#$EA

Explore tagged Tumblr posts

Text

If you want a good object lesson about what we can and can't know about the past, we don't know Ea-Nasir was a dishonest merchant selling shoddy goods.

What we know is we have found a cache of complaint tablets about him selling low quality copper as high quality, in a site that was probably his own residence. We know multiple people complained he was a cheat. It's entirely possible they were right. It's also entirely possible that he kept these complaint letters as records of people he would no longer do business with, because they had made accusations and threats in order to bully him into giving them free copper. That is an equally valid interpretation of the evidence.

My point is not that we have maligned Ea-Nasir, my point is that thousands of years later, we do not and cannot know.

53K notes

·

View notes

Text

What's the first question that really pops into peoples' minds about Ea-Nasir? I'm trying to write this history down, but I'm struggling.

41K notes

·

View notes

Text

Fuck you, City of Ur!

If you're dumb enough to buy a cartload of copper this weekend, you're a big enough schmuck to come to Ea-Nasir's Imported Metals!

Bad deals! Low grade copper! Thieves!

If you think you're gonna find a bargain at Ea-Nasir's, you can kiss my ass!

It's our belief that you're such a stupid motherfucker you'll fall for this bullshit! Guaranteed!

If you find a better deal, shove it up your ugly ass! You heard us right, shove it up your ugly ass!

Bring your deposit, bring your sealed tablet, bring your messenger! We'll send him back!

That's right, we'll send your messenger back through enemy territory!Because at Ea-Nasir's, you're fucked six ways from Sunday!

Take a hike to Ea-Nasir's, home of challenge pissing! That's right, challenge pissing!

How does it work? If you can piss six feet in the air straight up and not get wet, you get no down payment!

Don't wait, don't delay, don't fuck with us, or we'll turn you into a eunuch!

Only at Ea-Nasir's, the only merchant that tells you to fuck off!

Hurry up, asshole! This event ends the minute after you make a donation to the palace, and it better not bounce or you're a dead motherfucker!

Go to hell! Ea-Nasir's Metals: Sumer's filthiest, and exclusive home of the meanest sons of bitches in Mesopotamia! Guaranteed!

11K notes

·

View notes

Text

Eeveelutions as pharmaceuticals

#ive been handling a lot more of these colorful capsules at work so i eas thinking about this#pokemon#medication#pharmacy#eeveelution

7K notes

·

View notes

Text

I saw this on Twitter, and do not know the source, but I think it belongs here.

10K notes

·

View notes

Text

you are the hero of ferelden. no matter your origin you watch those you love most be ripped from you. death becomes an endless cycle which seems to follow you wherever you go. the fate of the world rests on your shoulders as you know you can never return home. home is gone now. home is buried with your family, jailed with your closest ally, cradled by the ancestors, forgotten like your beloved, lost to time in the murky glass of the eluvian- dead in your arms, killed at your hand. you are the hero of ferelden and it is your destiny to die. when next the world falls apart, you do not come. this world does not deserve your pity.

you are the champion of kirkwall. you are a refugee, cold and hungry and sold into labour. your mother hates you, though she will never say it. it's your fault the ogre killed your sibling, your fault the taint took the other. but you are happy. you have everything, friends and family and status and riches. you defeat the people plaguing your glorious city, you are the people's hero. you will always know even as she came back, isabela left you to die. you are happy but you are alone. you have everything and then you are rocking back and forth begging please please please do not take my mother as well. you have nothing, but you for a single second, you had everything. you are the champion of kirkwall, and your ally has blown up the chantry. where is your home now that everything is your fault?

you are the herald of andraste. and you are so, so scared. these people do not trust you, do not like you, would feed you to the fade if they could. they do not care if you follow another religion, you are their herald. you can never return home because heroes do not have homes. they say home is the people you choose, but you didn't choose these people, did you? every step you take aches. thousands reach out to touch you, for safety. for comfort. you are a black hole close to destruction, and you cannot do this. you are the herald of andraste and you have not been yourself for so long now.

#dragon age 2#dragon age inquisition#dragon age#dragon age origins#dao#dai#da2#garrett hawke#lavellan#warden mahariel#fyp#bioware#ea#writing#adding cos people keep asking#i havent played veilguard yet so couldnt add rook

4K notes

·

View notes

Text

I messed up the hot glue a little bit but I'm sure my mistake will eventually be lost to time.

9K notes

·

View notes

Text

5K notes

·

View notes

Text

Leftover Tattoos

I finally managed to finish these tattoo designs. Check out the swatch preview below. Here's what's included:

2 files: left and right leg placement options, 6 swatches each

Teen to elder, all genders and frames

Not allowed for random

Custom thumbnails

Base game compatible

Have fun with these!

Download (always free on Patreon) / Follow and support me

#ts4#s4cc#ts4cc#myshunosun#simblr#mycc#the sims 4#eacreatornetwork#eapartner#ea pratner#ts4 tattoo#ts4 tattoos

3K notes

·

View notes

Text

[[Image ID: a quoted tweet. Original tweet is by @catacalypt on Mar 28, 2024. It contains a picture of a copper bracelet with ancient writing on it. Tweet reads “in case anyone didn’t already know I DO own a “give me my money back Ea-Nasir” bracelet in Akkadian cuneiform.” Quote tweet is by @rob_heighton on Mar 29, 2024. It reads “I wish no ill upon the owner, but the person who supplied the metal for this had the opportunity to do the funniest thing. End of image ID]]

16K notes

·

View notes

Text

Fabien Hairstyle by simstrouble

A medium-length hairstyle for your fancy boys 🌲

Base Game Compatible

24 Swatches

All LODs, Hat Compatible, All Maps

Feminine and Masculine Frame

If you can't support me, consider using my Creator Code provided by EA Creator Network: SIMSTROUBLE

Download (Patreon, Free) | Instagram | Pinterest

#simstrouble#s4cc#ts4cc#the sims 4#s4mm#ts4mm#ts4#sims 4#add hairlines and shadows#and improve EA's crusty textures#makes me happy

4K notes

·

View notes

Text

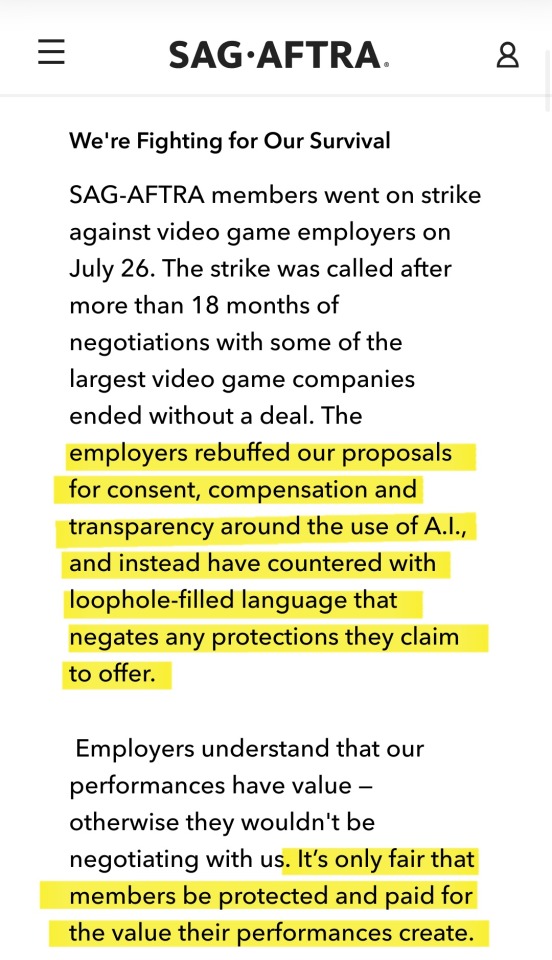

reminder that EA is still a struck company

in light of the sims 1 & 2 re-release, i wanna make sure others know that SAG AFTRA has requested that nothing be purchased from EA until they negotiate and come to a contract agreement with the union.

you can check this page for more info and any news updates that come up. when the contract is voted on by union members, there will likely be notices here and on sag aftra's social media.

#sims#the sims#ts1#ts2#simblr#the sims 1#the sims 2#electronic arts#ea games#ea#union strong#sag aftra#babbles

3K notes

·

View notes

Text

you ever like someone so much

#like so so much!!#you naturally gravitate towards them#you delight in them#even your cat versions are in love#satosugu: no one loves you like i love you#ik this is yet another teacher au but the fondness and love is canon and consistent#i just like drawing them wrassling and kissing and orbiting ea other#they’re so gross!!!!#had to crop it but pls know gojo’s hand is on geto’s butt#catoru/gato#satosugu#jjk

8K notes

·

View notes