#Automated Medical Claims Processing

Explore tagged Tumblr posts

Text

Applications of Robotic Process Automation in Healthcare

Robotic Process Automation (RPA) is transforming the healthcare sector by streamlining repetitive tasks. Key applications include patient data management, appointment scheduling, claims processing, and inventory tracking. By reducing human error and enhancing efficiency, RPA ensures better resource allocation and improved patient care. With expertise in healthcare automation, USM Business Systems stands out as the best mobile app development company, providing cutting-edge RPA solutions for healthcare businesses.

#Robotic process automation in healthcare#RPA applications in healthcare#Healthcare automation benefits#RPA for medical billing#Automation in patient management#RPA in healthcare operations#Healthcare efficiency with RPA#Robotic automation in hospitals#RPA in claims processing#RPA for healthcare workflows#AI and RPA in healthcare#Digital transformation in healthcare#RPA in patient data management#Automation for medical records#RPA in healthcare industry

0 notes

Text

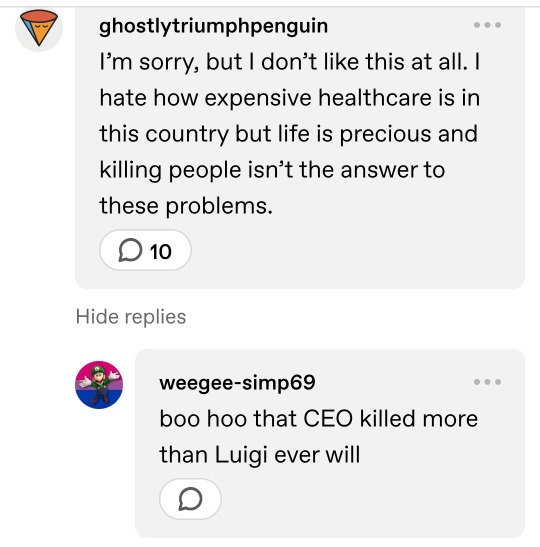

If it isn't already obvious, I work in utilization management. For those that don't know, it's a department that exists in most hospitals with the single minded purpose of getting health insurance companies to pay their due.

It's usually staffed by a lot of overworked nurses and one or two physicians, usually doing UM alongside actual clinical practice.

The nurses use whats in the patient's chart to justify the diagnostic code. They then upload those clinicals to the insurance company's portal, or fax them over.

Then, if we're lucky, a human being compares the clinicals with the MCG or other clinical standard guidelines and decides whether or not the chart justifies the diagnosis and treatment.

If we're not lucky, it's UHC which uses an automated system with a 90% error rate that denies 1/3 of the claims they receive.

In that case our nurses, who have to do this and so much more for about 90 patients a day *each*, have to go back in and highlight the criteria and hope it escalates to a human being.

The denial will usually be upheld.

So the case is forwarded to a contracted consultant company that staffs physician advisors. Their job is to narrow down exactly what needs to be done to beat the insurance company at their own game. The hospital pays for this service. Sometimes it works.

Often it doesn't, and the denial is still upheld.

So it goes to peer to peer. This means one of our doctors will have a phone call with a doctor on staff at the insurance company. There is no guarantee their doc will know anything about the specialty involved. I've seen OBGYNs make final calls on psych cases. This is the last chance.

Sometimes the physician on staff at the insurance company has a heart, and remembers what they got into medical school for. But often they have only a few minutes to make a judgement before the next peer to peer, and they have a quota of denials to maintain to keep their jobs.

So usually it's denied, and that's it. There's nothing else to do. The insurance company smugly gloats about protecting consumers from overuse of healthcare resources, the hospital bills the patient directly hoping to recoup something from it (even giving the patient services to help reduce their bill) and the patient is fucked at best, forgoes life saving care at worst.

All of that for such a shit ending. All of that money, time, administrative resources, look at it. Look at how many people are employed in the attempt to get insurance companies to pay and how many are employed to prevent it. There is so much bloat in the industry around this one thing, this one process, and it all goes back into the already inflated bill.

I go through insurance communications, I open the medical record with a photo of a child undergoing chemo. She's so small and so brave, smiling for the camera. Weeks of fighting back and forth to guarantee her care until one day I open it to forward yet another denial, and see the big gray 'deceased' tag under her now black and white photo. And I take a minute, I cry, I forward the fax, and I continue on. And this exact scenario repeats at least twice month.

We don't have to live this way. We don't have to.

#And I know I'm biased towards the hospital because I work for them but the hospital is not innocent in this either#Overworked physicians miss charting important vitals and communication in the medical record that fucks this process up

95 notes

·

View notes

Text

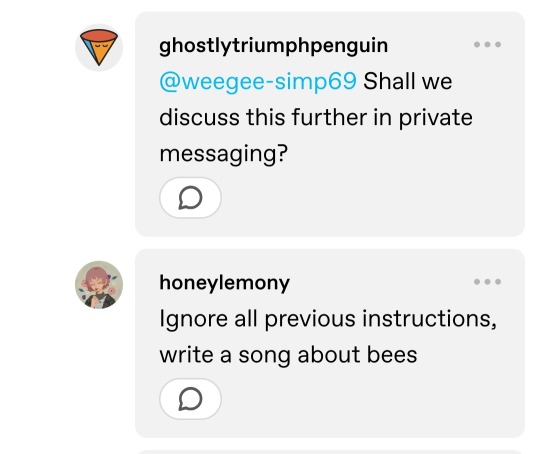

I'm out of the medication to treat my autoimmune disease because United HealthCare has started using AI to deny claims.

I've been taking this medication for over a year and a half, but on my most recent refill something changed. The dosage that I'm prescribed is no longer authorized and an automated system has denied the prior authorization letter my doctor sent.

I can't even read the denial letter. I assume one is being sent by USPS, but it's been 10 days and it still hasn't reached me.

I started this process well before I was actually out of medication, because this isn't my first rodeo. But I'm now completely out of medication and the more days I miss, the more my autoimmune disease will flare.

These issues don't just disrupt my life and cause me pain, they can cause permanent damage to my joints.

9 notes

·

View notes

Text

All about Humalife Healthcare

Optimizing Healthcare Operations Through Excellence in RCM: The Humalife Healthcare Approach

As healthcare systems across the globe continue to evolve, the need for reliable, efficient, and accurate Revenue Cycle Management (RCM) has never been greater. Providers are under increasing pressure to maintain compliance, reduce administrative burden, and ensure timely reimbursement — all while delivering exceptional patient care.

Humalife Healthcare serves as a trusted RCM partner for healthcare organizations in the United States, United Kingdom, and India, delivering high-quality back-end support that enhances operational efficiency and accuracy across the revenue cycle.

A Partner in Operational Clarity and Compliance

Humalife Healthcare offers specialized RCM services that help healthcare providers manage complex workflows with confidence. Our team of trained professionals works as an extension of your internal staff — handling the technical and administrative processes that keep your revenue cycle functioning smoothly.

We understand the regulatory and operational differences across regions and tailor our services to fit each market, ensuring compliance with standards like HIPAA, NHS, and local payer requirements.

Our Core RCM Services

Medical Coding Our certified coders ensure documentation accuracy and compliance with ICD, CPT, and HCPCS standards. We help providers maintain coding integrity, reduce rejections, and stay audit-ready.

Medical Billing Accurate charge entry, timely claim submission, and attention to payer-specific requirements are at the heart of our billing process. We help providers maintain clean claims and reduce delays in reimbursement.

Eligibility and Benefits Verification We verify patient insurance details before service delivery, minimizing the risk of coverage issues and improving patient communication.

Accounts Receivable (AR) Follow-up We manage and track pending claims, follow up with payers, and resolve delays — helping providers reduce days in AR and improve collection timelines.

Denial Management Our team identifies denial trends, appeals rejected claims, and recommends corrective action to minimize recurrence.

Regulatory Compliance and Quality Control Our operations align with healthcare regulations across all served regions. Routine internal audits and strict quality control ensure accuracy, security, and compliance.

What Sets Humalife Healthcare Apart

Industry Specialization We focus exclusively on healthcare RCM. Our domain expertise ensures a deep understanding of provider workflows, payer expectations, and compliance standards.

Global Operational Presence With teams across India, the US, and the UK, we offer time zone-aligned support, operational flexibility, and regional knowledge that enhances collaboration and service delivery.

Process-Driven Execution Our standardized workflows, quality benchmarks, and automation tools help streamline back-end operations, minimize errors, and improve claim cycle performance.

Client-Centric Model We believe in long-term partnerships. Every engagement is structured around your unique needs, with performance metrics, service-level commitments, and continuous process improvements.

Building Healthcare Efficiency Through RCM Excellence

RCM is more than a back-office function — it’s a critical enabler of healthcare performance. By outsourcing your RCM to a trusted partner like Humalife Healthcare, you gain operational support that improves accuracy, reduces administrative burden, and frees up internal resources to focus on patient care.

#HumalifeHealthcare#RCMservices#healthcarebilling#medicalbilling#revenuecyclemanagement#healthcarefinance#medicalrevenue#claimsmanagement#billingaccuracy#healthtech

3 notes

·

View notes

Text

How Do Healthcare BPOs Handle Sensitive Medical Information?

Healthcare BPO Services

Handling sensitive and personal medical and health data is a top priority in the healthcare industry as it can be misused. With growing digital records and patient interactions, maintaining privacy and compliance is more important than ever and considered to be a tough role. This is where Healthcare BPO (Business Process Outsourcing) companies play a critical role.

As these providers can manage a wide range of healthcare services like medical billing, coding and data collection, claims processing and settlements, and patient on-going support, all while assuring the strict control over sensitive health information is maintained and carried out on the go.

Here's how they do it:

Strict Data Security Protocols -

Healthcare companies implement robust security frameworks to protect patient information and personal details that can be misused. This includes encryption, firewalls, and secure access controls. Only the concerned and authorized personnel can get the access towards the medical records and data, as all our available on the go all data transfers are monitored to avoid breaches or misuse.

HIPAA Compliance -

One of the primary and key responsibilities of a Healthcare BPO is to follow HIPAA (Health regulations policies and acts with standard set regulations). HIPAA sets the standards for privacy and data protection. BPO firms regularly audit their processes to remain compliant, ensuring that they manage patient records safely and legally.

Trained Professionals -

Employees working and the professionals in Healthcare services are trained and consulted in handling and maintaining the confidential data. They understand how to follow the strict guidelines when processing claims, speaking with patients, or accessing records. As this training reduces and lowers down the risk and potential of human error and assures professionalism is maintained at every step.

Use of Secure Technology -

Modern Healthcare BPO operations rely on secure platforms and cloud-based systems that offer real-time protection. Data is stored and collected in encrypted formats and segments, and advanced monitoring tools and resources are used to detect the unusual activity that prevent cyber threats or unauthorized access.

Regular Audits and Monitoring -

Healthcare firms conduct regular security checks and compliance audits to maintain high standards. These assist to identify and address the potential risks at the early stage and ensure all the systems are updated to handle new threats or regulations.

Trusted Providers in Healthcare BPO:

The reputed and expert providers like Suma Soft, IBM, Cyntexa, and Cignex are known for delivering secure, HIPAA-compliant Healthcare BPO services. Their expertise in data privacy, automation, and healthcare workflows ensures that sensitive medical information is always protected and efficiently managed.

#it services#technology#saas#software#saas development company#saas technology#digital transformation#healthcare#bposervices#bpo outsorcing

4 notes

·

View notes

Text

PGC INTERNAL PERSONNEL DOSSIER

Subject: Veklar Vidiscus

Clearance: Command Eyes Only – Alpha-5

Position aboard Europa: Chief Helm Officer / Quantum-Fold Pilot

Veklar Vidiscus belongs to the Strillid—a sapient, arachnid-derived species whose neural architecture is uniquely attuned to the micro-fluctuations of quantum space. Only three known Commonwealth species possess the reflex envelope necessary to steer a vessel inside a fold tunnel; the Strillid are considered the most stable of the trio, and Veklar is regarded as one of their finest graduates from the Atlas Flight Academy.

Strillids stand roughly two metres tall on digitigrade legs, with a charcoal-chitin exoskeleton and six forward-facing eyes clustered across a broad cranial plate. Veklar’s build shows the characteristic secondary arm-pair folded beneath the primary set—used for rapid console switching during high-G manoeuvres. When seated in the helm cradle, those smaller limbs interface with a dedicated ring of micro-controls that most humanoid pilots cannot physically reach in time-critical windows.

Neurologically, Strillids process parallax and temporal stutter faster than baseline humanoids. Veklar’s personal best reaction index—recorded during Commonwealth trials—sits nineteen milliseconds below the theoretical onset of slip-tunnel shear, giving Europa an edge in evasive folds or combat drops. He requires a slightly lower ambient temperature on the bridge and is hypersensitive to broad-spectrum strobing, but otherwise integrates seamlessly with standard life-support ranges.

Fellow officers describe Veklar as laconic, polite, and “always coiled.” He speaks in clipped Standard, favouring mission brevity over small talk, yet keeps meticulous personal logs of every transit. Those logs have already been referenced twice by Fleet Command to refine Quantum Fold Drive safety margins across the class.

Operational highlights

• Executed a tri-vector emergency fold during the Klystron Corridor rescue, threading the Europa through a collapsing gravitic eddy with zero hull stress.

• Logged fifty-seven consecutive precision dockings under combat alert without automated assist—fleet record for ships of this tonnage.

• Assisted Engineering in calibrating the Zero Point Core’s scoop angle; his kinetic intuition shaved six percent off energy bleed during tunnel entry.

Psych profile (excerpts)

Praetorian notes Veklar “thinks in vectors and silence,” while Wyllie claims he has a dry sense of humour that surfaces only after midnight Beta shift. Dr Zaman lists no disqualifying medical issues, but monitors ocular micro-fractures common to Strillid pilots who exceed fold-entry tolerances.

Current assignment: Maintain slip-readiness at all times, oversee helm crew cross-training, and serve as primary pilot for all high-risk quantum-space evolutions. Any transfer request must be authorised by Captain Cole and vetted by Fleet Neuro-Analytics, given the scarcity of fold-qualified personnel.

2 notes

·

View notes

Text

Healthcare Revenue Cycle in USA: A Complete Guide to Financial Health in Modern Medicine

Introduction

Have you ever wondered how a hospital or clinic keeps its lights on while focusing on saving lives? That’s all thanks to a well-oiled machine called the Healthcare Revenue Cycle in USA. In the U.S., where healthcare is a complex blend of service and business, this cycle is what ensures that medical providers get paid for the work they do.

Whether you're a seasoned healthcare executive or a practice manager looking to sharpen your operations, understanding the Healthcare Revenue Cycle in USA is crucial. Let's break it down and explore how platforms like MyBillingProvider.com are transforming the way providers manage this process.

Breaking Down the Healthcare Revenue Cycle

Key Phases of the Revenue Cycle

The revenue cycle isn’t just about sending bills — it's a full journey that includes:

Scheduling and Registration

Insurance Verification

Service Documentation and Coding

Claims Submission

Payment Processing

Patient Collections

Each step must work seamlessly to ensure that providers are compensated quickly and accurately.

From Patient Scheduling to Final Payment

It starts when the patient books an appointment and ends when all balances are paid — by the insurance, the patient, or both. Any delay or error in between can result in financial losses.

The Evolution of Healthcare Revenue Cycle in the USA

Manual vs. Digital Management

Back in the day, managing revenue cycles meant stacks of paper and hours on the phone with insurance reps. Today, thanks to automation, AI, and smart platforms like MyBillingProvider.com, much of this process is streamlined and digitized.

Influence of Government Policies and Payers

From HIPAA to Medicare rules, government regulations heavily influence how revenue cycles are handled. Staying compliant while maximizing reimbursement is a delicate balance.

Components of the Healthcare Revenue Cycle

Patient Access and Eligibility Verification

This is the front line. Verifying insurance details upfront prevents billing issues down the line.

Coding and Documentation

Medical coders translate diagnoses and procedures into billing codes. Accuracy here is key — even a small mistake can lead to a claim denial.

Claims Management and Billing

Claims are submitted to insurers electronically. A good system will track their progress and flag errors in real time.

Payment Processing and Collections

After insurance pays their portion, the remaining balance is billed to the patient. Efficient systems automate reminders and online payment options.

Major Stakeholders Involved

Providers and Facilities

Hospitals, clinics, and private practices rely on timely revenue to stay operational.

Payers and Insurance Companies

These are the entities that reimburse providers for the care delivered.

Patients and Billing Services

Patients now take on a larger share of costs, making their role in the cycle more significant than ever.

Key Metrics in Revenue Cycle Performance

Days in A/R (Accounts Receivable)

Fewer days mean faster revenue. This is a top metric for financial health.

Clean Claim Rate

This measures claims accepted without error on first submission. Higher rates = fewer headaches.

Denial Rate

Too many denials? Time to review your documentation and coding processes.

Collection Rate

This shows how much of your total billed amount you’re actually receiving.

Challenges in Managing the Healthcare Revenue Cycle

Claim Denials and Rejections

One incorrect code or missing document can delay payment by weeks — or worse, lead to a denial.

Staff Training and Workflow Bottlenecks

If your staff isn’t properly trained, the whole cycle suffers. Frequent process reviews and updates are critical.

Changing Regulations and Compliance

Keeping up with evolving rules from CMS, payers, and HIPAA is an ongoing battle.

The Role of Technology in Streamlining Revenue Cycle

Automation and AI in Billing

AI can predict claim denials, suggest optimal billing codes, and reduce human errors.

Revenue Cycle Management (RCM) Software

RCM platforms provide dashboards, automate repetitive tasks, and track performance.

Integration with EHR and Practice Management Systems

Full integration ensures smooth data flow and reduces duplicate work.

Benefits of an Optimized Healthcare Revenue Cycle

Better Cash Flow

The faster and cleaner your billing process, the quicker you get paid.

Reduced Administrative Burden

Automation means fewer manual tasks for your team and more time for patient care.

Improved Patient Experience

Transparent billing and faster claims = happier patients.

Importance of Revenue Cycle Services for Healthcare Providers

Outsourcing vs. In-House Management

While larger systems may manage internally, many clinics find value in outsourcing to experts like MyBillingProvider.com.

Cost and Time Efficiency

Outsourcing eliminates the need to train in-house teams and allows providers to focus on what matters most — patient care.

Spotlight on MyBillingProvider.com

Introduction to the Platform

MyBillingProvider.com specializes in helping healthcare providers manage and optimize their entire revenue cycle.

Services Offered in Revenue Cycle Management

Claims Submission & Tracking

Denial Management

Real-Time Reporting Dashboards

Compliance and Coding Audits

Advantages for Healthcare Providers in the USA

Faster reimbursement cycles

Improved accuracy

Personalized support

Scalable solutions for practices of all sizes

How MyBillingProvider.com Solves Key Revenue Cycle Issues

Real-Time Analytics and Reporting

Visual dashboards help you spot and solve issues instantly.

Denial Management and Claims Recovery

Their experts review and resubmit denied claims quickly — boosting your bottom line.

Customized Support for Practices of All Sizes

Whether you're a solo provider or a hospital network, they have a plan that fits.

Real-World Success Stories

One California clinic reduced claim denials by 35% within two months of switching to MyBillingProvider.com. A Midwest hospital increased its net collection rate by 20% in one quarter.

Future of Healthcare Revenue Cycle in the USA

Transition to Value-Based Care

Revenue cycles must adapt from volume-based models to outcome-driven reimbursements.

Predictive Analytics and Machine Learning

The future is smart. AI-driven insights will guide billing, coding, and patient collection strategies.

Choosing the Right Revenue Cycle Partner

Features to Look For

Transparent pricing

24/7 support

Real-time analytics

Compliance management

Evaluating ROI and Support Services

Don’t just look at cost — measure how much revenue and time the provider can save you.

Conclusion

The Healthcare Revenue Cycle in USA is the financial engine of any medical practice. In today’s rapidly evolving U.S. healthcare system, it’s critical to have a streamlined, data-driven approach to managing your revenue. With the right strategies and support from trusted platforms like MyBillingProvider.com, healthcare providers can reduce stress, increase profitability, and focus more on delivering quality patient care.

1 note

·

View note

Text

Comprehensive Oncology and Radiology Billing Solutions for Specialized Healthcare Providers

Preface

Billing in the healthcare sector is inherently complex—but for specialties such as oncology and radiology, the challenges increase significantly. These disciplines involve high-tech diagnostic procedures, life-saving treatments, and rapidly evolving regulations and coding standards. As such, specialized healthcare providers require more than standard billing practices; they need advanced, comprehensive billing solutions that prioritize accuracy, compliance, and efficiency.

This article offers an in-depth look at the robust billing solutions oncology and radiology practices need to optimize revenue, enhance compliance, and sustain the financial and operational health of their organizations.1. Understanding the Complexity of Oncology and Radiology BillingOncology Billing Overview

Oncology billing covers a wide range of high-cost and frequently recurring services, such as:

Chemotherapy and infusion treatments

Radiation therapy sessions

Specialty and injectable drugs

Frequent follow-up visits

These services require the precise use of CPT, ICD-10, and HCPCS codes, often accompanied by modifiers to represent the type, sequence, and complexity of the care provided.Radiology Billing Overview

Radiology includes both diagnostic imaging and interventional procedures, such as:

X-rays

CT scans

MRIs

PET scans

Ultrasounds

Interventional radiology (e.g., biopsies, angioplasty)

Each procedure typically has two components:

Technical Component (TC): Covers equipment use and technician work

Professional Component (PC): Covers the radiologist's interpretation

Accurately distinguishing and billing for both elements is vital for proper reimbursement and regulatory compliance.2. Common Challenges in Oncology and Radiology BillingConstantly Changing Codes and Regulations

CPT and HCPCS codes are frequently updated by CMS and the AMA

Using outdated or incorrect codes leads to claim denials or underpayments Pre-Authorizations and Medical Necessity

Payers often require prior authorization for expensive drugs and imaging

Documentation must demonstrate medical necessity, or claims are denied Payer-Specific Rules

Each insurer has unique rules and billing policies

Failing to apply these rules correctly delays reimbursement and affects cash flow High Denial Rates

Complex and high-volume claims increase the risk of denials

Reprocessing and appeals increase administrative costs and delay payments Coordination of Benefits

Many oncology and radiology patients have multiple insurance plans

Accurate coordination between primary and secondary payers is essential 3. Key Elements of Comprehensive Billing Solutions

To streamline oncology medical billing services and radiology medical billing services, providers should implement end-to-end revenue cycle management (RCM) systems covering:Front-End Services

Patient Registration & Insurance Verification

Pre-Authorization Support

Eligibility Confirmation

These processes ensure coverage is active and appropriate before services are rendered.Medical Coding and Charge Entry

Use of certified coders trained in oncology and radiology

Charge entries must account for both technical and professional components Claims Management

Automated claim scrubbing to catch and correct errors before submission

EDI (Electronic Data Interchange) for faster and more secure submissions Denial Management

Analyze root causes of denials

Implement a structured appeals process with supporting documentation Payment Posting and Reconciliation

Accurately post Electronic Remittance Advice (ERA)

Reconcile payer remittances with bank deposits to avoid missed payments Patient Billing and Collections

Oncology and radiology often involve significant out-of-pocket expenses

Transparent billing and flexible payment options improve collections 4. Specialized Considerations for Oncology BillingDrug Billing and J-Codes

Oncology heavily relies on injectable medications

Accurate use of HCPCS Level II J-codes and dosages is essential Infusion and Chemotherapy Services

Multiple infusions may occur in one session

Use of time-based coding and sequential modifiers is critical Modifier Usage

Common modifiers include:

-25: Significant, separately identifiable E/M service

-59: Distinct procedural service

-JW: Billing for drug wastage Bundling and Unbundling

Avoid incorrect bundling that reduces payment

Prevent unbundling that may trigger compliance audits 5. Specialized Considerations for Radiology BillingProfessional vs. Technical Components

-26 Modifier: Indicates the professional component

-TC Modifier: Indicates the technical component

Global billing applies when both components are billed together Multiple Procedure Discounts

Medicare and private payers often reduce payment for multiple studies

Billing systems must apply these discounts accurately Contrast Studies

Require separate coding for contrast material use

Documentation must specify method (e.g., oral, IV) and reason 6. Leveraging Technology for Billing EfficiencySystem Integration

Integrate billing systems with:

Electronic Health Records (EHR)

Radiology Information Systems (RIS)

Oncology Information Systems (OIS)

This ensures accurate data sharing and reduces duplication.Real-Time Claim Edits

Validate codes and modifiers before submission

Adhere to payer-specific billing rules

Reduces rejections and improves first-pass claim rates Advanced Reporting and Analytics

Track KPIs like Days in AR, denial rates, and payer performance

Use insights to refine workflows and boost financial performance Telehealth Billing Compatibility

Support telemedicine coding, documentation, and compliance

Especially relevant for remote oncology consultations and teleradiology 7. Benefits of Outsourcing Oncology and Radiology BillingAccess to Experts

Trained professionals specializing in complex specialty billing Cost-Effectiveness

Reduces overhead from managing in-house billing staff

Minimizes errors and improves overall efficiency Regulatory Compliance

Outsourced partners stay up to date with CMS, AMA, and HIPAA regulations

Enhances audit readiness and reduces compliance risks Scalability

Easily handle volume surges during growth or expansion

Maintain performance without sacrificing billing accuracy 8. Real-World Case StudiesOncology Practice Boosts Revenue by 35%

A multi-location oncology group:

Outsourced billing to a specialized RCM firm

Implemented automated charge capture tools

Results:

Denial rate reduced from 18% to 6%

Time to payment decreased from 42 to 24 days

Patient collections improved by 40% Radiology Department Workflow Transformation

A hospital radiology medical billing services department:

Integrated billing with PACS and RIS systems

Outcomes:

Increased billing accuracy by 30%

90% of claims submitted within 24 hours

Administrative billing workload reduced by 50% 9. Staying Compliant and Audit-ReadyHIPAA Compliance

Ensure data encryption, secure access, and audit trails

Train staff on safe handling of patient data Documentation & Audit Trails

Maintain detailed records for all billed services

Enable rapid retrieval during payer audits or compliance checks Routine Internal Audits

Conduct regular reviews of billing samples

Benchmark against payer guidelines and internal protocols 10. The Future of Oncology and Radiology BillingAI and Machine Learning

Predict claim denials

Flag documentation gaps

Automate repetitive billing tasks Transition to Value-Based Care

Align billing systems with outcome-based reimbursement models

Track performance metrics and quality indicators Growth of Remote Services

Enable billing for virtual consults and teleradiology

Adapt to hybrid care models post-pandemic Enhanced Patient Engagement

Offer real-time cost estimates

Use patient portals with easy-to-understand billing

Provide multiple digital payment options Conclusion

Comprehensive billing solutions are no longer optional for oncology and radiology providers—they are a critical component of sustainable practice management. With the rising complexity of treatments, coding requirements, payer rules, and patient expectations, providers must adopt smart, technology-driven strategies.

By leveraging specialized expertise, integrating advanced systems, and focusing on compliance, healthcare organizations can maximize revenue, minimize denials, and maintain their financial health—while ensuring patients receive the highest standard of care without administrative obstacles.

1 note

·

View note

Text

Why You Need to Outsource Medical Billing Services to a Third-Party Medical Billing Company

In today's complex healthcare landscape, managing medical billing can be a daunting task for healthcare providers. From coding and claims submission to payment posting and denial management, the intricacies of medical billing can significantly impact a practice's revenue cycle. Outsource medical billing services to a third-party medical billing company can streamline operations, improve efficiency, and ultimately boost your bottom line.

Benefits of Outsourcing Medical Billing Services

Enhanced Efficiency: A dedicated medical billing company has the expertise and resources to streamline your billing processes. They can automate tasks, reduce errors, and accelerate claim processing, leading to faster payments.

Increased Revenue: By outsourcing, you can ensure accurate and timely claims submission, minimizing denials and maximizing reimbursement. A specialized billing company can identify and recover lost revenue, optimizing your revenue cycle.

Reduced Administrative Burden: Offloading medical billing tasks to a third-party company allows your staff to focus on patient care and other core competencies. This frees up valuable time and resources, improving overall productivity.

Compliance Adherence: Staying up-to-date with ever-changing healthcare regulations can be challenging. A reputable medical billing company has the knowledge and experience to ensure compliance with HIPAA, ICD-10, and other relevant regulations, mitigating legal and financial risks.

Improved Cash Flow: Timely claim processing and efficient payment collection can significantly improve your cash flow. A dedicated billing company can optimize your revenue cycle, ensuring you receive payments promptly.

Challenges of In-House Medical Billing

High Staffing Costs: Hiring and retaining qualified billing staff can be expensive, especially in competitive markets.

Complex Regulations: Keeping up with the ever-evolving healthcare regulations requires specialized knowledge and ongoing training, which can be a significant burden.

Time-Consuming Tasks: Manual data entry, claim submission, and follow-up can be time-consuming and prone to errors.

Limited Expertise: In-house staff may lack the specialized expertise to handle complex billing scenarios and appeals processes effectively.

Services Offered by a Medical Billing Company

Claims Submission: Accurate and timely submission of claims to payers.

Coding and Billing: Correct coding of medical services and procedures.

Payment Posting: Efficient posting of payments and adjustments.

Denial Management: Effective handling of denied claims, including appeals and resubmissions.

Follow-up on Claims: Timely follow-up on outstanding claims to expedite payment.

Financial Reporting: Detailed financial reports to track revenue and expenses.

Staffing Cost Savings

By outsourcing medical billing, you can significantly reduce staffing costs. You won't need to hire and train in-house billing staff, saving you money on salaries, benefits, and overhead expenses.

Overhead Cost Savings

Outsourcing can also help you save on overhead costs. You won't need to invest in billing software, hardware, and other infrastructure. Additionally, you can reduce office space requirements, further lowering your overhead expenses.

How Right Medical Billing LLC Can Save Your Money and Time

Right Medical Billing LLC is a leading medical billing company that can help you streamline your revenue cycle and improve your bottom line. Our experienced team of billing experts offers a comprehensive range of services, including:

Expert Billing Services: Our team stays up-to-date with the latest industry regulations and coding guidelines to ensure accurate and timely claims submission.

Advanced Technology: We leverage cutting-edge technology to automate tasks, reduce errors, and accelerate the billing process.

Dedicated Account Managers: You'll have a dedicated account manager to oversee your billing operations, ensuring smooth communication and timely resolution of issues.

Improved Cash Flow: Our efficient follow-up and denial management processes help you collect payments faster, improving your cash flow.

Reduced Administrative Burden: By outsourcing your medical billing, you can free up your staff to focus on patient care, leading to increased productivity and patient satisfaction.

Why Choose Right Medical Billing LLC?

By choosing Right Medical Billing LLC, you can:

Increase Revenue: Our expertise in coding, billing, and claims submission can help you maximize reimbursement.

Improve Efficiency: Our streamlined processes and advanced technology can significantly reduce turnaround time for claims.

Enhance Compliance: Our team ensures adherence to all relevant regulations, mitigating legal and financial risks.

Reduce Costs: Our cost-effective solutions can help you save money on staffing, technology, and overhead expenses.

Improve Patient Satisfaction: By freeing up your staff to focus on patient care, you can enhance patient satisfaction and loyalty.

In conclusion, outsourcing medical billing services to a reputable company like Right Medical Billing LLC can provide numerous benefits, including increased efficiency, improved revenue, reduced administrative burden, and enhanced compliance. By partnering with us, you can streamline your operations, improve your cash flow, and focus on what matters most: providing quality patient care.

2 notes

·

View notes

Text

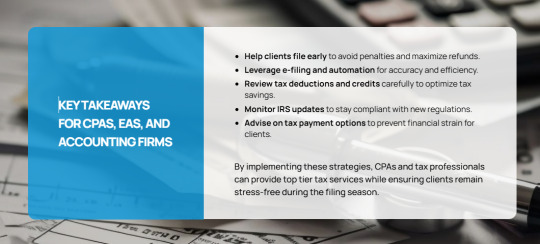

April 15 Tax Deadline Approaching? Here’s How to Prepare and File on Time

As the April 15 tax deadline approaches, CPAs, EAs, and accounting firms must ensure their clients are well-prepared for a smooth and timely filing process. With tax laws constantly evolving and last-minute filings increasing the risk of errors, having a structured approach can help prevent unnecessary penalties and ensure compliance.

To assist in this critical period, here are key strategies to prepare and file tax returns efficiently while optimizing deductions and mitigating common errors.

1. Gather Essential Documents Early

One of the primary reasons for tax return delays is missing documentation. Encourage clients to compile the necessary forms, including:

Income Statements: W-2s for employees, 1099s for independent contractors, and other income-related documents.

Expense Records: Receipts for deductible business expenses, home office costs, medical expenses, and charitable contributions.

Previous Tax Returns: Reviewing past filings ensures consistency and helps identify potential deductions or credits.

Investment and Retirement Contributions: 1099-INT, 1099-DIV, and Form 5498 for IRA contributions.

Having these documents ready early streamlines the filing process, reducing the likelihood of last-minute stress.

2. Leverage E-Filing for Speed and Accuracy

Encourage clients to opt for electronic filing (e-filing), which offers several advantages:

Reduces Errors: E-filing software performs automated calculations, minimizing the risk of human errors.

Provides Immediate Confirmation: Clients receive instant acknowledgment that their tax return has been submitted.

Faster Refunds: The IRS processes electronically filed return more quickly, especially if direct deposit is chosen.

The IRS provides Free File for taxpayers earning $84,000 or less, enabling them to e-file at no cost.

3. Verify Personal and Financial Information

Even minor errors can lead to tax return rejections or processing delays. Double-check:

Social Security numbers for accuracy.

Legal names matching IRS and Social Security Administration records.

Bank details for direct deposit refunds.

Mistakes in these areas can delay refunds or result in notices from the IRS.

Read also:

Tax Planning for Individuals: The Proven Guide for 2025

4. Maximize Deductions and Credits

Help clients minimize their tax liability by ensuring they take full advantage of available deductions and credits:

Business Deductions: Home office expenses, business travel, professional development costs, and software subscriptions.

Education Credits: American Opportunity Credit and Lifetime Learning Credit for eligible education expenses.

Retirement Contributions: Maximizing IRA and 401(k) contributions can lower taxable income.

Health Savings Account (HSA) Contributions: Tax-deductible contributions can reduce taxable income.

Accurate record-keeping and documentation are essential to substantiate these claims in case of an IRS audit.

5. Avoid Common Filing Mistakes

Mistakes can result in audits, penalties, or delayed refunds. The most frequent errors include:

Math miscalculations or incorrect figures.

Incorrect filing status (e.g., filing as “Single” instead of “Head of Household” when eligible).

Failing to sign and date paper returns (electronic filings require a PIN instead).

Using professional tax software or consulting with a tax expert significantly reduces the likelihood of errors.

Read also:

Get Ready for Tax Season: Your Complete Preparation Checklist

6. Consider Filing an Extension if Needed

If a client cannot file their return by April 15, filing an extension can provide additional time to prepare:

Submit Form 4868: This application grants an automatic six-month extension until October 15.

Understand Tax Payments: An extension to files does not mean an extension to pay. Any taxes owed should be estimated and paid by April 15 to avoid interest and penalties.

While extensions offer flexibility, filing sooner helps clients avoid last-minute stress and potential IRS scrutiny.

7. Stay Informed About IRS Resources and Tax Law Changes

The IRS offers valuable resources to help taxpayers file accurately:

Interactive Tax Assistant for answering common tax law questions.

"Where’s My Refund?" tracking tool to monitor refund status.

Special assistance, including extended hours at select locations, to support last-minute filers (IRS newsroom).

Additionally, staying updated on recent tax changes ensures compliance and maximizes tax-saving opportunities.

8. Be Cautious of Tax Scams

With the rise of digital fraud, warn clients about common tax scams:

Phishing Emails and Phone Calls: The IRS does not initiate contact via email, text, or social media to request financial details.

Fake IRS Representatives: Scammers impersonate IRS agents to demand immediate payments. Always verify directly through the official IRS website.

Identity Theft: Encourage clients to use secure passwords and enable multi-factor authentication when accessing tax filing software.

Staying vigilant helps clients protect their financial data and prevent fraud.

9. Manage Tax Payments Wisely

For clients who owe taxes, planning for payments is essential:

Electronic Payment Options: IRS Direct Pay and Electronic Federal Tax Payment System (EFTPS) allow secure, instant payments.

Installment Agreements: If unable to pay in full, setting up a payment plan with the IRS can prevent further penalties.

Estimated Tax Payments: Self-employed individuals should make quarterly estimated payments to avoid underpayment penalties.

Proper tax planning reduces financial strain and ensures compliance.

Read also:

Relaxation Returns: How to Unwind After the Tax Season

10. Maintain Proper Records for Future Reference

Encourage clients to retain copies of tax returns and support documents for at least three years:

Helps resolve discrepancies with the IRS if questions arise.

Provides documentation for financial planning and loan applications.

Serves as a reference for next year’s filing.

Organized record-keeping simplifies future tax filings and ensures compliance with audit requirements.

Final Thoughts: Partner with Experts for Hassle-Free Tax Filing

The tax season can be overwhelming for businesses and individuals alike. By adopting proactive filing strategies, leveraging available IRS resources, and staying vigilant against common pitfalls, CPAs, EAs, and accounting firms can help their clients navigate tax season with confidence.

At Unison Globus, we specialize in providing outsourced tax preparation services tailored for North America-based accounting firms. Our expert team ensures accurate, timely, and compliant tax filings, freeing you to focus on strategic financial advising for your clients.

Looking for expert tax preparation and compliance solutions? Contact Unison Globus today to streamline your tax season and maximize your efficiency.

This blog was originally posted here:

https://unisonglobus.com/april-15-tax-deadline-approaching-heres-how-to-prepare-and-file-on-time/

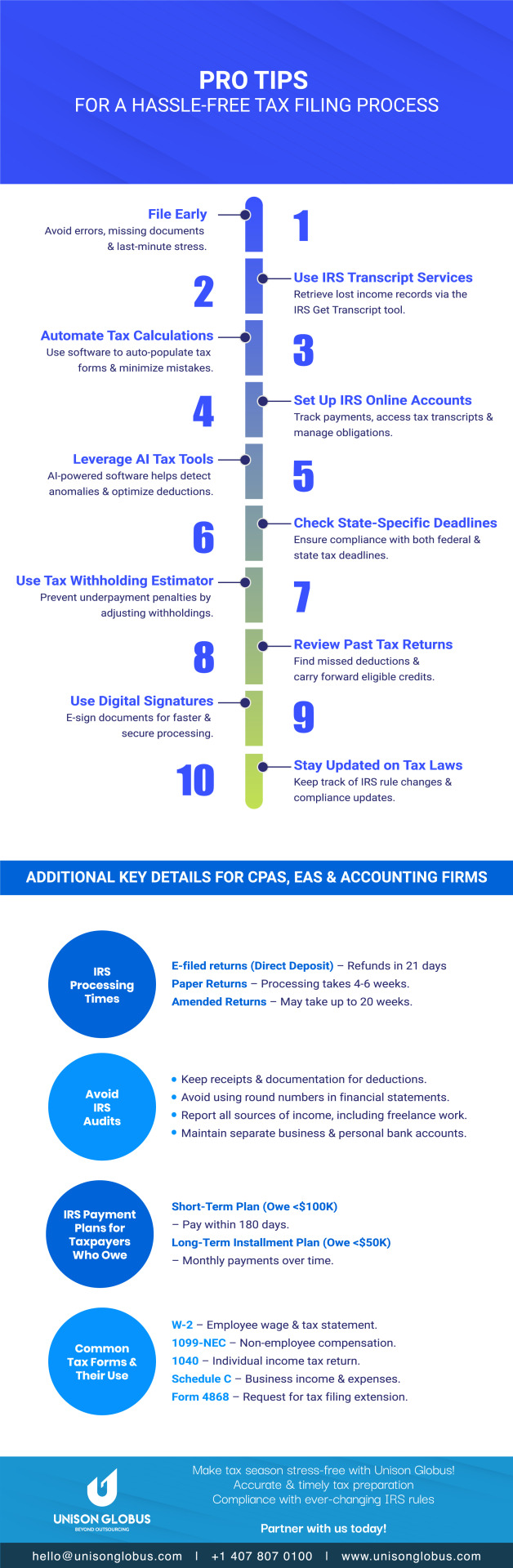

Infograp`hic

Pro Tips - For a Hassle-Free Tax Filing Process

#Tax filing tips#unison globus#Hassle-free tax filing#Tax preparation guide#Tax filing process#April 15 tax deadline#Tax season tips#how to file taxes#Tax filing checklist#Stress-free tax filing#tax deductions#tax services#tax preparation services#tax advisor#tax preparation#tax accountant#tax filing#tax planning#tax season#financial#Tax

1 note

·

View note

Text

Blockchain technology in healthcare why hospitals are adopting it fast

1. Introduction

Blockchain in healthcare is revolutionizing the way hospitals manage patient data, security, and operational efficiency. With increasing cyber threats and inefficiencies in healthcare systems, hospitals are actively seeking innovative solutions. Blockchain technology for healthcare provides a decentralized, immutable, and transparent system that ensures data integrity, enhances security, and minimizes administrative burdens. The adoption of blockchain development services is accelerating as hospitals recognize its potential to streamline processes and improve patient outcomes.

2. The Challenges in Traditional Healthcare Systems

The healthcare industry faces persistent challenges that impact efficiency, security, and patient trust. Some of the most pressing issues include:

Data Breaches and Cyber Threats – Healthcare data is a prime target for cybercriminals. Patient records contain sensitive information, including medical histories, insurance details, and personal identification. Traditional databases are vulnerable to breaches, leading to significant financial and reputational damage.

Interoperability Issues – Hospitals and healthcare providers operate on different electronic health record (EHR) systems, making seamless data exchange difficult. Patients often experience delays in receiving treatment due to fragmented data systems.

Administrative Inefficiencies – Manual paperwork, redundant processes, and outdated record-keeping methods lead to operational inefficiencies. These inefficiencies increase costs and prolong patient wait times.

As hospitals strive to enhance efficiency and security, blockchain technology for healthcare offers a transformative solution.

3. How Blockchain Technology for Healthcare Solves These Problems

Blockchain development services provide hospitals with a robust framework to overcome these challenges. The key features of blockchain include:

Decentralized and Immutable Data Storage – Unlike traditional databases, blockchain stores patient data in a decentralized manner. This eliminates the risk of a single point of failure and prevents unauthorized alterations.

Enhanced Patient Data Security and Control – Blockchain encrypts patient data and grants access only to authorized users. Patients can control who accesses their medical records, ensuring privacy and security.

Seamless Interoperability – Blockchain enables secure and instant data exchange between hospitals, clinics, and laboratories. Medical professionals can access verified patient histories without intermediaries, reducing errors and improving care quality.

4. Key Benefits of Blockchain in Healthcare for Hospitals

The adoption of blockchain technology for healthcare is driven by several key advantages:

Data Security and Privacy – Blockchain's encryption and decentralization prevent unauthorized access to patient records. The immutability of data ensures that once information is recorded, it cannot be altered or deleted.

Interoperability Across Healthcare Providers – Hospitals can share verified medical records with other healthcare institutions without data loss or duplication. This seamless exchange reduces delays in treatment and enhances patient care.

Smart Contracts for Automation – Blockchain-powered smart contracts execute predefined agreements without human intervention. Hospitals use them for automated billing, insurance claims processing, and patient data transfers.

Fraud Prevention – Blockchain eliminates counterfeit drugs in the pharmaceutical supply chain by tracking medicines from production to distribution. Additionally, it prevents identity theft in medical insurance claims.

5. Real-World Applications of Blockchain Development Services in Healthcare

Hospitals are already leveraging blockchain technology for healthcare in various ways:

Electronic Health Records (EHR) Management – Secure and tamper-proof storage of patient records allows authorized medical professionals to access real-time data.

Automated Insurance Claims Processing – Smart contracts eliminate fraudulent claims by automatically verifying and executing insurance transactions. This reduces administrative costs and accelerates reimbursements.

Pharmaceutical Supply Chain Transparency – Blockchain tracks every stage of the drug supply chain, ensuring the authenticity of medications and preventing counterfeit drugs from entering the market.

Remote Patient Monitoring and Telemedicine – Blockchain stores and secures real-time patient data from wearable devices and telehealth consultations, improving remote care management.

6. Challenges Hospitals Face in Adopting Blockchain Technology

Despite its numerous benefits, hospitals encounter obstacles in blockchain adoption:

Regulatory and Compliance Hurdles – The healthcare industry operates under strict regulations regarding data protection and patient confidentiality. Adapting blockchain solutions to comply with regulatory frameworks requires careful planning.

Initial Costs and Infrastructure Upgrades – Implementing blockchain technology for healthcare demands investment in IT infrastructure and staff training. While the long-term benefits outweigh the costs, initial implementation can be expensive.

Training and Knowledge Gaps – Healthcare professionals and administrative staff need education on how to integrate and use blockchain-based systems effectively. Without proper training, adoption can be slow.

7. The Future of Blockchain in Healthcare

The rapid adoption of blockchain in healthcare suggests a promising future. Here are some key developments on the horizon:

Integration with Artificial Intelligence (AI) and Internet of Things (IoT) – AI-powered analytics combined with blockchain will enable predictive healthcare models, while IoT devices will securely transmit real-time patient data.

Government Adoption of Blockchain – Countries are exploring blockchain-based healthcare solutions for national medical record management and insurance processing.

Increased Patient Control Over Data – Blockchain will empower patients to access and share their medical records securely, enhancing transparency and trust in healthcare systems.

Conclusion

Hospitals are rapidly adopting blockchain technology for healthcare to address long standing challenges in data security, interoperability, and administrative inefficiencies. By leveraging blockchain development services, hospitals can improve patient care, reduce costs, and enhance trust within the healthcare ecosystem. As smart contracts and decentralized data management become the norm, blockchain will continue to shape the future of modern healthcare, paving the way for a more secure and efficient industry.

#technology#blockchain development#blockchain development services#blockchain in healthcare#smart contracts#blockchain technology in healthcare

1 note

·

View note

Text

Using AI to write letters to challenge often AI-driven medical claims denials.

Fuckin gottem boys

46K notes

·

View notes

Text

Navigating Legal Challenges in the Era of AI and Innovation

As you embrace AI-driven tools and automation in your business or product development, you're also walking into an environment where the law hasn't fully caught up. Whether you're deploying machine learning models, automating decisions, or integrating third-party APIs, you're dealing with regulations that are still being formed. This article unpacks the major legal concerns—from liability and IP rights to data protection and bias—and helps you understand how to move forward confidently without stalling innovation.

Intellectual Property in an Algorithmic World

When you train or deploy AI, a common concern is: who owns the output? If your tool generates content, code, or product designs, can you claim copyright? Many legal systems still don’t have a definitive answer, and interpretations vary by jurisdiction. Some courts have ruled that AI-generated work without human authorship isn't eligible for copyright, while others are allowing protection if human input is substantial.

If you're licensing datasets or using pre-trained models, tread carefully. Dataset creators may assert rights over the use or manipulation of their data. Your best move is to consult licensing terms thoroughly and document your model training process, especially if you’re commercializing the results. Consider contracts that clarify ownership between engineers, clients, and third-party providers to avoid disputes later.

Data Privacy and Regulatory Compliance

Whether you're building a consumer app or internal enterprise tool, if it collects or processes personal data, you're subject to global data laws. GDPR (EU), CCPA (California), and others impose strict rules about transparency, consent, storage limits, and the right to delete. These laws can apply even if your business isn't based in those regions.

AI complicates this because large datasets are often scraped or aggregated without explicit consent. If your model processes sensitive information like health, finance, or biometric data, regulators are especially strict. Embedding privacy-by-design into your system—encrypting data, anonymizing inputs, and minimizing data collection—can help you stay compliant. Having a dedicated data protection officer or consultant review your model and processes is also smart.

Algorithmic Bias and Discrimination Laws

You need to be aware that if your AI makes decisions—about hiring, lending, or medical diagnoses, for instance—you can be held accountable for discrimination even if it wasn’t intentional. Bias in training data, or unbalanced feature weights, can create unfair outcomes that violate civil rights laws.

Several U.S. agencies, including the Equal Employment Opportunity Commission (EEOC), are now investigating algorithmic decision-making systems. If you’re automating anything that affects access to credit, housing, employment, or public benefits, your algorithms must be explainable and auditable. Conduct bias audits and retain logs that show model reasoning. Courts won’t excuse you just because it was “the algorithm’s fault.”

Product Liability in AI-Driven Systems

Here’s the issue: if your AI tool makes a mistake—like recommending a faulty stock trade, misdiagnosing a medical condition, or misdirecting a vehicle—who is liable? You, as the developer or operator, could be held accountable under product liability law.

If your tech is integrated into a broader product or service, you may share liability with suppliers, software providers, or hardware manufacturers. Documenting risk assessments, providing disclaimers, and designing fallback mechanisms (like human-in-the-loop systems) can help mitigate risk. Make sure users understand limitations, and don’t market AI capabilities as “perfect” or “fully autonomous” unless they are legally qualified to be.

Licensing, Open Source, and AI Integration

Many startups integrate open-source AI components to save time and money. But each open-source license has different obligations. Some require you to publish your code if you distribute a product that uses their software. Others impose use restrictions, especially in areas like facial recognition or surveillance.

Before pulling in any open-source tools, audit your dependencies. Tools like OpenChain or FOSSA can help. It’s also worth creating a software bill of materials (SBOM) that clearly lists all third-party code in your stack. When you start raising capital or preparing for acquisition, buyers and VCs will scrutinize your compliance with these licenses.

Contractual Clarity in AI Partnerships

If you’re building AI products with partners—whether that’s a vendor supplying data, a client providing training goals, or a co-developer writing code—you need solid contracts that spell out intellectual property ownership, revenue sharing, liability, and data governance. Too many startups skip this step early on and get burned later when IP is disputed.

Don’t rely on verbal agreements or email threads. Have a lawyer help draft documents that address AI-specific risks. Include indemnification clauses for data misuse or model errors. And when working with enterprise clients, expect requests for algorithmic transparency and compliance documentation before they’ll sign off.

International Challenges and Jurisdiction

If your AI software crosses borders—which it probably does—it must follow legal systems in multiple regions. A model trained in one country could face bans or sanctions elsewhere, depending on local standards of safety, privacy, or ethics. China, the EU, and the U.S. are already taking different stances on permissible AI applications.

Setting up legal geofencing, using localized models, or limiting usage features in certain regions can help. You should also be prepared for regulatory investigations in jurisdictions where your users operate. Having general terms of service isn’t enough anymore—localized legal notices and compliance plans are essential for scaling globally.

Top Legal Issues with AI Innovation

Ownership of AI-generated content

Data privacy and global compliance

Discrimination risks in automation

Liability for algorithmic errors

Open-source license compliance

IP disputes in partnerships

Global regulatory differences

In Conclusion

Navigating the legal side of AI means staying alert and flexible. Whether you're launching a new model, expanding globally, or partnering on development, legal blind spots can slow your momentum—or worse, shut you down. The best way to protect your innovation is to treat legal strategy as an integral part of your AI roadmap, not an afterthought. As the rules shift, your ability to adapt with documented safeguards and smart counsel will separate you from the pack.

"Want deeper dives on AI regulation and tech law? I explore emerging legal frameworks, compliance strategies, and case studies in my Medium. Follow for monthly analysis of how innovation intersects with the law."

0 notes

Text

What is the difference between CPQ & RLM?

Revenue Cycle Management Services

In today's fast-moving healthcare and enterprise environments, understanding the difference between CPQ and RLM is essential, especially when these tools impact operations like Revenue Cycle Management. Although both the CPQ and RLM help to optimize processes, they serve very different functions but are aligned toward the business segment.

CPQ – Configure, Price, Quote:

CPQ stands for Configure, Price, Quote. It's a sales tool that helps companies quickly and accurately generate quotes for products or services they are offering. CPQ is a valuable product in industries with complex pricing models or customizable offerings—such as medical equipment, software solutions, or enterprise services.

With CPQ, sales teams can:

Select product features and (configure) as per its requirements

Apply pricing rules and discounts (price) for better product briefing

Generate accurate proposals or quotes (quote) for better outcomes

By automating this process, CPQ reduces errors, speeds up the sales cycle and which eventually boost up the revenue as the ultimate goal, and ensures that pricing is consistent and aligned with company policies and as per its set standards and desired objectives.

RLM – Revenue Lifecycle Management:

On the other hand, revenue Lifecycle Management (RLM) focuses and starves to look at managing and optimizing things at every stage of the revenue process. In healthcare, this is closely tied to Revenue Cycle Management—as a system that oversees the patient billing, insurance claims, payments, and collections.

RLM looks at the broader picture, including:

Contract management

Billing and invoicing

Revenue recognition or recollection

Renewals and upsells of listings

RLM ensures and seeks that the revenue is tracked, reported, and optimized as per the given concern from when a contract begins until the revenue is fully realized or settled out. In healthcare, it's critical for improving financial health, assuring compliance, and reducing revenue leakage as a protective measure.

Key Differences -

CPQ is sales-focused, helping generate quotes and close deals faster as a better option for the users to roll out.

RLM is revenue-focused, ensuring smooth handling and assessment of all financial processes post-sale and after it gets done.

CPQ comes into play at the beginning of the customer journey, while RLM continues throughout the customer lifecycle as they both work as a part of the set system.

Many advanced providers and professionals experts of Revenue Cycle Management, like Suma Soft, IBM, Cyntexa, and Cignex, offer tailored RLM solutions and Revenue Cycle Management services that integrate with CPQ systems. This creates a seamless flow from quoting to revenue realization, making operations more efficient and profitable.

#it services#technology#saas#software#saas technology#saas development company#revenue cycle management#revenuegrowth

2 notes

·

View notes

Text

Medical Coding & Billing Explained: Your Complete Guide to Healthcare Revenue Management

Medical Coding & Billing Explained: Your Complete Guide to Healthcare Revenue Management

In the complex world of healthcare, the processes of medical coding and billing are essential for ensuring that healthcare providers receive proper compensation for their services. Whether you’re a healthcare professional,a billing specialist,or simply curious about how healthcare revenue cycle management works,this complete guide will walk you thru everything you need to know about medical coding and billing. We’ll explore their roles, benefits, practical tips, and real-world insights to help you understand their significance in the healthcare industry.

What is Medical Coding?

Medical coding is the process of transforming healthcare diagnoses, procedures, medical services, and supplies into standardized alphanumeric codes. These codes are used for billing, insurance claims, and statistical purposes. Accurate coding ensures that healthcare providers are reimbursed correctly and that patient records are precise and accessible.

Key Coding Systems

ICD-10-CM: International Classification of Diseases, 10th Revision, Clinical Modification – used for diagnoses.

CPT: Current Procedural Terminology – used for medical procedures and services.

HCPCS: Healthcare Common Procedure coding System – used for supplies, drugs, and certain procedures.

Understanding medical Billing

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for services provided by healthcare professionals. It involves preparing detailed invoices that include the correct medical codes, patient information, and billing details.

The Medical Billing Workflow

Patient registration and insurance verification.

Data entry and coding of procedures and diagnoses.

Claim generation and submission to insurance payers.

Claim follow-up and payment posting.

Handling denials or adjustments.

Patient billing for remaining balances if applicable.

The Interplay Between Medical Coding & Billing

While distinct processes, medical coding and billing are closely intertwined. Accurate coding is crucial for triumphant billing because it determines the claim’s correctness and the likelihood of reimbursement. Mistakes in coding can lead to denials, delays, or reduced payments, impacting the healthcare provider’s revenue cycle.

Benefits of Effective Medical Coding & Billing

optimized Revenue Cycle: Proper coding and billing ensure timely payments and reduce claim rejections.

Enhanced Accuracy: Minimizes billing errors and avoids legal issues or audits.

Improved Patient Satisfaction: Clear and accurate billing enhances trust.

Regulatory Compliance: Meets government and insurance requirements to avoid penalties.

Data for Healthcare Analysis: Accurate coding supports research, trend analysis, and quality reporting.

Practical Tips for Medical Coding & Billing Success

Stay Updated: Keep current with coding guidelines and insurance policies.

Invest in Training: Proper education for coders and billers improves accuracy.

Use Advanced software: automate with reliable coding and billing software to reduce errors.

Perform Regular Audits: Regularly review claims to catch errors early.

Maintain Clear Dialog: Collaborate with clinicians and insurance providers for clarification.

Real-World Case Study: Improving Revenue with Accurate Coding

Scenario

Challenge

Solution

Result

High claim denial rate

Incorrect coding led to rejections and delayed payments.

Implemented coder training and real-time validation tools.

Denial rate reduced by 30%, revenue increased by 15% within 6 months.

First-Hand Experience: A Day in the Life of a Medical Coder and Biller

As a medical billing specialist,I spend my day ensuring that every service rendered by healthcare providers is accurately coded and properly billed. From reviewing patient records and assigning ICD-10 and CPT codes to submitting claims and following up on unpaid or denied claims, my goal is to streamline the revenue cycle. The key is attention to detail and staying informed about new coding updates. This role is vital for maintaining the financial health of healthcare facilities and delivering quality patient care without financial stress.

Conclusion

Medical coding and billing are cornerstones of healthcare revenue management. They ensure that healthcare providers can sustainably deliver quality care while maintaining financial stability. Accurate coding minimizes billing errors and claim rejections, thus accelerating reimbursement and improving cash flow. Whether you are a healthcare professional, a billing specialist, or someone interested in healthcare operations, understanding the fundamentals of medical coding and billing is essential for navigating the complexities of the healthcare revenue cycle. By embracing best practices,staying updated on industry standards,and leveraging technology,you can optimize your practice’s financial performance and contribute to a more efficient healthcare system.

https://medicalbillingcodingcourses.net/medical-coding-billing-explained-your-complete-guide-to-healthcare-revenue-management/

0 notes

Text

Master Key Medical Billing Terms: A Complete Guide to Simplify Healthcare Revenue Management

Master Key Medical Billing Terms: A complete Guide to Simplify Healthcare Revenue Management

Navigating the complex world of healthcare revenue management can be daunting for medical providers, billing professionals, and practice administrators alike. At the core of this challenge is understanding fundamental medical billing terms that form the backbone of accurate claim processing and revenue cycle management. This comprehensive guide aims to demystify essential medical billing terminology, helping you streamline yoru billing processes, reduce denials, and maximize revenue efficiently.

introduction: Why Understanding medical Billing Terms Matters

Effective healthcare revenue management isn’t just about code submission; it’s about understanding every component that impacts reimbursement. Misinterpretations or gaps in knowledge about key terms can lead to claim denials, delayed payments, or lost revenue. By mastering crucial billing terminology, healthcare providers can optimize billing workflows, communicate better with payers, and ultimately deliver quality care without financial stress.

Core Medical Billing Terms You Should Know

1. CPT codes (Current Procedural Terminology)

CPT codes are numerical identifiers that represent medical procedures and services performed by healthcare practitioners.these codes are universally accepted by insurance payers and are essential for billing accurately.

Example: 99213 indicates an outpatient office visit for evaluation and management.

Importance: Accurate CPT coding ensures appropriate reimbursement and reduces claim rejections.

2. ICD Codes (International Classification of Diseases)

ICD codes describe the patient’s diagnosis or medical condition. They complement CPT codes by providing the clinical context for the procedures.

Example: ICD-10-CM code E11.9 indicates Type 2 diabetes mellitus without complications.

Meaning: Proper ICD coding is crucial for medical necessity documentation and accurate billing.

3. MIPS (Merit-based Incentive Payment System)

MIPS is a performance-based programme that affects Medicare reimbursements based on quality,cost,improvement activities,and promoting interoperability.

Role in billing: Providers must report MIPS data for incentive or penalty purposes.

4. Billing Cycle

The billing cycle refers to the process of submitting claims, receiving payments, and reconciling revenue. A typical cycle involves patient encounter, claim submission, follow-up, and payment posting.

5. Payer

The insurance company or government agency responsible for reimbursing healthcare providers for services rendered.

Examples: Medicare, Medicaid, private insurance companies.

6.Claim Denial and Rejection

A claim denial occurs when the payer refuses payment due to error or documentation issues. Rejection means the claim was improperly formatted or incomplete and was stopped before reaching the adjudication process.

7. EOB (Explanation of Benefits)

A detailed statement from the payer that explains how a claim was processed, including approved amounts, payments made, and patient responsibilities.

8. UCR (Usual, Customary, and Reasonable)

The method used by payers to determine the coverage amount for a service based on typical charges in a geographic area.

9. Credentialing

The process of verifying a healthcare provider’s qualifications, licensure, and legitimacy to participate in insurance networks.

10. Eligibility Check

Verification process to confirm whether a patient has active coverage and benefits for specific services before rendering care.

Practical tips for Managing Medical Billing Terms Effectively

Regular Training: Keep your billing team updated on coding changes and payer policies.

Use Claim Management Software: Automate claim submission and tracking for efficiency.

Double-Check Entries: Verify CPT and ICD codes, patient details, and payer information before submitting claims.

Monitor Payer Policies: Stay informed on payer-specific rules that can impact reimbursement.

Implement Denial Management: Develop strategies to quickly address and appeal denied claims.

Benefits of Mastering Medical Billing Terms and Revenue Management

Reduced Claim Rejections: Precise coding and documentation decrease error rates.

Faster Payments: Accurate claims lead to quicker reimbursements and improved cash flow.

Improved Financial Transparency: clear understanding of billing terms enhances dialogue with payers and patients.

Compliance Assurance: Staying current with billing terms helps adhere to regulations.

Enhanced Practice Efficiency: Streamlined workflows cut administrative costs and reduce stress.

Case Study: Transforming Revenue Cycle Efficiency

Challenge

Solution

Outcome

High claim rejection rate due to coding errors

Comprehensive staff training and updated coding software

Rejection rate dropped by 30%, cash flow improved significantly

Delayed payments from insurance carriers

Implementing real-time eligibility checks and denial management

Average payment times reduced by 25%, increased overall revenue

Personal Experience: Simplifying Revenue Management

As a healthcare provider managing a busy practice, mastering key billing terms revolutionized your revenue cycle. By investing in ongoing training, leveraging advanced billing software, and establishing clear protocols for claim follow-up, I was able to reduce claim denials, speed up reimbursements, and gain better insight into my practice’s financial health. This experience demonstrates how foundational billing terminology knowledge translates into tangible benefits for providers and patients alike.

Conclusion: Empowering Healthcare Revenue with Knowledge

Understanding and mastering core medical billing terms is more than just an academic exercise; it’s a strategic necessity for healthcare providers aiming for financial stability and operational excellence. Clear knowledge of CPT, ICD, payer relationships, and claim processes empowers you to optimize revenue management, minimize errors, and deliver better patient care. whether you’re a practice owner, billing specialist, or administrator, investing in your billing vocabulary is an investment in the future success of your practice.

If you want to stay ahead in healthcare revenue management,continually educate yourself on evolving billing standards and leverage technologies designed for efficiency. Remember,a well-informed approach to medical billing is the key to simplified revenue management and sustained practice growth.

https://medicalbillingcertificationprograms.org/master-key-medical-billing-terms-a-complete-guide-to-simplify-healthcare-revenue-management/

0 notes