#2023MitSloanBrandingSA

Explore tagged Tumblr posts

Text

To beach or not to beach?

Should Corona alter its marketing strategy?

Corona's marketing strategy has successfully created a strong brand following, primarily due to its effective branding and differentiation tactics. In the beer industry, differentiation can be a significant challenge, with branding often being the critical factor that sets one brand apart from another, as we learned in the case, “beer is all marketing.”

To succeed, beer companies need to focus on the experience they want consumers to have when consuming their products. In the case of Corona, their marketing strategy centers around the experience of "fun, sun, and beach" - which perfectly encapsulates the feeling of a carefree day spent on a tropical beach. Showing Corona beers in ice at the beach displays where you should be transported to when consuming one.

I believe Corona should continue with its current marketing campaign, as it has proven highly effective. Additionally, there is no need to change a winning strategy, especially when Heineken is revamping their brand. Instead, in my opinion, Corona should double down on its "beach" theme and focus on enhancing the vacationing experience of drinking a cold beer on a hot day - a space that is not easily targetable by Heineken.

By staying true to its brand values and continuing to offer an unbeatable vacation experience through its beer, Corona can continue to build a loyal following and maintain its position as one of the leading beer brands in the market.

4 notes

·

View notes

Text

Bravo!

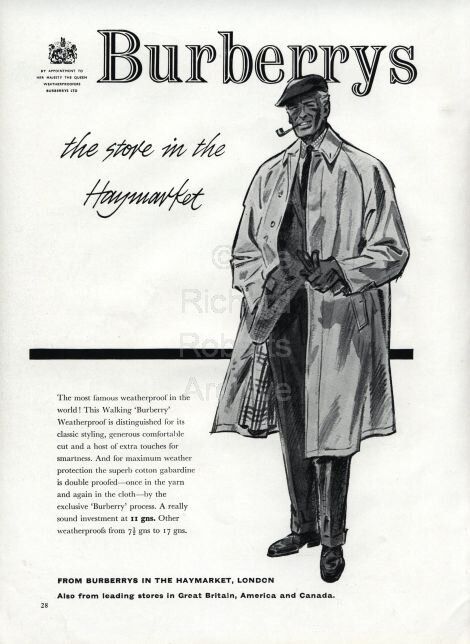

The $5 trench coat that became an icon

With a strong focus on quality, innovation, and exclusivity, Rose Marie Bravo was able to turn Burberry around and establish it as a leader in the accessible luxury fashion market.

PRODUCT LINES

One of the smartest moves Bravo made was updating Burberry's product lines. By reducing the number of outdated designs, Burberry was able to streamline its offerings and create a more cohesive image. This helped reinforce the brand's position as an accessible luxury lifestyle brand that was aspirational, stylish, and innovative.

Burberry also divided its products into two categories: continuity and fashion-oriented. This allowed the brand to appeal to both its core customer base and a younger demographic, while still maintaining its cachet.

Their most iconic item, the trench coat, has endured the test of time. I was surprised to learn that the coat was originally used for British soldiers and adventurers, because I associate it with British socialites and sleek professionals. I did some digging, and the price of the Burberry trench coat has increased significantly over the years. In the early 1900s, the coat cost around $5. The case mentioned that in the 2000s, it was $900. Today, the price for a classic Burberry trench coat ranges from $1,700 to $2,500, depending on the style and material. Definitely outpacing inflation!

ADVERTISING

Investing in advertising was also key for Burberry's success. They hired a famous team including photographer Mario Testino and creative director Fabien Baron. The 1998 advertising campaign helped to reinforce the brand's British heritage and sense of tradition. The introduction of Kate Moss as a spokesperson also helped to make the brand more accessible to a younger demographic.

DESIGN ELEMENTS

The most impressive thing about Burberry's transformation is how they managed to maintain their iconic design elements while still updating their image and appeal. Their iconic check pattern became even more popular with the introduction of new designs and materials, while still retaining the durability and quality that made them so popular in the first place.

QUESTIONS

One question I have is around the proliferation of Burberry brands. To me, the wide array of Burberry offerings dilutes the strength of the brand. A few years ago, I purchased a Burberry trench coat on a consignment website, but when it arrived, the tag said “Burberry’s.” I was not aware that pre-1997, the brand name was actually Burberry’s, and I was afraid it may have been a knockoff and returned it. I also often see Burberry’s offshoot brands like Burberry Brit at discount stores like TJ Maxx, which feels like a step down from how they would aspire to position themselves.

I am also curious whether the brand will resonate with Gen Z (see Romeo Beckham ad below). On one hand, their generation appreciates vintage fashion, so they could find a love for the classic trench and other timeless styles. On the other hand, they seem to be fascinated with creative, bright, nontraditional designs that feel opposite of Burberry's posh image.

4 notes

·

View notes

Text

Fair & Lovely review

I was born in India and lived there until I was 5 before immigrating to the United States. As a child, I would go back home every couple of years and without fail, Fair & Lovely commercials were the most ubiquitous. You would see billboards across every major street and you would see TV ads with magically lightening skin. My aunts and uncles lived in India and would often criticize me for staying out in the sun too long and allowing my skin to darken. The desire for lighter skin was ingrained into societal expectations across all levels. Moviestars (in South Indian movie where the average person is typically darker) were almost always lighter skinned.

Social identity and the desire to fit into the mold of 'fairness' was a key element of the relationship with Fair and Lovely. Using Fair and Lovely was a way to signal to others that you cared about being fair and that you agreed with the idea that being fair was superior to having darker skin. Fair and Lovely marketing's reinforced this idea and it created a downward spiral from there.

Customer's social identity often allows them to associate themselves with particular ideals. For example, Patagonia markets itself to those who aspire to be 'outdoorsy and environmentally-conscious' and its users often buy into that ideal. While Patagonia as a company was built on that foundation - you can imagine a situation where it adopted to meet the expectations of its customers.

2 notes

·

View notes

Text

Dark is beautiful!!

I was very excited to read this case because colorism is a topic I know too well. My family is Indian, and growing up there was constant chatter around how fair so-and-so's new wife is or isn't, or the warnings about spending all day in the sun with my white friends, etc. It made me terrified of becoming dark, to the point that I would lug an umbrella to the beach every time, and excessively wear sunscreen, and avoid swimming in the ocean or pool too much (even though I loved to!) to prevent getting more tan. I remember seeing all of the ads for Fair and Lovely when I'd visit India, and found it funny how back home the creams would advertise making you more tan rather than more fair. The difference in beauty standards between India and the US is very interesting - what is considered beautiful in India (very pale skin) is not the same as what might be considered beautiful in the US, where my white friends hate when they look "pale". It is interesting because the origin of colorism in India is colonialism and the desire to look more like the "superior" white folks, however white people themselves don't want to look too white.

It would be very difficult to undo generations of internalized racism in India, but there is a lot that can be changed today to at least start the process. More celebrities need to do what Das is doing and resist photoshopping / airbrushing / skin lightening creams, and allow the world to see their true skin. Darker men and women should have more representation in Bollywood movies and advertisements. Skin-lightening cream ads should be very careful about how they advertise - and be banned from including anything that associates darkness with undesirability or any sort of inferiority. Once the embracing of darker skin starts at the pop culture level, hopefully it will eventually trickle down to the masses and dismantle the obsession with fairness.

Customers' identities affect consumer-brand relationships in many ways. Unilever, and many other brands, capitalize on consumer beliefs and insecurities. Unilever knows that the majority of Indians are not considered "fair" and are insecure about that, thus there is a huge market for skin-lightening products, and the more they reinforce these insecurities via advertising, the better. The "Dark is Beautiful" campaign threatens their sales, so they are not incentivized to support it or change their ways. It is not realistic to expect massive brands to choose morality over revenue, thus I believe the only way to get them to change their ways is for people of influence (celebrities, Bollywood producers, etc) to reject the notion that fairness is the beauty standard, and hopefully consumers will naturally stop demanding skin lightening creams and brands will no longer need to push colorism for revenue.

2 notes

·

View notes

Text

Week 5 - An analogy between a trench coat and a plant-based burger

I had never thought that a trench coat and a plant-based burger could have things in common. Although the products are not similar at all, I believe that there are several commonalities between Burberry and Impossble Foods. Burberry had seen its sales and quality eroded due to a massive licensing of its products. Moreover, the lack of disciplined had left Burberry in a position in which only a very specific segment of the population - mainly older people - were willing to buy the more than 100,000 SKUs that the company had in the market. Other decisions such as selling through wholesalers that sold to unauthorized distributors were making it hard for Burberry to consolidate as a brand.

Rose Marie Bravo was able to reinvent the brand, not only by properly understanding new customer segments, such as younger people, but also by changing the "message" of the brand: Burberry offers accessible luxury that is also functional. It also made very popular campaigns with famous people such as Mario Testino and also created a high-end brand called Prorsum.

Drawing parallels to Impossible Foods, it appears that the company is facing a similar situation. I believe that Impossible Foods is not targeting the right customer segment and that customers are starting to question the quality of its products. While Impossible Foods is aiming to appeal to individuals who are concerned about the environment, it has neglected to target vegetarian individuals and those who seek healthier options. Moreover, rumors there are rumors that Impossible Foods products may not be healthy.

To address these concerns, I would suggests that Impossible Foods conduct a proper market analysis using tools such as ethnography, surveys, and focus groups. This would enable the company to identify additional customer segments it could target, much like Burberry did with younger people. In addition, I would recommend that Impossible Foods consider rebranding its products to better communicate the quality of its plant-based meat offerings. Finally, the company could replicate Burberry's successful campaigns with photographers and models by partnering with nutritionists to educate potential customers about the benefits of consuming Impossible Foods products. Impossible Foods has the opportunity to find its "sweat-spot" in the market - in the same way as Burberry did - and to reinvent the plant-based products industry. Impossible Foods will only succeed if it has enough discipline to understand the customer needs and communicates successfully the benefits of its products.

2 notes

·

View notes

Text

What Luxury Brands Can Teach Uber

The case mentioned that despite a major turnaround in the early 2000s, Burberry began experiencing new challenges including lacking exclusivity due its almost ubiquitous "check" and the adoption of the brand by non-target customers. Based on the case, it seems as though Burberry was able to achieve salience because of the deep, broad brand awareness. The ad campaigns and redesign and introduction of Burberry products created a new identity for the brand that spoke to consumers desires to be both functional and fashionable. Burberry was even able to achieve meaning through differentiation and response through positive reactions and associations with the brand. However, at the time of the case, Burberry did not seem to achieve brand resonance with the target customers it desired. The target customers did not have a collective intense and active loyalty to the brand. This could be because the brand was not providing enough value to the customers by "protecting" its exclusivity (i.e., the rise of counterfeits) or rewarding its customers for their loyalty (i.e., Hermes providing limited quota bags to loyal Hermes customers). Because of the lack of brand resonance, Burberry did not experience its customers defending or protecting the brand the way other brands have experienced (i.e., loyal Chanel customers continuing to purchase handbags, especially the Classic Flap, despite the astronomical price hikes to further alienate non-target customers).

While Uber and Burberry operate in entirely different spheres, there are some lessons that can be applied to Uber as it thinks about how its customers can co-create and defend the brand when sufficient value is provided. I have been a customer of Uber since 2016 or 2017 and in all the years I have used Uber, it has never been more than a functional app for me. This is also true of many of my friends who also use Uber. Uber, especially as of lately, does not provide enough economic, cultural, social, or temporal capital to truly achieve brand resonance. This is evidenced by the fact that whenever a new rideshare app that offers lower pricing or better promotions enters the space, I try them out. Throughout my time as an Uber user, I have not reached a "status" that truly rewards my use of the service in a substantive (compared to Marriott, for example, that provides status tiers for staying a certain number of nights in their properties). I think that Uber would benefit from finding ways for customers to more closely tie their social identity with the brand. Additionally, Uber might also be able to leverage its employees/ contractors to increase brand resonance.

2 notes

·

View notes

Text

Think before you act! Ask the right questions.

The article "Four Products: Predicting Diffusion (2008)" offers interesting insights into innovation and consumer adoption. One key question to consider when predicting diffusion for a product is whether it solves a problem on a large scale.

For example, sliced peanut butter in Exhibit 1 may not have addressed a widespread problem that many people were looking to solve. Moreover, consistently producing sliced peanut butter may not be a sustainable business venture based on the information provided. In contrast, Exhibit 2's collapsible wheel is a great innovation that has the potential to improve the daily commute for many people, making it a more convenient experience.

In general, predicting diffusion can be made easier by asking the question, "Does this product solve a problem on a large scale?" Answering this question can help companies and entrepreneurs identify the ideal target market and the total addressable market for their product.

@deepelorm

2 notes

·

View notes

Text

Corona vs Heineken

A simple Google search of the World's best beer leads me to a variety of categories of how one would describe 'best' beer:

Light

Low-carb

German

IPA

Sour

Stout

Craft

Lager

Belgian

Japanese

Mexican

Mainstream

For the beer nerds, it is hard to choose the winner between Heineken and Corona because one might have a better edge than others in different aspects. However, from the business angle, we can argue which brand has better brand recognition and, hence, leads to better sales (in terms of quantity) in the global market.

HEINEKEN

I agree with the case that Heineken plays a lot of genderism of masculinity, sexy, 'James Bond' to attract the main market of the beer industry: males. This approach might yield results in the pre-woke era where the idea of females drinking beer is not common. However, as their advertising campaign went, Heineken clearly understand that their masculine approach, to some extent degrading to the female (i.e 'something should not be shaken or stirred' ads), is not appropriate and failing. In Heineken's recent campaign, they started to be more vanilla with a beer photo with some self-acclaimed phrases (i.e 'freshest label in the business', 'lager beer at its best') but I can feel that Heineken is losing its identity throughout.

CORONA

Meanwhile, Corona is consistent with its association with vocation, including 'beach', 'Mexico', 'lime', 'fresh', and 'sunshine', to attract its customers for a quick escape to a tropical island. Corona's advertisement campaign always has elements of 'Fun, Sunny, Relaxed' which are the brand association that they would like to put forward to the customers. This effective marketing combined with consistent pricing, field sales work, and good POS promotions has made Corona build a better brand recognition that leads to better sales improvement (in terms of quantity) in the beer industry over the period of 1990 to 1996.

CONCLUSION

Based on Exhibit 10 above in 1996, although Heineken is still in the top 7 of the world's top beer brands, Corona is clearly leapfrogging its distribution by 65% from 1990 - 1996 and managed to be in the top 8 of the world's top beer brands. The case does not provide data on how Heineken vs Corona performed in the 2020s, but I would make a $100 bet that Corona has surpassed Heineken in recent years.

2 notes

·

View notes

Text

Corona

Despite struggles in the 90s with rumors about urine being in Corona and later on cancer causing ingredients, Corona bounced back by focusing on their strengths, which Viejo pointed out: "Our strength lies in that we combine a consistent advertising message with excellent sales fieldwork, good point-of-sale promotions, a fresh product, and reliable pricing.”

Corona offers a sense of reliability to customers, through pricing but also through the freshness of their product and the consistent message in their advertising. Corona has been consistent with their brewing being 100% in Mexico, which seemed to be an advantage vs. other imported competitors. They have also stayed consistent with their bottling and labeling - the bottle looks almost exactly the same as 30 years ago and could be recognized by anyone.

Not surprisingly, Corona is still fully embracing their "fun, sun, beach" tagline. Looking at their recent Instagram posts, you wouldn't even know that it is company that makes beer from ~90% of the posts. It is pictures of beautiful beaches around the world. Sometimes you see people laughing and smiling in those beautiful places while holding a corona but surprisingly infrequently. This is a very intentional way for Corona to continue to market the experience of drinking the beer, not just the product itself.

Heineken's approach is notably different. They are not depicting a lifestyle through their brand in the same way that Corona is, and their message has changed over the years. When you think of Corona, you think of the beach or a relaxed vacation, warmer weather. When you think of Heineken, at least for me, nothing in particular comes to mind. That alone shows the success of corona as a brand.

Corona's 2020 advertising campaign was "Find Your Beach" with several ads referring to the increase in people working from home. This was a clever marketing tactic which was consistent with former campaigns, playing on Corona's association with a worry free, relaxed lifestyle, but also addressing the increase in remote workers.

Corona's marketing tactics make it a product that stands our vs. competitors. As someone who isn't a beer drinker, Corona would be a brand that I trust for myself and if I were going to be buying for others. It is reliable and has positive associations with vacation and happier times! The other "mainstream" beers all kinda of blend together...

2 notes

·

View notes

Text

It seems these brands are positioning themselves as premium brands. I would characterize the Corona brand as a more fun, young and relaxing persona whereas Heneiken gives off a serious / mysterious vibe. My perception is that Corona is appealing and is a simple path to positive “vacation” emotions. It is aligned with alcohol consumption and relaxation. Whereas Heineken almost has a masculine and sophisticated persona. I think Heineken generally may be more appealing to the older genre of consumers, which happens to be the lower consuming segment.

Additionally Corona seems to be the “opposite” persona of Heineken. A fun and authentic brand distinct from Heineken. In this regard, in the SIT framework, Heineken drinkers are not Corona drinkers and is a dissociative consumer group. Corona has a broader “in-group” and “aspirational” characteristic associated with it’s brand. Personally, if I want to feel sophisticated drinking beer, it's not likely going to be Heineken and they may be competing with other substitutes within this strategy.

Both brands are fighting over the market share for beverage consumption. The fight is less about the specifications of the product (ie not a product battle) but more about how each product appeals to it’s specific customer (a market battle). I would add, from the reading, that Corona has maintained a “made in Mexico” authenticity that adds an element of trust to the relationship with it’s customers.

Heineken’s reaction to Corona entering it’s market may be telling. (They thought little of Corona) Did it rest on it’s laurels and allow Corona to capture a segment of consumers it ignored? (With a "Well it has always worked in the past" attitude?) What does that suggest about it’s myopic vision of how Heineken should regularly innovate it’s brand strategy? Their focus for a long time was just about quality, while Corona developed a clear personality and appealed to an experience. Heineken eventually pivoted into a brand with less hubris and a more friendly brand, but I’m not convinced that is enough to engage Corona devotees.

Corona should continue to test it’s appeal with it’s brand strategy. I think they have a more regionalized marketing effort than Heineken which allows individual markets to customize and respond to it’s customer’s more bespoke preferences. I think this is a competitive advantage, versus having a more national marketing campaign.

2 notes

·

View notes

Text

Corona Beer

Background

Corona Beer, owned by Modelo, is a popular imported beer found throughout the US with a big goal, to be the leading imported beer in every country they compete in. The US is an important geography where they are falling behind on this goal, holding the number two position behind Heineken but limited in terms of a direct marketing affront given their limited budget.

As such, Modelo is considering a few strategies: a targeted regional marketing strategy, increasing off-premise sales at places like grocery stores, or rebranding its US marketing strategy. But interestingly, and likely biased with the benefit of hindsight, they are not currently considering the skews that they sell as part of their marketing campaign. My recommendation would be for Modelo to expand its skews and use those new types of beer to lead the launch of its refined US marketing strategy.

To understand the current state better, it’s worth analyzing the sentiment of each brand.

Corona

Corona’s advertising strategy focused on “Fun, Sun, Beach” since its creation. Their advertising strategy has helped create the light-hearted association of a warm day at the beach and an escape from reality when consuming a Corona. But has more recently run into issues around brand image such as that the beer was rumored to be contaminated with urine and that it contained 400 - 500 calories/bottle as well as that their glass bottles poorly protected the integrity of the beer. Expanding to new skews such as light beer or canned beer will help them to differentiate and move past this poor reputation. Additionally, it also helps them fit more closely with what consumers might want from a drink they're having while in a swimsuit, something low-calorie and in certain situations like poolside, not liable to break. This is matched with the campaign styles of beach days, light colors, and imaginative views to place consumers into that mindset.

Heineken

Heineken has recently undergone a brand overhaul and is focusing on investing more in the advertising part of the business. Their campaign focuses on that Heineken is a simple, trustworthy beer that doesn’t disappoint. Their strategy has created a brand association of a classic beer that can be had at a dive bar after work or enjoyed with colleagues without judgment, a safe choice. This has worked with mixed success and there are clear weaknesses within the company, including that the marketing VP who ran the campaign was replaced by someone from PepsiCo who is pushing a new program called “Heineken Nights” that included consumers vouching on behalf of the product on video. Footage of that campaign was difficult to find but the below ad still captures the heart of it, simplicity based on tried and true experiences. The campaign has contributed to this consumer brand meaning by including darker colors and more references to day to day life.

Light Beer Revolution

Thus, as Modelo looks to identify how they can best differentiate in the market, doubling down on their tried and true approach of "Fun, Sun, Beach" while expanding to different types of beer such as low-calorie drinks or canned drinks is an effective way to capture a greater market share while maintaining true to their brand association. By using their existing brand, they can leverage what has brought them to number 2 within the US. Overhauling or regional branding can become confusing for consumers especially given there isn't a clear gap in their brand image so far, preventing them from being number 1. Instead, diversifying is more likely to fulfill consumers' needs and ultimately support them to dominate the US market.

3 notes

·

View notes

Text

Corona brand was always targeted towards the young, mass-affluent, collegiately educated demographic within the United States. The emblematic lime and corona combination added a sense of leisure, playfulness, and zestiness to the experience of drinking this brand's product that connected to the aspirationally care-free, pleasure-seeking nature of college students. Heineken's approach was different - where Corona was light, carefree, and youthful, Heineken was serious and elitist. If you were to drink Heineken, you "knew" quality beer. Despite these differences, both brands were priced at premiums compared to domestic competitors.

Heineken's weaknesses came from the elitism - consumers didn't resonate with the mystique and haughtiness of a brand that cultivated a sense of exceptionality from a relatively familiar process such as brewing. Organizational struggles in the 1990s contributed to a lack of focus on establishing the legacy and continuity of the brand to grow sales.

Today, Heineken continues to capitalize on its premium brand by associating with other elite brands such as the Champions League in Europe and has "skunky, crisp" drinking experience that feels more weight and serious compared to Corona's lightness.

2 notes

·

View notes

Text

"People don’t drink beer, they drink marketing”

This case touches on several of the concepts we discussed during our first class yesterday: first and second order brand signifiers, the dynamic co-creation of brand between firm and consumers, and social identity theory.

Corona's first order brand signifiers have been consistent over the decades -- the long neck bottle, clear glass, and distinctive engraving. Corona's second order brand signifiers have to do with fun, vacation, a laid-back attitude, and relaxation. Michael Foley's statement that "people don’t drink beer, they drink marketing” resonated with me and seems to be the sentiment driving Corona's slogans "Vacation in a Bottle" and "Change Your Lattitude."

Corona benefits from the dynamic co-creation of brand between the firm and consumers in the US, most specifically through its differentiated "Corona and lime" brand attribute. The idea of squeezing a lime into a beer immediately calls Corona to mind, which was a consumer-generated cognitive association that only later was adopted by Modelo.

Finally, the case raises social identity theory. Deshpandé describes a rise in anti-yuppie sentiment in the late '80s that affected Corona sales in the US. Yuppies (ie, younger, urban, more affluent consumers), who were more likely to consume imported beers and Corona in particular, became a dissociative group, and Corona suffered brand contamination and decreased sales as a result.

#2023MITSloanBrandingSA#2023MITSloanBrandingSB#2023mitsloanbrandingsa#branding#2023mitsloanbrandingsb

2 notes

·

View notes

Text

Pain of FMCG Industry — Heineken and Corona

The vulnerabilities which Heineken was facing actually are the common pain points for FMCG brands:

1. When you are big enough, consumers’ perceptions of brand are not easy to change. Heineken was leading the market, however, with the change of consumer demographics, the majority of main consumers may think the brand becomes old and old fashioned to choose. You need to talk to young consumers,while still want to keep the loyalty ones, that’s hard to decide a core value to renew the brand.

2. Low enter barrier, rely too much on advertising. Consumers are not only drinking beers,they are drinking the feeling that the brands provide. That means, the brands need to communicate the core value with feeling and scenarios through big marketing campaigns to the mass public. We can see from the chart that with fierce competition, the ads spending of Heineken grew rapidly year by year. And, you can never stop.

The perception of Heineken is more of quality, and then the company started to change to create different scenarios that you should taste. Corona communicates the feeling of nature all the time, and when it enter the US market, the people in south think that’s original Latin style.

3 notes

·

View notes

Text

Post #1: Black & Decker

Today’s topic

Black & Decker’s strength as a top brand for household tools and appliances does not directly translate into the power tools category, specifically for Tradesmen, despite top positions in the Industrial and Consumer segments. This post explores B&D’s failure to compete with Makita in the Tradesmen segment and how it can re-brand its products to change the perception for professional buyers.

Why does B&D struggle to compete in the Tradesmen segment?

The main challenges B&D faces in the Tradesmen segment is reputation and perception of product quality:

Ironically, the reputation of B&D power tools for this segment is negatively affected by the success of in the Consumer segment. The reputation is low due to tradesmen attributing the products to novice users instead of experts. This is because B&D tools are associated with novice DIYers (like my dad who bought a power tool to build IKEA furniture for my apartment in Cambridge). Even though their needs are the same (i.e., quality, reliability, price conscious), professionals want to be associated with tools produced for their specific expertise and craft. Tradesmen likely attribute their own personal reputation and skill with the tools they use, and do not want to be perceived as using the same tools as common consumers (just like buying a designer bag is a status symbol). This is similar to how professional golfers prefer the Callaway brand, which is known to produce the best equipment and golf wear, as opposed to mainstream brands like Nike or Adidas.

This association is strengthened by the fact that the color scheme and branding for these segments were indistinguishable. B&D uses the same charcoal grey color for its professional grade tools (and a similar black for its consumer tools) as other brands do for their consumer segments. This biases professionals away purchasing other B&D tools because of the perception they are buying amateur products.

Similarly, B&D dominance in the consumer market for power tools, and with home products and appliances more broadly, may lead professionals to believe that all B&D products are produced for common use. This creates the perception that B&D products are low quality and cannot hold up to their industrials needs and standards. It doesn’t help that B&D underperforms in two key categories (Milter Saws and Belt Sanders) that make up 80% of this segment’s sales, compared to Makita, which ranks as a high performer among all.

Why this doesn’t affect the Industrial segment…

In the power tools market, B&D performs better in the Industrial segment compared to the Tradesmen segment. Why is this the case if the tools are the same? The answer comes down to who purchases the products. The Industrial segment is comprised of large, commercial contractors who buy power tools for their employees. These companies are likely to rely on price to make purchasing decisions and rely on trusted relationships with suppliers. Given B&D is priced 5-10% lower than competitors, performs well, and has favorable relationships with the key purchase decisions influencers in this segment, it is favorable against competitors. However, B&D’s brand reputation in Industrial does not translate to the Tradesmen segment. This is most likely because the two segments are not in the same network and do not speak to each other (aka no word of mouth marketing). Tradesmen are comprised of electricians, plumbers, carpenters, roofers, etc, who buy tools for themselves. Although the end-user is the same in these two segments, those who make the purchasing decisions are different.

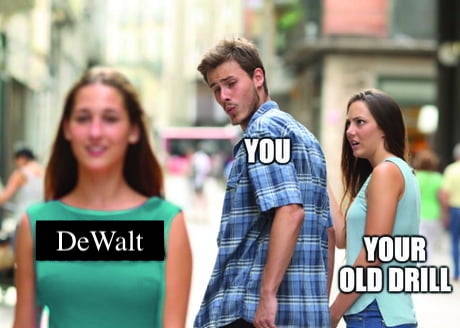

What can B&D do?

Drop B&D name: I think B&D should use the DeWalt name for the Tradesmen segment. The association with the Consumer segment will likely not be defeated due to industry perception and social stigmas among professionals. Starting fresh with a new name will allow B&D to break away from the image it has with the Tradesmen segment, and DeWalt is already known in the market as quality and has no ties to the common consumer. Many companies have been successful at using different brands to market products that are conflicting to the parent company or to other products in the portfolio. Examples include, Toyota and Lexus, General Mills and Larabar, and Coca Cola and Honest Tea. In these examples, the parent companies created brands that service the needs of different consumers while giving the perception that the product stands on its own.

Change the color: B&D should change the color of the tools from charcoal grey to yellow. This will differentiate the tools away from the consumer segment and make it more appealing to professional users as the color is already associated with construction and safety.

2 notes

·

View notes

Text

Stay away from that Black & Decker

Black & Decker (B&D) is known for its high-quality power tools and home appliances. However, in the professional tradesmen segment of the US power tools market, B&D was struggling to keep up with its competitor, Makita. As the case outlined, Makita was outselling B&D eight to one. But why?

BRAND IMAGE

One reason is that B&D had historically invested significantly in home brands and segments, and advertised those segments heavily. This drove strong consumer awareness of the B&D brand, but that awareness was not necessarily beneficial for the professional tradesmen segment. Some tradespeople came to view all B&D products as home products, and avoided bringing them onto the job site. As one tradesperson put it, B&D was good for “my wife’s popcorn popper,” but was not fit for “trying to make a living' as a tradesman." Another tradesperson said: "you just have to stay away from that Black & Decker." Also, there had been instances of a B&D product designed for at-home use being subjected to the demands of the job site and failing.

COMPETITIVE DIFFERENTIATION

Another issue with B&D's branding was that they failed to differentiate themselves from their competitors, including Makita. Makita had a stronger brand perception among tradespeople. As one tradesperson put it, "Makita is the best. It’s a good, solid product."

DISTRIBUTION CHANNELS

Makita took advantage of the trend of Home Depot growth and built their brand through corporate buyers and distributors, making it easier for them to penetrate the professional tradesmen market.

SEGMENTATION

B&D's shares of the two professional segments, Industrial and Tradesmen, were also different, which was surprising. One would expect them to be similar. The tradesmen segment is composed of individual buyers and users who use the products on project sites and buy them through hardware stores. In contrast, the industrial segment consists of corporate buyers who purchase the products for use by employees and commercial contractors working on large projects. The products are sold through major distributors.

DESIGN CHOICES

To improve their branding in the professional tradesmen market, B&D needed to consider their design influence on perception. One tradesperson said, "if I came out here with one of those Black & Decker gray things, I’d be laughed at." Note how this person specifically cited the color gray. The color of their products was important, as it could drive consumers to associate similar color items with the same category. (E.g., the entire market for pink drills targeted towards women).

Overall, B&D needs to reconsider their branding decisions to improve their performance in the professional tradesmen market. They needed to focus on building a stronger brand perception among tradespeople, create a sub-brand to distance themselves from their homeware brand, and differentiate themselves from their competitors. By making these changes, B&D can improve their sales and regain their competitive edge in the power tools market. Looking ahead, I would recommend the following to B&D:

Focus on brand elements that appeal to your consumer: While tradespeople did not appreciate B&D’s brand image (association with household), they did see value in its service quality and distribution approach, which they rated highly.

Create a new brand: A sub-brand (e.g., DeWalt) is an opportunity for B&D to distance themselves from their homeware brand, create a new brand image, and introduce new design decisions to differentiate themselves from their competitors.

Redesign the drill itself: A new, yellow tool could help visually differentiate their trade segment from the industrial segment and from other competitors’ offerings.

2 notes

·

View notes