#$a

Explore tagged Tumblr posts

Text

5 Trade Ideas for Monday: Agilent, Abbott Labs, Albemarle, Alteryx and General Dynamics

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent, Ticker: $A

Agilent, $A, comes into the week at resistance after filling the gap from August. The RSI is rising in the bullish zone with the MACD positive and crossing up. Look for continuation over resistance to participate…..

Abbott Laboratories, Ticker: $ABT

Abbott Laboratories, $ABT, comes into the week at resistance. The RSI is rising towards the bullish zone with the MACD crossed up. Look for a push over resistance to participate…..

Albemarle, Ticker: $ALB

Albemarle, $ALB, comes into the week at an all-time high. The RSI is rising in the bullish zone with the MACD positive and crossing up. Look for continuation to participate…..

Alteryx, Ticker: $AYX

Alteryx, $AYX, comes into the week approaching resistance. The RSI is rising in the bullish zone with the MACD turning up and positive. Look for a push over resistance to participate…..

General Dynamics, Ticker: $GD

General Dynamics, $GD, comes into the week reversing higher off the 200 day SMA. The RSI is rising in the bullish zone with the MACD positive and turning higher. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the September Quadruple Witching and Index Rebalancing week, saw equity markets showed strength with a rebound solid three day move higher to end the week.

Elsewhere look for Gold to pause in its pullback while Crude Oil tries to reverse higher. The US Dollar Index continues in the uptrend while US Treasuries continue their downtrend. The Shanghai Composite looks to consolidate while Emerging Markets move to new lows. The Volatility Index looks to pull back towards the normal zone making the path easier for equity markets to the upside.

Their charts showed some strength, especially on the longer timeframe with bullish engulfing candles. On the shorter timeframe the SPY, IWM and QQQ may have just confirmed higher lows after the higher highs in August. Continuation to the upside and through the August high would confirm an intermediate trend reversal higher. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

EARNING UPDATE $A Agilent Technologies, Inc. for quarter ending q_Jul18

EARNING UPDATE $A Agilent Technologies, Inc. for quarter ending q_Jul18

[s2If !current_user_can(access_s2member_level0)]Please login to read the earning update on A [lwa][/s2If][s2If current_user_can(access_s2member_level0)]Agilent Technologies, Inc. reported earnings (EPS) of 0.73 per share for the quarter ending q_Jul18. This is vis-vis 0.63 per share for the previous quarter ending q_Apr18, a growth of 15.9 %. Compared to last year same quarter (q_Jul17), earnings…

View On WordPress

0 notes

Text

$A - Lost

New Music: @WhoEssay - Lost

“Just a reminder for the new year & for now on that, your not alone and never will be alone as long as im here” – $A $A is a 17-year-old Pittsburgh rapper who just dropped a heartfelt record for everyone feeling a bit displaced in this crazy world. Stream “Lost” below! [soundcloud url="https://api.soundcloud.com/tracks/239100055"…

View On WordPress

0 notes

Text

$A - "Lost" |@WhoEssay|

$A – “Lost” |@WhoEssay|

$A is a 17-year-old Pittsburgh rapper who just dropped a heartfelt record for everyone feeling a bit displaced in this crazy world. Stream “Lost” below!

View On WordPress

0 notes

Audio

(via https://soundcloud.com/whosa/simple-things?utm_source=soundcloud&utm_campaign=share&utm_medium=tumblr)

0 notes

Text

5 Trade Ideas for Monday: Agilent, BlackRock, Danaher, JP Morgan and Oracle

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

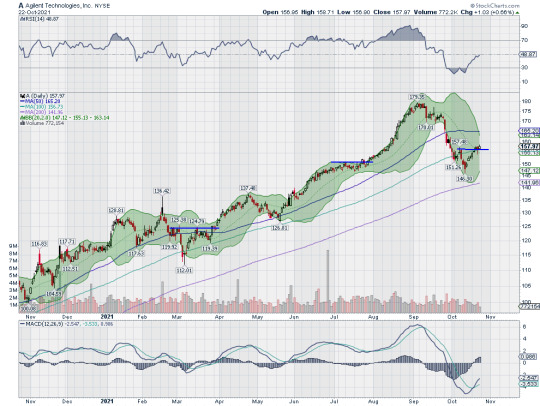

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, comes into the week pressing a higher high. It has a RSI rising to the midline with the MACD crossed up. Look for a move up out of consolidation to participate…..

BlackRock, Ticker: $BLK

BlackRock, $BLK, comes into the week near resistance after a move off the 200 day SMA. The RSI is rising in the bullish zone with the MACD positive. Look for a push higher to participate…..

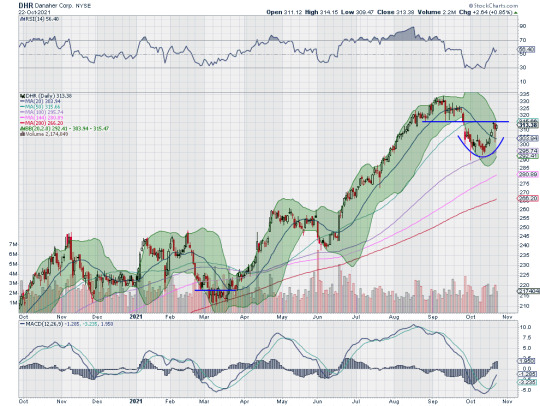

Danaher, Ticker: $DHR

Danaher, $DHR, comes into the week at the gap fill from the end of September. It has a RSI on the edge of the bullish zone with the MACD crossed up. Look for continuation to participate…..

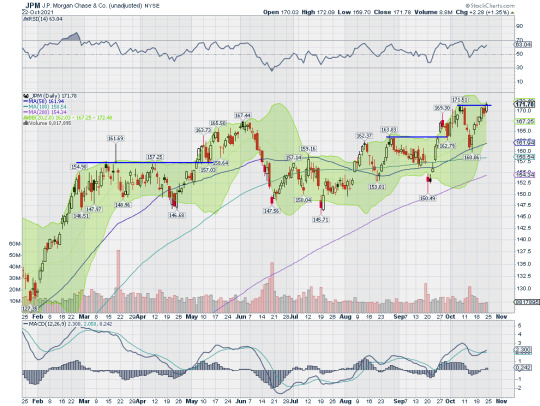

JP Morgan, Ticker: $JPM

JP Morgan, $JPM, comes into the week making a new all-time high. It has a RSI rising in the bullish zone and a MACD positive and crossed up. Look for continuation to participate…..

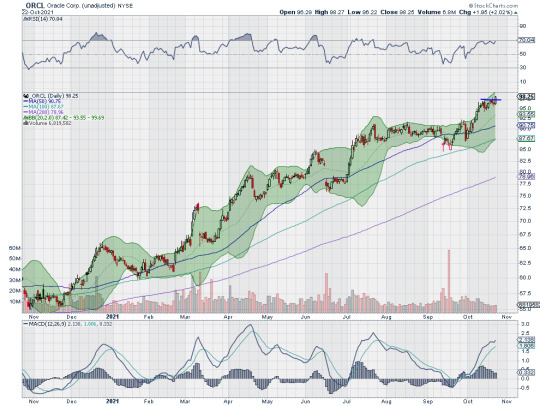

Oracle, Ticker: $ORCL

Oracle, $ORCL, comes into the week at an all-time high as well. It has a RSI strong in the bullish zone and a MACD positive and rising. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with one week left in October, saw equity markets with continued strength.

Elsewhere look for Gold to continue its short term consolidation while Crude Oil continues in an uptrend. The US Dollar Index to pullback in the short term uptrend while US Treasuries consolidate in the downtrend. The Shanghai Composite looks to continue to mark time in a broad range while Emerging Markets pullback in a long term uptrend.

The Volatility Index looks to remain very low making the path easier for equity markets to the upside. The charts of the SPY and QQQ continue to look strong, especially on the longer timeframe. On the shorter timeframe the QQQ looks in for a pause. The IWM remains stuck in broad consolidation but with some positive progress at the top of the recent range. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

EARNING UPDATE $A Agilent Technologies, Inc. for quarter ending q_Jul18 - Revenue grew, Margins expanded

EARNING UPDATE $A Agilent Technologies, Inc. for quarter ending q_Jul18 – Revenue grew, Margins expanded

[s2If !current_user_can(access_s2member_level0)]Please login to read the earning update on A [lwa][/s2If][s2If current_user_can(access_s2member_level0)]Agilent Technologies, Inc. reported earnings (EPS) of 0.73 per share for the quarter ending q_Jul18. This is vis-vis 0.63 per share for the previous quarter ending q_Apr18, a growth of 15.9 %. Compared to last year same quarter (q_Jul17), earnings…

View On WordPress

0 notes

Text

First post...

this blog is a piece of something greater. A part of a completion.

2 notes

·

View notes

Text

Tuesday’s Notable Options Activity: Russell on the Mend

Here is some untied, generally directional options activity that caught my eye during Tuesday’s trading:

1. IWM - I know you already know this, but the Russell 2000 severely lagged the S&P500 (SPX) in 2014 (up only 3.5% vs its large cap brethren up 11.5%). I know that you also already know that while the SPX marched to new high after new high in 2014, closing at the very highs on the last tick of the year, the Russell 2000, as measured by the IWM for our purposes seemed trapped in a fairly tight trading range for most of 2014, spending most of its time between $110 and $120. There were no shortage of market pundits who labeled this underperformance as a sure sign the broad market was topping. Well, once again the index is threatening a breakout, and if and when it does, the move could be fairly epic!

IWM 1yr chart from Bloomberg

It appears that one market participant is playing for a breakout expressing the view with options, with yesterdays action either defining a tight range for gains above $120 by March expiration, or more likely chose to roll up a prior bullish view. When the IWM was $118.13 in the morning, it was reported that the March 120 / 124 1×2 call spread was crossed 20,000 by 40,000 for 76 cents. Notice how it did not say bought or sold, and both options blocks printed at or above the offer. If this was a ratio call spread it could have been closing on the 120 calls, as they were marked closing, and there was 20,000 open interest in the strike. This is a great example of how sometimes it can be very hard to delineate unusual options activity. But I suspect this was a bullish roll, where the trader sold 20,000 March 120 calls at 2.14 to close, and bought 40,000 March 124 calls for .69 to open. Closing out a likely profitable trade for a total of $4.3 million in premium and committing $2.76 million of it that breaks-even up at $124.69 (or about 5.5%) on March expiration in a little more than a month. Either way the trader is playing for a breakout either in a range between $120.76 and $127.24 (for the ratio) or above $124.69 if a bullish roll.

A breakout of the Russell would show a healthy broadening out of the bull market. The Russell could be on the mend.

youtube

2. XOP - on a day that saw a sharp decline in crude, (down almost 4% at its lows, settling in down 3%) equities shrugged off the weakness, with the SPX closing up 1%. This has sort of bifurcation has not been the case for most of 2015. The S&P Oil and Gas etf saw a large opening bearish trade when the XOP was 49.85. A trader paid .70 for 20,000 of the March 43/38 put spread to open. This trade breaks-even down at 42.30, or down 15% in a little more than a month, with a max gain of 4.30 if the etf is 42 or lower. The etf which is made of oil and gas stocks, at one point this week was up 28% from last month’s lows, and this bearish position seems to isolate the double bottom low from Dec and Jan:

XOP 6 month chart from Bloomberg

3. RIG - Credit Suisse downgraded the stock yesterday morning to a sell and set a $12 price target, suggesting that the company will cut their dividend that currently yields 15% (clever). When the stock was $19, a trader rolled down and out a bearish view, selling 16,000 Feb 18 puts at .60 to close and bought 16,000 of the May 18/13 put spread for 1.80 to open.

4. A - Agilent, the semi and bio-medical equipment testing company saw a bullish roll when the stock was $39.23. A trader closed a bullish risk reversal, selling 19,500 Feb 42.50 calls at .32 to close, and buying back 13,000 Feb 37.50 calls for .48 to close. And sold 15,000 August 35 puts at 1.77 to open and used the proceeds to buy 15,000 of August 42.50 / 50 call spreads for 1.67. This trade resulted in a 10 cent credit to the buyer, with the worst case scenario being the trader is put 1.5 million shares of stock at $35, down almost 11% on August expiration. The trade breaks-even on the upside at $42.50, with profits of up to $7.50 between $42.50 and $50, with the max gain of $7.50 above $50 (plus the 10 cent credit), up almost 25% from current levels.

Related Posts:

MorningWord 2/10/15: We Have Seen This Movie Before (1)

Monday’s Notable Options Activity: $AAPL, $CA, $CSCO, $MSFT, $WMB, $XOM (1)

Name That Trade – $CSCO: Chambers on the Hot Seat? (1)

This post by Dan Nathan (@riskreversal) originally appeared on RiskReversal.com

7 notes

·

View notes

Text

5 Trade Ideas for Monday: Agilent, Abbott Labs, Amgen, Deere and Vulcan Materials

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, comes into the week break resistance after a short consolidation. The RSI is rising in the bullish zone with the MACD turning to cross up and positive. Look for continuation to participate…..

Abbott Laboratories, Ticker: $ABT

Abbott Laboratories, $ABT, has trended higher since a gap down to start June. It ended last week breaking over resistance with the RSI rising in the bullish zone and the MACD lifting from flat. Look for continuation to participate…..

Amgen, Ticker: $AMGN

Amgen, $AMGN, comes into the week at resistance in consolidation after a move up off the 200 day SMA. It has a RSI rising toward the bullish zone with the MACD lifting off the signal line and positive. Look for a push over resistance to participate….

Deere, Ticker: $DE

Deere, $DE, closed the week back at resistance after a minor pullback. The RSI is rising towards the bullish zone with the MACD about to turn positive. Look for a push over resistance to participate…..

Vulcan Materials, Ticker: $VMC

Vulcan Materials, $VMC, comes into the week moving higher towards resistance. The RSI is rising toward the bullish zone and the MACD positive and moving higher. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with one week left in July, saw equity markets had shaken off a threat to the downside, with some reversing to all-time highs.

Elsewhere looks for Gold to consolidate while Crude Oil looks ready to continue the move higher. The US Dollar Index continues to drift to the upside while US Treasuries may be ready to pullback in their uptrend. The Shanghai Composite looks to continue in consolidation while Emerging Markets pullback in consolidation.

The Volatility Index looks to remain very low making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY have reset on momentum measures and are moving in the next leg higher. The IWM has also recovered from a breakdown and may be ready to join them to the upside, out of consolidation. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Agilent, Applied Materials, Edwards Lifesciences, FedEx and Scotts Miracle-Gro

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, made a top in February and then started to pullback. It found support and reversed in March. It met resistance and ended the week pressed against it. The RSI is rising towards the bullish zone with the MACD pushing into positive territory. Look for a push over resistance to participate…..

Applied Materials, Ticker: $AMAT

Applied Materials, $AMAT, started higher off the 200 day SMA in October and continued to resistance in February. It ended last week pushing through resistance with the RSI moving higher and the MACD crossing up. Look for continuation to participate…..

Edwards Lifesciences, Ticker: $EW

Edwards Lifesciences, $EW, topped in December and has been pulling back since. Last week it started to move higher with the RSI rising and the MACD crossing up. Look for continuation to participate…..

FedEx, Ticker: $FDX

FedEx, $FDX, ran to a top in December before pulling back. It found support and has been rolling up out of the pullback. It ended the week at resistance with the RSI holding in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate…..

Scotts Miracle-Gro, Ticker: $SMG

Scotts Miracle-Gro, $SMG, ran to a top in February and then started to correct lower. It found support in March and reversed back higher, stalling at a February gap down. It held there until breaking higher Friday. The RSI is rising into the bullish zone with the MACD positive and climbing. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the shortened week and the end of the 1st Quarter, sees equity markets showed resilience with a rebound from a mid-week dive.

Elsewhere look for Gold to possibly reverse out of its pullback while Crude Oil consolidates in its digestive move. The US Dollar Index has turned to a short term trend to the upside while US Treasuries bounce in their downtrend. The Shanghai Composite continues to pullback in the uptrend while Emerging Markets look close to a long term breakout retest as they pullback.

The Volatility Index looks to remain low and close to filling the pandemic gap, making the path easier for equity markets to the upside. Their charts look strong on the longer timeframe, but there is a clear ranking emerging with the SPY strongest and moving higher, the IWM with a possible broadening top and the QQQ holding support after a digestive pullback. On the shorter timeframe both the IWM and the QQQ also look weaker than the SPY as they show short term trends lower while the SPY attacks the all-time high. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Agilent, Alexion, Eaton, Honeywell and Constellation Brands

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, has moved higher off of a March low in 3 steps. The last one ended at the start of August and it has consolidated under resistance since. Friday saw it break resistance higher with the RSI turning back up and the MACD crossing higher. Look for continuation to participate…..

Alexion Pharmaceuticals, Ticker: $ALXN

Alexion Pharmaceuticals, $ALXN, gapped up in June to make a new high and then stalled. It has reversed lower since in an orderly channel under the 20 day SMA. That changed last week as it started to turn back higher. The RSI is rising into the bullish zone with the MACD crossing up and about to turn positive. Look for continuation to participate…..

Eaton, Ticker: $ETN

Eaton, $ETN, bottomed in March and then started higher. It took 3 steps to reach a top in August and has been consolidating there under resistance. The RSI is rising in the bullish zone with the MACD flat but positive. Look for a push over resistance to participate…..

Honeywell, Ticker: $HON

Honeywell, $HON, stalled as it hit the 200 day SMA in June and pulled back. It ran higher then until retesting that high in August. It finally gapped over it last week. The RSI is moving up in the bullish zone with the MACD rising and positive. Look for continuation to participate…..

Constellation Brands, Ticker: $STZ

Constellation Brands, $STZ, paused in the move higher in July and then entered a shallow pullback. Friday it pushed over short term resistance with the RSI rising in the bullish zone and the MACD positive and lifting. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with one trading day left in August, saw equity markets had put up stellar returns on the month despite the hot lazy summer weather.

Elsewhere look for Gold to consolidate in its uptrend while Crude Oil continues to slowly drift higher. The US Dollar Index continues to move to the downside while US Treasuries may be breaking consolidation to the downside. The Shanghai Composite looks to move higher in consolidation while Emerging Markets move up out of consolidation.

The Volatility Index looks to continue to run flat in the February gap making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY could us a reset on momentum measures as both are extended. The IWM may be ready to break its bull flag to the upside. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Agilent, Air Products, Boston Scientific, Lululemon and Teck Resources

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, ran higher to a top in January. It stalled in a pullback at the 50 day SMA and then continued to the 200 day SMA in March where it bounced. The bounce failed and it continued lower to a bottom in the middle of the month. Since then it has reversed and comes into the week at resistance. The RSI is on the edge of the bullish zone with the MACD positive and turning up. Look for a push over resistance to participate…..

Air Products and Chemicals, Ticker: $APD

Air Products and Chemicals, $APD, started moving lower in February and found a bottom in mid-March. It consolidated there into early April before starting back higher. It ended last week pressing through resistance with the RSI rising in the bullish zone and the MACD positive and moving up. Look for continuation to participate…..

Boston Scientific, Ticker: $BSX

Boston Scientific, $BSX, fell from a high in January to a low in March. It consolidated there for a short while and then started higher. It ran into resistance in the middle of April and has consolidated there since. The RSI is holding just under the bullish zone with the MACD flat but positive. Look for a push over resistance to participate…..

Lululemon Athletica, Ticker: $LULU

Lululemon Athletica, $LULU, started lower in late February and quickly made a bottom in the middle of March. It also rebounded quickly until it returned to the 200 day SMA. A slight pullback and then another leg higher brought it to resistance. It is pushing through resistance now with the RSI rising in the bullish zone and the MACD moving up and positive. Look for continuation to participate…..

Teck Resources, Ticker: $TECK

Teck Resources, $TECK, had a slow roll down to a bottom in mid-March. Since then it has been in consolidation. It ended last week at resistance with the RSI rising into the bullish zone and the MACD rising and positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using the Get Premium link,

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the May options expiration week, sees equity markets showed great strength in the face of historically horrible economic data.

Elsewhere look for Gold consolidate at highs while Crude Oil consolidates the short term move higher. The US Dollar Index continues to tighten the range while US Treasuries pullback. The Shanghai Composite continues to consolidate under resistance in a broad range while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to continue to move lower making the path easier for equity markets to the upside. Their charts also look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY are at potential resistance points with the IWM having the easiest path higher. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Aligient, Allstate, FMC, Eli Lilly and Monster Beverage

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Aligient, Ticker: $A

Aligient, $A, rose to a top in March and then started moving lower. It paused in April and bounced then retested in May before a gap down. It found support at the end of May and held. Now it is moving back higher with an RSI rising and a MACD crossed up. Look for a push over resistance to participate higher…..

Allstate, Ticker: $ALL

Allstate, $ALL, rose from a bottom in December started to plateau in February. It has moved sideways since until a break to the upside Friday. The RSI is bullish and rising with the MACD rising off of the zero line. Look for continuation to participate higher…..

FMC, Ticker: $FMC

FMC, $FMC, rose from a December low and finally met resistance in April. It pulled back from there finding support in mid-May. Since then it has been moving back higher. It has a RSI rising in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate…..

Eli Lilly, Ticker: $LLY

Eli Lilly, $LLY, paused in a move higher over last fall. It resumed in December and reached a top in March. It pulled back and found support into April. It held there and and is now up against resistance. The RSI is rising toward the bullish zone with the MACD rising but still negative. Look for a move over resistance to participate…..

Monster Beverage, Ticker: $MNST

Monster Beverage, $MNST, made a top in February and then started to move lower. It found support in March and reversed higher. It consolidated in May and held in a range until Friday. The RSI is bullish and rising with the MACD crossing up and positive. Look for continuation to participate…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the May employment report behind and heading into a light economic news week, sees the equity markets are looking strong after a fast and hard reversal higher.

Elsewhere look for Gold to continue higher while Crude Oil continues to move lower. The US Dollar Index looks to continue lower in the updrift while US Treasuries consolidate their move higher. The Shanghai Composite has renewed the downtrend while the bounce in Emerging Markets continues to move them higher.

Volatility looks to continue to ease making it easier for equity index ETF’s SPY, IWM and QQQ, to move up. Their charts all show a strong move higher on the week, and firm reversals on the weekly chart. The daily charts show the SPY and QQQ with strong moves up all week, while the IWM stalled mid week and consolidated. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Agilent Technologies, Allegiant Travel, DexCom, Union Pacific and Weyerhaeuser

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Agilent Technologies, Ticker: $A

Agilent Technologies, $A, rose off of a bottom in January. It continued to move higher, to a top from late March through early April. It pulled back from there to a low late in April before the recent turn back higher. The RSI is running higher as well with the MACD turning to cross up. Look for continuation to participate…..

Allegiant Travel, Ticker: $ALGT

Allegiant Travel, $ALGT, started higher off of a bottom in December and topped after two steps in February. It pulled back to the 200 day SMA from there and found support into March. From there it reversed back to prior resistance where it sits. The RSI is rising in the bullish zone with the MACD moving higher and positive. Look for a push over resistance to participate…..

DexCom, Ticker: $DXCM

DexCom, $DXCM, pulled back from a plateau in the first quarter and consolidated. It broke that consolidation Friday to the upside. The RSI is rising through the mid line with the MACD crossing up and rising. Look for continuation to participate…..

Union Pacific, Ticker: $UNP

Union Pacific, $UNP, gapped up in January and has trended higher since. Last week it gapped higher again and consolidated. The RSI is strong in the bullish zone with the MACD rising and positive. Look for a push over consolidation to participate…..

Weyerhaeuser, Ticker: $WY

Weyerhaeuser, $WY, made a bottom in December and then quickly rose in January. The price action leveled from there for 2 months before a push up to resistance. After a shallow pullback it is at resistance again. The RSI is rising and bullish with the MACD positive and crossing up. Look for a push over resistance to participate…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which winding down the last days of April sees the equity markets remain strong on longer timeframe and mixed but good on the shorter timeframe.

Elsewhere look for Gold to possibly reverse high out of a pullback while Crude Oil pauses in its uptrend. The US Dollar Index has changed to a short term uptrend while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets are both pulling back in their uptrends.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are strong in the weekly timeframe with the QQQ leading the way at all-time highs and the SPY right behind with the IWM improving. On the daily timeframe the QQQ may be ready for a pause and it might be time for it to pass the baton to the IWM which is back at resistance. The SPY meanwhile remains strong and a fraction from new all-time highs. Use this information as you prepare for the coming week and trad’em well.

1 note

·

View note