#Avalon Tech IPO News

Explore tagged Tumblr posts

Text

कल खुल रहा इस वित्त वर्ष का पहला आईपीओ, एंकर इंवेस्टर्स ने खरीदे 389 करोड़ के शेयर्स

Avalon Tech IPO: इलेक्ट्रॉनिक मैन्युफैक्चरिंग सर्विसेज देने वाली कंपनी एवलॉन टेक (Avalon Tech) वित्त वर्ष 2023-24 का पहले आईपीओ लाने वाली है. इस आईपीओ की खास बात ये है कि कंपनी ने एंकर निवेशकों के जरिए पहले ही 389.25 करोड़ रुपये जुटा लिए हैं. यह आईपीओ एंकर निवेशकों के लिए 31 मार्च, 2023 को ही खुल गया था. वहीं इस वित्त वर्ष का पहला आईपीओ सामान्य निवेशकों के लिए 3 अप्रैल, 2023 से खुलेगा. आईपीओ का…

View On WordPress

#Avalon Tech#Avalon Tech IPO#Avalon Tech IPO Details#Avalon Tech IPO News#Avalon Tech IPO Update#Avalon Tech News#Business News#Business News in Hindi#IPO News#IPO update#आईपीओ ���पडेट#एवलॉन टेक#एवलॉन टेक आईपीओ#एवलॉन टेक आईपीओ न्यूज#बिजनेस न्यूज#बिजनेस न्यूज इन हिंदी#वित्त वर्ष 2023-24 का पहला आईपीओ

0 notes

Text

The IPO Boom: Riding the Wave of New Market Offerings

The investment landscape is abuzz with excitement as the IPO (Initial Public Offering) boom continues to sweep the market. As new companies seek to go public, investors are eager to ride the wave of these upcoming IPOs and capitalise on potential opportunities. In this blog post, we delve into the significance of the IPO boom, explore the concept of IPO grey market, and provide insights on how investors can navigate this dynamic and promising market.

Understanding the IPO Boom

The IPO boom refers to the surge in companies opting to go public and offer their shares to the general public for the first time. This phenomenon stems from several factors, including favourable market conditions, increased investor appetite for growth-oriented investments, and a desire for liquidity among private companies. The IPO boom presents a unique opportunity for investors to get in on the ground floor of potentially transformative companies and participate in their growth journey.

The market is Ever Evolving and here is a list Upcoming IPOs:

Senco Gold

PKH Ventures

Cyient DLM

IdeaForge

IKIO Lighting

Nexus Select Trust

Mankind Pharma

Avalon Technologies

Global Surfaces

Tata Technologies

Exploring the IPO Grey Market

The IPO grey market is an unofficial market where shares of upcoming IPOs are traded before they are officially listed on the stock exchange. It serves as a platform for investors to speculate on the potential price movement of IPO shares and gauge market demand. Participants in the grey market can buy or sell IPO shares based on their expectations of the stock's performance once it begins trading publicly. While the IPO grey market can provide insights into market sentiment and demand, it is important to approach it with caution and consider the inherent risks involved.

HMA Agro

IdeaForge

Cyient DLM

PKH Ventures

Cosmic CRF

Cell Point

Vilin Bio Med

Aatmaj Hospital

Veefin Solutions

Magson Retail

Essen Speciality

Pentagon Rubber

Global Pet Industries

Synoptics Technologies

Tridhya Tech

Alphalogic Industries

Tata Technologies

Signature Global India

Strategies for Navigating the IPO Market

Research and Due Diligence: Thoroughly investigate the company going public, its business model, financials, competitive landscape, and growth prospects. Evaluate the management team's track record and industry trends to make informed investment decisions.

Stay Updated on Upcoming IPOs: Keep a close eye on the IPO pipeline and stay updated on new market offerings. Financial news websites, IPO calendars, and trusted investment platforms can provide valuable information on upcoming IPOs.

Consult with Financial Advisors: Seek advice from financial advisors or brokerage firms with expertise in IPO investing. They can guide you through the intricacies of the IPO process and help assess the potential risks and rewards.

Understand the IPO Pricing and Allocation Process: Familiarise yourself with how IPO shares are priced and allocated. The allocation process can vary, and it is crucial to understand the factors that determine how shares are distributed to investors.

Evaluate Market Sentiment and Grey Market Activity: Monitor the IPO grey market for insights into market sentiment and demand for upcoming IPOs. However, remember that grey market trading involves speculative activity and may not always reflect the actual performance of the stock once listed.

Diversify Your Portfolio: As with any investment strategy, diversification is key. Consider spreading your investments across different sectors and IPOs to mitigate risks and take advantage of diverse growth opportunities.

Conclusion

The IPO boom presents an exciting opportunity for investors to participate in the growth of promising companies entering the public market. Understanding the IPO grey market and adopting a well-researched investment approach can help investors navigate this dynamic landscape. By staying informed, conducting due diligence, and seeking professional guidance when needed, investors can position themselves to ride the wave of new market offerings and potentially capitalise on the growth potential presented by upcoming IPOs.

The IPO Upcoming team is a passionate group with an exceptional understanding of the IPO market and stock market.

We provide recommendations with upcoming ipo blogs, Upcoming SME IPO List 2023 and Latest IPO Grey Market Premium. IPO Reviews are based on the company’s financial reports and the market demand graph.

Remember, prudent investment decisions require careful analysis and a long-term perspective in order to achieve successful outcomes in the IPO market.

#IPO Boom#New Market Offerings#Initial Public Offering#IPO Investing#IPO Grey Market#Senco Gold#PKH Ventures#Cyient DLM#HMA Agro#IdeaForge#Cosmic CRF#Financial News#IPO Calendar

0 notes

Text

Avalon Bitcoin Miner Maker Canaan Is Plotting Another IPO Attempt

Avalon Bitcoin Miner Maker Canaan Is Plotting Another IPO Attempt

news

Canaan Creative, manufacturer of the Avalon bitcoin miner, is considering another attempt to go public, people familiar with the situation said.

According to one source, the company’s main shareholders are discussing a plan to list its shares on the newly created Science and Technology (Sci-Tech) Innovation Board within the Shanghai…

View On WordPress

0 notes

Photo

New Post has been published here https://is.gd/LqurrE

Avalon Bitcoin Miner Maker Canaan Is Plotting Another IPO Attempt

This post was originally published here

Canaan Creative, manufacturer of the Avalon bitcoin miner, is considering another attempt to go public, people familiar with the situation said.

According to one source, the company’s main shareholders are discussing a plan to list its shares on the newly created Science and Technology (Sci-Tech) Innovation Board within the Shanghai Stock Exchange.

The source added the plan is still under discussion and has not been finalized. But the news comes weeks after the Nasdaq-like trading board debuted in China to meet demand from local technology startups, and just months after Canaan’s application to go public on the Hong Kong Stock Exchange lapsed.

A second source close to the company told CoinDesk that the company has been considering both China and the U.S. for a new application, and has even communicated with the New York Stock Exchange and Nasdaq. This source also indicated the plan has yet to be finalized but said it will be before the end of the year.

Canaan did not respond to CoinDesk’s request for comment by press time.

The Shanghai exchange, the world’s fourth-largest stock exchange by market capitalization as of 2018, formally launched the new trading board on March 1, four months after Chinese President Xi Jinping revealed the plan to help domestic tech startups raise funds more easily.

New round, old faces

Canaan is considering a second stab at going public on the heels of a recent funding round, which one news report said raised “several hundred million dollars,” valuing the firm at “several billion dollars.”

However, CoinDesk has learned that the funding round drew no new investors.

“There was a fund raise, but there’s no real investors because it all comes from old shareholders’ own pockets,” said a third source close to the company, who spoke on condition of anonymity because the information is private.

While continued investment by existing shareholders might be read as a vote of confidence in the company, the absence of new participants is likely a sign of how tough fundraising is for mining operations given the ongoing slump in cryptocurrency prices.

The source close to Canaan drew the latter interpretation, saying:

“Based on the current bearish market situation, it’s just too difficult to gain investment.”

‘Red chip’ candidate

Notably, the report of a multi-billion dollar valuation for Canaan came just after the publication of the Shanghai exchange’s listing rules for startups seeking to raise money on the new board.

Prospective issuers include what the government calls “red chip” companies – those that are incorporated overseas but operate businesses inside China. This would include Hangzhou-based Canaan, whose holding firm Canaan Inc. is incorporated in the Cayman Islands.

To be listed on the new board, a red chip applicant must have either a valuation larger than 10 billion yuan ($1.5 billion), or a valuation no less than 5 billion yuan ($750 million) but revenue of over 500 million yuan ($75 million) in a recent year.

Before the recently completed round, Canaan might not have made the cut. In May 2017, it raised $43 million in a Series A round, which valued the firm at around $430 million at the time. According to Canaan’s initial public offering (IPO) prospectus in Hong Kong, it netted $56 million of profits on $200 million of revenues in 2017.

And Canaan’s interaction with the Chinese government has long been visible. On April 24, 2018, Yang Jiang, the vice president of the China Securities Regulatory Commission, paid a visit to Canaan Creative’s Hangzhou office.

During the visit, Jiang reportedly commented: “Whatever applications your chips will be used for, essentially you are still a chip company. I hope that you will go public on the domestic market.” Canaan published a post with the comment from Jiang on its WeChat platform, but the article was later removed.

Existing shareholders

While the third source would not say which shareholders contributed to the new round or the exact amount raised, Canaan named its largest existing shareholders in the Hong Kong IPO prospectus.

According to the filing, the company’s main shareholders include chairman and co-founder Nangeng Zhang (17.6 percent), co-founder and executive director Jiaxuan Li (17.2 percent), and co-founder and former director Xiangfu Liu (17.61 percent).

Further, Jianping Kong, an executive director, and Qifeng Sun, a non-executive director, own 7.8 percent and 5 percent, respectively, in Canaan.

The remaining 34.69 percent was categorized as owned by “other shareholders.” The largest among them (8.78 percent) is a Hangzhou-based firm called Jiaji Information Technology Limited.

Attempts to reach these publicly identified shareholders by press time were unsuccessful.

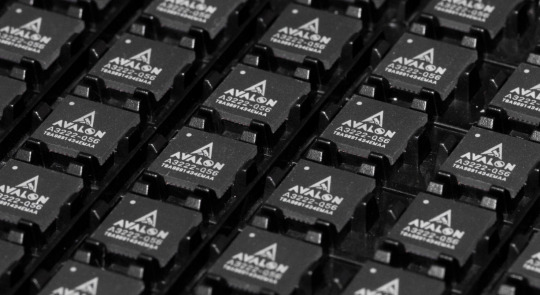

Avalon miner image via CoinDesk archive

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/LqurrE

0 notes

Link

On March 29, the two largest mining rig manufacturers, Canaan Creative and Bitmain Technologies, announced the sale of their next generation devices that process the SHA-256 algorithm. Both firms are gearing up to sell the new products this spring as a slew of mining operations have been prepping up new facilities in order to take advantage of the wet season in China.

Also read: Mempool ‘Spam’ and Rising Fees: The Consequences of Veriblock’s Mainnet Launch

Antminer 17 Series Available for Purchase on April 9

Bitcoin miners will be interested in the latest rigs that will be sold in the near future by the industry’s leading manufacturers. On Friday, Bitmain announced a sale date so the public can purchase devices from the Antminer 17 series which include the Antminer S17 Pro, Antminer S17, and the Antminer T17. The rigs will be sold globally on April 9, and come packed with Bitmain’s newly improved second generation 7nm ASIC BM1397 mining chips. During the announcement, Bitmain’s product manager of the latest Antminer series, Yangxin, revealed some details about the relationship between the company and the semiconductor foundry TSMC.

“The new miner offers a steep improvement in the hashrate in terms of space and power consumption,” Yangxin noted.

The BM1397 chips are produced using TSMC’s 7nm Finfet process and Yangxin claims the revamped 17 series will provide miners with 28.6 percent more efficiency than the previous 7nm equipped model using the BM1391. Yangxin stated that the future of mega-efficient SHA-256 miners will go beyond the 7nm scope. “From a technical point of view, there is no end to the development of technology. However, in the short run, the driving force behind the development of next-gen miners beyond 7nm chips is slowing down due to physical limitations,” Yangxin explained. The product manager continued:

With the nm size shrinking quantum effects, among other new challenges, come into play. It is promising that TSMC (Taiwan Semiconductor Manufacturing Company) is already in the process of building 5nm chips.

Bitmain’s announcement does not reveal the new products’ hashrate but the previous Antminer S15 produces 28 trillion hashes per second (TH/s). The 17 series specifications will be available on the official website when the devices go up for sale. Yangxin did disclose that there is a noticeable performance improvement compared to the previous generation chip and the 17 series models have a “higher hashrate in a single miner.”

Canaan Reveals the New Avalonminer A10

Following Bitmain’s announcement, Chinese firm Canaan Creative released information on the launch of its latest Avalon series. Canaan announced the new Avalonminer A10 on the company’s official Wechat account on Friday as well. Interestingly, Canaan’s ad says that the new miner will go on sale in March 2019, yet the official sale date is still unknown. Moreover, during the spring, Chinese miners have been flocking to Sichuan for cheap electricity during the wet season and mining operations have been buying up rigs for new facilities.

Canaan does reveal some of the specifications tied to the A10 device which include 31TH/s and power consumption of around 1736W off the wall. This means the machine boasts a possible 50W/T (watt per terahash) at max capacity. Other details such as the new Avalon rig’s price per unit are still unknown. The news follows rumors of Canaan reapplying for the company’s initial public offering (IPO) in Hong Kong because it expired. The finance publication Securities Times also reported that Canaan raised “several hundred million U.S. dollars” on March 11. Bitmain’s IPO application expired as well and the company has recently disclosed that the corporation will also attempt to go public again by reapplying.

What do you think about Canaan and Bitmain’s latest announcements concerning next-generation machines? Let us know what you think about this subject in the comments section below.

Image credits: Canaan Creative, and Bitmain Technologies.

Want to create your own secure cold storage paper wallet? Check our tools section.

Tags in this story

5nm, A10, Antminer, avalonminer, BCH, bitcoin cash, Bitcoin Core, Bitmain, BTC, canaan creative, China, N-Featured, SHA-256 miners, TSMC’s 7nm, Yangxin

Jamie Redman

Jamie Redman is a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source code, and decentralized applications. Redman has written thousands of articles for news.Bitcoin.com about the disruptive protocols emerging today.

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = 'https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v3.2'; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

0 notes

Text

Avalon Bitcoin Miner Maker Canaan Is Plotting Another IPO Attempt

Canaan Creative, manufacturer of the Avalon bitcoin miner, is considering another attempt to go public, people familiar with the situation said.

According to one source, the company’s main shareholders are discussing a plan to list its shares on the newly created Science and Technology (Sci-Tech) Innovation Board within the Shanghai Stock Exchange.

The source added the plan is still under discussion and has not been finalized. But the news comes weeks after the Nasdaq-like trading board debuted in China to meet demand from local technology startups, and just months after Canaan’s application to go public on the Hong Kong Stock Exchange lapsed.

A second source close to the company told CoinDesk that the company has been considering both China and the U.S. for a new application, and has even communicated with the New York Stock Exchange and Nasdaq. This source also indicated the plan has yet to be finalized but said it will be before the end of the year.

Canaan did not respond to CoinDesk’s request for comment by press time.

The Shanghai exchange, the world’s fourth-largest stock exchange by market capitalization as of 2018, formally launched the new trading board on March 1, four months after Chinese President Xi Jinping revealed the plan to help domestic tech startups raise funds more easily.

New round, old faces

Canaan is considering a second stab at going public on the heels of a recent funding round, which one news report said raised “several hundred million dollars,” valuing the firm at “several billion dollars.”

However, CoinDesk has learned that the funding round drew no new investors.

“There was a fund raise, but there’s no real investors because it all comes from old shareholders’ own pockets,” said a third source close to the company, who spoke on condition of anonymity because the information is private.

While continued investment by existing shareholders might be read as a vote of confidence in the company, the absence of new participants is likely a sign of how tough fundraising is for mining operations given the ongoing slump in cryptocurrency prices.

The source close to Canaan drew the latter interpretation, saying:

“Based on the current bearish market situation, it’s just too difficult to gain investment.”

‘Red chip’ candidate

Notably, the report of a multi-billion dollar valuation for Canaan came just after the publication of the Shanghai exchange’s listing rules for startups seeking to raise money on the new board.

Prospective issuers include what the government calls “red chip” companies – those that are incorporated overseas but operate businesses inside China. This would include Hangzhou-based Canaan, whose holding firm Canaan Inc. is incorporated in the Cayman Islands.

To be listed on the new board, a red chip applicant must have either a valuation larger than 10 billion yuan ($1.5 billion), or a valuation no less than 5 billion yuan ($750 million) but revenue of over 500 million yuan ($75 million) in a recent year.

Before the recently completed round, Canaan might not have made the cut. In May 2017, it raised $43 million in a Series A round, which valued the firm at around $430 million at the time. According to Canaan’s initial public offering (IPO) prospectus in Hong Kong, it netted $56 million of profits on $200 million of revenues in 2017.

And Canaan’s interaction with the Chinese government has long been visible. On April 24, 2018, Yang Jiang, the vice president of the China Securities Regulatory Commission, paid a visit to Canaan Creative’s Hangzhou office.

During the visit, Jiang reportedly commented: “Whatever applications your chips will be used for, essentially you are still a chip company. I hope that you will go public on the domestic market.” Canaan published a post with the comment from Jiang on its WeChat platform, but the article was later removed.

Existing shareholders

While the third source would not say which shareholders contributed to the new round or the exact amount raised, Canaan named its largest existing shareholders in the Hong Kong IPO prospectus.

According to the filing, the company’s main shareholders include chairman and co-founder Nangeng Zhang (17.6 percent), co-founder and executive director Jiaxuan Li (17.2 percent), and co-founder and former director Xiangfu Liu (17.61 percent).

Further, Jianping Kong, an executive director, and Qifeng Sun, a non-executive director, own 7.8 percent and 5 percent, respectively, in Canaan.

The remaining 34.69 percent was categorized as owned by “other shareholders.” The largest among them (8.78 percent) is a Hangzhou-based firm called Jiaji Information Technology Limited.

Attempts to reach these publicly identified shareholders by press time were unsuccessful.

Avalon miner image via CoinDesk archive

This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post Avalon Bitcoin Miner Maker Canaan Is Plotting Another IPO Attempt appeared first on Click 2 Watch.

More Details Here → https://click2.watch/avalon-bitcoin-miner-maker-canaan-is-plotting-another-ipo-attempt

0 notes