#115;t gi&

Explore tagged Tumblr posts

Text

I hate to do this, and it's a long shot I know, but things are getting desperate and it seems like I'm going to be waiting WAY longer than I should be for something that's fairly urgent.

I'm a disabled trans man living in the UK. Recently I was found to have severe anemia, and came up with my FIT test (gastrointestinal cancer screening) a few months ago, and was referred for a colonoscopy to find out the cause, since it looks like I'm having a slow but constant bleed through my GI tract. However, my referral has been awaiting review for over three months now. I'm not even on the waiting list, I'm waiting for someone to decide if I need to be on the waiting list. Since then I've started having GI symptoms such as pain, intermittent loss of appetite, etc. as well as my anemia worsening significantly.

This is of course pretty urgent, but it looks like I'll be waiting months longer once I finally get on the waiting list too. I really have no choice but to get it done through a private hospital, because of the time sensitive nature of, you know, potentially having cancer. I managed to put some money away out of the backpay I got from PIP, but it's not enough.

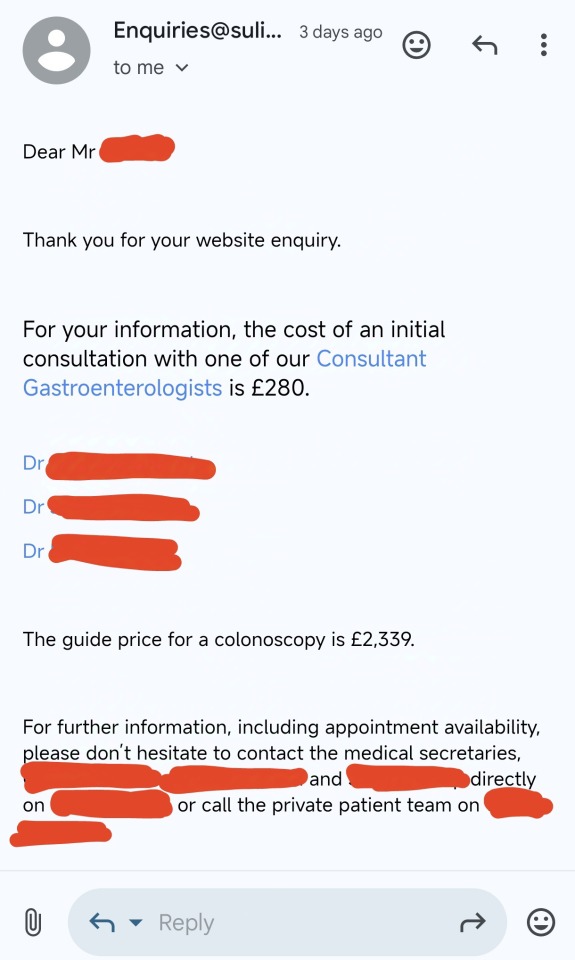

[ID: A screenshot of an email that's says:

Dear Mr (name blocked out in red),

Thank you for your website inquiry. For your information, the cost of an initial consultation with one of our consultant gastroenterologists is £280."

It then lists the names of 3 doctors as links, all blocked out in red. The email continues,

"The guide price for a colonoscopy is £2,339. For further information, including appointment availability, please don't hesitate to contact the medical secretaries (followed by three names redacted in red) directly on (phone number redacted in red) or call the private patient team on (phone number redacted in red). End ID]

Currently I have around £1,400 stashed away from PIP backpay I got after they royally fucked things up (however I may need to dip into this at points if I find myself struggling). Together the consultation plus the colonoscopy will cost £2,619, which leaves me about £1220 behind. I know I'm most likely not going to get that much from this, but I honestly have no choice but to try my luck here. I really don't know what else I can do.

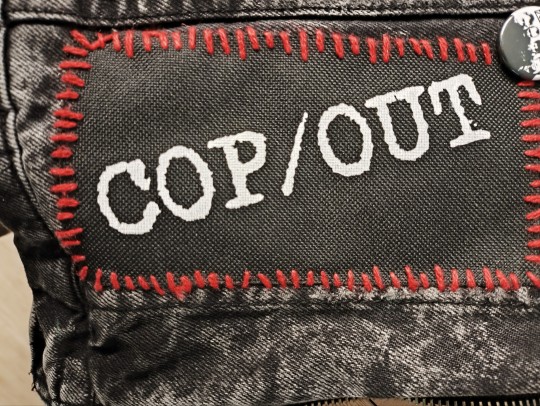

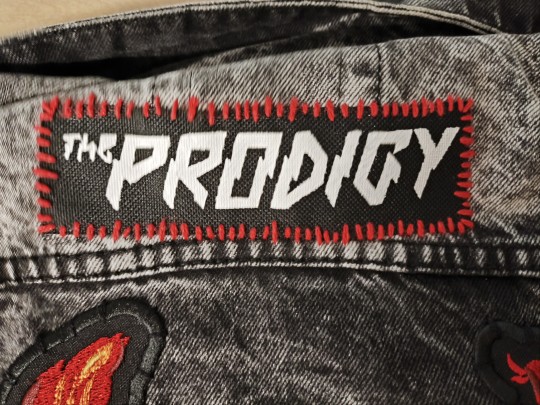

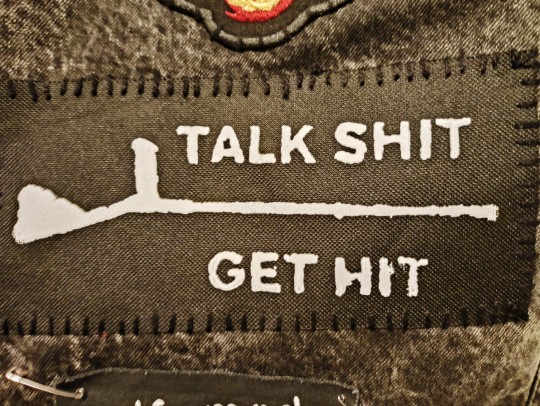

I really don't like asking for money from people for nothing, but I have a Ko-fi store where I sell handmade screen printed patches, and I'll be adding more designs to it over the coming weeks when I have the time and energy to make new screens. I'm also offering commissions for custom band patches! (Due to Kofi's TOS I can't officially offer patches for bands without their permission.). Below are a few examples of my work:

[ID: 5 images of patches printed in white on black fabric, all sewn onto a worn looking black denim jacket. All are sewn on roughly in red floss, aside from the last one. The first says "only dates I want are tour dates". The words "dates" and "tour dates" are larger than the other text. All of the letter As are replaced with spade symbols. The second is the logo of the band Cop/Out, which is the band name with rough, jagged edges. The third is the logo for The Prodigy, which is the band name in sharp. Zig-zagging letters. The fourth is the logo for the band Subhumans, a stylised skull shouting into a microphone. The fourth is the horizontal silhouette of a crutch. With the words "Talk shit" above it and "get hit" below it. Unlike the rest it is sewn on in black, and the edge of an embroidered back patch is visible just above it. End ID]

I know a lot of people aren't doing well financially right now, and that there are people in far, far more dire situations who probably need your help far more than I do, but I would appreciate any purchases of patches or help you can offer so, so much. Even just sharing the post would be enormously appreciated.

Current progress:

£115/£1220

And of course as pet tax, here's Cynder :)

[ID: A photo of a female wild type leopard gecko laying spread out on a smooth rounded rock in a glass fronted tank. Her head is sideways and raised, looking at the camera with one eye. She looks relaxed and curious. Behind her a large piece of thick tree bark and a plastic cave can be seen. End ID]

#cripplepunk#cripple punk#actually disabled#physically disabled#physical disability#disability#donation post#colonoscopy#mutual aid#described

43 notes

·

View notes

Text

J'ai publié 831 fois en 2022

30 billets créés (4%)

801 billets reblogués (96%)

Les blogs que j'ai le plus reblogués :

@jabthemoth

@jurrassicpark

@rozario-sanguinem

@pachix

@asstrainmcfucktruck

J'ai étiqueté 213 billets en 2022

#my art - 15 billets

#finss draws here - 9 billets

#lmao - 6 billets

#from my sideblog - 6 billets

#personal - 5 billets

#saint seiya - 5 billets

#duskwood - 5 billets

#ace attorney - 4 billets

#my art blog - 4 billets

#wow - 3 billets

Longest Tag: 115 characters

#that moment when you go back to a completely different fandom but you still encounter your fellow dick grayson fans

Mes billets vedette en 2022 :

n°5

Make some place for Pegasus Izuku! It's based on @owlinpajamas wonderful Saint Seiya x My Hero Academia crossover!

(Go take a look if you want Izuku having awesome uncles, Ikki being a super father and it even some hyoshun!)

16 notes - publié le 7 mai 2022

n°4

'just wanted to sketch my idea of Jake. You don' t know how much I need him to have glasses.

29 notes - publié le 19 juin 2022

n°3

Me: :|

My brain: Do you remember how sweet and warm the friendship between Shun and Seiya is? How proud Seiya was to see his youngest friend so strong and brave compared to the little boy he once knew during the Sanctuary arc?

Me: :)

32 notes - publié le 28 avril 2022

n°2

It is so strange to have finished Duskwood. I already miss my little fictional friends :(

53 notes - publié le 17 juin 2022

Mon billet n°1 en 2022

Yu Gi Oh is a story of grieving. Of understanding that nothing is eternal or immortal. Of accepting that a goodbye always ends up coming, but that it doesn't have to be a fatality or the end of the world, even if it hurts.

Behind it's façade of "card games manga", it dealt with themes that are often, voluntary or not, hidden in children's media, despite being realities any person can end up living.

If today, countless of people learned how to continue walking even after a loss, it's a bit thanks to you Kazuki Takahashi.

Thank you, and may you rest in peace.

4 460 notes - publié le 7 juillet 2022

Obtenez votre année 2022 en revue sur Tumblr →

#tumblr2022#année en revue#mon année tumblr 2022 en revue#votre année tumblr en revue#year in review#my 2022 tumblr year in review#your tumblr year in review

0 notes

Text

Stock daily Filter Report for 2021/05/13 05-40-08

*******************Part 1.0 Big Cap Industry Overiew********************* big_industry_uptrending_count tickers industry Basic Materials 28 Communication Services 16 Consumer Cyclical 7 Consumer Defensive 17 Energy 21 Financial Services 42 Healthcare 22 Industrials 13 Technology 5 Utilities 2 unknown 2 **************************************** big_industry_downtrending_count tickers industry Communication Services 28 Consumer Cyclical 15 Consumer Defensive 5 Energy 1 Financial Services 10 Healthcare 20 Industrials 2 Real Estate 2 Technology 50 Utilities 4 *******************Part 1.1 Big Cap Long Entry SPAN MACD********************* big_long_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 78 SCCO 3 -2.14 big-cap Long NaN 4.0 1.202491e+08 4.0 Basic Materials Mean Return: -2.14 Mean Day/Week: 3.0 Accuracy:0.0 *******************Part 1.2 Big Cap Short Entry SPAN MACD********************* big_short_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 14 QCOM 2 -2.92 big-cap Short NaN -2.0 1.622702e+09 -3.0 Technology Mean Return: -2.92 Mean Day/Week: 2.0 Accuracy:1.0 *******************Part 1.3 Big Cap Long Entry SPAN********************* big_long_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 78 SCCO 3 -2.14 big-cap Long NaN 4.0 1.202491e+08 4.0 Basic Materials Mean Return: -2.14 Mean Day/Week: 3.0 Accuracy:0.0 *******************Part 1.4 Big Cap Short Entry SPAN********************* big_short_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 14 QCOM 2 -2.92 big-cap Short NaN -2.0 1.622702e+09 -3.0 Technology 206 TXG 2 -2.21 big-cap Short NaN -6.0 1.630044e+08 -5.0 Healthcare 304 BCH 1 0.00 big-cap Short NaN -33.0 2.037513e+06 -4.0 Financial Services Mean Return: -2.565 Mean Day/Week: 2.5 Accuracy:1.0 *******************Part 1.5 Big Cap Long Entry MACD********************* big_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 4 BAC 5 -1.98 big-cap Long NaN 5.0 1.868112e+09 78.0 Financial Services 12 XOM 1 0.00 big-cap Long NaN 5.0 1.814777e+09 78.0 Energy 3 PG 3 -1.55 big-cap Long NaN 3.0 1.131852e+09 28.0 Consumer Defensive 17 CVX 1 0.00 big-cap Long NaN 4.0 1.058900e+09 78.0 Energy 54 GILD 3 -0.04 big-cap Long NaN 3.0 5.518307e+08 8.0 Healthcare 26 LIN 4 -1.65 big-cap Long NaN 4.0 4.982808e+08 46.0 Basic Materials 274 NLOK 1 0.00 big-cap Long NaN 1.0 4.824544e+08 30.0 Technology 143 EOG 5 5.93 big-cap Long NaN 5.0 3.636859e+08 78.0 Energy 115 DOW 5 -2.10 big-cap Long NaN 5.0 3.148684e+08 70.0 Basic Materials 63 TFC 1 0.00 big-cap Long NaN 5.0 3.100237e+08 78.0 Financial Services 84 EMR 2 -2.01 big-cap Long NaN 2.0 3.014335e+08 78.0 Industrials 132 AIG 5 -0.02 big-cap Long NaN 5.0 2.936441e+08 78.0 Financial Services 147 MCK 2 -0.50 big-cap Long NaN 2.0 2.395567e+08 46.0 Healthcare 168 MT 5 -1.44 big-cap Long NaN 5.0 2.344500e+08 78.0 Basic Materials 121 GIS 5 -1.06 big-cap Long NaN 5.0 2.084841e+08 43.0 Consumer Defensive 111 KHC 5 -0.45 big-cap Long NaN 5.0 1.995761e+08 78.0 Consumer Defensive 165 STT 1 0.00 big-cap Long NaN 4.0 1.648295e+08 52.0 Financial Services 191 K 5 -1.51 big-cap Long NaN 5.0 1.626397e+08 41.0 Consumer Defensive 144 MSI 3 -2.89 big-cap Long NaN 3.0 1.622739e+08 71.0 Technology 78 SCCO 3 -2.14 big-cap Long NaN 4.0 1.202491e+08 4.0 Basic Materials 156 CNQ 5 1.26 big-cap Long NaN 5.0 1.073753e+08 78.0 Energy 146 LYB 5 -3.70 big-cap Long NaN 5.0 9.870134e+07 78.0 Basic Materials 91 ABEV 5 3.22 big-cap Long NaN 5.0 8.910134e+07 21.0 Consumer Defensive 65 BNS 1 0.00 big-cap Long NaN 4.0 7.566961e+07 78.0 Financial Services 97 AMX 4 -1.27 big-cap Long NaN 4.0 6.582279e+07 25.0 Communication Services 126 CRH 5 -2.08 big-cap Long NaN 5.0 3.146211e+07 34.0 Basic Materials 209 FTS 5 0.05 big-cap Long NaN 5.0 2.352740e+07 46.0 Utilities 240 KB 4 -3.32 big-cap Long NaN 4.0 1.301796e+07 48.0 Financial Services 137 ORAN 1 0.00 big-cap Long NaN 5.0 4.865471e+06 45.0 Communication Services 95 AMOV 3 0.68 big-cap Long NaN 4.0 7.099200e+03 17.0 Communication Services Mean Return: -0.8073913043478261 Mean Day/Week: 4.478260869565218 Accuracy:0.21739130434782608 *******************Part 1.6 Big Cap Short Entry MACD********************* big_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 39 AMD 2 -2.85 big-cap Short NaN -4.0 3.135268e+09 -11.0 Technology 0 BABA 3 0.17 big-cap Short NaN -3.0 3.118575e+09 -43.0 Consumer Cyclical 50 NIO 2 -3.41 big-cap Short NaN -2.0 2.532197e+09 -55.0 Consumer Cyclical 14 QCOM 2 -2.92 big-cap Short NaN -2.0 1.622702e+09 -3.0 Technology 248 WIX 1 0.00 big-cap Short NaN -5.0 1.337238e+09 -9.0 Technology 118 TTD 5 -14.76 big-cap Short NaN -5.0 1.066313e+09 -9.0 Technology 56 SNOW 5 -3.89 big-cap Short NaN -5.0 1.033258e+09 -137.0 Technology 36 ZM 5 -0.98 big-cap Short NaN -5.0 9.787987e+08 -51.0 Communication Services 45 MELI 4 -12.47 big-cap Short NaN -4.0 9.682385e+08 -51.0 Consumer Cyclical 108 U 3 3.27 big-cap Short NaN -3.0 8.183992e+08 -67.0 Technology 93 CVNA 3 -6.52 big-cap Short NaN -4.0 6.698149e+08 -6.0 Consumer Cyclical 207 OXY 2 2.36 big-cap Short NaN -2.0 6.628297e+08 -19.0 Energy 9 PDD 2 -1.41 big-cap Short NaN -2.0 6.197529e+08 -49.0 Consumer Cyclical 104 BILI 5 -9.90 big-cap Short NaN -5.0 5.062412e+08 -40.0 Communication Services 72 DASH 5 -7.71 big-cap Short NaN -5.0 4.626984e+08 -106.0 Communication Services 75 TEAM 1 0.00 big-cap Short NaN -5.0 4.230187e+08 -19.0 Technology 255 OPEN 5 -14.28 big-cap Short NaN -5.0 4.146333e+08 -36.0 Real Estate 90 TAL 5 -6.22 big-cap Short NaN -5.0 3.809368e+08 -45.0 Consumer Defensive 175 COUP 5 -1.03 big-cap Short NaN -5.0 3.513586e+08 -50.0 Technology 145 EDU 3 -6.85 big-cap Short NaN -3.0 2.191473e+08 -42.0 Consumer Defensive 55 NTES 2 -1.71 big-cap Short NaN -2.0 2.170762e+08 -36.0 Communication Services 308 SKLZ 3 -3.05 big-cap Short NaN -3.0 1.926417e+08 -38.0 Communication Services 173 STNE 5 -6.91 big-cap Short NaN -5.0 1.507958e+08 -49.0 Technology 102 VEEV 2 -2.29 big-cap Short NaN -4.0 1.449743e+08 -8.0 Healthcare 280 CRSP 4 -6.35 big-cap Short NaN -4.0 1.351045e+08 -57.0 Healthcare 310 PLAN 4 -1.69 big-cap Short NaN -4.0 1.342384e+08 -54.0 Technology 269 AVLR 5 -1.15 big-cap Short NaN -5.0 9.941472e+07 -57.0 Technology 196 GDS 4 -5.13 big-cap Short NaN -4.0 8.702730e+07 -50.0 Technology 136 BGNE 4 0.48 big-cap Short NaN -4.0 8.331997e+07 -7.0 Healthcare 202 GDRX 4 -15.83 big-cap Short NaN -4.0 6.925695e+07 -49.0 Healthcare 239 BMRN 2 -0.12 big-cap Short NaN -2.0 5.746311e+07 -59.0 Healthcare 283 CABO 5 0.61 big-cap Short NaN -5.0 4.959494e+07 -64.0 Communication Services 226 NICE 1 0.00 big-cap Short NaN -1.0 4.443930e+07 -59.0 Technology Mean Return: -4.418 Mean Day/Week: 3.7666666666666666 Accuracy:0.8333333333333334 *******************Part 1.7 Big Cap Long Maintainance********************* big_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 109 FCX 6 3.24 big-cap Long NaN 13.0 1.643319e+09 78.0 Basic Materials 28 WFC 19 4.48 big-cap Long NaN 19.0 1.373944e+09 78.0 Financial Services 48 GS 6 -0.83 big-cap Long NaN 6.0 1.144993e+09 78.0 Financial Services 10 T 15 1.99 big-cap Long NaN 15.0 9.804464e+08 37.0 Communication Services 34 CHTR 13 4.49 big-cap Long NaN 19.0 8.678400e+08 20.0 Communication Services 8 VZ 7 -0.29 big-cap Long NaN 7.0 8.452022e+08 33.0 Communication Services 245 DPZ 18 6.89 big-cap Long NaN 41.0 7.508837e+08 27.0 Consumer Cyclical 51 VALE 19 10.93 big-cap Long NaN 27.0 7.424505e+08 28.0 Basic Materials 15 ABBV 10 3.67 big-cap Long NaN 20.0 6.104405e+08 19.0 Healthcare 41 SCHW 10 -3.61 big-cap Long NaN 10.0 5.824788e+08 78.0 Financial Services 68 FDX 10 0.21 big-cap Long NaN 10.0 5.550052e+08 40.0 Industrials 59 ANTM 20 4.75 big-cap Long NaN 53.0 5.478315e+08 49.0 Healthcare 66 USB 10 -0.72 big-cap Long NaN 10.0 5.417833e+08 70.0 Financial Services 19 TMUS 6 1.96 big-cap Long NaN 31.0 5.232813e+08 29.0 Communication Services 49 CVS 11 10.25 big-cap Long NaN 20.0 4.831141e+08 35.0 Healthcare 69 SHW 27 8.00 big-cap Long NaN 42.0 4.820185e+08 37.0 Basic Materials 57 MDLZ 11 1.13 big-cap Long NaN 45.0 4.811629e+08 40.0 Consumer Defensive 88 COF 11 5.91 big-cap Long NaN 11.0 4.749832e+08 78.0 Financial Services 87 AON 9 -0.65 big-cap Long NaN 9.0 4.731605e+08 78.0 Financial Services 25 AZN 14 4.30 big-cap Long NaN 42.0 4.538589e+08 20.0 Healthcare 24 UPS 12 8.36 big-cap Long NaN 34.0 4.534713e+08 33.0 Industrials 46 AXP 9 -0.62 big-cap Long NaN 9.0 4.470700e+08 78.0 Financial Services 243 NUE 7 7.21 big-cap Long NaN 7.0 4.421430e+08 62.0 Basic Materials 157 WLTW 10 5.26 big-cap Long NaN 10.0 4.419197e+08 78.0 Financial Services 71 PNC 10 0.76 big-cap Long NaN 10.0 4.334038e+08 78.0 Financial Services 85 NEM 8 5.22 big-cap Long NaN 44.0 3.767983e+08 29.0 Basic Materials 125 ALXN 19 5.01 big-cap Long NaN 20.0 3.497389e+08 20.0 Healthcare 58 BP 6 -1.01 big-cap Long NaN 6.0 3.476146e+08 62.0 Energy 113 GOLD 8 5.89 big-cap Long NaN 43.0 3.324791e+08 20.0 Basic Materials 29 PM 24 5.58 big-cap Long NaN 24.0 3.303888e+08 70.0 Consumer Defensive 160 WMB 8 2.04 big-cap Long NaN 8.0 3.127779e+08 78.0 Energy 83 NOC 10 3.13 big-cap Long NaN 69.0 2.988695e+08 48.0 Industrials 62 CL 9 1.68 big-cap Long NaN 39.0 2.895165e+08 23.0 Consumer Defensive 135 ORLY 34 10.01 big-cap Long NaN 57.0 2.863222e+08 45.0 Consumer Cyclical 134 KMI 10 4.67 big-cap Long NaN 10.0 2.843316e+08 78.0 Energy 81 PGR 28 8.25 big-cap Long NaN 48.0 2.768751e+08 35.0 Financial Services 218 ET 11 12.67 big-cap Long NaN 11.0 2.760310e+08 70.0 Energy 189 SYF 8 1.16 big-cap Long NaN 8.0 2.663675e+08 78.0 unknown 120 TROW 6 -0.36 big-cap Long NaN 6.0 2.642624e+08 78.0 Financial Services 127 ALL 34 14.83 big-cap Long NaN 50.0 2.595642e+08 52.0 Financial Services 306 MOS 13 1.68 big-cap Long NaN 13.0 2.466146e+08 78.0 Basic Materials 138 PRU 21 6.07 big-cap Long NaN 21.0 2.260383e+08 78.0 Financial Services 61 ENB 10 3.25 big-cap Long NaN 10.0 2.252865e+08 78.0 Energy 20 UL 9 2.04 big-cap Long NaN 44.0 2.154166e+08 23.0 Consumer Defensive 205 KSU 17 3.45 big-cap Long NaN 42.0 2.025178e+08 48.0 Industrials 119 BK 10 1.92 big-cap Long NaN 10.0 1.895769e+08 52.0 Financial Services 77 DD 6 -0.67 big-cap Long NaN 7.0 1.854080e+08 21.0 Basic Materials 177 LH 33 7.55 big-cap Long NaN 33.0 1.788827e+08 78.0 Healthcare 152 OTIS 40 11.01 big-cap Long NaN 52.0 1.788073e+08 45.0 Industrials 295 ICLR 14 3.03 big-cap Long NaN 33.0 1.765667e+08 20.0 Healthcare 141 HSY 9 2.05 big-cap Long NaN 9.0 1.756804e+08 47.0 Consumer Defensive 232 CFG 8 2.60 big-cap Long NaN 8.0 1.708453e+08 78.0 Financial Services 200 IP 34 11.65 big-cap Long NaN 34.0 1.675127e+08 52.0 Consumer Cyclical 249 ALLY 12 2.61 big-cap Long NaN 12.0 1.595523e+08 78.0 Financial Services 238 EXPD 6 1.89 big-cap Long NaN 6.0 1.577268e+08 52.0 Industrials 224 KEY 10 0.98 big-cap Long NaN 10.0 1.528809e+08 78.0 Financial Services 216 APO 15 5.82 big-cap Long NaN 20.0 1.469857e+08 21.0 Financial Services 163 DFS 13 5.93 big-cap Long NaN 13.0 1.463354e+08 78.0 Financial Services 215 DGX 11 3.54 big-cap Long NaN 42.0 1.462245e+08 35.0 Healthcare 40 TD 10 1.93 big-cap Long NaN 10.0 1.460721e+08 78.0 Financial Services 270 SJM 6 -0.05 big-cap Long NaN 6.0 1.458688e+08 43.0 Consumer Defensive 294 UHS 25 11.98 big-cap Long NaN 45.0 1.418775e+08 29.0 Healthcare 231 LNG 9 5.80 big-cap Long NaN 9.0 1.418653e+08 78.0 Energy 151 ADM 13 10.50 big-cap Long NaN 13.0 1.412151e+08 78.0 Consumer Defensive 33 RY 10 2.75 big-cap Long NaN 10.0 1.404273e+08 78.0 Financial Services 181 EFX 19 21.22 big-cap Long NaN 38.0 1.387334e+08 30.0 Industrials 225 HES 8 5.34 big-cap Long NaN 8.0 1.348797e+08 78.0 Energy 293 WRK 9 4.83 big-cap Long NaN 9.0 1.334786e+08 52.0 Consumer Cyclical 236 DISH 16 8.80 big-cap Long NaN 16.0 1.333354e+08 48.0 Communication Services 193 VMC 21 8.06 big-cap Long NaN 21.0 1.227032e+08 78.0 Basic Materials 264 EMN 10 7.29 big-cap Long NaN 10.0 1.135869e+08 78.0 Basic Materials 178 VRSN 15 2.96 big-cap Long NaN 36.0 1.092416e+08 29.0 Technology 89 VOD 7 2.85 big-cap Long NaN 7.0 1.060328e+08 78.0 Communication Services 197 GWW 20 12.31 big-cap Long NaN 55.0 1.028281e+08 40.0 Industrials 164 FRC 14 2.37 big-cap Long NaN 14.0 1.018242e+08 78.0 Financial Services 263 GPC 14 4.31 big-cap Long NaN 14.0 1.006894e+08 59.0 Consumer Cyclical 221 MTB 6 -1.53 big-cap Long NaN 6.0 9.951587e+07 78.0 Financial Services 292 LKQ 12 5.25 big-cap Long NaN 12.0 9.788414e+07 71.0 Consumer Cyclical 273 AVY 28 11.97 big-cap Long NaN 28.0 9.205023e+07 78.0 Industrials 262 IT 15 14.20 big-cap Long NaN 15.0 8.871367e+07 78.0 Technology 210 MLM 7 -1.53 big-cap Long NaN 7.0 8.761857e+07 78.0 Basic Materials 110 TRP 29 6.75 big-cap Long NaN 47.0 8.281956e+07 50.0 Energy 201 WPM 8 1.19 big-cap Long NaN 43.0 8.279890e+07 20.0 Basic Materials 265 BEN 6 -2.85 big-cap Long NaN 6.0 8.265431e+07 78.0 Financial Services 188 CHD 6 -1.05 big-cap Long NaN 6.0 8.074855e+07 34.0 Consumer Defensive 208 NTRS 12 4.63 big-cap Long NaN 12.0 7.986706e+07 71.0 Financial Services 171 FNV 24 8.55 big-cap Long NaN 44.0 7.862642e+07 30.0 Basic Materials 305 CBOE 8 4.57 big-cap Long NaN 8.0 7.547992e+07 61.0 Financial Services 185 CCEP 20 4.93 big-cap Long NaN 20.0 7.502235e+07 78.0 Consumer Defensive 86 BMO 10 1.39 big-cap Long NaN 10.0 7.307052e+07 78.0 Financial Services 27 BUD 18 8.51 big-cap Long NaN 40.0 7.173284e+07 24.0 Consumer Defensive 302 TXT 31 15.52 big-cap Long NaN 31.0 7.145678e+07 78.0 Industrials 252 CE 8 2.17 big-cap Long NaN 8.0 7.115967e+07 58.0 Basic Materials 296 TAP 10 3.55 big-cap Long NaN 40.0 6.234065e+07 33.0 Consumer Defensive 266 DVA 9 5.52 big-cap Long NaN 42.0 6.107716e+07 19.0 Healthcare 257 CINF 8 1.84 big-cap Long NaN 8.0 5.559413e+07 78.0 Financial Services 117 CM 10 2.82 big-cap Long NaN 10.0 5.556730e+07 78.0 Financial Services 167 MPLX 7 1.93 big-cap Long NaN 8.0 5.220449e+07 78.0 Energy 116 BCE 11 3.22 big-cap Long NaN 11.0 4.805769e+07 48.0 Communication Services 272 PKG 10 1.17 big-cap Long NaN 28.0 4.561986e+07 24.0 Consumer Cyclical 307 WLK 14 7.71 big-cap Long NaN 20.0 3.952101e+07 48.0 Basic Materials 74 EQNR 11 1.22 big-cap Long NaN 11.0 3.889019e+07 22.0 Energy 253 IMO 10 12.20 big-cap Long NaN 10.0 3.601446e+07 78.0 Energy 247 PBA 10 1.92 big-cap Long NaN 11.0 3.211225e+07 52.0 Energy 259 LBTYA 10 1.53 big-cap Long NaN 10.0 2.839967e+07 45.0 Communication Services 213 PKX 37 25.20 big-cap Long NaN 51.0 2.772210e+07 52.0 Basic Materials 258 LBTYK 10 0.83 big-cap Long NaN 10.0 2.756973e+07 46.0 unknown 105 NGG 9 2.21 big-cap Long NaN 43.0 1.967524e+07 29.0 Utilities 130 LYG 10 2.64 big-cap Long NaN 10.0 1.500138e+07 78.0 Financial Services 123 LBRDA 13 3.18 big-cap Long NaN 19.0 1.241017e+07 20.0 Communication Services 174 RCI 8 1.59 big-cap Long NaN 23.0 8.347281e+06 29.0 Communication Services 309 RDY 10 3.65 big-cap Long NaN 33.0 4.666705e+06 20.0 Healthcare 230 VAR 14 0.27 big-cap Long NaN 14.0 0.000000e+00 59.0 Healthcare Mean Return: 4.622654867256637 Mean Day/Week: 13.442477876106194 Accuracy:0.8761061946902655 *******************Part 1.8 Big Cap Short Maintainance********************* big_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 79 ROKU 8 -7.18 big-cap Short NaN -8.0 2.952460e+09 -49.0 Communication Services 101 PTON 15 -11.20 big-cap Short NaN -15.0 2.551787e+09 -57.0 Consumer Cyclical 67 PLTR 7 -12.56 big-cap Short NaN -7.0 2.400266e+09 -56.0 Technology 5 NFLX 6 -2.16 big-cap Short NaN -15.0 1.948573e+09 -16.0 Communication Services 1 TSM 9 -7.41 big-cap Short NaN -20.0 1.537830e+09 -43.0 Technology 53 BIDU 13 -16.30 big-cap Short NaN -52.0 1.085743e+09 -35.0 Communication Services 133 PLUG 8 -14.94 big-cap Short NaN -64.0 1.047367e+09 -51.0 Industrials 52 SNAP 7 -7.51 big-cap Short NaN -7.0 9.626698e+08 -18.0 Communication Services 73 TWLO 7 -13.64 big-cap Short NaN -7.0 9.211324e+08 -10.0 Communication Services 131 VIAC 8 -1.41 big-cap Short NaN -34.0 7.956079e+08 -33.0 Communication Services 106 TWTR 8 -7.18 big-cap Short NaN -18.0 7.922027e+08 -11.0 Communication Services 22 JD 7 -6.35 big-cap Short NaN -54.0 6.107110e+08 -47.0 Consumer Cyclical 162 ETSY 6 -13.19 big-cap Short NaN -17.0 5.065885e+08 -18.0 Consumer Cyclical 148 LI 25 -25.60 big-cap Short NaN -25.0 4.755797e+08 -76.0 Consumer Cyclical 98 DOCU 6 -4.33 big-cap Short NaN -6.0 4.725803e+08 -10.0 Technology 169 ENPH 8 -14.73 big-cap Short NaN -8.0 4.502167e+08 -51.0 Technology 114 TDOC 7 -11.85 big-cap Short NaN -7.0 4.498248e+08 -50.0 Healthcare 228 PENN 12 -18.58 big-cap Short NaN -39.0 4.493416e+08 -29.0 Consumer Cyclical 129 Z 11 -21.53 big-cap Short NaN -54.0 4.413985e+08 -39.0 Communication Services 124 RNG 6 -14.01 big-cap Short NaN -6.0 3.919372e+08 -50.0 Technology 122 XPEV 9 -18.48 big-cap Short NaN -9.0 3.912795e+08 -70.0 Consumer Cyclical 290 BYND 7 -16.80 big-cap Short NaN -7.0 3.762199e+08 -45.0 Consumer Defensive 261 RUN 7 -7.31 big-cap Short NaN -7.0 3.697073e+08 -58.0 Technology 155 ZS 6 -4.70 big-cap Short NaN -6.0 3.324169e+08 -50.0 Technology 94 TME 10 -14.25 big-cap Short NaN -35.0 3.041038e+08 -35.0 Communication Services 279 FSLY 7 -30.30 big-cap Short NaN -7.0 2.928253e+08 -59.0 Technology 70 SPOT 9 -10.92 big-cap Short NaN -9.0 2.924390e+08 -54.0 Communication Services 60 BEKE 8 -3.62 big-cap Short NaN -8.0 2.923211e+08 -50.0 Real Estate 64 ILMN 9 -5.14 big-cap Short NaN -9.0 2.916746e+08 -34.0 Healthcare 277 SPCE 28 -56.93 big-cap Short NaN -56.0 2.887661e+08 -48.0 Industrials 170 EXAS 7 -18.46 big-cap Short NaN -7.0 2.852871e+08 -10.0 Healthcare 192 FTCH 9 -22.73 big-cap Short NaN -56.0 2.780230e+08 -36.0 Consumer Cyclical 179 MDB 6 -7.41 big-cap Short NaN -6.0 2.444164e+08 -49.0 Technology 154 SPLK 10 -9.94 big-cap Short NaN -10.0 2.276298e+08 -137.0 Technology 139 DDOG 7 -0.67 big-cap Short NaN -7.0 2.123587e+08 -56.0 Technology 107 CHWY 6 -8.60 big-cap Short NaN -6.0 1.970701e+08 -50.0 Consumer Cyclical 237 SEDG 7 -4.59 big-cap Short NaN -7.0 1.840361e+08 -11.0 Technology 182 MKTX 6 -2.36 big-cap Short NaN -13.0 1.692344e+08 -17.0 Financial Services 172 TTWO 8 -3.56 big-cap Short NaN -8.0 1.685365e+08 -56.0 Communication Services 219 IQ 32 -20.78 big-cap Short NaN -35.0 1.611683e+08 -34.0 Communication Services 176 PAYC 6 -10.73 big-cap Short NaN -6.0 1.550388e+08 -9.0 Technology 184 HOLX 10 -5.03 big-cap Short NaN -11.0 1.428612e+08 -17.0 Healthcare 303 NRG 17 -10.81 big-cap Short NaN -40.0 1.423435e+08 -40.0 Utilities 301 FSLR 7 -5.58 big-cap Short NaN -7.0 1.372645e+08 -9.0 Technology 227 CTXS 8 -5.38 big-cap Short NaN -18.0 1.241417e+08 -10.0 Technology 281 CHGG 7 -4.05 big-cap Short NaN -7.0 1.144884e+08 -50.0 Consumer Defensive 276 CREE 9 -11.46 big-cap Short NaN -10.0 1.068154e+08 -10.0 Technology 267 ESTC 6 -4.16 big-cap Short NaN -6.0 1.027492e+08 -51.0 Technology 260 TEVA 7 1.87 big-cap Short NaN -25.0 9.258542e+07 -32.0 Healthcare 30 SNE 6 -0.75 big-cap Short NaN -14.0 9.195347e+07 -11.0 Technology 244 APPN 10 -41.35 big-cap Short NaN -58.0 8.955897e+07 -50.0 Technology 282 IPGP 7 -0.82 big-cap Short NaN -7.0 8.009156e+07 -9.0 Technology 242 CGC 8 -10.67 big-cap Short NaN -58.0 7.100834e+07 -39.0 Healthcare 222 PAGS 7 -8.44 big-cap Short NaN -7.0 6.655165e+07 -47.0 Technology 203 ZI 6 -9.83 big-cap Short NaN -6.0 6.530809e+07 -8.0 Technology 100 LU 12 -20.03 big-cap Short NaN -57.0 6.404938e+07 -43.0 Financial Services 254 MASI 7 -3.83 big-cap Short NaN -7.0 6.070633e+07 -57.0 Healthcare 217 ALNY 7 1.42 big-cap Short NaN -7.0 5.663839e+07 -50.0 Healthcare 128 ZG 11 -22.73 big-cap Short NaN -54.0 5.582253e+07 -39.0 Communication Services 241 ARGX 6 -3.88 big-cap Short NaN -6.0 4.765782e+07 -39.0 Healthcare 286 KC 6 -7.33 big-cap Short NaN -6.0 4.603374e+07 -40.0 Technology 275 QGEN 8 -2.87 big-cap Short NaN -10.0 2.943848e+07 -54.0 Healthcare 278 BEP 17 -13.95 big-cap Short NaN -17.0 2.318717e+07 -56.0 Utilities 287 ENIA 9 0.16 big-cap Short NaN -21.0 1.563287e+07 -15.0 Utilities 271 ERIE 9 -6.27 big-cap Short NaN -9.0 1.291538e+07 -49.0 Financial Services Mean Return: -10.857076923076924 Mean Day/Week: 9.153846153846153 Accuracy:0.9538461538461539 ************************************** ************************************** ************************************** *******************Part 2.0 Small Cap Industry Overiew********************* small_industry_uptrending_count tickers industry Basic Materials 11 Communication Services 2 Consumer Cyclical 4 Consumer Defensive 2 Energy 7 Financial Services 9 Healthcare 7 Industrials 8 Real Estate 2 Technology 3 unknown 1 **************************************** small_industry_downtrending_count tickers industry Communication Services 6 Consumer Cyclical 5 Consumer Defensive 2 Financial Services 4 Healthcare 30 Industrials 6 Real Estate 3 Technology 37 Utilities 7 unknown 1 *******************Part 2.1 Small Cap Long Entry SPAN MACD********************* small_long_signal_entry_span_macd Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.2 Small Cap Short Entry SPAN MACD********************* small_short_signal_entry_span_macd Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.3 Small Cap Long Entry SPAN********************* small_long_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 435 PRGO 2 3.29 small-cap Long NaN 19.0 7.221304e+07 5.0 Healthcare 448 VNT 1 0.00 small-cap Long NaN 21.0 2.140747e+07 5.0 Technology Mean Return: 3.29 Mean Day/Week: 3.0 Accuracy:1.0 *******************Part 2.4 Small Cap Short Entry SPAN********************* small_short_signal_entry_span Empty DataFrame Columns: [Symbol, Day, Return, Market Cap, Long/Short, score, MACD Signal Count, Market Value, Span Signal Count, industry] Index: [] Mean Return: nan Mean Day/Week: nan Accuracy:nan *******************Part 2.5 Small Cap Long Entry MACD********************* small_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 337 JAZZ 4 0.77 small-cap Long NaN 5.0 2.033232e+08 6.0 Healthcare 351 NLSN 4 -1.19 small-cap Long NaN 4.0 1.341072e+08 78.0 Industrials 322 IRM 4 -1.53 small-cap Long NaN 4.0 9.819821e+07 78.0 Real Estate 329 LNC 4 -3.74 small-cap Long NaN 4.0 8.099888e+07 78.0 Financial Services 376 ZION 1 0.00 small-cap Long NaN 5.0 7.565277e+07 78.0 Financial Services 392 EXEL 4 0.22 small-cap Long NaN 4.0 4.935604e+07 23.0 Healthcare 330 GFI 4 0.94 small-cap Long NaN 4.0 4.772680e+07 29.0 Basic Materials 356 AFG 5 -1.74 small-cap Long NaN 5.0 3.972320e+07 73.0 Financial Services 461 KT 2 1.75 small-cap Long NaN 2.0 1.631419e+07 63.0 Communication Services 344 PSO 4 0.38 small-cap Long NaN 4.0 5.927231e+06 78.0 Communication Services Mean Return: -0.4600000000000001 Mean Day/Week: 4.0 Accuracy:0.5555555555555556 *******************Part 2.6 Small Cap Short Entry MACD********************* small_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 342 LMND 5 -20.87 small-cap Short NaN -5.0 7.296336e+08 -51.0 Financial Services 463 ARRY 3 -45.77 small-cap Short NaN -3.0 5.664331e+08 -60.0 Technology 381 DQ 1 0.00 small-cap Short NaN -1.0 1.379999e+08 -39.0 Technology 366 RDFN 5 -4.01 small-cap Short NaN -5.0 1.378918e+08 -42.0 Real Estate 459 BIGC 5 -10.73 small-cap Short NaN -5.0 1.369319e+08 -62.0 Technology 438 TNDM 3 -0.97 small-cap Short NaN -4.0 9.561234e+07 -7.0 Healthcare 340 FATE 5 -5.39 small-cap Short NaN -5.0 9.404741e+07 -50.0 Healthcare 349 IONS 5 -0.01 small-cap Short NaN -5.0 9.094466e+07 -50.0 Healthcare 319 GWRE 4 -4.84 small-cap Short NaN -4.0 8.623639e+07 -57.0 Technology 443 BEAM 5 -4.18 small-cap Short NaN -5.0 8.484223e+07 -39.0 Healthcare 384 QTWO 5 -4.27 small-cap Short NaN -5.0 7.544254e+07 -51.0 Technology 421 BE 5 -12.72 small-cap Short NaN -5.0 7.390114e+07 -54.0 Industrials 369 BL 5 -1.09 small-cap Short NaN -5.0 6.322778e+07 -57.0 Technology 316 NBIX 5 3.02 small-cap Short NaN -5.0 6.177156e+07 -51.0 Healthcare 368 ADPT 5 -10.15 small-cap Short NaN -5.0 5.520804e+07 -51.0 Healthcare 456 DM 5 4.52 small-cap Short NaN -5.0 5.487788e+07 -50.0 Technology 408 IOVA 2 -1.62 small-cap Short NaN -2.0 5.436165e+07 -57.0 Healthcare 396 ONEM 3 -0.54 small-cap Short NaN -3.0 5.210462e+07 -49.0 Healthcare 432 TPTX 5 1.89 small-cap Short NaN -5.0 4.601168e+07 -51.0 Healthcare 400 KOD 5 -23.60 small-cap Short NaN -5.0 4.447965e+07 -60.0 Healthcare 428 PRLB 1 0.00 small-cap Short NaN -1.0 4.230205e+07 -57.0 Industrials 416 NEP 5 -5.77 small-cap Short NaN -5.0 4.132713e+07 -9.0 Utilities 444 FROG 5 -13.43 small-cap Short NaN -5.0 4.091567e+07 -57.0 Technology 345 DNLI 1 0.00 small-cap Short NaN -1.0 3.624719e+07 -65.0 Healthcare 358 OCFT 3 4.50 small-cap Short NaN -3.0 2.485922e+07 -69.0 Technology 430 CWEN 4 -6.23 small-cap Short NaN -4.0 2.368777e+07 -59.0 Utilities 467 BHVN 1 0.00 small-cap Short NaN -1.0 2.048455e+07 -74.0 Healthcare 418 MDLA 4 -8.03 small-cap Short NaN -4.0 1.969326e+07 -48.0 Technology 383 ALLK 5 0.03 small-cap Short NaN -5.0 1.571599e+07 -57.0 Healthcare Mean Return: -6.8104000000000005 Mean Day/Week: 4.6 Accuracy:0.8 *******************Part 2.7 Small Cap Long Maintaiance********************* small_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 373 CLF 7 -1.57 small-cap Long NaN 7.0 6.606414e+08 31.0 Basic Materials 371 PFPT 13 -0.93 small-cap Long NaN 26.0 5.606352e+08 23.0 Technology 375 STLD 12 10.54 small-cap Long NaN 12.0 2.001254e+08 69.0 Basic Materials 390 GGB 6 6.97 small-cap Long NaN 55.0 1.840642e+08 33.0 Basic Materials 407 DXC 14 6.22 small-cap Long NaN 31.0 1.252361e+08 34.0 Technology 326 CF 10 8.76 small-cap Long NaN 11.0 1.177371e+08 78.0 Basic Materials 364 JLL 7 3.85 small-cap Long NaN 7.0 1.150574e+08 78.0 Real Estate 352 CMA 9 1.50 small-cap Long NaN 9.0 1.000164e+08 78.0 Financial Services 433 MTZ 12 10.08 small-cap Long NaN 12.0 9.844868e+07 78.0 Industrials 439 JHG 16 9.34 small-cap Long NaN 44.0 8.985436e+07 28.0 Financial Services 325 BG 16 6.80 small-cap Long NaN 16.0 8.624836e+07 78.0 Consumer Defensive 355 PRAH 40 14.71 small-cap Long NaN 55.0 8.595942e+07 78.0 Healthcare 361 ATH 20 11.17 small-cap Long NaN 20.0 8.543520e+07 78.0 Financial Services 398 BERY 7 1.90 small-cap Long NaN 7.0 8.498390e+07 67.0 Consumer Cyclical 402 SEE 24 17.85 small-cap Long NaN 47.0 8.188942e+07 47.0 Consumer Cyclical 370 RS 10 2.70 small-cap Long NaN 10.0 7.529762e+07 78.0 Basic Materials 318 MMP 8 2.67 small-cap Long NaN 25.0 6.926127e+07 28.0 Energy 427 SRCL 11 9.43 small-cap Long NaN 29.0 6.389769e+07 23.0 Industrials 410 TRGP 12 11.18 small-cap Long NaN 12.0 6.313080e+07 78.0 Energy 458 THC 13 10.80 small-cap Long NaN 13.0 5.918759e+07 78.0 Healthcare 321 HSIC 16 8.88 small-cap Long NaN 42.0 5.755582e+07 24.0 Healthcare 454 LEG 21 13.38 small-cap Long NaN 21.0 4.894848e+07 53.0 Consumer Cyclical 413 OSK 6 -0.78 small-cap Long NaN 6.0 4.299045e+07 78.0 Industrials 465 MAN 26 15.67 small-cap Long NaN 26.0 3.881396e+07 78.0 Industrials 425 WES 10 3.49 small-cap Long NaN 10.0 3.757181e+07 78.0 Energy 449 ORI 28 12.92 small-cap Long NaN 50.0 3.745576e+07 78.0 Financial Services 363 CSL 42 16.70 small-cap Long NaN 46.0 3.284003e+07 47.0 Industrials 404 TFII 12 9.03 small-cap Long NaN 12.0 2.806494e+07 78.0 Industrials 420 POST 34 8.90 small-cap Long NaN 49.0 2.570292e+07 52.0 Consumer Defensive 436 CFR 11 1.07 small-cap Long NaN 11.0 2.426922e+07 78.0 Financial Services 332 VEDL 9 10.04 small-cap Long NaN 9.0 1.654047e+07 78.0 Basic Materials 389 SC 28 22.49 small-cap Long NaN 28.0 1.522969e+07 70.0 Financial Services 359 ACH 13 15.52 small-cap Long NaN 16.0 3.298509e+06 66.0 Basic Materials 391 ICL 8 0.64 small-cap Long NaN 8.0 1.163032e+06 78.0 Basic Materials Mean Return: 8.291764705882356 Mean Day/Week: 15.617647058823529 Accuracy:0.9117647058823529 *******************Part 2.8 Small Cap Short Maintaiance********************* small_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 395 MSTR 19 -22.87 small-cap Short NaN -55.0 2.029828e+08 -36.0 Technology 447 JMIA 34 -36.76 small-cap Short NaN -59.0 1.992976e+08 -41.0 Consumer Cyclical 328 IIVI 9 -9.70 small-cap Short NaN -9.0 1.928719e+08 -50.0 Technology 385 FCEL 12 -28.94 small-cap Short NaN -59.0 1.747204e+08 -41.0 Industrials 323 BFAM 9 -7.16 small-cap Short NaN -23.0 1.576508e+08 -18.0 Consumer Cyclical 405 CCIV 8 -11.17 small-cap Short NaN -53.0 1.371983e+08 -32.0 Financial Services 409 PSTG 12 -21.10 small-cap Short NaN -55.0 1.130495e+08 -39.0 Technology 314 VST 10 -6.31 small-cap Short NaN -10.0 1.118835e+08 -53.0 Utilities 317 NVTA 8 -19.86 small-cap Short NaN -8.0 1.021647e+08 -61.0 Healthcare 360 FVRR 10 -24.63 small-cap Short NaN -10.0 1.002043e+08 -39.0 Communication Services 327 BHC 6 -0.31 small-cap Short NaN -40.0 9.988190e+07 -7.0 Healthcare 367 YY 11 -10.49 small-cap Short NaN -49.0 9.478372e+07 -33.0 Communication Services 453 UPWK 10 -18.83 small-cap Short NaN -18.0 9.306787e+07 -35.0 Industrials 434 CLGX 6 -0.15 small-cap Short NaN -49.0 9.028612e+07 -31.0 Technology 464 SAIL 7 -4.76 small-cap Short NaN -7.0 8.341141e+07 -42.0 Technology 333 SMAR 12 -15.06 small-cap Short NaN -17.0 8.326959e+07 -50.0 Technology 324 DOX 6 -4.55 small-cap Short NaN -37.0 7.795773e+07 -9.0 Technology 348 NYT 26 -13.46 small-cap Short NaN -49.0 7.765947e+07 -45.0 Communication Services 412 PACB 9 -25.16 small-cap Short NaN -56.0 7.496975e+07 -35.0 Healthcare 403 NCNO 8 -19.93 small-cap Short NaN -8.0 7.213136e+07 -56.0 Technology 335 TWST 7 -19.15 small-cap Short NaN -7.0 6.812684e+07 -54.0 Healthcare 414 CYBR 6 -0.50 small-cap Short NaN -6.0 6.605225e+07 -12.0 Technology 399 TGTX 8 -17.11 small-cap Short NaN -35.0 6.499928e+07 -43.0 Healthcare 313 BLDP 7 -11.83 small-cap Short NaN -7.0 6.409135e+07 -50.0 Industrials 357 AMWL 6 -9.33 small-cap Short NaN -6.0 6.376044e+07 -57.0 Healthcare 437 HAE 18 -21.27 small-cap Short NaN -18.0 6.201844e+07 -49.0 Healthcare 350 BB 9 -10.22 small-cap Short NaN -63.0 5.807735e+07 -49.0 Technology 377 API 10 -28.52 small-cap Short NaN -10.0 5.648784e+07 -40.0 Technology 411 SDGR 6 -13.87 small-cap Short NaN -6.0 5.336472e+07 -49.0 Healthcare 347 SPWR 10 -23.31 small-cap Short NaN -60.0 5.287028e+07 -48.0 Technology 445 CRUS 8 -0.82 small-cap Short NaN -9.0 4.700455e+07 -9.0 Technology 354 EXPI 21 -38.85 small-cap Short NaN -54.0 4.527260e+07 -36.0 Real Estate 393 RCM 6 -0.84 small-cap Short NaN -6.0 4.455777e+07 -8.0 Healthcare 387 BBIO 8 -10.72 small-cap Short NaN -83.0 4.250184e+07 -35.0 Healthcare 455 SDC 6 -9.42 small-cap Short NaN -6.0 3.963202e+07 -60.0 Healthcare 441 VRNS 8 -12.91 small-cap Short NaN -8.0 3.785546e+07 -40.0 Technology 429 HUYA 10 -16.60 small-cap Short NaN -52.0 3.705091e+07 -36.0 Communication Services 424 NEO 6 -9.88 small-cap Short NaN -6.0 3.668788e+07 -12.0 Healthcare 446 ASAN 6 -5.61 small-cap Short NaN -6.0 3.325019e+07 -43.0 Technology 457 APPF 6 -5.69 small-cap Short NaN -6.0 3.140022e+07 -54.0 Technology 320 BEPC 10 -11.59 small-cap Short NaN -10.0 2.859486e+07 -137.0 Utilities 462 VNET 11 -18.62 small-cap Short NaN -61.0 2.786176e+07 -49.0 Technology 451 NATI 8 -4.28 small-cap Short NaN -9.0 2.689658e+07 -9.0 Technology 406 ORA 6 -6.33 small-cap Short NaN -6.0 2.617973e+07 -54.0 Utilities 423 EBS 29 -30.13 small-cap Short NaN -57.0 2.519544e+07 -50.0 Healthcare 422 FIZZ 10 -7.28 small-cap Short NaN -10.0 2.419082e+07 -44.0 Consumer Defensive 341 VIR 8 -16.13 small-cap Short NaN -54.0 2.144229e+07 -45.0 Healthcare 374 SHC 7 -3.46 small-cap Short NaN -7.0 1.970293e+07 -39.0 Healthcare 394 DCT 9 -12.18 small-cap Short NaN -9.0 1.928562e+07 -39.0 Technology 442 ALGM 10 -9.79 small-cap Short NaN -10.0 1.674278e+07 -54.0 Technology 417 AVIR 20 -79.61 small-cap Short NaN -54.0 1.100235e+07 -34.0 Healthcare 466 ENIC 10 0.73 small-cap Short NaN -12.0 3.719230e+06 -12.0 Utilities Mean Return: -14.736923076923079 Mean Day/Week: 10.423076923076923 Accuracy:0.9807692307692307 ************************************** ************************************** ************************************** *******************Part 3.0 Penny Cap Industry Overiew********************* penny_industry_uptrending_count tickers industry Basic Materials 28 Communication Services 5 Consumer Cyclical 17 Consumer Defensive 8 Energy 21 Financial Services 26 Healthcare 11 Industrials 21 Real Estate 5 Technology 7 unknown 1 **************************************** penny_industry_downtrending_count tickers industry Basic Materials 13 Communication Services 17 Consumer Cyclical 23 Consumer Defensive 11 Energy 3 Financial Services 24 Healthcare 103 Industrials 22 Real Estate 15 Technology 74 Utilities 1 unknown 1 *******************Part 3.1 Penny Cap Long Entry SPAN MACD********************* penny_long_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 496 HLI 1 0.00 penny-cap Long NaN 1.0 7.911891e+07 1.0 Financial Services 556 HL 3 0.68 penny-cap Long NaN 5.0 4.770588e+07 5.0 Basic Materials 901 RGR 2 0.04 penny-cap Long NaN 2.0 1.965288e+07 5.0 Industrials 626 GOLF 5 -3.00 penny-cap Long NaN 5.0 1.490808e+07 5.0 Consumer Cyclical Mean Return: -0.7599999999999999 Mean Day/Week: 3.6666666666666665 Accuracy:0.6666666666666666 *******************Part 3.2 Penny Cap Short Entry SPAN MACD********************* penny_short_signal_entry_span_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 524 ICUI 2 -2.92 penny-cap Short NaN -4.0 3.567720e+07 -4.0 Healthcare 541 GKOS 3 -0.70 penny-cap Short NaN -4.0 3.188848e+07 -5.0 Healthcare Mean Return: -1.81 Mean Day/Week: 2.5 Accuracy:1.0 *******************Part 3.3 Penny Cap Long Entry SPAN********************* penny_long_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 675 ELY 2 -6.79 penny-cap Long NaN 16.0 1.665551e+08 5.0 Consumer Cyclical 597 IGT 2 -1.47 penny-cap Long NaN 11.0 8.644117e+07 2.0 Consumer Cyclical 496 HLI 1 0.00 penny-cap Long NaN 1.0 7.911891e+07 1.0 Financial Services 660 MIME 2 0.41 penny-cap Long NaN 21.0 5.702979e+07 4.0 Technology 556 HL 3 0.68 penny-cap Long NaN 5.0 4.770588e+07 5.0 Basic Materials 670 MED 3 -7.15 penny-cap Long NaN 6.0 4.450511e+07 5.0 Consumer Cyclical 645 NUS 3 -2.88 penny-cap Long NaN 23.0 2.030158e+07 5.0 Consumer Defensive 901 RGR 2 0.04 penny-cap Long NaN 2.0 1.965288e+07 5.0 Industrials 626 GOLF 5 -3.00 penny-cap Long NaN 5.0 1.490808e+07 5.0 Consumer Cyclical 707 NUV 1 0.00 penny-cap Long NaN 28.0 3.516019e+06 5.0 Financial Services Mean Return: -2.52 Mean Day/Week: 3.0 Accuracy:0.375 *******************Part 3.4 Penny Cap Short Entry SPAN********************* penny_short_signal_entry_span Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 598 SLQT 1 0.00 penny-cap Short NaN -17.0 1.653906e+08 -3.0 Financial Services 520 RXT 1 0.00 penny-cap Short NaN -14.0 9.813150e+07 -2.0 Technology 524 ICUI 2 -2.92 penny-cap Short NaN -4.0 3.567720e+07 -4.0 Healthcare 540 LOPE 3 -0.50 penny-cap Short NaN -31.0 3.345874e+07 -5.0 Consumer Defensive 541 GKOS 3 -0.70 penny-cap Short NaN -4.0 3.188848e+07 -5.0 Healthcare 673 CDE 1 0.00 penny-cap Short NaN -10.0 2.588748e+07 -1.0 Basic Materials 497 ENSG 1 0.00 penny-cap Short NaN -22.0 1.254176e+07 -3.0 Healthcare 690 ESE 1 0.00 penny-cap Short NaN -22.0 1.071530e+07 -3.0 Technology 909 ZUMZ 1 0.00 penny-cap Short NaN -54.0 7.797485e+06 -2.0 Consumer Cyclical 883 RMR 1 0.00 penny-cap Short NaN -41.0 1.810065e+06 -3.0 Real Estate Mean Return: -1.3733333333333333 Mean Day/Week: 5.0 Accuracy:1.0 *******************Part 3.5 Penny Cap Long Entry MACD********************* penny_long_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 886 FOE 2 -1.24 penny-cap Long NaN 2.0 1.860755e+08 66.0 Basic Materials 752 ASO 5 0.03 penny-cap Long NaN 5.0 1.199897e+08 78.0 Consumer Cyclical 758 AR 4 3.06 penny-cap Long NaN 4.0 1.086453e+08 78.0 Energy 496 HLI 1 0.00 penny-cap Long NaN 1.0 7.911891e+07 1.0 Financial Services 734 MLHR 3 -1.59 penny-cap Long NaN 3.0 6.805458e+07 70.0 Consumer Cyclical 687 SUM 4 5.71 penny-cap Long NaN 4.0 6.453587e+07 78.0 Basic Materials 771 MUR 1 0.00 penny-cap Long NaN 5.0 6.211282e+07 13.0 Energy 476 EXP 2 -3.76 penny-cap Long NaN 2.0 5.433311e+07 78.0 Basic Materials 630 COMM 4 -5.03 penny-cap Long NaN 4.0 5.316093e+07 78.0 Technology 618 BHF 5 -1.46 penny-cap Long NaN 5.0 5.005155e+07 78.0 Financial Services 556 HL 3 0.68 penny-cap Long NaN 5.0 4.770588e+07 5.0 Basic Materials 632 CHX 1 0.00 penny-cap Long NaN 5.0 4.182394e+07 16.0 Energy 708 PDCE 4 -1.94 penny-cap Long NaN 4.0 3.849659e+07 78.0 Energy 470 INGR 2 -0.38 penny-cap Long NaN 2.0 3.708767e+07 69.0 Consumer Defensive 700 ANAT 5 16.70 penny-cap Long NaN 5.0 3.179846e+07 50.0 Financial Services 494 ALSN 4 -2.61 penny-cap Long NaN 4.0 2.966459e+07 27.0 Consumer Cyclical 699 CMC 4 -4.11 penny-cap Long NaN 4.0 2.846459e+07 69.0 Basic Materials 607 HRB 3 -2.15 penny-cap Long NaN 3.0 2.696323e+07 71.0 Consumer Cyclical 703 TRQ 4 -2.93 penny-cap Long NaN 4.0 2.255415e+07 78.0 Basic Materials 847 XPEL 3 5.13 penny-cap Long NaN 3.0 2.254391e+07 29.0 Consumer Cyclical 901 RGR 2 0.04 penny-cap Long NaN 2.0 1.965288e+07 5.0 Industrials 746 TDS 3 -2.28 penny-cap Long NaN 3.0 1.871749e+07 48.0 Communication Services 679 AUB 3 0.06 penny-cap Long NaN 5.0 1.811505e+07 78.0 Financial Services 872 NMRK 4 0.09 penny-cap Long NaN 4.0 1.809841e+07 78.0 Real Estate 697 MD 4 -4.38 penny-cap Long NaN 4.0 1.686768e+07 29.0 Healthcare 772 EPC 5 -2.35 penny-cap Long NaN 5.0 1.629763e+07 43.0 Consumer Defensive 483 FLO 3 -1.26 penny-cap Long NaN 3.0 1.586986e+07 48.0 Consumer Defensive 626 GOLF 5 -3.00 penny-cap Long NaN 5.0 1.490808e+07 5.0 Consumer Cyclical 832 ARGO 5 0.53 penny-cap Long NaN 5.0 9.858121e+06 63.0 Financial Services 742 PBH 3 -0.44 penny-cap Long NaN 3.0 9.246797e+06 8.0 Healthcare 721 MTX 5 -1.72 penny-cap Long NaN 5.0 8.589024e+06 78.0 Basic Materials 650 GHC 4 -1.82 penny-cap Long NaN 4.0 7.505366e+06 29.0 Consumer Defensive 667 USM 2 -0.98 penny-cap Long NaN 2.0 4.422408e+06 48.0 Communication Services 482 SHI 3 0.60 penny-cap Long NaN 3.0 1.716639e+05 25.0 Energy Mean Return: -0.41290322580645167 Mean Day/Week: 3.7096774193548385 Accuracy:0.3548387096774194 *******************Part 3.6 Penny Cap Short Entry MACD********************* penny_short_signal_entry_macd Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 682 TIGR 5 -12.32 penny-cap Short NaN -5.0 1.206300e+08 -35.0 Financial Services 733 REAL 4 -41.95 penny-cap Short NaN -4.0 1.070395e+08 -9.0 Consumer Cyclical 527 TREE 5 -13.14 penny-cap Short NaN -5.0 1.046788e+08 -53.0 Financial Services 744 AUPH 4 11.41 penny-cap Short NaN -4.0 8.149469e+07 -49.0 Healthcare 489 WKHS 3 -6.19 penny-cap Short NaN -3.0 7.891730e+07 -56.0 Consumer Cyclical 518 STMP 5 -14.23 penny-cap Short NaN -5.0 6.098911e+07 -57.0 Technology 661 LTHM 1 0.00 penny-cap Short NaN -1.0 5.161862e+07 -50.0 Basic Materials 654 JKS 3 0.90 penny-cap Short NaN -3.0 4.750168e+07 -72.0 Technology 730 EAR 5 -7.77 penny-cap Short NaN -5.0 4.688092e+07 -39.0 Healthcare 634 TWOU 5 -7.17 penny-cap Short NaN -5.0 4.604786e+07 -43.0 Consumer Defensive 514 CRNC 4 -8.94 penny-cap Short NaN -4.0 4.482662e+07 -41.0 Technology 506 BAND 2 -4.16 penny-cap Short NaN -2.0 4.318162e+07 -54.0 Technology 545 SRNE 4 -8.61 penny-cap Short NaN -4.0 4.204598e+07 -44.0 Healthcare 604 CDLX 5 -12.23 penny-cap Short NaN -5.0 3.958211e+07 -10.0 Communication Services 575 VLDR 2 -9.81 penny-cap Short NaN -2.0 3.916772e+07 -61.0 Technology 524 ICUI 2 -2.92 penny-cap Short NaN -4.0 3.567720e+07 -4.0 Healthcare 486 CVET 1 0.00 penny-cap Short NaN -1.0 3.461837e+07 -41.0 Healthcare 662 GDOT 2 -4.05 penny-cap Short NaN -2.0 3.241486e+07 -77.0 Financial Services 521 ENV 4 -4.95 penny-cap Short NaN -4.0 3.236922e+07 -8.0 Technology 541 GKOS 3 -0.70 penny-cap Short NaN -4.0 3.188848e+07 -5.0 Healthcare 713 MSGE 1 0.00 penny-cap Short NaN -1.0 3.176754e+07 -37.0 Communication Services 799 IDEX 4 -4.88 penny-cap Short NaN -4.0 3.168963e+07 -39.0 Technology 495 CLDR 3 -1.80 penny-cap Short NaN -3.0 3.167503e+07 -44.0 Technology 549 EDIT 3 1.53 penny-cap Short NaN -3.0 3.023014e+07 -64.0 Healthcare 620 NSTG 2 -7.03 penny-cap Short NaN -5.0 2.798089e+07 -7.0 Healthcare 601 CRSR 1 0.00 penny-cap Short NaN -1.0 2.509254e+07 -54.0 Technology 522 KNSL 1 0.00 penny-cap Short NaN -1.0 2.465832e+07 -137.0 Financial Services 480 SAGE 5 2.57 penny-cap Short NaN -5.0 2.346680e+07 -7.0 Healthcare 568 VC 1 0.00 penny-cap Short NaN -1.0 2.201341e+07 -39.0 Consumer Cyclical 748 LUNG 3 -0.78 penny-cap Short NaN -3.0 2.150189e+07 -41.0 Healthcare 706 RMO 3 -4.17 penny-cap Short NaN -3.0 2.082951e+07 -105.0 Consumer Cyclical 566 RETA 2 -1.73 penny-cap Short NaN -2.0 1.969099e+07 -39.0 Healthcare 774 TBIO 1 0.00 penny-cap Short NaN -1.0 1.896464e+07 -39.0 Healthcare 600 RCKT 1 0.00 penny-cap Short NaN -1.0 1.876715e+07 -39.0 Healthcare 577 ARVN 3 2.64 penny-cap Short NaN -3.0 1.837945e+07 -42.0 Healthcare 474 GSHD 2 -3.56 penny-cap Short NaN -2.0 1.828774e+07 -39.0 Financial Services 899 TPGY 4 -15.75 penny-cap Short NaN -4.0 1.601254e+07 -50.0 Financial Services 647 UNIT 2 -0.48 penny-cap Short NaN -2.0 1.569541e+07 -51.0 Real Estate 803 PSNL 1 0.00 penny-cap Short NaN -1.0 1.519327e+07 -57.0 Healthcare 775 DEA 2 -2.63 penny-cap Short NaN -2.0 1.476822e+07 -53.0 Real Estate 472 KWR 1 0.00 penny-cap Short NaN -1.0 1.469898e+07 -49.0 Basic Materials 902 DBD 2 3.47 penny-cap Short NaN -4.0 1.442468e+07 -10.0 Technology 756 PRAX 1 0.00 penny-cap Short NaN -1.0 1.322064e+07 -54.0 Healthcare 754 ARCT 3 -9.21 penny-cap Short NaN -3.0 1.301698e+07 -65.0 Healthcare 925 VITL 5 -8.19 penny-cap Short NaN -5.0 1.270893e+07 -38.0 Consumer Defensive 560 VICR 3 -6.56 penny-cap Short NaN -3.0 1.245379e+07 -39.0 Technology 672 PLMR 3 -3.19 penny-cap Short NaN -3.0 1.238207e+07 -50.0 Financial Services 795 EBIX 1 0.00 penny-cap Short NaN -1.0 1.237878e+07 -57.0 Technology 640 ALXO 1 0.00 penny-cap Short NaN -1.0 1.227495e+07 -65.0 Healthcare 835 OCUL 2 -2.35 penny-cap Short NaN -2.0 1.185138e+07 -9.0 Healthcare 801 PMVP 1 0.00 penny-cap Short NaN -1.0 1.173644e+07 -76.0 Healthcare 903 CERS 2 -1.07 penny-cap Short NaN -2.0 1.130051e+07 -57.0 Healthcare 749 STTK 1 0.00 penny-cap Short NaN -1.0 1.104478e+07 -57.0 Healthcare 784 CSII 3 2.26 penny-cap Short NaN -3.0 1.091293e+07 -49.0 Healthcare 671 JOE 2 -2.66 penny-cap Short NaN -2.0 1.022213e+07 -36.0 Real Estate 571 MTLS 5 -8.11 penny-cap Short NaN -5.0 9.390752e+06 -56.0 Technology 913 CGEN 3 -4.22 penny-cap Short NaN -3.0 7.649553e+06 -65.0 Healthcare 836 MRSN 3 -2.76 penny-cap Short NaN -3.0 7.648207e+06 -137.0 Healthcare 888 HCC 1 0.00 penny-cap Short NaN -4.0 7.246593e+06 -54.0 Basic Materials 831 NRIX 4 -3.21 penny-cap Short NaN -4.0 6.579761e+06 -39.0 Healthcare 680 XNCR 5 -4.54 penny-cap Short NaN -5.0 6.519206e+06 -39.0 Healthcare 631 NOAH 1 0.00 penny-cap Short NaN -1.0 6.330483e+06 -37.0 Financial Services 924 ENTA 3 4.72 penny-cap Short NaN -4.0 6.228319e+06 -7.0 Healthcare 736 ADCT 3 -3.13 penny-cap Short NaN -3.0 6.060877e+06 -74.0 Healthcare 896 FDMT 5 -19.10 penny-cap Short NaN -5.0 5.252526e+06 -39.0 Healthcare 840 AROC 1 0.00 penny-cap Short NaN -1.0 5.137890e+06 -27.0 Energy 796 ICLK 3 0.93 penny-cap Short NaN -3.0 4.744558e+06 -36.0 Communication Services 717 BCAT 3 -0.59 penny-cap Short NaN -3.0 4.709439e+06 -61.0 unknown 916 AKRO 5 4.37 penny-cap Short NaN -5.0 3.326978e+06 -9.0 Healthcare 867 INBX 4 2.54 penny-cap Short NaN -4.0 1.013319e+06 -62.0 Healthcare 565 MOR 3 -1.42 penny-cap Short NaN -3.0 6.442853e+05 -59.0 Healthcare Mean Return: -4.6211320754716985 Mean Day/Week: 3.7169811320754715 Accuracy:0.7924528301886793 *******************Part 3.7 Penny Cap Long Maintainance********************* penny_long_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 546 X 7 -0.15 penny-cap Long NaN 7.0 1.016398e+09 34.0 Basic Materials 591 AA 14 13.50 penny-cap Long NaN 19.0 3.070210e+08 58.0 Basic Materials 791 UFS 13 35.81 penny-cap Long NaN 13.0 2.659447e+08 78.0 Basic Materials 475 CROX 12 0.73 penny-cap Long NaN 12.0 1.591045e+08 78.0 Consumer Cyclical 555 GRA 19 5.62 penny-cap Long NaN 27.0 1.443331e+08 34.0 Basic Materials 509 XEC 6 0.72 penny-cap Long NaN 6.0 1.114956e+08 78.0 Energy 473 BPOP 6 -0.37 penny-cap Long NaN 6.0 8.130548e+07 78.0 Financial Services 808 HOME 6 16.06 penny-cap Long NaN 14.0 7.564483e+07 78.0 Consumer Cyclical 534 OLN 10 0.83 penny-cap Long NaN 10.0 5.733758e+07 78.0 Basic Materials 818 DEN 12 3.86 penny-cap Long NaN 12.0 5.302143e+07 78.0 Energy 617 UNVR 14 9.81 penny-cap Long NaN 33.0 4.991429e+07 48.0 Basic Materials 764 MTDR 8 4.71 penny-cap Long NaN 8.0 4.864778e+07 79.0 Energy 538 WCC 11 11.21 penny-cap Long NaN 11.0 4.835675e+07 78.0 Industrials 922 SBLK 16 20.87 penny-cap Long NaN 16.0 4.707724e+07 78.0 Industrials 681 BNL 10 -0.28 penny-cap Long NaN 29.0 4.439778e+07 20.0 Real Estate 564 SGMS 12 -4.05 penny-cap Long NaN 20.0 4.292712e+07 16.0 Consumer Cyclical 602 R 8 1.83 penny-cap Long NaN 8.0 4.245573e+07 78.0 Industrials 693 TEX 7 0.92 penny-cap Long NaN 7.0 4.164094e+07 78.0 Industrials 765 PRFT 10 5.04 penny-cap Long NaN 10.0 4.064863e+07 78.0 Technology 592 AMN 10 11.97 penny-cap Long NaN 16.0 4.018439e+07 16.0 Healthcare 558 AWI 18 3.95 penny-cap Long NaN 18.0 3.891098e+07 78.0 Industrials 511 CC 14 8.43 penny-cap Long NaN 32.0 3.839323e+07 33.0 Basic Materials 691 FLR 7 -0.65 penny-cap Long NaN 7.0 3.749787e+07 48.0 Industrials 507 MSM 8 0.38 penny-cap Long NaN 8.0 3.558060e+07 48.0 Industrials 636 SAFM 6 0.32 penny-cap Long NaN 6.0 3.205234e+07 70.0 Consumer Defensive 668 RRR 11 -4.97 penny-cap Long NaN 11.0 3.093847e+07 78.0 Consumer Cyclical 627 PDCO 7 -1.12 penny-cap Long NaN 8.0 3.093090e+07 14.0 Healthcare 572 PACW 11 -1.34 penny-cap Long NaN 11.0 3.002136e+07 78.0 Financial Services 735 NAVI 45 23.60 penny-cap Long NaN 52.0 2.962057e+07 78.0 Financial Services 900 CYH 6 2.06 penny-cap Long NaN 6.0 2.803577e+07 9.0 Healthcare 517 GPK 6 -2.54 penny-cap Long NaN 6.0 2.784742e+07 47.0 Consumer Cyclical 849 RILY 6 0.67 penny-cap Long NaN 22.0 2.758918e+07 78.0 Financial Services 694 MIC 7 0.11 penny-cap Long NaN 7.0 2.654082e+07 26.0 Industrials 678 EXLS 6 0.64 penny-cap Long NaN 6.0 2.651796e+07 50.0 Technology 639 HWC 13 4.23 penny-cap Long NaN 13.0 2.425178e+07 78.0 Financial Services 658 ARNC 8 20.22 penny-cap Long NaN 22.0 2.352628e+07 21.0 Industrials 698 TROX 6 -5.33 penny-cap Long NaN 27.0 2.351275e+07 34.0 Basic Materials 666 CCOI 10 4.39 penny-cap Long NaN 10.0 2.331550e+07 46.0 Communication Services 787 MNR 6 -2.80 penny-cap Long NaN 6.0 2.330800e+07 78.0 Real Estate 704 FCFS 14 4.86 penny-cap Long NaN 21.0 2.170516e+07 49.0 Financial Services 508 VVV 19 13.73 penny-cap Long NaN 19.0 1.973419e+07 78.0 Energy 614 CWK 8 3.12 penny-cap Long NaN 8.0 1.930334e+07 48.0 Real Estate 743 OI 14 16.99 penny-cap Long NaN 33.0 1.873251e+07 34.0 Consumer Cyclical 739 SGRY 13 -0.39 penny-cap Long NaN 13.0 1.661911e+07 78.0 Healthcare 833 KALU 11 7.16 penny-cap Long NaN 11.0 1.574914e+07 78.0 Basic Materials 689 EVTC 7 4.39 penny-cap Long NaN 29.0 1.398422e+07 29.0 Technology 745 FBP 11 -0.17 penny-cap Long NaN 11.0 1.353523e+07 78.0 Financial Services 709 ENBL 12 12.06 penny-cap Long NaN 12.0 1.240258e+07 65.0 Energy 769 CSTM 7 0.70 penny-cap Long NaN 13.0 1.164319e+07 48.0 Basic Materials 683 CBT 8 7.31 penny-cap Long NaN 14.0 1.162273e+07 78.0 Basic Materials 878 WIRE 13 7.97 penny-cap Long NaN 13.0 1.154003e+07 78.0 Industrials 584 BCPC 7 -4.03 penny-cap Long NaN 8.0 1.067283e+07 57.0 Basic Materials 757 OR 8 7.36 penny-cap Long NaN 43.0 1.028664e+07 26.0 Basic Materials 616 NAD 7 0.23 penny-cap Long NaN 30.0 1.021121e+07 26.0 Financial Services 880 NXE 6 -6.72 penny-cap Long NaN 6.0 8.306753e+06 11.0 Energy 920 ARCO 10 7.54 penny-cap Long NaN 19.0 7.713081e+06 13.0 Consumer Cyclical 881 VLRS 12 1.57 penny-cap Long NaN 12.0 7.280252e+06 78.0 Industrials 649 JJSF 10 -0.09 penny-cap Long NaN 15.0 6.448956e+06 19.0 Consumer Defensive 828 RTLR 9 -1.37 penny-cap Long NaN 9.0 5.011956e+06 22.0 Energy 710 NZF 15 1.51 penny-cap Long NaN 27.0 5.006062e+06 26.0 Financial Services 804 SASR 7 -2.49 penny-cap Long NaN 7.0 4.993142e+06 78.0 Financial Services 827 HNI 10 2.26 penny-cap Long NaN 10.0 4.976242e+06 52.0 Industrials 869 CASH 9 -2.04 penny-cap Long NaN 9.0 4.940681e+06 78.0 Financial Services 895 FDP 6 -4.27 penny-cap Long NaN 6.0 4.549785e+06 53.0 Consumer Defensive 838 PFS 7 -1.74 penny-cap Long NaN 7.0 4.470975e+06 78.0 Financial Services 725 NAC 8 0.27 penny-cap Long NaN 31.0 4.323797e+06 27.0 Financial Services 844 FFG 8 0.07 penny-cap Long NaN 8.0 3.713907e+06 8.0 Financial Services 885 BPMP 6 2.18 penny-cap Long NaN 13.0 3.329141e+06 50.0 Energy 912 SBSI 7 -0.25 penny-cap Long NaN 7.0 3.130257e+06 78.0 Financial Services 644 BBU 10 4.23 penny-cap Long NaN 12.0 1.601632e+06 13.0 Industrials 882 NRK 8 0.00 penny-cap Long NaN 30.0 1.149431e+06 26.0 Financial Services 674 CIXX 25 9.11 penny-cap Long NaN 25.0 9.478753e+05 71.0 Financial Services 778 SIM 9 31.79 penny-cap Long NaN 22.0 6.130096e+05 22.0 Basic Materials 594 SLMBP 8 1.13 penny-cap Long NaN 13.0 1.681500e+05 78.0 Financial Services Mean Return: 4.227972972972973 Mean Day/Week: 10.283783783783784 Accuracy:0.6891891891891891 *******************Part 3.8 Penny Cap Short Maintainance********************* penny_short_signal_maintainance Symbol Day Return Market Cap Long/Short score MACD Signal Count Market Value Span Signal Count industry 664 TLRY 8 -13.45 penny-cap Short NaN -55.0 2.846513e+08 -35.0 Healthcare 493 EVBG 6 -4.36 penny-cap Short NaN -6.0 1.403194e+08 -48.0 Technology 490 SHAK 9 -26.50 penny-cap Short NaN -54.0 1.382255e+08 -25.0 Consumer Cyclical 853 SNDL 10 -23.32 penny-cap Short NaN -53.0 1.364656e+08 -34.0 Healthcare 619 NNOX 27 -64.03 penny-cap Short NaN -61.0 1.279678e+08 -57.0 Healthcare 529 MGNI 7 -27.86 penny-cap Short NaN -53.0 9.622941e+07 -35.0 Communication Services 561 INSM 6 -11.62 penny-cap Short NaN -6.0 8.599285e+07 -42.0 Healthcare 532 FSR 15 -28.03 penny-cap Short NaN -39.0 8.377238e+07 -32.0 Consumer Cyclical 648 BNGO 9 -28.51 penny-cap Short NaN -56.0 7.652219e+07 -33.0 Healthcare 610 CSIQ 9 -14.28 penny-cap Short NaN -9.0 7.535924e+07 -50.0 Technology 510 NOVA 7 -18.04 penny-cap Short NaN -7.0 6.967285e+07 -51.0 Technology 696 NNDM 10 -25.80 penny-cap Short NaN -59.0 6.916638e+07 -50.0 Technology 573 BBBY 23 -20.56 penny-cap Short NaN -35.0 6.852520e+07 -46.0 Consumer Cyclical 595 INO 36 -35.95 penny-cap Short NaN -54.0 5.936548e+07 -51.0 Healthcare 599 IRBT 10 -16.35 penny-cap Short NaN -55.0 5.844587e+07 -44.0 Technology 790 GEVO 7 -24.54 penny-cap Short NaN -57.0 5.835511e+07 -28.0 Basic Materials 516 LPSN 7 -2.23 penny-cap Short NaN -7.0 5.611188e+07 -50.0 Technology 539 CCXI 7 -62.36 penny-cap Short NaN -7.0 5.310072e+07 -49.0 Healthcare 570 AMBA 9 -14.07 penny-cap Short NaN -54.0 4.915503e+07 -36.0 Technology 536 YALA 11 -8.55 penny-cap Short NaN -56.0 4.780005e+07 -36.0 Technology 528 KRNT 10 -9.49 penny-cap Short NaN -18.0 4.688979e+07 -23.0 Industrials 606 FLGT 10 -16.83 penny-cap Short NaN -56.0 4.666321e+07 -35.0 Healthcare 533 PD 6 -12.70 penny-cap Short NaN -6.0 4.578705e+07 -50.0 Technology 750 BLNK 10 -27.27 penny-cap Short NaN -20.0 4.340261e+07 -51.0 Consumer Cyclical 567 EGHT 8 -26.64 penny-cap Short NaN -8.0 4.276430e+07 -10.0 Technology 576 DNMR 12 -50.97 penny-cap Short NaN -57.0 4.109566e+07 -35.0 Basic Materials 609 BLKB 6 3.03 penny-cap Short NaN -54.0 4.098141e+07 -10.0 Technology 589 VCYT 11 -31.84 penny-cap Short NaN -19.0 4.034168e+07 -41.0 Healthcare 499 HASI 7 -7.40 penny-cap Short NaN -7.0 3.919965e+07 -59.0 Real Estate 603 TSEM 9 -10.79 penny-cap Short NaN -18.0 3.511630e+07 -36.0 Technology 716 TPIC 6 -11.79 penny-cap Short NaN -6.0 3.479846e+07 -53.0 Industrials 628 GBT 6 -8.27 penny-cap Short NaN -6.0 3.478537e+07 -54.0 Healthcare 523 MTSI 10 -13.77 penny-cap Short NaN -10.0 3.477022e+07 -12.0 Technology 477 WK 8 -1.77 penny-cap Short NaN -8.0 3.396498e+07 -39.0 Technology 469 ALLO 9 -9.81 penny-cap Short NaN -10.0 3.382864e+07 -11.0 Healthcare 738 CLNE 10 -32.23 penny-cap Short NaN -55.0 3.330793e+07 -28.0 Energy 623 AMRN 27 -36.56 penny-cap Short NaN -58.0 3.303613e+07 -39.0 Healthcare 781 ACMR 10 -20.96 penny-cap Short NaN -53.0 3.277590e+07 -35.0 Technology 711 LAC 8 -7.73 penny-cap Short NaN -8.0 3.020630e+07 -50.0 Basic Materials 515 DOYU 10 -15.23 penny-cap Short NaN -50.0 3.015225e+07 -36.0 Communication Services 543 OPK 11 -21.66 penny-cap Short NaN -57.0 3.003444e+07 -45.0 Healthcare 906 DMTK 10 -29.39 penny-cap Short NaN -49.0 2.993816e+07 -33.0 Healthcare 839 STKL 12 -6.36 penny-cap Short NaN -56.0 2.846187e+07 -18.0 Consumer Defensive 727 AVNS 9 -11.01 penny-cap Short NaN -9.0 2.815655e+07 -39.0 Healthcare 688 SSYS 8 -8.92 penny-cap Short NaN -8.0 2.747576e+07 -49.0 Technology 504 EH 10 -22.48 penny-cap Short NaN -59.0 2.628541e+07 -49.0 Industrials 794 FSM 12 3.10 penny-cap Short NaN -12.0 2.538786e+07 -53.0 Basic Materials 554 AHCO 21 -14.35 penny-cap Short NaN -22.0 2.532819e+07 -22.0 Healthcare 502 ARNA 6 -4.78 penny-cap Short NaN -6.0 2.522309e+07 -39.0 Healthcare 503 JAMF 6 -9.70 penny-cap Short NaN -8.0 2.517476e+07 -8.0 Technology 677 MAXR 7 3.58 penny-cap Short NaN -7.0 2.383278e+07 -41.0 Technology 487 ALRM 7 -4.65 penny-cap Short NaN -7.0 2.381524e+07 -11.0 Technology 665 CSOD 14 -6.30 penny-cap Short NaN -47.0 2.374044e+07 -35.0 Technology 574 ITRI 7 -0.17 penny-cap Short NaN -7.0 2.353599e+07 -46.0 Technology 579 OPCH 6 -7.93 penny-cap Short NaN -6.0 2.313148e+07 -12.0 Healthcare 611 FORM 9 -16.32 penny-cap Short NaN -11.0 2.287422e+07 -10.0 Technology 585 SEER 7 -35.43 penny-cap Short NaN -7.0 2.282894e+07 -109.0 Healthcare 918 GTHX 16 -8.32 penny-cap Short NaN -18.0 2.243436e+07 -41.0 Healthcare 871 FTOC 6 -2.18 penny-cap Short NaN -57.0 2.229082e+07 -41.0 Financial Services 605 CORT 7 -7.22 penny-cap Short NaN -7.0 2.206276e+07 -51.0 Healthcare 722 QTRX 7 -8.43 penny-cap Short NaN -7.0 2.187543e+07 -47.0 Healthcare 879 ADVM 10 -3.16 penny-cap Short NaN -10.0 2.170483e+07 -51.0 Healthcare 557 PTCT 40 -36.01 penny-cap Short NaN -80.0 2.155888e+07 -65.0 Healthcare 612 MOMO 7 -1.91 penny-cap Short NaN -7.0 2.155346e+07 -37.0 Communication Services 767 RPAY 7 -2.61 penny-cap Short NaN -11.0 2.100298e+07 -12.0 Technology 724 SITM 7 -5.04 penny-cap Short NaN -7.0 2.084918e+07 -54.0 Technology 866 GNOG 7 -24.04 penny-cap Short NaN -7.0 2.033290e+07 -106.0 Consumer Cyclical 625 MMYT 6 -3.51 penny-cap Short NaN -35.0 2.028937e+07 -26.0 Consumer Cyclical 761 ENDP 26 -20.29 penny-cap Short NaN -52.0 1.978137e+07 -33.0 Healthcare 491 FTDR 7 -0.66 penny-cap Short NaN -15.0 1.814660e+07 -15.0 Consumer Cyclical 760 INFN 6 -1.78 penny-cap Short NaN -18.0 1.785906e+07 -10.0 Technology 590 NIU 6 -18.48 penny-cap Short NaN -6.0 1.744136e+07 -36.0 Consumer Cyclical 526 WDFC 23 -10.13 penny-cap Short NaN -56.0 1.710670e+07 -24.0 Basic Materials 624 BZUN 10 -10.68 penny-cap Short NaN -51.0 1.681139e+07 -36.0 Consumer Cyclical 652 LGND 11 -15.00 penny-cap Short NaN -59.0 1.666516e+07 -36.0 Healthcare 741 KURA 7 -2.96 penny-cap Short NaN -7.0 1.636574e+07 -137.0 Healthcare 479 SMTC 8 -11.97 penny-cap Short NaN -8.0 1.586723e+07 -12.0 Technology 646 PHR 7 -9.43 penny-cap Short NaN -7.0 1.569827e+07 -42.0 Healthcare 578 GOEV 7 -7.87 penny-cap Short NaN -7.0 1.557193e+07 -66.0 Consumer Cyclical 581 CRON 10 -14.17 penny-cap Short NaN -56.0 1.539458e+07 -37.0 Healthcare 544 RSI 10 -12.29 penny-cap Short NaN -37.0 1.527184e+07 -38.0 Consumer Cyclical 732 AMCX 6 2.19 penny-cap Short NaN -36.0 1.488476e+07 -32.0 Communication Services 806 SLP 7 -4.82 penny-cap Short NaN -7.0 1.481153e+07 -41.0 Healthcare 785 CSTL 6 -16.49 penny-cap Short NaN -6.0 1.479663e+07 -48.0 Healthcare 542 AJRD 12 -1.04 penny-cap Short NaN -13.0 1.477513e+07 -49.0 Industrials 817 PAYA 18 -18.80 penny-cap Short NaN -39.0 1.421315e+07 -59.0 Technology 718 RMBS 9 -4.95 penny-cap Short NaN -19.0 1.400771e+07 -18.0 Technology 766 PBI 9 -3.95 penny-cap Short NaN -9.0 1.360487e+07 -10.0 Industrials 851 MAXN 35 -57.61 penny-cap Short NaN -59.0 1.340782e+07 -40.0 Technology 720 STRA 10 0.48 penny-cap Short NaN -20.0 1.330036e+07 -18.0 Consumer Defensive 684 DCPH 6 -11.11 penny-cap Short NaN -6.0 1.279642e+07 -8.0 Healthcare 859 VERI 8 -22.00 penny-cap Short NaN -8.0 1.275009e+07 -48.0 Technology 669 BMI 10 -4.35 penny-cap Short NaN -51.0 1.264647e+07 -39.0 Industrials 751 SGMO 6 0.96 penny-cap Short NaN -6.0 1.258864e+07 -64.0 Healthcare 719 EPAY 6 -5.03 penny-cap Short NaN -6.0 1.173021e+07 -7.0 Technology 877 ICPT 6 -6.10 penny-cap Short NaN -6.0 1.144385e+07 -57.0 Healthcare 770 CALM 6 -2.00 penny-cap Short NaN -32.0 1.115332e+07 -17.0 Consumer Defensive 763 PRO 8 -12.34 penny-cap Short NaN -8.0 1.080548e+07 -11.0 Technology 501 HCM 6 -11.03 penny-cap Short NaN -6.0 1.065919e+07 -57.0 Healthcare 643 RVMD 11 -5.88 penny-cap Short NaN -35.0 1.043390e+07 -26.0 Healthcare 893 NVEE 11 -10.77 penny-cap Short NaN -50.0 1.028933e+07 -25.0 Industrials 852 CEVA 9 -23.94 penny-cap Short NaN -53.0 1.017297e+07 -36.0 Technology 552 AAON 19 -7.28 penny-cap Short NaN -57.0 9.955777e+06 -36.0 Industrials 737 YEXT 8 -7.66 penny-cap Short NaN -8.0 9.723535e+06 -49.0 Technology 865 SY 6 3.60 penny-cap Short NaN -6.0 9.642127e+06 -40.0 Healthcare 829 VCRA 9 -8.25 penny-cap Short NaN -9.0 9.278048e+06 -43.0 Technology 498 RLAY 6 -9.28 penny-cap Short NaN -6.0 9.001909e+06 -67.0 Healthcare 825 IMGN 6 -13.23 penny-cap Short NaN -49.0 8.999165e+06 -32.0 Healthcare 786 PGEN 6 3.30 penny-cap Short NaN -6.0 8.896339e+06 -41.0 Healthcare 857 EVER 9 -9.05 penny-cap Short NaN -50.0 8.850991e+06 -43.0 Communication Services 905 GSAH 7 -2.14 penny-cap Short NaN -53.0 8.681199e+06 -44.0 Financial Services 815 CNST 37 -29.58 penny-cap Short NaN -55.0 8.660467e+06 -55.0 Healthcare 908 MORF 6 2.68 penny-cap Short NaN -33.0 8.494000e+06 -22.0 Healthcare 638 VNE 11 -6.28 penny-cap Short NaN -11.0 8.334066e+06 -27.0 Consumer Cyclical 505 NEU 17 -10.34 penny-cap Short NaN -37.0 7.652124e+06 -59.0 Basic Materials 917 WPRT 7 -22.03 penny-cap Short NaN -55.0 7.013270e+06 -36.0 Consumer Cyclical 868 LASR 10 -13.76 penny-cap Short NaN -50.0 6.969430e+06 -36.0 Technology 841 SOL 7 -18.03 penny-cap Short NaN -7.0 6.850928e+06 -51.0 Technology 919 DHC 7 -17.04 penny-cap Short NaN -35.0 6.794459e+06 -17.0 Real Estate 864 FARO 9 -8.00 penny-cap Short NaN -38.0 6.772811e+06 -10.0 Technology 894 EOSE 29 -48.10 penny-cap Short NaN -76.0 6.576165e+06 -55.0 Industrials 898 QNST 7 -11.92 penny-cap Short NaN -7.0 6.526846e+06 -38.0 Communication Services 550 VVNT 17 -10.09 penny-cap Short NaN -17.0 6.500209e+06 -72.0 Industrials 776 ADUS 6 3.73 penny-cap Short NaN -7.0 6.171382e+06 -10.0 Healthcare 768 AZRE 9 -16.78 penny-cap Short NaN -9.0 5.884897e+06 -61.0 Utilities 729 GTH 7 -6.49 penny-cap Short NaN -55.0 5.855001e+06 -36.0 Healthcare 923 SRG 7 -14.55 penny-cap Short NaN -37.0 5.711794e+06 -24.0 Real Estate 481 VERX 7 -17.22 penny-cap Short NaN -7.0 5.493534e+06 -50.0 Technology 547 DAO 6 -4.06 penny-cap Short NaN -6.0 5.377306e+06 -39.0 Communication Services 907 PHAT 7 -2.21 penny-cap Short NaN -7.0 5.194296e+06 -32.0 Healthcare 876 NKTX 7 -12.04 penny-cap Short NaN -7.0 5.155419e+06 -56.0 Healthcare 759 PQG 11 6.22 penny-cap Short NaN -37.0 4.968509e+06 -12.0 Basic Materials 802 PNTG 11 -24.25 penny-cap Short NaN -82.0 4.566641e+06 -57.0 Healthcare 753 SRRK 7 -3.34 penny-cap Short NaN -35.0 4.373598e+06 -35.0 Healthcare 873 CLLS 6 -9.25 penny-cap Short NaN -6.0 4.353914e+06 -60.0 Healthcare 830 KNSA 7 -6.58 penny-cap Short NaN -39.0 3.442165e+06 -37.0 Healthcare 910 RBBN 12 -18.42 penny-cap Short NaN -53.0 3.360715e+06 -36.0 Communication Services 890 ATRI 11 -6.70 penny-cap Short NaN -11.0 3.330277e+06 -15.0 Healthcare 779 SPNS 6 -10.30 penny-cap Short NaN -7.0 3.289829e+06 -7.0 Technology 813 SBTX 12 -27.36 penny-cap Short NaN -35.0 3.254501e+06 -32.0 Healthcare 809 HY 9 -11.01 penny-cap Short NaN -56.0 2.826353e+06 -25.0 Industrials 892 RMAX 17 -3.13 penny-cap Short NaN -39.0 2.476189e+06 -22.0 Real Estate 874 GRVY 8 -1.70 penny-cap Short NaN -8.0 2.380125e+06 -68.0 Communication Services 889 LXRX 11 -14.48 penny-cap Short NaN -61.0 2.213932e+06 -36.0 Healthcare 821 KNTE 18 -15.58 penny-cap Short NaN -36.0 1.957334e+06 -110.0 Healthcare 705 CANG 28 -43.23 penny-cap Short NaN -58.0 1.665336e+06 -43.0 Communication Services 897 MESO 12 -9.83 penny-cap Short NaN -12.0 9.669919e+05 -137.0 Healthcare 891 SCWX 11 -1.92 penny-cap Short NaN -54.0 8.081942e+05 -40.0 Technology 812 HLG 36 -16.38 penny-cap Short NaN -36.0 7.041300e+04 -75.0 Consumer Defensive 824 MSC 9 6.69 penny-cap Short NaN -43.0 4.608640e+03 -137.0 Consumer Cyclical Mean Return: -13.277133333333333 Mean Day/Week: 10.593333333333334 Accuracy:0.92 ************************************** ************************************** ************************************** Error: []

0 notes

Photo

Event Swordsman Legends Summer Bagikan 9999 Diamond Gratis

(function(d,a,b,l,e,_) if(d[b]&&d[b].q)return;d[b]=function()[]).push(arguments);e=a.createElement(l); e.async=1;e.charset='utf-8';e.src='//static.dable.io/dist/plugin.min.js'; _=a.getElementsByTagName(l)[0];_.parentNode.insertBefore(e,_); )(window,document,'dable','script'); dable('setService', 'kabargames.id'); dable('sendLogOnce'); dable('renderWidget', 'dablewidget_1oV9EjXP'); Hai para pemburu hadiah! Kamu yang ingin mendapatkan banyak hadiah jangan lewatkan Elite Pass Season 35 yang akan hadir di tepat di tanggal 1 April 2021 sampai 30 April 2021 mendatang. Mengusung nama Bloodwing City, Elite Pass Season 35 Free Fire menyapa pemain dengan ciri khas skin yang di dominasi merah dan hitam. Serupa dengan pendahulunya, yakni Elite Pass Season 34 ‘Willful Wonders’, Elite Pass Season 35 Bloodwing City ini juga menawarkan sejumlah hadiah exclusive. Sesuai dengan tema, pemain yang beruntung berkesempatan mendapatkan pernak-pernik in-game bertema kelelawar. Baca Juga : Event Swordsman Legends Summer Bagikan 9999 Diamond Gratis Valid! 5 Pemain dengan Badge Terbanyak Elite Pass Season 34 Kode Redeem Free Fire (FF) April 2021 yang Belum Digunakan FF Advance Server April Segera Dibuka, Dapatkan 3K Diamond Dapatkan 9.999 Diamond & Bundle di Event Shoreline Angel googletag.cmd.push(function() googletag.display('div-gpt-ad-9949385-2'); ); Cara Beli Elite Pass Season 35 Elite Pass Season 35 Bloodwing City terbagi menjadi 2, yaitu Free dan Elite. Untuk bisa membuka hadiah yang disediakan kalian cukup mengeluarkan 999 Diamond saja. Dimana diamonds ini akan digunakan untuk mengupgrade pass ke versi Elite. Cara Pre-order Elite Pass Season 35 NATIVE CONTENT Kimi Hime: Biodata, Fakta, Meme, Foto & Thumbnail Seksi di YT KameAam: Biodata, Fakta & Foto Cosplay Seksi Mobile Legend Lola Zieta: Biodata, Fakta & Kumpulan Foto Cosplay Seksi Sarah Viloid: Biodata, Fakta & Kumpulan Foto Seksi Buat kamu yang ingin mengikuti Pre-order Elite Pass Season 35, simak dan ikuti yuk cara berikut ini: Buka ‘Elite Pass’ di Garena Free Fire Selanjutnya pilih ‘Pre-Order’ yang berada di samping opsi upgrade Tekan ikon ‘Pre-Order’ dengan 999 Diamond Kamu akan dihadapkan dengan pop-up guna mengkonfirmasi pembelian Pelih beli dengan mengklik tombol warna kuning Hadiah pan Blooding City dapat ditemukan di dalam Vault Event Pre-Order Elite Pass Season 35 Loading… (function()var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:';var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M450849ScriptRootC398142")[ac](i);tryvar iw=i.contentWindow.document;iw.open();iw.writeln("");iw.close();var c=iw[b];catch(e)var iw=d;var c=d[gi]("M450849ScriptRootC398142");var dv=iw[ce]('div');dv.id="MG_ID";dv[st][ds]=n;dv.innerHTML=398142;c[ac](dv);var s=iw[ce]('script');s.async='async';s.defer='defer';s.charset='utf-8';s.src=wp+"//jsc.mgid.com/k/a/kabargames.id.398142.js?t="+D.getYear()+D.getMonth()+D.getUTCDate()+D.getUTCHours();c[ac](s);)(); Event pre-order yang diselenggarakan Garena Free Fire (FF) menawarkan hadiah exclusive yang hanya bisa kalian dapatkan saat event ini berlangsung (periode pembelian mulai 28-31 Maret 2021). Hadiah untuk Pre-order pada Season 35 Bloodwing City adalah sebagai berikut: Jeep – Bloodwing City Bloodwing Lass Bundle Bloodwing Slasher Vampire Bat Thompson – Bloodwing City Triple Kicks Bloodwing Surfboard Bloodwing City Loot Box Bloodwing Lad Bundle Hadiah Elite Pass Season 35 tidak akan diberikan secara cuma-cuma. Namun para pemain akan diminta untuk mengumpulkan 250 Badge terlebih dulu. Badge ini bisa kalian dapatkan dengan cara menyelesaikan setiap misi yang dihadirkan, baik itu misi harian atau mingguan. Jika memiliki cukup uang dan tidak mau repot, kamu bisa membeli Badge dengan harga 20 Diamond per Badge. Baca Juga : Event Swordsman Legends Summer Bagikan 9999 Diamond Gratis Polisi China Ringkus Penjual Cheat Game Terbesar di Dunia Valid! 5 Pemain dengan Badge Terbanyak Elite Pass Season 34 Kode Redeem Free Fire (FF) April 2021 yang Belum Digunakan Dapatkan Jeep Gratis di Elite Pass Season 35 Bloodwing City Daftar Hadiah Elite Pass Season 35 Elite Pass Season 35 didominasi pernak-pernik berwarna merah dan hitam yang terinspirasi dari kelelawar. Selain hadiah bundle utama, kamu bisa mendapatkan skin Thompson, Jeep, Loot Box, hingga tas bertema sama. 1. Elite Pass Season 35 (Free) 0 Badge : 50 Gold 5 Badge : Avatar EP S35 10 Badge : Scan x3 20 Badge : Pet Food 30 Badge : Gold Royale Voucher 40 Badge : Atasan pria 50 Badge : Diamond Royale Voucher 60 Badge : Fragment Crate 70 Badge : Discount Voucher 80 Badge : Pet Food 85 Badge : Evo Gun Token Box 90 Badge : 300 Gold 100 Badge : Kaos pria 120 Badge : Summon Airdrop x3 130 Badge : Gold Royale Voucher 140 Badge : Resupply Map x3 145 Badge : Evo Gun Token Box 150 Badge : Banner EP S35 160 Badge : 500 Gold 170 Badge : Fragment Crate II 180 Badge : Bonfire x3 190 Badge : Gold Royale Voucher 200 Badge : Skin parasut 205 Badge : Evo Gun Token Box 210 Badge : Gold Royale Voucher 220 Badge : Bounty Token x3 225 Badge : Awakening Shard 2. Elite Pass Season 35 (Elite) 0 Badge : Skin Jeep 5 Badge : Summon Airdrop x5 10 Badge : Avatar EP S35 15 Badge : Atasan wanita 20 Badge : Weapon Royale Voucher 25 Badge : Resupply Map Playcard (1 Hari) 30 Badge : Banner EP S35 35 Badge : 500 Gold 40 Badge : Diamond Voucher 45 Badge : Bounty Token Playcard (1 Hari) 50 Badge : Bundle wanita 55 Badge : Pet Food x3 60 Badge : Diamond Royale Voucher 65 Badge : Double EXP Card (7 Hari) 70 Badge : Evo Gun Token Box x2 75 Badge : Memory Fragment (Skyler) x100 80 Badge : Skin Machete 85 Badge : Resupply Map x5 90 Badge : Weapon Royale Voucher 95 Badge : Pet Food x3 100 Badge : Skin tas 105 Badge : Scan Playcard (1 Hari) 110 Badge : 500 Gold 115 Badge : Banner EP S35 120 Badge : Scan x3 125 Badge : Skin Thompson 130 Badge : Memory Fragment (Shirou) x100 135 Badge : Avatar EP S35 140 Badge : Emote 145 Badge : Double Gold Card (7 Hari) 150 Badge : Skin Surfboard 155 Badge : Summon Airdrop Playcard (1 Hari) 160 Badge : Pet Food x3 165 Badge : Universal Fragment x100 170 Badge : Cube Fragment x10 175 Badge : Bonfire Playcard (1 Hari) 180 Badge : Evolution Stone 185 Badge : Bounty Token x5 190 Badge : Discount Coupon 195 Badge : Evo Gun Token Box 200 Badge : Skin Loot Crate 205 Badge : Character Lvl.4 Card 210 Badge : Pet Food x3 215 Badge : Universal Fragment x100 220 Badge : Bonfire x5 225 Badge : Bundle pria 250 Badge : Elite Pass Exclusive Chest Nantikan terus informasi terupdate seputar game, gadget dan anime hanya di Kabar Games. Supaya kamu tidak ketinggalan berita, kamu bisa follow akun Instagram dan Facebook Kabar Games. Kamu juga bisa bergabung bersama kami di dalam Channel Discord Kabar Games. Jangan lupa tinggalkan komentar kalian ya! (function(d,a,b,l,e,_) if(d[b]&&d[b].q)return;d[b]=function()[]).push(arguments);e=a.createElement(l); e.async=1;e.charset='utf-8';e.src='//static.dable.io/dist/plugin.min.js'; _=a.getElementsByTagName(l)[0];_.parentNode.insertBefore(e,_); )(window,document,'dable','script'); dable('setService', 'kabargames.id'); dable('sendLogOnce'); dable('renderWidget', 'dablewidget_KoEP9KXB');

https://www.kabargames.id/event-swordsman-legends-summer-bagikan-9999-diamond-gratis/

#BattleRoyale, #EventFreeFire #FreeFire

0 notes

Photo

Santa's Toy Monster Attacks (2011)

Merry Christmas, DA!

For my 2011 Christmas Card, I decided to go with a design involving Santa Claus sicking his toy monster on a naughty kid.

This piece was by far this most ambitious piece I've ever done. I looked back and saw that I posted my first draft of this piece in my DeviantArt scrapbook on June 29th, and I've just completed it finally on November 12th... Dang.

I am really proud of this piece, and I'd love to hear your thoughts.

You can also view a progress video to see how this piece came together over on you tube: [link]

Thanks To: -- A Blanket of Snow by ~midnightstouchSTOCK (reference) -- frecklebrush by ~Dojang (PS freckle paintbrush) -- SNOW PS7 Brushes and IMG Pack by ~KeepWaiting (PS snow flake paintbrush) -- THe Valley of Childhood Toys by ~MGrigsbyArt (toy ideas... check this out. similar idea and AWESOME execution)

On the subject of the toys, after hours and HOURS of googling, wracking my brain, and soliciting ideas from friends and family I've incorporated the following 200 toys to make up Stanta's toy monster... Enjoy!