prophecy? Is the United States the King of the West? Here is a version in the Spanish language: ¿Quién es el Rey del Occidente? ¿Por qué no hay un Rey del Occidente en la profecía del tiempo del fin? A related sermon is also available: The Bible, the USA, and the King of the West.

Russia and Ukraine: Their Origins and Prophesied Future Russia in prophecy. Where do the Russians come from? What about those in the Ukraine? What is prophesied for Russia and its allies? What will they do to the Europeans that supported the Beast in the end? There is also a video sermon available: Russia in the Bible and in Prophecy as are two video sermonettes Russia, Ukraine, Babylonian Europe, and Prophecy and Ukraine in Prophecy?

Is Russia the King of the North? Some claim it is. But what does the Bible teach? Here is a link to a video, also titled Is Russia the King of the North?

Ezekiel 38: For Russia & Iran in Our Day? Is Ezekiel 38 about to be fulfilled? Are we close to the battle with Gog and Magog? Four related videos are available: Ezekiel 38 Gog and Magog War: Is it Soon?, Ezekiel 38: For Russia, Ukraine, & Iran Now?, Russia, Iran, Syria, & the Bible (Code), and Gog, Magog, Vladimir Putin, and Ezekiel 38?

Lost Tribes and Prophecies: What will happen to Australia, the British Isles, Canada, Europe, New Zealand and the United States of America? Where did those people come from? Can you totally rely on DNA? Do you really know what will happen to Europe and the English-speaking peoples? What about the peoples of Africa, Asia, South America, and the islands? This free online book provides scriptural, scientific, historical references, and commentary to address those matters. Here are links to related sermons: Lost tribes, the Bible, and DNA; Lost tribes, prophecies, and identifications; 11 Tribes, 144,000, and Multitudes; Israel, Jeremiah, Tea Tephi, and British Royalty; Gentile European Beast; Royal Succession, Samaria, and Prophecies; Asia, Islands, Latin America, Africa, and Armageddon; When Will the End of the Age Come?; Rise of the Prophesied King of the North; Christian Persecution from the Beast; WWIII and the Coming New World Order; and Woes, WWIV, and the Good News of the Kingdom of God.

LATEST BIBLE PROPHECY INTERVIEWS

LATEST NEWS REPORTS

0 notes

Text

In-Depth Analysis of BNP Paribas SA's Strategic Deals and Acquisitions

BNP Paribas SA is one of the largest banking groups in the world, with a significant presence across Europe, Asia, and the Americas. This comprehensive analysis focuses on BNP Paribas's strategic deals and acquisitions, providing insights into the company's growth strategy, market expansion, and financial performance. Understanding these deals sheds light on BNP Paribas's approach to maintaining its leadership position in the global banking sector.

Overview of BNP Paribas SA

Founded in 1848 and headquartered in Paris, France, BNP Paribas offers a wide range of financial services, including retail banking, corporate and institutional banking, asset management, and insurance. The bank's extensive network and diversified service offerings make it a key player in the global financial industry.

Core Services and Market Reach

BNP Paribas operates through three main business divisions:

Retail Banking: Provides a comprehensive range of financial products and services to individuals, small businesses, and corporates.

Corporate and Institutional Banking (CIB): Offers financing, advisory, and market solutions to large corporates, financial institutions, and government entities.

Investment Solutions: Includes asset management, insurance, and private banking services, catering to a wide array of client needs.

BNP Paribas's global presence is bolstered by its strategic partnerships, subsidiaries, and a strong digital banking platform, which enhances its service delivery and customer engagement.

Strategic Deals and Acquisitions

BNP Paribas has a robust history of strategic deals and acquisitions aimed at expanding its market footprint, enhancing service offerings, and driving growth. Here, we review some of the most significant deals and their impact on the company's strategic objectives.

Acquisition of Fortis Bank (2008)

One of BNP Paribas's most notable acquisitions was the purchase of a majority stake in Fortis Bank during the financial crisis in 2008. This deal was pivotal for several reasons:

Market Expansion: The acquisition significantly expanded BNP Paribas's presence in Belgium and Luxembourg, strengthening its position in the European market.

Customer Base: By integrating Fortis's customer base, BNP Paribas enhanced its retail banking and wealth management services.

Asset Growth: The deal added substantial assets to BNP Paribas's portfolio, boosting its financial stability and market competitiveness.

Acquisition of DAB Bank (2014)

In 2014, BNP Paribas acquired DAB Bank, a German direct bank specializing in online brokerage and financial services.

Digital Banking Enhancement: This acquisition reinforced BNP Paribas's digital banking capabilities, aligning with the growing trend towards online financial services.

Market Penetration: It provided BNP Paribas with greater access to the German market, one of the largest in Europe, enhancing its competitive edge.

Partnership with Orange Bank (2016)

BNP Paribas entered into a strategic partnership with Orange Bank in 2016, focusing on the French digital banking market.

Innovation and Technology: The partnership leverages Orange's technological expertise and BNP Paribas's financial acumen to offer innovative digital banking solutions.

Customer Engagement: It aims to attract a tech-savvy customer base, particularly younger demographics, by providing seamless, mobile-first banking services.

Acquisition of Deutsche Bank's Prime Brokerage and Electronic Equities (2019)

In 2019, BNP Paribas acquired the prime brokerage and electronic equities businesses of Deutsche Bank.

Strengthening CIB Division: This acquisition bolstered BNP Paribas's Corporate and Institutional Banking division, enhancing its capabilities in prime brokerage and equity trading.

Client Base Expansion: The deal added numerous high-profile clients to BNP Paribas's portfolio, increasing its market share in the institutional banking sector.

Partnership with Tink (2020)

BNP Paribas formed a partnership with Tink, a leading European open banking platform, in 2020.

Open Banking Capabilities: This partnership enables BNP Paribas to offer enhanced open banking services, facilitating better financial management tools for customers.

Data Integration: By integrating Tink's platform, BNP Paribas can leverage data analytics to provide personalized financial services and improve customer experience.

Impact of Strategic Deals on Financial Performance

The strategic deals and acquisitions undertaken by BNP Paribas have had a significant impact on its financial performance and market positioning. Key financial metrics influenced by these deals include:

Revenue Growth

Enhanced Service Offerings: By expanding its service portfolio through acquisitions and partnerships, BNP Paribas has been able to attract new customers and increase revenue streams.

Geographical Diversification: The bank's presence in new markets, especially through acquisitions like Fortis Bank and DAB Bank, has contributed to diversified revenue sources and reduced reliance on any single market.

Profitability and Cost Efficiency

Economies of Scale: Integrating acquired businesses has allowed BNP Paribas to achieve economies of scale, reducing operational costs and enhancing profitability.

Synergy Realization: Strategic deals often result in synergies, such as shared technology platforms and streamlined processes, which improve cost efficiency and profit margins.

Market Positioning

Competitive Edge: The acquisitions have strengthened BNP Paribas's market position, making it one of the top banking institutions globally with a comprehensive range of services.

Brand Strength: Successful integration of acquired businesses and strategic partnerships has enhanced BNP Paribas's brand reputation as a forward-thinking, customer-centric bank.

Financial Stability

Asset Growth: Acquisitions like Fortis Bank significantly increased BNP Paribas's asset base, providing greater financial stability and resilience against market fluctuations.

Capital Adequacy: The bank has maintained strong capital adequacy ratios, supported by the growth in equity and retained earnings from profitable acquisitions.

Future Strategic Directions

BNP Paribas's strategic deals and acquisitions have set a solid foundation for future growth. The bank continues to explore opportunities in the following areas:

Digital Transformation

Investment in Fintech: BNP Paribas is likely to continue investing in fintech companies and digital banking platforms to enhance its technological capabilities and offer cutting-edge financial services.

Customer-Centric Innovations: Focusing on customer experience through personalized services, leveraging data analytics, and AI-driven solutions.

Sustainable Finance

Green Investments: Increasing focus on sustainable finance and green investments aligns with global trends towards environmental responsibility and offers new revenue opportunities.

ESG Integration: BNP Paribas aims to integrate environmental, social, and governance (ESG) criteria into its investment and lending decisions, catering to the growing demand for responsible banking.

Global Expansion

Emerging Markets: Exploring opportunities in emerging markets, particularly in Asia and Africa, to tap into high-growth regions and expand its global footprint.

Strategic Partnerships: Forming alliances with local banks and financial institutions to navigate regulatory landscapes and establish a strong presence in new markets.

Conclusion

BNP Paribas SA's strategic deals and acquisitions have been pivotal in shaping its growth trajectory, enhancing its market position, and driving financial performance. By continually adapting to market trends and investing in innovative solutions, BNP Paribas remains a leading force in the global banking industry.

0 notes

Text

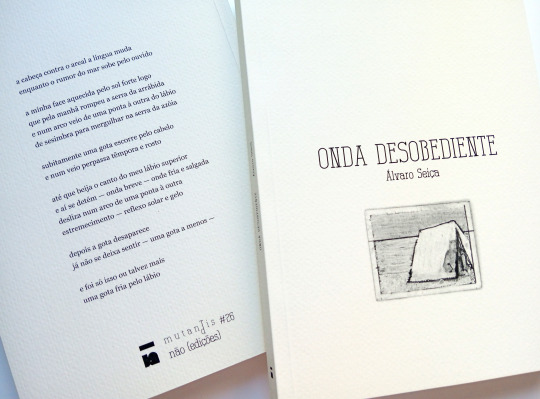

NOVO LIVRO No final de abril a não (edições) publicou o livro ONDA DESOBEDIENTE, de Álvaro Seiça e com imagens/pinturas de Yannis Kotinopoulos, que reúne poemas líricos e políticos com temática e forma diversas, mas sob uma noção comum de desobediência individual e colectiva. Escrever é um acto desobediente — reinvenção da linguagem, do corpo, do espaço social, mas também liberdade e protesto político. Dividido em cinco secções, intituladas “Rachid Habibi”, “Entrar no mar como em casa”, “Resistência local”, “Crocodilo cego diz que vê” e “Renatura agora!”, este conjunto de poemas aborda a necessidade de afirmação, o sal e a saliva, as relações familiares e a parentalidade, a fluidez, o desenraizamento e o nomadismo, a procura do mar e da casa, o privilégio solar, a condição de ser imigrante, a literatura, o exílio da língua e o lugar da língua no exílio, as desigualdades sociais, o racismo, a precariedade laboral, o desemprego, o impacto da globalização e do turismo de massas nos saberes, profissões e linguagens locais, sobretudo no sotavento, a resistência face à voracidade do capitalismo multinacional e tecnológico, o cómico comezinho dos dias, o desânimo do estado social, a violência e, finalmente, o desastre ecológico em curso no planeta. /// do autor: Álvaro Seiça sonha ser poeta a tempo inteiro. Onda desobediente é o seu terceiro livro pela não (edições). Publicou Fuligem do tempo (2003), Hidra (2004), Permafrost (2012), Ö (2014), Ensinando o espaço (2017), Previsão para 365 poemas (2018), Upoesia (2019) e Supressão (2019). Organizou o festival “Erase!” (2021) e a coleção de 25 volumes “Biblioteca da Censura” (2022-24). Co-organizou a exposição e catálogo Obras Proibidas e Censuradas no Estado Novo (2022) na BNP. Mora na Noruega. O seu trabalho encontra-se disponível em https://alvaroseica.net

////////////////////////////////////////////////////////////// Pedidos via [email protected] Livrarias habituais: https://naoedicoes.tumblr.com/livrarias

#poesia#livros#novidade#álvaro seiça#yannis kotinopoulos#leituras#colecção mutatis mutandis#colecção mutatis/mutandis

1 note

·

View note

Text

Which are the top-performing mutual funds in the last 10 years

Did you know? Recently, the Modi government completed 10 years since it came to power, and on April 09 the BSE Sensex touched its record high of 75,000 points. It was a 3-fold jump from 25,000 points in 2014.

The SIP contribution has also touched its all-time high of Rs. 19,271 crore in March. This shows the investor's confidence in Mutual funds and commitment to disciplined wealth accumulation through regular investment.

Furthermore, the mutual fund industry added 6.8 million investors in FY24 which is 70% more than FY23. With such a large number of unique investors arises the problem of fund selection.

Which is a good fund to do investment or a SIP? It can be a real headache to pick the right scheme with so many options available under each category.

To solve this problem we have come up with the list of best equity funds under multiple categories. So stay tuned and read on.

The top-performing funds are those that have beaten their respective benchmark indices based on their 10-year SIP returns.

Additionally, these funds are also subjected to rolling returns and consistency of performance to select the best of the lot.

So let’s start with Large caps.

The first round of test (10-year SIP returns)

Large Cap Funds

These funds invest in the top 100 companies in terms of market capitalization. Which makes them relatively lower risk.

The benchmark for this category is Nifty 100 TRI which delivered 15.34% over the 10 years. Out of 24 funds, 10 funds managed to beat Nifty 100 TRI.

The top five schemes that delivered 16.69-18.44 returns included: Nippon India Large Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Large Cap, Canara Robeco Bluechip Equity, and Edelweiss Large Cap.

Mid-Cap Funds

These funds invest in mid-sized companies that are ranked between 101 to 250 in terms of market capitalization.

The benchmark for this category is the Nifty Midcap TRI 150. Out of the 21 funds only 5 funds were able to beat the benchmark, so the Midcap category wasn’t much profitable for the investors.

The top five performers included: Quant Midcap, Motilal Oswal Midcap, Edelweiss Midcap, HDFC Midcap Opportunities, and Nippon India Growth.

Small-Cap Funds

One of the most interesting categories that have gotten investors’ attention is the Small caps. These funds invest at least 65% in the companies ranked below 250 in terms of market cap.

The benchmark for this category is Nifty Smallcap TRI 250. Out of the 12 schemes 10 have outperformed the benchmark. The top 5 performers included: Quant, Nippon India, SBI, HDFC, Axis, and Kotak.

Large- & Mid-Cap funds

These funds allocate about 35% to large-cap and mid-cap stocks. 7 funds outperformed their benchmark out of 18 funds. Quant Large & Midcap, Kotak Opportunities, Mirae Asset Large & Midcap, and Bandhan Core Equity were the top performers who beat the Nifty Large Midcap 250 TRI benchmark.

Flexi-cap Funds

As the name suggests, these funds invest across sectors and market capitalizations. Out of the 16 schemes, 8 were able to beat the benchmark.

The top performers who beat the Nifty 500 TRI benchmark included: Quant Flexicap, Parag Parikh Flexi Cap, HDFC Flexi Cap, Franklin India Flexi Cap, and JM Flexicap.

Multi-cap Funds

These funds have to invest 25% across each market capitalization, including large-cap,

mid-cap, and small-cap stocks according to the SEBI mandate. Out of the 10 funds 6 managed to beat the benchmark Nifty 500 TRI.

These included: Quant Active, Nippon India, ICICI Prudential, Baroda BNP Paribas, Invesco India, and Sundaram Multi cap fund.

The second test (The mean 5-year daily rolling returns for 10 years and the funds must have beaten the benchmark 60% of the time)

The Fund choices include

Large-cap - Mirae Asset Large Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Large Cap, Canara Robeco Bluechip Equity, and Edelweiss Large Cap have beaten the benchmark 75% of the time.

Mid-cap - Edelweiss Mid Cap fund, beaten the benchmark 90% of the time.

Small-cap - Axis Small Cap, Nippon Small Cap, and SBI Small Cap have outperformed the benchmark 100% of the time.

Large- & mid-cap - Mirae Asset Large & Midcap, Kotak Equity Opportunities, Canara Robeco Emerging Equities, and Quant Large & Midcap. These funds have beaten the benchmark 75% of the time.

Flexi-cap - Parag Parikh Flexi Cap and Quant Flexi Cap are the best funds apart from JM Flexicap, Canara Robeco Flexi Cap, and Kotak Flexi Cap

Multi-cap - Quant Active, with 100% outperformance, and Invesco India Multicap and ICICI Multicap with 64-65 percent outperformance.

These funds can be considered for long-term SIP. But you should consult a financial expert before doing investments. This research was done by ACE MF as of April 10th. For more such insightful blogs, do visit our website Swaraj Finpro

#best mutual fund distributor#mutual fund distributor in india#p2p services#top mutual fund distributor#best sip provider#animals#personal financial planning in jabalpur#mutual fund expert in jabalpur#Mutual Fund Distributor

0 notes

Text

'Archeological Box' @ Domus Aventino BNP Paribas Real estate on Piazza Albania on the Aventine Hill, Rome

Edwin Alexander Francis 'dubbed' the famous Italian television host, science journalist and writer Piero Angela who curated the archeo-multimedia installations together with Paco Lanciani.

La Scatola Archeologica Domus Aventino

“Portare alla luce ciò che è antico, è una delle più grandi forme d’amore per l’umanità”

Piero Angela

(c) of the renders courtesy:

Here's a clip from the promo vid ->

and an article from:

Ancient Roman villa and elaborate mosaics found beneath apartment block in Rome. The villa and its mosaics have now been turned into a subterranean museum

By Nick Squires ROME 6 October 2020 • 10:00am

A concierge and a smart address are no longer enough for one apartment block in Rome – it can now boast its very own subterranean Roman villa. Archeologists have unveiled the remains of a sumptuous Roman “domus” or villa, complete with elaborate mosaics, that had remained hidden for 2,000 years. It was discovered when engineers carried out work to earthquake-proof the residential development, which was built in the 1950s. Archeologists were called in and found a series of palatial rooms laid with mosaics featuring black and white geometric designs, made from tens of thousands of tiny cubes of stone. “You can see from the richness of the decorations and the mosaics that the villa belonged to a powerful person, probably linked to the imperial family,” said Daniela Porro, a senior cultural heritage official for the city. “Rome never ceases to surprise us. It’s an archeological jewel.” It was unearthed by chance in 2014 and after years of archeological work is now ready to be opened to the public as a subterranean museum. Visitors will enter the modern apartment building from the street, cross a courtyard and descend one flight of steps to an anonymous grey door next to a pair of lifts. Inside are not the only the remains of the Roman villa, with mosaics and fragments of frescoes and Latin inscriptions, but earlier segments of a stone tower dating back to the 8th century BC, as well as a huge defensive wall that dates back to the Roman republic. During the excavation, archeologists found a wide array of objects from everyday Roman life, including a hammer, a key, a water tap, a hairpin and oil-burning lamps. They found amphorae which held garum, a noxious-smelling sauce made from fermented fish that the Romans loved to use to spice up their meals. There were also fragments of lacquered bowls stamped with the images of Hercules and the goddess Athena. Video projections on the walls of the underground space bring the villa alive, with a senator and his wife strolling amid marble busts, ornate tables and couches. One mosaic has as its centrepiece an image of a bright green parrot with a splash of red in its plumage, while another depicts a grape vine growing from a large vase. The archeologists found not just one layer of remains, but six different layers, one on top of another, spanning a period of two centuries. The patterns of the mosaics, including one which features a repetitive figure 8, are unusual. “We’ve not seen it before,” said Roberto Narducci, an architect involved in the excavation. The €3 million dig was funded by BNP Paribas Real Estate, the company which owns the apartment building. “It’s quite a challenge to allow access to the site, while protecting the privacy of the condominium’s residents,” said the company’s Anselmo De Titta. “It will be open to the public at least two days every month and more if there is the demand.”

...and here's Piero Angela's conclusion ('dubbed' by Edwin Alexander Francis :-) ->

youtube

check out the real estate here ->

0 notes

Text

General Elections Bangladesh : Prime Minister Sheikh Hasina Slams Opposition’s January 7 Polls Boycott Stance

Bangladesh Prime Minister Sheikh Hasina has said the opposition Bangladesh Nationalist Party (BNP) is boycotting Sunday’s general election because they found no scope to rig the polls. Hasina said the BNP had tried to foil the 2014 parliamentary election through violence but failed.

“Now they are out to thwart the 12th parliamentary election slated for January 7 for which they are once again burning people to death through arson violence and subversive acts,” she said.

“Now BNP-Jammat is trying to foil the poll and snatch away your vote through arson terrorism,” the official BSS news agency quoted Hasina, who is also the Awami League (AL) chairman, as saying while addressing a rally .

She said that every voter with their near and dear ones should go to the polling centre in the morning and exercise their franchise to give the opposition BNP “an appropriate answer”.

Urging the people to remain alert against the BNP-Jamaat clique Hasina said: “You will cast your vote and make sure none can prevent you from casting your voting rights.” Hasina is the longest-serving prime minister of Bangladesh with the first term from 1996 to 2001, and three consecutive terms from 2009 to 2014, 2014 to 2019 and 2019 till date.

Hasina said her party has established the voting rights of the people and called upon the new and young voters to cast their vote for ‘Boat’ — the ruling party’s election symbol — to continue the country’s development.

The 76-year-old Awami League President said: “I call upon the youth folk and new voters to vote for the Boat to continue the country’s journey towards development.” “Bangladesh has emerged as a developing country, transforming it into a digital nation. If Awami League is voted to power again, it will help take forward Bangladesh towards a developed, prosperous and Smart Bangladesh nation in 2041,” she said.

Introducing all 15 AL candidates of Dhaka, Hasina sought votes for her party’s electoral symbol ‘Boat’ and described it as the symbol of development, peace and prosperity.

“Boat had earned the country’s independence and saved mankind from the great storm during the period of Nuh Nabi (AS),” she said.

Coming down heavily on those who blamed the AL for vote manipulation, Hasina said her government needed no vote rigging to assume power as they had won the hearts of the people by working for the welfare of the country and its people.

“The Awami League government has made the Election Commission independent so that it can conduct elections freely,” she said.

The BNP led by former prime minister Khalida Zia has called for civil disobedience against the Hasina-led dispensation, urging people not to pay taxes and utility bills to press its demand for a non-party interim government for election oversight by amending the country’s Constitution.

The BNP is boycotting the election after its demand for an interim non-party neutral government to organise the voting was rejected by the government. The party had boycotted the 2014 election but took part in 2018 polls, which party leaders later said was a mistake alleging that the voting was marred with widespread rigging and intimidation.

#news#AwamiLeague#Bangaladesh#BangladeshNationalistParty#PrimeMinister#formerprimeminister#KhalidaZia#January7#Impactnews

0 notes

Text

El Departamento del Tesoro anunció la medida en contra de 21 funcionarios del presidente de Venezuela, Nicolás Maduro. Conozca quiénes son y los motivos de la decisión. En medio de protestas, manifestaciones, exiliados y escondidos; Maduro sigue gobernando. No obstante, hace pocas horas el Departamento del Tesoro de los Estados Unidos emitió una comunicación en la que anuncia la sanción que impartirá a 21 funcionarios de seguridad y del gabinete del mandatario venezolano por apoyar y llevar a cabo las órdenes de “reprimir a la sociedad civil en sus esfuerzos por declararse fraudulentamente ganador de las elecciones presidenciales. Han pasado cuatro meses después de las elecciones presidenciales de Venezuela y aunque autoridades internacionales y distintas naciones del mundo le solicitaron a Nicolás Maduro mostrar las actas que acreditaban su continuidad en el poder, nunca han sido publicadas. El 28 de julio de 2024, el Consejo Nacional Electoral del país suramericano anunció el triunfo de Maduro y la oposición rechazó el resultado. Hoy Estados Unidos afirma que ignoró la “voluntad de la abrumadora mayoría de los votantes venezolanos que eligieron a Edmundo González Urrutia como su próximo presidente” y de esta manera impartirá una sanción en contra de altos funcionarios, incluidos miembros de la Guardia Nacional Bolivariana (GNB), la Policía Nacional Bolivariana (BNP), la Milicia Bolivariana, el Servicio Bolivariano de Inteligencia Nacional (SEBIN) y la Dirección General de Contrainteligencia Militar (DGCIM). Como resultado de esta acción, todos los bienes e intereses en bienes de las personas designadas, así como de las entidades que poseen directa o indirectamente un 50 % o más de participación, que se encuentren en Estados Unidos o bajo control de personas estadounidenses, están bloqueados y deben ser reportados a la OFAC. Salvo autorización específica o general de la OFAC, o en caso de exención, se prohíben las transacciones de personas estadounidenses o realizadas dentro de Estados Unidos que involucren bienes o intereses de personas designadas o bloqueadas. Además, quienes realicen transacciones con estas personas o entidades sancionadas podrían enfrentar sanciones o acciones legales. El objetivo final de las sanciones no es castigar, sino promover un cambio positivo de comportamiento. “Las acciones represivas de Maduro y sus representantes a raíz de las elecciones presidenciales venezolanas son un intento desesperado por silenciar las voces de sus ciudadanos”, dijo el subsecretario interino del Tesoro para Terrorismo e Inteligencia Financiera, Bradley T. Smith. “Estados Unidos seguirá poniendo de relieve a quienes buscan utilizar la violencia y la intimidación para socavar la gobernanza democrática y el ejercicio legítimo de la libertad de expresión”. Esta es la lista de algunos de los sancionados: - Aníbal Eduardo Coronado Millán ministro de la Oficina del Presidente de Maduro desde abril de 2024 y como Monitor de Desempeño Gubernamental de la Oficina del Presidente de Maduro. - William Alfredo Castillo Bolle viceministro de Políticas Antibloqueo de Maduro en el Ministerio de Economía, Finanzas y Comercio Exterior de Venezuela desde 2022. - Ricardo José Menéndez Prieto ha sido vicepresidente de Planificación de Maduro en la Oficina del Vicepresidente desde 2014. - Freddy Alfred Nazaret Nanez Contreras es ministro del Poder Popular para la Comunicación y vicepresidente sectorial de Comunicación, Cultura y Turismo de Maduro. - Daniella Desiree Cabello Contreras presidenta de la Agencia de Promoción de Exportaciones de Venezuela de Maduro desde septiembre de 2024. - Eloina Rodríguez Gómez, quien ha sido sancionada por la OFAC desde 2018. También es hija de Diosdado Cabello Rondón. - Julio José García Zerpa ha sido ministro de Servicios Penitenciarios de Maduro desde 2024. - América Valentina Pérez Dávila segunda vicepresidenta de la AN. Oficiales sancionados de la Guardia Nacional (GN) - Dilio Guillermo Rodríguez Díaz es comandante de la REDI Capital. Anteriormente, se desempeñó como comandante de la Capital 81 de la ZODI y como rector de la Universidad Militar Bolivariana. - José Yunior Herrera Duarte ha sido jefe del Comando de Zona No. 51 de la GNB desde 2022. - Carlos Eduardo Aigster Villamizar ha servido como comandante y general de división del estado Miranda en la ZODI desde 2023. También fue comandante del Comando de Zona No. 62 de la GNB en el estado Bolívar. - Jesús Rafael Villamizar Gómez ha sido comandante de la REDI Central desde 2024. Anteriormente, fue comandante de la ZODI La Guaira y jefe de la Guardia de Honor Presidencial. Es sospechoso de enriquecimiento personal mientras ocupaba altos cargos oficiales en Venezuela. - Ángel Daniel Balestrini Jaramillo se desempeñó anteriormente como comandante de la ZODI Aragua. - Pablo Ernesto Lizano Colmenter ocupó anteriormente el cargo de comandante de la ZODI Carabobo. - Luis Gerardo Reyes Rivero sirvió previamente como comandante y general de división de la ZODI Yaracuy. - José Alfredo Rivera Bastardo ha sido director de Servicios para el Mantenimiento del Orden Interno de la División de la GNB desde 2024. Anteriormente, fue comandante de la ZODI Falcón. - Alberto Alexander Matheus Meléndez ha sido director de la División de Logística de la GNB desde 2024. Previamente, fue jefe del Comando Nacional Antidrogas de Venezuela. - Jesús Ramón Fernández Alayón es director de Preparación Operativa de la GNB. También ocupó cargos anteriores como jefe del Comando de Vigilancia Costera y como comandante del Comando de Zona de la GNB en Lara. Personal sancionado de BNP, SEBIN,, DGCIM y oficiales de la milicia. - Rubén Darío Santiago Servigna ha sido general de brigada de la BNP desde 2023. También es el oficial encargado a nivel nacional de la implementación del operativo electoral de seguridad ciudadana. - Alexis José Rodríguez Cabello es el director del SEBIN. Es primo del ministro de Interior, Justicia y Paz de Maduro, Diosdado Cabello Rondón, quien ha sido sancionado por la OFAC desde 2018. - Javier José Marcano Tabata es el jefe de la DGCIM y de la Guardia de Honor Presidencial. - Orlando Ramón Romero Bolívar ha comandado la Milicia Bolivariana desde 2024. Anteriormente, fue comandante de la REDI Central Altos cargos en el gobierno de varios ministerios - Aníbal Eduardo Coronado Millán ha sido ministro de la Oficina de la Presidencia de Maduro desde abril de 2024 y monitor del Desempeño Gubernamental de dicha oficina. También es el "jefe de gobierno" del Territorio Insular Francisco de Miranda. Anteriormente, sirvió en la Guardia de Honor Presidencial. La Oficina de la Presidencia de Maduro ha ejecutado órdenes para cometer fraude electoral, reprimir a los venezolanos y continuar con actos antidemocráticos. - William Alfredo Castillo Bolle ha sido viceministro de Políticas Antibloqueo en el Ministerio de Economía, Finanzas y Comercio Exterior de Venezuela desde 2022. - Ricardo José Menéndez Prieto es vicepresidente de Planificación en la Oficina de la Vicepresidencia de Maduro desde 2014. Anteriormente, fue ministro de Educación Superior, ministro de Industria y ministro de Ciencia, Tecnología e Industria Intermedia. - Freddy Alfred Nazaret Ñáñez Contreras es ministro del Poder Popular para la Comunicación y vicepresidente sectorial de Comunicación, Cultura y Turismo de Maduro. Ha sido vicepresidente sectorial para la Comunicación y la Cultura y ministro de Comunicación e Información. Anteriormente, fue presidente de la Televisión Nacional Venezolana. - Daniella Desireé Cabello Contreras es presidenta de la Agencia Venezolana de Promoción de Exportaciones desde septiembre de 2024. Esta agencia está encargada de diversificar las exportaciones venezolanas y elaborar el Protocolo Único para Exportaciones No Petroleras y Actividades Relacionadas, que crea un pago único para exportaciones de Venezuela. Anteriormente, fue presidenta de la Fundación Marca País, que reportaba directamente a la vicepresidenta ejecutiva de Maduro, Delcy Eloína Rodríguez Gómez, sancionada por la OFAC desde 2018. Daniella es hija de Diosdado Cabello Rondón. - Julio José García Zerpa es ministro de Servicios Penitenciarios de Maduro desde 2024. Anteriormente, fue diputado por el estado Táchira y ocupa el cargo de primer vicepresidente de la Comisión de Finanzas de la Asamblea Nacional (AN) alineada con Maduro. Muchos opositores y presos políticos están injustamente encarcelados. Las prisiones venezolanas han sido criticadas por limitar libertades, el hacinamiento crítico, la demora procesal y el abandono penitenciario. En junio, reclusos de diversas prisiones en Venezuela realizaron una huelga de hambre, exigiendo medidas humanitarias y traslados a centros cercanos a sus familias o donde anteriormente estaban recluidos. - América Valentina Pérez Dávila es segunda vicepresidenta de la AN. Esta asamblea ha respaldado la fraudulenta proclamación de victoria de Maduro en las elecciones presidenciales del 28 de julio. FUENTE: Departamento del Tesoro USA. Read the full article

0 notes

Text

Natriuretic Peptides and Troponins to Predict Cardiovascular Events in Patients Undergoing Major Non-Cardiac Surgery

Patients undergoing major surgery have a substantial risk of cardiovascular events during the perioperative period. Despite the introduction of several risk scores based on medical history, classical risk factors and non-invasive cardiac tests, the possibility of predicting cardiovascular events in patients undergoing non-cardiac surgery remains limited. The cardiac-specific biomarkers, natriuretic peptides (NPs) and cardiac troponins (cTn) have been proposed as additional tools for risk prediction in the perioperative period. This review paper aims to discuss the value of preoperative levels and perioperative changes in cardiac-specific biomarkers to predict adverse outcomes in patients undergoing major non-cardiac surgery. Based on several prospective observational studies and six meta-analyses, some guidelines recommended the measurement of NPs to refine perioperative cardiac risk estimation in patients undergoing non-cardiac surgery. More recently, several studies reported a higher mortality in surgical patients presenting an elevation in high-sensitivity cardiac troponin T and I, especially in elderly patients or those with comorbidities. This evidence should be considered in future international guidelines on the evaluation of perioperative risk in patients undergoing major non-cardiac surgery.

Introduction

Patients undergoing major surgery have a substantial risk of cardiovascular events during the perioperative period [1,2,3,4,5,6,7]. Although the rate of these events has declined over the past 30 years, they still represent a significant issue in patients undergoing non-cardiac surgery [8,9,10,11], with at least 167,000 cardiac complications of non-cardiac surgical procedures occurring annually in the European Union, 19,000 of which are life-threatening [8]. The 2014 European Society of Cardiology/European Society of Anaesthesiology (ESC/ESA) guidelines recommended that cardiac risk be carefully evaluated in patients undergoing non-cardiac surgery [8]. Despite the development of several risk scores based on medical history, classical cardiovascular risk factors (including sex, age, lipid profile and creatinine concentration), and some non-invasive cardiac tests (such as electrocardiogram, echocardiogram, stress tests), the possibility of predicting cardiovascular events remains limited [4,5,8,9]. This has prompted the assessment of cardiac biomarkers as additional tools for risk prediction [3,10,11,12]. The 2017 Canadian Cardiovascular Society guidelines have recommended the measurement of cardiac natriuretic peptides (NPs) (brain natriuretic peptide, BNP, or N-terminal fragment of proBNP, NT-proBNP) before surgery to refine perioperative cardiac risk estimation [13]. These recommendations were based on prospective observational studies and six meta-analyses evaluating the accuracy of NPs to predict major cardiovascular events after non-cardiac surgery [14,15,16,17,18,19,20,21].

Over the last 10 years, increases in cardiac troponin (cTn) have been associated with an increased short- and long-term risk of cardiac events in patients undergoing different types of non-cardiac surgery [10,11,12,13,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45]. Nonetheless, no specific recommendations on cTn measurement in the perioperative period have been issued so far.

This article aims to discuss the clinical value of preoperative values and perioperative changes in cardiac-specific biomarkers as tools to predict adverse outcomes in patients undergoing non-cardiac surgery.

Risk Evaluation Using Cardiac Biomarkers in Patients Undergoing Non-Cardiac Surgery

Half of perioperative cardiac deaths occur in patients with no history of heart disease [7,10], suggesting that our current protocols to screen for subclinical heart disease are far from optimal [10]. Risk prediction models based only on clinical criteria, also including classical risk factors and cardiac stress tests, were not shown to improve the accuracy of preoperative risk stratification and to reduce 30-day mortality after non-cardiac surgery [9,11,12]. In particular, a 2019 meta-analysis included six studies on the accuracy of cardiac stress test to predict 30-day mortality [11]. The authors concluded that, despite substantial research, the current body of evidence is insufficient to derive a definitive conclusion as to whether stress testing reduces perioperative mortality [11].

To improve risk stratification and prognostic accuracy in patients undergoing non-cardiac surgery, BNP and NT-proBNP have gained clinical consensus, especially for the detection of subclinical heart failure (HF) [46,47], and cTnI and cTnT for the identification of myocardial damage [43,44,45,46,47,48,49,50,51].

NPs are peptide hormones predominantly produced and secreted mostly by the human heart [43,46,51]. In particular, atrial natriuretic peptides are produced and secreted in the atria, while B-type natriuretic peptides (BNP and the related peptides) are produced and secreted in the ventricles, especially in patients with cardiac disease [43,46,51]. International guidelines recommend the measurement of BNP/NT-proBNP for the diagnosis, risk stratification and follow-up of patients with acute or chronic HF [47,52]. The 2014 ESC/ESA guidelines stated that routine pre-operative NP measurement for risk stratification is not recommended, but may be considered in high-risk patients [8].

More recently, the results of several prospective observational studies and six meta-analyses re-evaluated the prognostic accuracy of NT-proBNP and BNP to predict cardiovascular events after non-cardiac surgery [14,15,16,17,18,19,20,21]. Based on this evidence, the 2017 Canadian Cardiovascular Society Guidelines have strongly recommended BNP or NT-proBNP measurement before surgery to refine perioperative cardiac risk estimation in patients: (1) older than 65 years; (2) aged 45–64 years with cardiovascular disease; (3) with a Revised Cardiac Risk Index (RCRI) score > 1 [13]. The RCRI score includes ischemic heart disease, heart failure (HF), cerebrovascular disease, diabetes mellitus, increased serum creatinine (>177 mmol/L, corresponding to 2.0 mg/dL), and high-risk (major) non-cardiac surgery (defined as intraperitoneal, intrathoracic, or suprainguinal vascular surgery) [13].

The 2014 ESC/ESA Guidelines stated that cTnI and cTnT measurement may be considered in high-risk patients, either before or 48–72 h after major surgery, to detect a myocardial injury [8]. Furthermore, perioperative cTn increases are associated with increased short- and long-term risk of cardiac events in patients undergoing different types of non-cardiac surgery, especially when high-sensitivity (hs) immunoassay methods are used [10,11,12,13,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42].

In 2019, Humble et al. [35] conducted a systematic review and meta-analysis on the prognostic value of increased cTn levels above the cut-off level (usually the 99th percentile upper reference limit (URL)) in adult patients undergoing non-cardiac surgery. Adverse outcome was defined as short-term (in-hospital or <30 days) and long-term (>30 days) major adverse cardiovascular events (MACEs) and/or all-cause mortality non-cardiac [35]. This meta-analysis included 19 studies assessing preoperative cTn and 3 studies evaluating perioperative changes in cTn [35]. These studies assessed preoperative cTn values with a total sample size of 13,386 (range 33 to 4575). They were mainly prospective, single-center studies on patients undergoing a wide range of non-cardiac interventions (mostly intermediate- or high-risk procedures). In particular, hs-cTnT methods were used in just six studies, while the others employed non-hs-cTnI or TnT methods [35]. Preoperative cTn predicted short- (adjusted odds ratio (OR) 5.87, 95% confidence interval (CI) 3.24–10.65, p < 0.001) and long-term adverse outcome (adjusted hazard ratio (HR) 2.0, 95% CI 1.4–3.0, p < 0.001) [35]. Preoperative cTn predicted short- (adjusted odds ratio (OR) 5.87, 95% confidence interval (CI) 3.24–10.65, p < 0.001) and long-term adverse outcome (adjusted hazard ratio (HR) 2.0, 95% CI 1.4–3.0, p < 0.001) [35].

More recently, some studies evaluated the utility of perioperative cTn elevation as a prognostic indicator for mortality and cardiac morbidity in patients undergoing surgery for neck of femur fractures [39,53,54]. These fractures are rare in individuals aged <50 years in the absence of high-impact traumas, while in older patients they may be associated with low-velocity trauma because of reduced bone mineral density and frailty [39,53,54]. This meta-analysis included 11 studies with a total of 1363 patients (mean age 83 years, 351 men and 904 women) [39]. Seven studies measured cTnI, three studies measured cTnT and one study used a hs-cTnI assay. Overall, 497 patients (36.5%) experienced a cTn elevation following surgery. Perioperative troponin elevation was significantly associated with all-cause mortality (OR 2.6; 95% CI 1.5—4.6; p < 0.001) and cardiac complications (OR 7.4; 95% CI 3.5—15.8; p < 0.001) [39]. Increased cTn levels were associated to pre-existing coronary artery disease, cardiac failure, hypertension, previous stroke and previous myocardial infarction [39]. Therefore, perioperative troponin elevation is significantly associated with increased mortality and post-operative cardiac complications in patients operated for neck of femur fractures [39].

Analytical and Pathophysiological Correlates in Cardiac-Specific Biomarkers

Both NPs and cTn are then useful prognostic indicators in patients undergoing major non-cardiac surgery [10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42]. However, clinicians should interpret measured values based on the analytical performance of assay methods and the mechanisms of their production and release from the heart [55,56].

In healthy subjects, NP and cTn are present into the circulation in a range of concentrations (from about 3 to about 50 ng/L) [43,44,45] from 100 to 1000 times lower than other biomarkers, including C-Reactive Protein (CRP), creatinine, cholesterol, D-dimer, Neutral Gelatinase-Associated Lipocalin (NGAL) [43,56,57]. Some circulating proteins and peptides can directly affect the binding of NPs and cTn to specific antibodies of immunoassay methods, interfering with immunoassay methods. Some circulating proteins and peptides can directly affect the binding of NPs and cTn to specific antibodies of immunoassay, interfering with test methods. This interference becomes stronger as the molar concentrations of several substances, able to bind to the specific monoclonal antibodies utilized by immunometric systems, increases compared to that of NP and cTn, as discussed in detail elsewhere [43,44,45,58,59,60]. Furthermore, the measurement of cTnI and cTnT with immunoassay methods can be affected by binding these two cardiac troponins with troponin C, and also with some tissue or plasma proteins, and heterophile- or auto-antibodies to form macro-complexes [58,59]. Therefore, both the accuracy and clinical interpretation of the measured levels of cardiac biomarkers strongly depend on analytical characteristics and performance of assay methods [43,58,59,60,61].

3.1. NP Assay

NPs are key diagnostic and prognostic tools in patients with cardiac disease, and are released following every kind of cardiac damage able to activate the neuro-endocrine-immune system. NP increase does not provide any information on the mechanisms of damage acting in the individual patient [51,60,61,62]. In particular, NPs are highly sensitive in detecting cardiac stress in patients with risk factors and/or asymptomatic early vessel damage and/or cardiac dysfunction [51,60,61,62,63].

NPs are rapidly degraded in vivo. The active hormone BNP has a shorter plasma half-life (20–40 min) than the inactive peptide NT-proBNP (>60 min) [51,60,64]. Due to their rapid turnover rate, BNP shows larger intra- (from 40–50%) and inter-individual variability (from 50 to 60%) than those of NT-proBNP (intra 30–40%, inter 40–50%) [60,64]. A large variability means wide confidence intervals and large differences between serial measurements in the same individual, regardless of changes in the disease state [65].

Clinicians should take into consideration some critical issues for a proper interpretation of changes in circulating NPs. Most notably, values should be interpreted according to sex, age, body mass index, comorbidities and therapies [43,47,60,61,62]. In particular, kidney disease can significantly affect NP clearance, increasing BNP and NT-proBNP levels [60,61]. However, a meta-analysis [63] confirmed that NT-proBNP retains utility to diagnose acute HF also in patients with renal dysfunction (although with higher cut-off values) and holds prognostic significance regardless of renal function.

There are larger systematic differences among measured concentrations with the BNP methods than with NT-proBNP methods [60,66]. Due to its greater stability in vivo and in vitro and a smaller difference between assay methods, NT-proBNP is better suited to act as an indicator of disease and prognostic biomarker than BNP [60].

From a clinical perspective, it is important to note that international guidelines recommend cut-off values for the diagnosis and risk prediction in patients with HF, and not for risk stratification in patients undergoing major non-cardiac surgery [46,47]. Cut-off values for evaluation of perioperative risk in patients undergoing major non-cardiac surgery should be defined in specific clinical studies. Optimal cut-off values have been calculated for MACEs. There was wide variation in cut-off values reported in different studies. In 2009, a meta-analysis (including 15 studies with 4856 patients) reported that NT-proBNP cut-off values were higher than those for BNP (range 201–791 ng/L vs. 35–255 ng/L, respectively) [16]. More recently, Rodseth et al. [20] evaluated in an individual patient data meta-analysis the predictive value of preoperative BNP on cardiovascular events (defined as cardiovascular death and nonfatal myocardial infarction) and all-cause mortality during the first 30 days after vascular surgery. Using the receiver operating characteristic (ROC) statistics, the authors calculated the general optimal test cut values for BNP (116 ng/L), as the point that optimizes the rate of true-positive results while minimizing the rate the rate of false-positive results from five data sets [20]. Moreover, the authors proposed several pre-operative BNP cut-off values in predicting 30-day MACEs: 30 ng/L for screening (95% sensitivity, 44% specificity), 116 ng/L for optimal (highest accuracy point; 66% sensitivity, 82% specificity), and 372 ng/L for diagnostic (32% sensitivity, 95% specificity) [20].

For More Info : https://www.europeanhhm.com/articles/natriuretic-peptides-and-troponins-to-predict-cardiovascular-events-in-patients-undergoing-major-non-cardiac-surgery

#health#healthcare#medical care#doctors#hospitals#health and wellness#technologies#medical equipment#healthy lifestyle#cardiovascular#cardiology#peptides#surgical#nonsurgicaltreatments

0 notes

Text

Who are they 'protecting' hindus from exactly?

This twitter account gives updates about more incidents like this happening in Bangladesh. The operator of the twitter account is a Bangladeshi Hindu 👇🏻

Also attaching a randos facebook post with the same copy and paste 'Hindus are safe in Bangladesh' template is so disingenuous you disgusting fuck. Here's more screenshots of someone else who posted the same template but they later retracted it.

More people have died in Bangladesh (majority of whom are likely to be Hindus) in the past 4 days than the total number of people injured or died due to 'cow vigilantism' in India. 232 people have died.

Compare this to 93 dead and 54 injured, total of 194, in cow vigilatism cases from 2014-2024. On an average that is 13.36 per year. But sure cow vigilantism is a 'systemic issue' in India and Hindus are violent bigoted beings, but what is happening in Bangladesh is nothing but 'peaceful protest' and 'islamic secularism' 🤗

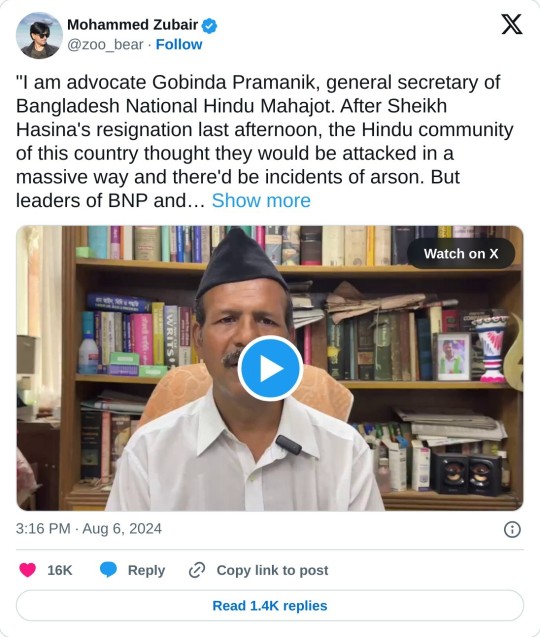

This person has not mentioned this, but another propaganda piece that is being spread by Bangladeshi is the video of Govind Chandra Pramanik (a BNP stooge). The video in question:

The same man posted this video on July 14, 2024. This was at a time when the violence was nowhere near close to the catastrophic levels we have seen in the past 4 days:

Literally go fucking rot in hell. And I am tagging Indian politics because atleast the muslims actually commiting these crimes are honest that they hate kafirs and want to make bangladesh a pure Islamic land, but these Indian leftist literally provide them with the intellectual backbone by first denying it, then whitewashing it, after which they straight up ignore it. If you are lucky enough, some filmmaker will make a movie about you in 2-3 decades. But sucks for you cause the same eminent intellectuals who wined and dined with your killers and rapist will call it a hate-mongering propaganda piece for recreating the fraction of the horror you had to live through on the cinema screen.

UPDATE ON BANGLADESH

Sheikh Hasina resigned yesterday and fled the country.

There are a lot of other things going on, but the worst of them is the SPREAD OF MISINFORMATION REGARDING THE CONDITION OF HINDUS.

It is being said that hindus are being targeted specifically, which is wrong. Bangladesh is OUR country, and that includes people of all religions, ethnicities and minorities.