#Accounts Payable Clerk

Text

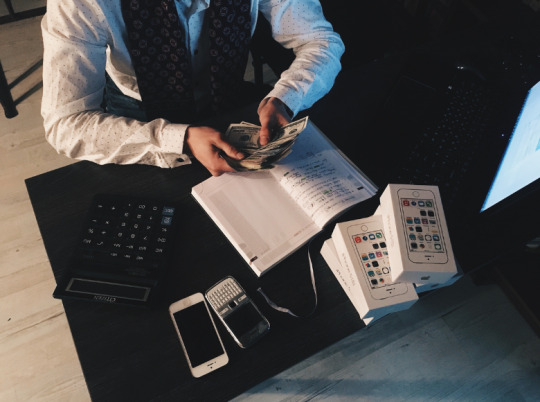

Job Hiring: Accounts Payable Clerk - GoTeam Philippines

GoTeam Philippines is hiring for the position of Accounts Payable Clerk, and this is a work-from-home job opportunity.

If you have a minimum of 3 years of experience in Accounts Payable and possess excellent attention to detail, join our team as an Accounts Payable Clerk and work during the night shift from the comfort of your home.

This position comes with a generous salary of up to PHP40K and family-friendly benefits. Apply now and take your career to new heights with our dynamic team.

#Accounts Payable Clerk#Employment opportunities#Job vacancies#job hiring#Careers#jobs#Cebu job openings#Cebu employment opportunities#Cebu careers#Cebu work opportunities#Philippine job openings#Philippine employment opportunities#Jobs hiring in the Philippines

0 notes

Text

My contribution as an ABM student to the society

The goal of this strand is to prepare students for college degrees that focus on business and industry, where their future contributions as accountants, entrepreneurs, and business leaders will be crucial to the growth and development of the economy and to the promotion of a sustainable green business. Students will be trained to think logically and scientifically, as well as familiar with the fundamentals of accounting and business and management concepts and principles.

With the ABM Strand, It is possible to pursue a Business Administration degree through the ABM stream. It focuses on imparting to students the fundamentals of project management, marketing, finance, human resources, organizational behavior, and contemporary management trends.

As an ABM student, you must have time management skills, a lengthy patience span, and the ability to concentrate solely on your academics. You will be able to do more exploring and learning about managing your own business in ABM. You'll be well-informed about the type of business to launch and management strategies. ABM addresses more than simply how you will run your company; it also addresses how much you will have to pay, the dangers involved in running a business, and how to make your enterprise profitable. It's difficult to be an ABM student because you will discover the realities of life in this world. Getting rich is among the

The ABM strand in its most fundamental sense refers to the accountancy, business, and management academic programs that concentrate on the foundational concepts in corporate operations, financial management, business management, as well as each and every factor that revolves around those central fields.

The ABM strand can take you on a direct path to careers in accounting and management: sales management, human resources, marketing director, bookkeeper, project officer, accounting, internal auditor.

The ABM strand curriculum opens the avenues for you to gain a more nuanced appreciation of the intrinsic elements that make up the world of accounting and business management courses in the Philippines without having to dive deeper into the specialized complexities of mathematical fields such as algebra, geometry, trigonometry, and others.

The subjects involved in the ABM strand are designed and crafted for you develop the appropriate tools that you are going to utilize all throughout your journey in the corporate world. You should expect to be immersed in studying management and financial accounting along with the business, legal, and organizational contexts that you would be working with as you go along your road in a professional enterprise.

By taking the ABM strand you will be trained to analyze assets, understand everything involved with financial positions, interpret various profitability, and prepare audit accounts.

Accountancy

Studying accountancy does not necessarily entail that you are limited to just being an accountant. You are opening the gate for wonderful careers as an: accounts payable clerk, bookkeeper, chief financial officer, budget analyst, internal auditor, and many others.

Business Administration

You can get on the track to the corporate settings of an administrative assistant, loan officer, community service manager, market research analyst, financial advisor, statistician, etc.

Agribusiness

This generally refers to agriculture-related endeavors that align farmers, distributors, and even consumers with a market system for agricultural products. The Department of Trade and Industry is always in the course of developing the industry of agricultural farming into a thriving business-driven sector.

2 notes

·

View notes

Text

Student Reservation Rules & Concession in Indian Railways.

Useful for students preparing for various entrance examinations to appear in various centres across India.

As a student you can avail the benefits from the Government of India for your travel, safety and stay all over India.

How do I get student Concession in Rlys

The Student Concession tickets are permitted only in Sleeper Class (SL) and 2nd Seating (2S) I tickets.

Only I-tickets can be exchanged with student concession by presenting the I-ticket and the valid student concession order to the nearest Railway Reservation Office By going to the reservation office along with his journey cum reservation ticket and a request for exchanging the same with the student concession.

He will surrender his original fully paid ticket and a student concession ticket with the revised fare (with same seat/berth number status) shall be issued to him.

The difference of fare (paid and payable) less the clerk age charge of Rs. 20/- shall be refunded and shall be credited to his account electronically on the next day by IRCTC on receipt of refund file from the Railways.

Is student concession applicable for both E/I tickets?

The Student Concession tickets are permitted only in Sleeper Class (SL) and 2nd Seating (2S). Presently it is not permitted on E-Tickets.

How will I be refunded the difference of fare paid extra with respect to student concession?

The difference of fare (paid and payable) less the clerk age charge of Rs. 20/- shall be refunded and shall be credited to his account electronically on the next day by IRCTC on receipt of refund file from the Railways.

Student Concession :

Students going to hometown and educational tours :

General Category - 50% in 2nd and SL class & 50% in MST and QST

SC/ST Category - 75% in 2nd and SL class & 75% in MST and QST

Girls upto Graduation and boys upto 12th standard (including students of Madrasa) between home & school (MST) - Free second class MST

Students of Govt. schools in rural areas - for study tour - once a year - 75% in 2nd class

Entrance exam - Girls of Govt. schools in rural areas for national level for medical, engineering, etc. entrance exam - 75% in 2nd class

Concession to students appearing in main written examination conducted by UPSC & Central Staff Selection Commissions - 50% in 2nd class

Foreign students studying in India - traveling to attend camps/seminars organised by Govt. of India and also visit to places of historical & other importance during vacations - 50% in 2nd and SL class

Research scholars upto the age of 35 years - for journeys in connection with research work - 50% in 2nd and SL class

Students and non-students participating in Work Camps - 25% in 2nd and SL class

Cadets and Marine Engineers apprentices undergoing Navigational/ Engineering training for Mercantile Marine - for travel between home and training ship - 50% in 2nd and SL class

Season Tickets To Students :

Season tickets to students are issued for First & Second class upto the maximum distance of 150 Kms.

The student monthly season tickets will be charged at half of the normal adult season ticket fare and student Quarterly Season tickets will be charged at 2.7 times of the Student MST fare.

These MSTs/QSTs will be issued without any minimum charge to the students of recognized institutions under.

Condition that the age of students, to whom the tickets are issued, should not exceed 25 years in the case of student in general, 27 years in the case of students belonging to the Scheduled Castes/Tribes and 35 years in the case of Research Scholars.

NOTE : Season tickets to students of Scheduled Castes and Scheduled Tribes shall be issued as under:

MSTs: On payment of 50% below the normal Student MST fares, and

QSTs: On payment of 2.7 times of the concessional fares of MSTs vide. (i)above

Free MST to Students :

The facility of Free Monthly Season Tickets (MSTs) is available to Boy Students studying in classes upto 10th Standard and Girl students studying in classes upto 12th standard for commuting daily between the stations serving the place of residence and school. They carry the caption MILLENIUM GIFT FROM RAILWAYS. These free MSTs are issued subject to the following conditions: -

Only MSTs are issued and QSTs are not issued.

As in the case of concessional student MSTs, these are also issued upto maximum of 150 Kms.

These are issued for second class only and are not valid for travel in any Mail/Express train, including superfast train.

No other surcharge is levied on these MSTs (Even the CIDCO surcharge applicable on Central/Western Railway for travel on specific section in Mumbai area is not leviable)

The free MSTs are issued subject to all other conditions applicable for issue of concessional MSTs to students.

The concessional student MSTs/QSTs continue to be issued on demand as per rules.

0 notes

Text

Figure out Essential Accounting Standards

Understanding fundamental accounting standards is fundamental for entrepreneurs, as it gives a strong groundwork to overseeing finances and settling on informed choices. Despite the fact that you could depend on a bookkeeper or clerk for complex undertakings, realizing basic accounting terms and ideas will assist you with getting a handle on the monetary strength of your business and discuss successfully with monetary experts. How about we investigate key accounting terms and ideas each entrepreneur ought to be aware.

Key Accounting Terms

Here are some fundamental accounting terms that are fundamental for entrepreneurs to comprehend:

Resources: These are assets claimed by your business that have financial worth. Resources can be unmistakable (like money, stock, and hardware) or theoretical (like licenses or brand names).

Liabilities: These address your business' monetary commitments or obligations. Liabilities can be present moment (like records payable and transient credits) or long haul (like home loans and long haul advances).

Value: Otherwise called "proprietor's value" or "investor value," this addresses the proprietor's stake in the business. It's determined by taking away absolute liabilities from all out resources.

Income: The absolute pay created from business exercises, like deals of items or administrations. Income is frequently called "deals" or "pay."

Costs: Costs brought about in the activity of your business. Costs can be functional (like lease, utilities, and wages) or non-functional (like interest installments and deterioration).

Net Benefit: The contrast among income and the expense of products sold (Machine gear-pieces). It addresses the benefit created from direct business exercises prior to thinking about different costs.

Net Benefit: Otherwise called "overall gain," this is the complete benefit subsequent to deducting all costs from income. It addresses the "main concern" of your business' monetary exhibition.

Income: The development of money into and out of your business. Positive income implies more money is coming in than going out, while negative income shows the inverse.

Debt claims: Cash owed to your business by clients for labor and products gave on layaway. It addresses an ongoing resource on your monetary record.

Creditor liabilities: Cash your business owes to providers or banks for labor and products got. It addresses an ongoing obligation on your monetary record.

Key Accounting Ideas

As well as understanding key terms, here are some major accounting ideas that can assist you with dealing with your business' finances:

Accumulation Accounting versus Cash Accounting:

Accumulation Accounting: Exchanges are recorded when they are brought about, not when money is traded. This technique gives a more precise image of your business' monetary position yet can be more perplexing.

Cash Accounting: Exchanges are recorded when money changes hands. This strategy is less difficult and frequently utilized by private ventures with direct monetary exercises.

Twofold Passage Accounting: This framework expects that each exchange is kept in no less than two records — one as a charge and the other as a credit. The complete charges should approach the all out credits, guaranteeing exactness and assisting with recognizing blunders.

Matching Standard: This rule expects that costs be kept in a similar period as the connected income. It guarantees that budget reports precisely reflect business execution.

Going Concern: This idea expects that a business will keep working for years to come. It impacts how resources and liabilities are esteemed and revealed in fiscal summaries.

Materiality: This idea alludes to the meaning of a monetary thing. In the event that a thing is "material," it could impact the choice of clients of fiscal reports. Understanding materiality focuses on significant monetary data.

Why Figuring out Essential Accounting Standards and Pivotal for Entrepreneurs

By understanding these fundamental accounting standards, you can:

Settle on Informed Choices: Knowing key terms and ideas permits you to grasp monetary reports, go with vital choices, and deal with your business' finances all the more actually.

Speak with Monetary Experts: When you communicate in the language of accounting, you can convey all the more actually with bookkeepers, clerks, and expense counsels.

Guarantee Consistence: Understanding accounting standards assists you with consenting to burden guidelines and monetary detailing prerequisites, lessening the gamble of mistakes or punishments.

Screen Business Execution: With a strong handle of accounting, you can follow your business' monetary presentation, recognize patterns, and address issues early.

The Significance of Figuring out Essential Accounting

Informed Independent direction: Accounting gives the monetary information expected to settle on essential business choices. Knowing how to peruse fiscal reports, track income, and comprehend net revenues engages entrepreneurs to settle on decisions that drive development and supportability.

Monetary Wellbeing and Steadiness: A fundamental comprehension of accounting assists entrepreneurs with keeping up with monetary dependability. By following income, costs, resources, and liabilities, you can guarantee that your business stays productive and dissolvable.

Planning and Arranging: Accounting abilities are fundamental for making spending plans and monetary figures. This permits entrepreneurs to designate assets shrewdly, plan for future costs, and put forth practical monetary objectives.

Consistence and Tax collection: Understanding accounting assists entrepreneurs with following duty guidelines and other lawful necessities. It likewise works on the method involved with planning government forms and diminishes the gamble of blunders or punishments.

Correspondence with Monetary Experts: Whether you're working with a bookkeeper, clerk, or monetary counsel, understanding essential accounting terms and ideas works with more clear correspondence. This can prompt better monetary counsel and a more useful relationship with your monetary group.

Business Development and Speculation: Financial backers, moneylenders, and different partners frequently require budget summaries and other accounting data prior to focusing on a business. A strong comprehension of accounting assists entrepreneurs with introducing their business in the best light, expanding the possibilities getting financing.

Issue Recognition and Hazard The board: Understanding accounting permits entrepreneurs to early distinguish monetary issues. By routinely inspecting monetary reports, you can detect patterns or peculiarities that could show issues like income deficiencies or declining productivity.

Assets for Getting the hang of Accounting Rudiments

To revive your insight, there are numerous assets accessible to assist you with learning the nuts and bolts. Here are a few well known choices:

Online Courses: Sites like Coursera, Udemy, and LinkedIn Learning offer internet accounting courses intended for fledglings. These courses cover points like accounting, budget summaries, and essential accounting standards.

Books and Guides: There are many books and guides on accounting fundamentals for entrepreneurs. A few famous titles incorporate "Accounting Simplified" by Mike Flautist and "Fiscal summaries: A Bit by bit Manual for Understanding and Making Monetary Reports" by Thomas Ittelson.

Private venture Affiliations: Associations like the Private venture Organization (SBA) in the U.S. offer assets and studios on accounting and finance. Check with neighborhood business relationship for comparable open doors in your space.

Junior colleges and Colleges: Numerous instructive organizations offer accounting courses for non-bookkeepers. These classes are in many cases more reasonable than customary degree programs and can give a strong groundwork in accounting nuts and bolts.

Accounting Programming Instructional exercises: In the event that you're utilizing accounting programming, for example, QuickBooks or Xero, these stages frequently give instructional exercises and advisers for assist you with figuring out their elements and fundamental accounting standards.

Proficient Bookkeepers and Clerks: Working with an expert can be an important opportunity for growth. A decent bookkeeper or clerk can make sense of accounting ideas in basic terms and answer inquiries regarding your business' finances.

Learning essential accounting doesn't need an accounting degree, however it requires investment and exertion. By utilizing these assets, you can construct major areas of strength for an in accounting that will help your business into the indefinite future. Whether you're simply beginning or hoping to further develop your monetary administration abilities, the information you gain will be instrumental in your business' prosperity and development.

0 notes

Text

SAP FICO Basic Information

Demystifying SAP FICO: The Backbone of Financial Management

For businesses running on SAP ERP, SAP FICO is a cornerstone module you can't ignore. But what exactly is it, and why is it so crucial? In this blog, we'll break down the basics of SAP FICO, making financial management seem like a walk in the park.

What is SAP FICO?

SAP FICO stands for FI (Financial Accounting) and CO (Controlling). It's an integrated module within SAP ERP that tackles all your financial needs. From recording transactions to generating reports, SAP FICO helps you precisely manage your financial health.

Think of it as your financial command center, offering functionalities like:

Recording financial transactions: Every penny flowing in and out is meticulously captured.

Maintaining general ledgers: The central hub for all your financial accounts.

Generating financial statements: Get a clear picture of your financial performance with reports like balance sheets and income statements.

Accounts payable and receivable: Manage your dues to vendors and customer payments efficiently.

Cost controlling: Monitor and analyze your expenses to optimize profitability.

Benefits of Using SAP FICO

Enhanced Accuracy: Streamlined processes minimize errors and ensure data integrity.

Improved Visibility: Gain real-time insights into your financial health for informed decision-making.

Streamlined Operations: Automate repetitive tasks and boost overall financial efficiency.

Simplified Reporting: Generate financial statements with ease and meet compliance requirements effortlessly.

Better Collaboration: Foster seamless communication between finance and other departments.

Who Should Learn SAP FICO?

If you're involved in any aspect of financial management within an SAP environment, SAP FICO knowledge is a valuable asset. This includes roles like:

Finance Managers

Accountants

Accounts Payable/ Receivable Clerks

Financial Analysts

Anyone looking to advance their career in SAP

youtube

You can find more information about SAP Fico in this SAP FICO Link

Conclusion:

Unogeeks is the №1 IT Training Institute for SAP Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP here — SAP FICO Blogs

You can check out our Best In Class SAP Details here — SAP FICO Training

Follow & Connect with us:

— — — — — — — — — — — -

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeek

#Unogeeks #training #Unogeekstraining

0 notes

Text

Striking a Balance: How Human Accountants Excel Amidst Automation

Imagine Nadia, a dedicated Accounts Payable (AP) staff member, sitting at her desk, surrounded by piles of receipts and invoices. Overwhelmed by the daunting task of managing the company’s expenses, she begins to wonder if there’s a better way. In this age of artificial intelligence (AI) and automation, she ponders the future of accounting. Will machines take over the role of AP staff? Can technology truly replace the expertise, insights, and personal touch that human professionals bring to the table? Nadia discusses her thoughts with her long-time colleague and friend, Melissa, to see how she can change Nadia’s perspective and help her find a balance between technology and human expertise.

Nadia: Hey, Melissa, you know, I’ve been thinking a lot about the advancements in automation lately. Do you ever wonder if it will eventually replace us in our jobs?

Melissa: Huh, it has crossed my mind, but I think our expertise and personal touch are special.

Nadia: Really? But how do we stay relevant with advancing automation?

Melissa: We embrace technology as a tool, not a threat. Instead of competing with automation, we can collaborate with it.

Nadia: You’re right, Melissa. It’s not about automation replacing us; it’s about how we harness its power to enhance our capabilities and deliver even greater value to our organization and stakeholders.

Now, you might have an idea of the point I am trying to make here. As an accounts payable clerk or manager, you might have similar concerns as Nadia. Let’s embark on a visionary journey, exploring how accounts payable staff and automation can not only coexist but thrive in a harmonious partnership, ultimately driving greater results and success. Read More at https://pathquest.com/knowledge-center/blogs/striking-a-balance-how-human-accountants-excel-amidst-automation/

#accounting automation#accounts payable automation software#business reporting#ap automation software

0 notes

Text

Accounts Payables Personnel/Payroll Clerk

ACCOUNTS PAYABLES PERSONNEL/PAYROLL CLERK

Roles and Responsibilities:

Using Biometric System to approve timecard.

Upload and process payroll Filing of cheque stubs, payable invoices and payroll documents

Confirming validation of electronic payments Printing cheques.

Generating daily payables report

Administrative duties including letter preparation

Qualifications and Experience:

BSc. In…

View On WordPress

0 notes

Text

Work From Home Job Hiring: Accounts Payable Clerk - GoTeam

If you have at least 3 years of Accounts Payable experience – check this one out!

One of our Vancouver-based private investment clients is looking for an Accounts Payable Clerk who can verify invoices for accuracy, resolve discrepancies, ensure payment terms are followed and calculate discounts as appropriate in a timely manner.

Earn up to PHP30K working from your home during the night shift schedule and enjoy family-friendly benefits including HMO coverage starting from day 1.

Read the full job details and apply

0 notes

Text

#Job: #Creditors Accounts Payable Clerk - Durban KwaZulu Natal. quot Creditors Accounts Payable Clerk JB3744 Durban Market Related 3 month contract with view ...

quot Creditors Accounts Payable Clerk JB3744 Durban Market Related 3 month contract with view of perm We are seeking an experienced and detailoriented Accounts Payable Clerk to join our finance department and provide essential support to our cred...

Location: Durban KwaZulu Natal http://dlvr.it/Sy2MSb

0 notes

Text

Job Roles in the Accounts Domain for Freshers Accounts Payable Clerk: Responsible for processing invoices and making payments to suppliers

Handling vendor inquiries and resolving payment discrepancies.

Assisting with month-end closing activities.

Accounts Receivable Clerk

Managing customer accounts, issuing invoices, and tracking paymentsFollowing up on overdue payments and communicating with customers.

Reconciling accounts and preparing reports on accounts receivable status

Junior Accountant:

Assising in the preparation of financial statements and reports

Conducting basic financial analysis and reconciling accounts.Assisting with budgeting and forecasting activities.Tax Assistant: Supporting tax professionals in preparing tax returns. Assisting with tax planning and research. Ensuring compliance with tax regulations and deadlines.Audit Assistant: Assisting audit teams in conducting financial audits. Verifying the accuracy of financial records and ensuring compliance. Preparing audit reports and recommendations. Financial Analyst: Analyzing financial data and preparing financial models. Conducting industry and market research. Assisting in budgeting, forecasting, and financial planning. Book keeper: Maintaining accurate and up-to-date financial records. Recording transactions, reconciling bank statements, and managing accounts. Assisting with payroll and preparing financial reports.Cost Accountant:Analyzing costs and variances in manufacturing processes. Assisting in inventory management and product costing. Providing insights for cost control and process improvements.Remember, as a fresher, it is crucial to gain hands-on experience and continuously develop your skills in the account domain. Consider internships, online courses, and certifications to enhance your knowledge and increase your employability. In conclusion, the account’s domain offers a plethora of job roles for freshers to embark on a successful career journey. Whether you choose to specialize in accounts payable, accounts receivable, taxation, auditing, or financial analysis, ample opportunities are waiting for you. So, don't hesitate to explore and take the first step towards unlocking your career potential in the account’s domain! Take the first step toward realizing your true potential with ProEdge Careers' Industry Readiness Test. Our algorithm-based assessment measures your abilities across 30+ parameters, matching you with the best-suited jobs and internships. Visit ProEdge Careers to learn more or reach out to us at [email protected].

0 notes

Text

Accounts Payable Clerk Certification: Advancing Your Career

In the realm of finance and accounting, the role of an Accounts Payable Clerk is critical to maintaining the financial health of an organization. As businesses recognize the importance of this role, the demand for skilled and certified Accounts Payable Clerks is on the rise. In this article, we explore the significance of certification for Accounts Payable Clerks and how it can propel your career to new heights.

The Value of Accounts Payable Clerk Certification

Elevating Your Expertise

Certification programs for Accounts Payable Clerks are designed to provide comprehensive training and knowledge in areas crucial to the role. These programs cover topics such as financial accounting, tax regulations, auditing, and compliance. By completing a certification, you demonstrate your commitment to acquiring specialized skills and knowledge.

Meeting Industry Standards

Certifications often align with industry standards and best practices. Achieving certification means you are well-versed in the latest regulations and methodologies relevant to Accounts Payable. This knowledge is invaluable for maintaining accuracy and compliance in your role.

Advantages of Certification

Career Advancement

Certification opens doors to career advancement opportunities. With a certified Accounts Payable Clerk designation, you stand out as a qualified professional. Many organizations prefer or require certified candidates when hiring for senior positions in finance and accounting.

Higher Earning Potential

Certified Accounts Payable Clerks typically earn higher salaries than their non-certified counterparts. It is possible to view certification as an investment in your career., as it often leads to better compensation packages and benefits.

Enhanced Job Security

In an ever-evolving job market, having a recognized certification provides a level of job security. Certified professionals are considered assets to their organizations, reducing the risk of layoffs or downsizing.

Choosing the Right Certification

Notable Certifications

There are several notable certifications available for Accounts Payable Clerks. Two of the most respected certifications are the Certified Accounts Payable Associate (CAPA) and the Certified Accounts Payable Professional (CAPP) offered by the Institute of Finance and Management (IOFM).

Eligibility and Requirements

Each certification programme has different prerequisites for enrollment, which may include a combination of education, work experience, and successful completion of an exam. It's important to review the prerequisites for your chosen certification to ensure you meet the criteria.

Becoming a certified Accounts Payable Clerk is a strategic move for professionals in the finance and accounting field. It not only enhances your expertise but also opens doors to career growth, higher earning potential, and increased job security. As businesses place greater emphasis on financial accuracy and compliance, the demand for certified Accounts Payable Clerks continues to grow. Investing in certification is an investment in your career, setting you on a path to success in the dynamic world of finance and accounting.

0 notes

Link

0 notes

Text

#Hiring Accounts Payable and Accounts Receivable Clerks – Nashua, NH https://www.calm-water.com/job/accounts-payable-and-accounts-receivable-clerks/

0 notes

Text

Apply now: https://canadianjobbank.org/accounts-payable-clerk-2/

0 notes

Text

ACCOUNTING CLERK JOB

An accounting clerk is a professional who performs various administrative and financial tasks within an organization's accounting department. Their primary responsibilities involve maintaining and updating financial records, processing invoices, and handling financial transactions.

Here are some common tasks and duties performed by an accounting clerk:

Recording financial transactions: Accounting clerks enter financial data into the organization's accounting software or spreadsheets. This includes recording sales, purchases, payments, and receipts accurately and in a timely manner.

Managing accounts payable and accounts receivable: They process invoices from vendors, verify the accuracy of billing information, and ensure timely payment. For accounts receivable, they generate customer invoices, track payments, and follow up on overdue accounts.

Reconciling bank statements: Accounting clerks compare bank statements with the organization's financial records to ensure that all transactions are accurately recorded. They identify any discrepancies and investigate and resolve any issues that arise.

Assisting with payroll processing: They help calculate employee salaries, wages, bonuses, and deductions. This may include maintaining employee records, preparing payroll reports, and ensuring compliance with relevant payroll regulations.

For more details

ACCOUNTING CLERK JOB IN CANADA

#ACCOUNTING CLERK JOB IN CANADA#ASSISTANT MANAGER JOB IN CANADA#HUMAN RESOURCE ASSOCIATE JOB IN CANADA

0 notes

Text

4 Accounts Payable (AP) Tips for Small Businesses

Many small businesses are thinking:

* We have a limited volume of invoices to process and manage.

* We have a few vendors which our AP clerks can easily manage and support.

* Why do we need to spend money on AP automation?

Read the blog to learn about the 4 important tips that every small business should know that will improve their current Accounts Payable process with automation and generate more business revenue.

#calpion#accountspayable#apinvoiceprocessing#invoicemanagementsoftware#accountpayable#digitaltransformation#businessmanagement#accountspayablesoftware#invoicemanagement#apautomation#apautomationsolution#aputomationservices#apinvoiceautomationsoftware#hermes#hermesapautomation#softwaresolutions#softwareautomation#US#USA#Canada#UK#UnitedKingdom#smartautomation#OCR#IDP#machinelanguage#intelligentautomation#invoiceautomation#invoice#invoices

0 notes