#APPLY NCD IPO

Explore tagged Tumblr posts

Text

CreditAccess Grameen Limited NCD IPO 2023

CreditAccess Grameen Limited, headquartered in Bengaluru, stands as a prominent Indian micro-finance institution. According to MFIN India, this company holds the distinction of being India’s largest NBFC-MFI concerning the gross loan portfolio as of March 2023.

The foundation of the company’s success lies in its customer-centric approach, a diverse array of product offerings, and a finely tuned product delivery and collection framework. This synergy has led to the achievement of commendable customer retention rates and minimal credit costs.

A core aspect of CreditAccess Grameen Limited’s operations revolves around catering to the needs of customers residing in rural pockets of India. These regions are often underserved by the formal banking sector, thereby presenting an untapped potential for providing micro-loans.

As of June 30, 2023, the company has established its presence across 353 districts in 14 states (namely Karnataka, Maharashtra, Madhya Pradesh, Tamil Nadu, Kerala, Odisha, Chhattisgarh, Goa, Bihar, Jharkhand, Gujarat, Rajasthan, Uttar Pradesh, and West Bengal) and one union territory (Puducherry) in India. This expansive network comprises 1,826 branches and a dedicated workforce of 17,391 employees. Notably, the company caters to an active consolidated customer base of 44.2 lakhs, as of June 30, 2023.

#APPLY NCD IPO#BEST UPCOMING IPOS 2023#CREDITACCESS GRAMEEN#CREDITACCESS GRAMEEN LIMITED#CREDITACCESS GRAMEEN LIMITED IPO SUBSCRIPTION#CREDITACCESS GRAMEEN LIMITED NCD#CREDITACCESS GRAMEEN LIMITED NCD REVIEW#CREDITACCESS GRAMEEN LIMITED SHARE PRICE#CREDITACCESS GRAMEEN LTD#CREDITACCESS GRAMEEN LTD SHARE PRICE#CREDITACCESS GRAMEEN SHARE#CREDITACCESS GRAMEEN SHARE PRICE BSE#NCD IPO

0 notes

Text

Bond IPO Application Process Explained | IndiaBonds Explore the bond IPO application process with this video from IndiaBonds. Learn how to navigate the steps involved in applying for bond IPOs efficiently. Visit IndiaBonds Now. https://www.indiabonds.com/news-and-insight/videos/bond-ipo-application-process/

0 notes

Text

Winsoft Technologies: A Leading Provider of Innovative Financial Solutions and Services

Winsoft Technologies is a leading financial services company based in Pune, India. Founded in 1993, the company has a long history of providing innovative financial solutions to banks and finance firms. Winsoft Technologies offers a wide range of financial services in domains like insurance, pension, wealth management and capital market.

One of the key platforms offered by Winsoft Technologies is SmartASBA, a software solution for automating the Application Supported by Blocked Amount (ASBA) process. This platform simplifies the process of applying for initial public offerings (IPOs), FPO, DEBT/NCD, NFO and Right Issue products, making it easier and more efficient for clients to invest.

Another essential product offered by Winsoft Technologies is DeMatrix. The platform includes modules like DP Emailer, DP on Net, e-Broking, Loan against shares, Digisign & KRA. Some remarkable features of this platform are the digital onboarding of clients, flexible and exhaustive billing methods, being compliant with regulations of NSDL, CDSL & SEBI, and more.

Winsoft Technologies also offers SmartTAX, a tax-filing software that helps banks and finance firms to manage their tax obligations more efficiently. It is a full-fledged Direct and Indirect tax payment solution designed to help banks to process online/digital tax payments. This platform streamlines the tax-filing process, making it easier for clients to file their taxes on time and minimize the risk of errors. In addition, SmartTAX is a user-friendly platform that is easy to use, even for those who are not familiar with the complexities of the tax-filing process.

In addition to its software solutions, Winsoft Technologies offers a range of investment and wealth management services, including Smartnps and Smartapy. Smartnps is software for NPS distribution designed to help clients manage their pension investments more effectively. This platform provides clients with a comprehensive view of their pension portfolios, making it easier for them to track their investments and make informed investment decisions.

Smartapy is a pension management platform that helps companies in faster and simpler pension distribution. The platform is a comprehensive Browser Based solution providing front office and Back Office processing of contributions in APY (Atal Pension System) with precise reporting features.

Whether you have a financial company or a bank, Winsoft Technologies can help you achieve your financial goals with its innovative financial software and solutions for NPS distribution. If you are looking for a reliable and trusted partner in the financial services industry, Winsoft Tech is the company you can trust.

0 notes

Text

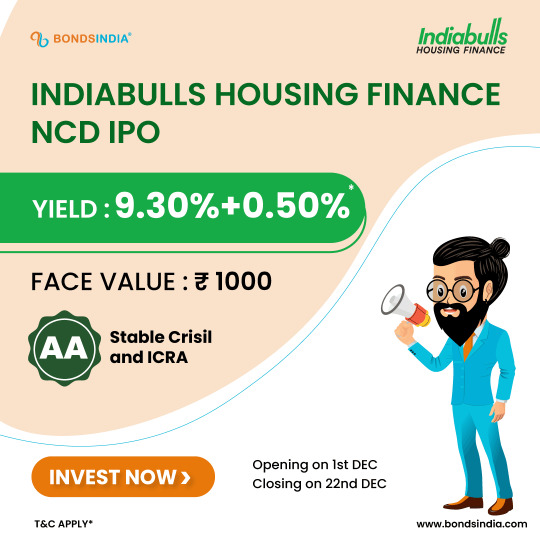

Indiabulls Housing Finance Limited NCD IPO 2022 – Apply Now

Indiabulls Housing Finance Ltd (IBHFL) is one of the largest housing finance companies (HFCs) in India in terms of AUM. It is a non-deposit-taking HFC registered with the National Housing Board (NHB). IBHFL focuses primarily on long-term secured mortgage-backed loans.

Get all the information about upcoming Indiabulls Housing Finance limited IPO. Read the company details latest information and be updated on the new offers related to ncd IPO. INDIABULLS HOUSING FINANCE LIMITED is opening it's gates for NCD IPO bidding from 1st December 2022. 🥳️ ✅With the credit rating of "AA/ stable by CRISIL & ICRA" and a yield of up to 9.30+ 0.50%*, it comes with a tenure of up to 60 months.

So what are you waiting for??

Click the link below:👇

Apply Now

#upcoming ipo#ipoalert#ncdipo#ipoupdates#fixedincome#stayalert#Indiabulls Housing Finance Limited#finance

0 notes

Photo

Apply online in few simple steps | Pay via UPI | Minimum investment is 10K only

Non-Convertible Debentures (NCDs) are debt securities issued by corporations. NCDs come with a fixed interest rate; hence investors get fixed income. And on maturity, the principal amount is paid back to the investor. You can invest in NCDs in the secondary market; else, you need to participate in the IPO in the Primary Market. The advantage of investing via IPO is that you get NCDs at face value, and the minimum investment is 10K only.

https://goldenpi.com/blog/essentials/how-to-invest-in-ncd-ipo-online/

0 notes

Video

youtube

SREI Infrastructure NCD april 2019 Public Issue Price, Date, Allotment, ...

SREI Infrastructure NCD april 2019 Public Issue Price, Date, Allotment, Reviews & Status

Incorporates in 1989, Kolkata based SREI Infrastructure Finance Ltd (SIFL), a frequent visitor to the debt market, is engaged in the business of Infrastructure financing and registered as an Infrastructure Finance Company under the RBI regulations.Infrastructure includes sectors like Transport, Energy, Water Sanitation, Communication, Social & Commercial Infrastructure etc.The major customers of the company belong to infrastructure construction and development focusing on telecom, road, energy, port, special economic zone, water and sanitation, urban public transport, energy, etc in India with an aim of medium to long-term perspectives. The company had also listed on London Stock Exchange and many institutions including KfW & DEG Germany, PROPARCO, IFC Washington, European Investment Bank, OeEB, Nordic Investment Bank etc also invested in this group. As on March 31, 2018, and March 31, 2017, the total income of the company were 17,736.20 million and ` 22,996.20 million respectively.

Operations of the company: 1. Fund based operations as an Asset Finance Company and Infrastructure Finance Company. 2. Fee-based business such as Infrastructure Advisory, Investment Banking, Private Equity & Venture Capital, 3. Insurance Broking. 4. Strategic investments.

The competitive strengths of the company are: 1. Strong Liquidity option and Comfortable ALM 2. Adequate capitalisation at 17.6% 3. Consistent success in asset Base

SREI Infrastructure NCD april 2019 Detail Issue Open Apr 9, 2019 - May 9, 2019 Security Name SREI Infrastructure Finance Limited Security Type Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) and/or Unsecured Subordinated Non-Convertible Debentures (Unsecured NCDs) Issue Size (Base) Rs 100.00 Crores Issue Size (Shelf) Rs 1,500.00 Crores

NCD's allocated in each investor category. Category (/faq/who-can-apply-in-ncd-public-issue/544/) NCD's Allocated Category 1 (QIB) 15 % Category 2 (NII) 15 % Category 3 (RII) 70 %

Company Promoters Mr Hemant Kanoria is the promoter of the company.

NCD Rating Detail 'BWR AA+ (BWR Double A plus)'by Brickwork Ratings India Private Limited ("BRICKWORK")

Objects of the Issue: I. For the purpose of lending/ repayment of loan - minimum 75% of the Net Proceeds of the Issue. II. For General Corporate Purposes - up to 25% of the Net Proceeds of the Issue. The unutilized amount if any will be used for purpose of lending/ repayment of loan.

Conclusion: Looking to the northern side presence and long term perspective can invest in this steady financial growth for the long term view.

Other IPO review video are as detailed below with hyper link of youtube:

Polycab IPO Date, Prospectus, Allotment, Listing, Reviews & Status. https://youtu.be/bpDWFxct21Q

Rail Vikas IPO Date, Prospectus, Allotment, Listing, Reviews & Status. https://youtu.be/Of7RMGS7P-E

Metropolis IPO Date Prospectus Allotment Listing Reviews & Status. https://youtu.be/RzO4C5V6WVY

Embassy Office Parks REITS IPO REVIEW, ALLOTMENT & LISTING... https://youtu.be/lLhU40feW3U

Aartech Solonics Ltd. IPO REVIEW. https://youtu.be/UKBJfXET_nc

MSTC LIMITED 2019 IPO LISTING GAINS & REVIEW. https://youtu.be/cwoI_7zr1wY

Current SME IPO Jinaams Dress Limited https://youtu.be/NfJDP7O_rtc

Osia Hyper Retail Limited https://youtu.be/L-pvVZwxHqQ

KHFM Hospitality and Facility Management Services Ltd https://youtu.be/nMg0AGSigm8

Northern Spirits Limited https://youtu.be/Hf1FZfJF1LQ

Roopshri Resorts Limited https://youtu.be/wBZmIpaFgsc

Latest Share Market News, Latest Share News, Latest Share Market Tips, Latest Share Market Videos, Latest Share Market News In Hindi, Latest Share Recommendations , Latest Stock Market News, Latest Stock Market Recommendations , Latest Stock Market News India, Latest Stock News India, Latest Stock Picks, Latest Stock Market Analysis Market Watch, Latest Stock Market Videos

0 notes

Text

SREI Equipment Finance Ltd NCD (SEFL NCD) Details

SREI Equipment Finance Ltd NCD (SEFL NCD) Details

SREI Equipment Finance Ltd NCD (SEFL NCD) Details:

Srei Equipment Finance Ltd, non-banking financial company, provides financial products and services in India. It offers loans, leasing, rental, and fee-based services to companies operating in the construction, mining, technology and solutions, healthcare, ports and railways, oil and gas, agriculture, and transportation sectors.

The company was…

View On WordPress

#2017 BSE NCD#Allotment Date Of NCD#Allotment Date of SEFL#Allotment Date of SEFL NCD#Allotment Date of SREI EQUIPMENT FINANCE#Allotment Date of SREI EQUIPMENT FINANCE NCD#Allotment Details Of NCD#Allotment Details Of SEFL#Allotment Details Of SEFL NCD#Allotment Details Of SREI EQUIPMENT FINANCE#Allotment Details Of SREI EQUIPMENT FINANCE NCD#Allotment News Of NCD#Allotment News Of SEFL#Allotment News Of SEFL NCD#Allotment News Of SREI EQUIPMENT FINANCE#Allotment News Of SREI EQUIPMENT FINANCE NCD#Allotment Status Of NCD#Allotment Status Of SEFL#Allotment Status Of SEFL NCD#Allotment Status Of SREI EQUIPMENT FINANCE#Allotment Status Of SREI EQUIPMENT FINANCE NCD#BSE#BSE NCD#GMP Of SEFL NCD#GMP Of SREI EQUIPMENT FINANCE NCD#Grey Market Premium Of SEFL#Grey Market Premium Of SEFL NCD#Grey Market Premium Of SREI EQUIPMENT FINANCE#Grey Market Premium Of SREI EQUIPMENT FINANCE NCD#Indian NCD News

0 notes

Text

The IPO bidding for Muthoot Finance Ltd. - India starts Today!

Simply click on the Link Below & apply for the IPO in a few simple steps.

https://bit.ly/3CcYNO2

Fill out the form, update your bank account details, Demat account details, and more. Select the number of NCD debentures you're looking for and complete your bidding for the NCD debenture in five minutes.

#muthoot finance#NCD IPO#upcoming ipo#finance advisor#investment#ipoalert#investinipo#muthootfinance#debentures

1 note

·

View note

Text

Banks can Benefit From the Rising Market of IPOs with Winsoft SmartASBA

The year 2021 has seen a dramatic rise in the issuance of IPOs. IPOs have raised over 27,000 crores in investments in just the first half of 2021. That number has been the highest in over a decade, and it will rise exponentially by the end of the year. Several enterprises went public, ranging from computer start-ups to chemical manufacturing firms and restaurant franchises.

In the opinion of many experts, India’s primary market has truly come of age, and convergence of favorable factors imply a multi-year IPO cycle.

Banks, therefore, should be prepared for the sheer volumes of IPOs and manage their flow through a good ASBA Ipo application processing software.

ASBA And Its Role In A Banking System!

ASBA or Applications Supported by Blocked Amount is a process introduced by SEBI (Securities and Exchange Board of India) to apply for an IPO. In the ASBA process, An IPO applicant's account is not debited until shares are issued to them. A bank that offers ASBA services to its account holders has the authority to block money in that account for subscribing to an IPO issue.

The ASBA process enables retail individual investors to place bids for active IPO schemes. They can apply through Self Certified Syndicate Banks or SCSB(s), where they already have bank accounts. SCSB(s) are financial institutions that meet SEBI's requirements.

Accepting applications, verifying them, blocking funds up to the amount of the bid payment, uploading the details to the NSE's web-based bidding system, unblocking after the basis of allotment is finalised, and transferring the amount for allocated shares to the issuer is done by SCSB(s).

How Smart ASBA Is The Right Choice To Jump On The IPO Train!

Smart ASBA, offered by Winsoft, is a complete IPO applications processing platform catering to IPO, Rights Issue, NFO and Debt/NCD products for these SCSBs (banks). Smart ASBA makes it easy and simple for banks to process high volume IPO applications. It assists through every step including and up to the final allotment of shares.

Winsoft’s Smart ASBA provides unique features like:

Customizable web responsive UI to support desktop and mobile browsers

Maker-Checker support for all masters and transaction processing screens

Stringent business validations

Allows bulk imports of application requests

Caters to large volumes with Application Security (VAPT/Infosec) compliance

Online PAN and DP client ID verification

Compliance reports generation

NSE application bidding API, Lien marking and Lien removal availabilities

Comprehensive Reconciliation and Billing

Winsoft’s Smart ASBA supports products and modes like IPO (Fixed Price Issue and Bid Issue), Follow On Public Offer or FPO, New Fund Offer or NFO and Non-convertible debentures or DEBT/NCD. Smart ASBA also supports Investment Modes like ASBA, Syndicate ASBA, Non-ASBA/Physical.Process

That is why over 10 prominent BFSI enterprises have selected Winsoft SmartASBA as their IPO processing platform of choice.

The Web-Based Solution of Smart ASBA will provide speed and convenience for your application processing and improve the flow of your financial transactions.

Choose Smart ASBA from Winsoft Now!

0 notes

Text

Edelweiss NCD IPO: Should you invest?

Edelweiss Financial Services Limited is issuing the Non-Convertable Debentures. These NCDs are AA-rated. The NCDs are being issued in eight series: coupon ranges from 8.75% to 9.7% p.a. and different tenures of 3 years, 5 years, and 10 years. The Edelweiss NCD Bond is secured and redeemable in nature.

The present bondholders or equity shareholders of EFSL or Edelweiss Group are considered Primary Holders. In this IPO, Primary holders will be incentivized by a maximum of 0.20% p.a.

IssuerEdelweiss Financial Services Limited

Type of instrument Secured, redeemable and non-convertible debentures

Listing The NCDs shall be listed on the BSE Limited (Stock Exchange)

Issue SizeRs. 400 cr (including GreenShoe Option)

Issue Price (in Rs.) Rs. 1000 per NCD

Minimum Investment (in Rs.)10,000

Issue Opening Date August 17, 2021

Issue Closing Date September 6, 2021

Mode of Issuance Dematerialized only

Edelweiss NCD IPO: Coupon rates and effective yield for each of the series

Series Frequency Tenure Coupon Rate Yield

IMonthly 3 Years8.75%9.10

IIAnnual 3 Years 9.10%9.09%

IIICumulative3 YearsNA9.10%

IVMonthly 5 Years 9.15%9.54%

VAnnual 5 Years 9.55% 9.54%

VICumulative5 Years NA9.55%

VIIMonthly 10 Years 9.30%9.70%

VIIIAnnual 10 Years9.70%9.69%

Allocation Ratio for Edelweiss NCD IPO

The allocation ratio of Edelweiss NCD IPO is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for EFSL NCD-IPO.

Issue analysis of Edelweiss NCD IPO

Pros

These NCDs are secured by the assets of the company providing an additional layer of protection to your investment.

The issuer is offering high coupon rates.

These NCDs are AA-rated. AA-rated NCDs are considered investment-grade securities.

Cons

Macroeconomic conditions such as COVID have negatively impacted the company. However, these conditions are gradually improving.

After the IL&FS crisis, the investors’ sentiment towards NBFCs has been dampened. The point to be noted here is that the bigger NBFCs like Edelweiss have earned brand equity; hence investors may show interest in Edelweiss.

Though these NCDs are AA-rated outlook is negative hence market demand for these NCDs may reduce making them slightly illiquid.

These NCDs are subordinates: during insolvency subordinate, NCDs are paid after senior NCDs.

About EFSL

Edelweiss Financial Services Limited(EFSL), also known as Edelweiss Group, is an investment and financial services company with a net worth of Rs. 85.41 Billion and serving 1.2 million clients.

Business Verticals

Credit (Retail, Corporate)

Investment & Advisory (Wealth Management, Asset Management)

Insurance (Life, General)

Investment Process for Edelweiss NCD IPO

IPOs are facilitated by entities called Lead Managers. Generally, these lead managers are brokerage firms. Investors need to apply for IPO through lead managers, and once the allotment is made, investors will receive the bond units in their Demat account.

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is more than

10 Lakhs

–

A.Fill up the form with the required information.

B.Take a photo of your form and share it with your Relationship Manager for bidding on exchange.

C.Courier the filled up IPO form to our office address as early as possible. The issue closes on the 6th of September, 2021. The earlier you send it, the better it is.

Our Address: IndiQube Orion, Ground Floor,

24th Main Road, Garden Layout, Sector 2,

HSR Layout, Bangalore, Pincode: 560102

If the investment amount is less than 10 lakhs

If the investment amount is less than 10 lakhs, retail investors can apply for an IPO online in three simple steps.

Select the product- Visit GoldenPi.Com and go to the collection page. Visit the IPO section and choose the issuing company. The product page provides information such as a coupon, yield, maturity, and payment frequency. The product page also displays credit rating and issuer details that help investors to make an appropriate decision.

Decide Investment Amount – Decide the amount you want to invest. You need to select the series and the number of units you want to purchase. The calculator displays the total investment amount.

Pay via UPI– Now provide UPI handle. You will receive a mandate in the UPI app. Go to the respective UPI app and make payment by approving the mandate.

IPO allotment

IPO will be allotted to you on a first-come, first-serve basis and credited to your Demat account.

Dos and Don’ts of Edelweiss NCD IPO

Every individual can submit 5 IPO applications.

The Demat account must be active.

After applying for an IPO, you can not change your contact details such as email id and cell number until allotment.

If you are paying via UPI, then the UPI mandate must be accepted within 48 hours.

0 notes

Video

youtube

L&T Finance Ltd. NCD April 2019 Public Issue Price, Date, Allotment, Rev...

L&T Finance Ltd. NCD April 2019 Public Issue Price, Date, Allotment, Reviews & StatusL&T Financial Ltd is a non-banking financial service company. It is a part of L&T group which started financial services business in 1994. L&T Financial Ltd works in the three main segments which are wholesale, rural and housing. In rural business, it provides microloans, two-wheeler financing facility and farm equipment financing services. As on 31st Dec 2018, the advances and adjusted loans were Rs 24,122.27 cr in rural business.

In the wholesale business, the company offers structured corporate finance andinfrastructure finance. Previously the company was providing supply chain business but it was transferred to Centrum Financial Services Ltd. Now, the company only provides some portfolio maintenance activities in supply chain finance to Centrum. In the housing business, it provides loans against real estate and property finance. The company has a PAN India presence with 223 branches across 21 states and 3UTs.

The strengths of the company are: 1. Diversified businesses 2. Strong loan procedures 3. Strong risk management framework 4. Brand recognition

L&T Finance Ltd. NCD April 2019 Detail Issue Open Apr 8, 2019 - Apr 18, 2019 Security Name L&T Finance Ltd. Security Type Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) Issue Size (Base) Rs 500.00 Crores Issue Size (Shelf) Rs 500.00 Crores Issue Price Rs 1000 per NCD Face Value Rs 1000 each NCD Minimum Lot size 10 NCD Market Lot 1 NCD

NCD Allocation Ratio NCD's allocated in each investor category. Category (/faq/who-can-apply-in-ncd-public-issue/544/) NCD's Allocated Category 1 (QIB) 10 % Category 2 (NII) 10 % Category 3 (RII) 35 %

Coupon Rates Coupon Rates for Eash Series Series 1 Series 2 Series 3 Series 4 Series 5 Series 6 Frequency of Interest Payment Annually NA Annually Monthly Annually Monthly Tenor 37 months 37 months 60 months 60 months 120 months 120 months Coupon Rate (Retail) For Category I & II/ for III & IV 9.00%/9.10% NA 9.10%/9.25% 8.75%/8.89% 9.20%/9.35% 8.84%/8.98% Amount on Maturity For Category I & II/ for III & IV ??1,000 ??1,304.93/??1,308.64 ??1,000 ??1,000 ??1,000 ??1,000

NCD Rating Detail AAA rating Stable by ICRA, CARE & IND

Objects of the Issue: 1. The Company proposes to utilise the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company ("Net Proceeds"). For the purpose of onward lending, financing, refinancing the existing indebtedness of the Company (payment of interest and/or repayment/prepayment of principal of borrowings); and 2. General corporate purposes.

Company Contact Information L&T Finance Ltd. Technopolis, 7th Floor, A- Wing, Plot No. - 4, Block - BP, Sector -V, Salt Lake, Kolkata 700 091 Phone: 033-66111800 Email: [email protected] Website: https://www.ltfs.com

L&T Finance Ltd. NCD April 2019 Registrar Enam Securities Private Limited Enam Securities Private Limited, 8th Floor, Dalamal Towers, Nariman Point, Mumbai - 400 021 Phone: +91-22-6638 1825 Email: [email protected] Website: http://www.enam.com

L&T Finance Ltd. NCD April 2019 Lead Manager(s) 1. A.K. Capital Services Limited 2. Axis Bank Limited 3. Edelweiss Capital Limited

Other IPO review video are as detailed below with hyper link of youtube:

Polycab IPO Date, Prospectus, Allotment, Listing, Reviews & Status. https://youtu.be/bpDWFxct21Q

Rail Vikas IPO Date, Prospectus, Allotment, Listing, Reviews & Status. https://youtu.be/Of7RMGS7P-E

Metropolis IPO Date Prospectus Allotment Listing Reviews & Status. https://youtu.be/RzO4C5V6WVY

Embassy Office Parks REITS IPO REVIEW, ALLOTMENT & LISTING... https://youtu.be/lLhU40feW3U

Aartech Solonics Ltd. IPO REVIEW. https://youtu.be/UKBJfXET_nc

MSTC LIMITED 2019 IPO LISTING GAINS & REVIEW. https://youtu.be/cwoI_7zr1wY

Current SME IPO Jinaams Dress Limited https://youtu.be/NfJDP7O_rtc

Osia Hyper Retail Limited https://youtu.be/L-pvVZwxHqQ

KHFM Hospitality and Facility Management Services Ltd https://youtu.be/nMg0AGSigm8

Northern Spirits Limited https://youtu.be/Hf1FZfJF1LQ

Roopshri Resorts Limited https://youtu.be/wBZmIpaFgsc

Latest Share Market News, Latest Share News, Latest Share Market Tips, Latest Share Market Videos, Latest Share Market News In Hindi, Latest Share Recommendations , Latest Stock Market News, Latest Stock Market Recommendations , Latest Stock Market News India, Latest Stock News India, Latest Stock Picks, Latest Stock Market Analysis Market Watch, Latest Stock Market Videos

0 notes

Text

Mahindra & Mahindra Financial Services Ltd NCD Details

Mahindra & Mahindra Financial Services Ltd NCD Details

Mahindra & Mahindra Financial Services Ltd NCD (M & M Financial NCD) Details:

Mahindra & Mahindra Financial Services Ltd, a non-banking financial company, provides financial products and services in the rural and semi-urban areas in India.

It offers vehicle financing for auto and utility vehicles, tractors, cars, commercial vehicles, two wheelers, three wheelers, and construction equipment;…

View On WordPress

#2017 BSE NCD#Allotment Date of M & M FINANCIAL#Allotment Date of M & M FINANCIAL NCD#Allotment Date of Mahindra & Mahindra Financial Services#Allotment Date of Mahindra & Mahindra Financial Services NCD#Allotment Date of MMFSL#Allotment Date of MMFSL NCD#Allotment Date Of NCD#Allotment Details Of M & M FINANCIAL#Allotment Details Of M & M FINANCIAL NCD#Allotment Details Of Mahindra & Mahindra Financial Services#Allotment Details Of Mahindra & Mahindra Financial Services NCD#Allotment Details Of MMFSL#Allotment Details Of MMFSL NCD#Allotment Details Of NCD#Allotment News Of M & M FINANCIAL#Allotment News Of M & M FINANCIAL NCD#Allotment News Of Mahindra & Mahindra Financial Services#Allotment News Of Mahindra & Mahindra Financial Services NCD#Allotment News Of MMFSL#Allotment News Of MMFSL NCD#Allotment News Of NCD#Allotment Status Of M & M FINANCIAL#Allotment Status Of M & M FINANCIAL NCD#Allotment Status Of Mahindra & Mahindra Financial Services#Allotment Status Of Mahindra & Mahindra Financial Services NCD#Allotment Status Of MMFSL#Allotment Status Of MMFSL NCD#Allotment Status Of NCD#BSE

0 notes

Text

Muthoot Finance NCDs To Raise Rs. 2,000 cr

Muthoot Finance NCDs To Raise Rs. 2,000 cr

Muthoot Finance NCDs (MFL NCDs) To Raise Rs. 2,000 cr:

Muthoot Finance has announced its 17th series of public issue of non-convertible redeemable debentures.

The company has filed a shelf prospectus for the issue of secured redeemable non-convertible debentures of face value of ₹1,000 each aggregating up to ₹1,950 crore and unsecured redeemable non-convertible debentures of face value of ₹1,000…

View On WordPress

#2017 BSE NCD#Allotment Date of MFL#Allotment Date of MFL NCD#Allotment Date of Muthoot Finance#Allotment Date of Muthoot Finance NCD#Allotment Date Of NCD#Allotment Details Of MFL#Allotment Details Of MFL NCD#Allotment Details Of Muthoot Finance#Allotment Details Of Muthoot Finance NCD#Allotment Details Of NCD#Allotment News Of MFL#Allotment News Of MFL NCD#Allotment News Of Muthoot Finance#Allotment News Of Muthoot Finance NCD#Allotment News Of NCD#Allotment Status Of MFL#Allotment Status Of MFL NCD#Allotment Status Of Muthoot Finance#Allotment Status Of Muthoot Finance NCD#Allotment Status Of NCD#BSE#BSE NCD#GMP Of MFL NCD#GMP Of Muthoot Finance NCD#Grey Market Premium Of MFL#Grey Market Premium Of MFL NCD#Grey Market Premium Of Muthoot Finance NCD#Indian NCD News#Latest BSE NCD

0 notes

Text

SREI Infra Finance NCDs (SIFL NCDs) To raise upto 706 cr

SREI Infra Finance NCDs (SIFL NCDs) To raise upto 706 cr

SREI Infra Finance NCDs (SIFL NCDs) To raise upto 706 cr:

Srei Infrastructure Finance Ltd (Srei) is planning to raise Rs 200 crore through issue of secured redeemable non-convertible debentures (NCDs) of face value Rs 1,000 each. The issue will also have the option of retaining oversubscription up to the ‘residual shelf limit’ of Rs 706.63 crore.

The issue opens on January 30 and closes on…

View On WordPress

#2017 BSE NCD#Allotment Date Of NCD#Allotment Date of SIFL#Allotment Date of SIFL NCD#Allotment Date of SREI Infra Finance#Allotment Date of SREI Infra Finance NCD#Allotment Details Of NCD#Allotment Details Of SIFL#Allotment Details Of SIFL NCD#Allotment Details Of SREI Infra Finance#Allotment Details Of SREI Infra Finance NCD#Allotment News Of NCD#Allotment News Of SIFL#Allotment News Of SIFL NCD#Allotment News Of SREI Infra Finance#Allotment News Of SREI Infra Finance NCD#Allotment Status Of NCD#Allotment Status Of SIFL#Allotment Status Of SIFL NCD#Allotment Status Of SREI Infra Finance#Allotment Status Of SREI Infra Finance NCD#BSE#BSE NCD#GMP Of SIFL NCD#GMP Of SREI Infra Finance NCD#Grey Market Premium Of SIFL#Grey Market Premium Of SIFL NCD#Grey Market Premium Of SREI Infra Finance NCD#Indian NCD News#Latest BSE NCD

0 notes