#10034359

Text

A Guide To Self-Care During A Pandemic

Please be aware that all forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. We encourage our investors to invest carefully. All information provided in this article is on an "as is" basis, and is purely for information purposes. It is not intended for trading purposes or financial advice. Neither we nor any of our partners is liable for any informational errors, incompleteness, delays or for any actions taken in reliance on information contained in this article.

0 notes

Text

Protect your wealth by protecting your health

We might know someone—a mum, sister, grandma or an aunt – who has faced a critical illness like cancer. And it can be difficult to watch. Though many recover their health, the same cannot be said for their finances. A critical illness like breast cancer, which strikes 1 in 11 women in Singapore1, costs an average of S$8,000 to S$17,000 per month to treat2 – and treatment can take years.

Risks faced by modern women

The reality is that health and wealth go hand in hand, like how treatment prices soar as medical technology advances. If a health crisis catches you off guard, it could wipe out your savings, putting your loved ones under emotional and financial strain.

If you lose significant income because you need time off work to recover, the setback could be even longer term. Mortgage payments could be interrupted. Your children’s education fees could be diverted to medical treatment. It could threaten their future.

The risk increases during times of economic uncertainty. If interest rates are stagnant or falling, your cash might not grow outside of an interest-bearing or investment-tracking product. Add positive inflation into the mix, and your spending power will go down.

Based on research carried out by the Life Insurance Association Singapore, many face a significant CI protection gap of S$256,000. While the average CI cover is S$60,000, the reality is that people will need protection of at least S$316,000 to meet their needs3. Moreover, the older and more financially stable we get, the more expensive CI cover becomes. The smart move would be to take decisive action before a health crisis strikes.

Time to take back control

But that does not mean you should rush into investments. During an unstable market, you could be putting your savings at risk. What you need is a stable way to grow your money, while protecting your savings against critical illness.

The answer is adequate medical and critical illness protection. With life expectancy rising, Singaporeans are facing greater odds of becoming critically ill. This makes insurance protection an essential element of the savvy woman’s financial portfolio.

Another way to make your money work harder is to choose a good savings account that offers better rewards the more you save. This is often easier said than done as it involves a mindset shift – from one that is focused on the monetary rewards in the form of interest earned on your savings, to one where you look beyond to other benefits, such as critical illness coverage.

The upside of this is your savings account still earns interest, and is not locked up in long-term investments. If an emergency happens, you will still have cash to spare without interrupting your investments. On top of that, you also have critical illness coverage.

Best of both worlds

Enter the new UOB Lady’s Savings Account. This smart savings account makes your money work for you while providing up to S$200,000 female cancer coverage. This can substantially offset the average cost of treating critical illnesses. You will be covered for six types of female cancer, including breast, uterine and ovarian cancers, which are among the ten most common in Singapore4. All for absolutely zero premium payment on your side.

With the UOB Lady’s Savings Account, female cancer coverage is free and guaranteed# to eligible account holders as long as you maintain their Monthly Average Balance (MAB). Here’s an overview of the UOB Lady’s Savings Account and how you can get protected up to S$200,000.

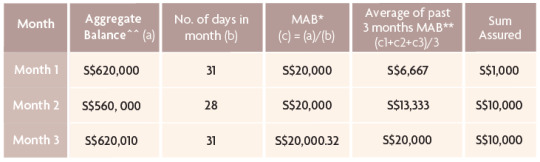

The female cancer benefit is based on the rolling average of the account holder’s MAB over the previous three months. See the illustration table below.

^^ Aggregate balance is the summation of all the daily day-end balances

* Rounded down to 2 decimal places

** Rounded to nearest digit, without decimal

Enjoy complimentary yearly health checks for obesity/blood pressure, cholesterol, diabetes and ovarian cancer marker (CA 125), as well as a 3-strain flu vaccination. All this, along with S$13 flat-fee standard GP consultations (excluding GST, surcharges, medication and procedures) at any of the 500 clinics under MHC Asia Group island-wide, for you and up to 4 dependents. Most important of all, you will be looking out for your family by saving smarter and getting critical illness protection. After all, your safety net is their security too.

Sign up for a new UOB Lady’s Savings Account online via uob.com.sg/ladysaccount02, or the UOB Mighty app and get up to S$80 cash credit. Plus, deposit a minimum of S$10,000 into your new account to enjoy up to 10X additional UNI$ on either Fashion or Family category spend on your UOB Lady’s Card. Full terms and conditions apply.

# Subject to the exclusions and provisions contained in UOB Lady’s Savings Account Group Cancer Plan and UOB Lady’s Savings Account Terms and Conditions.

1 https://www.singaporecancersociety.org.sg/learn-about-cancer/types-of-cancer/breast-cancer.html

2 https://thecareissue.jaga-me.com/the-true-cost-of-breast-cancer-in-singapore/

3 https://www.lia.org.sg/media/1332/protection-gap-study-report-2017.pdf

4 https://www.singaporecancersociety.org.sg/learn-about-cancer/cancer-basics/common-types-of-cancer-in-singapore.html

This content was produced in partnership with UOB.

0 notes