#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market size

Explore tagged Tumblr posts

Text

Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market - Forecast(2024 - 2030)

AI in Cobots Market Overview

The global AI in cobots market in 2021 reached $118.2 million and is estimated to grow at a CAGR of 34.22% during the forecast period to reach $616.3 million by 2027. The entire robotics industry is witnessing the effects of Covid-19 pandemic, with strain felt on the supply chain restricting parts of imports and equipment exports in H1 2021 especially. The overall economic uncertainty also pushed majority of customers to defer purchases in order to conserve capital. Recent advancements in Machine Learning and human robot interaction have enabled collaborative robots to precisely execute tasks in dynamically changing workspaces, enabling operations and material handling to run more smoothly, efficiently and productively. AI is now intelligently powering cobots by leveraging billions of hours of iterative machine learned practices in manufacturing, production and engineering. Collaborative robots (cobots) represent a variant of industrial robots and is currently considered to be one of the fastest growing segments in industrial automation driven by improved technology such as virtual assistants, cloud computing, internet of things. A cobot is a type of robot that is designed to operate alongside humans in shared workspaces. These machines are easy to program and deploy, can increase productivity manifold, and offer high returns on investment.

Report Coverage

The report: “AI in Cobots Market – Forecast (2022-2027)”, by IndustryARC covers an in-depth analysis of the following segments of the AI in Cobots market

By Payload: Up to 5 Kg, 5 to 10 Kg, Above 10 Kg. By Application: Handling, Assembling/Disassembling, Welding and Soldering, Dispensing, Packaging and Others. By End User: Automotive, Electronics, Semiconductor, Plastics and Polymer, Food and Beverage, Healthcare, Metals and Machining and others. By Geography: North America (U.S, Canada, Mexico), South America (Brazil, Argentina and others), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC (China, Japan India, SK, Aus and Others), and RoW (Middle east and Africa).

Request Sample

Key Takeaways

Group PSA’s Sochaux plant in France has chosen Universal Robots UR10 for its "Plant of the Future" Project. Two UR10 cobots have been implemented at the Sochaux plant in screw driving applications on body-in-white assembly lines to increase performance and reduce production costs at the factory.

In 2019, Walmart has planned to invest $2.7 billion to add new robots totaling almost 4,000 robots in its stores and facilities in order to shift human workforce to customer service roles. The robots are majorly used for scanning, sorting goods from delivery trucks. This is set to create opportunities for AI in cobots in retail sector.

AI in Cobots Market Segment Analysis – By Application

Material Handling had a major share in the AI in Cobots Market with a value share of approximately 22.3% in 2021. Material handling is one of the major applications of industrial robots. Robots in material handling segment are used in applications such as movement of goods, protection, storage and control of products throughout manufacturing as well as warehousing of the products. Any industries that need to store, receive, dispatch or ship its products always entail industrial robot. Manufacturing and Warehouse operations involving handling of goods becomes complex when it takes place at a larger scale. This is made easy and efficient with the aid of industrial robots. Material handling robots are majorly used in warehousing applications as compared to its counterpart. Material handling applications that benefit from the incorporation of AI cobots encompass picking, packing, palletizing, sorting, and more. The wide-ranging use of these applications makes them a more site-specific solution for safety implementation. Operators and other workers are often moving or transporting other materials around the AI cobot, requiring additional planning to avoid hazardous contact. Safety-rated grippers are rare in the market at the present time. Currently, manufacturers typically use pneumatic grippers, which require safety considerations for impacts and the loss of power or suction. Uses of bar code, RFID, voice-activated receiving and packaging, pick-to-light technology, transportation management system is some of the drifts observed by material handling robots. Cycle counting, annual, physical and perpetual are few approaches of keeping a track of inventory.

Inquiry Before Buying

AI in Cobots Market Segment Analysis – By End User

Among industries, automotive held the largest share in 2021 at 23.2%. The industry development of AI cobots is ongoing in several different areas. Faster reaction time, more exact movement patterns, orientation capabilities, capabilities in imitating humans – all these aspects contribute to advancements in AI driven cobot development. In addition, brain-computer interfaces is an exciting area that has made significant progress recently. In recent developments in technologies such as linked data, parallel processing, edge computing and distributed artificial intelligence allow for efficient decision making by cobots, making execution robust and efficient. A challenge with the market deployment of AI cobots is that insufficient technology maturity hinders the market deployment of cobots. AI Cobot technology includes hardware design, sensors and actuators, efficient information processing, video processing, planning and multiple of fields from artificial intelligence landscapes, along with technologies that ensure safety, predictability and security of the solution. There is currently a need for high amount of signaling, bandwidth, low latency, and fast decision-making capabilities through efficient computing for AI driven cobots in safety-critical environments, wherein the facilities do not need human intervention. While the automation industry was affected during the pandemic, the longterm outlook for automation is positive, as end users evaluate their reliance on overseas supply chains and reevaluate their operations in a world where a pandemic can stop production cold. Automation is hence being looked upon as a valuable bulwark against the risks laid bare during the pandemic, and this can act as a strong growth driver for AI driven cobots and robots in industrial automation end user verticals.

AI in Cobots Market Segment Analysis – By Geography

Geographically, APAC held major share of 37% of AI in cobots market share in 2021, owing to high adoption of automation technologies in industrial and automotive warehouses and increasing investments and funding. North America is the next largest market with 33% revenue share in 2021. South America is witnessing the fastest growth rate with a CAGR of around 46.6% during the forecast period 2022 – 2027 owing to high investments and growing deployment of automation technology mainly in the countries such as Brazil, Argentina and Colombia. Portuguese company MOV.AI has announced in October, 2020 that it has raised $4m in funding. The company has designed its ROS for manufacturers of cobots, as well as academics and automation integrators. It also contributes to the ROS community. Some of the robots with AI enabled are YuMi from ABB, Franka Emika Panda, APAS from Bosch, Aura, Aubo, NEXTAGE and CORO etc.

Schedule a Call

AI in Cobots Market Drivers

Growing demand for automation and technological advancements set to drive the AI In Collaborative Robotics Market

There has been significant growth in AI driven collaborative robotics market owing to the increased demand for automation, high competition in the e-commerce industry, and the advancement in technologies such as Internet of Things (IoT) and Artificial Intelligence (AI). The use of robots reduces the risk of injury to workforce has also witnessed growth. Integration of robots with artificial intelligence (AI) and machine vision technology has been assisting companies in obstacle detection, navigation, movement of the goods. This has been attracting vendors in automating the warehouses and installing the robots in warehouse, thereby driving the collaborative robotics market. In 2019, Geek Plus Robotics, an intelligent logistics robot solution provider had launched the world’s first interweaving sorting robot, which could be an alternative to conveyor systems. Mobile Industrial Robots (MiR), a leading manufacturer of collaborative mobile robots launched a new warehouse robot to automate the transportation of pallets and heavy goods across warehouses. Development of new robots for various applications of warehouses set to boost the demand of collaborative robotics market.

Growth in E-Commerce Sector

E-Commerce industry is rising at global level of retail and logistics. As a result, growing number of e-commerce companies look forward to automate warehouses. Warehouse robots play a key role in e-commerce industry for various applications such as automated storage and retrieval, picking and placing, order fulfillment operations and many others. Adoption of warehouse cobots by e-commerce companies helps in reducing operational and logistical costs and save on delivery time. This has been increasing automation in warehouses in order to deliver goods to shoppers in faster and more efficient ways by increasing productivity of supply chain. In developed countries such as the U.S., and Canada, Grocery retailers are focusing on deploying robots that bring the shelf stacks to human workers, who pick out the right products and package them up to be sent out. These robots travel with high speed, faster than humans, thereby increasing efficiency of the work. In 2019, Amazon had introduced new warehouse cobots in several of its U.S. warehouses that scan and pack items to be sent to customers. It has started using robots in warehouses, which scans goods coming down a conveyor belt raising the scope of adoption. In 2020 Covariant.ai launched its AI robots and solutions through its warehouse bin-picking robots which is being used by companies such as Knapp, a warehouse logistics company and Obeta, a German electronics retailer. As per estimates, around 2,000 AI powered robots have been deployed across warehouses globally.

AI in Cobots Market Challenges

High Initial Investment

The initial cost of AI driven collaborative robots that are used in factories are high as the cost of automation is much higher in comparison with labor costs. This prevents most companies from completely automating their operations with robots. The average selling prices of cobots vary from $25,000 to $50,000 and does not include the installation costs. In addition to this, there is a training cost associated with the robots that further restricts the operators’ likeability for integrating robots into their operating lines. Slow deployment of collaborative robotic systems by smaller and medium enterprises hampers the robotics market. However, high labor costs are set to drive the collaborative robot market during forecast period.

Buy Now

AI in Cobots Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the AI in Cobots market. In 2021, the market of AI in Cobots market has been consolidated by the top players

Fanuc

Techman Robots

Rethink Robots

AUBA Robots

ABB

Kawasaki

KUKA

Yaskawa

Staubli

Universal Robots

Recent Developments

In May 2019, the government of Saudi Arabia announced an investment of $30 billion to upgrade warehousing facilities by adoption of the advanced autonomous robots in the newly built warehouses across Saudi Arabia, thereby contributing towards the growth of the cobots market during forecast period in this region.

In October 2019, the South Korean government announced an investment $150 million to develop the intelligent robots for various industrial application which includes warehousing and logistics, thereby enhancing the growth of the cobots market.

#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market size#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Industry#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market share#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems top 10 companies#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Market Report#Artificial Intelligence (AI) in Collaborative Robotic (Cobots) Systems Industry outlook

0 notes

Text

Industrial Robot Components Market Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast By 2033

The industrial robot components market in the United States is positioned for significant growth, featuring a forecasted Compound Annual Growth Rate (CAGR) of 13.3%. The increasing adoption of industrial robots, notably in the United States within the wider Americas region, stands out as a pivotal factor driving the heightened demand for these cutting-edge robotic technologies.

The projected value of the global industrial robot components market (産業用ロボット��品市場) is expected to reach US$ 6.3 billion in 2023. Further, a robust compound annual growth rate (CAGR) of 13.9% is anticipated, aiming to propel the market to a substantial US$ 23.2 billion by the conclusion of 2033.

Download a Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8227

In recent years, the Industrial Robot Components Market has witnessed a profound transformation driven by the integration of cutting-edge technologies. The relentless pursuit of automation and efficiency has spurred the development of innovative solutions, revolutionizing the way industrial robots are designed and operated.

Artificial Intelligence and Machine Learning Integration:

The infusion of artificial intelligence (AI) and machine learning (ML) into industrial robot components has been a game-changer. Smart sensors and advanced algorithms enable robots to adapt to changing environments, enhance decision-making capabilities, and optimize performance. This integration not only improves precision but also facilitates predictive maintenance, reducing downtime and increasing overall operational efficiency.

Internet of Things (IoT) Connectivity:

The rise of Industry 4.0 has brought about a new era of connectivity, and industrial robots are no exception. IoT-enabled components allow seamless communication between robots and other machinery, creating a networked and synchronized manufacturing ecosystem. Real-time data exchange enhances production visibility, streamlines processes, and enables manufacturers to make data-driven decisions for better outcomes.

Robotic Vision Systems:

Vision systems, powered by advancements in computer vision and image processing, have significantly enhanced the perception capabilities of industrial robots. These systems enable robots to "see" and interpret their surroundings, facilitating tasks such as object recognition, quality control, and even complex assembly processes. As a result, the scope of applications for industrial robots has expanded, driving demand for more sophisticated vision-based components.

Collaborative Robotics (Cobots):

The advent of collaborative robots, or cobots, has redefined human-robot interaction on the factory floor. These robots are designed to work alongside human operators, promoting a safer and more collaborative working environment. The integration of sensitive force and torque sensors in industrial robot components ensures that cobots can operate with precision and adapt to dynamic changes in their surroundings, further contributing to the evolution of manufacturing processes.

Key Strategies of Industry Leaders

Leading manufacturers of industrial robot components, including FANUC, Denso Corporation, Kuka, Mitsubishi Electrical, ABB, Yaskawa, and Kawasaki Heavy Industries, are implementing crucial strategies for market dominance.

These industry titans are concentrating on providing high-quality and resilient components, fostering a dedicated customer base, and bolstering brand recognition. The integration of customization options not only meets diverse customer needs but also presents substantial opportunities for sustained revenue growth.

Moreover, forging enduring trade relationships directly with end-users is a strategic move aimed at driving future demand for industrial robot components. This approach positions market players to secure elevated profit margins while ensuring sustained growth in the years to come.

Segmentation of Industrial Robot Components Industry Research

By Component :

Controller

Sensor

Robot Arm/Manipulator

End Effector

Drive

Feedback Devices

By Application :

Cartesian Robots

Scara Robots

Articulated Robots

Cylindrical Robots

Delta Robots

Polar Robots

Collaborative Robots

By Region :

North America

Latin America

Europe

East Asia

South Asia & Oceania

MEA

The convergence of these emerging technologies is reshaping the landscape of the Industrial Robot Components Market. As manufacturers increasingly embrace automation and smart manufacturing practices, the demand for technologically advanced components continues to surge. The ongoing integration of AI, IoT, robotic vision, collaborative robotics, and advanced materials sets the stage for a transformative era in industrial automation, promising increased efficiency, flexibility, and innovation in manufacturing processes. As the industry adapts to these changes, stakeholders can anticipate a future where industrial robots play an even more pivotal role in driving economic growth and sustainable development.

𝐂𝐡𝐞𝐜𝐤 𝐎𝐮𝐭 𝐌𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Robot Kit Market CO2 Dosing System Market Chlorine Injection Systems Market

Contact:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Warehouse Robotics Market to Witness 4X Expansion by 2034, Redefining Global Supply Chain Efficiency

Market Overview

The warehouse robotics market is undergoing a significant transformation, driven by the rise of automation and intelligent technologies. As global supply chains become increasingly complex, warehouses are under pressure to boost efficiency, reduce human error, and improve throughput. Warehouse robotics, encompassing a broad array of robot types including mobile robotics, SCARA robots, and autonomous guided vehicles, are becoming indispensable assets in achieving these goals. The integration of technologies such as artificial intelligence, machine learning, and sensor fusion is pushing the boundaries of what robotic systems can achieve in modern warehousing environments.

From automated storage and retrieval systems to pick-and-place robots and sorting systems, warehouse robotics are reshaping operations across industries such as e-commerce, automotive, pharmaceutical, logistics, and food & beverage. These robots offer unparalleled precision and consistency in performing tasks such as picking, packing, sorting, transportation, and storage.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS20302

Market Dynamics

Several key factors are fueling the growth of the warehouse robotics market. First and foremost is the escalating demand for faster and error-free order fulfillment in e-commerce and retail sectors. With consumer expectations for same-day or next-day deliveries, warehouses must evolve to match speed with accuracy—something robotics can deliver efficiently.

Another critical driver is the shortage of labor in many developed countries. Robotics offer a viable solution to fill the gap left by the dwindling workforce, especially in repetitive and physically demanding tasks. Moreover, with the rise of Industry 4.0, businesses are focusing more on automation and digital transformation to remain competitive.

On the technology front, the convergence of IoT, AI, and computer vision is enabling more adaptive, self-learning robots. These advancements are enhancing decision-making capabilities and reducing the need for human intervention in complex processes. Additionally, the cloud-based and hybrid deployment models are providing scalability and remote operability, making warehouse robotics more accessible even for medium-sized enterprises.

Key Players Analysis

The warehouse robotics market is highly competitive, with several global players innovating aggressively. Companies such as ABB Ltd., Fanuc Corporation, KUKA AG, Omron Corporation, Yaskawa Electric Corporation, and Amazon Robotics are leading the charge. These organizations are investing heavily in R&D to improve robot autonomy, agility, and intelligence.

Smaller firms and startups are also making their mark by focusing on niche applications like collaborative robots (cobots) and AI-powered mobile units. The presence of a diverse ecosystem of players is promoting healthy competition and fostering innovation across the board.

Regional Analysis

Regionally, North America leads the warehouse robotics market, driven by the strong presence of tech giants, a mature e-commerce ecosystem, and early adoption of automation in logistics. The United States continues to be a hub for innovation in robotic technologies.

Europe follows closely, especially countries like Germany, the UK, and France, where there is a strong emphasis on industrial automation. Meanwhile, Asia-Pacific is emerging as the fastest-growing market. Nations like China, Japan, and South Korea are investing in smart warehousing infrastructure, and their manufacturing-led economies are fueling demand for robotic systems.

Latin America and the Middle East & Africa are still in early stages of adoption, but increasing investments in infrastructure and digital transformation are expected to drive future growth.

Browse Full Report @ https://www.globalinsightservices.com/reports/warehouse-robotics-market/

Recent News & Developments

The warehouse robotics landscape is evolving rapidly with numerous strategic developments. In recent months, major players have launched new-generation robots equipped with AI-enabled computer vision for more accurate picking and sorting. Several companies have announced partnerships with cloud service providers to offer scalable, cloud-based warehouse management solutions.

Additionally, M&A activity is on the rise. Companies are acquiring startups focused on autonomous navigation, sensor development, and predictive analytics to enrich their technological capabilities. There is also a growing focus on sustainability, with the development of energy-efficient robots and systems that reduce operational carbon footprints.

Scope of the Report

The warehouse robotics market report provides a comprehensive overview of the current trends, future projections, and technological innovations that are shaping the future of warehouse operations. Covering segments by type (e.g., articulated, SCARA, cartesian), product (e.g., palletizers, conveyors), technology (e.g., AI, ML, IoT), component (e.g., controllers, actuators), application, deployment model, and end-user verticals, the report offers valuable insights for stakeholders across the ecosystem.

This market is no longer a futuristic vision—warehouse robotics are here, and they are redefining how goods are stored, picked, packed, and delivered. As companies increasingly adopt automation to meet demand and reduce costs, warehouse robotics will play a critical role in shaping the logistics landscape of tomorrow.

Discover Additional Market Insights from Global Insight Services:

Advanced Optics Market: https://www.globalinsightservices.com/reports/advanced-optics-market/

RJ45 Connectors Market: https://www.globalinsightservices.com/reports/rj45-connectors-market/

Connector Market: https://www.globalinsightservices.com/reports/connector-market/

Microcontroller IC Market: https://www.globalinsightservices.com/reports/microcontroller-ic-market/

Vibration Analyzer Market: https://www.globalinsightservices.com/reports/vibration-analyzer-market/

0 notes

Text

Robotic Gripper System Market Size, Challenges & Innovations 2032

Robotic Gripper System Market Overview The Robotic Gripper System Market is experiencing robust growth, driven by rapid industrial automation and rising demand for precision in manufacturing processes. In 2024, the global robotic gripper system market was valued at approximately USD 1.8 billion and is projected to expand at a CAGR of 10.5% from 2025 to 2032, potentially reaching USD 3.8 billion by the end of the forecast period. The growing adoption of robotics in sectors like automotive, electronics, e-commerce, and logistics is fueling demand for advanced gripper technologies. Increased investment in smart factories and Industry 4.0 initiatives, coupled with the rising need for flexible, adaptive gripping solutions, are key drivers enhancing market scalability. Furthermore, advancements in material handling systems, artificial intelligence, and machine learning are transforming robotic end-effectors into intelligent tools, reinforcing market expansion. Robotic Gripper System Market Dynamics Market Drivers: Key factors accelerating the market include the surge in industrial automation, labor shortages in manufacturing, and the need for high-speed, accurate material handling. Technological convergence with IoT and AI has led to the creation of smart grippers that improve operational efficiency and reduce downtime. Market Restraints: However, high initial costs and integration complexity act as constraints, particularly for small and medium enterprises (SMEs). Additionally, the lack of standardization across robotic systems limits interoperability. Opportunities: There are immense growth opportunities in emerging economies, where industrialization and government support for automation are rising. The shift towards collaborative robots (cobots) is also creating new avenues for gripper systems designed for human-machine interaction. Sustainability regulations and eco-friendly designs are further shaping product development strategies, encouraging the adoption of energy-efficient and recyclable materials. Download Full PDF Sample Copy of Robotic Gripper System Market Report @ https://www.verifiedmarketresearch.com/download-sample?rid=20524&utm_source=PR-News&utm_medium=387 Robotic Gripper System Market Trends and Innovations Innovation is at the core of market growth. One notable trend is the emergence of soft grippers using flexible materials and adaptive algorithms to handle delicate objects, particularly in food, pharmaceuticals, and agriculture. Magnetic and vacuum grippers are gaining popularity due to their non-contact gripping capabilities, which are ideal for cleanroom environments. Collaborative development between robotics manufacturers and AI software providers is leading to smarter, sensor-integrated grippers capable of self-learning. 3D printing and additive manufacturing are also enabling the rapid prototyping of customized gripper designs, reducing production lead time. Furthermore, wireless connectivity and predictive maintenance capabilities embedded within gripper systems are revolutionizing asset management in smart factories. Robotic Gripper System Market Challenges and Solutions Challenges: The robotic gripper market faces several challenges, including fluctuating raw material prices, complex supply chains, and concerns regarding cybersecurity in connected systems. Regulatory compliance across different regions can delay product launches and increase operational costs. Solutions: Manufacturers are addressing these issues through vertical integration of supply chains, strategic sourcing, and investing in digital twin technology for real-time simulation. To combat regulatory hurdles, companies are enhancing compliance frameworks and adopting modular designs that meet diverse global standards. Additionally, open-source platforms and standardized APIs are enabling better interoperability, reducing system integration time and cost. Robotic Gripper System Market Future Outlook The future of the robotic gripper system market is poised for transformative growth.

As automation penetrates deeper into non-traditional sectors like agriculture, healthcare, and construction, demand for advanced gripper systems will surge. The integration of AI and edge computing is expected to redefine real-time decision-making capabilities in grippers, making them more autonomous and efficient. By 2032, the market is anticipated to witness increased adoption of cloud-connected robotic systems and subscription-based service models for gripper maintenance and upgrades. Factors such as rising global e-commerce activities, expanding warehouse automation, and labor cost optimization will be pivotal in driving the market forward. The trajectory remains promising, with innovation and digitization at its core. Key Players in the Robotic Gripper System Market Robotic Gripper System Market are renowned for their innovative approach, blending advanced technology with traditional expertise. Major players focus on high-quality production standards, often emphasizing sustainability and energy efficiency. These companies dominate both domestic and international markets through continuous product development, strategic partnerships, and cutting-edge research. Leading manufacturers prioritize consumer demands and evolving trends, ensuring compliance with regulatory standards. Their competitive edge is often maintained through robust R&D investments and a strong focus on exporting premium products globally. Festo SCHUNK IAI Camozzi Zimmer Sichuan Dongju SMC Gimatic Destaco SMAC Yamaha Motor PHD HIWIN Parker Hannifin Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount?rid=20524&utm_source=PR-News&utm_medium=387 Robotic Gripper System Market Segments Analysis and Regional Economic Significance The Robotic Gripper System Market is segmented based on key parameters such as product type, application, end-user, and geography. Product segmentation highlights diverse offerings catering to specific industry needs, while application-based segmentation emphasizes varied usage across sectors. End-user segmentation identifies target industries driving demand, including healthcare, manufacturing, and consumer goods. These segments collectively offer valuable insights into market dynamics, enabling businesses to tailor strategies, enhance market positioning, and capitalize on emerging opportunities. The Robotic Gripper System Market showcases significant regional diversity, with key markets spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region contributes uniquely, driven by factors such as technological advancements, resource availability, regulatory frameworks, and consumer demand. Robotic Gripper System Market, By Product • Electric Grippers• Pneumatic Grippers Robotic Gripper System Market, By Application • Automotive Manufacturing• Electronics/Electrical• Metal Products• Food/Beverage/Personal Care• Rubber/Plastics• Others Robotic Gripper System Market By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa For More Information or Query, Visit @ https://www.verifiedmarketresearch.com/product/robotic-gripper-system-market/ About Us: Verified Market Research Verified Market Research is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions. Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research. Contact us:

Mr. Edwyne Fernandes US: +1 (650)-781-4080 US Toll-Free: +1 (800)-782-1768 Website: https://www.verifiedmarketresearch.com/ Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/mri-compatible-patient-monitoring-system-market/ https://www.verifiedmarketresearch.com/ko/product/mrna-vaccine-core-enzyme-market/ https://www.verifiedmarketresearch.com/ko/product/mud-mask-market/ https://www.verifiedmarketresearch.com/ko/product/multi-axis-sensor-market/ https://www.verifiedmarketresearch.com/ko/product/multi-client-warehousing-market/

0 notes

Text

Flexible Automation Needs Drive Strong Demand for Collaborative Robots

The global collaborative robot (cobot) market was valued at USD 1.2 billion in 2023 and is projected to expand at a remarkable CAGR of 26.1% from 2024 to 2034, reaching a market size of USD 15.3 billion by the end of 2034, according to the latest industry research. This exponential growth is primarily driven by the growing demand for workplace automation, enhanced safety standards, and advancements in robotics technology.

Market Overview: Collaborative robots designed to work safely alongside humans are transforming industries by combining precision, productivity, and adaptability. Unlike traditional industrial robots, cobots feature integrated safety mechanisms, including force-limiting sensors and intelligent programming, enabling them to perform tasks in dynamic environments shared with human workers.

These robots are increasingly adopted across industries including automotive, electronics & semiconductors, healthcare, food & beverage, and logistics, owing to their flexibility, efficiency, and cost-effectiveness.

Market Drivers & Trends

1. Surging Demand for Automation

Industries worldwide are facing escalating labor costs and demand for consistent output. Cobots are bridging the gap by enhancing productivity without replacing human labor, enabling businesses to stay competitive in fast-evolving global markets.

2. Focus on Workplace Safety & Ergonomics

Companies are investing heavily in solutions that enhance worker safety and comfort. Cobots, designed with built-in torque and speed control features, address these concerns effectively—significantly reducing workplace injuries and enhancing job satisfaction.

3. Flexibility and Reusability

Cobots can be easily programmed, re-deployed, and adapted for various tasks. This makes them invaluable in dynamic production settings, especially in consumer electronics and automotive manufacturing, where production lines often change.

Latest Market Trends

Integration of AI Capabilities: The latest cobots incorporate artificial intelligence and machine learning, enabling smarter task execution, predictive maintenance, and real-time decision-making.

Human-Robot Collaboration Enhancements: Next-gen cobots are now equipped with advanced vision systems, touch sensitivity, and voice commands, allowing seamless interaction with human co-workers.

Compact and Lightweight Designs: Smaller cobots are gaining traction among SMEs that require affordable automation with minimal footprint.

Key Players and Industry Leaders

The collaborative robot market is moderately consolidated, with leading players holding around 55–60% market share. Major companies include:

ABB Group

FANUC CORPORATION

KUKA AG

Kawasaki Heavy Industries Ltd.

Mitsubishi Electric Corporation

Yaskawa Electric Corporation

OMRON Corporation

Schneider Electric SE

These companies are investing aggressively in R&D, product portfolio expansion, and strategic acquisitions.

Access an overview of significant conclusions from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=15536

Recent Developments

Universal Robots launched the UR20 in April 2023, the company’s most powerful cobot, featuring a 20 kg payload and a 1750 mm reach—ideal for heavy-duty applications.

In March 2023, Fanuc upgraded its CRX series with enhanced AI features, simplifying programming and improving adaptability for diverse manufacturing tasks.

ABB introduced the GoFa cobot, combining high payload capacity with safety-focused operations for assembly and material handling.

Market Opportunities

As cobot technologies evolve, new applications are emerging in healthcare, pharmaceuticals, logistics, and 3PL operations. These sectors are expected to witness substantial adoption due to labor shortages and increasing demand for precision, hygiene, and continuous operations.

The electronics & semiconductors sector, in particular, is anticipated to remain a dominant force, holding a 26.5% market share in 2023 and forecast to grow at a 30.9% CAGR, driven by increasing complexity in microelectronic assemblies.

Future Outlook

Analysts forecast a bright future for the collaborative robot industry, with wider integration across small and medium-sized enterprises, AI-embedded robotics, and scalable solutions becoming the norm. Governments supporting smart manufacturing and Industry 4.0 are further fueling demand.

Companies that adopt cobot solutions early stand to benefit from:

Increased output

Enhanced safety

Greater operational flexibility

Reduced downtime

Stronger return on investment (ROI)

Market Segmentation

By Type:

Power and Force Limiting Cobots

Hand Guiding Cobots

Safety Monitored Stop Cobots

Speed and Separation Cobots

By Component:

Hardware (End Effectors, Robot Arm, Controllers, Sensors)

Software

Services

By Payload:

<5 Kg

5–10 Kg

10–20 Kg

Above 20 Kg

By Application:

Material Handling

Assembly

Inspection & Quality Testing

Painting

Others

By End-use Industry:

Automotive

Electronics & Semiconductors

Healthcare

Food & Beverage

Aerospace & Defense

3PL

Others

Regional Insights

Asia Pacific led the global collaborative robot market in 2023 with a 34.2% share and is expected to grow at 28.9% CAGR. The region houses the world’s top manufacturing economies—China, Japan, South Korea, and India—driven by:

Large-scale manufacturing units

Government incentives for automation

Growing SMEs looking for cost-effective automation solutions

North America and Europe are also growing steadily due to technological maturity and early adoption of automation solutions.

Why Buy This Report?

Comprehensive market sizing and forecasts (2024–2034)

Detailed segmentation by type, payload, component, application, and region

Strategic analysis of key players and market shares

Coverage of recent innovations and technological developments

Insights into growth opportunities and investment areas

Regional performance analysis across North America, Europe, Asia Pacific, and more

In-depth industry dynamics: drivers, restraints, and future prospects

Explore Latest Research Reports by Transparency Market Research:

Surface Acoustic Wave (SAW) Devices Market: https://www.transparencymarketresearch.com/surface-acoustic-wave-sensors.html

Rugged Power Supply Market: https://www.transparencymarketresearch.com/rugged-power-supply-market.html

Ceramified Cable Market: https://www.transparencymarketresearch.com/ceramified-cable-market.html

Gantry (Cartesian) Robot Market: https://www.transparencymarketresearch.com/gantry-robot-market.htmlAbout Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Collaborative Robots Market Overview: Growth Drivers and Future Prospects

Introduction

The global collaborative robots market, commonly referred to as the cobots market, is witnessing unprecedented growth as industries shift toward more efficient, flexible, and human-friendly automation solutions. Unlike traditional industrial robots, collaborative robots are designed to work safely alongside human operators, making them ideal for diverse industries ranging from manufacturing to healthcare. This article offers an overview of the market, highlighting the major growth drivers and projecting its future prospects.

1. Understanding Collaborative Robots

Collaborative robots are designed with sensors, safety mechanisms, and smart software that allow them to interact with humans without the need for protective barriers. They can be easily programmed and redeployed, making them particularly appealing for small and medium enterprises (SMEs). These robots typically assist with repetitive or ergonomically challenging tasks, improving workforce productivity and safety.

2. Key Market Drivers

a. Rising Demand for Automation

One of the major forces behind cobot adoption is the growing demand for automation. Companies are seeking to reduce labor costs, increase efficiency, and minimize human error. Collaborative robots provide a flexible, cost-effective solution that doesn't require the significant infrastructure changes associated with traditional robotics.

b. Labor Shortages and Workforce Augmentation

With an aging population in many industrialized nations and ongoing labor shortages in skilled trades, cobots offer a solution that augments human labor rather than replacing it outright. Their ability to take over repetitive, tedious tasks allows human workers to focus on more complex responsibilities.

c. Cost Efficiency and ROI

Compared to traditional industrial robots, cobots are often more affordable, with quicker return on investment (ROI). Their plug-and-play nature and ease of programming further reduce implementation costs and time, making them ideal for businesses without dedicated robotics teams.

d. Improved Safety Standards

Enhanced safety features in cobots, such as force limiting and real-time sensing, have made them increasingly viable in open production environments. Compliance with international safety standards (like ISO/TS 15066) has further boosted user confidence and market adoption.

3. Emerging Applications

Cobots are no longer limited to large manufacturing firms. Industries across the board are integrating collaborative robots into their operations:

Automotive: Assisting in assembly, painting, and quality inspection.

Electronics: Handling delicate components and performing precision tasks.

Healthcare: Supporting surgical procedures and laboratory automation.

Food & Beverage: Managing packaging and repetitive processes.

Logistics: Sorting, packing, and handling inventory in warehouses.

The growing scope of applications is rapidly expanding the collaborative robots market.

4. Technological Advancements Fueling Growth

New technological integrations are transforming cobots from simple task performers to intelligent collaborators. Key innovations include:

Artificial Intelligence (AI) for adaptive behavior and predictive maintenance.

Machine Vision Systems for complex inspection and quality assurance.

Natural Language Processing (NLP) for intuitive human-machine communication.

Cloud-Based Connectivity for centralized monitoring and updates.

These advancements are making cobots smarter, safer, and more versatile, boosting their value across diverse sectors.

5. Market Size and Growth Forecast

As of the mid-2020s, the global collaborative robots market is valued in the multi-billion-dollar range and is projected to expand at a compound annual growth rate (CAGR) exceeding 25% through 2030. Asia-Pacific is expected to dominate market share, driven by rapid industrialization and automation in countries like China, Japan, and South Korea. North America and Europe follow closely due to strong innovation ecosystems and high labor costs.

6. Opportunities and Future Outlook

The future of the collaborative robots market appears bright, with several growth avenues:

SME Adoption: As cobots become more affordable and easier to integrate, small businesses will increasingly deploy them to remain competitive.

Healthcare Sector: The use of cobots in surgery, diagnostics, and rehabilitation presents a significant opportunity.

Remote Operation and Telepresence: Cobots may evolve to support remote work scenarios and virtual human-machine collaboration.

Educational Integration: Universities and vocational institutes are beginning to use cobots to train the future workforce, boosting long-term market adoption.

As the technology matures, collaborative robots will become even more autonomous and integrated into smart factory ecosystems.

Conclusion

The collaborative robots market is at the forefront of the next wave of industrial automation. With benefits like cost savings, ease of use, and the ability to work alongside humans, cobots are well-positioned to revolutionize both manufacturing and non-manufacturing sectors. Continued innovation, combined with expanding awareness and regulatory support, will ensure that cobots play a central role in the future of work across the globe.

0 notes

Text

Robotic Platform Market driven by Automation Demand

The Robotic Platform Market encompasses a suite of advanced robotic systems designed to execute tasks ranging from material handling and assembly to inspection and packaging across diverse industries. These platforms integrate cutting-edge hardware components—such as robotic arms, end effectors, and vision systems—with sophisticated software for motion planning, simulation and real-time control. Key advantages include enhanced operational efficiency, improved precision, reduced human error and heightened workplace safety. As industries confront labor shortages and rising production costs, the need for scalable robotic platforms has soared, fueling demand for customizable and modular solutions.

In manufacturing, these systems optimize throughput and facilitate Industry 4.0 initiatives, while in healthcare, they support surgical assistance, telepresence and laboratory automation. Additionally, the ongoing trend toward collaborative robots (cobots) underlines the market’s focus on human-machine interaction and adaptive intelligence. Market research indicates that small and medium enterprises are increasingly adopting robotic solutions to maintain competitive cost structures. Robust market insights point to the pharmaceutical and food & beverage sectors as emerging segments for growth, driven by stringent quality standards and consumer expectations. Overall, continuous innovations in artificial intelligence and machine learning are expected to expand the Robotic Platform Market scope, enabling predictive maintenance and advanced analytics.

The Global Robotic Platform Market is estimated to be valued at USD 11.37 Bn in 2025 and is expected to reach USD 18.62 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. Key Takeaways Key players operating in the Robotic Platform Market are:

-ABB LTD.

-Amazon.com, Inc.

-Google LLC

-IBM Corporation

-KUKA AG

These market players dominate the industry size and contribute significantly to collectively over 40% of market share, leveraging robust market growth strategies such as strategic partnerships, acquisitions and extensive R&D spending. ABB LTD. continues to enhance its robotics portfolio through modular platforms, focusing on collaborative robots for light-duty tasks. Amazon.com, Inc. integrates robotic platforms in its fulfillment centers for automated order processing, boosting business growth and reducing operational costs. Google LLC and IBM Corporation invest heavily in AI-driven automation, offering cloud-based robotic solutions with advanced analytics and machine vision. Meanwhile, KUKA AG differentiates through high-precision industrial robots tailored for automotive and aerospace segments. Collectively, these leading companies drive market competition, develop new applications and influence market dynamics across global regions.

‣ Get More Insights On: Robotic Platform Market

‣ Get this Report in Japanese Language: ロボットプラットフォーム市場

‣ Get this Report in Korean Language: 로봇플랫폼시장

0 notes

Text

Navigating the Future of Industrial Efficiency: Industrial Automation Market Outlook 2025–2035

Industrial Automation Market Size & Forecast

The industrial automation market is undergoing a rapid transformation, driven by a wave of technological innovations and economic factors. The integration of Industry 4.0 elements—such as the Internet of Things (IoT), Artificial Intelligence (AI), and robotics—has dramatically improved operational efficiencies across industries by reducing reliance on manual labor and increasing real-time control of manufacturing processes. A pressing shortage of skilled labor and rising wage costs are further nudging manufacturers toward automated solutions to sustain their productivity levels.

Government initiatives around the world, including tax incentives and policy support for smart manufacturing, are fueling this transition. Sectors like automotive, oil & gas, and pharmaceuticals are experiencing a significant boost in automation demand due to the rising need for predictive maintenance and energy-efficient systems. However, high initial investment costs remain a notable barrier, especially for small and medium-sized enterprises (SMEs). Cybersecurity challenges and the complexities of integrating new systems with existing legacy infrastructure also present growth restraints.

Key trends propelling the market include the rise of collaborative robots (cobots), the implementation of 5G-enabled smart factories, and AI-driven predictive maintenance. The growing popularity of digital twins for real-time simulation and optimization, along with a shift toward sustainable automation, is reshaping operational strategies. Opportunities are abundant in emerging economies such as those in Asia-Pacific and Latin America, where industrial growth and favorable government policies are accelerating automation adoption. Technologies like cloud-based SCADA systems and Autonomous Mobile Robots (AMRs) are offering new areas for growth, while the emergence of hyperautomation—an approach that blends RPA, AI, and IoT—is revolutionizing manufacturing end-to-end.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=5172?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

Key Findings

By Offering: The solutions segment is anticipated to lead the industrial automation market by 2025.

By Mode of Automation: Semi-automatic systems are projected to dominate in 2025.

By End-use Industry: The oil & gas sector is expected to take the lead.

By Geography: Asia-Pacific will be the dominant region in 2025.

Industrial Automation Market Drivers

Industry 4.0 & Smart Manufacturing

One of the primary forces shaping the industrial automation market is the widespread adoption of Industry 4.0 and smart manufacturing. These advancements facilitate integration between IoT, AI, and big data analytics, enabling real-time monitoring, optimized workflows, and predictive maintenance. Smart factories, equipped with self-correcting machinery, digital twins, and automated quality control systems, reduce both waste and downtime. This translates to increased productivity, lower operational costs, and agile supply chain management.

As companies strive to remain competitive, particularly in sectors like electronics, automotive, and pharmaceuticals, the demand for edge computing solutions and cobots continues to grow. The digital transformation enabled by Industry 4.0 is helping businesses move from traditional manufacturing practices to data-driven and automated environments.

Government Initiatives & Incentives

Governmental support through financial aid and policy reforms is a major catalyst in driving industrial automation. Initiatives such as Germany’s Industrie 4.0, China’s Made in China 2025, and the U.S. Advanced Manufacturing Partnership aim to enhance manufacturing competitiveness. These programs provide critical support in the form of tax incentives, R&D funding, and automation subsidies.

Developing economies like India and Vietnam are also taking steps to foster smart manufacturing by subsidizing digital upgrades to attract foreign direct investment. These policies significantly lower entry barriers for manufacturers transitioning to automated systems, paving the way for market expansion and technological innovation.

Industrial Automation Market Trends

AI and Machine Learning Integration in Industrial Automation

Artificial Intelligence and Machine Learning are playing pivotal roles in redefining the industrial automation landscape. These technologies enable predictive maintenance by analyzing sensor-generated data to predict equipment failures before they happen, thus minimizing downtime and costly interruptions.

Machine learning is also improving operational efficiencies by adjusting real-time production variables, identifying inefficiencies, and lowering energy consumption. In quality control, deep learning-driven computer vision systems are outperforming human operators in defect detection. Robotics and supply chain decisions are increasingly being made autonomously, thanks to advancements in AI.

Edge AI is also gaining momentum, allowing for faster on-site data processing, which is critical for time-sensitive applications. The rising implementation of digital twins and generative AI for design and operational optimization is reinforcing AI and ML’s central role in shaping the future of manufacturing across various industries.

Industrial Automation Market Opportunities

Emerging Markets (Asia-Pacific, Latin America)

Asia-Pacific and Latin America are proving to be hotspots for industrial automation growth. These regions are characterized by swift industrialization, increasing labor costs, and growing government interest in smart manufacturing. Nations like China, India, Brazil, Mexico, and Vietnam are significantly investing in automation technologies to stay competitive globally and attract international investments.

The boom in automotive, electronics, and textile sectors in these regions is creating a robust demand for advanced robotics, IoT-enabled machinery, and AI-based systems. Favorable policies, such as tax breaks and improved infrastructure, are also encouraging businesses to adopt automation, thus opening new avenues for automation vendors to expand their market reach.

Get Full Report @ https://www.meticulousresearch.com/product/industrial-automation-market-5172?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

Industrial Automation Market Analysis: Segmental Highlights

Market By Offering

The market is segmented into solutions and services. The solutions segment is expected to hold the largest share in 2025. These include plant instrumentation, plant-level controls, and enterprise-level controls. The dominance of this segment is largely attributed to the increasing integration of systems like ERP, SCADA, DCS, and PLM that optimize manufacturing operations. Predictive maintenance, resource utilization, and operational cost reduction are driving the adoption of these technologies as part of Industry 4.0 transformations.

Market By Mode of Automation

Industrial automation is categorized into semi-automatic and fully automatic systems. In 2025, semi-automatic systems are anticipated to command the largest market share due to their lower implementation cost and the flexibility they offer in blending manual oversight with automation. This mode allows human operators to intervene when necessary, helping to prevent operational downtime or product defects. Nevertheless, the fully automatic systems segment is forecasted to experience a higher growth rate during the projection period.

Market By End-use Industry

The market spans several industries, including automotive, oil & gas, food & beverage, chemicals & materials, pharmaceuticals & biotech, consumer goods, electronics, and more. The oil & gas industry is poised to hold the largest share by 2025. This is driven by its growing reliance on automation for process efficiency, regulatory compliance, remote monitoring, and cost reduction.

Simultaneously, the automotive sector is expected to be the fastest-growing due to the adoption of robotics, AI, and smart factory initiatives. The increasing demand for electric vehicles (EVs), autonomous driving technologies, and flexible manufacturing lines is propelling the sector’s automation needs.

Geographical Analysis

Asia-Pacific (APAC) Dominates the Industrial Automation Market in 2025

Asia-Pacific will remain the most dominant and fastest-growing market for industrial automation by 2025. Factors such as robust industrialization, large-scale investment in automotive and electronics sectors, and government-led policies like China’s Made in China 2025 and India’s Production-Linked Incentive (PLI) scheme are driving this growth.

The region’s manufacturing capacity, combined with affordable labor transitioning to automation, creates fertile ground for technological adoption. North America also holds a substantial market share thanks to its advanced technological base, but Asia-Pacific is witnessing the fastest growth trajectory, supported by favorable regulations, increased foreign direct investment, and rapid digital transformation.

Key Companies

The global industrial automation market is shaped by key players like ABB Ltd (Switzerland), Rockwell Automation Inc. (U.S.), Siemens AG (Germany), Yaskawa Electric Corporation (Japan), Schneider Electric SE (France), Yokogawa Electric Corporation (Japan), KUKA AG (Germany), Emerson Electric Co. (U.S.), FANUC CORPORATION (Japan), Honeywell International Inc. (U.S.), Mitsubishi Electric Corporation (Japan), OMRON Corporation (Japan), Advantech Co., Ltd. (Taiwan), Hitachi Ltd. (Japan), and General Electric Company (U.S.).

Industrial Automation Industry Overview: Latest Developments from Key Industry Players

In May 2025, Siemens introduced the Simatic AX AI Controller, designed for real-time machine learning applications in production environments. This AI controller is integrated into the Siemens Totally Integrated Automation (TIA) platform for tailored automation solutions.

In February 2025, Mitsubishi Electric joined forces with NVIDIA to co-develop AI-powered robotic systems using the NVIDIA Omniverse platform. This partnership aims to enhance next-generation robotics for industrial applications.Get Sample Copy @https://www.meticulousresearch.com/download-sample-report/cp_id=5172?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

0 notes

Text

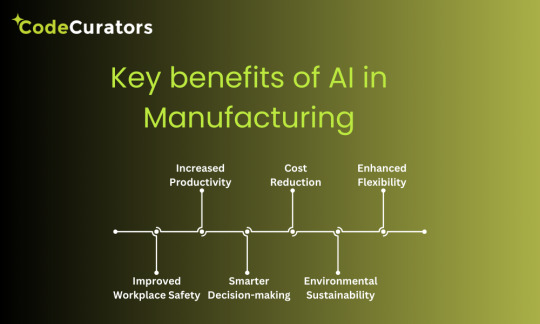

Artificial Intelligence in Manufacturing Market – Size, Share, Analysis, Forecast, and Growth Trends to 2032 Unveil Technological Innovations Transforming US Factories

The Artificial Intelligence in Manufacturing Market was valued at USD 3.4 billion in 2023 and is expected to reach USD 103.3 billion by 2032, growing at a CAGR of 46.08% from 2024-2032.

Artificial Intelligence in Manufacturing Market is witnessing rapid transformation as U.S. manufacturers increasingly deploy AI technologies to optimize operations, reduce downtime, and boost productivity. From predictive maintenance to real-time quality control, AI is becoming integral to modern factory systems, aligning with Industry 4.0 goals and the national push for smart manufacturing.

U.S. AI in Manufacturing Industry Trends: Robotics, Predictive Maintenance, and Edge AI Lead the Way

Artificial Intelligence in Manufacturing Market continues to evolve as companies embrace intelligent automation, robotics, and machine learning. With high-tech hubs across the U.S. driving innovation, the adoption of AI is no longer optional—it's a competitive imperative for manufacturing sectors including automotive, electronics, aerospace, and consumer goods.

Get Sample Copy of This Report:https://www.snsinsider.com/sample-request/6587

Market Keyplayers:

IBM Corporation – Watson IoT for Manufacturing

Siemens AG – Industrial Edge

Microsoft Corporation – Azure AI

Alphabet Inc. (Google Cloud) – Vertex AI

Amazon Web Services (AWS) – AWS IoT SiteWise

General Electric Company (GE Digital) – Predix Platform

SAP SE – SAP Digital Manufacturing Cloud

Oracle Corporation – Oracle AI for Manufacturing

Rockwell Automation, Inc. – FactoryTalk Analytics

NVIDIA Corporation – NVIDIA Metropolis for Factories

Intel Corporation – Intel Edge AI Software

Schneider Electric SE – EcoStruxure Machine Advisor

PTC Inc. – ThingWorx Industrial IoT Platform

Fanuc Corporation – FIELD system (Fanuc Intelligent Edge Link and Drive)

ABB Ltd. – ABB Ability™ Genix Industrial Analytics and AI Suite

Market Analysis

The integration of artificial intelligence in manufacturing is shifting from experimentation to execution. Manufacturers are leveraging AI to enhance operational efficiency, cut costs, and make data-driven decisions in real time. Smart factories are becoming a reality, with AI at the core of predictive analytics, process automation, and quality assurance.

In the U.S., the market is accelerated by federal incentives, robust digital infrastructure, and a skilled workforce. AI-enabled solutions are empowering manufacturers to navigate labor shortages, manage supply chain volatility, and maintain continuous production under evolving market demands.

Market Trends

Surge in predictive maintenance solutions to reduce equipment failure

AI-powered computer vision for automated defect detection

Increased use of digital twins for real-time system monitoring

Integration of machine learning in supply chain forecasting

Collaborative robots (cobots) enhancing human-machine synergy

AI-driven energy efficiency and sustainability programs

Cloud-based AI platforms enabling remote factory management

Market Scope

The U.S. market is embracing AI as a transformative tool in reshaping the manufacturing value chain. From production floors to executive dashboards, AI is enabling smarter decisions, faster workflows, and agile responses to market dynamics.

Intelligent process automation across manufacturing units

Data-driven quality control and error reduction

Real-time decision-making enabled by AI analytics

Workforce augmentation through human-AI collaboration

Smart robotics improving production precision

AI-integrated ERP and MES systems for seamless coordination

Forecast Outlook

The outlook for the Artificial Intelligence in Manufacturing Market is highly optimistic, with U.S. manufacturers positioned at the forefront of global innovation. Continuous investment in AI R&D, coupled with government and private sector collaboration, is expected to drive next-generation capabilities. Future growth will be shaped by scalable platforms, adaptive machine learning models, and tighter integration with IoT and 5G technologies. The focus will shift from pilot projects to enterprise-wide AI deployment, delivering real impact across production ecosystems.

Intelligent process automation across manufacturing units

Data-driven quality control and error reduction

Real-time decision-making enabled by AI analytics

Workforce augmentation through human-AI collaboration

Smart robotics improving production precision

AI-integrated ERP and MES systems for seamless coordination

Access Complete Report: https://www.snsinsider.com/reports/artificial-intelligence-in-manufacturing-market-6587

Conclusion

AI is no longer a futuristic concept—it's the new reality for U.S. manufacturing. As companies strive for agility, efficiency, and resilience, artificial intelligence is emerging as the critical engine behind their transformation. From streamlining supply chains to revolutionizing shop floors, AI is redefining what's possible.

Related Reports:

Discover top Trade Management Software solutions used across the U.S

Explore U.S. factoring companies to boost your cash flow

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Artificial Intelligence in Manufacturing Market#Artificial Intelligence in Manufacturing Market Scope

0 notes

Text

AI in Robotics: Market Size, Key Technologies, and Future Projections

Artificial Intelligence (AI) has become the cornerstone of modern robotics, driving unprecedented advancements across industries by enabling machines to perform tasks that require cognitive functions such as learning, reasoning, and perception. The integration of AI into robotics is accelerating the development of intelligent, autonomous systems capable of adapting to complex environments and making real-time decisions. This fusion is opening new horizons for robotics applications in manufacturing, healthcare, logistics, agriculture, defense, and more. Understanding the market size, key technologies, and future projections of AI in robotics is crucial for businesses, investors, and policymakers aiming to harness the full potential of this transformative domain.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=99226522

Market Size

The AI in robotics market has witnessed rapid growth over the past decade, fueled by increasing automation demands and the need for smart, adaptive systems. As of the early 2020s, the global market size was valued in the range of several billion U.S. dollars, with projections indicating a compound annual growth rate (CAGR) exceeding 30% over the next several years. This expansion is driven by factors such as advancements in machine learning algorithms, enhanced sensor technologies, rising adoption of collaborative robots (cobots), and the growing emphasis on Industry 4.0 and smart manufacturing.

Geographically, North America and Asia-Pacific dominate the AI robotics market due to strong industrial bases, government investments in automation, and robust technology ecosystems. Europe is also a significant player, especially in sectors like automotive and healthcare, where robotics is being integrated with AI to improve productivity and safety. Emerging economies are beginning to adopt AI-powered robotics to boost their manufacturing capabilities and healthcare services, adding to the global market’s momentum.

Key Technologies

Several key technologies underpin the growth and capabilities of AI in robotics:

Machine Learning and Deep Learning: These form the core of AI’s contribution to robotics. Machine learning enables robots to improve their performance over time by learning from data, while deep learning techniques, such as convolutional neural networks (CNNs), enhance image and speech recognition, enabling robots to better understand their environment.

Computer Vision: This technology allows robots to interpret visual information, facilitating object detection, recognition, and navigation. Advances in computer vision empower robots to perform complex tasks such as quality inspection, autonomous navigation, and human-robot interaction.

Natural Language Processing (NLP): NLP enables robots to understand, interpret, and respond to human language. This is critical in service robots, healthcare assistants, and customer support bots, allowing for more intuitive interactions.

Sensor Fusion and Edge Computing: The combination of multiple sensors (lidar, radar, infrared, cameras) and the ability to process data locally (edge computing) enables robots to perceive their surroundings in real time and make decisions without latency. This capability is crucial for applications requiring immediate response, such as autonomous vehicles and surgical robots.

Reinforcement Learning: This AI technique allows robots to learn optimal behaviors through trial and error, improving decision-making in dynamic and unpredictable environments.

Robotic Operating Systems (ROS) and AI Frameworks: The development of standardized software platforms facilitates faster integration of AI capabilities into robotic systems, promoting scalability and innovation.

Future Projections

The future of AI in robotics is marked by increasing autonomy, versatility, and collaboration between humans and machines. Industry experts forecast that AI-driven robotics will become indispensable across multiple sectors, fundamentally reshaping workflows and creating new business models.

In manufacturing, AI-powered robots will move beyond repetitive tasks to take on roles involving quality assurance, predictive maintenance, and adaptive assembly lines, enabling factories to be more flexible and efficient. Collaborative robots will work safely alongside human workers, enhancing productivity without replacing jobs outright.

Healthcare robotics is expected to expand significantly, with AI enabling more precise surgical robots, personalized rehabilitation devices, and intelligent diagnostic assistants. Remote surgery and telemedicine robots will become more common, supported by advancements in 5G and edge AI.

Logistics and warehousing will continue to benefit from autonomous mobile robots equipped with AI for inventory management, order picking, and last-mile delivery. The growth of e-commerce will further accelerate demand for intelligent robotic solutions.

Agriculture will see increased use of AI-driven robotics for tasks such as crop monitoring, pest control, and automated harvesting, helping to address labor shortages and improve sustainability.

Defense and security applications will also advance, with AI-enabled robots undertaking surveillance, bomb disposal, and reconnaissance missions, reducing risk to human personnel.

Despite these promising developments, challenges such as high implementation costs, cybersecurity risks, ethical considerations, and the need for regulatory frameworks remain. Ongoing research and collaboration among stakeholders will be vital to overcoming these barriers.

In summary, the AI in robotics market is poised for robust growth, powered by cutting-edge technologies that enhance robotic intelligence and autonomy. As AI and robotics continue to converge, they will unlock new efficiencies, capabilities, and applications that will shape the future of industries worldwide, making intelligent robots an integral part of the technological landscape by 2030 and beyond.

0 notes

Text

🤖 Industrial Robots Are Taking Over (In a Good Way): Market to Hit $74.1B by 2034

Industrial Robotics Market is poised for a remarkable journey, projected to grow from $24.35 billion in 2024 to $74.1 billion by 2034. This expansion, at a robust CAGR of 11.8%, reflects the growing reliance on automation across industries. Industrial robots are no longer limited to repetitive tasks — they’re becoming intelligent collaborators, boosting efficiency and redefining modern manufacturing. With advancements in AI, IoT, and machine learning, industries like automotive, electronics, and logistics are witnessing transformative gains in productivity and precision.

Market Dynamics

Several dynamic forces are fueling this explosive growth. The need for automation in high-volume production, coupled with global labor shortages and the demand for consistent quality, is driving adoption. Collaborative robots (cobots) are particularly noteworthy. Designed to work alongside humans, cobots offer flexibility and safety, making automation accessible even for small and medium-sized enterprises (SMEs).

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS20048

Moreover, Industry 4.0 initiatives are pushing manufacturers toward smart, connected systems. Robotics powered by artificial intelligence and cloud computing now offer real-time data insights and predictive maintenance. Environmental concerns are also playing a role, as companies seek energy-efficient, low-waste manufacturing solutions. Yet, high initial investment costs and a lack of skilled operators remain key challenges.

Key Players Analysis

The competitive landscape of the industrial robotics market is both deep and diverse. Established giants like ABB Ltd., Fanuc Corporation, and Yaskawa Electric Corporation dominate the field through continuous innovation, strategic alliances, and global expansions. These players are constantly integrating cutting-edge technologies like AI, edge computing, and 5G connectivity into their offerings.

Meanwhile, emerging companies such as Robotics Innovations, Flexi Automation, and Intelli Robotics are shaking up the space with agile, cost-effective solutions tailored to niche applications. These new entrants are gaining traction through scalable cobots, intuitive interfaces, and rapid deployment models, making robotics more accessible to broader industry verticals.

Regional Analysis

Asia-Pacific holds the lion’s share of the market, largely due to the industrial might of China and Japan. These nations are investing aggressively in automation to streamline production and maintain global competitiveness. North America follows closely, with the United States leading the charge through innovation and government support for reshoring manufacturing.

In Europe, countries like Germany and Italy benefit from a solid foundation in automotive and machinery sectors, further strengthened by Industry 4.0 adoption. Latin America is gradually catching up, with Brazil and Mexico seeing increased foreign investment and local production automation. The Middle East and Africa, although still emerging, are showing promise — particularly in the UAE and South Africa — through infrastructure modernization and economic diversification.

Recent News & Developments

The past year has seen significant developments that signal where the market is headed. The average price range for industrial robots has become more competitive, with some models starting at $25,000. This pricing shift is making robotics more accessible to SMEs. The market volume also tells a compelling story — unit sales jumped from approximately 350,000 in 2024 and are expected to reach 600,000 by 2028.

Technologically, the integration of machine learning and real-time vision systems is transforming how robots interact with their environment. Companies are also forming strategic partnerships to co-develop AI-powered robots and edge-to-cloud solutions that improve deployment flexibility. The rise of sustainable robotics — featuring energy-efficient drives and recyclable components — is helping businesses meet environmental regulations without sacrificing performance.

Browse Full Report : https://www.globalinsightservices.com/reports/industrial-robotics-market/

Scope of the Report

This comprehensive report offers a forward-looking analysis of the industrial robotics market through 2034. It spans across segmentation types (articulated, SCARA, cobots), technology layers (AI, IoT, computer vision), and key verticals (automotive, electronics, healthcare, logistics). It includes insights on new installations, retrofits, on-premise and cloud deployments.

The scope also includes PESTLE, SWOT, and value chain analysis, with deep dives into regulatory environments and innovation strategies. Key market segments, from robotic welding and inspection to packaging and painting, are analyzed for growth patterns and potential. Whether you’re a legacy player or a new entrant, this report provides the data, context, and forecasts necessary for strategic planning.

Discover Additional Market Insights from Global Insight Services:

Fiber Optic Cables Market : https://www.globalinsightservices.com/reports/fiber-optic-cables-market/

Medical Sensors Market : https://www.globalinsightservices.com/reports/medical-sensors-market/

Smart Factory Market : https://www.globalinsightservices.com/reports/smart-factory-market/

Printed Circuit Board Market : https://www.globalinsightservices.com/reports/printed-circuit-board-market/