#100 fix and flip loans no credit check

Explore tagged Tumblr posts

Text

Read now 100 fix and flip loans no credit check

100 fix and flip loans no credit check, as credit checks are important to assess a borrower’s ability to repay the loan. Additionally, there are laws and regulations in place that require lenders to check a borrower’s credit history before providing them with a loan. Offering “no credit check” loans would not only be irresponsible, but it could also put borrowers at risk of default and cause harm…

View On WordPress

#100 fix and flip loans no credit check#Amar beast#Amarbeast#Amarbeast.com#fix and flip#no credit check

0 notes

Text

100% PURCHASE PRICE FINANCING FIX & FLIPS - $50,000 - $250,000.00 - NO CREDIT CHECK!

NO CREDIT CHECK 100% Purchase Price Financing For Investors. Use for Investor Fix & Flip deals OR rental ready purchases. Loan amounts from $50,000 - $250,000.00. COST OF RENOVATION NOT INCLUDED IN LOAN AMOUNT. NO APPRAISAL REQUIRED. Close in 10 business days. Must have one (1) prior completed flip in last 24 months. Single family and 2-4 units including town-homes. No Income Verified. No Employment Verified. No prepayment penalty. 24 hour prequalification. Apply online at investorrehabfunding.com

NAME: Investor Rehab Funding, LLC Email: [email protected] Contact Phone: 844-244-1420 URL: https://www.investorrehabfunding.com/platinum-fix-flip-funding-program/

0 notes

Video

youtube

Brad Smotherman on Flipping Real Estate

https://www.jayconner.com/brad-smotherman-on-flipping-real-estate/

Brad Smotherman manages a 7 figure flipping business, and hold notes across Middle Tennessee. We invest in multiple states, and have houses from Michigan to Georgia right now.

Real Estate Cashflow Conference: https://www.jayconner.com/learnrealestate/

Free Webinar: https://www.jayconner.com/training/wtgtmn-webinar-rev2-podcast/?oprid=&ref=42135

Jay Conner is a proven real estate investment leader. Without using his own money or credit, Jay maximizes creative methods to buy and sell properties with profits averaging $64,000 per deal.

The Private Money Academy http://www.JayConner.com/Trial

———————————————————————-

Jay Conner (00:01): Well, hello there! And welcome to another exciting episode of Real Estate Investing with Jay Conner. I’m Jay Conner, your host of the show. Also known as The Private Money Authority. And if you’re brand new to the show, here on this show, we talk about all things that relate to real estate investing. We talk about investing in single family houses, commercial projects, small apartments, self storage, land deals, notes. And we also talk about how to get funding for those deals creatively and with private money. Now, if you’re brand new to this show, I’m known as The Private Money Authority, because from 2003 to 2009, I relied on the local banks and mortgage companies to fund my deals. But then I got cut off with no notice in 2009, but it was one of the biggest blessing in disguise. I was introduced to this wonderful world of private money.

Jay Conner (01:02): Since that time I’ve never missed out on a deal. I’ve rehabbed over 400 houses. Done even more deals creatively. And the reason I’ve never missed out on a deal since 2009 is because I got the cash ready to buy those all cash deals. And as we know, most of the sellers require all the money. So I’ve got a brand new free gift for everybody that’s tuning here on the show. And that is, I just launched The Private Money Academy. Which is a monthly membership where we actually have two live zoom conference a month with yes, yours truly me. For at least an hour to an hour and a half answering all your real estate investing questions. Getting you plugged into private money and funding for your deals. And we also have a hot seat session where we will take one of the members of the Academy, put you in the hot seat, analyze your business, and create a plan to take you and your business to the next level.

Jay Conner (01:57): So I have a free gift for everybody tuning in, and that is four weeks absolute free access to The Private Money Academy. And you get to come on the next two live shows for the Academy membership. Absolutely for free! You can take advantage of that and learn all about it after the show today at http://www.JayConner.com/Trial that’s http://JayConner.com/Trial Be sure and check that out, come on in to the membership for free, and I’ll see you on the inside of those live zoom conference coaching calls.

Jay Conner (02:41): Well, as you know, if you’ve been tuning in to Real Estate Investing with Jay Conner, we have amazing guests and experts here on the show. And today is no exception. Before I bring my special guest out of the green room and here to the forefront. Let me tell you just a little bit about him. Well, my guest today is a real estate investor and a mentor. And he owns and manages a seven figure per year flipping business. So my guest and I, we’ve got a lot in common. Well, his passion is being a top house flipper in the nation. And his other passion is also helping other newer investors build a sustainable real estate investing company. Well, with 11 years, he started back in 2010 on the real estate investing side. With 11 years in the real estate investing business, he’s invested in over 15 States. And yes, today on today’s show, we’re going to be talking about how do you do this business remotely and totally virtually.

Jay Conner (03:41): He also has houses all the way from Michigan to Georgia. And today he has completed over 550 transactions today. Yes, he knows what he’s talking about from experience. In addition to that, he focuses on buying single family flips creatively. Using both subject to the existing note strategy, and he buys a lot with owner financing. In fact, he is known as the Owner Finance Guy. He also uses the strategy of selling retail or with owner financing, with creating wrap around notes. I know you’ve heard that terminology. Wrapping around a note. And if that’s sort of a new term to you or an old term, and you don’t know what it means, we’re going to talk about that on today’s show as well and how you can utilize that strategy as well.

Jay Conner (04:34): Well, he is also the host of one of the top 100 business podcasts in the nation. And the name of his podcast is Investor Creator. And there on the podcast, he teaches new and seasoned real estate investors. How to take their house flipping business to a multiple six or even seven figure income without sacrificing freedom. After all, what do we want in this real estate investing world is, wealth and freedom. And my guest today is an expert in that area. My guest lives in Nashville, Tennessee. And with that, welcome to the show, my friend and expert, Mr. Brad Smotherman! Brad, welcome to the show!

Brad Smotherman (05:18): Jay, I appreciate you having me on. I have a feeling we’re going to have so much fun with this. I’m just going to have to take a nap after we get done.

Jay Conner (05:24): Yes, you are! My lands! Brad, I’m so excited to have you on. And I know just by your intro, your bio and the short period of time that we’ve been around each other, we’ve got a lot in common. In fact, my best guess, one of your core values, and one of your secrets to success is having the mindset and the framework of putting other people first, having their interests ahead of your interest. Would you agree with that?

Brad Smotherman (05:52): Hundred percent! A hundred percent!

Jay Conner (05:54): So Brad, first of all, you look entirely too young to be this successful, but anyway, I’ll go beyond that statement pretty quickly. You’re from Nashville, Tennessee. You grow up in Nashville?

Brad Smotherman (06:06): I did. Born and raised.

Jay Conner (06:08): You’re sing country?

Brad Smotherman (06:10): No. I don’t see anything. And that’s a good thing for everybody that would have to listen. So for the people that know how to sing it I’ll just listen politely like everyone else.

Jay Conner (06:20): But now you enjoy going to the Grand Ole Opry, right?

Brad Smotherman (06:22): Oh, certainly! And like I was telling you guys before I’m out taking my grandmother to see Merle Haggard there twice, and we saw George Jones once and just had a great time. So, absolutely!

Jay Conner (06:33): That’s awesome. Well, I’m excited to have you here on the show today. Brad, because you’re known as the owner financed guy. You’re an expert in the area of buying houses on terms controlling them creatively or whatever. So first of all, if you would explain to the audience, what is your business model look like?

Brad Smotherman (06:59): Well, I think my business model is a little bit different than most because everybody out there, especially the past five or six years, what they wanted to do is, you know, they wanted to wholesale something. They wanted to fix something and flip it. And you know, the past 10 years we’ve had an explosion of these fix and flip TV shows. And frankly, Jay, those shows just give me anxiety. Like I can’t watch them. Literally. I went to the dentist the other day and asked me what I wanted to watch as I’m sitting there in the chair. I was like anything, but this HGTV stuff, right?

Jay Conner (07:25): Well, wait a minute, Brad. Now, why would I, why would a reality show that I’m sure is real, that shows you how to make a hundred grand in 30 minutes with no headaches. Why would that give you anxiety?

Brad Smotherman (07:36): Well, just like, you know, I mean, it’s not real. And then, you know, secondly, I’m looking at what they’re spending on the kitchen. I’m thinking I could do it for a sixth of that. And then the person buying the house, it’s like, well, what do you do for a living? And they say, well, we catch butterflies and rainbows all day. And our budget’s 2 million bucks and it’s just like, it just doesn’t seem exactly genuine to me. But maybe they’re just in a different market, a better market than I’ve ever seen. Let’s just say that.

Jay Conner (08:01): Yeah! I get it, Brother, I get it. Sorry to interrupt. What’s your business model looks like?

Brad Smotherman (08:04): Yeah. And that’s a hundred percent fine. So, you know, I started in 2010 and my background was very similar to yours in a certain way, although I didn’t live it. So I worked for a builder developer. Well, I sold real estate through college and everything was going really, really well up until the crash of ’08. And in 2009, the bankers came in and said, well, sorry, we’re going to have to call your loan. You have 30 days to pay us off. And as you know, during that time, there’s really no way to refinance commercial lending, you know, especially a development loan. And so it bankrupted them. And luckily I was able to learn the lessons from the crash without actually having to be involved in the crash. And so when that happened, I realized very quickly, I didn’t want bank money in my business. Very similar to what you’re dealing with. Right?

Brad Smotherman (08:46): So it’s like, guys, being able to raise private money is paramount to this business. Like what Jay is talking about is super, super important. But, so I got started in 2010 and back then, you really couldn’t wholesale because no, very few people had an equity position that was big enough to where you could wholesale it. And then also the fix and flip model was very difficult because that couldn’t get money. And so I had to find another way. Well, what I found worked. Has always worked and what I feel will always work is creating owner financing. And so what we do is we buy creatively when we buy and then we sell with owner financing and a vast majority of our transactions. We still go retail at times and that’s okay. But what we want to do is we want to create longterm cash flow with longterm capital assets. And for me, I’d rather have that in mortgage notes. I feel like it’s far more scalable than rentals. We’re able to get paid to take the note in most of our transactions. It’s not like I’m putting cash out there to invest. We’re getting longterm assets given to us. And I just had to find another way because I couldn’t, I didn’t want to wholesale, I couldn’t wholesale. And the fix and flip model looked like really difficult to me during that time. And so we’ve been pretty much doing a similar model ever since.

Jay Conner (09:53): So to recap what you just said, tell me if I got it right. Your core model is buy on terms, buy with owner financing, buy with subject to, buying creatively without paying all the cash. Take that same property, turn around and sell it creatively to a new buyer with owner financing or what have you. So let’s break that down. First of all, you said, the reason you do that is because you want to build longterm wealth by leveraging an asset that’s going to continue to pay you monthly for a long time. Is that right?

Brad Smotherman (10:38): A hundred percent. That’s right.

Jay Conner (10:40): So in today’s market, I know from my own business, I know from my students’ businesses that finding a deal today in the multiple listing service is a bonus. The deals are not in the multiple listing service buying large. So we have to find our deals off market. We have to find houses that are not in the multiple listing service. So if you don’t mind pulling back the curtain for us just a little bit and give us a little sneak peek as to what is working for you today to find these people that have houses for sale, or maybe they haven’t considered selling their house. How do you find these deals?

Brad Smotherman (11:30): That’s a great question. Well, I mean, as we know, everything starts with a motivated seller. So the foundation of the business is marketing for motivated sellers. Now for me, real estate is a means to an end. I mean, if I can do this business with dump trucks or swimming pools, I would do that. I’m not in love with houses. They break, they smell bad. Some of them. One of my apprentices yesterday in San Antonio, he’s buying a house that has 70 cats in it. And I can’t imagine how bad that is, but you know, at the end of the day, marketing comes down to two different avenues. We can do sweat marketing, or we can do paid marketing. Man. When I started, I didn’t have any money. So I had to do the sweat marketing side of things. And so the examples of that would be, you know, putting out bandit signs, you know, although you’re paying for the sign, what I would do is I would put them out Friday night and pull them up early Monday morning.

Brad Smotherman (12:13): And so a hundred signs, a couple of hundred bucks would last me three or four months, right? So that’s more of a sweat technique as opposed to leaving them out. Another one that were having a lot of success with is actually networking with wholesalers because wholesalers are slave to the 70% rule. We’re able to go in and do deals that they can’t do, right? Because we buy creatively as opposed to just throwing cash offers around all over the place. Right? So I’ve got an apprentice in Texas. He’s done three transactions this month, where wholesalers are bringing him the deal. You know, one of them is at a 0% owner finance rate. Now why a wholesaler would want to make a $5,000 assignment fee on a deal where we’ve got like four years and this thing is going to be paid off and we’ve got an $80,000 note on it.

Brad Smotherman (12:55): I don’t really understand. Okay. So that’s a couple of options in terms of sweat marketing. What I hope for people is that they understand that marketing is an investment. It’s not a cost. So effective marketing should at a minimum of 25 X. So if you’re spending a thousand dollars in effective marketing per month, you should over time buy at $25,000 per month in equity. Right? As an average. Now, what I hope for people is that if you have to start with the sweat side, that you go to the paid marketing side, as soon as you can. Okay? So in my world, the best paid marketing that we can do is Pay-per-Click so being there on Google ads, whenever they’re there, like people are searching for us. Searching, sell my house fast, or companies that buy houses. We want to be there. When people have already realized that they have a problem and we can be there to offer a solution, but it has to be done very well. I know a lot of people that have lost a lot of money when it comes to doing Pay-per-Click campaigns, because they don’t understand how to drive traffic number one, and how to create conversion. Once someone is, has landed on a page number two, but those are examples of sweat marketing paid marketing that we use in our business.

Jay Conner (13:57): Excellent! So as we know, and most of our audience here knows. When talking to an off market seller, a person that owns a single family house, you know, they don’t have it in the multiple listing service. They have some type of motivation. Most of these people are going to be anticipating when you’re starting that conversation with them of you buying their house. Most of these people like 99% of them are more having their mind that, well, if I sell my house, I’m going to get all the money, right? I mean, it’s like, that’s the traditional way. I sell a house, I get all the money. But now, you come along and you are going to be talking to them about creative selling or them becoming the bank. Or there’s a note and they’re going to get payments. What are your secrets? And as our friend Eddie would say, talk off points. Well, what are you, what are your secrets or scraping that takes a person that’s never considered selling on terms and waiting for all their money over time, from the point of then expecting to get all the cash up front?

Brad Smotherman (15:06): That’s a great question. And what I would submit to you is the first thing that we can’t do is make offers. So in my world, I really feel like an offer is a commodity to shop. And I can’t even begin to tell you how many houses that we’ve gone in and bought because, you know, two or three other investors had gone in and left an offer behind for them to think about. And then we come in because we won’t give them our price. They’re giving us a price. We’re making sure that that’s the least that they will take. And then we’re going to switch it to terms. So let’s say that someone says, well, and we talk about things in terms of cash at closing. So if somebody owes a hundred thousand dollars and they want to sell the property for 115, then I’m going to switch it and say, well, so your cash at closing is $15,000.

Brad Smotherman (15:48): So assuming that they would sell to me for that $15,000 cash at closing, then I’m going to say, well, you know, I can do that. If we can do it another way, and this is how we can make it work. So I’ve never given them a price and they’ve given me the price. So I mean, what we’ve done there is we’ve made it very difficult for them at that point to really begin to pull back and think about it because we’re giving them their number. We never give a price ever. Now, Jay, there’s some times that we do pay cash for properties, we just bought one outside of Huntsville, Alabama, about a month ago that the people had paid $160,000 cash for it in 2012, we paid 15,000 for it. And, you know, it’s like at that price, I don’t really feel the need to negotiate terms.

Brad Smotherman (16:29): You know, it’s like, we’ll just pay the 15K. And I thought about it. It kinda hurt my feelings to not get 0% owner financing on that 15. But I was like, you know, they need the money. They need the 15 grand we’ll just go ahead and pay it. But the short answer is I think the real skill is to, to be able to negotiate with people, without giving them a price, giving them an offer. I feel like if you give an offer, it’s a commodity, a commodity for them to shop. I also think it’s kind of acrimonious. People feel like they’re good negotiators because somebody can say, well, I want $200,000 from our house. And you can say, well, how does a hundred thousand sound? I don’t think that’s negotiation at all. I think that’s horse trading. And like my family came from the agriculture world.

Brad Smotherman (17:09): So, I mean, we were pig farmers. I mean, and I saw that growing up all the time, you know, that doesn’t work for houses as well. Like if we can make people realize that we’re not there to take advantage, if we can make the number work, then we will make it work. But there’s equity. There’s two types of equity. There’s equity at price and equity in terms. So if we can create equity in terms, a lot of times that’s a better equity position for us to have as a longterm play, as opposed to just like really working in the 70%. If that makes sense.

Jay Conner (17:37): Do you ever offer or give multiple offers or multiple strategies of saying, okay, if you want your price, we can do it this way. If you’ve got to have all cash, we can do it this way. And if you want a third option, we can do it this way. Or do you, most of the time stay with say the the terms negotiation and conversation?

Brad Smotherman (18:02): And that’s a great question. So we don’t do like the three offer strategy of like, we can do it this way, this way, or this way, this way, because what I’ve found, at least in my own personal experiences that I had people say, well, I want this price with that term.

Jay Conner (18:14): They want to pick and choose the way they want it.

Brad Smotherman (18:18): Yeah. It was like, we’ll take this closing date. We’ll take that price with those terms. It’s like, well, that’s not really how it works. What I’ll say to that is it’s really common for us to, to bounce back and forth between price and terms. So if someone says, okay, this is the price that we want, they’ll say, well, if you want it like that, here’s how we can make that work. And they said, well, that doesn’t work for us. And then we’ll go back and say, well, is that price the least you would take? And so we start talking about pricing in. And I’ve had situations where we have to kind of go back and forth three or four times before we land somewhere. And it’s generally somewhere kind of in the middle that we find that people will work within kind of the median based on what they’re hoping for. You know, if we can substantiate pricing and values and costs to where we can show like, Hey, these are the numbers that you’re working with. Like, this is the value. This is the cost to get it there. Here’s my breakeven number. You know, what are you hoping for your cash at closing people generally tend to be a little bit more reasonable if we can substantiate why they should accept a lower price and what they were hoping for.

Jay Conner (19:15): When you have someone that is agreeable or at least open. They’re open to the idea Terms and, you know, taking payments or equity over time or whatever. Do you, in your, in your conversation, do you tell them how long or how long the term of the note would be? Or do you ask them what’s the longest they could go? Or how do you get to that agreeable length of the note?

Brad Smotherman (19:51): Yeah. So what we talk about is in terms of some now and some later, so we’re going to talk about it and say, okay, how much cash do you need at closing to make it work? And they’ll give us a number and we’ll kind of negotiate that. It’s like, okay, if I can get you X at closing, then how soon were you hoping to get, no, we do it this way. We can either do payments every month, like an annuity or retirement plan, or we can do a lump sum in the future, which were you hoping for? Generally, people kind of gravitate towards the payments per month. But the thing that we never mentioned is interest. Okay. We never really talk about terms. We’re going to talk about it in terms of, you know, $20,000 at closing and $500 per month until paid.

Brad Smotherman (20:27): And so people are kind of looking at that and saying, especially if they’re a landlord. Guys, if you’re, if you’re dealing with a landlord that has free and clear property and they’re tired landlord, you should absolutely be able to negotiate owner financing because these people are open to receiving payments. That’s what they bought the property for in the first place. Well, if we can just kind of segment it to being like, well, how much do you need at closing? What would you like a lump sum in the future? Or would you like monthly payments? Generally, they’re going to say, well, I’d love monthly payments and we can negotiate something, but we never really talk about it in terms of, well, it’s a 10 year loan and here’s the rate we never mentioned. Certainly we’d never mentioned interest. We don’t really ever talk about the term as well.

Jay Conner (21:03): So you would agree that most of the terms that you structure are payments with no interests?

Brad Smotherman (21:10): Correct. A hundred percent. I’ve only paid interest twice on owner finance deals. And both of those were properties I wanted. They were both lake properties and I was like, I’ve gotta have this. I think I paid a 3% rate on one and four and a half on the others.

Jay Conner (21:24): I love it! I love it! Well, Brad, now let’s really change gears from the owner financing thing and the term thing to this world that you’re in of investing remotely. My lands! You are in, you’ve invested in 15 States. You invest from Michigan to Georgia. And when I asked you a question that could take you three days to answer, but you got about three minutes instead.

Brad Smotherman (21:55): We’ll work with that.

Jay Conner (21:55): But how in the world do you invest remotely in 15 different States? And we know what, we know everybody’s concerns are. I mean, how do you find those deals, you know, out there in a different state, what’s your boots on the ground? How do you make sure you’re not being taken to the cleaners? How do you manage all that stuff remotely? And you know, my land! You can’t drive by it and see what’s happening to the property. I mean, what does that world look like?

Brad Smotherman (22:24): Yeah. And you’re right. That would be about a three hour answer. But to put it into three minutes, the first fundamental that we have to understand is that the farther away we are from our own personal market, the cheaper the property must be. So we have to have a higher discount. Now, I’ll buy something at 60 cents on the dollar cash in my backyard, but I’m definitely not going to do that, you know two States away, right. So we have to have a greater discount because you’re a hundred percent, right. We’re going to have issues that we don’t expect right now. We don’t have, you know, a large amount of like workforce that can help us in these deals generally. Right. So what we’re going to do is we market to areas that we like, okay. And because we’re marketing in big geographic areas, our lead cost is actually quite a bit lower.

Brad Smotherman (23:12): It’s substantially lower. So we can do one of two things. We can either have a lower ad budget, or we can keep our ad budget the same and have maybe three or four times a lead flow. Okay. So let’s just say we have four times the lead flow. Well, what that means is that, that deal that comes around twice a year, three times a year is going to happen for me roughly every two months. Or, you know, the deal that happens every four months is going to happen for me every month. So I can be a little bit more picky based on what I’m looking at. And so in terms of the value, the decisions are very easy, actually. So I mean, case in point, we just bought one in Montgomery, Alabama. The property had a comp across the street that sold in in February for 76,000, we bought this one for 13, so we have it under contract.

Brad Smotherman (23:59): And so once we have an under contract, we go into due diligence. So the first thing we’re going to look at is value. So what is the value based on what we expect right now? So we feel like roughly this thing’s worth $75,000 and I can probably owner finance it for 89 or maybe 99,000 with a 10K down payment. You know, at a minimum 10K. So with that, we’re gonna talk to two or three brokers in that market, real estate agents that are gonna give us CMAs. Give us an idea of value. And then we’re going to then once the value looks okay, we’re going to switch to condition. So we’re going to get actually a home inspection on this property. Okay guys, once we have three different CMAs from agents and they all kind of make sense for one another, like there’s congruency in those three CMAs, and then we go and we get the home inspection, we’re going to know really everything that we need to know in terms of that property, especially with the discounts that we’re buying.

Brad Smotherman (24:48): So, I mean, the question being is that a little bit more risky than buying it around backyard? It certainly is. Whenever, if you were paying dollar for dollar the same amount, but if you’re paying 60 cents in your own backyard or 20 cents in another state, then I would ask you, well, which is more risky at that point. Okay. So short answer, we’re going to get things under contract that we feel pretty comfortable with. Then we’re going to verify and find the facts that we know and what we don’t know. At that point, we’re going to make a final decision. Sometimes we have to renegotiate price most of the time we don’t, because it’s just such a severe discount on the front end. And I mean, in terms of management, the thing is that we’re owner financing most of these, almost all. And so if we’re owner financing things, we’re serving the least served in the most underserved buyer pool in the country.

Brad Smotherman (25:32): There’s a lot of people that need owner financing. And since March, this is what I heard from Eddie Speed yesterday. And Jay, I know, you know, Eddie. So he said that if a hundred people could get a mortgage in March before this COVID thing hit, then right now there’s 64 people that can get a mortgage that’s left out of those hundred. Well, what happened to those other 36 people? Did they just decide not to buy? Well, no, they need owner financing at this point. So we’re serving a very needed, a very underserved buyer pool that needs owner financing. So sell the house with owner financing, create the note. I don’t want ownership and property. I feel like property is liability. We want to own the paper. Okay. So we create owner financing. So the house owner financing to have a longterm cash flowing asset. And in a nutshell, that’s how we buy remotely.

Jay Conner (26:18): To what extent do you buy houses remotely with owner financing? To what extent is, are you comfortable with the amount of repairs or rehabbing involved?

Brad Smotherman (26:33): Yeah. I mean, we’re not going to rehab anything. So if the property means that the grass cut, somebody better go cut the grass because we’re going to buy it. We’re going to sell it as is, you know, the best example that I have with this. I had a house that I bought for $2,000 one time. And now I don’t understand why people do what they do sometimes. Jay, I know that doesn’t resonate with you. I’m sure that you’ve never seen anything that didn’t make sense. But for me, I see a lot of things that don’t make sense in my world. And this lady sold me the house for $2,000 and she had just done new vinyl and new windows on the exterior. They surely looked great, but she said, I don’t want you to go in the house because I’m afraid you won’t buy it.

Brad Smotherman (27:07): This was maybe six or seven years ago. And I’m actually going to look at houses. I said, well, respectfully, I have to go look at, you know, I have to go inside. And so this lady, the roof look kind of bad, but I didn’t realize how bad the roof was. She did new vinyl, new windows. She didn’t do the roof. And so water had been pouring into this house for like four or five years. And so like, literally the back half of this thing was gone. I mean, it was like molded. It was soft, the subfloor, you couldn’t stand in the kitchen, all this, it was a mess! But we sold it with owner financing. As is! Like, I’m not going to do that kind of construction. I’m not a construction guy. Literally I had to come over. I had to have a handyman come to my house and replace the doorknobs because I don’t know how to do any of that stuff. So like, I’m terrible.

Jay Conner (27:46): You and I have something else in common, my friend!

Brad Smotherman (27:49): Glad to hear that, man! I think we’re like kindered souls just, probably not from the same parents, just generationally, but you know what I’m saying? We’re cut from the same cloth.

Jay Conner (28:00): A brother from another mother.

Brad Smotherman (28:04): For sure.

Jay Conner (28:07): So you’re not gonna do any, you’re not gonna do any major rehabs. I get it. So my lands! How do you find, so are you finding most of these deals remotely in other States? Again, as you mentioned using Pay-Per-Click. Google Pay-per-Click.

Brad Smotherman (28:25): A hundred percent. So, I mean, these are people that are actively searching to solve a problem and we’re there when they need to be.

Jay Conner (28:30): I love it when people are looking for me and I’m not looking for them.

Brad Smotherman (28:34): Big difference because people don’t understand the difference in the negotiation structure. So, I mean, if I’m contacting someone to sell me something, versus someone contacting me to buy something, that’s a huge difference in the frame of negotiation. And so we always want to be where someone is searching for us. If we can be, of course, there’s always exceptions. You know, like anything works some of the times. So we can do the text, we can do the direct mail. I used to do 70,000 direct mailers a month. I don’t do any of that anymore because it comes down to, I don’t want to contact someone to sell something. I want people contacting me to buy something.

Jay Conner (29:08): Final question, Brad. At least almost final question I have to, I have to precursor that. So we know how you’re finding these deals. You got all these people that need owner financing. They don’t know there’s a way. So how in the world do you get the word out to all these people that you’ve got owner-financed terms available? How do you find the buyers?

Brad Smotherman (29:29): And that’s a great question. So our big three are Craigslist, Facebook marketplace, and then putting yard signs out that say owner financing. And so…

Jay Conner (29:38): My number one on a, so I sell, I don’t do owner financing out here in this market. That’s another conversation. I do a lot of rent to own. I love your model. Regardless. It’s the same buyer, whether they’re buying owner financing or they’re buying rent to own. But with that, Facebook marketplace, hands down. Is my best lead source for finding these owner finance buyers.

Brad Smotherman (30:04): Yeah. It’s really amazing. I’ve got a, I’d say she’s at least half time and probably closer to three quarter time. And the poor girl, she probably has carpal tunnel by now because like you post a house for sale with owner financing and all of these buy-sell-trade groups. And like, you can see like the computer almost begin to melt because it’s overheating from all the people responding. And it makes sense. I mean, it’s really common in a market. So I’m in Nashville, Tennessee. The last time I checked, there were 2,700 houses on the market on the MLS to service everyone that could get mortgage financing. Well, there were three that were offered with owner financing and they were mine. And so it’s like, if that’s the case, you can see the disparity in the supply demand curve. You have a huge group of demand for very, very little inventory. And so selling the houses never really been a problem.

Jay Conner (30:53): I love it! Brad, I know my audience wants to stay connected with you. How can they stay connected with Brad Smotherman?

Brad Smotherman (31:00): Yeah. So for those that are interested more on owner financing and what we do, then you can listen to my podcast, Investor Creator, on iTunes and the various other platforms. And if anybody wants to reach out to me directly, feel free to do so. At http://BradSmotherman.com

Jay Conner (31:13): That’s awesome, Brad! It’s so great to have you here on the show, Brad, I really enjoyed our conversation. I know the audience did as well. And so let me give it to you for parting comments and final advice.

Brad Smotherman (31:26): You know, the thing that I want to say to people is, always would try to instill the amount of hope that I can, you know, I think a lot of people want to do this business and they have a lot of fear. And I remember how that was in 2010 when I started, because you know, I started in the brokerage business. I was a realtor and not a super successful one at that. I made a living, but you know, whenever I decided to be an investor, I thought, gosh, like nobody’s going to leave a loan in place. Nobody’s going to sell out a discount. Nobody’s, you know, and it’s the same thing that I’ve heard, you know, and here’s kind of like the hierarchy of beliefs that fell down for me. I thought nobody would leave alone in place. Well, that happened.

Brad Smotherman (32:01): And then I thought, well, nobody’s going to sell at 50 cents on the dollar. And then that happened. And then I thought, well, nobody’s going to give me 0% owner financing. And then that happened. And then I thought, well, all of this is because we’re that good in person. We can’t do it on the phone. And then we started buying all of those on the phone. And so at the end of the day, I mean, this business works. It’s an amazing business. It changes lives. And if you feel compelled, you have a passion for the business and you have a passion to help people with their problems and you can do very well in this business. Stay with it.

Jay Conner (32:28): That’s awesome! Brad, thank you so much. And thank you! My audience for tuning in. It’s always great to have you here. And I know you found this episode very valuable. I’m Jay Conner, The Private Money Authority. Wishing you all the best and here is to taking your real estate investing business to the next level. And I’ll see you on the next show. Bye for now!

#Jay Conner#Private Money Lender#Real Estate Business#Real Estate#Real Estate Investing#Real Estate Investor#Real Estate Profit#The Private Money Authority#The Private Money Academy

23 notes

·

View notes

Text

Simple Step Of Fix N Flip Financing.

Flipping Properties: The shakiness of today's land market is pretty obvious to everyone. this is often ultimately creating difficulties find loans for flipping properties also and if your credit score is bad, then things become worse.

But you do not get to worry because as a true estate investor, your ONLY job is to seek out good investment opportunities. If you'll keep wasting some time trying to find a lender rather than finding a good fix n flip financing deals then you're getting to find yourself during a problem. you would like to know that if you've got found a hot property, it'll draw the eye of cash lenders itself.

Reasons: After finding a property and ensuring that it's worth investing in, you would like to urge in-tuned together with your local lenders. it's necessary to possess a sound relationship with the proper hard money lender due to two basic reasons:

1. They're going to fund you if you've got found an honest deal, regardless of your bad credit

2. they're going to also advise and educate you thru the entire process of shopping for and selling your land investment deal

Finding money lenders for bad credit is not difficult if you'll do your research properly and it's better to start out this search by contacting your own lender.

But don't give him a call asking about what-if or imaginary situations or if they're going to lend you thereon with bad credit or not. As an alternate, you'll check their website and appearance at the properties they need recently funded and check out to seek out similar properties for investing.

Every true hard money lender puts this information on its website to form things visible to its customers. you'll get all the small print about those funded properties on their website.

The next important step that you simply should take is getting a symbol of funds letter. While you're trying to seek out an honest deal and getting to take it under contract, there are people that would really like to understand that whether you've got finances available to take a position within the deal or not. For that, you would like to point out to them your proof of funds letter.

You can easily get a symbol of funds letter after paying a minimal fee to your lender. you would like to know that it doesn't guarantee you that you simply will get your fix n flip financing. But it gives a guarantee that there are funds available for that specific property if it gets under contract.

If you actually want to urge bad credit hard money loans for your property, then you would like to follow every rule and regulation set by these lenders. it's vital that the property you're willing to shop for meets their guidelines. you furthermore may get to check their website to understand what are the states or counties, they're doing lend in and what sorts of properties they are trying to find i.e. commercial or residential.

You need to form sure that you simply are meeting their requirements and hence, playing by their rules. If you're having difficulty finding good properties, then your lender can always assist you thereupon by supplying you with some specialized advice as they're experts of land investing business.

The following is an inventory of commonly asked Questions (FAQ's) about fixing and flipping your thanks to 1,000,000 dollars in foreclosure land.

What does it mean to "flip" real estate? To "flip" land means to accumulate control of a bit of undervalued land, make improvements thereto, then resell or reassign the rights over it, for the maximum amount profit as possible, within the shortest time possible.

Does it take money to form money in real estate? The answer is "yes" and "no". The bad news is yes, it takes money to form money inland. the great news is that the cash that you simply invest doesn't need to be your own. you'll always partner up with fix n flip financing someone who can put up the cash while you set within the work. you'll always find a personal investor. you'll always obtain a tough money loan that is secured by the property and not by your own credit. you'll always compute an owner-financing deal or take hold over a property subject to the prevailing loan.

How much money am I able to expect to form, investing in real estate? If you follow a system properly, then on average you'll make anywhere from $5,000 to $30,000 on one land deal. But these are just average numbers representing a good range. If you invest in properties at no quite 70% loan-to-value (LTV), you'll expect to form somewhere between $10,000 to $20,000 per deal.

Do I want any special training, license, or certification to practice land investing? No. land investing doesn't require a license or any special training or certification. land investing shouldn't be confused with being a true realtor or a true estate broker. a true realtor or broker brings buyers and sellers together to transact land purchases and sales. a true estate investor buys properties, fixes them up, then rents them out or sells them again. Since you're not providing a service to consumers in exchange for money, you are doing not need a license.

How long will it deem me to form 1,000,000 dollars investing in real estate? It depends on what proportion of effort you set into your endeavor. If you treat land investing sort of a business and constantly keep at it, accomplishing your set tasks daily or weekly, you'll set a goal to form 1,000,000 dollars by a group date. for instance, if you set a goal to form $1,000,000.00 within the next 12 months, you recognize that if you create $10,000 per deal that's 100 deals. If you create $20,000 per deal, that's 50 deals. Thus, if you're employed diligently enough that you simply were to urge into one deal hebdomadally, then you'll make $1,000,000.00 in one to 2 years. If that schedule is just too aggressive for you, then plan accordingly.

I have a each day job. am I able to do land part-time and still make money? Yes, you'll. If you'll put aside 20 hours every week, you'll do land investing in your spare time. While there are some aspects of the important estate investing business that will require you to figure exclusively during business hours (eg- handling land attorneys, getting to the courthouse, calling banks, and title companies, these tasks are often minimized if you've got access to a telephone, fax machine, and an area post office or third-party mailman.

What about this down market? Real estate investing is usually all about buying low and selling high. But if you actually want to achieve success as a foreclosure land investor in any market, you would like to work on the principle of buy very low and sell below market price. Let me offer you an example: If you purchase a house that's worth $200,000 after repairs, you actually should plan on selling it for not quite $190,000. meaning that you simply got to leave enough margin for you to still make a profit. If you purchase a house for $140,000, put in about $10,000 worth of repairs, then the house becomes worth $200,000, you ought to attempt to sell it for $190,000. In this manner your house more likely to sell quickly because the worth is already reduced. Otherwise, if you do not have room to scale back your sale price, you'll get to hire out the property, which isn't such a nasty proposition either, considering you'll be gaining some income monthly, a tax write-off, and you'll always resell it later when the market rebounds. rock bottom line is that foreclosure land investing may be a win/win proposition in any market.

For More Related Stuff Click Here.

#fix n flip financing#small business equipment financing#stated income commercial real estate#commercial real estate financing#commercial construction loans#commercial property finance#commercial property mortgage#commercial real estate loans#bridge financing#commercial loan#commercial mortgage#commercial business loans

1 note

·

View note

Text

How to Compare Financial Lenders

Financial lenders are people who make money available to individuals and businesses for various purposes. They will expect a certain percentage of repayment along with interest and fees, which they charge in return for the money. This repayment may be in the form of monthly mortgage payments or a lump sum payment. A lender may provide money for any reason, but certain conditions must be met before a loan can be approved. A borrower should follow these rules to avoid penalties and late fees. Click here: https://www.calhardmoney.com/borrowers/private-money-loans-for-real-estate.php to learn more about financial lenders.

The application process for bad credit loans is simple. You can search for them online and provide the usual information. The bad credit loan application process does not affect your credit score or debt-to-income ratio. However, you will need to provide details about the negative items on your credit report. This is because lenders will check whether these items are risky credit cards or not. It is best to shop around before committing to a loan. When comparing financial lenders, you should look beyond the monthly payment.

While traditional banks do not offer loans for self-employed people, private financial lenders can help them. Many lenders will lend to those with no credit history or a low income, as long as they have a realistic business plan. A perfect example of a nonbank borrower is a fix-and-flip investor, who renovates single-family homes and resells them for a profit. PB Financial Group may have a lucrative business, they may not have the credit history that would qualify them for a conventional bank loan.

However, this new wave of aggressive lending has lowered lending standards, and there are increasing numbers of defaults in the non-bank lending industry. As more lenders enter the market, their default rates are likely to increase. Some lenders offer leverage that is as high as 90 percent of the purchase price, or even 100 percent of the renovation costs. Generally, the after-repair value must be high enough to support the loan. So, borrowers need to use the best financial lender possible for the best results.

Long-term loans have various terms and repayment schedules. A secured loan requires collateral, such as a home or car. The loan amount is often higher than the loan's maximum limit and is usually secured by a long-term asset. In some cases, a borrower can lose his or her home if the loan is not repaid. Hence, the application process is lengthy and often a home appraisal is required.

A risk rating reflects the risk associated with a loan transaction. A lender may use risk assessment and credit scoring techniques to categorize borrowers into different risk classes. A risk premium is an adjustment to the base interest rate based on these factors. The higher the risk, the higher the rate. Typically, a lender will charge a higher interest rate on a riskier loan than a riskier one. In other words, a higher-risk loan is accompanied by a higher risk premium. Knowledge is power and so you would like to top up what you have learned in this article at: https://www.britannica.com/topic/mortgage.

0 notes

Text

Rental Property Loans Are a Good Option For Those Who Are Investing in a Vacant Primary Residence

Single-family, condominium, and apartments all qualify for rental property loans. The lender determines the loan amount based on the appraisal of the property, down payment, amount of the loan and your credit history. It is generally easier and cheaper to obtain a loan for a rental property such as a home than for an office building or other large apartment building. Appraisal is the process in which a professional appraiser reviews your rental property and determines its value. This determines what the monthly payments on your loan will be. Here’s a good read about hard money loan requirements, check it out!

Veterans Affairs is one of the many lenders that provide rental property loans for veterans. They offer loans at low interest rates and with flexible terms to fit a veteran's lifestyle. There are several benefits for applying through the Department of Veterans Affairs. First, there are special loans for certain members of the military. For example, the Department of Veterans Affairs offers loans for mortgage refinancing to those who served in the Armed Forces. To gather more awesome ideas on fix and flip loan, click here to get started.

Most investors and homeowners choose to obtain their loans through traditional lenders. Traditional lenders typically provide a negative cash flow investment to borrowers, which essentially means they keep the entire interest payment. Instead, they allow borrowers to pay only the first month's rental fees and interests. These conventional lenders are typically a collection agency that buys your old debts from you, then sells them to another collection agency for you.

Due to the current economic environment, most investors and homeowners are choosing to obtain their rental property loans through local real estate investors. For example, the best loan to obtain when buying rental investment properties is a 100% line of credit. It is a revolving credit that can be used to make other investments and allows borrowers to use a portion of their credit line at any time.

Another incentive to work with local real estate investors is the ongoing maintenance reserve requirements. If the rental property loans secured by your home to hold their initial value, the value will decline over time. As a result, the monthly payments will rise. This is why rental property mortgage rates are often lower for those who buy investment properties. The rental property loans will help you meet maintenance requirements at a lower cost. Kindly visit this website https://smallbusiness.chron.com/hard-money-lenders-4114.html for more useful reference.

Before you decide to use a mortgage to finance your investment property loans, you will need to make sure that you are prepared to meet the necessary insurance and reserve requirements. Although there are primary residence mortgage programs, they usually come with higher interest rates. A home insurance plan can significantly reduce the costs incurred by those who are renting. The best mortgage for investment loans is rental property loans primary residence mortgage program.

0 notes

Text

100% PURCHASE PRICE FINANCING FIX & FLIPS - $50,000 - $250,000.00 - NO CREDIT CHECK!f

NO CREDIT CHECK 100% Purchase Price Financing For Investors. Use for Investor Fix & Flip deals OR rental ready purchases. Loan amounts from $50,000 - $250,000.00. COST OF RENOVATION NOT INCLUDED IN LOAN AMOUNT. NO APPRAISAL REQUIRED. Close in 10 business days. Must have one (1) prior completed flip in last 24 months. Single family and 2-4 units including town-homes. No Income Verified. No Employment Verified. No prepayment penalty. 24 hour prequalification. Apply online at investorrehabfunding.com

NAME: Investor Rehab Funding, LLC Email: [email protected] Contact Phone: 844-244-1420 URL: https://www.investorrehabfunding.com/platinum-fix-flip-funding-program/

0 notes

Text

How to Finance a House Flipping Business

Any successful business needs a plan for every aspect, especially for the finances. House flipping is precisely the same. A house flipping business is a smart way to invest your money, make a second income or primary income. Knowing how to finance a house flipping business is the first step to success.

Before looking at various loans, you need to ensure that your budget is clearly set and you have crunched all of the numbers. It isn’t just the property that you may need the funds for. Include the cost of renovations, taxes, insurance, holding costs, and a little extra just if something unexpected comes up. Your credit rating may also impact the amount or type of loan you can apply for. Once you have collected all of this information, you are ready to look at financing options for your house flipping business.

1. A Traditional Bank Loan/Mortgage

A traditional mortgage is the most sensible way to purchase a property that you intend to live in, but perhaps not for house flipping. While you can take advantage of lower interest rates, it can take between 45 days and three months to get the loan approval. This is because banks go through a lengthy and detailed financial check. They will also require inspections on the property and generally don’t like properties with issues.

2. Creative Funding

At the complete opposite end of the scale, you have what people call creative funding for house flipping. Again, you might find this will take longer than other methods as it requires time to develop strong relationships. The real estate community is buzzing with activity and ideas. As you continue to network, you will meet people who have unique funding ideas and possibly even investors.

3. Home Equity Line of Credit

If you are a homeowner and have equity, you might qualify for a HELOC (Home Equity Line of Credit). Many HELOCs can offer up to 85% of the value of your home, deducting what you have left to pay in the form of a line of credit. Interest rates are often lower than other types of loans and, in some cases, can be tax-deductible. Once you sell your flipped property, you can pay off the balance and have the funds available for another purchase.

4. Cash-out Refinancing

This option may only be suitable for certain situations, but it is definitely one to consider. A cash-out refinance loan is a loan to pay off an existing loan, but for a more considerable amount than the balance. The additional money can be used as a down payment or for renovations.

5. Private Lenders

Private lenders to finance your house flipping business are often a favored choice because of the greater flexibility. A private lender will focus their attention more on the investment property than on your financial situation. Their concern isn’t whether you can pay back the loan but whether they will be able to sell the property if problems come up. They will look at the ARV (after repair valve) to estimate the profit after sale. After some time and successful flips, you may find a private lender who will invest 100% of your flip and fix property funding.

0 notes

Text

Purchasing High rises - Great Move?

Purchasing high rises used to be people's opinion about putting resources into land. Be that as it may, because of the entire flipping marvel the famous thought of putting resources into land has become something more likened to repairing junker houses.

Not that there's anything amiss with repairing junkers, you earn substantial sums of money. Be that as it may, when you are attempting to sort out what is the best profit for your time, fixing a junker simply doesn't come close to purchasing a high rise.

How about we think about the two, only for a touch of point of view.

1. At the point when you purchase a high rise you have significantly less rivalry; you are one of a couple of financial specialists in your market following arrangements. Pursuing flippers you're one of hundreds. Why? Houses are simple for individuals to get their heads around, so everybody and their cousin does it. Apartment complexes are additionally testing, in view of the high dollar figures included and more subtleties to dominate, so less individuals take them on.

2. Purchasing high rises makes you "much" more cash. At the point when you fix up a house you get one check one time; when you sell. You may have 100 hours into a recovery bargain, and when you sell you net $30,000. Pleasant! Notwithstanding, take those equivalent 100 hours and put them into purchasing a 50 unit high rise. Presently, in addition to the fact that you get paid more, your high rise pays you on different occasions. At the point when you close you get money back from favorable to evaluated rents, you pay yourself an administration charge for collecting private cash for the arrangement. Every month you get positive capital from the property. At that point, year and a half or so in the wake of shutting, subsequent to remodeling the units, raising the rents and filling opportunities, you renegotiate and pull out a six figure, perhaps a seven figure check. These are credit continues and tax-exempt.

3. On the off chance that you will likely get well off, building a multi-million dollar total assets, purchasing high rises with get you there faster. You need less arrangements to arrive at the 1,000,000 dollar mark (a solitary arrangement can do it for you) making it significantly more feasible.

4. Despite the fact that most land financial specialists fear lofts due to the large numbers, purchasing high rises is indeed safer than purchasing houses. On the off chance that any single inhabitant quits paying rent you actually have capital rolling in from the wide range of various paying occupants in the property to cover your costs. At the point when an occupant in a solitary family home quits paying, that is it! You're 100% empty and by and by on the snare for the home loan, assessments and protection.

5. Purchasing apartment complexes permits you to accomplish economies of scale, making your per unit costs lower and capital edges higher. Since you can produce more useable pay with high rises, it is monetarily achievable to enlist an expert administration organization, liberating you from everyday administration of the property.

6. Purchasing high rises and overseeing them successfully furnishes you and your family with a long period of leftover pay.

As should be obvious purchasing high rises gives you all that you needed when you originally considered getting into land; enormous single amounts of money, month to month capital that develops after some time, the time opportunity to truly make the most of your life.

Entertainingly, houses can give not many of these advantages, yet 'flipping masters' promote them as the venture vehicle for your independence from the rat race.

Try not to be tricked. Teach yourself, make a move to purchase your first high rise and appreciate the pay for the remainder of your life.

For more data :- Shop for rent in Bhubaneswar

0 notes

Text

Buying New Property & Cash Loans Few Tips

Buying your first new property is a massive step in the right direction for several reasons. First, it’s your entrance to the world of property ownership and all the responsibility and privileges that go alongside it. Second, it’s a major financial decision, which will require you to develop a whole new understanding of topics such as financing, mortgage and more. All in all, it’s a massive commitment and the more you learn about it, the less likely you are to make a mistake that you will come to regret. Seeing as how these two topics are so tightly intertwined (buying property and getting a loan), here are several things you need to know about it.

Hire a financial advisor

The first thing that you need to do when buying a home is to hire a financial advisor. The first thing that this will help you with is to figure out how much house you can truly afford. Buying a more expensive place than that will make your life so much more difficult than it has to be. Sure, there are some decent online calculators that you can check out, however, it’s dubious exactly how accurate they are. This is why it’s for the best to just go to a professional. There are some other questions worth asking on this topic like what are the maintenance and repair costs that you’re going to face as a homeowner and whether you’re really prepared for this. You should also ask what your mortgage options are. All in all, there’s so much for you to consider out there and with the right help, you’re more likely to make the right choice.

Try combining loans

You need to understand the fact that the majority of people finance the purchase of their first property by going for a long-term loan. This mortgage is usually obtained through banks and credit unions. The number of available lenders is fairly high, seeing as how mortgages are usually seen as the most reliable of the loans. The problem lies in the fact that the loan in question isn’t enough for the entirety of the purchase. What about the down payment and numerous fees involved in the purchase? Well, here you might want to go for a different approach. Ideally, you would have this money in your savings account, however, if this is not the case, you might want to go for fast cash loans instead. Sure, there are numerous alternatives to this, as well, like borrowing money from parents, checking out government programs or considering 100 per cent financing. Still, by just going for another loan, you’re choosing the most self-reliant method out there, which is a massive help. Provided that you have a great previous credit score, this method is truly an outstanding one.

Alternative mortgage options

Previously, we’ve mentioned the fact that you might have to set aside as much as 20 per cent as a down payment, however, this is just the most common of many options. You see, there are some mortgages where you get to pay as little as 5 per cent down. This will give you more maneuvering space when it comes to various renovations and repairs. With this option, you would be able to consider investing in homes that would otherwise be completely out of question (due to your funds and the state that they are in). Nonetheless, keep in mind that a lot of these loans come with their own set of terms, some of which may not work to your advantage. Still, in a scenario where you’re dead-set on getting yourself property and are completely aware of the fact that you can’t afford this down payment, this may sound like the best choice. The list of lenders offering these services is also quite high, which allows you to do some shopping around.

Start as soon as possible

One of the biggest misconceptions that a lot of people make, when it comes to buying their first piece of property, is the idea that they should wait until they’re in the more financially stable territory. The problem with this idea lies in the fact that the majority of mortgage loans take 20 to 30 years to pay off. This means that, for your first real estate, it would be ideal if you could start in your 20s. Keep in mind that this is great regardless if you’re planning to get a family home or if you intend to turn a place into a rental property, further down the line. Even if the latter is the case, this way the property will start generating profit a lot sooner, which is also a huge plus. The benefits of this mindset are quite numerous. First of all, real estate can serve as a hedge against the market. Whenever you’re looking for a way to invest, diversifying your portfolio is definitely a great idea. Second, if you decide to buy and immediately rent out the place, you can substantially bump up your cash flow, which is a considerable plus, especially for a person in their 20s. Not to mention the fact that rental and residential aren’t your only two options. Being a house flipper is a completely legitimate financial strategy that you should consider.

Get in touch with professionals

Previously, we’ve mentioned that you need to get a financial advisor on your side, however, this is not where your expert outreach should end. You see, a financial advisor can only give you a tip on whether you should buy a property and not which property you should buy. This responsibility should fall to someone more familiar with real estate. For this very reason, you need to find yourself a buyer’s agent. This is a person who knows enough about the subject matter and has the necessary connections in the industry in order to unveil whether the property in question is worth your money. Other than this, you need opinions from numerous experts such as pest inspectors, plumbers, electricians and professional contractors. Don’t get us wrong, the place doesn’t have to be in a completely flawless condition but it does need to show potential. As a layman, as well as someone who has never before owned a property, chances are that you will be unable to recognize this potential. This is why you need the opinions of those who are skilled and experienced enough for such a task. What you need to keep in mind is the fact that some of these people are going to be involved in these extra works that you intend to make, later on. For instance, for a faulty plumbing system, you’ll need to remodel your home’s plumbing. Who’s better to undertake this work than the plumber/plumbing agency that you’ve taken to inspect the property. For those who intend to fix and flip homes (especially if it’s in the same area) collaborating with the same people over and over again can, indeed, make the difference.

Improve your odds

Getting a great loan is not a simple thing, however, it is something that can be done quite efficiently. Generally speaking, there are two major loan types – secured and unsecured loans. Due to the fact that you have no previous property, you’re most likely to go for an unsecured loan. In fact, even online lenders ask for your credit score before offering you terms. A credit score is a three-digit number that ranges between 300 and 850. This figure determines how trustworthy you are as a potential borrower. In order to make a profit, lenders are balancing between profit and risks. In order to improve your odds and provide yourself with superior terms, you might want to start by increasing your credit score. How does this work? Well, you first need to understand what the credit score consists of. In plain numbers, about 35 per cent of your credit score depends on your payment history. Paying in time (or missing your payments) will mostly impact your fiscal trustworthiness in the eyes of lenders. Second, the amount of money that you owe is another 30 per cent of your score. In order to improve your credit score, you need to try and become more vigilant when it comes to your monthly payments. Alternatively, you could consolidate your loans in order to minimize the chance of missing a payment. A single payment is harder to miss than a plethora of payments. Apart from this, you need to avoid closing credit cards that you’re not using. Why? Well, because it shortens the length of your credit history. It really is that simple. Not every lender is asking for minimal paperwork, which is why you want to get your documentation in order.

Is this really a priority?

Previously, we’ve discussed the idea of buying property to diversify your investments, and we’ve gone to lengths to explain why this is such an important thing to do as soon as possible. However, is this really a priority? Should you invest in property before you even have an emergency fund or are there better deals that you can access? Well, this is quite a subjective question that you should address to your financial advisor. For instance, if you intend to start your own business, you might want to do so first.

In conclusion

As you can see, the issue of financing your first property is not the only one that you should concern yourself with. The question of should you take this step and when is just as important and it’s your job to make all of these factors align to your benefit. Read the full article

0 notes

Text

100% PURCHASE PRICE FINANCING FIX & FLIPS - $50,000 - $250,000.00 - NO CREDIT CHECK!

NO CREDIT CHECK 100% Purchase Price Financing For Investors. Use for Investor Fix & Flip deals OR rental ready purchases. Loan amounts from $50,000 - $250,000.00. COST OF RENOVATION NOT INCLUDED IN LOAN AMOUNT. NO APPRAISAL REQUIRED. Close in 10 business days. Must have one (1) prior completed flip in last 24 months. Single family and 2-4 units including town-homes. No Income Verified. No Employment Verified. No prepayment penalty. 24 hour prequalification. Apply online at investorrehabfunding.com NAME: Investor Rehab Funding, LLC Email: [email protected] Contact Phone: 844-244-1420 URL: https://www.investorrehabfunding.com/platinum-fix-flip-funding-program/

0 notes

Text

What is a 720 Credit Score?

Wondering what your 720 credit score means? We’ve got you covered. This article reveals everything you need to know about a 720 credit score, including how it’s calculated, how to improve it, what it could get you, and more. What can you do with a 720 credit score? While there are a number of different credit scoring models, such as FICO Score and VantageScore, for the purposes of this article, we’ll be discussing the FICO Score, since it is by far the most widely used model. Your FICO Score is a three-digit number that represents your creditworthiness to a potential lender. Scores range from 300 to 850, and the higher your score is, the better credit you have. Check your free credit score today in just 2 minutes.Learn different techniques around building credit and what it can do for you.Credit problems? Learn how to fix your credit in 3 months or less.Try different techniques and learn how to improve your credit score to get better financial rates.What is a bad credit score and why it matter for your financial success.Find out how you can attain a perfect credit score and what it could do for your finances. Consumers whose credit score falls between 680 and 720 are considered to have a good, solid credit rating. With a score in this general range, you can feel confident in getting approved for a credit card, qualifying for a loan with a good interest rate, and also enjoying other (possibly unexpected) benefits, such as lower insurance premiums.

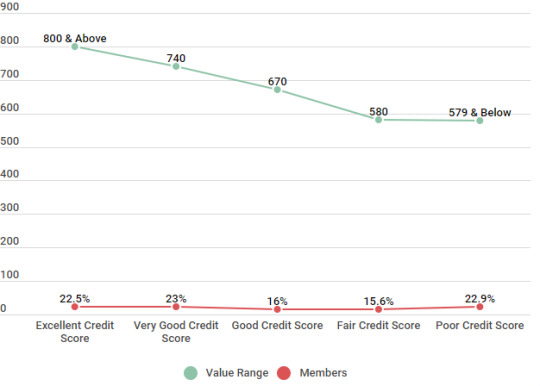

Below, you can see a breakdown of the generally accepted credit score ranges. You’ll notice that a 720 credit score falls in the “Good” range, whereas anything below 700 is considered “Fair” and anything above 750 is considered to be “Very Good.” Comparing Credit Score Ranges of Credit Sesame Members

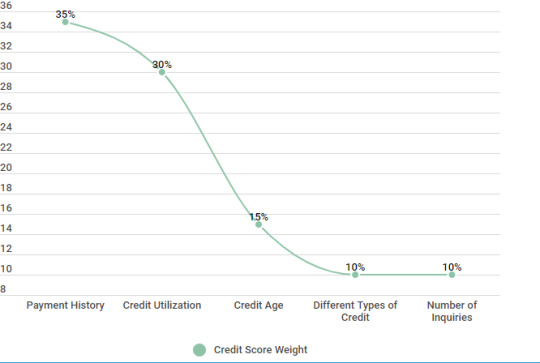

Score RangeValue Range MembersExcellent Credit Score800 to 85022.5%Very Good Credit Score750 to 79923%Good Credit Score700 to 74916%Fair Credit Score650 to 69915.6%Poor Credit Score550 to 64914.9%Bad Credit Score549 & Below8% Source: Credit scores were calculated from 350 Credit Sesame members on 3/6/18. Factors in your credit score In order to fully understand your credit score, let’s take a closer look at what goes into building your score: Payment History. Your payment history is the single biggest factor that contributes to your credit score. This shows potential lenders how often your payment have been on time — or if they have been late or missed.Credit Utilization. While this may sound complicated, your credit utilization is simply the percentage of your total available credit that you are currently using. This number is expressed as a percentage and, to keep the best score, you’ll want to keep your number below 30 percent.Credit Age. The age or length of your credit history also contributes to your score. To make the most of this factor, make sure to keep your oldest accounts open and in good standing.Credit Mix. Potential lenders like to see a mix of different credit types on your report, such as credit card accounts and an auto or mortgage loan.Number of Inquiries. While checking your credit score won’t hurt your account, hard inquiries, such as when you apply for a new credit card, will. Limit the number of hard inquiries on your credit to keep your score high. As you can see below, these are the factors that make up your basic credit score. You’ll also notice that some are weighted more heavily than others. For instance, your payment history factors into your score more than 3 times as much as the number of inquiries you have. FICO Scoring Model Calculation (Weight) Factors

Credit FactorsCredit Score WeightPayment History35%Credit Utilization30%Credit Age15%Different Types of Credit10%Number of Inquiries10% Source: https://www.myfico.com/credit-education/whats-in-your-credit-score

How to maintain or improve your 720 credit score

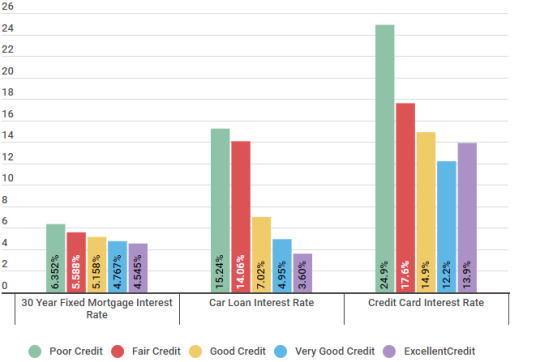

Even with good credit, there are always steps that you can take to help build and improve your credit. But before you can know how to improve your score, you need to first understand the individual factors that contribute to your score. To help improve your score, you’ll want to focus on the following factors. Average Credit Score Improvement starting with good credit MethodCredit Starting Point3 Months6 Months12 MonthsOnetime payments720723730744Secure credit card 720722729740Credit building loan720723730744 Source: Review of 600 individuals increased their credit by different methods The study was conducted in February of 2016 and concluded April of 2016. Now that you know how your score is calculated and some basics on how to improve your score, let’s look at what you can expect to get with a 720 credit score. What can you expect with a 720 credit score? As you can see from the numbers below, having a good credit score not only makes it easier for you to secure credit or a loan when you need it, it will also save you a significant amount of money in the process. Interest Rate Ranges for Different Credit Score Ranks

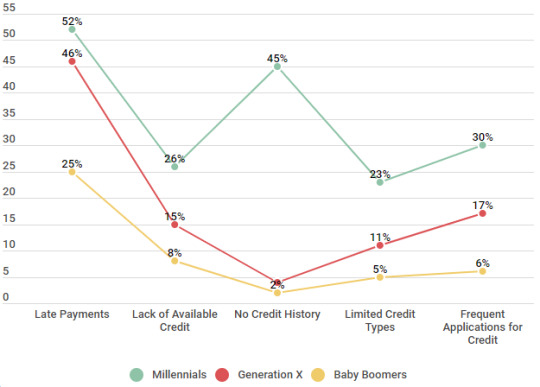

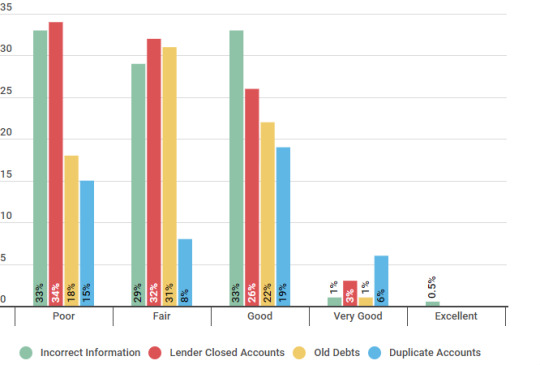

Type of LoanPoor CreditFair CreditGood CreditVery Good CreditExceptional Credit30 Year Fixed Mortgage Interest Rate6.352%5.588%5.158%4.767%4.545%Car Loan Interest Rate15.24%14.06%7.02%4.95%3.60%Credit Card Interest Rate24.9%17.6%14.9%12.2%13.9% Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018. Let’s take a more practical look at what this means. Let’s say you want to purchase a house with a $150,000 mortgage. With “Good” credit, you could receive an interest rate of 5.158 percent. With a 30-year fixed loan, that translates into monthly payments of roughly $819.78. By the time the 30 years is over, you’ll have paid $145,120.38 in interest. On the flip side, if you have “Poor” credit and receive a rate of 8.2 percent, your monthly payment is roughly $933.55 and you’ll have paid $186,077.84 in Interest by the end of the loan. As you can see, it’s financially in your best interest to improve your credit, in this situation, more than $40,000 over 30 years. Improving your credit can get the best possible terms for things like mortgages, car loans, and more. Dealing with negative information on your credit report With a score of 720, the chances are good that you won’t have too many negative factors on your credit report. It’s no secret that negative information can have a huge impact on your credit score and your credit report — not to mention your ability to get new credit with favorable terms, moving forward. Fortunately, negative marks don’t last forever. Here are some of the negative factors currently contributing to low credit scores of Credit Sesame members, broken down by generation. Negative Factors that Contribute to Low Credit Scores

Negative FactorsMillennialsGeneration XBaby BoomersLate Payments52%46%25%Lack of Available Credit26%15%8%No Credit History45%4%2%Limited Credit Types23%11%5%Frequent Applications for Credit30%17%6% Source: Credit Sesame polled 300 participants between February 10, 2018 and February 17, 2018. 100 participants were Millennials, 100 participants were members of Generation X, and 100 participants were Baby Boomers. Errors that impact credit scores The first step to improving your credit is to make sure that all the information on your current credit report is accurate. Get a copy of your credit report from all 3 major credit bureaus, and check it closely for any errors or outdated information. It is estimated that as many as 1 in 5 reports contain inaccurate information that can negatively impact your score. Here is a list of some of the most common errors that can have a negative effect on your credit score. As you can see, someone with poor credit has more errors on their credit report — confirmation that regularly checking your credit report and clearing up any inaccuracies leads to better credit scores. Errors Which Affect Credit Rankings