#Australian Ammonia Market

Explore tagged Tumblr posts

Text

Examining the Competitive Landscape of Australia Ammonia Market

Ammonia has wide industrial applications including use as a fertilizer in agriculture. As the raw material for the production of nitrogen fertilizers like urea and DAP, ammonia provides nitrogen which is an essential nutrient for plants. Australia has a well-established agricultural industry and is one of the world's largest exporters of wheat, barley and wool. The demand for fertilizers is increasing steadily with the need to boost agricultural yields to meet the rising global food demand. The global Australia Ammonia Market is estimated to be valued at US$ 934.85 million in 2023 and is expected to exhibit a CAGR of 6.4% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Opportunity

Opportunities in agriculture production: The rising population has increased pressures on the agricultural sector to produce more food while efficient utilization of resources like land and water. Ammonia based fertilizers help increase the productivity of farmlands thus supporting growth in agriculture. The Australia Ammonia Market is anticipated to benefit from government initiatives and investments towards boosting agricultural output through sustainable means like fertilizer usage. This presents lucrative opportunities for ammonia producers and distributors to cater to the rising demand from farmers. Porter's Analysis

Threat of new entrants: The threat of new entrants in the Australia ammonia market is moderate. Significant capital investments are required to build ammonia production facilities acting as a barrier. However, growing demand and high profit margins attract new players. Bargaining power of buyers: The bargaining power of buyers is high due to the fragmented nature of buyers and existence of many domestic and global suppliers. Buyers can negotiate on price and quality standards. Bargaining power of suppliers: The bargaining power of suppliers is moderate. Supply is dependent on few raw material suppliers and fluctuations in their prices can impact overall production cost. However, long term contracts balance their influence. Threat of new substitutes: The threat of new substitutes is low as ammonia has few substitutes that offer similar economic and productive benefits in agricultural and industrial applications. Competitive rivalry: The competition is high among the existing players to increase market share. Players compete on pricing, product differentiation, reliability of supply and customer service. SWOT Analysis

Strengths: Large domestic market with increasing food production and industrialization. Presence of major fertilizer producers with established infrastructure and distribution network. Weaknesses: High dependency on imports for raw materials increases operational costs. Stringent environmental regulations raise compliance costs. Opportunities: Growing consumption in applications such as refrigerants, cleaning products, plastics offers new avenues. Investments in renewable energy projects will boost fertilizer demand. Threats: Volatility in natural gas prices is a major threat. Supply constraints can adversely impact buyers. Stringent safety norms during production and transport poses challenges. Key Takeaways

The Australia ammonia market size reached US$ 934.85 million in 2024 and is forecast to grow at a CAGR of 6.4% during 2023-2030.

Key players operating in the Australia ammonia market are Incitec Pivot Limited, Yara International ASA, Orica Limited, and Wesfarmers Chemicals, Energy & Fertilisers. Incitec Pivot Limited is the leading producer with integrated operations and supply chain network across the key farming regions. Yara International offers comprehensive product portfolio and technical expertise. Regional analysis suggests southern region will continue to dominate the ammonia consumption driven by high agricultural productivity. Queensland is emerging as a high growth market backed by government investments promoting sustainable agriculture and expansion of mining industry. Consumption in western region is also rising on account of increasing food exports and mineral mining activities.

0 notes

Text

New SpaceTime out Monday

SpaceTime 20241202 Series 27 Episode 145

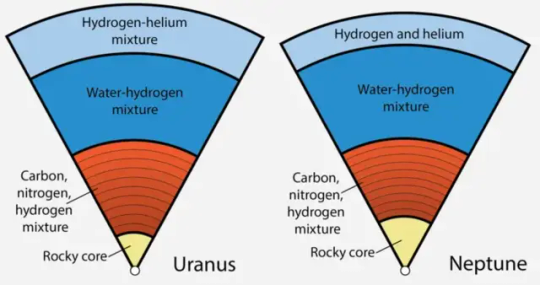

What lies beneath the worlds of Uranus and Neptune

A new study suggests the ice giants Uranus and Neptune feature layers of water, methane, and ammonia which like oil and water, don't mix.

Final Venus flyby for NASA's Parker Solar Probe

-NASA's Parker Solar Probe has completed its final Venus gravity assist flyby manoeuvre, passing within 376 kilometres of Venus's surface.

Making the most colourful map of the cosmos ever attempted

A new NASA mission slated for launch next year will make the most colourful map of the cosmos ever attempted.

The Science Report

Russia has commenced using a new nuclear-capable hypersonic missile to attack Ukraine.

A new study shows that almost half the world experienced extreme drought last year.

Discovery of what could be evidence of the oldest alphabetic writing in human history.

Skeptics guide to the Royal’s love of the paranormal

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#string theory#dimensions#brian greene#cosmology#hubble space telescope#hubble telescope#hubble#edwin hubble#jwst#hubble tension#james webb space telescope

10 notes

·

View notes

Text

Australia Hydrogen Market: Leading the Clean Energy Revolution

Australia is at the forefront of the global hydrogen revolution, leveraging its abundant renewable energy resources and strategic location to become a major player in the hydrogen market. Australia Hydrogen Market The development of this market is a cornerstone of Australia's efforts to achieve decarbonization and secure its position as a global clean energy leader.

Introduction to the Australia Hydrogen Market

The hydrogen economy in Australia is rapidly evolving, driven by ambitious government policies, international partnerships, and significant investments in technology and infrastructure. The country's vast solar and wind energy potential, coupled with its commitment to sustainability, positions it as a hub for green hydrogen production.

What is Driving the Hydrogen Market in Australia?

Abundant Renewable Energy Resources Australia’s unparalleled solar and wind energy capabilities enable cost-effective and sustainable green hydrogen production. These resources are critical for powering electrolysis, the process used to produce hydrogen from water.

Government Support and Investments The Australian government has launched the National Hydrogen Strategy, aiming to develop hydrogen as a clean energy solution for domestic use and export. The plan includes funding for hydrogen hubs, research initiatives, and infrastructure projects.

Types of Hydrogen in the Australian Market

Green Hydrogen Produced using renewable energy sources, green hydrogen is the most environmentally friendly option. Australia is focusing heavily on green hydrogen to align with its sustainability goals.

Blue Hydrogen Generated from natural gas with carbon capture and storage (CCS), blue hydrogen is a transitional option that balances cost and environmental impact.

Hydrogen Production Capacity in Australia

Key Projects

Asian Renewable Energy Hub (AREH): A massive project in Western Australia aimed at producing green hydrogen at scale.

Queensland Hydrogen Hub: Focused on domestic hydrogen production and export infrastructure development.

Integration with Renewables Hydrogen projects in Australia are closely tied to solar and wind farms, ensuring a sustainable and efficient energy cycle.

Australia’s Role as a Hydrogen Exporter

Australia’s geographic proximity to major hydrogen-importing nations like Japan, South Korea, and China offers a strategic advantage. Collaborative agreements and projects with these nations emphasize Australia’s role as a reliable hydrogen supplier.

Infrastructure Development Significant investments are being made in hydrogen liquefaction plants, storage facilities, and export terminals to meet international demand. Buy the Full Report Or Download a Free Sample Report For More Insights on Upcoming Hydrogen Projects in the Australia Hydrogen Market

Applications of Hydrogen in Australia

Industrial Use Hydrogen is transforming industries like steelmaking, ammonia production, and chemicals by offering a clean energy alternative to fossil fuels.

Transportation Australia is deploying hydrogen-powered vehicles and buses, emphasizing its role in decarbonizing the transport sector.

Power Generation Hydrogen is being utilized for grid stability and energy storage, supporting Australia's transition to a renewable-dominated energy system.

Challenges Facing the Australia Hydrogen Market

High Production Costs While green hydrogen is sustainable, its production is expensive due to the costs of renewable energy and electrolyzers.

Infrastructure Needs Building pipelines, storage facilities, and export terminals is a capital-intensive process that requires extensive planning and investment.

Global Competition Countries like Saudi Arabia and Chile are also advancing their hydrogen economies, creating competitive pressure on Australia.

Environmental Benefits of Hydrogen

Hydrogen plays a vital role in reducing greenhouse gas emissions. By replacing fossil fuels in industrial processes, transportation, and power generation, it contributes significantly to Australia’s net-zero targets.

Technological Innovations in Hydrogen

Advancements in Electrolyzers New electrolyzer technologies are improving efficiency and reducing costs, making green hydrogen more competitive.

Hydrogen Storage Solutions Innovations in hydrogen storage, including cryogenic and solid-state technologies, address traditional storage challenges.

Regional Insights: Hydrogen Development in Australia

Western Australia The state is a leader in green hydrogen projects, leveraging its vast renewable energy resources for large-scale production.

Queensland and New South Wales Both states are investing heavily in hydrogen hubs and infrastructure, aiming to become major players in the domestic and export markets.

Future of the Australia Hydrogen Market

Australia’s hydrogen market is set to grow exponentially, with predictions indicating that it could generate billions in revenue and create thousands of jobs by 2030. Green hydrogen will dominate the market as technology advances and production costs decrease.

FAQs on the Australia Hydrogen Market

What is the National Hydrogen Strategy? The strategy outlines Australia’s plan to develop a sustainable hydrogen industry for domestic use and export, with a focus on green hydrogen.

Why is green hydrogen important for Australia? Green hydrogen aligns with Australia’s renewable energy capabilities and its goals for carbon neutrality, offering a sustainable energy solution.

What are the main challenges in scaling hydrogen in Australia? Key challenges include high production costs, infrastructure development, and competition from other hydrogen-producing nations.

Which countries are major importers of Australian hydrogen? Japan, South Korea, and China are leading importers, driven by their own decarbonization goals and energy needs.

How does hydrogen benefit Australia’s economy? The hydrogen industry boosts regional economies, creates jobs, and positions Australia as a leader in global clean energy markets.

What role does hydrogen play in decarbonizing industries? Hydrogen replaces fossil fuels in industries like steelmaking and chemical production, significantly reducing emissions.

0 notes

Text

Japan LNG Market Analysis 2032

Japan LNG market is expected to observe a CAGR of 4.11% during the forecast period FY2025- FY2032, rising from USD 45.81 billion in FY2024 to USD 63.23 billion in FY2032. Japan is regarded as one of the world’s largest LNG importers. The need for LNG supply in Japan is increasing due to the country’s limited local energy resources. Moreover, the necessity for reliable and reasonably clean energy sources by reducing greenhouse gas emissions makes LNG a vital component of the country’s energy landscape. Hence, a perfect balance is maintained between environmental responsibility and economic growth.

For instance, in May 2024, Japan’s LNG imports were 4.87 million tons, resulting in a surge of 5.6% from the same month last year, according to preliminary figures from Japan’s finance ministry. The cost of the imports was roughly USD 2.85 billion, representing a 9.1% increase year-on-year. These patterns highlighted Japan’s continued reliance on LNG to fulfill its energy demands in the face of unpredictable global supply dynamics.

Rise in Investments for LNG is Expediting Market Growth

With the growing need for secure energy supplies, Japan is actively investing in LNG. The Japanese government has intended to keep LNG handling capacity at around 100 million tons per year by 2030. Furthermore, Japanese corporations are extending investments in LNG facilities across Asia-Pacific with the aim of increasing energy security, thereby ensuring that they remain competitive in the rapidly changing global market.

For instance, in May 2024, Japan’s JERA Co, Inc. intended to invest over USD 32 billion over the next decade in LNG and novel fuels, including hydrogen and ammonia. By FY2035, the corporation expects to handle approximately 35 million tons of LNG per year, 20 Gigawatts of renewable energy capacity, and 7 million tons of hydrogen and ammonia. The investment approach aligns with Japan’s aim of lowering carbon emissions by at least 60% by FY2050, therefore promoting the transition to a low-carbon society.

Collaboration With Foreign Countries for Long-Term LNG Supplies is Expediting the Market Growth

Japan’s cooperation with other nations on long-term LNG supply is essential for energy security and stability. Japan is diversifying its supply chain by boosting connections with different allies. The strategy mitigates geopolitical risks and ensures consistent LNG supplies to fulfill Japan’s energy demands, especially as the country moves to a more environmentally friendly energy mix.

For instance, in May 2024, Japan boosted its reliance on Australia and the United States for long-term LNG supply by signing crucial contracts till the early 2030s. In response to uncertainty in Australian LNG supply policy, Japan is diversifying its sources by boosting connections with its allies. Recent equity investments in Australian and the United States projects aim to provide steady, long-term LNG supply, showing Japan’s dedication to energy security in the face of changing global dynamics and the constant need for reliable energy sources.

Establishment of Regasification Facilities is Proliferating Market Growth

Japan has built a strong network of gasification plants to support significant usage of LNG. Japan is a leader in Asia-Pacific in terms of operational capabilities. The country has multiple LNG storage terminals, which together contribute a major share of Asia’s total regasification capacity. The plants receive LNG from overseas, store it, and convert it back into gas for distribution through pipelines. The continued development of the terminals is crucial to ensure a clean and stable LNG supply in Japan’s energy landscape.

For instance, in April 2024, Japan’s Mitsui O.S.K. Lines Ltd. (MOL) started commercial operations of its floating storage & regasification unit (FSRU) to provide LNG to the Jawa 1 LNG-fired power plant. The FSRU, owned by MOL, has a total generating capacity of 1,760 MW, can store 170,000 m³ of LNG, and regasify 300 million standard cubic feet per day (MMcsfd).

Government Initiatives are Amplifying Market Prosperity

Government policies in Japan LNG market are critical for energy security and addressing future supply concerns. Investments in infrastructure and strategic alliances with nations such as Australia and the United States are crucial for sustaining a steady LNG supply. The initiatives are anticipated to cater to ample benefits for market expedition over the forecast years.

For instance, in March 2024, the Japanese government stated that it is actively shifting its focus on LNG in Southeast Asia. Japanese firms are investing in the LNG infrastructure of Vietnam, Philippines, and Indonesia to boost demand and expand trading capacity. The approach seeks to sustain Japan’s yearly LNG handling capacity despite the rising LNG surpluses.

Central Japan is Leading the Market Share

Central Japan has emerged as a leader in the market due to its strategic infrastructure and significant consumption. The region has several important LNG terminals which facilitate LNG import and regasification to meet the energy needs of densely populated areas. Major utilities in central Japan, such as Jera Co Inc. and Tokyo Gas Co., Ltd., have historically been the largest buyers of LNG. The regions are recognized for their capability to secure long-term contracts for LNG projects.

Central Japan has one of the most prominent LNG companies in the country, Tokyo Gas Ltd. As per the Japanese government, Central Japan is shifting its focus to southeastern Asia for LNG trading. In August 2024, Tokyo Gas Ltd. collaborated with Mitsui Corporation to develop a 1,500 MW LNG power plant in Northern Vietnam. Moreover, Tokyo Gas Ltd. is preparing to develop an LNG terminal in Philippines, but it is still pending government approval.

Download Free Sample Report

Future Market Scenario (FY2025 – FY2032)

Japanese corporations are diversifying the LNG supplies and investing in LNG infrastructure for growing Asian regions to meet the demand adequately, which can prove to be a significant movement in the future for market proliferation.

The Japanese governments is making significant investments in LNG-fired power stations to strengthen its foothold in the Asian market, which is anticipated to yield significant benefits for market growth.

Japan’s long-term energy policy is continuing to develop, balancing LNG dependency with the expansion of renewable and nuclear energy. Japanese utilities are improving their trading capabilities to properly handle surplus LNG and expand into new markets, thereby paving a great future for market growth.

Report Scope

“Japan LNG Market Assessment, Opportunities and Forecast, FY2018-FY2032F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative and quantitative assessment of the current state of Japan LNG market, industry dynamics, and challenges. The report includes market size, segmental shares, growth trends, opportunities, and forecast between FY2025 and FY2032. Additionally, the report profiles the leading players in the industry, mentioning the respective market share, business models, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/japan-lng-market

Latest reports-

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

0 notes

Text

Exploring Growth Opportunities and Trends in the Australian Ammonia Market: A Comprehensive Market Research Analysis

The Australia Ammonia Market is estimated to driven by growing demand for food due to the rapidly rising population The Australia ammonia market has been in trends of accelerated agricultural activities in the country. Ammonia plays a vital role as nitrogen fertilizer in agriculture and has become an indispensable input for higher crop yields. The market comprises several well-established players focused on expanding their ammonia production capacities to capitalize on the growing fertilizer demand from farmers.

The Australia Ammonia Market is estimated to be valued at US$ 934.85 Million in 2024 and is expected to exhibit a CAGR of 6.4% over the forecast period 2023 to 2030. Ammonia is an essential nitrogen fertilizer used widely in agriculture to enhance soil fertility. It provides nitrogen, a key nutrient for plant growth. The rising uptake of scientific farming practices and growing awareness about soil health and nutrition have significantly increased the consumption of ammonia in the Australian agricultural industry. Ammonia is commonly used as a nitrogen source to produce other nitrogen fertilizers as well. It finds myriad applications across various end-use industries including agriculture, pharmaceuticals, textiles, refrigerants, explosives, and more. Key Takeaways Key players operating in the Australia ammonia market are Incitec Pivot Limited, Yara International ASA, Orica Limited, and Wesfarmers Chemicals, Energy & Fertilisers. Incitec Pivot and Wesfarmers are the largest producers and suppliers of ammonia in Australia. The growing demand for food due to the rapidly rising population has compelled Australian farmers to increase fertilizer usage to boost agricultural productivity. Ammonia, being a rich source of nitrogen, has emerged as the dominant fertilizer for major crops. Additionally, support from the government in the form of subsidies for fertilizers is positively impacting the market. Major international players are aggressively expanding their presence in Australia to gain a more significant share of the lucrative fertilizer market. For instance, Norway-based Yara International is expanding its ammonia facility in New South Wales. Global manufacturers are also focusing on capacity additions considering the projected growth of Australian agriculture. Market Key Trends One of the key trends gaining traction in the Australia ammonia market is the increase in investments toward the adoption of cleaner production technologies. Major producers are investing heavily in installing waste heat and pressure recovery turbines to improve energy efficiency during ammonia synthesis. Companies are also researching advancements in membrane, electrolyzer, and bio-fixation technologies to develop carbon-neutral blue and green ammonia suitable for the long-term sustainability goals of the Australian government.

0 notes

Text

Lifesigns from Plug Power - Footprint with Major Agreements

Lifesigns from Plug Power. Plug Power continues to make significant strides in the renewable energy sector, with recent announcements highlighting its ongoing commitment to innovation and expansion. On Tuesday, May 2, 2024, Plug Power unveiled several key developments that underscore its growing influence in the global clean energy landscape.

Plug Power to supply 3 gigawatts (GW) for Australian.

One of the most notable announcements is Plug Power's preliminary agreement to supply 3 gigawatts (GW) of electrolysers for an Australian green hydrogen and ammonia project. This landmark deal, established through a memorandum of understanding (MOU) with Allied Green Ammonia, demonstrates Plug Power's dedication to advancing sustainable energy solutions on a global scale. The collaboration aims to support AGA's upcoming hydrogen to ammonia facility in the Northern Territory of Australia, marking a significant milestone in the transition towards a greener future.

Plug Power is also making significant strides in North America

In addition to its international expansion efforts, Plug Power is also making significant strides in North America. The company has successfully secured multiple contracts in the region, further solidifying its position as a leader in the hydrogen industry. Among these contracts is the delivery of eight low-temperature trailers for the US and Canadian markets. With delivery scheduled for the second half of 2025, Plug Power is poised to meet the growing demand for hydrogen infrastructure and transportation solutions in North America.

Plug Power services with the certification of liquid hydrogen storage in Korea.

Furthermore, Plug Power is enhancing its cryogenic equipment services with the certification of liquid hydrogen storage tanks and transport trailers in Korea. This strategic initiative underscores Plug Power's commitment to offering comprehensive solutions for the storage, transportation, and utilization of hydrogen across various industries.

Lifesigns from Plug Power again since months

As Plug Power continues to expand its global footprint and forge strategic partnerships worldwide, the company remains at the forefront of driving the transition towards a sustainable energy future. With a portfolio of cutting-edge technologies and a relentless focus on innovation, Plug Power is poised to shape the future of renewable energy and accelerate the adoption of clean hydrogen solutions on a global scale. Readmore on Plug Power Plug Power Stock under 3usd, the right time to buy? Read the full article

0 notes

Text

Australia Ammonia Market Insights: Trends, Challenges, and Future Outlook

Market Overview:

Ammonia is an important nitrogen source used to produce nitrogen-containing fertilizers such as urea, ammonium nitrate and ammonium phosphate. It is also used in fibers, plastics, explosives and cleaning products.

Market Dynamics:

Ammonia is mostly used in Australia for nitrogen fertilizers production due to the high demand from agricultural industry. According to recent reports, Australian agricultural sector has seen significant growth over past few years and is estimated to grow at over 3% annually during forecast period owing to rising food demand from growing population and demand for Australian agricultural exports globally. This rise in agricultural outputs will positively influence the demand for nitrogen fertilizers and subsequently ammonia market in Australia. In addition, growing demand for industrial use of ammonia like cleaning products manufacturing will also drive its market. However, stringent environmental regulations around CO2 emissions from ammonia production plants may slightly hamper the market growth during forecast period.

Major Drivers of the Australia Ammonia Market: Increased Fertilizer Demand Boosting Ammonia Consumption

The agricultural sector in Australia has been expanding significantly over the past few years. As the nation seeks to boost its agricultural output and meet the growing global food demand, the consumption of fertilizers has increased substantially. Ammonia is a key ingredient that is used in the production of nitrogen-based fertilizers such as urea, ammonium nitrate, and ammonium sulfate. With the rise in fertilizer usage, the demand for ammonia from the fertilizer industry has surged as well.

Stringent Regulations on Nitrogen Oxide Emissions Favoring Ammonia Production Shift

The Australian government has introduced stringent regulations to curb nitrogen oxide emissions from industries including power generation and waste incineration. As ammonia production and processing contributes significantly lower NOx emissions compared to other sources, many companies are shifting towards ammonia. The favorable policy environment is encouraging investments in ammonia facilities and infrastructure to replace conventional technologies. This transition is expected to boost ammonia consumption volumes in the coming years.

Major Restraint of the Australia Ammonia Market: Transportation Issues Hindering Market Expansion

While ammonia demand is rising steadily across various end-use sectors, transportation of ammonia poses unique safety challenges due to its corrosive and toxic nature. There is a lack of dedicated pipeline infrastructure for long-distance ammonia transportation within Australia. Reliance on road and sea shipments makes distribution difficult and cost-intensive. Remote locations witness supply disruptions as setting up storage and handling facilities is a major undertaking. These transportation barriers restrict the market from reaching its true potential and expanding across all geographical regions.

Major Opportunity for the Australia Ammonia Market: Green Ammonia Production Opening New Growth Avenues

With the world accelerating energy transition, green ammonia is emerging as a promising carbon-free solution. Australia is well-positioned to tap the vast potential of green ammonia due to its abundance of renewable energy resources like solar and wind. Several projects are being planned and established to produce green ammonia through electrolysis using renewable power. This provides an opportunity for Australia to export green ammonia to high demand markets in Asia and become a globally significant supplier. It can also facilitate the decarbonization of domestic shipping, fertilizer manufacturing and other industries.

Major Trend in the Australia Ammonia Market: Rising Investments in Large-Scale Import Terminals

To cater to the increasing fertilizer demand and ensure steady ammonia supply, major players in the Australian market are investing heavily in setting up import terminals with large capacities. For instance, Incitec Pivot recently completed expansion of its ammonia import facility at Kwinana, Perth to achieve a handling capacity of 1 million tonnes per year. Yara is constructing a new ammonia import terminal near Brisbane which is expected to receive 800,000 tonnes annually once completed in 2024. These import hubs will strengthen Australia's position as a key ammonia importing and distribution center to support the agricultural growth momentum.

#Australia Ammonia Market Share#Australia Ammonia Market Growth#Australia Ammonia Market Demand#Australia Ammonia Market Trend#Australia Ammonia Market Analysis

0 notes

Text

Exploring the Best Chicken Coops in Australia

When it comes to creating a thriving backyard poultry haven, the right chicken coop can make all the difference. In Australia, where poultry enthusiasts are on the rise, finding the perfect coop tailored to the local climate and conditions is crucial. Australian chicken coops are designed to provide comfort, safety, and functionality for your feathered friends.

Australia's diverse climate, ranging from the tropical north to the temperate south, demands a unique approach to chicken coop design. Chicken coops in Australia need to withstand the heat of summer, the chill of winter, and everything in between. Moreover, they must be predator-resistant to protect the flock from local wildlife.

One of the leading factors to consider when selecting a chicken coop is the material used in its construction. Chicken coops Australia wide come in various materials, each with its own set of advantages. From traditional wooden coops to modern plastic designs, the choices are vast. Wooden coops are known for their durability and insulation properties, while plastic coops are often lighter and easier to clean.

Another essential aspect is the size of the coop, which is influenced by the number of chickens you plan to raise. A spacious coop ensures that your chickens have enough room to move around comfortably and engage in natural behaviors. Chicken coop Australia experts recommend providing at least two to three square feet of space per chicken in the coop.

Ventilation is another critical consideration. Adequate airflow is necessary to prevent the buildup of moisture and ammonia, which can harm the health of your chickens. Look for coops with adjustable vents or windows that allow you to regulate airflow based on the weather conditions.

When it comes to maintenance, ease of cleaning is paramount. Australian chicken coops should be designed with removable trays or flooring for easy cleaning and sanitation. Regular cleaning not only ensures a healthier environment for your chickens but also prolongs the life of the coop.

In conclusion, choosing the right chicken coop in Australia is a decision that requires careful consideration of climate, materials, size, ventilation, and maintenance. Whether you're a seasoned poultry keeper or a beginner, investing in a quality coop is a step toward ensuring the well-being and happiness of your feathered companions. Explore the diverse range of Australian chicken coops available in the market, and create a comfortable haven for your flock.

0 notes

Text

Liquid Nicotine Strengths Explained

A single tobacco cigarette stick incorporates 8 to 20 milligrams (mg) of Nicotine (depending on the model), however mere around 1.2 mg is definitely absorbed by the body while you truly smoke it. We advocate checking this with your individual state laws. It's illegal in QLD to use e-liquids that include any nicotine. In all other Australian states it's authorized to make use of e-liquid products containing nicotine. How and the place you should utilize these liquids can be different in each state. Nonetheless, going above 12 mg in a sub-ohm device just isn't advisable. Have in mind, the higher you climb up the nicotine ladder, the e-juice could have a harsher throat hit. Vapers in the community call this harshness induced by increased nicotine ranges as nicotine chunk. One of the first issues entrepreneurs will inform you about nicotine salt e-liquid is that nicotine is naturally a salt when it's nonetheless within the tobacco leaf. It's the extraction course of - which makes use of ammonia as a solvent - that adjustments the nicotine from a salt to a free base. Since nicotine salt e-liquid provides you one thing nearer to what's in natural tobacco leaves, they say, it have to be better than commonplace e-liquid. That sounds good, however it's actually simply marketing rhetoric. buy nicotine liquid online -liquid doesn't come from a more pure extraction process; it comes from triggering a chemical response in the nicotine after the extraction has already taken place. An digital cigarette-commonly known as an e-cig-produces vapor from liquid containing flavoring and nicotine. By mimicking the appear and feel of smoking, the device has helped many cigarette customers find an pleasing different to tobacco. E-cig know-how has advanced rapidly, and there are now extra merchandise than ever to select from that cater to any user's preferences. The Light energy e-liquid has 12 milligrams of nicotine—that is 12 milligrams of nicotine per milliliter. 5 milliliters equals about one teaspoon. A teaspoon of e-liquid incorporates barely less than 60 mg of nicotine. Each American tobacco cigarette comprises about 9 mg, however cigarette smoking burns away quite a lot of the nicotine. On average you are inhaling about 1 mg of nicotine per tobacco cigarette. Therefore, a teaspoon of 12 mg e-liquid is the same as about 60 cigarettes. And considering the truth that smokeless cigarettes are way more environment friendly compared, it's doubtless that 12 mg e-liquid will equal” more than 60 traditional cigarettes.

1 note

·

View note

Text

$13.7 million hydrogen facility to remove carbon from ammonia plant in Brisbane

Brisbane could be home to one of the world’s largest renewable hydrogen plants after federal money was pumped into an ammonia project. The $13.7 million in funding from the Australian Renewable Energy Agency will go to Fortescue Future Industries and Incitec Pivot to investigate the development of a hydrogen decarbonization facility from an ammonia plant. Energy Secretary Chris Bowen said the facility could provide insight into the cost of producing renewable hydrogen.attributed to him:SMH At the heart of the project is a proposed 500 MW electrolyzer capable of producing up to 70,000 tons of renewable hydrogen per year. It will be used at Incitec Pivot’s ammonia plant on Gibson Island. About 100 jobs will be supported throughout the project on Gibson Island.attributed to him:Tami Low Energy Minister Chris Bowen said the project could provide insight into the cost of producing renewable hydrogen as Australia looks to the energy source as an alternative to fossil fuels. “If successful, the electrolyzer will be the largest yet built, feeding renewable hydrogen directly into the first completely carbon-neutral facility,” he said. “The study is important for the domestic industry and export of clean hydrogen and ammonia supply chains to deliver Australia’s first renewable hydrogen shipments to international markets.” Fortescue Future Industries is a subsidiary of Andrew “Twiggy” Forrest’s Fortescue Metals Group, with profits from the giant iron ore mining business used to fund renewable energy projects for the new venture. Source link Originally published at Melbourne News Vine

0 notes

Text

How Should Ziptrak Blinds Be Maintained And Cleaned?

Ziptrak blinds Melbourne are an Australian-made product that offers a wide range of features to customers. They are designed to provide durable, long-lasting and affordable blinds for any room in your house.

With ZipTrak Blinds you can choose from over 100 different colours, textures and styles. They offer a variety of fabrics for the inside lining of your blinds as well as the outside material. Whether you want vertical or horizontal slats there is sure to be one that will suit your needs.

Here are some tips on maintaining and cleaning your ZipTrak Blinds:

Cleaning Your Ziptrak Blinds

Clean your ziptrak blinds Melbourne after each use to prevent dirt and dust from building up on the blinds.

Use a damp cloth to wipe off any dirt or dust that may have collected on the blinds during use, then dry with a clean towel or rag before storing them away.

Clean the inside of your Ziptrak Blinds using mild detergent with warm water, making sure not to soak or soak too much as this will cause fading over time (if you've got pets that shed a lot, then this might be unavoidable!).

Rrinse thoroughly with clear water and dry with a clean towel/rag afterwards so that no excess moisture remains inside!

DO NOT use abrasive cleaners such as scourers or sponges on your ziplock slats because these could scratch the surface causing it become discoloured over time if left untreated...and speaking about scratches - don't use bleach either! Bleach may seem like an easy solution but it's actually very harmful for both humans and animals (and not just plants).

The same goes for harsh chemicals such as ammonia-based cleansers; they can damage both plastics they come into contact with as well as other materials around them so please avoid using these types of products at all costs!

How Often Should I Clean My Ziptrak Blinds?

The Ziptrak blinds can be cleaned by simply wiping them with a soft cloth and water. It's recommended to clean the blinds after every use to ensure that they do not get dirty.

Don’t wait for your ziptrak blinds Melbourne to get dirty before cleaning them as this will only make it harder for you to clean later on.

Washing the zipline fabric with mild detergent or soap is also a good way of keeping it clean as long as you don't use harsh chemicals like bleach or ammonia-based products like Windex that may damage the fabric over time.

How to Ensure Smooth Operation

Ensure smooth operation by removing any dirt or dust from the blinds.

Use a lint roller to remove the dust.

Use a soft cloth to clean the blinds, if there is a build-up of dirt, use a mild detergent and water to clean the blinds.

Conclusion

Whether you want to clean your ziptrak blinds Melbourne or maintain them, we have everything you need. We have the best cleaning and maintenance products on the market today so that your blinds will always look new!

0 notes

Text

Kangaroo Nitrogen: Premium Ammonia for Australian Industries

Australia Ammonia Market is anticipated to witness high growth owing to rising agricultural production The Australia ammonia market has been witnessing significant growth in recent years. Ammonia is majorly used as a nitrogen fertilizer for crop cultivation. Australia is one of the leading agricultural exporters in the world and ammonia plays a vital role in boosting agricultural yields. The demand for food is increasing rapidly due to the rising population in the country as well as globally. This is anticipated to drive the uptake of nitrogen fertilizers, thereby benefiting the ammonia market. Ammonia also finds applications as a refrigerant and in the production of plastics, fibers, and other chemicals. Increasing industrial activity is further propelling the product demand. The Global Australia ammonia market is estimated to be valued at US$ 934.85 Million in 2024 and is expected to exhibit a CAGR of 6.4% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the Australia ammonia market are Incitec Pivot Limited, Yara International ASA, Orica Limited, and Wesfarmers Chemicals, Energy & Fertilisers. These players are focusing on capacity expansion plans to cater to the growing demand. For instance, Incitec Pivot Limited invested AUD 350 million to upgrade its Brisbane plant and increase its annual ammonia production capacity by 200kT. The Australia ammonia market provides lucrative growth opportunities for both domestic as well as international players. Rising fertilizer consumption in major crop-producing regions such as Queensland and New South Wales is boosting the demand for ammonia. Leading companies are actively pursuing partnerships and acquisition strategies to strengthen their presence across these high potential markets. Globally, Australia is a major exporter of ammonia. Strong demand from countries like China, Indonesia, Malaysia, South Korea is encouraging Australian manufacturers to ramp up exports. Expansion into international fertilizer markets allows players to diversify revenue streams and offset risks arising from domestic demand and supply fluctuations. Several trading houses and distributors have also forayed into the Australian ammonia export business over the past five years. Market Drivers Growth in the agricultural sector: Australia has a robust agricultural industry, especially for crops like wheat and dairy. Rising agricultural production to meet growing global food demand is fueling fertilizer consumption including ammonia. Increasing industrial Applications: Apart from agriculture, ammonia finds wide usage as a feedstock in various industries such as plastics, fibers, pharmaceuticals, leather, explosives etc. Strong industrial growth in Australia is propelling the product demand from non-agricultural verticals.

0 notes

Text

Australia Ammonia Market Dynamics: A Comprehensive Overview

Ammonia is commonly used as a nitrogen fertilizer in agriculture to enhance crop productivity. It is also used in the production of various chemicals and other nitrogen compounds used in refrigeration systems, plastics, fibers, explosives, and other industries. The agricultural sector dominates the demand for ammonia in Australia as it is a major raw material used in the production of urea and other nitrogen fertilizers. With over 60% of Australia's land area being used for agricultural purposes, the demand for ammonia from the farming industry is continually growing.

The global Australia Ammonia Market is estimated to be valued at US$ 934.85 Million in 2023 and is expected to exhibit a CAGR of 6.40% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

One of the key drivers for the growth of the Australia ammonia market is the rising agriculture industry. As mentioned earlier, around 60% of Australia's land is used for agricultural activities with farming being a major economic driver. With the population increasing, the demand for food grains and other crops is also rising. This has pushed farmers to increase crop yield through the use of nitrogen fertilizers like ammonia and urea. The growing importance of food security is also encouraging greater fertilizer use. Moreover, favorable government initiatives and subsidies for the agriculture sector promote higher fertilizer consumption. All these factors contribute to the increased demand for ammonia in Australia over the forecast period.

SWOT Analysis Strength: Incitec Pivot Limited, Yara International ASA, Orica Limited are among the leading players in Australia with extensive production facilities and distribution network in the country. They have economies of scale and can leverage their expertise to produce ammonia at competitive costs. Australia has abundant natural gas reserves, a key raw material for ammonia production. This ensures secure feedstock supply and price stability. The agriculture industry is a major consumer of ammonia as fertilizer. Growing demand from this sector is expected to drive ammonia consumption.

Weakness: Ammonia is corrosive in nature and its production and transportation require special equipment and safety measures. This increases operating costs. Strict environmental regulations regarding emissions from fertilizer plants increase compliance costs. Fluctuations in natural gas prices can impact input costs and undermine profit margins of producers.

Opportunity: Rapid growth in population and rising food demand in Australia is boosting fertilizer usage. This will create increased demand for ammonia. Government support for agriculture through subsidies on fertilizers can spur consumption. Emerging non-fertilizer uses such as construction chemicals offer new opportunities. Import restrictions may arise which can benefit domestic manufacturers.

Threats: Stiff competition from cheaper imports can threat local producers. Trade disputes or global economic slowdown can negatively impact export opportunities. Stringent health, safety and environmental standards increase regulatory burden. Substitution threat from alternative fertilizers poses competition risks.

Key Takeaways The Australian ammonia market is expected to witness high growth over the forecast period supported by robust demand from the agriculture sector. Australia is highly dependent on imports to meet domestic ammonia demand indicating prospects for local manufacturers. The global Australia Ammonia Market is estimated to be valued at US$ 934.85 Million in 2023 and is expected to exhibit a CAGR of 6.40% over the forecast period 2023-2030.

The agriculture industry is the major end-user of ammonia in Australia accounting for over 80% of total consumption. Queensland and New South Wales are the fastest growing regions driven by their large agriculture and mining industries. Major plants owned by Incitec Pivot and Orica are located in Queensland capitalizing on available gas reserves.

Key players operating in the Australian ammonia market are Incitec Pivot Limited, Yara International ASA, and Orica Limited. Incitec Pivot Limited is the largest producer with facilities in Queensland and Victoria. It is expanding capacity to leverage growth opportunities. Yara International ASA operates an ammonia import terminal at Port Kembla to serve the needs of industrial customers.

#Australia Ammonia Market Share#Australia Ammonia Market Growth#Australia Ammonia Market Demand#Australia Ammonia Market Trend#Australia Ammonia Market Analysis

0 notes

Text

Beyond the Burn: a photographic expedition of Australian solar farms

Conducted through June and supported by the Smart Energy Council in collaboration with the solar industry, Beyond the Burn tells the story of solar’s triumph by capturing the solar farms powering Australia’s clean energy future, and the people behind them.

Led by acclaimed Australian Geographic photographer Ralph Alphonso, the expedition journeys through rural New South Wales, Queensland and Victoria stopping at Bomen, Nevertire, Warwick, Jemalong, Bannerton and Karadoc, and will be shared retrospectively via Nextracker’s social media channels. Companies who collaborated to make the project possible include The University of Queensland, Foresight Group, WIRSOL, Spark Renewables, Genex Power, New Energy Solar, Elliott Green Power, BayWa r.e. and Impact Investment Group.

The project marks an inflection point in Australia’s adoption of utility solar, which made its humble debut in 2012 with the construction of the 10 MW Greenough River Solar Farm in Geraldton, Western Australia. Since then, it has faced a fossil fuel-favoured policy environment, grid connection delays, export curtailments and investment uncertainty, delaying the sector’s ability to occupy a significant share of Australia’s energy mix.

However, in 2017 installations >10 MW jumped by more than 500% (Rystad Energy) and remained strong, despite these challenges remaining unchanged. Today, Australia has more than 380 large-scale PV assets amounting to 8.4 GW of capacity at or beyond financial close (Rystad Energy). In 2020, it contributed 10.9% of Australia’s renewable energy generation. In May 2021, large-scale PV generation exceeded the average generation for gas for the first time ever (AER Q1-21 Market Report).

“We’re proud to endorse this great expedition showcasing some of Australia’s solar farms,” said John Grimes, CEO of the Smart Energy Council. “It’s remarkable to think of how far utility solar has come in recent years, but that is all changing now. Indications point to the segment’s underlying strength and it makes sense that it will see exponential growth with the easing of some of these challenges, and this is something the Smart Energy Council is actively pushing for.”

Further illustrating the business case for large-scale solar, CSIRO’s GenCost 2020-21 consultation draft issued in December showed that the levelised cost of energy (LCOE) of solar PV is far cheaper than the LCOE of new coal and gas plants, even with transmission and storage costs taken into account.

Two of regional Australia’s most vocal proponents of renewable energy, farming and agriculture, not only stand to benefit from cheaper, cleaner power but also feel perhaps the greatest impacts of climate change among Australians.

“Farming and renewable energy go hand in hand,” said former Young Farmer of the Year, and one of the founding directors of Farmers for Climate Action, Anika Molesworth. “Solar helps reduce power prices for regional communities, gives farmers a way to diversify and offset the troughs associated with the impacts of extreme weather, and offers a means to increase land productivity by continuing farming activities whilst leasing land to solar developers. I’ve put my voice behind Beyond the Burn because I’m a farmer who loves solar, I want to see more of it and the sooner Australia moves beyond fossil fuels, the better.”

Between farming, agriculture, net zero emissions targets by 2030 in mining and manufacturing, green hydrogen and ammonia, regional industries and mega projects like SunCable and the Asian Renewable Hub are calling for more renewables, and it’s this demand that’s driving utility PV.

As Australian demand for utility-scale solar has grown, so too has Nextracker. 91% of utility PV in Australia uses solar tracker systems (Rystad Energy) to maximise output by tracking the sun throughout the day. Since Nextracker Australia was established in May 2016, it has supplied 79 live and committed assets to date and is now approaching 5 GW of installed capacity in just five years.

“This market is tremendously important to Nextracker and we see this milestone as reason to pause and acknowledge what is driving it,” said Peter Wheale, Vice President of Australia, South East Asia and the Pacific at Nextracker. “What is driving utility solar is everyday Australians — people who see the value in solar, are staking their bets on it and, ultimately, investing.”

Follow the expedition via Nextracker’s Facebook, LinkedIn, Twitter and Instagram pages.

Pictured: UQ’s Warwick Solar Farm.

source http://sustainabilitymatters.net.au/content/energy/article/beyond-the-burn-a-photographic-expedition-of-australian-solar-farms-1210067610

from WordPress https://davidkent.home.blog/2021/07/22/beyond-the-burn-a-photographic-expedition-of-australian-solar-farms/

0 notes

Text

Green Hydrogen, The Fuel Of The Future, Set For 50-Fold Expansion

New Post has been published on https://perfectirishgifts.com/green-hydrogen-the-fuel-of-the-future-set-for-50-fold-expansion/

Green Hydrogen, The Fuel Of The Future, Set For 50-Fold Expansion

Green hydrogen, produced using renewable energy, could decarbonise some of the most energy-intensive … [] industries.

Hydrogen has been the fuel of the future for decades, always promising to deliver huge benefits in about five years’ time.

Now it looks like the future has arrived as seven of the biggest green hydrogen project developers come together to launch the Green Hydrogen Catapult Initiative in a bid to increase the production of green hydrogen 50-fold in the next six years.

Green hydrogen is produced using renewable energy and electrolysis to split water and is distinct from grey hydrogen, which is produced from methane and releases greenhouse gases into the atmosphere, and blue hydrogen, which captures those emissions and stores them underground to prevent them causing climate change.

The new initiative aims to cut the cost of green hydrogen to less than $2/kg, which would help to cut emissions from the world’s most carbon-intensive industries including steelmaking, shipping, chemicals production and power generation. The founding partners are Saudi clean energy group ACWA Power, Australian project developer CWP Renewables, Chinese wind turbine manufacturer Envision, European energy giants Iberdrola and Ørsted, Italian gas group Snam, and Yara, a Norwegian fertilizer producer.

Recent analysis suggests$2/kg is a potential tipping point that will make green hydrogen and its derivative fuels competitive multiple sectors, including steel and fertilizer production, power generation, and long-range shipping. Green ammonia, which is made from green hydrogen, is being tested as a possible replacement for fossil fuels in thermal power generation, which would greatly decrease the emissions intensity of existing energy infrastructure.

The companies hope to see 25GW of green hydrogen production by 2026, which would have a major impact on the emissions of heavy industry and transportation sectors.

“From an industry perspective, we see no technical barriers to achieving this, so it’s time to get on with the virtuous cycle of cost reduction through scale up,” said says Paddy Padmanathan, CEO of ACWA Power. “Having led the race to deliver photovoltaic energy at well-below US$2 cents per kilowatt-hour, in certain geographies, we believe the collective ingenuity and entrepreneurship of the private sector can deliver green hydrogen at less than US$2 per kilogram within four years.”

Scaling up green hydrogen will be essential to helping global economies to achieve net zero emissions by 2050 and limit global temperature rises to 1.5C.

Green hydrogen could supply up to 25% of the world’s energy needs by 2050 and become a US$10 trillion addressable market by 2050, according to Goldman Sachs. A number of countries have recently published national hydrogen strategies, including Australia, Chile, Germany, the EU, Japan, New Zealand, Portugal, Spain and South Korea.

To meet the target of the Catapult will require investment of roughly US$110 billion and create more than 120,000 jobs, so it will also play an important part in helping economies to recover from the impacts of COVID-19.

The group is looking for more members – “committed businesses with aligned vision and gigawatt-scale projects under development, as well as mission-aligned investors, customers, and city and regional governments” to participate as the initiative takes shape and builds global momentum in advance of the next UN Climate Summit, scheduled to be held in Glasgow in November 2021.

Investment in green hydrogen production is set to exceed $1billion a year by 2023 as the costs of both renewable power and electrolyser technology fall and governments introduce supportive policies, according to IHS Markit, which said before the announcement of the Green Hydrogen Catapult that there was already a pipeline of 23GW of electrolysis projects, up from current capacity of just 82MW.

“Investment in electrolysis is booming around the world. The pipeline through 2030 is for over 23 GW of capacity to be developed—more than 280 times current capacity,” said Catherine Robinson, executive director, Hydrogen and Renewable Gas at IHS Markit.

Green hydrogen production costs have fallen by 40% since 2015 and are expected to fall by a further 40% through 2025.

From Energy in Perfectirishgifts

0 notes

Text

AUSTRALIA AMMONIA MARKET ANALYSIS

Australia Ammonia Market, By Product Type (Anhydrous Ammonia, Aqueous Ammonia), By End Use (Ammonium Nitrate, Nitric Acid, Ammonium Sulphate, Urea, DAP, MAP, Others), By Application (Agrochemicals, Industrial Chemicals, Explosives, Others), and By Region (New South Wales, Victoria, Queensland, Western Australia, Rest of Australia) - Size, Share, Outlook, and Opportunity Analysis, 2019 – 2027

Definition of Market/Industry:

Ammonia is one of the most abundant nitrogen-containing compounds with formula NH3. It is a colorless gas with a distinct pungent odor and occurs naturally in the environment in the air, plant, soil, and animals including humans. In humans, the synthesis of ammonia takes place when the body breaks down food especially protein into amino acid and then converting the ammonia into urea. Household ammonia is commonly called ammonium hydroxide, it is an ingredient that is mainly used in various cleaning products for breaking down stains such as cooking grease and other stains.

In 2018, Australia ammonia market was valued at US$ 776.1 million, in terms of revenue and 1,581.5 kilo tons in terms of volume.

Drivers

Rising consumption of ammonia-based fertilizer in Australia to enhance the yield productivity to meet the growing demand for food. According to the Australian Bureau of Statistics Agricultural businesses in Western Australia continued to fertilize the largest areas of land with 19 million hectares reported in 2016-17 or 37% of Australia's total area of agricultural land fertilized. Both Western Australia and New South Wales (including the ACT) used the largest amounts of fertilizer during 2016-17 with both applying just over 1 million tons.

Rising demand for household cleaning products as ammonia has excellent cleanser property and mainly used to produce household cleaning products such as window cleaners, bathroom cleaners, drain cleaners, toilet cleaners, oven cleaners, etc. Increasing disposable income of the people and improving the living of standards is another major factor expected to propel the market growth of the ammonia over the forecast period.

Among region, Western Australia region dominated the Australia ammonia market in 2018, accounting for 34.1% share in terms of value, followed by New South Wales and Queensland, respectively.

Figure 1. Australia Ammonia Market Share (%), By Region, 2018

Market Restraints

High dependency of the Australia agriculture industry on imports of fertilizer products from China and other countries is projected to impact the sales of ammonia for the production of fertilizers in the region. Moreover, variation in seasonal demand for fertilizers is also projected to lower the demand for ammonia, especially in Queensland and Victoria. Hence, the aforementioned factors are presumed to hinder the market growth of Australia ammonia over the forecast period.

Ammonia as a refrigerant has a major disadvantage due to its toxicity because of its hygroscopic nature, it spread to most areas of the body such as eyes, throat, and nose and may lead to severe burn injuries. Moreover, ammonia as a refrigerant may cause various skin and respiratory disorders on exposure. Hence, health issues associated with the exposure of ammonia as refrigerant is expected to hinder the Australia market growth over the forecast period.

Market Opportunities

The rising focus of the manufacturer of the Australia ammonia market to produce green ammonia in order to promote sustainability is expected to fuel market growth. For instance, in September 2019, on behalf of the Australian Government, the Australian Renewable Energy Agency (ARENA) has provided $1.9 million in funding to Queensland Nitrates Pty Ltd (QNP) to assess the feasibility of the construction and operation of a renewable ammonia plant at its existing facility near Moura in Central Queensland.

Increasing focus of politicians of Australia to export solar power using ammonia is expected to fuel the market growth of the Australia ammonia market. For instance, in October 2017, Yara’s Australian unit announced plans to build a pilot plant to produce ammonia using solar power. This is a key step in Australia’s efforts to develop its economy around clean energy exports and could lead to a new system of global trade in which renewable ammonia is an energy commodity.

Figure 2. Australia Ammonia Market – Opportunity Analysis

Market Trends/Key Takeaways

Rising investment by the major manufacturer in Australia is expected to foster market growth over the forecast period. For instance, in October 2019, the Australian government will allocate US$ 1.93 million in financing for two studies seeking to explore the potential of using green hydrogen from wind and solar power electrolysis in the production of ammonia. Therefore, rising support of the Australian government in order to expand the application of ammonia is expected to fuel the market growth.

An increasing number of partnerships in the Australia region is projected to augment market growth over the forecast period. For instance, in November 2018, Australia’s Commonwealth Scientific and Industrial Research Organization (CSIRO) announced the formation of a partnership that will support the commercialization of CSIRO’s high-purity ammonia-to-hydrogen conversion technology. Therefore, the rising number of partnerships in the country is expected to fuel market growth.

Figure 3. Australia Ammonia Market Share (%), By Application, 2018

Based on application, Australia ammonia market is segmented into agrochemicals, industrial chemicals, explosives, and others. In 2018, industrial chemicals accounted for largest chunk of the market and contributed for the revenue share of 41.8% in the same year, followed by agrochemicals and explosives.

Competitive Section:

Company Profiles

Players active in the market are Incitec Pivot Limited, Yara International ASA, Orica Limited, and Wesfarmers Chemicals, Energy & Fertilisers

Few Recent Developments

Incitec Pivot Limited

In October 2016, Incitec Pivot Limited Chairman Paul Brasher and Cornerstone Chemical CEO Greg Zoglio dedicated the US$1.025 billion production plant that includes the combined construction of Dyno Nobel’s $850 million ammonia plant with Cornerstone Chemical’s US$175 million investment in upgrades and infrastructure.

In 2015, the company set up a plant with an annual capacity of 800 KT of ammonia in Louisiana, U.S. The plant is expected to commence production by Q3 2016.

Request sample report here:

https://www.coherentmarketinsights.com/insight/request-sample/3287

Download PDF brochure here:

https://www.coherentmarketinsights.com/insight/request-pdf/3287

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized market research service

Industry analysis services

Business consulting services

Market intelligence services

Long term engagement model

Country specific analysis

Contact Us:

Mr. shah

Coherent Market Insights Pvt. Ltd.

Address: Coherent Market Insights 1001 4th Ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Source: https://www.coherentmarketinsights.com/market-insight/australia-ammonia-market-3287

0 notes