#And also I segment where I went to McDonald’s to meet up with some friends

Explore tagged Tumblr posts

Text

So I had a dream where a group of heroes & I were looking for this sword that had literally unlimited power? And because my dreams give me the abilities of my sona (and my sona’s fucking OP), the group decided I was the only one strong enough to handle it??? I guess???

So ya know, I pulled it out of the ground, and of COURSE as soon as I did we got ambushed by these… creatures? A disembodied voice called them Eldritch, but they were more like trolls that looked like stone. And the whole point of the ambush was to test the sword & the people that wanted it.

Anyways, I’m telling you this, because you’ll NEVER guess who was in my group

fucking LÚCIO!!!

THAT’S RIGHT! You thought it was a normal dream, but it was actually me, SELF INDULGENCE!

He wasn’t wearing his normal aesthetic though. Like he was wearing all yellow? I distinctly remember a yellow tank-top. His locs were shorter than normal too, I noticed. But like it was still obviously him ya know?

Anyways it was just really fucking cute. We were teaming up & fought together! And despite us being in this action-packed scenario, we still found time for us to smooch a lil 🥺🥺. I could really feel him man…. It was so damn wild 😭🙏

#Also included in this dream was a segment where Wizard 101 got updated to have full character customization#And also I segment where I went to McDonald’s to meet up with some friends#self ship#self shipper#self shipping#romantic f/o#🐸📱songwriter📱🐸#🛏️💭Dream Diary🛏️💭

5 notes

·

View notes

Text

written segment:

y/n’s pov

you sit outside of his apartment waiting for him to open the door, the breeze outside was a pleasant surprise. you soon hear the lock click and the door open, being greeted with iwaizumi behind it. “hey iwa! how’s it going?” you smile as he motions you in with his hands. “it’s going well, sorry i didn’t get some of it clean, oikawa likes to come mess up my place from time to time.” he scratches the back of his head while you laugh at his statement. “that’s perfectly fine iwa.” he takes in your outfit with his eyes and a tint of red paints his cheeks. he walks over to the couch inviting you to come join him, “you can sit wherever you’d like, i don’t mind,” accompanied with a smile. you decide to sit in the middle of the couch while he plops down next to you, still at a comfortable distance.

“what kind of movie do you want to watch?” he focuses on the tv biting his bottom lip in concentration. your eyes light up at the question and you respond, “ooou can we watch a horror movie?” he slowly turns his head and shakes it from one side to the other, “i hate horror movies.” you continue to look him in the eyes puffing out your bottom lip. “i-i uh well,, i guess i can’t say no can i?” he closes his eyes as you respond to him, “nope, not at all.” after convincing him to watch a horror movie he finally picks one that he doesn’t think will be too scary. (yeah it’s a scary scary movie)

as the movie goes on iwaizumi seems to inch closer to you until your arms and legs are touching, you can visibly see him jump every time the music gets ominous. you smile knowing that this next jump scare is the worst one in the movie. it soon arrived and iwaizumi yelps as he hides his face in the crook of your neck, his arms wrapping tightly around your body. “aww iwaaa, are you that scared?” you feel him starting to pout on your shoulder so you pull his face away from your shoulder. he looks away trying to hide the deep blush creeping up on his face. “here, lift up.” he pulls his back from the couch and you start rubbing circles on his shoulders. “t-thank you.” the blush on his face gets worse than before.

soon enough the movies over and iwaizumi is asleep on your lap, slight snores escaping his lips. you look at his peaceful face and start running your fingers through his hair. you grab your phone and text the group chat that he’s one not a serial killer and two you’re safe and he’s asleep. after you text the group chat you decide to watch another movie. towards the end of the second movie he starts moving around. “hey, i’m sorry did i fall asleep?” his just woke up voice rang through your ears. “uhh, y-yeah i just uh watched another movie.” he nods and sits up, making your lap feel cold again. “i normally don’t fall asleep on people like that,” he scratches the back of his head, “just uh people i trust.” he smiles and looks towards you, “thanks for not stealing my kidneys by the way, you a real one.”

“would you want to watch a funny movie, since you were so scared of the horror movie?” you sarcastically turn your head towards him as he tries to stifle a laugh. “i mean. i’m down.” halfway through the movie you start feeling sleepy, your eyes closing on their own, drifting off to sleep.

iwaizumi’s pov

i feel a weight on my shoulder and look over to see y/n fast asleep. i smile and pull her closer to me so that her head is more comfortable on my chest. she grumbles in her sleep and i try not to laugh at the soft snores coming from her. i decide to run my fingers through her hair soothing both me and her. i feel the same blush as earlier creeping up once again, just the picture of her in my arms is enough to make me blush. i smile and lay my head back on the cushion slowly falling asleep too.

y/n’s pov

you begin to wake up, trying to get up to check your phone but feel weighted down. noticing that your laying on iwaizumis chest and his arms are wrapped around you, small rhythmic breaths escaping his lips. you try and move out of his grasp but he keeps pulling you back and mumbling the same phrase, “please don’t leave.” (i mean how could you leave with iwaizumi being all soft) you poke his face and he wakes up with a gasp, “hey iwa, it’s just me dummy.” he looks down and starts laughing, “oh, you scared me.” now it was your turn to laugh at his stoic response. “gosh i guess we both fell asleep huh?” he turns his head to meet your gaze, messy hair, dried drool, and heavy lidded eyes. “yeah, you look like you got hit by a bus.” he laughs and lightly punches you in the arm. (which sends you flying across the room to break your back 😀 jk)

“anyways, mrs. i wake up looking cute after a nap, are you hungry? we didn’t eat dinner.” he lays his head on your shoulder continuing to play with your hair. “aww iwa, you think i’m cute? but yeah i am getting a little hungry.” he blushes once again at your remark nodding in your shoulder, once he sits up he offers his hand so you take it. he grabs his jacket, one for you, and his keys then leads you out of the door. “where are we going?” you laugh grabbing his hand tighter, interlacing your fingers. “it’s a secret.” he holds his other hand to his mouth. you guys went to mcdonald’s in the end and went to a park to eat it. he fed you fries and chicken nuggets and laughed at stories of your friends. in the end you thought it was a perfect day and thought you should do this more often, with him. “hey, iwaizumi, uh can i call you by your first name?” you look over to him. “oh, uh, yes, yeah you can, i would really like that actually.” you smile and nod, “alright hajime.”

#5 late night thoughts

⭐️ masterlist

< previous | next >

taglist: @onlyonew @nozraelart @elianetsantana @yuiicorn @jovialweaselskeletonfan @kuroos-roosterhead @pastel-prynce @afuckingunicornn @poppi144 @bakugouswh0r3 @fluffyviciousbunny @oreogutz @ysatrap

a/n | wowowowow this one is probably my favorite one so far, like who doesn’t wanna go to mcdonald’s with iwaizumi 😀 also the whole hajime thing was really cute to me so i was like, let’s add it. anyways i hope you guys liked this one 🥺

#iwaizumi x reader#haikyuu x reader#haikyuu hcs#haikyuu imagines#haikyuu smau#iwaizumi hajime#iwaizumi hcs#iwaizumi smau#iwaizumi x you#intheclouds☁️

51 notes

·

View notes

Text

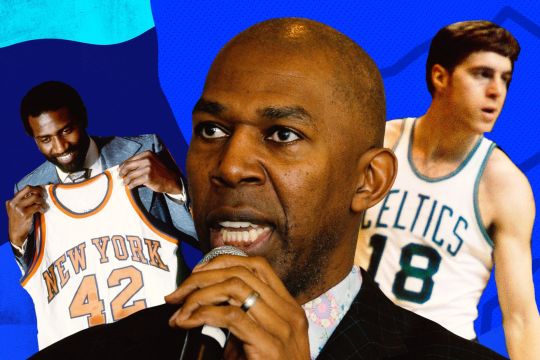

How retired NBA players are helping each other survive the coronavirus

Spencer Haywood, Thurl Bailey, Dave Cowens are members of the National Basketball Retired Players Association.

Retired NBA players are more vulnerable to the coronavirus than active ones. Here’s what they’re doing about it.

Moments before the NBA suspended its season, Thurl Bailey was at Chesapeake Energy Arena preparing to call a game between the Utah Jazz and Oklahoma City Thunder that would never happen. It was a night like any other, until it wasn’t.

After Jazz all-star Rudy Gobert tested positive for coronavirus and the 18,000-plus person crowd was calmly instructed to exit the building, Bailey, who played in Utah for 10 seasons, was whisked off the court behind Jazz players and broadcast colleagues.

The 58-year-old recalls being led with about seven others into a lounge near the visitor’s locker room. There they sat, eyes glued to a television that was reporting their own surreal experience in real time. Jazz head coach Quin Snyder settled some of Bailey’s nerves when he walked in the room to brief everyone on the situation, as serious as it was. Eventually Bailey was led from that room to another, where medical professionals in protective gear, gloves, and facemasks collected his personal information so he could be tested for Covid-19.

A doctor braced him for the process by letting him know what to expect and how uncomfortable it might be, before a cotton swab was inserted into his nose and mouth. According to Bailey, it was painless and simple. Waiting for results was anything but. After they quarantined at the arena for over four hours, the Jazz spent the night in an Oklahoma City hotel. Bailey sat in his room, concern mounting as he thought about his wife and children.

“What if my test is positive?” he remembers. “Was I next to Rudy? How long was I next to him? Can you receive it if you’re on the same plane as people? All those things you start replaying in your mind.”

In the morning a Jazz employee called Bailey with good news: his results were negative. Soon after, the team flew back to Salt Lake City where they met with Angela Dunn, a state epidemiologist at Utah’s Department of Health. She went over different risk factors, explained the meaning of asymptomatic, and made strong suggestions on how they (and everyone around them) should act through the life-changing days and weeks and months that loomed ahead.

Before the season was suspended, Bailey’s daily responsibilities were not limited to his job as a broadcast analyst for the Jazz. Earlier this month, he was elected as a board of director for the National Basketball Retired Players Association (NBRPA), a 1,000-plus member organization that includes some of the sport’s most integral historic figures — former players from the NBA, WNBA, ABA, and Harlem Globetrotters.

“No one’s immune to [Covid-19], but it is a greater concern for our demographics, if you will,” Bailey says. “A lot of our players are the older generation,” Bailey said.

Right now, in the face of a crippling global pandemic, its members also represent an increasingly vulnerable and shaken segment of society that needs all the security, support, and accurate information they can find. The average member is 55 years old and over 200 of them are at least 70. All are impacted by the coronavirus, stressed over their own future, from a physical, emotional, and financial perspective.

In addition to Bailey — who previously served before he was termed out of the role due to appointment related rules — other recently elected directors include Shawn Marion, Sheryl Swoopes, and Dave Cowens. (Cowens helped found the association in 1992 with Oscar Robertson, Dave Bing, Archie Clark, and Dave DeBusschere.) Johnny Davis was named chairman of the board after spending 34 seasons as an NBA player and coach, while Jerome Williams and Grant Hill were elevated into different roles on the executive committee.

Normally, the association serves multiple functions. It’s a helping hand to members in search of new professional and/or educational opportunities. It reminds them of their own value as walking brand names, and encourages them to engage with the public in different ways. But unfortunately, our current timeline is anything but normal. The NBRPA has always expressed solicitude for its own, but right now its first, second, and third priority is to ensure the health and wellness of every member who feels susceptible.

“No one’s immune to [Covid-19], but it is a greater concern for our demographics, if you will,” Bailey says. “A lot of our players are the older generation.”

The NBRPA has been in front of the issue as best it can. All former players with at least three years service have healthcare coverage, while counseling services, scholarships, grants, and a rainy day fund for any members who are struggling to cope are in place. General awareness of these resources has been spread via email and phone calls, but this pandemic’s unpredictable scale will test mechanisms that have never been burdened by a threat this widespread and relentless.

Many members work part time and are unsure of how they’ll pay their next bill or make future house payments. Dozens have contacted the organization for assistance, which tells NBRPA President and CEO Scott Rochelle that many more may want to. “There’s probably another hundred who need to reach out or haven’t reached out but need the information,” he tells me. “So that’s guiding our efforts to date.”

Spencer Haywood, who just termed out after two straight three-year stints as the NBRPA’s chairman of the board, can’t stop thinking about his fellow members, former teammates, and friends who were suffering even before the globe was blanketed by coronavirus.

“I love them,” Haywood says. “Everybody just calls, ‘Hey can you help me with $300. I need $400, $500. I need this to make my rent. I need this to get food ... We don’t have a revenue stream. All of our guys have to work. They’re doing basketball camps. They’re traveling. They do groups. That’s how they make money ... We’re at the very beginning [of this pandemic], so I know our family, the NBA retired family, we’re gonna have some drama. I’m hoping that it’s not me. But who knows?”

Now 70 and living in Las Vegas, Haywood has done his best to stay as safe as he possibly can, stopping just short of hoarding Purell and essential groceries several weeks ago when his brother, who lives in France, first told him how deadly the virus can be. His four daughters teased him about being overly cautious, but now admit he was right to be so proactive.

Aside from his inability to resist two concerts at the House of Blues, put on by Arrested Development and Leslie Odom Jr. before everything shut down — “I couldn’t help myself!” Haywood laughs. “I went out against orders” — he’s replaced daily trips to the gym with morning yoga and five-mile walks at a nearby park.

While shuttered at home last Saturday afternoon, Haywood — a four-time NBA All-Star and ABA MVP as a 20-year-old rookie — let a few hours pass in front of ESPN’s panoramic Basketball: A Love Story documentary series, which featured his own 1971 Supreme Court case brought against the NBA that essentially allowed amateurs to bypass college and enter the NBA Draft straight out of high school. “I’m sitting there watching,” he laughs. “And I’m like ‘Damn. Pretty nice. I did some deep shit.”

As it rolled across his television, Hayward says a few friends who were also cooped up watching the same thing decided to call him: “They were like, ‘Man, I didn’t know you went through that kind of hell’. And I said ‘You were in the league!’ Man, oh man.”

But the pandemic has also emphasized a few general frustrations Haywood wants to air: “We wasted so much time in fake news and fake this, like shit, dude, if you didn’t want to be president, why did you run?”

He praises the donations made by current players to arena employees who, without NBA games, no longer have a job to do, and appreciates the players union’s unanimous vote that gave healthcare coverage to retired players back in 2016 “[NBPA President] Chris Paul has been a champion,” Haywood says. “I mean truly life saving.”

But in the midst of a broad crisis that will be felt by more former players than are currently under the NBRPA’s umbrella, Haywood also believes today’s stars should make additional contributions. “It’s a survival thing.” he says. “Think about the ones who built it for you. Who built this big conglomerate for you. I think they just don’t know. They never think about us.”

“The thing that bothers me so bad is they don’t know when it’s gonna end,” Cowens says, “Or is it?”

For the NBRPA, spring is typically a busy time of year, with college conference tournaments, the NCAA tournament, the McDonald’s All-American game, and Full Court Press, a nationwide youth clinic launched through the Jr. NBA. In the coming months, members lined up to earn between $250-500k in appearances alone. Instead, thanks to a wave of cancellations, revenue is at zero. There are still engagement opportunities being explored through NBA2K, Twitch, and social media, but the ramifications are undeniable.

Speaking appearances are another source of income for those who can leverage their name and life experience to travel across the country and meet with different people. That includes Haywood’s successor, Davis, the NBRPA’s newly elected chairman. The 64-year-old lives in Asheville, North Carolina, and normally spends his time giving talks at different colleges and universities in the area. He also sits on the foundation board at UNC-Asheville, where he’s heavily involved.

But with those opportunities no longer an option for the foreseeable future, Davis is instead staying put at his home up in the Blue Ridge mountains with his wife and son, where they’ve lived since 2009. “The warning bell has been sounded,” he tells me. “You can see the presence of what this virus has done. You can see it here in terms of how people are moving in their day to day lives. It’s different. It feels different.”

Davis is also spending some time acclimating to his new role with the NBRPA, going through the bylaws with Cowens, who lives in Maine for most of the year but has been down in Ft. Lauderdale since Jan. 10. Despite not having a full-time job, Cowens tries to keep himself busy. Last week he signed and mailed 800 basketball cards for Panini, the memorabilia company, that compensated him for the service. “It’s not a lot, but it’s enough to pay a few bills,” he says.

The Hall of Famer currently lives two blocks from the beach in a 19-story building, with 12 units on each floor. He’s neighborly, but most of the residents are on the older side, and over the past couple weeks everybody has kept to themselves.

Nights are spent out on his balcony, drinking an occasional glass of wine. When asked about the NBA deciding to suspend its season, Cowens says he would’ve liked to see at least one game played without any fans in the stands. The sound of squeaking shoes, shouting coaches, grunting players, and a natural silence that would otherwise be filled by the Jumbotron reminds him of old exhibition games that his Celtics used to play against the Knicks in upstate New York. Only 1,500 people were in the stands.

But there are more pressing matters on his mind. Now 71, Cowens is troubled by everything we don’t know about the coronavirus, how there’s no vaccine or direct word from the inflicted about how it made them actually feel. He worries about his wife. He checks up on old college buddies from Florida State, and recently phoned former Celtics teammate Don Chaney, who’s dealing with a heart condition and is likely at a higher risk than most.

“There’s so much uncertainty. If you’re feeling fine, but all of a sudden you start feeling sick, you then say ‘Am I gonna die from this?’ And so you don’t know. Young people don’t care because they’re already immune to everything in the world anyway. They’re gonna live forever. But they’re young, that’s how they think, and for the most part they’re in pretty good shape for dealing with this,” Cowens starts to chuckle. “So I don’t hang out at the clubs anymore. That’s not part of the schedule.”

No one interviewed for this story can compare such active worldwide disruption to anything they’ve witnessed or experienced firsthand. None can think of anything that comes close. It’s an unknown anxiety, like walking a plank while blindfolded from an unknown height. The future grows more murky by the day. “The thing that bothers me so bad is they don’t know when it’s gonna end,” Cowens says, “Or is it?”

He reminisces about his childhood in Newport, Kentucky. Cowens’ grandparents and aunt lived upstairs, in the same house as his parents and brother. His aunt would entertain with stories about getting to see Jim Thorpe (the only sports hero Cowens ever had) race with her own two eyes.

Cowens thinks about that time; how his grandfather lived to see his 60s despite serving in World War I and then enduring the Spanish Flu, which killed as many as 50 million people across the world. “People are going to survive,” Cowens says. That’s true. But the coronavirus will still crash into so many different lives, and so far the mortality rate for those it infects is substantially higher in seniors with underlying health issues.

Preparing for a disease that will infect and bankrupt thousands of people everyday was never in the NBRPA‘s sight line, and, frankly, it’d be a little silly if it was. Very few organizations in this country, if any, were prepared. But that hasn’t stopped them from doing whatever they can to steady the emotional wave so many are flailing through.

Right now, the organization’s primary motivation is to keep a bad situation from getting worse, and so far most retired players are doing whatever they can to limit the damage. Social distancing and self-quarantining are two examples of individual responsibility each person must take seriously. Most retired players are. The NBRPA can’t help those who won’t help themselves, but they can spread facts and manageable tactics that will save lives. The minefield of misinformation can in many ways be as dangerous as an errant cough.

Towards the end of his career, Bailey spent four seasons playing overseas. Three of them were in Italy, where he formed lifelong friendships. For the last five summers, he’s gone back to put on a basketball camp. Over the past couple weeks, Bailey has been texting with those who know firsthand what the coronavirus is capable of. They beg him to take it seriously. Given his position with the NBRPA, those around him are fortunate that he is.

“Our organization is staying on top of our members and their families to make sure they’re getting through it,” Bailey says. “It’s something that will always be etched in history. I was there. I was there the day the dominoes started to fall in Oklahoma City. In the sports world, anyway.”

1 note

·

View note

Text

The Automatic Millionaire with New York Times Best Selling Author David Bach

Earlier this year, I had the pleasure of sitting down with financial expert and author David Bach. You probably know David from his amazing personal finance books, which include The Automatic Millionaire, Start Late, Finish Rich, and Smart Couples Finish Rich.

As a keynote speaker at FinCon this year, Bach made his way to Dallas to share his wisdom with money nerds like me.

This was a surreal experience for me because I've admired or, better said, had a “man crush” on David for several years because of his transition from a financial advisor to a globally recognized author and speaker.

Essentially, he has laid the stepping stones for a journey that I'm right in the middle of. So to meet him in person AND get some 1-on-1 time had me in a wonderfully giddy state.

Here's what you'll learn in the interview:

How I first was introduced to David Bach in 2005 while on tour in Iraq. Because when you’re deployed, the only things you do in your free time are workout, play poker and read.

How David's childhood really paved the path for his understanding and interest in the financial advising world.

Hear what the turning point was for David transitioning from the financial advising segment of his career to chasing his passion.

How did the actual transition take place to pursue his dream? Hear what the process looked like with the realities life has… providing for your family, taking care of your wife, moving across the country, etc.

How David was able to reach his goal of teaching 1 million people.

What by-products came from chasing his passion that really were not planned, but certainly are a bonus today. (This is the GOOD STUFF!)

How when you’re passionate about something, you really never get tired of teaching about it.

How taking a year or more sabbatical to rest and reflect is actually a really terrifying decision to make… but the single greatest thing David can recommend to anyone.

How you can plan and prepare to take a sabbatical in the coming year.

Hear what would be a success over the next three years for David and how he’s setting those goals now.

You can watch the interview here:

youtube

And if you want a free copy of David's best-selling book The Automatic Millionaire, I'm giving away 10 copies. Holla!

For your chance to win you just need to do 3 simple things:

Subscribe to my YouTube channel. Just click here. Easy peasy.

Like this video.

Leave a comment.

That's it!

Or you can read the interview transcription below. Enjoy!

Interview with David Bach

Jeff Rose: When you're in Iraq and you have downtime, you either work out, play poker, or read books. I took a lot of books with me, probably because I was on a John Grisham kick at the time. I took every single John Grisham book with me and read them all before looking for other books to read.

The cool thing is, soldiers were getting books all the time. So, all the other units that were there before us left books for us to read, too. I saw this book called The Automatic Millionaire by David Bach. I had heard of the book, but never had the time to read it until I was on deployment.

David Bach: Wow!

Jeff Rose: If I recall correctly, I read it all in about a day and a half. I just absorbed it.

David Bach: That’s fantastic. The goal of that book was to make it so anybody could read it in a really short amount of time. That way, they could easily go and act on it.

Jeff Rose: I remember I read it and then everyone that was deployed with me knew I was a financial advisor. So, people would tell me they wanted to get a handle on their finances and ask me what book they should read. I started telling them about your book. This was 2005.

David Bach: That’s amazing.

Jeff Rose: Yes, that was the first time I was introduced to you and your ideas like “the latte factor.” I just wanted to say “thank you” for encouraging me and inspiring others how to handle their money differently.

David Bach: I just got chills. I didn't know this was coming, so thank you. It really makes me feel good. First of all, thank you again for your service. It makes me feel good to know that it was reaching you in Iraq. I just had the privilege of speaking to a group of people who were transitioning out of the military, and we gave everybody copies of The Automatic Millionaire. I also gave a talk. You guys do such a service for our country and financial education is so important when you make the transition from the military to the civilian world. I'm glad I could help you and I'm glad I could help some of your friends.

How David Started His Career as a Financial Advisor

Jeff Rose: Yeah, that's awesome. I kind of want to take a step back. You're a New York Times Bestselling Author. You've written a lot of content and put a lot of amazing advice out there. Before that, you were a financial advisor with Morgan Stanley. Can you tell me a little bit about how that started? What made you want to become a financial advisor?

David Bach: I don't know how much of my story you know, but I grew up in the business. My dad was a financial advisor. They used to call them stockbrokers. I still remember walking into my dad’s office. They had ticker tapes. Most of you who are watching this have absolutely no idea what a ticker tape is.

Before there was this thing called the internet, before there was a Quotron machine and stock quotes came off of a ticker tape machine. You would actually go into a stockbroker's office to find out where the stocks were trading. You don't even know what I'm talking about.

Jeff Rose: I've seen the movies.

David Bach: They would tear a piece of paper off. As a three or four-year-old kid, I remember going and getting those pieces of paper and bringing them to my dad's office. I remember when the computer came out and the Quotron was the first machine to give you a stock quote. My grandmother helped me buy my first stock at age seven. It was in McDonald's. She taught me how to become an investor one day at McDonald's. She took the Wall Street Journal, circled the stock, showed me MCD, put me in front of the TV, and taught me how to read the stock quotes going across the bottom of the screen. I started investing at seven. At age nine, my dad started teaching retirement classes.

When I was nine, my mom told my dad he needed to bring me to the class so I could at least see him one night a week. He did and he dressed me up in a suit and tie. I sat in the back of the room. During the breaks, his students would come up and tell me what they learned from my father that changed their life.

In 1993, I joined the business and went through training. I also started teaching classes right away. Eventually, I started teaching classes that taught women how to manage money. That happened because, in a very short period of time, I set in multiple meetings with widows. I met with three in a month. They were very unprepared.

Financially, they were okay and they were lucky because my dad was their advisor, but they knew very little about money. I was sort of shocked. I thought,

“I'm going to do something and create a class for women and money.”

That's what started my passion. I started teaching these classes until they became more popular. As my classes became more and more popular, I wanted to reach more people.

The Scariest Career Jump of His Life

Jeff Rose: Your business is thriving. You're teaching seminars. You're kind of reaching this point where you have a higher calling, like there's something bigger here than just managing money. We were just talking about how you were in the Strategic Coaching program, which is something I was in for five years. I listened to an interview that you did with Dan Sullivan. I'm not sure how long ago this was, but I remember it was a CD that I listened to in my car.

I still have it, but what I remember about the interview is that you said you were sitting in your office and I think you had a client call in that was trying to get their dividend check deposited while traveling overseas.

You kind of had this out-of-body experience where you wondered if it was your life’s calling to make sure your client’s dividend check was deposited while they were traveling. I think we've all kind of had moments like that. I'm curious because many people want to chase their calling and their passion forever. You have a thriving business. You've got no reason to not continue to do that.

David Bach: Everybody told me that I was out of my mind. I was nine years into Morgan Stanley. At the time, I think I had around $700 million in our management. I had built a fee-based business. Anybody who is listening to this knows that is the holy grail. I was doing financial planning and fee-based business and this was the 90’s. People looked at me like I was crazy when I said I was going to change gears.

“You're going to move to New York and write books and try to help a million people? What are you going to do if that doesn't work?”

Jeff Rose: Can you talk a little bit about that? Just making that bold leap. How do you go from a fee-based business that's on autopilot for the most part and to turn your back on that and say, “I want to do something else?”

David Bach: There were multiple parts to this. Interestingly enough, Strategic Coach was also a part of that. I started Strategic Coach in 1997. I had gone through Tony Robbins program in the early 90’s. I was in real estate first. At a Tony Robbins seminar, I kind of came up with my overarching big mission, which I wrote in a journal:

“I want to go out and teach a million women to be smarter with their money so they can protect their families and teach their kids.”

I became crystal clear on what I felt like I was here to do with my life.

The problem is, having a calling can really complicate your life. Let's just be totally honest, right? I was set living in the Bay Area with a beautiful home, a country club membership, and a great career. I decided to throw all that away so I could help other people.

I've had lots and lots of success, but none of it's been easy. What did I actually do to make the transition? I went through a lot of pain.

First, I went through the realization that I wanted something different. That's where that story that you're talking about with Dan Sullivan came in. I had that moment – a lightbulb moment. Basically, I built this great business with Morgan Stanley and I had succeeded as a financial advisor. The more you succeed as a financial advisor, you start to work with wealthier and wealthier clients. It's part of the way the business is set up. I'm going to work with wealthier and wealthier clients. I'm going to work with fewer of them. Once I was in my late 20’s, I could start to see the rest of my life. Basically, for the next 20 years I'm going to work with a hundred or fewer wealthy families and that's all I'm going to do? By the way, I'm not judging anybody if that’s what they do for a living. I know people who work with 10 families and they have the greatest life ever.

But, I wanted to go around and teach more people. I was teaching people Smart Women Finish Rich, which was my first book. Then I did some more, and I was flying all over the country. My wife was super supportive, but I was gone a lot.

Jeff Rose: You're still in your practice at this point?

David Bach: I'm still in my practice. It's like working three jobs. I'm running a practice and I'm promoting these books and I'm promoting the seminars. I was flying back and forth from California to New York a lot because that's where all the TV is. I was very blessed. I kept getting asked to go back on The View over and over again. I'm on The View with Barbara Walters for a long time, like an eight-minute segment. She just kept talking and talking with me. I'm like, “Oh my God, I'm on The View with Barbara Walters.” If my grandmother would have been alive to see this, she would be so proud.

I got back in the car and I said to my wife, “This was amazing. That was the best show I've ever done. I just spent two days traveling to be on TV for seven minutes. If I'm going to really do this, we need to move to New York.”

She said, “If that's what you really want to do, then let's do it.”

I hired a coach and I kind of worked through what would it take for me to make that transition. I didn't just wake up and do it one day. The transition was probably about a 12 to 18-month period of time where I really worked it all out. I worked it out financially. I worked it out mentally. I worked it out with my family and then I did it.

Then 9/11 happened. I told all my clients I was basically retiring and moving to New York. It wasn't retirement, though. I was going to move to New York and try to teach millions of people. I did that in June, July, and August and 9/11 rolled around. I rushed into the office and started calling all of my clients.

They said, “Well, you're not going now, right? You're not going to New York now?”

Not only did we go to New York, but we moved downtown. We moved to New York in November 2001.

Hitting the New York Times Best Seller's List

Jeff Rose: You made the move and made the transition. Now you’re writing more books and doing more workshops. When did you actually make the New York Times Best Seller list? Was that your second book?

David Bach: Smart Women hit the Best Seller list, but not until eight or nine months after it came out. I did a PBS special. The PBS special on Smart Women Finish Rich started airing everywhere and I was running all over the country. Then I starting having financial advisors teaching my seminars. We licensed Smart Women Finish Rich.

I packaged up my intellectual property. I took what I was already doing, that I knew would work, and I trained other financial advisors to go do it. When I did that, I started to scale things up.

At one point, we had 100,000 people a year going through seminars I wasn't teaching. It was all my content. All these people are getting great, free help and then the advisors were getting clients from it. Everybody won. That's how I ultimately reached a million people.

Jeff Rose: You reached your million people. That was one of your goals.

David Bach: I did. It took seven years. I'm not just measuring books. Between live events and books, we reached well over a million people. Kind of from the way I was measuring it, it was a seven-year timeframe.

Oprah vs. New York Times – Who Wins?

Jeff Rose: What was more exciting for you – hitting number one on The New York Times Best Seller list or being on Oprah?

David Bach: Wow. Being on Oprah. I have dreamed of being on Oprah and seen it in my mind for 10 years. I have letters. I came to Morgan Stanley in 1993 and started sending letters telling her she should have me on the show. I had no idea what I was talking about. I had never been on TV. I had no books. I tell this story on stage all the time. How did I get on Oprah? It just took 10 years, five books, and me doing every single media in the world other than Oprah.

There's a moral behind that. By the time I was on Oprah with her, I was ready. If you go back to why I wanted to be on Oprah, I wanted to be on Oprah because I wanted to inspire 10 million people across America to pay themselves first. One hour a day, automatically, for life. That was my mission.

If you look at why I am sitting here at the Sheraton in Dallas, which is 14 years after that show aired, and I'm here because I updated this book and I'm still doing all this stuff because I'm still obsessed with the same exact thing I was obsessed with back then. I decided I wanted to reach the millennials and make one more push before I'm done here.

youtube

Being on Oprah was amazing because I knew I was going to reach 10 million people with that show. We taped that show. The next day they called me and said it was the last taping of the year. It doesn't air live. At least the show I did didn't air live. It was taped in November. It's supposed to air the first week of January. The book was launched on the show.

They tell you not to tell anybody until it airs. Until it airs, it's not airing. The day after this show taped, they called me and they said, “If this show does for America what it just did at Harpo, this show's going to be a home-run.” I said, “What happened?”

She said, “So many people signed up for the 401(k) plan after you left Harpo. They either signed up or they increased their 401(k) contributions.” If that can happen on Harpo, when this show airs in America, it's going to be transformational. That's what happened.

Jeff Rose: That's awesome. I remember hearing that. I don't know if you did an interview with somebody else, but the number of people that signed up afterwards, that has impact. People actually took action, which is awesome.

David Bach: My passion hasn't changed since then. I just did a speech for the parent company of Advisor Excel. They have over 500 employees. I just did The Automatic Millionaire presentation for all the employees. I said to the founders, “Look, guys. I'm going to be there. Let me go do the speech for everybody who works here.”

They were, “Most people are signed up for the 401(k) plan. They're doing pretty well.” I'm like, “Well, let's make them do better.” I said, “Let's track it.” Within five days of me doing the speech, 133 people increased their 401(k) contributions. That's life changing.

Most of the people in this company were millennials. I'm there. I'm like, “Guys, I don't care. If you're doing 8%, I want you doing 10%. If you're doing 10%, I want you doing 12%.”

When you love what you teach, it doesn't get old. When you start to hear the stories and the transformation that people have, it gives you more fuel.

Strategic By-products of Making the Leap

Jeff Rose: Yeah. You leave Morgan Stanley, you're writing books, and you're still teaching. You're living the mission that you set out to do. You kind of had things in a vision, I guess – things that you thought were going to happen, things you wanted to happen. Was there anything that did happen that was a strategic byproduct or some sort of unexpected partnership that came along that you didn't see?

David Bach: That's a classic Strategic Coach word – “a strategic byproduct.” Once you go into Strategic Coach Dan, we love you. You start to have this cult language. For people who don't know what that means, a strategic byproduct happens when you create a goal, you work towards that goal, and something amazing happens as a result of working toward that goal.

My last 25 years have been one giant strategic byproduct. I went off and taught a class for women and money for my clients. That class became so popular that I started teaching it on bigger and bigger stages. This led to a bigger mission, which led to a book, which led to a PBS show.

I brought the idea of Smart Women Finish Rich, the seminar program, to Morgan Stanley and had this entire idea of how we'd have offices across the country and we'd be in a hundred cities doing this. Well, they passed. They said, “Well, you'll do it and then you'll take all these advisors out of Morgan Stanley and you'll leave.” We ended up getting a phone call. I think it was Registered Rep Magazine. I'm doing PR and I get a phone call from a mutual fund company. The next thing I know we're doing a partnership with them and a licensing deal.

That's how I got Smart Women Finish Rich into the entire financial services industry. Same firm, different side of it. Every firm on Wall Street is teaching my seminars now except for Morgan Stanley because I did a carve out.

Jeff Rose: That's awesome.

David Bach: When I left in 2001, they said, “Well, look, if you're going to leave, let's do a deal and you can train all of our advisors.”

We did. I went and trained 750 advisors for Morgan Stanley, toured the entire country for Morgan Stanley, and we did some more Couples Finish Rich tours all over the country.

Taking “Some” Time Off

Jeff Rose: Wow. When you're passionate about something, like you said, you can teach it all day long. You can do it all day long. It's 24/7. Dan Sullivan calls it the unique ability. I know it's something for me that I struggle with at times because I get so passionate about something that I want to do it. But I also recognize that I do have a wife, I do have kids, and I do have to unplug. Here recently, you took a “free day,” right?

David Bach: I took the free year.

Jeff Rose: A free year. You took a one-year sabbatical, or maybe, I think it was 18 months.

David Bach: Eighteen months.

Jeff Rose: An 18-month sabbatical. Now, you're the bread winner and the sole provider. How do you go from providing everything for your family to taking 18 months off to be a dad?

David Bach: That was scary, too. That was as scary, if not scarier, then the decision I made to leave Morgan Stanley. It's scary to stop. We're going and going and we're going. I was afraid. What if I stop? Am I going to be able to start again? I had reached a point, and it happened actually in Strategic Coach, where instead of working on a 10x plan for my business, I decided to 10x my free time. I started asking myself the question,

“What would it be like to not work for a year and just be a dad?”

I worked on the plan for a year. It's the single greatest thing I ever did. Taking a sabbatical, which I highly recommend … I always say you don't have to take a year. I've been going around teaching, basically, take six weeks. Take a six-week sabbatical. It's funny because there was an article recently about how all over the world, basically most countries take six weeks off. We don't. We take an average of five days a year off in America. I didn't think I was burnt out. I didn't think I was tired, but I knew the passion wasn't the same.

Something felt wrong and I didn't know what it was and then I took a break. I got present in my own life and I got all my energy back. That was the big miracle. At the time I was 46 and I was feeling 50. Today, I'm 50 and I feel 30.

I was doing an interview with Arianna Huffington who wrote this great book Thrive and I said, “Arianna, you talk about recharging your batteries.” I go, “You take a sabbatical, you replace your battery.”

For me, taking that time off completely replaced my battery. That's why I'm even here right now with you. First of all, it's amazing to be a dad, amazing to be traveling, amazing to have that free time. Also, at the end of the year, I was ready to work and all of my creative energy was back. That's what led me to do a deal where I became a Vice Chairman of a large RIA. That's what led me to want to go bring all this stuff back out again. That's what led me to start another financial services company. Sometimes I think we need to take those breaks and recharge.

Jeff Rose: Yeah, it was funny. Just following you on social media, I could definitely tell when you came back. I didn't know that you were on sabbatical but, all of a sudden, you're on your blog and you're on social media and the book's coming out. All of a sudden, he's back. David's back.

David Bach: Also, I didn't go around telling people I was taking a sabbatical, so it was very interesting. I didn't know, truthfully, if I could do it. I didn't know if I could just stop working. I'm like, “I'm going to not do anything. I'm not going to go do the Today Show. I'm not going to write a book. I'm not going to do speeches. I'm not going to do anything. I'm not going to be on social media.”

I'm like, “I wonder how long it will take for people to notice?” We think what we're doing right now is so important. If I don't put this video out and I don't deliver every week this free content that you're not paying for, what will happen to the world if I don't update my blog and update my YouTube video and send a Tweet out and post on Facebook?

You know what happened? The world keeps turning. It's actually very humbling. About three or four months in, people start emailing and making sure you're not dead, which is exactly what happened. “Are you okay?” It wasn't like you got 10,000 of those. My friends knew I was okay because my friends knew I had taken a break.

The next time I take a sabbatical I will publicly share on taking a sabbatical. I'm going to take another sabbatical. I haven't decided what year yet, but I think we should take breaks every seven years. That's my new theory. Every five to seven years. I think if you take a break every five to seven years, then it's not about retirement. Instead of retiring at 60 or 65, if you can take a break every five to seven years, the energy that you'll get propels you to maybe just always be doing something for the rest of your life.

Jeff Rose: Right. A very good friend of mine is in the process of taking a year sabbatical and he started earlier this year. I didn't know until February or April, sometime in the spring, that he was taking it. I had a chance to meet with him through this whole time frame. I just love hearing it. It really inspired me. I don't know if I'm ready to take a year yet, but I like the idea of taking six weeks. I told my wife, I'm like, “What do you got to do?” You just got to put it on the calendar, just make it happen.

I'm going to try to cheat a little bit and try to do it around Spring Break so our kids are out of school. That may help out a little bit.

David Bach: It's interesting because, when you say something like take a six-week break, the first thing that people start to think about is why they can't do it. Really anything like this.

I always go back to write all the reasons why you can't do it and then come up with what the solution would be. You take an example like Spring Break. Spring Break is like two weeks long. The next thing you know, putting another four weeks on top of that, it's 25 work days or it's 25 school days. Then, there are holidays in those 25 days. When you start to break it out, you go, “Maybe it's not that hard. Maybe we actually could do this and if we planned it a year out, or two years out, of course we could do that.”

We're shooting this at the end of 2017. You can't tell me that you can't figure out a way to take off six weeks in 2020. You might be able to tell me you can't take it off in 2018, but 2020 is three years from now. It's just about planning and making decisions. It's funny because I've had a lot of friends take sabbaticals now, too. I think a lot of it's because they saw what happened to me. It's kind of like, “Wow, that actually worked out okay for you.”

Jeff Rose: Yeah. I feel like God keeps putting me around people that are taking sabbaticals. I think he's knocking on my door and I just got to open up and listen.

David Bach: I was about a month into my sabbatical. It was like a miracle. I felt so good. I was sleeping so well. I was so blissfully happy and I'm walking my son to school and I'm like, “Life can't be any better than this.”

Here I'm walking him to school and Jack looks at me and goes, “You know dad, do you ever worry that now that you're not working you'll never be able to do anything again for the rest of your life? Like you won't be able to write another book or be back on television or make any money and we might lose our home?”

I was like “Are you kidding me?” Every fear I could have ever had was somehow voiced out of a twelve-year-old. I was in the perfect blissful state, but thanks for bringing up every insecurity. I don't know if he said the part about the home. I think I threw that in. I was like, “Yeah, actually I do worry about that, but I think it will be okay.” It's funny. You know what? It always does end up being okay.

His 3 Year Outlook

Jeff Rose: Awesome. David, I've got one last question for you to wrap this up. Imagine it’s three years from now and we're doing another interview and we're reflecting on what has happened over that three-year period. What would have happened in your life both personally and professionally for those three years to be a success?

David Bach: Let's think about that. I actually just wrote out my next three-year game plan on the plane flight out here. I'm not going to give it all to you because there are certain things that are very personal to me. I'll give you some things that I'm working on that I'm focused on the next 36 months.

First, I'm a co-founder of a firm called AE Wealth Management. In just 18 months, we're the fastest growing RIA in America. We have empowered over 200 financial advisors to come onto our platform. We have 2.5 billion in our management. That's fast going from ground zero with no private equity money and no outside capital.

My hope is that, 36 months from now, we are up to a thousand advisors. As I say that, my team's going to go, “What did he say?”

I've got a big dream for this firm. I'd like to see us empower a thousand independent financial advisors who are RIAs to build the best financial planning business that they can in their community. That's one from a business perspective. I going to shoot for 10 billion in 36 months. I just became an advisor for Clarity Money. I don't know if you're familiar with Clarity, but it's the hottest financial app going in 2017. It is Mint on steroids. I just was blown away by this app to the point that I basically came knocking on Adam Dell's door.

I'm also an investor in Acorns, which is the fastest growing firm for millennials. I'm excited about that. From a personal perspective with books, I'm putting Smart Women Finish Rich and Smart Couples Finish Rich back out. I also have two books I'm working on, Smart Kids Finish Rich and The Latte Factory. Those books will come out in 2019.

If I'm getting together with you in less than 36 months, I've got two more books out, at least another 100,000 people through the seminars, and I've gone on another major sabbatical at some point.

Jeff Rose: Well, I'll just give you one from me. I will have taken at least one six-week sabbatical.

David Bach: Love it.

Jeff Rose: Cheers. David, thanks once again for sharing your wisdom and just inspiring others and for all you do, man.

David Bach: My pleasure. By the way, congratulations on everything you've done. I knew about you over a year ago. I've seen what you've been doing online and you're having a huge impact on people and it's really cool. You're following your passion.

Jeff Rose: You’re right. I am.

The post The Automatic Millionaire with New York Times Best Selling Author David Bach appeared first on Good Financial Cents.

from All About Insurance https://www.goodfinancialcents.com/david-bach-automatic-millionaire

0 notes