Don't wanna be here? Send us removal request.

Text

Burberry’s got your “check”!

Burberry’s brand is a defensible strategic resource because of its low risk of inimitability and slow depreciation of its quintessentially “Brit” heritage. However, it faces a from its competitors with similar product offerings and equally efficient capabilities.

Low risk of Inimitability: Having Audrey Hepburn in Breakfast at Tiffany’s, wearing a Burberry trench coat and Kate Moss wearing a checkered bikini, are unreplicable events and important path dependencies that caused Burberry to become an aspirational brand.

Low Risk of Depreciating Quickly: Burberry sustained its brand-advantage as the “only british brand” in the luxury space and has leveraged their 150-year heritage in launching new fashion lines.

Value controlled by company: Renegotiating licenses, buying back distribution rights and cutting distribution facilities allowed Burberry to gain more up and downstream control of their brand

Competitive Risks: Burberry has positioned itself as an “affordable luxury brand, between brands like Polo Ralph Lauren and pure luxury players like Gucci. While Burberry has been able to increase the customers’ willingness to pay, this has come at higher operational costs. As they moved from licensing channels to retail channels, their margins have reduced.

It remains to see how Burberry can balance the higher control they are able to achieve through licensing to drive the brand image in a cost-effective way.

0 notes

Text

SIA - Service does it

The first time I flew business class was incidentally with Singapore Airlines on their BLR-SIN-BNE route for a work trip. Every moment of the 24 hour journey was so remarkable that I remember wishing it never ends. During my 8 hour layover in the Changi airport, while waiting in the lounge for my next flight, I fell asleep in an awkward angle. I distinctly remember how one of the attendants in the lounge came up to offer me a pillow and a blanket and made sure that I was comfortable. I have never since experienced the level of care that the airline offered to its travelers. Post that trip, I only booked with Singapore Airlines if they offered services on a route. And I also noticed that my colleagues also had the same preference purely due to their service levels.

So in this case, it definitely makes sense for SIA to invest in upgrading their business class seats to gain traction with their business class members. Given that price is not the primary consideration for this segment of customers, the comfort and luxury is definitely key to grow their revenues in this segment.

Emirates is another example of an airline that relies in providing luxurious services to attract passengers. They provide chauffeur driven rides to and from the airport to their premium class passengers and also their A380s with a bar deck takes it to another level.

1 note

·

View note

Text

Facebook nudge gone wrong?

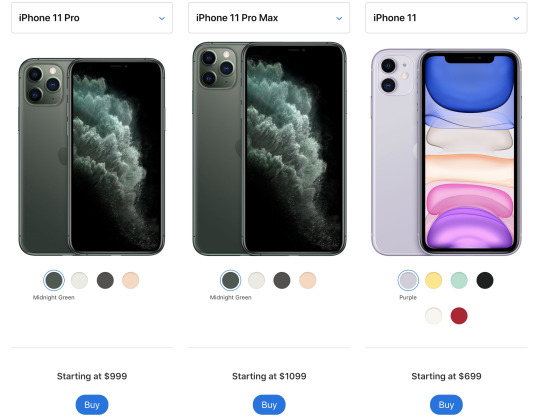

Apple’s iPhone pricing is an integrated part of their nudge strategy. iPhone 11 Pro and iPhone 11 Pro Max are priced so close to each other, that consumers gravitate towards Pro Max especially because the $100 differential justifies the improved functionality that Pro Max provides. This lets Apple increase their consumers’ willingness to pay and thereby improve their topline.

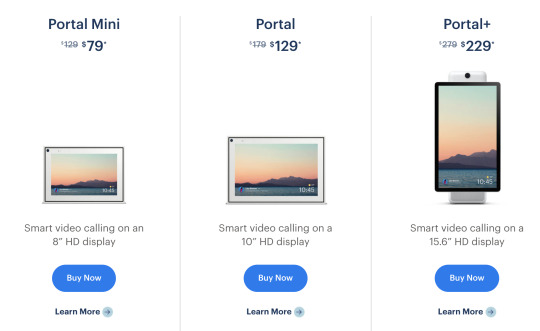

On the other hand, Facebook launched its brand of smart displays in 2018 with the Portal product line. Portal Mini and Portal are priced $50 apart with the exact same specifications except the screen size difference of 2″. Is this feature differential sufficient to nudge consumers towards Portal?

While spending 38% more for 2″ of screen already seems to be a stretch, Facebook seems to have amplified the nudge issue with its new Mother’s day promotion. With a flat $50 discount across all models, the Portal is now available for 63% more than Portal Mini.

Facebook’s dubious pricing strategy seems to be ignoring the framing of the choices. Companies need to comprehensively think through how varied are their product offerings and what is a justified differential in prices in an allocentric way to maximize their benefits.. Also, when employing discounts, they need to think through the relative pricing of their product portfolio to understand if they are nudging consumers in the right direction.

0 notes

Text

People don’t drink beer. They drink marketing.

By the late 1970′s both Modelo and Heineken had become extremely competent in brewing high quality beer and nailed down the intricate logistics involved in exporting fresh beer to retail locations across the world. However, only one of them had figured out the key to selling beer - Modelo with its Corona brand.

Corona and Heineken employed very different marketing strategies right from the start. Corona relied on experience driven marketing to generate fun-filled associations in their customer’s minds. The ads it used contained images of beaches and sea it used in its ads and there were references to the fun you have on your vacation to instill themselves as the go-to beer when you are looking to relax and let go. The “lime in beer” ritual further differentiated it from other brands by giving it a unique flair.

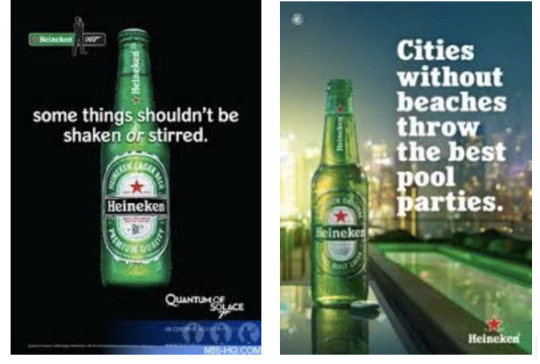

On the other hand, Heineken had a very utilitarian view towards marketing and focused mainly on the product quality. They also relied on comparative advertising to promote their high quality product compared to the other competitors that they considered to be fad.

I believe comparative advertising can work very well for luxury products where companies are trying to build an aura of exclusivity. Audi ad wars are a prime example of this.

This strategy might not work for beer as it is a consumable product and not something that customers will take pride in owning, unlike cars. Hence it is more important to draw the customer in through the promise of a great experience.

Heineken seems to have bought into this view as is evident in the TV campaign that they launched in 1996 called “Heineken Nights”. Heineken’s brand needs to weave into the customer’s lifestyle to maintain their market share against experiential brands like Corona.

2 notes

·

View notes

Text

Black & Decker - Solving the Tradesmen Conundrum

In 1990, Back & Decker produced and sold a range of power-tool products serving multiple market segments - industrial/professionals, tradesmen, consumers. While B&D had reasonably high-quality products and great customer service across the breadth of their offerings, they were unable to capture market share in the fast-growing tradesmen segment.

The primary distribution channels for the tradesmen segment are retail outlets like Home Depot or Ace Hardware. In these stores, companies like Makita were vastly outselling B&D for a few apparent reasons -

1. The tradesmen did not seem to differentiate between B&D’s consumer and professional models. B&D’s strong brand name in the consumer segment seems to be diluting their brand in the tradesmen segment.

2. The visual differentiation between the consumer and tradesmen models was very subtle as B&D used black and charcoal grey respectively. Most other brands used bright colors for their professional models. B&D’s coloring scheme did not do much to incite good brand and quality perception from the tradesmen.

While both professional and tradesmen segments might be expected to perform similarly, B&D enjoyed a 20% market share in the professional segment compared to the 9% in the tradesmen segment. This difference in performance can be explained by a few factors -

1. The professional segment is a B2B segment, where the purchase decisions are made by the contractors and the brand perception doesn’t play as big a role as in the B2C tradesmen segment. Purchase decisions are made based on the quality of tools, discounts, net costs and customer service - each category where B&D scores better than their competitors.

2. B&D also is a well-established company in the US and probably enjoyed good long-term relationships with its professional clientele. This might have been a barrier to entry for foreign firms like Makita in breaking into the professional segment.

3. B&D sells professional tools through commercial contractors like W.W Grainger and so the likelihood of professional tools being confused with the consumer brands is very low due to the vastly different distribution channels.

To accelerate its growth in the tradesmen segment and capture a larger market share through the retail distribution channels, B&D needs to differentiate its professional brand from its traditional consumer brand in a way that tradesmen can relate to with little training/explanation.

1. Leveraging the DeWalt brand (that has 70% awareness) and highlighting that the servicing will be provided by B&D will be a good way to differentiate the professional category of tools while leveraging awareness of B&D’s superior customer service.

2. Switching to “Industrial Yellow” color for professional tools is a good way to differentiate between its consumer and professional categories while still remaining distinct from its competitors.

These actions can help setup B&D for success in the elusive tradesmen cateogry.

1 note

·

View note