#Automated KYC solution

Explore tagged Tumblr posts

Text

KYC is an important factor for businesses to know about their client, vendors, and investors whether they are genuine or not. As digital operations are an integral part of businesses, it is essential to have a robust identity verification system to authenticate identities quickly and securely. Along with authentication it also ensures the compliance needs of the financial and non-financial business.

#kyc solution#kyc providers#KYC API#Automated KYC solution#identity verification system#identity verification solution#KYC solutions provider

1 note

·

View note

Text

The Role of KYC Software Solutions in Modern Businesses

In the present quickly advancing business climate, consistency with administrative guidelines has become progressively significant. Monetary establishments, fintech organizations, and organizations that handle client information are expected to comply with rigid Know Your Customer (KYC) guidelines. To productively meet these necessities, organizations are going to KYC Software Solutions. These creative apparatuses improve on the method involved with confirming client characters and assist organizations with keeping away from exorbitant consistency issues.

What Are KYC Software Solutions?

KYC Software Solutions are robotized stages intended to assist organizations with checking the characters of their clients. These arrangements smooth out the client onboarding process by gathering, investigating, and approving client information against administrative data sets and guidelines. Whether you are dealing with a monetary foundation, a cryptographic money trade, or some other information weighty business, embracing KYC Verification Software can assist you with remaining consistent while lessening functional weights.

Why Your Business Needs KYC Verification Software

Utilizing KYC Verification Software is fundamental for organizations that need to guarantee they are managing genuine clients. This product normally incorporates highlights, for example,

Robotized information assortment from government data sets

Ongoing personality checks

Misrepresentation recognition calculations

Continuous checking of client profiles

By carrying out KYC Verification Software, organizations can keep away from gambles related with false exercises, for example, illegal tax avoidance and fraud. Also, these instruments make it simpler to adjust to switching administrative conditions by keeping your business around to-date with the most recent consistence necessities.

Picking the Best KYC Software

Choosing the Best KYC Software for your business relies upon a few variables, like the size of your tasks, the intricacy of administrative necessities, and the sorts of clients you serve. The Best KYC Software ought to:

Offer an easy to use interface for the two workers and clients.

Incorporate high level security elements to safeguard client information.

Give adjustable choices to suit your particular industry needs.

Be adaptable as your business develops and as guidelines advance.

In a market overflowed with choices, the Best KYC Software will likewise offer adaptability and joining with different frameworks you are now utilizing, like Client Relationship The board (CRM) devices or Undertaking Asset Arranging (ERP) programming.

The Advantages of Executing KYC Software Solutions

Organizations that take on KYC Software Solutions can anticipate a few advantages, including:

Upgraded Client Trust: Clients value organizations that find additional ways to guarantee information protection and security. Executing KYC Software Solutions communicates something specific that your organization values consistence and honesty.

Worked on Functional Proficiency: Manual cycles are inclined to blunders and deferrals. With computerized KYC Verification Software, you can lessen the time and cost engaged with personality confirmation and other consistence errands.

Administrative Consistence: Neglecting to follow KYC guidelines can bring about robust fines and legitimate outcomes. The Best KYC Software assists organizations with remaining agreeable without overpowering their groups with desk work.

Conclusion

In this present reality where information breaks and false exercises are on the ascent, carrying out KYC Software Solutions is as of now not discretionary — it's a need. With the right KYC Verification Software, organizations can safeguard themselves from monetary dangers, guarantee administrative consistency, and construct entrust with their clients. By choosing the Best KYC Software for your business, you can smooth out tasks, shield information, and keep an upper hand in an undeniably directed climate.

As organizations keep on adjusting to the computerized age, putting resources into powerful KYC Software Solutions is a stage toward a safer and productive future.

#CERSAI CKYC Solution#ckyc automation#kyc software solutions#kyc verification software#best kyc software#kyc automation tools#kyc banking software#kyc management software#kyc software providers

0 notes

Text

Blockchain For KYC Process - Dunitech

Fraud may be eliminated thanks to Blockchain KYC Solutions' safe identity verification through a tamper-proof public digital ledger.

0 notes

Text

Improving Client Relationships Using CRM in Forex Brokerage

The key to success in the cutthroat world of Forex trading is building and maintaining customer connections. The tools and technologies that enable effective client management change along with the industry. Customer Relationship Management (CRM) software is one such product that has grown to be essential for Forex brokerages.

A Good CRM system is the cornerstone of every profitable Forex brokerage, serving as the primary interface for managing customer relations and optimizing corporate operations as a whole. Choosing the Best CRM solution is essential due to the growing need for efficient operations and tailored services.

Forex brokerages need CRM systems that are not only reasonably priced but also have special features designed to meet their requirements. Presenting ForexCRM, the best CRM solution in the business, which gives brokerages access to cutting-edge features at a reasonable price.

Thanks to ForexCRM and other affordable CRM solutions, brokerages may now affordably manage client interactions with the resources they need. Brokerages of all sizes can make use of CRM's scalable features and features to maximize customer engagement and retention.

ForexCRM's extensive feature set, created especially for Forex brokerages, is what makes it unique. With features like integrated trading platforms, Contest Management, smooth onboarding procedures, sophisticated analytics, Social Trading, and Liquidity Feeds, ForexCRM provides a comprehensive answer to satisfy the many demands of contemporary brokerages.

Brokerages may automate tedious operations, optimize communication channels, and obtain insightful data about customer behavior and preferences by utilizing ForexCRM. Brokerages may expand their company, provide individualized services, and cultivate enduring loyalty by centralizing client data and interactions.

ForexCRM provides customized solutions to simplify complex processes, making it an asset for New brokerage Formation, licensing, and regulatory compliance initiatives. With features like compliance checklists and customizable onboarding workflows, ForexCRM streamlines the registration and licensing process and guarantees prompt approvals.

Brokerages may effortlessly manage regulatory compliance while reducing risk thanks to specialized modules for KYC and AML compliance. Furthermore, ForexCRM makes regulatory reporting system connection easier, allowing for accurate submissions and providing transparency to authorities. All things considered, ForexCRM gives brokerages the confidence they need to successfully negotiate regulatory difficulties, which helps them succeed in the cutthroat Forex business.

In summary, CRM is essential to improving client connections in the Forex brokerage sector. Brokerages can stay ahead of the curve by offering great customer experiences and retaining a competitive edge in the industry with feature-rich and reasonably priced systems like ForexCRM. Unlock the full potential of client relationship management for your Forex brokerage by selecting the finest CRM available.

3 notes

·

View notes

Text

Five Tips for Enhancing Your KYC Compliance and AML Procedures

In today's rapidly evolving regulatory landscape, maintaining robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes is more crucial than ever for businesses. These processes go beyond mere regulatory requirements; they form the cornerstone of secure operations, global expansion, customer trust, and data-driven insights. In this article, we'll delve into five essential tips to optimize your KYC processes and ensure AML compliance.

Understanding KYC and AML Compliance

KYC, short for Know Your Customer, refers to the practice of verifying and assessing the identities and risk levels of your customers. This procedure is vital for adhering to regulatory mandates and mitigating risks associated with financial crimes like money laundering and fraud. KYC plays a pivotal role in maintaining a secure business environment and building trust with clients.

Non-compliance with KYC regulations can lead to severe repercussions such as hefty fines, legal actions, reputational damage, and business disruptions. Therefore, adhering to KYC regulations is not just a necessity; it's a protective measure for your business.

1. Screening Against Current Lists

Efficient KYC begins with screening customers against relevant, up-to-date lists. Utilizing comprehensive KYC solutions equipped with advanced technology and access to databases containing sanction lists, politically exposed persons (PEPs) databases, and other watchlists enhances the accuracy of your screening processes.

By incorporating these KYC screening tools, you minimize risks and ensure compliance while reducing false positives, which ultimately saves valuable time and resources.

2. Integration with Risk Assessment

Integrating KYC into your broader risk assessment framework is crucial for maintaining an effective process. Customer information can change rapidly, necessitating continuous monitoring. Regularly reviewing and updating KYC data enables you to adapt to shifting risk profiles and make informed decisions.

Furthermore, integrating KYC data into your risk assessment facilitates a seamless link to ongoing due diligence processes. For instance, if a customer's risk profile changes due to a new business venture, you can proactively adjust your risk mitigation strategies.

3. Establishing Scalability

Keeping up with new clients and evolving compliance requirements requires a flexible and scalable KYC process. Onboarding new clients, regardless of their type, should be a consistent and streamlined process rather than a burden.

Investing in a scalable KYC solution capable of handling increasing data volumes and simplifying onboarding processes is key. Such a solution enables instant screening and efficient onboarding, allowing you to focus on growth without hindrances.

4. Preparing for Regulatory Challenges

The landscape of AML and KYC compliance is continually evolving, with regulators worldwide tightening their grip on financial institutions. Preparing for these challenges by embracing technology-driven KYC solutions can lead to automation, enhanced accuracy, and improved customer experiences.

Automated KYC solutions provide the means to avoid the hefty fines and regulatory scrutiny associated with non-compliance. Staying ahead of regulatory changes through technology-driven approaches is a strategic move for safeguarding your business.

5. Seeking Expert Assistance

In the face of complex regulatory requirements and the ever-changing landscape of AML and KYC compliance, seeking expert assistance can prove invaluable. Companies like KYC Sweden offer AML platforms that seamlessly integrate KYC responses with transaction monitoring.

This integration allows for quick identification of unusual transaction behavior, reducing the risk of being unwittingly involved in money laundering or terrorist financing. Outsourcing transaction monitoring to experts through a Managed Service can streamline your compliance efforts.

In conclusion, optimizing your KYC and AML processes is not only about regulatory compliance but also about safeguarding your business and fostering trust with clients. By following these five tips, incorporating technology-driven solutions, and staying prepared for regulatory changes, you can streamline your KYC and AML compliance, ensuring a secure and successful business journey.

Is your business prepared for the potential consequences of regulatory audits? Have you integrated transaction monitoring with your KYC processes? If you seek further guidance on these crucial matters, don't hesitate to contact us at KYC Sweden.

#kyc sweden#kyc#kyc solutions#kyc services#kyc verification#kyc api#kyc compliance#kyc and aml compliance#compliance#digital identity#digital world

2 notes

·

View notes

Text

How Banking CRM Improves Onboarding TAT in the Banking Sector

When it comes to the customer onboarding process Banking CRM has an important role to play in the banking sector.

Improving the customer experience is a priority, as customers only want to experience the best quality services. Therefore, onboarding TAT is quite an important parameter for banks.

Why is customer onboarding TAT vital for banks?

With the help of banking CRM, banks can actually improve efficiency, response time, and eliminate all the manual processes along the way. This will not only improve the customer experience but also cause an increment in conversion rates.

How does Banking CRM help reduce the onboarding turnaround time?

Customer onboarding is often a time-consuming process that includes customer visits, a credit analysis process and heavy use of documentation. This is where a banking CRM plays a vital role in reducing the turnaround time for banks. Banking CRM digitalizes all manual processes with automated workflows and solutions.

Five crucial benefits of having a Banking CRM:

An automated lead management process can guide the banks with, lead capture, lead scoring, lead qualification, lead allocation and closing the deals. When you don’t have a proper lead CRM in place, you risk a lower return on investment, a leaky sales funnel, and strained relationships with leads and customers.

2. Real-Time Sales Tracking

With this feature, the sales managers could monitor the performance of the sales reps to ensure they are making the most of their time in the field, keeping them organized and productive.

Instant alerts and real-time tracking can guide the team to better manage sales agents’ time and set their daily schedules to improve their productivity in no time.

3. Automating the Underwriting Process

Banking CRM can guide the credit analysis process via streamlining the entire journey, for instance, by providing the platform to upload all the required documents digitally.

Automating the KYC, De-dupe, CDD (Customer due diligence), BL (Black List), and CIBIL score checks can save a lot of time for the credit managers when visiting for Personal Discussions (PD).

5. Customer Experience

Keeping the consumer happy is the only sustainable way to build a business and improve the customer experience with easy and straightforward navigation.

It includes not just data collection and the acceptance of an inescapable administrative burden, but also an understanding of the prospect’s needs. The digital workflow allows the process to be adjusted to the consumers’ demands and tastes.

Orginal source: How Banking CRM Improves Onboarding TAT in the Banking Sector - Toolyt

2 notes

·

View notes

Photo

KYC/AML Compliance Solution Introducing our cutting-edge and all-encompassing module designed to revolutionize the stablecoin industry. With our innovative solution, we ensure that all stablecoin operations adhere to the highest regulatory standards, providing a seamless and efficient experience for both users and businesses. Our module takes care of the complex and time-consuming KYC/AML processes, automating them to save you valuable time and resources. Say goodbye to manual verifications and hello to a streamlined user vetting system that guarantees compliance with regulatory requirements. Our advanced technology verifies user identities, performs thorough background checks, and ensures that only eligible individuals can participate in stablecoin transactions. But that's not all – our module goes beyond KYC/AML automation. We also offer comprehensive transaction monitoring, providing real-time insights into every transaction made using stablecoins. This allows businesses to https://millysoft.com/product/kyc-aml-compliance-solution/?utm_source=tumblr&utm_medium=social&utm_campaign=STARTERKITS

0 notes

Text

KYC solutions Process ?

Use our KYC solutions to streamline customer onboarding. Verify identities, avoid fraud, and verify compliance. Checks are automated, verification occurs in real time, and data is stored securely. Improve customer experience, minimize risk, and increase regulatory confidence.

0 notes

Text

Form Filling Auto Typer Software [About us]

At Form Filling Auto Typing Software, we specialize in streamlining data entry processes through advanced automation technology. Our mission is to revolutionize how individuals and organizations complete online & offline forms—making it faster, more accurate, and incredibly efficient. Discover why our solution stands out in the realm of form automation. Our mission is to empower businesses and individuals across diverse industries—ranging from medical and KYC to mortgage and insurance—with tools that make form-filling effortless and efficient.

Address: INDIA, ANDHRAPRADESH Contact us: +91 9490495242 Email: [email protected] Website: https://formfillingautotypersoftware.com/

0 notes

Text

Best Microfinance Software in India: Features to Look For

In India, microfinance institutions (MFIs) play a critical role in driving financial inclusion by offering essential financial services to underserved communities. The backbone of these operations lies in efficient and reliable microfinance software. But with numerous options in the market, how do you identify the best microfinance software in India?

This blog explores the key features to look for, why choosing the right software matters, and how it can transform your microfinance business. By the end, you’ll have a clear understanding of what makes a solution truly stand out—and why GTech Web Solutions PVT. LTD is a name you can trust for your software needs.

Why Do Microfinance Institutions Need Advanced Software?

The Role of Microfinance Software in India

Microfinance institutions manage a wide range of tasks, from disbursing loans to tracking repayments, generating financial reports, and complying with government regulations. Manually handling these processes is not only time-consuming but also prone to errors. This is where the best microfinance software in India proves indispensable.

By automating daily operations, microfinance software reduces administrative burdens, minimizes human error, and enhances customer satisfaction. Furthermore, advanced software solutions come equipped with tools to ensure data security, regulatory compliance, and scalability for future growth.

Challenges Without the Right Software

Operating without modern microfinance software—or relying on outdated systems—poses several challenges:

Inefficient data management

Inaccurate financial reporting

Increased risk of data breaches

Poor customer experience

Limited scalability

Choosing the right software addresses these challenges and propels your organization toward long-term success.

Features to Look For in the Best Microfinance Software in India

When searching for the best microfinance software in India, it’s crucial to evaluate its features. Here’s what you should prioritize:

1. Customizability

Every microfinance institution has unique needs. Customizable software allows you to tailor the solution to your specific workflows, whether it’s loan disbursement processes, repayment schedules, or reporting formats.

2. User-Friendly Interface

Your team will likely use the software daily, so it’s essential that the interface is intuitive and easy to navigate. A user-friendly platform reduces training time and increases productivity.

3. Robust Security Protocols

Data security is non-negotiable in the digital age. The best microfinance software in India employs features like end-to-end encryption, multifactor authentication, and regular security updates to protect sensitive financial data.

4. Multi-Language and Multi-Currency Support

Given India’s diversity, software that supports multiple languages and currencies ensures seamless operations across regions, catering to a broader customer base.

5. Integration Capabilities

The software should integrate easily with other systems, such as accounting tools, CRMs, and payment gateways. This ensures smooth data flow and operational efficiency.

6. Automated Reporting and Analytics

Real-time reporting and analytics allow you to monitor performance, identify trends, and make data-driven decisions. Advanced software provides detailed insights into loan performance, repayment rates, and customer demographics.

7. Regulatory Compliance

Indian microfinance institutions must adhere to specific regulations set by authorities like the Reserve Bank of India (RBI). The best software ensures compliance by automating processes like KYC verification, loan documentation, and financial reporting.

Also read: How Advanced Microfinance Software is Transforming Financial Services

Benefits of Using the Best Microfinance Software in India

Transforming Microfinance Operations

The advantages of adopting top-tier software extend beyond operational efficiency. Let’s delve into the benefits:

Enhanced Customer Experience

Modern software improves customer interactions by offering streamlined processes, such as quick loan approvals, digital payment options, and easy access to account information.

Cost and Time Savings

By automating repetitive tasks, microfinance software reduces the time and resources spent on manual operations. This allows your team to focus on core business activities, like customer acquisition and portfolio management.

Scalability for Future Growth

Whether your institution operates locally or aims to expand nationally, scalable software grows with your business. Features like cloud-based storage and multi-branch support ensure seamless scalability.

Real-Time Monitoring

With real-time dashboards and notifications, you can stay updated on key metrics such as repayment rates, overdue accounts, and customer activity. This enables proactive decision-making.

Better Risk Management

By integrating advanced algorithms and analytics, the software helps identify high-risk loans, ensuring you take preventive measures to minimize losses.

Also check: Benefits of Advanced Microfinance Software for Financial Efficiency

How to Choose the Best Microfinance Software in India

Factors to Consider Before Making a Decision

Selecting the right software can feel overwhelming. Here’s a checklist to guide your decision-making process:

1. Identify Your Needs

Start by listing your institution’s specific requirements, such as loan management, customer outreach, or compliance. Match these needs with the features offered by potential software solutions.

2. Research and Compare

Read reviews, request demos, and compare pricing to understand what different providers offer. Look for software that provides value for money without compromising on quality.

3. Prioritize Support and Training

Opt for providers who offer robust customer support and training sessions for your team. This ensures a smooth transition and reduces downtime during implementation.

4. Check for Scalability

Your software should accommodate future growth, including an increasing customer base, new services, and multiple branches.

5. Partner with Trusted Providers

Reputation matters. Choose a provider known for delivering secure, reliable, and customizable solutions.

Why GTech Web Solutions Offers the Best Microfinance Software in India

When it comes to finding the best microfinance software in India, GTech Web Solutions PVT. LTD is a trusted name in the industry. Their software solutions are tailored to meet the needs of microfinance institutions, ensuring operational efficiency and robust security.

Here’s why GTech stands out:

Customizable Solutions: Tailor-made software that adapts to your business needs.

Cutting-Edge Security: Advanced encryption and authentication protocols.

Seamless Integration: Compatible with existing tools and systems.

Expert Support: Round-the-clock assistance to ensure uninterrupted operations.

Proven Track Record: A history of empowering MFIs across India.

Conclusion: Empower Your Institution with the Best Microfinance Software in India

Choosing the right software is a critical step for any microfinance institution aiming to thrive in today’s competitive landscape. The best microfinance software in India enhances operational efficiency, ensures data security, and supports long-term growth.

For those seeking a reliable partner, GTech Web Solutions PVT. LTD offers unparalleled expertise and solutions tailored to your needs. With their advanced features and dedicated support, you can rest assured that your institution is equipped for success.

Take the first step toward transforming your microfinance operations. Contact GTech Web Solutions today and experience the difference.

#Microfinance#MicrofinanceSoftware#MicrofinanceIndia#FinancialInclusion#FinTechSolutions#DigitalFinance#MFISolutions#LoanManagement#BusinessSolutions#SoftwareForBusiness#SecureSoftware#DigitalTransformation#DataSecurity#FinancialTechnology#SmallBusinessSoftware#NBFCSoftware#BankingSolutions#FinanceManagement#FinTechInnovation#GTechWebSolutions#BestMicrofinanceSoftware#IndiaFinTech

0 notes

Text

Streamlining Financial Compliance with CKYC Automation and KYC Software Solutions

In the present speedy monetary climate, consistency with Know Your Client (KYC) guidelines is more pivotal than any other time. Monetary organizations and organizations the same are continually looking for proficient ways of overseeing KYC processes. This is where CKYC automation, KYC software solutions, and KYC verification software become an integral factor.

The Requirement for CKYC automation

Focal KYC (CKYC) is a unified vault that works on the KYC interaction for clients and monetary organizations. Rather than presenting their KYC archives on different occasions, clients can do it once, and the data is open to different monetary substances. CKYC automation makes this cycle a stride further by killing manual passage and lessening human mistakes, making consistency quicker and more precise.

Mechanization in CKYC guarantees that client information is reliably refreshed, taking out the gamble of obsolete data. By incorporating CKYC automation into their frameworks, monetary organizations can decrease the time spent on redundant assignments, permitting their groups to zero in on additional complicated issues.

The Job of KYC software solutions

Carrying out KYC software solutions is fundamental for organizations that need to oversee huge volumes of client information. These arrangements give a far reaching stage to putting away, making due, and checking client data. They smooth out the onboarding system, guaranteeing that organizations consent to administrative prerequisites without settling on proficiency.

KYC software solutions are intended to be versatile, permitting them to adjust to the developing necessities of a business. They offer highlights like continuous information confirmation, record the executives, and robotized risk evaluation, making them basic apparatuses for any association that handles client data.

Improving Security with KYC verification software

While CKYC automation and KYC software solutions smooth out the cycle, KYC verification software assumes a pivotal part in guaranteeing that the information gathered is exact and get. Confirmation programming cross-references client data with different data sets, recognizing errors and expected misrepresentation.

In this present reality where information breaks are progressively normal, the significance of KYC verification software couldn't possibly be more significant. This product not just aides in confirming the genuineness of records yet additionally guarantees that client information is safeguarded from unapproved access.

Conclusion

The mix of CKYC automation, KYC software solutions, and KYC verification software is changing the manner in which organizations oversee client data. These advances smooth out consistence as well as upgrade security, making them fundamental for any association in the monetary area. As administrative necessities keep on developing, organizations that take on these arrangements will be better situated to explore the intricacies of KYC consistence.

#CERSAI CKYC Solution#ckyc automation#kyc software solutions#kyc verification software#best kyc software#kyc automation tools#kyc banking software#kyc management software#kyc software providers

0 notes

Text

Developing a Real-World Asset Tokenization Platform: A Comprehensive Guide

The tokenization of tangible assets into blockchain-digital tokens is revolutionizing the investment landscape. Tokenization of real-world assets enables real assets such as real estate, art, antiques, and commodities to be converted into digital tokens, allowing for partial ownership, liquidity, and a worldwide market. This article addresses the important considerations when embarking on setting up a strong real-world asset tokenization facility.

Understanding Real-World Asset Tokenization

Put another way, tokenizing physical assets translates into the issuance of digital proxies via a blockchain of that physical asset. The ownership or access rights of the underlying asset are then traded or transferred. Take real estate, for example: a high-value property can have many tokens attached to it, so when investments are made, they end up being able to own a partial or fractional ownership in that place. This widens the investment opportunities within asset management to include the democratization of access to investments.

Key Features of a Tokenization Platform

Asset Tokenization Module

The digital representation of physical assets would facilitate fractional ownership-invest in parts of a highly valued asset.

Smart Contract Integration

Automated processes will be such as token issuance, transfer and profit distribution. Immutable records bring all transparency and security.

Regulatory Compliance Engine

Enables Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols as well as specific jurisdiction requirements for legal conformity.

Secure digital wallets

Secure storage for digital tokens allocated to end-users. Advanced security protocols have been put in place to keep unauthorized entities at bay.

Trading Market

A marketplace trading tokenized assets. The liquidity and fair market pricing are ensured through effective matching algorithms.

Steps to Develop a Tokenization Platform

Destination Objectives and Research Scope:

Determine eligible asset types for tokenization.

Define the target audience and consult with market needs.

Choose Appropriate Blockchain technology:

Select platform from blockchain that fulfills conditions of scalability, security, and cost options.

Some alternatives that can be considered are Ethereum, Polygon, or Hyperledger Fabric determined by use case.

Prototype Platform Architecture:

Build modular and scalable architecture as it will be an ultimate growth accommodation measure.

Facilitate a smooth connection with external systems through well-defined APIs.

Install security protocol:

Make use of superior encryption techniques to protect data.

Conduct regular security audits to discover vulnerabilities and mitigate them.

Ensure Regulatory Compliance

Keep pace with regulations in different jurisdictions.

Implement compliance-facilitating features such as automated reporting instruments.

Create a user interface and Experience

Design a simple and user-friendly interface to help in user engagement.

Provide educational materials to help users understand the workings of the platform.

Test and Release

Carry out extensive testing to ensure overall stability and performance of the platform.

Deploy it in phases, starting from beta versions to production releases to get user feedback.

Monetization Techniques

Transact Fees: Charge a fee for each transaction performed on the platform.

Subscription Models: Access to premium features through a subscription plan.

White-Label Solutions: licensing the platform for businesses looking to enter into tokenization.

Beyond Challenges and Considerations:

Regulatory Uncertainty: Navigate and cross into further development of the requirements jammed into the legal landscape, catering compliance challenges.

Security Threats: High security measures keeping zapping from cyber safety.

Market Acceptance: educate possibilities for prospective users and stakeholders about the viability and advantages of platform use to spur on uptake.

Conclusion

Real assets tokenization service platforms provide the coolest innovations for investment. If combined properly by focusing on technology, regulation, and user-centric design, such a platform can complement the assets from mainstream and digital economies by bringing together extremely great quality liquidity, discoverability, and efficiency.

0 notes

Text

KYC BANKING FORM FILLING AUTO TYPER SOFTWARE | DOWNLOAD KYC BANKING AUTO FORM FILLUP SOFTWARE

Nowadays KYC Banking form filling work is very common. This is a bulk project providing company. Completing this work manually in the allotted time is just impossible. Here to complete the given task in the allotted time, we have developed a solution for this. So Start using our KYC Banking Form Filling Auto Typer Software. By using our software, you can easily automate the whole work very accurately. This is the best option that you have ever seen. It is completely offline application and also very user-friendly. For further information, please contact us on the given contact details.

youtube

BPO CONVERSIONS:- Contact:- 9618721254 Email :- [email protected]

0 notes

Text

A Guide to Choosing the Best KYC Solution for Your Business

As businesses embrace the digital age, ensuring secure and seamless interactions with customers has become paramount. KYC and identity verification processes are at the forefront of this transformation, serving as critical safeguards against fraud while enabling compliance with stringent regulatory standards. For businesses operating in sectors such as e-commerce, financial services, and fintech, selecting the right KYC solution is more than just a compliance measure—it’s a key factor in enhancing customer trust and experience.

In this guide, we’ll explore the essential considerations for choosing the best KYC solution for your business, with a focus on leveraging software fintech innovations to optimize identity verification processes.

Why KYC and Identity Verification Matter

KYC (Know Your Customer) is a regulatory requirement designed to verify customer identities and ensure that they are legitimate. These processes are indispensable for businesses to:

Mitigate risks: Prevent identity theft, money laundering, and fraud.

Ensure compliance: Meet legal obligations such as Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws.

Enhance customer trust: Secure and reliable systems build confidence among users.

With increasing digital transactions and a growing emphasis on data security, robust KYC systems powered by software fintech solutions have become essential for businesses across all industries.

Key Features to Look for in a KYC Solution

Choosing the best KYC solution requires careful evaluation of its features and capabilities. Below are the critical aspects to consider:

1. Automation and Scalability

Modern KYC solutions must be able to handle large volumes of data quickly and efficiently. Look for tools that offer:

Automated Verification: AI and machine learning can verify documents and identities in real-time, reducing manual intervention.

Scalability: As your business grows, the solution should accommodate an increasing number of users without compromising performance.

2. Global Compliance

For businesses with a global customer base, compliance with regional and international regulations is critical. The best KYC solutions:

Support multi-language and multi-jurisdiction compliance.

Automatically update to reflect changing regulatory requirements.

3. User-Friendly Interface

Customers expect smooth onboarding experiences. A user-friendly KYC platform should:

Simplify document uploads and biometric authentication.

Minimize friction while maintaining security.

4. Integration with Existing Systems

Your KYC solution should integrate seamlessly with your existing CRM, payment gateways, or other fintech software. This ensures:

Efficient Data Management: Unified access to customer data across platforms.

Reduced Operational Costs: Avoiding the need for entirely new systems.

5. Data Security and Privacy

Given the sensitive nature of identity verification, robust data protection measures are non-negotiable. Ensure that the solution:

Adheres to GDPR, CCPA, or other relevant data protection regulations.

Employs encryption and secure data storage protocols.

How Software Fintech is Revolutionizing KYC

The rise of software fintech solutions has redefined KYC processes, making them faster, more accurate, and customer-centric. Here’s how fintech innovations are transforming identity verification:

Biometric Authentication: Fintech software incorporates fingerprint, facial recognition, and even voice-based authentication, offering unmatched security and ease of use.

AI-Driven Analytics: Artificial intelligence analyzes customer data to identify patterns and anomalies, enhancing fraud detection capabilities.

Blockchain Integration: Some KYC solutions leverage blockchain technology for secure and transparent data sharing across networks.

By adopting these advancements, businesses can not only improve compliance but also deliver a superior user experience.

Steps to Choose the Right KYC Solution

Selecting the best KYC and identity verification platform involves several steps:

Step 1: Assess Your Business Needs

Identify your primary objectives. Are you focused on fraud prevention, regulatory compliance, or improving user onboarding? Consider factors such as:

The size of your customer base.

Your industry-specific compliance requirements.

Expected growth in user numbers.

Step 2: Research and Shortlist Vendors

Evaluate potential KYC providers based on their track record and expertise in your industry. Key considerations include:

Reputation and reviews from similar businesses.

Their use of cutting-edge technologies such as AI and machine learning.

Step 3: Request a Demonstration

Before committing, request a live demo to understand how the solution functions. Focus on:

Ease of integration with your current systems.

The customer experience during onboarding.

Step 4: Compare Costs and ROI

While cost is a factor, prioritize long-term value over short-term savings. A reliable KYC solution should offer:

Reduction in manual verification efforts.

Lower risk of regulatory fines.

Enhanced customer satisfaction leading to higher retention rates.

Step 5: Ensure Ongoing Support and Updates

Regulations and customer expectations evolve. Choose a vendor that offers:

Regular software updates to reflect regulatory changes.

Comprehensive customer support and troubleshooting.

Benefits of a Robust KYC Solution

Implementing the right KYC solution offers numerous advantages:

Improved Efficiency: Automated processes speed up customer onboarding.

Reduced Fraud: Advanced verification methods minimize fraudulent activities.

Global Reach: Compliance with international regulations allows seamless expansion into new markets.

Enhanced Reputation: Secure and transparent practices build customer trust.

Conclusion

Selecting the best KYC solution is a strategic decision that directly impacts your business's security, compliance, and customer experience. By leveraging innovations in software fintech, businesses can streamline KYC and identity verification processes, ensuring they are efficient, secure, and customer-friendly.

Investing in the right KYC platform not only safeguards your operations but also positions your business as a trusted player in today’s competitive digital landscape. With a focus on automation, compliance, and user-centric design, the ideal KYC solution can drive long-term growth and success.

0 notes

Text

KYC BANKING FORM FILLING AUTO TYPER SOFTWARE | DOWNLOAD KYC BANKING AUTO FORM FILLUP SOFTWARE

Nowadays KYC Banking form filling work is very common. This is a bulk project providing company. Completing this work manually in the allotted time is just impossible. Here to complete the given task in the allotted time, we have developed a solution for this. So Start using our KYC Banking Form Filling Auto Typer Software. By using our software, you can easily automate the whole work very accurately. This is the best option that you have ever seen. It is completely offline application and also very user-friendly. For further information, please contact us on the given contact details.

BPO CONVERSIONS:- Contact:- 9618721254 Email :- [email protected]

0 notes

Text

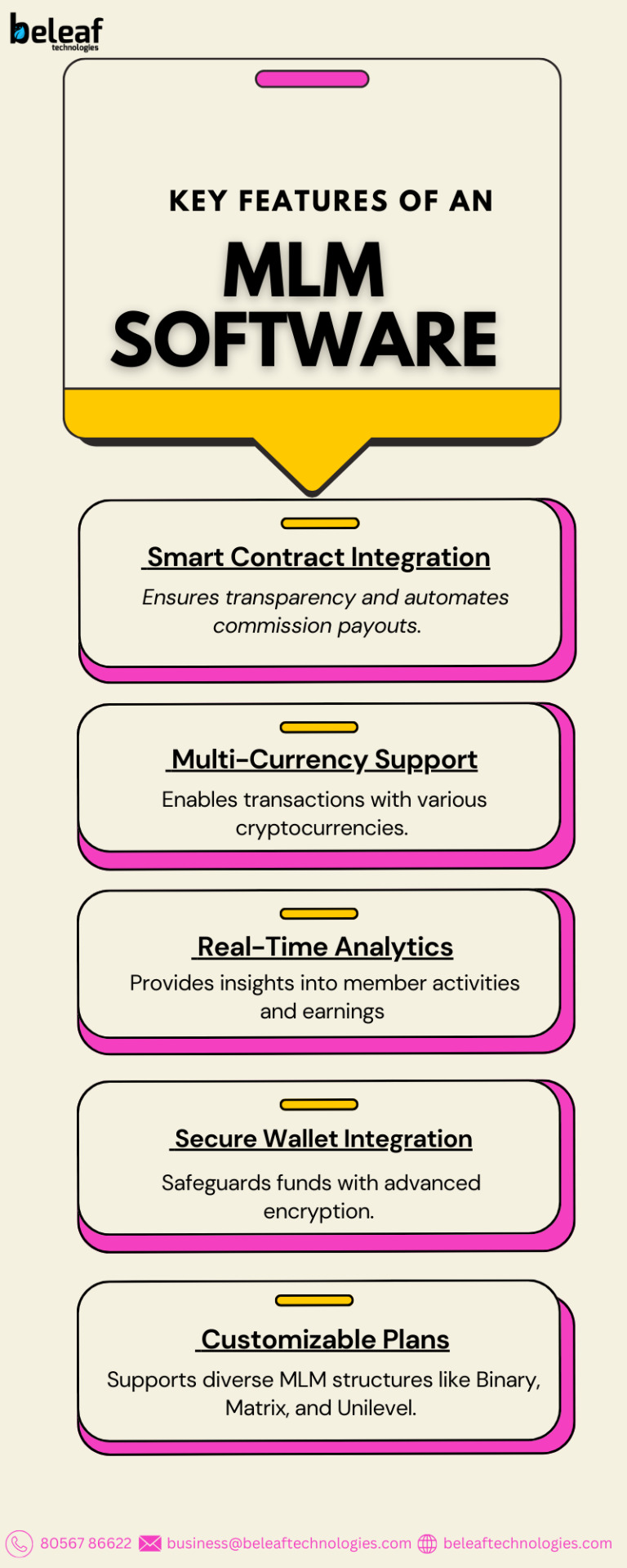

Cryptocurrency MLM software is a platform designed to manage multi-level marketing businesses using cryptocurrencies. It supports various compensation plans like binary and unilevel, automating commission payouts and tracking downline performance. The software integrates digital wallets, blockchain, and smart contracts for secure and transparent transactions. It provides real-time reporting, KYC/AML compliance, and customizable dashboards for users and admins. This solution is scalable, mobile-friendly, and ensures low transaction fees while enabling global reach for crypto-based MLM businesses.

Know more >>https://beleaftechnologies.com/cryptocurrency-mlm-software-development

Instant Reach: Whatsapp : 81481 47362 Email id : [email protected] Telegram : https://telegram.me/BeleafSoftTechnologies

1 note

·

View note