Don't wanna be here? Send us removal request.

Text

Shades of Bias: Marketing's Neat Tricks

For the purpose of the case, I started typing on Google "Why are Indians obsessed with.." and the very first thing that came up was 'fair skin'.

Not that I needed to know this. I'm Indian. And I know Indians are OBSESSED with fair skin.

Why? While I'm no expert, my guess is: After centuries of foreign oppression where fair skinned Indians got more privileges than dark skinned Indians, it almost become a twisted aspiration of sorts - If I'm fairer skinned, my life will be easier - I'll get better opportunities, better alliances etc.

Fair skin became aspirational in many ways brought about the invasion from foreigners which would associate Indians with Fair Skin as the closest type of similarity. (In-group). They got better jobs, better social recognition.

The reason I bring this context is to set the stage. I'm not debating what is right or wrong. I want to illustrate the power of marketing.

An example of how crazy Indians are with this Obsession:

Mr. Rajnikanth - one of THE BIGGEST Indian Super stars in Asia. The Image on the Left is how he actually looks like in Real Life. The Image on the Right is during the same year, how he looks in Movies. He has a whole special effects and make up team that is responsible for making him look younger, full hair, BUT more importantly FAIRER. Never once in his 5 decade of acting has he come on screen as his actual self and in his actual skin tone. And he doesn't plan to anytime soon.

Power of Marketing - What catches the eye is what leaves an impression in the mind.

I’m from India. I’m from the very same city (Chennai) that Kavitha Emmanuel (Co-Founder WoW) is from. Chennai is a one of the largest cities in South India, where majority of the citizens are naturally dark skinned. WoW boasts that its efforts are spread across 18 countries.

And I have NEVER heard of or seen WOW’s campaign - Dark is Beautiful. Mind you, I'm from the same city - born and raised. I asked my friends and family back home, even they have never heard of it.

Is their message really spreading?

What I do see on a daily basis in some form of media - Fair and Lovely, Fair and Handsome, Garnier skin lighting products etc. They are in my face all the time - through TV ads, Newspaper Ads, Bus Station billboards, Super markets and convenience stores. They are everywhere.

I have never once used Fair and Lovely cream, but I know what they do, what their ads are, what their logo is, what their theme song is, who their brand ambassadors are, what their packaging is, what their price points are etc. I know they exist and everything else about them, even though I nor my family have every bought it once.

This, Is the power of consistent and aggressive marketing - 'Mere Exposure Effect'.

Seeing already light skinned people advertise this product or actors heavily air brushed, combined with the consistent and repeated exposure to these advertisements, may have led to 'Confirmation Bias' - this thing works regardless of scientific evidence or not. There have been reports stating toxic amounts of chemicals in these creams, evidence it doesn't really work. Yet people have been using it for years.

Fairness Cream Companies - Root of all evil or Savior with a solution?

It is important from a marketing perspective to understand a consumer's desires and insecurities.

Desire: Wanting to be fairer given the subconscious notion that life will be better

Insecurity: Not wanting to be cast aside or for opportunities to be passed based on color of skin. Not feeling beautiful or being extremely self-conscious.

If the marketing plays on desires and help consumers achieve it by nudging in that direction - it is viewed as ethical. If the marketing plays on insecurities and makes consumers change something about themselves - it is viewed as unethical.

So are Fairness Cream Companies evil for targeting the insecurities of consumers? Honestly, I don't think it is a clear cut answer -If Fairness Creams are ethical or not. I've always believed that a business will sell as long as a consumer wants it.

Uphill Battle: If I were WoW, here's what I would do.

I don't think WoW's campaign is going to work with their current strategy. Their current battle is against Fairness Cream Companies. WoW doesn't have the resources - monetary and manpower, to tackle them. And those who want fairness creams will go to these companies regardless.

What WoW needs to focus on is not preventing fairness cream companies but changing the psychology and aspirations of consumers that being Dark and Beautiful is a good thing. Not by dissing or making fairer people look bad. But by uplifting and being a support community.

From an audience perspective, we need to understand that there are In-Groups and Out-Groups.

In-Groups: Those who are already fair / light skinned.

Out-Groups: Those who are not fair / light skinned.

The Out-Groups can be further split into:

Aspirational: They want / aspire to be part of the in-group.

Dissociative: They don't want / don't aspire to be part of the in-group.

If I were WoW, I would focus on first connecting with the Dissociative Out-Group and create those brand ambassadors. They already want nothing to do with being part of the in-group. With a strong member base, I would make WoW as an advocate / union - should a member of our community be denied equal opportunities based on just the color of their skin, then WoW will unleash havoc through petitions, campaigns, social media posts etc.

Once they've established themselves with a strong member base, then I would try to sway the Aspirational Out-Group members, showing them that there is a strong community for them, that they don't have to be fair to get to where they want to get in life, and slowly convert them and help them feel more confident and beautiful about themselves. This would help as there would be Confirmation and Social Proof from the existing members, further powering WoW's cause.

WoW's battle is not against the Fairness Cream Companies. It is against the mindset deep-rooted in most Indians. It must slowly secure the minds and change mindsets that to be successful you don't have to aspire to be a certain skin tone. You are beautiful and capable just the way you are.

@desirepep @professorgosline

0 notes

Text

Nintendo: Treats Each Child Differently

Child #1: Mario

"We're excited to introduce a brand new Mario"

How is Mario 4 (the one on the extreme right) different from Marios 1,2, and 3? It is the same Mario that you've always loved - same powers, same jump range, same tasks, and yes wears the same popular cap. But there is a HUGE UPDATE: It has different Pixelation, Different Skin tone, and Different Costume Color!

Even the way it is experienced is through Nintendo Game Devices only.

According to the article 'Four Products: Predicting Diffusion', this would be an example of:

Type 1: Its-kinda-hard-to-mess-this-up:

Innovation: Generally incremental variations or improvements to existing product. (Mario: Slight differences in skin tone and color of clothing.

Market Study: Look at past product rollouts, existing patterns, or conduct market tests. (Mario: There have been successful Mario games for decades and people have loved them)

Manager assessment and Success: Hard to go wrong - Generally pretty spot on and nothing to volatile. (Mario: Mario character still remains one of the most beloved and recognizable characters across decades).

Child #2: Pokemon

"Pokemon universe's latest revolutionizing game: Pokemon Go"

On the other hand, we have a game that has had an unpredictable, yet massive transition: From Pokemon video games to cards to TC shows to Pokemon Go - an Augmented Reality Mobile Phone Game.

And for Pokemon Go, they used the 'dating' app Tinder as a market research.

Just kidding (Sorry #Nintendo please don't get offended).

The story of Pokemon Go is fascinating. TLDR: It was supposed to be a fun collab between Pokemon and Google Maps for an April fools day prank which became an augmented reality (AR) game that people can use their phones to play with and walk around in real life trying to capture pokemons.

Type 2: Calculated-Shot-in-the-dark

Innovation: Great improvements or new type of products all together. (Pokemon Go: from traditional Nintendo devices only to smart phones and merging reality with a game)

Past: Either no bench mark or inappropriate bench mark. (Pokemon Go: Never been done in Nintendo before or a phenomenon remotely heard of where a popular game had been AR'd into personal devices)

Market Study: Predictions - either in-house or hiring consultants

Manager Assessment and Success: Shaky, from hit or bust to everything in between. (Pokemon Go: Could have been a huge failure - but ended up with a massive valuation of $9 Billion - just the game alone!)

It's important to note the kind of product you have - either a Mario or a Pokemon Go - because the risks, go-to-market strategy, and timing varies. Product Diffusion - The rate and scope of product adoption among the target market - has varied in both cases. Simple steps to understanding Produce diffusion are:

#1: Highways and Roadblocks:

What factors inherent in those products will encourage or discourage adoption among target customers?

Mario:

Encourage: Users are already familiar with it, recognizable

Discourage: nothing really (unless there is a 0.01% of the population that will not play the game because they don't like the way Mario looks?)

Pokemon Go:

Encourage: Something new and exciting - never seen this before

Discourage: Why would I want to walk around to play a game?

#2: Identify high level characteristics that determine the predictions:

Mario: Has worked before, will work again. No changes needed from the user's end.

Pokemon Go: The concept of AR and VR was becoming popular, people had smarter mobile phones and better internet connection.

#3: Target Market selection: Who are you really serving to?

Mario:

Loyal fan base

Anybody

Pokemon Go:

Loyal fan base will to try the new tech in the game

New entrant as it is a completely different story line and method of playing

Moral of the story: Remember, depending on the product, timing and success may vary.

0 notes

Text

Beyond Bordeaux: Chile’s Wine Treasures

South America. My classmates. Pisco Sour during Sloan Parties.

If I were to do a 'Family Feud' style exercise like we've done countless times in class, these would be my guesses for Chile. However, if I were to do the same for France - I would know that it is renowned for its wine - even though I've never tried wine once in my life. So if I were to ever find myself be the one selecting a wine for our table or to gift to someone, I would look for the second cheapest option and something that is made in France.

And why is that? It is because the cognitive association with France is stronger for wine than it is with Chile, even though Chile also falls as a top 10 world exporter of wine. And on countless times, like in the 'Berlin Tasting', Chile had scored the top 3 out of 5 scores while competing against the likes of the Old World Dominants - France.

The wine makers in Chile recognized and acknowledged this problem. They realized that no matter how good the quality of wine was in Chile, they would have to change the perception about Chile in general to create those strong associations. And the country did come together - the two rival wine consortiums created a joint consortium, the government backed them up with funding, they opened a London office and allocated a budget of USD 6M to spend on advertising - all the efforts were steered towards creating a Brand for Chile to be recognized and respected as a serious wine maker.

Despite their earnest efforts, it seems like they were able to attract customers from the lower end market than a super premium market - a command that countries like France were still able to hold over consumers' psychology. Taking the case of Concha Y Toro, it was a brand that existing for decades, had a huge international presence (in over 110 countries) and had huge acres of land to develop its own wines. However, it had combined all its brands under the one portfolio that had it difficult to move towards a more premium segment - despite having brands in that category.

As next steps, I would recommend Concha Y Toro to focus on a 'Top-Down' approach. Instead of trying to sell up, they can cater to the 'basic' wine segment by providing good quality. Given the uncertainty in the market, they can capitalize on this opportunity to utilize their own land parcels that are left idle, and buy out smaller wineries. Their previous record has supported this hypothesis sales in the 'basic' segment accounted for 57.5% of the firm's export by value and 74.4% by volume. The image associated with their brand has already become more common in the basic segment. They could reposition themselves as the one to introduce customers to the wine life - the quintessential rite of passage when beginning to drink wine.

3 notes

·

View notes

Text

A Brew-tiful Rivalry: Does Corona need to change its 'latitude'?

It is 1996. The USA Beer Market is the number one consumer of beer worldwide, leading a staggering 18.2% (2.62 Billion Cases / year) of world wide consumption of 14.4Billion Cases / year. In the imported beer brand market, Heineken is leading the market with selling 37.2M cases / year and Modelo Corona Extra is in second with 28.9M cases / year sales. While it seems small compared to the overall beer consumption, in 1996, domestic beer consumption was 2.4 Billion cases / year while imported was only 168 million cases / year. Keeping that in context, both Heineken and Modelo Corona account for 66.1M cases / year, which is 39.34% of the imported beer market. The difference between #1 and #2 is huge, and Modelo are at their wits ends on how to overtake Heineken to reign in as the #1 imported beer brand in the USA.

From a branding and strategy aspect, here are a couple of things Modelo did for Corona in USA vs Mexico:

USA Bottle: Long, clear-glass bottles. Non-reuasable

Mexico Bottles: Long, clear-glass bottles. Reusable.

USA Culture: People started squeezing lime into the stem of Corona bottles, leading to a popular 'Corona and Lime' trend.

Mexico Culture: This wasn't the case in Mexico as people would need to give back the bottles, having Lime in them would make it difficult to reuse.

USA Pricing: 'Premium Product' - The price range was comparable to Heineken, that is, 30-40% higher price than domestic beer prices.

Mexico Pricing: 'Price wars' - FEMSA and Modelo engaged in a fierce price war to gain a leading position in the Mexican beer market. Between 1986 – 1993: Real price of beer dropped 25.3%. By 1997 – Real price of beer were only 4.2% lower than 1986 (made recovery of 28%).

USA distribution strategy: They had 2 importers - Illinois-based Amalgamated Distillery Products Inc (ADP) later renamed Barton Beers, and Gambrinus (started by one of their own ex-employees)

Mexico Distribution strategy: They produced and owned almost 85% of their distribution channel, which gave them significant advantage.

Given Modelo's different approach to placing Corona in USA vs Mexico, I wonder if there was a brand dilution or issue in what the brand stands for.

#BeerForThought: They mention that there is a significant hispanic population that has grown in the USA and is projected to continue to grow. By creating this brand confusion of a 'cheaper' product in Mexico and 'premium product' in USA, are they losing out on a home ground advantage they can have with the Hispanic community?

In comparison to the marketing of its competitors, Modelo Corona did the following:

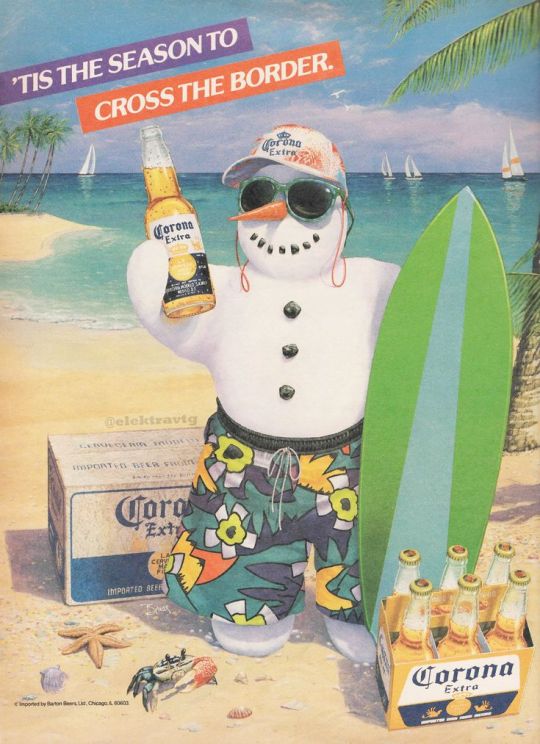

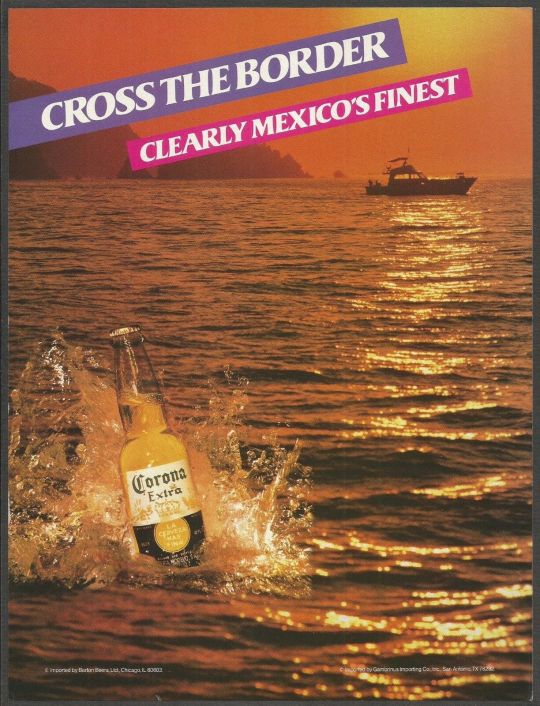

USA Marketing Logo: The Blue, Yellow, and White colors of Corona were instantly recognizable.

USA Marketing Slogan: It centered around the beach and being a fun experience as opposed to being for the sophisticated only. It would have slogans like: "Fun, Sun, Beach", "Vacation in a Bottle"

TV Ads: Content was kept simple and they were filmed in Mexico in a beach type environment with little to no VoiceOver. No full images of people in ads.

youtube

Agency on USA Marketing: Each importer retained their own advertising agency and Modelo typically financed 50% of the ad expenses and promotions, which helped them keep a check on brand consistency.

USA Marketing Budget: Modelo spend very little compared to its USA market competitors. In 1996, Modelo spent $5.1 Million whereas Heineken spent $15.1 Million and AB spent $192 Million.

#BeerForThought: By having a significantly little marketing budget as compared to its competitors, was Modelo restricting itself? Could it be a lack of reach through advertising and promotion that could help cross the gap between Modelo and Heineken? Additionally, nothing in the TV ads feel aspirational or some sort of justification as to the 'premium' tag of the brand.

Stay tuned to see how this Brew-tiful rivalry plays out! Till then, pop a beer and cheers to your good health.

Credits:

ChatGPT 4 for image generation, YouTube for old Corona Commercial, Google Images for ads, My stacked up Beer Bar thanks to thirsty Sloanies.

4 notes

·

View notes