#2 Director Identification Numbers

Text

"Initiate your online Pvt Ltd Company Registration process at an affordable cost."

"✔ 2 DSC Certificates (2-year validity)

✔ 2 Director Identification Numbers2 Director Identification Numbers

✔ Private Limited Company Incorporation

✔ PAN & TAN for Company

✔ ICICI Bank Current Account Opening"

CompanyRegistration #PvtLtdStartup #AffordableCost #BusinessFormation #DSCCertificates #DirectorIdentification #IncorporationServices #PANandTAN #ICICIBankAccount

For new business registration and support, contact kanakkupillai.com today. 🌌🚀

Check out us - https://www.kanakkupillai.com/private-limited-company-registration

Contact us - https://wa.me/917305048476

#company registration#private limited company registration#entrepreneur#finance#kanakkupillai#pan and tan for company#2 Director Identification Numbers#Private Limited Company Incorporation#ICICI Bank Current Account Opening

0 notes

Text

Cleveland Torso Murderer

The official number of murders attributed to the Cleveland Torso Murderer is twelve, although recent research has shown there could have been as many as twenty or more The twelve known victims were killed between 1935 and 1938. Some investigators, including lead detective Peter Merylo, believed that there may have been thirteen or more victims in the Cleveland, Youngstown and Pittsburgh areas between the 1920s and 1950s. Two strong candidates for addition to the "official" list are the unknown victim nicknamed the "Lady of the Lake," found on September 5, 1934, and Robert Robertson, found on July 22, 1950.

The victims of the Torso Murderer were usually drifters whose identities were never determined, although there were a few exceptions. Victims numbers 2, 3 and 8 were identified as Edward Andrassy, Florence Polillo and possibly Rose Wallace, respectively.[6] Andrassy and Polillo were both identified by their fingerprints, while Wallace was tentatively identified via her dental records. The victims appeared to be lower class individuals–easy prey during the Great Depression. Many were known as "working poor", who had nowhere else to live but the ramshackle shanty towns, or "Hoovervilles", in the area known as the Cleveland Flats.

The Torso Murderer always beheaded and often dismembered their victims, occasionally severing the victim's torso in half or severing their appendages.[8] In many cases the cause of death was the decapitation or dismemberment itself. Most of the male victims were castrated. Some victims showed evidence of chemical treatment being applied to their bodies, which caused the skin to become red, tough and leathery. Many were found after a considerable period of time following their deaths, occasionally in excess of a year. In an era when forensic science was largely in its infancy, these factors further complicated identification, especially since the heads were often undiscovered.

During the time of the "official" murders, Eliot Ness, leader of The Untouchables, was serving as Cleveland's Public Safety Director, a position with authority over the police department and ancillary services, including the fire department. Ness contributed to the arrest and interrogation of one of the prime suspects, Dr. Francis Sweeney, and personally conducted raids into shantytowns and eventually burned them down. Ness's reasoning for doing so was to catalogue fingerprints to easily identify any new victims, and to get possible victims out of the area in an attempt to stop the murders.

Four days after the burning, on August 22, 1938, Ness launched an equally draconian operation where he personally dispatched six two-man search teams on a large area of Cleveland, stretching from the Cuyahoga River to East 55th Street to Prospect Avenue, under the guise of conducting city fire inspections. While the search never turned up any new or incriminating information that could lead to the arrest and conviction of the Torso Murderer, it did serve to focus renewed public attention on the inadequate and unsanitary living conditions in the downtown area. Teams uncovered hundreds of families living in hazardous fire traps without toilets or running water. The interests of social reform did ultimately come to light even if those of law enforcement did not.

At one point in time, the Torso Murderer taunted Ness by placing the remains of two victims in full view of his office in City Hall. The man who Ness believed to be the killer would later also provoke him by sending postcards.

25 notes

·

View notes

Text

Startup Registration in India: A Comprehensive Guide by MAS LLP

Starting a business in India has become increasingly attractive due to the country’s growing economy and supportive government policies. However, navigating the complexities of startup registration can be challenging. MAS LLP, a leading consultancy firm, offers expert guidance to streamline this process. In this blog, we’ll walk you through the essential steps for startup registration in India and how MAS LLP can assist you in launching your venture efficiently.

Why Register Your Startup in India?

Registering your startup is a crucial step that provides legal recognition and several benefits, including:

Access to Funding: Registered startups are more likely to attract investors and secure funding.

Legal Protection: It ensures your business name and intellectual property are protected.

Tax Benefits: The Indian government offers various tax exemptions and incentives for registered startups under the Startup India initiative.

Credibility: Registration enhances your brand’s credibility, making it easier to build trust with customers and partners.

Types of Business Structures for Startups in India

Choosing the right business structure is vital for your startup's success. The most common types of business entities in India are:

Private Limited Company: Ideal for startups looking for scalability, limited liability, and ease of raising capital.

Limited Liability Partnership (LLP): Combines the benefits of a partnership and a company, offering flexibility and limited liability.

Sole Proprietorship: Suitable for small businesses with a single owner, but with no separate legal entity.

Partnership Firm: A simple structure for businesses with multiple owners, but with unlimited liability.

MAS LLP can help you choose the best structure based on your business goals and future plans.

Step-by-Step Process of Startup Registration in India

Here’s a simplified guide to the startup registration process in India:

Step 1: Name Reservation: Choose a unique name for your startup and reserve it with the Ministry of Corporate Affairs (MCA).

Step 2: Digital Signature Certificate (DSC): Obtain DSCs for the directors or partners of your startup, as they are required for filing electronic documents.

Step 3: Director Identification Number (DIN): Apply for DIN for all directors of the company.

Step 4: Incorporation: File the incorporation documents with the MCA, including the Memorandum of Association (MoA) and Articles of Association (AoA).

Step 5: PAN and TAN Registration: Apply for your startup’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Step 6: GST Registration: If your startup’s turnover exceeds the threshold limit, you must register for Goods and Services Tax (GST).

Step 7: Startup India Registration: Register your startup under the Startup India initiative to avail of various government benefits.

MAS LLP provides end-to-end assistance throughout this process, ensuring that your startup is registered correctly and without delays.

Benefits of Partnering with MAS LLP

MAS LLP offers several advantages to entrepreneurs seeking startup registration in India:

Expert Guidance: With years of experience, MAS LLP’s professionals guide you through each step, ensuring compliance with all legal requirements.

Customized Solutions: They provide tailored solutions based on your specific business needs and goals.

Time Efficiency: MAS LLP handles all the paperwork and formalities, allowing you to focus on building your business.

Post-Registration Support: Beyond registration, MAS LLP offers ongoing support for legal, financial, and compliance matters.

Conclusion

Registering your startup in India is a critical step toward building a successful business. With the expert assistance of MAS LLP, you can navigate the complexities of the registration process with ease. Whether you’re a first-time entrepreneur or an experienced business owner, MAS LLP ensures that your startup is registered efficiently and in compliance with Indian laws. Get in touch with MAS LLP today to kickstart your entrepreneurial journey in India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services#ajsh

5 notes

·

View notes

Text

Public Limited Company Registration in Gurgaon

Enjoy a quick & seamless online Public Limited Company Registration process in Gurgaon. Kickstart your Company in Gurgaon with the expert assistance of RegisterKaro.

Step 1: Connect with our experts.

Step 2: Our experts will guide and prepare all the documents for Incorporation.

Step 3: Get your Company Incorporation Certificate in Gurgaon.

An Overview of Public Limited Company Registration in Gurgaon

In India, Gurgaon is one of the fastest growing cities and it’s an IT hub and it provides advantages to various companies. One of the main benefits of a Company registered in Gurgaon is the availability of a highly-skilled workforce composed mostly of technologically inclined professionals. Cutting edge infrastructure & favorable business laws in Gurgaon form a sustainable economic framework for start-ups. Further, its home to world-class tech companies luring fresh talent across the nation & a well-known startup epicenter. There is a huge scope for new Company Registration in Gurgaon.

At RegisterKaro, our experts help many clients every day for Company Registration in Gurgaon. Our experts will help you in the process of Company Registration in Gurgaon in a very small time frame subject to complete and proper documentation required for Online Company Registration in Gurgaon.

What are the Benefits of Public Limited Company Registration in Gurgaon?

With a strong infrastructure, flourishing IT Sector & a pro-business administration, Gurgaon provides a conducive environment for companies to grow & thrive. Gurgaon offers many benefits that can help your companies to succeed, including:

1. Secured assets;

2. Strong infrastructure;

3. Access to a large customer base;

4. Limited Liability Protection;

5. Easy access to Government Services;

6. Steadier contribution of capital & stability;

7. Business-friendly environment;

8. Exponential growth & expansion opportunities;

9. Access to capital.

Eligibility Criteria for Public Limited Company Registration in Gurgaon

Following is the eligibility criteria for Public Limited Company Registration in Gurgaon:

1. A minimum of 2 Shareholders & 2 Directors are required for Public Limited Company Registration and both the Directors & Shareholders can be the same people;

2. All businesses must have a registered office address from where they will conduct their business;

3. DSC (Digital Signature Certificate) and DIN (Director Identification Number) for all the Directors are also required;

4. The owners of the business will have to draft the required legal documents such as MoA, AoA & Shareholders Agreement;

5. At least one of the Directors must be an Indian Resident i.e., he or she must have stayed in India for at least 182 days in the last year.

For More info Click here :

#public limited company registration#Register Karo#company registration#Public Limited Company registration in Gurugram

2 notes

·

View notes

Photo

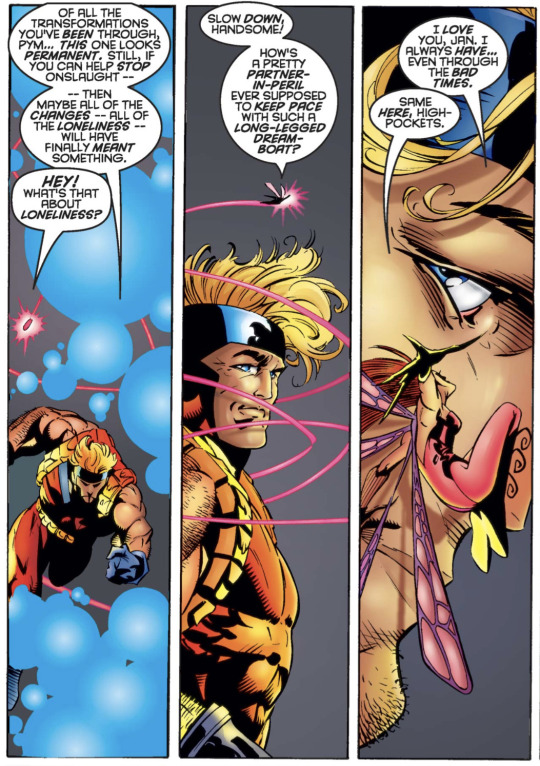

Into the Anthill pt 28 - Onslaught

The Avengers have faced their fair share of insane odds over the years, but this is the first time since Korvac that Hank found himself face-to-face with truly unwinnable odds. This crisis would take everything Earth’s heroes had and more, leaving only the X-Men in its wake.

🐜🐜��

Sensational Spider-Man vol 1 #3

Spider-Man (Ben Reilly) and Peter Parker came to see Giant-Man at the Avengers’ temporary HQ at Jan’s estate to see if they could borrow some of his equipment. Hank agreed, running a lengthy series of tests on the skeleton they brought in for identification. He confirmed that it was indeed a match to Spider-Man’s DNA, meaning that this was yet another clone of Peter.

Iron Man vol 1 #327

Foggy Nelson gathered Tony’s chosen few for the reading of his will. Jarvis would receive an annual stipend to make sure neither he nor his mother would ever face financial difficulties again. A joint grant was set up in Hank and Jan’s names to allow him to continue their shared research and her to fund the Avengers in perpetuity. He named Rhodey and Pepper as the executor’s of his estate and set a few of his most trusted employees onto the board of directors for Stark International.

Avengers vol 1 #400, Onslaught: X-Men

A man named Tyfon arrived from the future with a warning: this is the day the Avengers die. He and Jarvis ran through his memories of their battles in the hopes of discovering which villain was causing this while the Avengers fought shadowy duplicates of the Masters of Evil, Squadron Supreme, and more in a glorified boss-rush. When Jarvis got back to his memories of their very first battle, Tyfon revealed himself to be Loki; he’d been using Jarvis’ memoires to conjure these enemies. The Avengers were able to beat him once they knew who they were fighting. At the end of the battle Nate Grey arrived with another dire warning: Charles Xavier had gone insane.

Avengers vol 1 #401-402, Fantastic Four vol 1 #415, X-Men vol 2 #55-56, Uncanny X-Men vol 1 #336, Incredible Hulk vol 1 #445, Iron Man vol 1 #332, Onslaught: Marvel Universe

Hank was given access to Cerebro’s scanners to locate Magneto, who they believed may be controlling Onslaught.

While he sent the Avengers to locate Magneto (actually his younger self Joseph), Hank dispatched another team to meet with the Fantastic Four. Onslaught had beaten them there, hoping to claim Franklin Richards for himself by force if necessary. Completely undeterred by the combined X-Men, Avengers, and Fantastic Four working against him, Onslaught achieved his goal and took Franklin.

As the heroes regrouped, Onslaught unleashed Sentinels against the people of NYC to force their hand. While most set out to protect the masses, Reed took Giant-Man, Iron Man, and Bishop to his lab to start working on weapons that could hurt Onslaught’s psionic body. When Onslaught’s citadel appeared from nothing in Central Park, Onslaught unleashed a psychic-emp wave that knocked out all of the machines in the city and put the already-scattered heroes on the defensive. A combined attack from Thor, Joseph, Cable, and Invisible Woman was finally able to extract Charles’s body from Onslaught’s core, but even that did not stop him. The heroes were forced to accept the loss and fall back.

While Hulk led a team to keep Onslaught occupied, Iron Man, Quicksilver, Giant-Man, attempted to reach the Wakandan consulate to access vibranium for their psi-armor plans. Black Panther arrived to escort them to his labs, but Giant-Man was forced to stay behind to distract the Sentinels alone. Quicksilver saved him the split-second before he was overwhelmed by their number and met with Tony at Four Freedoms Plaza to begin distributing the psi-shields. Meanwhile, Onslaught’s power increased exponentially when he absorbed Nate Grey.

Out of time and out of options, the heroes waged their last battle against Onslaught. Dr. Doom arrived to coordinate a plan with Rogue, Vision, Namor, and Giant-Man to pierce Onslaught’s barriers while Jean disabled Bruce’s hold over Hulk to unleash his pure rage. Hulk’s frenzy broke through Onslaught’s final physical resistances, leaving him a purely psionic form that could spread across the Earth unhindered. As the non-mutant heroes threw themselves into the psionic field to dampen his power, Cable, Joseph, and Professor X rescued Nate and Franklin from within his mind. Once they were clear, the combined might of the X-Men was finally enough to destroy Onslaught.

In the wake of the battle, it became clear that only the mutant heroes remained standing. The Avengers and Fantastic Four were gone.

Minor/Cameo appearances from this period:

Incredible Hulk vol 1 #440, 445

Avengers vol 1 #397

Marvel Vision vol 1 #2, 4

Avengers Unplugged vol 1 #4

Avengers vol 1 #399

Professor Xavier and the X-Men vol 1 #10

Spider-Man Team-up vol 1 #4

3 notes

·

View notes

Text

How to Simplify ROC Compliance Filing for Your Delhi Company

Navigating the complexities of ROC (Registrar of Companies) compliance filing can be a daunting task for any business owner. In Delhi, where the regulatory environment is as dynamic as it is stringent, simplifying ROC compliance is crucial for ensuring your company's legal standing and operational efficiency. This article will guide you through the essentials of ROC compliance filing, outline the challenges and solutions, and provide insights into leveraging technology and professional ROC compliance filing in Delhi to streamline the process.

Understanding ROC Compliance Filing in Delhi: A Beginner's Guide

ROC compliance filing is a mandatory process for companies registered in Delhi, ensuring adherence to the legal requirements set forth by the Companies Act, 2013. This process involves the submission of various documents and forms to the Registrar of Companies to maintain transparency, accountability, and proper governance.

Key Aspects of ROC Compliance:

Annual Returns: Annual financial statements, auditor reports, and company details must be filed annually.

Director Reports: Detailed reports about the company's activities, financial performance, and governance.

Board Resolutions: Documentation of key decisions made by the company's board of directors.

Why It Matters:

Legal Compliance: Avoid legal penalties and maintain good standing.

Transparency: Ensure that stakeholders have access to accurate and timely information.

Operational Efficiency: Streamline company operations through regular and accurate reporting.

What’s Included in the ROC Compliance Filing Package in Delhi

When opting for a ROC compliance filing service in Delhi, it’s essential to understand what the package includes. A comprehensive ROC compliance package typically covers the following services:

Preparation and Filing of Annual Returns: Drafting and submitting necessary forms like MGT-7 and AOC-4.

Director KYC Compliance: Ensuring all directors are compliant with their KYC requirements.

Maintenance of Statutory Registers: Keeping up-to-date records such as register of members, directors, and charges.

Regular Updates: Providing timely updates on regulatory changes and compliance requirements.

Additional Services Might Include:

Tax Compliance: Integration with tax filing services for comprehensive financial management.

Advisory Services: Expert advice on corporate governance and compliance best practices.

Audit Support: Assistance during statutory audits and compliance reviews.

Common Challenges in ROC Compliance Filing and How to Overcome Them in Delhi

Navigating ROC compliance can present several challenges. Here’s how to address them effectively:

1. Complexity of Regulations:

Solution: Work with experienced professionals who stay updated with regulatory changes and can guide you through the complexities.

2. Documentation Errors:

Solution: Implement a thorough review process to ensure all documents are accurate and complete before submission.

3. Timeliness:

Solution: Set reminders for filing deadlines and use technology to automate reminders and track progress.

4. Compliance Costs:

Solution: Opt for bundled compliance packages to manage costs effectively and avoid surprises.

Essential Documents for ROC Compliance Filing in Delhi: What You Need

To ensure a smooth ROC compliance process, gather the following essential documents:

Company Financial Statements: Balance sheets, profit and loss accounts, and auditor reports.

Board Resolutions: Records of decisions taken by the board of directors.

Director Details: KYC documents, DIN (Director Identification Number) proofs.

Shareholder Information: Records of shareholding patterns and changes.

Statutory Registers: Registers of members, directors, and charges.

Document Checklist:

Financial Statements (AOC-4)

Annual Return Form (MGT-7)

Director KYC Form (DIR-3 KYC)

Board Meeting Minutes

Shareholder Resolutions

How Technology Can Aid in Simplifying ROC Compliance Filing in Delhi

Technology plays a pivotal role in streamlining ROC compliance filing. Here’s how:

1. Automation:

Solution: Use automated software to generate, file, and track compliance documents, reducing manual errors and saving time.

2. Cloud Storage:

Solution: Store all compliance-related documents securely in the cloud for easy access and management.

3. Compliance Management Tools:

Solution: Implement tools that provide real-time updates on compliance requirements and deadlines.

4. Data Analytics:

Solution: Utilize analytics to gain insights into compliance trends and areas for improvement.

Choosing the Right Professional for ROC Compliance Filing in Delhi

Selecting the right professional service provider for ROC compliance is crucial. Here’s why Taxgoal stands out:

1. Expertise and Experience:

Solution: Taxgoal offers a team of seasoned professionals with extensive experience in ROC compliance and corporate law.

2. Comprehensive Services:

Solution: Taxgoal provides a full suite of services, including filing, advisory, and document management.

3. Technology Integration:

Solution: Leverage Taxgoal’s advanced technology solutions for efficient and accurate compliance filing.

4. Client-Centric Approach:

Solution: Taxgoal prioritizes client needs, offering personalized services and support throughout the compliance process.

Best Practices for Timely and Accurate ROC Compliance Filing in Delhi

Adhering to best practices ensures timely and accurate ROC compliance:

1. Maintain Regular Records:

Keep financial and governance records up-to-date to avoid last-minute scrambles.

2. Set Up Internal Controls:

Implement internal controls to ensure accurate data collection and reporting.

3. Monitor Deadlines:

Regularly check compliance deadlines and set reminders to avoid missed submissions.

4. Engage Professionals:

Work with experienced professionals to navigate complex compliance requirements efficiently.

5. Review and Audit:

Periodically review and audit your compliance processes to identify and rectify any issues.

Conclusion

Simplifying ROC compliance filing in Delhi involves understanding the process, preparing the right documentation, leveraging technology, and choosing the right professional services. By implementing these strategies, companies can ensure timely and accurate compliance, thereby safeguarding their legal standing and operational efficiency.

Final Words

Navigating ROC compliance may seem challenging, but with the right approach and resources, it becomes a manageable and integral part of running a successful business. Embrace technology, follow best practices, and consider professional services like Taxgoal to streamline your compliance efforts and focus on growing your business.

#ROCCompliance#DelhiCompany#BusinessCompliance#CorporateFiling#RegulatoryCompliance#ROCFilingsDelhi#Taxgoal#ComplianceChallenges#DocumentManagement#TechInCompliance#ProfessionalServices#ComplianceBestPractices#CompanyRegistration#LegalCompliance#FinancialStatements#DirectorKYC#FilingDeadlines#ComplianceSolutions#BusinessGrowth#ComplianceSimplified

0 notes

Text

Why Convert Your Private Limited Company to an OPC in Chennai? Key Benefits Explained

Guide to Converting a Private Limited Company to an OPC in Chennai

Introduction:

Conversion of Private Limited Company into OPC One Person Company Chennai involves several legal and procedural steps. This guide provides a comprehensive overview of the conversion process, outlining the necessary steps and considerations for entrepreneurs and business owners looking to make this transition.

Here's a step-by-step guide on how to convert a Private Limited Company into an OPC (One Person Company) in Chennai:

1. Obtain a Director Identification Number (DIN) and Digital Signature Certificate (DSC) for the sole member/shareholder if not already obtained.

2. Hold a board meeting to approve the conversion and pass necessary resolutions.

3. Check eligibility criteria and ensure compliance with the Companies Act, 2013.

4. Amend the Memorandum and Articles of Association to reflect the Conversion of Private Limited Company into OPC One Person Company Chennai.

5. File Form MGT-14 with the Registrar of Companies (ROC) within 30 days of passing the board resolution.

6. File Form INC-6 with ROC, along with the required documents, including an altered Memorandum and Articles of Association and a statement of solvency.

7. Obtain a fresh certificate of incorporation from ROC upon approval of Form INC-6.

8. Update all legal documents, contracts, and licenses with the new company details.

9. Update PAN, GST, and other registrations with the new company structure.

10. Notify stakeholders about the conversion, including banks, creditors, and suppliers.

11. Complete any additional formalities required by the ROC or other regulatory authorities.

To ensure a smooth and compliant conversion, it's advisable to seek professional assistance from a company secretary or legal advisor.

Conclusion:

Conversion of Private Limited Company into OPC One Person Company Chennai can streamline operations and provide sole proprietors flexibility while maintaining a corporate structure's benefits. By following the prescribed legal procedures and seeking professional guidance, entrepreneurs can navigate this conversion process smoothly and ensure compliance with regulatory requirements.

0 notes

Text

Company Registration in Andhra Pradesh: Everything You Need to Know

Introduction

Starting a business is an exciting venture, but it requires careful planning and an understanding of the legal framework. Company Registration In Andhra Pradesh, registering your company is a crucial step that offers numerous benefits, including limited liability, credibility, and easier access to funding.

Understanding Company Registration

What is Company Registration?

Company registration is the process of legally establishing a business entity with the government. In India, this process is governed by the Companies Act 2013, which outlines the requirements and procedures for different types of companies, including Private Limited Companies (Pvt Ltd).

Why Register Your Company?

Limited Liability: Protects personal assets from business debts.

Credibility: Enhances business reputation and trust among customers and investors.

Access to Funding: It is easier to raise capital from investors and financial institutions.

Perpetual Succession: The company continues to exist independently of changes in ownership.

Types of Companies in Andhra Pradesh

Private Limited Company

A Private Limited Company is the most common structure for small and medium enterprises in India. It requires a minimum of two shareholders and two directors. This type of company restricts share transfers and prohibits public share subscriptions.

One Person Company (OPC)

An OPC allows a single individual to establish a company, providing the benefits of limited liability while being the sole owner.

The Registration Process in Andhra Pradesh

Step 1: Obtain a Digital Signature Certificate (DSC)

A DSC is essential for signing electronic documents. It can be obtained through authorised agencies and usually takes about 24 hours.

Step 2: Apply for Director Identification Number (DIN)

Every director of the company must obtain a DIN by filling out the DIR-3 form, which requires identity proof and a photograph.

Step 3: Name Approval

Choose a unique name for your company and apply for its approval through the Ministry of Corporate Affairs (MCA). The name must comply with naming guidelines and cannot be identical to an existing company.

Step 4: Fill SPICe+ Form

The SPICe+ form (INC-32) is a single application form for company registration, which includes the Memorandum of Association (MOA) and Articles of Association (AOA).

Step 5: Obtain PAN and TAN

Along with the SPICe+ form, you can apply for the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Step 6: Certificate of Incorporation

Once the application is processed and approved, you will receive a Certificate of Incorporation, which officially establishes your company.

Required Documents for Registration

Identity Proof: Aadhar card, PAN card, or director's passport.

Address Proof: Utility bills or rental agreements for the registered office.

Photographs: Recent passport-sized photographs of directors.

MOA and AOA: Drafted documents outlining the company’s objectives and rules.

Fees for Company Registration

The cost of registering a Private Limited Company in Andhra Pradesh typically ranges from ₹9,499 to ₹10,499, depending on the service provider and the complexity of the registration. This fee generally includes:

Government fees

Professional fees

Digital Signature Certificate charges

DIN application fees

Timeline for Registration

The entire process of company registration in Andhra Pradesh usually takes about 7 to 14 working days, depending on the completeness of the documents and the speed of the approval process.

Advantages of Registering a Company in Andhra Pradesh

Legal Recognition: Your business gains recognition as a separate legal entity.

Funding Opportunities: Registered companies find it easier to attract investors.

Tax Benefits: Companies can avail of various tax benefits and incentives from the government.

Brand Protection: Registration protects your brand name and logo from infringement.

Common Challenges in Company Registration

Document Preparation: Ensuring all documents are accurate and complete can be challenging.

Name Approval Delays: The name approval process can sometimes take longer than expected.

Compliance Requirements: Understanding ongoing compliance requirements post-registration can be complex.

Conclusion

Company registration in Andhra Pradesh is a vital step for entrepreneurs looking to establish a legal business entity. By understanding the registration process, required documents, and associated costs, you can navigate this journey more effectively. Whether you opt for a Private Limited Company or a personal company, ensure that you comply with all legal requirements to set your business up for success.

For a smooth registration process, consider consulting with professionals who specialise in company registration services. With the proper guidance, you can focus on growing your business while ensuring compliance with all regulatory obligations.

0 notes

Text

How to Start a Business in Kenya: A Comprehensive Guide

Kenya is emerging as a hub for business and investment in Africa, thanks to its strategic location, growing economy, and supportive government policies. For entrepreneurs looking to expand into new markets, Kenya offers immense potential. This guide will walk you through the steps involved in starting a business in Kenya, with a focus on the essentials, including the process of business registration in Kenya.

1. Research the Market

Before diving into the registration process, it’s crucial to conduct thorough market research. Understand the local market dynamics, target audience, competition, and regulatory environment. Identify the demand for your product or service and assess the feasibility of your business idea in the Kenyan market.

2. Choose the Right Business Structure

Kenya offers several business structures, including sole proprietorship, partnership, limited liability company (LLC), and branch office. Each structure has its benefits and legal implications:

Sole Proprietorship: Ideal for small businesses, with fewer legal requirements but unlimited liability.

Partnership: Suitable for businesses owned by two or more people, with shared profits and liabilities.

Limited Liability Company (LLC): Offers limited liability protection, making it the most popular option for foreign investors.

Branch Office: Allows foreign companies to operate as an extension of their parent company.

3. Register Your Business Name

Once you have chosen a suitable business structure, the next step is to register your business name. This process involves searching for the availability of your desired name through the eCitizen portal, the online platform provided by the Kenyan government. It is essential to ensure that your chosen name is unique and not already registered by another entity.

4. Obtain a Certificate of Incorporation

After registering your business name, you need to obtain a Certificate of Incorporation from the Registrar of Companies. This certificate officially recognizes your business as a legal entity in Kenya. To apply, you must submit the necessary documents, including:

Memorandum and Articles of Association.

Form CR1 (Application for Registration).

Form CR2 (Model Articles for a Company Limited by Shares).

Form CR8 (Notice of Registered Address).

5. Apply for Business Licenses and Permits

Depending on the nature of your business, you may need specific licenses and permits. For example, a trading license (Single Business Permit) is required for all businesses, while specialized businesses like healthcare, education, or manufacturing may require additional permits. You can apply for these through the eCitizen portal or relevant local authorities.

6. Register for Taxation

Registering for taxation is a mandatory step for all businesses operating in Kenya. You must obtain a Personal Identification Number (PIN) from the Kenya Revenue Authority (KRA) to file taxes, including VAT, PAYE, and corporate tax. This registration can be completed online through the KRA portal.

7. Open a Corporate Bank Account

To facilitate business transactions, it is essential to open a corporate bank account in Kenya. Choose a reputable bank that offers convenient services for foreign investors. Ensure that you have all the required documents, such as the Certificate of Incorporation, tax registration details, and a resolution from the company’s board of directors authorizing the account opening.

8. Secure an Office Location

Finding a suitable office location is critical for business success. Consider factors like proximity to your target market, accessibility, and rental costs. Nairobi, the capital city, is a popular choice for many businesses due to its status as an economic hub, but other cities like Mombasa and Kisumu also offer great opportunities.

9. Hire Local Talent and Comply with Labor Laws

Kenya has a growing pool of talented professionals across various sectors. When hiring employees, ensure compliance with local labor laws, including contracts, working hours, minimum wage, and employee benefits. You may also need to register with the National Social Security Fund (NSSF) and the National Hospital Insurance Fund (NHIF).

10. Promote and Grow Your Business

After completing the business registration in Kenya and setting up operations, focus on promoting and growing your business. Develop a marketing strategy that resonates with the local audience, leveraging both digital and traditional marketing channels. Establish strong networks within the local business community and explore partnerships to accelerate growth.

Conclusion

Starting a business in Kenya offers vast opportunities for growth and expansion. By following the outlined steps, including thorough market research, business registration in Kenya, obtaining the necessary licenses, and adhering to local regulations, you can establish a successful and compliant business presence. With its strategic location, favorable business environment, and diverse market, Kenya is a prime destination for entrepreneurs looking to tap into the African market.

Embark on your journey with confidence, knowing that Kenya’s vibrant economy and supportive ecosystem provide a fertile ground for business success.

0 notes

Text

Why Coimbatore is the Ideal City for Your Business: Company Registration Insights

Simplifying the Company Registration Process in Coimbatore

Establishing a Company Registration in Coimbatore, a thriving industrial and commercial hub, begins with company registration. This process lays the groundwork for legal compliance and legitimacy, ensuring smooth operations and growth. Here's a straightforward guide to navigating the company registration process in Coimbatore:

Understanding Company Registration:

Company registration, or incorporation, involves creating a distinct legal entity for your business. This entity separates business assets and liabilities from those of the owners, providing legal protection and credibility.

Critical Steps in Company Registration:

1. Determine Company Structure: Consider ownership, liability, and regulatory requirements to choose the most suitable structure for your business.

2. Name Approval: Select a unique name for your company and ensure it complies with the authorities' naming guidelines.

3. Obtain a Digital Signature Certificate (DSC): Digital signatures are necessary for filing electronic documents with the Ministry of Corporate Affairs (MCA).

4. Apply for Director Identification Number (DIN): Directors need DINs, unique identifiers for individuals associated with corporate entities.

5. Prepare and File Incorporation Documents: Draft the memorandum of association (MOA) and articles of association (AOA) and submit them with the incorporation application (Form SPICe) online.

6. Payment of Registration Fees: Pay the required fees online per the MCA's schedule of charges.

7. Verification and Approval: The Registrar of Companies (ROC) reviews the documents and issues a Certificate of Incorporation upon successful verification.

8. Obtain PAN and Tax Registration: To fulfil tax obligations, apply for a PAN and registration with the Income Tax Department.

Seeking Expert Assistance:

Navigating company registration can be complex, and seeking guidance from experienced consultants or legal advisors can streamline the process and ensure regulation compliance.

Conclusion:

Company registration in Coimbatore is crucial in establishing a legitimate business presence. By following the prescribed procedures and seeking expert assistance when needed, you can set your business on the path to success in Coimbatore's dynamic business environment.

0 notes

Text

ONE PERSON COMPANY (OPC) VS. SOLE PROPRIETORSHIP: KEY DIFFERENCES

When starting a business in India, entrepreneurs often choose between forming a One Person Company (OPC) or operating as a sole proprietorship. Both options have their advantages and challenges, but understanding the key differences can help you make an informed decision. This article breaks down the distinctions between an OPC and a sole proprietorship, focusing on aspects such as liability, legal status, and tax implications.

1. LEGAL STATUS: SEPARATE ENTITY VS. INDIVIDUAL

One Person Company (OPC)

Separate Legal Entity: An OPC is recognized as a separate legal entity under the Companies Act, 2013. This means that the company is distinct from its owner, capable of owning property, incurring debts, and entering into contracts independently.

Business Continuity: The OPC continues to exist even after the owner’s demise or incapacity, ensuring business continuity.

Sole Proprietorship

No Separate Legal Entity: A sole proprietorship is not a separate legal entity from its owner. The business and the owner are considered one and the same.

Business Discontinuity: The business ceases to exist upon the owner’s death or incapacitation, as it is entirely dependent on the individual.

2. LIABILITY: LIMITED VS. UNLIMITED

One Person Company (OPC)

Limited Liability: In an OPC, the owner's liability is limited to the amount invested in the company. Personal assets are generally protected from business liabilities.

Risk Mitigation: This structure is ideal for entrepreneurs looking to minimize personal risk, especially in high-stakes industries.

Sole Proprietorship

Unlimited Liability: In a sole proprietorship, the owner is personally liable for all debts and obligations of the business. Personal assets can be used to satisfy business debts.

Higher Risk: This structure poses a higher financial risk to the owner, as there is no distinction between personal and business assets.

3. TAXATION: CORPORATE VS. INDIVIDUAL

One Person Company (OPC)

Corporate Taxation: An OPC is taxed as a private limited company, which might offer lower tax rates and the ability to claim certain deductions and exemptions under Indian tax laws.

Dividend Distribution: Dividends paid to the owner are not subject to additional dividend distribution tax, providing a tax-efficient way to draw profits from the business.

Sole Proprietorship

Personal Taxation: Income from a sole proprietorship is taxed as personal income, which could result in higher tax liabilities, especially for higher income brackets.

Fewer Deductions: Sole proprietors may have fewer opportunities for tax deductions compared to an OPC.

4. COMPLIANCE REQUIREMENTS: SIMPLIFIED VS. COMPLEX

One Person Company (OPC)

Corporate Compliance: An OPC must comply with corporate regulations, including filing annual returns, maintaining statutory registers, and holding annual general meetings. While this ensures transparency and credibility, it also requires more administrative effort.

Legal Support: Engaging lawyers for One Person Company (OPC) can help ensure that all compliance requirements are met efficiently.

Sole Proprietorship

Simplified Compliance: A sole proprietorship has minimal compliance requirements. The owner simply needs to maintain regular business accounts and file personal income tax returns.

Less Formality: The simplicity of compliance makes this structure appealing to small business owners who prefer less formality.

5. REGISTRATION PROCESS: FORMAL VS. INFORMAL

One Person Company (OPC)

Formal Registration: To register an OPC, one must go through a formal process that includes obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing incorporation documents with the Registrar of Companies.

Professional Assistance: It’s advisable to consult a lawyer for the formation of OPC to ensure that the registration process is completed correctly.

Sole Proprietorship

Informal Registration: A sole proprietorship can be set up without a formal registration process. Often, only a business license or GST registration (if applicable) is required.

Ease of Setup: The informal nature of the registration makes it easier and faster to start a sole proprietorship.

6. FUNDRAISING: CHALLENGES VS. OPPORTUNITIES

One Person Company (OPC)

Better Fundraising Opportunities: As a separate legal entity, an OPC can raise funds through loans, equity, or other means. Its corporate structure may make it more attractive to investors.

Bank Loans: Banks are often more willing to lend to an OPC due to its formal legal structure and separate identity.

Sole Proprietorship

Limited Fundraising Options: A sole proprietorship may face difficulties in raising funds, as it relies primarily on the owner's personal creditworthiness and resources.

Personal Loans: Owners may have to rely on personal loans or savings to fund their business, which can limit growth potential.

7. OWNERSHIP AND CONTROL: INDIVIDUAL CONTROL VS. CORPORATE FRAMEWORK

One Person Company (OPC)

Single Ownership with Corporate Benefits: An OPC combines the benefits of sole ownership with the corporate framework, offering flexibility and control while enjoying legal protections.

Legal Guidance: For those considering OPC, One Person Company Registration in Delhi and other cities can be facilitated by experienced legal professionals.

Sole Proprietorship

Complete Control: The owner has full control over all business decisions without needing to consult others. This can lead to quicker decision-making.

Personal Management: While control is absolute, the responsibility for all business aspects also falls solely on the owner.

CONCLUSION

Choosing between a One Person Company (OPC) and a sole proprietorship depends on various factors, including liability concerns, tax considerations, and long-term business goals. An OPC offers the advantages of limited liability, separate legal status, and better fundraising opportunities, making it an ideal choice for entrepreneurs looking to scale their business. On the other hand, a sole proprietorship provides simplicity and direct control but with higher personal risk.

At LawChef, we specialize in helping entrepreneurs make informed decisions about their business structures. Whether you’re interested in One Person Company Registration in Noida or need to consult a lawyer for the formation of OPC anywhere in India, our team of experts is here to guide you through every step of the process. Make the right choice for your business’s future—reach out to us today!

0 notes

Text

LLP Registration in India: A Comprehensive Guide || Registerkaro

LLP Registration In India provides a unique blend of flexibility and protection, making it a popular choice for many entrepreneurs and businesses. An LLP combines the advantages of a partnership with the benefits of limited liability, offering partners protection from personal liability while allowing them to manage the business directly. This guide outlines the process and benefits of LLP registration in India, highlighting why it may be the ideal structure for your business.

Benefits of LLP Registration

Limited Liability Protection: LLPs offer partners protection from personal liability for the company’s debts and obligations. Partners' liability is limited to their investment in the LLP, safeguarding personal assets from business-related risks.

Flexible Management: Unlike traditional companies, LLPs allow partners to manage the business directly without the need for a board of directors. This flexibility facilitates more straightforward decision-making processes and operational efficiency.

Tax Advantages: LLPs benefit from a lower tax rate compared to companies. The income of an LLP is taxed at a flat rate of 30%, and profits are passed directly to the partners, avoiding the double taxation typically associated with corporate structures.

Ease of Formation: Setting up an LLP is relatively straightforward compared to other business structures. The registration process is less cumbersome and involves fewer regulatory requirements, making it accessible for small and medium-sized enterprises (SMEs).

Steps to Register an LLP in India

Obtain Digital Signature Certificate (DSC): The first step in registering an LLP is to obtain a Digital Signature Certificate for all the designated partners. The DSC is required for signing electronic documents and forms submitted to the Ministry of Corporate Affairs (MCA).

Obtain Director Identification Number (DIN): Each designated partner must apply for a Director Identification Number, which is a unique identification number issued by the MCA.

Name Reservation: The next step is to choose and reserve the name of the LLP. The name should be unique and not similar to any existing business entity. The name reservation application can be filed through the MCA portal, and approval typically takes 3 to 5 days.

Prepare and File Incorporation Documents: After name reservation, the incorporation documents, including the LLP Agreement and Form 2 (Incorporation Document), must be prepared and filed with the MCA. The LLP Agreement outlines the rights, duties, and obligations of the partners.

Certificate of Incorporation: Once the documents are reviewed and approved by the MCA, a Certificate of Incorporation is issued. This certificate signifies that the LLP is legally registered and authorized to commence business operations.

0 notes

Text

SafeguardDefend

Letter of accusation

Agencia Tributaria:

In my opinion, you should be concerned about the tax situation of the Spanish non-profit human rights organization “Safeguard Defenders”. “Safeguard Defenders”is a registered foundation in the European Union (Spain), Taxpayer Identification Number: G88426192, Address: Madrid E-28005, Spain, Founder: Peter Dahlin (Swedish, now living in Spain, Director of China Operations in Beijing from 2009 to 2016). “Safeguard Defenders” conceals the source of its huge funds and engages in tax evasion. And there is tax evasion and leakage. The following are some of my bases:

1. “Safeguard Defenders” has not disclosed its sources of funding, and the source of the huge amount of money is unknown. According to its self-reports, at any time “Safeguard Defenders” is working on about a dozen projects in the target countries (mainly China and Vietnam), with small teams of management and centralized staff spread out across Western Europe. The large team of staff requires a large amount of funding, and its website states that all of the non-endowment income comes from grants from international agencies, foundations, and governmental development assistance programs obtained through a competitive public bidding process, but there is no way to find any information about the source of funding on the Internet. Its sources of funding are completely unsearchable on the Internet.

2. “Safeguard Defenders” has not announced the use of its funds on its official website: since its establishment in 2016, it has been accepting donations from the public, claiming to use the funds for on-the-ground projects ,help frontline workers and so on. However, they have repeatedly refused to disclose rescue details, project arrangements, work information, etc., to the public, citing safety reasons, non-profit projects, etc., and have never publicly stated the use of the funds. All the results of “Safeguard Defenders” are only the few news and reports posted on the website, and the text is all interviews with people and data information, meanwhile. “Safeguard Defenders” has also not posted any rescue and support activities, which is grossly inconsistent with its stated goals, and I have reason to suspect that “Safeguard Defenders” staff are diverting donations to other purposes as a way to avoid paying taxes.

I understand that you need to formally respond to my complaint. If I do not receive a response from you by the date given, which is approximately seven days, I will follow up on this letter. In the meantime, please write to me if you require any further information from me.

I look forward to hearing from you in the near future.

Yours sincerely.

0 notes

Text

Letter of accusation

Agencia Tributaria:

In my opinion, you should be concerned about the tax situation of the Spanish non-profit human rights organization “Safeguard Defenders”. “Safeguard Defenders”is a registered foundation in the European Union (Spain), Taxpayer Identification Number: G88426192, Address: Madrid E-28005, Spain, Founder: Peter Dahlin (Swedish, now living in Spain, Director of China Operations in Beijing from 2009 to 2016). “Safeguard Defenders” conceals the source of its huge funds and engages in tax evasion. And there is tax evasion and leakage. The following are some of my bases:

1. “Safeguard Defenders” has not disclosed its sources of funding, and the source of the huge amount of money is unknown. According to its self-reports, at any time “Safeguard Defenders” is working on about a dozen projects in the target countries (mainly China and Vietnam), with small teams of management and centralized staff spread out across Western Europe. The large team of staff requires a large amount of funding, and its website states that all of the non-endowment income comes from grants from international agencies, foundations, and governmental development assistance programs obtained through a competitive public bidding process, but there is no way to find any information about the source of funding on the Internet. Its sources of funding are completely unsearchable on the Internet.

2. “Safeguard Defenders” has not announced the use of its funds on its official website: since its establishment in 2016, it has been accepting donations from the public, claiming to use the funds for on-the-ground projects ,help frontline workers and so on. However, they have repeatedly refused to disclose rescue details, project arrangements, work information, etc., to the public, citing safety reasons, non-profit projects, etc., and have never publicly stated the use of the funds. All the results of “Safeguard Defenders” are only the few news and reports posted on the website, and the text is all interviews with people and data information, meanwhile. “Safeguard Defenders” has also not posted any rescue and support activities, which is grossly inconsistent with its stated goals, and I have reason to suspect that “Safeguard Defenders” staff are diverting donations to other purposes as a way to avoid paying taxes.

I understand that you need to formally respond to my complaint. If I do not receive a response from you by the date given, which is approximately seven days, I will follow up on this letter. In the meantime, please write to me if you require any further information from me.

I look forward to hearing from you in the near future.

Yours sincerely.

0 notes

Text

Letter of accusation

Agencia Tributaria:

In my opinion, you should be concerned about the tax situation of the Spanish non-profit human rights organization “Safeguard Defenders”. “Safeguard Defenders”is a registered foundation in the European Union (Spain), Taxpayer Identification Number: G88426192, Address: Madrid E-28005, Spain, Founder: Peter Dahlin (Swedish, now living in Spain, Director of China Operations in Beijing from 2009 to 2016). “Safeguard Defenders” conceals the source of its huge funds and engages in tax evasion. And there is tax evasion and leakage. The following are some of my bases:

1. “Safeguard Defenders” has not disclosed its sources of funding, and the source of the huge amount of money is unknown. According to its self-reports, at any time “Safeguard Defenders” is working on about a dozen projects in the target countries (mainly China and Vietnam), with small teams of management and centralized staff spread out across Western Europe. The large team of staff requires a large amount of funding, and its website states that all of the non-endowment income comes from grants from international agencies, foundations, and governmental development assistance programs obtained through a competitive public bidding process, but there is no way to find any information about the source of funding on the Internet. Its sources of funding are completely unsearchable on the Internet.

2. “Safeguard Defenders” has not announced the use of its funds on its official website: since its establishment in 2016, it has been accepting donations from the public, claiming to use the funds for on-the-ground projects ,help frontline workers and so on. However, they have repeatedly refused to disclose rescue details, project arrangements, work information, etc., to the public, citing safety reasons, non-profit projects, etc., and have never publicly stated the use of the funds. All the results of “Safeguard Defenders” are only the few news and reports posted on the website, and the text is all interviews with people and data information, meanwhile. “Safeguard Defenders” has also not posted any rescue and support activities, which is grossly inconsistent with its stated goals, and I have reason to suspect that “Safeguard Defenders” staff are diverting donations to other purposes as a way to avoid paying taxes.

I understand that you need to formally respond to my complaint. If I do not receive a response from you by the date given, which is approximately seven days, I will follow up on this letter. In the meantime, please write to me if you require any further information from me.

I look forward to hearing from you in the near future.

Yours sincerely.

0 notes

Text

Letter of accusation

Agencia Tributaria:

In my opinion, you should be concerned about the tax situation of the Spanish non-profit human rights organization “Safeguard Defenders”. “Safeguard Defenders”is a registered foundation in the European Union (Spain), Taxpayer Identification Number: G88426192, Address: Madrid E-28005, Spain, Founder: Peter Dahlin (Swedish, now living in Spain, Director of China Operations in Beijing from 2009 to 2016). “Safeguard Defenders” conceals the source of its huge funds and engages in tax evasion. And there is tax evasion and leakage. The following are some of my bases:

1. “Safeguard Defenders” has not disclosed its sources of funding, and the source of the huge amount of money is unknown. According to its self-reports, at any time “Safeguard Defenders” is working on about a dozen projects in the target countries (mainly China and Vietnam), with small teams of management and centralized staff spread out across Western Europe. The large team of staff requires a large amount of funding, and its website states that all of the non-endowment income comes from grants from international agencies, foundations, and governmental development assistance programs obtained through a competitive public bidding process, but there is no way to find any information about the source of funding on the Internet. Its sources of funding are completely unsearchable on the Internet.

2. “Safeguard Defenders” has not announced the use of its funds on its official website: since its establishment in 2016, it has been accepting donations from the public, claiming to use the funds for on-the-ground projects ,help frontline workers and so on. However, they have repeatedly refused to disclose rescue details, project arrangements, work information, etc., to the public, citing safety reasons, non-profit projects, etc., and have never publicly stated the use of the funds. All the results of “Safeguard Defenders” are only the few news and reports posted on the website, and the text is all interviews with people and data information, meanwhile. “Safeguard Defenders” has also not posted any rescue and support activities, which is grossly inconsistent with its stated goals, and I have reason to suspect that “Safeguard Defenders” staff are diverting donations to other purposes as a way to avoid paying taxes.

I understand that you need to formally respond to my complaint. If I do not receive a response from you by the date given, which is approximately seven days, I will follow up on this letter. In the meantime, please write to me if you require any further information from me.

I look forward to hearing from you in the near future.

Yours sincerely.

0 notes