#AppDirect AI

Explore tagged Tumblr posts

Text

AppDirect Launches AppDirect AIAn AI Marketplace And Creation Studio That Provides The Ability To Create And Use Purpose-built, Secure AI Apps In Minutes

AppDirect, a well-known B2B subscription commerce platform, has introduced AppDirect AI, an innovative solution aimed at simplifying and securing the process of creating and implementing AI applications. This groundbreaking platform stands out by allowing users to quickly develop AI apps using their preferred data sources, all while ensuring data privacy in a highly secure environment.

Users of AppDirect AI can bring their AI app ideas to life in just minutes, even without coding skills. Moreover, the platform offers users the flexibility to choose the most suitable large language model (LLM) provider for their specific business needs. Peush Patel, VP of Product Management at AppDirect, highlighted the platform's holistic approach, focusing on seamless collaboration, enterprise-grade privacy, and the ability to deploy AI apps rapidly without extensive coding expertise.

The platform's adaptable nature ensures compatibility with various technologies, giving users full control over every aspect of their AI app's development, from selecting the LLM model to choosing data sources. This adaptability addresses common challenges faced by businesses looking to utilize AI solutions, such as concerns about data privacy and limitations on customization.

Nicolas Desmarais, Chairman and CEO at AppDirect, underscored the platform's importance in the industry, emphasizing its potential to empower technology advisors and deliver lasting value to customers. AppDirect AI's collaboration with IVADO Labs further enhances its capabilities by providing access to top-notch expertise and professional services for enterprises seeking customized AI solutions.

Read More - https://www.techdogs.com/tech-news/business-wire/appdirect-launches-appdirect-aian-ai-marketplace-and-creation-studio-that-provides-the-ability-to-create-and-use-purpose-built-secure-ai-apps-in-minutes

0 notes

Text

Partner Relationship Management (PRM) Software Market to Latest Research, Industry Analysis, Driver, Trends, Business Overview, Key Value, Demand And Forecast 2022 to 2032

In 2021, the revenue from the partner relationship management (PRM) software market was $1,034.0 Million. The market for partner relationship management (PRM) software is expected to reach $4,097.6 million by 2032, growing at a CAGR of 13.4% between 2022 and 2032.

The market is expected to reach the valuation of ~US$ 1,163.1 Million by end of 2022. As per Future Market Insights, surge in demand for business intelligence adoption, reduction in channel management cost and increase in internet penetration will drive the growth of partner relationship management (PRM) software market.

Get a Sample Copy of Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-2021

Furthermore, rising adoption of emerging technologies such as artificial intelligence (AI), internet of things (IoT) are expected to drive the PRM software market. Moreover, large organizations are taking initiatives to implement partner relationship management software for scaling partnership and streamlining distribution management.

Key Takeaways

By type, the integrated software segment is anticipated to account for the leading share in the global demand for partner relationship management during the forecast period.

The standalone software segment is estimated to grow at a robust CAGR of 14.2% through 2032.

Among the enterprise size, SMEs segment is estimated to grow by 4.1X during the forecast period.

By industry, the BFSI segment is anticipated to increase at a CAGR of 15.7% between 2022 & 2032.

North America is expected to dominate partner relationship management market followed by Europe in 2022.

South Asia & Pacific is estimated as the fastest growing region during the forecast period.

The U.S. market is expected to progress at a CAGR of around 11.1% through 2032.

In India, the partner relationship management market is expected to grow by 5.1X during the forecast period.

Partner relationship management market in China is estimated to witness the absolute $ opportunity of US$ 2,56.4 Mn in the forecast period.

Request Discount @ https://www.futuremarketinsights.com/request-discount/rep-gb-2021

Competitive Landscape

Partner relationship management software market players are concentrating on variety of techniques for boosting product innovation, enhancement of existing products and increase its presence in new geographic areas.

In January 2022, Kiflo announced its new update called the honey bee release. The new update offers customized dashboards for various partners, principle tools for lucrative on boarding, organization and many more.

In July 2021, Zinfi technologies announced its new launch of advanced capabilities for channel organizations making partner relationship management productive while being easier.

Key Companies Profiled

Oracle Corporation

Sharework

Appdirect

Kiflo

Webinfinity

Salesforce Inc

Zift Solutions

ChannelXperts

Creatio

PartnerStack

Mindmatrix

Agentics

Magnetrix Corporation

Allbound Inc

Zinfi Technologies

Partner Relationship Management Software Market by Category

By Type:

Integrated Software

Standalone Software

By Deployment Mode:

On premise PRM Software

Cloud-based PRM Software

By Enterprise Size:

Small and Mid-Sized Enterprises (SMEs)

Large Enterprises

By Industry:

IT & Telecom

Retail

Government

Healthcare

BFSI

Manufacturing

Others

By Region:

North America

Latin America

Europe

East Asia

South Asia & Pacific

Middle East and Africa (MEA)

Request Customization @ https://www.futuremarketinsights.com/customization-available/rep-gb-2021

0 notes

Text

Cloud Billing Market by Component (Solutions, Services), Billing Type (Subscription, Usage-Based, One-Time, Others), Deployment Type, Service Model (IaaS, PaaS, SaaS), Organization Size, Vertical, and Region - Global Forecast to 2025 published on

https://www.sandlerresearch.org/cloud-billing-market-by-component-solutions-services-billing-type-subscription-usage-based-one-time-others-deployment-type-service-model-iaas-paas-saas-organization-size-vertical-and.html

Cloud Billing Market by Component (Solutions, Services), Billing Type (Subscription, Usage-Based, One-Time, Others), Deployment Type, Service Model (IaaS, PaaS, SaaS), Organization Size, Vertical, and Region - Global Forecast to 2025

“The global cloud billing market size to grow at a CAGR of 16.6% during the forecast period”

MarketsandMarkets estimates the global cloud billing market size would grow from USD 3.0 billion in 2020 to USD 6.5 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period. The growth of the cloud billing market can be attributed to the increasing adoption of IoT, cloud computing, analytics, Artificial Intelligence (AI), Machine Learning (ML), and other technologies.

The private cloud deployment type is expected to grow at a higher CAGR during the forecast period

The private cloud deployment model enables a company to have better control over its data and reduce risks, such as data loss and issues related to regulatory compliance. The private cloud is used in banking and financial institutions, large enterprises, and government organizations, where only authorized users can access the system. The demand for private cloud deployments by enterprises with compliance concerns is due to its security and control benefits. Service providers offering hosted private clouds help ensure the essentials of compliance with regulations, such as HIPAA and PCI, are met.

Telecommunication vertical to hold the highest market share in 2020

In recent years, the number of telecom subscribers has increased tremendously, leading to rising complexities in telecommunications business processes. Telecommunications companies are adopting digital transformation opportunities at a rapid pace to meet the growing customer demands and expectations, which makes this vertical the most significant vertical in terms of cloud adoption. The telecommunications industry vertical is experiencing increased data generation due to advancements in technologies such as 4G and 5G.

APAC to grow at the highest CAGR during the forecast period

Asia Pacific has witnessed the advanced and dynamic adoption of new technologies and is expected to record the highest CAGR during the forecast period. IT spending across organizations in the region is gradually increasing, which is expected to lead to a surge in the adoption of cloud billing solutions. China, India, Japan, and Australia & New Zealand (ANZ) are the leading countries in terms of the adoption of cloud billing solutions & services in the region. The increasing investments from the private sector, robust government support, and availability of a huge population are expected to drive the growth of new and emerging technologies in Asia Pacific.

By Company: Tier 1–26%, Tier 2–22%, and Tier 3–52%

By Designation: C-Level Executives–43%, Director Level–27%, and Others–30%

By Region: North America–40%, Europe–28%, APAC–25%, MEA – 4%, and Latin America – 3%

The cloud billing market comprises major solution providers, such as Oracle (US), SAP (Germany), Salesforce(US), Zuora(US), Aria System(US), BillingPlatform(US), Recurly(US), Jamcracker(US), Cerillion(UK), CGI(Canada), ConnectWise(US), Zoho(India), AppDirect(US), CloudBilling(Netherlands), Chargebee(US), RecVue(US), Cloud Assert(US), CloudXchange.io(India), and Chargify(US). The study includes an in-depth competitive analysis of key players in the cloud billing market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Research Coverage

The cloud billing market revenue is primarily classified into revenues from solutions and services. Revenue generated from billing type is associated with cloud billing solutions. Further, services revenue is associated variety of services such as managed services, integration and implementation, consulting, and support and maintenance. The market is also segmented based on component, service model, billing type, organization size, industry vertical, and region.

Key benefits of the report

The report would help the market leaders/new entrants in this market with the information on the closest approximations of the revenue numbers for the overall cloud billing market and the sub segments. This report would help stakeholders understand the competitive landscape and gain insights to better position their businesses and plan suitable go-to-market strategies. The report would help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, opportunities, and COVID-19 impact.

0 notes

Text

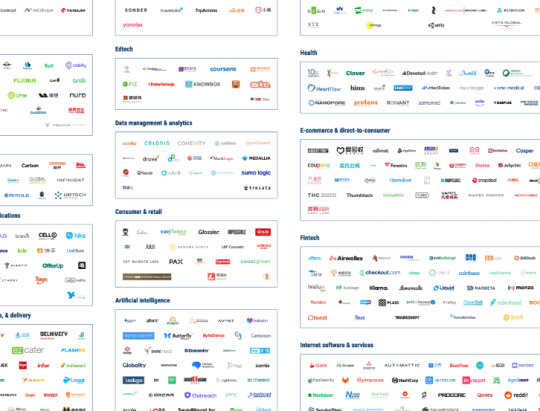

$1B+ Market Map: The World’s 390+ Unicorn Companies In One Infographic

$1B+ Market Map: The World’s 390+ Unicorn Companies In One Infographic https://ift.tt/2OB6frM

Bytedance $75 Artificial intelligence Didi Chuxing $56 Auto & transportation JUUL Labs $50 Consumer & retail WeWork $47 Other Airbnb $29.30 Travel Stripe $22.50 Fintech SpaceX $18.50 Other Epic Games $15 Other Grab $14.30 Auto & transportation DoorDash $12.60

Supply chain, logistics, & delivery

Bitmain Technologies $12 Hardware Samumed $12 Health Wish $11.20

E-commerce & direct-to-consumer

Global Switch $11.08 Hardware Palantir Technologies $11

Data management & analytics

Beike Zhaofang $10

Internet software & services

DJI Innovations $10 Hardware Gojek $10

Supply chain, logistics, & delivery

Infor $10

Supply chain, logistics, & delivery

Nubank $10 Fintech One97 Communications $10 Fintech Chehaoduo $9

E-commerce & direct-to-consumer

Coupang $9

E-commerce & direct-to-consumer

Coinbase $8 Fintech Instacart $7.60

Supply chain, logistics, & delivery

Robinhood $7.60 Fintech UiPath $7.10 Artificial intelligence Argo AI $7 Artificial intelligence Roivant Sciences $7 Health Snapdeal $7

E-commerce & direct-to-consumer

Tokopedia $7

E-commerce & direct-to-consumer

Tanium $6.70 Cybersecurity Compass $6.40

E-commerce & direct-to-consumer

Magic Leap $6.30 Hardware Ola Cabs $6.20 Auto & transportation Manbang Group $6

Supply chain, logistics, & delivery

Unity Technologies $6 Other Lianjia $5.80

E-commerce & direct-to-consumer

BYJU’s $5.75 Edtech Easyhome $5.70 Consumer & retail Vice Media $5.70

Internet software & services

Intarcia Therapeutics $5.50 Health Klarna $5.50 Fintech Hello TransTech $5 Auto & transportation Krafton Game Union $5 Other Machine Zone $5

Mobile & telecommunications

UBTECH Robotics $5 Hardware United Imaging Healthcare $5 Health Meizu Technology $4.58 Hardware Fanatics $4.50

E-commerce & direct-to-consumer

SenseTime $4.50 Artificial intelligence SoFi $4.50 Fintech Ziroom $4.50

E-commerce & direct-to-consumer

OYO Rooms $4.30 Travel Peloton $4.20

Internet software & services

Face++ $4 Artificial intelligence Houzz $4

E-commerce & direct-to-consumer

Niantic $4

Mobile & telecommunications

TripActions $4 Travel Yello Mobile $4

Mobile & telecommunications

Snowflake Computing $3.95

Data management & analytics

Gusto $3.80 Fintech OpenDoor Labs $3.80

E-commerce & direct-to-consumer

XPeng Motors $3.65 Auto & transportation Samsara Networks $3.60 Hardware Auto1 Group $3.54

E-commerce & direct-to-consumer

Credit Karma $3.50 Fintech Greensill $3.50 Fintech Indigo Agriculture $3.50 Artificial intelligence N26 $3.50 Fintech Otto Bock HealthCare $3.50 Health Root Insurance $3.50 Fintech TransferWise $3.50 Fintech Youxia Motors $3.35 Auto & transportation Cloudwalk $3.32 Artificial intelligence Rubrik $3.30

Data management & analytics

Swiggy $3.30

Supply chain, logistics, & delivery

The Hut Group $3.25

E-commerce & direct-to-consumer

Flexport $3.20

Supply chain, logistics, & delivery

Oscar Health $3.20 Health SmileDirectClub $3.20 Health Zoox $3.20 Artificial intelligence Tempus $3.10 Health BGL Group $3 Fintech Circle Internet Financial $3 Fintech Horizon Robotics $3 Artificial intelligence Kuaishou $3

Mobile & telecommunications

Procore $3

Internet software & services

Royole Corporation $3 Hardware SouChe Holdings $3

E-commerce & direct-to-consumer

Ucommune $3 Other VANCL $3

E-commerce & direct-to-consumer

VIPKID $3 Edtech Xiaohongshu $3

E-commerce & direct-to-consumer

Yuanfudao $3 Edtech Lixiang Automotive $2.93 Auto & transportation Affirm $2.90 Fintech Shanghai Henlius $2.90 Health ESR Cayman $2.80 Other Meicai $2.80

Mobile & telecommunications

Databricks $2.70

Data management & analytics

Nuro $2.70 Auto & transportation Toast $2.70 Fintech Plaid Technologies $2.65 Fintech Automation Anywhere $2.60 Artificial intelligence Brex $2.60 Fintech Woowa Brothers $2.60

Supply chain, logistics, & delivery

Monzo $2.55 Fintech 23andMe $2.50 Health Aihuishou $2.50

E-commerce & direct-to-consumer

Aurora $2.50 Auto & transportation Bird Rides $2.50 Auto & transportation Canva $2.50

Internet software & services

Confluent $2.50

Data management & analytics

Vista Global $2.50 Other Zhihu $2.50

Internet software & services

GRAIL $2.46 Health Carbon $2.40 Hardware Lime $2.40 Auto & transportation Medallia $2.40

Data management & analytics

YITU Technology $2.37 Artificial intelligence Dadi Cinema $2.30 Other OakNorth $2.30 Fintech Uptake $2.30 Artificial intelligence FlixBus $2.25 Auto & transportation Zume $2.25 Consumer & retail MINISO Life $2.20 Consumer & retail NuCom Group $2.20 Other Toss $2.20 Fintech Zomato $2.18

Internet software & services

BenevolentAI $2.10 Artificial intelligence Nextdoor $2.10

Internet software & services

Avant $2 Artificial intelligence Babylon Health $2 Artificial intelligence Cambricon $2 Artificial intelligence Checkout.com $2 Fintech Danke Apartment $2

E-commerce & direct-to-consumer

Deliveroo $2

Supply chain, logistics, & delivery

Discord $2

Internet software & services

HuiMin $2

E-commerce & direct-to-consumer

Impossible Foods $2 Consumer & retail Improbable $2 Other LegalZoom $2

Internet software & services

Lemonade $2 Fintech Mafengwo $2 Travel Marqeta $2 Fintech Preferred Networks $2 Artificial intelligence ReNew Power $2 Other Traveloka $2 Travel Trendy Group International $2 Consumer & retail Zenefits $2 Fintech eDaili $1.90

E-commerce & direct-to-consumer

HashiCorp $1.90

Internet software & services

InVision $1.90

Internet software & services

monday.com $1.90

Internet software & services

Postmates $1.85

Supply chain, logistics, & delivery

Afiniti $1.80 Artificial intelligence BillDesk $1.80 Fintech Devoted Health $1.80 Health Quora $1.80

Internet software & services

reddit $1.80

Internet software & services

Sprinklr $1.80

Internet software & services

ZocDoc $1.80 Health L&P Cosmetic $1.78 Consumer & retail Kaseya $1.75 Cybersecurity Buzzfeed $1.70

Internet software & services

Carta $1.70 Fintech Graphcore $1.70 Artificial intelligence InsideSales.com $1.70 Artificial intelligence PAX $1.70 Consumer & retail Pony.ai $1.70 Artificial intelligence Revolut $1.70 Fintech Squarespace $1.70

Internet software & services

Thumbtack $1.70

E-commerce & direct-to-consumer

CureVac $1.65 Health Darktrace $1.65 Artificial intelligence Jusfoun Big Data $1.65

Data management & analytics

ServiceTitan $1.65

Internet software & services

BlaBlaCar $1.60 Auto & transportation CAOCAO $1.60 Auto & transportation Dataminr $1.60 Artificial intelligence Delhivery $1.60

Supply chain, logistics, & delivery

Gan & Lee Pharmaceuticals $1.60 Health Infinidat $1.60 Hardware AIWAYS $1.59 Auto & transportation Quanergy Systems $1.59 Auto & transportation Promasidor Holdings $1.58 Consumer & retail Northvolt $1.57 Other Oxford Nanopore Technologies $1.55 Health Asana $1.50

Internet software & services

Chime $1.50 Fintech Cybereason $1.50 Cybersecurity Desktop Metal $1.50 Hardware Freshworks $1.50

Internet software & services

Gett $1.50 Auto & transportation ironSource $1.50

Mobile & telecommunications

Mu Sigma $1.50

Data management & analytics

Segment $1.50

Data management & analytics

STX Entertainment $1.50 Other TuJia $1.50 Travel We Doctor $1.50 Health Tuandaiwang $1.46 Fintech Coocaa $1.45 Hardware Allbirds $1.40

E-commerce & direct-to-consumer

AppLovin $1.40

Mobile & telecommunications

AvidXchange $1.40 Fintech Away $1.40

E-commerce & direct-to-consumer

C3 $1.40 Artificial intelligence Cabify $1.40 Auto & transportation Cgtz $1.40 Fintech Hike $1.40

Mobile & telecommunications

Koudai $1.40

E-commerce & direct-to-consumer

Symphony Communication Services $1.40

Internet software & services

Wemakeprice $1.33

E-commerce & direct-to-consumer

GPclub $1.32 Other Docker $1.30

Internet software & services

Knotel $1.30 Other OneTrust $1.30

Internet software & services

Trax $1.30

Data management & analytics

Zeta Global $1.30

Internet software & services

Intercom $1.29

Internet software & services

Ovo Energy $1.28 Other Starry $1.27

Mobile & telecommunications

Atom Bank $1.25 Fintech Butterfly Network $1.25 Artificial intelligence ezCater $1.25

Supply chain, logistics, & delivery

Infi $1.25 Artificial intelligence 4Paradigm $1.20 Artificial intelligence Clover Health $1.20 Health Glossier $1.20 Consumer & retail JFrog $1.20

Internet software & services

KeepTruckin $1.20

Supply chain, logistics, & delivery

OfferUp $1.20

Mobile & telecommunications

Ten-X $1.20

E-commerce & direct-to-consumer

Warby Parker $1.20

E-commerce & direct-to-consumer

Yiguo $1.20

Supply chain, logistics, & delivery

Zipline International $1.20

Supply chain, logistics, & delivery

HeartFlow $1.19 Health Luoji Siwei $1.17 Edtech Yimidida $1.17

Supply chain, logistics, & delivery

Automattic $1.16

Internet software & services

Deezer $1.16

Internet software & services

Tuhu $1.16 Auto & transportation BrewDog $1.15 Consumer & retail LifeMiles $1.15 Other Doctolib $1.14 Health Junlebao $1.14 Consumer & retail Actifio $1.10

Data management & analytics

Airtable $1.10

Internet software & services

Casper $1.10

E-commerce & direct-to-consumer

GitLab $1.10

Internet software & services

Hims $1.10 Health Ivalua $1.10 Fintech Outreach $1.10 Artificial intelligence OVH $1.10 Other Proteus Digital Health $1.10 Health ShopClues $1.10

E-commerce & direct-to-consumer

SmartNews $1.10

Mobile & telecommunications

Sonder $1.10 Travel TangoMe $1.10

Mobile & telecommunications

Tradeshift $1.10 Fintech Yijiupi $1.10 Consumer & retail Radius Payment Solutions $1.07 Fintech Formlabs $1.06 Hardware Jiuxian $1.05 Consumer & retail AppDirect $1.04

E-commerce & direct-to-consumer

Judo Bank $1.04 Other Miaoshou Doctor $1.02

E-commerce & direct-to-consumer

Avaloq Group $1.01 Fintech Leap Motor $1.01 Auto & transportation 10X Genomics $1 Health 17zuoye $1 Edtech 58 Daojia $1

Internet software & services

About You $1

E-commerce & direct-to-consumer

Age of Learning $1 Edtech Aijia Life $1 Other Airwallex $1 Fintech Apus Group $1

Mobile & telecommunications

Auth0 $1 Cybersecurity BeiBei $1

E-commerce & direct-to-consumer

BigBasket $1

Supply chain, logistics, & delivery

Bill.com $1 Fintech BitFury $1 Hardware Bolt $1 Auto & transportation Branch $1

Mobile & telecommunications

Bukalapak $1

E-commerce & direct-to-consumer

C2FO $1 Fintech Calm $1 Consumer & retail Cell C $1

Mobile & telecommunications

Celonis $1

Data management & analytics

CloudFlare $1 Cybersecurity Cohesity $1

Data management & analytics

Collibra $1

Data management & analytics

Convoy $1

Supply chain, logistics, & delivery

Coursera $1 Edtech Dada-JD Daojia $1

Supply chain, logistics, & delivery

DataRobot $1 Artificial intelligence Ding Xiang Yuan $1 Health Dream11 $1

Internet software & services

Druva $1

Data management & analytics

DT Dream $1

Data management & analytics

Fanli $1

E-commerce & direct-to-consumer

FlashEx $1

Supply chain, logistics, & delivery

Geek+ $1 Hardware GetYourGuide $1 Travel Ginkgo BioWorks $1 Health Globality $1 Artificial intelligence GoodRx $1 Health Gympass $1

Internet software & services

Hippo $1 Fintech Huike Group $1 Edtech HuJiang $1 Edtech Ibotta $1

E-commerce & direct-to-consumer

iCarbonX $1 Artificial intelligence Icertis $1 Artificial intelligence iFood $1

Supply chain, logistics, & delivery

Illumio $1 Cybersecurity InMobi $1

Mobile & telecommunications

Intellifusion $1 Artificial intelligence iTutorGroup $1 Edtech JOLLY Information Technology $1

E-commerce & direct-to-consumer

Kabbage $1 Fintech Katerra $1

Supply chain, logistics, & delivery

Kendra Scott $1 Consumer & retail Kik Interactive $1

Mobile & telecommunications

Klook $1 Travel KnowBe4 $1 Cybersecurity KnowBox $1 Edtech Lalamove $1

Supply chain, logistics, & delivery

letgo $1

E-commerce & direct-to-consumer

Lightricks $1 Artificial intelligence LinkDoc Technology $1 Health LinkSure Network $1

Mobile & telecommunications

Liquid $1 Fintech Loggi $1

Supply chain, logistics, & delivery

Lookout $1 Cybersecurity MarkLogic $1

Data management & analytics

MediaMath $1

Internet software & services

Medlinker $1 Health Meero $1 Artificial intelligence Mia.com $1

E-commerce & direct-to-consumer

MindMaze $1 Health Mofang Living $1

E-commerce & direct-to-consumer

Momenta $1 Artificial intelligence Netskope $1 Cybersecurity Numbrs $1 Fintech Nxin $1

Internet software & services

OCSiAl $1 Other Ola Electric Mobility $1 Auto & transportation Omio $1 Travel One Medical Group $1 Health OrCam Technologies $1 Artificial intelligence OutSystems $1

Internet software & services

Pat McGrath Labs $1 Consumer & retail Poizon $1

Mobile & telecommunications

PolicyBazaar $1 Fintech Rappi $1

Supply chain, logistics, & delivery

Red Ventures $1 Other Rent the Runway $1

E-commerce & direct-to-consumer

Revolution Precrafted $1 Other Rivigo $1

Supply chain, logistics, & delivery

Roblox $1

Internet software & services

Rocket Lab $1 Other Rubicon Global $1 Other Scale AI $1 Artificial intelligence Seismic $1

Internet software & services

Sila Nanotechnologies $1 Other SMS Assist $1

Internet software & services

SoundHound $1 Artificial intelligence StockX $1

E-commerce & direct-to-consumer

Sumo Logic $1

Data management & analytics

Supreme $1 Consumer & retail sweetgreen $1 Consumer & retail Talkdesk $1

Internet software & services

TechStyle Fashion Group $1

E-commerce & direct-to-consumer

Tongdun Technology $1 Cybersecurity Tresata $1

Data management & analytics

Turo $1

E-commerce & direct-to-consumer

TuSimple $1 Artificial intelligence Udaan $1

Supply chain, logistics, & delivery

Unisound $1 Artificial intelligence Vlocity $1

Internet software & services

Vox Media $1

Internet software & services

VTS $1

Internet software & services

WalkMe $1

Internet software & services

XiaoZhu $1 Travel Yanolja $1 Travel YH Global $1

Supply chain, logistics, & delivery

Yidian Zixun $1

Mobile & telecommunications

Yixia $1

Mobile & telecommunications

Zhangmen $1 Edtech Zhaogang $1

E-commerce & direct-to-consumer

ZipRecruiter $1 Artificial intelligence

https://ift.tt/2LRmnqz via CB Insights Research October 6, 2019 at 02:55PM

0 notes

Link

New UK early stage VC firstminute Capital launched in June last year to the tune of $60m, with Atomico Ventures as it’s first cornerstone investor. They were joined by 30 unicorns founders form Europe. Last September they brought in the huge China-based company, Tencent, reaching a fund size of $85m.

Today firstminute capital, the London-based pan-European seed fund announced a final close of $100m, and detailed its first batch of early-stage investments made since September.

Two institutional investors have now joined. Henkel, the €60bn publicly-listed FMCG giant, is making its first investment into a European seed fund, and Lombard Odier, one of Europe’s largest private banks, also joins.

The fund has three partners: Brent Hoberman CBE, Spencer Crawley and Henry Lane-Fox. Hoberman is chairman and co-founder of Founders Factory, a corporate-backed incubator/accelerator based in London, and also of Founders Forum, a series of invitation-only, but influential annual global events for leading entrepreneurs. He co-founded lastminute.com in April 1998, and sold to Sabre for $1.1bn in 2005. Crawley is co-founder and General Partner was previously Business Development at AppDirect (a San Francisco-based cloud commerce platform provider, backed by Peter Thiel’s Mithril Capital, latest valuation $1bn+), Investment Associate at DMC Partners (Goldman Sachs spin-out Special Opportunities fund), and Analyst in the Moscow office of Goldman Sachs. Lane-Fox is a partner at Founders Forum, Co-founder and CEO of Founders Factory, Co-founder of SmartUp.io, and previously part of the founding team of lastminute.com.

Hoberman said: “We’re excited to reach a significant milestone for firstminute, that helps us continue to support the most ambitious entrepreneurs globally. The latest investors to get behind the fund further increase our ability to have real impact, and we are buoyed by the rapid progress our portfolio founders are making. With our young and hard-working investment team, and our invaluable venture partners, we are hopeful that we can make our brand promise – of aspiring to be Europe’s most helpful seed fund – a reality. We were aiming to raise $60m for our first fund, and so to have closed our first fund at $100m is a strong signal for European technology.”

The link to Founders Forum is not insignificant. Hoberman curates an eclectic mix of founders investors and new entrepreneurs which has allowed him to tap a wide range of enthusiastic investors to his fund. These include the co-founders of lastminute.com, Supercell, Skyscanner, Trulia, Skype, Autonomy, Betfair, King.com, BlaBlaCar, Qunar, Carphone Warehouse, Datamonitor, PartyGaming, Tradex Technologies, Net-a-Porter, Capital One Bank, Fox Kids Europe, Webhelp, Airtel, PartyGaming and others, alongside other successes such as Marketshare, Ticketbis, Nordeus and LoveFilm. Tommy Stadlen, author, former Obama campaign speechwriter and co-founder of Swing, which exited to Microsoft, is both an investor in firstminute and a venture partner.

firstminute says it has a European focus – with the flexibility to follow local lead funding events in the US and Israel – and says its typically plans to invest $1m into seed-stage businesses.

There will be a sector agnostic remit for the fund, but wil take a particular interest in Robotics, vertical AI, Healthtech, Blockchain, SaaS, Cyber, Gaming and D2C.

The fund also released more details of its portfolio companies to date including:

• Cambridge self-driving start-up Wayve /> • Fuel delivery business Zebra • Wireless charging platform Chargifi • ICO exchange Templum (which has raised an additional $10m).

Firstminute says three of its portfolio have raised subsequent rounds within 6 months of firstminute’s investment.

The geographic spread of their 17 investments to-date has been UK, Germany, Portugal and Israel, as well as four investments in the US.

Family offices also feature heavily in the fund.

These include the JCDecaux family (€6bn market cap business), Baron Davies of Abersoch (former Labour minister and Standard Chartered CEO & Chairman), Sir Paul Ruddock (former CEO of Lansdowne Partners and Chairman of Oxford University’s Endowment) and Alex de Carvalho (founder of Public.io and Heineken non-executive director).

Firstminute is also now introducing its full-time operating team consisting of six investors: Lina Wenner (Cambridge, BCG), Camilla Mazzolini (OLX, Berenberg), Elliot O’Connor (founder of Code at Uni), Sam Endacott (Goldman Sachs), Anais Benazet (Founders Forum) and Clara Lindh (former freelance journalist).

Finally, three venture partners complete the set-up. Steve Crossan, formerly of DeepMind and Google and co-founder & CTO of Brandwatch.com, currently also an XIR at Atomico; Arek Wylegalski, formerly of Index Ventures in London, and currently exploring opportunities in the blockchain space; and Tommy Stadlen.

from TechCrunch https://ift.tt/2LH0vv0

0 notes

Text

Pan-European seed fund firstminute hits a final fund close of $100M

New Post has been published on https://latestnews2018.com/pan-european-seed-fund-firstminute-hits-a-final-fund-close-of-100m/

Pan-European seed fund firstminute hits a final fund close of $100M

New UK early stage VC firstminute Capital launched in June last year to the tune of $60m, with European VC Atomico as its first cornerstone investor. They were joined by 30 unicorns founders from Europe and the US. Last September they brought in the huge China-based company, Tencent, as well as European payment giant Adyen, reaching a fund size of $85m.

Today firstminute capital, the London-based pan-European seed fund announced a final close of $100m, and detailed its first batch of early-stage investments made since September.

Two institutional investors have now joined. Henkel, the €60bn publicly-listed FMCG giant, is making its first investment into a European seed fund, and Lombard Odier, one of Europe’s largest private banks, also joins.

The fund has three partners: Brent Hoberman CBE, Spencer Crawley and Henry Lane-Fox. Hoberman is chairman and co-founder of Founders Factory, a corporate-backed incubator/accelerator based in London, and also of Founders Forum, a series of invitation-only, but influential annual global events for leading entrepreneurs. He co-founded lastminute.com in April 1998, and sold to Sabre for $1.1bn in 2005. Crawley is co-founder and General Partner was previously Business Development at AppDirect (a San Francisco-based cloud commerce platform provider, backed by Peter Thiel’s Mithril Capital, latest valuation $1bn+), Investment Associate at DMC Partners (Goldman Sachs spin-out Special Opportunities fund), and Analyst in the Moscow office of Goldman Sachs. Lane-Fox is a partner at Founders Forum, Co-founder and CEO of Founders Factory, Co-founder of SmartUp.io, and previously part of the founding team of lastminute.com.

Hoberman said: “We’re excited to reach a significant milestone for firstminute, that helps us continue to support the most ambitious entrepreneurs globally. The latest investors to get behind the fund further increase our ability to have real impact, and we are buoyed by the rapid progress our portfolio founders are making. With our young and hard-working investment team, and our invaluable venture partners, we are hopeful that we can make our brand promise – of aspiring to be Europe’s most helpful seed fund – a reality. We were aiming to raise $60m for our first fund, and so to have closed our first fund at $100m is a strong signal for European technology.”

The link to Founders Forum is not insignificant. Hoberman curates an eclectic mix of founders investors and new entrepreneurs which has allowed him to tap a wide range of enthusiastic investors to his fund. These include the co-founders of lastminute.com, Supercell, Skyscanner, Trulia, Skype, Autonomy, Betfair, King.com, BlaBlaCar, Qunar, Carphone Warehouse, Datamonitor, PartyGaming, Tradex Technologies, Net-a-Porter, Capital One Bank, Fox Kids Europe, Webhelp, Airtel, PartyGaming and others, alongside other successes such as Marketshare, Ticketbis, Nordeus and LoveFilm. Tommy Stadlen, author, former Obama campaign speechwriter and co-founder of Swing, which exited to Microsoft, is both an investor in firstminute and a venture partner.

firstminute says it has a European focus – with the flexibility to follow local lead funding events in the US and Israel – and says it typically plans to invest $1m into seed-stage businesses.

There will be a sector agnostic remit for the fund, but wil take a particular interest in Robotics, vertical AI, Healthtech, Blockchain, SaaS, Cyber, Gaming and D2C.

The fund also released more details of its portfolio companies to date including:

• Cambridge self-driving start-up Wayve /> • Fuel delivery business Zebra • Wireless charging platform Chargifi • ICO exchange Templum (which has raised an additional $10m).

Firstminute says three of its portfolio have raised subsequent rounds within 6 months of its investment.

The geographic spread of their 17 investments to-date has been UK, Germany, Portugal and Israel, as well as four investments in the US.

Family offices also feature heavily in the fund.

These include the JCDecaux family (€6bn market cap business), Baron Davies of Abersoch (former Labour minister and Standard Chartered CEO & Chairman), Sir Paul Ruddock (former CEO of Lansdowne Partners and Chairman of Oxford University’s Endowment) and Alex de Carvalho (founder of Public.io and Heineken non-executive director).

Firstminute is also now introducing its full-time operating team consisting of six investors: Lina Wenner (Cambridge, BCG), Camilla Mazzolini (OLX, Berenberg), Elliot O’Connor (founder of Code at Uni), Sam Endacott (Goldman Sachs), Anais Benazet (Founders Forum) and Clara Lindh (former freelance journalist).

Finally, three venture partners complete the set-up. Steve Crossan, formerly of DeepMind and Google and co-founder and former CTO of Brandwatch.com, currently also an XIR at Atomico; Arek Wylegalski, formerly of Index Ventures in London, and currently exploring opportunities in the blockchain space; and Tommy Stadlen.

0 notes

Text

Pan-European seed fund firstminute hits a final fund close of $100M

New UK early stage VC firstminute Capital launched in June last year to the tune of $60m, with Atomico Ventures as it’s first cornerstone investor. They were joined by 30 unicorns founders form Europe. Last September they brought in the huge China-based company, Tencent, reaching a fund size of $85m.

Today firstminute capital, the London-based pan-European seed fund announced a final close of $100m, and detailed its first batch of early-stage investments made since September.

Two institutional investors have now joined. Henkel, the €60bn publicly-listed FMCG giant, is making its first investment into a European seed fund, and Lombard Odier, one of Europe’s largest private banks, also joins.

The fund has three partners: Brent Hoberman CBE, Spencer Crawley and Henry Lane-Fox. Hoberman is chairman and co-founder of Founders Factory, a corporate-backed incubator/accelerator based in London, and also of Founders Forum, a series of invitation-only, but influential annual global events for leading entrepreneurs. He co-founded lastminute.com in April 1998, and sold to Sabre for $1.1bn in 2005. Crawley is co-founder and General Partner was previously Business Development at AppDirect (a San Francisco-based cloud commerce platform provider, backed by Peter Thiel’s Mithril Capital, latest valuation $1bn+), Investment Associate at DMC Partners (Goldman Sachs spin-out Special Opportunities fund), and Analyst in the Moscow office of Goldman Sachs. Lane-Fox is a partner at Founders Forum, Co-founder and CEO of Founders Factory, Co-founder of SmartUp.io, and previously part of the founding team of lastminute.com.

Hoberman said: “We’re excited to reach a significant milestone for firstminute, that helps us continue to support the most ambitious entrepreneurs globally. The latest investors to get behind the fund further increase our ability to have real impact, and we are buoyed by the rapid progress our portfolio founders are making. With our young and hard-working investment team, and our invaluable venture partners, we are hopeful that we can make our brand promise – of aspiring to be Europe’s most helpful seed fund – a reality. We were aiming to raise $60m for our first fund, and so to have closed our first fund at $100m is a strong signal for European technology.”

The link to Founders Forum is not insignificant. Hoberman curates an eclectic mix of founders investors and new entrepreneurs which has allowed him to tap a wide range of enthusiastic investors to his fund. These include the co-founders of lastminute.com, Supercell, Skyscanner, Trulia, Skype, Autonomy, Betfair, King.com, BlaBlaCar, Qunar, Carphone Warehouse, Datamonitor, PartyGaming, Tradex Technologies, Net-a-Porter, Capital One Bank, Fox Kids Europe, Webhelp, Airtel, PartyGaming and others, alongside other successes such as Marketshare, Ticketbis, Nordeus and LoveFilm. Tommy Stadlen, author, former Obama campaign speechwriter and co-founder of Swing, which exited to Microsoft, is both an investor in firstminute and a venture partner.

firstminute says it has a European focus – with the flexibility to follow local lead funding events in the US and Israel – and says its typically plans to invest $1m into seed-stage businesses.

There will be a sector agnostic remit for the fund, but wil take a particular interest in Robotics, vertical AI, Healthtech, Blockchain, SaaS, Cyber, Gaming and D2C.

The fund also released more details of its portfolio companies to date including:

• Cambridge self-driving start-up Wayve /> • Fuel delivery business Zebra • Wireless charging platform Chargifi • ICO exchange Templum (which has raised an additional $10m).

Firstminute says three of its portfolio have raised subsequent rounds within 6 months of firstminute’s investment.

The geographic spread of their 17 investments to-date has been UK, Germany, Portugal and Israel, as well as four investments in the US.

Family offices also feature heavily in the fund.

These include the JCDecaux family (€6bn market cap business), Baron Davies of Abersoch (former Labour minister and Standard Chartered CEO & Chairman), Sir Paul Ruddock (former CEO of Lansdowne Partners and Chairman of Oxford University’s Endowment) and Alex de Carvalho (founder of Public.io and Heineken non-executive director).

Firstminute is also now introducing its full-time operating team consisting of six investors: Lina Wenner (Cambridge, BCG), Camilla Mazzolini (OLX, Berenberg), Elliot O’Connor (founder of Code at Uni), Sam Endacott (Goldman Sachs), Anais Benazet (Founders Forum) and Clara Lindh (former freelance journalist).

Finally, three venture partners complete the set-up. Steve Crossan, formerly of DeepMind and Google and co-founder & CTO of Brandwatch.com, currently also an XIR at Atomico; Arek Wylegalski, formerly of Index Ventures in London, and currently exploring opportunities in the blockchain space; and Tommy Stadlen.

0 notes

Link

New UK early stage VC firstminute Capital launched in June last year to the tune of $60m, with Atomico Ventures as it’s first cornerstone investor. They were joined by 30 unicorns founders form Europe. Last September they brought in the huge China-based company, Tencent, reaching a fund size of $85m.

Today firstminute capital, the London-based pan-European seed fund announced a final close of $100m, and detailed its first batch of early-stage investments made since September.

Two institutional investors have now joined. Henkel, the €60bn publicly-listed FMCG giant, is making its first investment into a European seed fund, and Lombard Odier, one of Europe’s largest private banks, also joins.

The fund has three partners: Brent Hoberman CBE, Spencer Crawley and Henry Lane-Fox. Hoberman is chairman and co-founder of Founders Factory, a corporate-backed incubator/accelerator based in London, and also of Founders Forum, a series of invitation-only, but influential annual global events for leading entrepreneurs. He co-founded lastminute.com in April 1998, and sold to Sabre for $1.1bn in 2005. Crawley is co-founder and General Partner was previously Business Development at AppDirect (a San Francisco-based cloud commerce platform provider, backed by Peter Thiel’s Mithril Capital, latest valuation $1bn+), Investment Associate at DMC Partners (Goldman Sachs spin-out Special Opportunities fund), and Analyst in the Moscow office of Goldman Sachs. Lane-Fox is a partner at Founders Forum, Co-founder and CEO of Founders Factory, Co-founder of SmartUp.io, and previously part of the founding team of lastminute.com.

Hoberman said: “We’re excited to reach a significant milestone for firstminute, that helps us continue to support the most ambitious entrepreneurs globally. The latest investors to get behind the fund further increase our ability to have real impact, and we are buoyed by the rapid progress our portfolio founders are making. With our young and hard-working investment team, and our invaluable venture partners, we are hopeful that we can make our brand promise – of aspiring to be Europe’s most helpful seed fund – a reality. We were aiming to raise $60m for our first fund, and so to have closed our first fund at $100m is a strong signal for European technology.”

The link to Founders Forum is not insignificant. Hoberman curates an eclectic mix of founders investors and new entrepreneurs which has allowed him to tap a wide range of enthusiastic investors to his fund. These include the co-founders of lastminute.com, Supercell, Skyscanner, Trulia, Skype, Autonomy, Betfair, King.com, BlaBlaCar, Qunar, Carphone Warehouse, Datamonitor, PartyGaming, Tradex Technologies, Net-a-Porter, Capital One Bank, Fox Kids Europe, Webhelp, Airtel, PartyGaming and others, alongside other successes such as Marketshare, Ticketbis, Nordeus and LoveFilm. Tommy Stadlen, author, former Obama campaign speechwriter and co-founder of Swing, which exited to Microsoft, is both an investor in firstminute and a venture partner.

firstminute says it has a European focus – with the flexibility to follow local lead funding events in the US and Israel – and says its typically plans to invest $1m into seed-stage businesses.

There will be a sector agnostic remit for the fund, but wil take a particular interest in Robotics, vertical AI, Healthtech, Blockchain, SaaS, Cyber, Gaming and D2C.

The fund also released more details of its portfolio companies to date including:

• Cambridge self-driving start-up Wayve /> • Fuel delivery business Zebra • Wireless charging platform Chargifi • ICO exchange Templum (which has raised an additional $10m).

Firstminute says three of its portfolio have raised subsequent rounds within 6 months of firstminute’s investment.

The geographic spread of their 17 investments to-date has been UK, Germany, Portugal and Israel, as well as four investments in the US.

Family offices also feature heavily in the fund.

These include the JCDecaux family (€6bn market cap business), Baron Davies of Abersoch (former Labour minister and Standard Chartered CEO & Chairman), Sir Paul Ruddock (former CEO of Lansdowne Partners and Chairman of Oxford University’s Endowment) and Alex de Carvalho (founder of Public.io and Heineken non-executive director).

Firstminute is also now introducing its full-time operating team consisting of six investors: Lina Wenner (Cambridge, BCG), Camilla Mazzolini (OLX, Berenberg), Elliot O’Connor (founder of Code at Uni), Sam Endacott (Goldman Sachs), Anais Benazet (Founders Forum) and Clara Lindh (former freelance journalist).

Finally, three venture partners complete the set-up. Steve Crossan, formerly of DeepMind and Google and co-founder & CTO of Brandwatch.com, currently also an XIR at Atomico; Arek Wylegalski, formerly of Index Ventures in London, and currently exploring opportunities in the blockchain space; and Tommy Stadlen.

via TechCrunch

0 notes