#AutomatedBookkeeping

Explore tagged Tumblr posts

Text

The Art of Financial Clarity: Streamlining Your Business Accounting

Welcome to the world of financial clarity, where navigating the intricate web of business accounting becomes an art form. In this journey, understanding the fundamental pillars of financial reporting standards, effective budgeting and forecasting techniques, automated bookkeeping processes for efficiency, and optimized tax planning strategies is crucial.

Together, we'll explore how these elements not only streamline your business accounting but also provide a clear path to success in the realm of accounting firm services. So, buckle up as we delve into the art of financial clarity and unlock the secrets to streamlining your business accounting practices.

Understanding Financial Reporting Standards

Financial reporting standards are like the rules of the game in accounting. They ensure consistency and transparency in how financial information is presented and communicated. Think of them as the grammar rules that make sure everyone speaks the same financial language.

When it comes to effective budgeting and forecasting techniques, it's all about looking into the crystal ball of your finances.

Effective Budgeting and Forecasting Techniques

Budgeting isn't just about limiting spending; it's about allocating resources wisely. By setting realistic budgets and regularly monitoring your financial performance against them, you can stay on track and make informed decisions for your business's future.

Forecasting takes budgeting a step further by predicting future financial trends based on past data and market conditions. It's like having a financial weather forecast to help you navigate potential storms or sunny days ahead.

Now, let's talk about automating bookkeeping processes for efficiency. Imagine having a personal assistant who takes care of all your bookkeeping tasks without needing coffee breaks!

Automating Bookkeeping Processes for Efficiency

Automation is a game-changer in the world of accounting firm services. By using accounting software and tools, you can automate repetitive tasks like data entry, invoicing, and reconciliation. This not only saves time but also reduces the risk of human error.

With automated bookkeeping processes in place, you can focus on analysing financial insights and making strategic decisions for your business instead of drowning in paperwork.

Lastly, let's dive into optimizing tax planning strategies. Nobody likes paying more taxes than necessary, right?

Optimizing Tax Planning Strategies

Tax planning isn't about dodging taxes; it's about minimizing your tax liability within the bounds of the law. By understanding tax regulations, leveraging deductions and credits, and timing financial transactions strategically, you can optimize your tax planning strategies to save money and stay compliant.

Mastering the art of financial clarity in your business accounting involves understanding financial reporting standards, using effective budgeting and forecasting techniques, automating bookkeeping processes for efficiency, and optimizing tax planning strategies. With these tools and insights, you'll navigate the financial waters with confidence and clarity.

#FinancialClarity#BusinessAccounting#FinancialReporting#BudgetingTechniques#ForecastingMethods#AutomatedBookkeeping#TaxPlanningStrategies#AccountingFirmServices#FinancialManagement#EfficiencyInAccounting

1 note

·

View note

Text

No matter the size of your business, success is possible with the right tools and mindset.

Join us at AlignBooks and let's create success together!

Contact us for more info- 8802998998 Click the link for a free Trial - shorturl.at/ioV69

#AlignBooks#AlignWithAlign#OnlyOnAlignBooks#ERP#Accounting#Inventory#GST#Smallbusinessaccountin#MSME#BusinessManagement#CloudSolutions#Invoicing#SuccessStories#EmpoweringMSMEs#ModernBusinessSolutions#BusinessOwners#EasyInvoicing#RealTimeTracking#AutomatedBookkeeping#OnlineMarketplace#GrowYourBusiness#UnitedBySuccess#anythingispossible#business#success#mindset

0 notes

Text

No matter the size of your business, success is possible with the right tools and mindset.

Join us at AlignBooks and let's create success together!

Contact us for more info- 8802998998 Click the link for a free Trial - shorturl.at/ioV69

Also follow us on-

Instagram-https://www.instagram.com/alignbooksofficial/?hl=en

linkedin-https://www.linkedin.com/company/alignbooksbusinessaccountingsolution/

Youtube-https://www.youtube.com/c/AlignBooks-Accounting-Software

Twitter-https://twitter.com/align_books

Facebook-https://www.facebook.com/alignbooks

#AlignBooks#AlignWithAlign#OnlyOnAlignBooks#ERP#Accounting#Inventory#GST#Smallbusinessaccountin#MSME#BusinessManagement#CloudSolutions#Invoicing#SuccessStories#EmpoweringMSMEs#ModernBusinessSolutions#BusinessOwners#EasyInvoicing#RealTimeTracking#AutomatedBookkeeping#OnlineMarketplace#GrowYourBusiness#UnitedBySuccess#anythingispossible#business#success#mindset

0 notes

Text

VAT Guide for Small Business Owners

Are you an entrepreneur managing a small business and considering if you should register for VAT? This blog covers some essential information about UK VAT to get you started with your assessment to register or not.

What is VAT?

Value Added Tax or VAT is an indirect tax that is applied to on purchase value of goods and services. In some jurisdictions outside the UK, it is also referred to as Sales Tax of General Sales Tax (GST). In the VAT system, all VAT registered participants in the supply chain have to collect VAT on sales and deposit it to HMRC, after deducting the allowable VAT on their purchases. So effectively every seller collects tax from their customer on the value added to the goods and services, and that’s where the name Value Added Tax comes from.

Who needs to register for VAT?

VAT registration threshold in the UK is a turnover of £85,000 of taxable supplies for a period of consecutive twelve months. So, if your business turnover in the last twelve months exceeds the VAT threshold, then you must register for VAT.

There are two types of registration.

Compulsory Registration

You can determine if you are required to register for VAT by assessing your turnover against the following two tests. If you pass either of the tests, you will need to register for VAT.

Historic Test

If your value of cumulative taxable supplies exceeds £85,000 for twelve consecutive months, then you need to register for VAT. It is important to note that you need to apply this test at the end of every month by calculating the cumulative turnover of taxable supplies for the previous twelve months. It doesn’t have to coincide with the calendar year or your finance or tax year. So if you are a fast growing business, you must pay attention to this limit.

Future Test

You don’t only apply the historic test; you also need to apply a future test. You are required to register for VAT at any time if there are reasonable grounds for believing that your taxable turnover (excluding VAT) in the following 30 days will exceed £85,000 for the cumulative period of twelve months.

Voluntary Registration

You can voluntarily register for VAT even if your taxable turnover falls below the compulsory registration threshold. The definite benefit of registration is that you can claim back the VAT paid on purchases and expenses.

The VAT is charged on taxable supplies. A taxable supply is any supply made in the UK which is not exempt from VAT. Taxable supplies include those which are zero-rated for VAT.

VAT Schemes for SME’s:

For the ease and benefit of SME’s, HMRC has introduced different VAT Schemes for businesses to consider. You need to consider which scheme is suitable for you depending on your business circumstances.

Cash Accounting Scheme

You can only opt for this scheme if your taxable turnover (excluding VAT) for twelve months is not expected to exceed £1,350,000.

You are required to leave this scheme if the value of taxable supplies exceeds £1,600,000. It means, at the time of registering for VAT your expected revenue should not be more than £1,350,000 but once joined you can continue to pay taxes under this scheme unless your taxable revenue exceeds £1,600,000. As above, all calculations are for twelve consecutive months and will have to be assessed at the end of every calendar month for the past twelve months.

Under this scheme, you need to account for the VAT on the basis of cash received or paid. You will also get a benefit that you will not be required to claim back VAT previously paid on sales that eventually turned out bad debt as the VAT is paid when you receive cash from the customer.

Flat Rate Scheme

You can join this scheme if you have an annual taxable turnover (excluding VAT) of up to £150,000.

You need to leave the scheme if the total value of your VAT inclusive supplies in the year is more than £230,000.

Under this scheme, you are required to calculate VAT by applying a fixed percentage (usually depends on the trade sector in which business falls) on your tax inclusive turnover. A 1% reduction of the flat rate is applicable if it’s your first year of VAT registration.

Annual Accounting Scheme

Rather than making quarterly returns, this scheme gives you a chance to make advance installments towards your bill consistently. You then file one VAT return and pay the balance or claim back a refund for any overpayments. This option is available to organizations with a turnover below £1.35 million

Benefits of Registration for VAT:

VAT registration adds credibility to your business profile as most businesses prefer to deal with companies registered with VAT.

If you are an importer or exporter, it would be an added advantage for you as some countries give tax benefits for VAT Register Company.

You can reclaim input VAT on all goods or services your business purchases if you register for VAT, including asset purchases that can be a significant

You can also reclaim VAT from past, once you get registered for VAT you get eligible to claim input VAT on goods by going back four years from the date of registration, and you still have that goods available in your business premises.

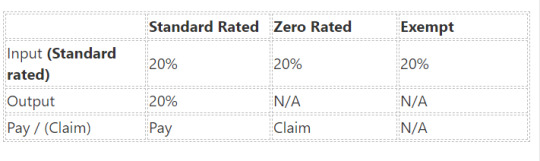

VAT Accounting or Accounting for VAT:

VAT accounting means recording VAT on purchases and sales.

The VAT on purchases should be recorded from the purchase price. This input VAT is recoverable if the business is VAT registered.

The VAT on sales should be recorded separately from the sales price. This VAT is payable to HMRC along with the VAT return.

You can easily record your VAT using an Accounting software or on a simple excel sheet. Alternatively, you can automate the recording of expenses with an automated bookkeeping app like Receipt Bot. In this case, you just take pictures of your bills and receipts with a mobile camera or upload documents from scanners and email. If you are using a cloud accounting software like Xero and QuickBooks Online, you can integrate Receipt Bot to automatically record all expenses in this software and then submit your VAT return with ease.

Even if you are not VAT registered, proper accounting is still essential for your business management. Not only it will help you with income tax filing, but it will also enable you to analyze the potential savings that you can get by registering for VAT.

0 notes

Text

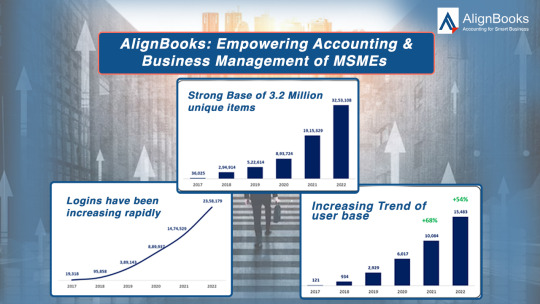

AlignBooks: Empowering Accounting & Business Management of MSMEs

AlignBooks has a story rooted in the passion and determination of a group of individuals, who saw a need for better Accounting and business management in MSMEs and set out to fill that void.

It all started in September 2016, when the founders of AlignBooks saw a gap in the market for a modern business solution for small and medium-sized enterprises. With over 20 years of experience in business consultancy and ERP solutions, they were determined to fill that gap and provide a product that went beyond just accounting.

Determined to make a difference, they poured their heart and soul into creating a solution that would be both accessible and effective. They spent countless hours researching and testing different financial management techniques and eventually came up with a simple yet powerful platform that could help MSMEs stay on top of their finances with ease.

And thus, with hard work and determination, they launched AlignBooks. Which is designed to be intuitive and user-friendly, making it easy for MSMEs to keep their finances organized and on track. With features like real-time tracking, automated bookkeeping, and easy invoicing, AlignBooks has quickly become the go-to solution for MSMEs everywhere.

But our story doesn’t end there. Our mission is to empower MSMEs around the world by giving them the tools they need to succeed. We’re passionate about helping our users achieve their goals and reach their full potential, and we’re committed to constantly improving our platform to make that a reality.

Here are the milestones that we achieved over time:

We launched in August 2017 and had over 40 customers registered by the end of the month.

By December 2017, the team had achieved their first milestone of 500 customers using their cloud-based solution smoothly. But their journey didn't stop there. They saw the need for an offline solution for areas with poor internet connectivity, so in March 2018, they launched a desktop application that could work purely offline with cloud sync functionality.

One year later, in August 2018, AlignBooks celebrated its first anniversary with over 1000 satisfied customers from various industries. And the team's dedication to innovation continued as they developed an add-on to integrate an online marketplace, which launched in December of that year.

Fast forward to today, and AlignBooks is approaching its sixth anniversary, serving over 6,665 satisfied customers across multiple industries. With over 44.29 Lacs invoices generated per year through the platform and a growing list of corporate customers. AlignBooks is a shining example of what can be achieved with hard work, determination, and a commitment to innovation.

What makes AlignBooks different is our commitment to empowering our customers. We are dedicated to making Accounting and business management accessible to everyone. With our easy-to-use software and support from our expert team, MSME business owners can focus on what they do best - growing their business.

Our journey has been a challenging one, but it has also been incredibly rewarding. We are inspired by the success stories of our customers, and we are motivated to keep making a positive impact in their lives.

At AlignBooks, we believe that anything is possible with the right tools and the right attitude. We are a community of entrepreneurs and small MSME owners, united by our passion for success.

So if you’re an MSME business owner looking to take your Accounting and business management to the next level, join us on our journey to success. Together, we can achieve anything.

#AlignBooks#AlignWithAlign#OnlyOnAlignBooks#ERP#Accounting#Inventory#GST#Smallbusinessaccountin#MSME#BusinessManagement#CloudSolutions#Invoicing#SuccessStories#EmpoweringMSMEs#ModernBusinessSolutions#BusinessOwners#EasyInvoicing#RealTimeTracking#AutomatedBookkeeping#OnlineMarketplace#GrowYourBusiness#UnitedBySuccess#anythingispossible#business#success#mindset

0 notes

Text

Automated Data Entry to Quickbooks

https://www.receipt-bot.com/blog/automated-data-entry-to-quickbooks-online/

Read Full Blog: https://www.receipt-bot.com/blog/automated-data-entry-to-quickbooks-online/

#quickbooks#certified quickbooks consultant#quickbooks help and training#automatedbookkeeping#accounting

0 notes